Complete Guide to Consulting Invoice Templates for Your Business

Effective billing is a crucial aspect of managing any service-based business. A well-organized and professional document can not only simplify the process of requesting payment but also enhance your reputation with clients. Crafting a clear, structured bill is essential for smooth financial transactions and helps prevent misunderstandings about fees and services provided.

Using the right structure for your payment requests can save time and reduce errors. Customizing a billing document to suit your unique needs allows you to maintain consistency and professionalism. With the right approach, you can ensure that each client receives a transparent and accurate summary of the work completed, along with the agreed-upon fees.

Professionals across various industries rely on tailored billing solutions to ensure that payments are processed smoothly. These documents are not only essential for keeping your cash flow on track but also serve as a vital record for both parties involved in the transaction. Whether you’re just starting or looking to optimize your billing routine, understanding how to create the perfect document is key to managing your business finances effectively.

Consulting Invoice Templates for Efficient Billing

Efficient billing is essential for maintaining a smooth cash flow in any service-based business. A structured and clear document outlining the services rendered and the amount due ensures both the provider and the client are on the same page. By adopting a standardized format, you can save time, reduce errors, and improve the professionalism of your financial communications.

Having a well-designed payment request not only simplifies your administrative tasks but also sets the tone for your business interactions. With the right framework, you can quickly generate accurate records for each transaction. This streamlines the process of requesting payment and helps avoid delays that could affect your bottom line.

Efficiency is key when managing your finances. By using a carefully structured format, you can minimize the time spent creating each document, leaving more room to focus on client work. This approach is particularly valuable when dealing with multiple clients or ongoing projects, as it allows for consistent documentation across the board.

Tailored designs offer added flexibility, allowing you to adjust details based on the specific needs of each client. Whether you prefer a simple layout or a more detailed summary, having a customizable framework ensures you can always present a polished and professional request for payment.

Why Use Consulting Invoice Templates

Using a standardized billing format simplifies the process of requesting payment and reduces the likelihood of errors. A pre-structured document ensures that all necessary details are included, which not only helps you stay organized but also presents a professional image to your clients. By utilizing an established format, you can avoid the time-consuming task of creating a new document from scratch every time you need to request payment.

Having a consistent layout also enhances accuracy, making it easier to track payments and manage financial records. With clearly defined sections for services, hours worked, and payment terms, both you and your clients will have a transparent understanding of the charges. This transparency can lead to quicker approvals and a smoother payment process.

Efficiency is another key benefit. With the right framework, you can quickly adapt the document to suit the specifics of each job or client. Customization options allow you to cater to different project needs without losing the structure that makes your billing easy to process and understand. This adaptability also helps maintain a high level of professionalism in every interaction.

Time-saving features like automatic calculations or pre-filled fields allow you to generate an accurate payment request in just a few clicks. This allows you to focus more on your core business activities, rather than spending unnecessary time on administrative tasks.

