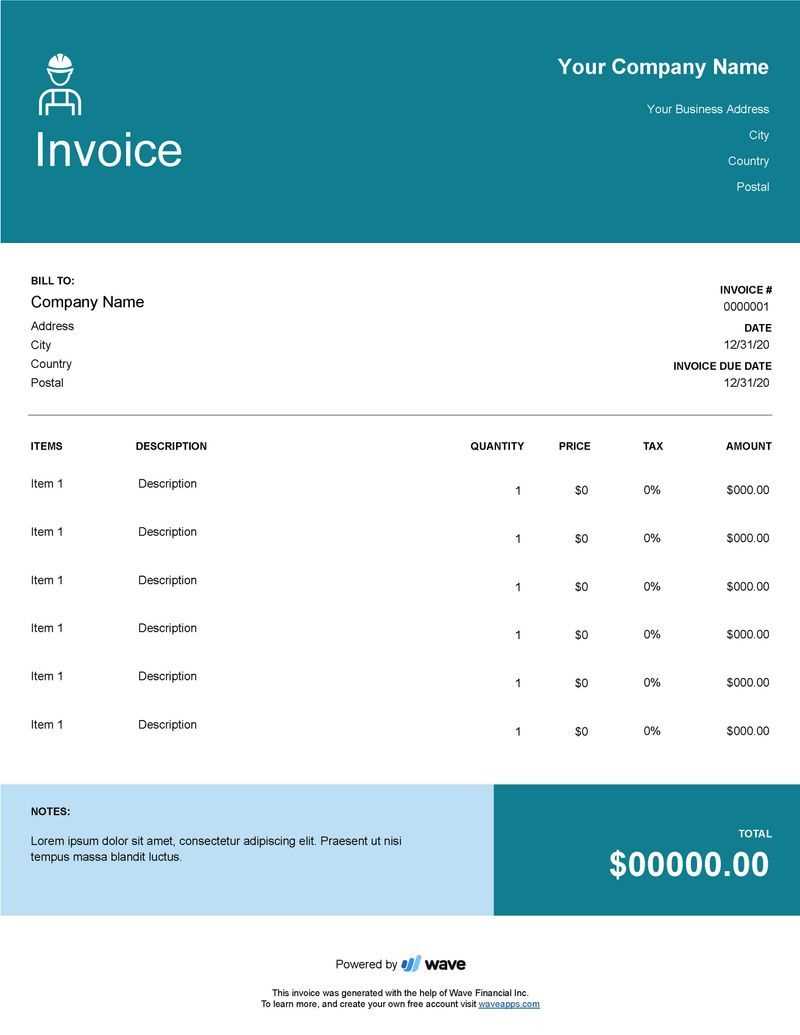

Contractor Invoice Template for Efficient Billing

For individuals offering services on a freelance or contractual basis, managing payment requests is crucial for maintaining cash flow and professionalism. Whether you’re a designer, consultant, or tradesperson, having a well-organized document to detail the work completed and the amount owed ensures smooth financial transactions. Crafting a clear and concise billing statement can help prevent misunderstandings and facilitate timely payments.

By using a structured format to present payment details, you can not only streamline your financial processes but also build trust with clients. A properly designed document includes all necessary components, such as the scope of work, payment terms, and due dates. Professionals who use such tools can focus more on their craft, knowing that their billing is handled efficiently and correctly.

While there are many formats available, tailoring the design to meet your specific needs and aligning it with your business practices will ensure better communication. This approach is particularly beneficial for maintaining accurate records, tracking outstanding balances, and staying organized in the long term.

Creating a Professional Billing Document

Developing a structured and professional payment request form is essential for ensuring clarity and accuracy in financial transactions. A well-crafted document not only outlines the work completed but also establishes clear expectations for payment. This helps to avoid confusion and enhances your professional image, ensuring that clients understand the terms and conditions of their payment obligations.

