Free Consultant Invoice Template in Word Format

When managing a freelance or consulting business, it’s essential to have clear and professional billing documents that ensure smooth transactions. These documents not only help in tracking payments but also build trust with clients by presenting your services in an organized and formal manner. With the right tools, creating these forms can be both easy and efficient.

In this guide, we’ll explore how to craft effective billing forms using widely accessible software, enabling you to produce customized and professional-looking records. We’ll cover the structure, design, and essential details that make such documents functional and legally sound.

By understanding the key components of a well-structured document and knowing how to personalize it to fit your needs, you can streamline your administrative tasks and focus more on your core business. Whether you’re just starting or looking to refine your current process, this guide will help you create a document that works for you.

Consultant Invoice Template Benefits

Using pre-designed billing forms offers several advantages that can significantly enhance both the efficiency and professionalism of your business operations. These documents help streamline the billing process, saving time while ensuring consistency and accuracy. When you rely on well-structured forms, you avoid errors that can lead to payment delays or misunderstandings with clients.

Time and Effort Savings

Creating a billing document from scratch can be time-consuming, especially when you need to ensure that all the necessary information is included. By using a pre-designed form, you can quickly fill in the required details and focus on other important tasks. Here are some key benefits:

- Quick setup: Pre-made forms are ready to use, so you can start generating records immediately without needing to design or format from the ground up.

- Consistency: Templates ensure that every document follows the same structure, reducing the chance of missing important details.

- Customizable: Many templates allow easy adjustments, meaning you can personalize them for different clients or project types.

Professional Appearance

Using well-designed forms boosts your image and helps convey professionalism. Whether you are working with individuals or companies, having a formal document reflects your commitment to quality. Clients will appreciate the clarity and order in your billing records, which can improve relationships and encourage faster payments.

- Clear layout: A clean, organized structure makes it easier for clients to understand the charges and payment terms.

- Enhanced credibility: A polished document helps build trust with clients, showing that you take your work seriously and are reliable in your financial dealings.

Why Use Word for Invoices

Choosing the right software for creating billing documents is crucial for both ease of use and flexibility. Many professionals and small business owners prefer using word processing programs for generating these records due to their accessibility, customization options, and simple functionality. By selecting a familiar platform, users can focus on content without being distracted by complex features or steep learning curves.

One of the main advantages of using such software is the ability to create clean, professional-looking documents quickly. With built-in formatting tools and predefined styles, it’s easy to create a polished result, whether for one-time projects or ongoing client relationships. Additionally, these programs allow for easy adjustments, whether you need to add custom details or adjust the layout for different clients.

Another benefit is the compatibility and ease of sharing. Files created in a word processor are widely accepted and can be shared via email or other platforms without compatibility issues. This ensures your records can be viewed by anyone, regardless of the software they use. Moreover, the ability to save documents in multiple formats (such as PDF) gives added flexibility when sending finalized versions to clients.

How to Create a Consultant Invoice

Creating a billing document requires attention to detail and a clear structure to ensure accuracy and professionalism. The process of building one from scratch or using a pre-designed layout can be straightforward, as long as you include all the necessary elements. By following a simple step-by-step approach, you can quickly generate an effective document that serves both your needs and those of your clients.

To begin, gather all relevant information that should be included in the document. This typically includes your business name, contact details, the recipient’s information, a description of services provided, and the agreed-upon payment amount. Once this information is collected, it’s time to structure it clearly so that it is easy to read and understand.

