Copywriter Invoice Template for Easy Freelance Billing

Managing payments efficiently is crucial for freelancers, especially when dealing with multiple clients and projects. Having a clear, structured document for requesting payment helps ensure timely transactions and reduces confusion. The right billing method allows you to stay organized and maintain professionalism, ultimately improving your cash flow and client relationships.

In this guide, we will explore how to craft a professional payment request document that fits your needs. Whether you’re working on small tasks or large contracts, a well-organized billing structure is key. From design to the necessary details, understanding the elements that should be included can save you time and help avoid common issues that arise when tracking payments.

Learn how to customize your own payment requests, understand best practices, and discover tools that can simplify this part of your business. By the end, you’ll be equipped with the knowledge to create efficient, error-free requests and take control of your freelance finances.

Copywriter Invoice Template Overview

When working as a freelancer, it’s essential to have a clear and professional document for requesting payment. This document serves as the official request for compensation after completing a project. It outlines the services provided, payment terms, and any other relevant details. A well-designed payment request not only ensures smooth transactions but also reinforces trust and professionalism with clients.

For freelancers, having a consistent format for payment requests can save valuable time and reduce errors. With a standard format, you’ll always know exactly what information needs to be included, making the process of creating and sending requests much more efficient. Whether you’re handling one-off projects or long-term clients, using a structured document can prevent misunderstandings and delays in payment.

Benefits of Using a Standard Format

Using a predefined structure for your payment requests offers several advantages. First, it saves time by eliminating the need to create a new document for each project. Second, it helps maintain consistency in your communication with clients. Consistency in the format ensures that clients can easily read and understand the details, which can lead to quicker payments. Finally, it provides a professional appearance, showing clients that you take your work and business seriously.

Key Components of a Payment Request

While each freelancer may have unique needs, there are several essential elements that should be included in every payment request. These typically include the work description, payment amount, due date, and the preferred method of payment. By ensuring that these components are clear and easy to find, you can prevent confusion and ensure both parties are on the same page. Additionally, adding your contact information and payment instructions makes it easier for clients to settle their accounts.

Why Freelancers Need an Invoice Template

Freelancers often juggle multiple projects and clients, which makes it essential to stay organized, especially when it comes to requesting payment. Having a standardized format for requesting payment ensures that both you and your client are clear on the terms and expectations. Without a proper system in place, tracking payments and maintaining professionalism can become difficult, leading to confusion and delayed transactions.

A predefined document for payment requests streamlines the entire process. It allows you to focus more on your work rather than spending time drafting a new request from scratch each time. By using a consistent approach, you can avoid missing critical details or making mistakes that could delay your payment. In addition, it helps establish trust with clients by demonstrating that you are serious and professional about managing your business.

Efficiency is one of the main reasons freelancers should adopt a standardized method for billing. By reducing the time spent on creating requests, you free up more time for actual work. With a clear structure, you’re less likely to forget important information, such as your payment terms or due dates. Furthermore, using the same format for every project provides a sense of consistency, which helps build your brand’s reputation and credibility.

Additionally, using a standard format ensures that you remain compliant with any relevant tax regulations or legal requirements. Whether you are working with one-time clients or long-term partners, having a reliable and professional payment system is essential for building long-lasting relationships and maintaining a steady cash flow.

Key Elements of a Payment Request

When preparing a payment request document, it is important to ensure that all necessary details are clearly outlined. A well-structured request helps prevent misunderstandings and ensures both parties are on the same page regarding the terms. While the specific content may vary depending on the project, there are several essential elements that should be included in every document to guarantee clarity and professionalism.

