Cool Invoice Template for Effortless and Professional Billing

For any business, presenting a polished and professional document for transactions is essential. A well-crafted financial document can enhance your brand’s image and make the payment process smooth for both you and your clients. The right design not only looks attractive but also ensures all crucial details are clear and easy to follow.

When crafting your document, it’s important to focus on both functionality and style. A visually appealing layout can leave a positive impression while ensuring that all the necessary information is easy to understand. From payment terms to contact details, every element should be organized for clarity and simplicity.

Whether you’re a freelancer, small business owner, or running a larger company, using a professional billing design can improve efficiency. It sets the tone for your interactions and helps clients feel confident in your professionalism. In this guide, we’ll explore how to create the perfect document that will suit your needs and leave a lasting impact.

Cool Invoice Template for Your Business

In today’s competitive market, the way you present your business communications can make a significant difference. A well-designed billing document not only reflects your professionalism but also improves the client experience. It’s essential that this document is both functional and aesthetically pleasing, ensuring that all relevant information is presented clearly and in an organized manner.

For businesses of all sizes, the right design can streamline your financial processes. A sleek and easy-to-understand document simplifies communication with your clients, helping to reduce misunderstandings and errors. Whether you are a freelancer or run a larger company, having a cohesive and consistent format will give your communications a polished look and reinforce your brand identity.