Key Components to Include

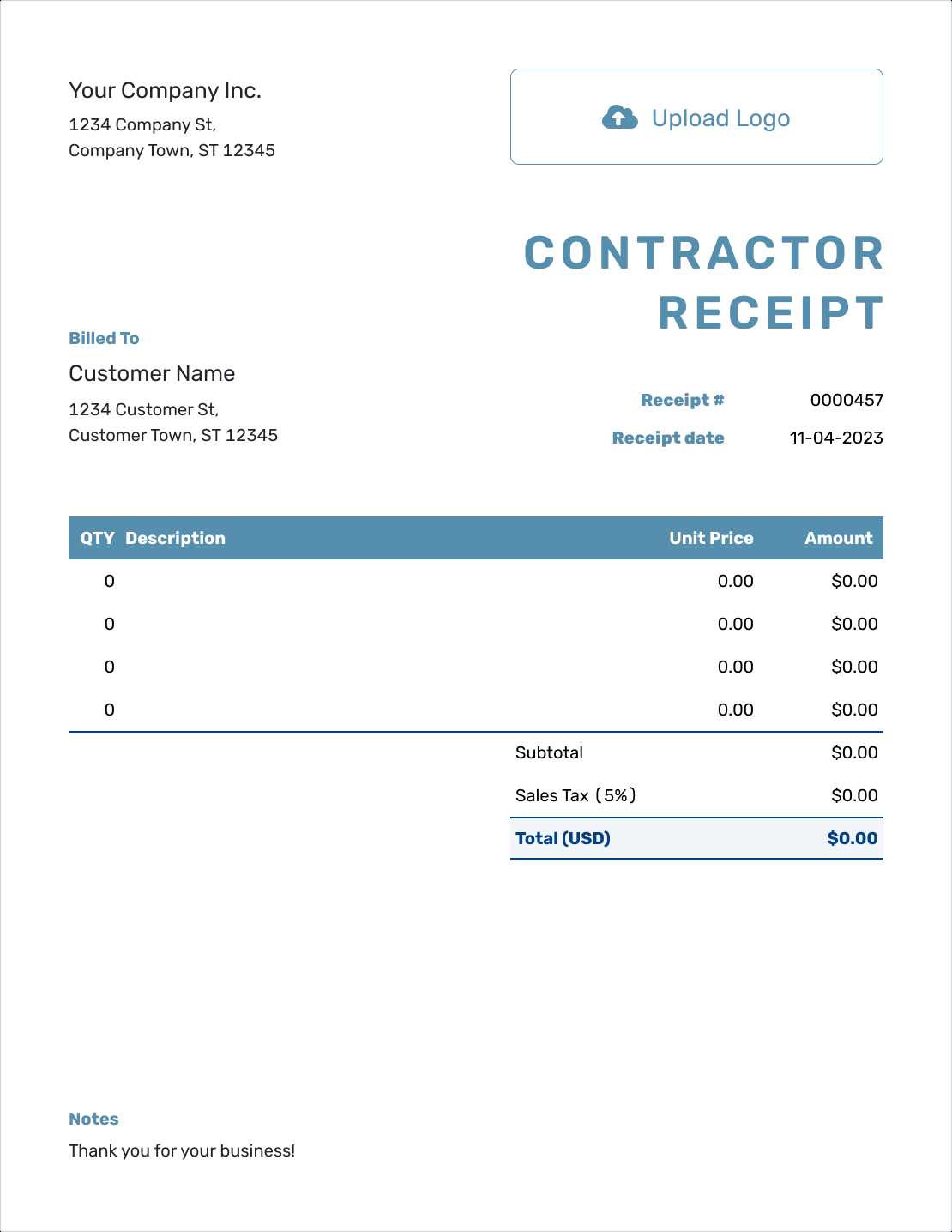

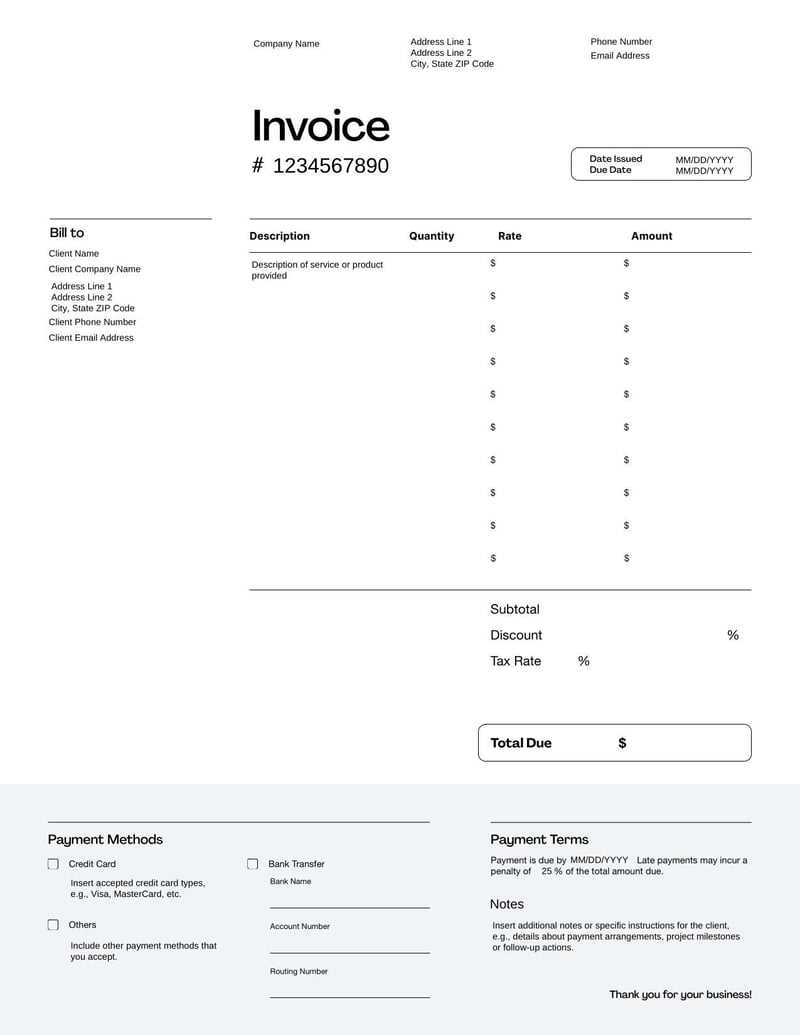

A successful billing statement should include several important sections to ensure all necessary information is covered. These elements should be organized in a way that is easy to read and understand. The following are the essential components:

- Your business name and contact information: Always include your details so the client knows how to reach you.

- Client information: Include the name, address, and contact details of the client.

- Description of services provided: Clearly outline the work completed and the dates during which services were rendered.

- Total amount due: Specify the amount owed, including any applicable taxes or additional fees.

- Payment terms: Indicate when payment is due and any penalties for late payments.

- Payment methods: Provide instructions on how the client can make payments (bank transfer, credit card, etc.).

