Contractor Service Invoice Template for Simple and Efficient Billing

For many independent professionals and small businesses, managing payments and financial transactions can be time-consuming and prone to error. Ensuring that clients are billed accurately and on time is essential for maintaining smooth cash flow and professional relationships. Having a clear and well-structured document to outline the work completed, payment terms, and associated costs is critical in this process.

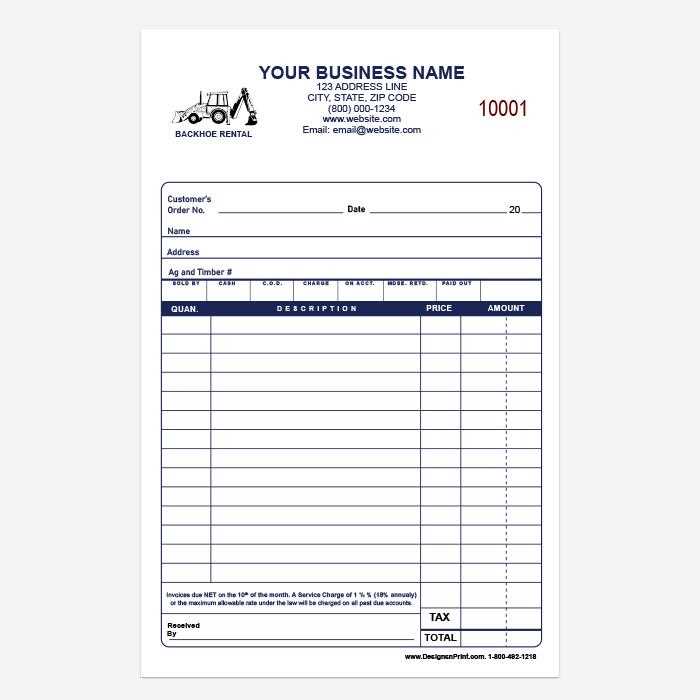

One of the most effective ways to streamline the billing process is by using a ready-made document that can be customized for each job. These documents not only save time but also reduce the risk of missing important details or making mistakes. With a professional layout and all necessary fields included, they allow you to focus on delivering high-quality work instead of spending hours on administrative tasks.

In this guide, we’ll explore how using an organized billing form can help you stay on top of payments, ensure accuracy, and project a more professional image to your clients. Whether you’re managing a single project or working with multiple clients, having a reliable system in place can make all the difference in maintaining an efficient and trustworthy business operation.

Understanding Contractor Service Invoice Templates

When managing projects, it’s crucial to have a clear method for documenting work completed and the corresponding payment details. This ensures transparency between the professional and their client, preventing misunderstandings and ensuring that compensation is accurate. A well-structured billing document not only saves time but also promotes a more organized approach to financial transactions.

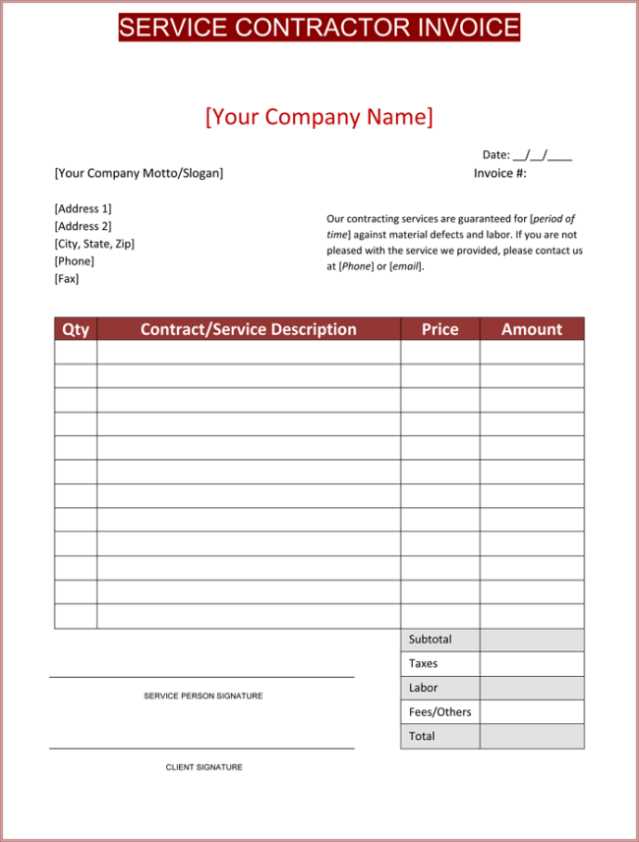

Key Components of an Effective Billing Document

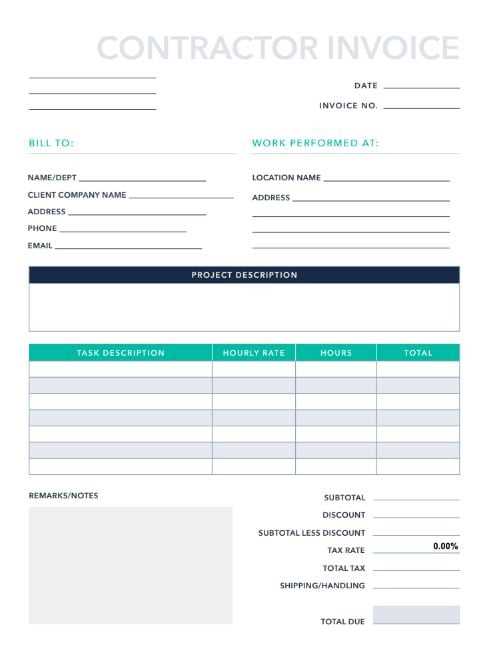

At its core, a professional billing document includes essential information such as the scope of work, the payment amount, and the terms of payment. This allows both parties to understand what has been agreed upon and eliminates any confusion that may arise later. Some common elements include the work description, cost breakdown, payment deadlines, and contact details. These elements provide clarity, ensuring that everything is accounted for properly.