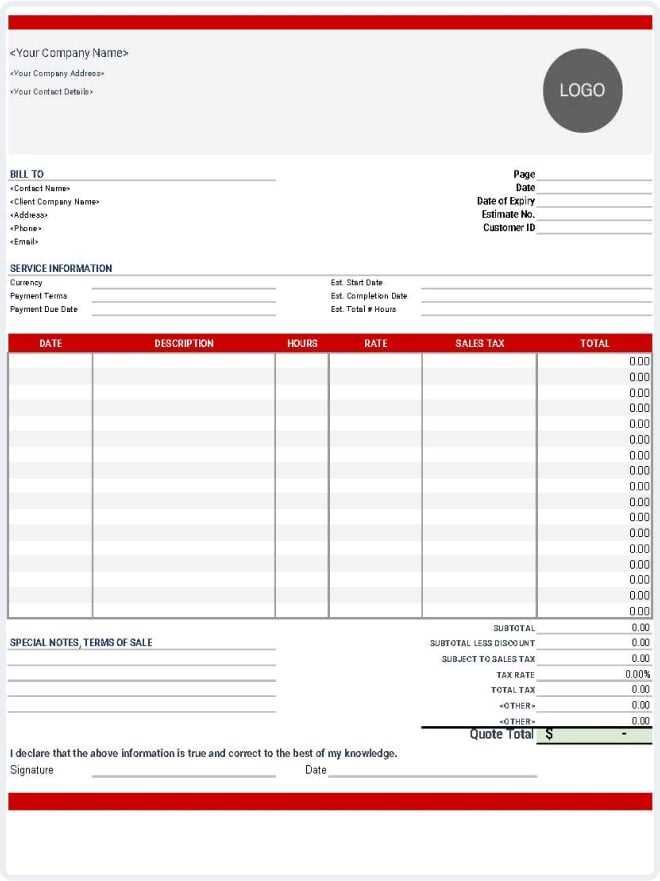

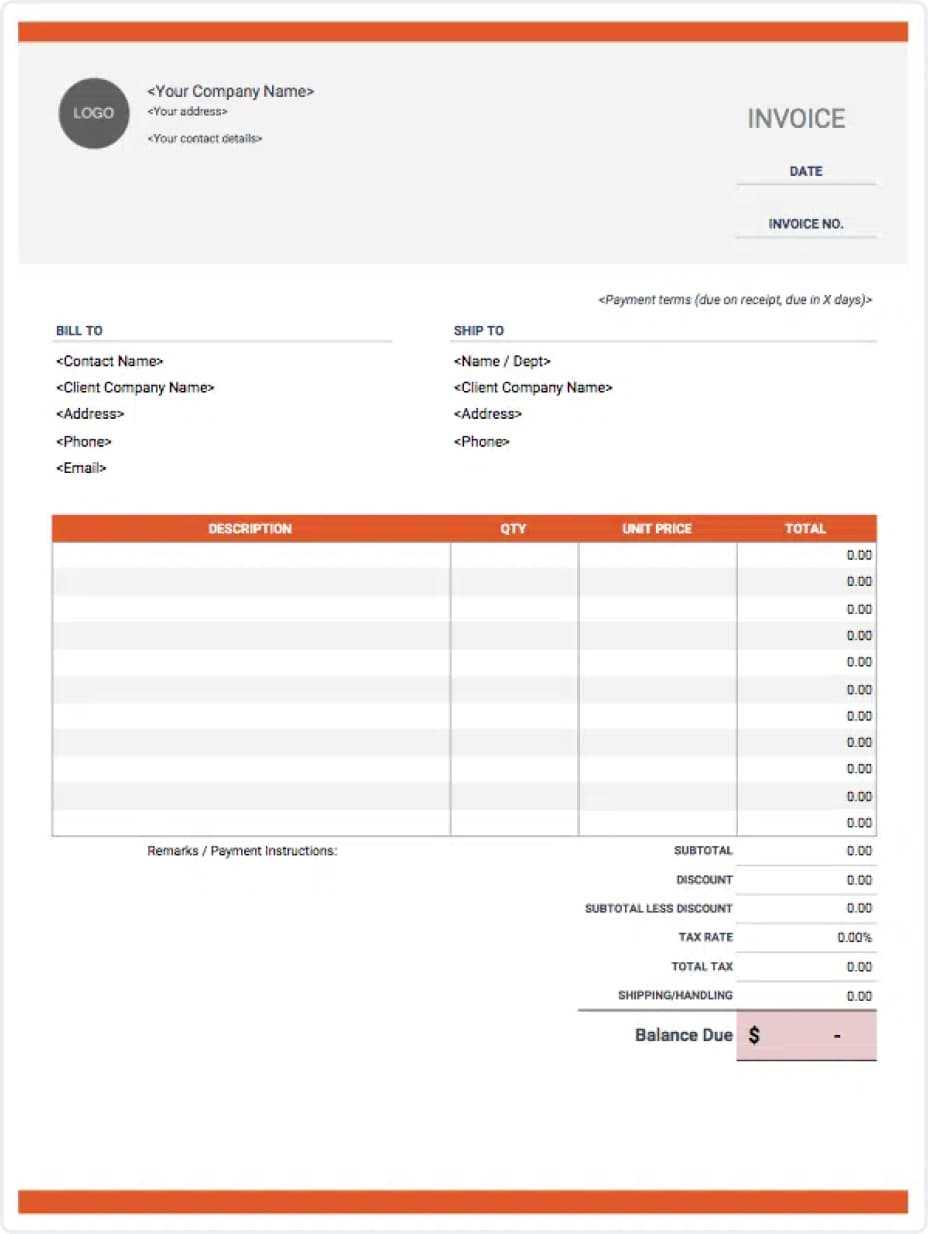

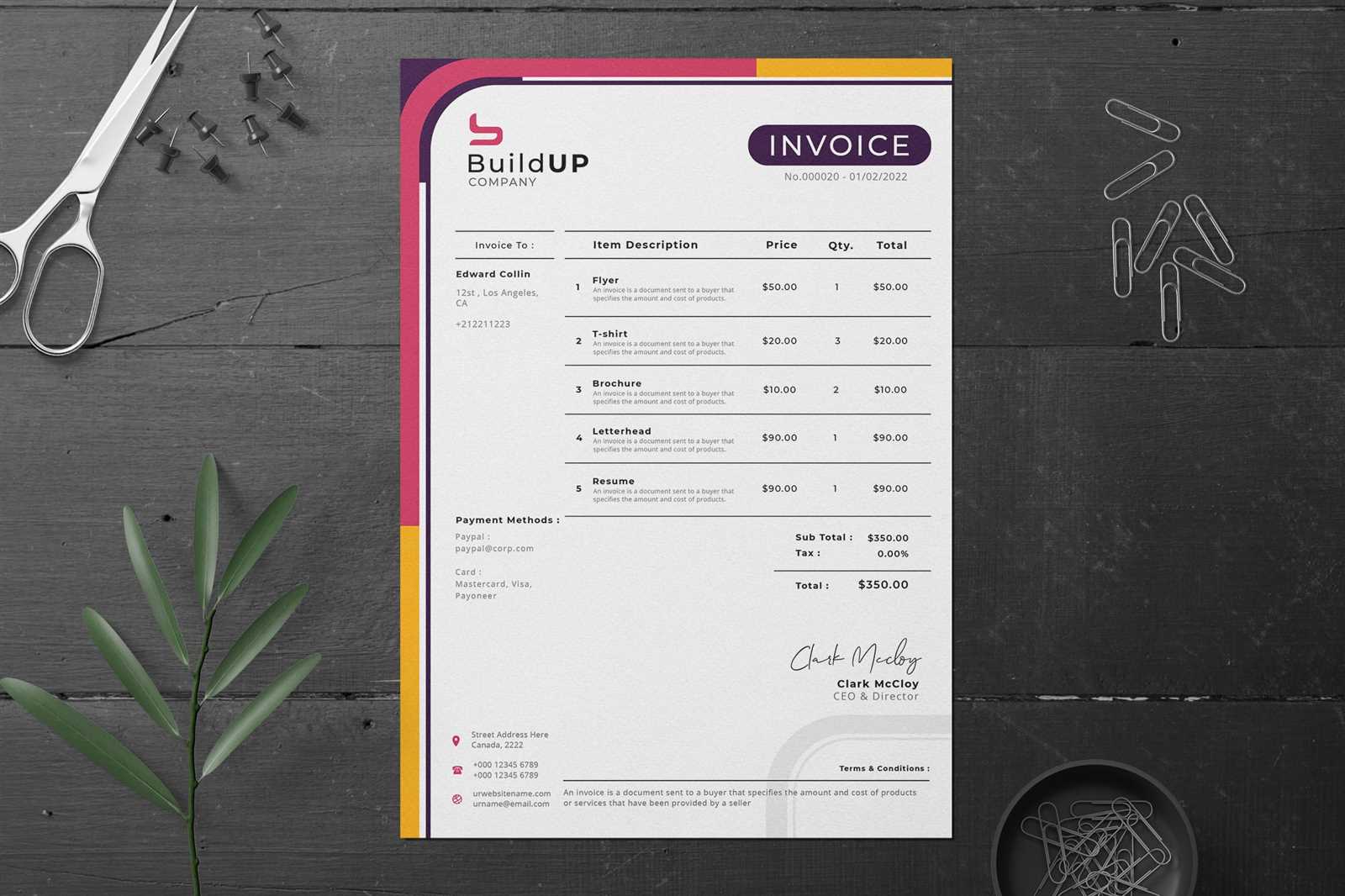

Here’s an example of a well-organized layout for your business documents, featuring all the necessary sections for clarity:

| Section | Description |

|---|---|

| Header | Includes your business name, logo, and contact information. This is the first thing your client will see, so make it eye-catching and professional. |

| Client Details | List the client’s name, address, and contact information for easy reference. |

| Service or Product Details | Clearly outline the goods or services provided, including quantities, rates, and descriptions. |

| Payment Terms | Specify due dates, late fees, and accepted payment methods to avoid confusion. |

| Footer | Include your business’s terms and conditions, along with any additional notes or instructions for the client. |

By structuring your documents this way, you ensure that every piece of vital information is easy to find and understand, while maintaining a clean, professional appearance. This can lead to faster payments and stronger business relationships.

Why a Modern Invoice Matters

A well-designed financial document goes beyond just being a record of a transaction; it plays a crucial role in maintaining professionalism and trust in business relationships. A sleek, modern design not only looks more appealing but also ensures that all necessary information is easily accessible, helping to avoid misunderstandings and mistakes.

First Impressions Matter

The way you present your billing documents can leave a lasting impression on your clients. A contemporary, easy-to-read design signals that you value both your work and your clients. It shows that you are organized and reliable, which can strengthen business relationships and encourage timely payments.

- Professional design builds trust and credibility

- Clear layout makes information easier to understand

- Consistency in appearance reinforces your brand identity

Efficiency and Clarity

Modern designs often incorporate elements that make the document easier to navigate, helping your clients quickly find the information they need. This can be especially important when dealing with large or complicated transactions. By using a streamlined format, you can ensure that both you and your clients save time and reduce errors.

- Organized sections for better readability

- Clear payment terms and due dates reduce confusion

- Room for customization based on specific client needs

In summary, adopting an updated and user-friendly document format not only reflects your professionalism but also fosters smoother, more efficient communication with clients. This simple step can improve your workflow, reduce mistakes, and lead to quicker payments.

How to Create a Cool Invoice

Creating a well-designed document for billing is an essential part of maintaining professionalism and ensuring that all parties involved are clear on the terms of the transaction. A thoughtfully designed document not only conveys important details but also enhances your brand’s image. The process of crafting a professional document can be simple when you focus on a few key elements that contribute to clarity and visual appeal.

The first step is to define the structure of the document. Every financial document should include essential components like the recipient’s details, a list of services or products provided, and the agreed-upon payment terms. Organizing this information logically will make the document more functional and user-friendly.

- Start with clear contact information: Include your company’s name, logo, and contact details at the top, along with the client’s name and address.

- Be clear with the services or products: List the services rendered or items sold, ensuring that descriptions are precise and quantities or units are specified.

- Set payment terms: Specify when the payment is due, the accepted methods of payment, and any late fees or discounts.

Next, choose a layout that is both functional and visually appealing. Minimalistic designs with sufficient white space make the document easier to read. Avoid cluttering the page with unnecessary information. Instead, focus on providing only what the client needs to know in a straightforward and easy-to-understand format.

Design Tips:

- Use clean fonts that are easy to read.

- Incorporate your brand colors for consistency.

- Keep the layout balanced with appropriate spacing between sections.

Finally, include any additional details that may be specific to your business or client. This could be terms and conditions, a thank-you note, or a reminder of upcoming services. Customizing the document for each client adds a personal touch and strengthens the business relationship.

By following these steps, you can create a visually appealing and functional billing document that communicates professionalism and encourages timely payments.

