How to Use a Consular Invoice Template for International Shipments

When engaging in international trade, proper documentation is crucial for ensuring smooth transactions and compliance with regulations. Among the many documents required for customs clearance and shipment processing, one specific form plays a key role in validating the details of goods being exported. This document serves as an official record that outlines the nature, quantity, and value of the merchandise, helping authorities assess taxes, duties, and prevent fraud.

For businesses involved in cross-border transactions, creating and submitting the correct paperwork is not only a legal obligation but also a vital step in avoiding delays or additional costs. While there are various types of forms used in international shipping, understanding how to properly format and complete this particular document is essential for maintaining efficiency and reducing risks.

In this guide, we will explore the various components of this important document, how to prepare it, and how a ready-made solution can simplify the process. Whether you are new to global trade or looking to streamline your operations, understanding these documents will help you meet regulatory requirements and facilitate smoother international shipments.

Consular Invoice Template Overview

In international trade, accurate documentation is essential for smooth customs processing and compliance with regulations. One of the most important documents used for this purpose is a formal record that details the shipment’s contents, value, and origin. This document not only ensures proper clearance but also facilitates the correct calculation of taxes, duties, and other fees that may apply to the goods being shipped. Understanding how to properly fill out and submit this essential paperwork can save time and avoid unnecessary complications.

The use of a standardized form for these details allows exporters and customs authorities to efficiently exchange the necessary information. With a clear and organized format, this document helps reduce errors and ensures consistency across international transactions. It also provides transparency, giving customs officials the information they need to verify the legitimacy of the goods being shipped.

Key Features of the Document

The primary components of this essential form include a description of the goods, their total value, the country of origin, and specific details about the exporter. These sections must be filled out accurately to prevent delays in the clearance process. By using a structured format, the document ensures all necessary information is included and easy to review.

Benefits of Using a Structured Form

Using a standardized format not only simplifies the preparation process but also minimizes the risk of errors. A well-organized document can expedite customs clearance and prevent costly mistakes, such as under- or over-reporting the value of the goods. Furthermore, it provides an efficient way to communicate necessary details between exporters, shipping companies, and customs officials, ensuring smooth transactions across borders.

What is a Consular Invoice?

In international trade, accurate documentation is a key element in ensuring smooth customs processing. One of the critical documents required for exporting goods to certain countries is a formal declaration that provides essential details about the shipment. This document serves as an official record of the goods’ value, origin, and description, and it helps authorities determine the appropriate duties and taxes. It is used to authenticate the details of the shipment and facilitate customs clearance in the destination country.

This form is typically required when exporting goods to specific countries that demand additional verification of the shipment’s details. It must be completed with care to ensure the accuracy of the provided information, as any discrepancies can lead to delays or even fines. The document acts as a certification of the merchandise and may need to be stamped or signed by an authorized official in the exporting country.

Key Information Included in the Document

The document typically contains several important pieces of information, including:

- Exporter’s details: Name, address, and contact information of the exporter.

- Recipient’s information: Details of the buyer or recipient in the destination country.

- Description of the goods: Clear and concise details of the items being shipped, including quantity, weight, and value.

- Country of origin: The country where the goods were manufactured or produced.

- Value of the shipment: The total value of the goods, often including the currency used for the transaction.

Why This Document is Important

Having a properly filled-out form is crucial for several reasons:

- Customs clearance: It ensures that the goods pass through customs smoothly without unnecessary delays.

- Regulatory compliance: Many countries require this document as part of their regulatory framework for imports and exports.

- Accurate duty assessment: It helps authorities assess the appropriate taxes and duties based on the shipment’s value and contents.

In summary, this document serves as an essential part of international trade, helping both the exporter and the receiving country ensure that all necessary details of the shipment are verified and correctly processed.

Why Consular Invoices Are Important

In global trade, documentation is more than just a formality–it ensures that goods are properly accounted for, accurately valued, and comply with international regulations. This particular document serves as an official declaration, confirming the details of the merchandise being exported and providing a clear, verified record for customs authorities. Its importance lies in its ability to facilitate smooth and efficient customs processing, ensuring that goods can be cleared without unnecessary delays or issues.

For businesses involved in international shipping, using this document properly is essential for maintaining compliance and avoiding costly mistakes. By providing accurate and complete information, it reduces the likelihood of customs errors and disputes, helping shipments move through the system without interruption. Furthermore, it protects exporters and buyers alike by ensuring transparency and trust in cross-border transactions.

Key Reasons for Its Importance

Here are some of the main reasons why this document is vital for international trade:

- Facilitates Customs Clearance: The document helps customs authorities verify the contents, value, and origin of goods, ensuring faster processing through customs checkpoints.

- Ensures Legal Compliance: Many countries require this document as part of their trade regulations, making it a legal obligation for exporters to provide it.

- Prevents Delays: By accurately detailing the shipment’s value and description, this document helps prevent delays caused by misclassification or missing information.

- Accurate Duty Assessment: The document helps customs calculate the correct taxes and duties owed based on the value and type of goods being shipped.

- Reduces Risk of Fines: Inaccurate or incomplete information can lead to fines or penalties; using this document correctly minimizes such risks.

Protecting All Parties Involved

For both exporters and importers, the benefits of providing accurate and comprehensive information extend beyond legal requirements. The document ensures that both parties have a shared understanding of the transaction, reducing the potential for disputes and promoting smoother business operations. With transparent documentation, both the buyer and seller can avoid misunderstandings related to the shipment’s value, quantity, or specifications.