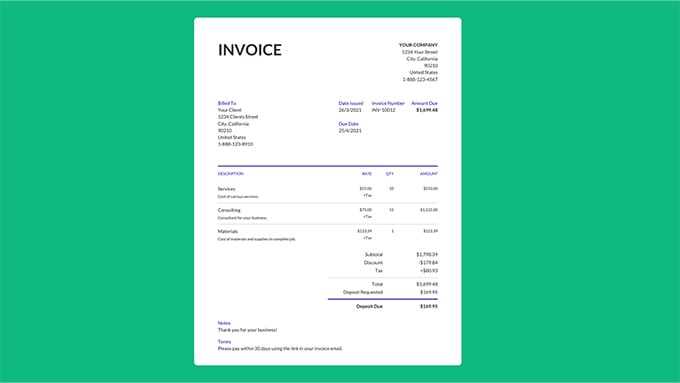

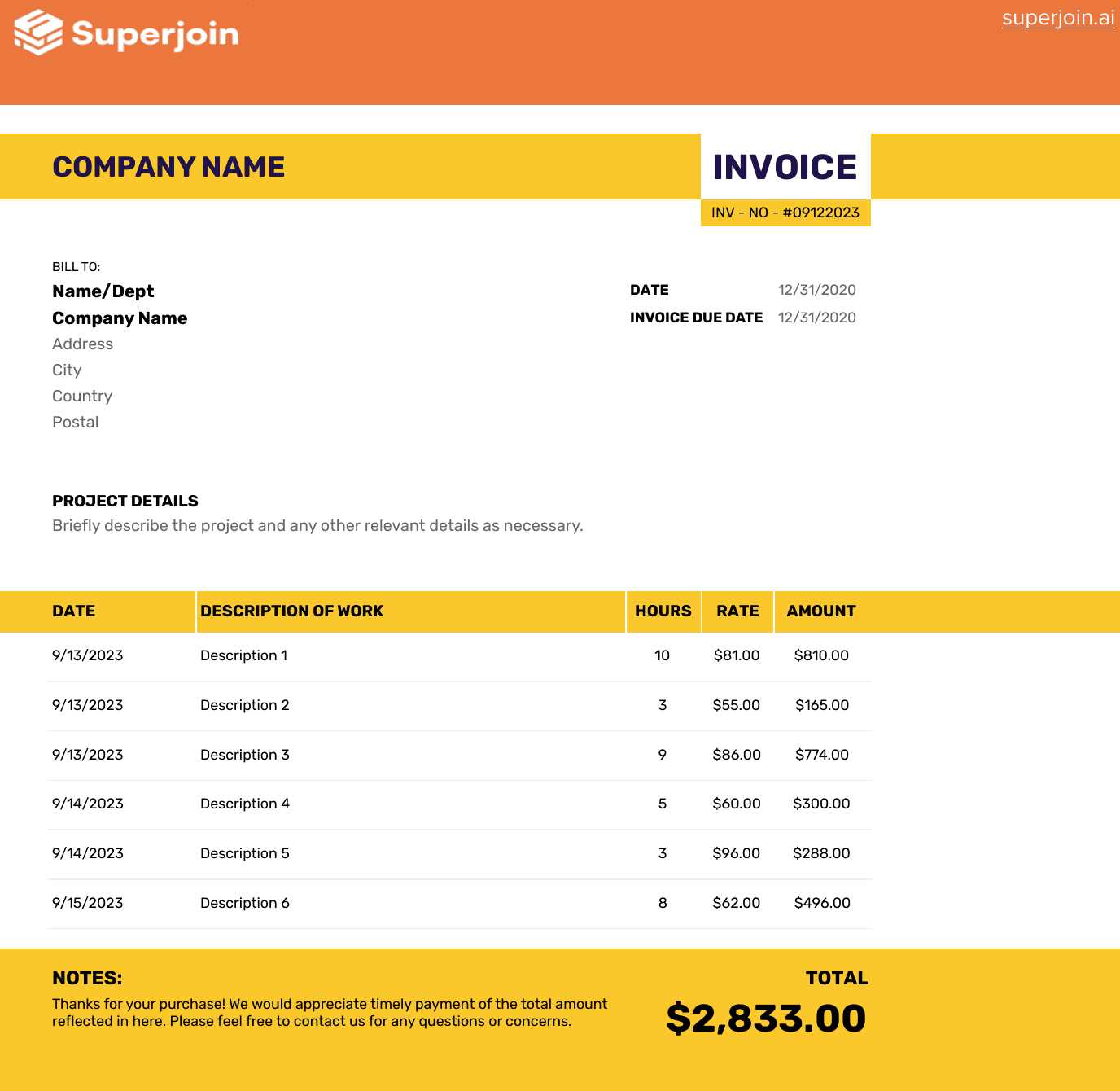

Key Elements of a Consulting Invoice

Creating an accurate and professional document for requesting payment requires a few essential components. Each section plays a vital role in ensuring clarity and transparency between the service provider and the client. These elements help avoid confusion, reduce payment delays, and maintain a smooth financial workflow.

Basic Information

- Your contact details: Include your name, business name, phone number, and email address.

- Client information: List the client’s name, company, and contact details.

- Unique reference number: A unique identifier for each payment request helps with tracking and record-keeping.

