How to Create a PayPal Invoice Template for Your Business

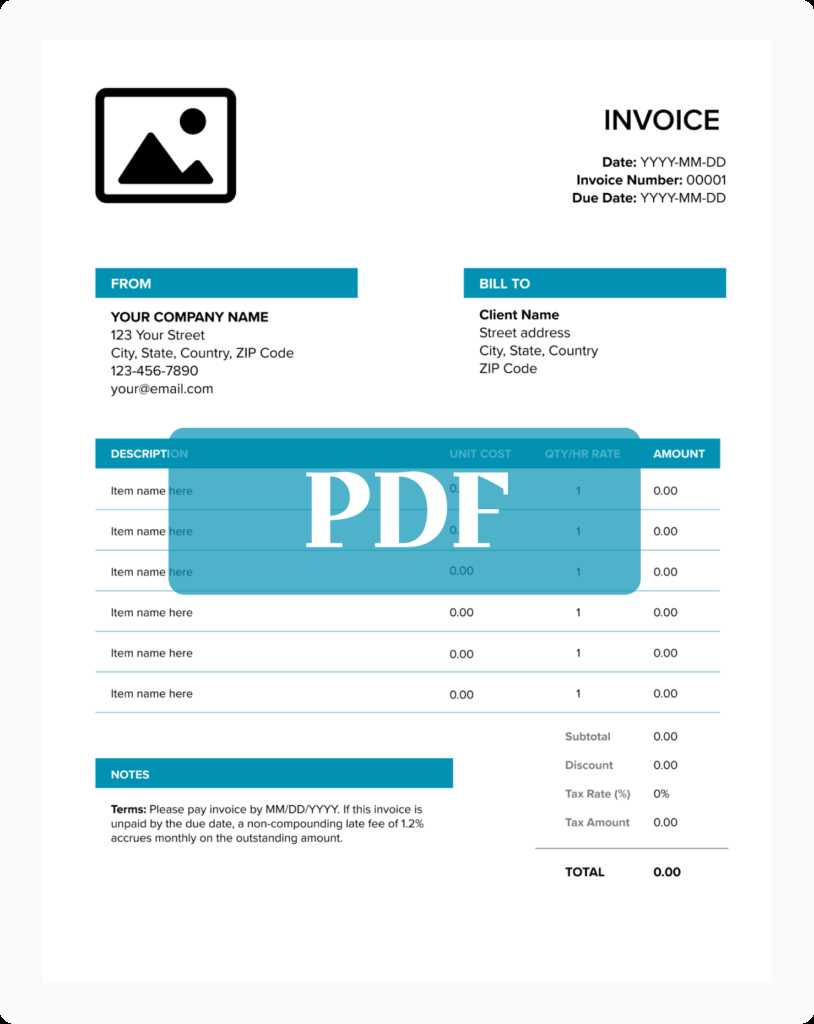

In today’s digital world, managing payments efficiently is crucial for businesses of all sizes. A well-designed billing document can help streamline transactions, ensuring that both parties are clear about the amount due, payment terms, and other essential details. Whether you’re running a small business or freelancing, having a custom document ready for clients can save time and reduce errors in financial exchanges.

Customizing your billing format to match your brand identity is an important step in presenting a professional image. With the right setup, you can easily send detailed payment requests that look polished and are tailored to meet your specific needs. This allows you to focus more on growing your business while keeping financial records in order.

By understanding the key features and tools available, anyone can set up a clear and effective billing system. The process of crafting these documents doesn’t need to be complicated or time-consuming, and it can be done with just a few simple adjustments to ensure accuracy and professionalism.

How to Design a PayPal Invoice

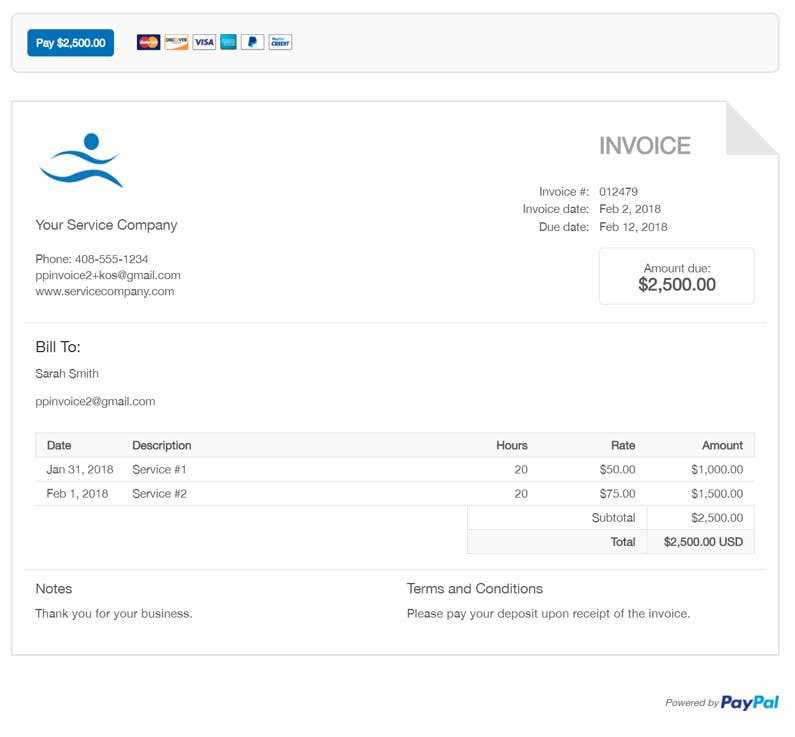

When it comes to managing payments with clients or customers, a well-structured document is essential for clarity and professionalism. Designing an effective payment request involves incorporating key elements such as pricing details, payment terms, and business information. The goal is to make the process smooth for both the sender and the recipient while maintaining a polished, consistent look that aligns with your brand.