Design Tips for a Professional Look

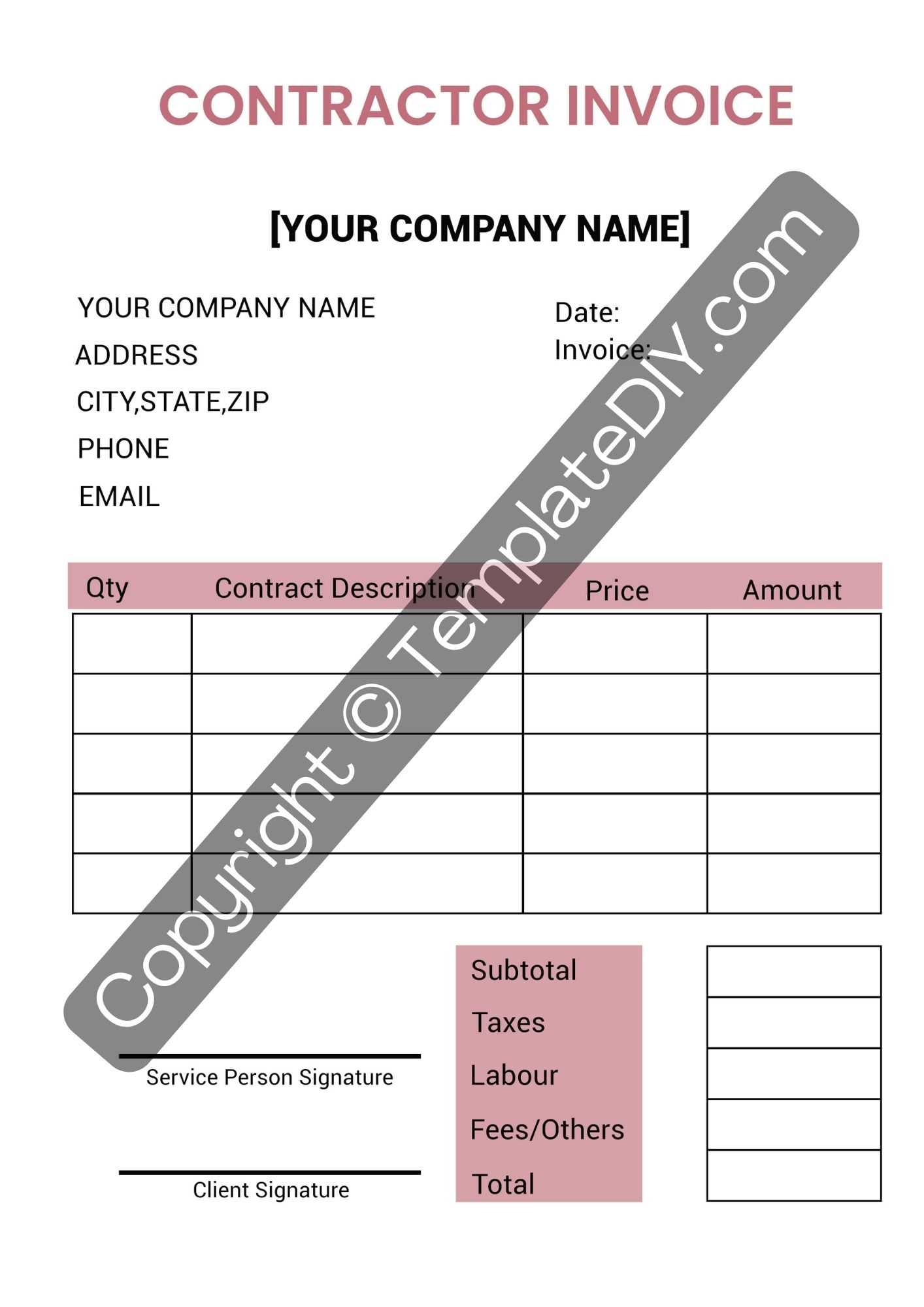

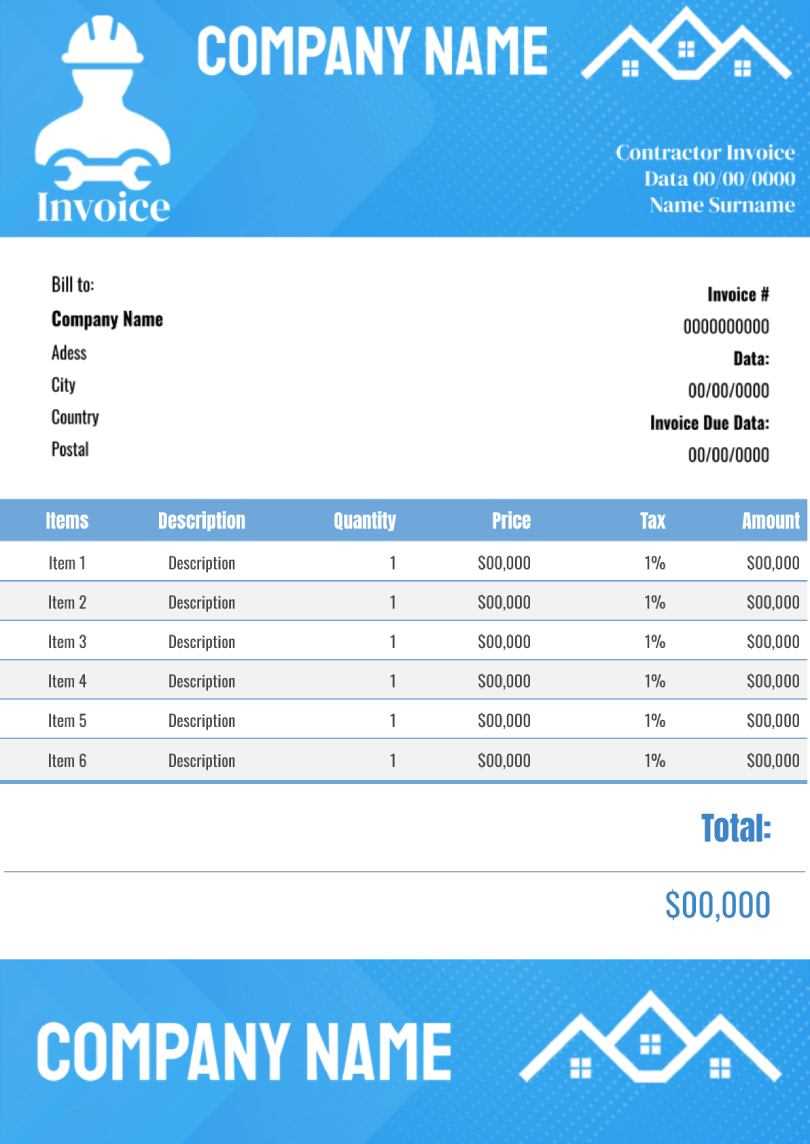

Aside from the content, the design of your billing document plays a significant role in how it’s perceived. A clean, professional layout not only makes it easier for clients to understand but also demonstrates your attention to detail. Consider these tips:

- Use a simple and clear font: Choose legible fonts like Arial, Helvetica, or Times New Roman to enhance readability.

- Stay organized: Group related sections together and use headings or bullet points to break up text.

- Incorporate your branding: Include your business logo and consistent colors that reflect your brand identity.

- Leave space for notes: Always provide room for additional remarks, such as terms of agreement or special instructions.

By including these essential components and design features, you’ll create a billing document that is not only clear and comprehensive but also professional and aligned with your business standards.

