Contractors Invoice Template for Simplified Billing

When it comes to managing payments for your work, having a clear and organized method is essential. Professionals in various fields need a reliable system to request compensation for services rendered. This process helps ensure that you are paid promptly and that your clients understand the details of the charges. A well-structured document is the key to achieving this goal.

Creating a structured document allows for the inclusion of important details such as service descriptions, payment amounts, and deadlines. By customizing this document to fit your specific needs, you can maintain clarity and avoid misunderstandings. A simple, well-organized layout provides a professional appearance that clients will appreciate.

Additionally, making use of digital tools can simplify the entire process, offering efficiency and accuracy. With the right approach, you can save time and ensure that every payment is accounted for, enhancing your overall business operations.

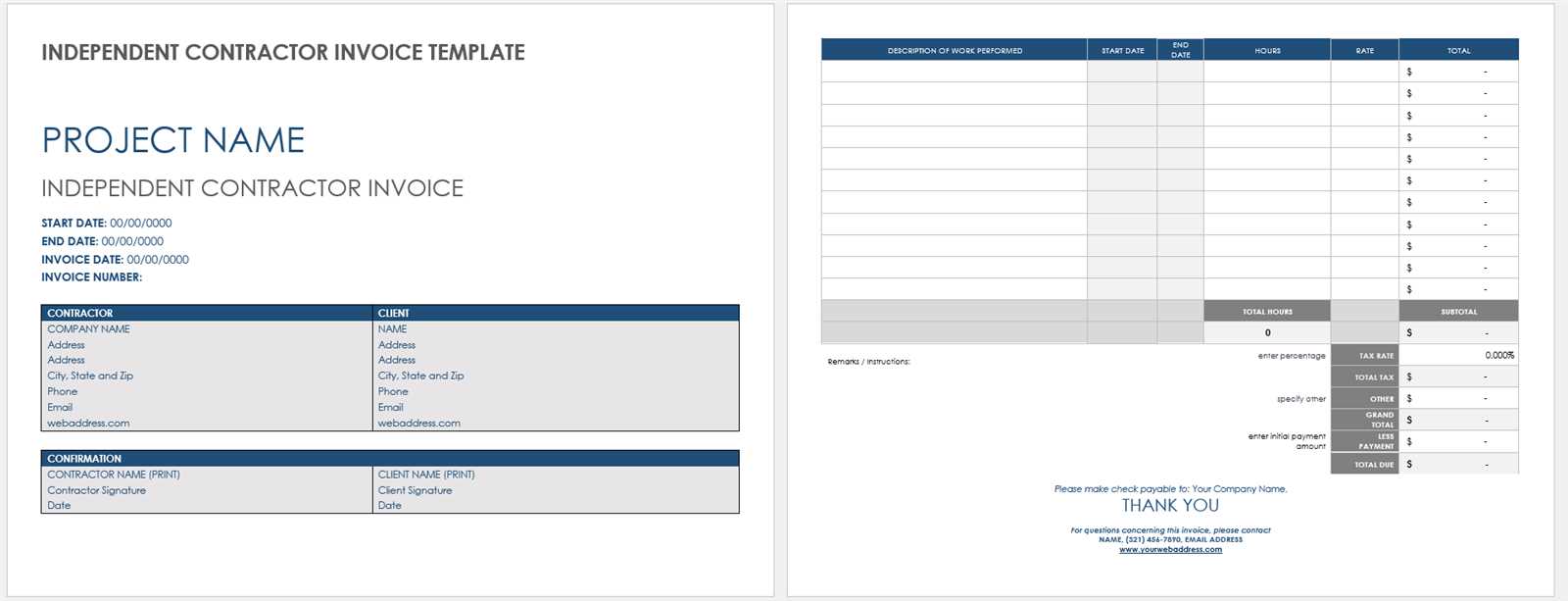

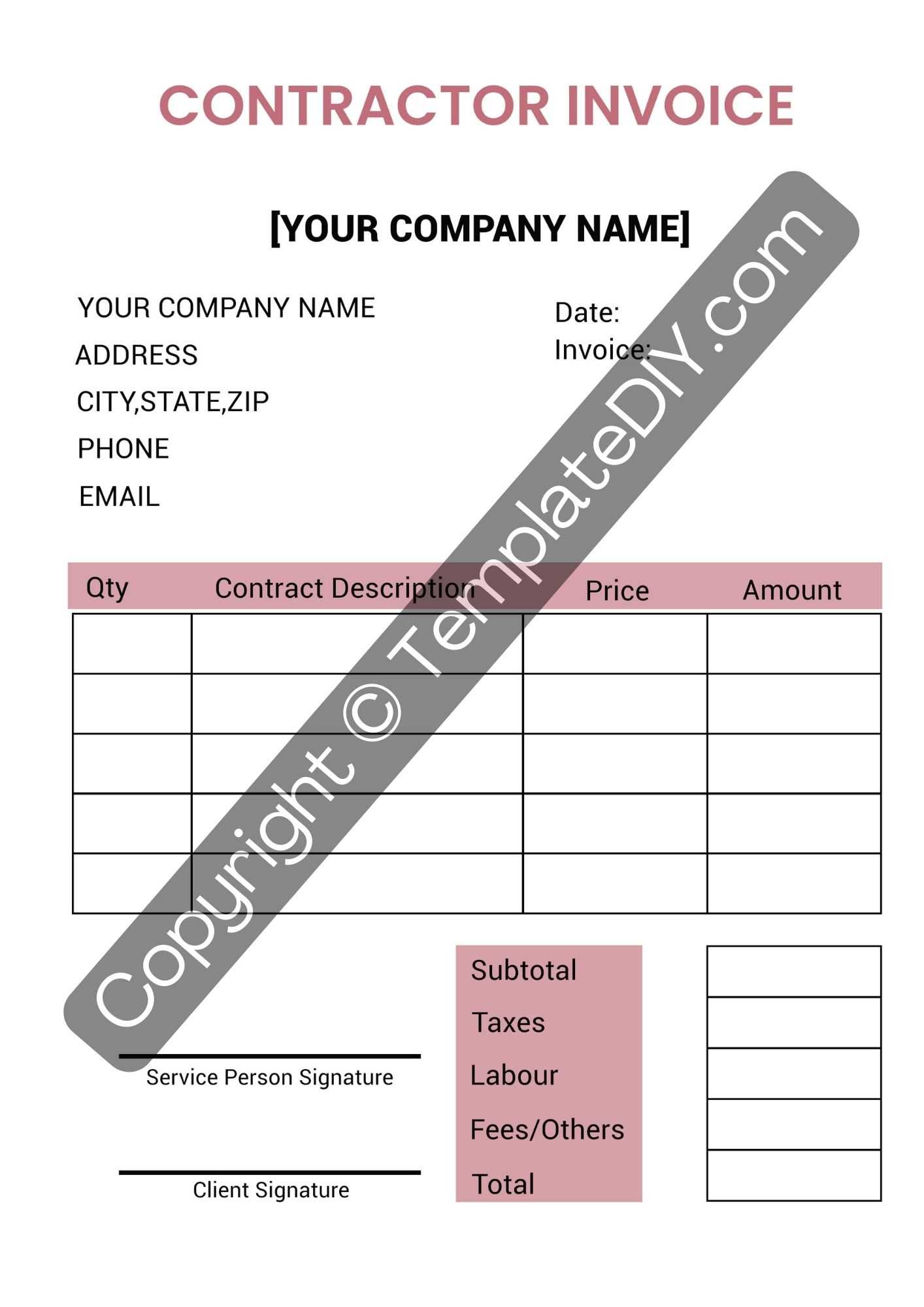

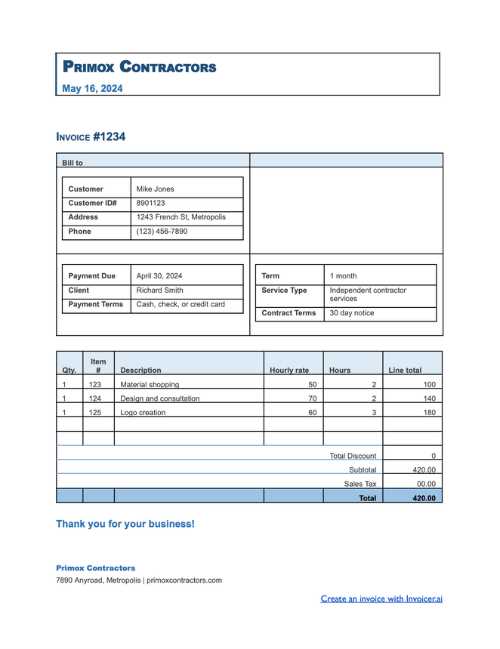

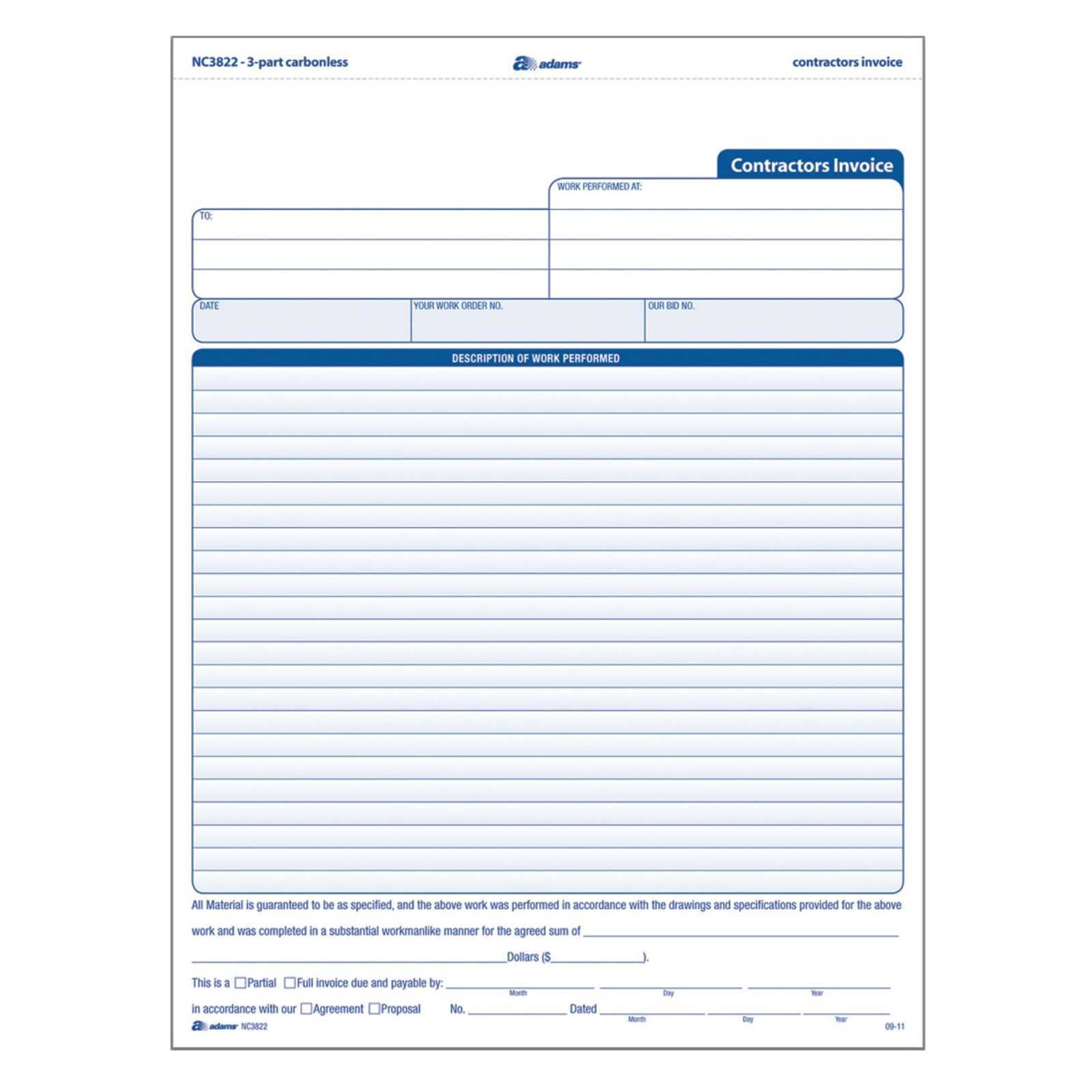

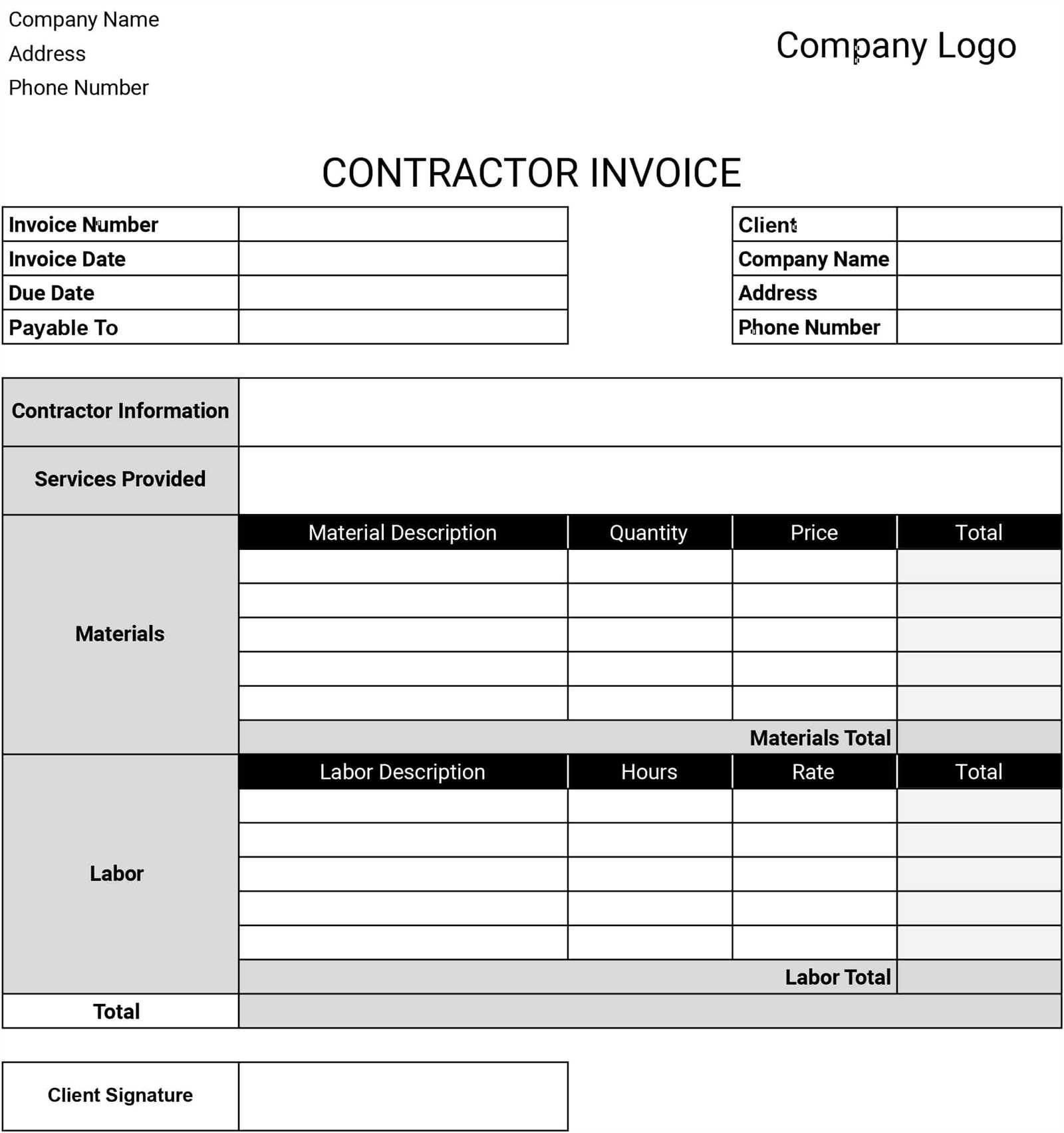

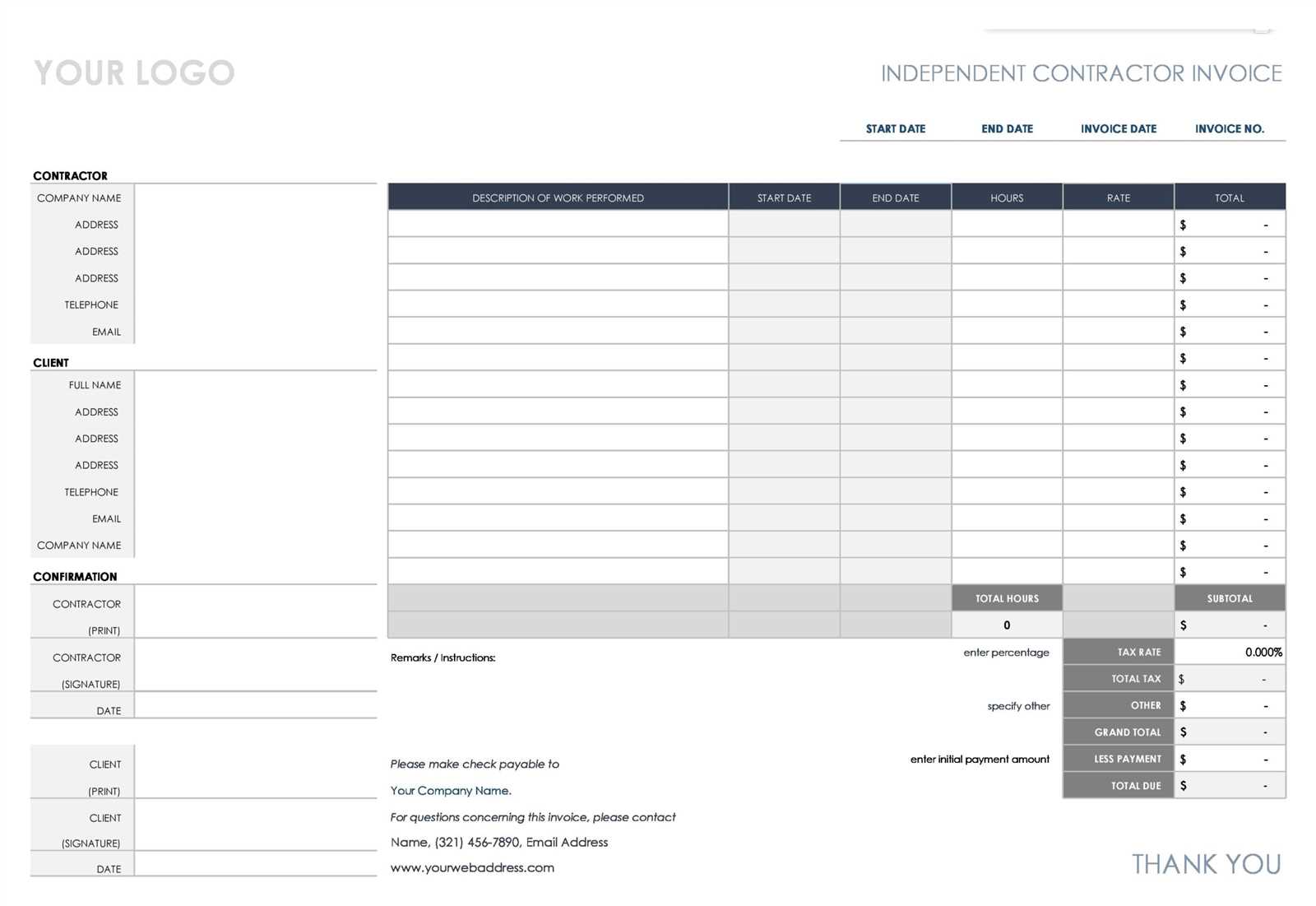

Contractors Invoice Template Overview

Professionals who provide services often need a structured document to request payment for their work. This document serves as a formal request that outlines the services rendered, the amount due, and the payment terms. By using such a document, you can ensure clarity in financial transactions and maintain a professional relationship with your clients.

Purpose and Importance

The primary goal of this document is to make the billing process clear and straightforward. It ensures that both parties are on the same page regarding the work completed and the corresponding compensation. A properly formatted document helps prevent confusion and disputes, providing an easy reference for both the service provider and the client.

