Cost Plus Invoice Template for Efficient and Transparent Billing

For businesses that provide services or project-based work, creating accurate and transparent billing can be a challenge. In such cases, an approach that reflects both time and expenses incurred is essential to ensure fair compensation while maintaining clear communication with clients.

One effective method for achieving this balance involves incorporating both the direct costs of materials and labor, along with an added markup to cover overheads and profits. This approach provides a clear breakdown of how charges are calculated, fostering trust between the provider and the customer.

By utilizing customizable billing forms that streamline this process, businesses can simplify their operations and reduce the risk of errors. These forms allow for easy adjustments based on the specifics of each project or contract, making the process more efficient for both parties.

Understanding Cost Plus Invoicing

When it comes to billing clients for services or projects, it’s essential to choose a method that reflects both the actual expenses incurred and the provider’s profit. One widely used approach combines the real costs of materials, labor, and other expenditures with a fixed markup percentage to determine the final amount. This method allows businesses to cover their operational costs while also ensuring a reasonable profit margin.

In this approach, the client is billed based on the expenses directly related to the work, with an added charge for the service provider’s overhead and profit. This model is particularly useful in industries where project scopes may change or fluctuate, such as construction or consulting. By using this method, businesses can maintain flexibility and transparency in their billing processes.

How It Works

The process typically involves two main components: the actual expenses and the markup. Here’s how each part functions:

- Expenses: These include the direct costs of materials, labor, and other necessary resources required for completing a project.

- Markup: This is a percentage added on top of the total expenses to cover administrative costs, profits, and unforeseen expenses that might arise during the course of the work.

Why Use This Approach?

There are several advantages to using this method for billing:

- Transparency: Clients can see exactly how their charges are calculated, including detailed breakdowns of costs and profit margins.

- Flexibility: If the scope of work changes, costs can be easily adjusted, providing flexibility for both the service provider and the client.

- Fairness: Both parties know that charges will reflect actual expenses, which helps to avoid disputes or misunderstandings over pricing.

What is a Cost Plus Invoice

A method of billing that involves charging clients for the actual expenses of materials, labor, and other resources, along with an added fee to cover overheads and profits, is a common approach in many industries. This allows service providers to ensure they are reimbursed for all the expenses involved in completing a project, while also making a reasonable profit. The final amount billed to the client consists of these direct costs, with an additional markup that reflects the service provider’s operational costs and desired earnings.

This type of billing structure is frequently used in projects with fluctuating costs, where it is difficult to determine the exact total amount in advance. It offers both the client and the service provider a more flexible and transparent way to handle charges. Below is a breakdown of how this approach works:

Key Components

- Direct Costs: All expenses related to the materials, labor, and other necessary resources for the completion of a project.

- Markup: An additional percentage added to cover the service provider’s profit and overhead expenses. This ensures that the business remains profitable despite variable costs.

How Charges Are Calculated

The final charge to the client is determined by calculating the total expenses and then applying the markup. For example, if a project incurs $5,000 in expenses and the agreed-upon markup is 20%, the total billed amount would be $6,000.

- Step 1: Calculate all direct expenses associated with the project.

- Step 2: Apply the markup percentage to the total expenses.

- Step 3: Add the markup to the original expenses to get the final billed amount.

This method provides clear, straightforward billing while ensuring that the business is compensated for both tangible costs and the necessary overhead to run the operation.

Benefits of Using a Cost Plus Invoice

Adopting a billing system that combines actual expenses with an added fee for profit can provide numerous advantages for businesses and clients alike. This method ensures that service providers are fully reimbursed for their expenditures while offering a transparent and adaptable approach to pricing. Below are some of the key benefits of using this method for your billing process.

Enhanced Transparency

One of the primary advantages is the transparency it offers both the business and the client. By clearly outlining the breakdown of all expenses and the added fees, clients can easily understand how their charges are calculated. This helps to build trust, as clients can see that the pricing is based on actual costs, rather than arbitrary or inflated estimates.

Improved Flexibility

This billing method is highly flexible, particularly for projects that have unpredictable or changing requirements. If additional materials or resources are needed as the project progresses, the billing can be adjusted to reflect the new costs. This ensures that businesses are not left absorbing unexpected expenses, while clients are only charged for what is actually used or delivered.

- Accommodates project scope changes: With this method, it’s easy to account for any unexpected developments in a project, such as increased material usage or additional labor hours.

- Adjusts to market fluctuations: As material costs or labor rates change, this model allows for quick adjustments, ensuring that businesses remain profitable even in volatile conditions.

Fair Pricing for Both Parties

Since charges are based on actual expenditures, both the service provider and the client can feel confident that the pricing is fair. The service provider is compensated for all the resources required to complete the work, and the client only pays for what was actually used or consumed during the project. This creates a balanced approach that minimizes disputes over pricing.

- Clear and accurate billing: Both parties can clearly see the breakdown of each charge, helping to avoid misunderstandings or disagreements.

- Ensures reasonable profit: The markup percentage ensures that the service provider can cover overheads and make a fair profit without overcharging the client.

Overall, this approach to billing can simplify financial management, foster trust, and provide both flexibility and fairness in project-based work.

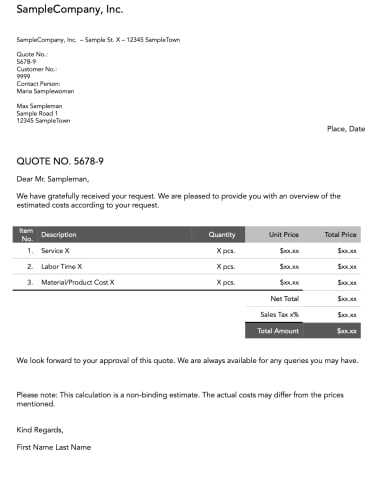

How to Create a Cost Plus Invoice

Creating an effective billing statement that accurately reflects the expenses incurred during a project, along with an added fee for profit, is essential for both businesses and clients. The process involves calculating all direct expenditures, applying the appropriate markup, and ensuring that the client receives a clear breakdown of all charges. Below are the steps to create a comprehensive and transparent billing statement using this approach.