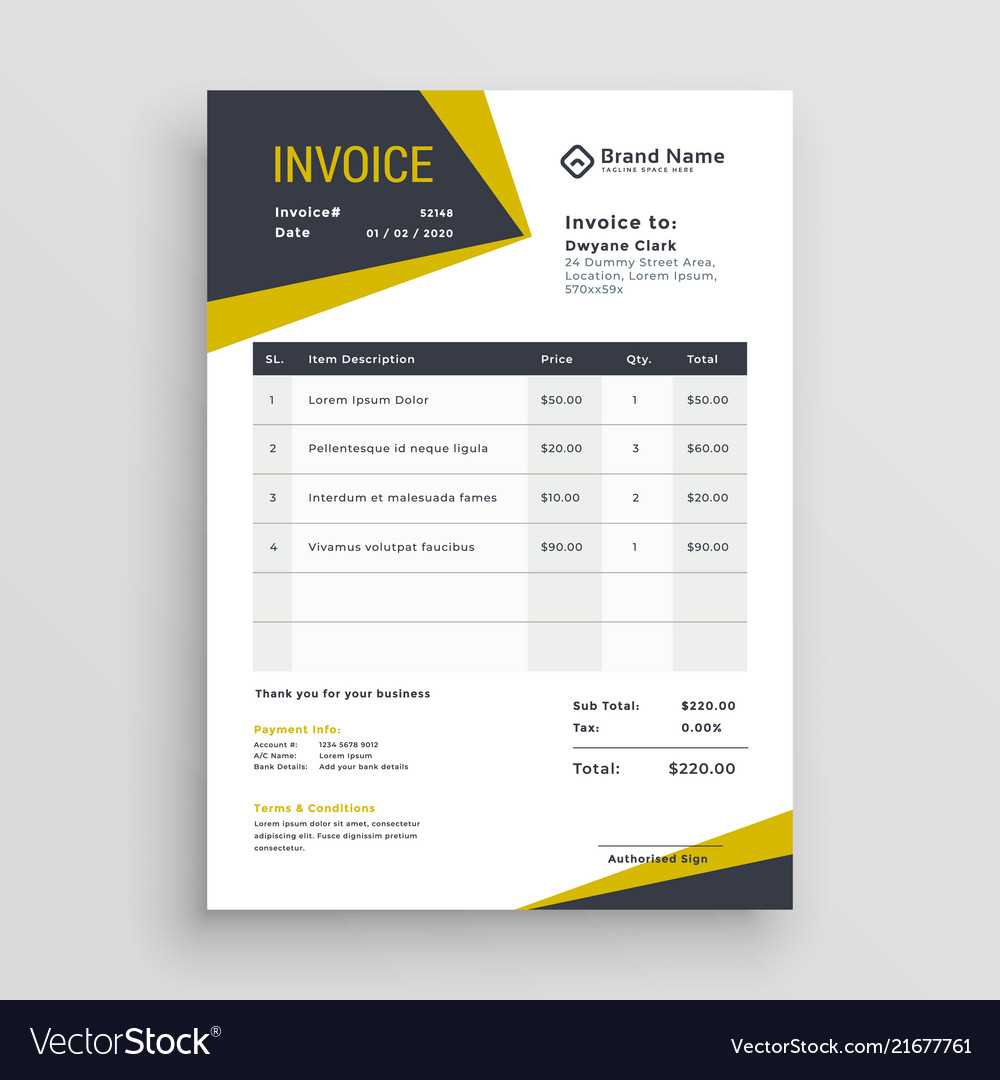

Best Features of Stylish Invoices

A well-designed billing document can make a significant impact on your business by improving communication, enhancing brand identity, and ensuring clarity in financial transactions. The key to a successful document lies in the features it includes. A modern and visually appealing design not only makes a positive impression but also simplifies the process of reviewing and processing payments. Here are some of the best features to include in a sleek, professional billing document.

1. Clear and Organized Layout

A clean and logical layout is crucial for making the document easy to read and navigate. By organizing the content in a structured way, you ensure that the client can quickly find important information such as due dates, amounts owed, and payment details. The right balance between text and white space can make the document more digestible and less overwhelming.

- Simple sections for contact details, services, and payment terms

- Clear headings and subheadings to guide the reader

- Ample white space to avoid clutter and increase readability

2. Professional Branding

Incorporating your company’s brand identity into the document can leave a lasting impression. By using consistent colors, fonts, and logos, you make your communications instantly recognizable and reinforce your brand image. A professional, branded design conveys that you are reliable and trustworthy.

- Customizable design elements that match your brand colors

- Incorporation of your business logo and taglines

- Consistent font choices that reflect your company’s style

3. Clear Payment Terms and Due Dates

Including precise payment terms is vital to avoid confusion. Make sure to clearly state the due date, accepted payment methods, and any late fees or discounts for early payments. This transparency ensures that both you and your client are on the same page, reducing the likelihood of disputes.

- Specific payment deadlines

- Accepted payment methods (e.g., credit card, bank transfer, etc.)

- Late fees or early payment discounts

4. Customization Options

Every business has unique needs, and a flexible design allows you to tailor the document to suit different clients or types of transactions. Whether it’s adding a personal thank-you note or including detailed service descriptions, the ability to adjust the document for specific purposes will make it more versatile and impactful.

- Ab

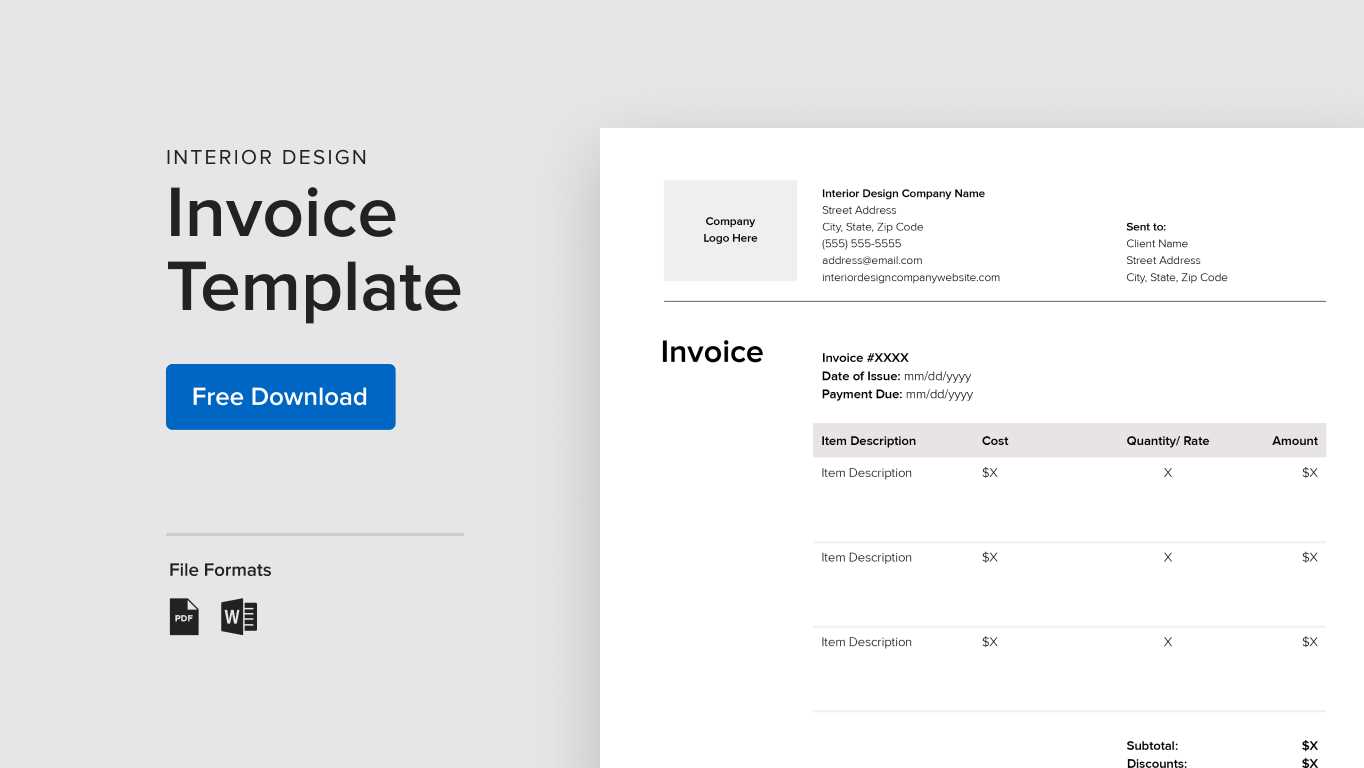

Free Invoice Templates You Can Use

If you’re just starting out in business or want to save time and money on creating billing documents, free options can be a great way to get started. Many platforms offer professionally designed formats that are easy to customize and use for your business needs. These free resources allow you to quickly generate professional-looking documents without the need for expensive software or design skills.

Below are some of the best free options available that can help you create a polished document in no time:

- Microsoft Word: Offers basic, editable formats that you can modify according to your business needs. Ideal for simple, clean layouts with all essential fields.