Essential Elements for a Professional Billing Request

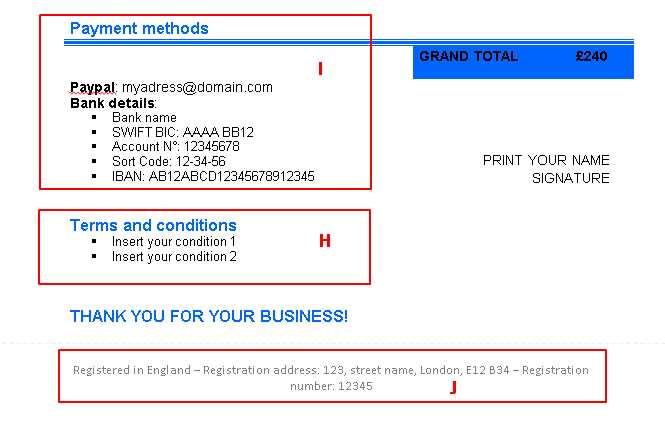

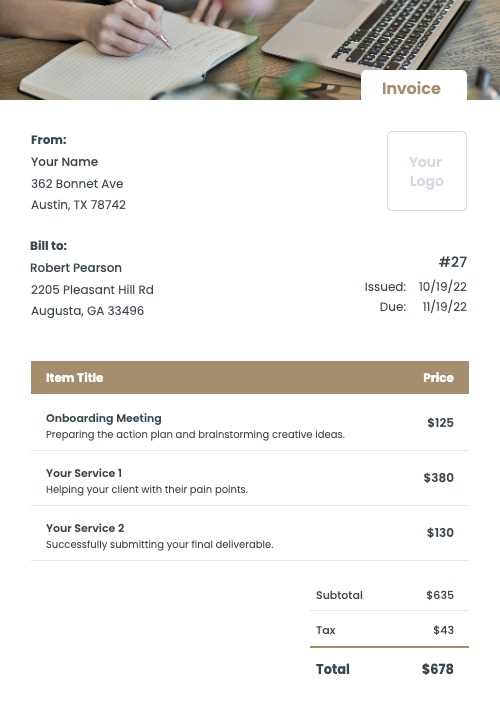

The first step in designing a payment document is to ensure it includes all the necessary information. Start by adding your business details, such as the name, contact information, and address. This helps establish trust and gives recipients a way to reach you if they have any questions. Next, include the payment amount, along with a clear breakdown of the services or products being billed. A detailed list makes it easier for clients to understand exactly what they’re paying for, reducing confusion.

Personalizing the Design and Layout

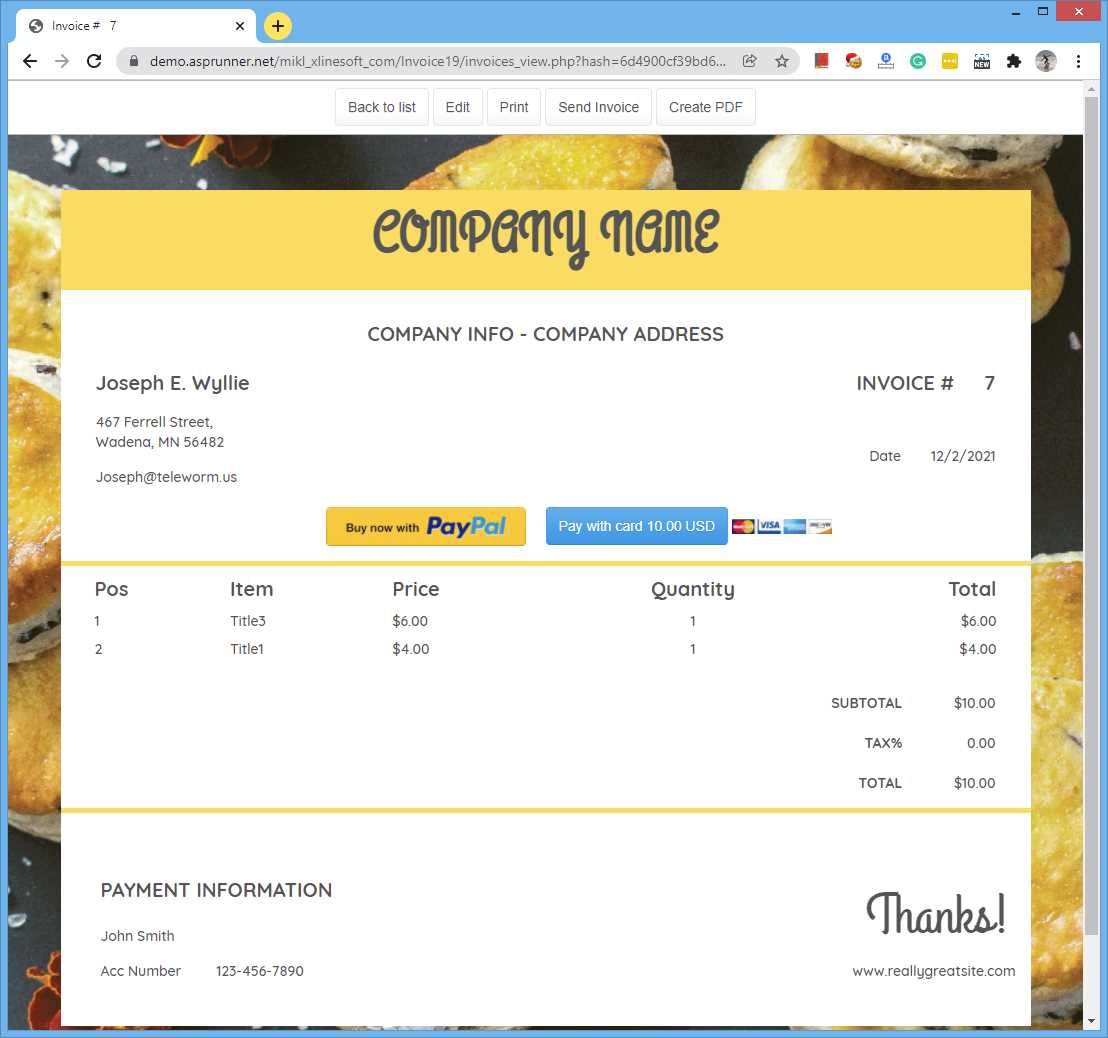

While the content is crucial, the design and layout are just as important. Make sure that the document is visually appealing and easy to read. This can be achieved by using clear fonts, appropriate spacing, and section headings. If your brand has a logo, consider adding it to the top for a more professional appearance. Consistency in design not only strengthens your brand identity but also makes the document more user-friendly for clients.