Step 1: Gather All Expenses

The first step is to collect all the relevant expenses associated with the project. This includes:

- Material Costs: All raw materials, tools, or resources used during the project.

- Labor Costs: Wages for the time spent by employees or contractors working on the project.

- Other Expenses: Any additional costs incurred, such as transportation, equipment rental, or third-party services.

Ensure that all costs are accurately recorded to avoid discrepancies when calculating the total amount due.

Step 2: Apply the Markup

Once the total expenses are determined, the next step is to calculate the markup. This is typically a fixed percentage that covers overheads and provides the desired profit margin. To do this:

- Determine the markup percentage: This can vary depending on the industry, project type, and agreed terms with the client. Common markup percentages range from 10% to 30%.

- Calculate the markup amount: Multiply the total expenses by the markup percentage. For example, if your total expenses are $5,000 and your markup is 20%, your markup amount would be $1,000.

The markup amount is then added to the total expenses to arrive at the final billed amount.

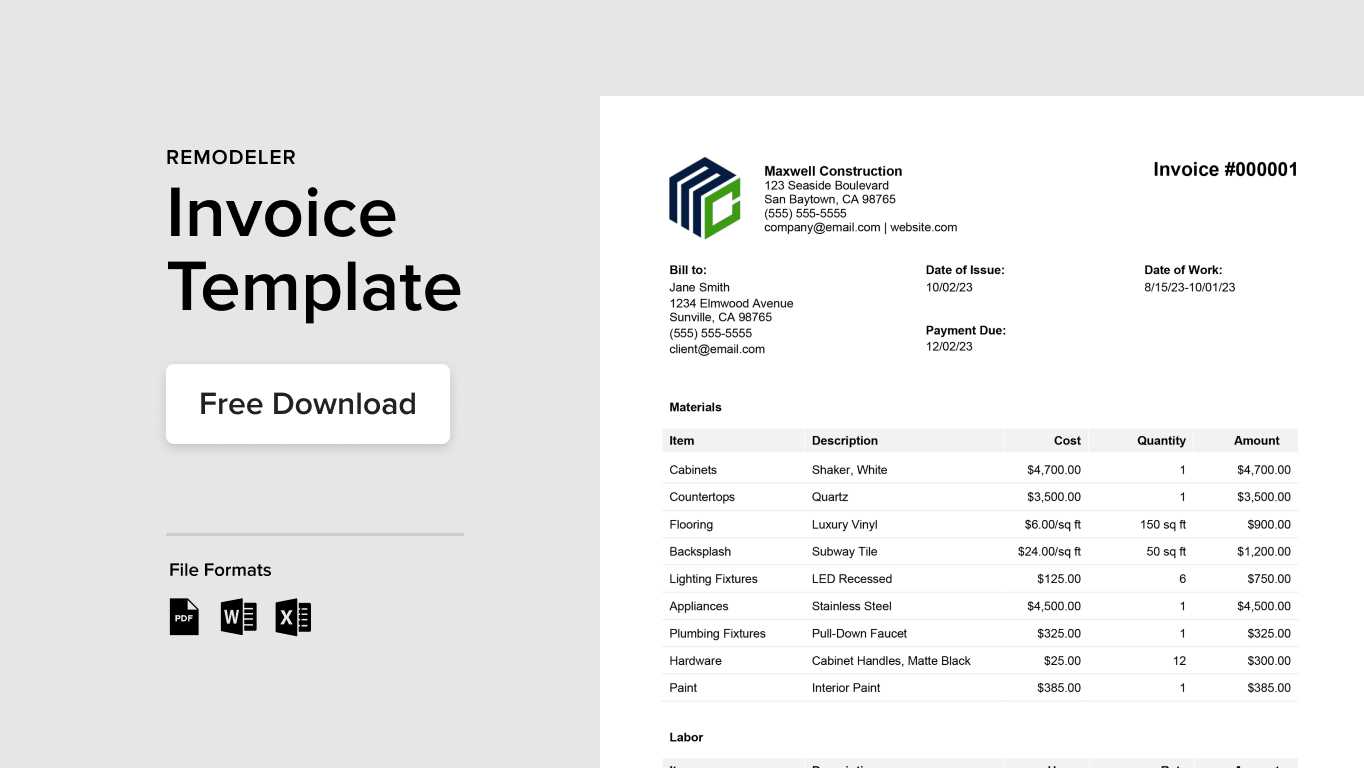

Step 3: Create the Final Statement

Once the calculations are complete, you can draft the final billing document. Ensure that it includes:

- Client and Project Information: Include the client’s name, project details, and invoice number for reference.

- Expense Breakdown: List all expenses separately (materials, labor, other costs), showing both individual amounts and the total expenses.

- Markup and Final Total: Clearly show the markup percentage and the total amount due, including both expenses and markup.

