Cool Xero Invoice Templates to Simplify Your Billing

Effective billing is crucial for maintaining a smooth workflow and strong client relationships. The way you present your financial documents can make a significant impact on your business image. With the right approach, invoices can not only fulfill their functional role but also enhance professionalism and trust. Having a well-designed, user-friendly document can streamline your processes and save time.

In today’s digital age, there are numerous ways to customize these documents to meet your specific needs. Whether you are a freelancer, small business owner, or part of a larger enterprise, using modern tools to personalize your financial paperwork can help simplify administrative tasks. A variety of ready-made formats are available, offering flexibility in design and functionality. These options can cater to different industries, ensuring that you maintain a polished, cohesive look for all your transactions.

Personalization is key when choosing the right design. Adjusting key elements like layout, branding, and additional fields allows businesses to align their documents with their unique style. Moreover, using a digital system for managing and sending invoices can reduce errors and prevent delays in payments. In this article, we will explore the best options for creating tailored, professional billing documents that fit your needs and elevate your business presentation.

Creative Billing Designs for Professionals

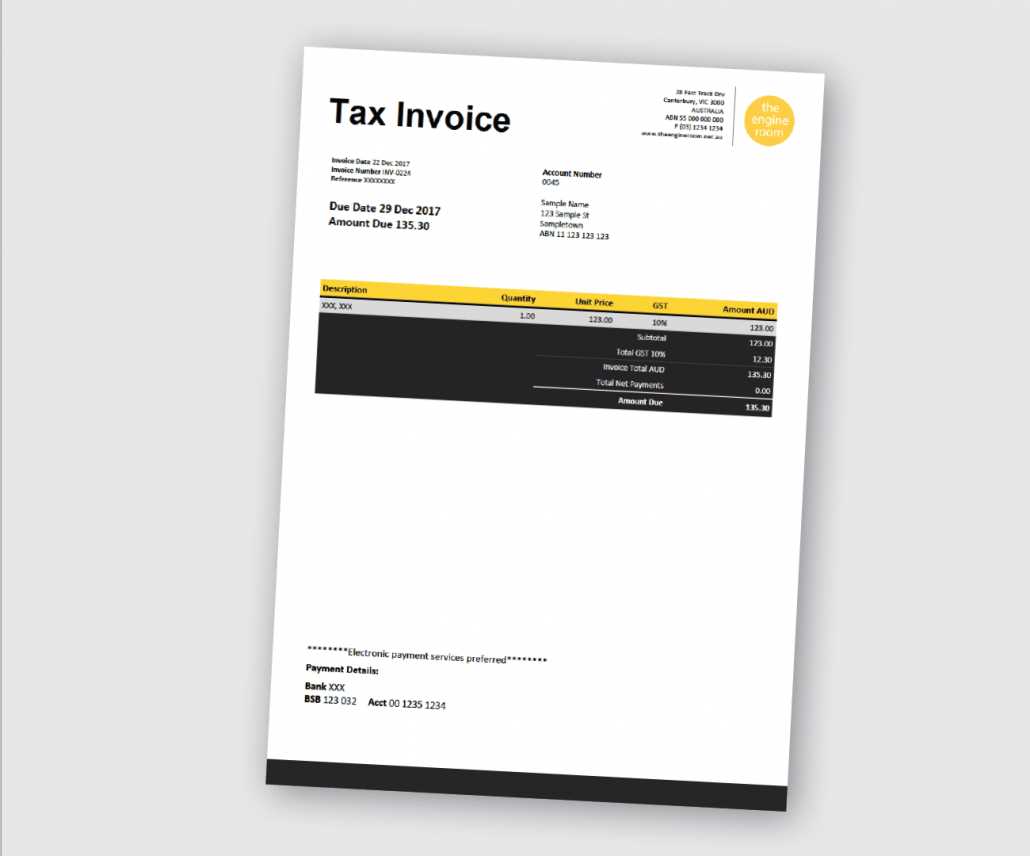

For business professionals, having visually appealing and functional billing documents is essential. A well-structured, clear, and customized layout not only ensures accuracy but also reflects the quality of the services provided. Choosing the right design can elevate the professional image of your business, making transactions smooth and efficient for both parties.