Key Features

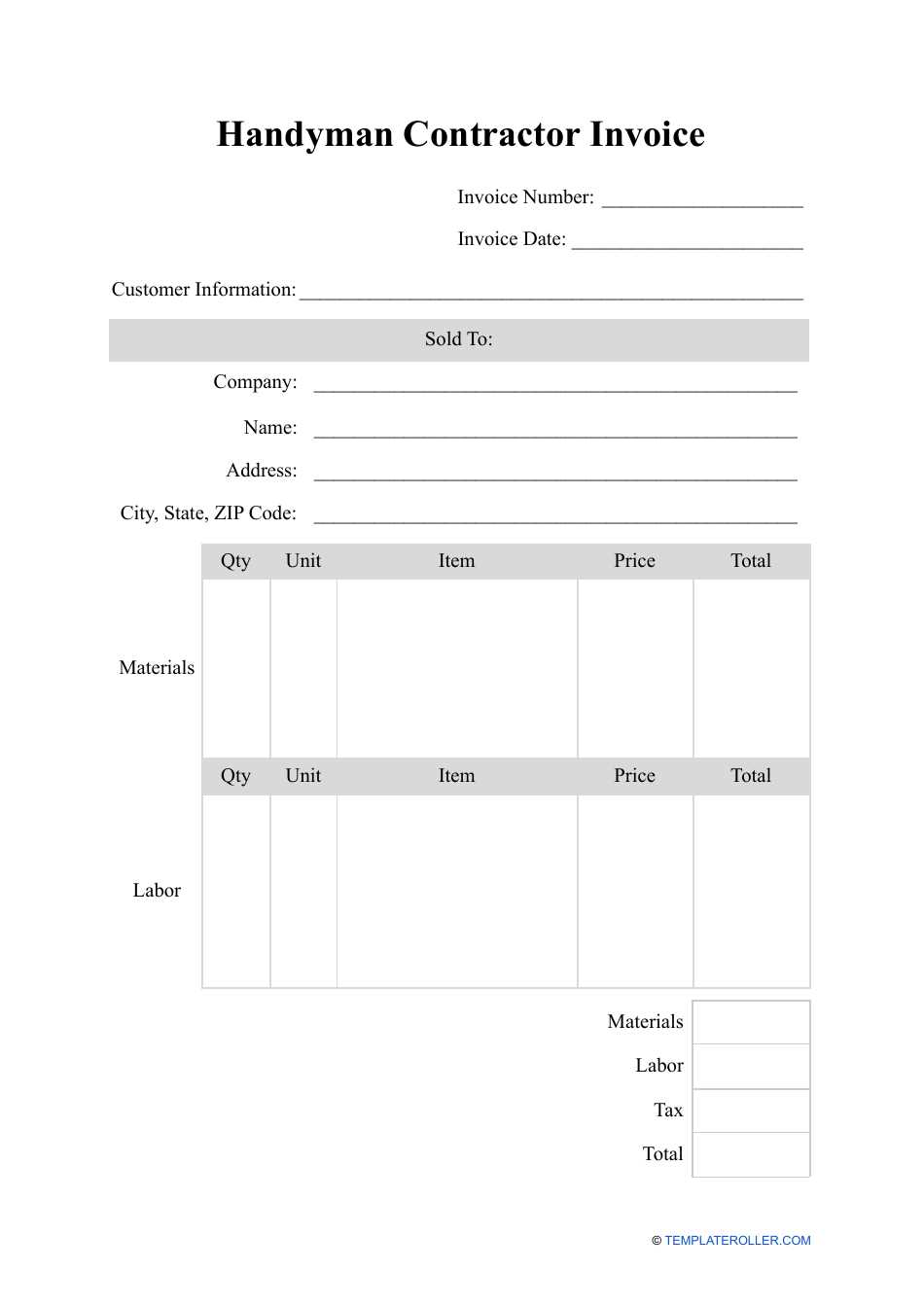

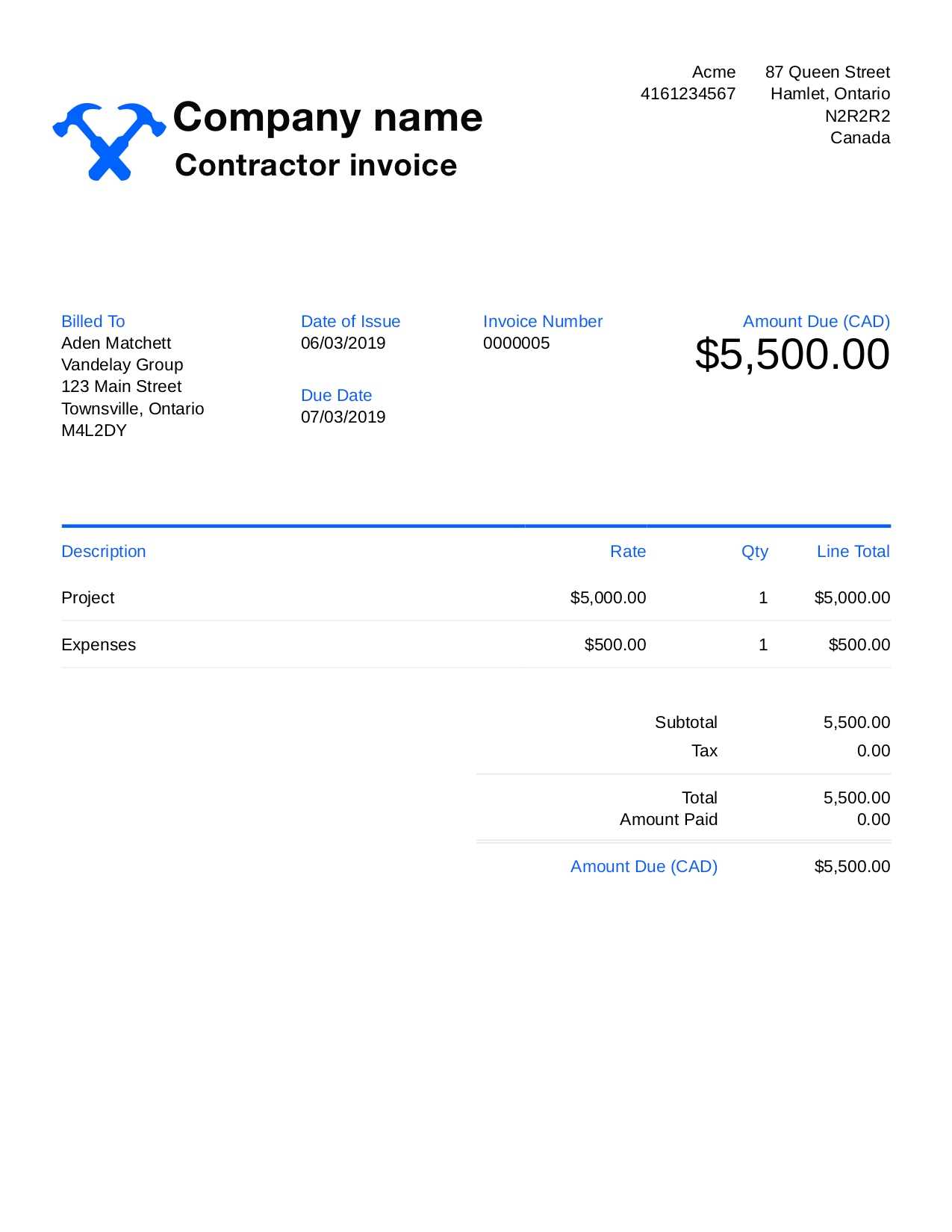

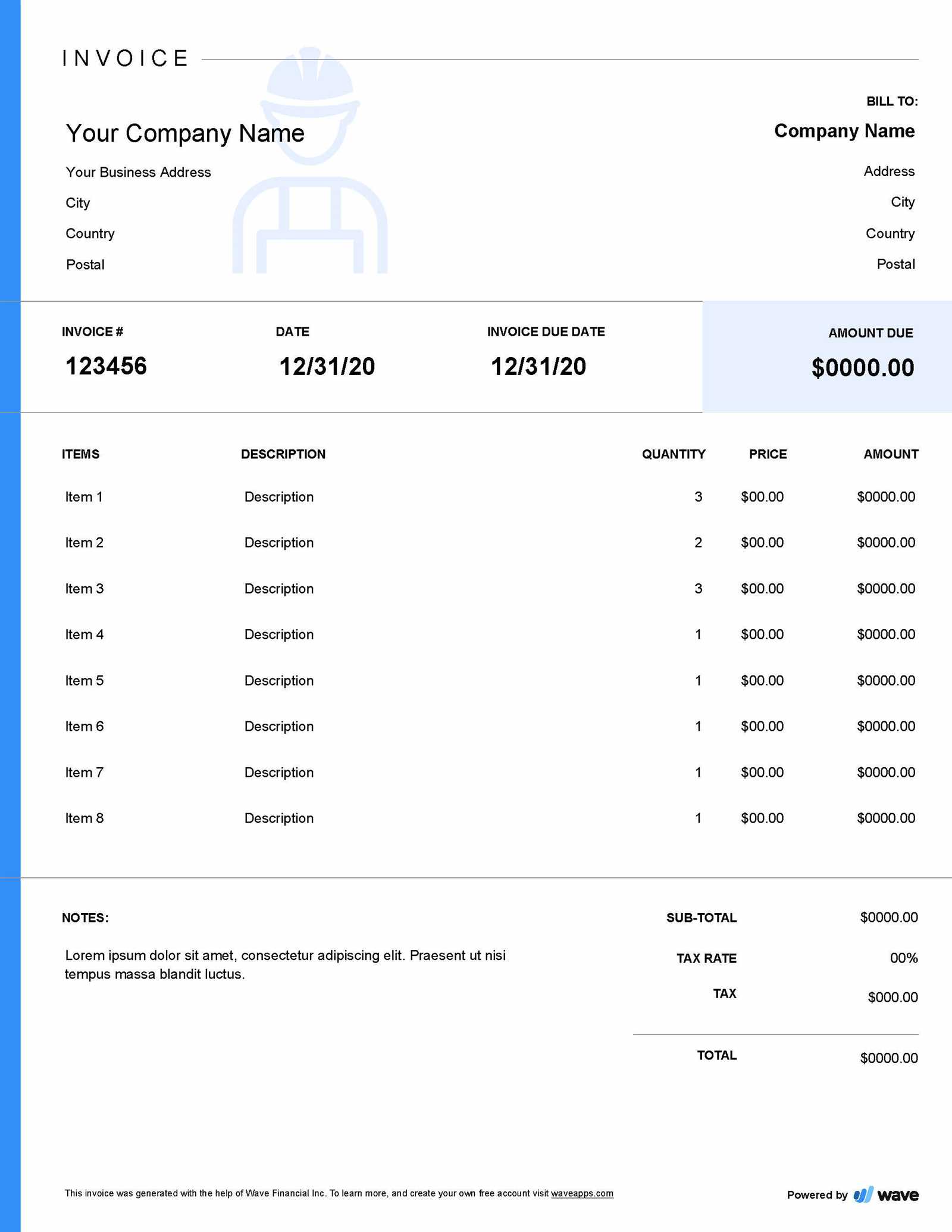

At its core, this document should include essential details such as the date of the transaction, a breakdown of services or tasks performed, the total amount due, and payment terms. It can also feature fields for client information, service descriptions, and even payment methods. The flexibility of this format allows professionals to tailor it to their specific needs while maintaining a standardized structure.

Why You Need a Contractor Invoice

When offering services or completing projects, it is crucial to have a formal document that ensures both parties agree on the details of payment. This document not only serves as a request for compensation but also helps establish transparency and professionalism in the transaction. It protects both the service provider and the client by clearly outlining the terms of payment.

Clarity and Transparency

Clarity is essential in any financial transaction. Having a well-structured document allows both you and your client to fully understand the terms of payment, including the total amount due, deadlines, and payment methods. This reduces the risk of misunderstandings or disputes and ensures that everyone is on the same page.

