How to Create a PDF Invoice Template for Your Business

For any business, having a well-organized and clear method for requesting payment is essential. A well-structured billing document ensures that clients understand the charges and provides all the necessary details for smooth transactions. This is not only a tool for communication but also a way to maintain professionalism and consistency in financial dealings.

With the right approach, you can develop a versatile billing format that fits your specific needs and is easily shareable across different platforms. Whether you are managing a small startup or an established company, a good document structure saves time, reduces errors, and enhances your overall workflow.

In this guide, we’ll explore how to craft an efficient and polished financial statement that reflects your business identity, provides clarity for your clients, and keeps you organized. By the end, you will have a practical solution that can be used repeatedly with minimal adjustments, streamlining your billing process and ensuring accuracy in every transaction.

How to Design a Billing Document Format

Designing an effective payment request is essential for any business. The process involves organizing the necessary details in a structured way that is easy to understand and visually appealing. A well-designed document not only ensures clarity but also helps in building trust with clients by providing a professional and consistent look for every transaction.

To begin, you should select a tool or software that allows you to customize the layout according to your specific needs. Many options are available, from basic word processors to advanced design applications. Once you have your platform, you can start by adding the most important sections, such as contact information, service description, payment terms, and amounts due.

Next, focus on formatting. Keep the document clean and well-organized, using clear headings and spaces to separate each section. It’s important to ensure that the information is easy to follow, and that your clients can quickly find the key details. You can also include your business logo and adjust the font and colors to match your brand identity.

Once you’ve finalized the design, save the document in a format that is easily shareable and accessible across all devices. This will ensure that the recipient can view and store the document without any compatibility issues, allowing for smooth transactions every time.

Understanding the Importance of Billing Documents

A well-structured billing document plays a crucial role in ensuring smooth transactions between businesses and clients. It serves not only as a request for payment but also as a formal record of services rendered or products sold. Having a consistent and reliable way of presenting financial details helps both parties understand the terms of the agreement and avoids potential misunderstandings.

Key Reasons for Using a Standardized Billing Format

By adopting a standardized approach for financial documents, businesses can enjoy a variety of benefits:

- Professionalism: A polished document reflects well on your business and helps build trust with your clients.

- Efficiency: Having a predefined structure saves time and reduces the need to create new documents from scratch for every transaction.

- Consistency: A consistent format ensures that important details are always included, reducing errors and confusion.

- Clarity: A clean and organized document helps clients easily understand what they are being charged for and the terms of payment.

Benefits for Record-Keeping and Compliance

Having a reusable and standardized document format also simplifies record-keeping and tax-related activities:

- Organization: With a set format, all financial records are neatly organized and easy to access when needed.

- Legal Protection: Clear and consistent records can protect your business in case of disputes or audits.

- Tax Reporting: A structured format makes it easier to track income, expenses, and tax liabilities, ensuring compliance with tax regulations.

Ultimately, the importance of having a well-designed, reusable document cannot be overstated. It supports both operational efficiency and long-term business growth.

Choosing the Right Software for Billing Documents

Selecting the appropriate software for generating billing records is essential for any business. The right tool ensures ease of use, customizability, and efficiency when creating and managing financial statements. Whether you’re a small business or a large enterprise, the software you choose should help streamline your workflow and maintain professionalism in every transaction.

When evaluating software options, consider factors such as ease of use, features, compatibility, and cost. Some tools offer simple drag-and-drop interfaces, while others provide advanced customization and automation features. It’s important to select a platform that aligns with your business size, technical needs, and budget.

| Software | Features | Ease of Use | Price |

|---|---|---|---|

| Tool A | Customizable fields, multi-currency support | High | Free / Paid |

| Tool B | Automated reminders, client database | Medium | Paid |

| Tool C | Pre-designed layouts, mobile compatibility | Very High | Free |

Choosing the right platform also depends on how much control you need over the design, as well as any additional features such as tax calculations or integration with accounting software. By evaluating these key factors, you can ensure you select the best option for your business needs.