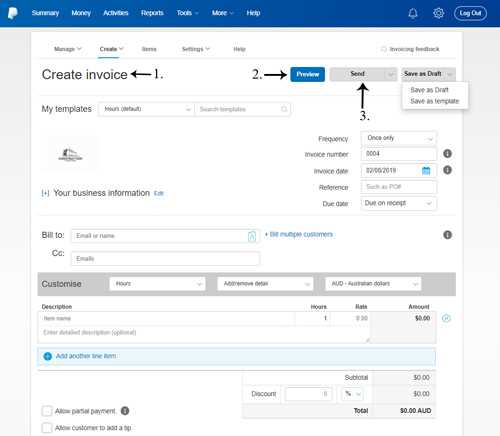

Step-by-Step Guide to PayPal Invoices

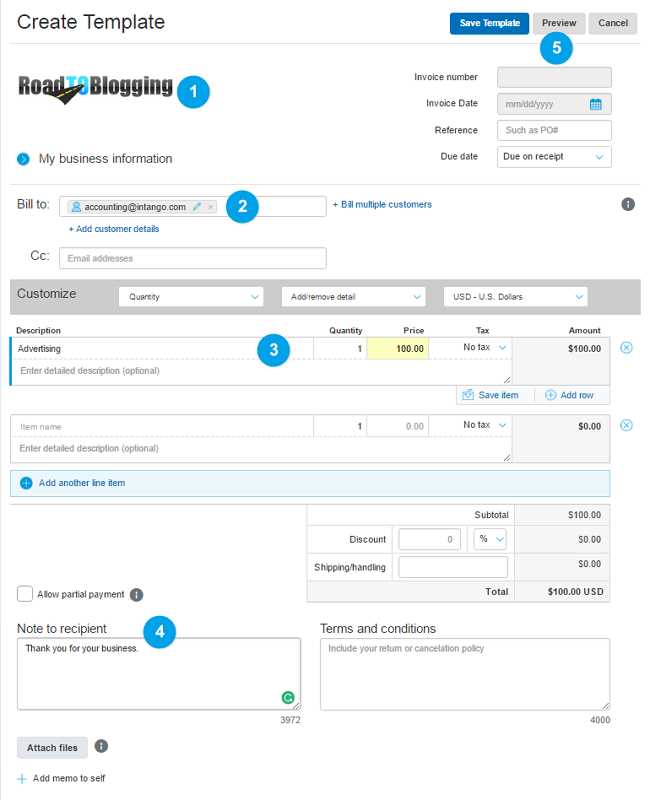

Designing and sending a professional payment request is a straightforward process that helps ensure smooth transactions. By following a few simple steps, you can efficiently generate a document that clearly outlines the details of the payment, reducing the risk of confusion or delays. This guide will walk you through the essential steps to create a polished billing request, from setting up the basics to customizing it for your specific needs.

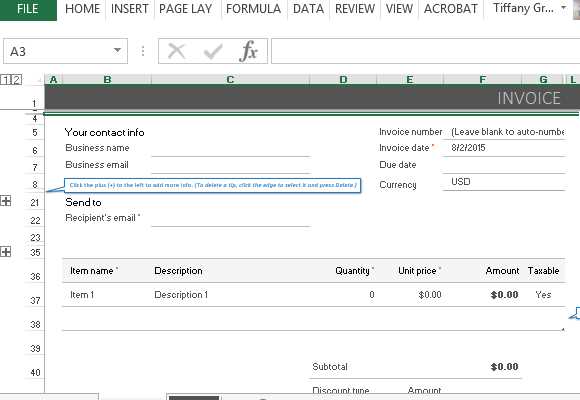

Step 1: Set Up Your Account

The first step in preparing any payment document is making sure your business account is fully set up. Ensure that your business information, including your name, email, and contact details, are correct and updated. This will ensure that your payment requests are professional and that your clients can easily get in touch with you if necessary.

Step 2: Add Payment Details

Once your account is ready, you can begin adding the essential details of the payment. Start by inputting the amount due and providing a clear description of the services or products being billed. Make sure to include any necessary taxes or discounts so the recipient can easily see the breakdown of charges. This transparency will help build trust and reduce the chances of disputes.

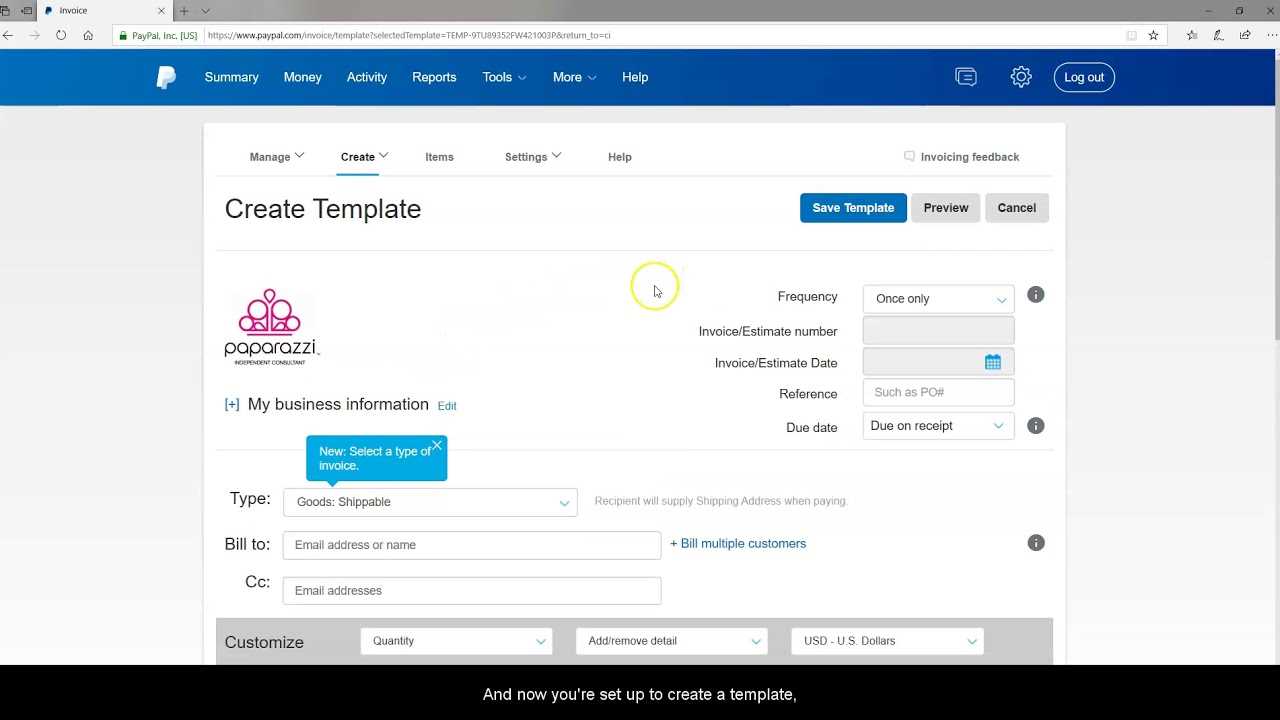

Step 3: Customize the Appearance

To make your billing document stand out, you can customize the design and layout to reflect your brand’s identity. Add your logo, choose a color scheme that matches your brand, and use easy-to-read fonts. A professional and visually appealing layout will not only make the request look polished but also create a positive impression on your clients.

Step 4: Review and Send

Before sending the payment document, review all the details carefully. Double-check the payment amount, client information, and any applicable terms or deadlines. Once everything looks good, you can easily send the document via email or share a link directly with your client for online payment. This simple process ensures that both you and the client are on the same page.

Understanding PayPal Invoice Templates

Having a pre-designed document to handle payment requests simplifies the process of managing transactions and ensures consistency in your communications with clients. Such a document is structured in a way that automatically includes key details, such as the amount owed, client information, and payment terms. This makes it easy to issue clear and professional payment requests every time, without the need to manually enter the same information over and over again.