Professionalism and Legal Protection

Presenting a properly formatted document helps to project a professional image. It shows that you take your work seriously and value clear communication. Additionally, this document serves as legal protection in case of any payment disputes, as it acts as an official record of the agreed-upon terms. With a documented record, both parties have a reference in case of any issues or discrepancies.

Key Elements of a Contractor Invoice

To ensure effective communication and a smooth payment process, it’s essential to include specific components in your billing document. These key elements help provide clarity, professionalism, and a formal record of the services rendered. When creating your document, make sure to include the following critical information.

- Date of Issue: The date the request is being made for payment.

- Service Provider Information: Your name, business name, and contact details.

- Client Information: The recipient’s name and contact information.

- Description of Services: A clear breakdown of the tasks performed or goods delivered.

- Total Amount Due: The agreed-upon price for the work completed, including any applicable taxes or discounts.

- Payment Terms: This includes the due date, accepted payment methods, and any late fees.

Including these elements ensures that your request for payment is detailed and professional. It also helps both parties maintain a clear understanding of the financial transaction, which can prevent confusion and disputes down the line.

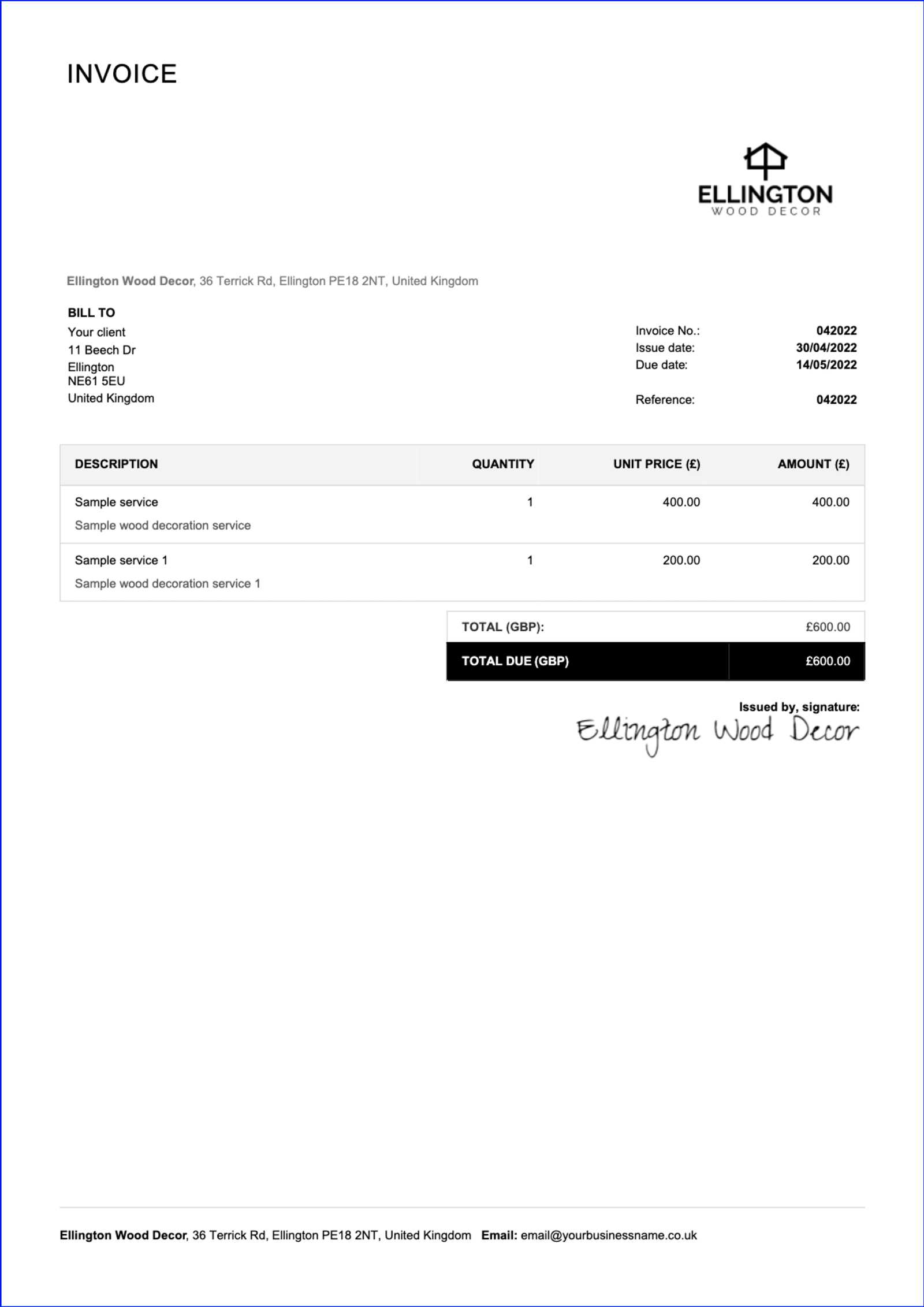

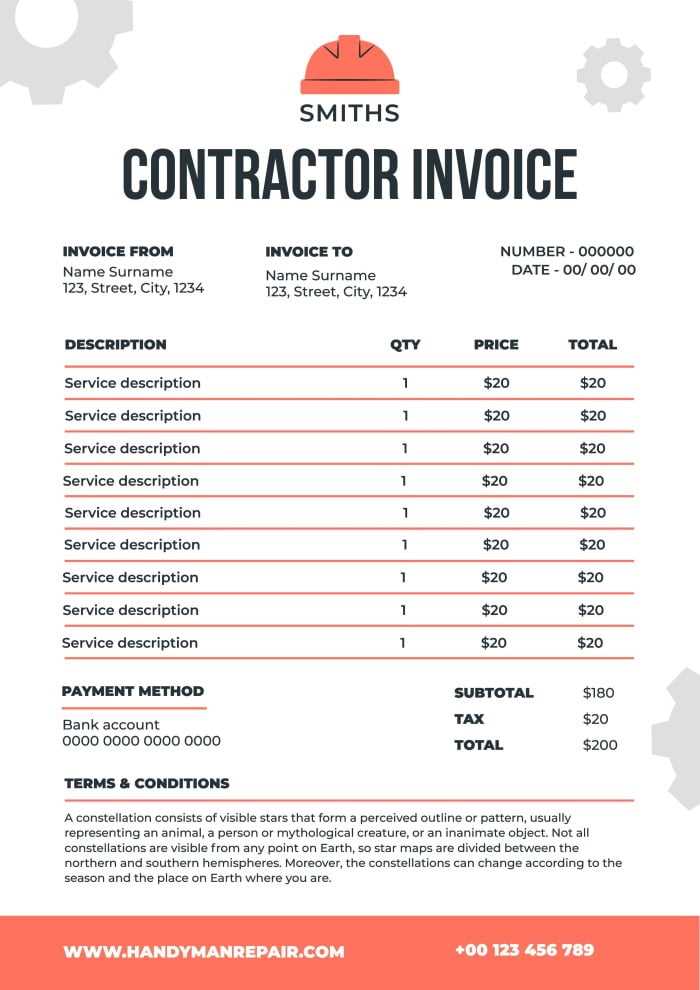

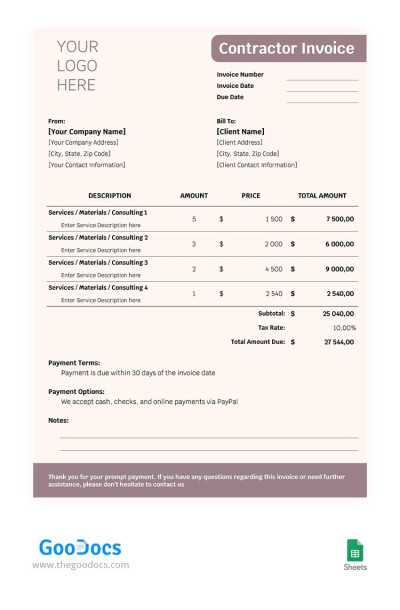

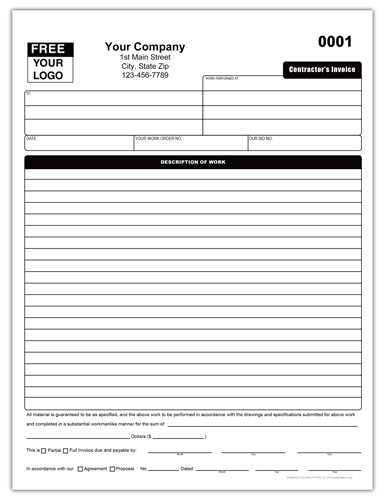

How to Customize an Invoice Template

Personalizing your billing document is essential to meet the unique needs of your business while maintaining professionalism. Customizing the layout and content allows you to better reflect your brand, provide clear information, and streamline the payment process. Here are some steps you can follow to tailor this document to your specific requirements.

