How to Create a Business Invoice Template for Your Company

Creating an effective billing document is essential for any company that provides services or products. A well-structured form ensures clear communication with clients and helps streamline financial processes. By developing a reliable system, businesses can simplify the task of requesting payments, track transactions, and maintain a professional image.

When designing such a document, it’s important to focus on both functionality and appearance. The goal is to have a format that includes all necessary information without overwhelming the recipient. A thoughtfully designed form can improve client relationships, enhance payment processing, and reduce misunderstandings.

Efficiency is key–business owners and freelancers alike can benefit from a consistent, easy-to-use structure that saves time and effort. In the following sections, we’ll explore the elements needed to design a billing document that is clear, professional, and tailored to your specific needs.

How to Create an Invoice Template

Designing a payment request document requires a clear structure that ensures all essential details are included. A well-designed document not only helps in requesting payment from clients but also sets the tone for professionalism. The process involves selecting the right format, organizing key sections, and ensuring that the final version is easy to use and customize for future transactions.

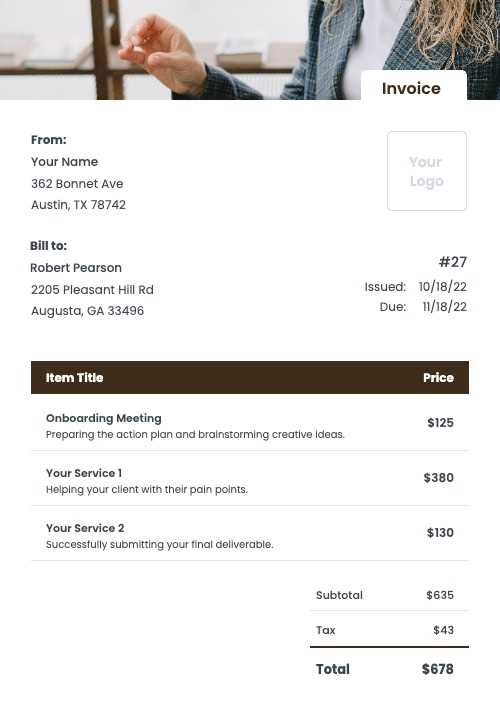

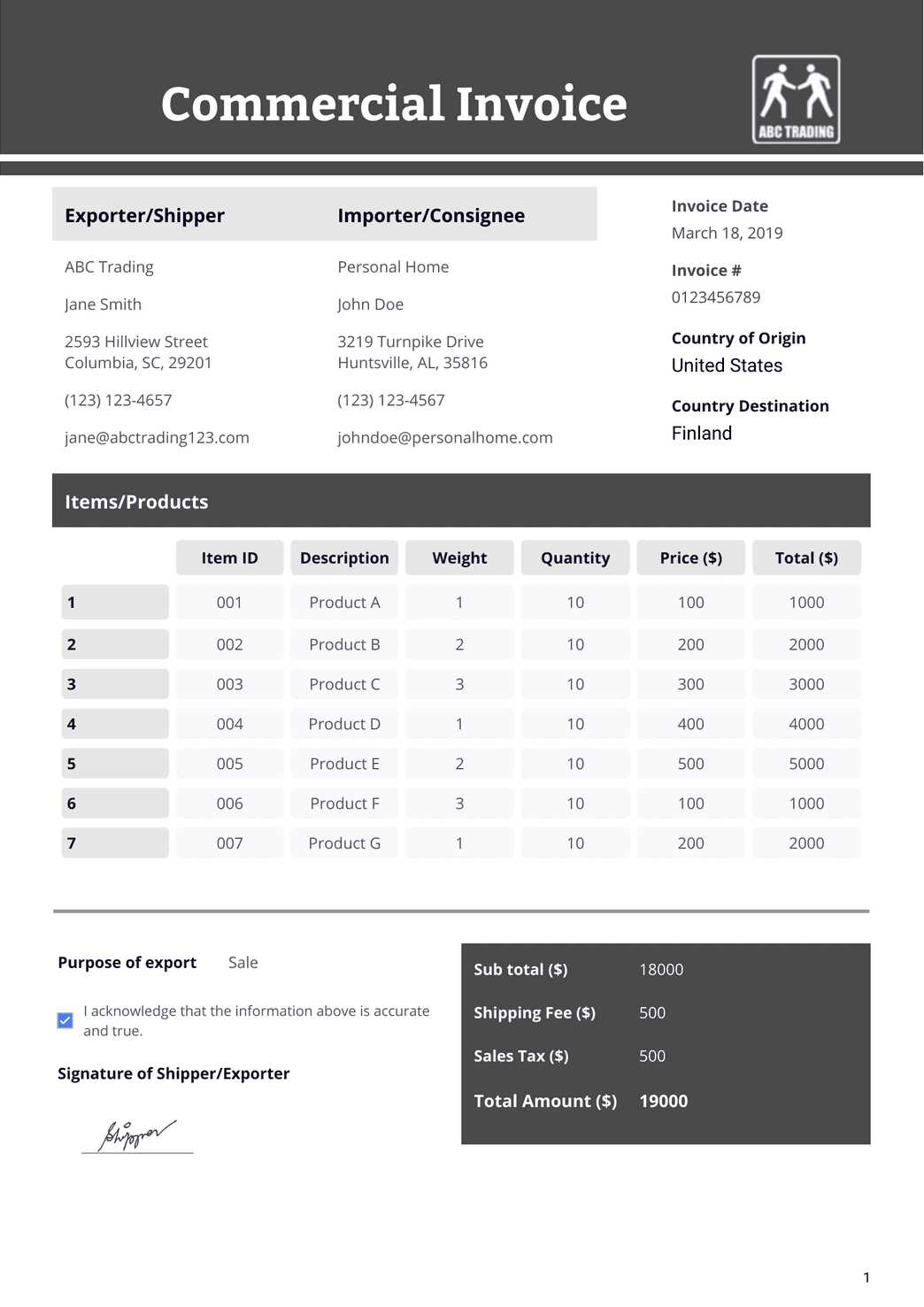

The first step in building such a document is to understand the critical components that need to be included. It’s important to feature sections for contact information, payment terms, and a breakdown of services or products. Below is a simple example of how these elements can be arranged in a user-friendly format:

| Section | Description |

|---|---|

| Header | Company name, logo, and contact details. |

| Client Information | Customer’s name, address, and contact details. |

| Date | Date of the document creation or transaction. |

| Description of Goods/Services | Detailed list of what was provided, including quantities and prices. |

| Amount Due | Total amount owed, including taxes and discounts if applicable. |

| Payment Terms | Specific conditions like payment deadlines and methods. |

| Footer | Any additional notes, such as payment instructions or company policies. |

Once you have decided on the sections, it’s time to lay them out in a clean, logical order. Make sure the document remains clear and readable, even when the content changes for different clients. This structure can be reused multiple times, saving valuable time with each new payment request.

Choosing the Right Format for Invoices

When designing a document to request payment, selecting the appropriate layout is crucial for ensuring clarity and professionalism. The format you choose should reflect the nature of your services or products, while also being easy to navigate for your clients. It should support clear communication and reduce the likelihood of misunderstandings during the payment process.

