Free Consulting Invoice Template for Easy Professional Billing

Managing payments and keeping accurate financial records is essential for every business, especially for independent professionals and service providers. With the right tools, the process can be streamlined, ensuring both clarity and efficiency in tracking income and expenses.

Creating a document to outline the services rendered, the associated costs, and payment terms is a key step in establishing professional relationships and maintaining organized accounts. A well-structured document can save you time, reduce errors, and present a polished image to your clients.

Simple yet effective solutions can make all the difference in ensuring you receive timely payments while minimizing administrative burdens. The availability of customizable resources allows you to adapt your billing practices to your specific needs, helping you stay on top of your business finances with ease.

Free Consulting Invoice Template for Professionals

For service providers, maintaining professional standards in financial transactions is crucial. Whether you’re a freelancer, contractor, or small business owner, having a well-organized method for documenting services and payments can enhance credibility and streamline your workflow.

Many professionals benefit from using pre-designed resources to create billing documents that are easy to fill out and customize. These ready-made solutions provide a clear structure, allowing you to focus more on your work and less on administrative tasks. With the right document, you can ensure accuracy and clarity in every transaction, helping to build trust with clients and reduce the risk of payment delays.

Using a customizable resource tailored for your specific needs allows for quick adjustments, whether you’re detailing hourly rates, project fees, or other charges. This flexibility means you can adapt the document to reflect your business model, ensuring it aligns with both your practices and client expectations. The simplicity of such documents often leads to faster payments, allowing you to focus on growing your business.

Why You Need a Consulting Invoice

Having a structured document to record the details of services rendered is essential for maintaining clear and professional communication with clients. It serves as both a proof of agreement and a formal request for payment, ensuring that both parties are on the same page regarding the terms of the engagement.

A well-organized document helps to avoid misunderstandings and disputes over payment. It lays out the specifics of the work, the associated costs, and the expected timeline for payment. Here are some key reasons why you need such a document:

- Clarity and Transparency: A detailed document makes it clear what services were provided, how much they cost, and when the payment is due.

- Legal Protection: It acts as a formal record, helping protect you legally in case of payment disputes.

- Professional Image: Using a formalized document adds credibility to your business and builds trust with clients.

- Improved Cash Flow: Proper documentation helps clients understand payment expectations, leading to quicker and more consistent payments.

- Tax and Record-Keeping: Well-documented transactions make tax filing and financial tracking much easier.

By using such a resource, you simplify administrative tasks while ensuring that your business operations remain smooth and professional.