Why Professionals Need a Structured Billing Document

For independent workers, managing payments and ensuring timely compensation can be a complex task. Without a well-organized document, tracking the details of completed work, payment terms, and due dates becomes challenging. Having a standardized method for requesting payment can help streamline the process, ensuring that nothing is overlooked and all necessary information is communicated clearly.

Clarity and Professionalism

A formal payment request not only provides clear information about the work completed but also reflects a professional image. When clients receive a polished, easy-to-read document, they are more likely to take the transaction seriously and respond promptly. By maintaining consistency in your billing process, you establish trust and confidence with your clients.

Efficiency and Record-Keeping

Using a standardized document saves time by eliminating the need to manually create new forms for each client. It allows for quicker processing and reduces the chances of missing important details. Furthermore, having a structured approach to billing ensures accurate record-keeping, making it easier to track payments and manage finances over time. Efficientdocumentation can also serve as a valuable reference in case of disputes or audits.

In addition to these benefits, a consistent billing method minimizes errors and the risk of forgetting crucial details, ensuring that every aspect of the transaction is addressed professionally and thoroughly.

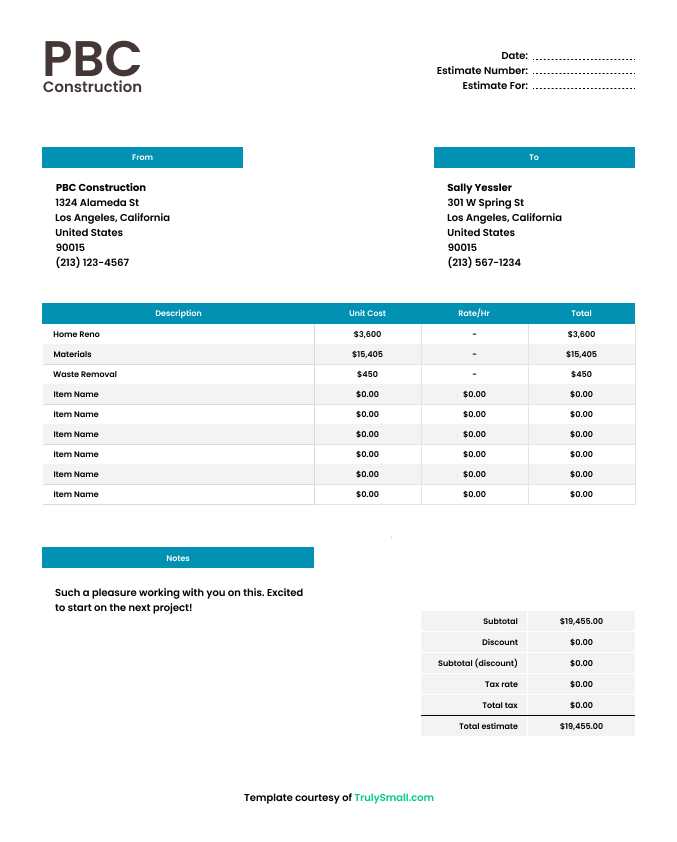

Essential Elements of a Billing Statement

For an effective payment request, it is crucial to include all necessary components to ensure clarity and completeness. A well-organized document not only outlines the specifics of the work done but also ensures that both parties are clear about the payment expectations. Missing even a single element can lead to confusion or delays in receiving payment.

Each section of the document should serve a specific purpose, providing detailed information that supports the terms of the agreement and helps the client understand exactly what they are being charged for. From contact details to payment terms, each component plays a role in making the request professional and understandable.

Here are some of the key elements to include in any payment request:

- Header with Business Details: Include your company name, address, phone number, and email address at the top of the document.

- Client Information: Clearly state the client’s name, address, and contact information to ensure proper identification.

- Service Description: Provide a detailed breakdown of the services rendered, including dates and hours worked or milestones achieved.

- Amount Due: Clearly specify the total amount owed, along with any taxes, discounts, or additional fees that apply.

- Payment Instructions: Include the method of payment and account details or instructions for clients to follow when settling the bill.

- Payment Due Date: Clearly state when payment is expected and any late fees that may apply if the due date is missed.

Including these essential components ensures that the payment request is clear, professional, and minimizes the risk of misunderstandings. By being thorough, you can help clients feel confident in processing payments promptly and accurately.

How to Customize Your Billing Document

Adapting a payment request form to meet your specific needs ensures that the document reflects your unique business practices and client relationships. Customizing the design and content allows you to create a professional appearance while maintaining consistency in how you present your financial transactions. By tailoring the document, you can align it with your branding and make it more relevant to the types of services you offer.

Adjusting the Layout

The layout of your payment request plays a critical role in how easily clients can read and understand it. You can adjust the layout by incorporating your logo, using a specific color scheme, or organizing the content in a way that best suits your business style. Ensure that the most important details, such as the amount due and payment instructions, stand out to avoid confusion.

Adding Custom Sections

While many forms come with standard fields, you can add custom sections based on the needs of your services. For instance, if you offer long-term projects, you might want to include a section for progress milestones or retainer fees. Additionally, adding notes or terms that apply specifically to your industry can help provide context and clarity for the client.

Customizing the document to reflect your business practices not only enhances professionalism but also simplifies the payment process, making it clear and straightforward for both parties.

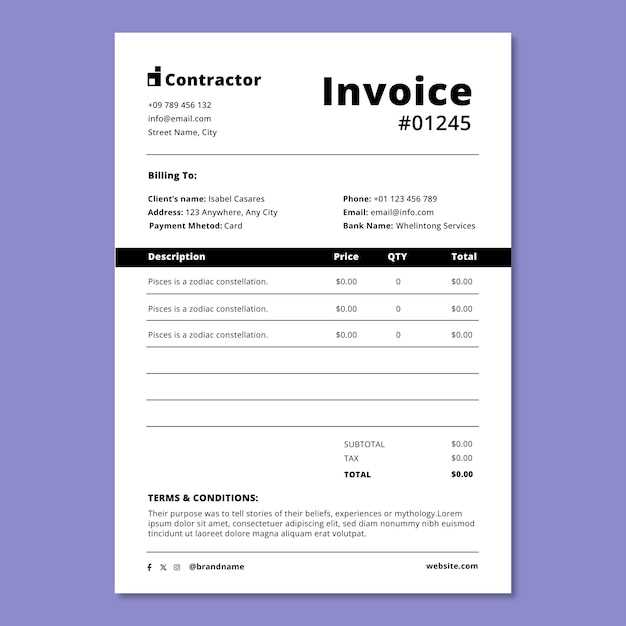

Best Practices for Billing Document Formatting

When creating a document for requesting payment, it’s essential to present the information in a clear and professional manner. Proper formatting ensures that clients can quickly find the details they need, such as the services provided, the total amount owed, and payment terms. A well-organized document not only reflects positively on your business but also helps avoid confusion and delays in payment processing.