- Google Docs: Free and easy-to-use, Google Docs provides various templates that are simple to access and edit online, making it a good choice for businesses on the go.

- Canva: Known for its user-friendly design interface, Canva offers free templates with modern designs that you can fully customize with your branding and content.

- Zoho: Offers free, customizable billing solutions that integrate with their other business tools. These are great if you’re already using Zoho’s CRM or other services.

- Invoicely: A free platform that provides online invoicing features along with customizable formats, suitable for freelancers and small businesses.

By using these free resources, you can have a professional-looking document in just a few minutes, helping you streamline your workflow and present your business in the best light. Whether you need a simple layout or a more stylish design, there is a free option that can cater to your requirements.

Make sure to take advantage of these free solutions and customize them to fit your brand identity and business needs. With minimal effort, you can create effective and aesthetically pleasing documents that will impress your clients and simplify your financial processes.

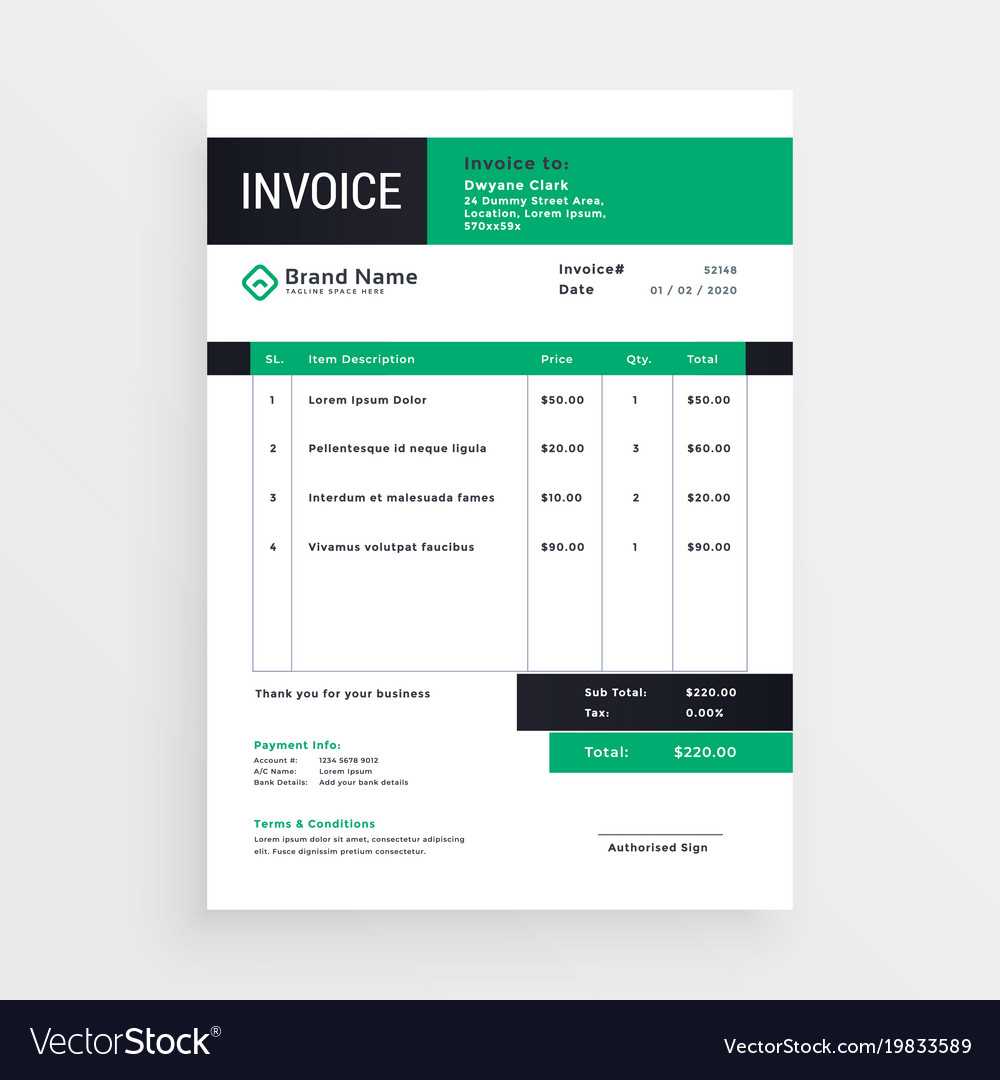

Design Tips for a Professional Look

The design of your billing documents plays a crucial role in how your business is perceived. A well-thought-out layout not only makes the document easier to understand but also communicates professionalism and attention to detail. The goal is to create something that reflects your brand identity while maintaining a clear and organized structure. Here are some essential design tips to help you achieve a polished, professional look.

1. Keep It Simple and Clean

Minimalistic designs are often the most effective. A cluttered document can overwhelm the reader and make it harder for them to find the key details. Focus on simplicity by using clear headings, ample white space, and a structured layout. The goal is for your client to easily locate information such as payment terms, amounts, and due dates without distraction.

- Use easy-to-read fonts like Arial or Helvetica

- Avoid using too many different font types or sizes

- Ensure there’s enough space between sections for readability

2. Use Your Brand’s Colors and Logo

Incorporating your company’s colors and logo helps reinforce your brand identity. Using consistent design elements across your documents makes them instantly recognizable and professional. Choose a color scheme that aligns with your brand but avoid using too many colors, as this can make the document feel chaotic and less serious.

- Stick to two or three primary colors

- Place your logo in a prominent location, such as the top left corner

- Make sure the colors you choose maintain high contrast for readability

3. Organize Information with Clear Sections

Organization is key to creating a document that is both functional and visually appealing. Break your content into distinct sections, such as client details, service descriptions, payment terms, and the total amount due. Use borders, shading, or lines to visually separate these sections and guide the reader’s eye through the content.

Section Purpose Header Displays your business name, logo, and contact information. Client Information Includes client name, address, and other contact details for reference. Service/Product Breakdown Lists items or services provided, with details on quantities and rates. Paym Simple Steps to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific business needs and make it more personal for each client. Whether you’re looking to add your logo, change the layout, or include specific details, customizing the design can make your document stand out and reflect your brand’s identity. Here are a few easy steps to help you modify your document quickly and effectively.

1. Add Your Branding

Start by incorporating your company’s logo, color scheme, and brand fonts. This ensures that your document aligns with your overall brand identity and reinforces a professional image. Place your logo at the top, along with your business name and contact details.

- Insert your logo in the header section.

- Use brand colors for text, borders, and headings.

- Choose fonts that reflect your brand’s tone (e.g., modern, classic, or creative).

2. Adjust the Layout

Depending on your business type and the amount of detail you need to include, you may want to adjust the layout of your document. You can modify the placement of sections, such as moving the client’s details to the top or adding additional rows for services. Ensuring the document flows logically will make it more user-friendly for your clients.

- Rearrange sections (e.g., payment terms at the top or bottom).

- Make sure there’s enough space between sections to avoid clutter.

- Consider adding a section for notes or special instructions if needed.

3. Add Specific Details

Customize the content of your document based on each transaction. Include specific descriptions of the services or products provided, along with quantities, rates, and any applicable taxes. Providing clear and concise information will help avoid confusion and ensure timely payments.

- Break down each service or product with details like unit price and quantity.

- Include any discounts or special offers if applicable.

- Ensure the payment terms and due dates are clearly specified.

4. Review and Save Your Document

Once you’ve made the necessary changes, review the entire document to ensure all details are accurate and properly formatted. After reviewing, save the file in a suitable format (PDF or Word) to preserve the layout and make it easy to send to your clients.

- Check for typos and inconsistencies.

- Ensure the document is aligned correctly and looks professional.

- Save your customized document for future use or send it immediately.

