Contractor Hours Invoice Template for Easy Billing

Accurate billing is crucial for anyone providing services, as it ensures that time and effort are properly compensated. Creating well-structured documents for payment requests can significantly streamline financial processes, minimize errors, and foster better client relationships. A solid framework for these records helps to outline the work completed, establish payment terms, and maintain transparency with clients.

Customizing these documents to suit specific needs is an important aspect, as it allows professionals to cater to various industries while keeping things simple and clear. Including necessary details such as work duration, rate, and additional charges can help avoid confusion and speed up the payment process. Furthermore, clear guidelines on how to present and submit such documentation can make the whole process more efficient.

Whether you’re new to professional billing or looking to optimize your current system, understanding the core elements of these payment requests will empower you to create effective records that ensure timely and accurate payments for your work.

Why Use a Contractor Invoice Template

Utilizing a structured document for billing offers a simple yet effective way to ensure that payments are handled accurately and efficiently. Having a predefined format allows professionals to quickly create records that cover all necessary details, preventing errors and misunderstandings. This approach not only saves time but also enhances the overall professionalism of the payment process, making it easier to maintain clear financial communication with clients.

A standardized format can help you streamline the process of recording services provided, the time spent, and the amount due. It reduces the likelihood of omissions and mistakes, which could otherwise lead to delayed payments or disputes. Additionally, using such a format can foster trust with clients, who will appreciate the clarity and transparency in how charges are presented.

By adopting a consistent method for billing, professionals can ensure they are well-organized and ready to handle transactions smoothly, ultimately improving their cash flow and reinforcing positive client relationships.

