Construction Business Invoice Template for Streamlined Billing

Managing financial transactions in any project requires clear documentation and a streamlined process. Whether you’re working on small or large-scale tasks, having an organized method to track payments and expenses ensures smooth operations. Proper documentation not only helps maintain professionalism but also aids in maintaining a transparent relationship with clients.

For those in the construction industry, having a reliable tool for managing client payments is crucial. By utilizing a well-structured document, you can easily outline services rendered, costs, and payment expectations. This not only simplifies communication but also ensures that both parties are on the same page, reducing the risk of disputes or misunderstandings.

In this guide, we will explore how to create a clear and effective financial document that suits your needs. From essential components to customization tips, you’ll discover how to enhance your billing processes and ensure that you’re getting paid promptly and fairly.

Construction Business Invoice Template Overview

Effective billing documentation is essential for managing payments, ensuring transparency, and keeping your projects organized. A well-designed form provides a clear record of the services provided, the costs incurred, and the payment expectations, helping to maintain a professional image. It serves as a key tool for tracking and collecting payments in a timely manner.

Importance of Clear Billing Records

When dealing with clients, providing an easy-to-understand record of all services and associated costs is critical. A structured form minimizes the chances of misunderstandings and disputes by clearly outlining agreed-upon terms, dates, and pricing. It also allows you to maintain a record of past transactions for future reference, simplifying accounting and financial management.

