Consultant Invoice Template for Professional Services

Creating accurate and timely billing documents is essential for anyone offering specialized expertise. Whether you’re an independent worker or part of a larger consultancy, having a clear and professional way to present charges is crucial for maintaining trust and ensuring payments are processed without delay.

Effective billing practices not only help in getting paid on time but also reflect the professionalism of the individual or team behind the work. This guide explores how to simplify the billing process through structured, customizable formats, making the task less time-consuming and more efficient for all parties involved.

With the right tools, you can generate documents that are both clear and comprehensive, ensuring that all necessary details–such as payment terms, labor rates, and client information–are included. This will enhance your reputation and contribute to smoother transactions with clients.

Benefits of Using a Consultant Invoice Template

Streamlining your billing process is essential for maintaining professionalism and efficiency in your business transactions. By utilizing a structured document for outlining charges and payment terms, you can ensure accuracy and clarity for both you and your clients. This approach simplifies the process, saving valuable time and reducing the likelihood of errors.

One of the major advantages of using a well-organized document is that it ensures all necessary details are included without omission. Key information such as hourly rates, work descriptions, and due dates are clearly presented, minimizing confusion and potential disputes. Additionally, a consistent format helps build trust with clients, as they know exactly what to expect every time.

Efficiency is another important benefit. With a ready-made structure, you can quickly fill in the relevant data and send the document without having to start from scratch each time. This is particularly useful for those managing multiple clients or projects simultaneously, as it saves time while maintaining accuracy and professionalism.