By following these simple steps, you can create a customized billing document that reflects your business identity and meets your client’s needs. With just a few adjustments,

Choosing the Right Format for Invoices

Selecting the appropriate format for your billing document is crucial for ensuring smooth transactions and clear communication with your clients. The format you choose can impact how professional the document looks, how easy it is to understand, and how convenient it is for both you and your clients to manage payments. Whether you are dealing with one-time clients or ongoing projects, finding the right structure is key to maintaining an organized workflow.

1. Digital vs. Paper Format

In today’s fast-paced business environment, digital formats are often the preferred choice due to their convenience, ease of sharing, and ability to be integrated with accounting software. Digital documents can be sent via email, stored for future reference, and easily edited. However, some clients may still prefer a paper copy, especially in industries that are slower to adopt digital solutions. Consider your target audience when deciding on the format.

- Digital: Easy to send, store, and manage. Formats like PDF or Word are most common.

- Paper: More traditional, may require printing and mailing. Can be more time-consuming and costly.

2. Editable Formats vs. Fixed Formats

Editable formats like Word or Excel offer flexibility, allowing you to customize your documents for each client and transaction. These formats are especially useful if you frequently adjust services, rates, or other details. On the other hand, fixed formats, such as PDFs, are ideal when you want to prevent any changes after sending the document, ensuring that the details remain unchanged. Both formats have their uses depending on the level of customization you need.

- Editable: Ideal for businesses that require flexibility in adjusting the content regularly.

- Fixed: Best for sending finalized documents that you don’t want altered.

3. Integration with Accounting Tools

If you’re using accounting software or an online payment platform, it’s important to choose a format that integrates seamlessly with these tools. Many accounting solutions offer automatic generation of documents, saving you time and reducing the risk of errors. Formats like CSV, Excel, or specialized invoice files often work best for integration with these platfo

Why Branding Is Key in Invoices

Branding is an essential part of how businesses communicate with clients, and it extends beyond marketing materials to include every interaction, including billing documents. A strong brand presence on your billing documents can create a lasting impression, build trust, and reinforce professionalism. Incorporating your brand’s visual identity not only improves the look of your document but also enhances your company’s credibility and fosters stronger client relationships.

1. Professional Image and Consistency

When your document reflects your brand’s colors, logo, and overall style, it conveys a sense of consistency and professionalism. Clients are more likely to trust a business that presents itself consistently across all platforms, whether it’s a website, business card, or billing statement. The appearance of your document can be a direct reflection of how you value your business and your clients.

- Consistency in design creates a recognizable and professional image.

- Clients are more likely to take you seriously when your documents are aligned with your overall branding.

- A well-branded document shows attention to detail and a commitment to quality.

2. Building Trust and Recognition

A client who recognizes your logo or color scheme in a billing document will feel more secure in their transaction, knowing they are dealing with a reputable company. By integrating your brand’s identity, you make it easier for clients to remember your business, which helps foster long-term relationships. Familiarity breeds trust, and clients who trust your brand are more likely to continue working with you.

Brand Element Impact on Client Perception Logo Enhances recognition and conveys professionalism. Color Scheme Creates a visually consistent experience and reinforces brand identity. Typography Reflects the business’s tone, whether formal, creative, or casual. By strategically using your brand’s elements, you transform a simple transaction into an opportunity to reinforce your business identity. Clients will appreciate the effort put into making every detail align with your company’s values and aesthetic, which can increase satisfaction and loyalty.

Incorporating your brand into every aspect of your business, including your bill

Incorporating Payment Terms Effectively

Clear and well-defined payment terms are crucial for maintaining healthy cash flow and ensuring that both you and your clients have a shared understanding of expectations. Including these terms in your billing documents helps set the tone for professional business relationships and reduces the likelihood of disputes. Effectively communicating your payment policies also ensures that clients know when and how to pay, preventing delays and misunderstandings.

To ensure that your payment terms are effectively incorporated, it’s important to present them in a clear and organized manner. Here are some key practices to follow:

1. Clearly State Payment Deadlines

Make sure to specify the due date for payment, whether it is immediate, 30 days after receipt, or another agreed-upon timeline. Clearly outlining when payment is expected sets a professional tone and prevents unnecessary delays.

- Example: “Payment due within 30 days of the issue date.”

- Example: “Payments must be received by the 15th of each month.”

2. Include Accepted Payment Methods

Let your clients know which payment methods you accept. This reduces confusion and ensures that clients know how to proceed with the payment. Whether you prefer bank transfers, checks, or online payments, list the options clearly.

- Bank transfers

- Credit or debit card payments

- Online payment platforms (PayPal, Stripe, etc.)

3. Specify Late Fees or Penalties

To encourage timely payments, it’s important to clearly outline any late fees or penalties for overdue payments. By setting this expectation upfront, you reduce the likelihood of delays and ensure that clients understand the consequences of not meeting payment deadlines.

- Example: “A late fee of 2% per month will be applied to overdue balances.”

- Example: “If payment is not received within 15 days, a $25 late fee will apply.”

4. Provide a Payment Plan Option (If Applicable)

For larger projects or clients who may need more time, offering a payment plan can be a great way to facilitate a positive experience for both parties. Clearly o

How to Make Your Invoices Stand Out

When it comes to billing, standing out from the crowd can make a huge difference in how your business is perceived and how quickly payments are processed. A well-designed document that grabs attention, reflects your brand, and is easy to read can leave a lasting impression. Making your bills memorable doesn’t just improve professionalism, it also helps reinforce your business identity and builds client trust.

1. Use a Unique and Professional Design

A well-structured design with attention to detail can make your billing documents not only stand out but also leave a lasting impression on clients. Focus on creating a balance between visual appeal and functionality, ensuring that all key details are easy to locate.

- Incorporate your logo and brand colors to strengthen your company identity.

- Choose a clean, readable layout with clear headings and ample white space.

- Use stylish yet professional fonts to enhance the aesthetic while maintaining readability.

2. Personalize Each Document

Adding a personal touch to your billing document can make your clients feel valued. Personalization can range from addressing the client by name to including a handwritten note or customized thank-you message. These small gestures can go a long way in building stronger business relationships.

- Include a personalized message thanking the client for their business.

- Use the client’s name or specific project details to make the document feel tailored.

- Consider adding a reminder of future projects or services that may be beneficial to the client.

3. Clear Breakdown of Services

Ensure that your billing document includes a detailed, transparent breakdown of the services or products provided. Clients appreciate clarity, and a well-organized list of items will help prevent confusion and potential disputes. This demonstrates transparency and reinforces trust in your business practices.

- List individual services or products with detailed descriptions and itemized costs.

- Highlight any discounts, taxes, or additional fees clearly so there are no surprises.

- Organize information in a logical sequence (e.g., from most to least expensive).

4. Incorporate Customizable Features

By offering clients the option to customize certain aspects of their billing documents, such as payment terms, discounts, or payment methods, you can make the document feel more personalized and flexible. This can

Essential Information to Include on Invoices

To ensure smooth transactions and avoid misunderstandings, it’s important that your billing documents include all the necessary details. Properly outlining key information not only streamlines payment processing but also enhances your professionalism and helps maintain clear communication with your clients. Below are the essential components that every business document should include to make the billing process as efficient and transparent as possible.

1. Business Information

Your company details are crucial for identification and for legal or administrative purposes. This includes your business name, address, and contact information.

- Business Name: Clearly display your full business name for proper identification.

- Business Address: Include the physical or mailing address of your company.

- Contact Information: Provide phone numbers, email addresses, and possibly a website URL.

- Tax Identification Number (TIN) or VAT Number: Essential for tax purposes and legally required in some regions.

2. Client Information

Properly identifying the client is essential to avoid confusion and ensure that payments are correctly attributed. This section should include:

- Client’s Name: The legal name of the client or business entity you are billing.

- Client’s Address: Provide the client’s address to ensure proper record-keeping and for any required legal notices.

