Free Copy of Invoice Template for Easy Billing

Managing financial transactions efficiently requires a reliable system for documenting payments and receipts. Whether you are a freelancer, small business owner, or large enterprise, having a standardized format for your billing is essential. This system helps maintain professionalism and ensures accuracy in your financial records. A well-structured document can save time and reduce errors when communicating with clients or customers.

With the right structure in place, you can streamline your invoicing process, making it easier to track sales and services rendered. The flexibility of pre-designed formats allows customization to suit various business needs. By utilizing an organized approach, you not only make your operations more efficient but also enhance your brand’s credibility in the eyes of your clients.

Whether you are looking for a simple layout or a more detailed format, choosing the appropriate document structure is key to smooth business transactions. The process of creating these essential records becomes much more manageable with the right tools at hand, ensuring you maintain clarity and professionalism with every transaction.

Why Use an Invoice Template

Maintaining consistent and accurate billing is essential for any business or freelancer. Having a pre-designed format for documenting transactions can save significant time, reduce mistakes, and improve overall professionalism. With a structured approach, it’s easier to manage payments, track outstanding amounts, and ensure all relevant details are included in your financial records.

By using a standardized format, you eliminate the need to recreate a document from scratch every time. This consistency not only speeds up the billing process but also enhances the clarity of your communication with clients or customers, helping to avoid confusion and ensuring prompt payments.

Here are some reasons why using a pre-built structure can be beneficial:

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed formats allow you to quickly fill in necessary details without starting from zero. |

| Consistency | A standardized structure ensures that all required fields are included and presented clearly every time. |

| Professional appearance | A well-structured document enhances your image and credibility, reflecting a polished and organized business. |

| Accuracy | Having a defined layout reduces the chances of missing important information, leading to fewer errors. |

| Customization | Many formats can be easily adjusted to meet specific business needs or branding preferences. |

Ultimately, using a well-organized format ensures your records are clear, accurate, and professional, which is crucial for building trust and maintaining smooth business operations.

