How to Use Copart Invoice Template for Vehicle Auction Transactions

When engaging in vehicle auctions, it’s crucial to have proper documentation that outlines the costs and terms of the transaction. This document not only serves as proof of purchase but also helps manage and track expenses related to the acquisition. Whether you’re an experienced buyer or new to the process, having the right form in place can make all the difference in ensuring smooth and transparent dealings.

Understanding the key components of such a document is vital. It includes essential details such as the item description, transaction amounts, additional fees, and payment terms. Properly managing and filling out this document ensures that all necessary information is clearly stated and easy to reference in the future. The form should be simple to navigate while maintaining accuracy and legal clarity.

Using a consistent format can save time and prevent errors. It allows for quick updates and avoids confusion, especially when dealing with multiple purchases or complicated transactions. In this guide, we will explore how to utilize such a document effectively, offering insights on its structure, filling process, and how to handle common issues that might arise during the transaction process.

Understanding Vehicle Purchase Documentation

When engaging in a vehicle auction, proper documentation plays a crucial role in ensuring that all aspects of the transaction are clear and legally recognized. This written record serves as an official acknowledgment of the agreed-upon terms, listing essential details about the vehicle, associated costs, and payment requirements. It acts as both a receipt and a reference for future needs, such as taxes, registration, and resale.

Key elements of this document include the description of the vehicle, the final price, additional charges, and payment conditions. Each field must be completed accurately to avoid confusion or disputes. The layout should be organized in a way that makes all necessary details easy to locate and verify, offering a straightforward understanding of the transaction for both buyer and seller.

Adhering to a structured format not only ensures the document’s clarity but also saves time when filling it out. It can be edited or updated as needed without risking important information being overlooked. Knowing how to properly interpret and utilize this document is essential to managing your purchases efficiently and avoiding common errors that may arise during the buying process.

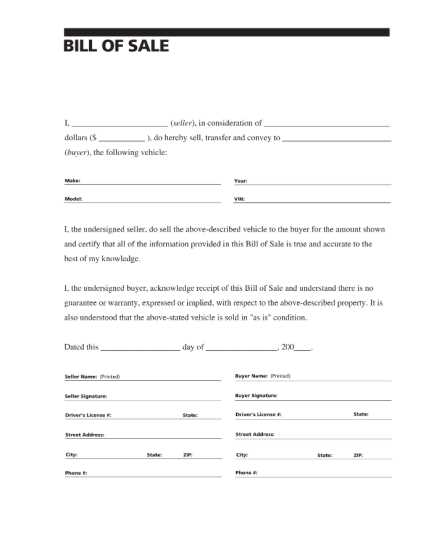

What Is a Vehicle Purchase Document

In the context of buying a vehicle through an auction or online marketplace, a specific document outlines the details of the transaction, including the cost, vehicle description, and payment terms. This record is essential for both parties involved in the deal, ensuring that the agreement is clear and legally binding. It serves as proof of the transaction and helps buyers track their purchases while meeting all necessary requirements for ownership transfer and taxation.