Key Features of a Payment Request Document

These ready-made forms come with a set of built-in fields that are designed to capture the most important details for billing purposes. They allow you to add specific information, such as the due date, services or products provided, and any taxes or discounts. This structure reduces the chances of missing important data and ensures that the request is easy for clients to read and understand.

| Feature | Description |

|---|---|

| Business Information | Includes your company’s name, address, and contact details for clarity and professionalism. |

| Payment Breakdown | Shows the list of products or services provided along with their individual prices and the total amount due. |

| Terms & Conditions | Allows you to set up payment terms, including due date, late fees, or discounts for early payments. |

| Custom Branding | Customizable options for adding logos, colors, and fonts to match your company’s branding. |

Why Use Ready-Made Payment Forms?

These pre-made forms are designed to save you time and effort. With everything in place, you don’t have to worry about formatting or forgetting key details when creating a payment request. Additionally, they ensure that every document you send has a consistent, professional appearance, helping you to maintain a reliable and credible image with clients.

Customize Your PayPal Invoice for Clients

Customizing your billing document to suit each client can enhance the professionalism of your transactions and improve client satisfaction. A personalized request not only reflects attention to detail but also helps in building stronger relationships with your customers. By adjusting certain aspects of the document, you can cater to specific needs and preferences, making the payment process more transparent and efficient.

Personalization begins with your client’s information. Adding their name, business details, and contact info ensures the document feels tailored and personal. It also helps avoid any confusion, especially if you work with multiple clients or large teams. Additionally, incorporating specific payment terms–such as deadlines, late fees, or discounts–adds clarity and encourages prompt payments.

Another key customization is the inclusion of relevant service or product descriptions. Breaking down the charges in a way that matches your client’s expectations can increase transparency and reduce disputes. For example, if your client prefers detailed breakdowns, ensure each item is listed separately with corresponding amounts. You can also adjust the layout to highlight specific charges or important terms, giving the document a more organized and polished appearance.

Why Use PayPal for Invoicing?

Using an online platform for sending payment requests offers numerous advantages for both businesses and clients. Leveraging such a service simplifies the billing process, streamlines payment collection, and enhances overall efficiency. By choosing a trusted and widely-used platform, you can enjoy the benefits of secure transactions, easy tracking, and faster payments, all in one place.

Here are some of the key reasons why you should consider using an online service for generating payment requests:

- Ease of Use: The process of setting up and sending payment requests is intuitive, allowing you to focus on your work rather than spending time on administrative tasks.

- Security: With built-in encryption and fraud protection, your transactions are safeguarded, giving both you and your clients peace of mind.

- Professional Appearance: The platform offers ready-to-use formats that help you maintain a polished, professional image with minimal effort.

- Global Reach: Sending and receiving payments is easy across borders, with the option to handle multiple currencies, making it ideal for international clients.

- Automatic Payment Reminders: Set up automatic notifications to remind clients of pending payments, ensuring timely transactions.

In addition to these benefits, using a platform for managing payment requests integrates seamlessly with your existing accounting or financial systems. This not only saves time but also reduces the risk of human error in tracking payments and maintaining records.

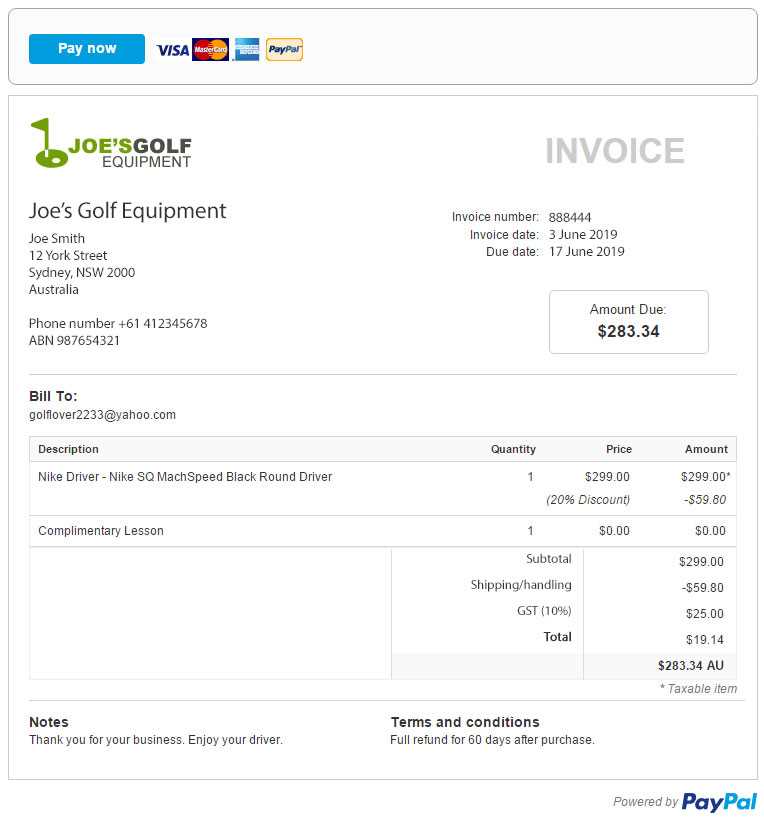

Key Elements of a PayPal Invoice

For any business or freelancer, sending clear and professional payment requests is essential to ensuring smooth financial transactions. A well-structured document should contain specific elements to communicate all the necessary details to the recipient. These elements help both parties understand what is being billed, the due date, and the terms of payment, reducing confusion and promoting timely payments.

Essential Information to Include

- Business Details: Your company name, address, and contact information should always be included. This helps establish your professionalism and provides the client with easy access to your information if needed.

- Client Information: It’s important to include the client’s name and contact details for easy reference and to ensure accuracy in the billing process.

- Itemized List of Services or Products: A clear breakdown of the services or goods provided with their corresponding prices is crucial. This transparency helps prevent misunderstandings and builds trust.

- Total Amount Due: The total amount should be clearly displayed, including any taxes, discounts, or additional charges, so the recipient knows exactly how much to pay.

- Due Date: Always include the payment deadline to ensure the recipient is aware of the expected timeframe for settling the amount.

Additional Features to Consider

- Payment Terms: Define any specific payment conditions such as late fees, discounts for early payment, or acceptable methods of payment.

- Invoice Number: A unique reference number helps you track and organize your billing records, making it easier to manage your accounts.

- Personalized Branding: Add your company’s logo, use custom fonts, or adjust colors to create a consistent look that reflects your brand’s identity.

- Notes or Messages: Include a brief note or thank you message to express appreciation to your client and foster positive relationships.

Incorporating these key elements into your payment request ensures that all the necessary information is included, helping you maintain a professional approach and reducing the likelihood of payment delays or disputes.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for billing can significantly streamline the payment process and improve overall business efficiency. By having a consistent and professional structure in place, you can save time, reduce errors, and ensure that all essential details are included every time you send a request for payment. These ready-made formats make managing your finances more organized and less stressful.