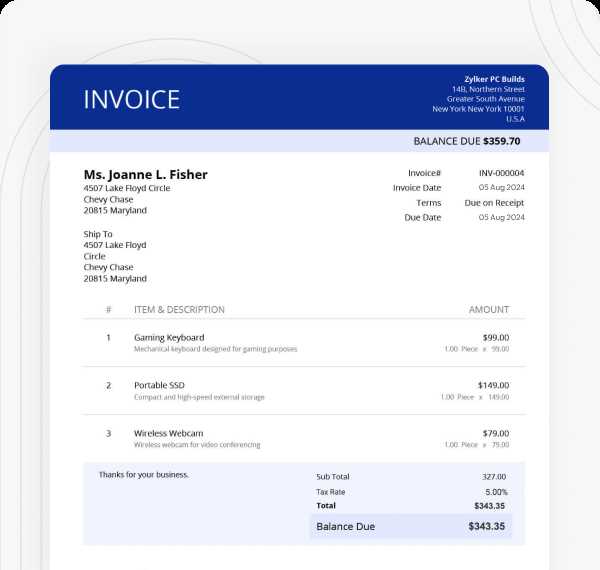

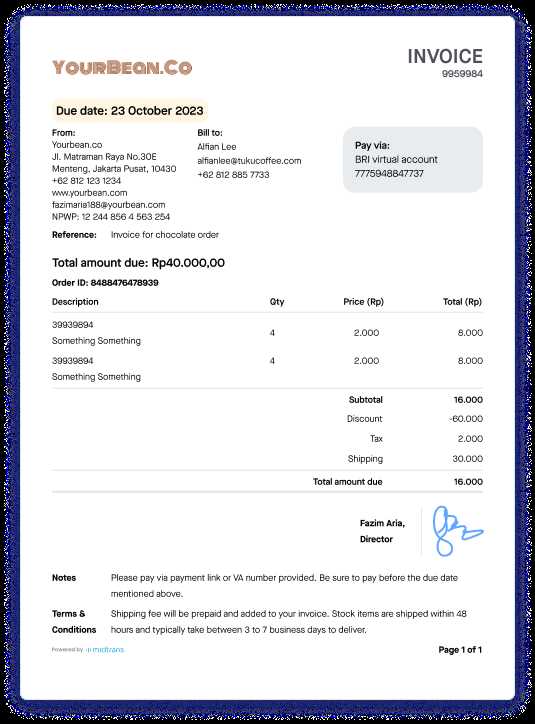

- Client Information – Always include your client’s full name or company name, address, and contact details. This ensures that both parties know who the request is directed to.

- Your Information – Similarly, provide your own business or personal contact details, including name, address, and email, so the client can reach out with any questions.

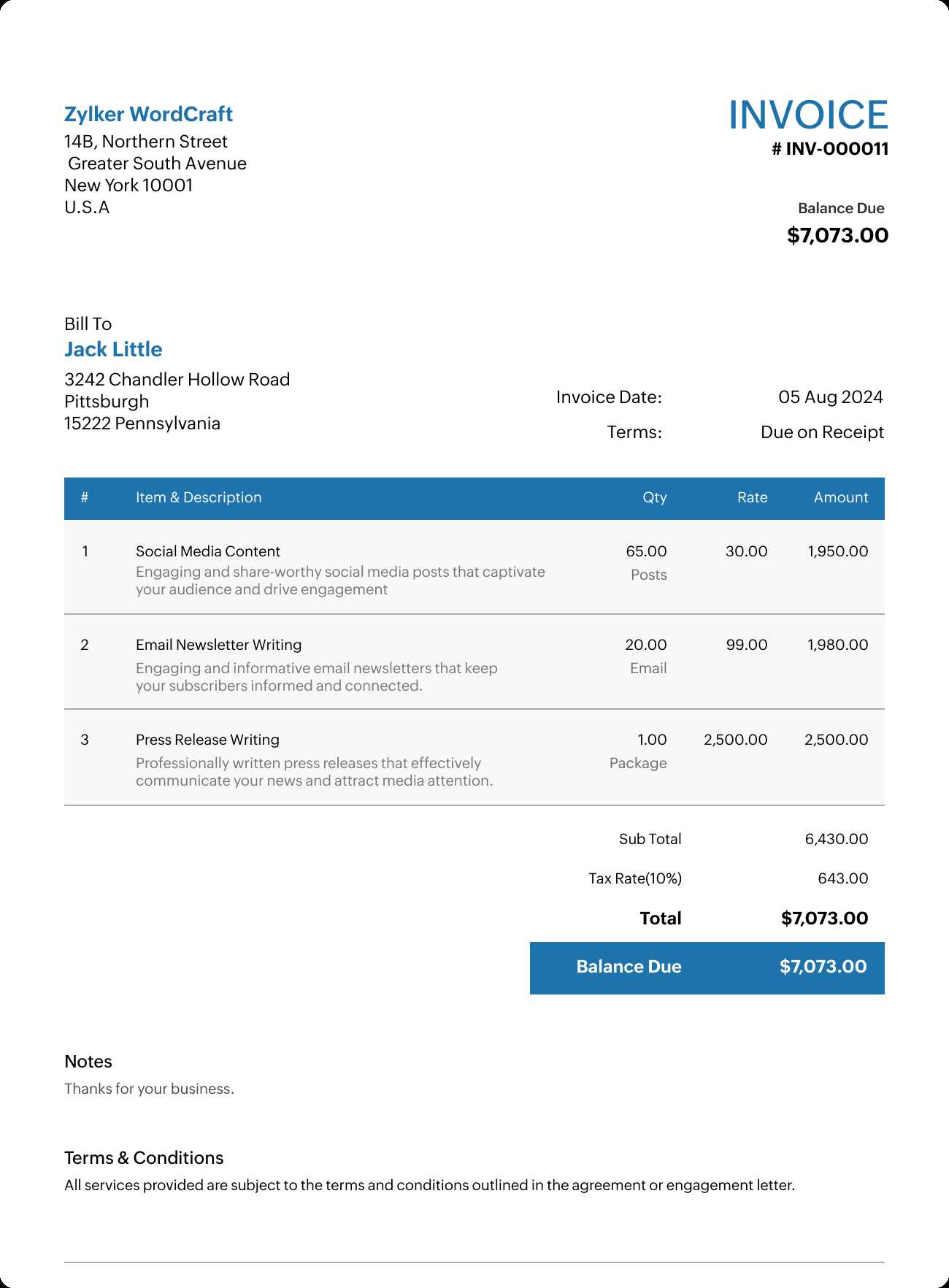

- Work Description – A clear description of the work completed is essential. List the services provided in detail, including any specific tasks or milestones completed during the project.