- Contact Details: Include the client’s phone number and email address for easy communication, especially if there are any issues with the payment.

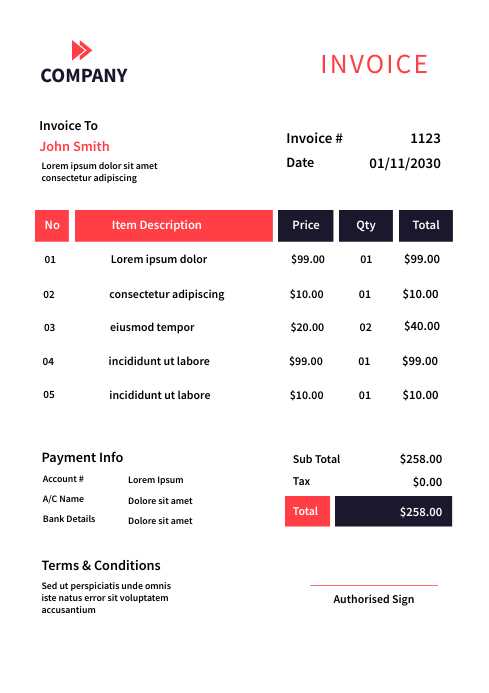

3. Document Number and Date

Assigning a unique reference number to each billing document is essential for tracking purposes. Additionally, clear date information helps both parties stay organized.

- Document Number: Use a unique, sequential number for each document, such as INV001, INV002, etc., to help with record-keeping and reference.

- Issue Date: Specify the date when the billing document is created or issued.

- Due Date: Clearly state the payment deadline, making it easy for your client to know when payment is expected.

4. Detailed List of Goods or Services

Providing a detailed list of what you are charging for is essential for clarity and transparency. This section should clearly outline each item or service provided, along with the associated cost.

- Invoice Template Options for Freelancers

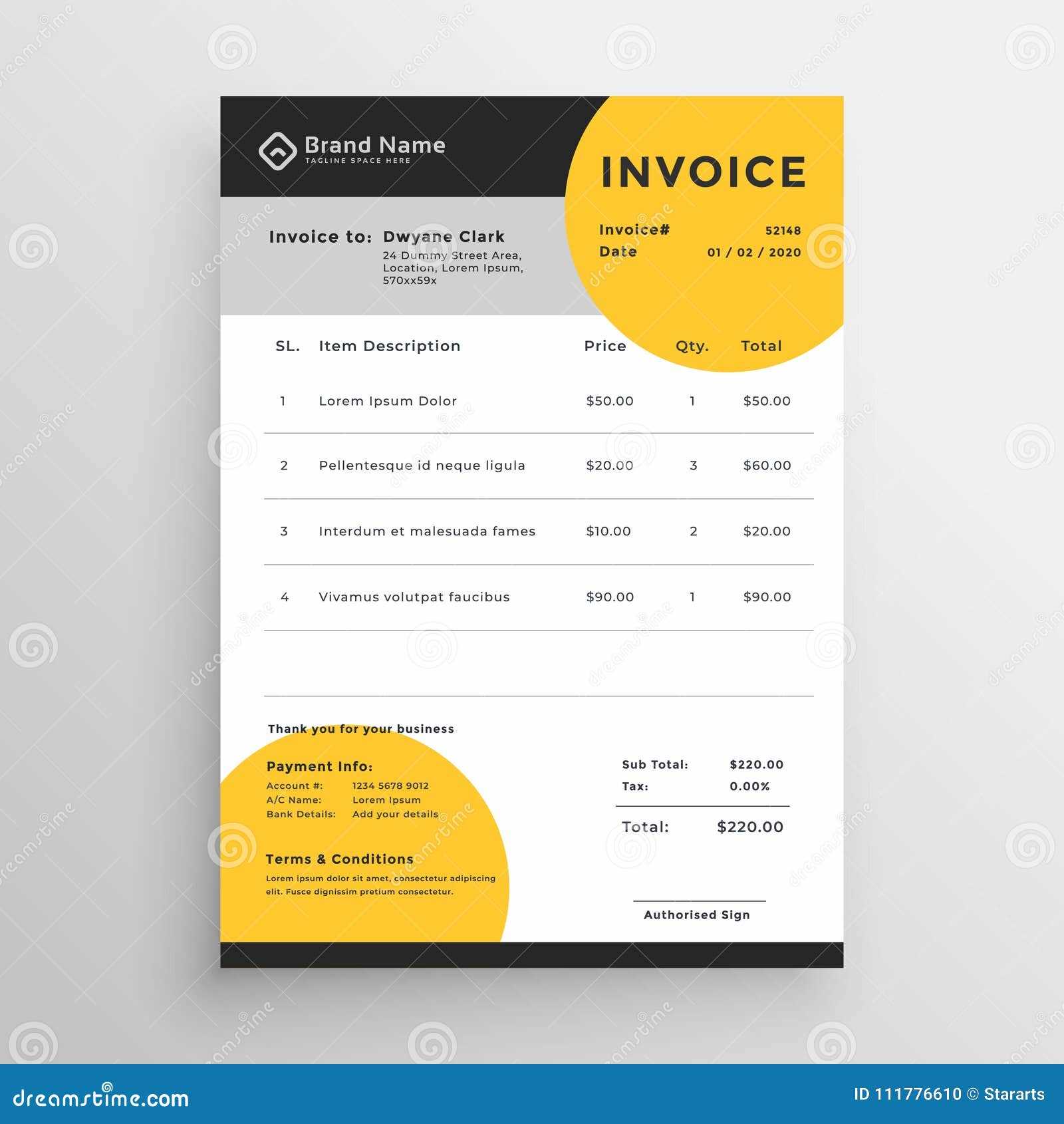

Freelancers often work with a variety of clients across different industries, so having a flexible and professional billing solution is crucial for managing payments efficiently. Selecting the right format for your billing documents can make a significant difference in how clients perceive your business and how smoothly the payment process runs. Whether you need a simple design or something more detailed, there are various options to consider when creating or choosing the best format for your needs.

1. Simple and Clean Designs

For freelancers who prioritize efficiency and clarity, a simple design that focuses on the essentials is often the best choice. This type of document usually includes all the necessary details in a straightforward layout without unnecessary embellishments. The goal is to provide clear information that is easy for clients to read and understand.

- Minimalist Layout: Includes only the essential details, such as client name, services rendered, cost, and payment terms.

- Readable Fonts: Uses clear, professional fonts that are easy to read and navigate.

- Clean Formatting: Information is well-organized, often with lines or borders to separate different sections.

2. More Detailed and Customizable Designs

Freelancers who offer a wide range of services or handle larger projects may prefer a more detailed format. These documents often provide additional features such as itemized lists, project descriptions, and personalized fields to ensure clarity and avoid misunderstandings.

- Itemized Billing: Breaks down services into individual tasks with associated costs, making it easier for clients to understand what they are being charged for.

- Customizable Fields: Includes sections for custom notes, payment plans, or reminders for future work.

- Professional Design: Often uses logos, brand colors, and a more polished layout to create a visually appealing and professional document.

3. Online Tools and Automated Options

With the rise of digital tools, many freelancers now prefer using online platforms that automate the creation and management of their billing documents. These tools often offer customizable templates, the ability to track payments, and the convenience of sending documents directly via email.

- Cloud-Based Solutions: Tools like FreshBooks or Wave allow freelancers to create and send bills online while also managing payments and tracking income.

- Automated Payment Reminders: Some tools can automatically send payment reminders to clients when deadlines approach.

- Mobile-Friendly: Many online tools offer mobile apps, allowing freelancers to send and manage invoices directly from their phones.