There are various options available that cater to the needs of different industries, allowing individuals to select a layout that suits their particular field. Whether you’re in consulting, design, or any other professional sector, having the ability to tailor your financial documents to align with your branding and the nature of your work can make a significant difference. With these personalized designs, you can easily incorporate your business logo, contact details, payment terms, and other necessary elements.

By utilizing ready-made solutions, professionals can save valuable time while ensuring that their documentation is consistent and organized. These customizable options can be adjusted to meet your exact needs, helping you maintain a polished and cohesive appearance across all communications with clients. The key is finding the right balance between simplicity and functionality, allowing for a seamless billing experience that aligns with your business objectives.

Why Professional Billing Designs Matter

For any business, efficient financial documentation plays a critical role in ensuring smooth transactions and maintaining strong relationships with clients. Customized billing documents help ensure that all necessary details are clearly presented, reducing the risk of errors and misunderstandings. The right format can also make a positive impression, reflecting the professionalism and reliability of your business.

Benefits of Using Customized Billing Solutions

Using pre-designed options that can be easily customized offers numerous advantages. Here are some key reasons why personalized billing documents are essential:

- Consistency: Tailored designs allow you to maintain a consistent brand image across all client communications, reinforcing your company’s identity.

- Efficiency: Ready-made formats save time, allowing you to quickly generate accurate and professional-looking documents without starting from scratch.

- Accuracy: With the right format, it’s easier to include all required fields, such as payment terms, taxes, and discounts, ensuring every document is complete and error-free.

- Automation: Many systems allow for automatic population of fields, reducing manual entry and minimizing the risk of mistakes.

How Customization Improves Client Experience

Personalized billing documents also enhance client interaction by offering clear, easy-to-read statements. When clients can quickly understand the details of their transaction, it builds trust and professionalism. Additionally, a well-structured document that aligns with your brand creates a sense of reliability, which can lead to stronger client relationships and repeat business.

Top Features of Professional Billing Documents

When choosing a billing solution for your business, it’s essential to look for features that enhance efficiency, accuracy, and presentation. Well-designed financial documents come with a variety of options that allow for customization and automation, making the invoicing process faster and more reliable. These key features not only simplify administrative tasks but also improve the overall client experience by presenting clear, professional statements.

Key Elements to Look For

Below are some of the most valuable features that a high-quality billing document format should offer:

| Feature | Description |

|---|---|

| Custom Branding | Ability to add logos, color schemes, and contact details to align with your company’s identity. |

| Automatic Calculation | Automatic addition of taxes, discounts, and totals, reducing the risk of manual errors. |

| Predefined Fields | Includes key fields such as payment terms, due dates, and itemized services, ensuring nothing is missed. |

| Client Notes Section | Space to add personalized messages, such as thank-you notes or special instructions, improving communication. |

| Recurring Billing Options | Enables easy creation of recurring billing schedules for clients with regular services or subscriptions. |

Additional Functional Benefits

Beyond the core features, some billing document formats also offer added functionalities to streamline processes:

- Multi-Currency Support: Ideal for businesses dealing with international clients.

- Cloud Integration: Syncs with accounting software to automatically update and track financial records.

- Mobile-Friendly: Optimized designs that can be viewed and edited easily on mobile devices.