- Amount Due – Specify the total payment required, breaking down the cost if necessary (e.g., hourly rate, project rate, or additional charges). Being transparent about the pricing helps avoid confusion later on.

- Due Date – Include the date by which payment is expected. This is crucial for managing cash flow and ensuring timely payments.

- Payment Methods – Indicate the preferred methods of payment (e.g., bank transfer, PayPal, check) to avoid any issues when the client attempts to pay.

- Terms and Conditions – Clearly state any relevant terms, such as late fees, cancellation policies, or refund terms. This helps to protect both parties in case of disputes.

By including these elements, you ensure that the request is comprehensive and professional, reducing the likelihood of confusion or delays in payment. A clear and well-organized document also reinforces your credibility as a professional in your field.

How to Customize Your Payment Request

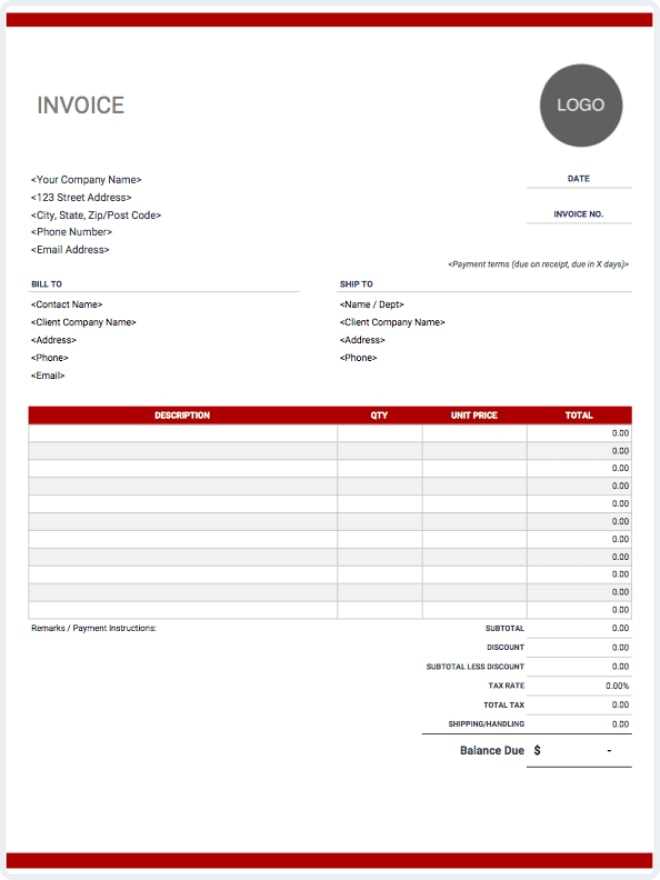

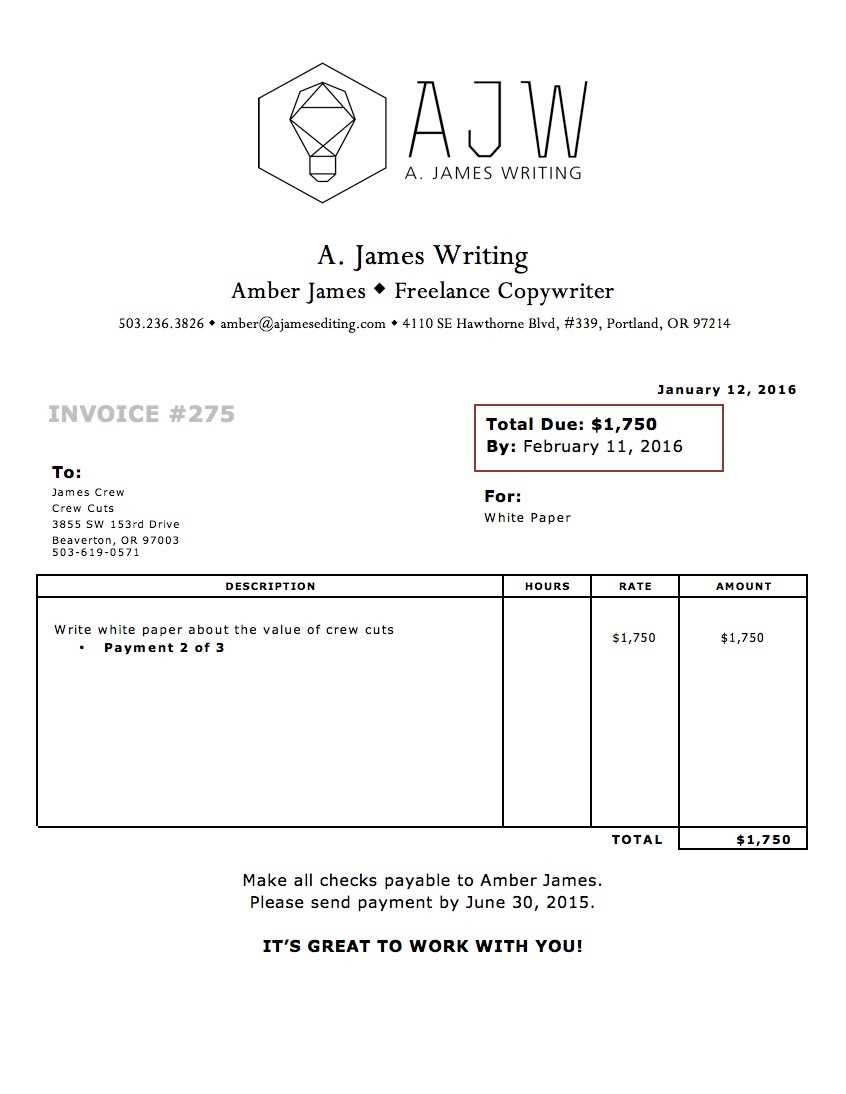

Creating a personalized payment request document that reflects your unique style and business needs can help reinforce your professionalism. Customization allows you to tailor the document to suit different clients, projects, or payment structures. By adjusting the layout, language, and specific details, you can ensure that each request aligns with both your brand and the expectations of the client.