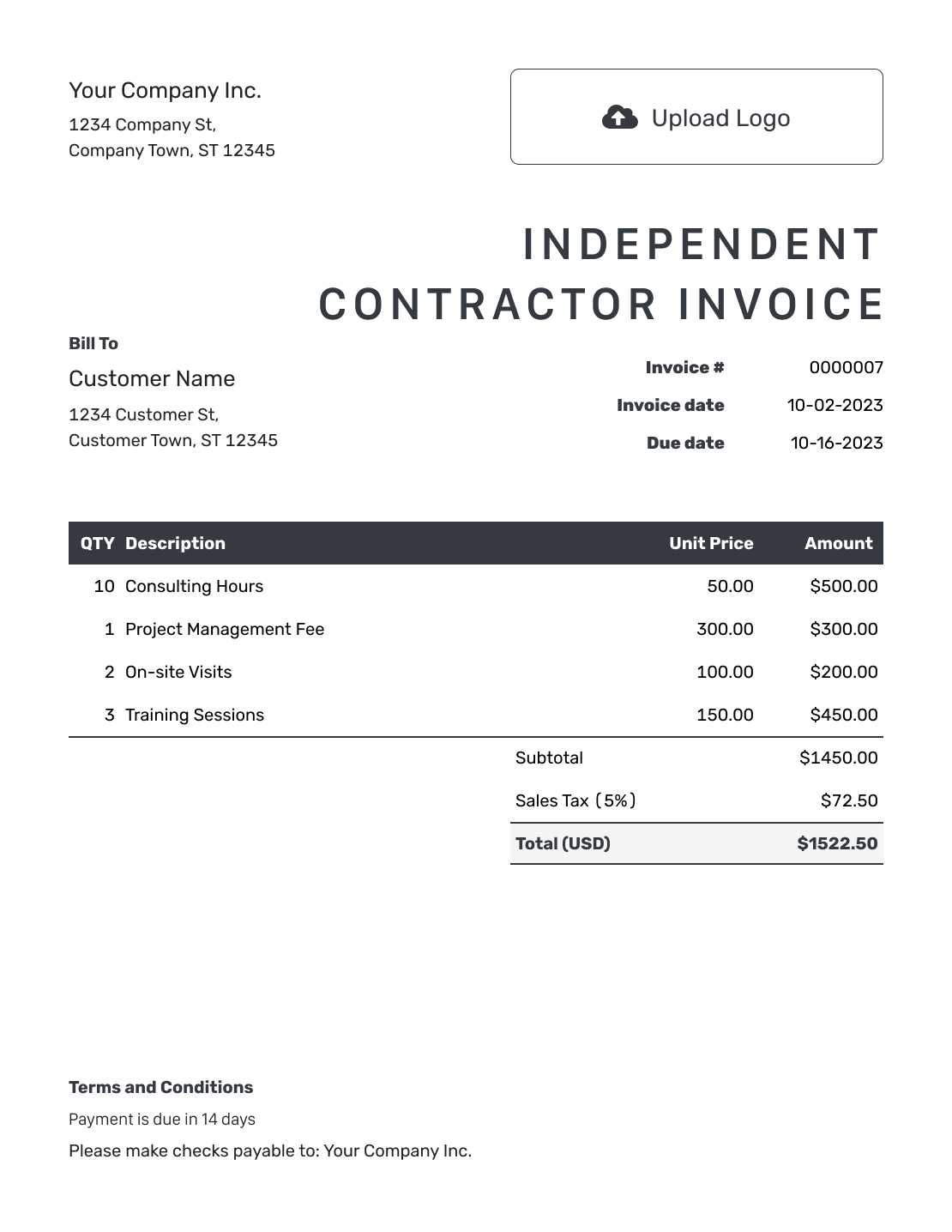

How to Create a Consulting Invoice

Creating a professional billing document is a straightforward process that helps ensure accuracy in your financial transactions. The goal is to clearly outline the services provided, the cost, and payment details, making it easy for clients to understand and process your request. Follow these simple steps to craft an effective document for your business.