In essence, the document is a critical tool for maintaining trust and efficiency in global commerce, helping businesses navigate the complexities of international shipping and regulatory compliance.

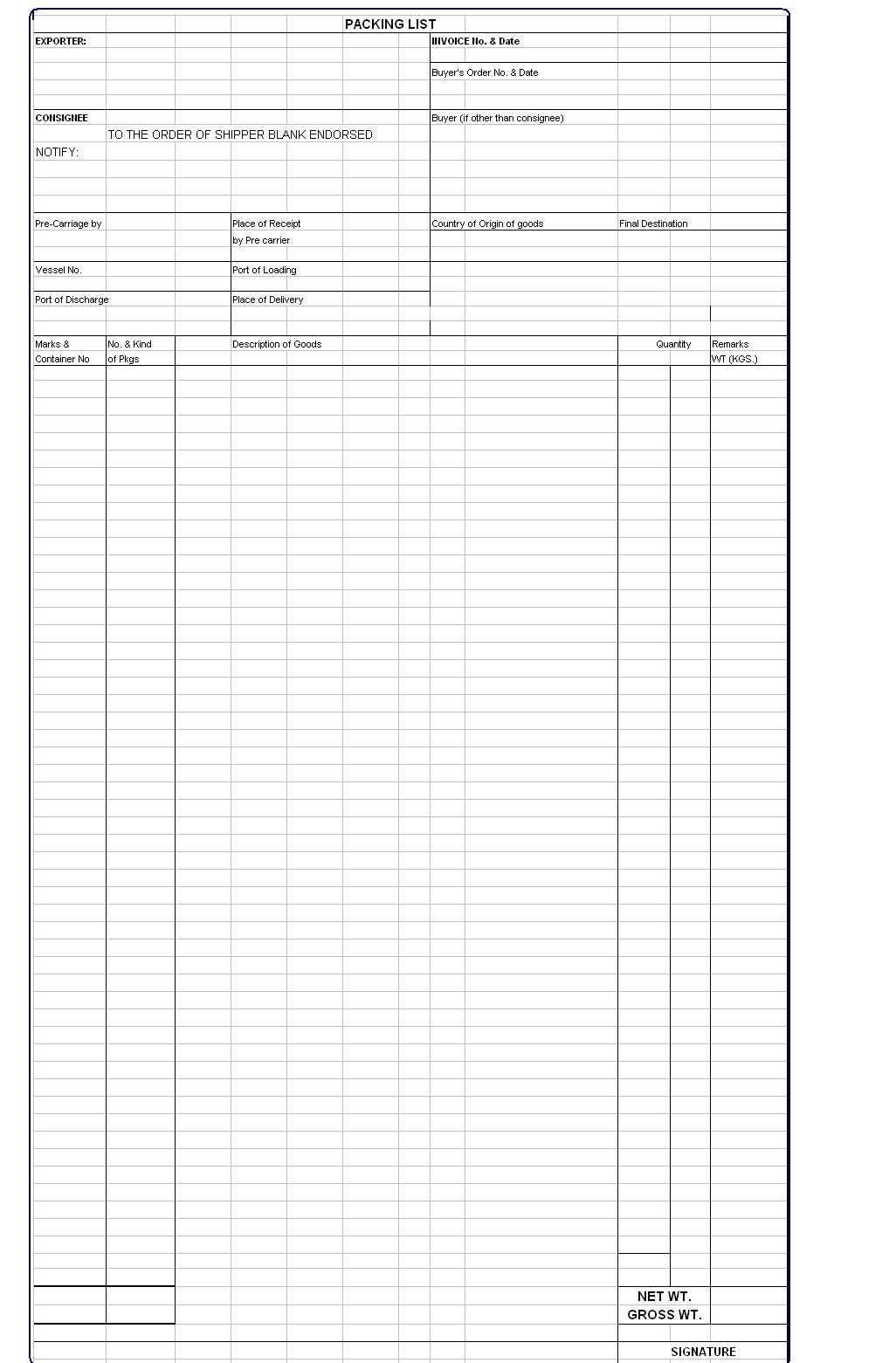

Essential Elements of a Consular Invoice

For international trade to proceed smoothly, it is vital to ensure that all necessary documentation is accurate and complete. This particular form must include key information that customs authorities rely on to process shipments efficiently. A well-structured document not only speeds up clearance but also prevents costly delays and ensures compliance with regulatory standards.

The essential elements of this document include both general shipment information and specific details about the goods being exported. Every field must be filled out carefully to avoid errors or omissions that could lead to complications at customs checkpoints. Below are the primary components that should always be included in this essential document.

Key Information to Include

- Exporter Details: The full name, address, and contact information of the exporting company or individual.

- Recipient Information: The name, address, and contact details of the importer or recipient in the destination country.

- Description of Goods: A detailed, clear description of the products being shipped, including the quantity, weight, and specifications. This helps prevent confusion about the items in transit.

- Country of Origin: The country where the goods were manufactured or produced. This is critical for customs and tariff classification.

- Value of Goods: The total value of the shipment, often including the unit price and total price, and typically expressed in the relevant currency.

- HS Code or Tariff Classification: The harmonized system (HS) code used to classify the goods based on their nature and function. This helps determine the applicable duties and taxes.

- Export License Number: In some cases, the document may require the exporter’s license number, especially for controlled or regulated items.

- Signature and Date: The document should be signed by an authorized representative of the exporting company, along with the date of completion.