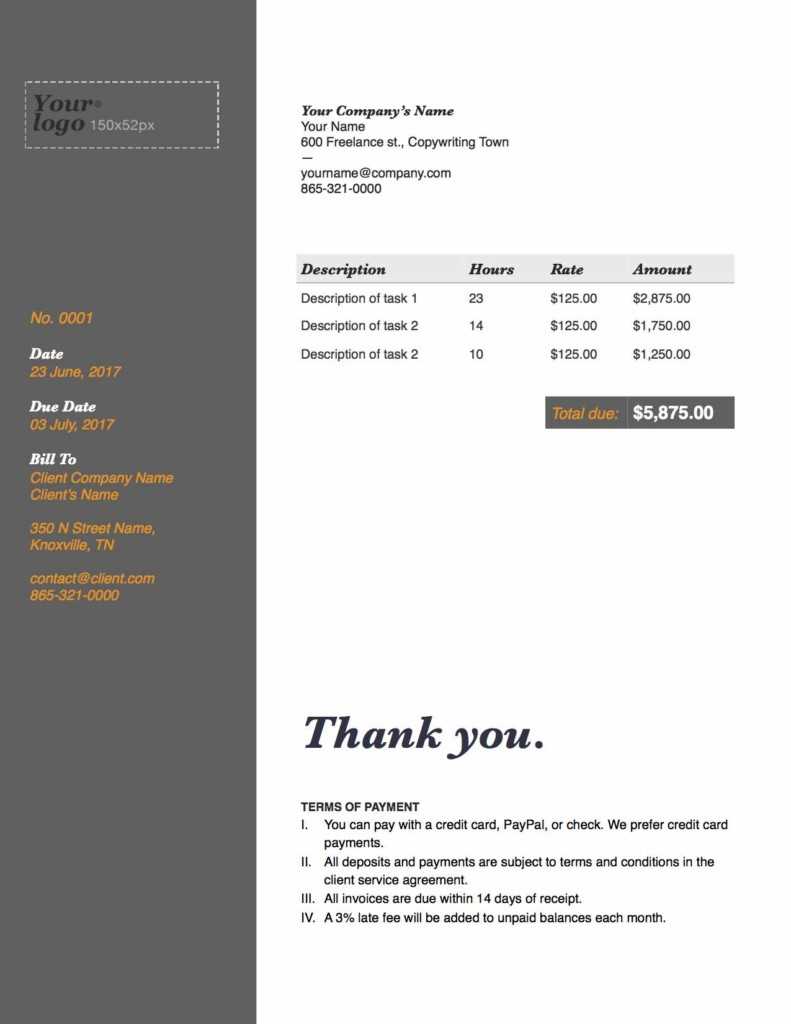

Adjusting the Layout and Design

The visual appearance of your payment request is important, as it can make a lasting impression. You can customize the design by adding your business logo, adjusting the font and colors to match your branding, or including other visual elements such as headers or footers. Make sure that the layout is clear and easy to navigate, so your clients can easily locate all relevant information, such as the amount due and payment instructions.

Modifying the Content

While the core components of a payment request should remain consistent, some details may vary depending on the project or client. For example, you might want to add special payment terms for a one-time project or modify the work description based on the specific services rendered. You can also include personalized notes, such as a thank you message or a reminder about the agreed-upon payment schedule. Customizing the content ensures that each request feels tailored to the individual client, fostering a more personal and professional relationship.