Detailed Breakdown

- Service description: Clearly describe the work completed, including any relevant dates and details.

- Hours or units worked: Specify the amount of time or the number of units billed, along with the corresponding rate.

- Total amount due: Clearly display the total fee for the services provided, including taxes if applicable.

Having these key elements in place ensures that the payment request is straightforward and easy to understand. Each section plays an important role in helping both parties stay organized and avoid any confusion during the transaction process.

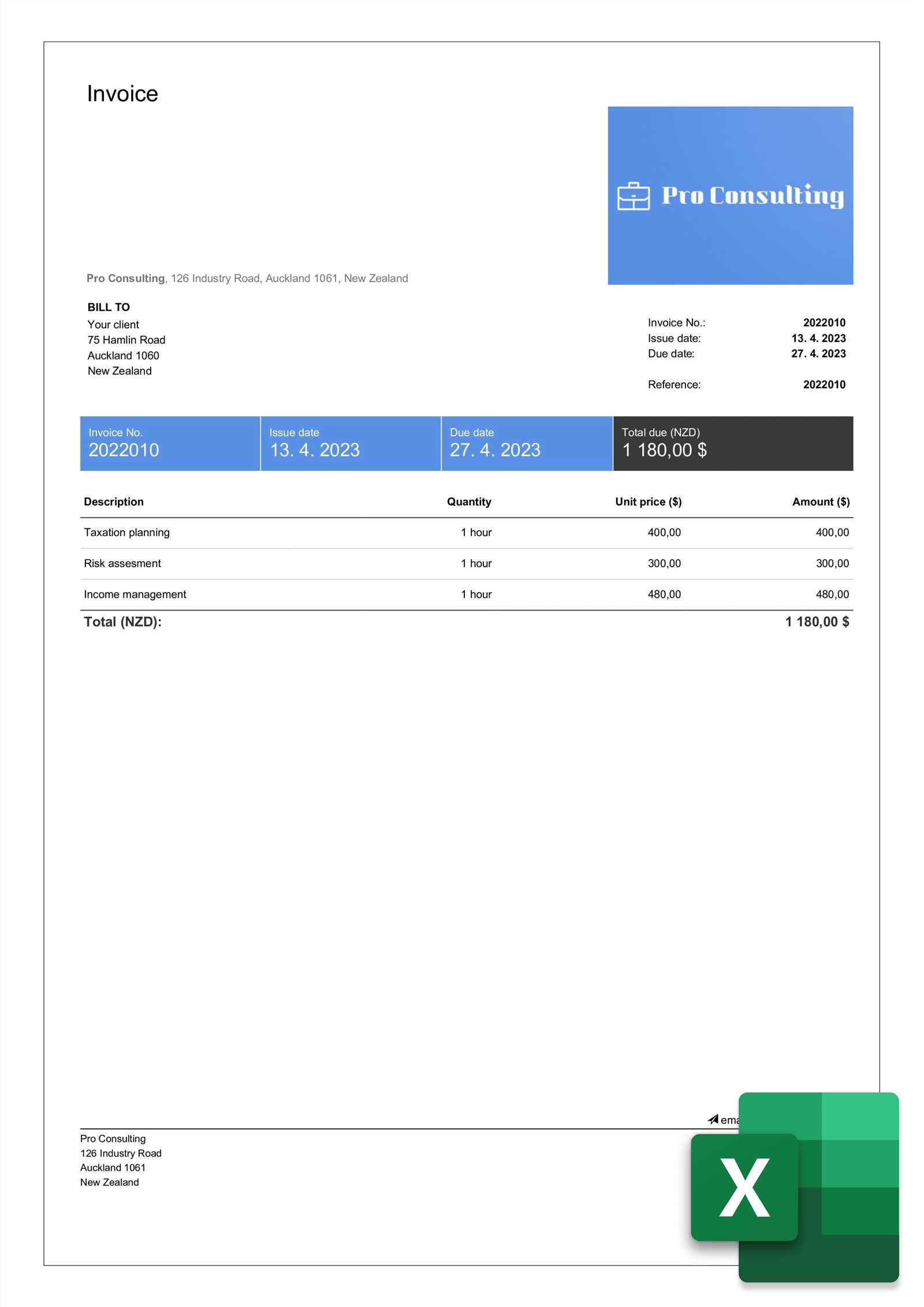

How to Customize Your Invoice Template

Personalizing your billing document to suit your specific needs is crucial for maintaining a professional and organized process. Customization allows you to present the necessary details clearly, while reflecting your unique brand style and adjusting to various client requirements. This approach helps you create a document that is both functional and aligned with your business identity.