Following these best practices for formatting can significantly improve the readability and effectiveness of your document:

- Use Clear and Readable Fonts: Choose simple, legible fonts such as Arial or Times New Roman to ensure easy reading. Avoid using overly decorative fonts that may be difficult to read on digital or printed copies.

- Organize Information Logically: Structure the document with clear headings and sections, making it easy to navigate. Group similar information together, such as client details, service descriptions, and payment terms.

- Highlight Key Details: Use bold or underlined text to make important elements like the amount due or payment due date stand out. This draws the client’s attention to essential information and reduces the chance of overlooking critical details.

- Leave Adequate White Space: Ensure there is enough space between sections and text to prevent the document from looking overcrowded. Proper spacing improves readability and gives a more professional appearance.

- Use Bullet Points or Numbered Lists: When providing descriptions of services or payment terms, break down the information using bullet points or numbered lists for clarity and ease of reference.

By following these formatting guidelines, you create a streamlined, user-friendly document that encourages prompt payments while reinforcing your professionalism.

Common Mistakes to Avoid

When preparing a formal request for payment, it’s easy to overlook important details that can lead to confusion or delays. Even small errors can create complications in the payment process, affecting your cash flow and client relationships. By being mindful of these common mistakes, you can ensure that your request is clear, professional, and efficient.

Overlooking Key Information

One of the most common mistakes is leaving out critical details, which can result in misunderstandings or payment delays. Always ensure that the document includes:

- Accurate client details: Double-check that the client’s name, address, and contact information are correct.

- Clear service descriptions: Provide enough detail to avoid confusion about the work completed, including dates and specific tasks.

- Payment terms: Clearly specify when payment is due and any late fees, if applicable.

Formatting and Organization Issues

Another frequent mistake is poor formatting, which makes the document difficult to read and understand. Here are a few tips to avoid formatting errors:

- Cluttered text: Avoid cramming too much information into one section. Use headings, bullet points, and spacing to organize the content.

- Unclear payment instructions: Ensure that your payment details, including methods and deadlines, are easy to find and understand.

- Inconsistent font and style: Stick to one or two fonts and keep the document visually consistent to maintain professionalism.

By addressing these common mistakes, you can improve the clarity and effectiveness of your payment requests, ensuring a smoother transaction process for both you and your clients.

Understanding Payment Terms and Conditions

Clearly defining the terms of payment is essential for ensuring both parties are on the same page regarding the financial aspects of a project or service. Payment terms outline the expectations for when and how payment should be made, and help avoid misunderstandings or delays. These conditions are vital not only for the professional relationship but also for maintaining cash flow and financial stability in your business.

Below is a table that highlights some common payment terms and conditions you might encounter:

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the date of the billing statement. |

| Due on Receipt | Payment is expected immediately upon receiving the payment request. |

| 50% Upfront | Half of the total amount is due at the start of the project, with the remaining balance due upon completion. |

| Late Fees | Fees are charged if the payment is not made by the agreed-upon due date, often expressed as a percentage of the outstanding balance. |

| Milestone Payments | Payments are made based on completed phases or milestones of the project. |

Understanding these terms ensures you are clear about what to expect from your clients and what they should expect from you. Properly communicating these conditions in your documentation helps reduce the likelihood of disputes and ensures a smooth transaction process.

Tracking Payments with Your Billing Document

Effective tracking of payments is crucial for maintaining a clear and organized financial record. By incorporating specific elements into your payment request, you can easily monitor whether your clients have fulfilled their financial obligations. This ensures that you stay on top of outstanding balances and avoid any miscommunications that could delay payment or affect your cash flow.

Key Payment Tracking Features

Including the following features in your payment request helps you stay organized and track payments more efficiently:

- Unique Invoice Number: Assigning a unique identifier to each document makes it easy to reference and track specific payments in your accounting system.

- Payment Due Date: Clearly stating the due date allows both you and the client to know when payment is expected, helping to reduce delays.

- Payment Status: Including a section that shows whether the payment has been received or is still pending ensures that both parties are on the same page.

- Payment Method Details: Specify the accepted methods of payment and include any necessary account details or links to facilitate the transaction.

Using Digital Tools for Tracking

In today’s digital age, utilizing online tools and software can significantly streamline the payment tracking process. Many accounting platforms allow you to send, track, and manage payments in real-time, providing you with instant updates on whether a payment has been made or is still outstanding.

By tracking payments effectively, you can ensure timely follow-ups, reduce the risk of missed payments, and maintain a more organized and efficient workflow.

How to Invoice Hourly vs Project Rates

Choosing the right pricing model for your services can significantly impact both your earnings and client satisfaction. Some professionals prefer to charge by the hour, while others opt for a flat fee based on the entire project. Each method has its benefits and drawbacks, and understanding how to apply them correctly ensures that you are fairly compensated and that your clients feel confident in the terms.