Remember that clear communication is key. By making these adjustments, you not only ensure that your documents look professional but also that the payment process runs smoothly and without confusion.

Free vs Paid Payment Request Templates

When it comes to creating a payment request document, freelancers often face the decision between using a free or a paid version. Each option offers distinct benefits, but understanding their differences can help you choose the best one for your needs. While free resources might seem appealing due to their lack of cost, paid versions often come with additional features that can save time and provide a more professional finish.

Benefits of Free Payment Request Templates

Free payment request resources are widely available and accessible for freelancers who are just starting out or have limited budgets. These templates are often simple and easy to use, providing the essential components needed for billing, such as work description, payment amount, and due date. Many free versions also come in multiple formats, like Word or PDF, making them versatile for different clients. For freelancers on a tight budget, these options can be a good starting point as they help maintain a professional appearance without any upfront costs.

Advantages of Paid Payment Request Templates

Paid versions typically offer more advanced features and customization options that can streamline the billing process. They often include additional elements, such as automated calculations for totals or taxes, customizable branding options, and integrated payment links. Paid templates can also include built-in features like reminders, payment tracking, and multiple currency options, which can be especially useful for international clients. Investing in a paid version might be worth it for freelancers who want to save time, reduce errors, and present a more polished, consistent billing system to their clients.

Ultimately, the choice between free and paid payment request documents depends on your specific needs, the complexity of your projects, and the level of professionalism you wish to project. If you’re just starting out and don’t mind doing some manual work, free options may be sufficient. However, for those looking for efficiency and a more branded, automated approach, paid options provide a valuable upgrade.

How to Create a Payment Request from Scratch

Creating a payment request document from scratch can seem daunting, but it’s a straightforward process when you know what to include. The key is to ensure that all necessary information is clearly laid out and easy to understand. By following a few simple steps, you can craft a document that is professional, effective, and ensures you get paid on time.

Steps to Build a Payment Request

Follow these steps to create a customized payment request for your freelance work:

- Header Information: Start by including your contact details at the top of the document. This should include your name (or business name), address, email, and phone number. It’s also important to add your client’s contact details below yours for easy reference.

- Unique Identifier: Assign a unique number or code to each document for easy tracking. This could be a simple sequential number or include a reference code related to the project.

- Work Description: Clearly describe the work completed. Be specific about the services rendered and any milestones achieved. Include dates or timeframes if applicable.

- Total Amount Due: List the total amount you are requesting for payment. If necessary, break it down into categories, such as hourly rates or project fees, to provide more clarity.

- Payment Terms: Specify the payment terms, such as the due date, late fees, or any discounts for early payment. Be clear about the method of payment, whether it’s through bank transfer, PayPal, or another method.

- Notes or Terms: You can include any additional information, such as a thank you note, a reminder about the next steps, or any relevant project details that may help clarify the payment request.

Formatting Tips for a Professional Look

- Keep It Clean: Ensure that the layout is easy to read, with sufficient space between sections. Use bullet points or numbered lists to organize information clearly.

- Use a Clear Font: Choose a professional font like Arial or Times New Roman, and avoid using too many different fonts or colors. The document should look polished and easy to follow.

- Double-Check for Accuracy: Before sending, make sure all details are correct, such as the client’s name, payment amount, and due date. Accuracy will help prevent confusion and delays in receiving payment.

By following these steps and keeping things organized, you can create a simple yet professional payment request that clearly communicates the necessary details and ensures smooth transactions.

Essential Details to Include in Payment Requests

Creating a clear and effective payment request is crucial for ensuring smooth transactions with clients. A well-structured document should include all the necessary information to avoid confusion and ensure prompt payment. By including the right details, you can make the process of billing easier for both you and your client, helping to establish a professional relationship and prevent delays.

Here are the essential elements that should always be included in your payment request document:

- Your Business Information: Include your name or company name, address, phone number, and email address. This makes it easy for clients to contact you if there are any questions or issues with the payment.

- Client Information: List the client’s name or company name, along with their contact details. This ensures that the document is directed to the right person or department within the client’s organization.

- Unique Reference Number: Assign a unique identification number to each payment request for tracking purposes. This number will help both you and the client easily locate specific documents if necessary.

- Work Description: Provide a detailed summary of the services or products you delivered. Specify any milestones or tasks completed, along with dates or timeframes to avoid ambiguity.

- Payment Amount: Clearly state the total amount due, and break it down if applicable. For example, if you’re billing by the hour or in stages, show the hourly rate and number of hours worked or list any separate charges for different aspects of the project.

- Due Date: Specify when the payment is due. This could be a specific calendar date or the number of days after the document is issued (e.g., “Due within 30 days”).

- Payment Terms: Include any relevant terms, such as early payment discounts, late payment penalties, or specific payment methods (e.g., bank transfer, PayPal, check). Make it clear how the client can make the payment and provide necessary details (e.g., account numbers or PayPal email).

- Additional Notes or Terms: If there are any special conditions, such as project revisions or confidentiality agreements, list them here. You can also add a personal note thanking the client for their business.