By incorporating these featu

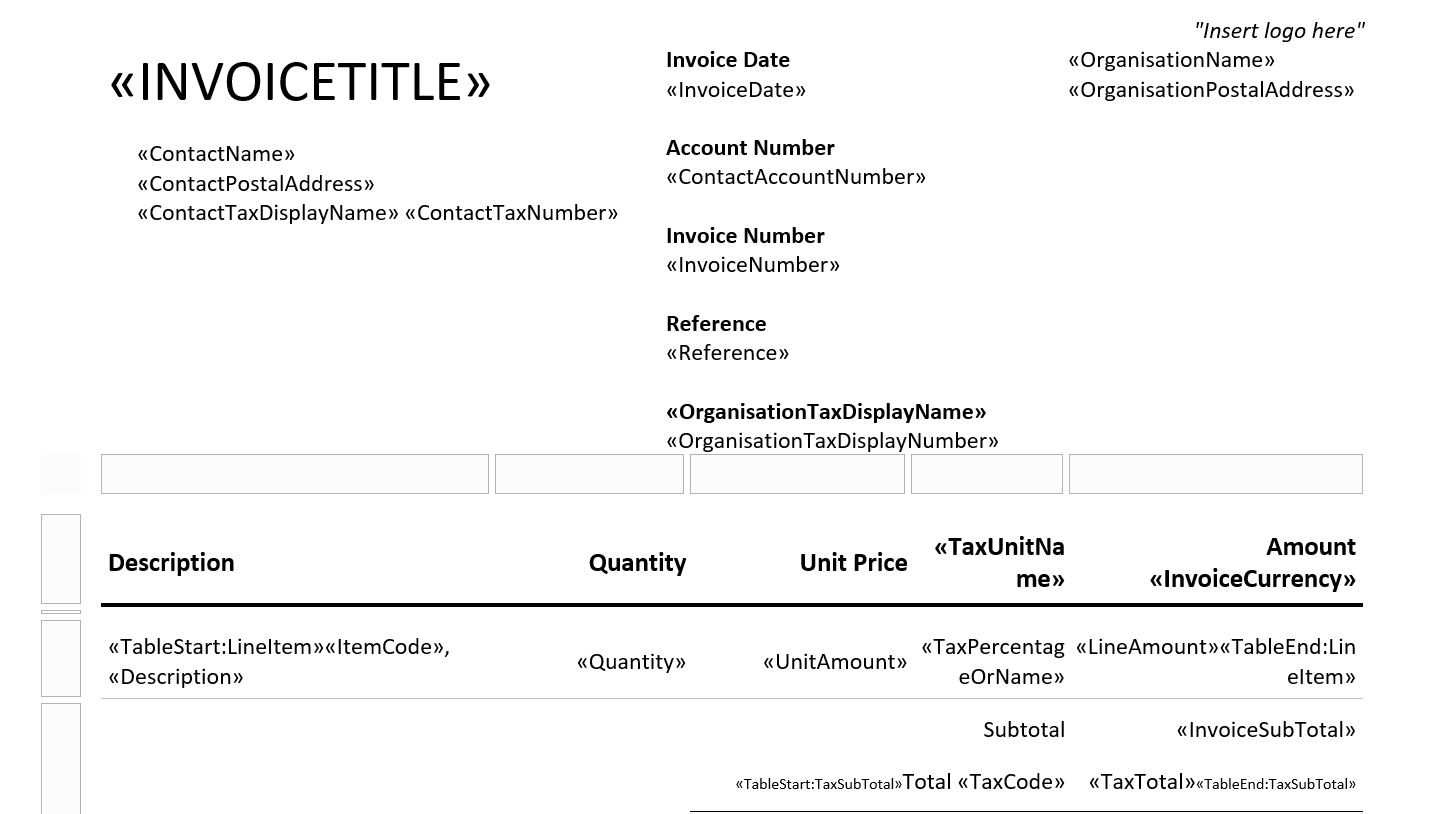

How to Customize Your Billing Documents

Customizing your financial documents allows you to tailor them to the unique needs of your business. Personalization not only helps maintain a consistent brand image but also ensures that all necessary information is included in a clear and professional manner. With the right tools, you can easily modify layouts, add or remove fields, and integrate your company’s branding to create documents that align perfectly with your workflow.

Steps to Personalize Your Documents

To get started with customization, follow these simple steps to modify your billing documents:

- Choose a Base Design: Start by selecting a layout that best suits your business style. Choose from basic, professional, or detailed designs depending on your needs.

- Add Your Branding: Incorporate your company logo, color scheme, and contact information to personalize the look and feel of the document.

- Set Payment Terms: Include essential details like payment due dates, discounts, or late fees to ensure transparency with clients.

- Include Custom Fields: Add or remove fields according to your business requirements, such as specific product descriptions, service categories, or custom taxes.

- Adjust Layout and Format: Modify the arrangement of sections, text size, and column width to ensure that the document is easy to read and visually appealing.

Additional Customization Options

In addition to the basic customizations, here are some advanced options to further enhance your documents:

- Recurring Billing: Set up automatic billing for clients with ongoing services, ensuring timely and consistent payments.

- Multi-Currency Support: If you deal with international clients, enable multi-currency support to automatically convert prices into the appropriate currency.

- Client Notes: Add personalized messages for your clients, such as thank-you notes or special instructions.

- Digital Signatures: Enable the option for clients to digitally sign the document for faster processing and approval.

By following these steps and taking advantage of customization options, you can create billing documents that are not only efficient but also reflective of your professional brand and specific business needs.

