Top Construction Invoice Templates for Contractors and Professionals

Efficient financial management is essential for anyone working in the building and renovation industry. Whether you’re managing large-scale projects or small repairs, keeping track of payments and ensuring accurate billing is key to maintaining cash flow. By using well-designed documents, professionals can easily record the details of their work and communicate payment expectations to clients.

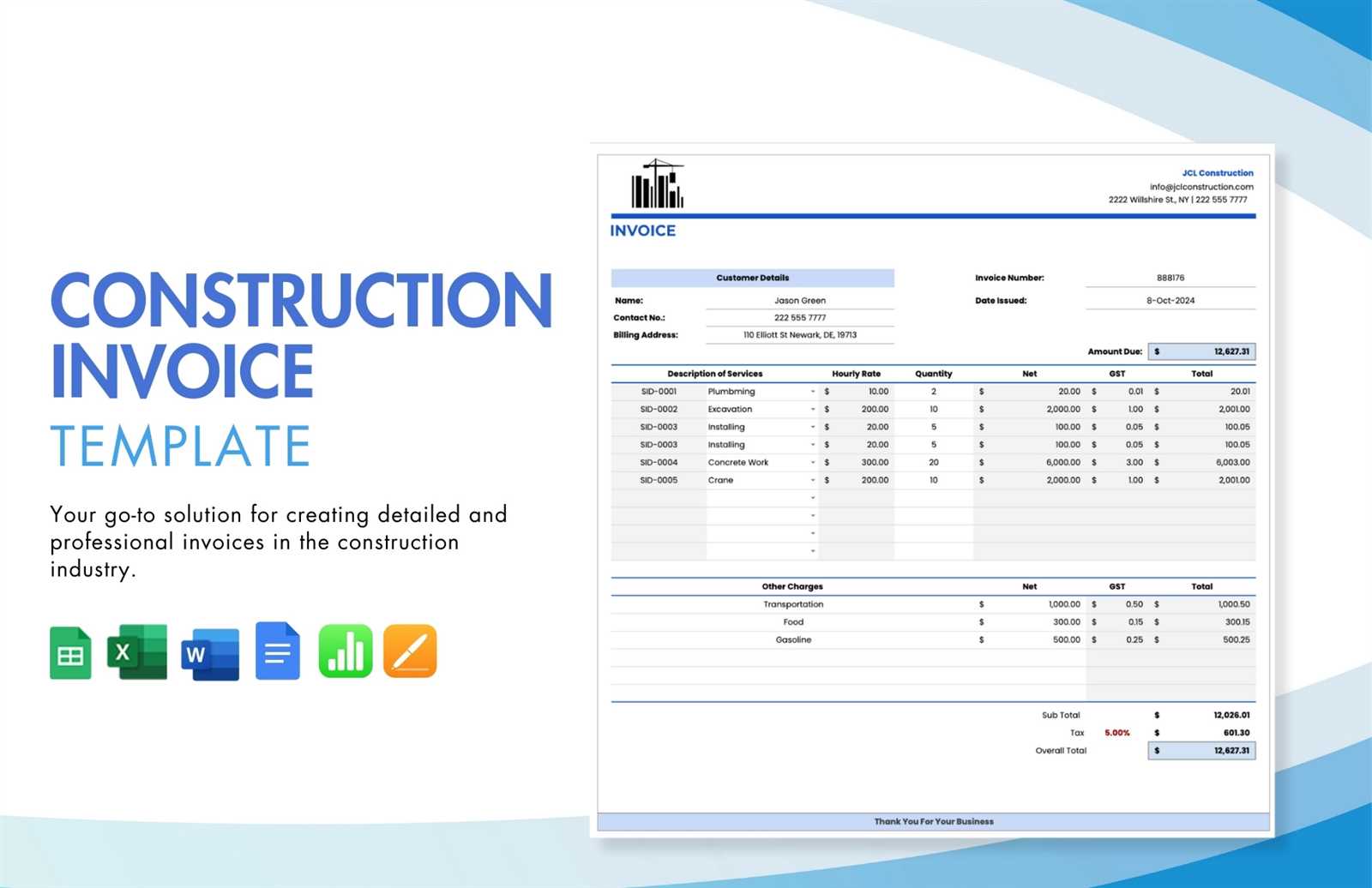

Customizable formats allow contractors to focus on what they do best while handling financial documentation seamlessly. With the right structure, these documents help ensure clarity in transactions, provide a professional appearance, and minimize errors. Utilizing a reliable format can save time and reduce stress when it comes to receiving payments for services rendered.