By ensuring that these details are always included, you can create a comprehensive, professional payment request that reduces the chances of errors and delays. Clear documentation not only makes the payment process easier but also helps in maintaining a good working relationship with your clients.

Common Mistakes in Payment Requests

Creating a payment request document might seem straightforward, but there are several common mistakes that freelancers often make, which can lead to confusion or delays in receiving payment. These errors typically occur when the necessary details are omitted, incorrectly formatted, or unclear. By being aware of these pitfalls, you can ensure that your payment requests are accurate, professional, and effective in getting you paid on time.

Here are some of the most common mistakes to avoid when preparing your payment requests:

- Missing Client Information: Failing to include your client’s full name, company name, or correct contact details can lead to confusion, especially if there are multiple contacts within the organization. Make sure all relevant information is complete and accurate.

- Unclear Work Descriptions: If the details of the work completed are vague or incomplete, it can cause misunderstandings. Always provide a clear and concise description of the tasks or services rendered, including any project milestones or deadlines met.

- Incorrect Payment Amounts: Double-check the numbers before sending the document. This includes verifying the hourly rate, project fee, or any additional charges. Miscalculations can delay the payment process or even cause disputes.

- Omitting Payment Terms: Failing to include payment terms, such as the due date or late fees, can create confusion about when payment is expected. Be sure to specify whether you expect payment within 30 days, immediately, or on another agreed-upon timeline.

- Not Including a Unique Identifier: Every payment request should have a unique reference number for easy tracking. Without this, both you and your client may struggle to keep records organized, especially when multiple transactions occur over time.

- Unclear Payment Instructions: Always provide clear instructions on how you expect to be paid. Whether it’s through a bank transfer, PayPal, or another method, ensure that the client knows exactly how to send the payment and include any relevant details, such as bank account numbers or PayPal email addresses.

- Forgetting to Proofread: A simple typo or grammatical error can undermine your professionalism. Always proofread your payment request before sending it. Even small mistakes can make it look rushed or careless, which might affect your client’s perception of your work.

- Not Including Contact Information: In case the client has questions or needs clarification, make sure your contact information is clearly listed on the document. This can include your email address, phone number, or any other preferred method of communication.

By avoiding these common mistakes, you can create more effective and professional payment requests that ensure timely payment and smooth business operations. A well-crafted request not only improves your chances of being paid on time but also enhances your reputation as a dependable and organized freelancer.

Choosing the Best Payment Request Format

When it comes to sending a request for payment, choosing the right format is crucial. The format you use will determine how easily your client can understand the document and process the payment. Whether you’re sending a physical document or an electronic file, selecting the appropriate structure will help ensure that all the necessary details are clear and professional. This section will explore the different options and help you decide which format works best for your business and your clients.

Types of Payment Request Formats

There are several ways to format a payment request document, each with its own benefits. Understanding the key differences between them can help you choose the one that suits your needs:

- Word Document: This format is highly customizable and widely accepted. It’s easy to edit, add details, and personalize the document for each client. However, it may require a client to download the file, and it’s less visually structured than some other formats.

- PDF: A PDF format ensures that the document will appear the same to every recipient, regardless of the device or software they are using. This format is ideal for maintaining consistent layout and design. It’s also more professional and secure, as it’s harder to edit once sent.

- Excel or Google Sheets: For those who need to calculate totals, taxes, or discounts, using a spreadsheet format can be beneficial. These formats allow for automatic calculations, reducing the chances of errors. They are particularly useful for clients who may need detailed breakdowns of costs or hourly rates.