Time-Saving Advantages

Consistency is key when it comes to financial documents. With a pre-designed structure, you don’t have to manually input the same information over and over again. Fields for business details, payment terms, and amounts are already set up, allowing you to quickly fill in new client or transaction-specific data. This not only reduces the time spent creating requests but also minimizes human error.

Enhanced Professionalism and Accuracy

By using a well-organized document, you ensure that every communication with clients maintains a high level of professionalism. Clear formatting and detailed sections make it easy for recipients to understand the payment requirements, reducing the chances of confusion or missed payments. Accurate billing is crucial to maintaining trust, and having a consistent structure ensures that all important details are captured correctly.

Additionally, pre-designed billing formats often include built-in features like automatic tax calculations and payment reminders, which further enhance the accuracy and timeliness of transactions. This can result in faster payment cycles and a smoother cash flow for your business.

How to Add Your Logo to Invoices

Including your logo on payment requests is a great way to reinforce your brand identity and present a professional image to clients. Adding a custom logo not only enhances the appearance of your documents but also makes them instantly recognizable, helping you build trust and credibility. Fortunately, incorporating your logo into your billing documents is a simple process that can be done in just a few steps.

Steps to Insert Your Logo

- Step 1: Prepare your logo image file in a high-quality format (JPEG, PNG, or GIF) to ensure it looks clear and professional when added to the document.

- Step 2: Open your billing document editor or platform, and look for an option to insert an image or add a logo. This is often found in the header section of the document settings.

- Step 3: Upload your logo file to the platform, making sure it fits properly within the designated space. Adjust the size if needed to avoid stretching or distortion.

- Step 4: Position your logo appropriately, usually at the top or upper-left corner, where it will be most visible to the recipient. Ensure it doesn’t overcrowd other important information.

Best Practices for Logo Placement

- Keep it Simple: Ensure the logo doesn’t overpower the rest of the document. It should complement the content and not detract from key details like payment amounts or terms.

- Maintain Consistency: Use the same logo that appears on other business documents and communications to maintain a unified brand image.

- Choose the Right Format: Opt for a transparent background if possible, so your logo blends seamlessly with the document’s design, regardless of color.

By following these steps and best practices, you can easily incorporate your logo into your payment requests, elevating your brand’s visibility and ensuring that every document you send is professional and on-brand.

Setting Up Payment Terms in PayPal

Establishing clear payment terms is essential for ensuring both you and your clients are on the same page regarding when and how payments should be made. By defining these terms upfront, you can avoid misunderstandings, reduce delays, and maintain a steady cash flow. Payment terms can cover various aspects such as deadlines, late fees, accepted payment methods, and discounts for early payments. Setting these parameters in advance allows you to handle transactions smoothly and efficiently.

Key Payment Terms to Include

- Due Date: Specify the exact date by which the payment must be completed. Clearly communicate any grace period or exact deadline to avoid delays.

- Late Fees: If you charge fees for overdue payments, make sure to outline the penalty amount and the conditions under which they apply.

- Accepted Payment Methods: Indicate the types of payments you accept, whether it’s credit cards, bank transfers, or other online methods.

- Early Payment Discounts: If you offer a discount for payments made before the due date, specify the discount percentage and the time frame for it to apply.

- Partial Payments: If you allow for installment payments or deposits, include the terms for how these should be handled and the schedule for any remaining balances.

How to Set Up Payment Terms

- Step 1: Access your account settings and look for payment or billing options. You may need to navigate to the section for customizing payment details.

- Step 2: Enter your payment conditions in the appropriate fields. Be sure to include all relevant details such as due dates, fees, and any discounts for early payment.

- Step 3: Review the terms before finalizing. Double-check for any errors or missing information to ensure accuracy.

- Step 4: Save the payment terms for future use. They can be applied automatically to future billing requests or shared directly with clients when needed.

By clearly setting up these payment terms, you help ensure that both you and your clients are aware of your expectations. This can lead to faster, more efficient transactions and minimize potential disputes over payment schedules.

Automating Invoice Creation with PayPal

Automating the process of generating payment requests can save valuable time and reduce the risk of human error. With the right tools, you can streamline billing by automatically populating client details, payment amounts, and due dates. This allows you to focus on your work while ensuring that the payment process remains smooth and consistent, even for recurring clients or ongoing projects.

How Automation Can Improve Efficiency

By setting up automatic billing, you eliminate the need to manually enter information each time a payment request is issued. This can be especially helpful for businesses with a high volume of transactions or subscription-based services. With automation, essential fields like client name, service descriptions, and total due can be pre-filled, ensuring accuracy and consistency across all documents.

- Recurring Billing: Set up recurring payment schedules for clients who are billed on a regular basis. This reduces the administrative workload and ensures that payments are always on time.

- Payment Reminders: Automate reminders to be sent to clients before and after the payment is due, improving cash flow and reducing late payments.

- Customizable Templates: Use pre-designed formats that can be easily customized for different clients or services, saving time on document creation.

How to Set Up Automated Billing

To get started with automating payment requests, you’ll need to configure your system to handle recurring charges or generate automatic reminders. Most online billing platforms allow you to enter client information once, and then schedule payments to be sent out on a regular basis.

- Step 1: Log in to your account and navigate to the billing section where you can set up recurring payments.

- Step 2: Add the client’s payment details and select the frequency of the billing cycle (e.g., weekly, monthly, annually).

- Step 3: Review the payment schedule and confirm the automation settings.

- Step 4: Enable email reminders for clients so they receive notifications about upcoming or overdue payments.

Automating this process not only helps reduce the time spent on administrative tasks, but it also ensures that your clients receive consistent and timely payment requests, fostering a professional and reliable business environment.

Creating Recurring PayPal Invoices

Setting up recurring payment requests is a highly efficient way to handle ongoing transactions with clients who require regular billing. By automating the process, you can save time and ensure that payments are sent on schedule without manual intervention. Recurring payment requests are particularly useful for subscription-based services, memberships, or clients with long-term contracts, allowing you to maintain a consistent cash flow.

How Recurring Billing Works

With recurring billing, you define a set payment cycle, such as weekly, monthly, or annually, and the system automatically generates and sends payment requests based on the defined schedule. This ensures that your clients are invoiced regularly without requiring manual input each time. Additionally, it reduces the chance of human error and ensures your clients are charged consistently for services or products provided over time.

| Feature | Description |

|---|---|

| Billing Cycle | Choose the frequency of payments, whether it’s daily, weekly, monthly, or annually. |

| Automatic Payment Generation | Once set up, the system automatically generates and sends out payment requests according to the agreed-upon cycle. |

| Customizable Amounts | Set varying amounts for different billing periods, especially for services that change in price over time. |

| Payment Reminders | Automated reminders can be sent to clients to ensure they are notified before payments are due. |

| Recurring Payment Setup | Once a recurring schedule is set, the client can easily be charged automatically, reducing administrative work. |

Steps to Set Up Recurring Billing

- Step 1: Log into your account and navigate to the billing section where recurring payments can be configured.

- Step 2: Add the client’s details, including payment information and frequency preferences (weekly, monthly, etc.).

- Step 3: Define the amount to be billed for each cycle, whether it’s a fixed amount or variable depending on the services provided.

- Step 4: Set the payment start date and specify when the recurring payment should end, if applicable.

- Step 5: Review the setup and enable automatic invoicing. Your system will now automatically send requests to your client based on the schedule.

With recurring billing, your payment collection process becomes automated and predictable, ensurin

Invoice Customization for Different Currencies

When dealing with international clients or operating in multiple regions, it’s crucial to accommodate various currencies in your billing documents. Customizing payment requests to reflect the local currency of the client not only ensures accurate billing but also fosters trust and professionalism. Whether you’re working with fixed prices or variable rates, making adjustments for currency preferences helps simplify transactions and avoids confusion.

Why Customize Currency in Payment Requests?

Providing an invoice in the client’s local currency helps streamline the payment process, eliminating the need for clients to perform conversions or deal with exchange rate discrepancies. It also makes the document appear more professional and tailored to the client’s needs, reinforcing your brand’s credibility. Adapting your billing documents to local currencies can also help ensure that you comply with local tax regulations, as certain regions require specific currency formats or tax inclusions.

Steps to Customize for Multiple Currencies

- Step 1: Check the available currency options provided by your billing platform or service. Ensure the platform supports the currencies you need to accommodate for your international clients.

- Step 2: When setting up a payment request, select the appropriate currency based on the client’s location or preferences. Most platforms allow you to choose the currency at the time of creating the document.

- Step 3: Update the amounts to reflect the correct currency values. If applicable, adjust the total based on the exchange rates or any region-specific taxes.

- Step 4: Ensure that all currency symbols and formatting are correct. Some regions may have specific rules for how amounts should be displayed (e.g., comma vs. period as a decimal separator).

- Step 5: Double-check the final document for accuracy, ensuring that all figures match the client’s agreed-upon rates and that the currency is clearly indicated.

Best Practices for International Transactions

- Clear Currency Symbols: Always use the proper symbol for the currency to avoid confusion (e.g., $ for USD, € for EUR).

- Exchange Rate Transparency: If necessary, provide information about how exchange rates are handled to ensure your client understands the final amount.

- Tax Compliance: Make sure to include any necessary taxes in the local currency to comply with regional financial regulations.

- Regular Updates: Periodically review and update your payment terms and currencies to account for fluctuations in exchange rates or changes in tax laws.

Customizing your payment documents for different currencies not only improves the client experience but also helps ensure smooth transactions, compliance with local regulations, and accurate payments. By following these steps, you can effectively manage international billing while maintaining a professional and reliable service.

How to Send PayPal Invoices Quickly

Sending payment requests in a timely manner is crucial for maintaining cash flow and ensuring clients pay promptly. Automating and streamlining the process can significantly reduce the time spent preparing and sending documents. By following a few simple steps, you can quickly generate and send professional payment requests, ensuring your clients receive them as soon as possible, and avoiding unnecessary delays.

Steps for Fast Invoice Delivery

- Step 1: Use pre-filled billing formats. Many platforms offer customizable options where you can save client details, making it easier to quickly generate documents in the future.

- Step 2: Choose automatic payment request generation. Some systems allow you to set up automatic billing, ensuring payment requests are created and sent on specific dates without manual intervention.

- Step 3: Select email or instant messaging delivery. Most platforms enable you to send payment requests directly via email or messaging, ensuring immediate delivery to clients without delays.

- Step 4: Double-check client information. Always ensure that the correct contact details are used to avoid sending requests to the wrong email address, which could cause unnecessary delays.

- Step 5: Save and reuse previous documents. If you frequently bill the same clients, consider saving past requests as drafts to reduce setup time for new billing cycles.

Best Practices for Expedited Delivery

- Automate Payment Reminders: Schedule automatic reminders to be sent to clients before and after the payment due date, ensuring no payments are missed.

- Use Digital Payment Methods: Offer clients the ability to pay instantly through online methods to speed up the payment process once the request is sent.

- Track and Confirm Delivery: Ensure that each request sent is tracked and the client has received it. Some systems provide delivery confirmation, ensuring no payment request gets lost in transit.

By following these steps and leveraging automation tools, you can send payment requests faster, making the entire billing process more efficient and less time-consuming. This allows you to stay on top of your finances and improve client satisfaction by ensuring timely communication and payment.

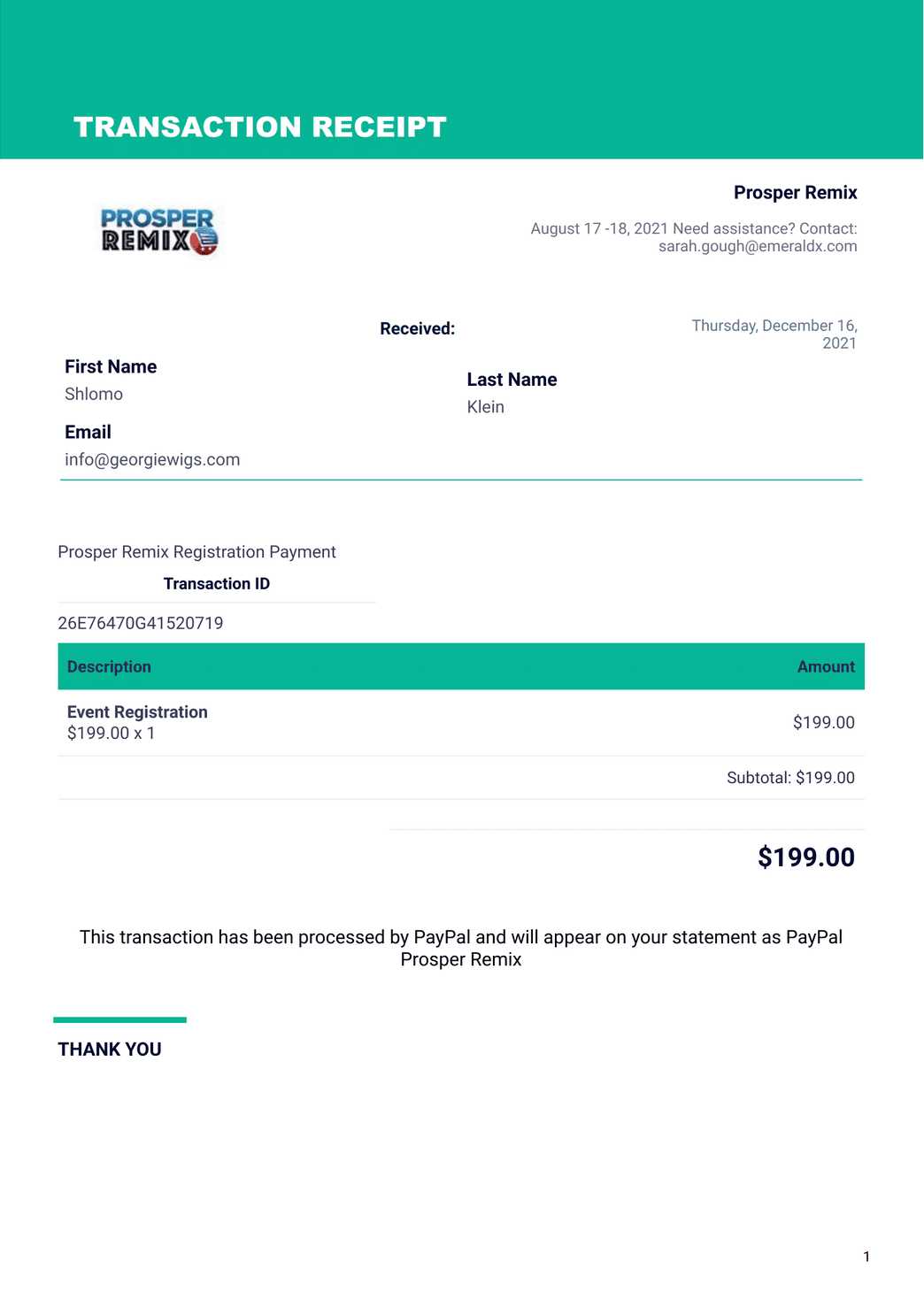

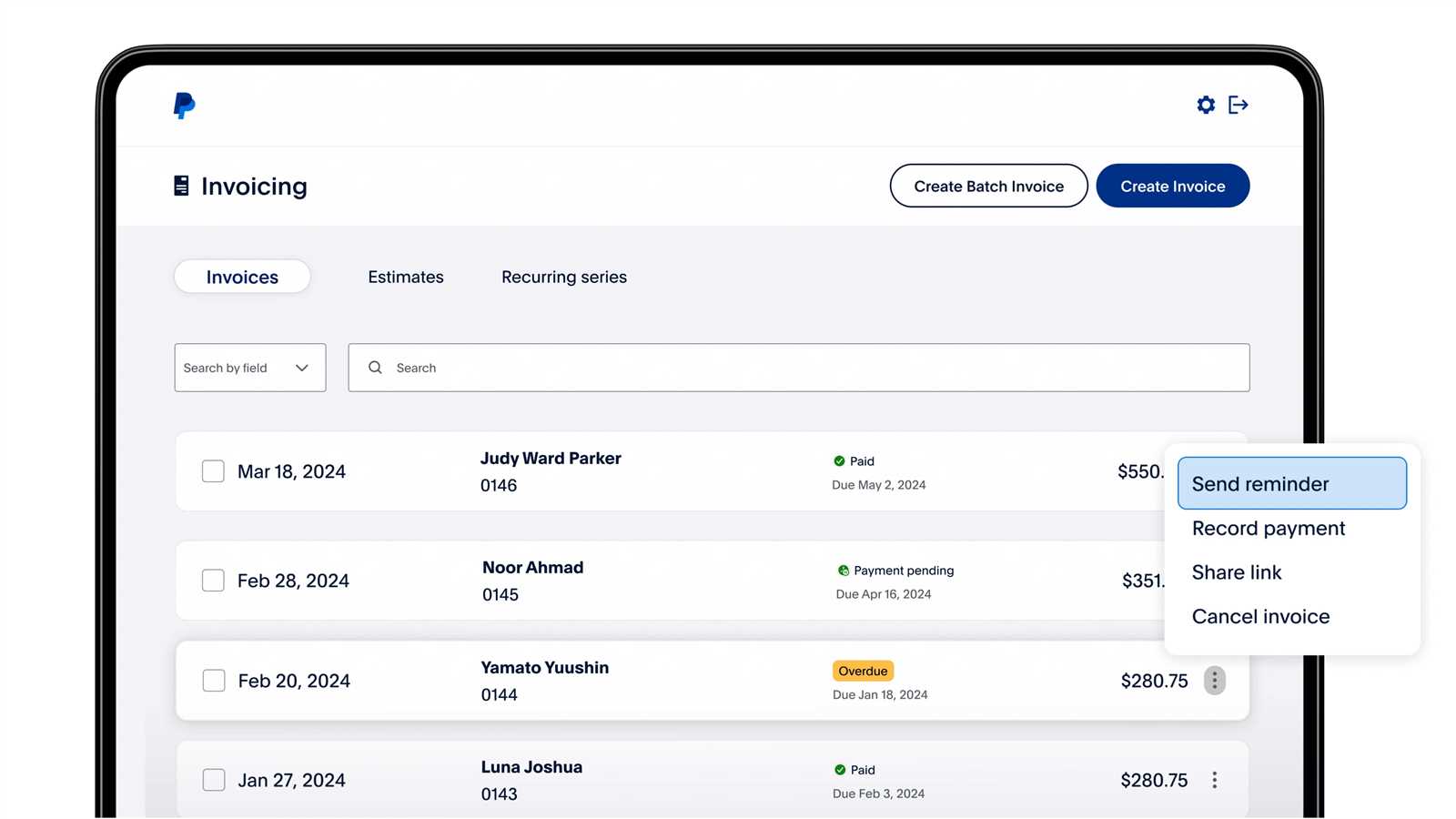

Tracking and Managing PayPal Invoices

Efficiently managing and tracking your billing documents is essential for keeping your finances organized and ensuring that you don’t miss any payments. By staying on top of issued requests, you can easily follow up on overdue payments, monitor the status of your transactions, and ensure that everything is properly recorded. Whether you’re handling a few clients or many, proper tracking helps you maintain a professional relationship and avoid any financial surprises.

Key Aspects of Managing Payment Requests

To effectively manage your billing process, it’s important to track the status of each payment request and have a system for organizing them. This includes keeping track of sent, paid, and overdue requests. Additionally, having the ability to quickly review past transactions can help with accounting, reporting, and resolving disputes if they arise.

| Status | Description |

|---|---|

| Sent | The request has been generated and sent to the client, but no payment has been received yet. |

| Paid | The client has completed the payment, and the transaction is confirmed. |

| Overdue | The payment is past the due date, and action may be needed to follow up with the client. |

| Partially Paid | The client has made a partial payment, and the remaining balance is still due. |

How to Track and Manage Payment Documents

- Step 1: Use an integrated platform that automatically tracks the status of each payment request. This ensures you don’t miss any updates and can quickly see if a request has been paid or is still outstanding.

- Step 2: Keep a detailed record of all sent requests, including the amount, due date, and any applicable taxes or fees.