There are several factors to consider when selecting the layout for your document. The most important is whether the format is flexible enough to accommodate different types of transactions. For example, if your offerings change frequently or if you deal with multiple clients, a customizable structure is ideal. Additionally, the format should be easy to read, with a logical flow that makes it simple for clients to find the necessary details, such as payment amount and due date.

For most, digital formats such as PDFs or Word documents are recommended, as they are universally accessible and easy to distribute. However, for those managing large volumes of transactions, using software with automated features may save time and ensure consistency. In the end, choosing the right format depends on your specific needs and the preferences of your clients.

Essential Elements of an Invoice Template

A well-designed payment request document must include several key components to ensure that all necessary information is conveyed clearly and accurately. Each section serves a distinct purpose, helping both the sender and recipient understand the details of the transaction. These core elements not only facilitate smooth payments but also contribute to maintaining professionalism in your business communications.

Key Details for Identification

The most important elements include identification information for both the sender and the recipient. This typically includes names, addresses, and contact details. Clearly displaying this information ensures that there are no misunderstandings about the parties involved. Additionally, a unique reference number or transaction ID helps keep track of records and makes it easier for both parties to reference the document in the future.

Transaction Breakdown and Payment Terms

Another essential part of any payment request document is the transaction breakdown. This section should list the services or goods provided, along with quantities and individual prices. It is also crucial to include payment terms, such as the total amount due, due date, and accepted payment methods. A clear structure of the transaction and terms will minimize any confusion and speed up the payment process.

Why Customize Your Invoice Template

Personalizing your payment request document is a powerful way to enhance your professional image and ensure that all your unique needs are met. Customization allows you to tailor the layout and content to better represent your brand and provide clear, relevant information to your clients. By adjusting the design, structure, and details, you can create a document that is not only functional but also aligned with your specific requirements.

Here are some key reasons to personalize your document:

- Brand Consistency: Including your logo, company colors, and fonts ensures that your communication is consistent with your brand identity.