Customization and Flexibility

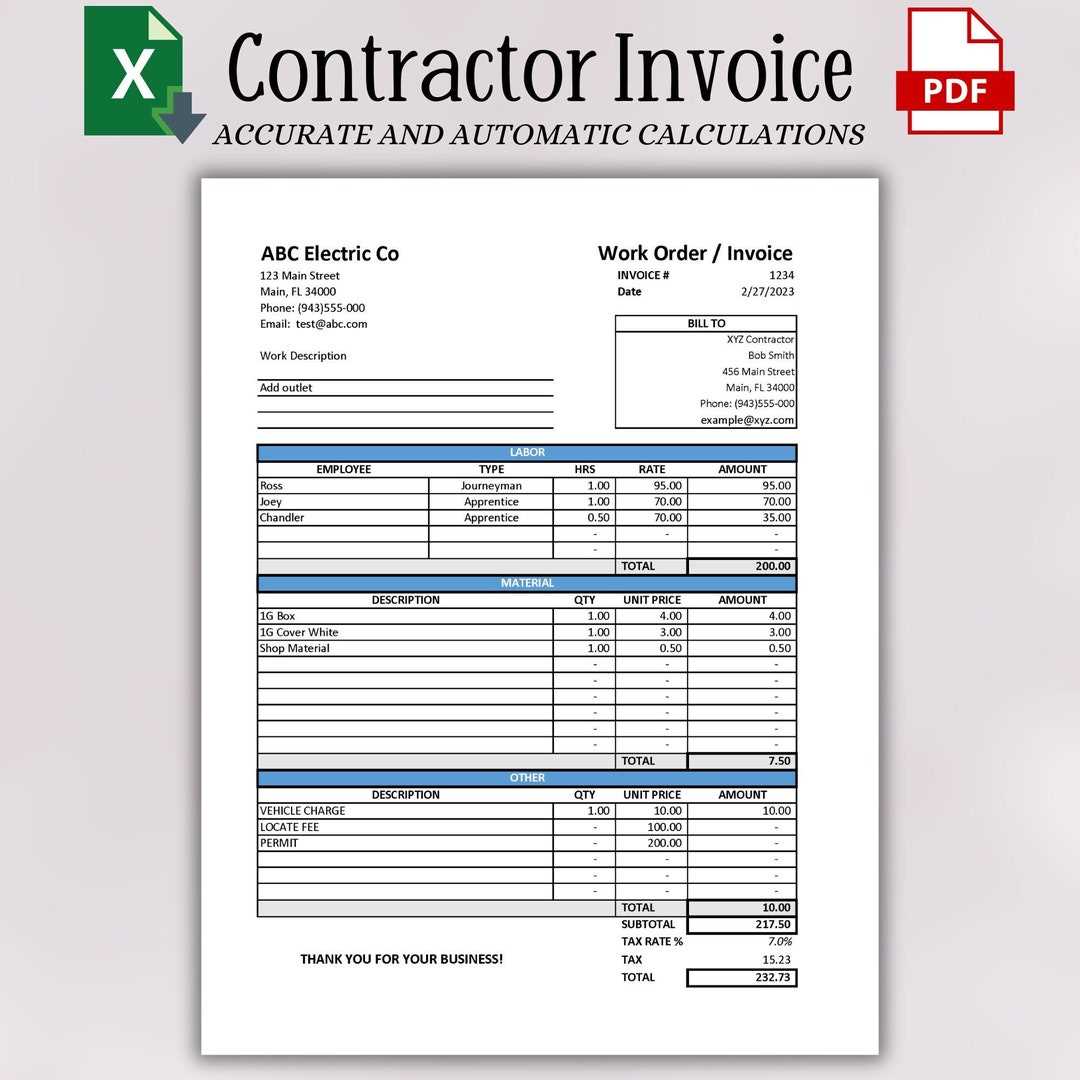

One of the benefits of using such a document is the ability to customize it according to the specific needs of each project. This flexibility ensures that your billing reflects the unique requirements of each job, whether it’s a small repair or a large-scale construction project. With customizable fields for labor, materials, taxes, and additional fees, you can adapt it for any type of service provided.

Why You Need a Professional Invoice

Having a polished and accurate billing document is crucial for maintaining a professional reputation and ensuring that all transactions are transparent. It not only outlines the services provided but also clearly states the expectations for payment, creating an official record for both you and your client. Without such a tool, there could be confusion or delays in receiving payment, potentially harming your relationship with clients.

A professionally structured document helps to avoid misunderstandings by providing detailed breakdowns of the work done, costs incurred, and any additional charges. It communicates credibility and reliability, which can be a deciding factor for future business opportunities. By presenting clients with clear, precise paperwork, you can foster trust and confidence in your services.