Key Information Included

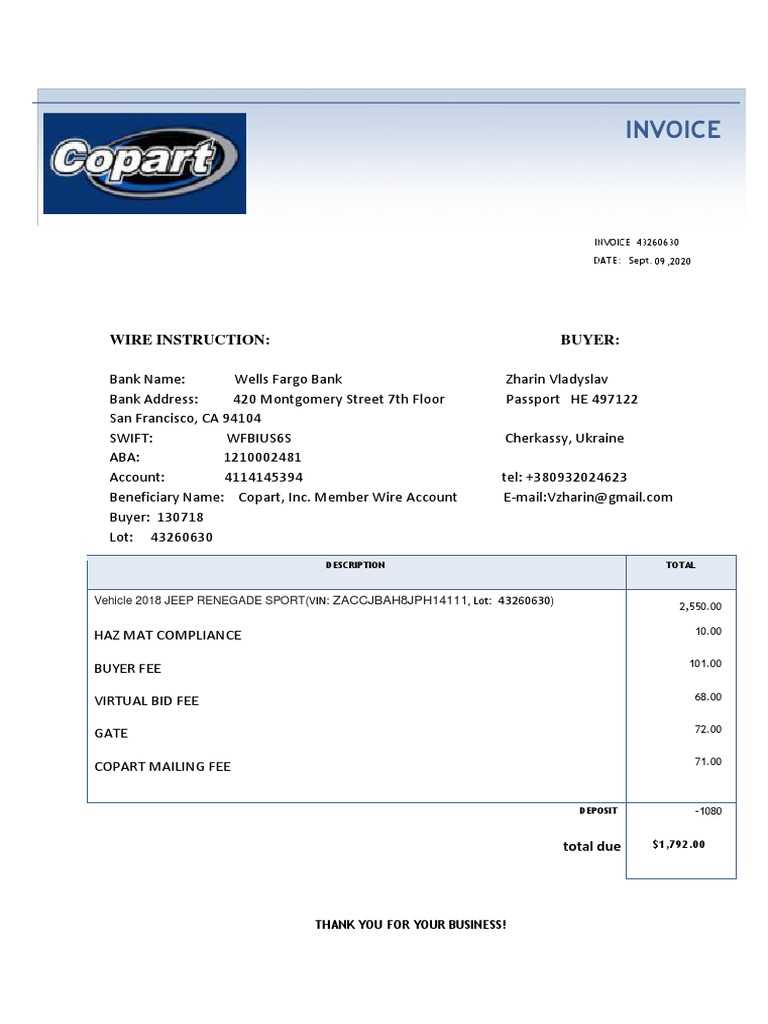

The document typically includes critical details such as the vehicle’s identification number (VIN), make and model, auction fees, and the final purchase price. It also lists any additional charges, such as taxes or handling fees, providing a complete picture of the total amount due. Understanding these components is important for both accurate record-keeping and ensuring transparency in the transaction process.

Why It’s Important

Having a well-structured document is not just about tracking payments; it’s also vital for legal purposes. This record ensures that the vehicle purchase complies with local regulations and can be used for registration, resale, or in case of any future disputes. Properly managing and storing this document is crucial to avoid complications down the line.