- Clarity and Relevance: Tailoring the sections allows you to focus on the most important information, reducing unnecessary clutter and making it easier for clients to understand the details.

- Professional Image: A custom-designed document presents a polished, organized image, making your company seem more reliable and trustworthy.

- Flexibility: A personalized document can be adapted to different types of services, payment structures, or specific client needs, saving time on repetitive adjustments.

- Legal and Tax Compliance: Customizing the layout allows you to incorporate region-specific legal or tax requirements, ensuring you meet local regulations.

By personalizing your payment request format, you not only improve efficiency and client relationships but also make a lasting impression that can set your services apart from competitors.

Understanding Invoice Numbering Systems

Establishing a clear and consistent numbering system for payment documents is essential for efficient record-keeping and organization. A well-structured numbering system helps both the issuer and the recipient keep track of transactions, facilitates easy retrieval of past records, and can aid in tax and financial reporting. It also provides an additional layer of professionalism to your communication.

There are several approaches to numbering your documents, each with its own benefits. The key is to choose a system that suits your workflow, ensures unique identifiers, and maintains clarity. Below are some common methods used for organizing document numbers:

- Sequential Numbering: The simplest system where each document is assigned the next available number in a series (e.g., #001, #002, #003). This is easy to implement and ensures that no numbers are skipped.

- Date-Based Numbering: This method incorporates the date into the document number, helping you track when the transaction occurred (e.g., 2024-001, 2024-002). It provides a time reference that can be useful for organizing documents by year or quarter.

- Client-Based Numbering: A system that includes a client-specific code or abbreviation followed by a sequential number (e.g., ABC-001, XYZ-002). This method is useful if you have multiple clients and want to easily identify which client the document belongs to.

- Category-Based Numbering: For businesses offering different types of services, a category prefix can be used to differentiate between various types of transactions (e.g., SRV-001 for services, PROD-001 for products). This helps organize different transaction types under one system.

Whichever numbering system you choose, it’s important to maintain consistency and avoid duplication. You should also consider whether your system needs to be flexible enough to accommodate future changes, such as adding new clients or expanding services. A clear and organized numbering system will streamline your operations and ensure that your records remain accurate and accessible.

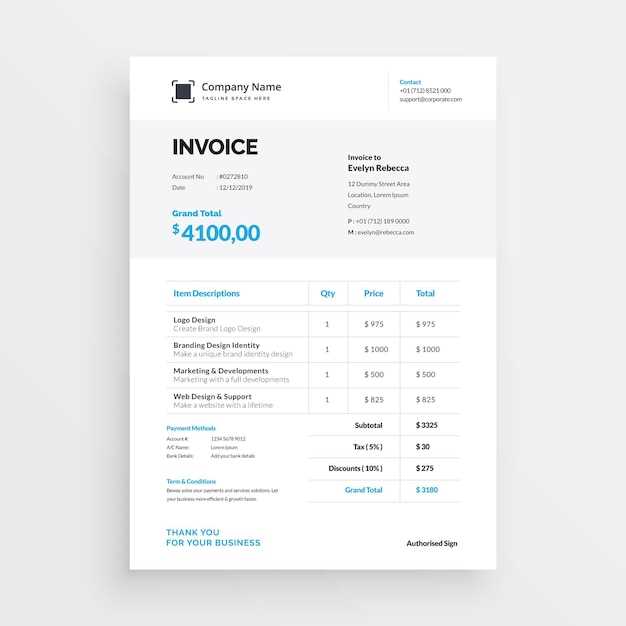

Adding Company Branding to Invoices

Incorporating your company’s identity into every aspect of communication, including payment requests, helps reinforce your brand image and ensures consistency across all touchpoints. By customizing your document with brand elements, you not only make the transaction more professional but also create a lasting impression with your clients. Adding your logo, colors, and fonts can make the document feel cohesive and aligned with your overall marketing strategy.

Logo and Color Scheme

One of the most powerful ways to showcase your brand is by including your company’s logo and using consistent colors throughout the document. Placing the logo prominently at the top ensures immediate recognition and gives the document a polished look. Likewise, choosing brand colors for headings, borders, or section highlights creates a visually cohesive design that reinforces your company’s identity.

Font Selection and Layout

Along with visuals, the font style and layout are crucial in maintaining a professional appearance. Use fonts that are consistent with your branding guidelines and ensure they are easy to read. Avoid overcomplicating the layout–keep it simple, with sufficient white space, and structured sections that match your brand’s design standards. By doing this, you convey clarity and professionalism while reinforcing your brand’s personality.