Adjusting Layout and Design

- Choose a clean and simple layout: Keep the document easy to read with a structured design that highlights key information.

- Branding elements: Add your company logo, brand colors, and font choices to ensure the document reflects your business identity.

- Header and footer: Include a professional header with your business name and contact details, and a footer with terms or payment instructions.

Customizing Payment Details

- Service description: Tailor the service description section to reflect your particular offerings or projects.

- Payment terms: Customize the payment conditions, including deadlines, late fees, and acceptable payment methods.

- Tax and discount fields: Modify the document to accommodate tax calculations or discounts that apply to certain clients or projects.

By making these adjustments, you can ensure that each document not only suits your operational needs but also presents a professional and personalized touch to your clients.

Free vs Paid Consulting Invoice Templates

When choosing a format for your billing needs, one of the main decisions is whether to opt for a free or paid solution. Both options offer distinct advantages and drawbacks, depending on your business requirements. Understanding the differences can help you decide which type is best suited to your needs and budget.

Advantages of Free Options

- Cost-effective: The most obvious benefit is that these documents are available at no cost, making them ideal for businesses with limited budgets.

- Basic features: Many free versions offer essential sections like service description, amount due, and payment terms, making them suitable for simpler transactions.

- Quick access: Free formats can often be downloaded immediately or accessed online without lengthy registration processes.

Benefits of Paid Solutions

- Customization options: Paid formats typically offer more flexibility, allowing you to tailor the design and structure to fit your business needs.

- Advanced features: These options often come with additional functionalities such as automatic calculations, tax fields, and integration with accounting software.

- Customer support: Paid services usually include customer support for troubleshooting and guidance, ensuring a smoother user experience.

Ultimately, the choice between free and paid options depends on the complexity of your requirements and the level of professionalism you wish to convey. For businesses that need basic functionality and are on a tight budget, free solutions can be a solid choice. However, for those looking for more robust features and customization, investing in a paid version may be worthwhile.

Benefits of Professional Invoice Design

A well-crafted payment request document not only serves as a tool for communication but also reflects the professionalism of your business. The design of such a document plays a significant role in how clients perceive your brand. A clear, organized, and polished format can help establish trust, reduce payment delays, and ensure that both you and your client have a shared understanding of the financial transaction.

Enhancing Credibility

Having a professional design demonstrates that you take your business seriously and care about the details. It gives clients confidence that they are working with a reliable and organized provider. A consistent, high-quality format can set you apart from competitors and help foster long-term client relationships.

Improving Client Experience

Clients appreciate a document that is easy to read and understand. A clean, well-structured layout makes it simpler for them to quickly review the charges, payment terms, and due dates. This reduces the chances of disputes or confusion and speeds up the payment process.

| Aspect | Professional Design | Basic Design |

|---|---|---|

| Clarity | Clear, easy-to-follow structure with all necessary details | Basic, less organized layout that may confuse clients |

| Brand Perception | Reflects credibility and professionalism | May seem amateur or hurried, affecting trust |

| Client Relations | Encourages smooth communication and prompt payments | Can lead to misunderstandings and payment delays |

Ultimately, investing in a well-designed document not only enhances the appearance of your business but also contributes to smoother financial transactions and better client satisfaction.