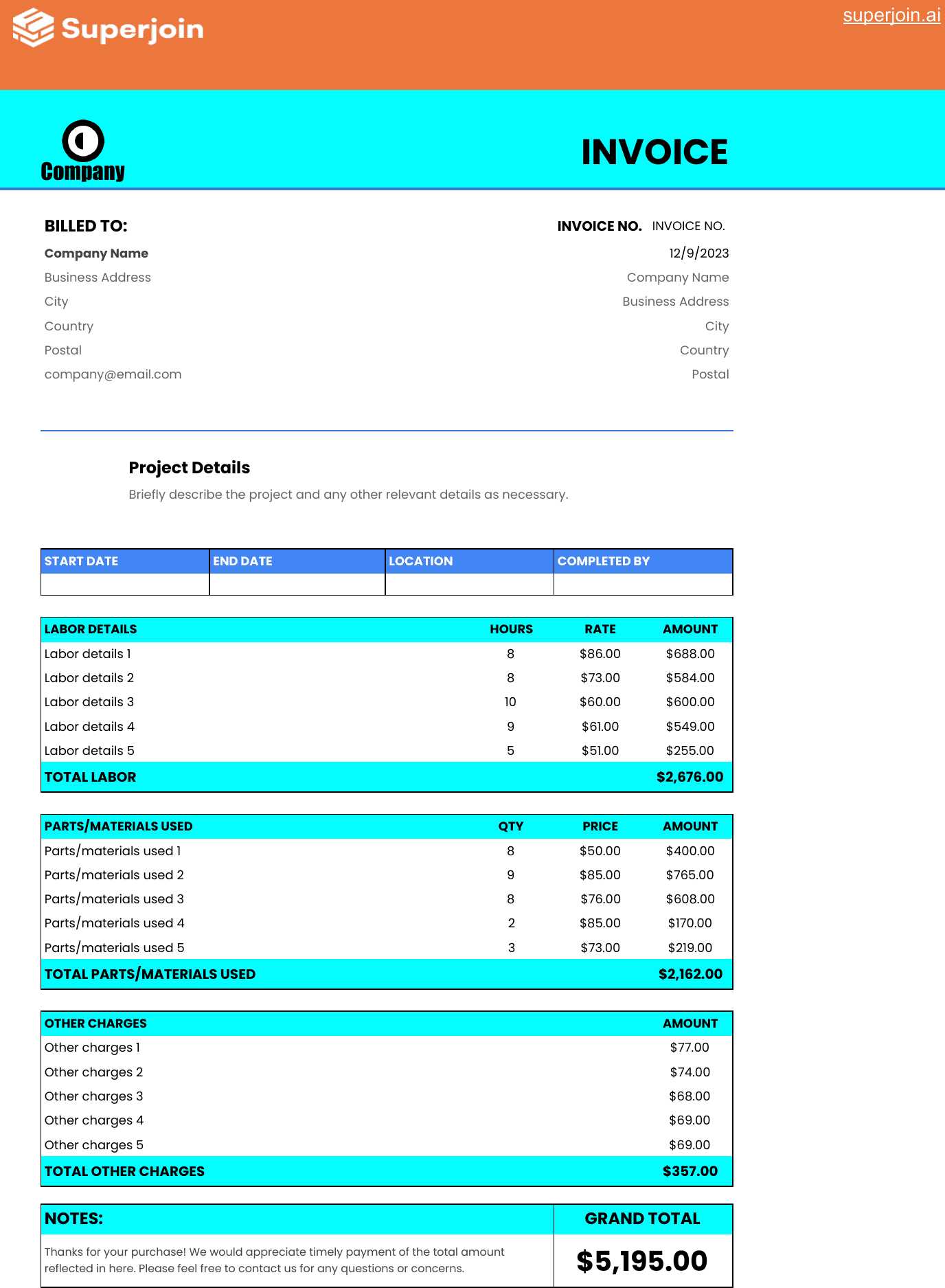

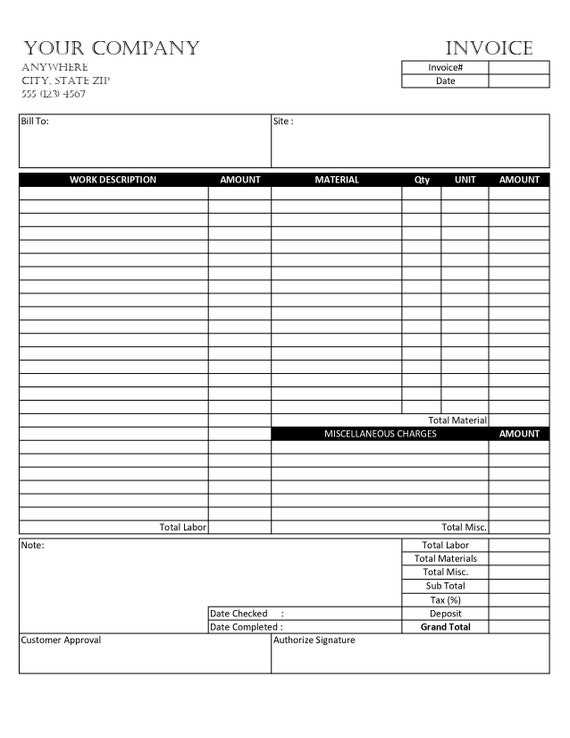

Key Features of a Good Template

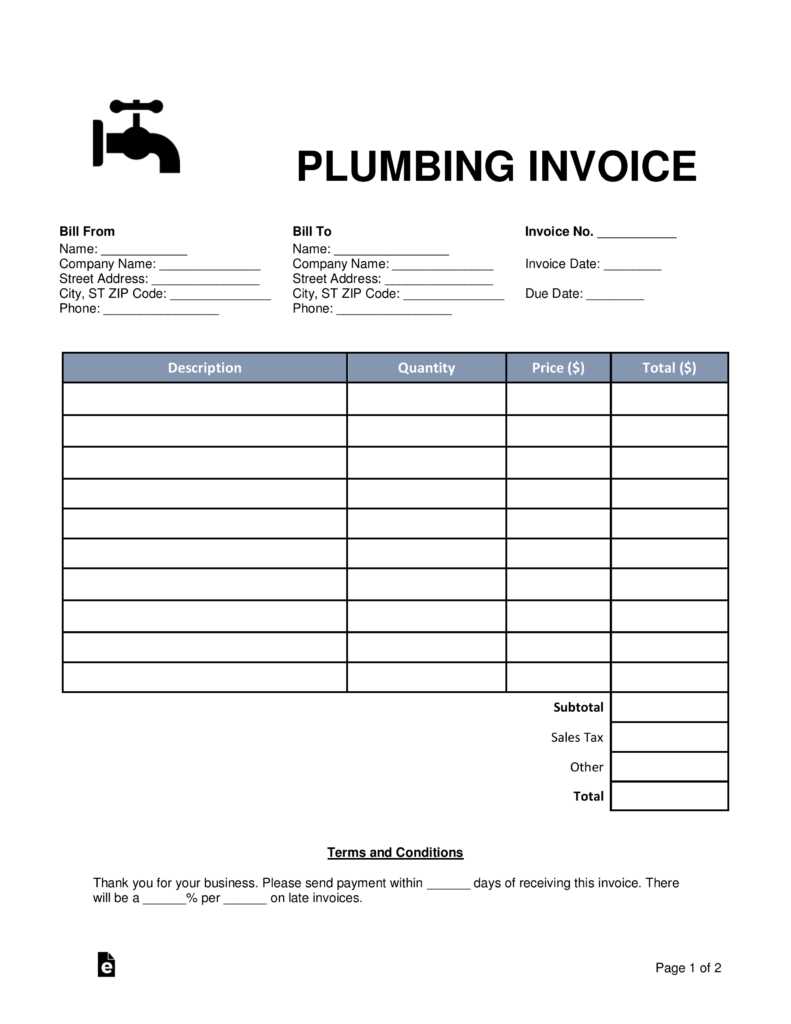

A well-designed document for payment requests should be organized, clear, and easy to follow. The layout and structure of the file should allow for seamless communication between the service provider and the client. When choosing or creating such a document, there are several important aspects to consider to ensure it meets both practical and professional standards.

- Clear Layout – The document should have a logical flow with easily distinguishable sections for different details, making it straightforward for the reader to understand.

- Professional Design – A clean, simple design without unnecessary clutter helps to present the information clearly and enhances your professional image.