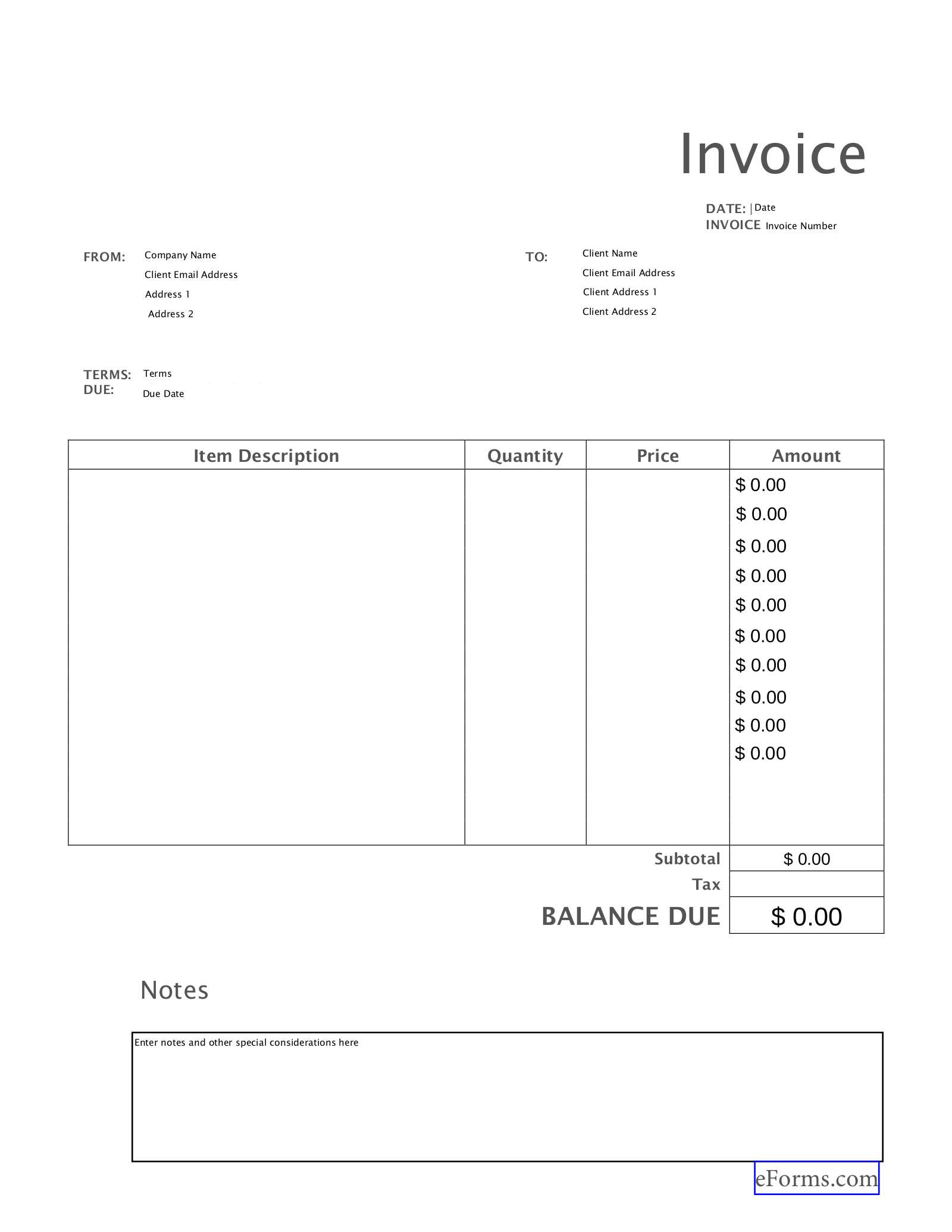

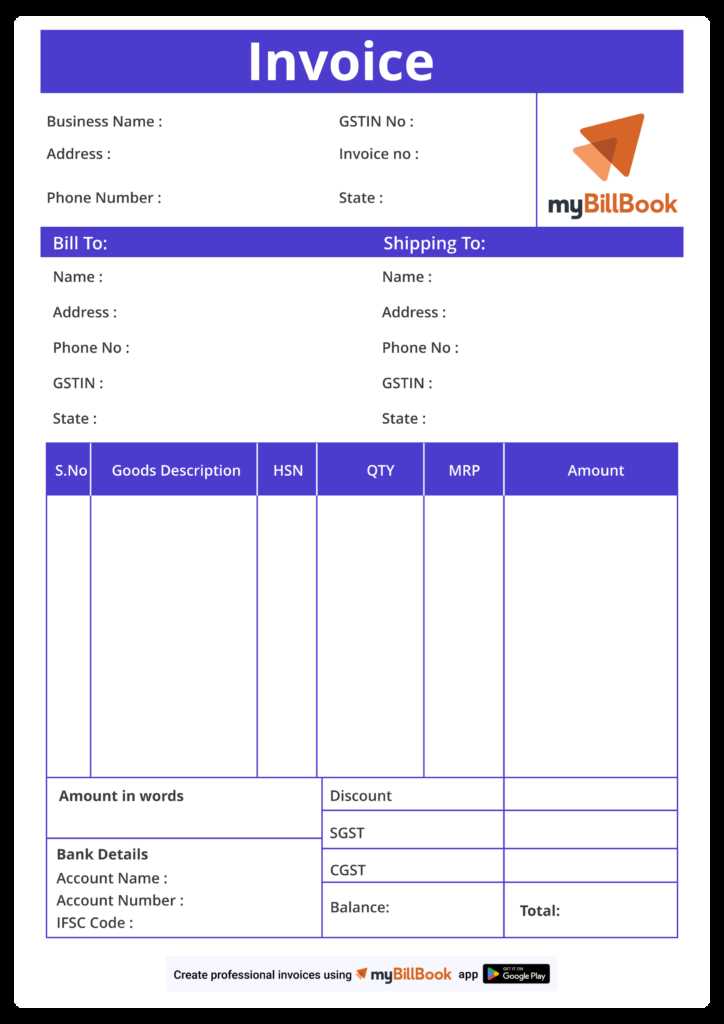

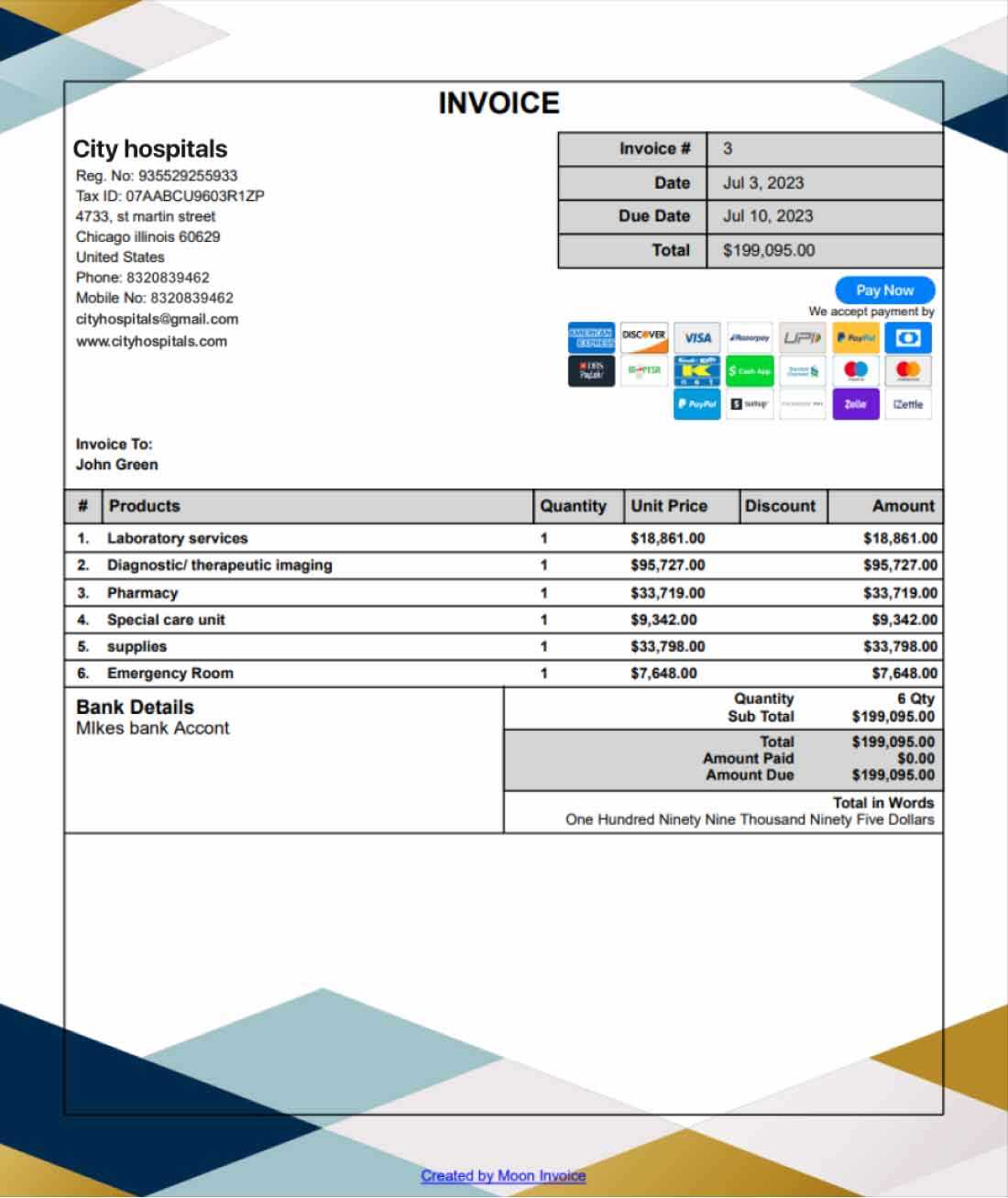

Key Elements of a Professional Billing Document

A well-crafted payment request not only facilitates smooth transactions but also reflects the professionalism of your business. To ensure clarity and consistency, certain key components must be included in every financial document. These elements provide essential information for both the recipient and the sender, ensuring there is no confusion about the terms, amounts, or due dates.