Why Accuracy Matters

Filling out each section correctly is essential for a smooth customs process. Inaccurate or incomplete information can result in delays, fines, or even the seizure of goods. Each of the listed elements plays a crucial role in ensuring the legitimacy of the shipment and avoiding any issues with customs authorities. Properly completing this form not only complies with legal requirements but also fosters trust between trading partners and ensures efficient business transactions across borders.

How to Create a Consular Invoice

Creating the necessary documentation for international shipments is a critical task that requires precision and attention to detail. This particular form needs to capture essential details about the goods being exported, the parties involved, and the shipment’s value. Completing it correctly ensures compliance with international trade regulations and helps avoid delays or penalties at customs checkpoints.

To create an accurate and legally compliant document, follow these steps to ensure that all required information is properly included:

Step-by-Step Guide

- Gather the Necessary Information:

Before starting, make sure you have all the details needed for the shipment, such as product descriptions, quantities, weights, and values. You will also need the exporter and recipient’s contact information. - Choose the Right Format:

Whether you are using a physical or digital form, ensure it matches the format required by the destination country. Many countries have specific templates or guidelines for how the document should look. - Fill in Exporter and Recipient Details:

Include the full name, address, and contact information of both the exporting company and the recipient. Double-check for accuracy to avoid issues with delivery or customs clearance. - Provide a Clear Description of Goods:

List each product being exported, including detailed descriptions, quantities, weights, and unit values. Ensure that the description matches the goods being shipped to avoid discrepancies. - Indicate the Country of Origin:

Clearly state where the goods were produced or manufactured. This is vital for determining tariffs and ensuring proper classification by customs authorities. - State the Total Value of Goods:

Include the total value of the shipment, breaking down individual item prices if necessary. Ensure this value matches any accompanying commercial invoices or receipts. - Include Export License and Tariff Codes:

If required, provide the export license number and the relevant Harmonized System (HS) code or tariff classification for each product to ensure correct duty assessment. - Sign and Date the Document:

The document must be signed by an authorized representative from the exporting company, confirming that the details provided are accurate. Include the date of completion.

Additional Tips for Accuracy

- Ensure that all values are consistent with other trade documents, such as purchase orders or commercial receipts, to avoid confusion.

- Double-check the accuracy of product descriptions, including brand names, serial numbers, and technical specifications, to prevent delays or rejection at customs.

- If you are unfamiliar with the process, consider seeking guidance from a customs expert or using a professional service to complete the document.

By following these steps and providing accurate details, you can create a well-structured and compliant document that facilitates smooth customs clearance and ensures the timely delivery of your goods to their destination.

Common Mistakes in Consular Invoices

When preparing documentation for international shipments, it’s essential to be thorough and accurate. Even minor errors can lead to significant delays, fines, or complications with customs. Despite its importance, many exporters still make common mistakes when completing these crucial forms. Understanding and avoiding these errors can help streamline the process and prevent costly disruptions in the shipping process.

In this section, we will highlight some of the most frequent mistakes made when filling out export forms and how to avoid them.

Frequent Errors to Avoid

- Incorrect or Incomplete Product Descriptions:

A vague or incomplete description of the goods can cause confusion for customs authorities. It’s important to provide detailed information about each item, including its nature, quantity, and specifications. Inaccurate descriptions may lead to customs holding up the shipment for clarification. - Missing or Incorrect Value Declaration:

The total value of the goods must match the actual selling price. Overstating or understating the value can result in penalties or delayed clearance. Always ensure the total value aligns with the commercial invoice and other supporting documents. - Failure to Include Exporter or Recipient Information:

Omitting the contact information for the exporter or recipient can lead to delays in processing or delivery. Ensure that full names, addresses, and phone numbers are provided and up to date. - Not Including the Country of Origin:

The country of origin is a critical piece of information for determining tariffs and duties. Leaving this blank or incorrectly filling it out can cause customs to hold the shipment or apply incorrect fees. - Overlooking Signatures and Dates:

A missing signature or an undated document can invalidate the form. Always ensure that an authorized person from the exporting company signs the document and that the date of preparation is clearly stated.

Additional Common Mistakes

- Incorrect Harmonized System (HS) Codes:

Using the wrong HS code for products can result in improper classification and wrong duties. Ensure that each product’s HS code is accurate, and double-check it with an updated tariff schedule if necessary. - Omitting Supporting Documents:

Sometimes, additional documents, such as export licenses or certificates of origin, are required. Failing to include these can lead to delays in the shipment’s clearance. - Inconsistent Information Across Documents:

If the information provided on the form differs from other paperwork, like the commercial invoice or packing list, customs may question the legitimacy of the shipment. Ensure all documents reflect t

Legal Requirements for Consular Invoices

When exporting goods internationally, ensuring compliance with the legal requirements of both the exporting and importing countries is essential. One of the key elements in this process is providing the correct documentation that verifies the shipment details, including product descriptions, values, and origin. This document is subject to specific legal guidelines that vary depending on the country of import and the nature of the goods being shipped. Failure to meet these legal requirements can result in delays, penalties, or even the seizure of goods.

The legal requirements for this particular document are designed to ensure transparency, prevent fraud, and enable proper assessment of duties and taxes. Understanding the regulations of both the destination country and the home country is crucial to ensure the document is completed correctly and submitted on time.