From detailing labor costs to including material expenses, the format you choose plays a significant role in how smoothly your billing process operates. The right solution can eliminate confusion and improve overall efficiency, making it a crucial tool for any professional in the field.

Construction Invoice Templates for Professionals

For anyone working in the building industry, managing payments effectively is critical to maintaining smooth operations and ensuring timely cash flow. Using well-structured billing documents not only simplifies the payment process but also enhances professionalism. Customizable forms provide an efficient way to track work done, materials used, and the associated costs, helping contractors and service providers maintain financial order.

Professionals can choose from a variety of formats, each designed to meet specific needs depending on the type of service or project. These ready-made solutions eliminate the need for creating documents from scratch and allow users to focus on their actual work while ensuring accurate record-keeping. Here are some important features that make these tools valuable:

- Customization: Tailor the details to fit each project and client, ensuring clarity in what’s being billed.

- Organization: Proper categorization of labor, materials, and other expenses makes it easier to review and track financials.

- Professional Appearance: Presenting clear, well-structured documents improves client relationships and enhances credibility.

- Accuracy: Built-in calculations and pre-defined fields help reduce errors and avoid confusion over payment terms.

By adopting such tools, professionals can streamline their financial processes, minimize mistakes, and improve overall client satisfaction. Whether working on a small home renovation or a larger commercial build, these efficient billing forms play a crucial role in successful project management.

Why Use Construction Invoice Templates

Maintaining clear and organized records is essential for any professional managing projects in the building industry. Proper documentation ensures both parties–contractors and clients–are on the same page regarding payments and services provided. By using predefined documents, the billing process becomes quicker, more accurate, and professional, reducing the chances of disputes or misunderstandings.

Benefits of Using Pre-Formatted Documents

Customizable billing solutions offer various advantages that can significantly improve financial management. Here are some reasons why utilizing such tools is beneficial:

- Time-saving: Ready-made formats reduce the need to create documents from scratch, saving valuable time.

- Clarity: A clear structure helps clients understand exactly what they are being charged for, enhancing trust and transparency.

- Consistency: Using the same format for all projects ensures uniformity in your billing process, making it easier to manage finances.

- Professionalism: A well-designed document gives your business a more polished, credible appearance, improving client relationships.

- Accuracy: Pre-set fields and built-in calculations reduce the risk of errors in totaling costs, improving financial reliability.

How These Tools Simplify Project Management

Adopting efficient billing solutions is a practical way to streamline your workflow. By keeping track of each project’s details in an organized manner, you can focus more on the work itself and less on the paperwork. These tools also make it easier to follow up with clients on outstanding payments, ensuring timely compensation for services rendered.