- Choose the Right Layout: Select a clean and organized structure that highlights key information. Ensure it is easy to read and navigate for your clients.

- Add Your Branding: Include your business logo, colors, and contact details to give the document a professional and personal touch.

- Adjust Service Descriptions: Modify the section describing the work done to suit your particular services, adding clarity and relevant details for each job.

- Update Payment Terms: Customize payment deadlines, late fees, and accepted payment methods to align with your business practices.

- Include Additional Fields: Depending on your needs, add sections such as discounts, taxes, or client-specific information to ensure all details are captured.

By following these steps, you can create a billing document that reflects your professional standards while ensuring a smooth transaction process. Customization helps ensure that your documents remain clear, accurate, and appropriate for any client or project type.

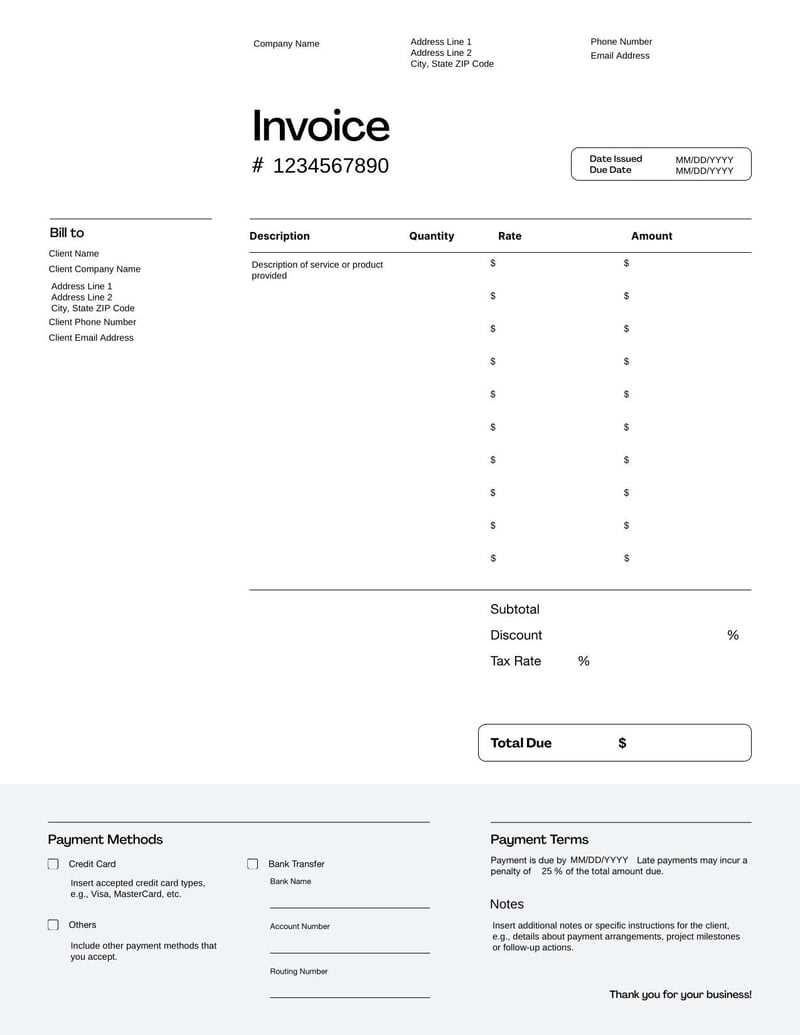

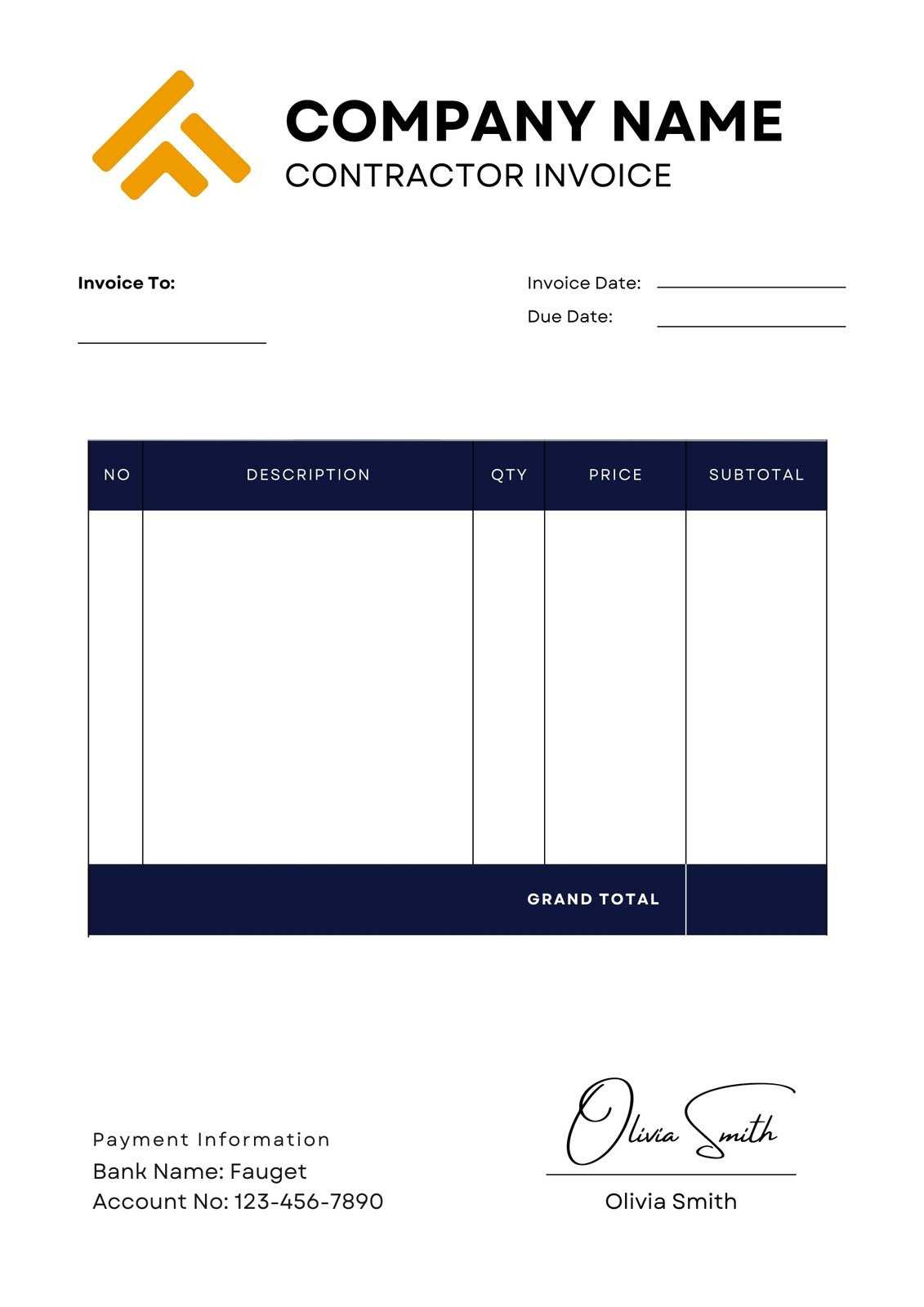

Choosing the Right Invoice Format

Selecting the appropriate structure for your payment request document is crucial for clarity and efficiency. The format should align with the nature of your work, the expectations of your clients, and your business needs. A well-organized structure ensures that all necessary details are easy to locate, which can help speed up the payment process and reduce errors.