Incorporating these elements into your documents not only enhances brand recognition but also helps foster a sense of trust and reliability with your clients. It’s a small touch that can make a big difference in how your company is perceived.

How to Include Payment Terms Clearly

When requesting payment, it’s crucial to outline the conditions clearly to avoid confusion and ensure both parties understand the expectations. Well-defined payment terms help establish trust and can prevent disputes later on. By providing clear details about due dates, acceptable payment methods, and any penalties for late payments, you can create a transparent and professional experience for your clients.

To include payment terms effectively, it’s important to be specific and concise. Here are some key aspects to cover:

- Due Date: Specify the exact date by which payment should be received. You can also offer a time frame (e.g., within 30 days of the transaction date).

- Accepted Payment Methods: Clearly list the payment methods you accept, whether it’s bank transfer, credit card, PayPal, or other options.

- Late Payment Penalties: If applicable, include information about any late fees or interest charges that may apply if the payment is not made on time.

- Discounts for Early Payment: Some companies offer a discount for early settlement. If you have such a policy, make sure to include this incentive as well.

- Currency: Specify the currency in which the payment should be made, especially if you’re dealing with international clients.

By incorporating these details in a clear, easy-to-read format, you ensure that your clients know exactly what to expect and reduce the risk of payment delays. Make sure to place the payment terms in a prominent position within your document, such as near the total amount due, so that they are not overlooked.

Choosing the Right Invoice Software Tools

Selecting the right software for managing payment requests is essential for streamlining your financial processes. The right tool can save you time, reduce errors, and ensure that you’re able to quickly generate accurate and professional-looking documents. With so many options available, it’s important to consider factors such as ease of use, customization options, and integration with other business systems.

Here are some key features to look for when choosing the best software for generating payment documents:

- User-Friendly Interface: The software should be intuitive, allowing you to create and send documents without a steep learning curve.

- Customization Options: Look for tools that allow you to add your company logo, change colors, and modify the layout to match your branding.

- Automated Features: Many software solutions offer automation features, such as automatic numbering, recurring billing, and email reminders, which can save time and reduce manual work.

- Payment Integration: Consider software that integrates with popular payment platforms like PayPal, Stripe, or bank transfers, allowing clients to pay directly from the document.

- Tracking and Reporting: The tool should help you track outstanding payments, generate financial reports, and manage overdue accounts easily.

- Cloud-Based Accessibility: Cloud-based software allows you to access your documents from anywhere, which is useful for businesses with remote teams or multiple locations.

By considering these features and selecting the right tool for your needs, you can streamline the creation and management of your payment requests. The right software can also enhance your professionalism and make it easier for clients to complete their transactions on time.

Design Tips for Professional Invoices

Designing a well-structured and visually appealing payment request document is crucial for leaving a lasting impression on clients. A polished, professional look not only enhances credibility but also makes the document easier to read and understand. Simple design choices, such as spacing, font selection, and layout, can make a big difference in how your document is perceived.

Key Design Elements to Consider

To ensure your document stands out while maintaining a clean and professional appearance, consider the following design tips:

- Consistent Layout: Use a clear and logical layout that guides the reader through each section. Group related information together, such as client details and payment breakdowns, to make it easy for clients to navigate the document.

- Legible Fonts: Choose simple, easy-to-read fonts. Avoid decorative or overly stylized fonts, as they can detract from the professionalism of the document. Sans-serif fonts like Arial or Helvetica are commonly used for clarity.

- Use of White Space: Don’t overcrowd the document with information. Proper spacing between sections and text ensures that the document looks organized and is easy to read.

- Alignment and Margins: Properly align text and use consistent margins to ensure a balanced, symmetrical appearance. Misaligned elements can make your document look messy and unprofessional.

- Contrast and Readability: Make sure there is enough contrast between text and background. Light text on a dark background or dark text on a light background is best for readability.

Adding a Personal Touch

While it’s important to maintain a professional tone, adding small personal touches can help differentiate your document. Consider incorporating your company’s color palette or logo to reinforce your brand identity. However, ensure that these elements do not overwhelm the primary content of the document.

By following these design tips, you can ensure that your payment requests are both functional and visually appealing. A professional document not only helps in receiving timely payments but also strengthens your relationship with clients by demonstrating attention to detail and professionalism.