Choosing the right billing format or tool depends on the freelancer’s specific needs, the complexity of the work, and how much time they want to spend on administrative tasks. Whether you opt

How to Use Invoices for Client Trust

Billing documents are not just a tool for requesting payments–they also serve as an important reflection of your professionalism and can play a key role in building trust with clients. When clients receive clear, accurate, and well-structured billing statements, it reinforces your credibility and helps foster a positive business relationship. By following best practices, you can turn your billing process into a tool that promotes transparency, reliability, and trust.

1. Provide Clear and Accurate Details

Transparency is essential when it comes to billing. Clients are more likely to trust you if they can easily understand what they are paying for and why. A detailed breakdown of services, including pricing and descriptions, ensures there is no confusion and promotes confidence in your work.

- Itemized Billing: Clearly list each service or product provided, with corresponding prices. This avoids ambiguity and ensures clients know exactly what they are being charged for.

- Accurate Dates: Include accurate dates for when services were provided or goods were delivered, helping clients track the timeline of your work.

- Clear Payment Terms: Clearly outline the payment due date, methods of payment accepted, and any applicable fees. This transparency reduces the chance of misunderstandings.

2. Be Consistent with Your Format

Using a consistent format for all your billing documents helps create a professional image and makes it easier for clients to process and track payments. When clients receive documents in a consistent format, they can easily find the information they need, which shows that you are organized and reliable.

- Standardized Design: Use the same layout, logo, and brand elements across all documents. This consistency creates a sense of reliability and makes your business more recognizable.

- Predefined Fields: Always include key information like contact details, payment instructions, and due dates in the same sections. This helps clients quickly find the information they need.

- Consistent Numbering: Use a unique numbering system for each document to keep your records organized and help clients reference previous transactions.

3. Offer Payment Flexibility

Providing your clients with various payment options and clear instructions on how to pay shows that you value their convenience and are committed to making the process as easy as possible. Flexibility in payment methods can increase the likelihood of timely payments and reduce client frustration.

- Multiple Payment Methods: Accept a variety of payment methods, such as bank transfers, online payment systems (like Pay

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s easy to overlook small details that can have a significant impact on your professionalism and the payment process. Even minor errors can lead to confusion, delayed payments, or damaged client relationships. Being aware of the most common mistakes can help you avoid these pitfalls and ensure that your billing process is smooth and efficient. Below are some of the most frequent mistakes and tips on how to prevent them.

1. Missing or Incorrect Client Information

One of the most fundamental errors is failing to include the correct details about the client. If the name, address, or contact information is incorrect, it can lead to confusion or delays in processing payments. Ensure that all information is accurate before sending out your documents.

- Double-check client details: Always confirm the accuracy of the client’s name, address, and contact information before sending the bill.

- Verify contact preferences: Ensure you are sending the bill to the correct email address or postal address as per the client’s instructions.

2. Unclear or Missing Payment Terms

Without clearly defined payment terms, clients may not know when or how to pay. Vague language or missing due dates can cause misunderstandings and lead to delays in payment. Be specific about your payment expectations.

- Set clear due dates: Always include a specific date by which payment is expected, such as “due within 30 days” or “due upon receipt.”

- Outline accepted payment methods: Specify whether you accept credit card payments, bank transfers, checks, or other forms of payment.

- Include late fee policies: If applicable, mention any penalties for late payments, such as interest rates or flat fees for overdue balances.

3. Lack of Detailed Descriptions

Failing to provide detailed descriptions of the goods or services delivered can leave clients unsure of what they are being charged for. It’s important to break down the services clearly to avoid disputes and confusion.

- Provide clear itemization: List each service, product, or project deliverable with a brief description, quantity, rate, and total cost.

- Avoid vague terms: Instead of writing “consulting services,” specify the nature of the services provided, such as “strategic business planning consultation” or “website design services.”

4. Incorrect or Missing Dates

Dates are a critical component of any billing doc

Invoice Templates for Small Businesses

For small business owners, keeping track of payments and maintaining a professional image is essential for success. Having well-structured and clear billing documents not only helps in organizing financial transactions but also builds trust with clients. For small businesses, using pre-designed billing documents can save time, reduce errors, and ensure consistency. These customizable formats can be tailored to reflect the specific needs of a business while maintaining a professional appearance.

1. The Benefits of Using Pre-Designed Billing Documents

Small businesses often operate with limited resources, and finding efficient solutions for administrative tasks like invoicing can make a significant difference. Using ready-made billing structures can streamline the process and ensure accuracy.

- Save Time: Pre-designed documents eliminate the need to create a new layout for each bill, allowing you to focus on your core business activities.

- Ensure Consistency: Using a consistent format helps maintain a professional image and ensures that clients are accustomed to a standard layout.

- Reduce Errors: With templates, key fields like dates, amounts, and descriptions are clearly defined, minimizing the chances of missing or incorrect information.

2. Customizing Billing Documents for Your Business

While using pre-made layouts is a time-saving option, customizing these documents to reflect your brand is just as important. By adding your business logo, adjusting color schemes, and including your company’s contact details, you create a personalized and professional billing experience for your clients.

- Brand Identity: Include your logo, business name, and any other branding elements to reinforce your identity.

- Contact Information: Make sure your phone number, email, and website are prominently displayed for easy communication.

- Personalized Touch: Tailor the document with specific details such as your payment terms, policies, and any other relevant information that aligns with your business practices.