- Essential Information Sections – It should clearly include sections for work description, payment terms, rates, and the total amount due.

- Customizability – The document should allow for easy editing to accommodate various clients, services, and rates without disrupting the layout.

- Accurate Calculations – Built-in formulas or clear spaces for manually inputting calculations ensure that totals are correct and avoid mistakes.

- Payment Instructions – Including clear instructions for how the client should make the payment, such as due dates and accepted payment methods, is essential for smooth transactions.

By ensuring these key features are present, you can create a functional, efficient document that simplifies the billing process and encourages prompt payments.

How to Customize Your Invoice

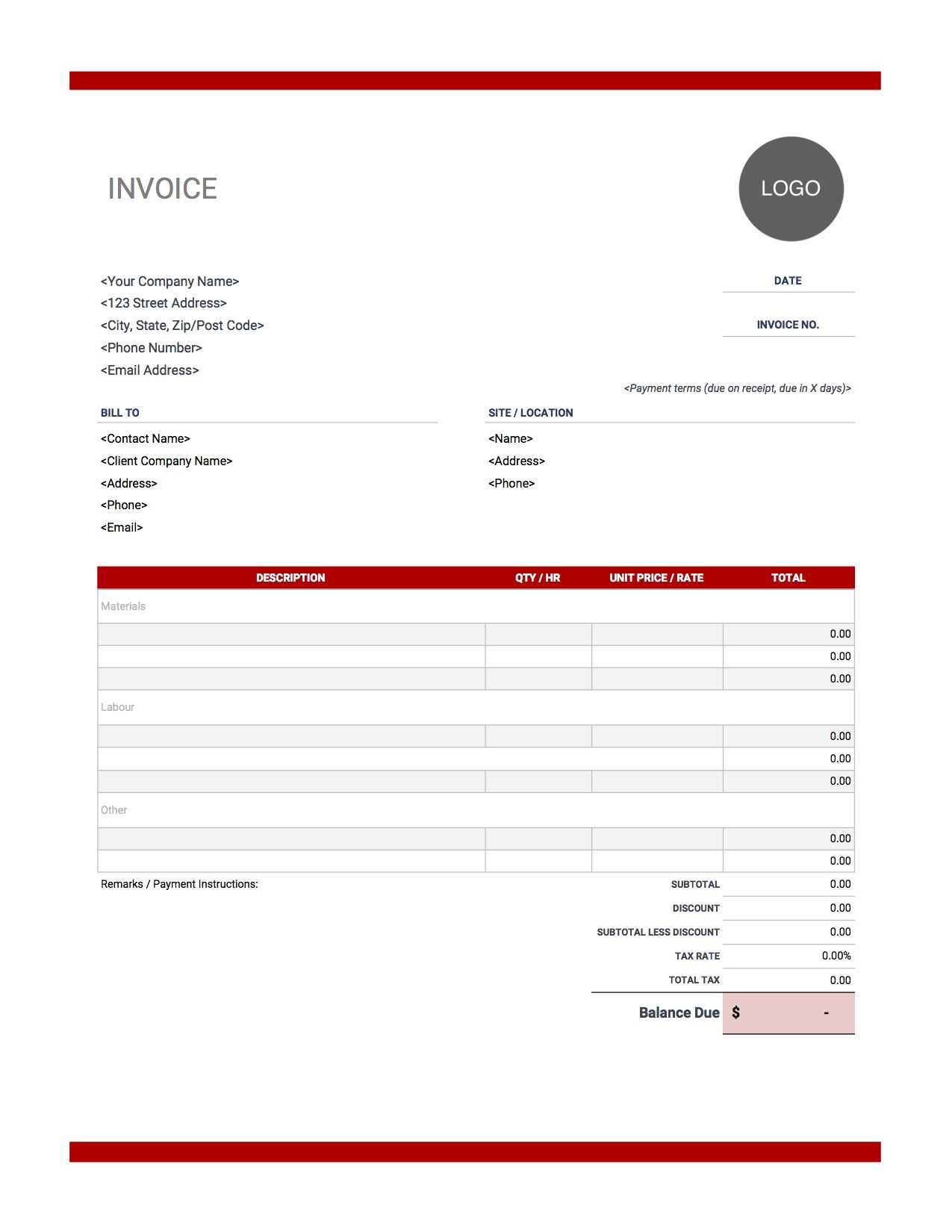

Customizing a billing document allows you to tailor it to your specific needs, ensuring that it accurately reflects the work completed and the terms agreed upon with your client. A personalized format not only enhances professionalism but also ensures clarity and precision, which is vital for smooth transactions. Below are some important steps to take when customizing your payment record.

| Step | Description |

|---|---|

| Adjust the Layout | Modify the layout to match your style or brand, ensuring that the most important information is easy to find. |

| Personalize Contact Details | Include your company or personal contact information and your client’s details for quick reference. |

| Modify Service Descriptions | Ensure that the work completed is described in a way that matches the services you provided, using clear and specific terms. |

| Update Payment Terms | Clearly specify the due date, accepted payment methods, and any penalties for late payment if applicable. |

| Include Optional Charges | Include any additional charges or fees, such as taxes, that may apply to the work completed. |

By following these steps, you can ensure that your billing records are not only professional but also adaptable to any project or client, creating a smooth and effective payment process.