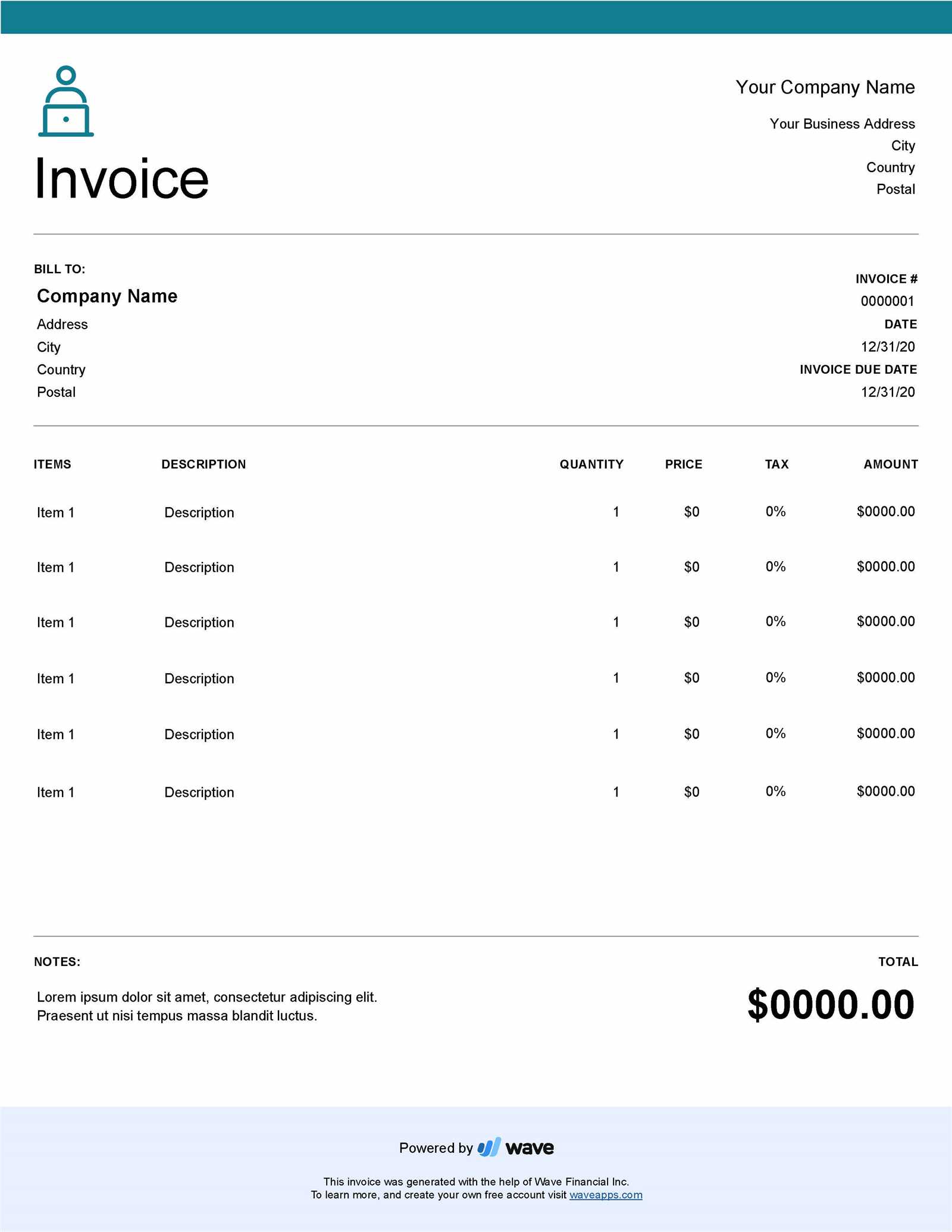

How to Create an Invoice in Word

Using a word processing program like Microsoft Word is a convenient and accessible way to design a professional document to request payment. Word offers various features that allow you to customize the layout, add necessary details, and ensure the document is clear and easy to read. With just a few steps, you can create a personalized document that looks polished and aligns with your needs.

Here’s a simple guide to help you build a well-organized payment request document in Word:

- Open a New Document: Start by opening a blank document in Word. You can either use a built-in layout or design one from scratch, depending on your preference.

- Insert Header Information: At the top of the document, include your company or personal details, such as name, address, phone number, and email. You may also want to add your logo if available.

- Client Information: Below your information, leave space for the client’s details, including their name, address, and contact information. This ensures that both parties are clearly identified.

- Transaction Details: Add a section to list the services or products provided. Include a description of each item, quantity, individual prices, and any applicable taxes. Use a table to neatly organize this information.

- Amount Due: After the transaction details, include a subtotal, followed by the total amount due. Make sure to clearly indicate any additional charges or discounts applied.

- Payment Terms: Include the payment due date, accepted methods of payment, and any other relevant terms, such as late fees or early payment discounts.