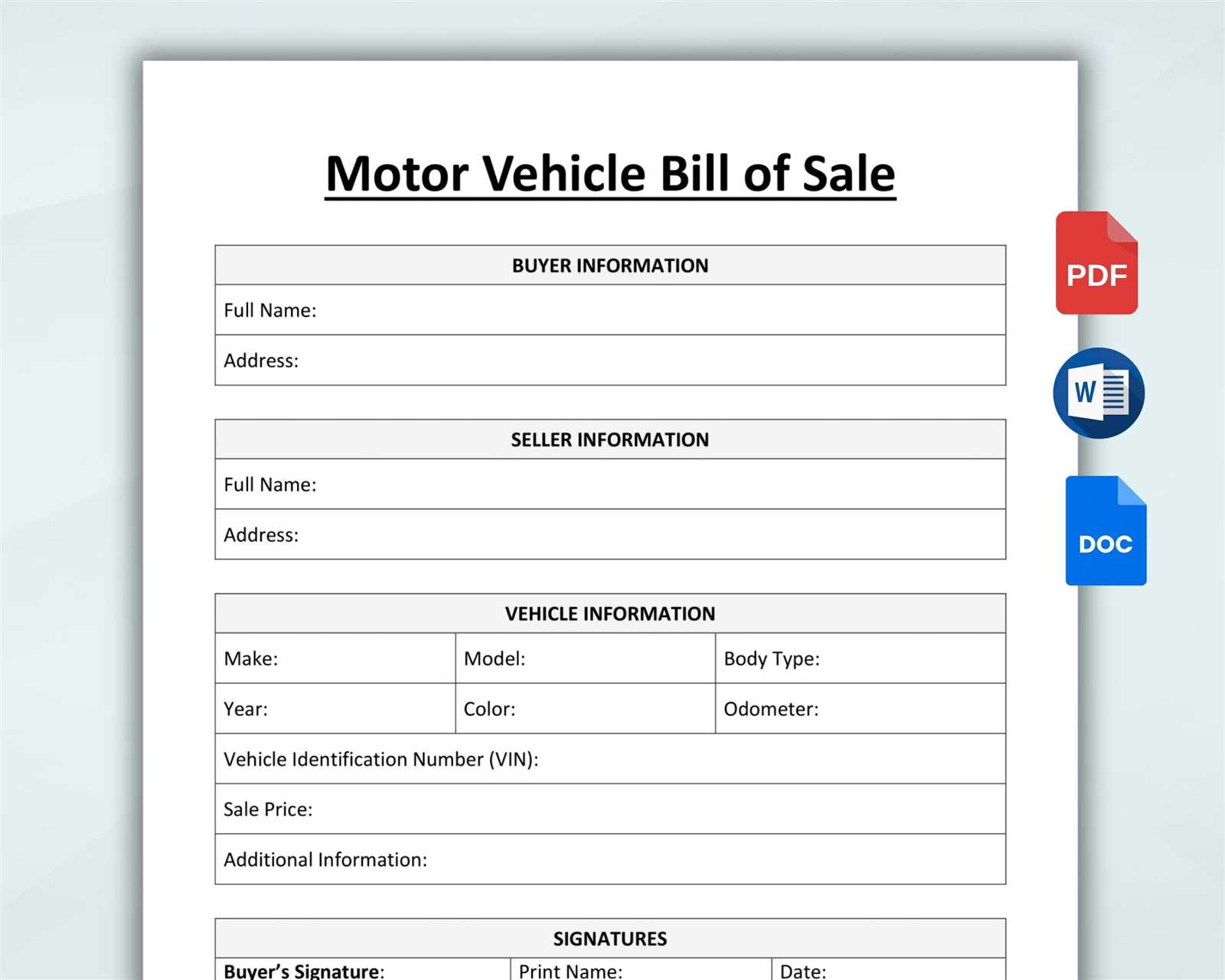

Why You Need the Document Format

When managing a vehicle auction purchase, having a standardized form to record transaction details is essential. A structured format ensures that all necessary information is captured accurately, reducing the likelihood of errors and simplifying the tracking of payments. Without a clear template, critical elements may be overlooked, leading to potential issues with ownership, taxes, or legal matters in the future.

Consistency and Accuracy

A standardized format ensures that every purchase is documented in the same way, making it easier to verify the details later on. From the vehicle’s description to payment terms, consistency is key to avoiding misunderstandings. Whether you’re buying one vehicle or multiple, this uniformity makes managing your transactions simpler and more organized.

Efficiency in Handling Transactions

Using a ready-made document helps save time and effort. Instead of manually creating a new form each time, you can quickly fill in the necessary details. This efficiency is especially valuable when dealing with multiple purchases or working under tight deadlines, ensuring that all the required information is captured without unnecessary delays.

How to Download the Vehicle Transaction Document

Accessing and downloading the necessary documentation for a vehicle purchase is a simple process when following the right steps. Whether you’re using an online auction platform or dealing directly with a seller, having the correct form ready is essential for record-keeping and payment verification. Below are the basic steps to retrieve this document efficiently:

- Log into your account on the auction platform or marketplace where the purchase was made.

- Navigate to your purchase history or order summary section.

- Select the transaction for which you need the documentation.

- Look for the option to download or view the transaction details.

- Choose the preferred file format, such as PDF or Excel, for easy storage or printing.

- Click on the download button and save the file to your device.

Once downloaded, ensure that the document contains all relevant information, such as the vehicle’s description, payment terms, and any additional fees. Having an accurate record will help ensure a smooth experience for any future processes related to your purchase.

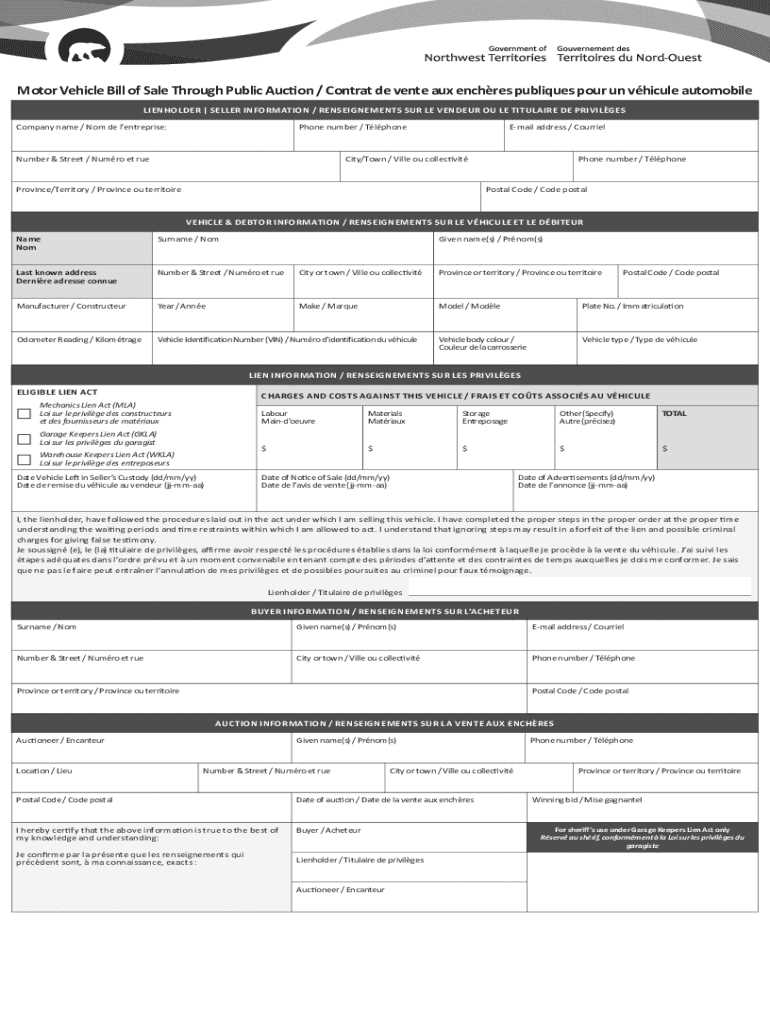

Essential Fields in Vehicle Purchase Document

When managing a vehicle auction transaction, it’s important to include specific details that clarify the terms of the purchase. These essential fields ensure that both the buyer and seller are on the same page and provide the necessary information for future reference. Accurately filling out these sections is key to preventing any misunderstandings or complications during the process.