Why Having a Standardized Form Matters

Using a standardized format for each project is beneficial for both efficiency and consistency. It helps the professional keep track of different projects and ensures that all necessary information is included without omission. Moreover, a well-prepared document presents a polished image to clients, helping to build trust and maintain long-term working relationships. Having such a document ready for each job is an investment in the professionalism and reliability of your business.

What is a Billing Document for Professionals?

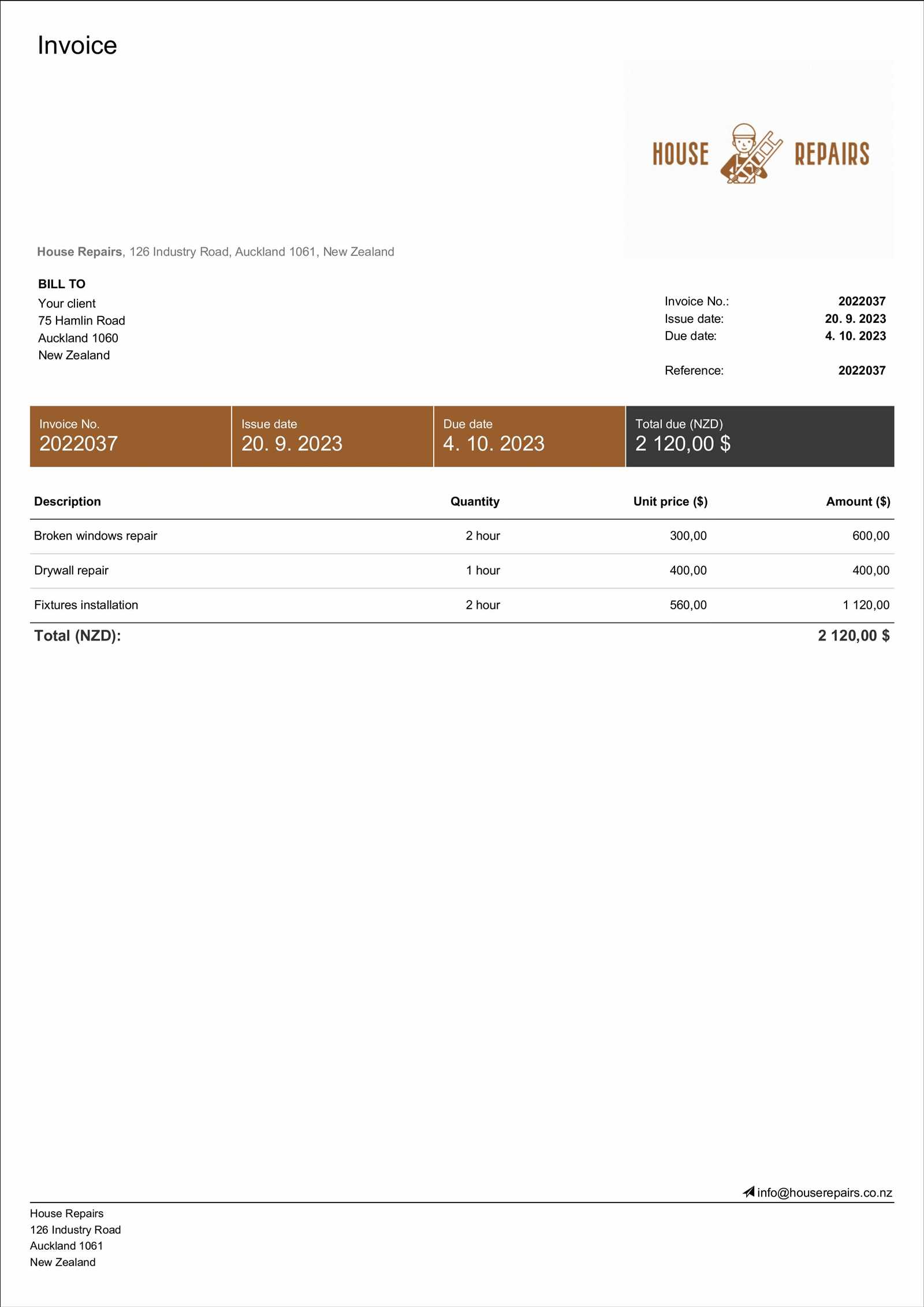

A billing document for professionals is a formal written record that outlines the details of the work completed and the corresponding payment expectations. It serves as an official request for compensation, detailing the scope of the job, the agreed-upon fees, and the timeline for payment. Such a document helps ensure that both the provider and the client are aligned on the financial aspects of the project.

This type of document typically includes several key elements, all of which play a crucial role in ensuring clarity and transparency. These components help avoid confusion and provide a straightforward way for both parties to confirm what has been completed and the amount due. Here are some of the most important details included in these documents:

| Component | Description |

|---|---|

| Work Description | A detailed explanation of the tasks or services performed, including any special requests or custom work. |

| Payment Amount | The agreed-upon cost for the work, often broken down by hours or services provided. |

| Payment Terms | Details on how and when the payment is to be made, such as due dates and late fees if applicable. |

| Client Information | Contact details of the client, ensuring there is no confusion regarding who is being billed. |

| Provider Information | The professional’s details, including business name, address, and contact information. |

This structured approach ensures that both parties understand the expectations, making it easier to manage payments and avoid any potential conflicts down the line.

Why Use a Billing Document Format?

Using a predefined document layout for financial transactions simplifies the entire process of requesting payment. It eliminates the need to create a new record from scratch for each project, saving time and reducing the risk of errors. By relying on a consistent format, professionals can ensure that all necessary details are included, and both parties understand the terms clearly. This approach helps maintain a smooth workflow and enhances efficiency in managing multiple clients or projects.

Consistency and Accuracy

A standardized structure allows professionals to maintain accuracy in every transaction. With a fixed format, important details such as cost breakdowns, deadlines, and contact information are less likely to be overlooked or omitted. The consistency of using the same design for each bill fosters trust and demonstrates professionalism to clients.

Time-Saving and Efficiency

By using a pre-designed document, much of the administrative burden is lifted. Professionals can focus on their core work instead of spending valuable time creating a new record each time. This efficiency ultimately leads to faster processing of payments, helping to maintain healthy cash flow and streamline the financial side of the business.

Key Elements of a Billing Document

A well-structured financial document should include several key components to ensure clarity, accuracy, and transparency for both the professional and the client. These elements help break down the work performed, the amount owed, and the payment terms, ensuring that all necessary information is present for both parties to understand the transaction. Below are the essential parts that should always be included in any professional billing document:

| Component | Description |

|---|---|

| Header | The title or label that identifies the document as a financial request, such as “Payment Request” or “Billing Summary.” |

| Work Description | A detailed breakdown of the tasks performed, including any specific deliverables or milestones achieved during the project. |

| Amount Due | The total cost for the work provided, including any applicable fees, taxes, or additional charges. |

| Payment Terms | The conditions under which payment is due, including due date, late payment penalties, or discounts for early payment. |

| Client Information | Clear contact information for the client, such as their name, address, and phone number, to ensure proper identification of the recipient. |

| Professional Details | The contact information of the professional or business issuing the billing document, including their name, address, and phone number. |

These key components ensure that all necessary information is provided in an easy-to-read format. Having these elements clearly defined helps avoid confusion and ensures both parties are on the same page regarding the terms and amount due.

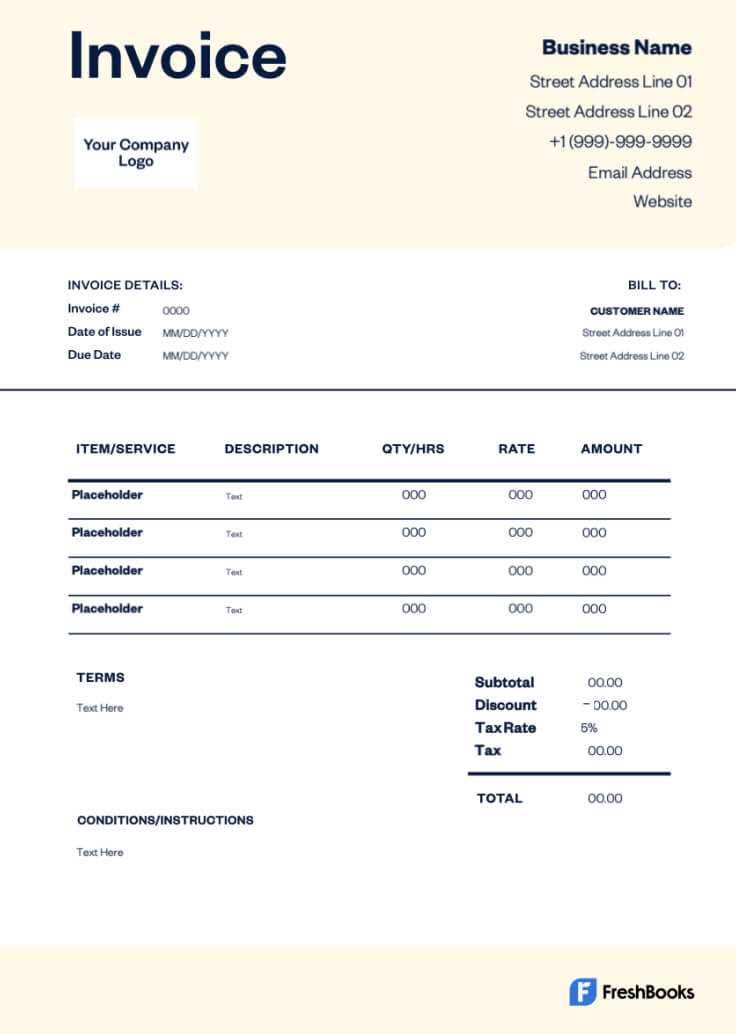

How to Customize a Billing Document Format

Customizing a billing document allows professionals to tailor the record to fit their specific needs, ensuring that all relevant details are included and the layout suits their business style. By adjusting certain elements, you can create a unique and professional-looking financial statement that reflects your brand while still including all the essential components for a clear and effective transaction. Personalizing your document helps enhance the client experience and maintains consistency across different projects.

Adjusting Key Information

One of the first steps in customization is ensuring that your business and client details are correctly displayed. This includes adding your business logo, contact information, and payment instructions. Personalizing the header with your company name or project title also adds a professional touch. Ensure that the client’s details, such as their name and address, are clear and easy to find.

Formatting and Design

Next, consider the design and layout. While clarity is most important, the overall look of the document can reflect your professionalism. You can modify the color scheme, font style, or text alignment to make it visually appealing. You can also adjust the positioning of the sections, such as placing payment terms or a work summary at the top for easy reference. Adding a section for additional notes or comments can be useful for explaining special terms or providing further context.

Tip: Consistency is key. Make sure the format you choose is easy to replicate for future projects, helping you maintain efficiency in your billing process.

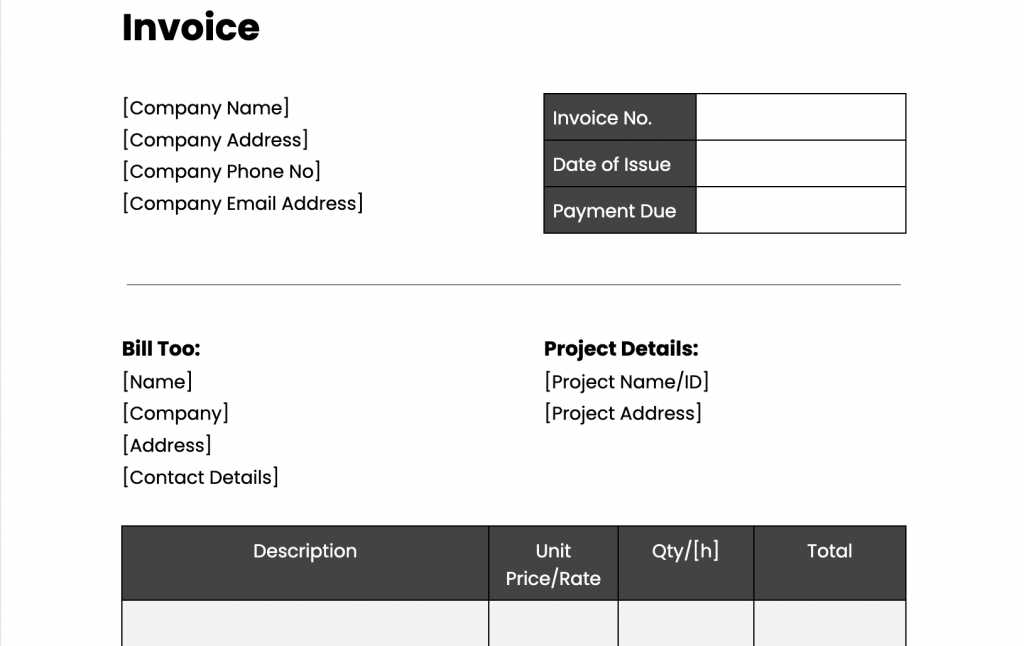

Benefits of Using Digital Billing Documents

Using a digital format for financial records offers numerous advantages over traditional paper-based methods. Digital documents not only save time and reduce errors but also enhance the overall efficiency of the billing process. By automating certain tasks, such as calculations or formatting, professionals can focus more on their core work while ensuring that clients receive clear and accurate statements promptly.

Increased Efficiency and Time-Saving

With a digital record, there’s no need to start from scratch every time you need to issue a bill. Pre-designed formats can be reused, reducing the time spent on administrative tasks. You can easily input project-specific details and instantly generate a professional-looking document ready to send to your client. This eliminates the need for manual calculations or formatting adjustments, allowing for quicker turnaround times.

Improved Organization and Accessibility

Digital files can be easily stored and organized, making it simple to track past transactions and payments. You can create folders or use cloud storage to keep everything in one place, ensuring that documents are accessible whenever you need them. Additionally, sharing these documents with clients is faster and more convenient through email or online platforms, reducing the delays often associated with postal mail.

Reduced Errors and Increased Accuracy

Automation in digital documents helps prevent common mistakes, such as incorrect calculations or missing information. Many digital formats come with built-in functions to automatically calculate totals, taxes, and discounts, reducing human error. This accuracy ensures that both you and your client are on the same page regarding the amount due and the terms of payment.

Overall, digital billing records streamline your workflow, improve accuracy, and help you maintain a professional image, all while saving you time and effort in managing your finances.

Common Mistakes to Avoid in Billing Documents

When preparing financial records for clients, it’s easy to overlook certain details that can lead to confusion or delays in payment. Small mistakes in the document can result in misunderstandings, missed payments, or even damaged professional relationships. Being aware of common errors can help ensure that the document is accurate, professional, and free from complications.

Common Errors in Billing Documents

Here are some of the most frequent mistakes to avoid when creating financial statements:

| Mistake | Explanation |

|---|---|

| Missing Contact Information | Failing to include complete details of both the client and the professional can cause confusion, especially if there are questions or disputes about the billing. |

| Incorrect Dates | Forgetting to include the issue date or the payment due date can create confusion regarding when payment is expected or when the work was completed. |

| Unclear Payment Terms | Vague or absent payment terms can lead to disputes over how and when the payment is due. Clearly stating deadlines and penalties for late payments is essential. |

| Not Itemizing Costs | Failing to break down the costs by individual task or service makes it harder for clients to understand what they are being charged for, leading to potential disputes. |

| Omitting Taxes or Fees | Forgetting to include taxes, discounts, or other fees can result in the client receiving an unexpected total, which could delay payment. |

How to Prevent These Mistakes

The best way to avoid these issues is to double-check all details before sending the document. Ensuring that all necessary fields are filled, the dates are accurate, and the payment terms are clearly stated can help keep everything on track. Using a consistent structure for every billing record can also minimize the chance of missing any important details.

By paying attention to these common errors, you can maintain a professional image and ensure that your transactions run smoothly.

How to Set Payment Terms on Billing Documents

Establishing clear payment terms is essential for ensuring that both parties are on the same page regarding the financial aspects of the transaction. By clearly outlining when and how payment is expected, professionals can avoid misunderstandings and prevent late payments. Well-defined terms help create a smooth, professional relationship and ensure that the provider receives compensation in a timely manner.

Key Payment Terms to Include

When setting payment terms, there are several important elements to consider. These details not only protect your business but also set expectations for your client. Here are the key aspects to include:

- Due Date: Specify the exact date by which payment is expected. This helps avoid confusion about deadlines.

- Late Fees: If applicable, include a fee for late payments. Clearly outline how much will be charged if payment is not received by the due date.

- Discounts for Early Payment: Offering a discount for early payment can encourage prompt payment and build goodwill with clients.

- Payment Methods: Indicate the accepted forms of payment (e.g., bank transfer, credit card, checks) to ensure that there are no issues with how payments are made.

Communicating Payment Expectations

Clearly communicating payment terms upfront ensures that your client knows exactly what is expected. Avoid using ambiguous language, and be explicit about deadlines, fees, and any other conditions. Including these details in every billing document will help maintain consistency and encourage timely payments.

Tip: It’s always a good idea to discuss payment terms before starting a project to ensure mutual understanding and avoid potential conflicts down the road.

Including Taxes and Fees on Billing Documents

When preparing financial records, it’s crucial to include any applicable taxes and additional fees that may affect the total amount due. Including these charges upfront ensures that the client is fully aware of the final cost and avoids confusion or disputes later on. Properly listing taxes and fees also helps maintain transparency and compliance with local regulations.

Types of Taxes and Fees to Consider

Depending on your location and the nature of the work, various taxes and fees might need to be included in the final amount. Here are some common examples:

- Sales Tax: This is a tax levied by local or national governments on goods and services. It is usually calculated as a percentage of the total amount.

- VAT (Value-Added Tax): Common in many countries, VAT is a tax added at each stage of production or distribution. It’s important to ensure the correct rate is applied.

- Handling or Processing Fees: Some professionals charge additional fees for handling or processing certain types of transactions, especially for specific materials or services.

- Travel or Transportation Fees: If travel is required to complete the work, transportation costs should be itemized separately in the document.

How to Include Taxes and Fees Clearly

When adding taxes and fees to a financial document, it’s important to list each one separately with a clear description. This provides full transparency and prevents any misunderstandings. For example, if you are adding a sales tax, include a line for “Sales Tax” followed by the rate applied and the total amount. Similarly, any additional charges should be clearly labeled with a brief explanation. Summing up these additional amounts at the bottom of the document ensures that the final total is easy to understand and accurate.

Tip: Always double-check the tax rates and any applicable fees for your specific region to avoid overcharging or undercharging your client.

Best Practices for Billing Professionals

When managing payments for your work, following best practices ensures that the process remains smooth, professional, and transparent. Proper billing not only helps maintain a positive relationship with your clients but also ensures that you get paid on time and without complications. By adopting a few simple strategies, you can avoid common mistakes and create an efficient, hassle-free billing system for your business.

Key Billing Practices to Follow

- Be Clear and Detailed: Always provide a clear description of the work performed, including the hours worked, tasks completed, and any specific materials used. This helps clients understand exactly what they are paying for.

- Include Payment Terms: Set clear payment terms, such as the due date and penalties for late payments. This ensures that both you and your client know when the payment is expected and what will happen if the deadline is missed.

- Set a Fair and Consistent Rate: Ensure that your hourly or project-based rate is consistent and reasonable. Having a set rate for all similar work helps avoid confusion and keeps billing straightforward.

- Send Bills Promptly: Send your payment request soon after completing the work to avoid unnecessary delays. The sooner you send the bill, the sooner you can expect to receive payment.

- Keep Records Organized: Maintain a proper record of all bills sent and payments received. This not only helps with tax filing but also gives you a quick reference in case of any discrepancies or disputes with clients.

Additional Tips for Smooth Billing

- Use a Digital Format: Switching to digital billing documents can streamline your process, reduce errors, and make it easier to track payments.

- Clarify Extra Charges: If there are additional costs such as travel or materials, make sure to list them separately to avoid any misunderstandings later on.

- Offer Multiple Payment Methods: Allowing clients to pay via different methods, such as bank transfer, credit card, or PayPal, can speed up the payment process.

- Stay Professional: Always maintain a professional tone in your billing communications. A polite and clear document helps reinforce your professionalism and fosters trust.

By following these best practices, you can ensure that your billing process is efficient, transparent, and fair for both you and your clients. This helps establish trust and ensures that you’re compensated on time for your hard work.

Billing Document Options for Professionals

There are several options available when it comes to designing and using financial request formats. Choosing the right one depends on the nature of the work, the preferences of the professional, and the needs of the client. From simple, basic designs to more detailed and customized formats, each option has its own set of features that can help streamline the billing process. Selecting the right structure is essential to ensure clarity, efficiency, and professionalism in each transaction.

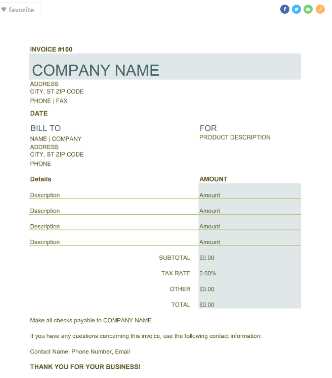

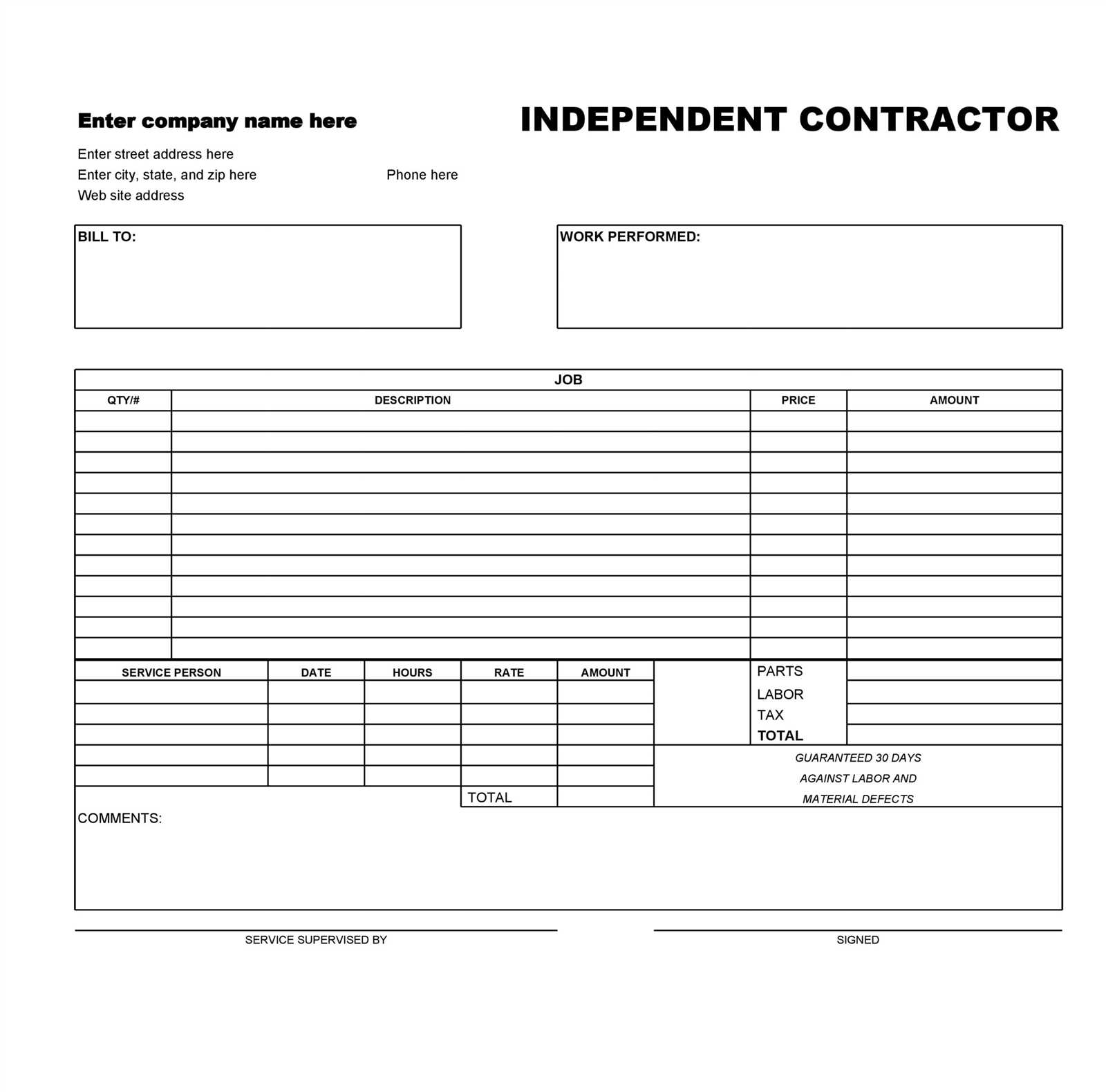

Basic Formats

For many professionals, a straightforward, no-frills format is sufficient. These documents include the essential details–such as the total cost, description of work, and payment terms–without unnecessary complexity. Basic formats are quick to fill out, easy to read, and ideal for smaller projects or when working with long-term clients who are familiar with the billing process.

Customized Designs

Some professionals prefer to use customized formats that align with their brand identity. These formats may include logos, specific color schemes, or personalized fields that reflect the nature of the work. Customized designs can help convey a sense of professionalism and make the billing document stand out, which can be especially useful for larger projects or high-value clients.

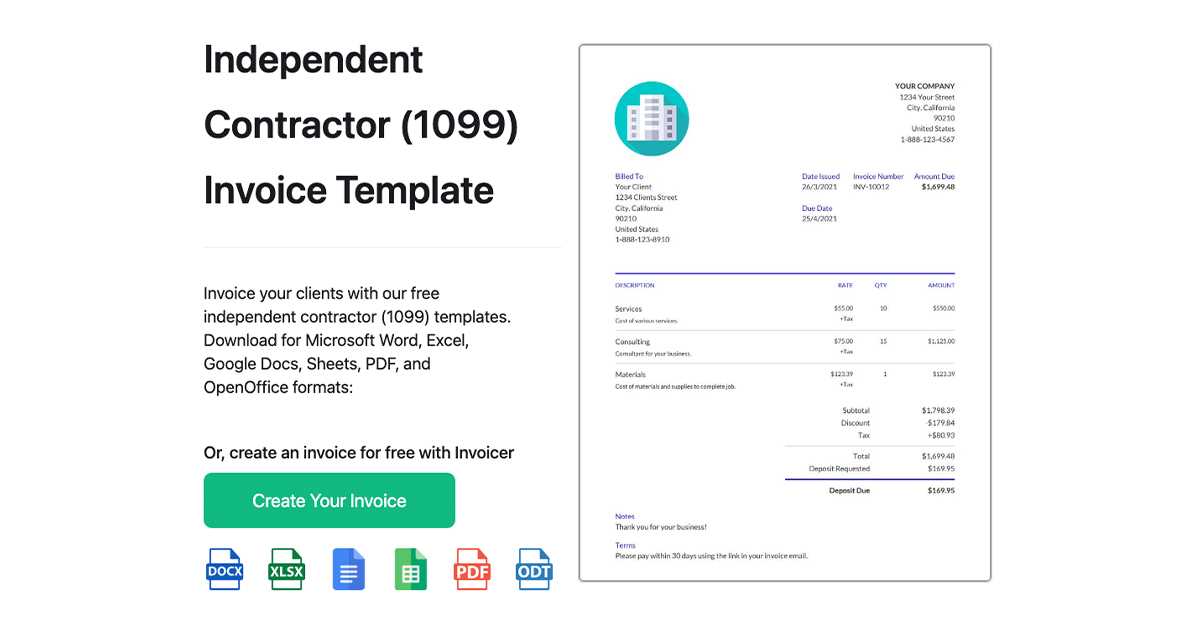

Digital Formats

Digital versions of billing documents are becoming increasingly popular due to their convenience and ability to integrate with online payment systems. These formats often include automated fields for calculating totals, taxes, and discounts, reducing the chance of human error. Digital options are easily shareable via email or online platforms, and they can often be stored and tracked in cloud-based systems for easy access and record-keeping.

Specialized Options

For more complex transactions, professionals may require specialized formats that include additional sections, such as milestones, payment schedules, or specific terms and conditions. These specialized options are useful for long-term projects or situations where payments are made in installments, and they help ensure that all parties are clear on expectations and deliverables.

Tip: Consider your business needs and the preferences of your clients when choosing a format. A simple, clean design works for most cases, but a more personalized or digital format can add value for larger, more complex projects.

How to Send Billing Documents Efficiently

Sending financial documents promptly and professionally is essential for ensuring that payments are processed quickly and accurately. Streamlining the process of sending requests for payment can help save time, reduce errors, and improve your cash flow. With the right approach, you can ensure that your documents reach clients without delay while maintaining a professional image.

Choosing the Right Delivery Method

One of the first steps in sending financial documents efficiently is choosing the appropriate delivery method. Here are some of the most common options:

- Email: Sending documents via email is one of the fastest and most common methods. It allows you to deliver the document instantly, ensuring your client has it in their inbox within minutes. Additionally, you can request a read receipt to confirm that the document has been received.

- Online Platforms: Many professionals and businesses now use online platforms or payment systems to issue billing documents. These systems often come with features that allow clients to view, download, and even pay directly from the document, streamlining the entire process.

- Postal Mail: While less common today, postal mail may still be an option if you are dealing with clients who prefer paper copies or if digital communication is not an option. Ensure that you send these documents via a reliable and traceable service to avoid delays.

Automating the Process

To save time and reduce the risk of errors, consider automating parts of the billing process. Many digital systems and accounting software offer the option to generate and send documents automatically once certain conditions are met. For example, once a project is marked as complete, the system can create the document, fill in relevant details, and email it to the client without manual input.

Automating this process ensures that billing documents are sent consistently, on time, and with accurate information, allowing you to focus more on the core aspects of your work.

Tip: Whether you are sending documents manually or automatically, always double-check the content before sending to ensure all details are correct, and any necessary attachments are included.

Tracking Payments with Billing Documents

Effective tracking of payments is crucial for maintaining healthy cash flow and staying organized. By keeping detailed records of payments made and outstanding balances, you can ensure that all financial transactions are accounted for and that clients pay on time. A well-structured financial document can help you easily monitor and manage incoming payments, preventing missed or delayed payments and ensuring transparency for both parties.

Key Features for Tracking Payments

When creating billing documents, there are several key features that can help with tracking payments:

- Payment Status: Always include a section that clearly indicates whether a payment has been made or is still due. This can be a simple “Paid” or “Unpaid” field, or a more detailed progress tracker for larger projects.

- Payment Date: Include a space for the payment date, so you can easily reference when the payment was made. This is helpful for reconciling accounts and tracking overdue payments.

- Balance Due: Clearly state the remaining balance if a partial payment has been made. This ensures that both you and your client understand the outstanding amount and helps avoid confusion.

- Payment Methods: Specify the accepted payment methods and any related fees, if applicable. This can be helpful for both parties to know how payments will be processed and if there are any extra charges.

Automating Payment Tracking

To further streamline the process, consider using accounting software or digital tools that automatically update the payment status as payments are received. These tools often allow you to input payment details once, and they will automatically update the balance due, mark the document as paid, and even send automatic reminders to clients if the payment is overdue.

Tip: Regularly review your payment records to ensure that all transactions are logged correctly. Keeping track of late payments or discrepancies early can prevent issues later.

Managing Late Payments on Billing Documents

Late payments can disrupt your cash flow and create unnecessary tension with clients. Managing overdue payments efficiently is crucial for maintaining financial stability and ensuring that your business continues to run smoothly. By setting clear expectations and having a structured approach to dealing with late payments, you can minimize delays and maintain professional relationships with your clients.

Steps to Take When Payments Are Late

When a payment becomes overdue, it’s important to act promptly and professionally. Here are some steps to follow:

- Send a Friendly Reminder: After the payment due date passes, send a polite reminder email or message to your client. Sometimes, a simple nudge is all that’s needed to prompt payment.

- Review the Terms: If the payment remains unpaid, review the terms that were agreed upon with the client. This will help you determine the next course of action and remind the client of the agreed-upon timeline and penalties, if any.

- Send a Formal Follow-Up: If the payment is significantly delayed, send a formal follow-up letter. This communication should be more direct and clearly state the overdue amount, any interest or late fees, and the consequences of further delays.

- Offer Payment Plans: In some cases, clients may be facing financial difficulties. Offering a payment plan or extending the deadline can be a good way to maintain the relationship while still ensuring you get paid.

Preventing Late Payments

While it’s impossible to eliminate late payments entirely, there are steps you can take to reduce their frequency:

- Set Clear Payment Terms: Ensure that your payment terms are clearly outlined from the start, including the payment due date, late fees, and any discounts for early payments.

- Request Deposits: For larger projects, ask for an upfront deposit or partial payment to cover initial costs. This can reduce the financial impact of late payments.

- Send Reminders Before the Due Date: Send a reminder a few days before the payment is due. This gives clients a heads-up and may encourage them to pay on time.

- Accept Multiple Payment Methods: Offering clients different ways to pay, such as credit cards, bank transfers, or online payment platforms, can make it easier for them to pay on time.

Tip: Stay professional when dealing with overdue payments. Maintaining clear, respectful communication can help you resolve payment issues without damaging client relationships.

Legal Considerations for Billing Documents

When issuing financial requests, it’s important to ensure that they meet legal requirements to protect both you and your client. Legal considerations can range from compliance with tax laws to ensuring that the terms of payment are clear and enforceable. Being aware of the legal aspects of billing documents helps avoid disputes and ensures that you are properly compensated for your work.

Key Legal Elements to Include

To make sure that your billing documents are legally sound, it’s essential to include certain key elements:

| Element | Purpose |

|---|---|

| Client Information | Includes the full name or business name, address, and contact details of the client. This ensures that there is no confusion about the party responsible for payment. |

| Detailed Work Description | Provides clarity on the nature of the work done, which helps to avoid misunderstandings or disputes about what was agreed upon. |

| Payment Terms | Specifies due dates, payment methods, and penalties for late payments. This makes it clear to the client when and how they need to pay and what happens if they fail to do so. |

| Tax Information | Ensures compliance with local and national tax laws, such as including tax rates or the tax identification number, when applicable. |

| Legal Disclaimers | Includes any disclaimers or terms that protect you legally in case of disputes, such as limits on liability or governing law provisions. |

Understanding Tax and Regulatory Compliance

It’s important to be aware of the local and national regulations regarding taxes when preparing billing documents. Depending on the nature of your work and your location, you may be required to charge sales tax, VAT, or other taxes. You should include all necessary tax information and ensure that you’re charging the correct rates according to local laws.

Additionally, many countries require businesses to include certain information, such as a tax ID number or business registration details, to be compliant with regulatory authorities. Always check with a local accountant or legal expert to ensure that your documents are in full compliance with the law.

Tip: Keep accurate records of all billing documents and transactions for tax purposes. In case of an audit or legal dispute, having proper documentation will protect you and your business.

How to Create a Billing Document from Scratch

Creating a financial document from the ground up can seem challenging, but with the right structure and attention to detail, it’s a straightforward process. Whether you’re starting a new business or just need to create a custom format for a specific client, understanding the essential components will help you build a professional, effective document that ensures you get paid on time.

Essential Steps for Creating a Billing Document

Follow these steps to create a clear and accurate financial request:

- Include Your Business Information: At the top of the document, include your name or business name, address, contact information, and any relevant registration details (such as a tax ID number). This ensures the recipient knows who the bill is from.

- Client Information: Clearly state the client’s name or business name, along with their address and contact details. This ensures that there is no confusion about who is responsible for the payment.

- Assign a Unique Reference Number: Give the document a unique reference or identification number. This helps with tracking and makes it easier for both you and your client to reference the document in future correspondence.

- Provide a Detailed Description of Work: Break down the tasks or products provided, including quantity, unit price, and total cost. Providing as much detail as possible helps avoid misunderstandings.

- Specify Payment Terms: State the total amount due, the due date, accepted payment methods, and any late fees or discounts. This ensures clarity and avoids confusion when it comes time to settle the balance.

- Include Tax Information: Depending on your location and the nature of the work, include any applicable taxes, such as sales tax or VAT. This ensures compliance with local tax laws.

Finalizing the Document

Once you’ve added all the necessary details, review the document for any errors or missing information. Double-check the client’s contact details, the accuracy of the work description, and the payment amount to avoid any issues down the line.

Finally, save the document in a standard format, such as PDF, to ensure it’s easy to share and can’t be easily altered by the recipient.

Tip: Use a consistent layout for your billing documents to ensure professionalism and make it easier for clients to understand the charges each time you send a request for payment.

Choosing the Right Billing Software

Selecting the right software to manage your billing documents is crucial for streamlining your financial processes. With so many options available, it’s important to consider features that align with your business needs, ease of use, and how well it integrates with your existing workflow. The right software can save you time, reduce errors, and provide a more professional experience for your clients.

Key Features to Look for in Billing Software

When evaluating different billing platforms, make sure the software offers the following essential features:

- Customizable Templates: The ability to create and save custom billing documents will save you time and ensure consistency. Look for software that allows you to add your branding, adjust fields, and tailor the document layout to your preference.

- Automated Calculations: A good billing platform should automatically calculate totals, taxes, and any discounts or late fees. This reduces the chance of human error and speeds up the process.

- Payment Tracking: Choose a platform that tracks payments and provides real-time updates on outstanding balances. This feature helps you manage cash flow and monitor overdue payments without additional manual effort.

- Multi-Currency and Multi-Language Support: If you have international clients, ensure the software supports multiple currencies and languages. This makes it easier to work with global clients without facing complications in payment processing.

- Integration with Accounting Systems: Billing software that integrates seamlessly with your accounting tools can save time and help maintain consistency across your financial records. Look for compatibility with popular platforms like QuickBooks or Xero.

Consider Ease of Use and Customer Support

The best software for your business is one that you can easily learn and use on a day-to-day basis. Look for platforms with a user-friendly interface and intuitive navigation. Additionally, choose a provider that offers strong customer support, so you can quickly resolve any issues or get answers to your questions when needed.

Tip: Many billing software platforms offer free trials or demo versions. Take advantage of these to explore the software and determine if it fits your business needs before committing to a paid plan.

How Billing Documents Improve Professionalism

Having a well-organized and consistent approach to requesting payment is key to building a professional image for your business. By using structured financial documents, you convey reliability, attention to detail, and a strong sense of organization. This not only helps foster trust with clients but also ensures smoother transactions and fewer misunderstandings.

Benefits of Structured Billing Requests

Here are several reasons why using a standardized financial request improves your professional reputation:

- Consistency: A uniform format for all your financial documents ensures consistency in your communications with clients. This makes it easier for them to recognize and understand your documents, improving their overall experience.

- Clear Communication: When you present detailed and clear breakdowns of charges, deadlines, and payment methods, you reduce the chances of misunderstandings and disputes. This leads to better client relationships and fewer delays in payment.

- Brand Representation: A well-designed financial document reflects your business brand. Adding your company logo, color scheme, and other branding elements makes the document feel more professional and personalized.

- Time Efficiency: Using a pre-designed structure speeds up the process of preparing your billing documents. This frees up more time for other important tasks, such as client communication and project completion.

How Professional Billing Helps Your Business

By investing in well-crafted financial requests, you position yourself as a business that values professionalism and organization. This sends a positive message to clients, encouraging them to pay on time and view your work as valuable. Additionally, it shows that you take the financial side of your business seriously, which can lead to increased respect and trust from clients.

Tip: Regularly review and update your billing process to ensure that your approach remains streamlined, accurate, and aligned with your evolving business needs.