Essential Information to Include

When creating a payment request document, it’s crucial to include all relevant details to ensure accuracy and avoid any confusion. A comprehensive record not only helps clients understand the work done but also outlines the financial terms in a clear and transparent manner. The following key components should always be present in your document.

Work Description – Provide a detailed description of the tasks completed. This helps to avoid any ambiguity and ensures both parties are on the same page about the scope of the work.

Time Spent or Quantity – Clearly outline the amount of time or quantity of work involved, including dates, hours, or specific tasks performed. This ensures that the charges are transparent and can be easily verified.

Rate or Fee – Specify the agreed-upon rate or fee for the services provided. Whether it’s an hourly rate, per project fee, or flat rate, this helps in calculating the total due amount.

Total Amount Due – The final amount due should be clearly stated at the bottom of the document, factoring in the time spent and the agreed rates. This ensures there are no misunderstandings regarding the payment.

Payment Terms – Specify when the payment is due, accepted payment methods, and any penalties for late payment. This sets clear expectations for both parties regarding the financial arrangement.

Contact Information – Include both your details and your client’s information to facilitate easy communication if any issues arise or further clarification is needed.

Incorporating these essential details into your payment request will not only enhance the professionalism of the document but also ensure smooth transactions and foster trust between you and your clients.

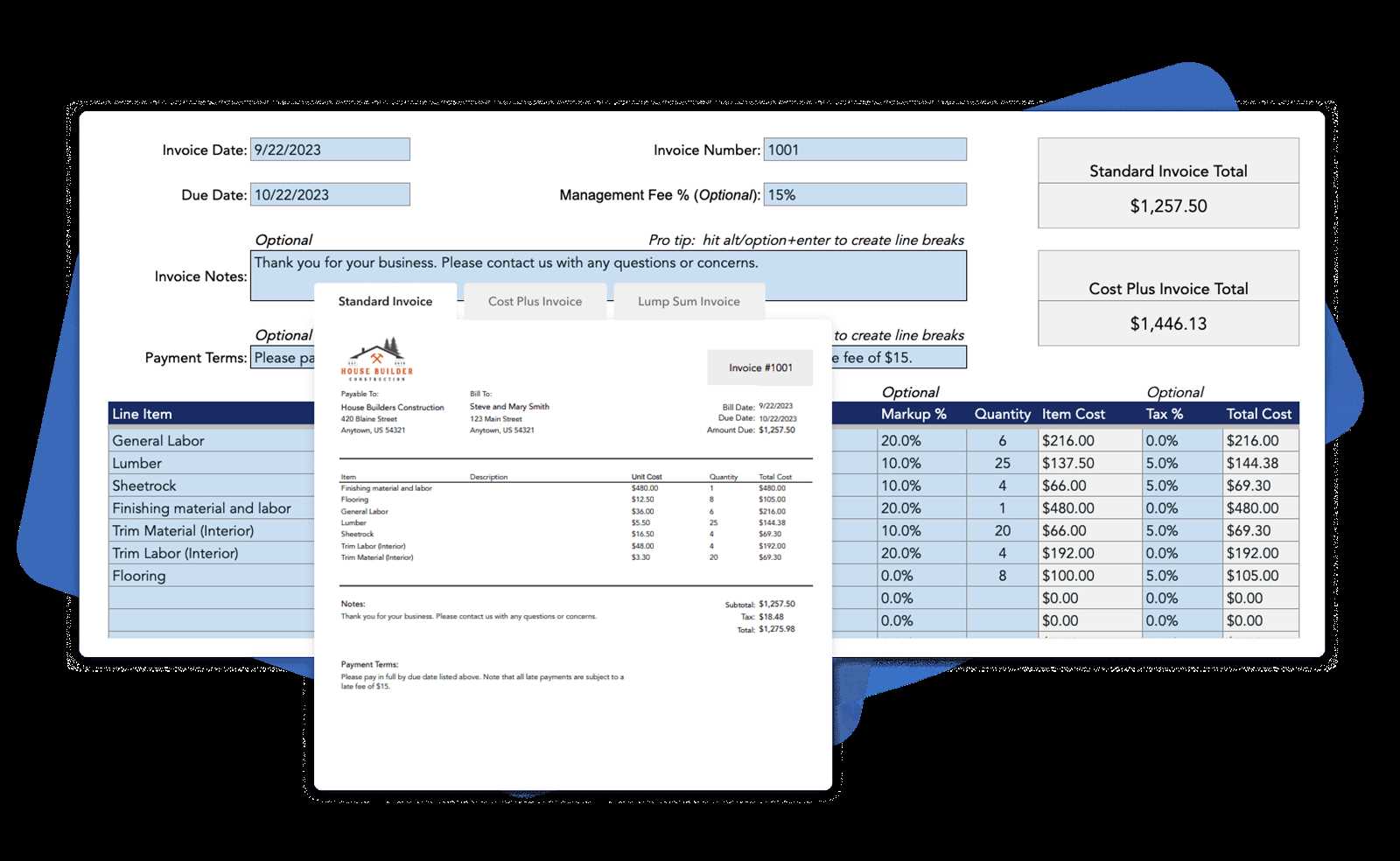

Best Practices for Accurate Billing

Maintaining accuracy in payment requests is essential for ensuring timely compensation and fostering positive client relationships. By following best practices in creating financial documents, you can avoid common mistakes and misunderstandings that might delay payments. Below are some key strategies to help you ensure that your billing process is both accurate and efficient.