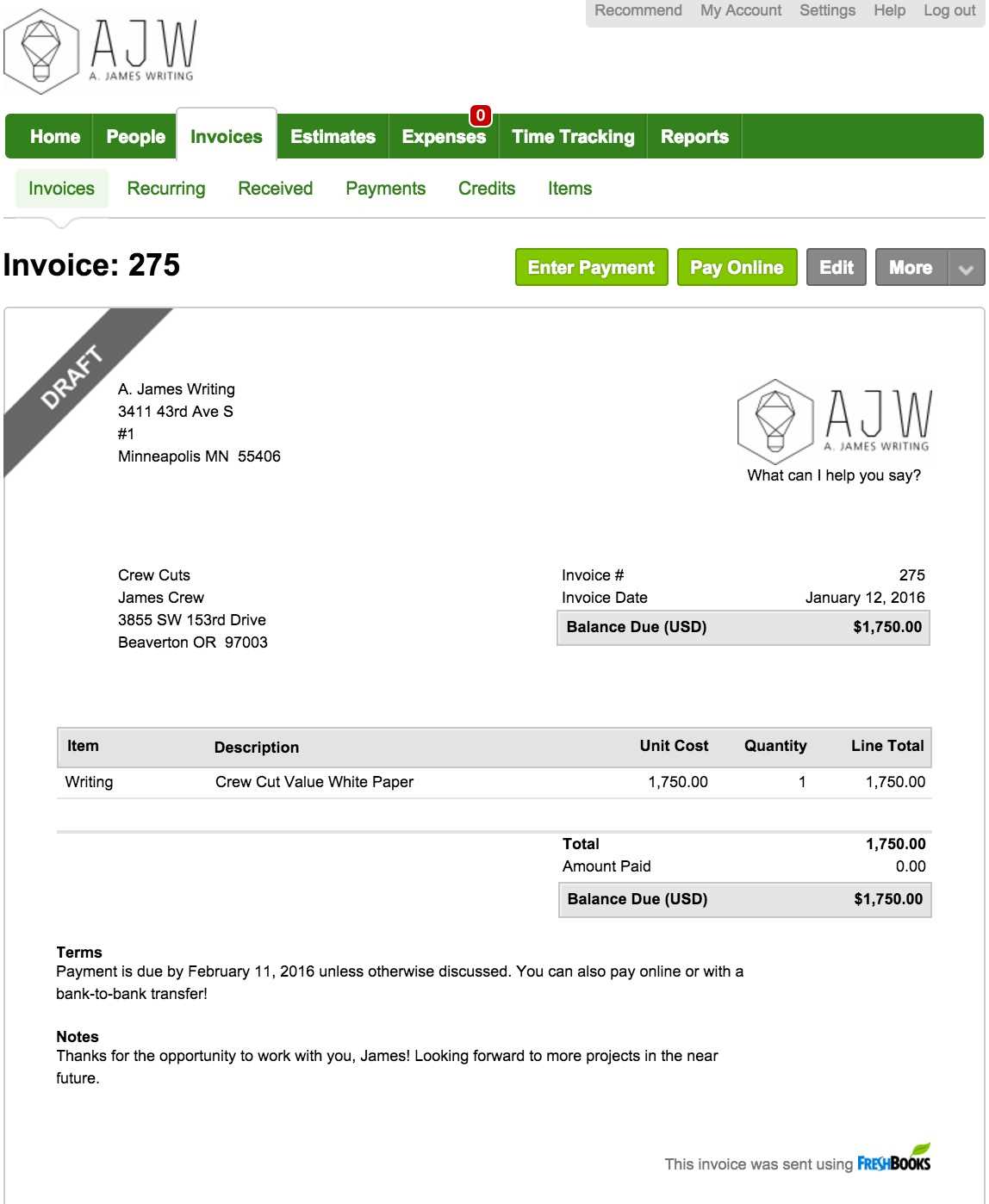

- Online Billing Systems: Many freelancers use online platforms or billing software to create and send requests. These platforms often offer pre-designed, professional formats and can automatically track payments. They also allow for easy integration with payment gateways, which can expedite the payment process.

Factors to Consider When Choosing a Format

When selecting the right format for your payment request, consider the following:

- Client Preferences: Some clients prefer to receive documents in specific formats. Always ask your clients what format they prefer to avoid any complications.

- Ease of Use: Choose a format that is easy for both you and your client to work with. If your client isn’t tech-savvy, a simple PDF or Word document might be a better choice than a complicated spreadsheet.

- Professionalism: Some formats, like PDFs, are more polished and professional than others. A well-designed document can leave a lasting positive impression and reflect your attention to detail.

By considering these factors, you can select the most effective format for your payment request, making the process smo

Benefits of Using a Payment Request Format

Using a pre-designed document format for creating payment requests offers numerous advantages for freelancers and small business owners. A consistent, well-organized layout helps to streamline the billing process, saving time and reducing the risk of errors. By leveraging a structured format, you can create professional and accurate payment requests that not only improve your efficiency but also enhance your overall business operations.

Here are some of the key benefits of using a pre-made format for your payment requests:

- Time-Saving: Having a ready-to-use document eliminates the need to start from scratch with each new request. With a few simple edits, you can quickly input the necessary details and send it off, reducing the amount of time spent on administrative tasks.

- Consistency: Using a standardized format ensures that your payment requests are always presented in a consistent and professional manner. This consistency builds trust with clients, as they know exactly where to find important information, such as payment amounts and due dates.

- Accuracy: Pre-designed formats often come with built-in calculations, ensuring that totals, taxes, and discounts are automatically computed. This reduces the likelihood of errors and helps prevent disputes with clients over incorrect amounts.

- Professional Appearance: A well-designed format gives your payment requests a polished, professional look. This not only makes your business appear more organized but also helps you stand out in the eyes of your clients, reinforcing your credibility and attention to detail.

- Customization: Even though you’re using a structured format, these documents can be customized to fit the specific needs of each project or client. You can adjust the layout, add personal notes, or modify terms based on the situation, all while maintaining a professional structure.

- Tracking and Organization: Many pre-designed formats include a section for unique identifiers or reference numbers, which can help you keep track of payments and organize your financial records. This is especially helpful when managing multiple clients or projects simultaneously.

By using a pre-made format for your payment requests, you can focus more on delivering quality work and less on administrative tasks. It helps ensure that all your documents are clear, professional, and easy to process, ultimately leading to smoother transactions and improved business operations.