Vehicle Information: This section typically includes the vehicle’s make, model, year, and identification number (VIN). This is the most critical part of the document as it clearly identifies the item involved in the transaction.

Transaction Details: This field lists the final purchase price, any applicable fees, taxes, and additional charges. Having this information laid out transparently ensures there is no confusion about the total amount owed.

Payment Terms: Clearly defined payment terms should also be included. This covers how and when the payment is due, along with any penalties for late payment or additional instructions for processing.

Buyer and Seller Information: The names, contact details, and addresses of both parties should be recorded. This helps to ensure that both sides are properly identified in case of any disputes or follow-up actions.

By ensuring that these key fields are present and accurate, the document can serve as an effective record of the transaction, protecting both parties and streamlining the entire process.

Filling Out Your Vehicle Transaction Document

Properly completing the documentation for a vehicle purchase is essential to ensure that all details are accurate and clear. This process helps avoid confusion or potential issues later on, such as disputes over pricing, taxes, or fees. By following a step-by-step approach, you can ensure that all required fields are filled in correctly and consistently.

Start by entering basic information, such as the vehicle’s make, model, and VIN (vehicle identification number). Ensure that the VIN is typed correctly, as it is the primary identifier for the vehicle. Double-check the spelling of the make and model to avoid any errors that could affect future documentation or registration.

Next, list the total purchase price, including any additional fees or taxes that may apply. If there are payment terms or conditions, such as deposits or installment plans, make sure these are clearly stated. This is important to prevent misunderstandings regarding the payment schedule.

Finally, include both the buyer’s and seller’s contact details, ensuring that addresses, phone numbers, and email addresses are correct. This information will be useful for communication and may be required for legal or registration purposes later on.

By following these steps carefully, you’ll ensure that your document is complete and legally sound, providing a clear record of the transaction for both parties involved.

Common Mistakes to Avoid

When completing the documentation for a vehicle purchase, it’s easy to overlook key details or make simple errors that can lead to complications later. These mistakes can cause delays in processing or even legal issues if not addressed properly. By being aware of common pitfalls, you can ensure that the transaction goes smoothly and all required information is accurately recorded.

Incorrect Vehicle Information: One of the most common errors is misspelling the vehicle’s make, model, or VIN (vehicle identification number). These details are crucial for identification and must be accurate. A small mistake in the VIN or model number can lead to problems during registration or when making future claims on the vehicle.

Overlooking Additional Fees: It’s important to include all additional charges, such as taxes, handling fees, or processing fees, in the document. Failing to do so could lead to confusion or disputes over the total cost of the purchase. Make sure all fees are clearly listed and accounted for.

Missing Payment Terms: Another common issue is not specifying payment terms clearly. This can result in misunderstandings regarding when payments are due, how they should be made, or what penalties may apply for late payments. Always ensure that payment details, including deadlines and methods, are explicitly stated.

By avoiding these mistakes, you can ensure that the transaction is recorded properly, preventing delays and complications down the road. Properly filling out the document is essential for a smooth and trouble-free purchase process.

How to Use Document for Vehicle Purchase

Once the transaction document is completed, it serves as a key reference for various post-purchase activities. It outlines all the essential details of the transaction, such as the vehicle’s information, final price, and payment terms, and acts as proof of purchase. Knowing how to properly use and reference this document is crucial for managing the vehicle purchase effectively.

Registration and Title Transfer: The document is often required for the vehicle registration process. You will need to present it to local authorities as proof of ownership and to complete any necessary paperwork for title transfer. It may also be required when updating insurance details or registering the vehicle with the DMV (Department of Motor Vehicles).

Tracking Payment and Fees: This record helps you keep track of payments made, including the final purchase amount, taxes, and any additional fees. If you paid in installments or included a deposit, you can refer to this document for payment terms and remaining balances. It also helps in case of any discrepancies or disputes about the financial terms of the purchase.

Tax and Resale Purposes: The document can be useful when preparing for tax filings, as it provides detailed information about the total purchase price and applicable taxes. It may also be required if you choose to resell the vehicle in the future, as it serves as proof of the original purchase.

By understanding how to use this document effectively, you can streamline the vehicle ownership process, ensuring that all requirements are met and preventing potential issues down the line.

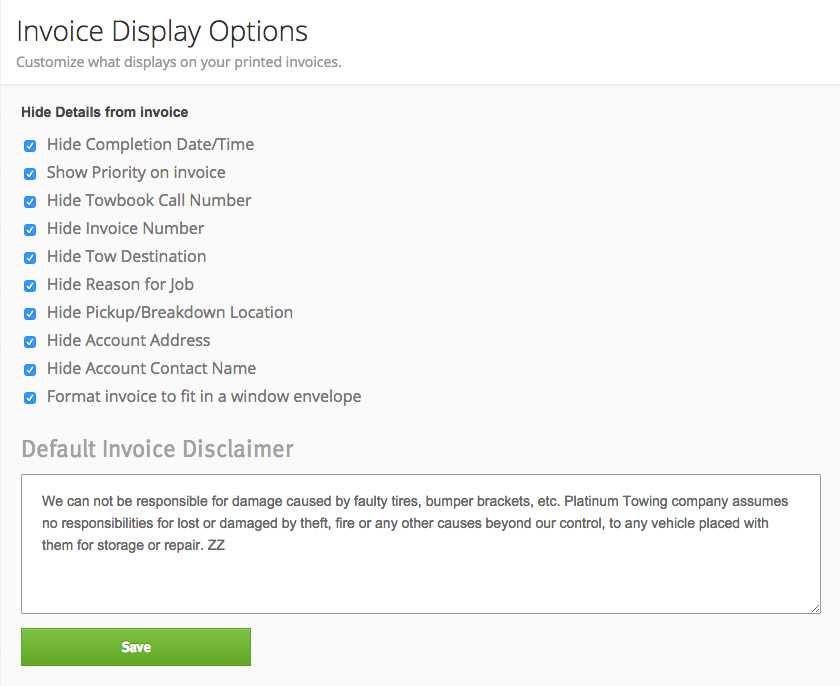

Formatting Document for Accuracy

Ensuring the accuracy of the transaction document is crucial to prevent misunderstandings or issues later in the process. Proper formatting not only helps organize information clearly but also ensures that all essential details are presented correctly. A well-structured document can help both parties avoid errors and streamline the entire transaction process.

Clear Structure: Organize the document into sections that are easy to navigate. Start with the vehicle details, followed by the pricing information, payment terms, and buyer and seller contact details. This logical flow makes it easier for anyone reviewing the document to quickly find relevant information.

Consistent Formatting: Use consistent fonts, spacing, and text alignment throughout the document. This will ensure readability and professionalism. For example, aligning numbers in columns can help clearly show pricing and amounts, while bolding headers makes important sections stand out.

Double-Check Information: Accuracy is key when filling out the document. Verify all vehicle details, including the make, model, and VIN (vehicle identification number), as well as the payment amounts. Small errors, such as a typo in the VIN or an incorrect fee, can cause significant issues down the line.

By following these formatting guidelines, you will create a document that is both professional and easy to understand, ensuring that all important details are accurate and clearly communicated.

How to Edit Purchase Document

Editing the purchase document is a simple yet essential task when it comes to updating or correcting transaction details. Whether you need to adjust payment terms, modify vehicle information, or add additional charges, knowing how to efficiently edit the document ensures that all the information remains accurate and up-to-date. This can be done manually or through digital tools designed for such tasks.

Steps to Edit the Document

To begin editing, open the document and review all sections for correctness. If you’re working with a digital version, it’s often easier to make changes using a word processor or PDF editor. In case of minor updates, such as updating the price or contact details, simply locate the section and make the necessary modifications. For more significant changes, like adjusting vehicle information or adding new sections, follow these steps:

| Step | Action |

|---|---|

| 1 | Open the document in the editing tool (Word, PDF editor, etc.). |

| 2 | Review all key details such as vehicle info, pricing, and payment terms. |

| 3 | Make the necessary changes, ensuring accuracy in all sections. |

| 4 | Save the updated version with a new file name to preserve the original. |

Important Considerations

When making edits, be sure to maintain the formatting and layout of the document for clarity. Small adjustments, such as changing font sizes or misaligning text, can create confusion and make the document harder to read. After completing the edits, double-check the document for accuracy to ensure that all information reflects the latest changes. Additionally, it’s always a good idea to back up the original version before making any edits, so you can refer to it if needed.

Saving and Storing Your Document

Once you have completed and reviewed your transaction document, it’s important to save and store it properly for future reference. Keeping the document organized and easily accessible will help you manage your records effectively, whether for legal purposes, tax filings, or resale. Proper storage ensures that you can quickly retrieve the document if needed, avoiding unnecessary complications down the road.

Digital Storage: One of the most efficient ways to store your document is by saving it in a digital format. This allows you to access it from anywhere and reduces the risk of physical damage. Use cloud storage services, such as Google Drive or Dropbox, to back up your file. These platforms also offer the added benefit of secure sharing if you need to provide the document to third parties.

Physical Storage: If you prefer to keep a hard copy, ensure that it is stored in a safe place where it won’t be damaged by moisture, fire, or wear. Use a filing cabinet or an accordion folder to organize your records by date or type of transaction. Be sure to label the document clearly for easy identification.

Backup Copies: Always make a backup copy of the document, especially if it contains important financial or legal information. Storing multiple versions–both digitally and physically–ensures that you won’t lose crucial information in the event of technical issues or unexpected circumstances.

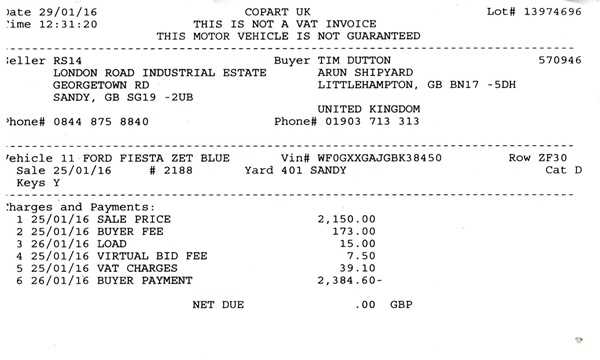

Digital vs. Printed Transaction Document

When managing transaction records, you have two primary options for storage and presentation: digital or printed formats. Each method comes with its own set of advantages and drawbacks, and choosing the best option depends on your needs, preferences, and the specific requirements of your transaction. Understanding the benefits of both formats can help you make an informed decision on how to best handle your document.

Advantages of Digital Format

- Accessibility: A digital copy can be accessed anytime and from anywhere, making it convenient for future reference or sharing with others.

- Space-Efficient: Storing documents digitally takes up no physical space, helping you keep your environment organized and clutter-free.

- Easy to Share: Digital files can be quickly emailed or uploaded to cloud storage, allowing you to easily share them with others or keep backups for security.

- Searchable: Electronic documents can be easily searched by keywords or date, saving time when looking for specific details.

Advantages of Printed Format

- Physical Copy: A printed document provides a tangible record that can be stored in a filing system or presented during in-person transactions.

- Legal or Regulatory Compliance: In certain situations, a physical copy may be required for legal or regulatory purposes, especially in transactions that need to be notarized or witnessed.

- No Dependence on Technology: Printed documents don’t require access to electronic devices or the internet, making them useful in situations where digital access is unavailable.

Ultimately, the choice between digital and printed documents depends on how you intend to use and store them. For most modern transactions, digital storage is the most efficient and accessible method, but keeping a printed version as a backup or for specific uses can still be beneficial.

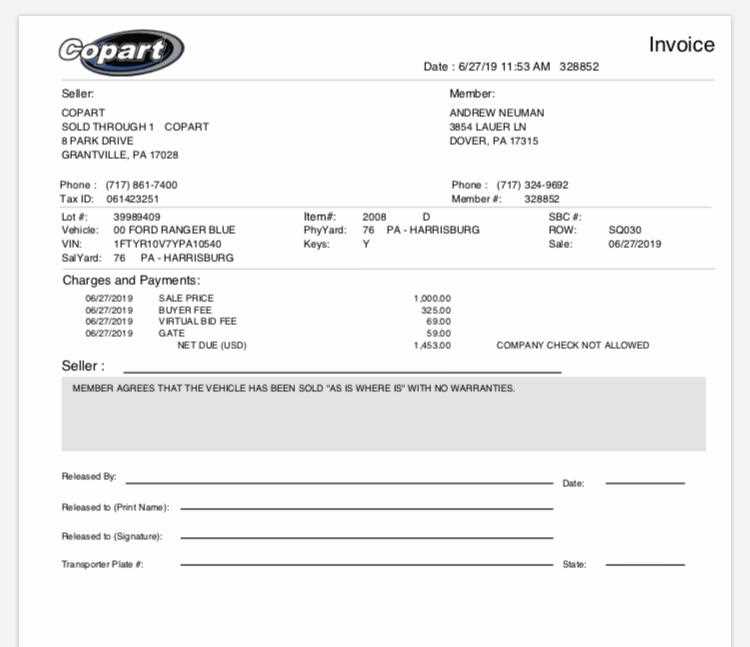

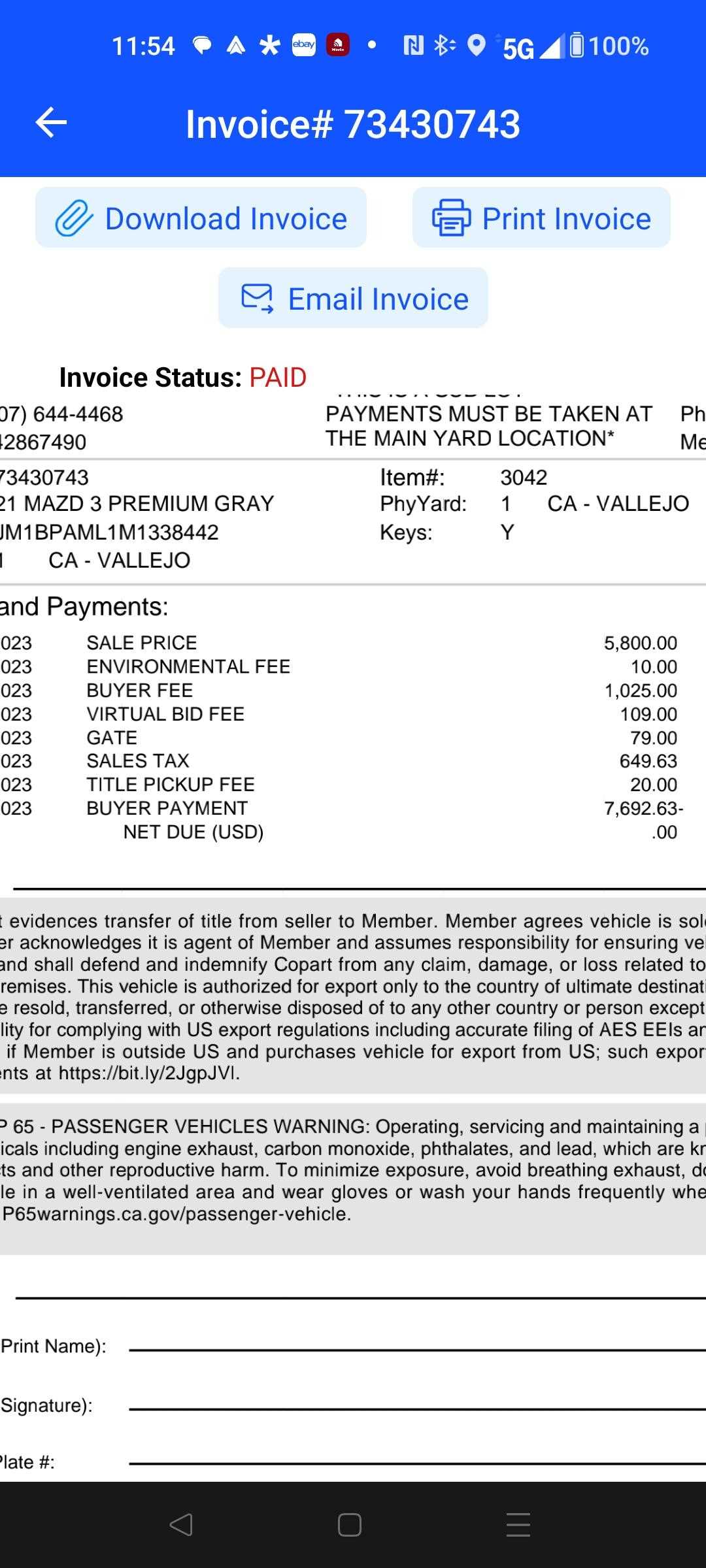

Understanding Transaction Fees

When reviewing your transaction document, it’s important to clearly understand the various fees associated with the purchase. These charges may not always be immediately apparent but can significantly affect the total cost. Fees are typically broken down into several categories, and each one serves a specific purpose related to the transaction or service provided. Knowing how to identify and interpret these charges ensures that you are fully aware of all costs involved.

Types of Common Fees

Transaction documents often include several different fees, which may vary depending on the service provider, transaction type, or location. Some common fees to look for include:

- Service Fees: Charges for handling, processing, or preparing items for delivery or pickup.

- Processing Fees: Fees associated with the processing of payments or transactions, especially when using third-party services or digital platforms.

- Administrative Fees: Costs related to the management and organization of your transaction, such as paperwork handling and system maintenance.

- Taxes: Depending on your location and the nature of the transaction, taxes may be applied to the total cost.

- Shipping or Delivery Fees: Costs for the transportation of goods to your location or a designated destination.

How Fees Affect the Total Cost

Understanding how each fee contributes to the overall price is crucial for budgeting and ensuring that you’re not caught off guard by unexpected costs. Some fees may be fixed, while others can vary depending on factors like the value of the item or the complexity of the transaction. Always review the full breakdown of charges before proceeding with payment to confirm that all fees are correct and reasonable.

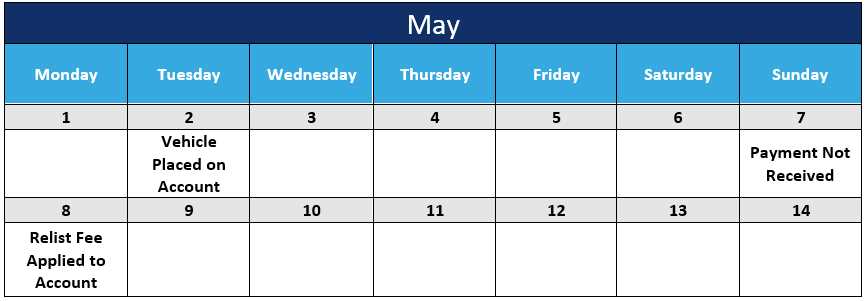

Paying Through Transaction Document

When settling payments for a transaction, it’s important to understand the process outlined in the document. This typically includes specific instructions for completing payment, the methods available, and any deadlines or terms that must be adhered to. Knowing how to navigate the payment process helps ensure that everything is handled correctly and on time, avoiding potential issues or delays.

Available Payment Methods

Most transaction documents provide a variety of payment options to accommodate different preferences. Some of the common methods include:

- Bank Transfers: A secure way to pay directly from your bank account. This method is often recommended for larger transactions.

- Credit or Debit Cards: Quick and convenient for payments of varying amounts. This method is typically processed immediately.

- Online Payment Services: Services like PayPal or other e-wallets can be used to make payments electronically.

- Checks: For those who prefer traditional payment methods, personal or certified checks may be accepted in some cases.

Understanding Payment Terms

Before making a payment, be sure to review the payment terms stated in the document. Key details to look out for include:

- Due Dates: The exact date by which payment must be made to avoid penalties or cancellation of the transaction.

- Late Fees: Any additional charges that may apply if payment is not received by the specified deadline.

- Accepted Currency: Ensure that the payment is made in the correct currency to avoid exchange rate issues or delays.

Following these steps ensures a smooth transaction and helps maintain good standing with the service provider.

What to Do If Document Details Are Incorrect

If you notice any discrepancies or errors in the transaction document, it’s important to address them promptly to ensure everything is in order. Mistakes can happen, but the key is to act quickly and follow the proper steps for correction. Whether it’s an incorrect amount, wrong details, or missing information, resolving the issue effectively will prevent delays and misunderstandings.

Steps to Take

Here’s what you can do if you find an error in your transaction document:

- Review the Details Carefully: Before taking any further action, double-check all the entries in the document. Verify your payment amount, the goods or services purchased, and any additional charges or fees listed.

- Contact Customer Support: Reach out to the customer service team or the department handling your transaction. Provide them with specific details of the issue, such as the incorrect amount, incorrect item information, or missing details.

- Request a Correction: If the error is confirmed, ask for a corrected version of the document. Make sure the updated document accurately reflects the correct details and that you receive it before making any further payments or processing.

- Document All Communication: Keep a record of your interactions with the service provider or seller, including emails, phone calls, or any written correspondence. This can help resolve any future disputes or issues that may arise.

Common Issues to Check

While reviewing your document, be on the lookout for common errors such as:

- Incorrect Amount: Ensure the total amount matches what was agreed upon or what you were quoted.

- Wrong Item or Service: Verify that the items or services listed are correct and match what was purchased.

- Missing Information: Check for any missing details, such as the correct billing address, purchase date, or shipping instructions.

Addressing these issues promptly can help avoid complications and ensure that the process moves forward smoothly.

Legal Importance of Transaction Documentation

Transaction records serve as an essential piece of evidence in legal matters, especially when it comes to validating agreements and ensuring compliance. Such documents hold legal weight, and having a properly documented record can protect both buyers and sellers in case of disputes. These documents detail the terms of the transaction, the agreed-upon price, and the specifics of the goods or services exchanged, making them crucial for upholding rights and obligations.

For any transaction, a clearly outlined record plays a critical role in ensuring transparency and avoiding misunderstandings. It helps prevent fraud and ensures that both parties can provide proof of the deal if needed. The legal importance of such records extends to cases where there may be a need for arbitration, refunds, or even litigation. Accurate documentation ensures that any claims are backed by concrete evidence, safeguarding the interests of all involved parties.

How to Share Your Transaction Record

Sharing your transaction record is a straightforward process, but it’s important to ensure that you do it securely and effectively. Whether you need to send it to a buyer, a financial institution, or a legal entity, there are various methods available. The key is to choose the right format and medium for the intended recipient, ensuring that all relevant details are clear and accessible.

Methods for Sharing

There are a few common ways to share your transaction record:

- Email: The simplest and quickest method. You can attach the document as a PDF or other file format and send it to the intended recipient.

- Cloud Storage: For larger files or secure sharing, uploading the document to a cloud service such as Google Drive or Dropbox allows you to share a link with the recipient.

- Physical Mail: If digital methods are not suitable, printing the document and sending it via postal services is always an option, though it may take longer.

Ensuring Accuracy

Before sharing the document, double-check that all information is accurate and up to date. Make sure that any confidential details are protected, especially if you’re sending the record electronically. Always verify the recipient’s details to avoid sending sensitive information to the wrong person.