Key Legal Requirements

The following table outlines some of the critical legal requirements for creating this essential shipping document:

Legal Requirement Details Accurate Product Description The description of goods must be precise and match the physical items being shipped. Vague or incorrect descriptions can result in shipment delays or additional inspections by customs authorities. Value Declaration The value of the goods must be declared accurately, reflecting the correct transaction amount or market value. Overstatement or understatement of value can lead to legal penalties. Country of Origin The document must clearly indicate the country where the goods were produced or manufactured. This is important for tariff classification and compliance with trade agreements. Export Licenses and Permits If required by the destination country, export licenses or permits must be provided alongside the document. These may be necessary for controlled or restricted items. Signatures and Certifications The form must be signed by an authorized representative of the exporting company and, in some cases, certified by local authorities or consulates. A missing signature can invalidate the document. Harmonized System Codes Correctly applying the Harmonized System (HS) code for each product is required by most countries to classify goods for customs purposes and apply appropriate tariffs. Meeting these legal requirements ensures that the shipment is processed smoothly, minimizing the risk of delays or fines. Exporters must familiarize themselves with the legal frameworks of both the home country and the destination country to ensure full compliance with all regulatory requirements for international trade.

How to Customize a Template

Customizing a form for international shipments is an important step to ensure it fits your specific needs and meets the requirements of both your business and the destination country. Tailoring this document involves adjusting its structure and content to reflect the unique details of your products, shipment, and regulatory obligations. By doing so, you can streamline the process and ensure compliance with the various customs and trade regulations.

Customization typically involves modifying standard templates to reflect specific shipment information such as product descriptions, values, and origin. It also requires ensuring that the form adheres to the standards set by the country of import. This section will guide you through the steps to customize this essential document effectively.

Steps to Customize the Document

- Choose the Right Format:

Start by selecting the correct format for the form. Ensure it is compatible with the importing country’s requirements. Some countries provide downloadable versions, while others may have specific instructions for creating the document manually. - Fill in the Shipping Details:

Input the specific details of the shipment, such as the full name and contact information of both the exporter and recipient, shipment date, and destination country. Ensure all addresses are accurate and up-to-date. - Provide Product Information:

Include a detailed description of each product, including the quantity, weight, and value. This section is crucial, as any vague or incorrect descriptions could lead to delays in customs processing. - Adjust for Local Requirements:

Make sure the form aligns with the regulatory requirements of the destination country. This may involve including additional certifications or documentation, such as export licenses or certificates of origin. - Update Payment Information:

Include details about the payment method, currency, and transaction value. Ensure that the total value of the shipment is clearly stated and matches the commercial invoice or any other supporting documents.

Finalizing and Verifying the Document

Once you’ve filled out all the necessary fields, review the document thoroughly for accuracy. Make sure all values, descriptions, and contact details are correct. Inaccurate information can lead to delays or fines at customs.

- Double-check all product details: Ensure that item descriptions match the actual goods being shipped and that quantities and prices are consistent with other trade documents.

- Confirm signature and date: Before submission, ensure that the document is signed by an authorized representative and includes the correct date.

- Save and Export the Document: Once customized, save the document in a secure format, such as PDF, and store it for easy access during shipping and customs clearance.

Customizing this form for each shipment ensures that you provide all necessary information in a clear and professional manner. It helps prevent delays and ensures that customs processing proceeds as smoothly as possible. By carefully tailoring each document to your needs and the requirements of the destination country, you increase the likeliho

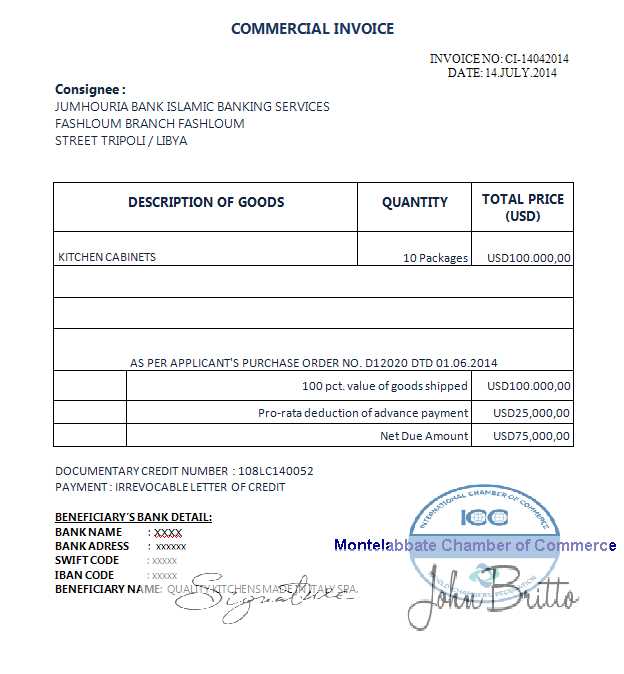

Consular Invoice vs Commercial Invoice

In international trade, proper documentation is crucial for the smooth movement of goods across borders. Two of the most commonly used documents in global shipping are the customs declaration document and the commercial transaction document. While both serve to verify the details of a shipment, they differ in their purpose, content, and requirements. Understanding the distinctions between these two documents is vital for ensuring compliance with trade regulations and avoiding unnecessary delays at customs.

Although both forms provide information about the goods being exported, each serves a distinct role in the shipping process. The primary difference lies in their use: one is typically required by customs authorities for clearance purposes, while the other is used to establish the terms of the transaction between the seller and the buyer. Below, we will explore the key differences between these two documents.