Free vs Paid Billing Document Designs

When it comes to selecting the right format for your financial documents, one of the key decisions you’ll face is whether to use free or paid options. Both choices come with their own set of benefits and limitations, depending on your specific business needs. While free solutions may seem like a cost-effective choice, paid options often offer more advanced features and customization options that can save you time and enhance your professional image.

Comparing Free and Paid Designs

Below is a comparison of the advantages and drawbacks of both free and paid billing document formats:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization options, often with predefined layouts. | High level of customization, allowing you to adjust every aspect of the design. |

| Design Variety | Usually basic, with limited choices in design and layout. | Wide variety of premium designs with modern, professional aesthetics. |

| Advanced Features | Minimal or no advanced features like automated calculations, recurring billing, or multi-currency support. | Includes advanced features such as automated taxes, discount calculations, and multi-currency handling. |

| Support | Limited or no support for troubleshooting issues. | Full customer support and access to resources for troubleshooting and customization. |

| Cost | Free to use, no upfront costs. | Paid subscription or one-time fee, depending on the provider. |

Which Option Is Right for You?

The choice between free and paid billing formats ultimately depends on the complexity of your business needs. If you’re just starting out or run a small business with simple requirements, free designs might be sufficient. However, for businesses that require more advanced functionality, such as recurring billing, multi-currency support, or enhanced branding, paid solutions are likely to provide a better experience in the long run.

Choosing the Right Billing Document Design for Your Business

Selecting the right financial document layout for your business is crucial to ensure clarity, professionalism, and efficiency in your transactions. The ideal design should not only reflect your brand but also accommodate your specific invoicing needs, such as detailing services, applying discounts, and managing taxes. With numerous options available, it’s important to choose a solution that aligns with your business structure and the types of clients you serve.

Factors to Consider When Choosing a Design

When deciding on the right format, consider the following key factors to ensure it meets your needs:

- Business Size: Larger companies may require more complex designs with additional fields, while small businesses may benefit from simpler layouts that focus on clarity.

- Industry Requirements: Different sectors may need specific sections in their documents, such as project details for consultants or SKU numbers for product-based businesses.

- Customization Options: Look for layouts that allow you to easily incorporate your brand colors, logo, and contact details, ensuring consistency across all communications.

- Features and Functionality: Consider whether you need advanced features like automated tax calculations, recurring billing, or multi-currency support, especially if you work with international clients.

- Ease of Use: The design should be simple enough to use regularly, with clear fields and an intuitive layout that minimizes errors and saves time.

Tips for Selecting the Best Fit

To help make the right decision, here are some tips for choosing a design that will work best for your business:

- Assess Your Workflow: Think about how often you need to generate new documents and whether the design allows you to quickly add or update details.

- Prioritize Key Features: Identify which features are essential, such as payment terms, itemized breakdowns, or the ability to include customized notes for clients.

- Test Different Options: If possible, experiment with a few options to see which one works best for your business style and client expectations.

- Consider Client Experience: Ensure that the format is easy for your clients to read and understand, with all necessary information clearly displayed.

By considering these factors, you can choose the right billing document design that will not only streamline your administrative tasks but also leave a lasting positive impression on your clients.

Best Practices for Designing Billing Documents

Creating professional and clear financial documents is essential for any business. The layout and design of your billing records not only affect how information is presented but also influence the client’s experience with your brand. A well-designed document can build trust and enhance your professional reputation, ensuring that your clients understand the details of their transactions easily and efficiently. By following certain best practices, you can improve both the functionality and appearance of your documents.

Key Design Principles

When designing your financial statements, consider the following principles to ensure your documents are both functional and aesthetically pleasing:

- Clarity: Keep the design simple and clear, with well-organized sections. Avoid clutter and make sure the most important information stands out, such as the total amount due, payment terms, and due date.

- Consistency: Use consistent fonts, colors, and spacing throughout the document. This helps maintain a professional look and makes it easier for clients to read and understand the information.

- Branding: Incorporate your company’s logo, colors, and contact information in a way that aligns with your brand identity. A personalized design reinforces your business’s professionalism and makes your documents instantly recognizable.

- White Space: Allow for adequate space between sections to prevent the document from looking crowded. This makes the content easier to digest and visually appealing.

- Responsive Layout: Ensure your design is optimized for different devices, especially mobile phones, as many clients view documents on the go.