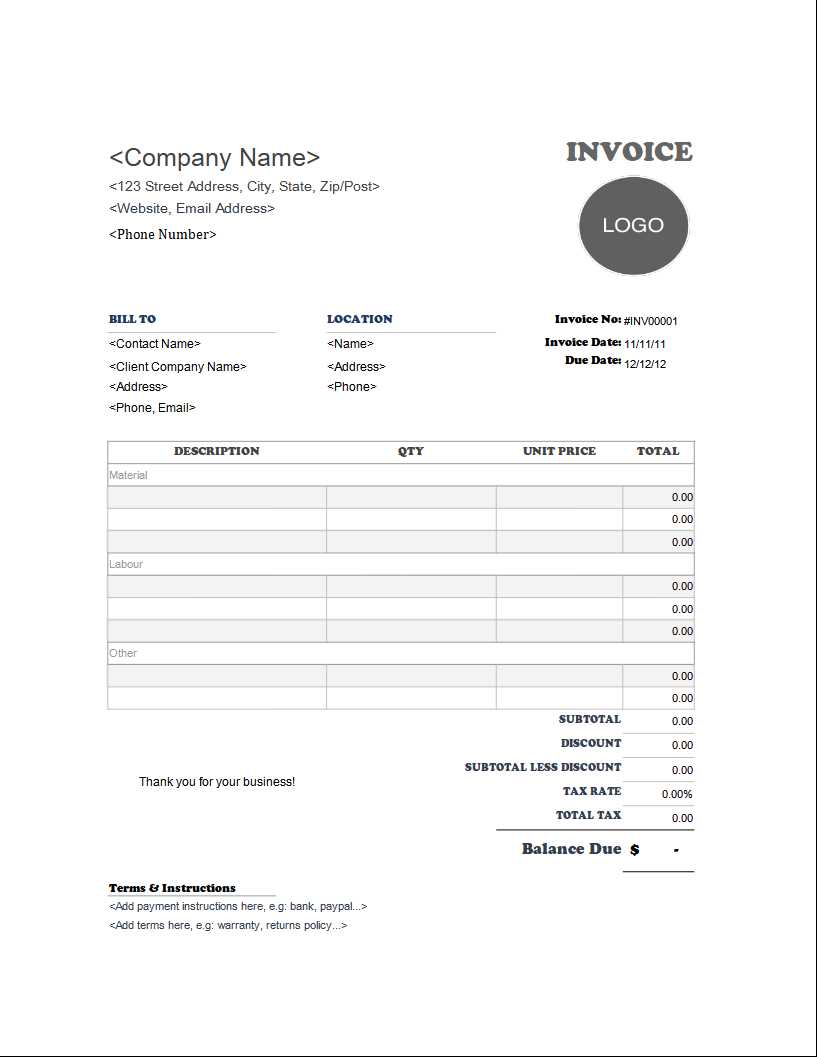

Key Elements of a Construction Invoice

When creating a billing document for services rendered, it’s important to ensure that all necessary details are included to avoid confusion and ensure a smooth transaction. Each section of the document plays a crucial role in clearly communicating what is being charged and the payment terms. A well-structured document not only helps manage financial aspects effectively but also ensures professionalism in all dealings with clients.

Essential Details to Include

For the document to be comprehensive and clear, it should contain several key pieces of information:

- Contact Information: Include the full name, address, and contact details of both the service provider and the client.

- Unique Identifier: Assign a reference number to each document for easy tracking and future reference.

- Project Description: Clearly describe the scope of work completed or materials provided, with itemized lists where applicable.

- Labor and Material Costs: Break down the charges for labor, materials, and other expenses separately to ensure transparency.

- Payment Terms: Define the agreed-upon payment schedule, including deadlines for partial or full payments.

- Due Date: Specify the exact date by which the client is expected to settle the amount owed.

- Late Fees: Include any penalties or interest charges that may apply if payment is not received on time.

Formatting for Clarity and Professionalism

A clean, organized layout ensures that all the relevant information is easy to find. Using sections with clear headings, bullet points, and consistent fonts can significantly enhance the readability of the document. The clearer and more professional the presentation, the more likely clients will feel confident in the accuracy of the charges and the legitimacy of the work.