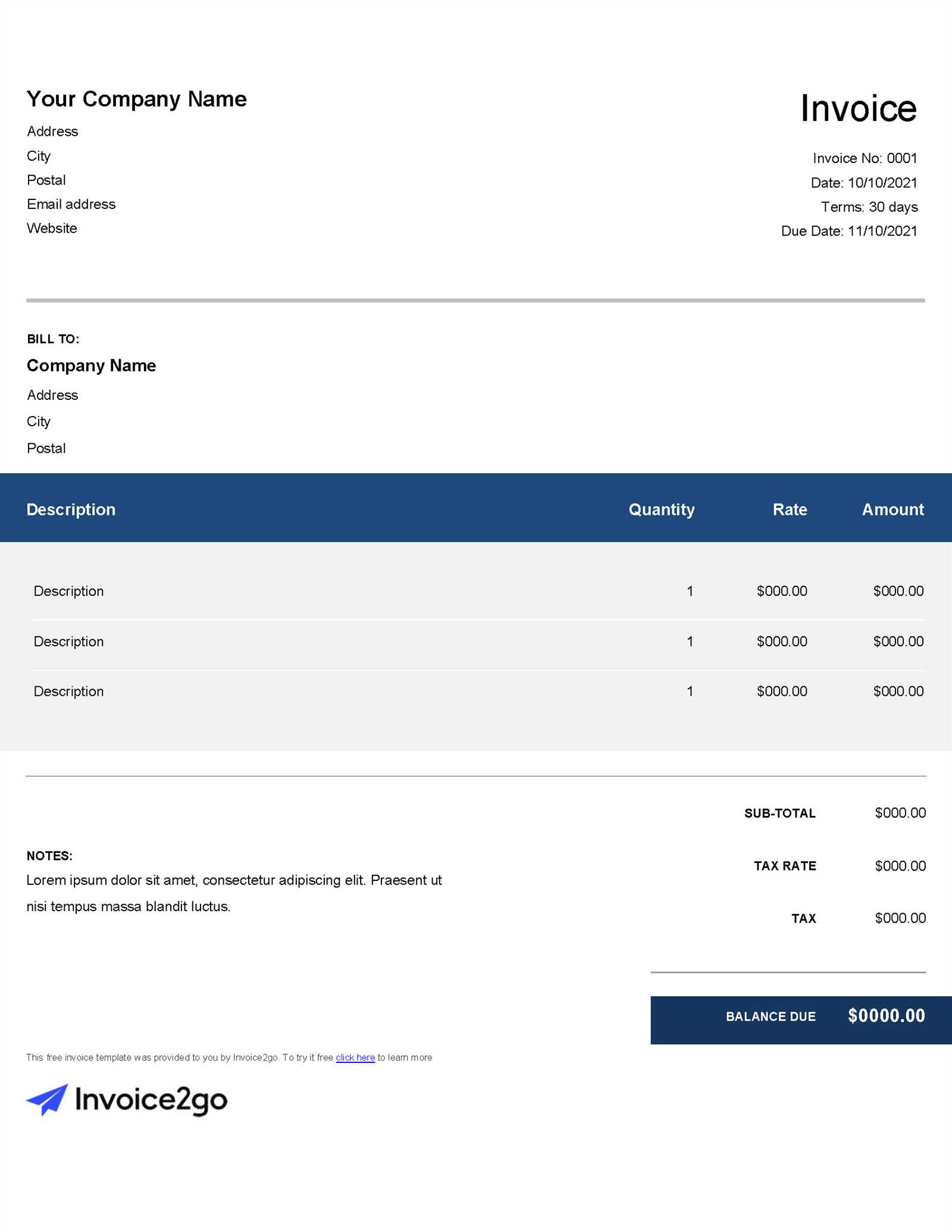

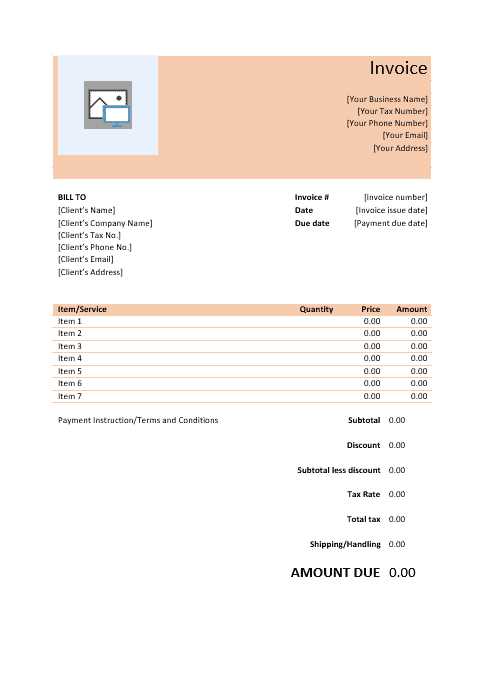

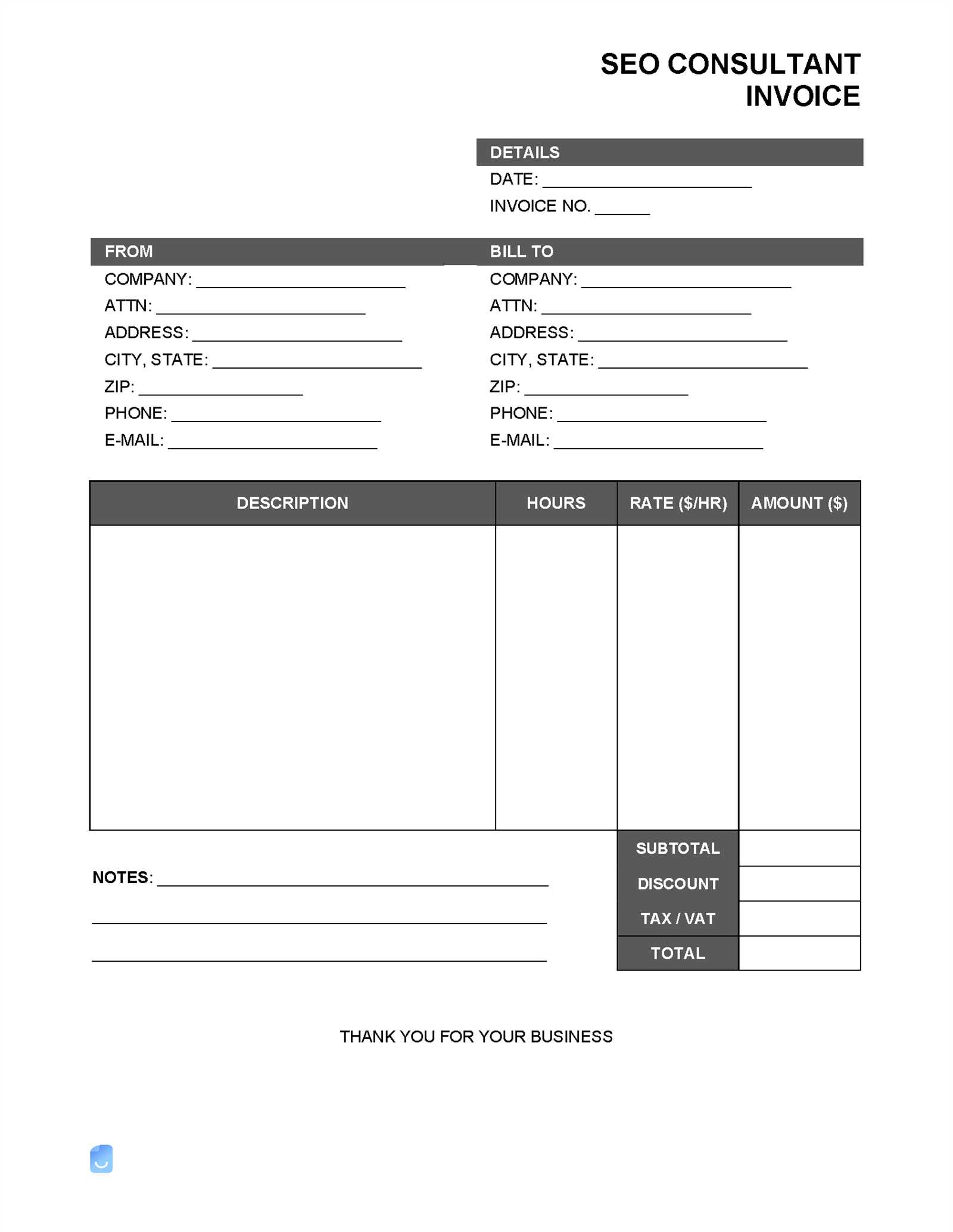

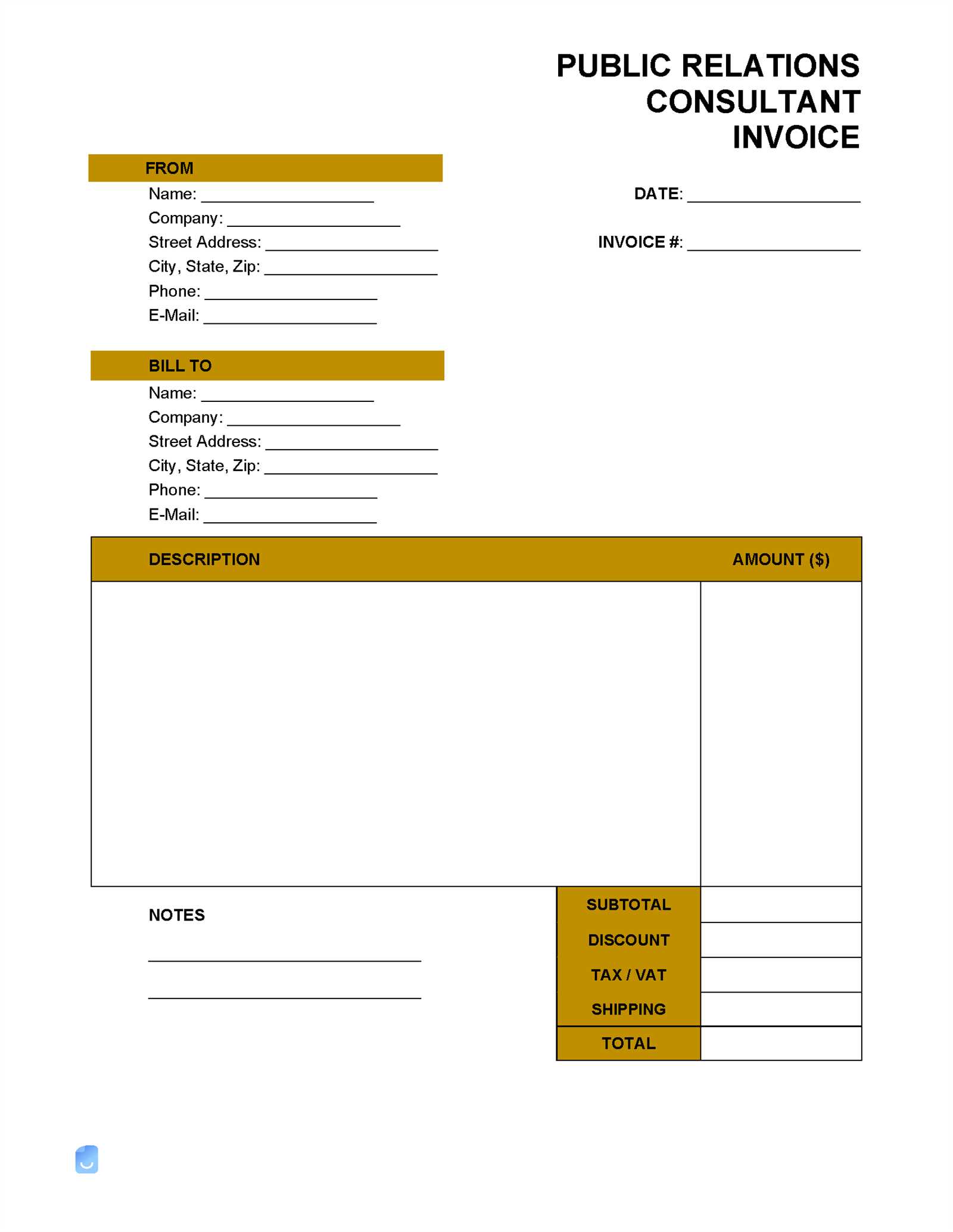

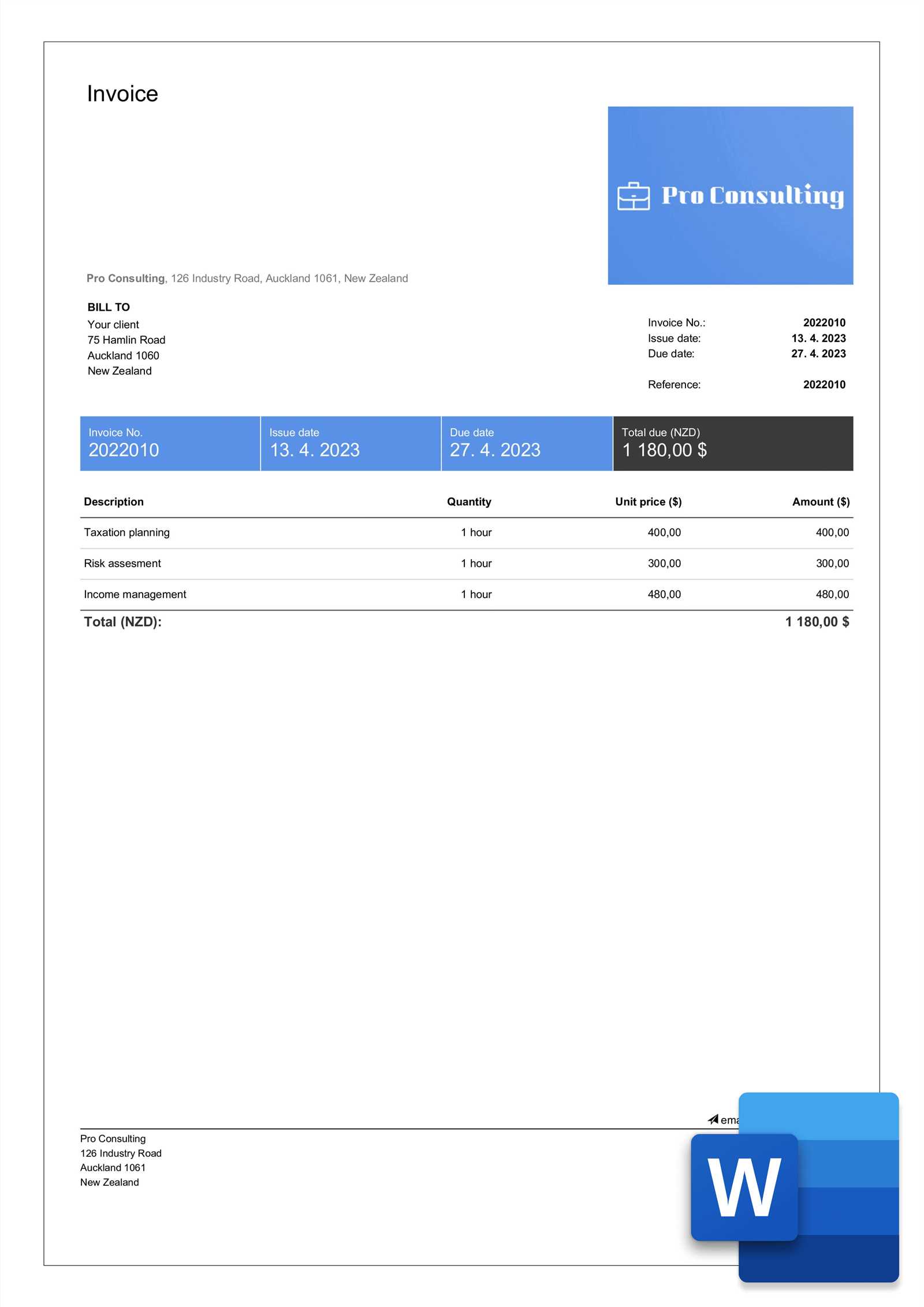

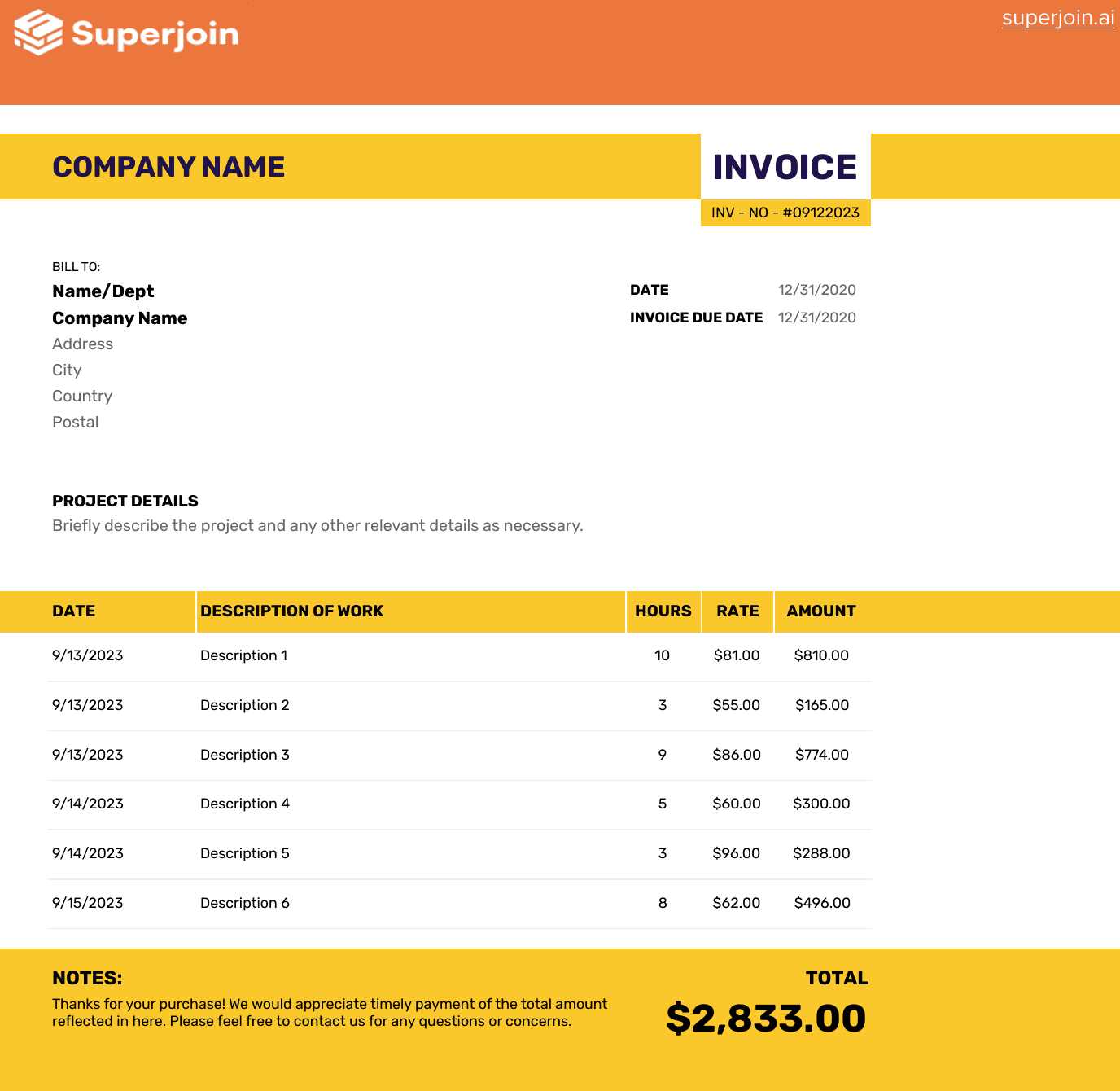

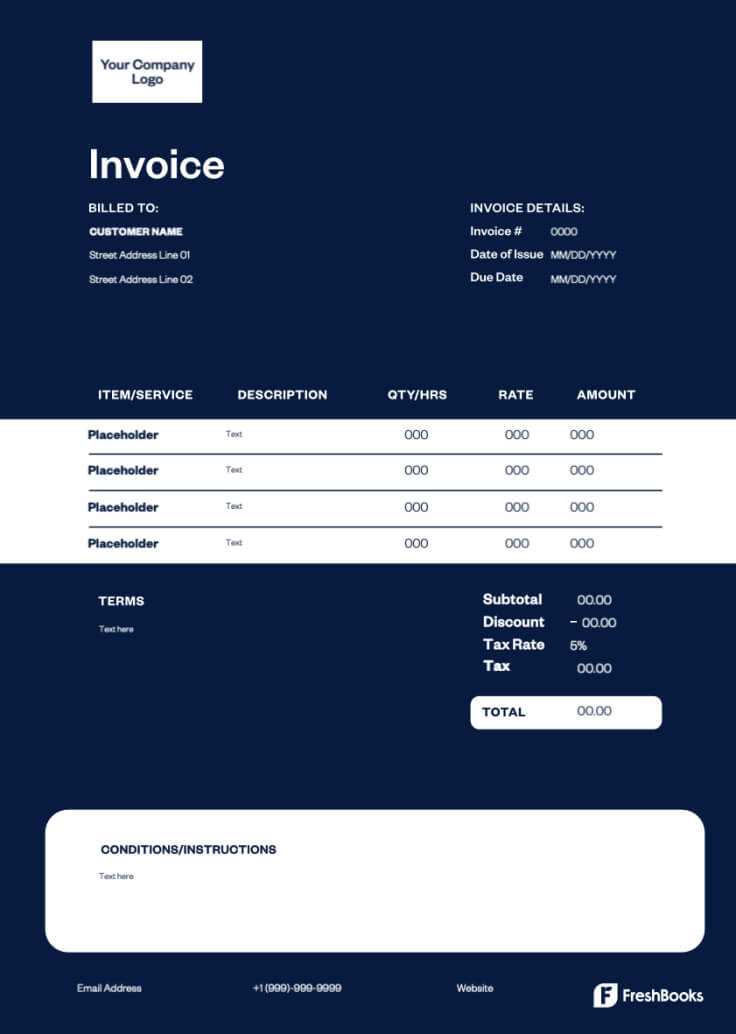

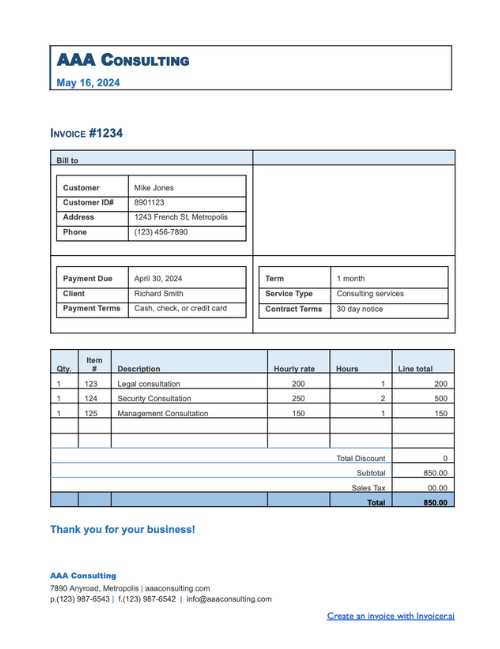

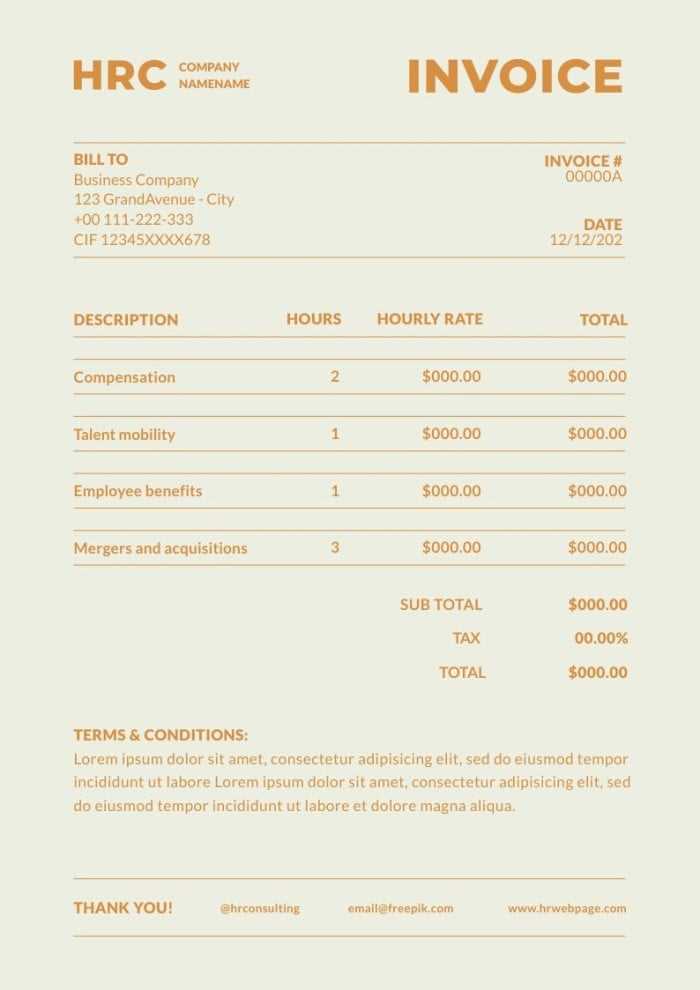

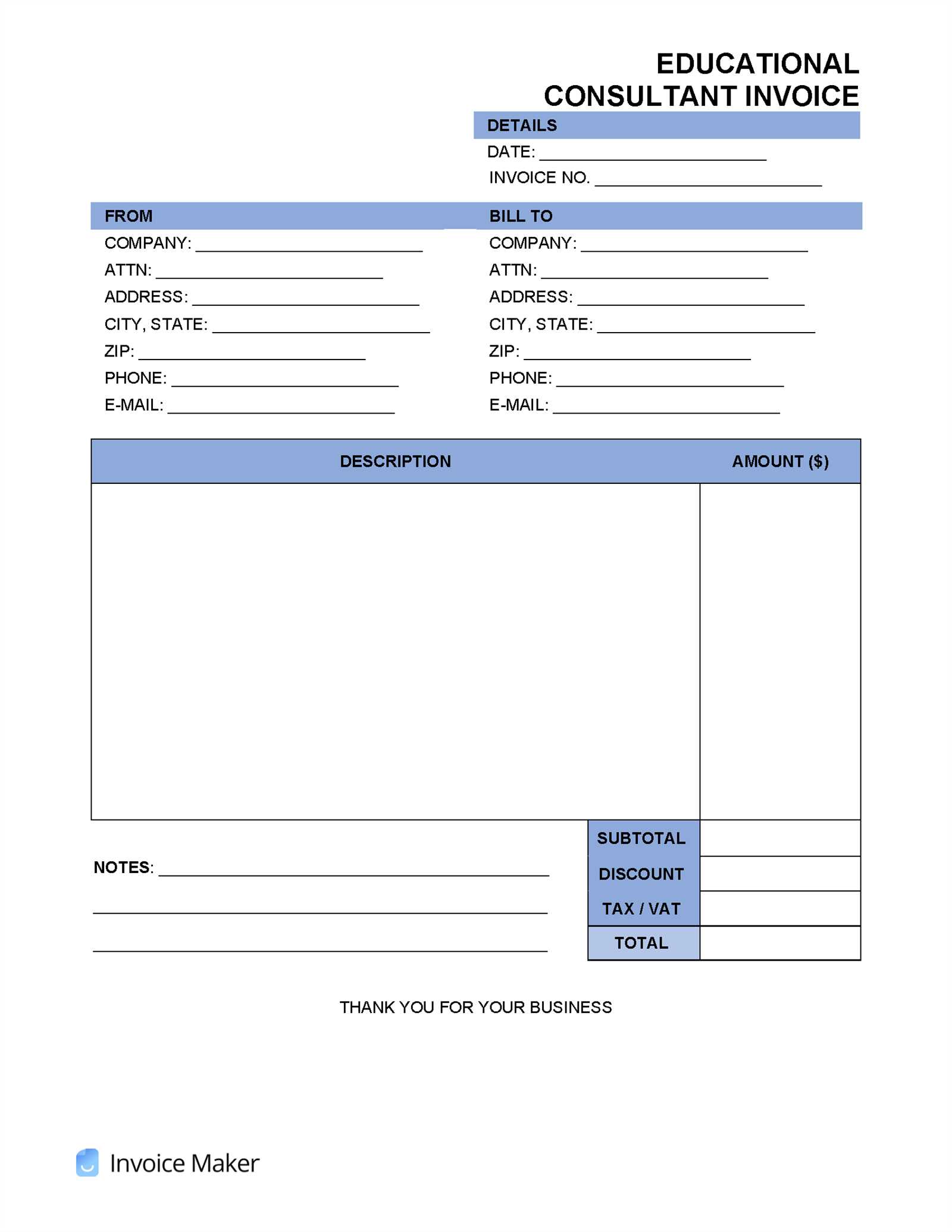

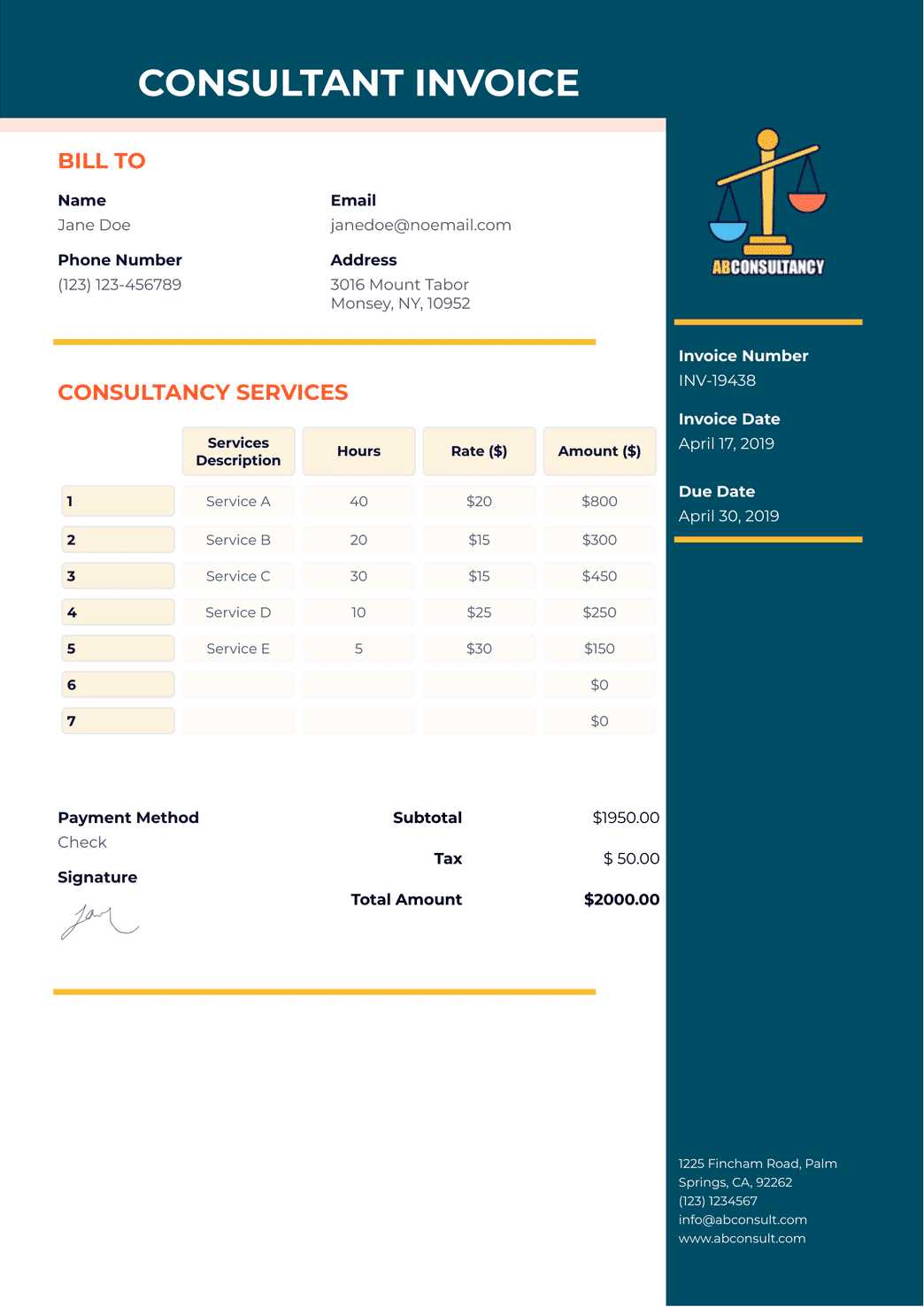

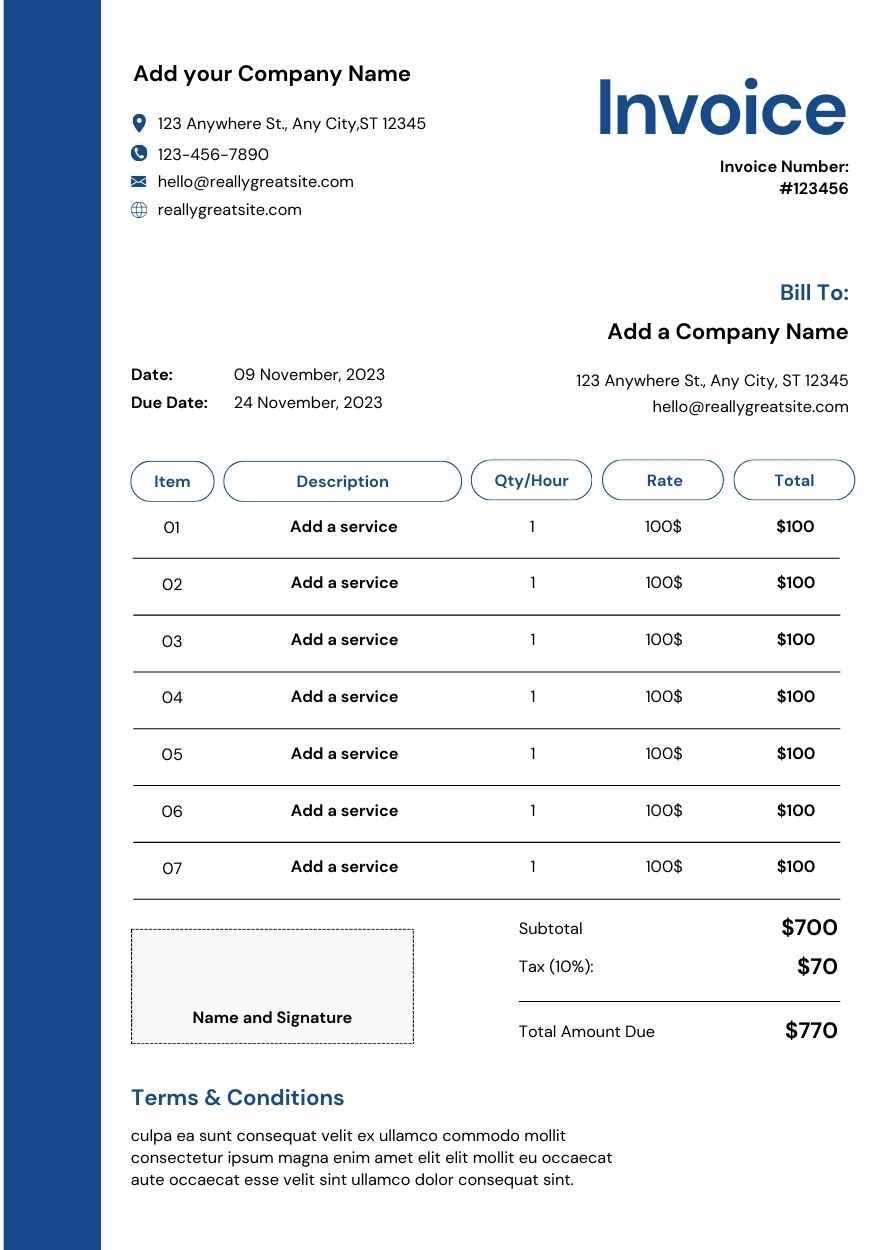

Key Features of Professional Invoice Templates

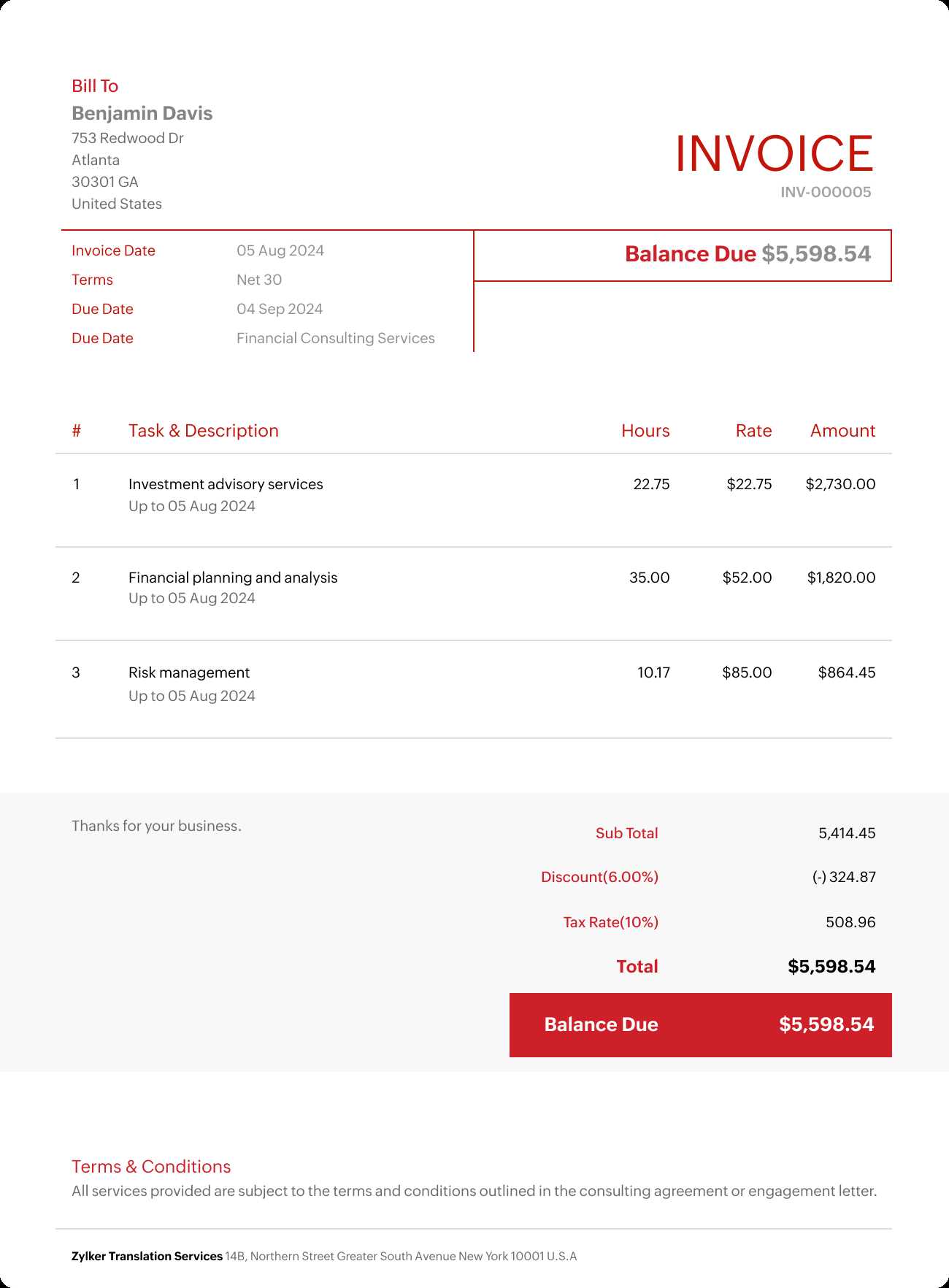

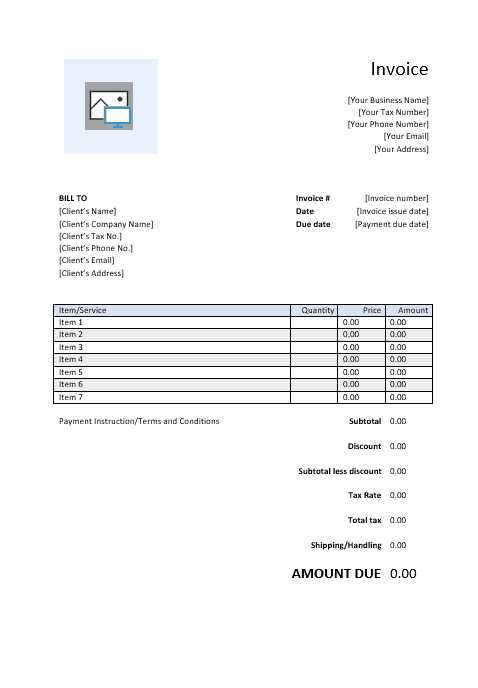

A well-designed document for billing is more than just a way to request payment; it serves as a clear record of the transaction and reinforces your credibility. The best formats include several key elements that ensure both clarity and completeness, making it easy for clients to understand the charges and terms.