- Payment Terms: Specify the payment due date and any late fees or paym

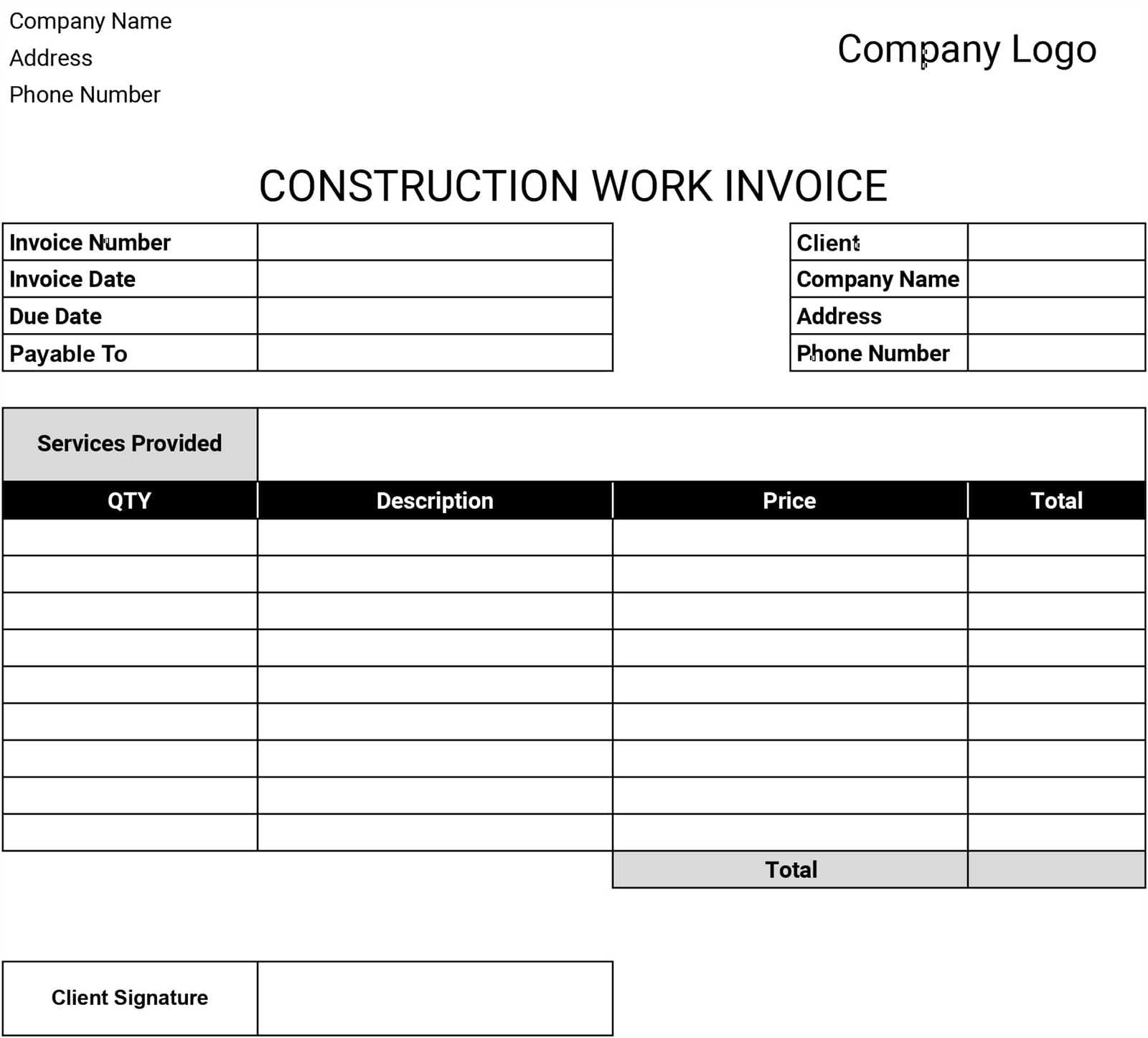

Key Elements of a Cost Plus Invoice

To create an effective billing statement based on actual expenses and a markup, it’s important to include all the necessary details to ensure transparency and clarity for both the client and the service provider. These key components ensure that the charges are clearly outlined and easily understood. Below are the essential elements that should be included in a well-structured billing document.

Expense Breakdown

One of the most important sections of any billing document using this method is the detailed expense breakdown. It should include:

- Materials: A list of all materials used in the project, including quantities and unit prices.

- Labor: The number of hours worked by each employee or contractor, along with their hourly rates.

- Additional Expenses: Any other costs, such as transportation, subcontracted services, or equipment rentals, should be listed separately.

Each of these categories should be clearly labeled with corresponding costs, allowing the client to understand exactly what they are being charged for.

Markup and Profit

In addition to the raw expenses, a markup is typically applied to ensure that the service provider covers overheads and earns a profit. This section should include:

- Markup Percentage: Clearly state the percentage used to calculate the markup based on the total expenses.

- Markup Amount: The total amount added to the expenses as a result of the markup percentage. This is the additional charge the client will pay.

- Total Amount Due: The final amount, which is the sum of expenses and markup, is clearly displayed as the total balance the client needs to pay.

Providing this information helps ensure that the client is fully aware of how the final total was calculated and the reason for the markup.

Payment Terms and Conditions

It’s essential to include payment terms in the document to avoid any confusion or disputes. The payment terms should cover:

- Due Date: Clearly specify when the payment is due to avoid delays or misunderstandings.

- Accepted Payment Methods: Indicate which payment methods are accepted (e.g., bank transfer, credit card, PayPal, etc.).

- Late Fees: If applicable, mention any penalties or interest charges for overdue payments.

By including these key elements, businesses ensure that both parties are on the same page regarding what is being billed, how the charges are calculated, and when payment is expected.

When to Use a Cost Plus Invoice

There are certain situations where a billing method based on actual expenses and an additional fee for profit is the most appropriate and effective approach. This method provides flexibility and ensures that both the service provider and the client are fairly compensated, especially when project costs are unpredictable or variable. Below are some scenarios where this billing strategy is commonly used and beneficial.

Unpredictable Project Scope

For projects where the scope of work is difficult to define in advance or may change during the process, this billing approach is ideal. Industries such as construction, consulting, or custom manufacturing often deal with fluctuating requirements, making it challenging to estimate the final cost. In such cases, using this method ensures that all expenses are covered as the project progresses, with the client only paying for the actual resources used.