- Footer: In the footer, you can add additional information such as payment instructions, your company’s bank details, or a thank-you note for the client’s business.

Once you’ve filled in all the necessary information, review the document for accuracy and ensure it is formatted neatly. Word provides tools for adjusting spacing, alignment, and font styles to make the document visually appealing and easy to read. Once you’re satisfied with the design, save the document and share it with your client via email or print it out for physical delivery.

Using Word to design payment documents is an excellent option if you want flexibility and simplicity. It’s a straightforward process that allows you to generate professional-looking documents quickly while maintaining control over the content and format.

How to Create an Invoice in Excel

Excel is a powerful tool for generating detailed and organized payment documents. Its grid structure makes it easy to arrange the necessary information in a clear and logical way. With Excel, you can customize the layout, automate calculations, and ensure accuracy, which makes it a great option for tracking and managing transactions.

Follow these steps to design an effective document using Excel:

- Open a New Workbook: Begin by launching Excel and opening a blank workbook. Start with a clean slate so you can customize the document to your needs.

- Set Up Your Header: In the top rows, add your company or personal details, such as name, address, phone number, and email. Use bold text or larger font sizes to highlight this information, ensuring it stands out.

- Client Information: In the next section, input the client’s details, including their name, company name (if applicable), address, and contact info. This will clearly identify both parties in the transaction.

- Transaction Details: Create a table for listing the products or services provided. Include columns for descriptions, quantities, unit prices, and subtotal for each item. Excel’s grid layout makes it easy to align and manage this information neatly.

- Automatic Calculations: Use Excel’s built-in formulas to automatically calculate subtotals, taxes, and the total amount due. For instance, use the SUM function to total the price column, and the formula for calculating taxes to avoid manual errors.

- Payment Terms: In a separate section, outline the payment terms. Include the due date, acceptable payment methods, and any late payment penalties or early payment discounts. This section ensures the client understands the expectations for timely payment.

- Footer Section: Add a footer with your payment instructions, bank details, or a polite thank-you note to the client. This is also a good place to include additional information, such as your business’s tax identification number if required.

Excel’s flexibility and functionality allow you to customize the document as needed. You can adjust the column widths, apply colors or borders for clarity, and even use templates to speed up the process. Once you’ve completed the design, save the document as a template for future use, or export it as a PDF for easy sharing with your clients.

Excel makes it simple to design and track detailed payment requests, while also offering powerful tools for ensuring accuracy and consistency across your documents. Whether you are managing a few clients or many, it provides the flexibility and organization necessary to handle payments efficiently.

Saving Your Invoice Template for Reuse

Once you have designed your payment request document, saving it for future use is a practical way to streamline your workflow. Instead of starting from scratch each time, having a reusable version allows you to quickly generate accurate documents while maintaining consistency across transactions. By saving your layout, you ensure that all necessary fields and formatting are ready for each new client or project.

Here are some effective methods to save and organize your document for easy reuse:

- Save as a Template File: In programs like Microsoft Word or Excel, you can save your document as a template file (.dotx or .xltx). This way, every time you open the file, it’s ready to be filled with new client information and transaction details, without altering the original design.

- Use Cloud Storage: By storing your file in cloud storage services such as Google Drive or Dropbox, you can access it from anywhere. This is especially helpful if you’re working from multiple devices or need to share the document with a team.

- Organize by Categories: If you manage different types of transactions or clients, it can be useful to organize your saved documents by categories. For example, you can create separate folders for different services, clients, or regions, making it easier to find the right version when needed.

- Save Versions with Date References: If you need to keep track of updates or changes over time, consider saving multiple versions of your document with date references in the filename. This allows you to keep a history of changes, which can be useful for auditing purposes or reviewing past transactions.

- Automate with Software: If you’re using invoicing software, many tools allow you to save and reuse customized layouts. You can set up reusable fields and even automate the population of client details for future use, saving you time and reducing errors.

By saving your payment request documents for reuse, you minimize the time spent on administrative tasks and maintain a professional and consistent appearance in all your communications. Reusable templates ensure that you can focus on the important aspects of your work, while the layout remains standardized and easy to manage.

Common Mistakes to Avoid in Invoices

Even small errors in your payment request documents can lead to confusion, delayed payments, and a lack of professionalism. It’s important to ensure that all details are accurate and clearly presented. By avoiding common mistakes, you can enhance client satisfaction and streamline your financial processes.

Here are some frequent errors to watch out for when preparing your documents:

- Incorrect Contact Information: Always double-check that both your details and the client’s information are correct. An incorrect phone number or email address can delay communication and payment processing.

- Missing or Incorrect Dates: Ensure that the date of the transaction, as well as the payment due date, are clearly specified. Missing or inaccurate dates can lead to misunderstandings about payment deadlines.

- Failure to Itemize Charges: Clearly break down the products or services provided, including quantities and individual costs. Lack of transparency in pricing can cause confusion and disputes over the total amount due.

- Omitting Payment Terms: Be sure to specify the terms of payment, including the accepted methods, late fees, or discounts for early payment. Failing to outline these can result in delayed payments or missed opportunities for timely settlement.

- Using Unclear or Complex Language: Keep the language simple and professional. Avoid jargon or overly complex terms that could confuse the recipient. The goal is for the document to be easily understood at a glance.

- Not Including a Unique Identifier: Each document should have a unique reference number. Without it, tracking payments and maintaining accurate records can become a challenge.

- Formatting Issues: Poor alignment or overcrowding text can make the document hard to read. Ensure that there is sufficient spacing between sections and that the text is well-aligned for a clean, organized look.

- Failure to Proofread: Always review your document before sending it. Typos, incorrect calculations, or missing information can make you appear unprofessional and could cause problems down the line.

By paying attention to these common mistakes and taking steps to avoid them, you can ensure that your payment request documents are clear, accurate, and professional. This not only helps in maintaining positive client relationships but also speeds up the payment process.

How to Automate Invoice Creation

Automating the process of generating payment request documents can significantly save time and reduce human error. By implementing automation, you can streamline repetitive tasks, ensure consistent formatting, and speed up the billing cycle. This can be particularly beneficial for businesses with a high volume of transactions or recurring clients.

Here are some steps and tools that can help automate the generation of these documents:

- Use Accounting Software: Accounting tools like QuickBooks, Xero, or FreshBooks offer automated features to generate detailed payment requests based on your input. Once you set up your client and product details, these programs can automatically create documents, calculate totals, and even send them directly to clients.

- Set Up Recurring Billing: For ongoing clients or subscriptions, you can automate the creation of regular payment requests. Most accounting software allows you to create recurring billing schedules, which automatically generate and send documents at set intervals.

- Integrate with Payment Platforms: Many platforms, such as PayPal or Stripe, allow for automated document generation when a transaction occurs. By linking your payment processor to your accounting or invoicing software, the system can automatically generate a payment request after each sale.

- Use Custom Scripts or Macros: If you’re working with spreadsheets like Excel, you can set up custom scripts or macros that will automatically fill in the client details, product descriptions, and pricing. This can save significant time when generating documents for repeat clients.

Example: Automating an Invoice with Excel

| Step | Action |

|---|---|

| Step 1 | Input basic client details and items into the spreadsheet. |

| Step 2 | Use formulas to automatically calculate totals, taxes, and discounts. |

| Step 3 | Set up a macro that will generate a PDF version of the document for easy emailing. |

| Step 4 | Save the document as a template for future use with other clients. |

By automating the creation of payment documents, you can ensure timely and accurate billing while reducing the manual work involved. This approach not only saves time but also increases efficiency and reduces the chance of mistakes in the payment process.

Ensuring Your Template Is Mobile-Friendly

In today’s digital world, many clients and customers prefer to access documents on their smartphones or tablets. As a result, ensuring that your payment request document is mobile-friendly is essential for a smooth user experience. A well-optimized document allows clients to easily view, understand, and act on the request, even when they are on the go.

Here are some tips to ensure your document looks great on mobile devices:

1. Simplify the Layout

- Keep it Clean: Avoid cluttering the document with too many elements. Stick to the essential information, such as client details, product descriptions, and the total amount due.

- Use a Single Column: A single-column layout is ideal for mobile screens, as it allows the content to flow naturally without the need for horizontal scrolling.

- Large, Readable Fonts: Use larger font sizes for key information like amounts and due dates to ensure they are easy to read on small screens.

2. Optimize for Different Devices

- Responsive Design: If you’re using a digital tool to generate your document, make sure it’s set to automatically adjust for different screen sizes. This ensures that the layout looks good on both desktop and mobile devices.

- Test Across Devices: Before sending a payment request, test how the document looks on various devices (smartphones, tablets, desktops) to ensure that the layout holds up across all platforms.

By making your document mobile-friendly, you’re improving your client’s experience and increasing the chances of timely payments. A responsive, easy-to-read document ensures that your clients can access and process their payment quickly, no matter where they are.

Best Practices for Invoice Formatting

Properly formatting your payment request document is essential for ensuring clarity, professionalism, and smooth communication with clients. A well-structured document not only makes it easier for your clients to understand the charges but also improves the likelihood of timely payments. In this section, we’ll discuss key formatting practices to help you present a clear and professional payment request.