Key Strategies for Precision in Billing

To avoid errors and ensure your payment requests are clear and complete, follow these steps:

| Best Practice | Description |

|---|---|

| Track Work Consistently | Keep a detailed log of services rendered, noting exact times or quantities, so calculations are straightforward and accurate. |

| Double-Check Calculations | Before submitting any payment request, verify all calculations for accuracy. This includes total amounts, rates, and additional fees. |

| Use Clear, Simple Language | Ensure that the description of work and rates is clear and easily understood. Avoid using ambiguous terms that might lead to confusion. |

| Review Payment Terms | Double-check payment terms for accuracy. Clearly state due dates, accepted payment methods, and any late payment penalties. |

| Maintain Consistency | Use a consistent format and layout for all payment records to avoid confusion and help clients quickly understand the document. |

Common Mistakes to Avoid

To ensure the accuracy of your billing, steer clear of the following errors:

- Omitting details on work completed or time spent.

- Miscalculating totals or forgetting to factor in additional charges.

- Using unclear or confusing terminology in the description.

- Failing to clearly communicate payment terms or due dates.

By following these best practices, you can avoid common pitfalls and ensure that your payment requests are accurate, timely, and professional.

How to Calculate Contractor Work Hours

Accurately determining the amount of time spent on a project is crucial for ensuring proper compensation. Whether you charge by the hour or based on completed tasks, having an efficient method to track and calculate time is essential. Below are steps to help you accurately calculate the time spent on each project or task.

Steps to Calculate Time Worked

To calculate the time spent on a project or job, follow these simple steps:

- Track Start and End Times – Record the exact start and end times for each task you work on, noting any breaks taken during the work period.

- Calculate Total Time for Each Task – Subtract the start time from the end time to determine the time spent on each task. If the task is split into multiple segments, total the time for each segment.

- Account for Breaks – Deduct any non-work time, such as lunch breaks or personal time, from the total work time to ensure accuracy.

- Sum Up the Total Time – Add the time spent on all tasks to calculate the total time worked for the entire project.

Common Time-Tracking Methods

There are different methods you can use to track time worked. Here are a few options:

- Manual Time Logs – Simply write down start and end times on paper or in a digital document.

- Time-Tracking Apps – Use software tools that allow you to log time with a start/stop button for each task.

- Time Sheets – Keep detailed records in a spreadsheet or template, listing all tasks, start and end times, and total time worked for each entry.

By following these steps and using reliable methods for tracking time, you can ensure that the time worked is calculated accurately, preventing discrepancies and ensuring fair compensation for services provided.

Creating a Professional Look for Invoices

A well-designed payment request not only enhances professionalism but also helps ensure prompt payment. The appearance of your document can create a lasting impression on clients, making it easier for them to process and understand the details. By focusing on clean, structured design and clear information, you can create a professional and efficient payment record.

Design Elements for a Polished Document

Here are key design elements to consider when creating a clean and professional document:

| Design Element | Best Practices |

|---|---|

| Use Consistent Branding | Incorporate your logo, color scheme, and fonts that align with your business’s identity. |

| Organize Information Clearly | Use headings, sections, and bullet points to break down the content for easy navigation. |

| Maintain a Clean Layout | Leave adequate white space between sections to avoid a cluttered appearance. Ensure the document is easy to scan. |

| Highlight Key Details | Use bold or italic fonts to emphasize critical information like totals, due dates, and payment methods. |

Choosing the Right Format

Choosing the right format can also affect the overall professionalism of your document. Consider these options:

- PDF Format – A secure and professional format that ensures your document will appear as intended on any device.

- Word or Excel – Editable formats that allow you to make changes easily, though they may not appear as professional as a PDF.

- Online Invoicing Software – Dedicated platforms that provide ready-made designs and offer features for creating and sending documents quickly.

By focusing on these design principles, you can create a polished, professional document that leaves a positive impression and encourages prompt payment.

Common Mistakes to Avoid in Invoices

When preparing a payment request document, it’s easy to make small mistakes that can lead to confusion, delayed payments, or dissatisfaction from clients. Ensuring accuracy and clarity is essential to maintaining a professional relationship and encouraging prompt payment. Below are common errors that should be avoided when creating your payment documents.

Key Mistakes to Avoid

- Missing or Incorrect Contact Information – Failing to include your name, business name, or the client’s contact details can cause delays or issues with processing.