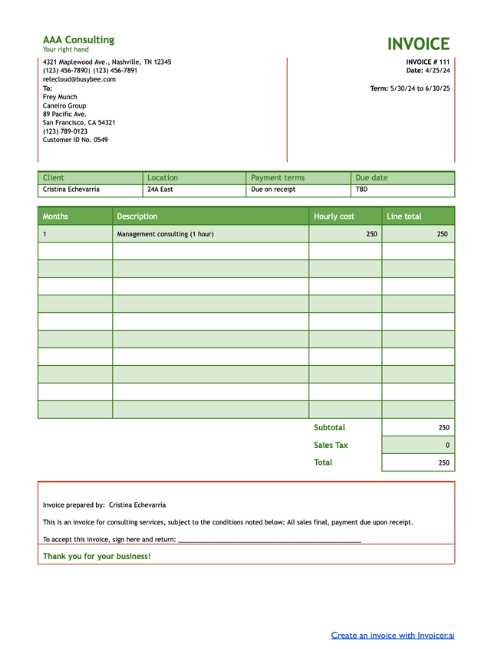

How to Choose the Right Template

Selecting the right format for your billing documents is essential for ensuring clarity and professionalism. The right layout should align with your business needs, offer customization options, and be easy for both you and your clients to use. With a wide variety of choices available, it’s important to understand what features matter most for your specific situation.

Consider Your Business Needs

- Complexity of services: If your services vary greatly from client to client, look for a layout that allows for detailed descriptions and flexible billing options.

- Branding: Choose a design that reflects your business’s style. A template with customizable branding options can help you maintain consistency across all documents.

- Frequency of billing: If you bill frequently, look for a format that is easy to update and automate to save time on repetitive tasks.

Look for User-Friendly Features

- Pre-filled fields: Select a layout that includes fields for client information, dates, and payment terms to simplify the process.

- Customization options: Make sure you can modify elements such as currency, tax rates, or payment instructions as needed.

- Professional appearance: Choose a format that gives a clean, organized look, ensuring your document conveys professionalism and clarity.

By considering these factors, you can select a format that not only suits your operational needs but also presents a polished and efficient way of handling your financial transactions.

Essential Features for Consulting Invoices

When creating a payment request, certain key elements are crucial to ensuring that all necessary details are included for both clarity and accuracy. A well-structured document not only makes it easier for the client to understand the charges but also ensures that you maintain professionalism and avoid potential payment issues. These fundamental features serve to simplify the process and provide transparency for both parties involved.

Core Information

- Contact details: Include your business name, address, phone number, and email, along with the client’s information for easy reference.

- Unique reference number: Every payment request should have a distinct identifier to help with tracking and organization.

- Service breakdown: Clearly outline what services or products were provided, along with any applicable details like project dates or hours worked.

Payment and Terms Details

- Amount due: Clearly state the total cost of the services, including any additional charges like taxes or fees.

- Payment due date: Specify the deadline for payment to avoid delays and ensure timely transactions.

- Accepted payment methods: List the available payment options, whether it’s bank transfer, credit card, or other methods.

These essential elements ensure that the document is professional, clear, and legally sound, helping to facilitate a smoother transaction for both you and your client.

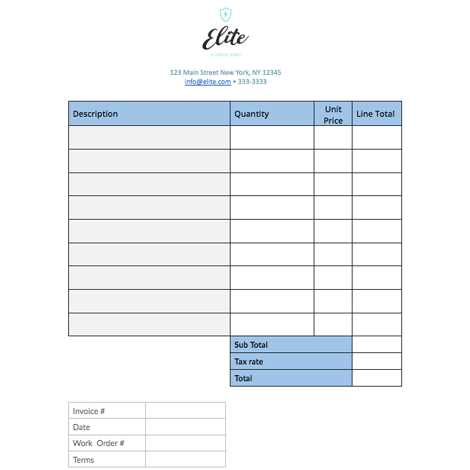

Steps to Create an Invoice Template

Creating a customized billing document is an important task for maintaining professionalism and organization in your business operations. A well-structured payment request not only ensures clarity but also saves time in the long run. The process of creating this document involves several key steps, each of which helps in organizing the necessary information and customizing the design to suit your needs.