Key Differences

- Purpose and Usage:

The customs declaration document is primarily used to satisfy the requirements of customs authorities. It verifies the details of the shipment, such as the value, origin, and description of the goods. On the other hand, the commercial document serves as a record of the sale between the exporter and the importer, outlining terms such as pricing, payment methods, and delivery terms. - Required Information:

The customs declaration document often contains additional information, such as export licenses, tariffs, and certifications required by the destination country. The commercial document, however, is more focused on the transaction itself, detailing product prices, quantities, and terms of sale. - Customs Clearance:

The customs document is specifically designed to facilitate the customs clearance process, and may need to be certified by consular authorities in some countries. The commercial document, while important for invoicing and payment purposes, does not have the same role in customs processing. - Legal Requirements:

In many cases, the customs declaration document is a legal requirement in the importing country, often mandated for certain types of goods or high-value shipments. The commercial document is generally required for record-keeping and transaction verification, but may not be subject to the same level of scrutiny from customs authorities.

Which Document Should You Use?

Both documents are necessary for international trade, but the requirement for each depends on the specific circumstances of the shipment. If you are shipping goods to a country that mandates the submission of a customs document for clearance, it is essential to ensure that the document is correctly completed and certified. At the same time, the commercial document will be needed to ensure that payment and contractual obligations are met.

In summary, while both documents serve different purposes, they are complementary. Ensuring that both are accurately prepared and submitted can help avoid delays, ensure compliance, and maintain smooth operations in cross-border trade.

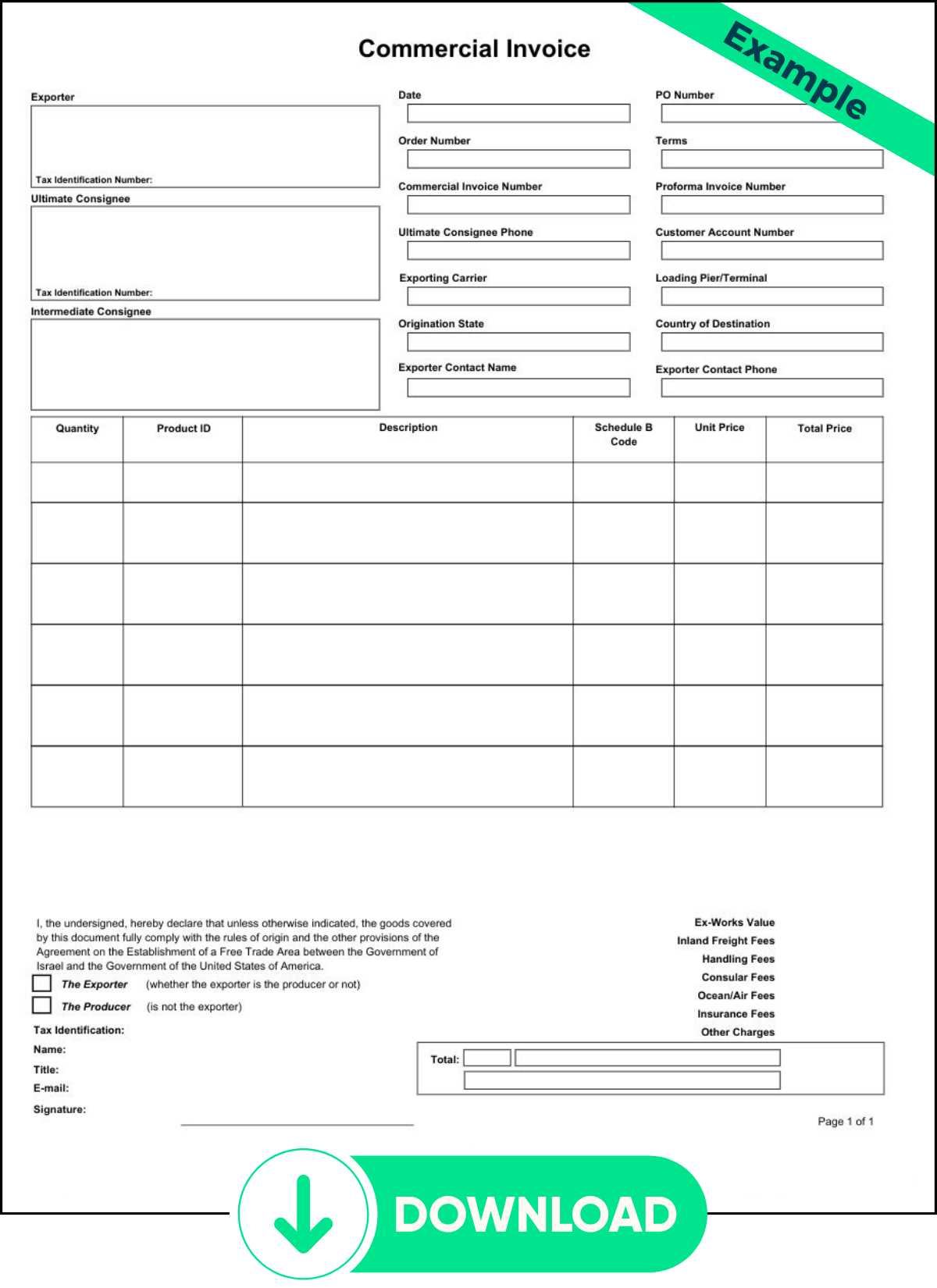

Where to Find a Reliable Template

When preparing documentation for international shipments, it is essential to use a well-structured and legally compliant form. Finding a reliable version of this document can save time and ensure that all necessary information is included to meet customs requirements. A proper form will help streamline the process of verifying your goods for export and importing, minimizing delays and avoiding errors that could cause complications with authorities.