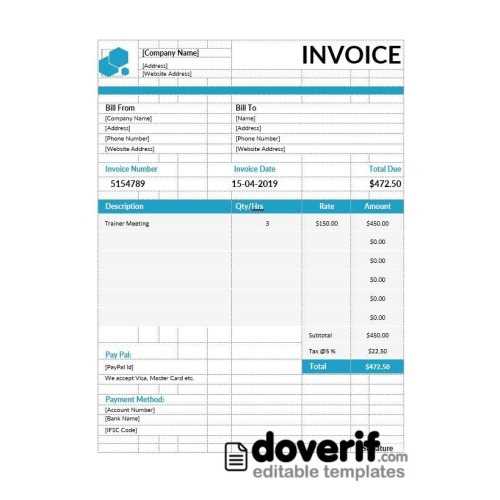

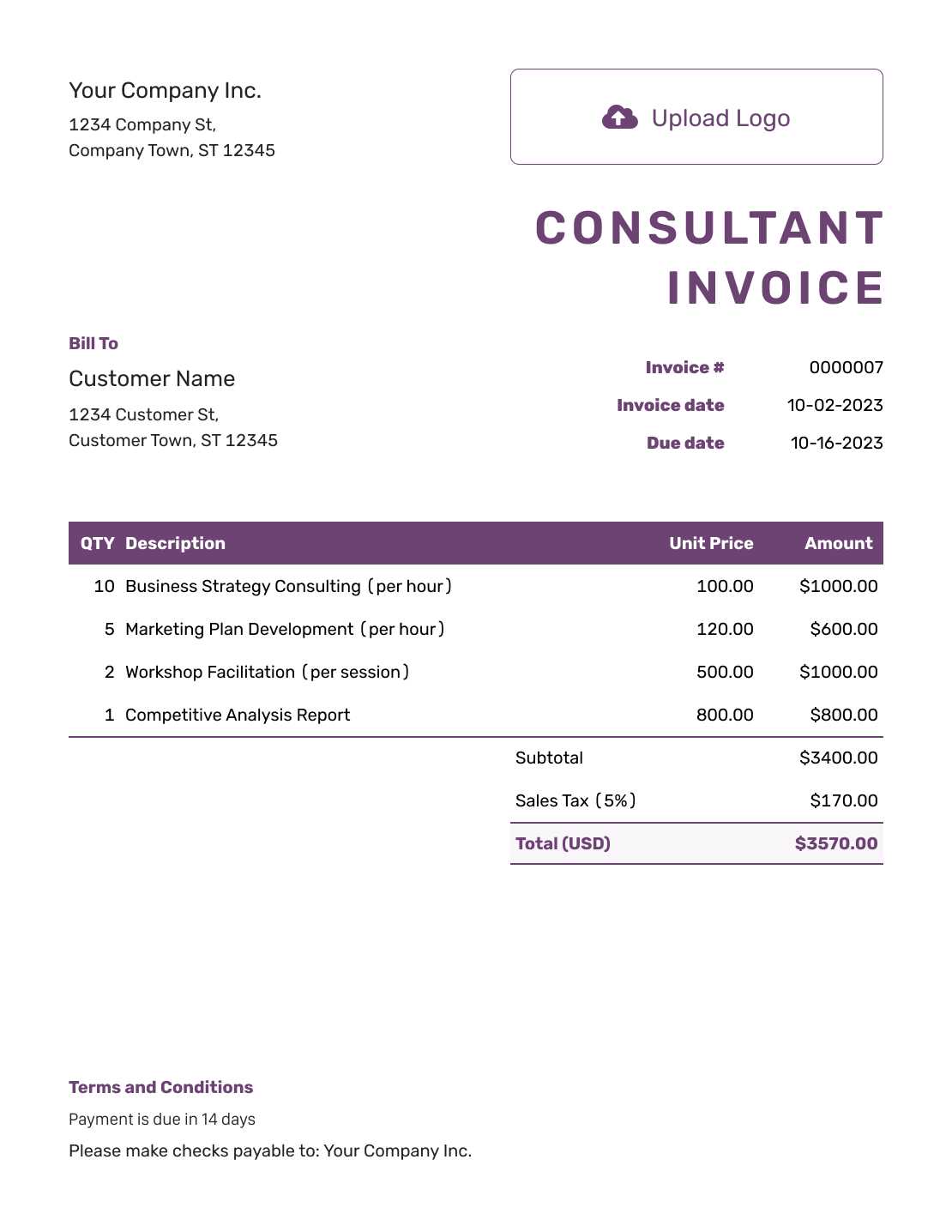

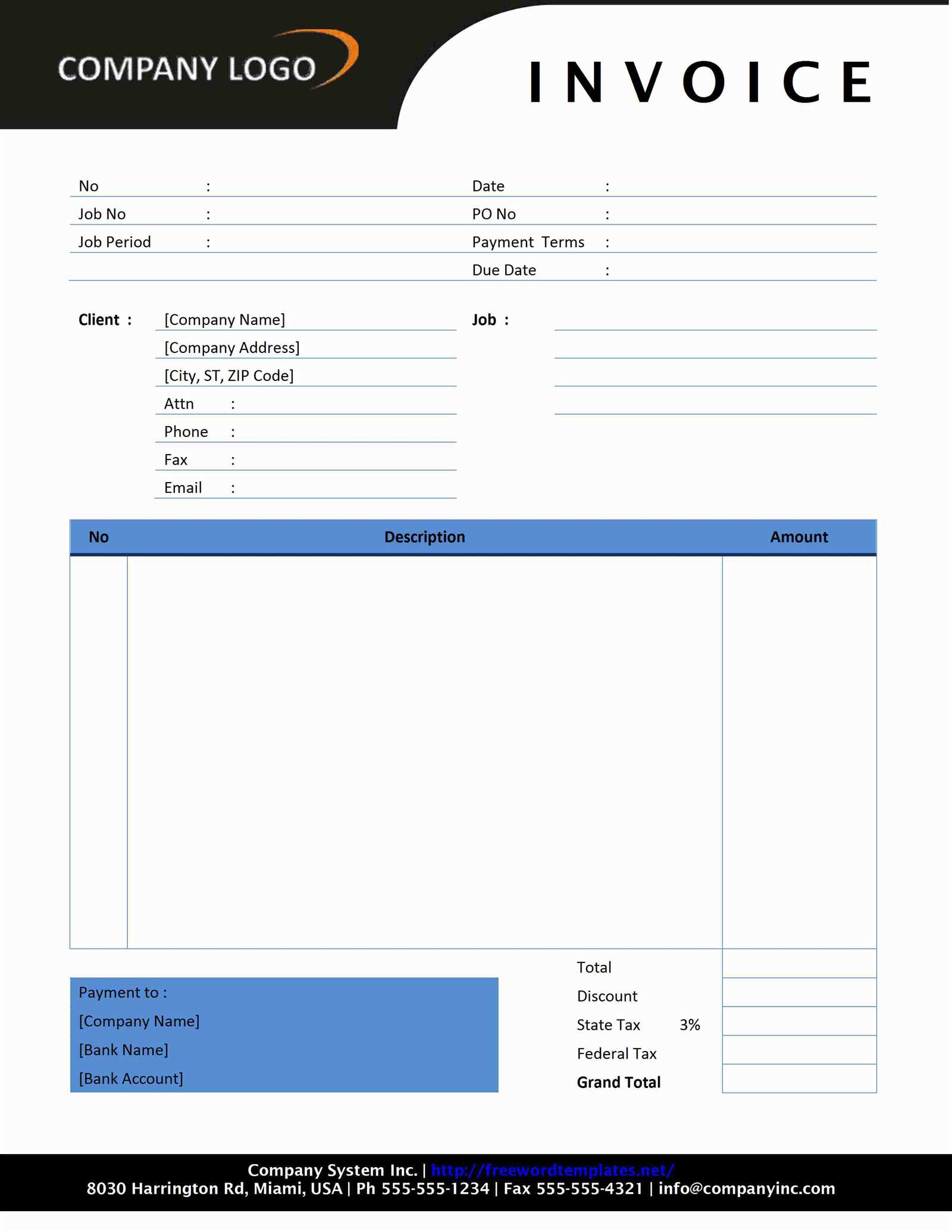

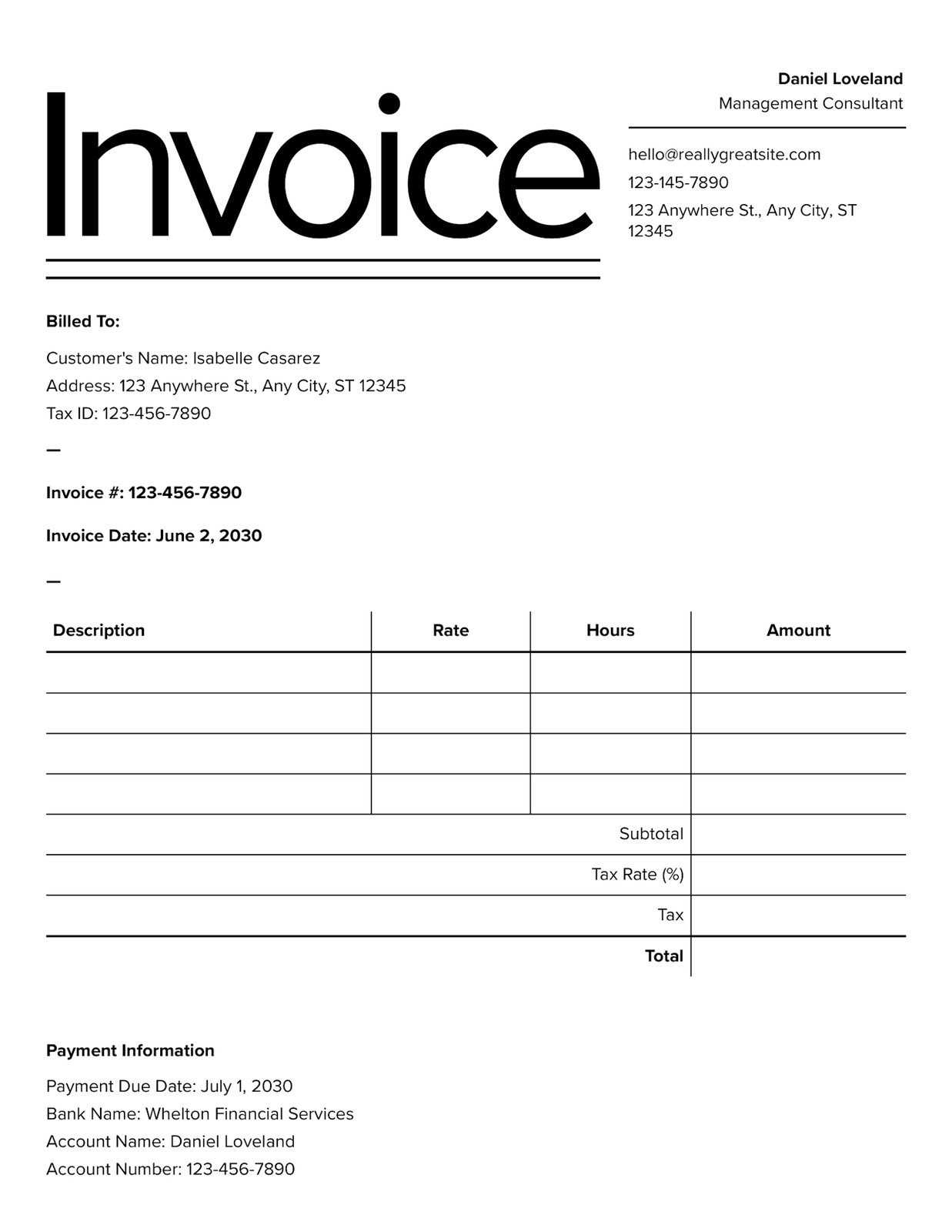

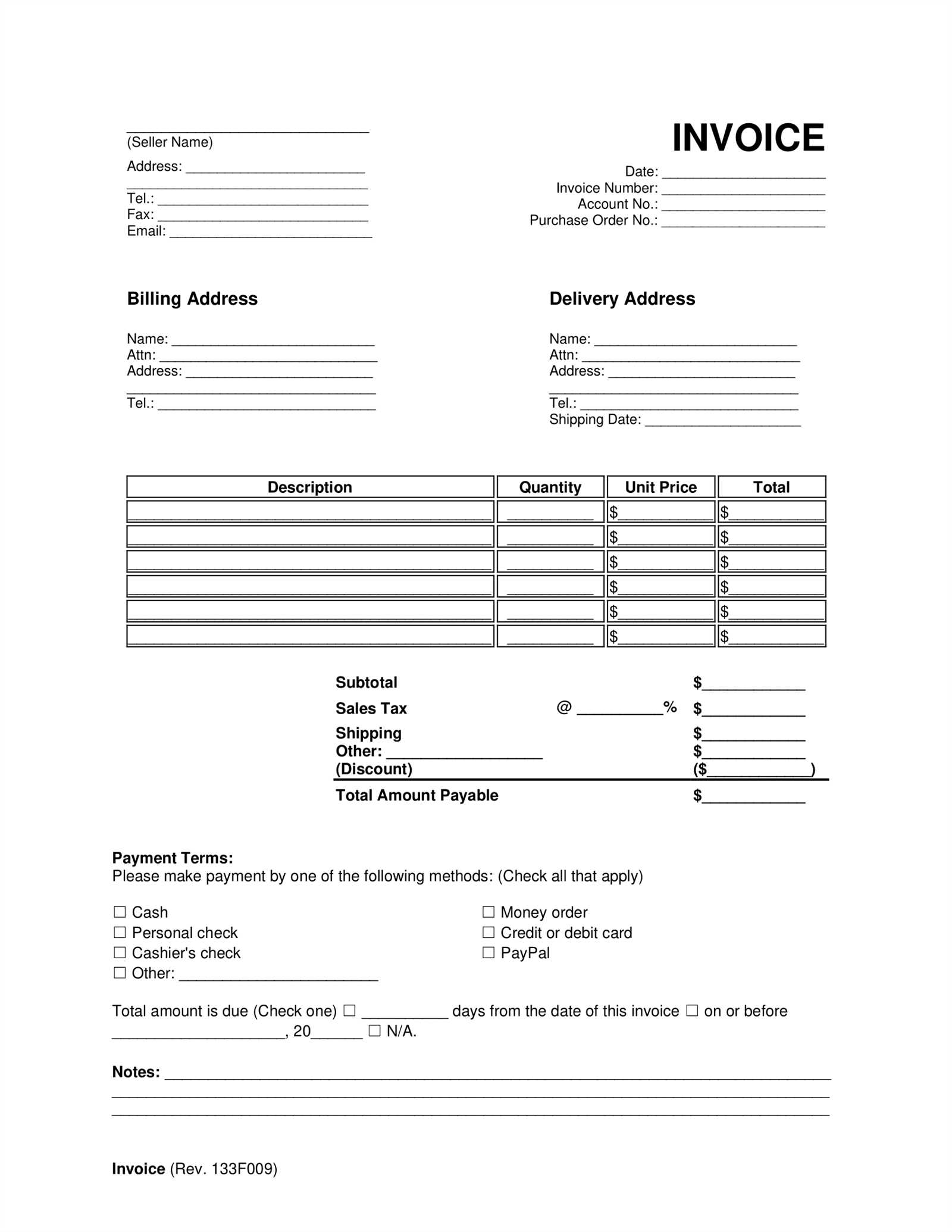

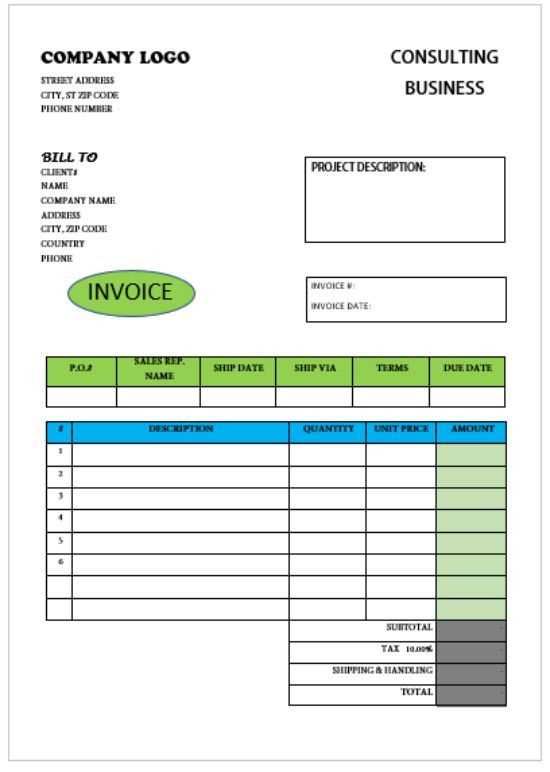

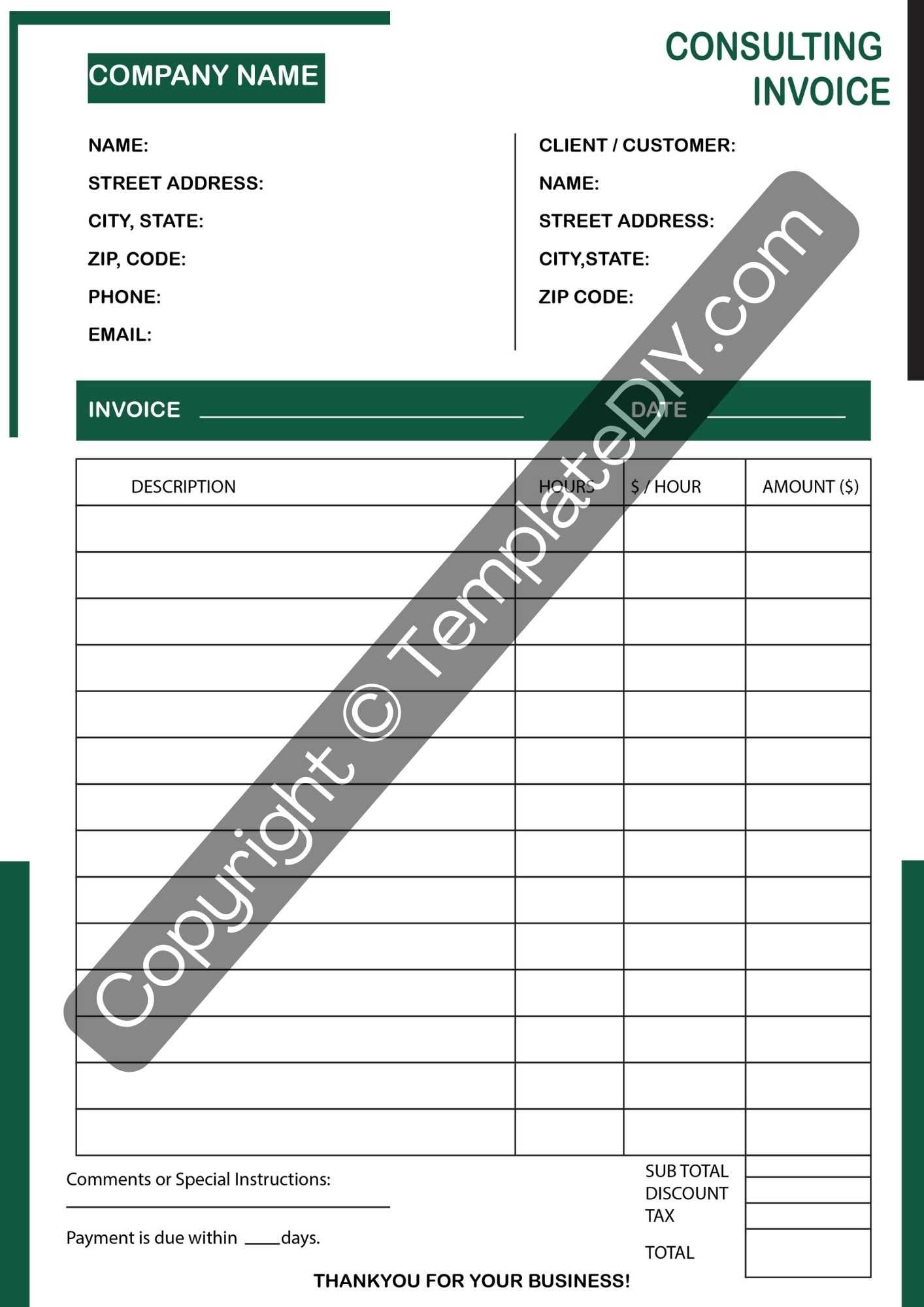

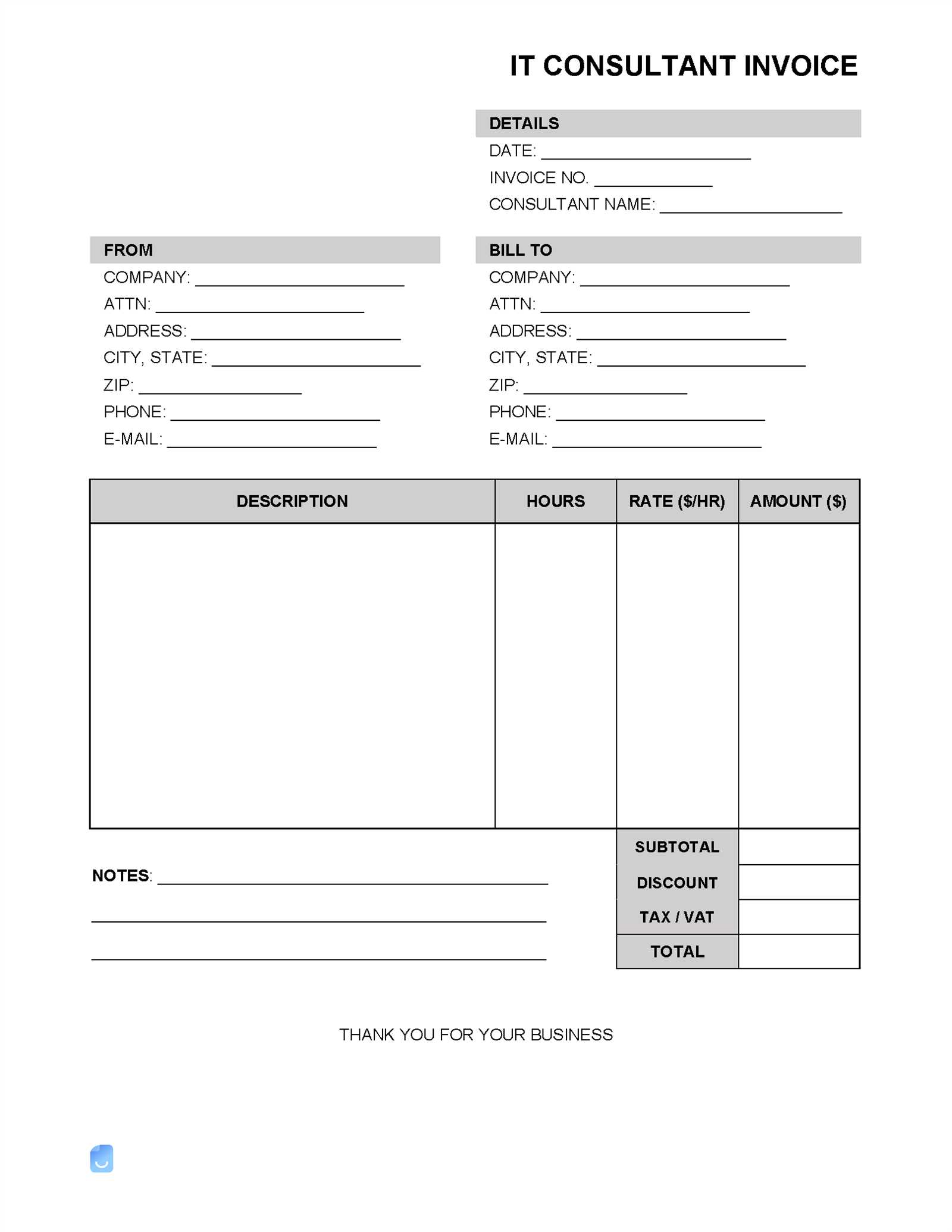

Start by adding a professional header with your company name and logo at the top of the document. Next, include the client’s details beneath the header, followed by the date the services were completed and the payment due date. Below that, list the services rendered with brief descriptions and their corresponding costs. Ensure each entry is organized in a table or bullet-point format for clarity.

Finally, calculate the total amount due and include any payment terms, such as accepted methods of payment, due dates, or late fees. To make the