Additional Tips for Enhancing Functionality

In addition to the visual aspects of your billing documents, you should also consider the following functional improvements to streamline the invoicing process:

- Use of Automated Calculations: Whenever possible, automate calculations such as taxes, discounts, and totals to reduce errors and save time.

- Clear Payment Instructions: Provide clear, concise instructions on how clients can make payments, including acceptable payment methods and any relevant details such as bank account information or online payment links.

- Itemized Details: Always include a detailed breakdown of the products or services provided, ensuring transparency and helping clients understand the value of what they are being charged for.

- Include Payment Terms: Clearly outline your payment terms, such as the due date, late fees, or discounts for early payments. This helps set cle

Time-Saving Benefits of Automated Billing Solutions

Managing financial documents can be a time-consuming task, especially when it comes to creating, updating, and sending them to clients. However, by using efficient, pre-designed layouts, businesses can streamline this process and significantly reduce the amount of time spent on billing tasks. These automated solutions not only improve accuracy but also allow business owners to focus on more strategic activities, such as growing their business or improving client relationships.

One of the key advantages of using ready-made formats is the ability to automate many aspects of the process. For example, fields such as tax rates, total amounts, and due dates can be automatically populated, saving you from manually entering the same information each time. This reduces human error and ensures consistency across all your financial documents.

Additionally, with these solutions, you can store client details and previous transactions, allowing for quick access and easy reuse. This is especially helpful for businesses that work with repeat clients or offer subscription-based services, as it eliminates the need to recreate documents from scratch for every transaction.

Another time-saving benefit is the integration of recurring billing, which automatically generates and sends documents at specified intervals. This feature helps maintain a steady cash flow without additional administrative effort, while also improving payment predictability.

By adopting these automated billing formats, businesses can free up valuable time, reduce manual work, and ensure that all financial communications are consistent, professional, and accurate.

How to Use Billing Documents for Branding

Billing documents are not just functional tools for managing payments; they are also a powerful way to reinforce your brand identity. Every time you send a financial document to a client, it’s an opportunity to remind them of your business values, professionalism, and attention to detail. Customizing your documents to reflect your brand can enhance client trust and leave a lasting impression, which can ultimately contribute to customer loyalty and business growth.

Key Elements to Customize for Branding

Here are some key aspects to focus on when personalizing your financial documents for branding purposes:

- Logo and Company Name: Make sure your logo is prominently displayed at the top of the document, along with your full company name. This creates immediate brand recognition and helps clients associate the document with your business.

- Color Scheme: Use your business’s color palette throughout the document. This includes headers, text highlights, and borders. Consistent use of your brand colors helps create a cohesive experience for your clients.

- Typography: Choose fonts that align with your brand’s personality. Whether you prefer a modern, professional look or a more casual and friendly style, the font you choose should complement your overall brand tone.

- Contact Information: Include all relevant contact details–such as your website, phone number, and email–using the same format as in your other marketing materials to maintain consistency.

- Tagline or Message: Incorporate your business’s tagline or a short personalized message (e.g., “Thank you for your business”) to reinforce your brand’s values and mission with each document.

Additional Tips for Stronger Branding

For even greater impact, consider these additional branding strategies:

- Custom Backgrounds: Adding a subtle background pattern or a faded version of your logo can make the document feel more unique and branded without overwhelming the content.

- Brand Imagery: If appropriate, include brand-related images or icons to enhance the visual appeal of the document while maintaining professionalism.

- Personalized Notes: Include a custom thank-you note or a reminder of your services to engage clients and give your communications a personal touch.

- Consistency Across Platforms: Ensure that your branding elements on billing documents match the branding found on your website, email signatures, and

Integrating Billing Documents with Accounting Systems

Seamlessly integrating your financial documents with your accounting system can significantly improve efficiency, accuracy, and time management. By linking your documents directly to your financial records, you can automate much of the data entry process, reduce the risk of errors, and ensure that all transactions are properly recorded. This integration provides a streamlined approach to managing both invoicing and bookkeeping tasks, ultimately helping you maintain a clearer, more organized financial overview.

When your financial documents are connected to your accounting software, several key benefits come into play. For instance, data like payments, taxes, and itemized services can be automatically synced to your records, eliminating the need for manual updates. This not only saves time but also ensures that your financial statements are accurate and up to date. Additionally, integrating these two systems allows for better tracking of accounts receivable, making it easier to monitor unpaid bills and manage cash flow.