There are several format options available, each catering to different types of businesses and preferences. Below is a comparison of common formats:

| Format | Best For | Advantages |

|---|---|---|

| Simple Layout | Freelancers, small businesses | Clear, minimal design, easy to customize |

| Itemized Breakdown | Complex projects, multiple services | Detailed, helps clients understand each charge |

| Digital Format | Businesses preferring quick delivery and online payments | Fast, easy to send via email, editable |

| Formal Design | Larger businesses, corporate clients | Professional appearance, looks official |

Choosing the right format depends on the complexity of your work and the nature of your client relationships. Whether you prefer a simple, straightforward approach or a detailed, formal layout, ensure that the format you choose effectively communicates all necessary information to the client.

Common Mistakes to Avoid in Invoices

Creating a payment request document might seem straightforward, but there are several common errors that can cause confusion or delays in payment. Avoiding these mistakes ensures that the process is smooth for both you and your clients, helping to maintain a professional reputation and avoid unnecessary disputes. Below are some key errors to watch out for when preparing this document.

Missing Essential Information

It is important to include all necessary details in your document. Missing information such as the total amount due, client details, or a description of the work completed can delay payments and cause confusion. Always double-check that everything is accurate before sending.

Ambiguous Payment Terms

Clear payment terms are crucial. Not specifying due dates, late fees, or acceptable payment methods can lead to misunderstandings. Be specific about when payment is expected and how it should be made to ensure a smooth transaction.

Inconsistent Formatting

Consistency in design is important for readability. Using inconsistent fonts, colors, or layouts can make your document look unprofessional and hard to navigate. Keep the format clean and organized to ensure that the essential details stand out and are easy for the client to find.

Best Practices for Professional Invoices

When preparing a payment request document, professionalism is key. A well-structured and polished document not only reflects positively on your business but also ensures smooth transactions with your clients. By following best practices, you can avoid common issues and enhance your credibility. Below are some recommendations to maintain a professional approach when creating these documents.

Essential Guidelines for a Professional Look

- Use Clear, Concise Language: Keep descriptions simple and to the point. Avoid jargon that could confuse the client.

- Include All Necessary Information: Make sure all relevant details such as services provided, payment terms, and due dates are included.

- Stay Consistent: Ensure that the format, fonts, and design elements are consistent throughout the document for better readability.

- Proofread Before Sending: Double-check all details for accuracy, including the amounts, dates, and client information.

- Ensure Easy Payment Options: Clearly display acceptable payment methods and relevant payment details to minimize confusion.

Additional Tips for Streamlining the Process

- Automate When Possible: Use software or tools to automate the generation of these documents, saving time and reducing errors.

- Provide Contact Information: Always include your contact information in case the client has any questions or issues.

- Be Transparent About Fees: Clearly outline any additional charges, such as late fees, to avoid misunderstandings later.

How to Calculate Invoice Amounts

Calculating the total amount due on a payment request requires accuracy and a clear understanding of the services or products provided. Ensuring that all components are correctly accounted for helps avoid confusion and ensures timely payment. Below are steps and considerations for accurately determining the total cost.

Breakdown of Costs

The total amount due should include the cost of all services or goods provided, along with any applicable taxes or additional fees. Here’s a general approach to calculating the final amount:

| Description | Amount |

|---|---|

| Base cost of services/products | $500 |

| Additional charges (e.g., shipping) | $50 |

| Taxes (e.g., 10%) | $55 |

| Total Amount | $605 |

Considerations for Accurate Calculation

- Understand the Scope of Work: Ensure that all work or products provided are accurately described and priced.

- Include Taxes and Fees: Account for local taxes, late fees, or other charges that may apply.

- Double-Check Quantities: Verify the quantities of goods or hours worked to ensure the correct calculation of totals.

Incorporating Taxes and Discounts

When calculating the final amount due, it’s essential to account for both taxes and discounts. These elements can significantly affect the total and should be applied accurately to ensure fairness and clarity in the transaction. Below is an overview of how to incorporate these adjustments into your calculations.

Calculating Taxes

Taxes are often required by law and are calculated based on the value of the services or products provided. Ensure that you apply the correct tax rate according to the local laws and regulations.

| Description | Amount |

|---|---|

| Base cost of services/products | $400 |

| Tax rate (e.g., 8%) | $32 |

| Total Amount After Tax | $432 |

Applying Discounts

Discounts can be a great way to incentivize customers or reward loyalty. When offering a discount, make sure to clearly specify it and subtract it from the total amount before taxes, unless otherwise indicated.

| Description | Amount |

|---|---|

| Base cost of services/products | $500 |

| Discount (e.g., 10%) | -$50 |

| Total After Discount | $450 |

Invoice Payment Terms Explained

Understanding payment terms is crucial for both businesses and clients to ensure smooth financial transactions. These terms define when and how payments should be made, preventing confusion and fostering a professional relationship. In this section, we’ll explore key payment terms that should be clearly stated in every financial document.

Common Payment Terms

Different businesses use various terms to specify when payments are expected and under what conditions. Some of the most commonly used terms include:

- Net 30: Payment is due within 30 days from the date of the document.

- Net 60: Payment is due within 60 days, allowing more time for the client to process the payment.

- Due on Receipt: Payment is required immediately upon receiving the document.

- Advance Payment: Full or partial payment is required before any services are provided or goods are delivered.

Early Payment Discounts

To encourage faster payments, some businesses offer early payment discounts. This means clients receive a reduced rate if the payment is made before a specified deadline. For example, a 2% discount might be offered if payment is made within 10 days.

- 2/10 Net 30: A 2% discount is available if payment is made within 10 days, with the full amount due in 30 days.

Tracking Payments from Clients

Efficiently managing and tracking payments from clients is essential for maintaining smooth cash flow and ensuring that all financial records are up-to-date. Proper tracking allows businesses to quickly identify any overdue payments and follow up accordingly. In this section, we will discuss methods for effectively monitoring payments and staying organized.

Methods for Tracking Payments

There are several approaches to keep track of client payments. Below are some common strategies:

- Spreadsheets: Simple spreadsheets can be used to log payments, track due dates, and calculate balances. This method is suitable for small businesses or freelancers with a limited number of clients.

- Accounting Software: More advanced software solutions provide automated tracking features, generating reports and sending reminders when payments are due or overdue.

- Bank Statements: Regularly reviewing bank statements allows for easy identification of incoming payments. This method is most effective when combined with a tracking system.

Tracking Overdue Payments

When a payment is overdue, it’s important to act promptly. Below are some ways to track and follow up on overdue payments:

- Automated Reminders: Set up reminders through accounting software or email to notify clients when payments are overdue.

- Follow-Up Calls: If automated reminders are not effective, a personal call or message may encourage faster payment.

- Late Fees: Consider implementing a late fee policy for overdue payments to incentivize timely payments.

Design Tips for Clean Invoices

A well-designed document not only ensures clarity but also presents a professional image to your clients. A clean, easy-to-read layout can make it simpler for your clients to understand the information and avoid confusion. This section will provide key design tips to help create visually appealing and functional documents.

Keep It Simple and Structured

When designing a document, it’s important to maintain a simple, structured layout. This makes it easier for clients to quickly locate key information. Below are a few tips for structuring your document:

- Use a clear header: Include your business name, address, and contact details at the top of the document, followed by the client’s details.

- Organize the details: Separate sections for services rendered, pricing, and payment terms. This helps avoid clutter and ensures readability.

- Use adequate spacing: Ensure there’s enough white space between sections and rows for easier scanning.

Font and Color Choices

Font style and color can significantly affect the readability of your document. Stick to professional fonts and avoid overusing colors. Here are some important tips:

- Choose legible fonts: Use simple fonts like Arial, Helvetica, or Times New Roman. These fonts are clear and widely accepted.

- Limit the use of colors: Use one or two colors to highlight important information such as totals, headings, or payment due dates.

- Ensure good contrast: Ensure that there is enough contrast between the text and background for easy readability.

