Consulting Services Invoice Template in Excel for Efficient Billing

Managing financial transactions efficiently is essential for any business or freelance professional. Having a structured way to document payments ensures that all parties are on the same page and that no details are overlooked. A well-organized method for tracking fees and expenses helps maintain a professional image while simplifying the process of payment collection.

One of the most effective ways to handle these records is through the use of easily customizable documents. These can be tailored to fit the unique needs of different projects, allowing for a straightforward breakdown of charges, due dates, and payment details. With the right tools, you can automate much of the administrative work and focus more on your core responsibilities.

By using a digital solution, you not only save time but also reduce the chance of errors. The flexibility of these formats allows for quick updates and adjustments, whether you’re adding new tasks or modifying rates. With such an approach, you can ensure timely payments while maintaining a professional and organized financial process.

Professional Billing Tools for Freelancers

Efficient billing is a crucial aspect of any independent professional’s workflow. Having the right system in place ensures that payments are processed quickly and accurately, while also maintaining a polished and professional approach. Customizable billing documents allow for easy tracking of services rendered, payment due dates, and client information, making the financial aspect of your work much more manageable.

Benefits of Customizable Billing Documents

Using flexible billing documents gives you the ability to tailor each record to specific project needs. Whether you’re managing hourly rates, flat fees, or expenses, these tools allow for precise calculations and clear breakdowns. Customization options enable you to add or adjust sections for discounts, taxes, or additional charges, ensuring your records reflect the exact details of the work completed.

Why Choose a Digital Solution

Digital solutions provide an added layer of convenience, as they can be easily updated, shared, and stored. With automated calculations and the ability to save frequently used formats, you can eliminate time-consuming manual work. Additionally, digital files are easier to organize and can be accessed from anywhere, ensuring that you’re always prepared to send professional documentation whenever it’s needed.

Why Use an Invoice Template

Having a standardized document to record transactions is essential for maintaining consistency and professionalism in any business. A structured approach to tracking payments not only ensures that all the details are accurate but also saves time by automating repetitive tasks. This tool simplifies the billing process and provides clarity for both the service provider and the client.

Key Advantages of a Structured Billing System

Using a pre-designed document for payment records offers several benefits:

- Time Efficiency: Quickly fill in the necessary details without starting from scratch each time.

- Accuracy: Reduce human error with automated fields and formulas for calculations.

- Consistency: Maintain a uniform format across all records, making your billing process seamless.

- Professional Appearance: A clean, well-organized format enhances your image and fosters trust with clients.

How Templates Simplify Billing Tasks

By utilizing a flexible document, you can easily adjust it to suit different client needs or project requirements. For instance, you can add sections for special rates, discounts, or taxes as necessary. This adaptability not only simplifies the creation of individual records but also keeps all essential information well-organized for future reference.

- Track payment statuses easily with clear due dates.

- Include custom payment terms to avoid misunderstandings.

- Access past records quickly for faster invoicing next time.