Many modern accounting platforms offer integration features that allow you to create, send, and track billing documents directly from the software. This means you don’t have to manually export or import data, reducing the chance of discrepancies between your documents and accounting records. These systems can also generate reports and insights based on the information in your financial documents, giving you a more comprehensive understanding of your business’s financial health.

Integrating billing solutions with accounting software ensures that all aspects of the invoicing and payment process are streamlined, reducing administrative workload while maintaining financial accuracy.

Common Mistakes in Billing Document Design

While designing financial documents, many businesses make common mistakes that can impact the professionalism, clarity, and effectiveness of the document. These errors can lead to confusion, missed payments, or delays in processing. By understanding and avoiding these pitfalls, you can ensure that your billing documents are clear, accurate, and create a positive impression with your clients.

Key Mistakes to Avoid

Here are some of the most frequent mistakes made when designing billing records and how to prevent them:

- Cluttered Layout: A busy, disorganized document can overwhelm your clients and make it difficult for them to find essential information. Keep the design clean, with ample white space and clear headings to separate key sections like total amount due, payment terms, and item descriptions.

- Missing or Inaccurate Details: Always double-check that all relevant details are included, such as the client’s name, address, and accurate billing breakdown. Omitting or misplacing information can cause confusion and delay payments.

- Poor Readability: Using hard-to-read fonts or small font sizes can make it difficult for clients to review the document quickly. Stick to clear, legible fonts and maintain a readable size (usually between 10 and 12 points) to ensure the information is easy to digest.

- Overcomplicating the Design: While it’s important to add your branding, it’s also essential to avoid overwhelming your clients with excessive design elements, such as too many colors, complex backgrounds, or unnecessary graphics. A simple, professional design is often more effective.

- Not Including Payment Instructions: Failing to clearly outline payment methods, deadlines, and any penalties for late payments can lead to confusion and delayed transactions. Always specify how and when payment should be made and make sure the instructions are easy to follow.

- Ignoring Mobile Compatibility: Many clients now view documents on their phones, so it’s important to ensure that your documents are mobile-friendly. Test how the document appears on different devices to make sure it remains legible and well-structured.

Tips for Better Design

To avoid these mistakes, keep these design tips in mind:

- Focus on Simplicity: A clean, well-organized design ensures that your clients can quickly locate key information.

- Use Clear Headings: Make it easy for your clients to navigate the document by using clear, bold h

Improving Client Communication with Billing Documents

Effective communication with clients is vital to maintaining strong business relationships and ensuring smooth financial transactions. By customizing and enhancing your financial documents, you can improve how you communicate with your clients, making it easier for them to understand important details such as amounts due, payment terms, and the services or products provided. Clear, professional documents help build trust and prevent confusion, leading to faster payments and higher customer satisfaction.

Clear and Transparent Information

One of the most important aspects of client communication is ensuring that the information you provide is transparent and easy to understand. Financial documents should include a detailed breakdown of charges, payment terms, and any relevant taxes or discounts. By making this information clear, you reduce the risk of misunderstandings and ensure that your clients are fully aware of what they are being billed for. This not only helps with timely payments but also reinforces your reputation for professionalism.

Personalized Messages and Branding

Customizing your financial documents with a personal touch, such as a brief thank-you note or a reminder about your services, can enhance your client interactions. Including your branding elements like logos, colors, and contact details ensures consistency across all communications and strengthens your brand identity. A well-branded document can leave a lasting impression on clients, making them more likely to engage with your business in the future.

By integrating these elements into your financial documents, you can improve client communication and create a more professional, cohesive experience for your customers.

Responsive Billing Documents for Mobile

As mobile usage continues to rise, it’s essential that your financial documents are optimized for viewing on all devices, especially smartphones and tablets. Clients may access your billing records on the go, and if the document is not mobile-friendly, it can lead to frustration and delays in payments. By designing responsive billing formats, you can ensure that your documents are easily readable and accessible, no matter what device your clients are using.

Why Mobile Responsiveness Matters

Mobile-responsive documents automatically adjust their layout and design to fit different screen sizes, ensuring that all the information remains clear and legible without the need for zooming or horizontal scrolling. With more clients managing their finances through smartphones, ensuring that your financial documents are mobile-friendly is crucial for a positive client experience. Responsive designs help avoid errors caused by misinterpretation or overlooked details due to poor formatting on smaller screens.