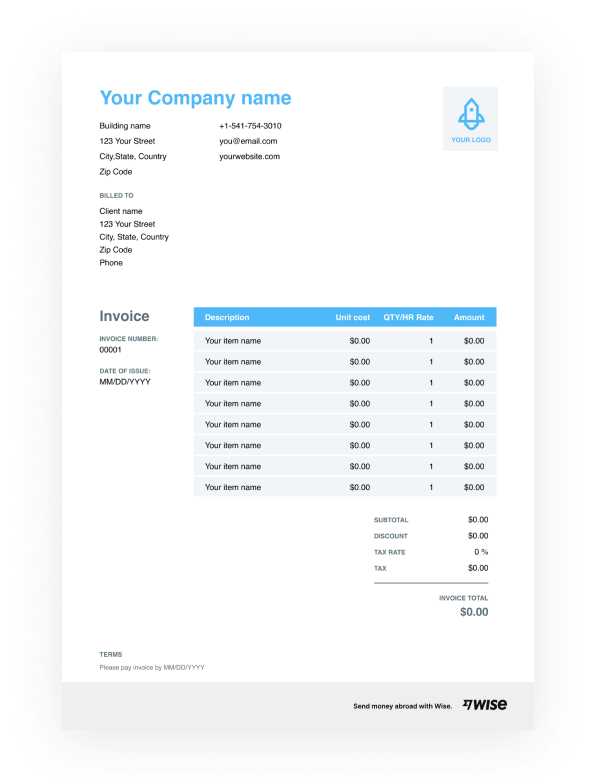

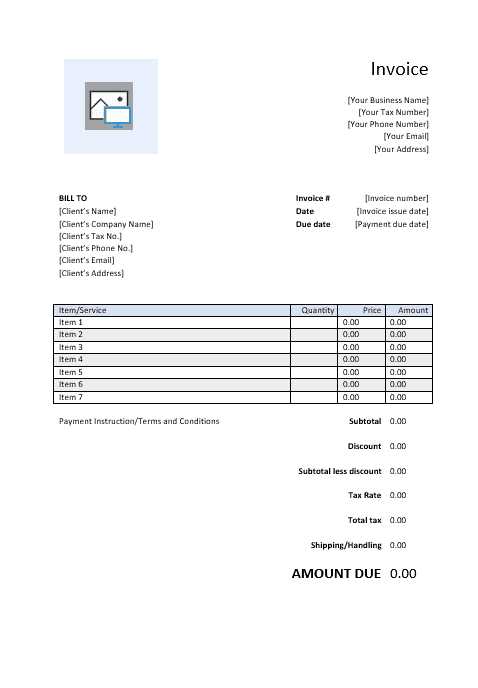

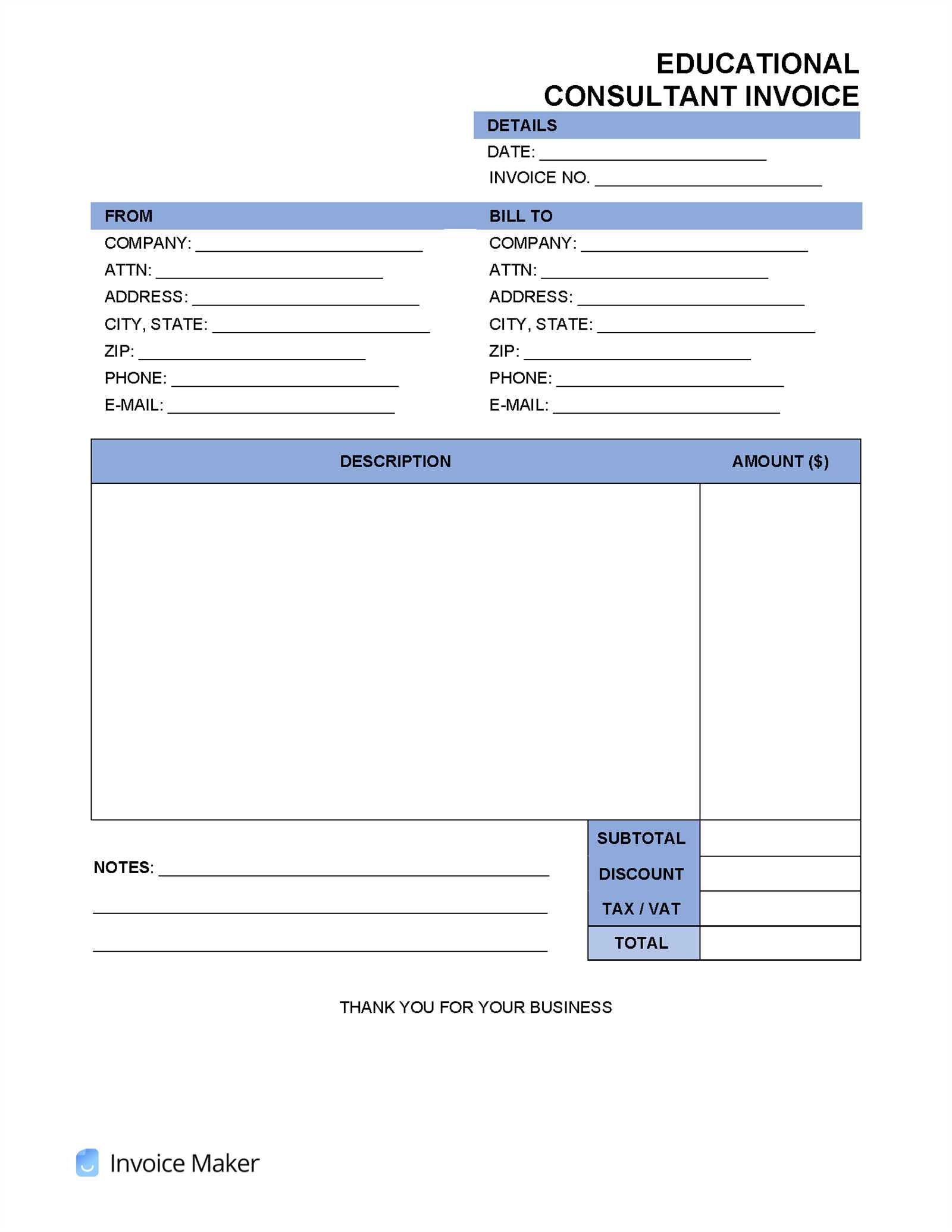

First, start by including your business details, such as your name or company name, address, and contact information. This helps the client easily identify who the document is from. Next, include the client’s information, ensuring their name, company name, and contact details are accurate.

Once the basic information is covered, clearly outline the services rendered. Include descriptions of each task, the hourly or flat rate charged, and the time period during which the work was performed. Make sure to provide a breakdown of costs if there are multiple services or items involved.

Additionally, specify the payment terms, including the total amount due, payment methods, and the due date. This ensures that the client knows exactly when and how to make payment. Finally, it’s important to number the document and include any necessary reference numbers, which helps with organization and tracking.

By following these simple steps, you can create a comprehensive and professional billing document that helps ensure timely payments and establishes a clear record of your work.

Top Features of a Consulting Invoice Template

A well-designed billing document should have all the necessary components to make financial transactions clear, organized, and professional. The features of an effective billing tool are key to ensuring accurate record-keeping and helping clients understand their obligations. Below are the most important characteristics that a high-quality document should include:

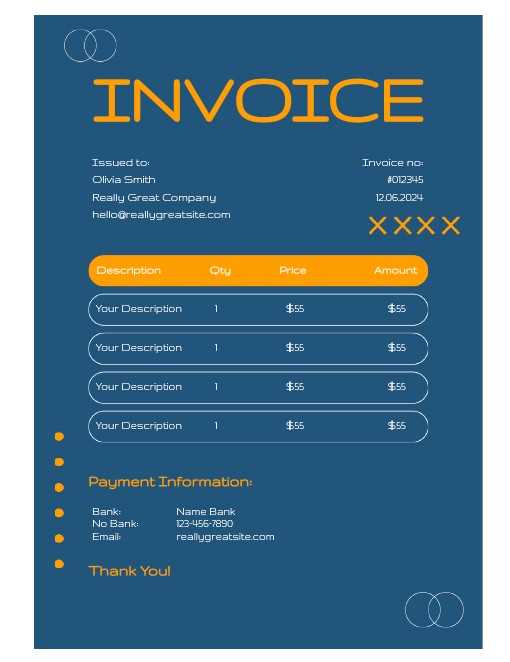

- Professional Layout: A clean, easy-to-read design that presents information clearly and makes a good impression on clients.

- Business and Client Information: Spaces to include your business details and the client’s contact information, making it easy for both parties to identify the transaction.