There are several resources where you can find trusted versions of this document, whether you’re looking for a standard format or something customized for specific countries or industries. Here are some of the best places to locate reliable versions:

- Official Government Websites:

Many countries provide downloadable versions of the necessary form directly on government or customs authority websites. These versions are updated regularly to ensure they comply with the latest regulations and legal requirements. - Trade Associations and Export Organizations:

Industry-specific trade organizations and export support services often provide standardized forms that comply with legal requirements. These resources can also provide guidance on how to complete the form correctly. - Customs Brokers and Shipping Services:

Customs brokers and shipping companies typically offer templates for international shipping documents, ensuring that the forms meet customs regulations for various destinations. They may also provide consultation services to ensure your documentation is accurate. - Online Document Providers:

There are various online platforms that offer downloadable or customizable forms for international trade. Look for well-reviewed sources that specialize in legal and trade documents. Be sure to confirm that the form meets current customs regulations before use. - Export Consultants:

If you work with export consultants, they can provide tailored forms for your specific needs. These professionals are often familiar with both the requirements of your home country and the import regulations of other nations, ensuring compliance with all relevant laws.

Choosing a reliable source for your documents is key to ensuring that your shipments are processed smoothly and without unnecessary delays. Be sure to check for updates regularly, as trade regulations can change frequently, and always ensure the form is appropriate for the specific destination country.

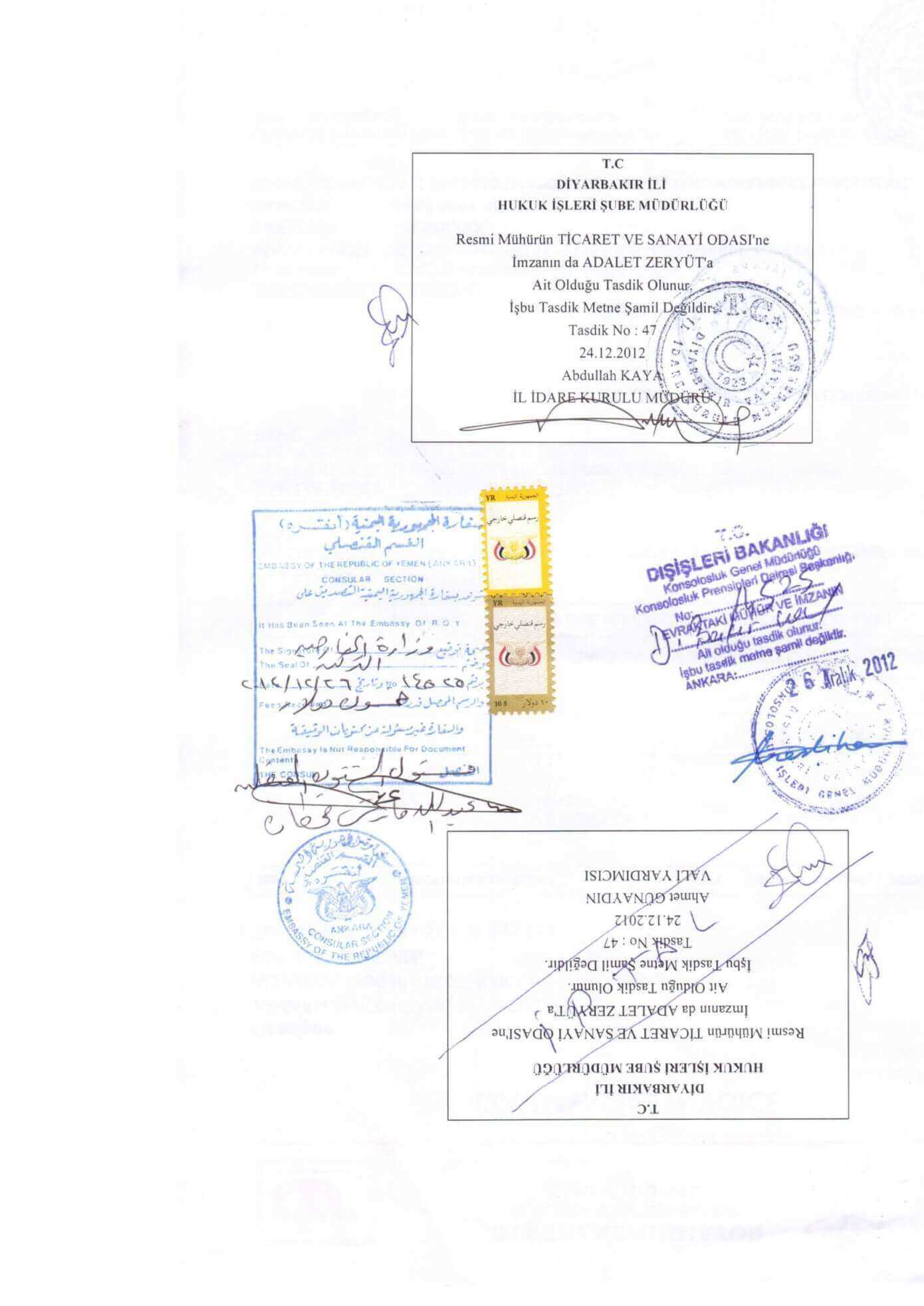

How to Submit Consular Invoices Correctly

Submitting the necessary documents for international shipments involves more than simply filling out the required form. Accuracy and attention to detail are essential to ensure that all information is presented in accordance with customs requirements. Failing to submit this document correctly can lead to delays, penalties, or even the rejection of the shipment by authorities. Understanding the correct submission process will help exporters avoid complications and ensure smooth customs clearance.

This section outlines the key steps to follow when submitting your shipment documentation. Ensuring each step is properly completed will increase the chances of timely approval and reduce the risk of delays.