Key Features of Mobile-Friendly Designs

Here are some important features to consider when designing responsive billing documents:

- Flexible Layout: Use a layout that adapts to different screen sizes. Avoid fixed widths that might cause text to overflow or images to become distorted on mobile devices.

- Legible Fonts: Choose fonts that are easy to read on smaller screens. Sans-serif fonts often work best for mobile, and make sure the text size is large enough for comfortable reading without zooming.

- Clear Hierarchy: Organize the document with clear headings, subheadings, and bullet points to guide the reader’s eye. Make sure important information like totals and payment instructions stand out.

- Minimalist Design: Keep the design simple and uncluttered, removing unnecessary elements that might distract from key information. Focus on what’s most important to the client: amount due, payment terms, and contact information.

- Optimized Images: Any logos or images should be sized appropriately for mobile screens to prevent them from taking up too much space or distorting the layout.

By creating responsive billing documents, you can enhance the client experience and ensure that your financial communications are clear and professional, no matter where your clients are viewing them.

How to Add Taxes and Discounts in Billing Documents

When creating financial documents, it’s essential to accurately reflect taxes and discounts in order to maintain transparency and ensure that your clients are billed correctly. Properly adding these adjustments not only helps in maintaining compliance with local regulations but also provides clarity to your clients. Whether you’re applying a standard tax rate or offering a special discount, making these additions clear is a key part of professional financial communication.

Adding Taxes to Your Documents

To apply taxes to your financial records, you’ll first need to determine the appropriate tax rate based on your location and the nature of the transaction. Once you have the correct tax rate, you can easily add it to your document in a few steps:

- Define Tax Rates: Set up your tax rates in the accounting system to ensure that they can be easily applied to future transactions.

- Apply Tax to Items: For each item or service in the document, select the correct tax rate. This will automatically calculate the amount of tax based on the price of the goods or services provided.

- Show Tax Breakdown: Ensure that the tax is clearly shown as a separate line item on the document. This transparency helps clients understand how the tax is calculated and ensures that they are not confused by the total amount due.

Adding Discounts to Your Documents

Discounts are a great way to incentivize customers or offer promotions, and they should be clearly reflected in your financial documents. To ensure your discounts are accurate, follow these steps:

- Apply Discount to Total or Items: You can choose to apply a discount to the overall total of the document or to individual items. Either way, make sure the discount is clearly indicated and subtracted from the total amount.

- Clearly State the Discount: Whether it’s a percentage or a fixed amount, specify the type of discount on the document. For example, “10% discount” or “$20 off” should be listed as a line item so your client can see the savings.

- Ensure Correct Calculations: Double-check that the final amount after the discount and taxes is accurate and that the client understands how it was derived. This builds trust and prevents confusion at the time of payment.

By accurately adding taxes and discounts, you not only ensure compliance with financial standards but also improve the clarity and professionalism of your billing documents. This process can be automated, allowing you

Creating Recurring Billing Documents

For businesses that offer subscription-based services or regular payments, generating recurring billing documents can significantly simplify the process and reduce administrative overhead. By automating the creation and sending of these documents, you can ensure timely payments without the need to manually recreate the same document each cycle. This process is not only time-saving but also helps maintain consistency and accuracy across your transactions.

Setting Up Recurring Payments

To create recurring billing documents, the first step is to configure the frequency and timing of the payments. This ensures that clients are billed automatically on the specified schedule, whether it’s weekly, monthly, or annually. Setting up these parameters allows you to focus on other business priorities while ensuring that the billing process runs smoothly.

The key elements in setting up recurring payments include:

- Frequency: Determine how often the document needs to be sent, such as monthly or quarterly.

- Start and End Dates: Specify when the recurring billing cycle begins and whether it has a defined end date or runs indefinitely.

- Amount to Be Charged: Set the exact amount to be billed each time. This can include fixed amounts or dynamic pricing depending on the services provided.

- Payment Terms: Define payment terms for each cycle, including due dates and any late payment penalties.

Automating the Process

Once you’ve configured the recurring billing cycle, the next step is to automate the creation and delivery of these documents. Automation not only saves time but also ensures accuracy and consistency. You can program your system to send invoices automatically at the beginning of each billing period, reducing the risk of missed payments.