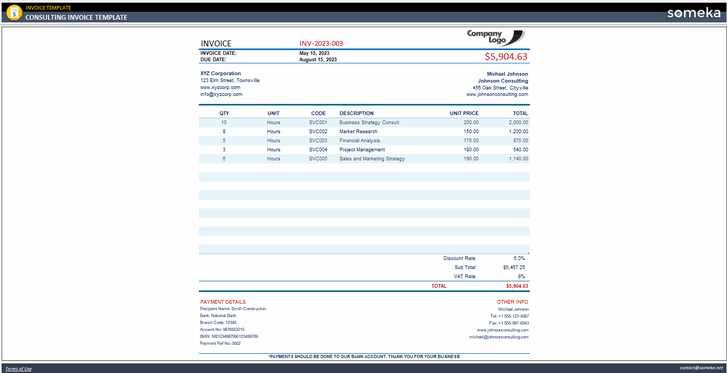

Step 1: Choose the Right Software or Tool

- Spreadsheet software: Programs like Excel or Google Sheets are great for creating a simple yet effective structure.

- Document editing tools: If you prefer more customization and a polished look, word processors like Microsoft Word or Google Docs can be used to format your document.

- Online platforms: Many online services offer pre-designed formats that can be easily edited and customized to your needs.

Step 2: Include Core Information

- Your details: Include your name, business name, address, phone number, and email.

- Client’s details: Ensure you add the client’s contact information for clarity.

- Unique document number: Every document should have a distinct reference number to track and organize the request.

Step 3: Outline the Charges

- Service description: Write a clear and concise description of the work completed or products delivered.

- Amount per service: Break down the cost for each individual service or product provided.

- Total amount due: Calculate and display the total amount payable, including taxes or discounts if applicable.

Step 4: Add Payment Terms

- Due date: Indicate the payment deadline to avoid delays.

- Accepted payment methods: List the methods through which payment can be made (e.g., bank transfer, credit card, etc.).

- Late payment penalties: Specify any additional charges for late payments, if necessary.

Step 5: Finalize the Design

- Professional layout: Use a clean, easy-to-read design that helps clients quickly locate key details.

- Branding elements: Customize the design with your company logo, colors, and fonts to reinforce your brand identity.

- Proofread: Always double-check for any errors in spelling, numbers, or details before sending.

By following these steps, you can create an organized, professional payment request that streamlines your financial processes and enhances your business image.

Common Mistakes in Consulting Invoices

While creating a billing document may seem straightforward, many businesses make avoidable errors that can lead to confusion, delayed payments, or even damaged client relationships. Understanding and avoiding these mistakes is crucial for ensuring a smooth transaction process. Whether it’s overlooking key details or failing to maintain clarity, these common missteps can cause unnecessary problems.

Missing or Incorrect Information

- Incomplete client details: Failing to include the full name, address, or contact information can cause delays in processing payments and create confusion.

- Incorrect payment amounts: Double-check all calculations to ensure the amounts are accurate. Even small errors can lead to disputes and affect trust.

- Lack of a unique reference number: Each document should have a unique identifier to make tracking and referencing easy for both parties.

Poorly Structured or Unclear Layout

- Unclear descriptions: Vague or ambiguous descriptions of services can lead to misunderstandings. Be specific about what was provided, along with relevant dates or quantities.

- Confusing payment terms: If the terms are unclear–such as payment due dates, late fees, or accepted payment methods–clients may delay payments or need further clarification.

- Overcrowded document: A cluttered, disorganized format can make it difficult for clients to find key information quickly. Keep the layout clean and easy to follow.

Avoiding these common errors can significantly improve your client relationships, speed up payment processing, and help maintain a professional image for your business.

Improving Client Trust with Invoices

A well-crafted payment request not only ensures timely payments but also plays a key role in building and maintaining trust with your clients. When the document is clear, professional, and transparent, it reassures clients that they are dealing with an organized and reliable business. This, in turn, fosters positive relationships and encourages repeat business.

Clarity and Transparency

- Clear breakdown of services: Providing detailed descriptions of what was delivered helps clients understand exactly what they are paying for. This reduces the likelihood of misunderstandings.

- Accurate amounts: Including precise figures for each service and the total amount due establishes credibility and prevents disputes.

- Visible payment terms: Transparent payment deadlines, accepted methods, and any penalties for late payments create a clear framework for the transaction, ensuring both parties are on the same page.