document complete, it’s important to add a polite thank-you note or message at the end, reinforcing your professionalism and appreciation for the business.

Key Elements of a Consultant Invoice

To ensure that your billing documents are both professional and functional, it’s essential to include certain critical elements that make the payment process clear and straightforward. These components not only ensure that your clients have all the information they need but also help prevent confusion or delays in receiving payments. Below are the key elements that should be included in any billing document.

- Your Business Information: This includes your company name, logo, address, phone number, and email address. This helps clients identify the source of the document and ensures they know how to contact you if necessary.

- Client Information: Always include the client’s name, company name (if applicable), and their contact details. This ensures that the document is directed to the right person or department.

- Unique Identification Number: Assign a unique reference or document number to each billing form. This number helps you keep track of your records and makes it easier for clients to reference the document when making payments.

- Service Details: Clearly outline the services or products provided, along with a brief description of each item. This helps clients understand exactly what they are being charged for.

- Dates: Include both the date the service was provided and the date the payment is due. This ensures there is no confusion regarding timelines.

- Payment Amounts: List the amount due for each service or product, including any taxes or additional charges. Be sure to clearly display the total sum at the bottom to avoid any ambiguity.

- Payment Terms: Specify how you would like to receive payment (e.g., bank transfer, check, PayPal) and any deadlines or late fees. This sets clear expectations for the client.

- Additional Notes: Add any extra information, such as a thank-you message, terms and conditions, or discounts applied. This adds a personal touch and reinforces professionalism.

Customizing Your Invoice in Word

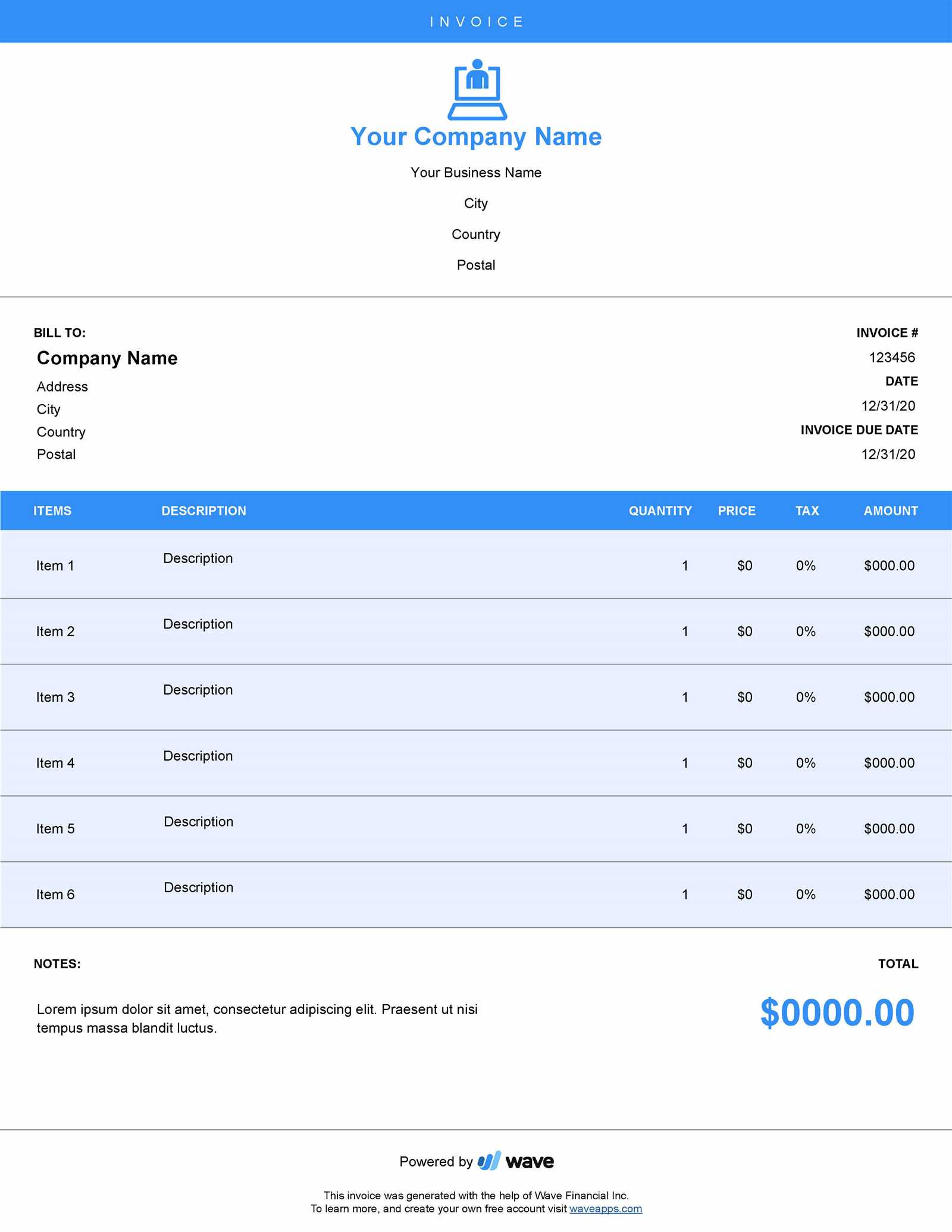

Personalizing your billing document allows you to reflect your brand’s identity while making sure all necessary information is clearly presented. With the right tools, you can modify the layout, colors, fonts, and other details to create a document that not only looks professional but also suits your specific needs. Customization ensures that your clients receive a polished, unique record that aligns with your business style.