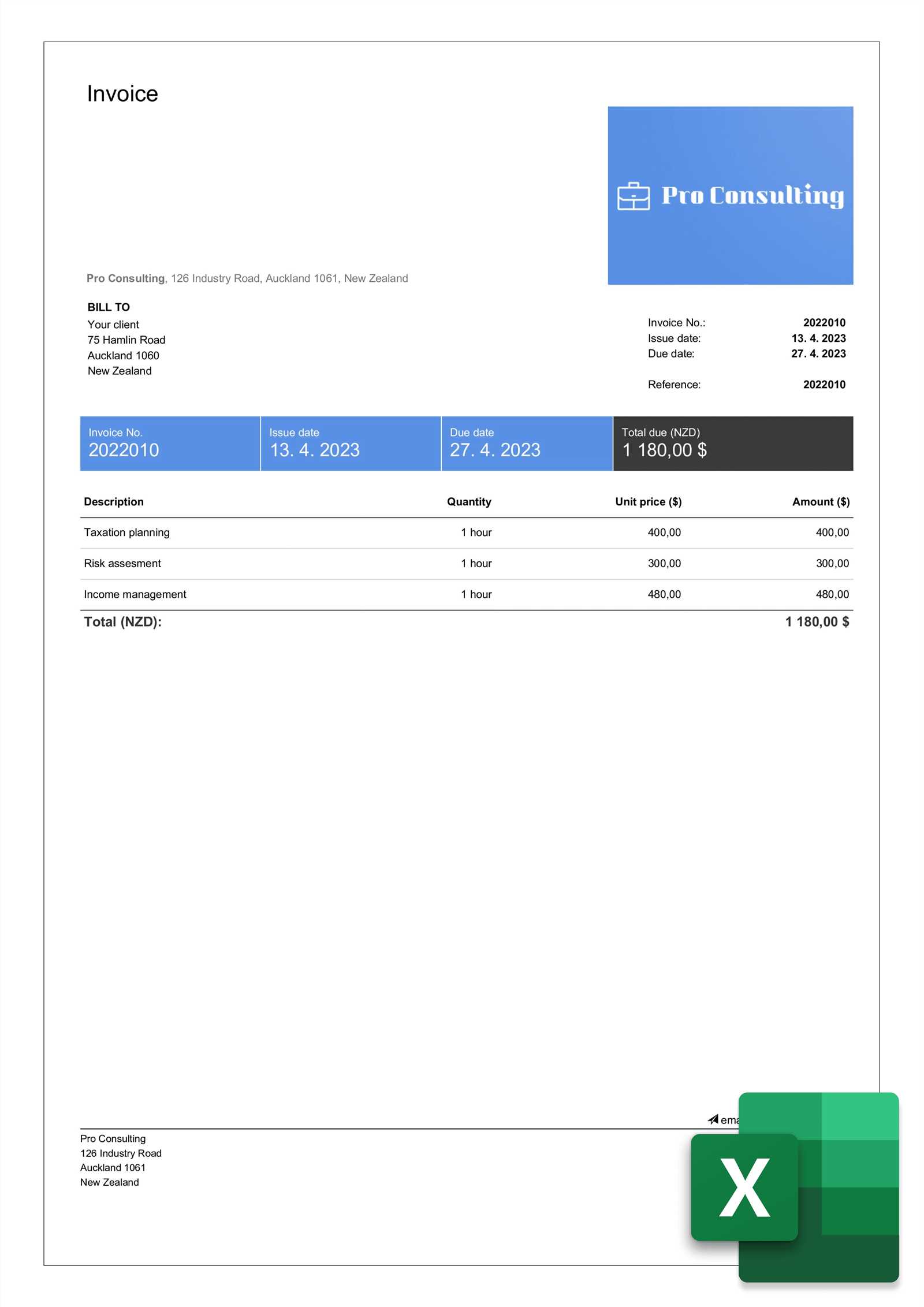

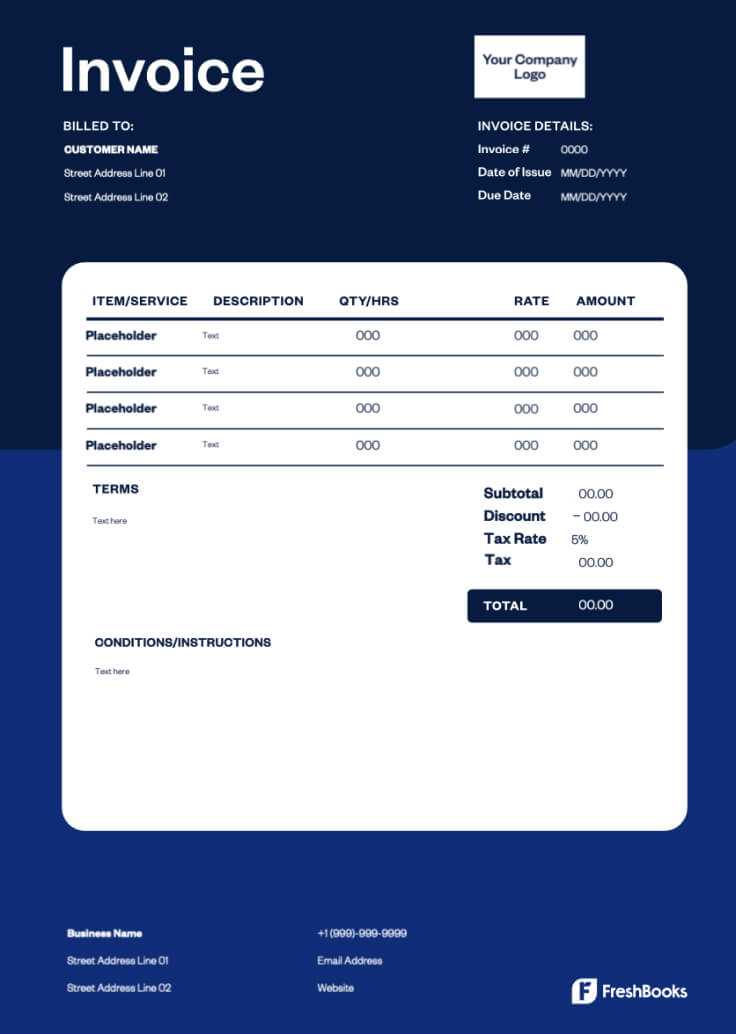

Key Features of an Excel Invoice

When managing financial documentation, having a tool that combines ease of use with powerful features is essential. A well-designed financial record can automate calculations, ensure accuracy, and streamline the overall billing process. Such tools are especially helpful in creating clear, organized records that both the business and the client can easily understand.

Automated Calculations and Formulas

One of the standout features of a well-structured document is the use of built-in formulas for automatic calculations. This allows for quick and error-free calculations of totals, taxes, discounts, and more. By inputting just a few key details, such as hourly rates or quantities, the document can instantly generate accurate amounts.

Customization and Flexibility

Flexibility is another key benefit, as these documents can be tailored to fit specific business needs. You can easily adjust the layout, add or remove sections, and update the content depending on the type of work or payment arrangement. This adaptability makes it simple to create personalized records that reflect the unique terms of each transaction.

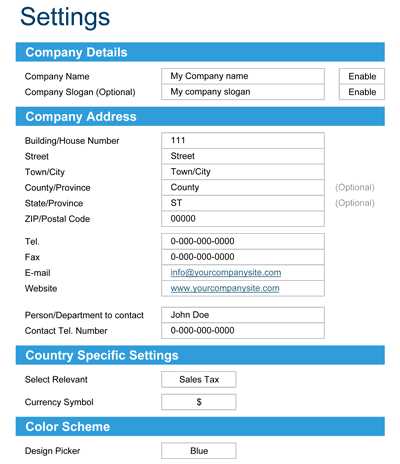

How to Customize Your Template

Personalizing your billing document is essential for ensuring it accurately reflects the specifics of your work and agreements with clients. Customization allows you to tailor every detail to suit different projects, rates, or client needs, providing a more professional and organized appearance. This flexibility also ensures that you only include the necessary information, avoiding clutter and focusing on the essentials.

Steps to Customize Your Document

Here are the key steps to follow when modifying your billing record:

- Adjust the Layout: Modify the columns and rows to fit the specific data you need to track, such as project descriptions, hourly rates, or quantity of services rendered.

- Change the Branding: Add your company logo, name, and contact details to the document to give it a professional look.

- Set Up Payment Terms: Include payment due dates, methods, and any late fee policies.

- Include Additional Sections: Add fields for taxes, discounts, or additional fees that may apply.

Why Customization Matters

Customizing your document ensures that all necessary information is clearly presented, which not only improves the clarity of your billing but also helps avoid confusion or disputes. Tailoring the design to your specific needs makes the document feel more personal and aligned with your business practices, building trust and professionalism with clients.

Benefits of Using Excel for Invoicing

Using a digital tool for managing financial records brings several advantages that can simplify the billing process. The flexibility and functionality of spreadsheet software make it an ideal choice for creating accurate and professional financial documents. By leveraging its built-in features, you can automate calculations, track payments, and easily customize the layout to suit your business needs.

Key Advantages of Spreadsheet Software for Billing

- Automation: Automatic calculations for totals, taxes, and discounts reduce the chances of human error.

- Customizable Layout: You can adjust the design, layout, and sections to match your specific requirements.

- Cost-Effective: No need for expensive invoicing software or subscriptions–spreadsheet tools are often included in basic software packages.

- Data Management: Easily track and manage records in one place, with options for sorting, filtering, and summarizing information.

Why Choose Digital Documents for Billing?

Digital documents allow you to store and organize all records in an accessible and secure format. You can quickly update past files, duplicate common entries, and store multiple templates for various clients or project types. Additionally, spreadsheets are easily shared via email or cloud storage, ensuring you can send invoices instantly and securely.

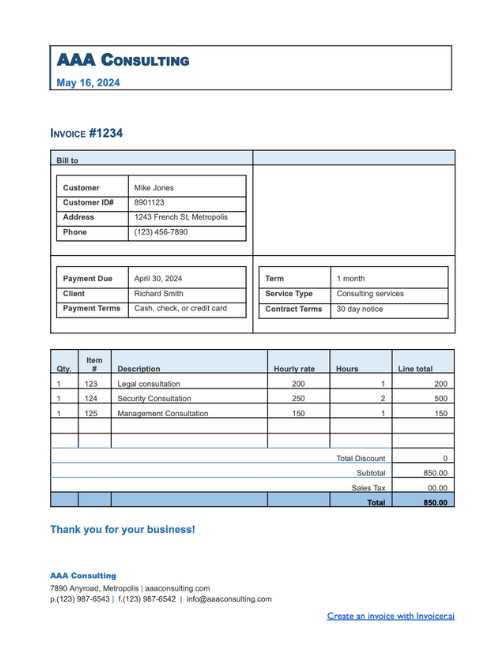

Steps to Create an Invoice in Excel

Creating a financial record for a completed project or transaction is a straightforward process when you use the right tools. By following a few simple steps, you can ensure that all necessary details are captured, calculations are accurate, and your document is clear and professional. Whether you are managing small tasks or larger projects, these steps will help streamline the process.