Professional Appearance

- Consistent branding: Using your business logo, color scheme, and font styles reinforces your brand’s professionalism and consistency, giving your clients confidence in your services.

- Clean, organized layout: A clutter-free design makes the document easy to read and navigate. This shows clients that you value their time and are committed to making the process as smooth as possible.

- Timely delivery: Sending a payment request promptly after completing work demonstrates efficiency and helps avoid delays in payment processing.

By focusing on these elements, you can enhance client trust and establish a reputation for professionalism that leads to stronger, long-lasting business relationships.

Time-Saving Tips for Invoicing

Creating and sending payment requests can often feel like a time-consuming task, but there are several strategies you can implement to streamline the process. By automating repetitive tasks, using efficient tools, and staying organized, you can significantly reduce the time spent on billing and focus more on growing your business.

Automate Where Possible

- Use invoicing software: Many invoicing platforms allow you to create and send professional documents automatically. These tools can store client details and service records for quick access, reducing the time needed to create each new document.

- Set up recurring invoices: For clients with regular payments, automate recurring billing. This feature can be set to generate invoices at specific intervals without requiring manual input each time.

- Integrate with accounting software: Syncing your invoicing tool with your accounting software can eliminate the need for manual data entry and ensure your records are automatically updated.

Standardize Your Process

- Use a consistent format: Create a standard layout and template for your billing documents. This way, you won’t have to reformat or adjust the design every time you need to send a payment request.

- Pre-fill client details: Save client information in your invoicing system so you can easily insert their name, contact information, and payment terms with just a few clicks.

- Store previous templates: Keep records of past documents for reference, especially for repeat clients. This allows you to quickly reuse or adapt an old document for future use.

By implementing these time-saving strategies, you can make the billing process more efficient and free up time to focus on more important aspects of running your business.

Invoice Automation for Consulting Firms

For professional services businesses, managing the billing process efficiently is crucial to maintaining cash flow and focusing on client work. Automating billing tasks can save time, reduce errors, and streamline financial operations. By using automation tools, firms can ensure consistent and accurate payment requests, allowing consultants to devote more energy to their core services rather than administrative tasks.

Benefits of Automating Billing Processes

- Faster turnaround: Automating the creation and sending of payment requests ensures that they are delivered on time, speeding up the payment cycle and reducing delays.

- Reduced errors: Automation minimizes the risk of manual mistakes, such as incorrect calculations or missing details, leading to fewer disputes and a smoother payment process.

- Improved client experience: Clients will appreciate the consistency and professionalism that comes with receiving timely, accurate billing documents, which can strengthen business relationships.

How to Automate Your Billing Process

- Choose the right software: Select a platform that allows you to automate various aspects of billing, from generating documents to tracking payment statuses.

- Set up recurring billing: For clients with regular payments, set up automated recurring billing to eliminate the need for manually creating new payment requests each cycle.

- Integrate with time tracking: For firms that charge based on hours worked, use integrated time-tracking software that automatically generates charges based on tracked hours and creates accurate payment requests.

- Use pre-built templates: Many automation tools offer customizable, pre-built layouts that ensure consistency and professionalism while reducing the time spent on document creation.

By automating your billing processes, you can significantly improve efficiency, reduce administrative burdens, and maintain a higher level of professionalism in every transaction.

Legal Considerations for Consulting Invoices

When creating a payment request document, it’s essential to ensure that it complies with relevant laws and regulations. A well-prepared billing document can help protect both parties involved in a transaction, ensuring clarity, transparency, and legal standing. Understanding the key legal aspects can prevent disputes and ensure that your business operates smoothly within the legal framework.

Key Legal Elements to Include

- Correct identification of parties: Clearly list your business name, contact information, and the client’s details. Including the full legal name of both parties helps avoid confusion and ensures accountability.

- Contractual agreement references: If applicable, reference any contracts or agreements that outline the scope of work and payment terms. This provides a clear link between the work completed and the agreed-upon payment terms.

- Accurate tax information: Depending on your location, you may be required to include specific tax details. Ensure that tax rates are correctly applied and reflect any local or national regulations.

Payment Terms and Compliance

- Payment deadlines: Clearly define the payment due date to avoid misunderstandings. Many jurisdictions have laws regarding the minimum time allowed for clients to settle outstanding balances.

- Late payment penalties: If your terms include late fees, ensure they are reasonable and comply with local laws regarding interest rates or penalties on overdue payments.

- Accepted payment methods: List all acceptable forms of payment, whether it’s bank transfer, checks, or digital payments, and ensure they are legal and available to clients in the relevant jurisdiction.

Retention of Records

- Keep records for a set period: In many countries, businesses are required by law to retain financial records for a specific period, often between 5 to 7 years. Keeping copies of all payment requests ensures compliance with these regulations.

- Provide receipts upon request: Be prepared to offer receipts or confirmations of payments once the transaction is complete. This is a legal requirement in many regions and helps maintain transparency with your clients.

By understanding and incorporating these legal considerations into your payment requests, you can safeguard your business, maintain client trust, and ensure compliance with applicable laws.

How to Track Payments with Invoices

Efficiently monitoring payments is crucial for maintaining a steady cash flow and avoiding overdue accounts. When you send out a payment request, it’s important to track whether and when the client has made the payment. By keeping a close record of all transactions, you can ensure timely follow-ups and stay on top of your financial situation.

Methods for Tracking Payments

- Record payment dates: Always note the date when the payment was received. Keeping a log of payment dates ensures you can quickly reference when each payment was made and how long it took to process.

- Monitor outstanding balances: Maintain a list of all pending payments and their due dates. This will help you identify overdue accounts and prompt you to follow up with clients in a timely manner.

- Use payment reference numbers: Each payment should be assigned a reference number or linked to a specific payment request. This allows you to easily track payments in your records and match them with the corresponding requests.

Tools to Help with Payment Tracking

- Accounting software: Utilize accounting tools that automatically update when payments are received. These tools can track payments in real-time and generate reports on outstanding balances and payment histories.

- Spreadsheets: For a more manual approach, you can use spreadsheet software to create a payment log. Include columns for client names, payment amounts, due dates, and status to keep everything organized.

- Online payment systems: If you accept digital payments, most payment platforms provide built-in tracking features that allow you to see when payments are made and automatically update your records.

By systematically tracking payments, you can ensure that your financial records are accurate, identify potential payment issues early, and maintain a professional approach to your billing processes.

Integrating Invoice Templates with Accounting Software

Connecting your billing documents with accounting software can significantly enhance the efficiency of your financial operations. By syncing your billing system with accounting tools, you can automate the transfer of data, reduce the risk of manual errors, and maintain up-to-date financial records without additional effort. This integration streamlines the entire process, from generating payment requests to tracking income and expenses.

Benefits of Integration

- Automatic data transfer: When you generate a payment document, the system can automatically update your accounting software with relevant details such as payment amounts, client information, and dates.

- Reduced manual entry: By linking your billing system with accounting software, you minimize the need for manual data input, which saves time and reduces the likelihood of errors in your financial records.

- Real-time updates: Integration allows both systems to stay current with the latest data, ensuring that your financial records are updated automatically as soon as a payment is made.

Steps for Successful Integration

- Choose compatible software: Select invoicing and accounting software that is designed to work together or offers integration features. Popular tools like QuickBooks, Xero, or FreshBooks support seamless connections with billing systems.

- Set up synchronization: After selecting the right software, configure it to automatically sync relevant data, such as client details, payment amounts, and due dates. This may involve connecting your payment processing system with the accounting software.

- Test the system: Before relying fully on the integration, test the process by generating a few documents and verifying that the data is correctly transferred to your accounting system. This will help ensure everything functions smoothly.

Additional Tips

- Keep your software up to date: Regularly update both your invoicing and accounting software to ensure compatibility and access to the latest features.

- Utilize automated reporting: Many accounting platforms can generate detailed financial reports based on your integrated data, providing you with valuable insights into your business’s financial health.

Integrating billing documents with accounting software not only simplifies the billing process but also enhances the accuracy of your financial records, making it easier to manage and monitor your business’s finances.