- Service Descriptions: Detailed descriptions of the work performed, including specific tasks and deliverables, along with the corresponding rates.

- Itemized Breakdown: A section that lists each service or item separately with its associated cost, ensuring transparency and preventing confusion.

- Total Amount Due: A clearly stated total, making it easy for clients to see the full amount due for payment.

- Payment Terms: Clear terms outlining the due date, accepted payment methods, and any late fees or penalties.

- Invoice Number: A unique identifier for tracking and managing billing records.

- Tax Information: The ability to include relevant tax details or VAT numbers if applicable, which is especially important for businesses operating in multiple regions.

- Notes Section: A space to add any additional information, such as project details, discounts, or reminders.

By incorporating these essential features, your billing document becomes an effective tool for smooth financial transactions and professional communication with your clients.

Benefits of Using Free Templates

Opting for pre-designed documents offers numerous advantages for businesses and individuals alike. These ready-made solutions allow users to save time and effort, eliminating the need for starting from scratch. With the help of a well-organized structure, tasks that might otherwise take hours can be completed in a fraction of the time, streamlining processes significantly.

One of the most notable benefits is the cost-effectiveness. Using pre-built designs reduces the need for expensive software or professional services, making it a practical choice for those with limited resources. This is especially useful for small businesses and freelancers who need high-quality results without breaking the bank.