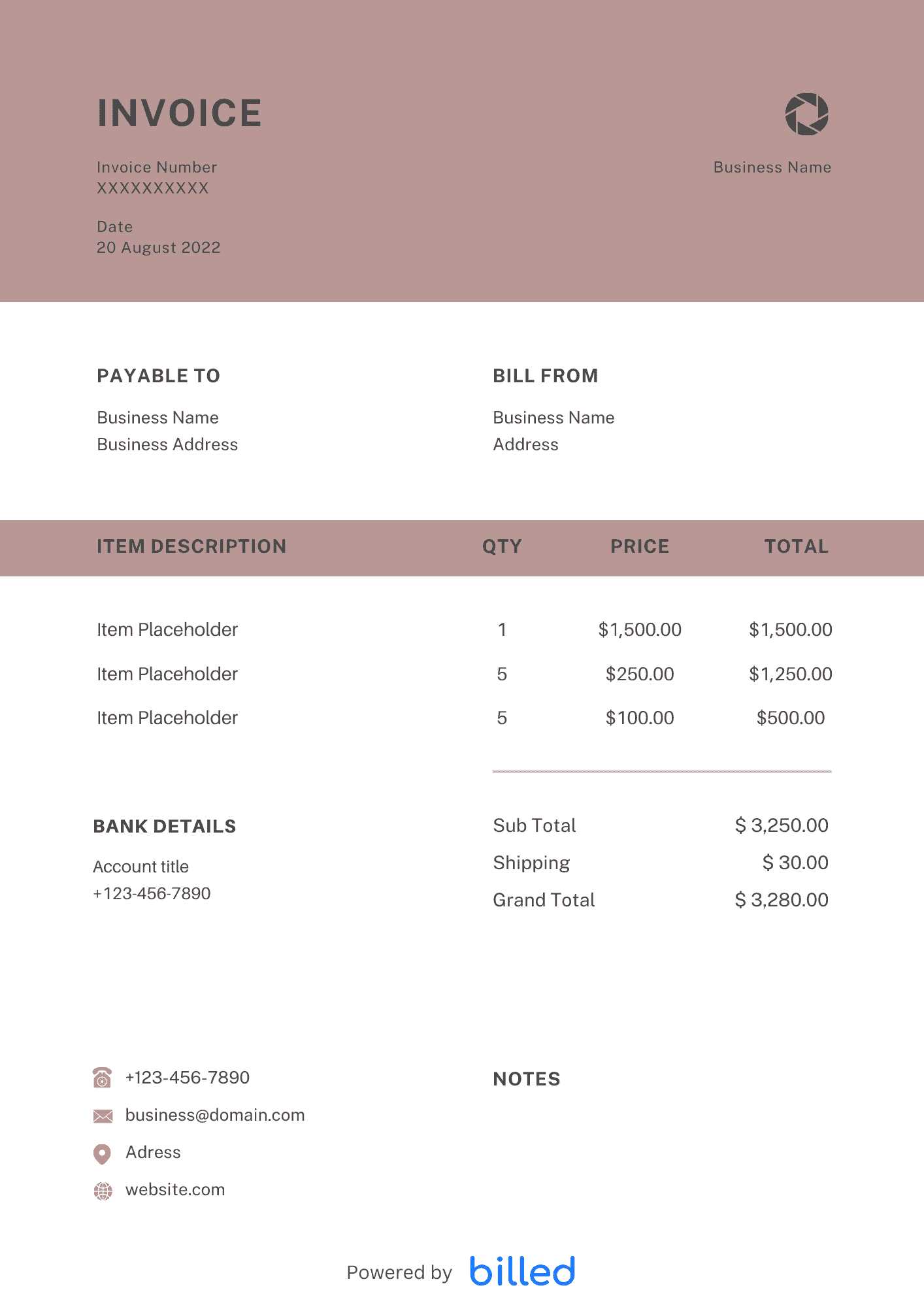

3. Types of Billing Formats for Small Businesses

Small businesses can choose from various formats, depending on their needs and the complexity of their transactions. Whether you are a freelancer, a retail shop owner, or a service-based business, there are templates designed to suit different industries and billing practices.

- Basic Layouts: Simple, straightforward layouts with essential fields such as services provided, payment amounts, and due dates.

- Itemized Documents: Ideal for businesses offering multiple products or services. These documents allow you to break down each item or service with descriptions and

How to Automate Your Invoicing Process

Automating your billing process can save you significant time and reduce the risk of errors. Instead of manually creating and sending billing documents, you can implement tools that handle most of the work for you. With automation, you can ensure timely payments, minimize mistakes, and focus more on growing your business. Below are some steps to effectively automate your billing system and streamline your workflow.

1. Choose the Right Automation Tool

The first step to automating your billing process is selecting a suitable tool or software. There are numerous solutions available, ranging from simple templates with automated features to comprehensive invoicing systems that manage everything from creation to payment tracking.

- Cloud-Based Software: Platforms like QuickBooks, FreshBooks, or Xero offer cloud-based invoicing systems that automate billing, track payments, and generate reports.

- Payment Gateway Integration: Some services integrate with payment gateways like PayPal or Stripe, allowing you to send bills and receive payments within the same platform.

- Automated Reminders: Look for tools that send automated reminders to clients about due payments, helping to reduce late payments and maintain cash flow.

2. Set Up Recurring Billing

If your business relies on subscriptions or repeat services, setting up recurring billing can save you time and effort. This feature automatically generates and sends billing documents at regular intervals, such as weekly, monthly, or annually.

- Subscription Models: Many billing systems allow you to create custom recurring schedules based on the needs of your clients.

- Automatic Payment Processing: When setting up recurring invoices, make sure the system supports automatic payment processing for seamless transactions.

- Flexible Billing Cycles: Choose tools that allow for flexible billing cycles, so you can customize payment terms to suit different client agreements.

3. Customize Automated Billing Documents

Even though automation handles the process, it’s still important to personalize your billing documents. Most software allows you to customize the look and feel of your bills to match your branding and provide a professional appearance.

- Branding Elements: Customize colors, fonts, and logos to ensure that each bill reflects your company’s identity.

- Payment Instructions: Clearly state your payment terms and instructions so clients know how to pay quickly and easily.

- Personalized Fields: Include custom fields for specific client needs, such as project numbers, contract IDs, or service descriptions.

4. Au

How to Automate Your Invoicing Process

Automating your billing process can save you significant time and reduce the risk of errors. Instead of manually creating and sending billing documents, you can implement tools that handle most of the work for you. With automation, you can ensure timely payments, minimize mistakes, and focus more on growing your business. Below are some steps to effectively automate your billing system and streamline your workflow.

1. Choose the Right Automation Tool

The first step to automating your billing process is selecting a suitable tool or software. There are numerous solutions available, ranging from simple templates with automated features to comprehensive invoicing systems that manage everything from creation to payment tracking.

- Cloud-Based Software: Platforms like QuickBooks, FreshBooks, or Xero offer cloud-based invoicing systems that automate billing, track payments, and generate reports.

- Payment Gateway Integration: Some services integrate with payment gateways like PayPal or Stripe, allowing you to send bills and receive payments within the same platform.

- Automated Reminders: Look for tools that send automated reminders to clients about due payments, helping to reduce late payments and maintain cash flow.

2. Set Up Recurring Billing

If your business relies on subscriptions or repeat services, setting up recurring billing can save you time and effort. This feature automatically generates and sends billing documents at regular intervals, such as weekly, monthly, or annually.

- Subscription Models: Many billing systems allow you to create custom recurring schedules based on the needs of your clients.

- Automatic Payment Processing: When setting up recurring invoices, make sure the system supports automatic payment processing for seamless transactions.

- Flexible Billing Cycles: Choose tools that allow for flexible billing cycles, so you can customize payment terms to suit different client agreements.

3. Customize Automated Billing Documents

Even though automation handles the process, it’s still important to personalize your billing documents. Most software allows you to customize the look and feel of your bills to match your branding and provide a professional appearance.

- Branding Elements: Customize colors, fonts, and logos to ensure that each bill reflects your company’s identity.

- Payment Instructions: Clearly state your payment terms and instructions so clients know how to pay quickly and easily.

- Personalized Fields: Include custom fields for specific client needs, such as project numbers, contract IDs, or service descriptions.

4. Automate Tax Calculations

Automating tax calculations is especially important for businesses that operate in multiple regions with varying tax rates. Many billing platforms have built-in tax calculation features that can apply the appropriate tax rate based on location or service type.

- Regional Tax Rates: Set up the system to automatically calculate taxes based on the location of the client or the type of service being provided.

- Integrated Sales Tax: Use software that integrates local tax rules so that taxes are always applied correctly, avoiding costly mistakes.

- Detailed Breakdown: Ensure that the system generates a clear tax breakdown on the billing document for client transparency.

5. Track Payments Automatically

Automated payment tracking helps you stay on top of your finances and ensures that payments are processed promptly. Most invoicing software integrates with payment processors to automatically mark bills as paid once payment is received.

- Real-Time Updates: When a payment is made, your system can automatically update the status of the billing document, so you always know which bills are pending or completed.

- Payment History: Automatically track and store payment history for each client, making it easier to generate reports or review past transactions.

- Late Payment Alerts: Set up alerts to notify you when a payment is overdue, helping you take timely action to follow up with clients.

6. Generate Reports Automatically

Automated invoicing tools often offer built-in reporting features that generate financial reports based on the data from your billing activities. These reports can give you valuable insights into your business’s financial health and help with tax filing or business planning.

- Revenue Reports: Automatically generate monthly, quarterly, or annual reports on total revenue from client payments.

- Outstanding Payments: Generate reports on overdue payments to identify clients that need follow-ups.

- Expense Tracking: Some platforms also allow you to track business expenses, helping you manage both income and costs in one system.

7. Integrate With Your Accounting Software

Integration between your billing and accounting systems is key for efficient financial management. Many invoicing tools can be integrated with popular accounting software to synchronize financial data automatically.

- Real-Time Sync: Integration with platforms like QuickBooks or Xero ensures your invoicing data is automatically synced with your accounting system, minimizing manual data entry.

- Tax Filing: Streamline tax filing by automatically syncing your billing data with accounting software that tracks deductible expenses and tax obligations.

- Client Records: Automatically update client records and payment histories across platforms for easier client management and reporting.

By automating your billing process, you not only save time and effort but also improve accuracy and cash flow management. With the right tools and strategies in place, you can streamline administrative tasks and focus on what really matters–growing your business.