Key Steps for Building a Financial Record

- Set Up the Document: Start by opening a new file and setting the page layout to your preference. Include sections for your business name, client details, and the transaction date.

- Add Item Descriptions: List the products or tasks completed, along with their corresponding rates and quantities. Include any additional charges such as taxes or handling fees.

- Include Payment Terms: Clearly specify the payment due date, methods of payment accepted, and any other relevant terms, such as late fees or discounts.

- Automate Calculations: Use built-in functions to calculate totals, taxes, and other values. This will ensure accuracy and save time.

- Finalize and Save: Double-check all information for accuracy, then save the document in your preferred format (e.g., PDF or the original file) for easy sharing and record-keeping.

Tips for a Professional Result

- Keep It Simple: Avoid clutter and focus on the key details. A clean layout makes the document easier to read.

- Use Clear Fonts: Choose easy-to-read fonts and sizes to enhance readability.

- Customize the Design: Add your business logo, adjust colors, or modify the table structure to create a document that reflects your brand.

Common Mistakes to Avoid in Invoices

When preparing financial records for a completed project, accuracy and clarity are crucial. Even small mistakes can lead to confusion, delayed payments, or strained relationships with clients. By being aware of common errors, you can ensure that your documentation is both professional and effective, helping to maintain a smooth financial process.

Frequent Errors in Financial Documentation

- Incorrect or Missing Contact Information: Always double-check that both your details and the client’s information are accurate and up-to-date.

- Failure to Include Payment Terms: Ensure you clearly state payment deadlines, accepted methods, and any applicable late fees or discounts.

- Unclear Descriptions of Work: Vague descriptions can lead to confusion. Be specific about the tasks or items provided to avoid disputes.

- Mathematical Mistakes: Errors in calculations, whether for individual amounts or totals, can cause delays and a loss of trust. Always double-check the numbers or use automated functions to ensure accuracy.

- Omitting Taxes or Additional Charges: Don’t forget to add applicable taxes, fees, or adjustments. Failure to do so may result in undercharging or miscommunication.

How to Prevent These Errors

To avoid these mistakes, take a systematic approach when preparing your documents. Use clear templates, double-check your entries, and make sure all necessary sections are included. Automating calculations can also help reduce human error, ensuring that all values are accurate from the start.

How to Track Payments with Excel

Efficiently monitoring payments is essential for keeping a clear overview of your finances and ensuring timely follow-ups. With the right structure in place, tracking incoming payments becomes simple and straightforward. Using a digital tool to log each transaction, update payment statuses, and calculate balances allows you to maintain accurate financial records without extra hassle.

Setting Up a Payment Tracking System

By creating a dedicated tracking sheet, you can easily log payment details, including the amount, date received, and the remaining balance. This system not only helps you stay on top of payments but also minimizes errors by automating certain calculations. Below is an example layout for setting up a payment tracking system:

| Client Name | Invoice Number | Amount Due | Amount Paid | Payment Date | Remaining Balance |

|---|---|---|---|---|---|

| Client A | 12345 | $500 | $250 | 01/15/2024 | $250 |

| Client B | 12346 | $300 | $300 | 01/20/2024 | $0 |

Automating Payment Calculations

To streamline the process, you can use basic formulas to automatically calculate the remaining balance as payments are made. For instance, use the formula “Amount Due – Amount Paid” in the “Remaining Balance” column. This eliminates the need for manual calculations, ensuring that the figures stay accurate and up to date.

Best Practices for Professional Invoices

Creating clear and professional financial documents is essential for maintaining a positive relationship with clients and ensuring timely payments. A well-structured record not only reflects your professionalism but also helps prevent misunderstandings and payment delays. By following a few best practices, you can create documents that are both effective and easy to process for clients.

Key Elements for Professional Financial Documents

- Clear Contact Information: Always include your business name, address, email, and phone number. The client’s details should also be easily visible for quick reference.

- Precise Descriptions: Be detailed about the work or products provided. Include dates, quantities, rates, and any applicable terms.

- Organized Layout: A clean, organized format helps the recipient quickly find key information, such as the total amount due and payment terms.

- Payment Terms: Clearly state the due date, preferred payment methods, and any penalties for late payments to avoid confusion later.

- Consistency: Use the same layout and format for all documents to maintain professionalism and make the process easier for your clients.

Additional Tips for Enhancing Professionalism

- Include a Personal Note: Adding a thank-you note or brief message can make the transaction feel more personal and strengthen client relationships.

- Use Easy-to-Read Fonts: Stick to professional fonts like Arial or Times New Roman, and avoid using too many different styles or sizes that may distract from the content.

- Be Transparent with Fees: If any extra charges or fees apply, make sure they are clearly outlined to prevent any surprises.

How to Add Taxes and Discounts

Including taxes and discounts in your financial records is an important step to ensure that all amounts are calculated correctly and in compliance with regulations. Taxes may vary depending on location or type of product, while discounts can be offered as a way to encourage early payment or as part of a special promotion. Properly accounting for both can improve accuracy and prevent future discrepancies.

To add taxes, determine the applicable tax rate for the region or service provided. Multiply the amount due by the tax rate to calculate the tax amount, and then add it to the total. Similarly, discounts are typically applied to the subtotal before taxes. If offering a percentage discount, calculate the discount by multiplying the subtotal by the discount rate, and subtract it from the total before taxes.

For example, if the subtotal is $500, a 10% discount would reduce the amount to $450. Then, if the applicable tax rate is 8%, you would add 8% of $450 ($36) to the total, making the final amount due $486.

Creating Recurring Invoices in Excel

Managing regular payments can be simplified by automating the creation of recurring financial records. This method is ideal for clients or transactions that occur on a regular schedule, such as monthly or quarterly. Automating these entries reduces the time spent manually creating new documents, ensures consistency, and helps maintain accurate billing records over time.

To create a recurring payment document, you can set up a system where key details such as the amount, due date, and frequency are pre-defined. By doing this, you can easily replicate the document each period, updating only the relevant details like the date or the specific period covered by the transaction.