First, a detailed breakdown of the work performed is essential. This includes itemized descriptions of tasks, hours worked, and rates charged, which provide transparency for the client. Additionally, including clear payment terms such as due dates, late fees, and accepted payment methods ensures that both parties are on the same page regarding financial expectations.

Another important feature is the consistent layout. A clean, organized structure makes it easy for clients to read and quickly find the necessary details. This includes spaces for client information, your contact details, and any relevant reference numbers or project identifiers that add to the professional appearance of the document.

How to Customize Your Invoice Template

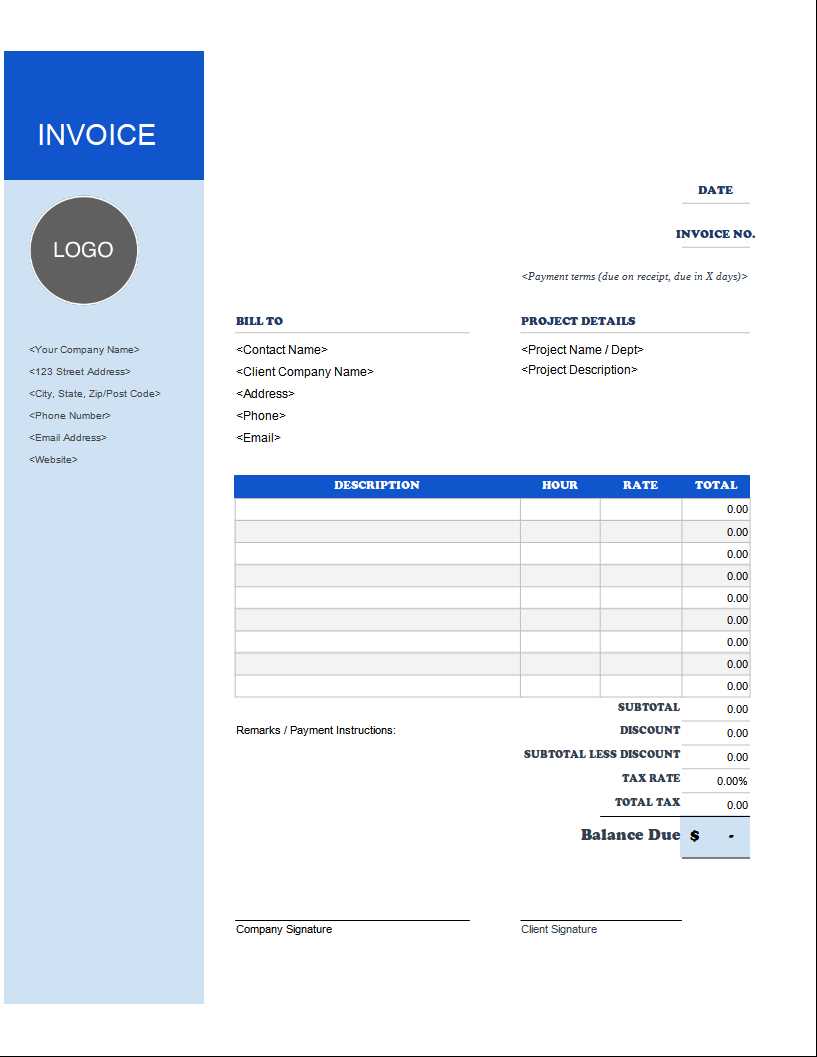

Personalizing your billing document to reflect your business’s unique needs and style can make a significant difference in both professionalism and efficiency. Customization allows you to align the format with your branding and ensure all essential details are included, creating a cohesive and polished document for clients.

Step 1: Adjust the Layout