- Unclear Work Descriptions – Vague or overly technical descriptions of the work performed can lead to confusion. Make sure to clearly outline the services rendered.

- Incorrect Pricing or Rates – Double-check the agreed-upon rates and calculations. Incorrect pricing or missing discounts can lead to disputes.

- Forgetting to Add Taxes – Always include taxes (if applicable) and clarify whether they are included or additional to the total amount.

- Not Providing Payment Terms – Without clear terms, such as due date, late fees, or accepted payment methods, clients may not know how to proceed with payment.

- Not Including an Invoice Number – An invoice number is crucial for tracking and referencing purposes. Omitting it can create confusion or make it difficult to reconcile payments.

How to Avoid These Mistakes

To avoid these errors and create a clear, professional document, follow these tips:

- Double-check all client and business contact information before finalizing the document.

- Provide specific descriptions of the services performed, and avoid jargon that may be unclear to the client.

- Verify your rates, discounts, and any additional fees before sending the document.

- Always add applicable taxes and ensure the total is calculated correctly.

- Clearly state the payment terms, including due dates and penalties for late payments.

- Use a unique reference number for each payment request to make tracking easier for both parties.

By avoiding these common mistakes, you will increase the chances of your payment documents being processed promptly and without complications, maintaining a smooth and professional transaction process.

How to Track Hours Efficiently

Efficiently recording the time spent on tasks is key to accurate billing and productivity management. Whether you’re managing multiple projects or keeping track of a single task, having a reliable system in place ensures you capture all the necessary details for future reference or payment processing. Here are some effective methods to help you track time more efficiently.

Time-Tracking Methods

Choosing the right time-tracking method can significantly improve your workflow. Below are some commonly used tools and techniques:

| Method | Advantages |

|---|---|

| Manual Logs | Simple and flexible, ideal for small projects. Can be done on paper or digitally using a spreadsheet. |

| Time-Tracking Apps | Automatic tracking, easy to use, and often integrates with other tools. Apps can track time on different devices and provide detailed reports. |

| Project Management Software | Comprehensive solution for teams, with built-in time tracking alongside task management. Ideal for larger projects or collaborative work. |

Best Practices for Efficient Tracking

Here are some best practices to ensure your time tracking is accurate and efficient:

- Track Time Regularly – Make it a habit to log your time immediately after completing each task or project to avoid forgetting details.

- Use Time Ranges – If you work in segments, use ranges (e.g., from 9:00 AM to 11:30 AM) to account for small breaks and adjustments.

- Set Reminders – Use alarms or notifications to remind you to log your time at the start or end of a task.

- Group Similar Tasks – If you perform similar tasks throughout the day, group them together for more efficient logging.

- Review and Adjust – Regularly review your time logs to ensure they align with the actual work performed and make adjustments as needed.

By using the right tools and following best practices, you can ensure that you track time accurately, leading to better management of your projects and tasks while avoiding billing errors.

Setting Payment Terms for Contractors

Establishing clear and fair payment terms is crucial when working with external professionals. A well-defined agreement helps prevent misunderstandings and ensures that both parties know exactly when and how payments will be made. Below are key considerations for setting effective payment terms in any working arrangement.

Key Elements of Payment Terms

When setting payment terms, there are several factors to take into account. These elements can help streamline the process and ensure timely payments:

| Element | Description |

|---|---|

| Payment Due Date | Clearly define when payment is expected. Common terms include “Net 30,” meaning payment is due within 30 days after the work is completed. |

| Late Payment Penalties | Specify the consequences for late payments, such as interest fees or a percentage of the total amount due. |

| Payment Methods | Outline acceptable payment methods, whether it’s a bank transfer, check, or digital payment systems like PayPal or Venmo. |

| Deposits or Retainers | Indicate whether a deposit is required before work begins. Retainers can provide assurance that funds are available for the completion of the project. |

| Milestone Payments | If the work is done in phases, set terms for payment upon completion of each milestone or phase. |

Best Practices for Clear Payment Terms

To ensure clarity and avoid disputes, follow these best practices when setting payment terms:

- Be Specific – Avoid vague language. Clearly state the due date and payment conditions, so there’s no ambiguity.

- Communicate Upfront – Discuss payment terms before starting the project, so both parties are aligned from the outset.

- Incorporate Flexibility – While clear terms are essential, some flexibility for extenuating circumstances may help foster a good working relationship.

- Provide Detailed Documentation – Always issue a formal record or agreement that outlines the payment terms, including any penalties or late fees.

- Review Terms Regularly – Periodically assess your payment terms to ensure they remain fair and relevant for both parties.

By taking the time to establish clear payment terms, you ensure smoother transactions and maintain a positive professional relationship throughout the project.

Digital vs. Paper Invoices: Pros and Cons

When choosing how to bill for work completed, there are two primary options: digital and paper-based billing methods. Each has its own advantages and drawbacks, depending on factors like convenience, security, and environmental considerations. In this section, we will explore the pros and cons of both methods to help you make an informed decision.

