Essential Consulting Fee Invoice Template for Your Business

For freelancers and professionals offering specialized services, ensuring timely and accurate payment is crucial. One of the most efficient ways to handle this is by creating clear and detailed payment documents. These documents not only help track transactions but also provide clients with the necessary information to process payments without delays.

By using a well-organized structure, you can easily outline the work performed, the corresponding amounts, and any additional terms or conditions. A well-crafted document serves as both a record for you and a reference for your clients, helping to build trust and maintain transparency in business dealings.

In this guide, we will explore how to design and personalize these essential documents to suit your specific needs, ensuring you receive the compensation you deserve without unnecessary complications.

Consulting Fee Invoice Template Guide

For professionals offering specialized services, creating an effective billing document is essential to ensure smooth transactions. A well-structured billing statement not only facilitates timely payment but also provides clarity and transparency to clients. By understanding the key components and formatting, you can craft a document that reflects your business standards and helps avoid misunderstandings.

Key Components of a Billing Document

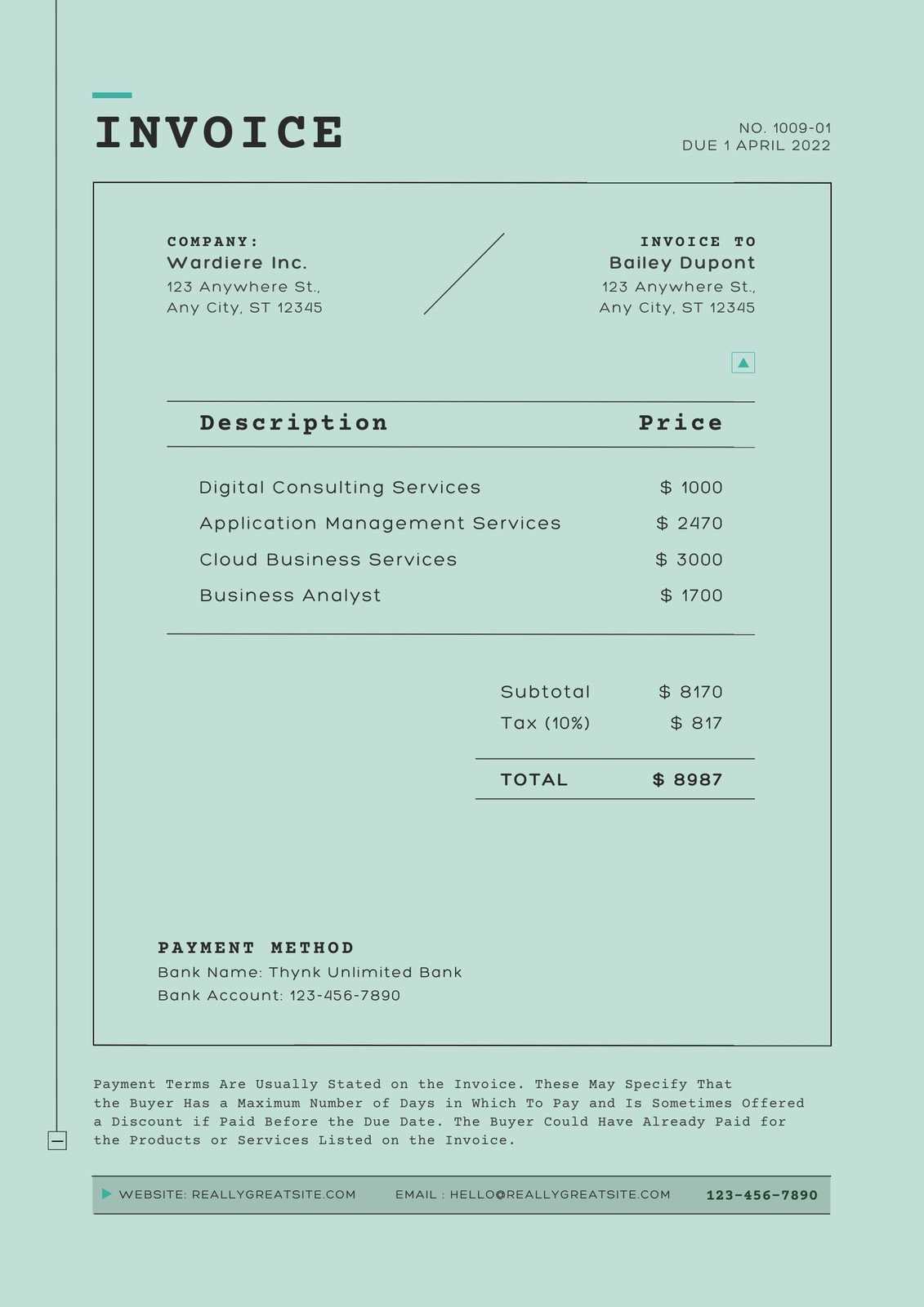

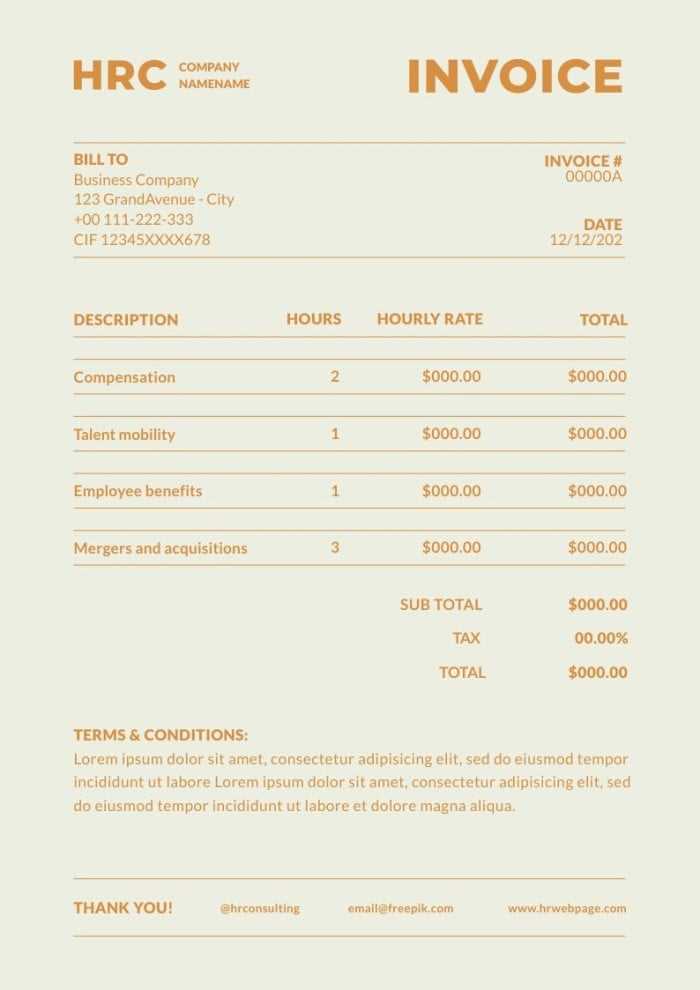

To ensure your payment requests are clear and professional, include the following details in each document:

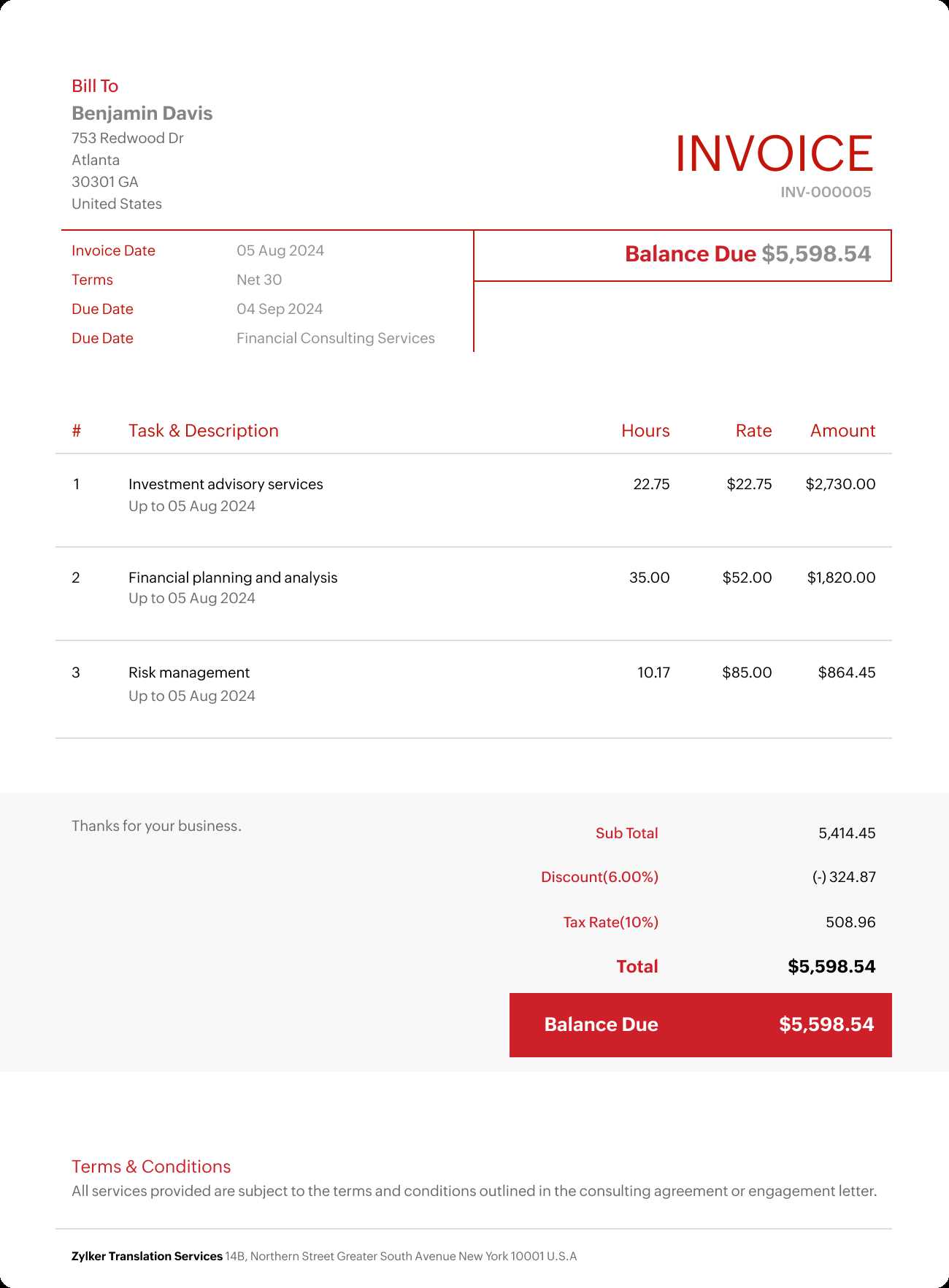

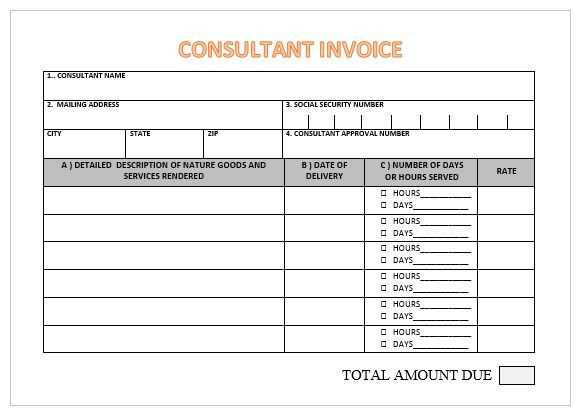

- Business and Client Information: Clearly state your name, business details, and the client’s contact information.

- Work Description: Provide a detailed list of services rendered, including hours worked and the nature of the tasks performed.

- Amount Due: Specify the agreed amount for services, breaking it down if necessary (e.g., hourly rate, flat rate, etc.).

- Payment Terms: Include the due date, late fees, and preferred payment methods.

- Additional Notes: Any special terms or conditions, such as discounts or previous payments, should be clearly stated.

How to Customize Your Billing Document

Personalizing the document to fit your business style and the nature of the services you provide can make a significant difference in how your clients perceive your professionalism. Here are a few tips:

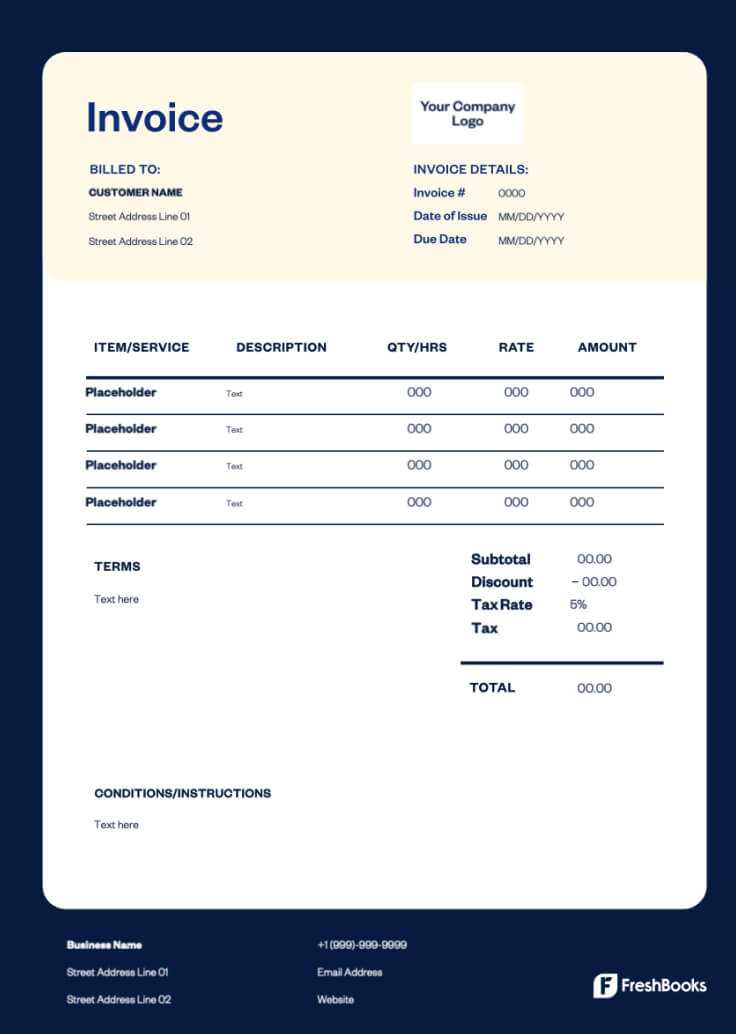

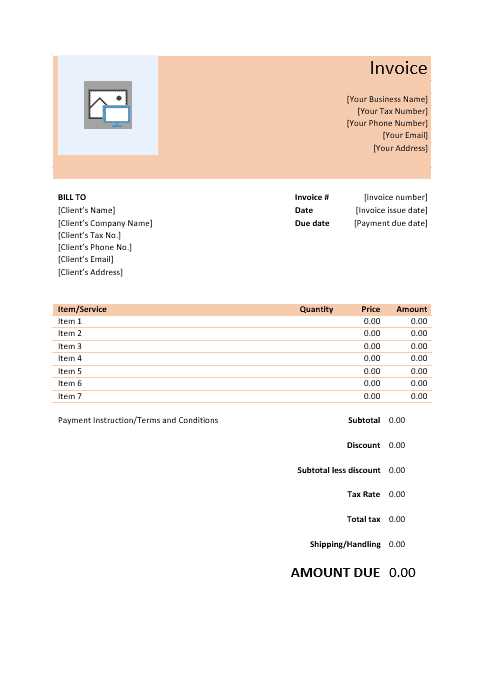

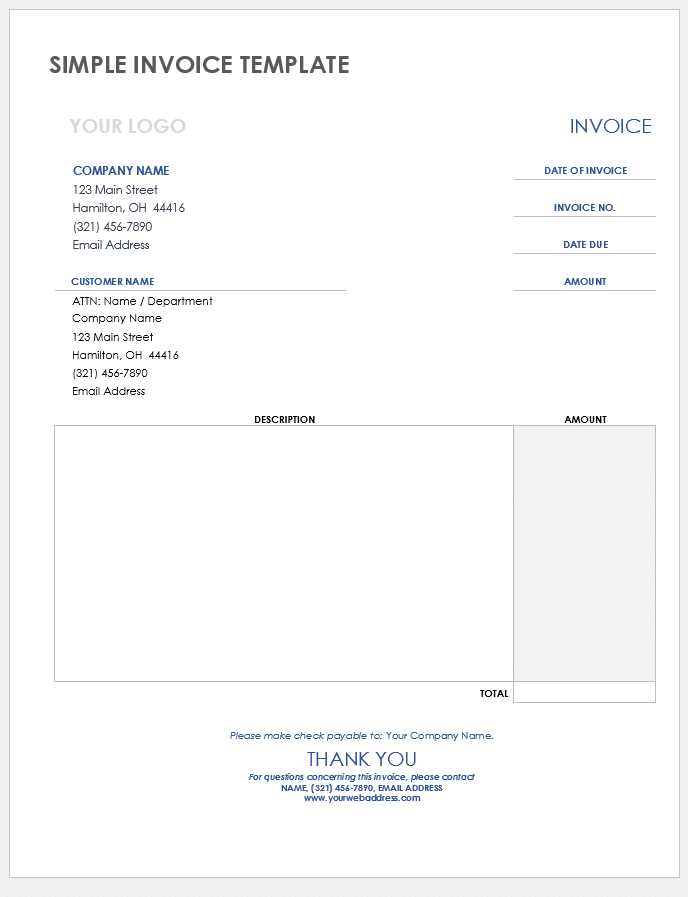

- Choose a clean and organized layout that highlights key information.

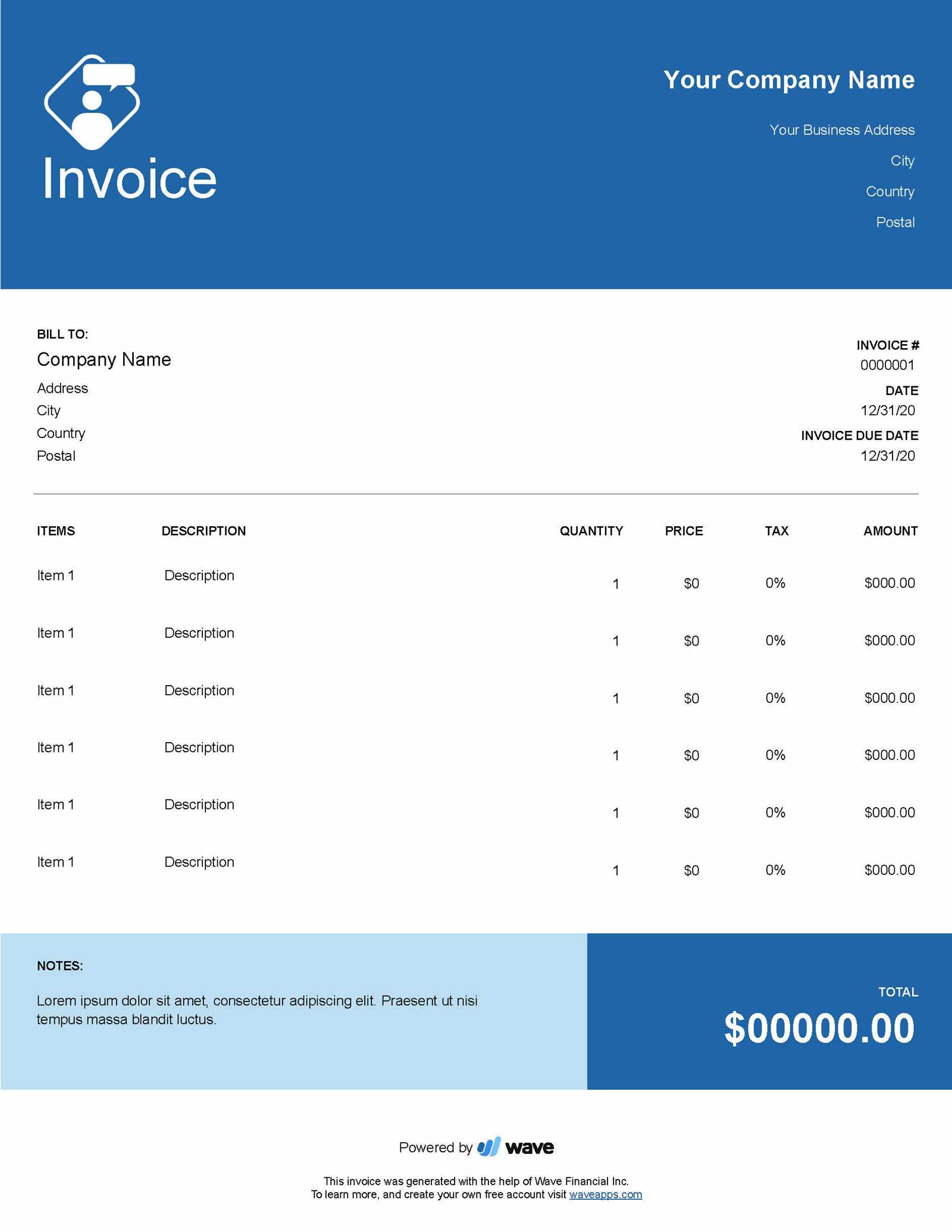

- Use your branding, such as logos and color schemes, to make your document easily recognizable.

- Incorporate automated fields (if using software) for dates, amounts, and client details to save time and reduce errors.

- Ensure consistency in font, spacing, and overall design to create a polished appearance.

By following these guidelines, you can create a straightforward and effective billing document that not only ensures accurate payments but also enhances your professional image.

Why You Need a Consulting Invoice

Having a clear, organized document to request payment for services provided is crucial for both you and your clients. This not only ensures that you are compensated properly but also helps maintain transparency and professionalism. Without such a document, misunderstandings may arise, leading to delayed payments or even disputes.

Ensuring Accurate Record Keeping

A well-prepared payment request serves as an official record of the work completed and the amount owed. This can be essential for tracking your income and managing finances, especially when preparing for tax season. Keeping these records organized will make it easier to report your earnings, track payments, and ensure everything is up to date.

Maintaining Professional Relationships

Using a formal billing structure demonstrates professionalism and helps build trust with your clients. It shows that you are serious about your work and value the business relationship. By providing clear terms, such as payment deadlines and accepted methods, you reduce the likelihood of confusion, which can strengthen your client connections in the long run.

In summary, having a detailed and well-structured payment request is essential for smooth transactions, accurate financial records, and maintaining strong client relationships.

Key Elements of an Invoice Template

For any professional providing services, a well-structured payment document is essential. It not only helps ensure accurate billing but also provides the necessary details for clients to make prompt payments. A good document should be clear, comprehensive, and easy to understand. Below are the key components that should be included to make sure your payment request is complete and effective.

- Your Contact Information: Clearly list your name or business name, address, phone number, and email. This helps clients know exactly who the document is from and how to reach you if needed.

- Client’s Contact Information: Include the recipient’s details–name, address, and contact information. This ensures that the payment is directed to the correct party.

- Document Number: Every request for payment should have a unique identification number. This helps you track each transaction and organize your financial records.

- Detailed Description of Services: List the services provided, including hours worked, rates, and any other pertinent details. This helps avoid confusion about what exactly is being charged.

- Total Amount Due: Specify the total amount your client owes. If applicable, include a breakdown of the amount to clarify how it was calculated.

- Payment Terms: State when the payment is due, and any applicable late fees or discounts for early payment. This ensures that both parties are clear about the payment expectations.

- Payment Methods: Specify how you prefer to receive payment, such as via bank transfer, credit card, or another method.

- Additional Notes: You may want to include extra details, such as tax information, reference numbers, or any other relevant terms and conditions.

Including all of these components ensures your billing document is professional, clear, and effective, making it easier for both you and your clients to process payments smoothly.

How to Customize Your Invoice

Personalizing your billing document helps create a professional and branded experience for your clients. A custom payment request not only reflects your business identity but also ensures that all necessary details are presented in a way that suits both your and your clients’ preferences. Customization can also make the process more efficient, reducing errors and saving time on future transactions.

Here are a few steps you can follow to tailor your document to your specific needs:

- Branding Your Document: Add your logo, business name, and contact information at the top of the document. This will make it clear to the client who the document is from and reinforce your brand identity.

- Choose a Clean Layout: Select a design that is easy to read and navigate. Keep sections well-organized, ensuring that key details like amounts due, payment terms, and work descriptions are clearly highlighted.

- Adjust Terms and Conditions: Include specific payment deadlines, late fees, or discounts for early payments that apply to your business. Adjust these terms depending on your particular agreements with each client.

- Use Automated Fields: If you’re using digital software, take advantage of automated fields for dates, amounts, and client information. This reduces the chance of mistakes and speeds up the creation of new payment requests.

- Incorporate Custom Notes: Add any additional information that may be relevant to the client, such as thank-you messages, reminders, or project milestones.

By making these adjustments, you not only ensure the document is more aligned with your business but also provide a smoother, more transparent experience for your clients.

Setting the Right Consulting Rate

Determining the correct amount to charge for your services is one of the most important aspects of running a successful business. Setting a fair yet competitive rate ensures you are compensated adequately for your expertise while also attracting and retaining clients. It’s essential to find a balance that reflects your skills, experience, and the value you bring to your clients, without pricing yourself out of the market.

To establish the right pricing structure, consider the following factors:

- Industry Standards: Research the going rates in your industry to ensure your pricing aligns with what others are charging for similar services. This helps you stay competitive while positioning yourself appropriately in the market.

- Your Experience and Expertise: If you have specialized skills or extensive experience, you can justify a higher rate. Consider your qualifications, certifications, and track record when determining your pricing.

- Market Demand: The demand for your services can significantly affect how much you can charge. If your area of expertise is in high demand, you may be able to charge more than if the market is saturated.

- Client Budget: Consider the financial capacity of your clients. Some businesses may be able to afford premium pricing, while others may require more budget-friendly options. Understanding your clients’ budgets can help you tailor your rates accordingly.

- Project Scope and Complexity: The complexity and size of a project should also influence your pricing. Larger, more complex projects typically warrant higher rates, while smaller or more routine tasks may be priced more moderately.

By carefully evaluating these factors, you can set a rate that reflects the value of your work while ensuring that both you and your clients are satisfied with the arrangement.

Choosing the Best Invoice Format

When creating a document to request payment for your services, selecting the right format is essential for clarity and efficiency. The format you choose will determine how easily your client can process the information, and how well you can track and manage your payments. A good format should be clear, professional, and adaptable to different types of projects and clients.

Types of Formats to Consider

There are several options to choose from when deciding how to structure your payment request:

- Simple Text Format: This is a straightforward option where the essential details are listed in a plain text document. It’s quick to create and works well for smaller businesses or casual transactions.

- Spreadsheet Format: Spreadsheets offer flexibility and are ideal if you need to track multiple projects or generate detailed cost breakdowns. This format can also easily calculate totals and tax, reducing errors.

- Professional Software: Using invoicing software can automate many aspects of the billing process, such as generating unique IDs, tracking payments, and creating customized layouts. Many tools allow for digital signature options and client portals for added convenience.

- PDF Format: A PDF is widely accepted, professional, and easily printable. It ensures that your layout remains consistent across different devices, making it a good choice for formal transactions and clients who prefer printed copies.

Choosing the Right Format for Your Needs

The best format for your payment request depends on your business model and the preferences of your clients. Consider the complexity of your services, the number of clients you handle, and how comfortable your clients are with digital documents. A simple layout may suffice for small projects, while larger engagements or long-term clients might benefit from more detailed tracking options.

By selecting the right format, you ensure that your payment requests are clear, professional, and easy to process, helping to streamline your workflow and foster stronger client relationships.

Common Mistakes in Consulting Invoices

While preparing documents to request payment for services rendered, professionals often make mistakes that can delay payment or lead to misunderstandings with clients. These errors can range from simple oversights to more serious issues that affect the clarity or accuracy of the document. Identifying and avoiding these common mistakes can help ensure smoother transactions and improve client relationships.

Errors to Avoid

- Missing or Incorrect Client Information: One of the most common mistakes is failing to include the correct details for the client, such as their name, address, or contact information. An inaccurate record can delay processing and cause confusion.

- Vague Descriptions of Services: If the services provided aren’t clearly outlined, clients may question the charges. Be specific about the tasks completed, hours worked, or deliverables provided to avoid any disputes.

- Incorrect Payment Terms: If the payment due date, late fees, or payment methods are not clearly stated or are incorrect, it can lead to confusion or missed payments. Always ensure that these terms are precise and easy to understand.

- Failure to Number Documents: Not assigning a unique number to each document can make it difficult to track payments or identify discrepancies. This can also cause issues with accounting and tax reporting.

- Omitting Tax Information: Many professionals forget to include applicable taxes or fail to provide tax identification numbers. This can result in non-compliance or delays in payment if the client is unable to process the transaction correctly.

How to Avoid These Mistakes

To avoid these common errors, take the time to double-check all details before sending out your payment requests. Use a standard format that ensures all essential information is included. Additionally, consider using invoicing software to automate parts of the process, which can help reduce human error and streamline the workflow.

By being thorough and precise in your payment documentation, you can reduce the likelihood of mistakes and foster a more professional and efficient process with your clients.

Tracking Payments with Invoice Templates

Effectively tracking payments is crucial for maintaining a healthy cash flow and keeping your financial records organized. By utilizing well-structured billing documents, you can easily monitor outstanding balances, identify overdue payments, and ensure that each transaction is recorded properly. This helps avoid confusion and ensures that your financial process remains efficient and transparent.

Here are some effective ways to track payments using a well-organized payment document system:

- Assign Unique Identifiers: Each payment document should have a unique reference number. This allows you to easily track which transactions have been paid and which are still outstanding.

- Include Payment Status: Make it clear whether the payment is pending, partially paid, or fully completed. This can be indicated with a simple status field next to the total amount due.

- Set Payment Due Dates: Clearly specify the due date for each payment. This helps both you and your clients stay on track and reduces the chances of overdue balances.

- Record Payment Methods: Keep track of how payments are made–whether through bank transfer, credit card, or another method. This helps in identifying which payment methods are most commonly used and provides a record for future reference.

- Track Partial Payments: If a client makes a partial payment, ensure that this is clearly recorded in your document. Update the remaining balance so that it’s easy to see how much is still owed.

- Use Accounting Software: Many accounting tools and invoicing software can help you automatically track payments. These tools provide an organized overview of all outstanding payments and automatically update the status as soon as payments are received.

By implementing these practices, you can ensure that payments are tracked effectively and that your business maintains a clear financial record. This system also improves communication with clients, as both parties will have access to the same up-to-date information regarding payment status.

How to Handle Late Payments

Late payments are a common challenge for businesses and professionals who rely on timely compensation for their work. Delays in receiving payments can disrupt cash flow and create unnecessary stress. However, handling late payments effectively requires a clear strategy, firm communication, and the ability to maintain positive client relationships while ensuring you are paid fairly and on time.

Here are a few steps to follow when dealing with overdue payments:

- Set Clear Payment Terms: Establishing clear payment deadlines and late fee policies upfront helps clients understand the expectations from the start. Make sure these terms are communicated clearly and included in all payment documents.

- Send Friendly Reminders: If a payment is overdue, start by sending a polite reminder. Sometimes, clients simply forget or face temporary issues, and a friendly nudge can resolve the situation without conflict.

- Offer Payment Options: If a client is facing financial difficulties, offer flexible payment options such as partial payments or extended deadlines. This can help maintain the relationship and still ensure you receive the payment in due course.

- Implement Late Fees: After a grace period, consider adding late fees to the outstanding amount as a deterrent. Make sure that the fees are reasonable and outlined in the initial agreement.

- Know When to Escalate: If reminders and late fees do not work, escalate the issue by sending a formal letter or involving a collection agency. Make it clear that you are serious about receiving payment but remain professional throughout the process.

Here’s a basic example of how a payment schedule with late fees might look:

| Payment Due Date | Late Fee Applied | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Due Date: 30th | No Late Fee | |||||||||

| 1-7 Days Late | 5% of Total Amount | |||||||||

| 8-14 Days Late | 10% of Total Amount | |||||||||

15+ Days

Using Invoices for Tax PurposesProper documentation of all transactions is essential for accurate tax reporting and compliance. By maintaining well-organized payment records, you can ensure that your income is properly reported and that you are able to claim appropriate deductions. These records serve not only as proof of income but also as a way to track business expenses, ensuring you meet tax requirements efficiently. Key Reasons for Keeping Payment Documents

How to Use Payment Documents for Tax Purposes

By keeping accurate records of all transactions and understanding how to use them for tax purposes, you will be better prepared for tax season and can reduce the risk of errors or compliance issues. Creating Professional Invoice DesignsA well-designed document not only communicates important payment details but also reinforces your brand identity. A professional design can create a lasting impression on your clients, making your business appear more credible and reliable. By focusing on clarity, consistency, and aesthetics, you can create documents that are both functional and visually appealing, ensuring smooth communication with your clients. Key Elements of a Professional Design

|