Steps for Correct Submission

- Complete the Form Accurately:

Ensure that all sections of the form are filled out correctly. This includes providing precise details about the goods, including their description, quantity, and value. The more accurate and clear the information, the less likely there will be issues during customs review. - Verify Supporting Documents:

Many countries require additional documents to accompany the primary shipment form. These may include export licenses, certificates of origin, or packing lists. Make sure all required documents are included, and check that they are properly signed and dated. - Check for Certification Requirements:

Some destination countries require that the form be certified by consular authorities. This process may involve having the document stamped or signed by the relevant consulate to confirm the authenticity of the information. Always verify whether certification is required before submission. - Submit the Form Early:

To avoid last-minute delays, it is important to submit the completed documentation well in advance of the shipment. Many countries require several days for processing, so timely submission ensures there are no unexpected delays in the shipping schedule. - Follow the Destination Country’s Guidelines:

Different countries may have different submission methods for these forms. Some may require physical submission, while others accept digital versions. Ensure that you follow the correct submission method as outlined by the destination country’s customs or trade regulations.

Confirming Submission and Tracking Progress

After submitting the form, it is essential to confirm that the documents were received and are being processed. Some countries offer tracking systems or acknowledgment receipts to confirm that the submission was accepted. Stay in touch with customs authorities to ensure everything is moving along as expected.

- Request Confirmation:

Always request confirmation that your submission has been received and processed. This can help prevent any misunderstandings or delays in the clearance process. - Monitor Processing Status:

Many customs authorities offer online systems to track the status of your submission. Regularly monitor this to ensure no additional steps or documents are required.

By following these steps and ensuring accuracy in every detail, exporters can minimize the risk of delays and complications. Correct submission of documentation is vital for efficient processing and smooth delivery of goods across international borders.

Consular Invoice for Different Countries

When engaging in international trade, it’s crucial to understand that each country has specific documentation requirements for verifying the details of goods being shipped. Depending on the destination, certain documents must be completed in a particular way to meet local customs regulations. This is especially important when dealing with high-value items, sensitive products, or shipments that require special clearance procedures.

While the basic format for such a form may remain the same, the details required and the process for submission can vary greatly from country to country. Below is a summary of key requirements for several major trading nations.

Country Key Requirements United States Requires a detailed description of the goods, including the Harmonized System (HS) code. The document must also be signed and may need to be certified by a U.S. consulate for certain types of goods. Germany Goods must be described in clear terms with the correct tariff classification. The document should also include a declaration of the product’s origin, and in some cases, consular legalization may be required. China In addition to the product details, the form must include a statement of value and origin. Certification by the local Chinese consulate is often required, especially for high-value shipments. Brazil The form must include product descriptions in Portuguese and may require additional documentation, such as export permits or certifications for certain types of goods. India India requires a clear breakdown of the product value, and the form must include the country of origin. Certification by the Indian consulate is necessary for certain goods, and all paperwork must comply with the Directorate General of Foreign Trade (DGFT) rules. As illustrated, while the form itself may be similar, the additional requirements and submission processes differ significantly between countries. Exporters must familiarize themselves with the specific guidelines for each destination country to avoid complications and ensure that shipments are cleared smoothly through customs.

Importance of Accurate Product Descriptions

Providing precise and clear descriptions of the products being shipped is one of the most critical aspects of international trade documentation. Accurate product details not only ensure compliance with legal and regulatory requirements, but they also play a pivotal role in customs clearance, tax calculation, and avoiding disputes. A well-described product can make the difference between smooth transit and costly delays.

Incorrect or vague descriptions can lead to misunderstandings with customs authorities, resulting in fines, shipment holds, or even rejection at the border. The customs process depends heavily on the information provided on shipping documents, and any ambiguity in the description may raise red flags, leading to further inspection or additional charges.

Key Reasons for Accuracy

- Customs Clearance:

Accurate product descriptions are essential for customs to determine the correct tariff classification and apply the right duties and taxes. Misclassification can lead to underpayment or overpayment of duties, resulting in delays or financial penalties. - Avoiding Misunderstandings:

A clear description helps ensure that both the buyer and the seller have the same understanding of the goods being shipped. Ambiguities or errors in the product description can result in disputes, returns, or non-compliance with the terms of the sale. - Compliance with Regulations:

Many countries have strict import regulations that require detailed descriptions of products to ensure they meet safety, health, and environmental standards. Failing to provide the required information may lead to the shipment being held or even destroyed.

What to Include in Product Descriptions

Element Details to Include Product Name Provide the full name of the product, including any brand names, model numbers, or serial numbers, if applicable. Materials and Composition Describe the materials the product is made from, especially if it is subject to import restrictions or regulations (e.g., chemicals, electronics, etc.). Quantity and Weight Specify the number of units being shipped and their total weight, as this information helps in the calculation of customs duties and shipping costs. Value State the accurate value of the goods being shipped, which is crucial for customs declarations and insurance purposes. Country of Origin Clearly state where the product was manufactured or assembled, as this may impact tariffs, trade agreements, or restrictions. By providing detailed and accurate descriptions of your products, you help ensure that your shipments are processed smoothly through customs, comply with all relevant trade regulations, and reach their destination without unnecessary delays or complications. The accuracy of your product descriptions directly impacts the efficiency and cost-effectiveness of your international trade operations.

What Information Needs to Be Verified

When preparing documents for international shipments, verifying the accuracy of the information provided is crucial for ensuring compliance with customs regulations. Incomplete or incorrect details can lead to delays, additional costs, or even the rejection of goods at the border. To prevent such issues, it is important to carefully check several key elements before submission.