- Construction Projects: Material and labor costs can change significantly as the project advances.

- Consulting Services: The time required and resources needed can vary depending on the scope of research or client needs.

- Custom Manufacturing: The cost of materials or parts can fluctuate based on availability or customization requests.

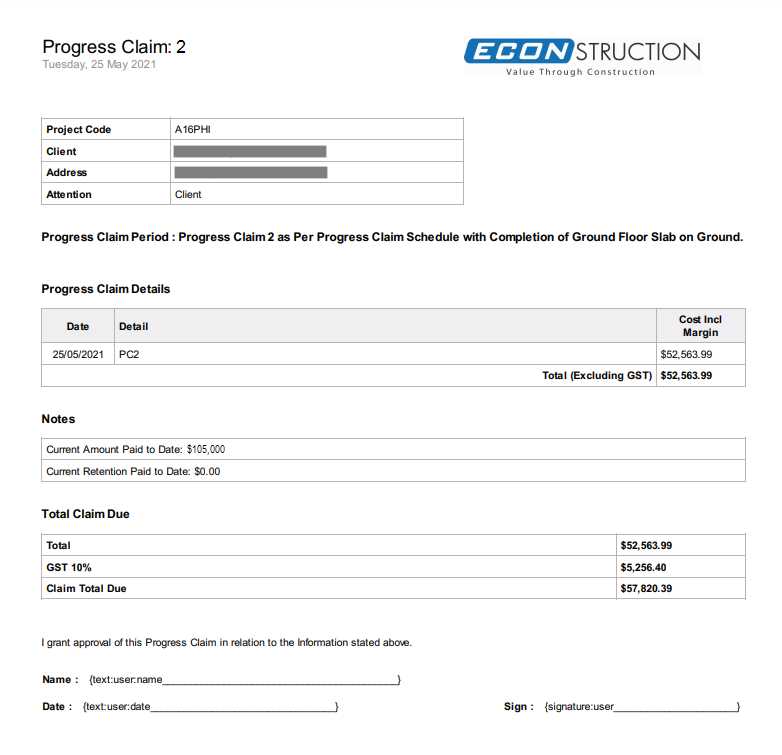

Long-Term or Ongoing Projects

For long-term or ongoing projects, where a fixed price might not be feasible due to the complexity or duration of the work, this method provides both parties with flexibility. It allows the service provider to be compensated for time and materials as the work progresses, while the client is not locked into a fixed cost that may not reflect the evolving nature of the project.

- Maintenance Contracts: Regular servicing or updates to equipment, systems, or facilities.

- IT Projects: Software development or systems integration projects where requirements may evolve over time.

By using this billing structure in these situations, both the service provider and the client can avoid financial surprises and ensure that payments are aligned with the actual work done.

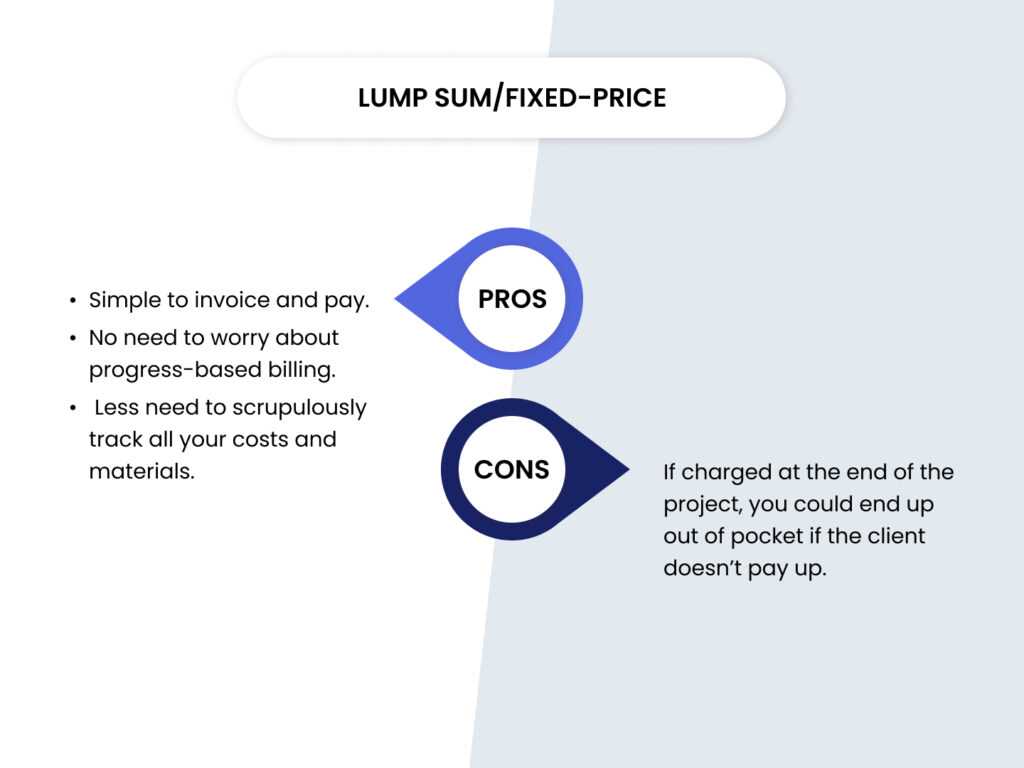

Cost Plus vs Time and Material Billing

When it comes to project-based work, two common billing methods are used to ensure that service providers are paid fairly for their time and resources. While both approaches account for the actual expenses involved, they differ in how the charges are structured and how the final amount is determined. Understanding the distinctions between these methods can help businesses choose the right approach based on the project requirements and client expectations.