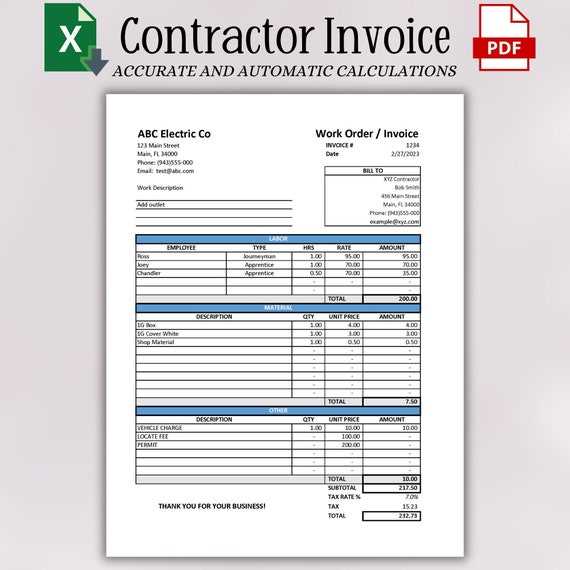

Hourly Billing

Hourly billing is ideal when the scope of work is unclear or may change during the course of a project. It allows flexibility for both you and your client. However, this method requires careful tracking of the time spent on each task to ensure accurate billing. Here are some points to keep in mind:

- Clear Time Tracking: Accurately record the time spent on each task to avoid misunderstandings. Tools like time-tracking software can be helpful.

- Hourly Rate Transparency: Clearly communicate your hourly rate upfront to avoid any confusion.

- Estimate the Total Hours: While hourly billing is flexible, providing a rough estimate of the total hours can help manage client expectations.

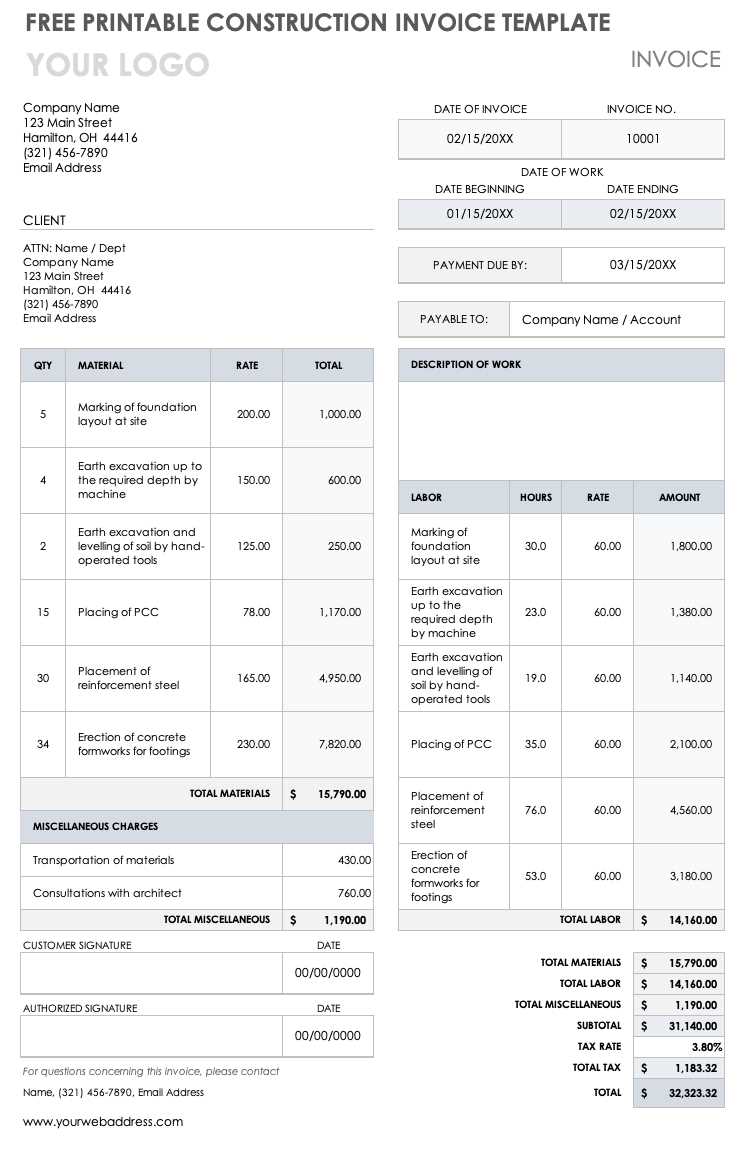

Project-Based Billing

Charging a fixed fee for an entire project is often preferred when the scope and deliverables are clearly defined. This pricing model gives the client certainty regarding the total cost, and you benefit from the opportunity to earn more if the project is completed efficiently. Consider these factors when opting for project-based pricing:

- Detailed Scope of Work: Clearly define what is included in the project to prevent scope creep, where additional tasks lead to unplanned work.

- Flat Fee Agreement: Agree on a fixed price for the entire project, including any revisions or changes, to avoid unexpected costs.

- Payment Milestones: Consider breaking the total payment into stages, such as an upfront deposit and payments upon completion of key milestones.

Both methods have their merits, and the best choice depends on the nature of the work and the preferences of your client. It’s importan