Advantages of Digital Billing

Digital methods of billing have become increasingly popular due to their speed, convenience, and integration with modern technology. Here are some of the main benefits:

- Speed and Efficiency: Digital records can be generated and sent instantly, reducing wait times for both the sender and recipient.

- Cost Savings: There are no printing or postage fees involved, making it a more affordable option in the long run.

- Ease of Tracking and Storing: Electronic records are easy to store, search, and organize, making it simpler to manage payments and invoices.

- Eco-Friendly: Digital billing reduces paper waste and supports a more sustainable approach to business practices.

- Automation: Many platforms offer automated reminders and follow-ups for overdue payments, which can streamline the entire billing process.

Disadvantages of Digital Billing

Despite the many benefits, there are also some drawbacks to consider when choosing digital billing:

- Technical Issues: Dependence on internet access and technology can sometimes cause delays or complications, especially if there are connectivity issues.

- Security Concerns: Online transactions can be vulnerable to cyber threats such as hacking or data breaches, requiring additional security measures.

- Client Preferences: Some clients may prefer paper records for their own accounting systems or may not be comfortable with digital payment methods.

Advantages of Paper Billing

While digital billing is popular, paper-based invoicing still has a place in many industries. Here are some benefits to using paper invoices:

- Physical Proof: A paper document can serve as a physical record of the transaction, which may be preferred by some businesses or clients for verification purposes.

- Less Dependence on Technology: No need for internet access, software, or digital platforms–ideal for individuals or businesses that are less tech-savvy.

- Client Familiarity: Some clients prefer paper invoices for easier reference and integration into their manual accounting systems.

Disadvantages of Paper Billing

While traditional paper-based billing has some advantages, it also comes with several significant challenges:

- Higher Costs: Printing, mailing, and storing paper invoices can be expensive, especially for businesses that deal with a large volume of clients.

- Slower Processing: Physical delivery can cause delays in receiving payments, as paper invoices must be mailed and manually processed.

- Environmental Impact: Paper billing generates waste and contributes to environmental harm, especially when printed in large quantities.

- Space for Storage: Storing physical invoices can take up significant space, and retrieving them may be time-consuming and cumbersome.

Ultimately, the decision between digital and paper billing depends on your business needs, client

How to Handle Invoice Disputes

Disagreements over payment requests can occasionally arise, especially when there is confusion about the terms or amounts involved. Effectively addressing these disputes requires clear communication, documentation, and a proactive approach to resolving conflicts. In this section, we will discuss strategies to manage and resolve payment-related disputes efficiently.

Steps to Take When a Dispute Arises

When a payment dispute occurs, it’s essential to stay calm and follow a structured approach. Here are the key steps to handle such situations:

- Review the Details: Start by thoroughly reviewing the terms of the payment request, including the agreed-upon services or goods, costs, and any relevant agreements or contracts.

- Communicate Early: Address the issue as soon as possible. Reach out to the other party to discuss their concerns and clarify any misunderstandings.

- Provide Supporting Documentation: Always ensure you have clear records of the work done, agreements made, and communications exchanged. This may include contracts, emails, and other written confirmation of terms.

- Stay Professional: Keep all communication polite and professional. Avoid escalation by focusing on a constructive solution rather than placing blame.

Effective Strategies for Resolving Disputes

Once you understand the issue, consider these strategies for resolving the dispute amicably:

- Negotiate a Compromise: If possible, try to negotiate a middle ground. This could involve adjusting the terms or agreeing on a payment schedule that suits both parties.

- Offer Alternative Solutions: If the dispute is based on a misunderstanding, suggest possible solutions such as offering a discount or providing additional services to make up for any inconvenience.

- Use Mediation: If direct negotiation doesn’t work, consider involving a neutral third party to mediate the discussion. Mediation can help both parties come to an agreement without resorting to legal action.

- Legal Action as a Last Resort: If the dispute remains unresolved despite efforts to settle, consider legal advice or action. However, this should always be the final option after all other avenues have been explored.

By remaining calm, professional, and well-prepared, you can handle disputes in a way that protects your interests and maintains positive relationships with clients or business partners. Always strive for clear agreements upfront to prevent conflicts from arising in the first place.

Benefits of Automated Invoice Tools

In today’s fast-paced business environment, efficiency and accuracy are key. Automated tools designed for payment requests and billing processes can save time, reduce errors, and improve financial tracking. These tools streamline the entire process, making it easier for businesses to manage transactions and keep their operations running smoothly. Here are some key benefits of using automated systems for managing payment requests.

Time-Saving Features

One of the most significant advantages of automated systems is the amount of time they save. Rather than manually creating and sending documents, automation can handle much of the work for you. Here’s how:

- Instant Generation: Automated tools allow you to generate payment documents instantly, using pre-set templates with all the required fields already included.

- Recurring Billing: If your business model involves recurring charges, automated tools can schedule and send payment requests at regular intervals without any manual input.

- Faster Processing: Automation speeds up the entire payment process, from the creation of the request to the delivery and receipt of payments.