Below are the critical elements that should always be part of a professional billing document:

| Element | Description |

|---|---|

| Header | Includes business name, logo, and contact information, ensuring recognition and professionalism. |

| Recipient Information | Details such as the client’s name, address, and contact details help in identifying who the document is intended for. |

| Unique Identification Number | A unique reference number for each document ensures easy tracking and retrieval in case of queries. |

| Description of Services or Products | A clear breakdown of the goods or services provided, including quantities, rates, and dates, ensures transparency. |

| Amount Due | The total amount owed should be clearly stated, including any taxes, discounts, or additional fees. |

| Payment Terms | Clearly outline payment methods, due dates, and any late payment penalties to avoid confusion. |

| Footer | Include any additional notes, such as thank-you messages or instructions for payment, as well as legal disclaimers if necessary. |

By including these essential elements in every payment document, businesses can ensure their transactions are not only efficient but also professional and easily understood by all parties involved.

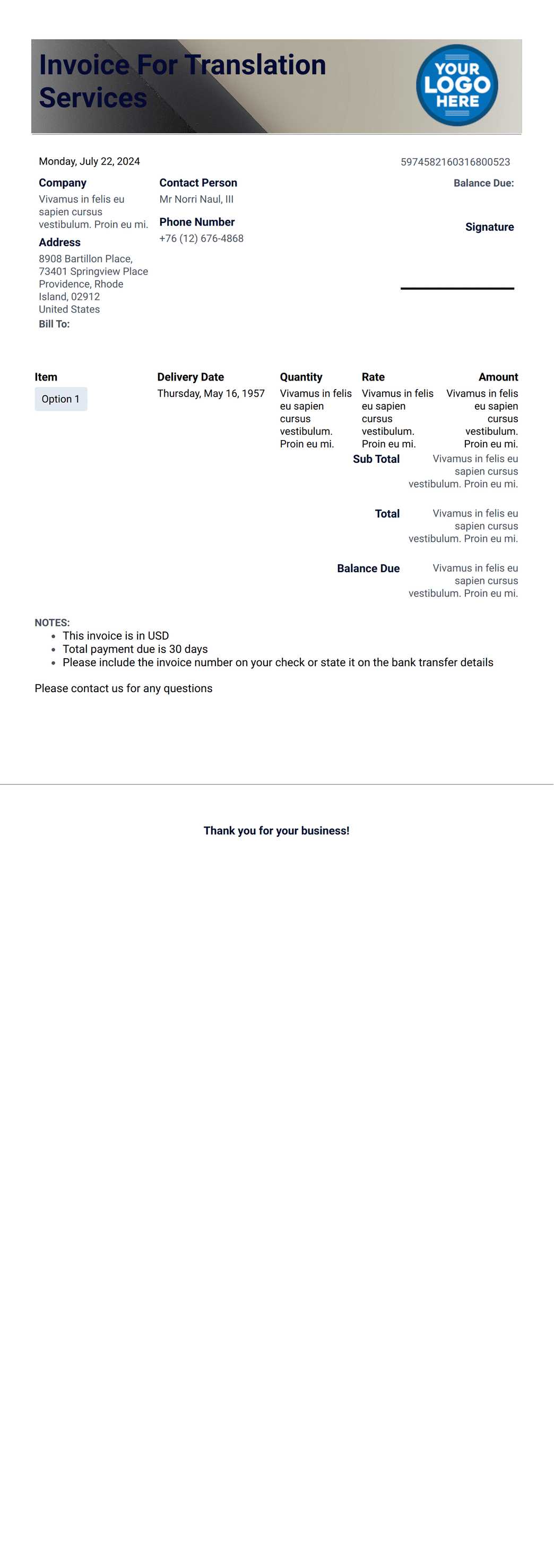

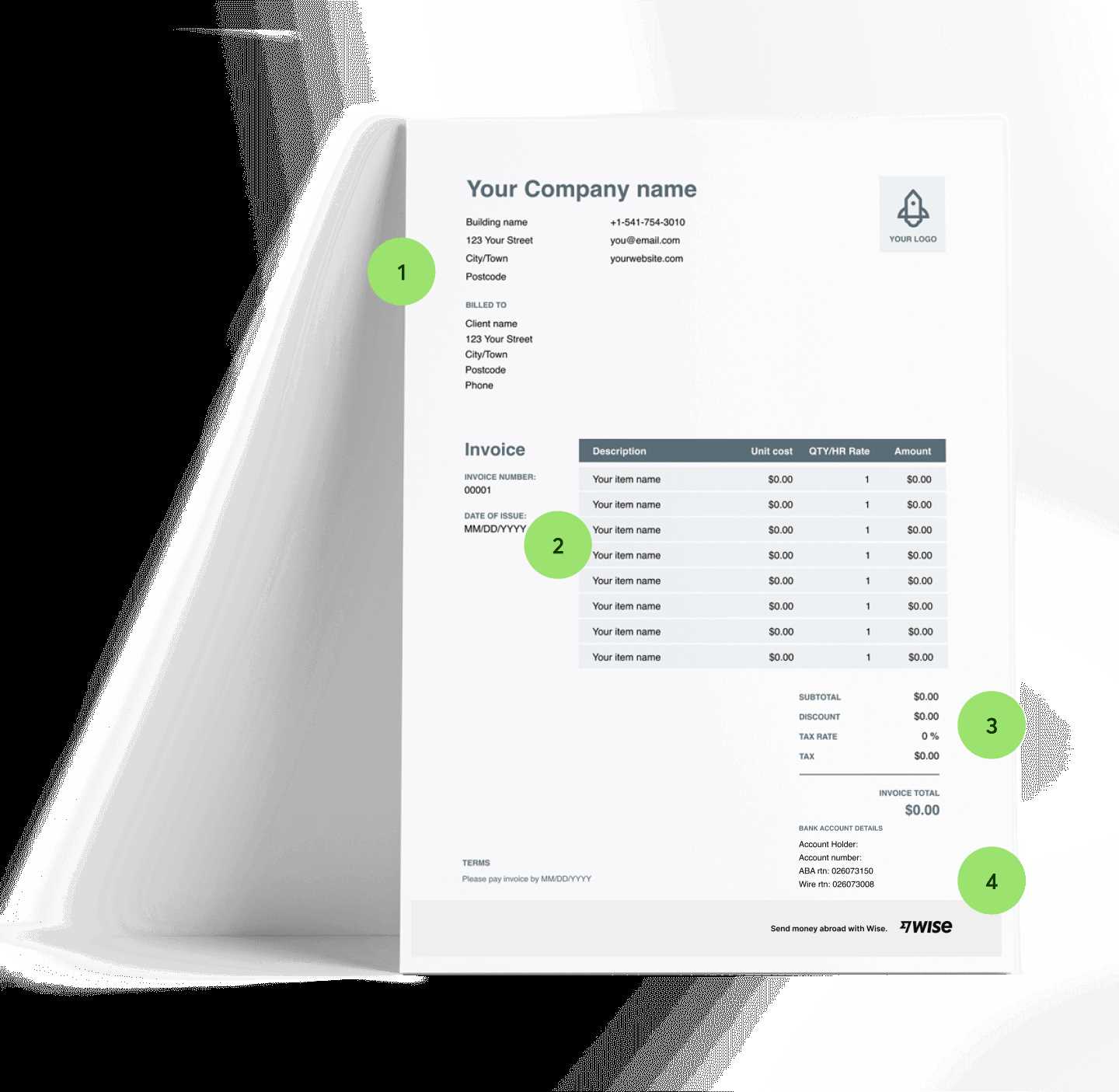

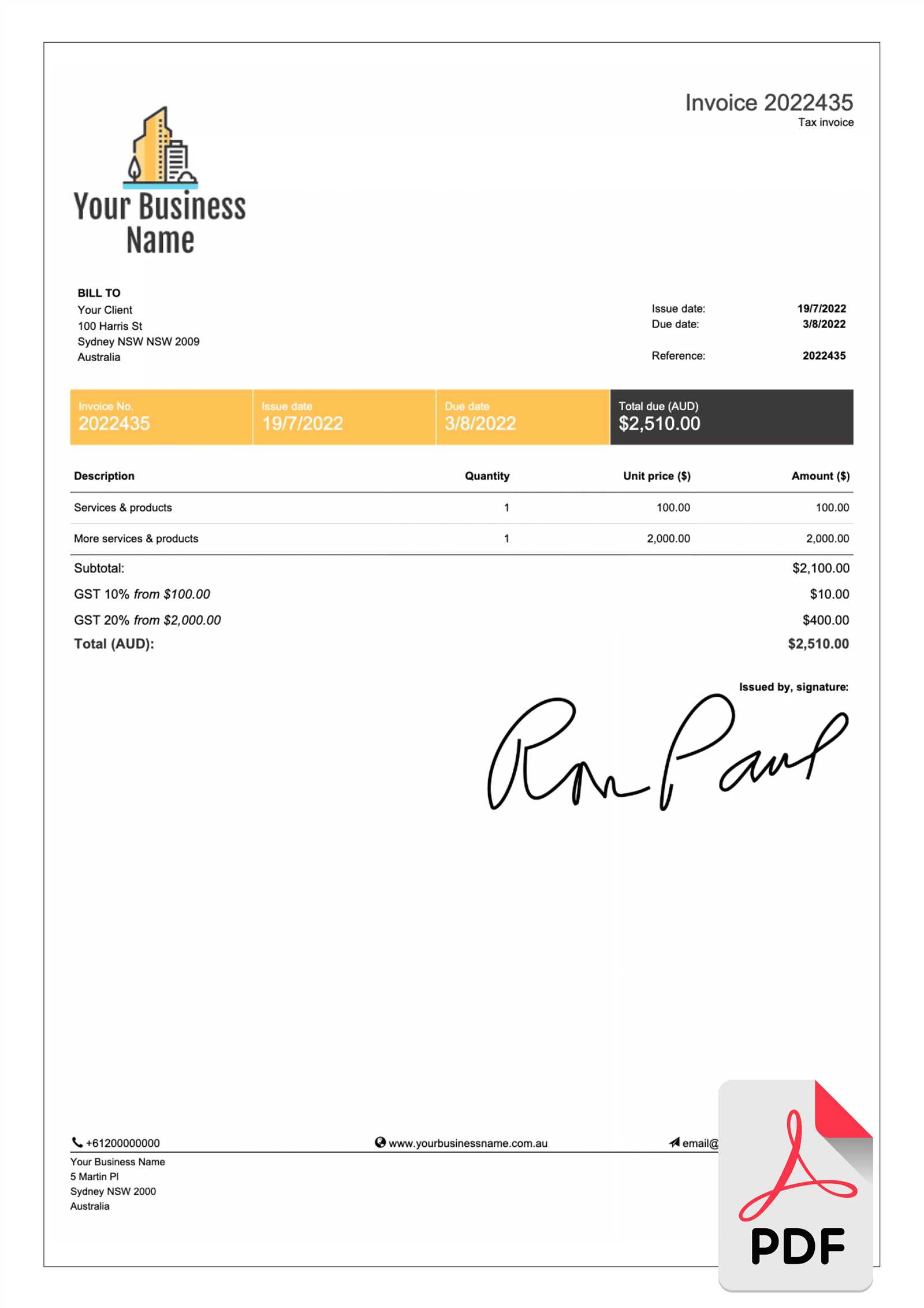

How to Add Branding to Your Invoice

Incorporating your business’s identity into financial documents is an essential step for making a lasting impression on clients. By adding personalized branding elements, you ensure that your materials reflect your company’s values and professionalism. This not only helps with recognition but also strengthens trust with your customers. Below are several effective strategies to infuse your brand into your transactional communications.