1. Use Clear and Logical Structure

- Start with Basic Information: Place essential details, such as your company name, address, and contact info, at the top of the document. Follow this with your client’s details to ensure easy identification.

- Break It Into Sections: Organize the document into distinct sections, such as the list of products/services, taxes, total amount, and payment instructions. This helps the reader easily locate the information they need.

- Include a Unique Identifier: Assign a unique reference number for each request. This will help both you and your client track the payment and avoid confusion in future correspondence.

2. Keep It Legible and Simple

- Use Consistent Fonts and Sizes: Choose a clean, readable font (e.g., Arial, Times New Roman) and use it consistently throughout the document. Make sure the font size is large enough to be legible on both mobile and desktop screens.

- Avoid Overcrowding: Ensure that there is sufficient spacing between sections and items. Use white space effectively to make the document less dense and easier to read.

- Highlight Key Information: Bold or underline important details like the total amount due and due date to make them stand out. This ensures clients can quickly spot the most critical pieces of information.

By following these best practices, you can ensure that your payment request documents are professional, easy to read, and likely to facilitate smooth transactions. A well-formatted document helps build trust with clients and promotes a positive payment experience.

How to Use Invoice Templates for Multiple Clients

Managing payment requests for different clients can quickly become overwhelming, especially if you handle a large number of transactions. However, by using a standardized format, you can simplify the process and save time while maintaining consistency across all your documents. Reusable layouts allow you to quickly adapt them to each client without starting from scratch every time.

Here are some steps for efficiently using a single layout across multiple clients:

- Standardize Key Information: Start with a basic structure that includes placeholders for essential information such as client name, address, payment details, and due date. This allows you to quickly update specific details for each client while keeping the overall layout intact.

- Use Dynamic Fields: Many tools, such as Microsoft Word or Excel, allow you to insert dynamic fields for client-specific information. This means that once you input your client’s name and details, they automatically populate in the right places throughout the document.

- Save Versions with Client Details: After generating the document for a particular client, save it with a unique file name (e.g., client name and date) so that you can easily find it later. This avoids any confusion between clients and helps you track payments efficiently.

- Customize Each Document: While the general format remains the same, it’s important to customize each document with client-specific details such as the product or service list, pricing, and any applicable discounts or payment terms. Personalization can help avoid errors and ensure that each document meets the client’s needs.

- Use Invoicing Software: If you’re dealing with many clients, consider using invoicing software that allows you to store reusable layouts and automatically fill in client-specific information. Software tools can also automate the sending and tracking of these documents, saving time and reducing manual work.

By using reusable payment request structures, you can streamline your workflow, maintain consistency, and avoid the need to re-enter common details for each client. This approach saves time and ensures that each document is accurate and professional, no matter how many clients you handle.

Legal Considerations for Invoice Templates

When preparing payment requests, it is essential to ensure that all documents comply with the relevant laws and regulations. A legally sound document helps protect both the provider and the client, ensuring clarity and minimizing the potential for disputes. Understanding what information must be included, as well as how to structure the document, is key to avoiding legal complications.

Key Legal Elements to Include

- Accurate Business Information: Ensure that your document includes your full legal business name, address, and contact details. This helps identify your business and ensures that it can be traced back in case of a dispute.

- Clear Payment Terms: State the payment deadline, any late fees, and applicable taxes. Clearly define whether the amount is due immediately or on a specific date. It’s also essential to outline acceptable payment methods.

- Legal Tax Details: If applicable, include tax registration numbers (e.g., VAT or GST ID) and specify the tax rate being applied to the goods or services. This ensures that tax laws are properly followed.

- Unique Reference Number: Every document should have a unique number for identification and record-keeping. This is critical for both your accounting system and any legal references if a dispute arises.

Compliance with Local Laws

- Know Your Local Regulations: Different countries and regions have varying requirements for payment request documents. Be sure to familiarize yourself with local laws concerning billing, taxes, and payment terms. This is especially important if you are dealing with international clients.

- Retain Documentation: Maintain a record of all documents sent and received. Legal requirements often mandate that you keep these records for a certain period of time, which could range from several months to years, depending on your jurisdiction.

- Client-Specific Requirements: Some clients may request specific terms or document formats, especially in regulated industries. It is important to understand and accommodate these needs to avoid legal complications or payment delays.

By ensuring that your payment request documents are legally sound, you protect your rights as a provider while maintaining transparency and trust with your clients. Proper documentation helps prevent disputes and fosters a positive business relationship.