How to Customize Your Invoice Template

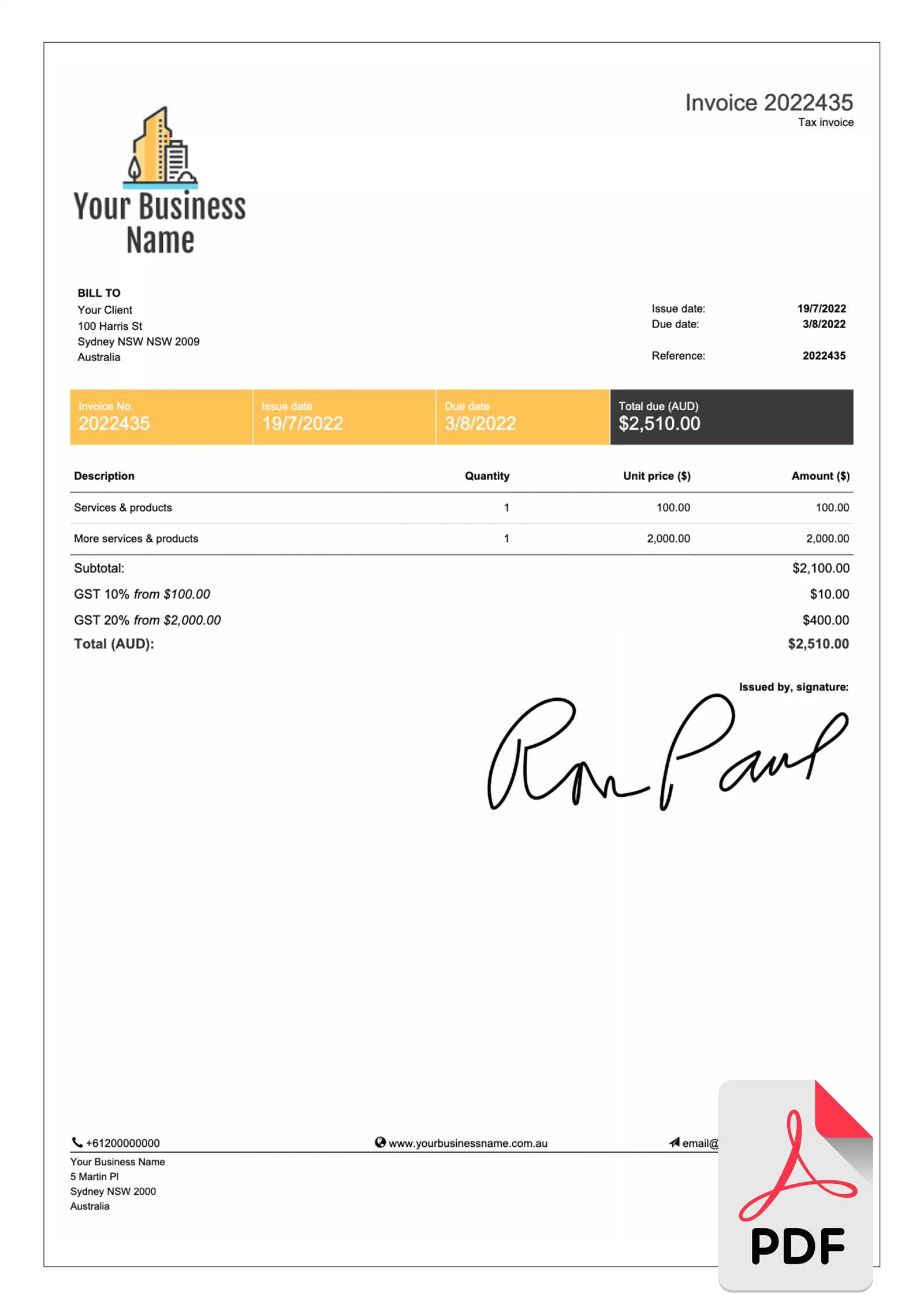

Adapting a pre-designed document layout to fit your business needs is crucial for maintaining a unique and professional appearance. Customization allows you to tailor the content, format, and design elements to reflect your brand identity and ensure clarity. Whether you’re adding a company logo, adjusting the color scheme, or modifying the structure, personalization makes your financial records stand out and feel more aligned with your business style.

Start with the basics: Ensure that the essential details, such as payment terms, service descriptions, and contact information, are correctly displayed. Most formats provide flexible fields that can be filled in with ease, but it’s important to make sure they’re presented in a way that aligns with your workflow and audience expectations.

Consider the following customization options:

- Adding your business logo for brand recognition.

- Modifying the header and footer sections to include additional details like your website or social media links.

- Changing fonts, colors, or borders to match your company’s visual identity.

- Adjusting the layout to highlight important information, such as payment due dates or special offers.

- Including personalized notes or terms of service to better communicate with your clients.

By making these adjustments, you create a document that not only serves its purpose but also reinforces your brand’s image and ensures a smooth transaction experience for your clients.

Benefits of Using Invoice Templates

Utilizing a ready-made format for creating financial documents brings numerous advantages that can improve the efficiency and professionalism of your business operations. These formats simplify the process of documenting transactions, ensuring consistency and reducing the risk of errors. With a structured design in place, you can focus more on your services or products rather than on the intricacies of creating a billing document from scratch each time.

Key benefits include:

- Efficiency: Quickly fill in the necessary fields, saving time and reducing administrative work.

- Consistency: A standardized design ensures that all important information is always included and correctly formatted.

- Professionalism: A clean and organized layout enhances your credibility and leaves a positive impression on clients.

- Accuracy: Pre-designed structures reduce the likelihood of missing essential details or making mistakes.

- Customization: Tailor the document to your brand’s identity, including logos, colors, and custom messages.

By using these pre-structured formats, you streamline your business processes while ensuring a consistent and professional presentation of your financial dealings.

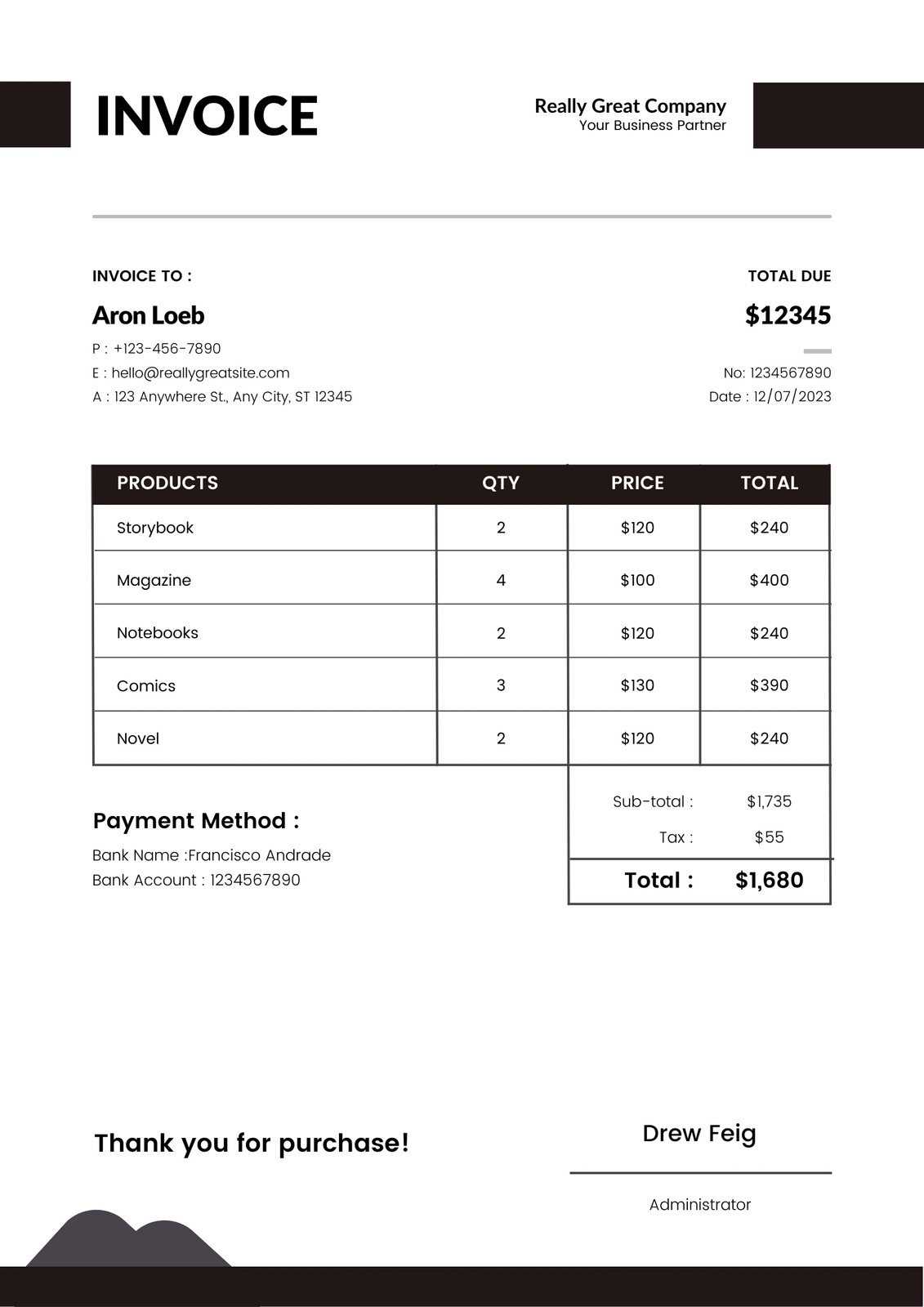

Top Features of a Good Invoice Template

A well-designed billing document is more than just a tool for requesting payments; it serves as a key component in establishing clear communication with clients and ensuring smooth financial transactions. The best formats not only make it easy to input data but also organize that information in a way that is both visually appealing and easy to understand. When selecting or designing such a document, it’s important to look for certain features that will enhance its effectiveness and usability.

Key features to consider include:

- Clear Layout: The format should be easy to follow, with well-defined sections for all relevant details such as payment terms, contact information, and service descriptions.

- Customizable Fields: A good document allows you to easily modify text and fields to suit different business needs and transaction types.

- Professional Design: Clean lines, consistent fonts, and a polished appearance help enhance your company’s image and ensure your documents look credible.

- Itemized List of Services: Including a detailed breakdown of products or services provided ensures transparency and helps avoid misunderstandings.

- Automatic Calculations: Built-in features for calculating totals, taxes, and discounts save time and reduce errors.

- Branding Elements: The ability to add your company logo, colors, and contact information ensures the document aligns with your business identity.

- Clear Payment Instructions: Include easy-to-follow instructions for clients on how to submit payment, along with due dates and payment options.

By incorporating these essential features, you create a more efficient, professional, and effective billing document that can enhance both client trust and financial clarity.

Choosing the Right Invoice Template for Your Business

Selecting the right format for your billing documents is essential for ensuring smooth transactions and maintaining a professional image. The correct choice can save time, improve accuracy, and align with your brand’s identity. Different businesses have different needs, so it’s important to consider several factors when deciding on a layout that works best for you and your clients.

Here are some key aspects to consider when making your selection:

- Business Type: The complexity of your services or products may influence the design. For example, service-based businesses may need a simple document with itemized descriptions, while product-based businesses may require more detailed pricing structures.

- Customization Options: Ensure the document allows you to easily add or remove fields, such as discounts, taxes, or multiple service lines, depending on the nature of your transactions.

- Branding Compatibility: Choose a format that allows you to include your company logo, brand colors, and consistent fonts to reinforce your business identity.

- Legal and Tax Requirements: Depending on your location, certain fields may be legally required (like VAT numbers or tax information). Make sure the layout can accommodate these details.

- Client Preferences: Consider your clients’ preferences for receiving bills, such as digital formats versus physical copies, and ensure the format works for both.

- Ease of Use: The layout should be intuitive and easy to fill in, with clearly defined sections for all necessary details, to ensure accuracy and save time.

By keeping these factors in mind, you can select a document structure that not only suits your business’s specific needs but also enhances your professional image and streamlines the billing process.

Where to Find Free Invoice Templates

For businesses of all sizes, finding a cost-effective solution for creating professional billing documents is essential. Fortunately, there are numerous resources available that offer free, customizable formats, allowing you to quickly generate detailed records without the need for expensive software or services. These formats are often easy to use and can be adapted to suit your specific business requirements.

Here are some popular places where you can find free formats for your business needs:

| Source | Description |

|---|---|

| Google Docs | Google offers a variety of free, editable document layouts that you can customize and store online for easy access. |

| Microsoft Office | Microsoft provides free templates within Word and Excel that can be tailored to your needs, with pre-built formulas and easy formatting. |

| Online Websites | Various websites such as Canva, Zoho, and Invoice Generator offer free downloadable layouts that can be customized directly on their platforms. |

| Freelancer Platforms | Freelancing platforms like Upwork and Fiverr may provide free templates as part of their resources for new freelancers or small business owners. |

| Accounting Software | Some free accounting software programs like Wave or FreshBooks offer basic versions with pre-designed document layouts available for download. |

By exploring these resources, you can easily access a variety of designs that fit your business style and ensure that your transactions are documented clearly and professionally.

Step-by-Step Guide to Filling Out Your Invoice

Creating a professional billing document requires accuracy and attention to detail. By following a clear and systematic approach, you can ensure that all necessary information is included and presented correctly. This guide provides a step-by-step breakdown of how to fill out a billing document, making the process smooth and efficient.

1. Include Your Business Information

- Company Name: Add your business name at the top to ensure clients know who the document is from.

- Contact Details: Include your address, phone number, email, and website, so clients can easily reach you if needed.

- Tax Identification Number (if applicable): If required by law, include your business’s tax ID or VAT number.

2. Add Client’s Information

- Client’s Name and Address: Clearly write the name of the person or business you are billing, along with their contact details.

- Client’s Email: Make sure to include an email address for digital communication or follow-up.

3. Assign an Invoice Number

- Unique Identifier: Each document should have a unique number for tracking purposes. This can be a simple sequential number or a more complex system depending on your business needs.

- Invoice Date: Record the date the document is created. This helps both you and your client keep track of timelines and due dates.

4. List Services or Products Provided

- Description: Include a brief but detailed description of the service or product you provided, so there is no confusion about what is being billed.

- Quantity and Price: Specify the number of units or hours worked and the price per unit or hourly rate.

- Total Amount: Multiply the quantity by the price to get the total cost for each item or service.

5. Include Payment Terms

- Due Date: Clearly state when the payment is due to avoid misunderstandings.

- Late Fees (if applicable): If you charge late fees, mention the terms, such as a percentage of the total amount for each overdue day.

- Accepted Payment Methods: List all the ways clients can pay, such as bank transfer, credit card, or online payment systems like PayPal.

6. Final Review and Send

- Check for Accuracy: Review all the information to ensure there are no errors or omissions.

- Send the Document: Once everything is filled out, send the document to your client via email or traditional mail, depending on your agreement.

By following this simple process, you can create clear, accurate, an

How to Edit Your Invoice Template Easily

Editing a pre-designed billing layout to fit your specific needs is a straightforward process when you know where to focus. Whether you’re adding details for a new client, changing the payment terms, or updating the design to better align with your brand, the right approach can make this task quick and easy. The flexibility of these layouts allows for simple adjustments, saving you time and effort while maintaining professionalism.

1. Open the Document in the Right Software

- Choose the Correct Platform: Depending on the format, open the document in a word processor like Microsoft Word, Google Docs, or a spreadsheet program such as Excel for easy editing.

- Online Tools: Many websites offer online document editing features, where you can directly customize your layout and save it in multiple formats.

2. Edit Basic Information

- Update Contact Details: Change your business name, address, phone number, or email address as necessary.

- Modify Client Information: Replace or add the client’s name, address, and contact info for each new transaction.

- Change Dates and Invoice Number: Always adjust the invoice number and ensure the date reflects the correct issue date of the document.

3. Adjust Itemized List

- Update Descriptions: Modify the description of products or services, ensuring clarity and relevance to the current transaction.

- Edit Prices and Quantities: Adjust the unit price and quantity of items or hours worked, as well as recalculating the totals if necessary.

- Remove or Add Line Items: If you need to include new services or remove old ones, simply delete or add new rows to your layout.

4. Customize the Design (Optional)

- Change Fonts and Colors: To better reflect your branding, you can modify fonts, colors, and other stylistic elements in the layout.

- Add Your Logo: Include your company’s logo in the header or footer of the document for a more professional appearance.

- Modify the Layout: Adjust the placement of sections such as payment terms or itemized lists for better readability.

5. Save and Reuse the Layout

- Save Changes: Once all edits are complete, save the document in a format suitable for sharing, such as PDF or DOCX.

- Create a Template: After editing, sav

Common Mistakes to Avoid with Invoices

While creating financial documents is an essential part of any business, it’s easy to overlook certain details that can lead to confusion or delays in payment. Whether it’s missing key information or formatting issues, small errors can create big problems, especially when dealing with clients or tax authorities. Understanding the common mistakes and how to avoid them can help ensure that your transactions run smoothly and professionally.

Here are some common mistakes to watch out for:

- Incorrect or Missing Contact Information: Ensure that both your business details and the client’s information are accurate and complete. Missing or incorrect contact info can delay communication and payment.

- Failure to Include Clear Payment Terms: Always specify payment due dates, any late fees, and acceptable payment methods. Ambiguity in this area can lead to delayed or missed payments.

- Omitting or Miscalculating Taxes: Tax calculations should be correct and clearly displayed. Mistakes here can result in legal issues or disputes with clients.

- Not Assigning a Unique Number: Each financial document should have a distinct identifier for tracking purposes. Failing to do so can create confusion and complicate record-keeping.

- Forgetting to Include Descriptions or Details: Always provide a clear breakdown of the services or products provided. Lack of detail can lead to misunderstandings or disputes.

- Inconsistent Formatting: Make sure the layout is clean and organized. A poorly formatted document can be difficult for clients to read and understand, leading to frustration or delays.

- Not Proofreading: Before sending the document, check for typos, errors, and missing information. Mistakes in the document can damage your professionalism and cause confusion.

By being mindful of these common pitfalls and taking the time to ensure accuracy, you can maintain professionalism and avoid unnecessary complications in your business transactions.

How to Organize Your Invoice Templates

Efficiently organizing your billing documents can save time, reduce errors, and make it easier to manage your financial transactions. Whether you use digital or physical formats, keeping everything in order ensures that you can quickly find, edit, and send your documents when needed. A well-structured system allows for smooth business operations and reduces the likelihood of mistakes.

1. Create a Centralized Folder System

- Group by Client: For each client, create a separate folder to store all related billing documents. This makes it easy to find specific records when needed.

- Organize by Date: Within each client’s folder, consider organizing documents by date to easily track your history of transactions.

- Use Subfolders for Different Purposes: Create subfolders for drafts, final versions, and paid documents to keep track of the document’s status.

2. Naming Conventions for Easy Access

- Include Key Information in File Names: Use clear and consistent naming conventions that include the client’s name, document number, and date. For example, “ClientName_Invoice_2024-05-01.”

- Avoid Special Characters: Stick to letters, numbers, and hyphens in your filenames to ensure compatibility across different platforms and systems.

- Version Control: If you make multiple versions of a document, label them clearly (e.g., “Invoice_v1,” “Invoice_v2”) to avoid confusion.

3. Utilize Cloud Storage or Backup Systems

- Cloud-Based Solutions: Use services like Google Drive, Dropbox, or OneDrive to store your billing documents securely and access them from any device.

- Regular Backups: Back up your documents regularly to avoid losing important files in case of computer malfunctions or accidental deletion.

4. Automate and Use Templates Wisely

- Pre-fill Repetitive Information: Use digital systems or software that allow you to pre-fill recurring details, such as your business information, tax rates, and payment terms.

- Organize Templates by Type: Keep a master folder with templates for different services or products, and update them as needed to ensure they remain current.

By organizing your billing documents in a methodical way, you can save valuable time, reduce the risk of errors, and maintain a high level of professionalism in your financial communications.

Importance of Accurate Invoice Details

Providing precise and clear information on financial documents is essential for maintaining a smooth business process. Accurate details help establish trust with clients, ensure timely payments, and prevent misunderstandings or disputes. Missing or incorrect information can delay transactions, lead to confusion, and negatively impact your professional reputation.

Here are some reasons why accuracy is critical when filling out financial documents:

Reason Impact of Accuracy Timely Payments Clear and accurate billing information helps clients understand the payment terms, ensuring payments are made on time without unnecessary delays. Legal Compliance Correct details such as tax rates, business ID numbers, and payment terms are often legally required and can protect both you and your client in case of audits or disputes. Avoiding Disputes Accurate descriptions of services or products, along with correct pricing, reduce the chances of disagreements between you and the client over what is being billed. Professional Image Documents free from errors reflect a high level of professionalism, enhancing your business reputation and encouraging repeat business. Efficient Record-Keeping Accurate financial records make it easier to track income, calculate taxes, and prepare for future transactions or audits. By paying attention to the accuracy of every detail on your billing documents, you can streamline operations, foster positive client relationships, and ensure that your business maintains a reputation for reliability and professionalism.

How to Save Time with Templates

Using pre-designed layouts for financial documents can drastically reduce the time spent on repetitive tasks. Rather than creating each document from scratch, you can use customizable formats that allow you to quickly fill in essential details. This approach not only saves time but also ensures consistency and accuracy across all your billing communications.

Here are several ways in which templates can help you save time:

- Faster Document Creation: By starting with a pre-made structure, you can focus on filling in the necessary information rather than designing the layout from the ground up.

- Consistency Across Transactions: Using the same layout ensures that all your documents follow a consistent format, which helps both you and your clients stay organized and reduces confusion.

- Pre-filled Information: Many customizable layouts allow you to pre-fill recurring details, such as your business contact information, tax rates, and payment terms, saving you from entering the same data each time.

- Quick Adjustments: If you need to make a minor change, such as updating pricing or adding a new service, you can easily tweak the document without redesigning it completely.

- Batch Processing: Templates allow for quicker generation of multiple documents. Once your template is ready, you can create several invoices or records at once, streamlining your workflow.

By incorporating reusable formats into your business process, you can save valuable time, maintain accuracy, and focus on growing your business rather than getting bogged down by administrative tasks.

How Invoice Templates Improve Professionalism

Using structured and consistent billing documents plays a vital role in presenting your business as organized and professional. When clients receive well-formatted, clear, and accurate records, they are more likely to trust your business and engage in long-term partnerships. A polished document reflects attention to detail and enhances your brand’s credibility.

1. Consistent Branding and Appearance

- Brand Recognition: By using a consistent layout with your business logo, colors, and fonts, you create a uniform appearance across all communications. This helps reinforce your brand identity with every transaction.

- Professional Design: Pre-designed layouts allow you to create visually appealing documents that look polished, which can be more impressive to clients than a hastily written or poorly formatted one.

2. Clear Communication and Accuracy

- Structured Information: Templates ensure that all necessary details are included in a logical and easy-to-read format, reducing the chance of misunderstandings or mistakes in billing.

- Reduced Errors: With predefined fields for client names, amounts, and dates, the chance of missing critical information or making calculation errors is minimized, further boosting your credibility.

By using structured, professional documents, you demonstrate reliability and commitment to quality, which can help foster stronger relationships with clients and encourage timely payments.

Using Invoice Templates for Freelancers

For freelancers, managing billing and payments can be a time-consuming and sometimes confusing task. Using structured billing documents can simplify the process and ensure that you maintain a professional image with your clients. With predefined formats, freelancers can quickly generate accurate and consistent invoices, which helps streamline cash flow and improve overall efficiency.

1. Simplifying the Billing Process

- Quick Creation: With a pre-designed layout, freelancers can easily fill in the necessary details, such as hours worked, project descriptions, and rates, significantly reducing the time spent on each document.

- Consistency: A standard format ensures that all documents look the same, making your work appear more organized and professional to clients.

2. Keeping Track of Payments and Projects

- Easy Record-Keeping: By using a consistent format, freelancers can easily organize and track their completed projects and payments, reducing the risk of missed invoices or overdue payments.

- Clear Payment Terms: Templates allow freelancers to clearly state payment terms, making it easier for clients to understand expectations and ensuring timely payments.

For freelancers, leveraging structured documents not only saves time but also helps maintain a consistent and professional approach to managing client relationships and financial transactions.

How to Protect Your Invoice Information

Protecting your financial documents is crucial for maintaining both the privacy of your business and the security of your clients’ sensitive information. With the growing threat of cyberattacks and identity theft, it is important to take proactive measures to ensure that your records remain safe from unauthorized access and misuse. By following a few key practices, you can protect your data and minimize potential risks.

1. Use Secure Storage Solutions

- Cloud Services with Encryption: Store your financial documents in trusted cloud storage platforms that offer encryption. This ensures that even if someone gains access to your account, your files remain secure.

- External Backups: Keep backups of your documents on external drives or offline storage, ensuring that your information is not compromised in case of a system failure or online breach.

2. Secure Communication Channels

- Use Password Protection: When sending or sharing financial records, always password-protect the file. This adds an extra layer of security, ensuring that only authorized individuals can open the document.

- Avoid Sending Sensitive Information via Email: Email is not always secure. Consider using encrypted email services or secure file-sharing platforms for transferring important documents.

By adopting these security practices, you can protect both your personal and client information, while maintaining the integrity of your business operations and financial transactions.