1. Include Your Logo and Business Name

Your logo serves as the cornerstone of your brand. Placing it prominently at the top of the document helps establish immediate recognition. Along with the logo, make sure to display your business name in a clear, legible font. This allows clients to associate the document with your organization effortlessly.

2. Use Consistent Brand Colors and Fonts

Colors and fonts are powerful tools in conveying your brand’s personality. Choose color schemes and font styles that match your overall branding guidelines. For example, if your company uses a specific set of corporate colors or a signature font, make sure these are reflected in the layout. This creates visual coherence and ensures that all materials, both digital and print, align with your branding.

| Element | Suggested Approach |

|---|---|

| Logo | Place at the top-center or top-left for easy visibility. |

| Business Name | Ensure it’s prominently displayed near the logo, using a clear and professional font. |

| Colors | Choose two or three primary colors that represent your brand. |

| Fonts | Use one or two fonts that reflect your brand’s style: one for headings and one for body text. |

These visual elements should be cohesive with your website and other marketing materials. The goal is for clients to instantly recognize your style, reinforcing your brand’s presence each time they receive a document from you.

Creating Customizable Fields for Your Template

Incorporating flexible fields into your document layout is essential for adapting to varying client requirements. Customizable sections allow you to enter unique details specific to each transaction, making your documents dynamic and tailored. By setting up fields that can be easily edited, you streamline the process of updating information without needing to redesign the entire structure each time.