Different countries and authorities may have specific verification requirements, but generally, the following details must be carefully reviewed for accuracy before submitting any shipment documentation.

Information What Needs to Be Verified Product Description The goods being shipped must be described clearly and accurately. Ensure that the names, specifications, and quantity match the actual products, as vague or incorrect descriptions can lead to delays in processing. HS Code The Harmonized System (HS) code is crucial for determining the classification and applicable tariffs. Verify that the correct HS code is used for each item to avoid misclassification, which could lead to wrong duties being applied. Value of Goods Ensure that the value of the goods is correctly stated based on the transaction value or the market value, as this will affect customs duties and taxes. Incorrect values can lead to fines or additional fees. Origin of Goods Confirm that the country of origin is accurately indicated. This is particularly important for trade agreements and preferential duty rates, as the wrong information may invalidate benefits. Shipping Details Verify the shipment’s details, including the recipient’s information and the shipping method. Ensure that all addresses, contact numbers, and delivery instructions are clear and correct. Customs Documentation Any necessary certificates, licenses, or export permits should be checked for correctness and completeness. For certain goods, certifications such as the Certificate of Origin or health and safety certificates may be required. By thoroughly verifying these critical details, you can avoid unnecessary complications with customs clearance and ensure that your goods are processed smoothly. Accurate information not only helps to meet regulatory requirements but also reduces the risk of delays and unexpected costs, making the international shipping process more efficient and cost-effective.

Best Practices for Handling Consular Invoices

Efficiently managing and submitting the required documentation for international trade can significantly impact the smoothness of the shipping process. Ensuring that all forms are correctly filled out, verified, and compliant with both the exporting and importing countries’ regulations is crucial for avoiding delays and complications. Adhering to best practices for handling these documents can help streamline the process and ensure that shipments move seamlessly through customs.

Implementing a structured approach to managing your trade documentation is essential for every export operation. Below are some key practices to follow when dealing with these essential forms.

Key Best Practices

- Double-Check All Information:

Always verify that the product descriptions, values, and origin details are accurate before submitting any documentation. A small mistake can cause delays, fines, or even rejection of the shipment. Cross-check all information against the original order or sales contract to ensure consistency. - Maintain Up-to-Date Templates:

Keep your forms and documents current with the latest regulatory changes. Customs requirements can evolve, and ensuring that your paperwork is always aligned with the most recent standards will prevent unnecessary back-and-forth with authorities. - Ensure Proper Certification:

For many countries, these documents require specific certification or legalization by consular officials. Verify the certification process for the destination country and ensure that all relevant signatures and stamps are applied to avoid rejection. - Use Clear and Detailed Descriptions:

Be as specific as possible in describing the goods. Provide all necessary details, such as materials, measurements, and packaging type, to prevent confusion at customs. Inaccurate or vague descriptions can lead to additional scrutiny and delays. - Stay Organized:

Organize your shipping documents in a consistent and methodical manner. This makes it easier to retrieve the correct forms when needed and ensures that you can quickly provide additional documentation if requested by customs officials. - Submit Early:

Submit the documentation well ahead of the shipment’s departure. Allow time for any potential corrections and for the consulate or relevant authorities to process the forms. Early submission reduces the risk of last-minute delays.

Final Recommendations

Handling these forms with care and attention to detail is key to ensuring that your shipments move smoothly through international borders. Following these best practices will not only help prevent delays but also demonstrate professionalism and an understanding of the global shipping landscape. By staying proactive and meticulous, you can streamline your shipping operations and improve your overall business efficiency.

Digital vs Printed Consular Invoices

With the ongoing digital transformation in international trade, businesses are now faced with the choice between submitting documentation electronically or in physical form. Both methods offer distinct advantages and challenges, and choosing the right option depends on various factors, including the destination country’s regulations, the speed of the transaction, and company preferences. Understanding the differences between digital and printed versions of these key shipping documents is crucial for ensuring compliance and smooth customs processing.

Each format has its own strengths, and it’s important to understand when one may be preferred over the other, especially when it comes to legal validity, ease of submission, and the nature of the goods being shipped.

Advantages of Digital Submissions

- Faster Processing:

Digital documents can be submitted instantly, speeding up the entire process from preparation to submission. This can be particularly beneficial when meeting tight deadlines or managing time-sensitive shipments. - Reduced Risk of Loss:

Electronic records are stored securely in databases, reducing the risk of physical documents being misplaced, damaged, or lost during transit. - Cost-Effective:

Eliminating the need for printing, mailing, and physical storage can result in lower administrative costs, making the digital option more economical for many businesses. - Easy to Update:

Digital documents can be easily updated or amended if needed, allowing for quick corrections without having to reissue physical forms.

Advantages of Printed Submissions

- Wider Acceptance in Certain Countries:

Some countries or customs authorities still require paper documents, particularly for high-value shipments or specific types of goods, where digital versions may not be accepted for legal or regulatory reasons. - Physical Signatures and Stamps:

In some cases, paper documents are needed for official signatures or stamps from customs officials or consular representatives, which are often required for certification purposes. - Better for High-Risk Shipments:

For goods that are considered high-risk, such as luxury items or sensitive products, printed documentation may be preferred by authorities for added security and verification.

Both methods of submission have their merits depending on the nature of the goods being shipped and the requirements of the destination country. Digital submissions offer speed and convenience, while printed submissions may still be necessary in certain scenarios, especially where legal authenticity or specific country requirements are concerned.

- Choose the Right Format: