Construction Contractor Invoice Template for Efficient Billing and Payment Management

Managing financial transactions is a crucial part of any project-based business. Clear and accurate documentation ensures both parties involved understand the payment process and expectations. Creating well-structured billing documents can save time and reduce confusion, allowing for smoother operations and faster payments.

Streamlining the billing process through organized forms helps avoid errors, delays, and disputes. Professionals working in the field often deal with a variety of clients and projects, making it essential to have a system that works consistently and efficiently. Using customizable formats ensures that the necessary details are always included, making it easy to track progress and settle payments on time.

By adopting a standardized approach, you can improve communication with clients, build trust, and enhance the overall professionalism of your business. Whether it’s for small jobs or large-scale undertakings, setting up a reliable financial documentation process is key to success.

Construction Contractor Invoice Template Guide

Creating a well-organized document to request payment is essential for maintaining professionalism and ensuring timely settlements. This type of document not only helps track work completed but also serves as a record of all financial transactions between you and your clients. With a properly structured form, you can avoid misunderstandings and streamline the billing process.

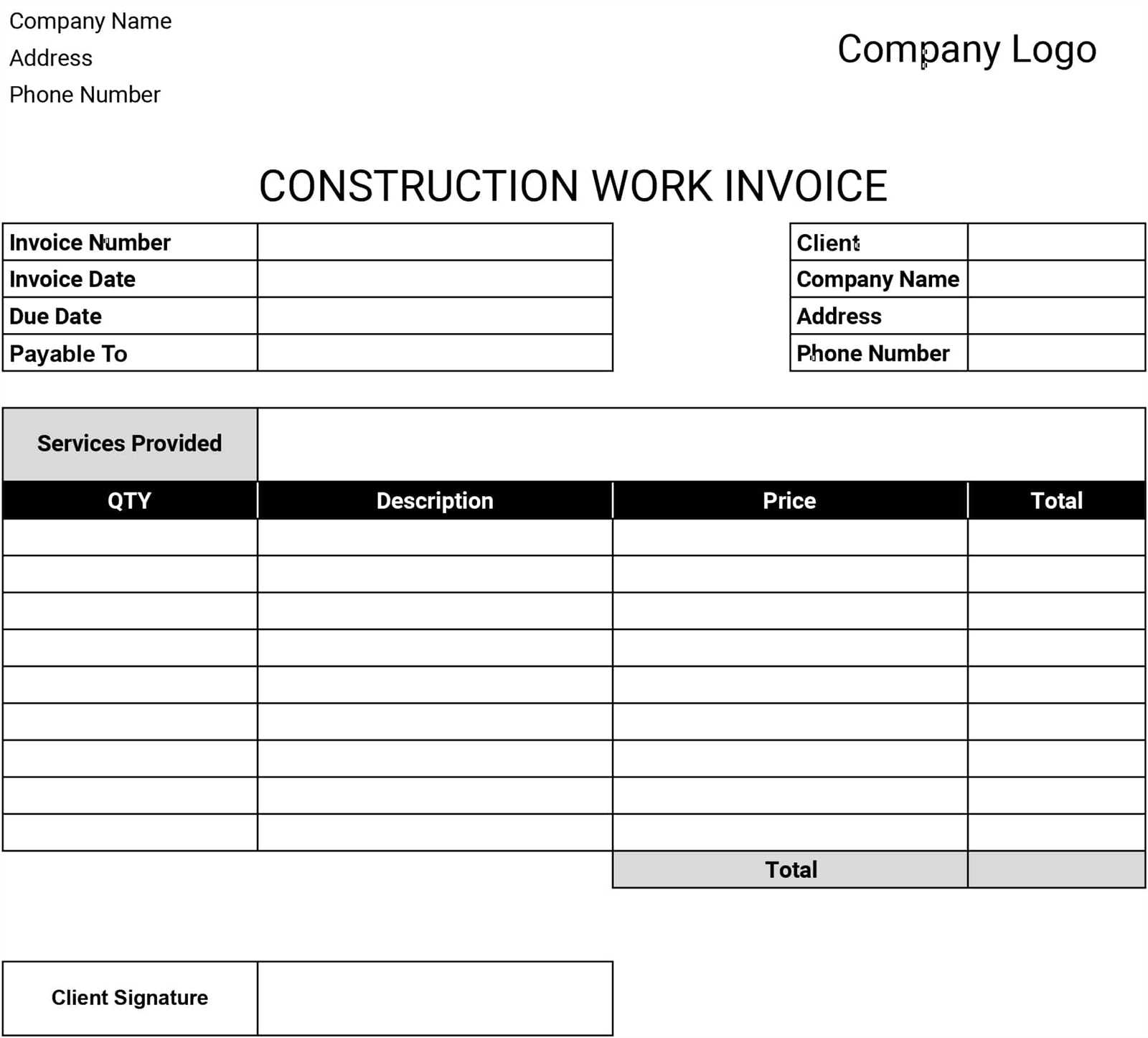

Designing your billing document starts with understanding the necessary information that must be included, such as work details, payment terms, and contact information. Having a standard format that covers all these aspects will help save time on each new project, making it easier to issue and manage payments.

Customizability is another important factor. Depending on the scope of each job, your billing document should allow room for adjustments to better reflect specific agreements, whether it’s hourly rates, materials used, or special discounts. By tailoring the layout, you ensure it fits each situation without missing critical details.

Finally, consistency is key. Once a reliable format is set, using it across all projects will improve your efficiency and professional image. This guide will help you understand how to create, customize, and use such documents to maintain smooth financial operations in your business.

Why Use an Invoice Template

Having a structured approach to requesting payment is essential for keeping business operations running smoothly. When a standard format is used for every project, it ensures that all necessary details are captured in a consistent manner. This minimizes the risk of errors, misunderstandings, and delayed payments, which can be a common issue in less organized billing processes.

Using a pre-designed format saves significant time and effort. Instead of creating a new document from scratch for each project, you can quickly fill in the relevant details. This efficiency allows you to focus on other aspects of your work while ensuring that the billing process remains seamless and professional.

Moreover, consistency in billing builds trust with clients. When clients receive clear, well-structured documents, they are more likely to understand the terms and be confident in the accuracy of the charges. This professionalism can enhance your reputation and encourage faster payments, ultimately improving cash flow and client relationships.

Key Components of an Invoice

For any billing document to be effective, it must contain certain critical information that ensures clarity and transparency between you and your clients. A well-structured payment request not only helps avoid confusion but also streamlines the settlement process. Here are the essential elements that should be included to make sure everything is properly accounted for.

Essential Information for Identification

Contact details are crucial. Your business name, address, phone number, and email should be clearly visible at the top of the document. Similarly, the client’s information is necessary to ensure you are addressing the right party. Including a unique reference number and the date of issuance also helps organize and track all requests more efficiently.

Details of the Work or Services Provided

It’s important to break down the work or services rendered in a clear, understandable way. A description of each task or material used, along with quantities, rates, and the total cost for each item, should be outlined. This level of detail ensures that clients know exactly what they are paying for and helps avoid potential disputes.

Payment terms, such as due dates, penalties for late payments, and accepted methods of payment, are also vital components. Having these terms clearly defined sets expectations for both parties and promotes timely settlements.

Benefits of Customizing Your Template

Customizing your billing document allows you to tailor it to your specific needs and business practices, making the process more efficient and professional. By adjusting the format, you ensure that all relevant details are included, and you can adapt the structure to reflect the nature of each project. Personalizing your forms not only improves functionality but also enhances your business image.

Flexibility is one of the primary benefits. With a customizable format, you can easily accommodate different types of work, varying rates, and special agreements with clients. Whether it’s adding custom fields for specific services or adjusting payment terms for a particular project, you gain the ability to make every document work in your favor.

Professionalism is also elevated when your documents carry a personalized touch. Incorporating your branding, logo, and unique layout sets you apart from competitors and reinforces your business identity. Clients are more likely to take your work seriously when all communications, including financial requests, are polished and reflect your company’s style.

Choosing the Right Format for Invoices

Selecting the appropriate structure for your billing document is a key factor in ensuring clarity and efficiency. The format you choose should align with your business needs and the nature of the projects you handle. Whether you prefer a simple, minimalist layout or a more detailed, comprehensive one, the right choice will make the entire billing process smoother and more professional.

Simplicity vs. Detail

Simple formats are ideal for small-scale or routine work, where the char

How to Add Payment Terms

Including clear payment terms in your billing documents is essential for setting expectations and ensuring prompt settlement of outstanding amounts. These terms outline when and how payments should be made, as well as any penalties or incentives for early or late payments. Properly defining these details can help avoid confusion and improve your cash flow management.

Start by specifying the due date for the payment. This should be a reasonable period based on your agreement with the client, typically ranging from 15 to 30 days. It’s important to clearly state this deadline so both parties are aware of the timeframe for payment.

Include information about accepted payment methods, such as bank transfers, credit card payments, or checks. This ensures that the client knows how they can settle the bill. Additionally, if you plan to apply a late fee for overdue payments, this should be clearly outlined in the terms, along with the interest rate or flat fee you intend to charge after the due date has passed.

Lastly, offering early payment discounts can be a useful way to encourage faster settlements. You can specify a discount percentage for payments made before the due date, which can motivate clients to prioritize your bill over others.

Tracking Hours and Materials Effectively

Accurate tracking of time spent and materials used is essential for providing transparent billing and ensuring you are compensated fairly for your work. A systematic approach to documenting these details not only helps you maintain clear records but also builds trust with clients. Whether you are working on a small project or a large job, monitoring these factors consistently is key to successful financial management.

Time Tracking Best Practices

- Record work hours daily: Keep a log of hours worked each day, including start and end times, and any breaks taken. This ensures accuracy and prevents the loss of critical data.

- Use time tracking tools: Consider using apps or software that automatically track time, reducing the risk of errors or forgotten hours.

- Provide a breakdown: For each task, list the number of hours spent, allowing your client to clearly see how time was allocated across different phases of the project.

Managing Materials and Costs

- Document all materials: List every material used, including quantities, unit costs, and total prices. This ensures clients can see exactly what they are paying for.

- Track purchases and receipts: Keep copies of all receipts and purchase records, making it easier to calculate total material costs accurately.

- Adjust for waste or overages: Account for any material waste or excess in your records to avoid discrepancies in final charges.

By keeping detailed records of both time and materials, you ensure accurate billing and minimize the chance of disputes, leading to smoother transactions and better client relationships.

Including Tax Information on Invoices

Properly including tax details in your billing documents is essential for legal compliance and transparency. Taxes are a common aspect of any service or product exchange, and it’s crucial to ensure that they are clearly stated to avoid confusion and potential issues with clients or tax authorities. By providing this information, you help your clients understand the breakdown of the total cost and avoid surprises when it comes to payment.

Start by specifying the tax rate applied to the charges. This should be the relevant rate based on your location or the location of the service or product being provided. Make sure to indicate whether the tax is a flat percentage or varies depending on the item or service. It’s also a good idea to include a brief description of the tax rate, such as “Sales Tax” or “VAT,” so clients can easily identify the charge.

Clearly list the tax amount in the billing document, separating it from the base amount. This transparency ensures that clients can easily see how much tax is being added and understand the full cost of the service. For larger projects or more complex transactions, it may be helpful to break down tax amounts for different line items, especially if multiple tax rates are applied.

Finally, be sure to include your tax identification number (TIN) or VAT number, if applicable. This provides clients with the assurance that you are properly registered with tax authorities and compliant with tax laws.

How to Add Discount Options

Offering discounts can be an effective way to encourage prompt payments, attract repeat business, or reward loyal clients. By clearly stating these discounts in your billing documents, you not only create an incentive for clients to settle their bills quickly but also demonstrate flexibility and a customer-friendly approach. Here’s how to incorporate discount options into your payment requests to ensure clarity and avoid confusion.

Types of Discounts to Offer

- Early payment discount: A common option is to offer a percentage off the total amount if the client pays before a specified due date. For example, a 5% discount for payments made within 10 days can encourage faster settlements.

- Volume-based discount: If you’re working on larger projects or with repeat clients, offering discounts based on the size or scale of the work can be a great incentive. This can be a fixed percentage or a flat amount, depending on the agreement.

- Seasonal or promotional discounts: Offering discounts during certain times of the year or as part of a promotional campaign can help boost sales or reward clients for continued business.

How to Add Discounts Clearly

- State the discount rate: Clearly indicate the percentage or amount of the discount on the document, and show how it impacts the total cost.

- Set terms for the discount: Specify the conditions under which the discount applies, such as the due date or minimum purchase requirement, to avoid misunderstandings.

- Apply the discount separately: List the discount as a separate line item on the document. This helps clients see both the original and adjusted amounts and understand exactly how much they are saving.

By clearly outlining discount options on your billing documents, you can incentivize quicker payments, strengthen relationships with clients, and maintain a transparent and professional approach to your financial transactions.

Ensuring Clarity and Professionalism

Maintaining a clear and professional approach in your billing documents is crucial for fostering trust with clients and ensuring smooth financial transactions. A well-organized and easy-to-read document not only communicates your expertise but also demonstrates your commitment to transparency and accuracy. By focusing on clarity, you reduce the chance of confusion and disputes, leading to faster payments and stronger client relationships.

Use a clean and structured layout that highlights important information. Key details such as the total amount due, work descriptions, and payment terms should be easy to find at a glance. Avoid cluttering the document with excessive text or unnecessary elements, as this can overwhelm the reader and detract from the essential information.

Consistent language and formatting contribute greatly to professionalism. Use clear and concise language to describe the services or work completed, and keep your formatting uniform throughout. This includes font choices, headings, and the alignment of figures. A polished, cohesive look not only boosts your image but also ensures that the recipient can easily navigate and understand the content of your financial documents.

Finally, remember that presenting yourself in a professional manner extends beyond the details of the work itself. A branded document that includes your logo, contact information, and business name adds an extra layer of credibility, leaving a lasting positive impression on your clients.

Setting Up Invoice Numbers and Dates

Properly assigning numbers and dates to your billing documents is essential for organization, tracking, and legal compliance. Unique reference numbers help you differentiate each transaction, while clear date references allow both you and your clients to keep accurate records. Establishing a system for these elements ensures you can easily track payments, follow up on overdue amounts, and maintain a professional approach to financial management.

Here are some important guidelines for setting up numbers and dates:

| Element | Best Practice |

|---|---|

| Invoice Number | Assign a unique, sequential number to each document. This number should be easy to track and follow a logical sequence (e.g., 001, 002, 003, etc.) to help you stay organized. |

| Issue Date | Clearly state the date the document is issued. This helps both you and the client identify the start of the payment period and avoid any confusion regarding deadlines. |

| Due Date | Indicate when the payment is expected. Typically, this is 15 to 30 days after the issue date, but it should reflect your agreement with the client. |

Consistency is key when it comes to numbering and dating your documents. By adhering to a consistent format, you make it easier to keep track of your financial records and maintain a smooth workflow across multiple projects. Additionally, unique numbers and well-defined dates make it easier to reference past transactions in case of future inquiries or disputes.

Best Practices for Sending Invoices

Sending a well-crafted billing document is just as important as creating it. The method you use to send it, the timing, and the clarity of the communication all contribute to ensuring that clients receive and process the document efficiently. Following best practices when delivering your payment requests will help maintain professionalism, reduce payment delays, and improve client relationships.

Method of Delivery

- Use email for digital submissions: Sending the document via email is fast, efficient, and easily trackable. Attach a PDF file to ensure the format remains intact and is easily accessible for the client.

- Provide hard copies when necessary: For clients who prefer physical copies or for high-value projects, sending a printed version by mail or hand delivery may be appropriate.

- Consider using an online payment platform: Many businesses now use online billing platforms that allow clients to view and pay bills directly. This can speed up the payment process and add convenience for the client.

Timing and Follow-Up

- Send promptly after project completion: Aim to send the billing document soon after the work is completed, ideally within a day or two. This ensures that the work is still fresh in the client’s mind and allows them to process the payment quickly.

- Set a clear due date: Include a specific due date for the payment and ensure the client understands the terms of late fees, if applicable. This helps establish clear expectations for both parties.

- Send reminders: If the payment deadline approaches and the client hasn’t paid yet, send a polite reminder. This can be an email or a follow-up phone call to ensure they received the document and are aware of the due date.

By implementing these best practices, you not only improve the likelihood of prompt payment but also reinforce a professional image and build stronger, more trusting relationships with clients. Clarity, consistency, and timely communication are key to managing your billing process effectively.

Common Mistakes to Avoid in Invoices

While creating billing documents may seem straightforward, there are several common errors that can lead to confusion, payment delays, or even disputes. By being aware of these mistakes and taking steps to avoid them, you ensure smoother financial transactions and maintain professional relationships with your clients. Here are some of the most frequent issues to watch out for:

- Missing or incorrect details: Failing to include essential information such as the work description, amount due, payment terms, or client details can cause delays or confusion. Always double-check that all sections are complete and accurate before sending the document.

- Unclear payment terms: Not clearly stating the payment deadline or terms, such as penalties for late payments, can lead to misunderstandings. Always specify when the payment is due and include any relevant conditions or fees for overdue payments.

- Errors in calculations: Simple mistakes in math, such as incorrect totals or tax rates, can result in incorrect amounts being billed. Always verify the math on your billing document to avoid potential issues with your client.

- Failure to provide a clear breakdown: Clients appreciate transparency. Not itemizing services or materials can make it difficult for them to understand what they are paying for. Ensure each charge is clearly listed with descriptions and corresponding costs.

- Omitting your contact details: Leaving out your business name, phone number, or email address can make it difficult for clients to contact you with questions or concerns. Make sure your contact information is easy to find on the document.

- Not using a consistent format: Inconsistent fonts, styles, or layouts can make your billing document look unprofessional and confusing. Stick to a clean, uniform design that makes it easy for clients to read and process the information.

Avoiding these common mistakes ensures that your billing documents are clear, accurate, and professional. This not only helps you get paid on time but also builds trust with your clients and prevents potential disputes from arising.

How to Manage Late Payments

Late payments can disrupt your cash flow and create unnecessary stress, but they are a common issue in business. Managing overdue payments requires a proactive and professional approach to ensure that you maintain positive client relationships while also protecting your financial interests. Establishing clear payment terms from the start and taking timely action when payments are delayed are key to minimizing the impact of overdue balances.

Establish Clear Payment Terms Upfront

The best way to prevent late payments is to set clear expectations at the beginning of a project or service agreement. Make sure to include detailed payment deadlines, any applicable late fees, and the methods of payment you accept. This clarity helps the client understand their obligations and reduces the chances of delays. Ensure that these terms are reiterated in the document you send, making it easier for both parties to stay on track.

How to Follow Up on Overdue Payments

When a payment is overdue, it’s important to act quickly but professionally. Here are some steps you can take:

- Send a polite reminder: If the payment deadline has passed, send a friendly email or message to remind the client of the outstanding balance. It’s possible they may have overlooked the due date or encountered temporary financial difficulties.

- Offer flexible payment options: If the client is struggling to pay the full amount at once, consider offering a payment plan or a small discount for early payment to help facilitate the process.

- Impose late fees if necessary: If your terms specify penalties for late payments, don’t hesitate to apply them after the grace period. Ensure the fee is clearly outlined in your agreement and documentation.

Taking a structured and professional approach to managing late payments helps protect your cash flow while maintaining positive relationships with clients. Remember, clear communication and flexibility can often resolve these situations smoothly, without escalating them into larger disputes.

Incorporating Your Branding on Invoices

Incorporating your brand identity into your billing documents is a powerful way to reinforce your business image and create a lasting impression with clients. A well-branded document not only adds a professional touch but also helps your clients recognize your company instantly. By customizing your payment requests to reflect your brand’s colors, logo, and tone, you enhance both credibility and the overall client experience.

Key Branding Elements to Include

- Logo: Place your company’s logo at the top of the document. This is the first thing clients will see and immediately associates the document with your business.

- Color Scheme: Use your brand’s colors for headings, borders, or accent details. This keeps the design cohesive and strengthens brand recognition.

- Typography: Choose fonts that align with your brand’s identity. Whether your style is modern, classic, or minimalistic, the fonts you use on your billing documents should match your overall brand tone.

Creating a Consistent Client Experience

By ensuring that your billing documents reflect your branding, you create a consistent and professional experience for your clients. Every piece of communication, from the first quote to the final payment request, should mirror your company’s look and feel. This consistency builds trust, helps your clients feel secure in their business with you, and strengthens your brand’s reputation.

How to Use Invoices for Recordkeeping

Efficient recordkeeping is essential for tracking your business transactions, managing cash flow, and preparing for tax season. Billing documents play a key role in this process by serving as detailed records of the work completed and payments received. By organizing and storing these documents properly, you ensure that your financial data is accurate, accessible, and compliant with legal and tax requirements.

Organize your documents systematically by keeping a dedicated folder or digital system for all your payment records. Categorize them by date, client, or project type to make it easier to find specific information when needed. This system helps you quickly retrieve documents for reference or auditing purposes.

Ensure proper data entry for each document you issue, including clear descriptions of services provided, amounts charged, and payment status. Having this information at hand will not only simplify your financial analysis but also allow you to follow up on overdue balances and prepare for financial reporting with ease.

By incorporating billing documents into your overall recordkeeping strategy, you create a reliable trail of transactions that supports business growth, enhances your organization, and helps you maintain financial transparency with clients and tax authorities.

Legal Considerations for Contractor Invoices

When creating and sending billing documents, it’s crucial to understand the legal aspects that can affect both you and your clients. These legal considerations help ensure that your financial transactions are clear, enforceable, and compliant with relevant laws. By including the necessary details and adhering to local regulations, you protect yourself from potential disputes and legal issues down the line.

Clearly define payment terms: One of the most important aspects of any billing document is the payment terms. These should specify the agreed-upon due dates, payment methods, and any late fees or penalties for overdue amounts. Clearly outlined payment terms help protect your rights and provide a legal basis for action if payments are not made on time.

Include proper business information: Make sure your business name, address, and contact details are clearly listed on the document. This not only promotes transparency but also provides essential information should any legal disputes arise. Clients should be able to easily contact you for any questions or clarifications regarding the payment.

Understand tax obligations: Depending on your location, there may be specific tax requirements that need to be included on your billing documents. This can include sales tax, VAT, or other applicable taxes. Failing to include the correct tax information can lead to fines or legal complications.

By ensuring your billing documents meet legal standards, you reduce the risk of misunderstandings and make it easier to enforce payment terms. This helps to maintain a smooth and professional relationship with clients while safeguarding your business interests.

Free Tools for Invoice Creation

Creating professional billing documents doesn’t have to be expensive or time-consuming. There are a variety of free tools available that make it easy to generate well-designed and accurate payment requests. Whether you’re just starting your business or need a quick solution for occasional use, these tools can help you streamline the billing process and ensure that your clients receive clear and accurate statements.

Many free platforms offer customizable templates, automatic calculations, and easy-to-use interfaces, allowing you to create and send documents in just a few clicks. By using these resources, you can focus more on your business and less on administrative tasks. Below are some popular options that can help simplify your billing process without any cost:

- Wave: A comprehensive free tool that allows you to create, send, and track billing documents. It also includes features like automatic payment reminders and integration with accounting software.

- PayPal Invoicing: A simple option for creating and sending professional billing requests directly through PayPal. It’s ideal for businesses already using PayPal for payments.

- Zoho Invoice: A user-friendly invoicing tool with a range of customizable features. The free plan is great for small businesses or freelancers who need a basic solution.

- Invoice Generator: This is an easy-to-use tool that allows you to create customized billing documents in minutes. It offers various design options and allows for quick downloads.

Using these free tools helps you save time, maintain professionalism, and keep your billing organized. Whether you’re creating a one-off payment request or managing multiple accounts, these resources provide everything you need to handle your financial documentation efficiently and effectively.