Best Construction Invoice Template for Streamlined Billing

Managing payments in the building industry can often be complex and time-consuming. Proper documentation is essential to ensure that both service providers and clients are on the same page regarding costs, timelines, and terms. A well-structured billing document helps avoid misunderstandings and guarantees that work is compensated appropriately.

By using a standardized billing format, contractors can easily outline the details of their services, list materials or labor, and specify payment terms. This ensures clarity and professionalism in all transactions, whether it’s a small renovation or a large-scale development project. With the right approach, invoicing can be a smooth, efficient process that benefits both parties.

In this guide, we’ll explore how to create an effective billing document, the components that should be included, and how to customize it to fit your business needs. By adopting an organized method, you’ll not only expedite payments but also maintain a trustworthy and transparent relationship with your clients.

What is a Billing Document for Building Projects

A billing document used in the construction industry is a formal record that details the work completed, materials used, and the cost for services rendered. It serves as a clear and professional way to request payment for work completed, ensuring that both parties involved have an understanding of the project scope and agreed-upon fees. This document is typically provided by the service provider and outlines everything the client needs to know in order to settle the outstanding amount.

Key Features of a Building Billing Document

Such a document typically includes a breakdown of the tasks performed, including labor and materials, along with associated costs. It also lists payment terms, deadlines, and any applicable taxes or additional fees. A well-organized format ensures that the client can quickly understand what they are paying for and why. This helps foster transparency and reduces the chances of disputes during or after the project’s completion.

Importance for Both Contractors and Clients

For contractors, having a clear and accurate document helps maintain professional relationships and ensures timely payments. For clients, this document provides a record of services received, ensuring they are only paying for what was agreed upon. By using a consistent and detailed format, both parties can avoid confusion, ensuring smooth financial transactions and a more efficient workflow.

Why Use a Billing Format for Building Projects

Using a standardized document format for requesting payment offers several benefits, both for service providers and clients. It simplifies the process of listing work completed, costs incurred, and payment expectations. By adopting a consistent structure, contractors can save time, reduce errors, and ensure that all necessary information is included for smooth financial transactions.

One of the main advantages of using a ready-made format is the ability to quickly create clear and professional records. This helps avoid confusion and ensures that all essential details, such as the scope of work, payment deadlines, and any extra charges, are communicated effectively. A well-organized billing document not only streamlines the process but also fosters trust and professionalism between the parties involved.

Furthermore, a structured approach makes it easier to keep track of multiple projects or payments at once. With minimal effort, contractors can generate accurate records that are tailored to each job, reducing administrative overhead. Overall, using a ready-to-use document format ensures that contractors spend less time on paperwork and more time focusing on their projects.

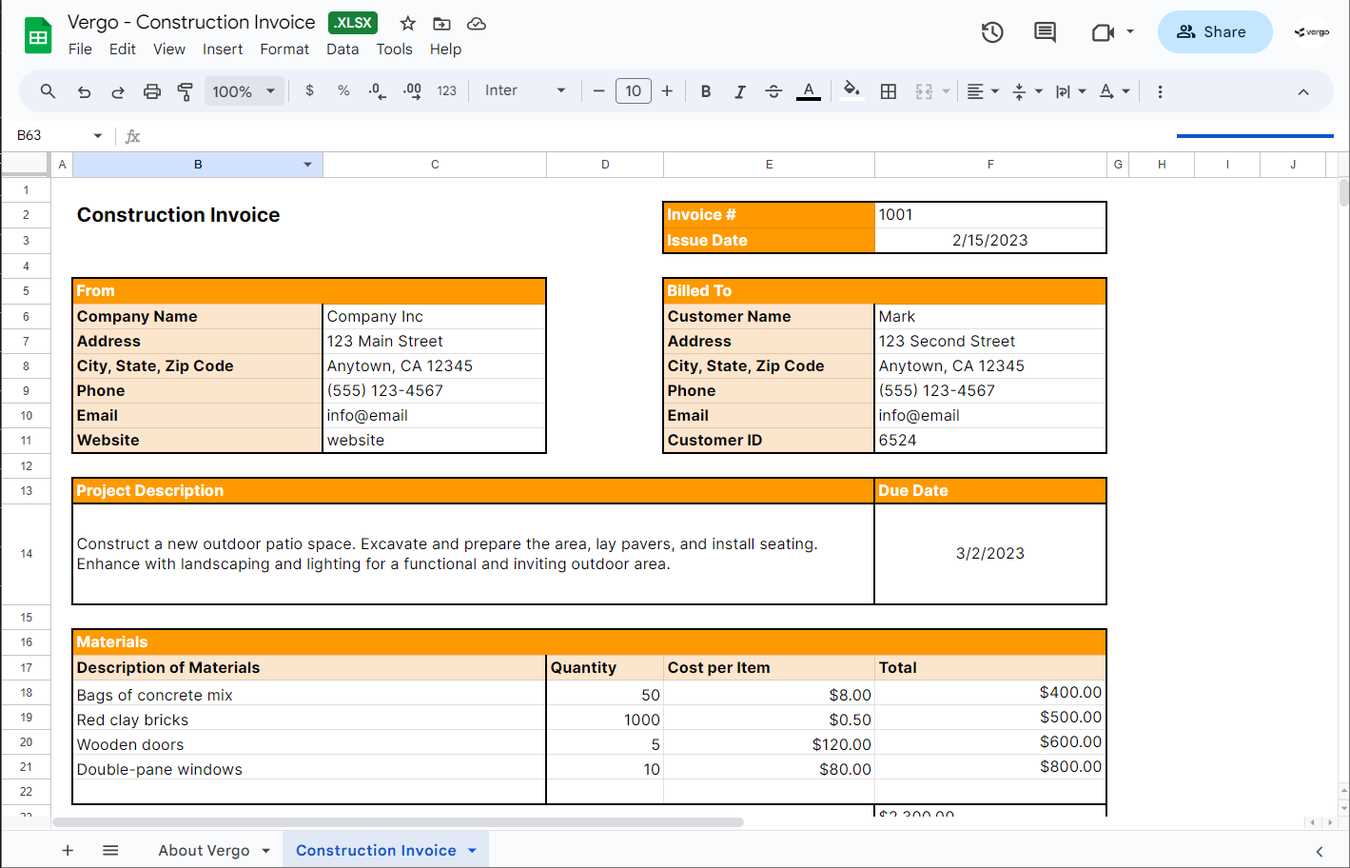

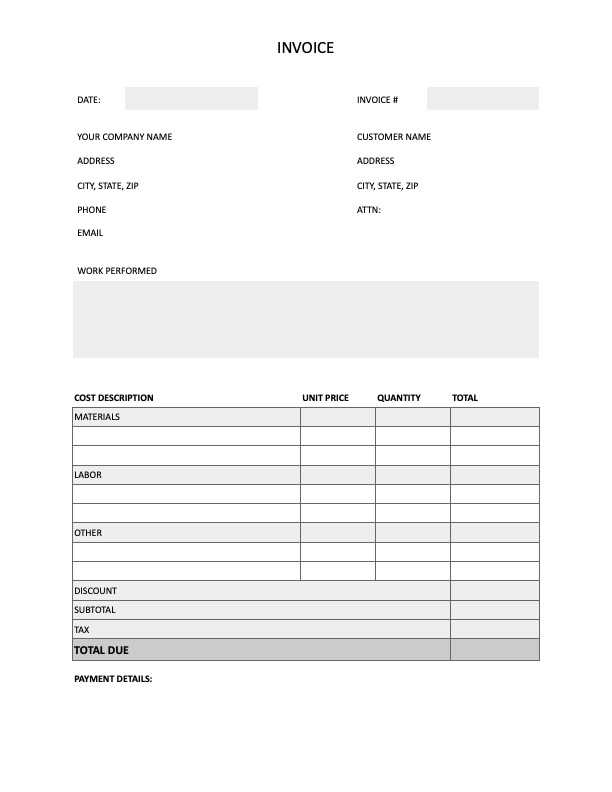

How to Create a Billing Document for Building Projects

Creating a clear and professional payment request is essential for any building project. A well-designed document helps ensure that all necessary details are included, reducing confusion and enabling quicker payment processing. Here are the basic steps to create an effective billing document for your work:

Step 1: Include Your Business Information

- Your business name

- Contact details (address, phone number, email)

- Business registration or tax number (if applicable)

Step 2: Add Client Information

- Client’s name or company name

- Client’s contact details

- Project address (if different from the billing address)

Step 3: Detail the Services Provided

- List all completed tasks and materials used

- Include a description of each item or service

- Provide the rate for each task or material

Step 4: Include Payment Terms

- State the total amount due

- Specify payment due dates

- Indicate any late fees or discounts (if applicable)

Step 5: Review and Finalize

- Check for any errors or missing information

- Ensure that the format is professional and easy to understand

- Double-check that all contact and financial details are correct

Once all the information is included, your billing document is ready to be sent to your client. By following these simple steps, you can ensure a smooth transaction and maintain a professional relationship with your clients.

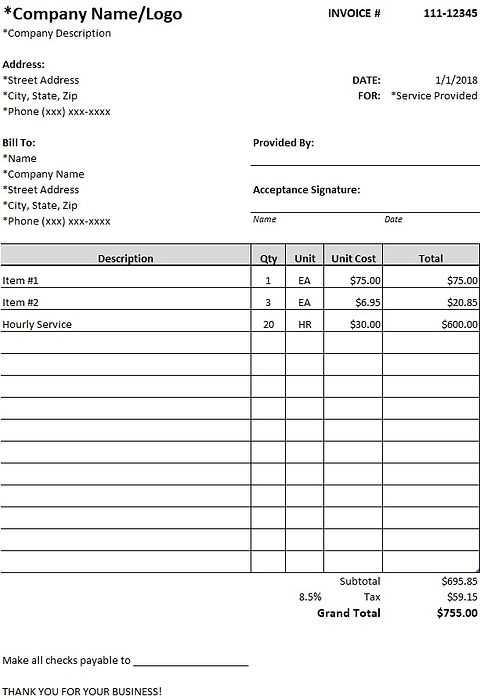

Key Elements of a Billing Document for Building Projects

Creating a detailed and effective billing record requires including all essential components to ensure both parties understand the charges and expectations. A complete and well-structured document includes various sections that highlight the scope of work, payment details, and other important information. Here are the key elements you should include:

| Element | Description |

|---|---|

| Header Information | Include your business name, address, contact details, and registration number. Also, add the client’s name and contact information. |

| Project Details | Describe the specific work completed, the project location, and any materials or equipment used. Be clear and detailed. |

| Work Breakdown | List individual tasks or services with associated costs. This breakdown helps ensure clarity and accuracy in billing. |

| Payment Terms | State the total amount due, payment deadlines, accepted payment methods, and any late fees or discounts. |

| Tax Information | If applicable, include relevant taxes, such as sales or VAT, and show how these are calculated based on the work completed. |

| Additional Notes | Provide any extra details, such as project milestones, terms of service, or special agreements that apply to the billing. |

Each of these elements is crucial for creating a transparent and professional payment document. By ensuring that all key details are included, you can avoid confusion and facilitate timely payments.

Benefits of Customizing Your Billing Document

Customizing your payment request document provides several advantages that can improve both your business efficiency and client relationships. A tailored document allows you to reflect your brand, adapt to specific project needs, and ensure clarity in communication. This personalization helps you stand out professionally and increases the likelihood of smooth, timely payments.

One key benefit is the ability to add your company’s logo, colors, and contact details, making the document more recognizable and professional. Customization also allows you to modify the layout and sections based on the nature of each project, ensuring that all necessary information is presented clearly and accurately. Whether it’s detailing specific services, adding project milestones, or incorporating unique terms, a customized record speaks directly to the unique aspects of the job at hand.

Another important advantage is the ability to align your document with your business’s workflow. Customization ensures that you can track payments, include relevant discounts or taxes, and offer clients easy-to-understand terms. This level of detail not only enhances transparency but also makes the entire billing process more efficient and organized, reducing errors and misunderstandings.

Essential Information for Your Billing Document

To ensure a seamless payment process, it’s important to include key details in your payment request document. Providing the right information helps eliminate confusion and ensures that your client understands the breakdown of charges, payment terms, and other relevant aspects. Below are the crucial elements to include in every billing document.

1. Contact Information

Both parties should have their contact information clearly displayed. This includes the service provider’s business name, address, phone number, email, and any registration or tax number, as well as the client’s details. This makes it easy for both parties to reach each other for any clarifications or follow-ups.

2. Breakdown of Services and Costs

Be sure to include a detailed list of all services rendered and materials used, along with the corresponding costs. This section should clearly describe the work completed, quantities, and prices for each item or service, ensuring that the client can easily see what they are paying for. Including unit prices and totals for each section will help both you and the client track expenses and avoid misunderstandings.

Including these essential details in your payment request document helps streamline the process and ensures that both parties are on the same page regarding expectations and financial agreements.

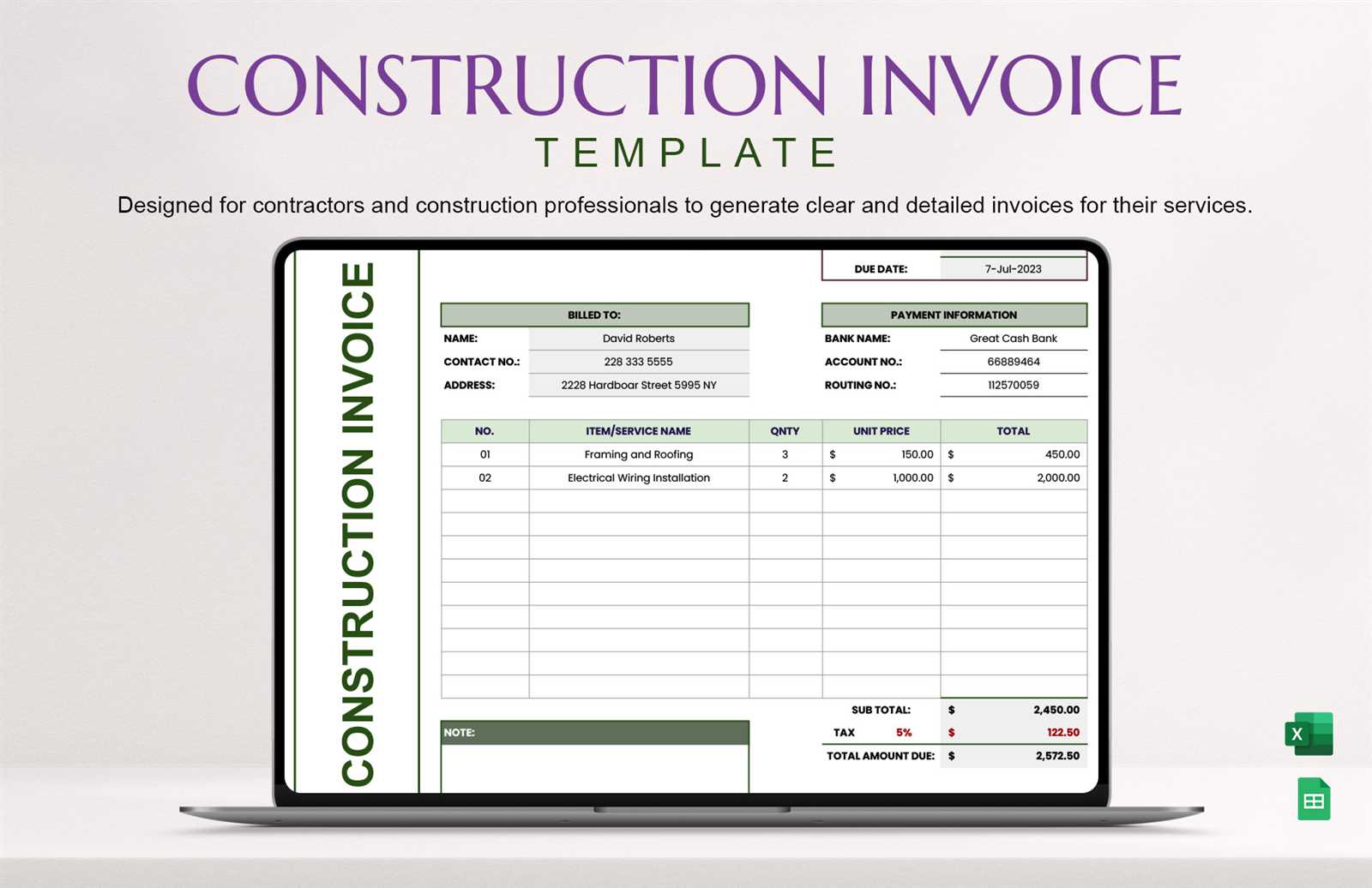

Free vs Paid Billing Document Formats

When choosing a format for your payment request, you have the option between free and paid solutions. Both have their advantages and limitations, depending on your needs. Free options can be a good starting point for smaller projects or new businesses, while paid versions often offer additional features that can benefit more established or complex operations. Below is a comparison of the key differences between the two options.

| Feature | Free Formats | Paid Formats |

|---|---|---|

| Cost | Free to download and use | Requires a one-time payment or subscription |

| Customization | Limited options for personalizing design and details | High level of customization to match business needs |

| Features | Basic features, such as service breakdown and totals | Advanced features, including automatic calculations, tax handling, and recurring billing |

| Support | Minimal or no customer support | Access to professional customer support and assistance |

| Ease of Use | Simple and straightforward, but may lack advanced tools | More user-friendly with additional help and resources for advanced users |

While free formats are ideal for basic needs and limited use, paid options offer more flexibility and functionality, which can be valuable for managing larger projects or a growing business. Ultimately, the right choice depends on your specific requirements, budget, and the volume of work you handle.

How to Edit a Billing Document

Editing a payment request document is a straightforward process that allows you to update important details such as costs, services, and client information. Whether you’re using a digital or paper format, making sure your document reflects accurate and up-to-date information is essential for smooth transactions. Follow these steps to ensure your document is properly edited and ready for submission:

Step 1: Open the Document

- If you’re working with a digital document, open the file using your preferred editing software (e.g., Word, Excel, or a PDF editor).

- If you’re using a physical form, ensure that the document is clear and legible for any manual edits.

Step 2: Update Client and Business Information

- Ensure that both the business name, address, and contact details, as well as the client’s information, are accurate.

- If there are any changes to the client’s billing address or contact information, update these fields immediately.

Step 3: Modify Service Descriptions and Costs

- Review the breakdown of services provided and ensure that any recent work completed is included.

- Adjust costs for labor, materials, or other services based on the actual expenses or any new agreements.

- Check quantities and pricing for any discrepancies and update them accordingly.

Step 4: Adjust Payment Terms

- If there are any changes to payment deadlines, late fees, or discounts, ensure that these details are updated in the document.

- Make sure that the total amount due reflects the revised pricing and terms.

Step 5: Review and Save

Common Mistakes in Billing Documents

When creating a payment request document, it’s easy to overlook small but important details that can lead to confusion or delays in payment. Whether you’re a contractor or service provider, avoiding common mistakes can ensure smoother transactions and a stronger relationship with your clients. Below are some of the most frequent errors and how to avoid them.

1. Missing or Incorrect Contact Information

Failing to include accurate contact details for both your business and the client can lead to misunderstandings or difficulties in communication. Ensure that all names, addresses, phone numbers, and email addresses are up-to-date. Incorrect details may cause delays in payments or even lead to a payment being sent to the wrong party.

2. Incomplete Service Descriptions

One of the most common issues is not providing a clear breakdown of the work performed. This can leave clients unsure of what they’re being charged for and lead to disputes. Be specific about the tasks completed, materials used, and labor hours worked. Detailed descriptions help avoid misunderstandings and ensure that the client knows exactly what they are paying for.

3. Incorrect Payment Terms

Another common mistake is not clearly stating the payment terms, such as deadlines, accepted payment methods, and any late fees. This can lead to missed payments or confusion about when the money is due. Be sure to highlight the due date and specify any penalties for late payments. A well-defined payment schedule makes it easier for clients to meet their obligations on time.

4. Overlooking Taxes or Additional Charges

Sometimes, service providers forget to include taxes, extra fees, or discounts that may apply. If these are left out, it can lead to discrepancies when the client reviews the document. Always double-check that any additional charges, such as sales tax or service fees, are correctly calculated and included.

5. Errors in Totals or Calculations

Simple mathematical errors can be one of the most frustrating mistakes for both parties involved. Always review the totals and ensure that calculations are accurate. A minor error can delay payment and cause unnecessary confusion, so it’s crucial to double-check your numbers before sending the document.

By avoiding these common errors, you can create a clear, professional document that improves communication and helps yo

How to Send Billing Documents Effectively

Sending a payment request document is just as important as creating it. The way you send it can impact how quickly and smoothly you get paid. By using the right approach, you can ensure that your client receives the necessary details in a timely and professional manner. Here are some key steps for sending your billing document effectively:

1. Choose the Right Delivery Method

- Email is the fastest and most efficient way to send a document. It’s also more likely to be seen immediately by the client.

- Postal mail may be suitable for clients who prefer hard copies or if email is not an option.

- In-person delivery might be appropriate for local clients, especially for smaller projects or if you have an ongoing relationship with them.

2. Double-Check Document Accuracy

- Before sending the document, review it carefully for any errors in contact information, pricing, or terms.

- Ensure that all charges, taxes, and totals are accurate.

- Make sure your business details and client information are up-to-date.

3. Attach Supporting Documentation

- If necessary, attach any backup materials, such as time sheets, receipts, or agreements, that explain the charges in detail.

- Providing this supporting documentation helps to clarify your charges and builds trust with the client.

4. Follow Up After Sending

- Once the document has been sent, it’s a good idea to follow up after a few days to confirm receipt and answer any questions.

- For larger or ongoing projects, consider setting a reminder to check in as the payment due date approaches.

5. Use Digital Tools for Efficiency

- Consider using online tools or software that allow you to send payment requests quickly and track when they have been received and opened.

- Automating this process can save time and reduce the chance of missing imp

Understanding Payment Terms on Billing Documents

Payment terms are a crucial part of any billing document, as they set the expectations for when and how payments should be made. These terms outline the timeline for settling the amount due and any conditions or penalties that may apply if payments are delayed. Understanding and clearly defining these terms ensures a smoother financial transaction between service providers and clients.

Common payment terms include the due date, late fees, and discounts for early payment. These details not only help manage cash flow but also provide both parties with clear expectations on payment timelines. Being transparent about payment terms from the start can help avoid misunderstandings and disputes later on.

Key Elements of Payment Terms

- Due Date: Specifies when the payment should be made, typically ranging from 30 to 60 days after the document is issued.

- Late Fees: If the payment is not received by the due date, a fee may be applied, often calculated as a percentage of the total amount due.

- Early Payment Discounts: Some service providers offer discounts if the payment is made before the due date. This encourages clients to pay sooner.

- Payment Methods: Clearly state how payments can be made (e.g., bank transfer, credit card, check, etc.).

Why Payment Terms Matter

- Cash Flow Management: Clear terms help businesses manage their finances and plan for upcoming expenses.

- Client Trust: Transparent payment terms help build trust and prevent confusion, ensuring both parties are aligned.

- Legal Protection: Having clearly defined terms can protect both parties in case of a dispute over payments.

By understanding and setting clear payment terms, you ensure a professional and efficient process for both you and your clients. These terms should be discussed and agreed upon upfront to avoid any delays or issues when it comes time to settle the balance.

Best Practices for Billing Document Organization

Organizing your billing documents is essential for maintaining efficient business operations and ensuring smooth financial transactions. Proper organization not only helps you stay on top of payments but also minimizes errors and enhances your professional reputation. Implementing a few simple practices can make the entire process more manageable and improve your overall workflow.

1. Maintain Consistent Document Naming

- Use a clear and consistent naming convention for your payment requests, such as including the client name and the date (e.g., “Smith_Project_March_2024”).

- This makes it easier to locate specific documents and helps avoid confusion when referring to past transactions.

2. Create Separate Folders for Each Client or Project

- Organize your payment requests by client or project, keeping each set of documents in its own folder.

- This will allow you to quickly find related billing details, contracts, and payment history for each client or project without digging through unrelated documents.

3. Utilize Digital Tools for Tracking

- Leverage accounting software or digital platforms to automate the creation and tracking of payment requests. This can also help with reminders and follow-ups.

- Consider using cloud storage services to ensure that your documents are securely backed up and easily accessible from anywhere.

4. Keep a Payment Log

- Create a separate log to track all issued documents, payment dates, and amounts received.

- Regularly update this log to ensure that you stay on top of outstanding balances and avoid missing payments.

5. Organize by Status

- Consider categorizing your documents by their status (e.g., “Paid,” “Pending,” or “Overdue”). This will help you quickly assess the financial health of your business and take necessary actions for overdue payments.

- Having this structure in place makes it easier to follow up with clients who have not yet paid.

6. Regularly Review and Update Recor

How to Track Payments for Your Billing Documents

Tracking payments effectively is key to maintaining financial stability and ensuring that all transactions are processed smoothly. By implementing a system to monitor payments, you can easily identify outstanding balances, follow up on overdue amounts, and stay on top of your cash flow. Below are some practical methods for tracking payments accurately.

1. Use a Payment Log

A payment log is one of the simplest yet most effective tools for tracking payments. This log can be a digital spreadsheet or a manual record where you note down key details such as:

- The document number or reference

- Client name and contact information

- Amount due and received

- Payment date and method

- Outstanding balance, if any

Updating this log every time a payment is made allows you to have an overview of your transactions and quickly identify any unpaid balances.

2. Use Accounting Software or Apps

For a more automated approach, accounting software or payment management apps can be invaluable. These tools often allow you to:

- Track payments and automatically update your records when money is received.

- Set reminders for follow-ups on overdue payments.

- Generate reports to view outstanding balances, past due amounts, and payment histories at a glance.

These digital solutions help save time, reduce human error, and ensure that your financial records are always up to date.

By keeping track of payments consistently, you can ensure timely follow-ups, reduce the likelihood of missed payments, and keep your business running smoothly.

Legal Considerations for Billing Documents

When issuing a payment request, it’s crucial to be aware of the legal aspects that govern such transactions. These considerations ensure that both parties – the service provider and the client – are protected, and that the terms of the agreement are enforceable. Properly addressing legal requirements not only safeguards your business but also fosters clear expectations and reduces the likelihood of disputes.

1. Clear and Detailed Payment Terms

One of the most important legal aspects of any payment request is ensuring that the terms are clearly outlined and understood by both parties. Payment terms should specify:

- Due dates and deadlines

- Accepted payment methods

- Late fees or penalties for overdue payments

- Discounts or incentives for early payment, if applicable

Having these terms written down provides legal protection in case of any misunderstandings or delays. In the event of a dispute, a well-documented payment schedule can serve as evidence of the agreed-upon conditions.

2. Compliance with Local Laws

Different regions or countries may have specific laws governing payment practices, such as regulations on late fees or the maximum time allowed for clients to make payments. It’s essential to familiarize yourself with local legal requirements to ensure that your documents comply with the applicable laws. This includes:

- Adhering to tax requirements and properly accounting for VAT, sales tax, or other applicable taxes

- Ensuring that your payment terms do not violate consumer protection laws or fair business practices

- Following regulations regarding the use of security interests, such as liens, if applicable to the work provided

By ensuring compliance with relevant laws, you reduce the risk of legal issues and protect both your business and your clients from potential conflicts.

How to Manage Multiple Billing Documents

Managing multiple payment requests can become challenging, especially when you have numerous clients or projects to handle. Without an organized system, it’s easy to lose track of outstanding balances, missed payments, and important deadlines. Implementing an effective strategy for handling several documents at once can streamline your workflow, ensure timely payments, and help maintain strong client relationships.

1. Create a Centralized Tracking System

Establishing a centralized system for tracking all your documents is essential. You can use a digital platform or software that consolidates all payment requests, making it easy to monitor their status. Key features to include in your tracking system are:

- The client or project name

- The amount due and payment due date

- Payment status (paid, pending, overdue)

- Any follow-up actions needed

By having a clear overview of each document’s status, you can prioritize follow-ups and ensure that no payments are missed.

2. Automate Payment Reminders

When handling multiple requests, manually tracking each one’s payment status can be time-consuming. Automating payment reminders can save you time and reduce human error. Set up email or text reminders to notify clients of upcoming due dates or overdue payments. Most accounting software includes this feature, allowing you to:

- Automatically send reminders at predefined intervals (e.g., 7 days before the due date, or 3 days after the due date).

- Reduce the likelihood of missed or delayed payments.

By implementing these strategies, you can efficiently manage multiple payment requests and maintain smooth cash flow for your business.

Why Timely Billing Matters in the Industry

Timely billing is crucial in any business, especially in industries that deal with large projects and extended timelines. Issuing payment requests promptly ensures a steady cash flow, prevents delays, and maintains professional relationships with clients. Delays in requesting payments can lead to financial strain and hinder the completion of ongoing projects. In this section, we will explore the importance of timely billing and the impact it has on a business’s operations.

1. Enhances Cash Flow

One of the most significant benefits of timely payment requests is the positive impact on cash flow. Without consistent and prompt billing, businesses risk running into financial difficulties, especially when working on large projects that may take months to complete. A steady cash flow allows for:

- Prompt payment for materials and services.

- Hiring and paying staff without delays.

- Investing in new projects without financial strain.

2. Reduces the Risk of Late Payments

When payment requests are sent on time, clients are more likely to make payments on schedule. Delaying billing can create confusion and lead clients to forget about payment deadlines. By sending documents promptly, businesses can avoid:

- Late fees or penalties associated with overdue balances.

- Decreased client trust due to poor payment practices.

3. Improves Professional Reputation

Consistently sending billing documents on time helps businesses build a reputation for reliability and professionalism. Clients are more likely to trust and return to businesses that follow through with their financial agreements in a timely manner. This also strengthens business-client relationships and fosters long-term partnerships.

4. Avoids Project Delays

In industries where project timelines are critical, delays in payments can lead to project delays. Timely billing ensures that funds are available to keep work moving forward without interruptions. When payment requests are issued promptly, businesses can avoid:

- Delays in the procurement of necessary materials.

- Slowdowns caused by lack of funding for labor or services.

5. Legal and Contractual Compliance

Timely billing also ensures that businesses comply with legal and contractual obligations. Most contracts specify payment schedules, and failing to adhere to these terms could lead to disputes or legal consequences. Ensuring that payment requests are issued on tim