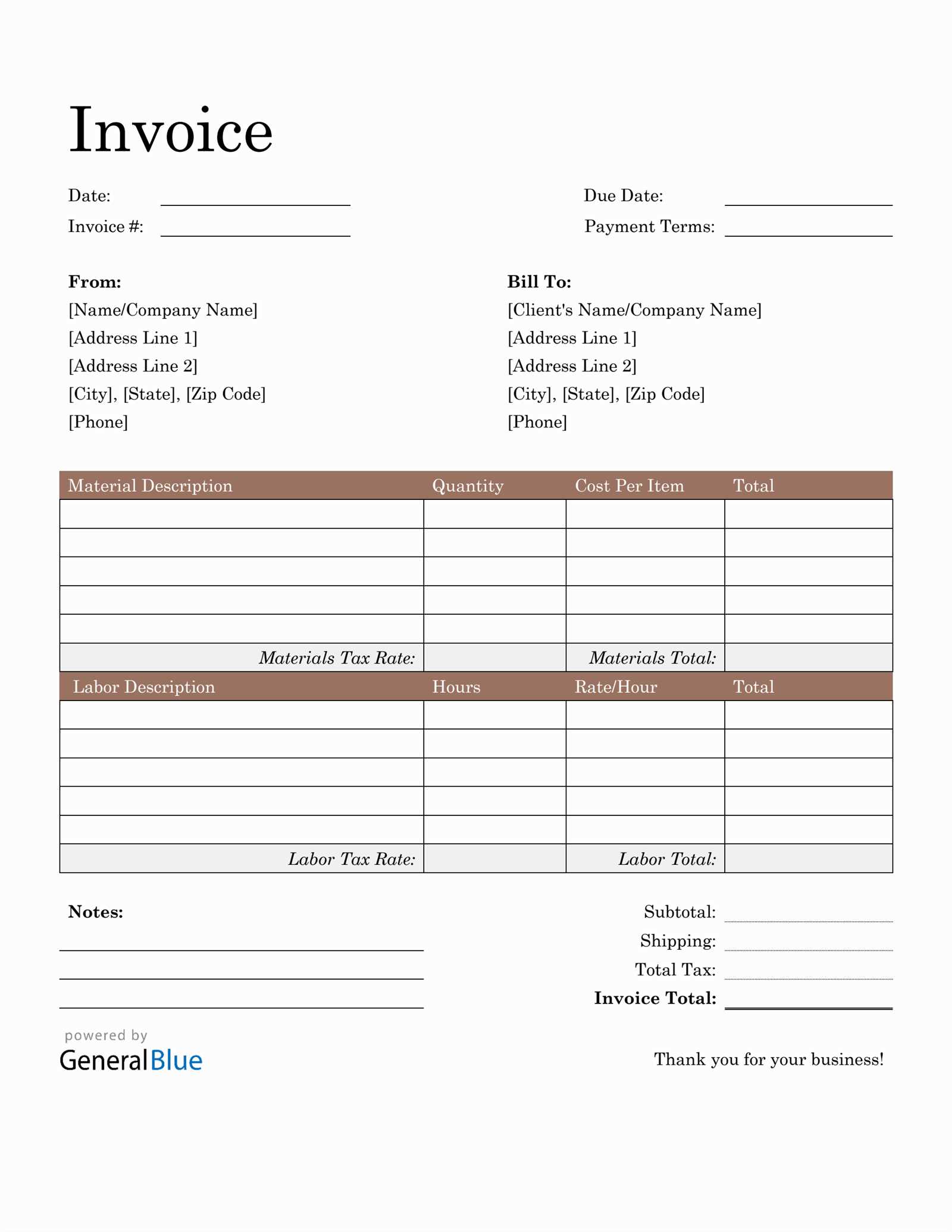

How to Customize Your Invoice

Customizing your billing documents is essential for ensuring they meet the specific needs of each project or client. Personalizing these documents not only helps present a professional image but also ensures clarity and accuracy in your transactions. Whether you are adding new sections or adjusting the layout, making these documents reflect your unique business style is a simple but effective way to improve your operations.

Adjusting the Layout and Design

The design of your document plays a significant role in how professional it looks. Here are some areas to focus on when tailoring the layout:

- Logo and Branding: Add your business logo, color scheme, and other branding elements to make your documents instantly recognizable.

- Header and Footer: Customize the header to include your business name and contact information, and add a footer with payment details or legal disclaimers.

- Font and Spacing: Use clear, legible fonts and ensure that there’s enough spacing to make the content easy to read.

Personalizing the Content

In addition to adjusting the visual design, you can modify the content to ensure it aligns with your specific projects or clients. Consider the following elements:

- Service Descriptions: Customize descriptions for each service or product provided, ensuring they are relevant to the work completed.

- Payment Terms: Adjust payment schedules and conditions according to each client’s agreement, whether it’s an upfront deposit, milestones, or final payment.

- Additional Fees: Include any additional charges such as delivery fees, permits, or unexpected costs, and ensure they are clearly stated to avoid confusion.

By personalizing these key aspects, you ensure that your documents are not only clear but also reflect your business’s unique practices and professional approach.

Free vs Paid Invoice Templates

When choosing a billing solution, professionals often face the decision between using free or paid documents. Both options have their advantages, depending on the specific needs of the business and the level of customization required. While free formats are easily accessible and cost-effective, paid versions often offer enhanced features and greater flexibility, making them a more suitable choice for businesses with more complex requirements.

Advantages of Free Billing Solutions

Free formats are an appealing option for smaller businesses or individuals just starting out. Here are some reasons why you might opt for a no-cost solution:

- No initial investment: Free documents are readily available without any upfront costs.

- Quick setup: Most free options are simple and easy to download, allowing for immediate use with minimal setup.

- Basic functionality: For many small projects or clients, free solutions provide enough features to manage basic transactions.

Benefits of Paid Solutions

For professionals with more complex billing needs, a paid solution can offer several advantages that free formats may lack:

- Advanced customization: Paid versions typically allow for more detailed personalization, such as custom fields or specific formatting styles.

- Integrated features: Paid solutions often come with added tools like automatic calculations, client management, or integration with accounting software.

- Customer support: With a paid option, you generally receive access to customer service, which can be invaluable if any issues arise.

Ultimately, the choice between free and paid options depends on the complexity of your business needs and your willingness to invest in features that streamline your billing process.

Best Construction Invoice Software Options

Choosing the right software for managing billing and financial documents can significantly improve the efficiency and accuracy of your business operations. Specialized software solutions offer a variety of features that automate tasks, minimize errors, and streamline the entire billing process. Whether you’re a small business or a large contractor, selecting the best tool can save valuable time and ensure smooth financial management.