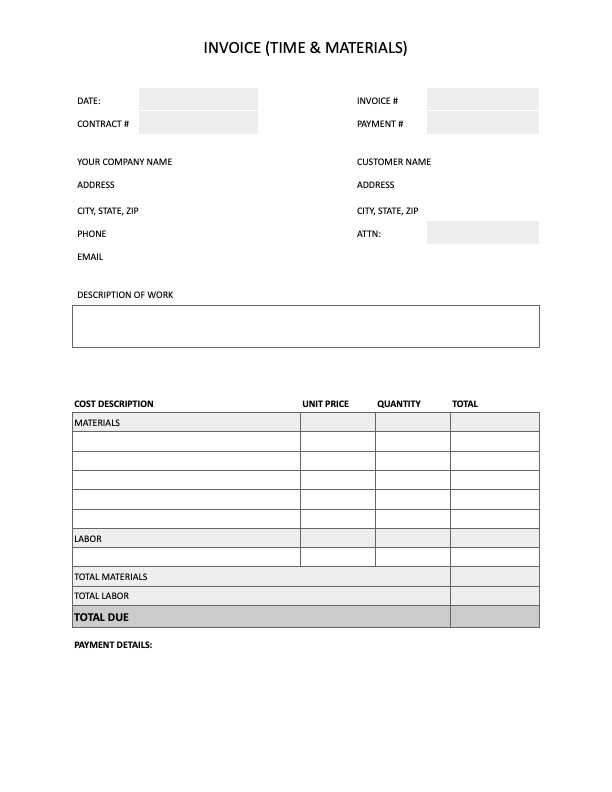

Time and Material Billing

Time and material billing focuses on charging clients for the actual time spent on a project and the materials used. In this model, businesses typically charge an hourly rate for labor and add the cost of materials as they are used. This method is most effective when the project scope is unclear or is likely to change during its execution, as it allows for flexibility in both labor and material costs.

- Labor Charges: The client is billed for the time spent on the project, usually at an hourly or daily rate.

- Material Costs: The cost of materials used in the project is added on top of the labor charges.

- Flexibility: This method allows for easy adjustments if the scope of work changes or additional materials are needed.

This approach is suitable for projects with uncertain or evolving requirements, where it is difficult to predict the final cost upfront.

Cost Plus Billing

In contrast, the method based on actual expenses with a markup involves first calculating the direct costs of the materials, labor, and other resources, and then applying a fixed percentage to cover the business’s overhead and profit. The markup is usually agreed upon in advance, which results in a more predictable billing structure compared to time and material billing.

- Expenses: All direct costs are itemized and presented to the client, including materials, labor, and other resources.

- Markup: A fixed percentage is applied to the total expenses to determine the service provider’s profit and overhead.

- Predictability: Since the markup is pre-agreed, the total cost is easier to estimate from the outset.

Key Differences

The main difference between the two approaches lies in how the charges are calculated. While time and material billing charges based on actual time and materials used, this method can sometimes lead to more unpredictable final costs. On the other hand, the approach with markup provides

Choosing the Right Markup Percentage

When creating a billing statement that includes both direct expenses and an added fee, determining the right markup percentage is crucial. The markup not only helps ensure that the business covers its operational costs but also provides a reasonable profit margin. However, choosing the appropriate percentage requires a balance between competitiveness in pricing and ensuring that the business remains profitable. Below are factors to consider when deciding on the ideal markup rate for your projects.

Industry Standards and Competition

Different industries have varying standards for markup percentages, influenced by factors such as the level of expertise required, the cost of materials, and the competitive landscape. For example, construction companies often apply a markup in the range of 10% to 20%, while service-based industries like consulting may charge anywhere from 15% to 40% depending on the complexity of the work.

- Research Industry Practices: Look at competitors and industry norms to gauge what markup is typical for your field.

- Consider Client Expectations: If your markup is too high compared to competitors, clients may look for lower-cost alternatives.

Calculating Operational Expenses

Your markup should reflect the overhead costs associated with running your business. This includes administrative expenses, employee wages, office supplies, and other fixed costs that are not directly tied to a specific project but are essential for your operations. Ensure that your markup percentage covers these costs and contributes to your business’s long-term sustainability.

- Assess Overhead Costs: Calculate all indirect expenses and determine how much you need to cover them in addition to your direct project costs.

- Profit Margin: Consider what level of profit you aim for based on your business goals and financial needs.

By evaluating both industry standards and your business’s operational needs, you can set a markup percentage that is fair to clients while ensuring your business remains profitable.

Common Mistakes in Cost Plus Invoicing

While billing based on actual expenses with an additional markup can be an effective way to ensure fair compensation, there are several common mistakes that businesses can make during this process. These errors can lead to misunderstandings with clients, financial losses, or missed opportunities for clearer communication. Understanding these pitfalls is key to improving accuracy and transparency in the billing process.

1. Failing to Document All Expenses

One of the most significant mistakes in this billing method is not keeping a thorough record of all the expenses associated with the project. This can include everything from materials to subcontracted services to incidental costs. Without a detailed account of these charges, it becomes difficult to justify the final bill to the client, potentially leading to disputes or confusion.

- Incomplete Records: If expenses are not properly tracked, it can be difficult to account for all the costs incurred.

- Lack of Documentation: Without clear documentation, clients may question the accuracy of the charges or even refuse to pay.

To avoid this, businesses should use accounting software or spreadsheets to track every expense, ensuring they can provide detailed receipts and explanations if needed.

2. Setting an Unrealistic Markup

Choosing an unreasonable markup percentage can alienate clients and harm your business reputation. If the markup is too high compared to industry standards, clients may feel the pricing is unfair, leading to loss of business. On the other hand, setting a markup that is too low may not cover overheads or provide a reasonable profit margin, putting the business at financial risk.

- Overpricing: Charging excessively high markup rates can make clients feel that they are being taken advantage of.