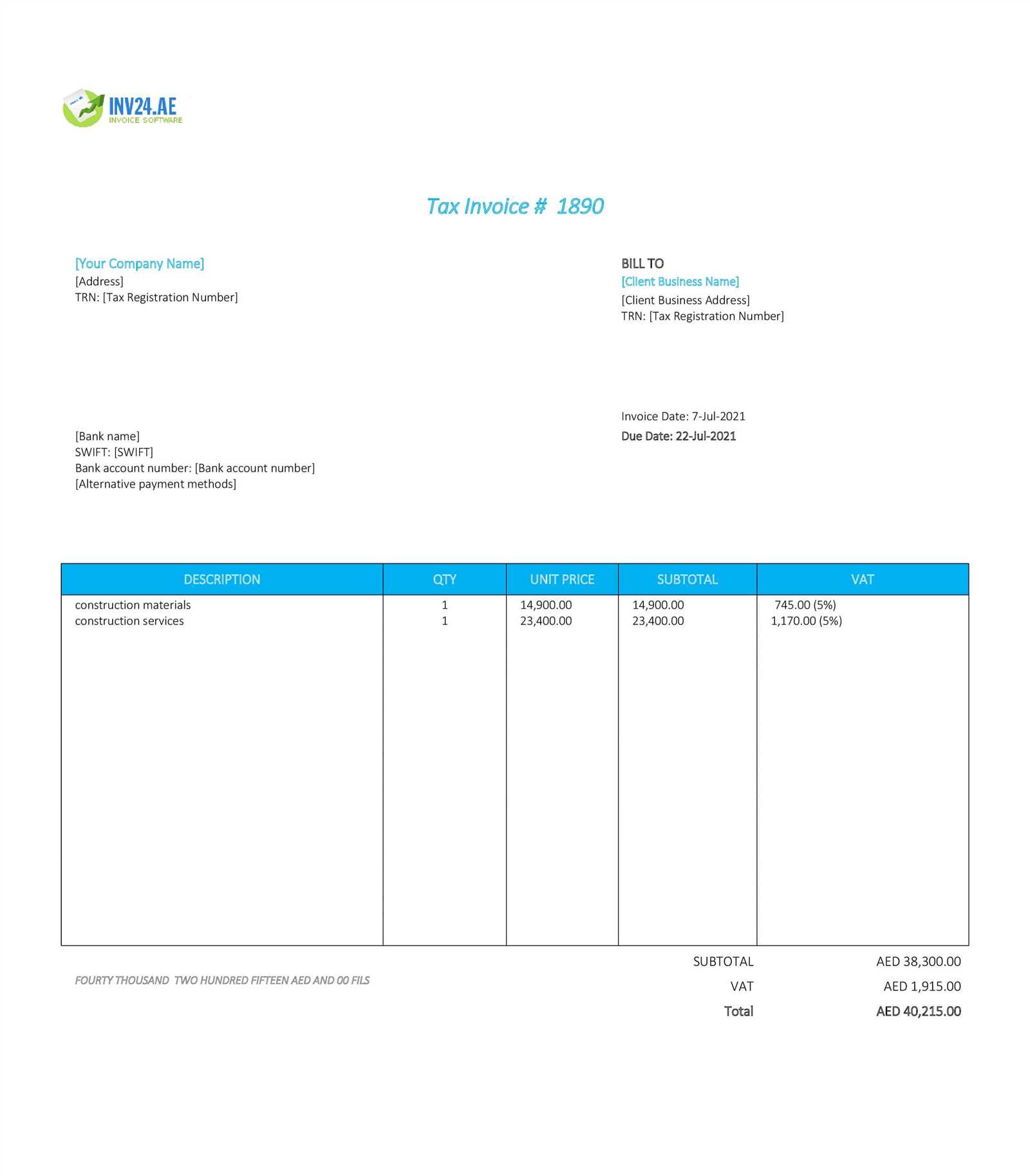

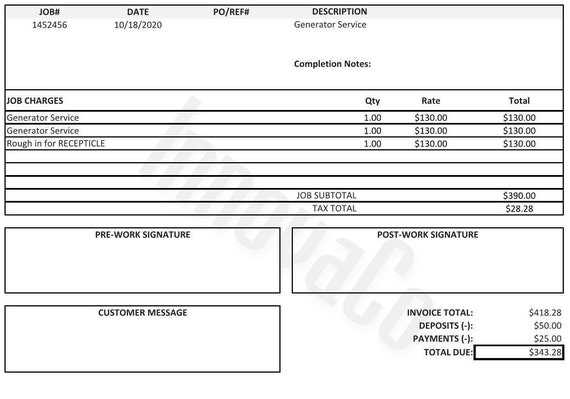

Key Elements of an Invoice Template

An effective billing document should include all the necessary details to ensure clarity and prevent confusion. These key elements help define the scope of work, outline the associated costs, and set clear expectations for both parties involved. Including these components guarantees that payments are processed smoothly and in a timely manner.

Contact Information is essential at the top of the document, listing both your and the client’s details, such as names, addresses, and phone numbers. This ensures that there is no ambiguity about the parties involved in the transaction.

Itemized List of Services is another crucial element. It should clearly state each task performed, along with the corresponding cost, allowing clients to see exactly what they are paying for. Additionally, including the payment terms–such as due date and accepted methods–helps set clear expectations regarding the timing and manner of payment.

Tax and Additional Fees should also be specified, as they can affect the total amount due. Including a section for any applicable taxes, delivery charges, or extra costs ensures full transparency in the billing process.