Here’s a table summarizing the setup process for recurring billing:

Step Details Step 1 Set the billing cycle frequency (weekly, monthly, etc.). Step 2 Define start and end dates for recurring payments. Step 3 Set the amount to be charged per cycle, including any additional fees. Step 4 Specify the payment terms, including due dates and late fees. Step 5 Automate the sending of billing documents on the set schedule. By setting up automated recurring billing, you not only save time but also improve cash flow management and ensure your clients are billed on time. This system is ideal for businesses with ongoing services or subscription models, allowing for seamless and efficient operations.

Automating Payments with Billing Documents

For businesses aiming to streamline their payment collection process, automating payments is a key solution. This approach reduces the need for manual intervention, ensures timely transactions, and minimizes the risk of late payments. By integrating payment automation with your billing system, you can provide your clients with a seamless, hassle-free way to settle their accounts on time.

How Payment Automation Works

Automating payments involves setting up your billing system to automatically charge your clients at predefined intervals, such as after the issuance of a financial document or at regular billing cycles. Once a client’s payment method is securely stored, the system can automatically process payments based on the terms outlined in the document, such as due date and payment amount.

- Set Up Recurring Payment Methods: Configure the billing system to accept and process recurring payments from clients, eliminating the need to manually request payment each cycle.

- Payment Reminders: Set up automated reminders for clients to alert them of upcoming payments, helping to reduce overdue amounts and ensure timely payment processing.

- Payment Confirmation: Automate the process of sending payment confirmations to clients once the transaction is successfully completed.

- Integrate Payment Gateways: Ensure your system is connected to secure online payment gateways to facilitate easy transactions directly from the document.

Benefits of Payment Automation

Automating payment collection brings several advantages to both businesses and their clients:

- Improved Cash Flow: Automatic payments ensure that funds are consistently collected on time, leading to better cash flow management.

- Reduced Administrative Burden: By automating the payment process, you reduce the amount of time spent on manual invoicing and follow-ups, allowing you to focus on other business tasks.

- Enhanced Client Experience: Clients appreciate the convenience of automated payments, as they don’t have to worry about remembering payment deadlines.

- Accuracy and Consistency: Automated systems help eliminate human error, ensuring that the correct amount is always billed and paid.

By integrating payment automation into your billing documents, you can create a smooth, efficient process that benefits both your business and your clients, improving overall productivity and customer satisfaction.

Top Sources for Billing Document Designs

When creating professional and functional billing documents, finding the right resources for high-quality designs is essential. The right design can enhance the professionalism of your communication, ensure clarity, and streamline the payment process. Fortunately, there are many platforms offering customizable document layouts that can be tailored to suit your business needs.

Popular Platforms for Document Designs

Here are some top sources where you can find great billing document designs that can be easily adapted to your system:

- Online Marketplaces: Websites like Etsy and Creative Market offer a wide variety of pre-designed document layouts. Many of these designs are customizable and can be adapted to different business needs.

- Accounting Software Providers: Many accounting software platforms, aside from just offering invoicing features, provide additional design options to create professional-looking documents. These platforms often come with easy-to-use templates designed for small businesses.

- Freelance Designers: Hiring a freelance graphic designer can be an excellent option if you’re looking for a unique and customized design. Platforms like Fiverr or Upwork connect businesses with professionals who specialize in creating tailored billing documents.

- Design Software Tools: Tools such as Canva or Adobe Spark allow users to create their own designs from scratch or customize existing templates. These platforms are user-friendly and offer various layout options to suit different business needs.

- Template Libraries: Websites such as Template.net and Invoice Home have extensive libraries of customizable document layouts, including designs that can be easily adapted for recurring bills, contracts, and estimates.

Key Factors to Consider When Choosing a Source

When selecting a source for billing document designs, keep these key factors in mind:

- Customization Options: Ensure that the source allows enough flexibility to adjust the layout, colors, and fonts according to your branding requirements.

- Ease of Use: Choose a source that provides easy-to-use interfaces or templates, so you don’t waste time learning complicated software.

- Professional Appeal: Always prioritize a design that looks polished and professional, as your billing document represents your brand.

- Compatibility: Make sure the design can be easily integrated with your existing billing or accounting system.

By sourcing high-quality document designs, you can ensure that your billing process not only runs smoothly but also maintains a strong, professional image for your business.