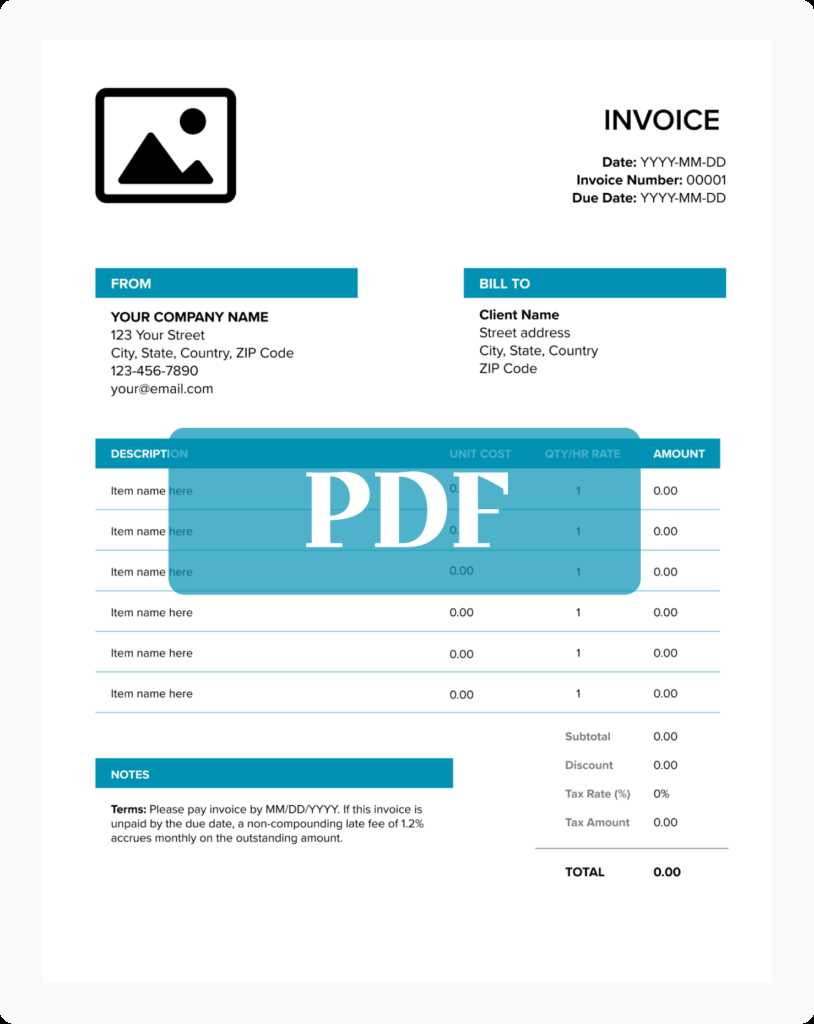

Including Taxes in Your Invoices

When requesting payment for your services or products, it’s essential to include the appropriate taxes in the total amount due. Tax inclusion ensures that you comply with local regulations and avoid unexpected complications. Understanding how to calculate and display taxes clearly on your payment requests can help both you and your clients avoid confusion and ensure that the final amount is transparent.

Types of Taxes to Include

The taxes you need to charge can vary depending on your location, the type of service or product you offer, and your client’s location. Here are some common types of taxes that may need to be included:

- Sales Tax: A tax on the sale of goods or services, typically based on the local or regional rate.

- Value Added Tax (VAT): A consumption tax placed on a product or service whenever value is added during production or distribution.

- Goods and Services Tax (GST): A single tax on the supply of goods and services, common in countries like Canada, Australia, and India.

- Excise Tax: Specific taxes on certain products like alcohol, tobacco, or fuel.

How to Calculate and Display Taxes

Properly calculating and displaying tax amounts is crucial for clarity and accuracy. Here are some best practices to follow:

- Determine Tax Rate: Identify the correct tax rate based on your jurisdiction and the nature of the goods or services provided. Ensure that you are using the correct rate for both your location and your client’s location if applicable.

- Itemized Tax Breakdown: Break down the tax amounts clearly in your document. This provides transparency and helps clients understand how the total is calculated.

- Subtotal and Tax Total: Clearly separate the cost of the services or products from the tax total, and list the final amount due at the bottom.

By including taxes in your payment requests, you protect yourself from legal issues and make the payment process smoother for both parties. Make sure to stay updated on tax regulations in your area to ensure compliance and accuracy.

Legal Considerations for Contractor Invoices

When preparing requests for payment, it’s important to ensure that all legal requirements are met to protect both you and your clients. Properly documented agreements not only help avoid disputes but also ensure compliance with tax laws and other regulations. Understanding the legal aspects of payment requests can safeguard you against potential legal issues and ensure smooth financial transactions.

Key Legal Elements to Include

To ensure your payment documents are legally compliant, make sure to include the following essential elements:

- Clear Agreement Terms: Specify the terms of the services, payment schedule, and any late fees or penalties for non-payment. This sets expectations and prevents misunderstandings.

- Proper Business Information: Include your full legal name or business name, along with your contact information and tax identification number (TIN), if applicable.

- Accurate Payment Details: Ensure that the payment methods, due dates, and any associated instructions are clearly outlined. Ambiguities can lead to delays or disputes.

- Tax Compliance: Make sure that you are charging the appropriate taxes based on your jurisdiction and your client’s location. Include the proper tax rates and ensure they are calculated correctly.

Protecting Yourself Legally

Incorporating legal protections into your payment requests can help you avoid legal challenges in the future. Here are some strategies to consider:

- Late Payment Penalties: Include terms regarding late payment fees or interest rates if a payment is not made within the agreed timeframe. This encourages timely payments and provides a legal basis for claiming penalties.

- Signed Agreements: Always ensure that the terms of the contract are clearly understood and agreed upon by both parties before sending any payment requests. A signed agreement can act as a reference in case of disputes.

- Clear Dispute Resolution Process: Outline a process for resolving disputes, including any mediation or arbitration steps. This can help you avoid costly litigation down the line.

By addressing these legal considerations in your payment documentation, you can reduce the risk of legal issues and ensure that your transactions are smooth and professional.

Automating Your Invoice Process

Streamlining the process of requesting payment can save you valuable time and reduce the likelihood of errors. By automating certain steps, you can ensure consistent, timely, and accurate payment requests. Automation tools allow you to handle multiple tasks more efficiently, from generating payment documents to tracking due dates and payments.

Benefits of Automation

Using automation tools in your payment requests offers several advantages:

- Time Efficiency: Automation eliminates the need to manually create and send each payment document. This allows you to focus on more critical business activities.

- Accuracy: Automated systems reduce human errors, ensuring that calculations, dates, and other important details are consistent across all payment documents.

- Consistency: Automated systems ensure that each payment request follows the same format and structure, providing a professional, uniform appearance for all clients.

- Improved Cash Flow: Timely and consistent reminders can be sent automatically, helping you collect payments on schedule and avoid delays.

How to Automate Your Payment Process

There are several tools and methods available to help automate your payment requests:

- Online Billing Software: Platforms like QuickBooks, FreshBooks, or Zoho can generate, send, and track payment requests automatically. These tools allow you to set up recurring billing, customize templates, and schedule reminders.

- Payment Integration: Linking your payment system to your financial software can automatically update your records as payments are made, reducing administrative work.

- Automated Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments. This can be done through email or text, saving you the hassle of manual follow-ups.

Automating your payment request process can greatly improve your business operations, increase efficiency, and help ensure a more organized, timely approach to managing payments.

Free vs Paid Invoice Templates

When creating payment documents, you have the option to choose between free and paid tools. Both types have their advantages and limitations, and understanding the differences can help you decide which is best suited for your business needs. While free options can be a good starting point, paid solutions often come with additional features that offer greater customization and professional polish.