Top Features to Look for in Billing Software

When evaluating software for creating and managing billing documents, it’s important to consider several key features that can enhance your workflow:

- Automation: Look for software that automates calculations, payment reminders, and even recurring billing for long-term projects.

- Customization: Ensure the software allows you to tailor documents to your specific needs, from branding to including detailed descriptions of services.

- Integration: The best tools integrate with other software, such as accounting platforms, to keep all your financial data in sync.

- Client Management: Opt for solutions that help manage client information, track project status, and store payment history for easy reference.

Popular Billing Solutions for Professionals

Here are a few widely used software options for professionals looking to streamline their billing process:

- QuickBooks: A popular choice for small businesses, QuickBooks offers invoicing, expense tracking, and seamless integration with other financial tools.

- FreshBooks: Known for its user-friendly interface, FreshBooks is great for freelancers and small contractors, offering easy project tracking and customizable documents.

- Zoho Invoice: A cloud-based solution that allows for customizable billing, automatic reminders, and integration with Zoho’s suite of other business tools.

- Wave: A free software option with invoicing capabilities, expense tracking, and basic accounting features suitable for small operations.

By selecting the right software, you can optimize your billing workflow, improve client relationships, and maintain financial clarity across all projects.

Understanding Payment Terms in Invoices

Payment terms are a critical part of any billing document, as they outline the expectations regarding when and how payment should be made. Clearly defined terms help ensure both parties–service providers and clients–are aligned on deadlines, fees, and methods of payment, preventing confusion or disputes. Understanding the key components of payment terms is essential for managing cash flow and maintaining healthy business relationships.

Typical payment terms can include the due date, late fees, and payment methods, among other conditions. By establishing clear and mutually agreed-upon terms at the start of a project, businesses can avoid delays in receiving payments, while clients understand their obligations and the consequences of non-payment.

Whether offering discounts for early payments or specifying penalties for late fees, customizing your payment terms to suit the project scope and client relationship can improve both client satisfaction and financial security.

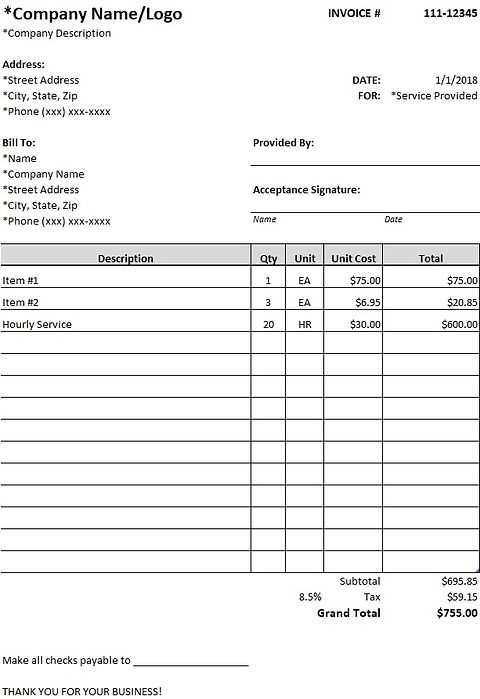

How to Invoice for Labor and Materials

When billing for work completed, it’s essential to accurately separate charges for both labor and materials to provide transparency and ensure clients understand the costs involved. Each component plays a significant role in determining the final amount, and clear breakdowns help prevent misunderstandings. Properly itemizing these costs ensures that both parties are clear on what is being charged and why.

Breaking Down Labor Costs

Labor charges typically involve the amount of time spent working on a project, multiplied by the agreed-upon hourly rate. When billing for labor, make sure to:

- Specify the number of hours worked: Clearly list the number of hours worked for each task or segment of the project.

- Detail the hourly rate: Include the rate for each worker or position involved, especially if different team members have different rates.

- Describe the tasks: Itemize the specific tasks completed during the billing period to ensure clients understand the value provided.

Calculating Material Costs

Material costs should be calculated based on the actual expenses incurred for purchasing supplies, tools, or equipment used during the project. To invoice for materials:

- List materials used: Provide a detailed list of all materials used, along with quantities and unit costs.

- Include receipts or documentation: Attach receipts or other proof of purchase to show the actual cost of materials.

- Markup for materials: If applicable, include any markup applied to materials for handling or sourcing, and make sure this is clearly explained.

By carefully distinguishing between labor and materials, you can create a clear and fair billing document that accurately reflects the value of your work while maintaining transparency with your clients.

Common Mistakes in Construction Invoices

When preparing billing documents, mistakes can happen, even to the most experienced professionals. These errors not only delay payments but can also create confusion between service providers and clients. It’s important to be aware of the common issues that arise in financial documents so that you can avoid them and ensure a smooth and timely transaction process.

Missing or Incorrect Details

One of the most frequent mistakes is leaving out key details or making incorrect entries. This can lead to unnecessary delays in payment processing. Some common issues include:

- Incorrect client information: Ensure that all client names, addresses, and contact information are correct to avoid issues with payment delivery.

- Wrong service descriptions: Clearly describe the services provided. Vague or incorrect descriptions may lead to disputes over what was actually completed.

- Missing dates: Always include the date the work was completed, along with the billing date, to avoid confusion about the time frame for payment.

Improperly Calculated Charges

Another common error occurs when charges are incorrectly calculated. This can be due to simple math mistakes or misunderstanding the agreed-upon terms. Consider the following potential issues:

- Errors in pricing: Double-check that the rates for labor and materials match what was agreed upon in the contract.

- Omitted discounts or extra fees: If any discounts or additional charges (like delivery or handling fees) apply, be sure to list them and calculate the total correctly.

- Failure to account for taxes: Always

How to Send Construction Invoices Efficiently

Sending billing documents in an efficient manner is crucial to ensure timely payments and maintain smooth communication with clients. The process of submitting these documents should be straightforward and professional to avoid any unnecessary delays or confusion. By streamlining your approach and using the right tools, you can make the entire process more effective and less time-consuming.

Methods for Sending Billing Documents

There are several methods available for delivering financial documents, each with its advantages. The choice depends on your preferences and your client’s needs:

- Email: This is one of the quickest and most commonly used methods. You can send a PDF or digital version of the document as an attachment. Make sure the file is named clearly, and include a brief note in the email body explaining the content.

- Mail: For clients who prefer traditional methods or require a hard copy, mailing a physical document may be necessary. Be sure to use reliable postal services to ensure the document arrives in a timely manner.

- Online Payment Systems: Some platforms, like PayPal or Square, allow you to send billing documents directly through their interfaces, making it easy for clients to view the charges and pay immediately.

Best Practices for Sending Billing Documents

Regardless of the method you choose, following these best practices can help ensure that your documents are received and processed efficiently:

- Confirm receipt: Always ask your client to confirm receipt of the document, especially when using email or online systems, to ensure it’s not lost in transit.

- Use clear file names: When sending digital copies, name the file clearly with relevant details like the project name or date of work to avoid confusion.

- Set reminders: Follow up with clients if you don’t receive payment within the agreed-upon time frame. Setting up automatic reminders through your software can help you manage this process.

- Provide multiple payment options: Offer various ways for clients to pay, such as credit card, bank transfer, or online payment services, to accommodate their preferences and encourage timely payment

Legal Considerations for Construction Invoices

When preparing and submitting billing documents, it’s important to understand the legal aspects that govern their use and enforcement. Properly structured financial records are not only crucial for ensuring timely payments but also for protecting both service providers and clients in case of disputes. Having a clear understanding of the legal requirements can help you avoid potential legal issues down the line and ensure that your transactions are compliant with relevant regulations.

Key Legal Elements to Include

Certain legal elements must be included in your billing documents to ensure they are enforceable and clear. These typically include:

- Clear terms and conditions: Outline payment terms such as due dates, late fees, and accepted payment methods to avoid confusion or disagreement later.

- Contractual agreement references: If applicable, reference any signed agreements or contracts that outline the work to be performed and the agreed-upon pricing.

- Tax identification numbers: Ensure that both parties’ tax IDs or business registration numbers are included for legal purposes and proper documentation.

- Itemized list of services: Provide a detailed breakdown of services rendered, ensuring it aligns with the initial agreement to prevent disputes over billing discrepancies.

Understanding Legal Protections and Liabilities

There are legal protections available for both parties involved in a transaction. These protections can vary based on your location and the nature of the services, but key considerations include:

- Mechanic’s lien rights: In certain jurisdictions, service providers may have the right to file a mechanic’s lien if payment is not received. It’s important to understand whether these rights apply to your situation and how to assert them properly.

- Late fees and interest charges: Ensure that any charges for late payments are clearly stated in the initial agreement and are compliant with local laws. Some jurisdictions limit the amount of interest you can charge.