1. Key Information Sections

Identify the critical details that will change with each instance, such as client names, addresses, and transaction dates. These are the core fields that need to be editable for each new entry. By leaving room for such information in predefined areas, you ensure a quick and accurate setup for every document you generate.

2. Flexible Payment and Itemized Breakdown

One of the most important sections to customize is the list of products or services provided. This area should allow easy input of varying quantities, prices, and descriptions. Providing flexibility here ensures that you can manage diverse transactions while keeping the structure uniform. Additionally, consider adding editable fields for taxes, discounts, or payment terms to accommodate different agreements with clients.

Ensuring these fields are easily adjustable not only saves time but also enhances the professionalism of your communication, allowing for error-free and personalized interactions every time.

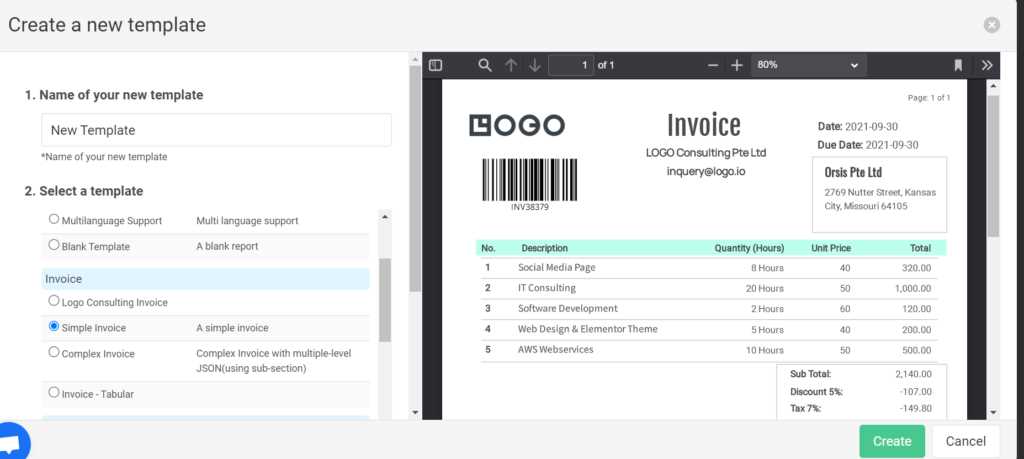

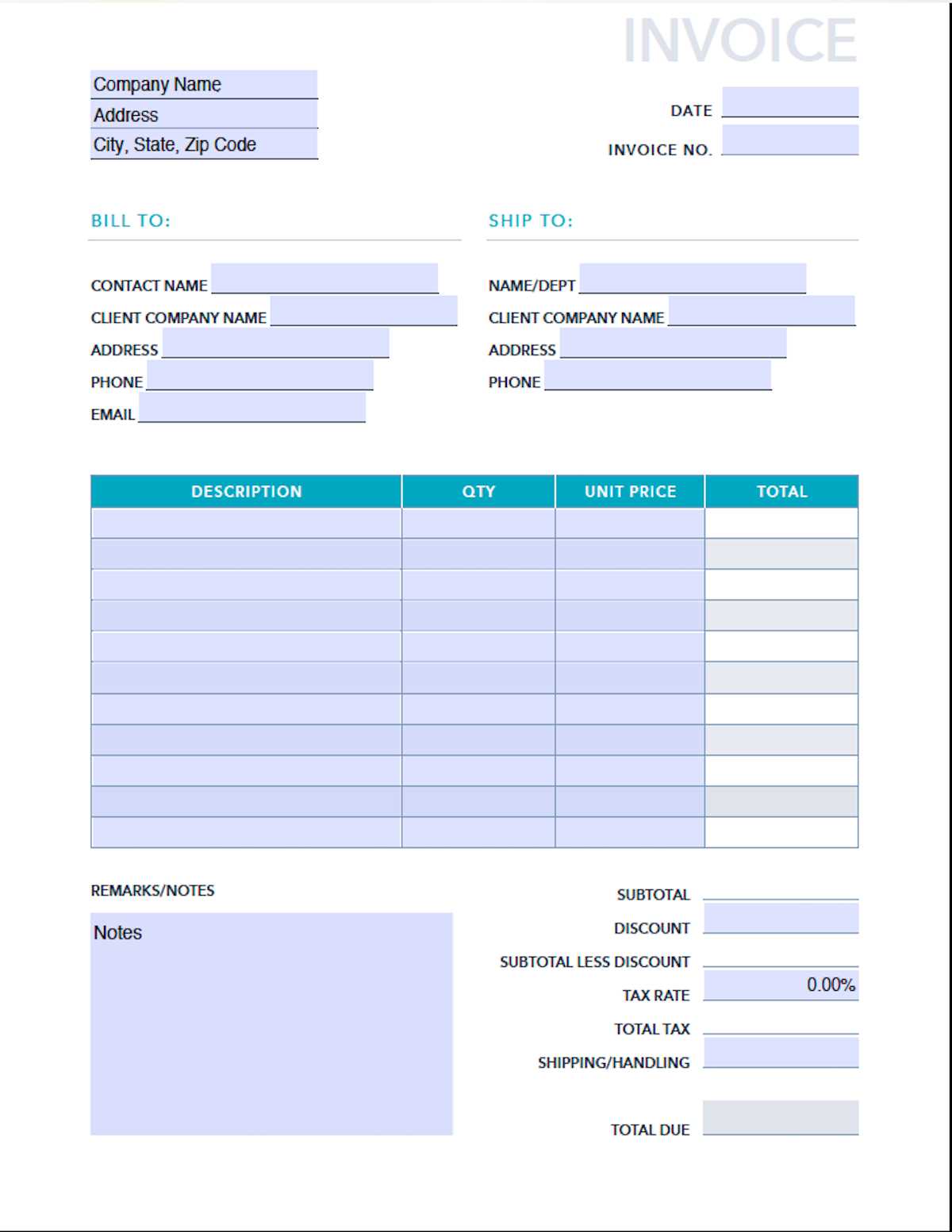

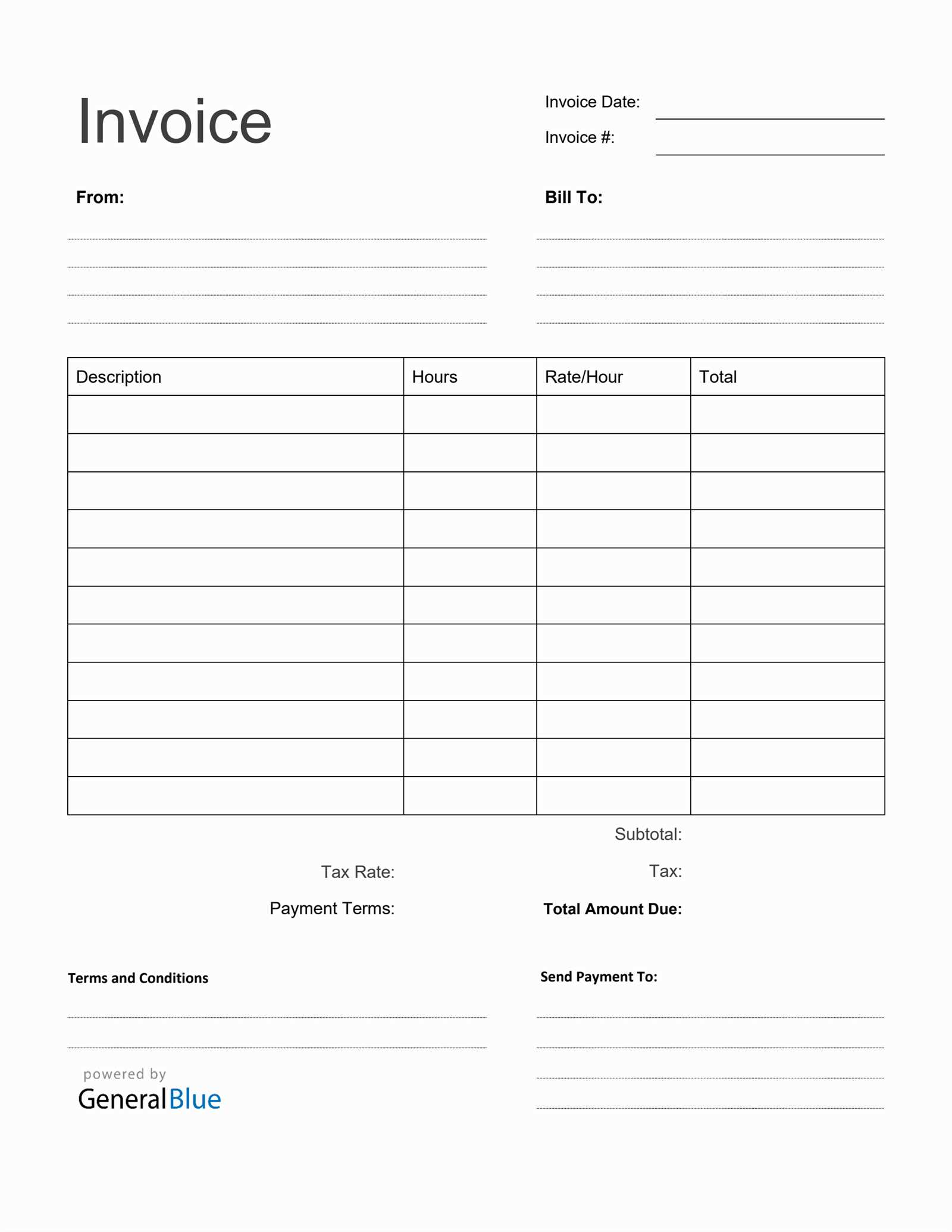

Steps to Design an Invoice Template

Designing a well-organized and functional document layout involves careful planning and attention to detail. By following a structured approach, you can ensure that all essential information is included while maintaining a clean, professional appearance. A carefully thought-out design not only simplifies the communication process but also reflects the professionalism of your business.

| Step | Description |

|---|---|

| 1. Define the Essential Elements | Identify the core components that must appear in every document, such as contact details, unique identifiers, payment terms, and itemized services or products. |

| 2. Choose a Layout | Decide on a clean and logical layout. Typically, this involves placing key details at the top, followed by a breakdown of items, totals, and payment instructions. |

| 3. Add Customizable Fields | Incorporate fields that can be updated for each transaction, including client information, dates, and amounts. This allows for personalization without altering the overall structure. |

| 4. Include Branding Elements | Ensure your business logo, color scheme, and fonts are present to maintain consistency with other brand materials. |

| 5. Review for Clarity and Readability | Ensure the design is simple and easy to read, with enough space for all necessary details without overwhelming the recipient. |

By following these steps, you can develop a document layout that is both functional and aligned with your brand’s identity, ensuring smooth transactions and clear communication with clients.

Incorporating Your Business Logo in the Template

Including your business logo in any document layout is a fundamental aspect of branding. It helps to establish instant recognition and ensures consistency across all your materials. By strategically placing your logo, you can create a professional look that reinforces your company’s identity every time the document is viewed.

1. Placement of Your Logo

Choose a prominent position for your logo, typically at the top-left or top-center of the page. This ensures that it is the first thing the recipient notices, immediately linking the document to your business. The placement should feel natural and balanced with the rest of the content, allowing for easy readability without cluttering the page.

2. Logo Size and Clarity

Ensure your logo is large enough to be easily recognizable, but not so large that it overpowers the content. The logo should be clear and sharp, without any distortion or pixelation. A high-quality version of the logo will maintain its integrity when viewed on different devices or printed. Consistency in logo usage helps build trust and credibility with your audience.

Remember, your logo is an extension of your brand. Keeping it visible and properly integrated into your layout will make your business look more polished and professional.

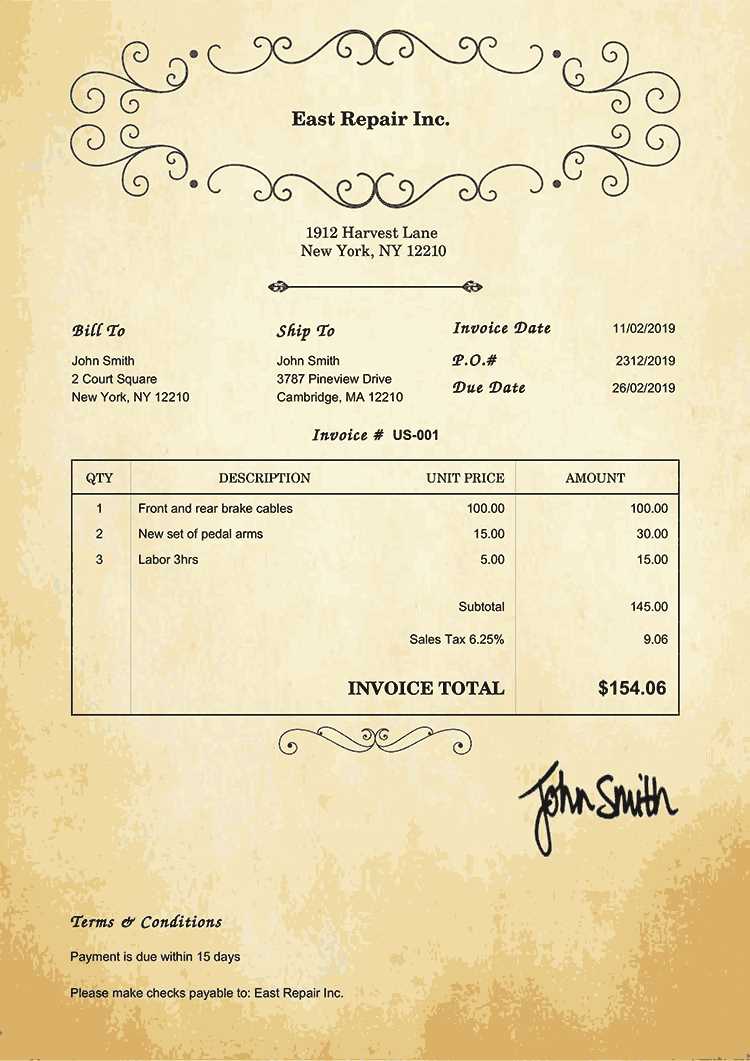

Adding Payment Terms and Conditions

Clearly outlining payment terms and conditions is essential for setting expectations and avoiding misunderstandings with clients. These terms define how and when payments should be made, as well as any additional policies related to late fees, refunds, or payment methods. Including this information ensures transparency and helps maintain a professional relationship with your customers.