- Underpricing: If the markup is too low, you might not cover the indirect costs of running the business, reducing profitability.

To avoid this, ensure that your markup percentage is based on both industry standards and the actual costs of running your business. Regularly review your expenses and adjust accordingly to maintain a fair and sustainable pricing structure.

3. Lack of Clear Communication with Clients

Another common mistake is not communicating the billing structure clearly to clients upfront. If the client is not aware of how the charges are calculated or the specific expenses that will be included, they may feel blindsided when the final bill is presented. Clear communication about the billing process can help manage expectations and prevent misunderstandings.

- Ambiguity: Without a detailed explanation, clients may struggle to understand how the charges add up, leading to confusion.

- Assumptions: Never assume that the client understands how your pricing works–always explain the method and what it entails.

Ensure that clients are fully informed of the billing structure before starting the project. Provide them with a clear breakdown of potential expenses and the markup to avoid surprises later on.

4. Ignoring Project Scope Changes

When the scope of a project changes, it is essential to update the cost calculations accordingly. Failing to adjust for additional materials, labor, or unforeseen expenses can result in undercharging or a lack of profitability. If the project scope expands during the course of work, ensure that any extra costs are included in the final bill.

- Not Revising Estimates: If the project grows in scope and the client is not informed about how this affects pricing, it could lead to disagreements.

- Absorbing Additional Costs: Some businesses may absorb extra costs instead of adjusting the markup, which can harm profitability.

Regularly review the project’s progress and any changes to the scope, and communicate these adjustments to the client as soon as they occur

How to Automate Cost Plus Billing

Automating the billing process for projects that involve tracking actual expenses and applying a markup can significantly improve efficiency, accuracy, and reduce administrative workload. By using the right tools and software, businesses can easily calculate, track, and generate detailed billing statements without manual intervention. Below are key steps to help automate the process and streamline your business operations.

1. Use Accounting or Billing Software

The first step in automating the billing process is selecting the right accounting or billing software. Many modern solutions offer features tailored to businesses that need to manage expenses and apply a fixed markup. These tools can track time, materials, labor, and other resources, automatically generating a detailed summary of expenses and adding the appropriate markup to produce an accurate final charge.

- Cloud-Based Solutions: Many cloud-based software platforms allow for easy integration with your accounting system and can automate invoicing with minimal input.

- Customizable Features: Look for software that allows you to set custom rules for how expenses are categorized and markups are applied.

Popular options like QuickBooks, FreshBooks, and Zoho Books can help businesses handle this process without manual effort.

2. Track Expenses Automatically

Automating expense tracking is another key step in simplifying the process. By integrating your accounting software with payment processors, project management tools, or inventory management systems, you can capture expenses in real time. This ensures that all relevant charges are automatically logged, reducing the risk of missed or forgotten items.

- Automatic Expense Import: Link your bank account or credit card to automatically import expenses as they occur.

- Time Tracking: Use time tracking tools to log hours worked by employees or contractors and have the software calculate labor costs.

Automation tools can also alert you when certain expenses exceed predefined limits, ensuring that you stay within budget or adjust your billing as needed.

3. Set Up Automated Markup Calculations

Once expenses are tracked, the next step is automating the markup calculations. Most software solutions allow you to define a fixed percentage markup that can be applied to the total expense amount. This ensures that each project’s markup is consistent and accurate without requiring manual adjustments.

- Pre-Set Markup Rates: Configure the system to apply different markup percentages based on project types or client agreements.

- Adjustments for Changes: If the scope of work changes or additional costs are incurred, the software can automatically adjust the final amount, ensuring accurate billing.

By automating this process, you ensure that every calculation is consistent

Integrating Cost Plus Templates with Accounting Software

Integrating project billing systems with accounting software is essential for streamlining business operations and ensuring accurate financial reporting. By connecting billing forms that include expenses and additional charges with accounting tools, businesses can automate the entire process–from tracking expenses to generating financial reports. This integration simplifies the workflow, reduces manual data entry, and enhances overall accuracy in financial tracking.

1. Benefits of Integration

Integrating your billing forms with accounting software can provide numerous benefits that help improve both the efficiency and accuracy of your financial management processes.

- Time Savings: Automation of data transfer between systems reduces the time spent on manual data entry, freeing up resources for more value-added tasks.

- Increased Accuracy: Direct integration minimizes human error, ensuring that the data entered into your accounting software matches your billing forms perfectly.

- Real-Time Financial Tracking: Integration allows businesses to track expenses and revenues in real-time, offering up-to-date insights into project financials.

- Better Cash Flow Management: By automatically generating bills and reports, businesses can more effectively manage their invoicing schedules and track overdue payments.

2. How to Integrate Billing Forms with Accounting Tools

Integrating your billing forms with accounting software requires selecting compatible tools and ensuring that they can communicate with each other efficiently. Below are some steps to follow for successful integration:

- Choose Compatible Software: Ensure that the accounting software you use is compatible with the billing systems or project management tools you’re currently using. Many accounting platforms, such as QuickBooks, FreshBooks, and Xero, have built-in integration options or third-party apps available to help sync data across systems.

- Link Expense Tracking Systems: Make sure that your expense tracking system or software integrates smoothly with the accounting platform. This allows for automatic importation of expenses, ensuring that every cost item is accurately reflected in the final bill.

- Set Up Data Syncing: Enable automatic syncing between the accounting software and your billing system. This can include syncing time entries, material costs, and additional charges, ensuring that every piece of information is captured correctly in real-time.

- Customize Templates for Integration: Modify your billing forms so that they include all relevant details, such as expense categories and markup rates. Many accounting tools allow you to design custom templates to match your business’s unique needs.

3. Best Practices for Effective Integration

To make sure the integration process runs smoothly, follow these best practices to maintain seamless communication

Design Tips for Professional Invoices

A well-designed billing statement not only helps convey professionalism but also ensures clarity and accuracy in the transaction details. The design of such documents plays a significant role in how clients perceive your business and can impact timely payments. By following a few key design principles, you can create a polished, easy-to-read statement that strengthens client relationships and improves overall efficiency.

1. Keep It Clean and Simple

Simplicity is essential when it comes to designing professional billing documents. A cluttered or overly complicated layout can confuse clients and lead to payment delays. Stick to a clean, organized structure that makes it easy for clients to understand the charges.

- Clear Sections: Divide the document into clear sections such as billing details, services rendered, and payment instructions. This makes it easier for clients to follow the information.

- Legible Fonts: Use professional and easy-to-read fonts like Arial or Times New Roman. Avoid overly decorative fonts that can make the document look unprofessional.

2. Use Brand Elements

Incorporating your brand’s logo, color scheme, and other visual elements into the document design not only makes it more recognizable but also helps establish consistency across all business communications. A cohesive brand identity reinforces your professionalism and leaves a lasting impression on clients.

- Logo Placement: Place your company’s logo at the top of the document, where it’s clearly visible, to make the document instantly recognizable.

- Brand Colors: Use your brand’s color palette sparingly to highlight key sections such as the total amount due or payment due date.

3. Be Transparent with Itemized Details

Clients appreciate transparency when it comes to billing. A professional document should provide a detailed breakdown of all services, products, and additional fees. This helps avoid misunderstandings and fosters trust between you and the client.

- Itemized List: List each service or product separately with corresponding charges. Include descriptions if necessary, so clients know exactly what they’re being billed for.

- Subtotal, Taxes, and Final Total: Clearly differentiate between the subtotal, taxes, and the total amount due. This makes it easier for clients to see the full breakdown of costs.

4. Add Payment Terms and Instructions

Clearly outlining payment expectations is key to avoiding confusion and ensuring timely payments. Specify payment due dates, accepted methods of payment, and any applicable late fees. Providing this information upfront helps clients understand your payment terms and encourages them to settle the bill on time.

- Due Date: Always include a specific due date for payment to avoid ambiguity.

- Accepted Payment Methods: Clearly list all accepted payment methods (e.g., credit cards, bank transfer, PayPal) to make it easy for clients to pay.

- Late Fees: If applicable, state any late fees or penalties

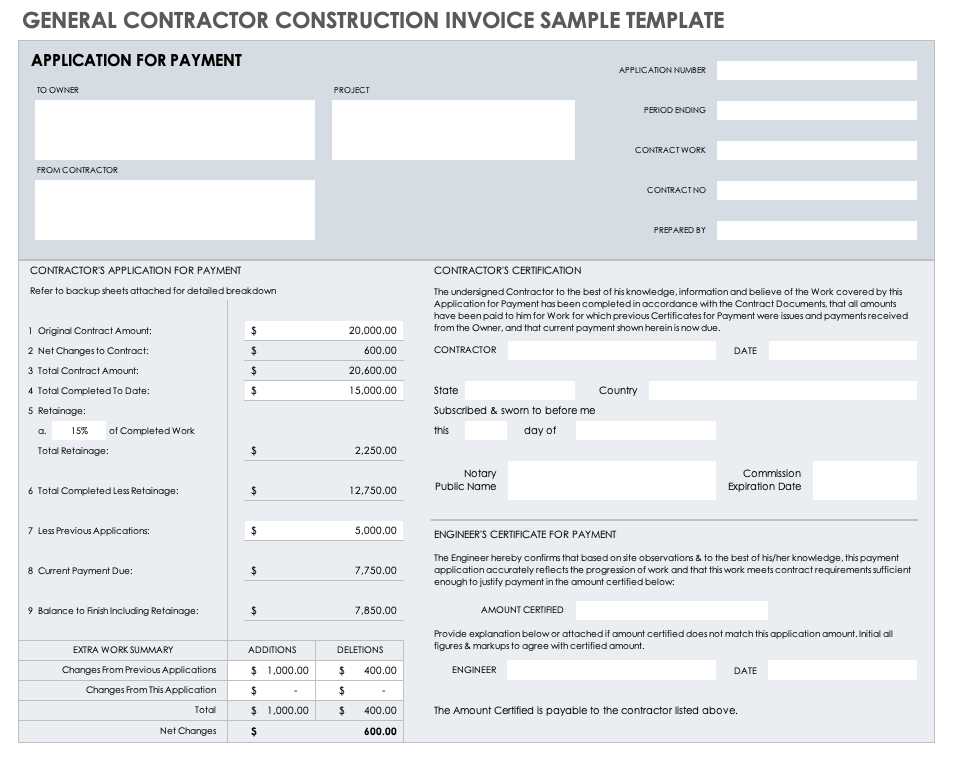

Cost Plus Invoice Template for Contractors

For contractors, managing project billing efficiently is essential to maintaining profitability and keeping clients satisfied. When projects involve fluctuating expenses and require the addition of a markup or fee, having a well-organized document to capture all relevant details becomes critical. Such a document ensures that all charges are transparent, accurate, and easy to understand, helping both contractors and clients stay on the same page throughout the project.

1. Structure of an Effective Billing Statement

An effective billing statement for contractors should have a clear and logical structure that makes it easy to track project costs and any applicable fees. Below are key sections that should be included in the document:

- Header: Include your company’s name, logo, and contact information at the top for easy identification.

- Client Information: Clearly list the client’s name, address, and contact details to ensure the statement is correctly assigned.

- Project Details: Include a brief description of the project, including the start and end dates, so the client can easily identify the work being billed.

- Itemized Costs: Provide a detailed breakdown of all expenses, including labor, materials, equipment, and other associated costs, to give the client full visibility into how the total is calculated.

2. Calculating Markup and Fees

For projects with fluctuating costs, it is essential to apply the correct markup percentage to the expenses. This ensures that contractors can cover overhead, labor, and other indirect costs while also making a profit. The billing statement should clearly show how the markup is calculated and how it contributes to the final total.

- Markup Explanation: Include a line that shows the markup percentage applied to each category (such as materials or labor) and how it affects the total amount due.

- Transparency: Providing this level of transparency builds trust and prevents confusion between the contractor and client.

3. Highlighting Payment Terms and Due Dates

For contractors, clearly outlining payment terms is essential to ensure timely payment. Include important details such as the due date, payment methods accepted, and any late fees that may apply. This helps avoid misunderstandings and encourages prompt settlement of the account.

- Payment Due Date: Make sure the due date is clearly marked, so there is no ambiguity about when the payment should be made.

- Accepted Payment Methods: List all available payment options, such as credit card, bank transfer, or check, for convenience

Legal Considerations in Cost Plus Billing

When implementing a billing structure that includes the reimbursement of expenses and an added markup, it’s crucial to understand the legal implications involved. Properly outlining and managing the terms of such agreements can help avoid disputes and ensure that both parties–the service provider and the client–are protected. Legal considerations touch on areas like contract clarity, compliance with local laws, and the transparency of charges, all of which are essential for maintaining a fair and professional relationship.

1. Clear Contractual Agreements

One of the most critical legal aspects is ensuring that the terms of the agreement are clearly defined and agreed upon in writing. Without clear documentation, misunderstandings can arise about what is being billed, how it is being calculated, and when payments are due.

- Detailed Scope of Work: Clearly define the scope of work to avoid confusion about what expenses and services are included in the final charges. A well-outlined scope helps both parties understand their obligations and expectations.

- Agreed Markup Rates: Be transparent about the markup percentage or fixed fee applied to expenses. Both parties should be in agreement on this percentage and how it will be calculated.

- Written Contract: Ensure that a formal agreement or contract is signed by both parties before starting the project. This contract should explicitly outline billing structures, payment schedules, and other relevant terms.

2. Compliance with Local Laws and Regulations

Different regions may have specific laws and regulations governing billing practices, including maximum allowable fees, tax rates, and the treatment of certain expenses. Ensuring compliance with these laws is not only essential for legality but also for maintaining a good reputation with clients and regulatory bodies.

- Tax Compliance: Be sure to account for any applicable taxes on materials or labor, depending on local tax laws. Failing to comply with tax obligations can result in fines or other legal consequences.

- Labor Laws: If you are billing for labor in your services, ensure that your practices are compliant with labor laws, including wage rates and any employee benefits or compensation rules.

- State and Local Regulations: Certain states or local jurisdictions may have specific rules regarding how billing is handled, including limitations on markups or

How to Adjust for Variable Costs

When managing projects with fluctuating expenses, it’s crucial to account for elements that can change over time. These variables may include material prices, labor rates, or unforeseen project needs. Adjusting the billing structure to reflect these changes ensures that businesses maintain profitability while offering fair and transparent pricing to clients.

1. Monitoring Fluctuations in Expenses

The first step in adjusting for variable expenses is to closely track any changes that occur throughout the course of the project. This may require frequent reviews of both direct and indirect costs as they evolve.

- Regular Updates: Track any shifts in material prices or labor rates on a weekly or monthly basis to stay ahead of potential budget overruns.

- Cost Reporting: Keep detailed records of all expenses, including receipts and invoices, to easily identify trends and discrepancies.

- Budget Monitoring: Compare the current spending to the original budget to identify areas where adjustments may be needed.

2. Adjusting the Billing Structure

Once fluctuations are identified, businesses can adjust their billing practices to reflect these changes. This might involve increasing the markup on materials or adjusting labor rates according to the market or project demands.

- Flexible Markup: Implement a flexible markup system that allows for adjustments based on market conditions, ensuring that the business remains profitable despite varying expenses.

- Threshold Alerts: Set thresholds for when adjustments should be made, ensuring that any significant change triggers an update to the pricing structure.

- Regular Communication: Communicate any adjustments to clients promptly, explaining the reason for the change and ensuring they are aware of how it impacts the total charge.

3. Communicating Changes with Clients

Transparency is key when adjusting for variable expenses. Clients need to be kept in the loop about why changes are necessary and how they affect the overall pricing.

- Clear Explanation: Provide a breakdown of why the changes were made and how the expenses have fluctuated over time. This helps clients understand the necessity of the adjustments.

- Written Agreement: If adjustments require changes to the original terms, update the contract or agreement to reflect

Improving Transparency with Cost Plus Invoices

When businesses engage in projects with fluctuating expenses, transparency becomes essential for maintaining trust between clients and service providers. By providing detailed breakdowns of all expenses and markups, clients can better understand the pricing structure and feel confident in the fairness of the charges. This openness not only helps avoid misunderstandings but also builds long-term relationships based on clarity and mutual respect.

1. Clear Breakdown of Expenses

To enhance transparency, it is crucial to break down the different components of a project’s expenses. By itemizing each charge, both fixed and variable, businesses provide clients with a comprehensive understanding of where their money is going. This also allows businesses to highlight any adjustments due to changes in market prices or unforeseen costs.

Expense Type Details Amount Materials Wood, steel, and concrete $2,500 Labor Labor for construction workers $3,000 Overhead Project management fees $1,000 Markup Applied percentage on materials and labor $1,050 Total $7,550 2. Regular Updates and Communication

Another key aspect of fostering transparency is consistent communication with the client throughout the project. Regular updates allow clients to track the progress of the work and understand how ongoing expenses are evolving. If changes occur, businesses should communicate the reasons behind them and provide updated estimates to avoid any surprises when the final payment is due.

- Frequent Progress Reports: Offer regula