How to Manage Multiple Clients’ Payment Requests

Managing payment requests for multiple clients can be a challenging task, especially when you’re working on several projects simultaneously. Keeping track of each request, the amounts due, and deadlines can become overwhelming without an effective system in place. However, by implementing a well-organized approach, you can stay on top of your finances and ensure timely payments for all of your clients.

Creating a System for Tracking Payment Requests

To efficiently manage multiple clients, it’s essential to have a clear system for tracking all the key details related to each payment. Using a combination of tools, such as spreadsheets or accounting software, can help keep everything organized and accessible. Here are some steps to manage your requests more effectively:

- Centralized Database: Use a spreadsheet or accounting tool to track all of your payment requests in one place. This will help you quickly access and review the status of each request without needing to search through multiple documents or folders.

- Unique Reference Numbers: Assign unique identifiers or reference numbers to each payment request. This will make it easier to locate specific requests and prevent confusion, especially when dealing with multiple clients.

- Due Dates and Payment Status: Always track the due dates for each payment and update the status of the request (e.g., paid, pending, overdue) to monitor progress. This will help you stay on top of late payments and follow up accordingly.

Using a Spreadsheet to Stay Organized

One of the most effective ways to manage multiple payment requests is through a simple spreadsheet. Below is an example of how to organize your payment requests using a table:

| Client Name | Reference Number | Amount Due | Due Date | Status |

|---|---|---|---|---|

| Client A | #001 | $500 | 2024-11-15 | Pending |

| Client B | #002 | $750 | 2024-11-20 | Paid |

| Client C | #003 | $300

Billing Software for FreelancersManaging payment requests manually can be time-consuming and prone to errors, especially when you’re handling multiple clients and projects. Billing software is designed to simplify this process by automating key tasks, such as generating documents, tracking payments, and sending reminders. By using a dedicated tool, you can save valuable time and ensure that your financial records remain organized and accurate. Here are some key benefits of using billing software for your freelance business:

Whether you’re a solo freelancer or managing a small business, billing software can help you maintain a streamlined and efficient payment system. By automating many of the manual processes involved in creating and tracking payment requests, you can focus more on your core work and less on administrative tasks. How to Track Payments with Billing Documents

Keeping track of payments is an essential part of managing any freelance or small business. Whether you have one client or many, it’s important to monitor the status of each payment to ensure that you’re paid on time. By including the right details in your payment requests and utilizing a proper tracking system, you can easily manage incoming payments, avoid errors, and stay on top of your finances. Here are a few effective ways to track payments and maintain an organized record:

By implementing these strategies, you can easily monitor the progress of your payments, follow up when necessary, and ensure that your financial records remain clear and organized. An effective tracking system not only keeps you on top of outstanding amounts but also improves your professional credibility by making payment management simple and transparent. Legal Requirements for Payment RequestsWhen creating payment documents for services rendered, it’s important to ensure that they meet all relevant legal standards. These requirements vary by country and region, but certain details are generally required to make the document legally valid and protect both the service provider and the client. Being aware of these legal obligations ensures you stay compliant and avoid potential issues down the line. Here are some common legal elements that should be included in your payment request documents:

By incorporating these key legal elements into your payment requests, you can ensure that the document complies with the necessary regulations and safeguards both you and your client. Keeping this in mind helps avoid legal complications and fosters professional transparency in all your business transactions. Tips for Faster Payment CollectionGetting paid on time is crucial for maintaining a healthy cash flow, but sometimes clients may delay payments for various reasons. To speed up the payment process, it’s essential to implement certain strategies that encourage prompt action. By setting clear expectations, providing easy payment options, and following up effectively, you can ensure that your financial transactions run smoothly. Here are some helpful tips to get your payments processed faster:

By implementing these tips, you can increase the likelihood of receiving faster payments and reduce the stress associated with overdue balances. A proactive, organized approach to payment collection will help you maintain a steady cash flow and a successful freelance or business operation. Organizing Your Payment Requests for Tax SeasonPreparing for tax season can be stressful, especially when it comes to gathering all the necessary financial documents. Keeping your payment records organized throughout the year is essential to ensure a smooth and efficient tax filing process. Whether you are self-employed or run a small business, maintaining a clear and systematic approach to tracking payments will save you time and reduce the risk of errors when it’s time to report your income. Tips for Organizing Your Payment Records

Here are a few effective ways to keep your payment requests organized and ready for tax season:

Preparing for Tax Filing

As tax season approaches, start reviewing your payment records in advance to ensure everything is in order. If you’ve used software for tracking payments, you should be able to easily generate reports summarizing your total income and any expenses related to your work. Having your payment documents organized and accessible will reduce the time spent sorting through receipts and statements, making the process much smoother when you’re ready to file your taxes. By staying on top of your payment records and maintaining a simple, organized system, you can reduce stress during tax season and ensure that your financial reporting is accurate and complete. |