Advantages of Free Options

Many businesses, especially startups or small enterprises, often opt for free solutions due to budget constraints. Here are some reasons why free options can work:

- Cost-Effective: Free solutions are, of course, available at no charge, making them perfect for those just starting out or working with limited budgets.

- Easy to Use: Most free systems offer simple, easy-to-use formats. There is little to no learning curve involved, which is ideal for those who need a quick solution.

- Basic Functionality: Free options typically cover the basic needs of creating and sending requests for payment. They often include essential fields like item descriptions, amounts, and dates.

Benefits of Paid Solutions

While free options are suitable for many, paid platforms often provide features that can make your payment processes more professional and efficient:

- Customization: Paid solutions offer greater flexibility in terms of customization, allowing you to personalize your requests with logos, fonts, and unique layouts.

- Advanced Features: With a paid plan, you can access advanced features such as recurring payments, automated reminders, integrated payment processing, and analytics tools.

- Support and Security: Many paid platforms come with customer support and more robust security features, ensuring that your financial data is kept safe and that you can get help if needed.

Choosing between free and paid tools depends on the scale of your operations and specific needs. If you’re just starting out and need a straightforward solution, a free option might be sufficient. However, as your business grows, the added functionalities of a paid tool may provide significant value in terms of time savings, professionalism, and financial management.

Creating an Invoice for International Clients

When working with clients from different countries, it’s essential to adapt your payment documents to meet international standards. These adjustments ensure that your requests for payment are clear, professional, and legally compliant, no matter where your clients are located. Proper formatting, currency considerations, and legal details can make a significant difference in the effectiveness of your communication and timely payments.

Key Considerations for International Requests

When crafting a request for payment for international clients, there are several factors to keep in mind:

- Currency: Always specify the currency being used. This helps avoid confusion, especially when dealing with clients from different regions who may use different forms of currency.

- Tax Compliance: Be aware of tax requirements in your client’s country. Some regions have different tax laws that may affect how you should bill, including VAT or other local taxes.

- Payment Methods: Offer a variety of payment methods to accommodate international clients, such as bank transfers, PayPal, or other global payment platforms.

- Language: Consider providing payment documents in the client’s native language to ensure clarity. If needed, translate key details, such as service descriptions and payment terms.

- Payment Terms: Clearly outline the payment terms, including due dates, any late fees, and payment schedules. This is particularly important for international clients to prevent misunderstandings.

Best Practices for International Payment Requests

Here are some best practices to follow when requesting payment from clients in other countries:

- Include International Addresses: Ensure that both your business address and your client’s address are clearly stated, including international postal codes and country names.

- Provide Complete Banking Information: If you’re requesting a bank transfer, be sure to include all necessary international banking details such as SWIFT/BIC codes and IBAN numbers.

- Factor in Exchange Rates: If your client pays in a different currency, you may need to account for exchange rates. Clarify whether the agreed-upon amount is fixed in your local currency or if it will be adjusted based on fluctuations.

By being mindful of these factors, you can create clear and professional payment documents that cater to the needs of your international clients, ensuring smooth transactions and reducing the potential for delays.

Invoice Template for Small Business Contractors

For small businesses, maintaining clear and professional payment documentation is crucial to ensure timely payments and avoid misunderstandings. Having a structured document that outlines services rendered, rates, and payment terms helps streamline the transaction process. This is especially important for those who work independently or run small enterprises, as it reflects professionalism and sets clear expectations with clients.

Essential Features of a Payment Request for Small Businesses

When creating a payment document for your small business, it’s important to include the following key details:

- Business Details: Include your company name, address, and contact information at the top of the document, along with the client’s details.

- Service Description: Clearly outline the services you provided, including the scope, duration, and any additional notes or specifics that clarify the work done.

- Payment Terms: Specify the amount due, payment methods accepted, and the due date. It’s also wise to outline any late fees or penalties for overdue payments.

- Unique Reference Number: Assign a unique number to each document to help track payments and keep your records organized.

- Tax Information: Include any necessary tax details, such as sales tax or VAT, to ensure compliance with local tax regulations.

Why a Structured Payment Document is Crucial for Small Business Owners

For small businesses, an organized document not only helps in getting paid on time, but it also creates a professional impression with clients. A well-structured payment request sets clear expectations for both parties and minimizes the chance of disputes. It also plays an important role in your accounting and tax filing, making it easier to track income and expenses throughout the year.

By using a simple, clear format that includes the essential details, small business owners can maintain a professional relationship with clients and improve the efficiency of their financial processes.

How to Keep Your Invoices Organized

Keeping financial records organized is key to maintaining a smooth workflow and ensuring that all transactions are properly tracked. For any business, staying on top of payment documents is essential for timely payments, accurate accounting, and preventing errors or disputes. Whether you’re running a small business or managing your personal projects, a system to keep all financial paperwork in order can save you time and reduce stress.

Implement a Filing System

One of the first steps to organizing your payment records is creating a reliable filing system. Here are some ways to do this:

- Physical Filing: Use folders or binders to categorize each payment request by client or project. Ensure each document is dated and labeled clearly.

- Digital Storage: Store your documents on your computer or in the cloud, organizing them into folders for each client or project. This allows for easy retrieval and reduces the risk of loss.

- Separate Completed and Pending Documents: Create different folders or labels for completed and outstanding transactions. This way, you can quickly see which payments are still pending and need follow-up.

Track Payments and Due Dates

Having an organized system for tracking due dates and payment statuses is crucial. Consider using a spreadsheet or accounting software to monitor when payments are due, when they’ve been received, and any overdue balances.

- Use a Payment Tracker: A simple spreadsheet with columns for due dates, payment amounts, and statuses will help you stay on top of your finances.

- Set Payment Reminders: Set reminders or alerts for upcoming payment deadlines to avoid late fees and to keep clients informed.

Staying organized not only makes your work easier but also improves your professionalism and ensures you don’t miss any important payments. By maintaining an efficient and structured system for managing financial documents, you can reduce confusion, stay on top of your business finances, and avoid unnecessary delays in payments.