Enhanced Accuracy

Manual processes are prone to errors, especially when dealing with multiple transactions. Automation reduces the risk of mistakes, ensuring that all information is consistent and accurate. Some of the accuracy benefits include:

- Pre-Filled Data: Automated systems can pull client and project details directly from your database, eliminating the need to manually input information each time.

- Automatic Calculations: The software can automatically calculate totals, taxes, and discounts based on the provided data, ensuring that no mistakes are made in the final amount.

- Consistent Formatting: Automated tools ensure that every document follows the same format and layout, maintaining consistency across all your requests.

Better Financial Tracking and Reporting

Automated tools also offer enhanced tracking features that help you monitor your finances more effectively. Here are a few ways these tools improve financial management:

- Centralized Data: All payment requests and related transactions are stored in a central system, making it easy to track and access information when needed.

- Real-Time Insights: Automated systems often come with dashboards or reporting features that provide real-time updates on outstanding payments, overdue amounts, and financial trends.

- Easy Reconciliation: With automatic syncing between your accounting software and payment tools, reconciling payments becomes easier, ensuring that all transactions are accounted for.

By incorporating automated tools into your billing process, you can not only save time but also increase the accuracy and efficiency of your operations. These tools are an investment that ultimately leads to smoother workflows and better financial management.

Ensuring Legal Compliance with Invoices

Maintaining legal compliance in financial transactions is essential for businesses, as failure to do so can lead to penalties or disputes. When creating payment requests, it’s important to follow local laws and regulations to ensure that all details are accurate and in line with legal requirements. From proper documentation to adhering to tax laws, ensuring compliance is a crucial part of running a smooth and professional business. Below are some key elements to consider when ensuring legal compliance in your financial requests.

Required Legal Information

Each document used for requesting payment must contain specific information to comply with the law. Failure to include the right details can result in fines or disputes. The following elements should be included:

| Required Information | Description |

|---|---|

| Business Information | Include your business name, address, and contact information to identify the entity requesting payment. |

| Client Information | Make sure to list the name and contact details of the recipient of the payment request. |

| Transaction Date | Clearly state the date when the payment request is issued, along with any relevant dates such as the service period. |

| Payment Terms | Specify payment due dates, methods of payment, and any penalties for late payments. |

| Tax Information | Ensure that applicable taxes are included, such as VAT or sales tax, in compliance with local tax regulations. |

| Unique Reference Number | Each payment request should have a unique number for easy reference in case of disputes or audits. |

Understanding Tax Obligations

Understanding your tax obligations is essential when creating documents for payment requests. Different regions have different requirements, and it is important to correctly calculate and apply any taxes that may be due. Some key aspects include:

- Sales Tax or VAT: Ensure that you apply the correct tax rate for the goods or services you are charging for, as this varies by jurisdiction.

- Tax Identification Number: In many regions, it’s required to display your business’s tax identification number (TIN) or VAT number.

- Tax Exemptions: If you or your clients qualify for tax exemptions, be sure to account for this properly to avoid issues with tax authorities.

Staying Up-to-Date with Legal Changes

Business regulations, especially those related to finance and taxes, can change over time. It’s important to stay updated on any legal changes that might affect the creation and processing of payment requests. Here are some steps to ensure compliance:

- Monitor Regulatory Changes:Tips for Timely Submission of Payment Requests

Submitting payment requests on time is essential for maintaining cash flow and fostering good relationships with clients. Delays in sending these documents can result in late payments and administrative complications. By staying organized and following some key practices, you can ensure that your requests are submitted promptly, improving the efficiency of your financial processes. Below are some tips to help you manage the timely submission of payment requests.

Set Clear Deadlines

Establishing clear deadlines for when payment requests should be sent out is an effective way to stay on track. Here are some suggestions for setting deadlines:

- Define Submission Dates: Decide in advance the frequency (e.g., weekly, bi-weekly, monthly) for sending requests. Mark these dates on your calendar.

- Align with Client Agreements: Ensure that your deadlines align with any pre-established contracts or agreements with your clients regarding payment schedules.

- Use Reminder Tools: Set reminders on your calendar or use task management apps to alert you when it’s time to prepare and submit the next payment request.

Organize Your Documentation

Having all the necessary details and documents organized ahead of time can significantly speed up the process. Here’s how to stay organized:

- Track Work Progress: Keep records of work completed and hours worked, if applicable, so that you can quickly reference these details when preparing a payment request.

- Maintain Accurate Records: Use a system (physical or digital) to store relevant documents such as contracts, agreements, or timesheets that you can easily access when needed.

- Standardize Formats: Create a standardized format for all payment requests, so you can quickly fill in the details and submit them with minimal effort.

Use Automated Tools

Automated tools can help streamline the process of generating and sending payment requests. Consider the following:

- Implement Accounting Software: Accounting tools can help automate calculations, generate payment requests, and send them directly to clients on a pre-scheduled basis.

- Integrate with Calendar Apps: Set up automated reminders for when payment requests are due and integrate them with your calendar or project management software.

- Track Payments: Some tools even allow you to track the status of payments, so you can follow up on