Another key advantage is flexibility. These documents can be easily customized to meet specific requirements, allowing for a personalized touch while maintaining professional standards. Whether you are adjusting content, layout, or visual elements, these tools often come with intuitive features that make the process straightforward.

Additionally, relying on pre-formatted designs ensures that all essential components are included, reducing the risk of missing critical elements. This reliability helps maintain consistency and professionalism across all communications, giving a polished and cohesive look to any business interaction.

Best Formats for Consulting Invoices

When creating professional documents for billing purposes, the structure and presentation are key to ensuring clarity and ease of understanding. A well-organized layout helps to communicate important information effectively while making the document easy to navigate for both parties involved. Choosing the right format is essential to maintaining professionalism and ensuring smooth transactions.

Traditional Layouts

One of the most common formats for billing documents follows a traditional structure that includes essential elements such as contact information, itemized services, and payment terms. This straightforward approach is effective for most businesses as it focuses on clarity. A clean, simple design allows clients to easily view the services provided and the corresponding charges, reducing confusion and making it easier to process payments.

Modern Digital Formats

In today’s digital age, many opt for more modern, interactive formats that can be customized to fit specific needs. These formats often include interactive elements, such as online payment links, and may be designed with a more visually appealing layout. Digital formats also provide the advantage of being easily editable and shareable, making them convenient for remote work or businesses that frequently deal with international clients.

Key Elements in a Consulting Invoice

Creating a clear and professional billing document requires attention to several key components. Including all the necessary details ensures that both parties have a clear understanding of the services rendered and the expected payment terms. Each section should be structured in a way that provides the recipient with all relevant information at a glance.

- Contact Information: Clearly list the names, addresses, and contact details of both the service provider and the client. This ensures that both parties are easily identifiable and reachable for any follow-up.

- Service Description: Include a detailed breakdown of the services provided, with descriptions that outline the scope of work. This transparency helps prevent misunderstandings about what was delivered.

- Payment Terms: Specify the payment due date, accepted methods, and any late fees or discounts. Clearly stating these terms helps to avoid confusion regarding when and how payment should be made.

- Amount Due: Clearly indicate the total amount owed, including any taxes or additional charges. This number should be easy to spot and unmistakably clear.

- Unique Reference Number: Assigning a unique number to each billing document helps with tracking and organizing financial records.

Including these essential elements not only ensures that your documents are professional and well-organized, but also promotes a smooth and timely payment process.

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your specific needs, reflecting your brand and the nature of the work you provide. A well-designed, personalized document not only enhances professionalism but also ensures all necessary details are included for clarity and ease of payment. Making adjustments to various sections of the document helps align it with your business style and requirements.

Adjusting Layout and Design

One of the first steps in customization is choosing a layout that suits your preferences. You can modify the font, color scheme, and overall structure to align with your branding. For instance, adding your company logo at the top or adjusting the positioning of text can give your document a personalized look. Ensuring the design is clean and easy to follow is essential for a positive client experience.

Modifying Key Information

Next, make sure all the relevant details are included and updated according to the specific project. This includes:

- Adding your business name and contact details.

- Including a unique reference number for tracking purposes.

- Providing a breakdown of services with corresponding rates or fees.

- Specifying payment instructions, including due dates and acceptable methods.

By adjusting these components, you ensure that each document is tailored to reflect the specifics of each transaction while maintaining consistency across all communications.

Common Mistakes to Avoid on Invoices

Creating a billing document requires attention to detail, as even small errors can lead to confusion or delays in payment. There are several common mistakes that can undermine the professionalism of your document and cause issues with your clients. Avoiding these errors ensures smooth transactions and helps maintain strong business relationships.

Incomplete or Incorrect Contact Information

One of the most critical mistakes is failing to include complete and accurate contact details. If your business name, address, or phone number is missing or incorrect, it can cause confusion or delays in communication. Additionally, make sure the client’s information is also up to date. Double-checking these details can prevent unnecessary back-and-forth and ensure that your client knows how to reach you if there are questions or concerns.

Unclear Payment Terms and Amounts

Another common issue is not clearly stating the payment terms. If the due date or payment instructions are vague, clients may not know when or how to pay, leading to delayed payments. It is equally important to provide a transparent breakdown of the total amount owed, including any applicable taxes, discounts, or additional fees. Without a clear amount, clients may dispute charges or become frustrated.