Table for Clarity

Tables are a great way to organize service descriptions and charges. Here’s an example of a clean table layout:

| Item/Service | Quantity | Price | Total |

|---|---|---|---|

| Web Design Service | 1 | $500 | $500 |

| Consulting Fee | 3 hours | $75/hour | $225 |

| Total | $725 | ||

Digital vs Paper Invoices: Pros and Cons

When deciding between using digital or paper formats for business documents, it’s important to weigh the advantages and disadvantages of each. Both methods have their strengths and challenges, and the choice often depends on factors like convenience, cost, and environmental impact. This section explores the pros and cons of both options to help you make an informed decision.

Digital Format

Digital documents are becoming increasingly popular due to their speed and ease of use. Below are some of the key advantages and drawbacks of using electronic formats:

- Pros:

- Convenience: Electronic files can be created, sent, and stored instantly, making the process faster and more efficient.

- Accessibility: These documents can be accessed from anywhere and at any time, reducing the need for physical storage space.

- Cost-Effective: Sending digital documents eliminates printing, paper, and postage costs.

- Environmentally Friendly: Reducing paper use helps to minimize environmental impact by lowering paper waste.

- Cons:

- Security Risks: Digital files are susceptible to hacking and other cyber threats if not properly secured.

- Technical Issues: Issues like lost files, software incompatibility, or technical failures may occur.

- Learning Curve: Some individuals may face difficulties in navigating digital platforms if they are not familiar with technology.

Paper Format

Despite the rise of digital alternatives, many businesses still rely on paper documents. Here are some benefits and potential disadvantages of using physical formats:

- Pros:

- Tangible Record: Paper documents provide a physical copy that can be kept for reference or auditing purposes.

- Familiarity: Many individuals are more comfortable handling paper documents and find them easier to process than digital formats.

- No Technical Barriers: No need for internet access, electronic devices, or special software to view or process paper documents.

- Cons:

- Higher Costs: Printing, mailing, and storing paper documents incur additional costs and resources.

- Risk of Loss: Physical documents can be easily lost or damaged due to environmental factors such as fire or water damage.

- Storage Issues: Paper files require physical space for storage, which can quickly become overwhelming and disorganized.

Legal Requirements for Contractor Invoices

Understanding the legal obligations when issuing financial documents is crucial for businesses. These documents must meet specific criteria to ensure they comply with tax regulations, avoid legal issues, and guarantee smooth financial transactions. In this section, we will explore the essential legal components that such documents must include, ensuring they are valid and enforceable.

Essential Information to Include

To meet legal standards, certain details must always be included in the documentation to make it valid. This includes:

- Contact Information: Include the full name, address, and contact information of both the sender and recipient.

- Unique Reference Number: Every document should have a unique reference number for tracking and organizational purposes.

- Date: The date of issuance and, if applicable, the payment due date must be clearly stated.

- Description of Services: Clearly describe the work or goods provided, including the scope, quantity, and time frame.

- Tax Information: If taxes apply, the tax rate and amount should be specified, along with the business’s tax identification number.

Compliance with Local Laws

Each region or country may have specific rules for these financial documents. It’s essential to be aware of local requirements, which might include:

- Tax Regulations: Ensure the correct tax codes are applied and that any exemptions or special conditions are followed.

- Payment Terms: Clearly outline the payment terms, including deadlines, late fees, and acceptable methods of payment.

- Currency and Language: For international transactions, make sure to state the currency and, if necessary, provide a translation of the document.

How to Handle Late Payments

Late payments are a common challenge for businesses, but addressing them promptly and professionally is crucial to maintaining cash flow and client relationships. When payments are delayed, it’s essential to have a strategy for managing the situation to ensure timely compensation without damaging your reputation. In this section, we will explore effective methods for handling overdue payments.

Start by setting clear payment terms upfront with your clients. This includes outlining due dates, acceptable payment methods, and any late fees or penalties that may apply. Having these details in writing helps avoid misunderstandings and provides a foundation for enforcing the terms if necessary.

If a payment becomes overdue, begin by sending a friendly reminder. This can be done through an email or phone call, politely reminding the client of the outstanding balance and the original due date. Sometimes, delays are simply the result of forgetfulness, and a gentle nudge is all that’s needed.

If the payment remains unpaid after the initial reminder, consider sending a formal notice that details the overdue amount, any late fees, and a final deadline for payment. This document should emphasize the importance of paying promptly to avoid further complications.

For recurring issues with late payments, it may be necessary to reassess your payment policies or even consider alternative actions such as halting further work until payment is received. Be sure to maintain a professional tone in all communications to preserve your relationship with the client while also ensuring your business is compensated for services rendered.

Tools to Create Invoice Templates

Creating professional documents for requesting payment can be made easier with the right tools. These tools allow users to design, customize, and automate the process of generating accurate billing statements. Whether you’re looking for a simple layout or advanced features, there are various options available to suit your business needs.

Here are some popular tools that can help you craft polished and effective documents:

- Microsoft Word – A classic and accessible option that offers flexible design capabilities, from basic layouts to more complex designs. Word allows users to create customizable documents quickly and efficiently.

- Google Docs – A free, cloud-based solution that enables easy collaboration and sharing. Google Docs includes templates for various business needs, including those for billing statements, with the ability to adjust layouts as required.

- Canva – An online design platform that is user-friendly and perfect for creating visually appealing layouts. Canva offers various customizable templates and allows for more creative freedom, including adding logos and unique branding elements.

- QuickBooks – This accounting software goes beyond simple document creation and integrates financial management tools. It automates many aspects of billing and can generate detailed, accurate records.

- Zoho Invoice – A comprehensive online tool that specializes in automating the billing process. It offers features like recurring payments, customizable designs, and integrated payment gateways for convenience.

Choosing the right tool depends on your business requirements and the level of customization you need. Whether you prioritize simplicity or advanced features, these tools help streamline the process and ensure you have professional billing statements ready when needed.

How to Invoice for Different Services

Billing for various types of work requires clear communication and proper documentation to ensure the customer understands the charges and services provided. The process may differ depending on the nature of the work, whether it’s hourly labor, project-based, or a subscription model. Each approach has its own set of guidelines for how to accurately calculate charges and present them to clients.

Here are some common service categories and how to approach the billing for each:

| Service Type | Billing Method | Details |

|---|---|---|

| Hourly Work | Time-based Charges | Track the hours worked and apply an agreed-upon rate per hour. This method is best for tasks that involve fluctuating time commitments. |

| Project-Based Work | Flat Fee | Charge a fixed price for the entire project. This works well for work with a defined scope and timeline. |

| Subscription Services | Recurring Billing | For ongoing work, set a recurring billing cycle. You can charge weekly, monthly, or annually, depending on the agreement. |

| Consulting Services | Retainer or Hourly | Offer either a fixed monthly retainer or charge by the hour. Retainers are ideal for long-term client relationships. |

Regardless of the type of work, it’s important to ensure the billing document clearly outlines the service performed, the time or scope involved, the agreed-upon rate, and any applicable taxes or additional charges. Being transparent with clients helps maintain a professional relationship and reduces misunderstandings.

Ensuring Accuracy in Contractor Invoices

Creating precise billing documents is crucial for maintaining trust and professionalism in business transactions. Whether providing services on a short-term or long-term basis, it’s essential that the final amount reflects the correct charges and is error-free. This involves a clear breakdown of the tasks, time spent, and rates applied. Here are some key steps to follow to ensure that all your billing documents are accurate:

Double-Check the Details

Before finalizing any billing document, carefully review all of the information to avoid any discrepancies. Some areas to focus on include:

- Client Information: Ensure that names, addresses, and contact details are up-to-date and accurate.

- Services Provided: List all services performed in detail to ensure both you and your client are on the same page.

- Rates: Double-check that the agreed-upon rates are correctly applied to the time or tasks listed.

Utilize Reliable Software or Tools

Manual errors can be minimized by using trusted tools or software to create your billing documents. These tools can automate calculations, reducing the risk of mistakes and ensuring that everything is accounted for correctly. Some helpful features to look for include:

- Automated Calculations: Software that automatically totals line items can help you avoid miscalculations.

- Templates: Pre-set designs allow for consistency and ensure that all required fields are included.

- Tax and Discount Features: Built-in features that apply taxes or discounts can help maintain accuracy.

By following these guidelines, you can create reliable and accurate billing documents that will improve client relations and ensure timely payments.