- Step 3: Set reminders for follow-ups on overdue or partially paid requests to ensure that no payments slip through the cracks.

- Step 4: Keep a history of past transactions and payments, making it easier to generate financial reports or resolve any disputes that may arise.

- Step 5: Implement a system to send automated reminders to clients for upcoming or overdue payments, saving you time and effort in manual follow-ups.

By staying organized and using proper tracking tools, you ensure that your payment process runs smoothly. This approach not only minimizes the chances of errors but also helps build trust with clients by maintaining clear, timely communication about their payment obligations.

How to Include Taxes in PayPal Invoices

When providing goods or services, it’s often necessary to add applicable taxes to the final amount to ensure compliance with local tax laws. Including taxes in your payment requests is essential for transparency and accuracy. Understanding how to calculate and add these charges can help avoid any confusion and ensure your clients are aware of the total amount due, including taxes, before making a payment.

Steps to Add Taxes to Billing Documents

Incorporating taxes into your payment documents is relatively straightforward once you understand how to calculate the correct amount. You can apply a percentage-based tax, depending on the jurisdiction, and add it to the total amount of the service or product being charged. Depending on the platform, the tax can either be calculated automatically or manually entered into the document.

| Tax Type | Description |

|---|---|

| Sales Tax | Applied to the sale of goods or services. The rate varies based on the location of the transaction. |

| VAT (Value Added Tax) | A consumption tax added to goods or services, typically calculated as a percentage of the price. Common in many countries outside the U.S. |

| GST (Goods and Services Tax) | A tax applied in some countries like Canada and Australia, typically based on the value of the goods and services sold. |

| Service Tax | Specific to services provided rather than goods sold. It is calculated based on the value of the service being rendered. |

How to Calculate and Include Taxes

- Step 1: Determine the applicable tax rate based on the region or country of the client. This could vary significantly depending on local tax regulations.

- Step 2: Apply the correct tax percentage to the pre-tax amount of the goods or services being billed. This can usually be done by multiplying the subtotal by the tax rate.

- Step 3: Add the calculated tax amount to the total price of the payment request. Ensure the tax amount is clearly itemized to avoid confusion.

- Step 4: Include any relevant tax identification numbers or legal information that may be required by local tax authorities.

- Step 5: Double-check that all tax-related information is clearly visible on the payment request, ensuring compliance with local laws and fostering transparency with the client.

By following these steps, you can accurately calculate and include taxes in your payment requests. This ensures that you remain compliant with tax laws while providing clear and professional billing documents for your clients. Including taxes properly also helps avoid any misunderstandings or disputes over payment amounts.

Ensuring Professional Appearance of Invoices

Maintaining a professional appearance in your billing documents is crucial for building trust with your clients and reflecting the quality of your business. Well-designed and clear payment requests help establish credibility and ensure that your clients view your business as organized and reliable. The presentation of your documents can influence how clients perceive you, and a polished look goes a long way in making a positive impression.

Key Elements for a Professional Look

To ensure your payment documents are perceived as professional, there are several key elements to consider. These include the clarity of information, the inclusion of your branding, and the overall design. A clean and organized layout, along with a clear itemization of services and costs, contributes to a well-presented document that clients can easily understand and trust.

| Element | Description |

|---|---|

| Branding | Ensure your logo, business name, and contact details are prominently displayed to reinforce your brand identity. |

| Clarity | Use clear headings, well-organized sections, and readable fonts to make the document easy to understand and navigate. |

| Itemization | Provide a detailed breakdown of services or products, including quantities, prices, and any applicable taxes or discounts. |

| Formatting | Maintain a consistent layout with clean lines, professional fonts, and appropriate spacing to avoid clutter and ensure readability. |

Best Practices for Creating a Polished Payment Document

- Use Clear, Concise Language: Avoid jargon and ensure all descriptions are easily understood. This will prevent misunderstandings and show professionalism.

- Include Your Branding: Always incorporate your logo and company name, along with relevant contact information, so clients can easily identify your business.

- Organize Information Logically: Break the document into clear sections: client details, itemized list of services, and the total amount due. This ensures the payment request is both clear and easy to navigate.

- Check for Consistency: Ensure fonts, colors, and formatting styles are consistent throughout the document. Consistency in design reinforces your attention to detail.

- Proofread: Always check for spelling, grammar, or formatting errors before sending a document to a client. Mistakes can make your business appear unprofessional.

By following these best practices, you ensure that your billing documents maintain a high level of professionalism. A well-crafted payment request not only fosters trust but also positions your business as organized and reliable, ultimately contributing to long-term client relationships.

Common PayPal Invoice Errors to Avoid

When preparing and sending payment requests, it’s crucial to avoid common mistakes that can lead to confusion, delays, or even disputes with clients. Errors in the billing document can undermine your professionalism and may result in delayed payments or a loss of client trust. By understanding the typical mistakes that occur during the invoicing process, you can ensure your requests are clear, accurate, and processed efficiently.

Common Mistakes in Billing Documents

Even the smallest error in your payment documents can cause problems. From incorrect amounts to missing details, these mistakes can create unnecessary issues for both you and your clients. It’s essential to be thorough in every step of the process to avoid these pitfalls and maintain a smooth billing experience.

- Incorrect Client Information: Always double-check client names, addresses, and contact details. Sending a request to the wrong address or including incorrect client information can delay payments and create confusion.

- Missing or Incorrect Payment Amounts: Double-check that the amount listed matches the agreed-upon amount. Errors in pricing or forgetting to include taxes or discounts can lead to misunderstandings.

- Unclear Payment Terms: Ensure your payment terms are clearly stated. Not specifying due dates, late fees, or payment methods can lead to uncertainty about when and how to pay.

- Lack of Itemization: Not breaking down services or products into clear line items can confuse clients. Always include a detailed list of what’s being charged to provide transparency and avoid misunderstandings.

- Failure to Include Relevant Details: Don’t forget to include important information such as your business name, contact information, or tax identification number. Missing these details can make your payment request look unprofessional.

How to Avoid These Errors

- Review All Information: Before sending any payment request, double-check all fields for accuracy. This includes client details, service descriptions, payment amounts, and terms.

- Use Automated Tools: Consider using billing software that helps reduce human error by auto-filling client information and calculating totals, taxes, and discounts.

- Set Clear Payment Deadlines: Specify exact due dates and payment methods to ensure your clients know when and how to pay, preventing confusion and delays.

- Be Detailed and Transparent: Break down charges in a way that makes sense, so clients can see exactly what they’re paying for. This promotes trust and minimizes disputes over the billing amount.

- Proofread Your Documents: Always read over your payment requests carefully before sending. Small errors can make a big difference in client perception and payment processing.

By being mindful of these common errors and taking steps to avoid them, you ensure that your payment requests are clear, professional, and free of unnecessary mistakes. A well-prepared payment request fosters trust and encourages timely payments from clients.