The first step in customization is adjusting the layout to suit your preferences and business requirements. You can choose to add or remove sections depending on the nature of your work. For example, you may want to add a section for project milestones, or if your work is based on hourly rates, include columns for hours worked and rates charged.

Step 2: Add Your Branding

Incorporating your logo, business name, and contact details adds a personal touch and helps with brand recognition. Most billing documents allow for easy insertion of a company logo at the top, alongside your contact information. You can also adjust fonts and colors to match your overall brand aesthetic.

| Section | Customization Tips |

|---|---|

| Client Information | Ensure it includes accurate billing address, phone number, and email. |

| Description of Work | Customize to clearly reflect services or tasks performed. |

| Payment Terms | Include your preferred payment method and due dates. |

Essential Elements in Consultant Invoices

When creating a document to request payment, including the right information is crucial for ensuring clarity and avoiding misunderstandings. A well-organized bill should clearly outline the work completed, the agreed-upon rates, and the terms of payment, allowing both parties to understand the transaction fully. These key details help maintain professionalism and ensure prompt payment.

First and foremost, the document should feature a clear description of the tasks or projects completed, along with specific dates and quantities. This transparency ensures that the client can easily verify the work performed. Additionally, specifying rates and hours worked is essential, particularly when charging based on time or unit pricing.

Another critical element is the inclusion of payment terms. This section outlines when the payment is due, any penalties for late payments, and acceptable payment methods. Ensuring that these details are visible and easy to understand reduces the chances of confusion or delayed payments.

Choosing the Right Template for Your Business

Selecting the correct structure for your billing document is an essential step in ensuring that your business transactions are clear, organized, and professional. The right format should not only reflect the nature of your work but also align with your brand’s identity and meet the specific needs of your clients. With many options available, it’s important to consider several factors when making your choice.

When choosing a structure, consider the following aspects to ensure it suits your business:

- Type of Work: Different tasks may require different levels of detail. For example, hourly-based work may need a section to track time spent, while project-based work might focus more on deliverables and milestones.

- Client Preferences: Some clients may prefer more detailed records, while others may find a simple, straightforward format sufficient. Understand your client’s needs to make sure your documents meet expectations.

- Branding: The design should reflect your business identity. Ensure that your document includes your logo, colors, and contact details in a way that aligns with your overall branding.