Sample Recurring Payment Layout

| Client Name | Amount | Payment Due Date | Frequency | Next Payment Date |

|---|---|---|---|---|

| Client A | $200 | 01/01/2024 | Monthly | 02/01/2024 |

| Client B | $450 | 01/15/2024 | Quarterly | 04/15/2024 |

By tracking the payment frequency and the next payment date, you can set reminders and easily replicate the structure for each new billing cycle. This helps in managing multiple clients and ensures payments are never missed.

How to Include Terms and Conditions

Including clear terms and conditions in financial documents is essential for protecting both parties in a transaction. These terms outline the expectations, responsibilities, and consequences if any part of the agreement is not fulfilled. By having a written record, both the provider and client have a clear understanding of the agreement, reducing the chance of misunderstandings or disputes.

When adding terms and conditions, it’s important to keep them concise yet comprehensive. Key elements should include payment deadlines, late fees, cancellation policies, and any other stipulations relevant to the agreement. These can be placed either at the bottom of the document or in a designated section for easy reference.

Common Elements of Terms and Conditions

- Payment Terms: Specify when the payment is due, how it should be made, and the consequences of late payments.

- Delivery and Completion: Outline any deadlines for the completion of work or delivery of products.

- Late Fees: State the penalty fees for payments not received by the due date.

- Refund and Cancellation Policy: Provide clear instructions on how cancellations or refunds will be handled, if applicable.

Where to Place Terms and Conditions

Terms and conditions should be included in a place that is easy to find. Typically, they are added towards the bottom of the document, but if the document is lengthy, a separate section may be used. Always make sure that both parties have access to these terms before proceeding with the transaction.

Invoice Design Tips for Clarity

Creating clear and well-organized financial records is essential for ensuring both parties can easily understand the details of the transaction. A well-designed document not only improves readability but also reduces confusion about payment terms, amounts, and other key details. A streamlined and easy-to-follow design helps ensure that no important information is overlooked.

To enhance the clarity of your financial documents, focus on layout, typography, and structure. Use simple formatting, bold headings, and a logical flow of information. This ensures that the document is professional and that the recipient can quickly locate essential details like total amounts, payment deadlines, and terms.

Key Design Tips for Readable Documents

- Use Clear Headings: Make sure each section has a clear, bold heading. This allows the reader to quickly identify key parts of the document, such as contact information, payment details, and deadlines.

- Prioritize Important Information: Place the most critical details, such as amounts and due dates, at the top or in prominent positions, so they are immediately noticeable.

- Keep Text Simple and Concise: Avoid cluttering the document with too much text. Keep descriptions and terms straightforward and easy to understand.

- Use Tables for Organization: Organizing numerical data, such as amounts, tax rates, and discounts, in tables helps break up the information and makes it easier to read.

Visual Enhancements for Better Clarity

- Spacing: Adequate spacing between sections, lines, and blocks of text prevents the document from feeling cramped and difficult to read.

- Font Choice: Use a clean, readable font such as Arial or Times New Roman. Avoid overly decorative fonts that may make the document harder to understand.

- Color Accents: Use color sparingly to highlight important information, such as due dates or total amounts, but ensure that the document remains professional and easy on the eyes.

How to Calculate Hourly Rates in Excel

Calculating hourly rates accurately is essential for setting fair pricing and ensuring that both parties are aligned on compensation. This process involves determining how much to charge per hour based on factors such as total earnings, working hours, and any additional expenses. Using a spreadsheet can simplify these calculations by automating the math and making it easy to adjust the rates as needed.

To calculate hourly rates, start by determining the total amount you want to earn and the number of hours you plan to work. From there, you can easily divide the total earnings by the total hours worked. In a spreadsheet, this can be done using basic formulas to automatically calculate and display the result. You can also factor in additional costs like overheads or materials, which might influence your final rate.

Steps to Calculate Hourly Rates

- Determine Total Earnings: Calculate how much you want to earn for a specific period, whether it’s a weekly, monthly, or project-based figure.

- Track Hours Worked: Keep a log of how many hours you have worked, or estimate the average number of hours you will spend on tasks.

- Use a Formula: In the spreadsheet, use the formula Hourly Rate = Total Earnings ÷ Total Hours Worked to get your rate.

- Account for Additional Costs: If there are other expenses involved (e.g., materials, travel), you can adjust the calculation to ensure these are covered.

Considerations for Accurate Calculation

- Overtime: If applicable, make sure to include any overtime or different rates for specific times worked, such as nights or weekends.

- Variable Costs: Remember to factor in fluctuating costs like tools, resources, or utilities that might affect the overall rate.

- Industry Standards: Research standard hourly rates in your industry to ensure your rate is competitive but also sustainable for your business.

How to Send Excel Invoices to Clients

Once you’ve prepared and customized your payment request document, the next step is to send it to your clients. Ensuring the file is sent properly and reaches the intended recipient is critical for timely payment and professional communication. There are several methods available to share your document, including via email, cloud sharing, or even physical delivery, depending on the client’s preference. Each method has its own advantages, and choosing the right one can streamline the payment process.

Sending your payment request electronically is the most common and efficient option. Most clients will appreciate receiving it through email, as it allows for quick access, easy record-keeping, and fast replies. Below are some steps and tips to follow when sharing your document electronically.

Steps to Send the Document via Email

- Save the File: After completing the payment request document, save it in a commonly used file format, such as PDF or .xlsx. Converting to PDF ensures the formatting stays intact and the file can be opened easily on any device.

- Attach the File: Open your email application and create a new message. Attach the saved document by clicking the attachment icon and selecting the file.

- Write a Clear Message: In the body of the email, briefly explain the purpose of the attached document and any important details, such as the due date or payment instructions.

- Use a Professional Subject Line: Make sure the subject is clear and relevant, such as “Payment Request for [Project Name]” or “Amount Due for [Client Name]”.

- Review and Send: Double-check the email for any errors and ensure that the correct recipient is listed. Once everything looks good, hit “send”.

Alternative Methods of Sending Documents

- Cloud Sharing Services: If your client prefers accessing documents through a cloud service like Google Drive, Dropbox, or OneDrive, you can upload the document to a shared folder and send them the link. This method is ideal for clients who work in collaborative environments or need ongoing access to multiple files.

- Physical Delivery: For clients who request paper copies or have specific preferences, you can print the document and mail it to the address provided. This is often slower and less efficient but might be required in some circumstances.

Automating Invoice Generation in Excel

Generating payment requests manually can be time-consuming, especially when dealing with numerous clients or recurring transactions. By automating this process, you can save time, reduce errors, and ensure consistency in your billing. Automation in spreadsheet software allows you to create a system where the document is generated automatically with minimal input, using formulas and predefined settings. This process ensures efficiency, accuracy, and faster turnaround for each request.

Using built-in tools such as formulas, macros, and other functions, you can automate key elements of your payment requests. These tools can streamline repetitive tasks like calculating totals, applying taxes, or even generating unique reference numbers. Below is an overview of some automation techniques and tips for creating a smooth and efficient process.

Key Features for Automating the Process

- Formulas for Calculating Totals: Use formulas like SUM and IF to calculate item totals, taxes, and overall amounts automatically. This reduces the chance of manual calculation errors.

- Dynamic Date Generation: Set up your system to automatically insert the current date or due date. This can be done using the TODAY() or DATE() functions in the spreadsheet.

- Itemized Details: You can create an automated list where clients’ orders or services are automatically populated from a database, making it easier to track and bill for multiple items or transactions.

- Unique Number Generation: Using a simple formula, such as CONCATENATE or RAND(), you can generate a unique reference number for each transaction to ensure proper tracking.

Setting Up Automation with Macros

Another advanced way to automate your process is by using macros, which are a series of commands that can be recorded and replayed. With macros, you can automate repetitive tasks such as formatting, generating new documents, or applying specific styles to your document.

Here’s a simple example of how to set up a macro for generating payment requests:

| Step | Action |

|---|---|

| 1 | Record a new macro in your spreadsheet tool. |

| 2 | Perform the tasks you want to automate (e.g., applying certain formats, entering common text, etc.). |

| 3 | Stop the macro recording once all steps are completed. |

| 4 | Save the macro and assign a shortcut key for easy access. |

| 5 | Use the macro every time you need to create a new payment document, saving time and ensuring consistency. |

By incorporating automation into your workflow, you can significantly reduce the time spent on manual document creation and ensure your payment requests are accurate and professional each time.