- Statute of limitations: Be aware of the statute of limitations in your area for collecting outstanding debts. This will help you understand how long you have to enforce payments if necessary.

By taking these legal considerations into account when creating and sending your financial documents, you can protect your business interests while maintaining professional and compliant practices.

Creating Invoices for Different Construction Projects

Each type of building or renovation task comes with its own set of requirements when it comes to documenting and charging for services. Whether you’re working on a residential remodel, a large-scale commercial development, or a specialized repair, the way you present your charges can vary greatly. It’s important to tailor your records to reflect the unique nature of each project to ensure clarity, accuracy, and legal compliance.

Below, we outline how to approach billing for various types of construction projects, ensuring that each aspect is properly documented to reflect the scope and complexity of the work performed.

Project Type Details to Include Billing Considerations Residential Renovations Include specifics of repairs or improvements, labor costs, and materials used. Breakdown charges clearly to avoid confusion, include payment milestones if applicable. Commercial Projects Provide itemized costs for labor, materials, equipment, and overhead. Account for additional expenses such as permits and inspections. Be clear about timeline and deadlines. Specialized Installations Include the nature of the installation, any custom materials, and specialized labor. Ensure pricing reflects the unique requirements of the project, and include any warranties or guarantees offered. Repairs and Maintenance Specify types of repairs, hours worked, and materials used. For ongoing maintenance, include frequency and duration. Set clear payment terms for ongoing services and adjust based on urgency or complexity of the repair. By tailoring the way you document and charge for services on each type of project, you can maintain transparency and professionalism. Being specific about costs and work performed helps avoid disputes and ensures timely payments for your services.

How to Manage Invoices for Multiple Clients

Managing billing records for several clients can become a complex task if not organized properly. Keeping track of each project, its payment terms, and individual requirements is crucial to ensure timely payments and avoid misunderstandings. Using a streamlined system that allows you to monitor all outstanding amounts, due dates, and communication with clients can significantly improve your financial operations.

Below, we highlight effective strategies and tools that can help you manage multiple billing records efficiently while maintaining a professional approach.

Strategy Details Benefits Use Accounting Software Automate the creation and tracking of billing records for each client. Most accounting tools offer features like invoice generation, tracking payments, and setting up reminders for overdue amounts. Saves time, reduces human error, and ensures consistency across all clients. Organize by Client or Project Create a separate folder or category for each client or project, whether on your computer or within your accounting software. This allows easy access to records and helps prevent mix-ups. Improves organization and makes finding records quick and efficient. Set Up Payment Milestones For larger projects, divide the work into stages with corresponding payments due at each milestone. This ensures you get paid regularly and reduces the risk of non-payment at the end of the project. Helps with cash flow management and ensures you are paid for work as it progresses. Keep Clear Communication Maintain clear communication with clients regarding payment terms, project status, and any changes in cost or timeline. This reduces the risk of disputes or delayed payments. Fosters trust with clients and prevents misunderstandings about payment expectations. By adopting these strategies, you can manage your billing process with multiple clients more efficiently, ensuring smooth operations and timely payments for all your services. Having a system in place will allow you to focus on delivering quality work while keeping your finances organized.

How to Track Payments from Clients

Keeping a close eye on payments from clients is crucial for maintaining cash flow and ensuring that all financial transactions are properly documented. Whether you’re handling multiple projects or working with a single client, establishing a reliable system to monitor incoming payments is essential. This will help you stay organized, spot overdue amounts quickly, and reduce the risk of financial disputes.

Below are key strategies to effectively track payments from your clients and keep your financial records accurate:

Set Clear Payment Terms

- Define payment deadlines and amounts upfront to avoid confusion later on.

- Specify whether payments should be made in installments or as a lump sum at project completion.

- Clearly communicate penalties or interest charges for overdue payments.

Utilize Payment Tracking Tools

- Use digital tools like accounting software or spreadsheet templates to keep track of incoming payments.

- Ensure that each payment is recorded with relevant project details (e.g., client name, amount, payment method).

- Set up automatic reminders or alerts for clients who have pending payments.

Regularly Reconcile Accounts

- Periodically review your financial records to ensure that all payments are accounted for.

- Cross-check your records with bank statements to verify that received payments match what has been logged.

- Adjust your records promptly if any discrepancies are found, and address the issue with the client as needed.

By implementing these methods, you can keep track of all incoming payments and stay on top of your financial responsibilities. Regular monitoring and clear communication with your clients will ensure a smooth process and reduce the chances of payment issues arising.