1. Specify Payment Deadlines

Clearly state when payment is due. Whether it’s immediately upon receipt, within 30 days, or after a specific event, providing a definitive deadline removes any ambiguity. Stating exact dates helps clients manage their accounts and avoid missed payments.

2. Detail Accepted Payment Methods

List the methods of payment that you accept, such as bank transfers, credit cards, or online payment platforms. This provides clarity and convenience for your clients, allowing them to choose the most suitable option for them. Clear instructions on how payments can be made can reduce delays and improve cash flow.

Including terms such as late payment penalties or discounts for early payment can also motivate timely transactions, further strengthening your payment management process.

Formatting a Clear and Readable Invoice

Properly formatting financial documents is crucial for ensuring that they are easy to understand and professionally presented. A well-organized layout not only improves readability but also helps recipients quickly find key information, such as payment details and itemized charges. The goal is to create a balanced structure that highlights essential elements while maintaining a clean and clutter-free design.

1. Use Headings and Subheadings

Break the document into distinct sections using clear headings. For example, use headings for the client’s details, service or product breakdown, payment terms, and totals. This allows readers to navigate the document easily. Ensure that each section is visually separated to prevent confusion and to help emphasize important points.

2. Align Information Properly

Align the content neatly, using left, right, or center alignment where appropriate. For example, align dates, numbers, and totals to the right for easy reading, while client names and descriptions can be left-aligned. Proper alignment creates a structured flow, making it simpler for recipients to find and process details.

Additionally, ensure there is sufficient spacing between sections and rows to avoid overcrowding. A clean and balanced layout encourages quick comprehension and conveys professionalism.

How to Save Your Invoice as a PDF

Once you’ve finalized your document, saving it in a universally accessible format is the next step. This ensures that your recipients can easily open, view, and print the file without encountering compatibility issues. Saving your document as a PDF guarantees that the layout and design remain intact, regardless of the device or software used to view it.

1. Using Word Processing Software

If you’ve used a word processing program like Microsoft Word or Google Docs to create your document, saving it as a PDF is simple. In Microsoft Word, select the “Save As” option, then choose “PDF” from the file type dropdown. In Google Docs, click on “File,” then “Download,” and select “PDF Document.” This will preserve your formatting, ensuring the file appears exactly as intended.

2. Using Online Tools

There are numerous online tools available that allow you to convert your document into a PDF. These tools are particularly useful if you’ve built the document in a different format, such as an Excel sheet or image. Simply upload the file to the online converter, select “Convert,” and download the resulting PDF. Using these tools makes the conversion process quick and easy, even without specialized software.

By saving your document in this format, you ensure that it is accessible, professional, and easy to share across different platforms.

Best Practices for Invoice File Naming

Choosing an appropriate and consistent file naming convention is essential for organizing and retrieving your documents efficiently. A clear and logical naming system reduces confusion, ensures easy identification, and streamlines file management, especially when dealing with multiple transactions over time. By following a few simple guidelines, you can make sure that each document is easily searchable and well-documented.

1. Include the Client Name or ID

Incorporating the client’s name or a unique identifier into the filename helps to quickly associate the document with a specific customer. This is especially useful when you manage several clients or projects simultaneously. For example, use the client’s full name or a client code along with the relevant document details to avoid any ambiguity.

2. Add the Date and Unique Reference Number

Including the date (in a consistent format such as YYYY-MM-DD) helps to organize files chronologically, while a unique reference number ensures each document can be distinguished from others. This combination allows for quick identification and minimizes the risk of duplicating or misplacing files. For example, a name like “JohnDoe_2024-11-07_001” clearly indicates the client, the date, and a specific reference number, making it easy to locate and track documents over time.

By following these practices, you ensure that your files are organized, easily searchable, and ready for sharing or archiving whenever necessary.

Creating Reusable Invoice Templates

Designing a flexible and reusable layout for your financial documents can significantly reduce time and effort when generating new records. Instead of starting from scratch each time, a well-organized structure allows you to quickly update the necessary information for each new transaction. This method is not only efficient but also ensures consistency in your communications with clients.

1. Define Essential Sections

To build a reusable structure, start by identifying the core sections that will appear in every document. Common sections to include are:

- Client details (name, address, contact information)

- Service/product descriptions

- Payment terms and due dates

- Totals and breakdowns of charges

- Company details (name, logo, contact info)

Once these areas are identified, make sure they are easy to update without affecting the overall layout.

2. Incorporate Customizable Fields

Ensure that parts of the layout are flexible enough to accommodate various entries. Some fields, such as the item list, date, or reference number, should be left editable to suit different client needs. A great way to implement this is by using placeholders or blank spaces that can be quickly filled in. This will allow you to generate a new document within minutes while maintaining a consistent structure.

3. Save and Store for Future Use

Once you’ve designed your reusable structure, save it in a format that is easily accessible for future transactions. Store it in a centralized location where you can quickly access and modify it as needed. Keeping your layout organized and ready to go will save time and ensure that your financial records are consistently formatted, regardless of how often you need to update them.

By following these steps, you can build an efficient system for handling multiple client records, ensuring that your documents remain professiona