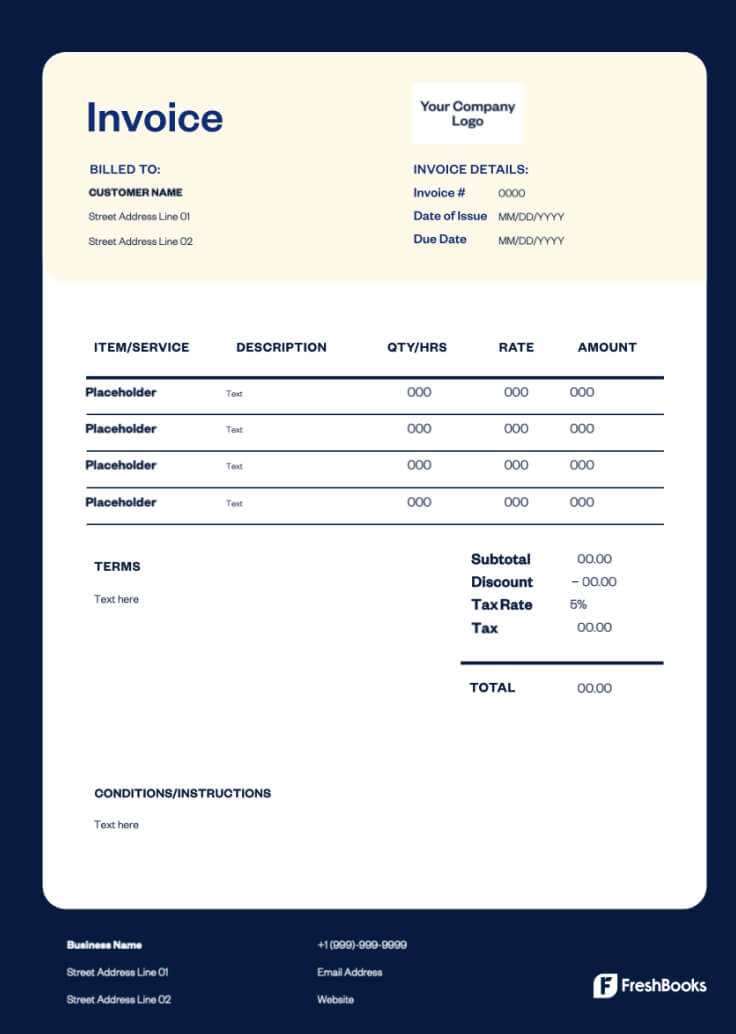

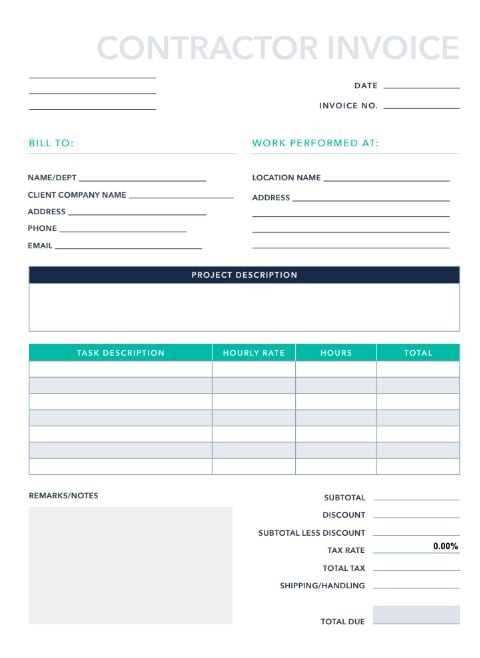

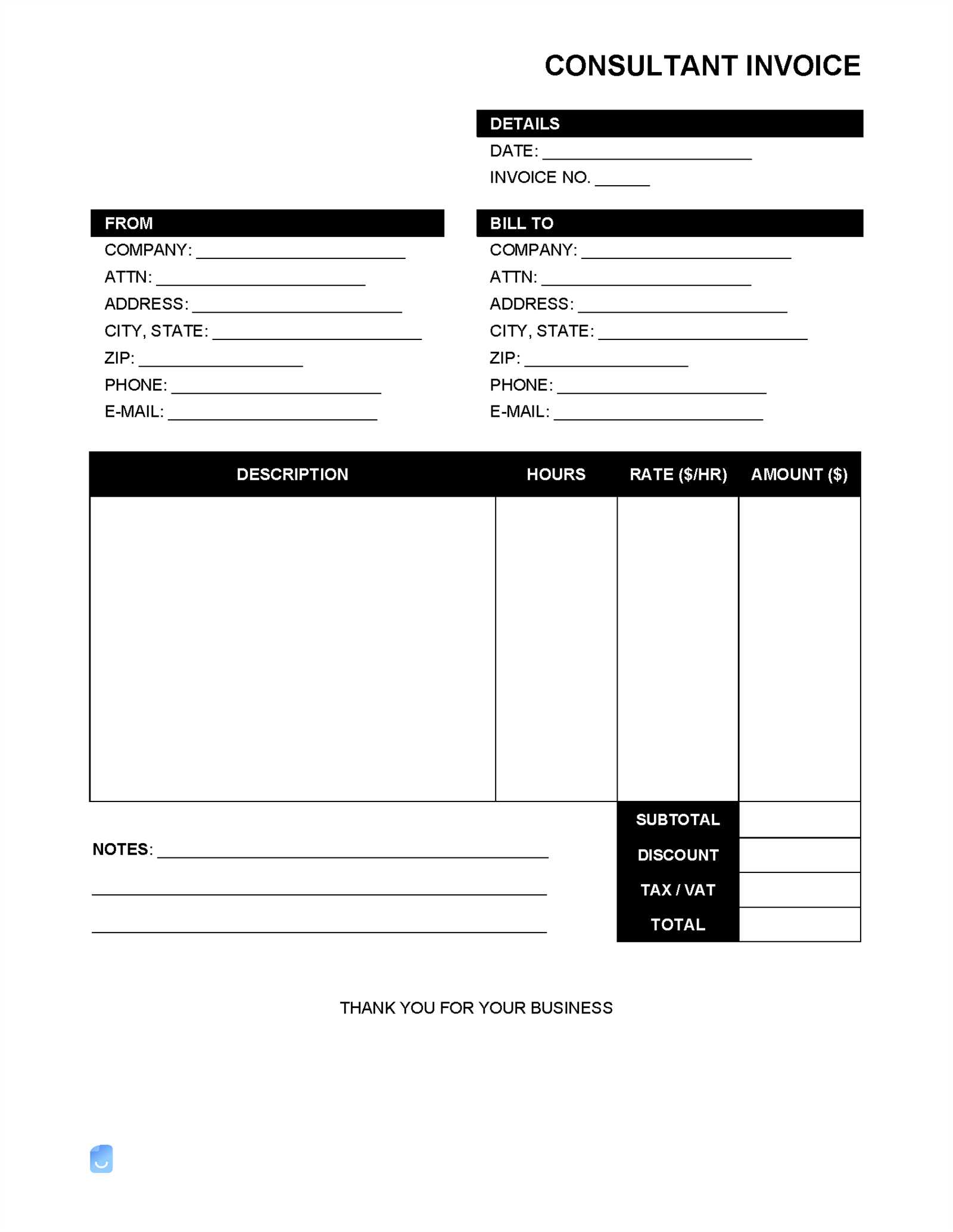

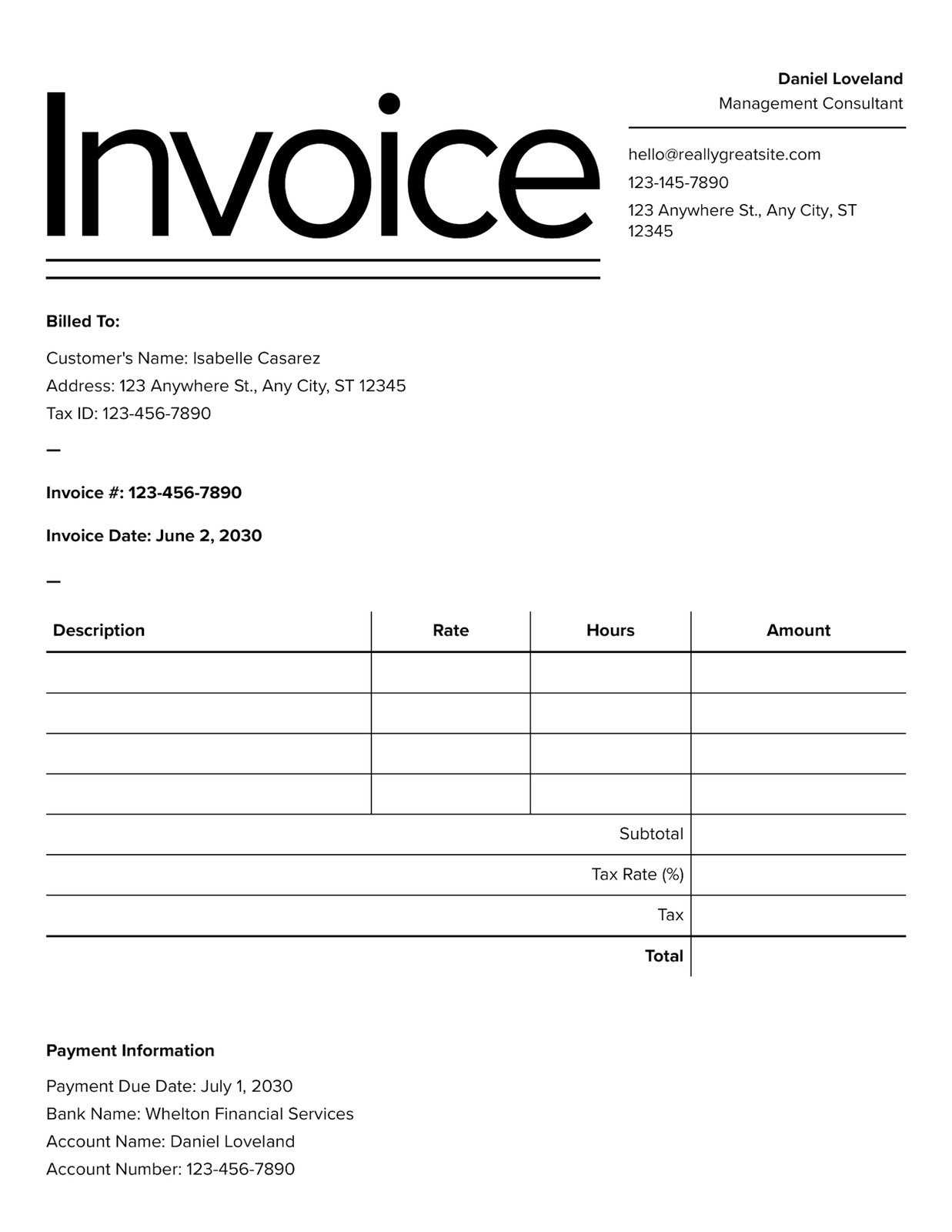

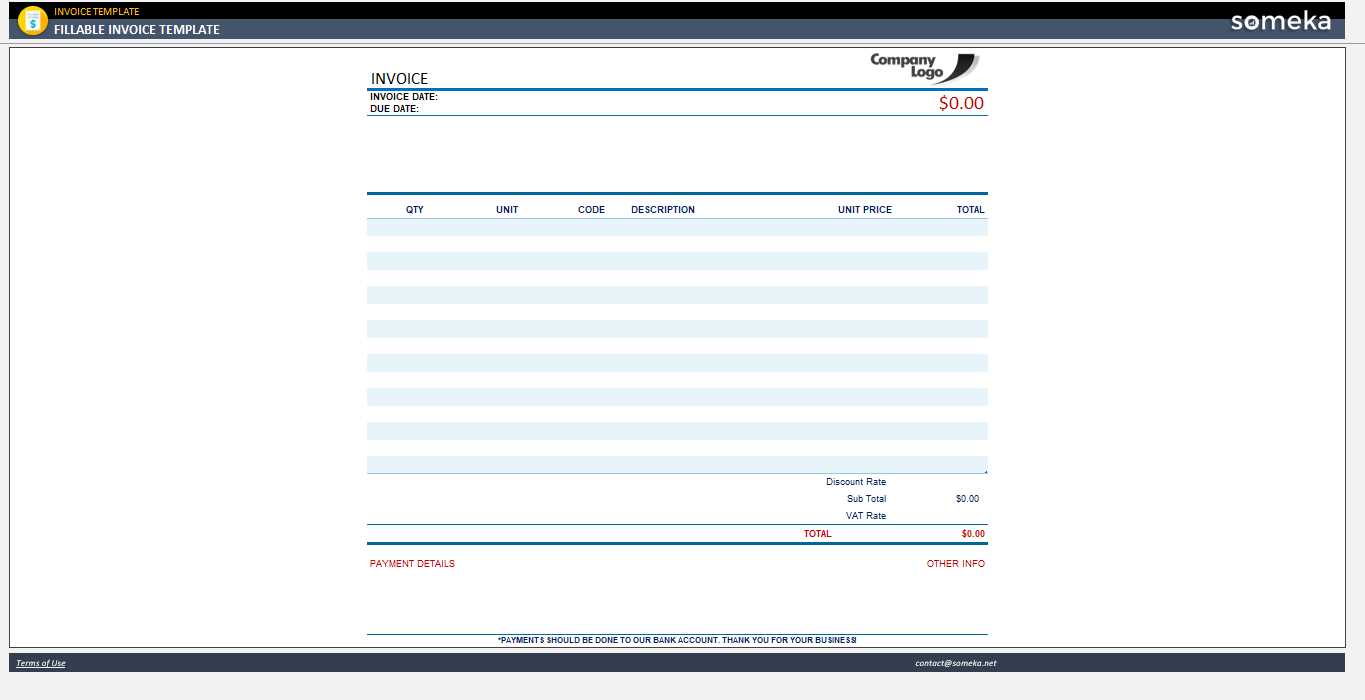

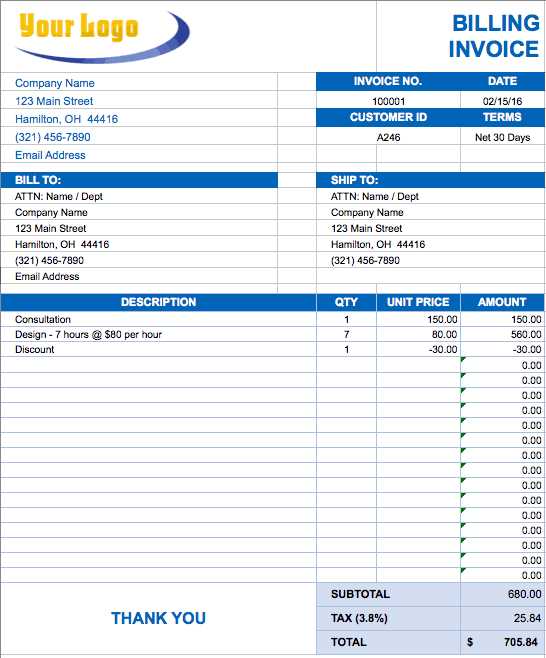

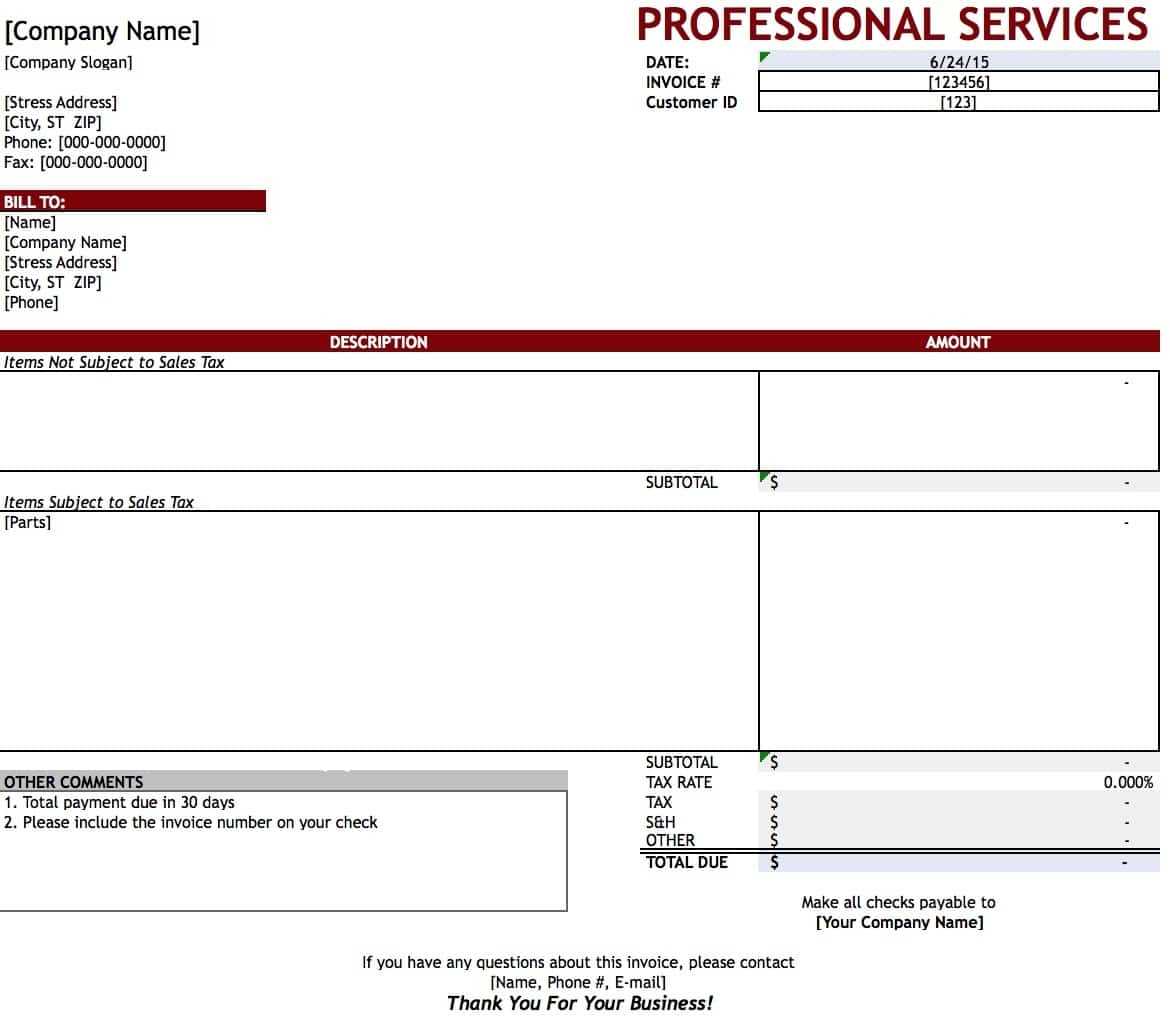

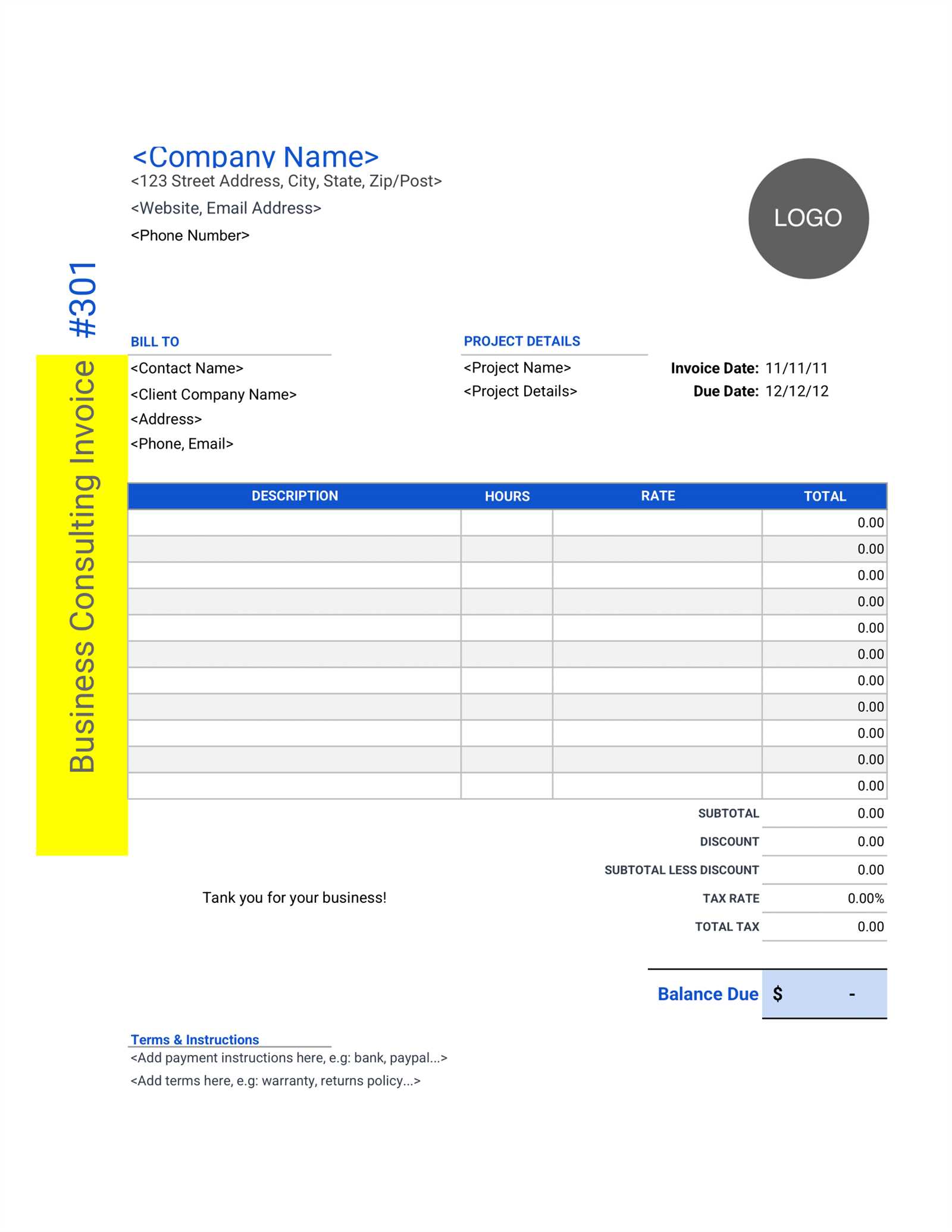

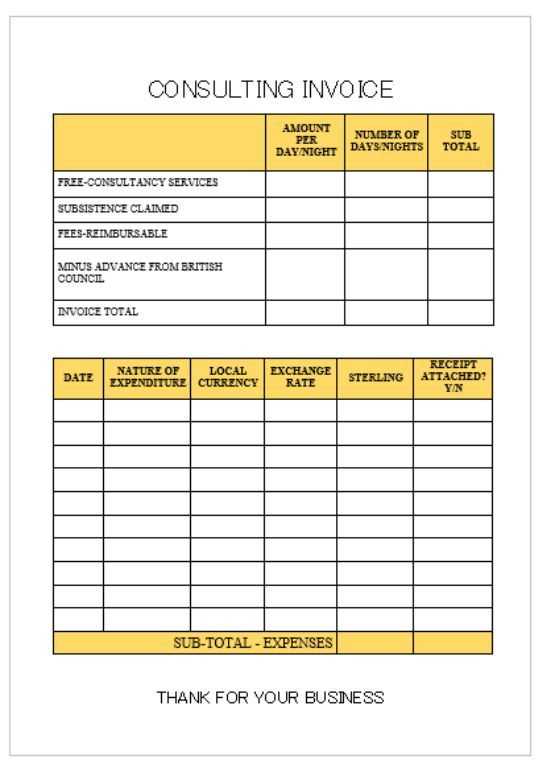

Free Invoice Templates for Consulting

Many professionals, especially those working on a project-based or freelance basis, require a streamlined method to request payment from clients. While custom designs can be created, pre-designed documents offer a convenient and efficient solution. These pre-built solutions are accessible for free and can save valuable time while ensuring all essential details are included in the billing process. They come with all the necessary fields and formulas, allowing for quick customization according to individual needs.

Using a ready-made document format, you can avoid mistakes and maintain a high level of professionalism. They provide a structured approach that ensures you don’t miss crucial components such as payment terms, itemized costs, or taxes. Below are some of the key benefits of using these pre-designed options:

- Quick Setup: Simply input your specific details, and the document is ready to send. There’s no need for complex formatting or calculations.

- Customizable: Adjust the fields to fit your business, whether you need to add extra lines for specific charges or modify the layout to suit your branding.

- Professional Appearance: These documents are designed to look clean and professional, making a strong impression on clients.

- Easy Access: Most options are available online, free of charge, and downloadable in various formats like PDFs or spreadsheets.

These ready-to-use options can significantly reduce the time spent on administrative tasks, allowing you to focus more on the core activities of your business. Whether you are a freelancer, a small business owner, or anyone who needs to generate payment requests, these formats can help streamline the process and ensure accuracy in every transaction.