When editing your document, focus on key aspects that will help streamline your billing process and improve the client’s experience. Here are a few ways to personalize and customize your billing form:

| Customization Aspect | Description |

|---|---|

| Branding | Add your business logo and use your brand’s colors for headers, footers, or section dividers. This creates a consistent look across all documents. |

| Fonts and Style | Choose a clear, professional font. Adjust font sizes for headings and section titles to make the document easy to read. |

| Service Breakdown | Organize the list of services in a table format for clarity. You can also add additional columns for discount rates, quantities, or time spent, depending on your business model. |

| Payment Instructions | Make payment instructions stand out by highlighting or bolding the relevant sections. This ensures that clients know exactly how to proceed. |

| Additional Notes | Include a personal note or a thank-you message at the end. This helps build rapport with your clients and reinforces positive relationships. |

By customizing your billing form, you create a document that not only meets your business requirements but also enhances your professional image.

Simple Tips for Professional Invoices

Creating a professional billing document is key to maintaining a strong business reputation and ensuring smooth payment processes. A well-organized document not only improves clarity but also reflects your attention to detail and commitment to quality. By following a few simple guidelines, you can create a document that stands out and instills confidence in your clients.

Here are some practical tips for ensuring your records look professional and help facilitate a seamless transaction:

| Tip | Description |

|---|---|

| Clear and Concise Layout | Keep the layout simple and easy to follow. Avoid cluttering the document with unnecessary information. Use white space effectively to make the content more digestible. |

| Professional Font | Choose a clean, easy-to-read font such as Arial, Helvetica, or Times New Roman. Stick to one or two fonts throughout the document to maintain consistency. |

| Proper Alignment | Align text properly–service descriptions, amounts, and dates should all be aligned to make the document easy to scan. Tables should have even spacing to avoid confusion. |

| Accurate Details | Ensure that all information, including names, dates, and payment terms, is accurate. Mistakes can lead to payment delays and reduce trust. |

| Clear Payment Instructions | Specify how the client should make the payment, including bank details, online payment methods, or physical address for checks. Make this section easy to find and understand. |

| Polite Language | Use polite, professional language throughout the document. A thank-you note at the end can help foster positive relationships with clients. |

By incorporating these simple tips into your billing documents, you can ensure that your business appears organized, trustworthy, and professional.

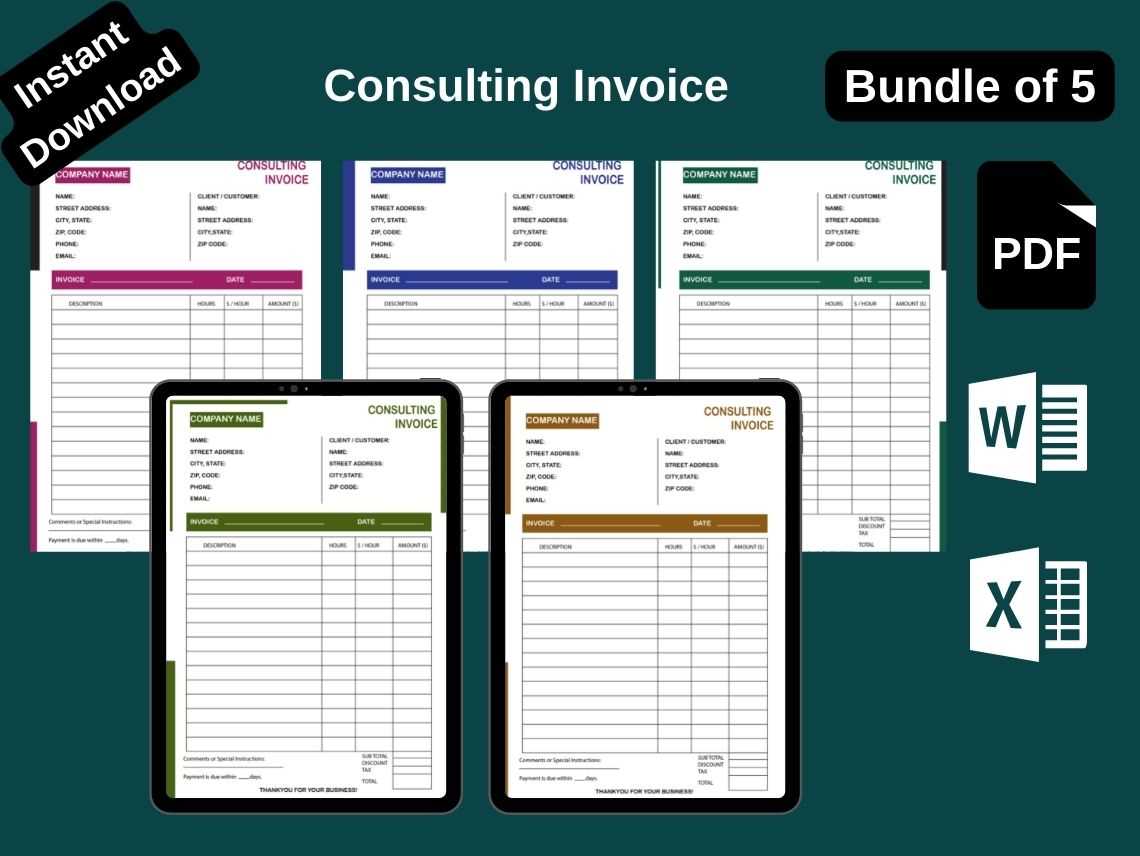

Free Consultant Invoice Templates Online

Finding free resources for creating billing documents can save you time and money while ensuring your records are professional. Numerous online platforms offer customizable forms that can be easily downloaded and adapted to your business needs. These free resources are especially helpful for freelancers or small business owners who may not want to invest in expensive software but still need polished and reliable documents.

Here are some key benefits of using free online resources for your billing records:

- Cost-Effective: Many websites offer free downloadable forms, eliminating the need for purchasing premium software or templates.

- Customizable: These forms are designed to be easily editable, allowing you to adjust the layout, content, and design to fit your business needs.

- Time-Saving: With pre-designed forms, you don’t need to start from scratch. Simply input your details and make any necessary adjustments to create a professional document quickly.

- Variety of Formats: Free online resources typically offer documents in multiple formats (such as PDF, Excel, or editable text files) to accommodate different preferences and tools.

Here are a few places where you can find free downloadable billing documents:

- Microsoft Office Templates: Offers a wide range of free forms that can be customized in Microsoft Office applications.

- Google Docs: Provides easy-to-use forms that can be shared or downloaded in multiple formats.

- Template Websites: Sites like Template.net, Invoice Simple, and FreshBooks offer free, customizable documents suitable for different industries.

- Freelance Websites: Many platforms for freelancers, such as Upwork and Fiverr, provide free resources and document samples to help with administrative tasks.

By taking advantage of these free resources, you can easily create and manage your billing documents without the added expense or complexity of premium software.

Choosing the Best Template for You

Selecting the right document format is essential to creating clear, professional, and effective billing records. Whether you are a freelancer, small business owner, or working with clients on an ongoing basis, it’s important to find a layout that suits your needs. The right format not only saves time but also helps ensure consistency and clarity in every transaction.

Factors to Consider When Choosing a Layout

When deciding on a design for your billing document, consider the following factors to ensure that it meets your specific needs and business type:

| Factor | Consideration |

|---|---|

| Industry Type | Different industries may have specific needs for billing forms. Choose a layout that reflects the type of services you provide and the expectations of your clients. |

| Complexity of Services | If you offer multiple services or products, a layout with detailed breakdowns and extra rows for descriptions might be needed. Simpler services may require a more straightforward format. |

| Personalization | Choose a layout that allows for easy customization. It should offer enough flexibility to add or remove sections based on your specific business requirements. |

| Ease of Use | The format should be user-friendly, with a clear structure that makes it easy for you to input information and for clients to read and understand the document. |

| Visual Appeal | A clean, professional design helps make a positive impression. Look for a format that balances clarity with visual appeal, avoiding unnecessary clutter. |

Common Template Formats to Consider

There are several popular options when choosing a layout for your billing records. Here are some common formats you might come across:

- Basic Format: A simple, no-frills layout that is easy to edit and suitable for straightforward services.

- Detailed Format: Includes additional sections for itemizing each service or product provided, often with spaces for notes, discounts, or taxes.

- Professional Style: A highly polished design with brand customization options like logos and color schemes. Ideal for businesses looking to maintain a strong visual identity.

- Minimalist Style: Focuses on clean lines and readability, with only the essential details. Great for businesses that want to convey simplicity and clarity.

By carefully considering these factors and selecting the right format, you can create billing documents that are both functional and visually appealing, ensuring that your clients receive clear and professional records every time.

Common Mistakes in Consultant Invoices

Even the most well-intentioned billing documents can sometimes contain errors that lead to confusion or delayed payments. It is essential to be aware of common mistakes when preparing these records to ensure smooth transactions with your clients. By addressing these common pitfalls, you can create more accurate and professional documents, reducing the risk of errors that can harm your business relationships.

Common Errors to Avoid

Here are some of the most frequent mistakes people make when preparing billing documents:

- Incorrect Client Information: Ensure that the recipient’s name, address, and contact details are accurate. Errors here can lead to payment delays and communication issues.

- Missing or Incorrect Dates: The dates of service completion and payment deadlines are critical. Always double-check these details to avoid confusion and ensure timely payment.

- Failure to Include a Unique Reference Number: Without a unique number, it becomes difficult for both you and the client to track specific transactions. Always assign a distinct reference to each document.

- Ambiguous Service Descriptions: Each service or product provided should be described clearly and accurately. Ambiguities can cause misunderstandings and make it harder for clients to verify charges.

- Not Including Payment Terms: Payment terms–such as due dates, accepted payment methods, and late fees–should be clearly stated to avoid confusion about expectations.

- Missing Total Amount Due: The total amount due should be prominently displayed. Failing to clearly show the total can cause delays in payment as the client may need to calculate it themselves.

- Incorrect Calculation of Taxes or Discounts: Ensure that taxes, discounts, and any other additional charges are accurately calculated. Mistakes in these calculations can lead to financial disputes or payment issues.

How to Avoid These Mistakes

To avoid making these errors, consider implementing the following best practices:

- Review Each Document: Always double-check the details before sending the document to your client. A thorough review can help catch mistakes before they become an issue.

- Use Templates or Software: Utilizing pre-designed layouts or accounting software can help ensure all required fields are completed and reduce the likelihood of errors.

- Establish Clear Payment Terms: Define your payment expectations upfront with each client to minimize misunderstandings later.

- Keep Records Organized: Maintain an organized system for tracking your transactions. This will make it easier to spot any discrepancies in your billing documents.

By avoiding these common mistakes and following best practices, you can create more accurate, professional billing documents that promote timely payments

How to Avoid Invoice Errors

Creating accurate and error-free billing documents is essential for maintaining smooth business operations and positive client relationships. Small mistakes in these records can lead to confusion, delayed payments, and even strained partnerships. To ensure that your billing records are correct and professional, it’s important to follow a few simple steps to reduce the chances of errors occurring.

Here are some effective strategies for avoiding common mistakes and ensuring your documents are flawless:

- Double-Check All Information: Before sending any document, review all details for accuracy. This includes client names, contact details, service descriptions, dates, and amounts. Small mistakes can easily lead to larger issues down the line.

- Use Reliable Tools: Consider using software or pre-designed layouts that are specifically made to help create accurate records. These tools can automatically fill in fields, reduce errors, and save time.

- Keep a Consistent Format: Consistency is key when creating billing documents. Use the same structure and terminology for every record to minimize confusion and ensure that you don’t forget important details.

- Set Clear Payment Terms: Always specify payment due dates, accepted payment methods, and any penalties for late payments. Clear terms help clients know exactly what is expected and reduce the likelihood of disputes.

- Incorporate Automatic Calculations: If possible, use automatic calculation features for taxes, discounts, and totals. This reduces the risk of human error when adding or multiplying amounts.

- Request Confirmation: Ask clients to confirm receipt of your document and the details contained within it. This proactive approach can help catch any errors early, before a payment is made.

- Maintain Organized Records: Keep accurate, easily accessible records of all transactions and billing documents. This will allow you to spot any inconsistencies or errors more easily and resolve them promptly.

By implementing these strategies, you can avoid the most common errors and ensure that your billing documents are clear, accurate, and professional. This will help foster strong business relationships and ensure timely payments.

Organizing Your Invoices Efficiently

Efficient organization of your billing documents is essential for smooth financial management and ensuring timely payments. A disorganized approach can lead to missed deadlines, forgotten transactions, or difficulty in finding specific records when needed. By developing a streamlined system for storing and managing your documents, you can save time, reduce errors, and stay on top of your financial tasks.

Here are some practical tips for keeping your records well-organized and easy to access:

- Create a Consistent Naming System: Develop a standard naming convention for your documents, such as including the client name, document type, and date (e.g., “ClientName_Service_2024-11-06”). This will make it easier to locate specific records later.

- Use Folders and Subfolders: Organize your documents into clearly labeled folders. For example, create a main folder for each client and subfolders for different types of transactions (e.g., services, payments, adjustments). This helps keep everything in one place.

- Leverage Cloud Storage: Storing your documents in cloud-based platforms like Google Drive, Dropbox, or OneDrive offers easy access from anywhere and provides additional security by backing up your files online.

- Maintain Separate Files for Different Years: Keep your records separated by year to avoid mixing up old and new transactions. This will also make year-end tax preparation easier.

- Use Software for Tracking: Consider using accounting or invoicing software that automatically tracks payments, overdue amounts, and document history. These tools can provide an overview of your financial situation at any time.

- Organize by Status: Sort your records by status–whether they are paid, unpaid, or overdue. This makes it easier to follow up on outstanding payments and keep track of your finances in real-time.

- Keep Physical and Digital Copies: If your business requires paper records, make sure to store physical copies in labeled folders and create digital backups. Digital copies are easier to organize and retrieve when needed.

By implementing these organizational strategies, you can streamline your workflow, minimize the risk of losing important records, and maintain a more efficient and professional approach to managing your financial documents.

Saving Time with Invoice Templates

Managing billing documents can be time-consuming, especially when you’re creating them from scratch for every transaction. By using pre-designed formats, you can streamline the process, ensuring that your records are created quickly and efficiently. These ready-made forms allow you to focus on your core tasks without compromising the quality and professionalism of your financial documents.

How Templates Help Save Time

Using pre-designed forms comes with several time-saving benefits that can significantly improve your workflow:

- Consistency: With a set format, you don’t have to worry about reinventing the structure every time you need to create a new document. This ensures all your records are uniform and easy to understand.

- Pre-filled Fields: Many forms come with placeholders for essential information like dates, client details, and services rendered. This means you only need to fill in the unique information for each transaction, reducing the time spent on formatting.

- Automation: Some tools allow for automatic calculations of totals, taxes, and discounts, saving you from having to manually calculate each item. This reduces the risk of errors and makes the process faster.

- Quick Customization: Most templates can be easily customized to suit your business’s needs, allowing you to adjust the design, add your logo, or modify sections without starting from scratch each time.

Practical Tips for Using Templates

To make the most out of ready-made formats, follow these simple tips:

- Save Custom Versions: After customizing a form for one client or project, save that version as a new template for future use. This way, you’ll avoid having to start over every time.

- Use Cloud-Based Tools: Storing your templates on cloud platforms allows you to access them anywhere, anytime, making it even easier to generate records while on the go.

- Update Templates Regularly: Ensure that your templates reflect the most current information, including payment terms, contact details, and legal information. This will keep your records professional and accurate.

By integrating pre-designed billing forms into your routine, you can save significant time and effort, ensuring a more efficient process while maintaining a high level of professionalism in your financial dealings.

How to Invoice Multiple Clients

Managing billing for multiple clients can be a challenge, especially when you have to create and track numerous documents simultaneously. However, with the right approach and tools, you can streamline this process and ensure that every client receives their billing record on time and without errors. Organizing your records and maintaining clarity in your documents is key to managing multiple transactions effectively.

Steps to Efficiently Bill Multiple Clients

When handling multiple clients, it’s important to stay organized and follow a structured approach. Here are some steps to ensure you don’t miss any details:

- Keep Client Information Organized: Maintain a master list of all clients with their contact details, payment terms, and services rendered. This will help you quickly reference information when creating records.

- Use a Standard Format: To save time, create a standard layout that you can use for all clients. This ensures consistency and helps you avoid errors when entering information.

- Track Due Dates: Keep a calendar or spreadsheet to track due dates for each client. This will help you stay on top of deadlines and ensure you don’t forget to send or follow up on any documents.

- Batch Processing: Instead of creating documents one by one, set aside time to batch process multiple documents at once. This is an efficient way to handle the administrative side of your business without constantly interrupting your workflow.

Helpful Tools for Managing Multiple Clients

There are various tools available to help you manage multiple transactions with ease:

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero offer built-in features to track payments, create records, and manage clients all in one place.

- Spreadsheets: Use Google Sheets or Excel to create a detailed client and payment tracking system. This can help you monitor payments, see who has paid, and identify any overdue amounts.

- CRM Systems: A Customer Relationship Management system can help you store client information, track communication, and ensure your billing records are organized.

Example of a Client Billing System

Here is an example of how you might organize your client billing process:

| Client Name | Service Provided | Amount Due | Due Date | Status |

|---|---|---|---|---|

| Client A | Consulting | $500 | 2024-11-15 | Unpaid |

| Client B | Proj

Invoice Design Best PracticesThe design of your billing documents plays a crucial role in ensuring clarity, professionalism, and efficiency. A well-structured, aesthetically pleasing document not only makes it easier for your clients to understand the charges but also reflects positively on your business. Whether you’re sending a simple record or a detailed breakdown, following design best practices can enhance communication and help avoid potential confusion. Here are some key design elements to consider when creating your billing records:

By following these design best practices, you ensure that your billing documents are not only functional but also reflect your professionalism and attention to detail. A well-designed document creates a positive impression and helps maintain clear communication with your clients, which can lead to smoother transactions and timely payments. Legal Requirements for Consultant InvoicesWhen creating billing documents, it is essential to ensure that they comply with legal requirements. These documents are not just for record-keeping; they also serve as official proof of the transactions between you and your clients. Ensuring that your billing records meet legal standards can help avoid disputes, fines, and complications, especially during audits or tax filings. Essential Legal Elements

To ensure that your documents are legally compliant, they must include specific information. While requirements can vary depending on your country or jurisdiction, the following details are generally mandatory:

Additional Legal ConsiderationsIn addition to the basic details, there are a few other legal aspects to consider:

By ensuring your billing documents meet all necessary legal requirements, you can avoid legal challenges, maintain professionalism, and build trust with your clients. Keep in mind that compliance is key to running a smooth and legal busin Tracking Payments with Consultant Invoices

Keeping track of payments is a critical part of maintaining cash flow and ensuring that your business remains financially healthy. Properly managing and monitoring payments from clients can help avoid missed payments, identify overdue balances, and streamline your financial processes. A well-organized system for tracking payments will also save you time and reduce stress when managing multiple clients and projects. Key Steps for Efficient Payment Tracking

To ensure that payments are properly recorded and tracked, it’s important to have a clear, organized system in place. Here are some key steps to effectively track payments:

Tools for Tracking PaymentsSeveral tools can help you automate and streamline the process of tracking payments:

By staying organized and using effective tools for tracking payments, you can reduce the risk of missed payments, improve cash flow management, and keep your finances in order. With accurate and up-to-date records, you can avoid potential issues and ensure timely payments from a |