By avoiding these mistakes, you ensure that your documents are professional, clear, and easy to understand, which helps maintain smooth financial processes and positive client relationships.

Ensuring Compliance with Your Invoice

To maintain a professional image and avoid legal complications, it’s crucial to ensure that your billing documents meet all necessary legal and regulatory requirements. Compliance not only helps protect your business but also fosters trust and transparency with your clients. By adhering to industry standards and local regulations, you can create documents that are both effective and legally sound.

- Include Required Business Information: Depending on your location, certain details such as your business registration number, tax identification number, or VAT number may be required on all billing documents.

- Accurate Tax Calculations: Ensure that any applicable taxes, such as sales tax or VAT, are calculated correctly and clearly displayed. Incorrect tax amounts can lead to disputes or fines.

- Clear Payment Terms: Specify the payment due date, late fees, and accepted payment methods. This helps to ensure timely payments and avoid misunderstandings.

- Compliance with Local Laws: Different regions have specific requirements for financial documents, such as mandatory information, formats, or retention periods. Make sure you’re familiar with your local regulations to stay compliant.

- Digital or Physical Format Requirements: If submitting electronically, ensure the file format complies with client or regulatory requirements. For physical documents, be aware of any postal or delivery guidelines.

By paying attention to these aspects, you can ensure that your billing documents meet legal and professional standards, avoiding potential issues and fostering stronger relationships with clients and partners.

How to Add Your Branding to Invoices

Incorporating your brand identity into your billing documents helps create a cohesive and professional image for your business. By adding visual elements that reflect your brand, you not only make your documents stand out but also reinforce your business’s identity with clients. A well-branded document increases recognition and builds trust, enhancing your business’s overall professionalism.

- Include Your Logo: Placing your company logo at the top of the document is one of the easiest and most effective ways to add your branding. It immediately associates the document with your business and makes it more recognizable.

- Customize the Color Scheme: Use your company’s primary colors to design headings, borders, and other elements. This subtle touch reinforces your brand identity and ensures consistency across all client-facing materials.

- Choose Consistent Fonts: Select fonts that match your brand’s style guide. Whether you use a modern sans-serif or a more traditional serif font, keeping it consistent with your marketing materials ensures a unified brand presence.

- Personalized Header and Footer: Consider adding a custom header and footer with your business name, slogan, or contact information. This gives a more polished look and makes your branding even more prominent.

- Use Custom Descriptions: Personalize the language you use in the document. Incorporating your business tone or voice in descriptions and terms can help set you apart from competitors while keeping the communication consistent with your brand’s overall messaging.

By making these simple adjustments, you can ensure that your billing documents reflect your business identity, making them not only functional but also a key part of your brand experience.

Using Invoices for Time Tracking

For many businesses, especially those offering services on an hourly basis, tracking time accurately is crucial for billing purposes and operational efficiency. By integrating time tracking into your billing documents, you can ensure that both you and your clients have a clear record of the time spent on specific tasks. This approach not only helps you get paid accurately but also provides transparency and accountability throughout the project.

When including time tracking in your documents, it’s important to present the information in a clear and organized manner. Below is an example of how you can structure the time details for each task performed:

| Description of Work | Hours Worked | Hourly Rate | Total |

|---|---|---|---|

| Task 1 – Research | 2 hours | $50 | $100 |

| Task 2 – Development | 5 hours | $50 | $250 |

| Task 3 – Consultation | 3 hours | $50 | $150 |

| Total | $500 |

By breaking down your hours and corresponding rates in this way, you provide your clients with a transparent breakdown of the work performed. It also serves as a useful record for both parties, making it easier to resolve any discrepancies that may arise.

How to Manage Multiple Invoices

Handling multiple billing documents simultaneously can become a challenging task without an organized system in place. Proper management ensures that you can keep track of outstanding payments, deadlines, and individual client details without confusion. An efficient method of managing these documents not only saves time but also reduces the risk of errors or missed payments.