Setting Up Recurring Invoices for Projects

For ongoing work or long-term agreements, setting up recurring billing can save time and ensure that payments are made on schedule. By automating the process, you eliminate the need to manually generate new records each month or at regular intervals, reducing the risk of human error and streamlining your financial operations. This is especially helpful for clients with consistent service needs or projects with multiple payment milestones.

To set up recurring billing effectively, consider the following steps:

- Define Billing Frequency: Decide whether payments should be made weekly, monthly, quarterly, or based on project milestones. Make sure the frequency aligns with the expectations set with the client.

- Automate Payment Reminders: Use software or online platforms that can automatically send payment reminders to clients. This reduces the administrative burden and ensures clients are notified in advance of upcoming payments.

- Clarify Payment Methods: Specify the acceptable payment methods (e.g., bank transfer, credit card, online payment systems) and include them in the agreement. Offering multiple payment options can make it easier for clients to pay on time.

- Track Payment History: Monitor all recurring payments in a centralized system. This will help you keep track of paid and outstanding amounts, ensuring that you don’t overlook any payments.

Setting up a recurring billing system can significantly reduce administrative tasks and ensure steady cash flow for long-term projects. It also helps maintain clear and transparent communication with your clients, reinforcing professionalism and trust.

Best Practices for Construction Invoices

Ensuring that financial documents are accurate, clear, and professional is essential for maintaining positive relationships with clients and ensuring timely payments. Following a set of best practices when creating these documents can help avoid confusion, streamline the billing process, and improve overall business efficiency. By adopting standardized methods, you can reduce errors, save time, and keep your financial operations organized.

Ensure Clarity and Detail

One of the most important aspects of any billing document is clarity. Clients should easily understand what they are being charged for and how the charges break down. Include detailed descriptions of services or materials provided, along with quantities and unit prices. This transparency helps avoid disputes and provides a clear record for both you and the client.

- Use Clear Descriptions: Make sure each service or item is described clearly, including the scope of work and the timeframe.

- List All Costs: Ensure all costs are listed separately–such as labor, materials, and other expenses–to avoid any ambiguity.

- Include Payment Terms: Specify when payments are due and any late fees or penalties for overdue payments.

Maintain Consistency

To keep things running smoothly, it’s important to maintain consistency in your records. Using the same format for all your documents not only simplifies your internal processes but also provides a professional appearance to clients. Consistency in billing makes it easier to track outstanding payments and manage your cash flow effectively.

- Standardize Your Layout: Use the same design and structure for each document, making it easy for clients to recognize and review.

- Set Up a Uniform Naming System: Label each document with a unique identifier or reference number, which helps with organization and record-keeping.

By following these best practices, you will ensure that the billing process remains efficient, transparent, and professional, helping you to maintain positive relationships with clients and avoid unnecessary delays in payment.

How to Handle Late Payments in Construction

Delayed payments can disrupt cash flow and create unnecessary stress for businesses. When payments are not received on time, it becomes critical to manage the situation effectively to minimize financial strain and maintain good client relationships. By implementing clear policies and communication strategies, businesses can reduce the impact of late payments and ensure smoother operations.

Set Clear Payment Terms Upfront

The first step in avoiding payment delays is to establish clear and precise payment terms before any work begins. Clients should know exactly when payments are due, what penalties may apply for late payments, and the accepted methods of payment. By setting expectations early, you reduce the chances of confusion later on.

- Outline Due Dates: Specify when payments should be made and consider offering milestones or progress-based payments for larger projects.

- Include Late Fees: Clearly state any late payment fees or interest charges to encourage timely settlement.

- Accept Multiple Payment Methods: Offer flexibility in payment options, such as bank transfers, credit cards, or online payment portals.

Communicate Effectively with Clients

If a payment is overdue, prompt and polite communication is key to resolving the issue quickly. Reach out to clients as soon as a payment is missed, and maintain a professional tone throughout the process. Avoid assumptions and give clients an opportunity to explain or rectify the situation.

- Send Payment Reminders: A gentle reminder can often resolve minor delays. Send a friendly note or email reminding the client of the outstanding balance.

- Follow Up Regularly: If the payment is still not received, follow up with a more formal communication, outlining the consequences of continued delay.

- Offer Payment Plans: In cases of financial difficulty, consider offering a payment plan to help the client manage their balance in installments.

Handling late payments professionally and calmly will not only help protect your business but also foster trust and transparency with clients. By following these steps, you ensure that your financial dealings remain positive, even when challenges arise.