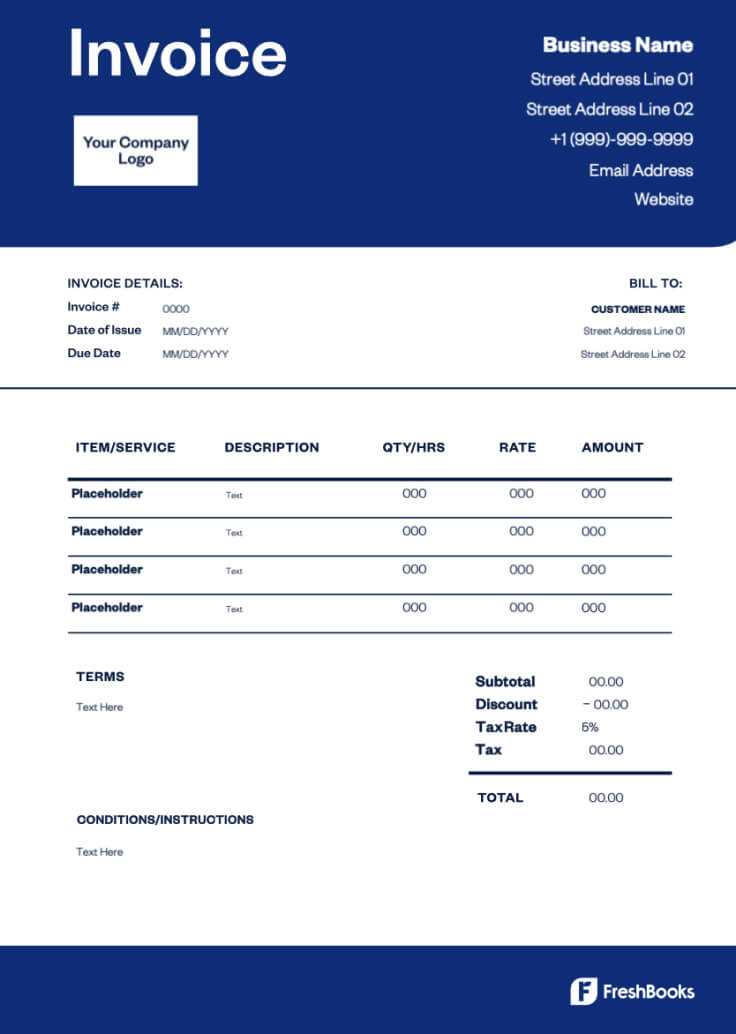

How to Include Tax and Discount Information

When finalizing a financial document, it’s important to clearly show how taxes and any applied discounts impact the total amount due. These elements not only provide transparency but also help the recipient understand the breakdown of the overall cost. Properly organizing this information ensures that both parties are on the same page regarding the amount payable and any adjustments that may have been made to the original price.

Tax is typically calculated based on the applicable rate in the region where the transaction occurs. It should be displayed clearly, usually as a percentage of the subtotal, and listed separately to avoid confusion. Including the specific rate and amount ensures that both parties are aware of how the final charge is determined. This section should also specify whether the tax is included in the total or added separately, depending on the business or legal requirements.

Discounts are often applied as a percentage or a fixed amount subtracted from the initial price. It’s essential to clearly state the discount terms, such as the percentage or value deducted, as well as any conditions that may apply (e.g., if the discount is contingent upon early payment). Like taxes, the discount should be listed separately to indicate how it affects the total amount due. This helps maintain clarity and avoids misunderstandings about the final price after adjustments.

By providing clear and detailed tax and discount information, both parties can easily track adjustments and understand the pricing structure, reducing the risk of errors or disputes down the line.

Automating Invoice Generation for Your Business

Automating the process of document creation for your financial transactions can significantly save time and reduce human error. By implementing automated systems, you can ensure that each transaction is properly documented with minimal manual intervention. This streamlines the workflow, improves accuracy, and frees up valuable resources for other tasks in your business.

There are several key benefits to automating this process:

- Efficiency: Automatically generating documents means you no longer need to manually input information for each new transaction. This reduces the chances of missing key details or making mistakes.

- Consistency: Automation ensures that every document follows the same structure and formatting, creating a uniform look and feel across all communications.

- Time-saving: Once set up, an automated system can generate these documents in just a few clicks, cutting down on administrative workload.

- Compliance: By automating calculations, such as taxes or discounts, you reduce the risk of errors that could lead to compliance issues with tax authorities or financial regulations.

To implement automation, you can use a range of tools that integrate with your existing business systems. Here are some steps to consider:

- Choose the right software: Look for a solution that integrates with your accounting system or CRM to ensure smooth data flow.

- Customize settings: Set up automated templates with fields that can auto-fill customer details, transaction dates, and pricing information.

- Define triggers: Automate the generation of documents based on specific actions, such as a completed sale or service delivery.

- Review and refine: Continuously monitor the automated system for accuracy and adjust settings as needed.

With these steps, you can ensure that your business runs more smoothly and efficiently, while maintaining accurate and professional records for all transactions.

Ensuring Mobile Compatibility of Your Template

In today’s fast-paced world, many users access important documents on their mobile devices. Whether your clients are reviewing documents on their phones or tablets, it’s crucial that these materials are easily readable and well-structured on all screen sizes. Optimizing your design for mobile use helps ensure a smooth experience for recipients and prevents potential issues, such as misaligned text or cut-off information.

Responsive design plays a key role in achieving mobile compatibility. This means designing the layout so that it adjusts dynamically to different screen sizes without losing functionality or clarity. Elements such as text, images, and tables should automatically resize to fit smaller displays, ensuring that everything remains legible and properly formatted.

Here are some tips to ensure your documents display well on mobile devices:

- Use fluid layouts: Instead of fixed-width elements, utilize percentage-based widths for containers and columns so that the layout adapts to different screen sizes.

- Keep content concise: On smaller screens, space is limited. Avoid overwhelming the user with too much text or complex tables, and focus on delivering key information in a clear, concise manner.

- Optimize font sizes: Ensure that font sizes are legible on smaller screens without needing to zoom in. Typically, a font size of at least 12px is recommended for body text.

- Test across devices: Check how your document looks on various mobile devices and screen sizes to identify any potential issues before sharing with clients.

By making these adjustments, you can ensure that your materials are user-friendly and professional, regardless of the device used to view them.

How to Test and Update Your Template

Once your design is set up, it’s crucial to test its functionality and appearance across various platforms and devices. Ensuring that everything displays correctly and operates smoothly is an essential part of providing a professional experience for your clients. Regularly updating and fine-tuning the design will keep it relevant, efficient, and aligned with any changes in your business requirements or regulatory standards.

Testing the Document

To ensure everything works as intended, test the layout, readability, and accuracy of the content. Here are some steps to follow:

- Check formatting: Verify that text, tables, and other elements are properly aligned and formatted on different screen sizes, including mobile and desktop devices.

- Validate data: Ensure that all dynamic fields (e.g., dates, client names, amounts) auto-populate correctly and consistently.

- Review for errors: Check for any inconsistencies, missing information, or incorrect calculations, such as tax rates or discounts.

- Test compatibility: Open the document on various software and devices to ensure it appears as intended across different platforms (e.g., iOS, Android, Windows, macOS).

Updating the Design

As your business grows or regulations change, you may need to update your design to reflect new requirements or improvements. Here’s how you can efficiently manage updates:

- Adjust layout: Modify columns, text sizes, and margins to accommodate additional information or improve readability.

- Update branding: If your logo or company colors change, make sure these updates are reflected in the design.

- Ensure legal compliance: Regularly check for any new tax laws or industry regulations that may require changes in how information is presented.

To track changes and ensure consistency, maintain a version history and keep a record of all edits made. This way, you can always revert to an earlier version if needed.

Example of Testing Data Table

| Item | Quantity | Price | Total |

|---|