- Flexibility: Choose a format that allows you to easily modify or update sections. This is especially important if you frequently work on different types of projects or with various pricing models.

By considering these factors, you can select a structure that is functional, professional, and reflective of your business approach.

Common Mistakes in Invoice Creation

Creating a billing document might seem straightforward, but several common mistakes can lead to confusion or delayed payments. Whether it’s omitting crucial details, miscalculating amounts, or failing to follow up on outstanding balances, these errors can impact both your cash flow and your professional reputation. Being aware of these issues is the first step toward ensuring smooth transactions with clients.

Here are some of the most common mistakes to avoid when preparing your billing documents:

- Missing or Incorrect Client Information: Always double-check the client’s name, address, and contact details. An incorrect address or missing contact info can delay processing or delivery.

- Un

Legal Considerations for Consultant Invoices

When preparing documents to request payment, it is important to be aware of the legal aspects that govern these transactions. Ensuring that your billing records comply with relevant laws not only protects your business but also ensures that clients have a clear understanding of the payment terms and conditions. Legal compliance can prevent disputes and safeguard your interests.

Key Legal Elements to Include

Several key elements must be included in any billing document to meet legal standards. These include:

- Clear Payment Terms: It is crucial to specify when the payment is due and what penalties apply for late payments. This ensures that both parties are aware of their financial obligations.

- Tax Information: If applicable, ensure that the correct tax rates are applied, and the tax amount is clearly stated. This is important for both compliance and record-keeping purposes.

- Legal Business Name and Contact Info: Always include your official business name, registration number (if applicable), and contact details. This allows clients to verify your business legitimacy and avoid potential issues.

- Dispute Resolution Clause: Including a section outlining how any disputes will be handled, such as through mediation or arbitration, can protect you in case of disagreements.

Common Legal Pitfalls to Avoid

Being aware of potential legal issues can help you avoid costly mistakes. Some common pitfalls include:

- Failure to Provide a Proper Record: Always maintain accurate a

How to Organize Invoice Data Effectively

Efficiently organizing your billing records is crucial for maintaining clarity, reducing errors, and ensuring smooth financial operations. Proper data management helps you track payments, monitor outstanding balances, and keep accurate records for tax purposes. Implementing a systematic approach can save you time and prevent issues down the line.

To organize your billing information effectively, consider the following practices:

- Use a Centralized System: Store all billing records in one central location, such as a digital spreadsheet or accounting software. This will make it easier to access and manage your data.

- Maintain Consistent Naming Conventions: Adopt a consistent method for naming your documents, such as including the client name, project name, and date. This will help you locate specific files quickly.

- Track Payments and Deadlines: Keep detailed notes on when payments are due and when they have been received. Set reminders for follow-ups to avoid overdue balances.

- Sort Data by Categories: Organize your data into categories such as client name, project type, or payment status. This allows for easy sorting and quick access to the relevant information when needed.

By implementing these strategies, you can streamline your billing management, reduce administrative overhead, and maintain a professional and efficient workflow.

Best Practices for Invoice Formatting

Ensuring that your billing document is well-structured and easy to read is essential for maintaining professionalism and ensuring prompt payments. A clear and consistent format not only makes it easier for your clients to understand but also helps avoid potential confusion or disputes. Adopting best practices in formatting can enhance your business’s reputation and streamline your financial processes.

Consider the following tips when formatting your billing documents:

- Use Clear Headings: Begin with distinct headings for each section, such as client information, services rendered, and payment details. This makes the document easier to navigate and ensures that important information stands out.

- Include Essential Information: Ensure all necessary details, such as your business name, contact information, and a unique reference number, are clearly visible. This will help avoid confusion and assist with tracking payments.

- Maintain Consistent Fonts and Spacing: Use a uniform font size and style throughout the document. Consistent spacing between sections and items ensures readability and a professional appearance.

- Use Tables for Line Items: When listing tasks or charges, use a table format to keep the information organized. This makes it easier for clients to see the breakdown of costs and review the charges.

- Highlight Important Information: Use bold or italics to emphasize key details, such as due dates, totals, or payment terms. This draws attention to the most critical elements and helps prevent them from being overlooked.

- Provide a Clear Total: Make sure the total amount due is easy to find and clearly indicated, usually a

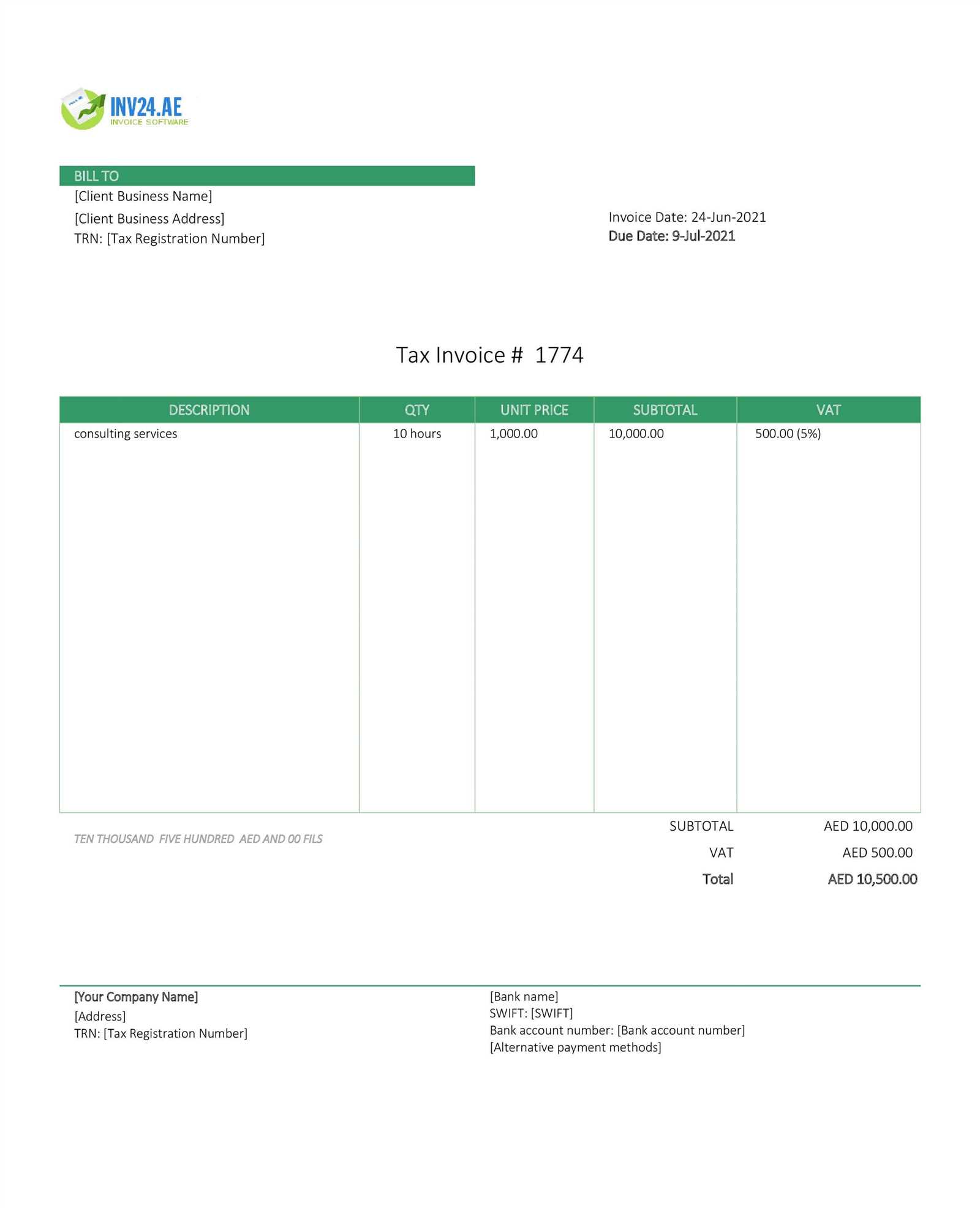

How to Add Taxes to Your Invoice

Including the correct tax details in your billing document is essential for legal compliance and clarity. Taxes must be accurately calculated and displayed to avoid confusion and ensure that both you and your client are aligned on the amounts due. The process involves understanding the applicable tax rates and how to apply them to your charges, ensuring transparency and professionalism in your financial dealings.

Here’s how to effectively add taxes to your billing document:

- Understand the Applicable Tax Rate: Different regions and types of work may have varying tax rates. Make sure you are aware of the correct tax rate that applies to your services or products.

- Clearly Label Tax Amounts: Clearly label the tax line on your document, making it easy for your client to identify the tax charge. This ensures transparency and avoids confusion over the final total amount.

- Include Tax Breakdown: If there are multiple taxes involved, provide a breakdown of each tax component. This can help your client understand exactly how the total tax amount is calculated.

Here is an example of how you can display tax information in a billing document:

Description Amount Base Amount $500.00 Tax (10%) $50.00 Total Amount $550.00 By clearly outlining tax charges in your billing documents, you help ensure a smooth and transparent transaction with yo

Managing Payments with Your Invoice Template

Effectively managing payments is a crucial aspect of maintaining cash flow and ensuring your business stays financially healthy. By clearly outlining payment terms and expectations in your billing documents, you help your clients understand when and how payments should be made. Providing organized and professional payment details ensures smoother transactions and reduces misunderstandings.

Here are some key strategies for managing payments effectively:

- Specify Payment Terms: Clearly indicate the due date for payment, as well as any late fees or discounts for early payment. This will set clear expectations for your clients and help avoid delayed payments.

- Provide Multiple Payment Options: Offering different payment methods (bank transfer, credit card, online payment) can make it easier for your clients to pay and increase the likelihood of timely payments.

- Include Clear Payment Instructions: Ensure your payment instructions are easy to follow, including account details or payment links, so clients know exactly how to submit their payments.

- Track Partial Payments: If clients are making payments in installments, track the amounts paid and update the remaining balance on the document, so clients can see what they owe.

Here is an example of how to format payment information in a document:

Description Amount Base Charges $1,000.00 Discount (5%) -$50.00 Total Due Creating Clear Payment Terms for Clients

Establishing clear payment conditions is essential for maintaining smooth financial interactions with clients. Clearly defined payment terms help prevent confusion, avoid delays, and ensure both parties understand when and how payments should be made. By being transparent about expectations, you foster trust and create a professional environment for both you and your clients.

To create effective payment terms, you should consider the following elements:

- Payment Due Date: Clearly specify when the payment is expected. Providing a due date, whether it’s within 30, 60, or 90 days, helps your clients know exactly when to make the payment.

- Late Fees or Penalties: If applicable, outline any penalties for overdue payments. This encourages timely payment and helps compensate for any inconvenience caused by delays.

- Accepted Payment Methods: Make sure to include the various ways your clients can pay, such as bank transfer, credit card, or online payment portals, so they have options to choose from.

- Discounts for Early Payment: Offering a discount for early payments can incentivize clients to pay ahead of schedule. This can be a great way to encourage faster cash flow.

- Partial Payments or Installments: If your clients are paying in installments, clearly state how much is due at each stage and when the remaining amounts are expected.

By being clear and consistent with your payment terms, you reduce the chance of misunderstandings and create a professional approach to financial transactions. A well-crafted set of payment conditions not only ensures that you are compensated on time but also builds long-term trust with your clients.

Designing a Professional Layout

Creating an organized and visually appealing billing document is crucial for leaving a lasting impression on your clients. A clean and well-structured layout not only enhances readability but also ensures that all necessary details are easy to locate. A properly designed format reflects your attention to detail and professionalism, helping you stand out in any industry.

To achieve an effective layout, consider the following key elements:

- Clear Header Information: Include your business name, logo, and contact information at the top of the page. This makes your document look polished and ensures clients can easily reach you if needed.

- Client Details: Clearly list the recipient’s name, business name (if applicable), and contact information. This avoids any confusion regarding which client the document pertains to.

- Itemized Breakdown: List the services or goods provided with clear descriptions, quantities, and individual pricing. This helps clients understand exactly what they are being charged for.

- Payment Instructions: Include any necessary instructions for submitting payment, including due dates and accepted payment methods. This ensures that clients know how to proceed without unnecessary back-and-forth.

- Visual Consistency: Use consistent fonts, spacing, and colors to keep the document neat and professional. Avoid overcrowding the page with too much text or excessive design elements.

Here’s an example of how a well-organized layout might appear:

Why Timely Billing is Crucial for Professionals

Sending billing documents promptly is essential for maintaining smooth financial operations and fostering positive client relationships. When these documents are delivered on time, it sets a professional tone and helps ensure that payments are made within the expected timeframe. Delays in issuing these documents can lead to payment disputes, financial setbacks, and tarnish your reputation.

Here are several reasons why prompt billing matters:

- Maintains Cash Flow: Timely submissions help ensure a consistent income stream, which is critical for covering operational costs and sustaining business growth.

- Builds Professional Credibility: Sending billing statements on time reflects well on your commitment to professionalism and reliability, making it easier to retain clients.

- Avoids Payment Delays: Late payments can cause unnecessary stress, affecting both your business operations and your relationship with clients.

- Promotes Financial Transparency: Regular and timely billing helps clients understand your charges, reducing misunderstandings and increasing trust between both parties.

- Increases Client Satisfaction: Clients appreciate efficiency and transparency. Sending timely billing ensures that there are no discrepancies or surprises when it comes to payments.

By prioritizing timely billing, you establish a strong foundation for continued success and build long-lasting client relationships. A reputation for delivering billing documents promptly can be a valuable asset for any professional business.

How to Track Outstanding Payments

Keeping track of unpaid bills is crucial for maintaining a healthy cash flow and ensuring that your business stays financially stable. Without a proper system in place, it can be easy to lose track of pending payments, leading to delays and unnecessary confusion. By organizing and monitoring outstanding payments, you can stay on top of your finances and follow up with clients in a timely manner.

Here are some effective ways to track pending payments:

- Use a Payment Tracking System: Utilize accounting software or a simple spreadsheet to monitor payment statuses. A dedicated system allows you to easily track the amount, due date, and status of each payment.

- Set Clear Payment Terms: Establish and communicate payment deadlines in advance. Clear terms help set expectations with clients and provide a point of reference when tracking unpaid balances.

- Send Friendly Reminders: If a payment is overdue, send a polite reminder. Often, clients may have simply forgotten or missed the due date. A gentle nudge can help resolve the issue quickly.

- Automate Notifications: Many accounting platforms allow you to set up automated payment reminders. These can be sent via email or text to notify clients of approaching due dates or overdue balances.

- Monitor and Reconcile Accounts Regularly: Keep track of payments in real time by reconciling your accounts regularly. This helps you stay on top of any discrepancies or missed payments, making it easier to follow up when necessary.

By staying organized and proactive in tracking outstanding payments, you ensure that your business operates smoothly and avoids financial disruptions. Implementing a solid payment management process helps build trust with clients and fosters better long-term relationships.

Integrating Billing Documents with Accounting Software

Linking your billing documents to accounting platforms can streamline your business’s financial processes. By combining these tools, you can reduce manual data entry, improve accuracy, and track payments more efficiently. This integration enables a seamless workflow between generating financial records and maintaining up-to-date books, making it easier to manage your finances.

Advantages of Integration

Integrating billing documents with accounting software brings several benefits that enhance your financial management:

- Automated Data Syncing: When you connect your billing system with accounting software, transaction data automatically transfers, minimizing the chances of errors from manual entry.

- Time Savings: The integration saves time by eliminating the need to input financial data separately into both systems. Instead, once a transaction is recorded, it’s instantly available for review and reporting.

- Better Reporting: Accounting software provides robust reporting features that analyze financial performance, which can help with decision-making. Integrated data makes these reports more accurate and insightful.

- Improved Cash Flow Management: With up-to-date records and immediate access to all financial data, it becomes easier to track outstanding balances and manage cash flow effectively.

- Regulatory Compliance: Integration helps ensure that all records are accurate and up-to-date, which is essential for tax compliance and financial audits.

How to Integrate Billing Systems

There are a few essential steps to integrate your billing system with accounting platforms:

- Choose Compatible Software: Ensure that your billing solution is compatible with the accounting software you are using. Many platforms offer built-in integrations or third-party tools to connect

Description Quantity Unit Price Total Consultation Session 3 $150.00 $450.00 Project Management