Organizing Your Records

The first step in managing multiple documents is creating a structured system for tracking them. You can use spreadsheets, software tools, or even cloud-based platforms to record and monitor the status of each document. Below is an example of how you can organize your records:

| Client Name | Document Number | Amount Due | Due Date | Status |

|---|---|---|---|---|

| Client A | 12345 | $500 | 2024-11-10 | Unpaid |

| Client B | 12346 | $750 | 2024-11-12 | Paid |

| Client C | 12347 | $1,200 | 2024-11-15 | Unpaid |

Setting Up Reminders and Alerts

To stay on top of multiple payments, set up reminders or automatic alerts for approaching due dates. Most digital tools offer features that allow you to track unpaid amounts and send out payment reminders automatically. This ensures that you don’t miss any important deadlines and helps you stay organized without manual follow-ups.

By following these practices, you can effectively manage several billing documents at once and keep your financial processes running smoothly.

Tracking Payments with Consulting Invoices

Effectively managing received and pending payments is essential for maintaining a smooth financial workflow. By keeping a clear record of all completed transactions, professionals can easily monitor client commitments, schedule follow-ups, and ensure timely cash flow. A structured system simplifies the process, allowing for a consistent and transparent approach.

Organizing Client Payment Data

Organizing payment details by client helps maintain clarity. This includes noting payment amounts, dates, and any terms agreed upon for each client. Such structured data assists in identifying overdue amounts and understanding each client’s payment habits, making future interactions and follow-ups easier.

Using Tables for Efficient Tracking

Tables provide a practical way to visualize all relevant details in a single view. A well-organized table can highlight key information such as dates, payment statuses, and any pending balances.

| Client Name | Payment Date |

|---|

| Client Name | Payment Date | Amount Received | Status | Balance Due |

|---|---|---|---|---|

| Client A | 2024-10-01 | $500 | Completed | $0 |

| Client B | 2024-10-05 | $300 | Pending | $200 |

With consistent updates, these tables provide a reliable reference for tracking financial progress, simplifying follow-ups, and making end-of-month accounting much easier to manage.

How to Use Invoices for Tax Purposes

Properly managing documentation of financial transactions is essential for simplifying tax reporting and ensuring compliance. Clear and organized records make it easier to identify deductible expenses, report income accurately, and avoid potential discrepancies during tax season.

Recording Income and Expenses

Keeping detailed records of all payments received and expenses incurred is vital for accurate tax calculations. Each payment record should include relevant details, such as payment date, client name, and amount received. Documenting expenses associated with providing services helps identify deductible costs, reducing taxable income and streamlining the tax filing process.

Staying Prepared for Tax Audits

Organized records can be a safeguard in case of an audit. By maintaining comprehensive documentation, professionals are well-prepared to substantiate income and expense claims. Essential details like payment dates, amounts, and cl

Where to Find Reliable Invoice Templates

Choosing a well-designed layout for financial records can simplify managing client payments and help maintain a professional image. Many online platforms offer customizable options that meet various business needs, allowing professionals to select formats that best suit their work style and client expectations.

Several trusted platforms provide easy-to-use options. Websites dedicated to office resources often feature a range of designs for different industries. Additionally, popular software providers offer downloadable formats within their accounting or document programs, ensuring compatibility and ease of use.

For added flexibility, platforms with cloud-based solutions allow for real-time updates and remote access. This feature is especially useful for those who need to keep track of details while on the go. Whether looking for basic or advanced functionalities, selecting a trustworthy source for record-keeping layouts can enhance efficiency and ensure a consistent look across client documents.

How Free Templates Save You Money

Using pre-designed layouts for tracking financial transactions can significantly reduce business costs. Instead of investing in expensive software or custom design, professionals can access practical options that streamline administrative tasks, allowing them to focus on core business activities while minimizing expenses.

Benefits of No-Cost Designs

Opting for no-cost layouts provides a range of benefits beyond just initial savings. These layouts are typically customizable, allowing for adjustments to fit specific needs, which eliminates the need for additional services. Many of these designs are compatible with commonly used software, making them easy to implement without technical expertise.

Comparing Costs

Below is a comparison showing potential savings when using ready-made formats versus other paid solutions:

| Option | Cost per Year | Advantages |

|---|---|---|

| Pre-Designed Layouts | $0 |