Customizing Your Construction Invoice

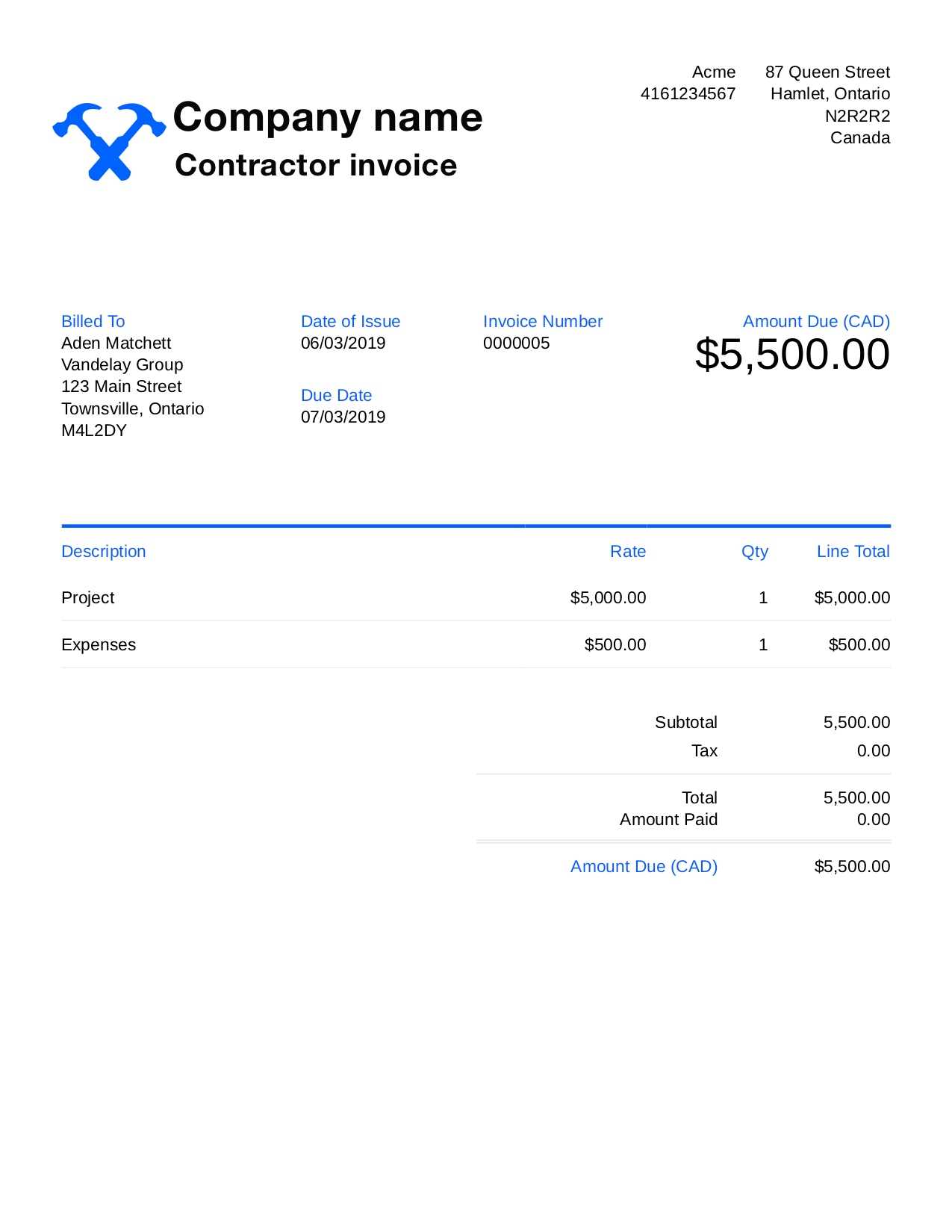

Adapting your billing document to suit each specific project allows for better accuracy and a more professional appearance. Customization ensures that all the relevant details are included, catering to the unique requirements of each job while maintaining consistency across all transactions. By personalizing your form, you make sure that it reflects the nature of the work and your brand.

Key customization options include adding your company logo and contact information, as well as adjusting the layout to fit the type of service you offer. You can also create fields for unique project-related details, such as materials used, labor hours, and any special agreements made with clients. These tailored elements make the document more relevant and specific to the task at hand, helping to avoid confusion and enhance the client’s experience.

How to Add Payment Terms

Including clear payment terms in your billing document is essential to avoid confusion and ensure that you get paid on time. These terms outline when and how payments should be made, and what happens if the payment is delayed. Establishing these guidelines helps manage expectations and prevents misunderstandings with your clients.

Steps to Include Payment Terms

To ensure that the terms are clear and professional, follow these steps:

- Set a Payment Due Date: Clearly specify when the payment is due, whether it’s within 30 days, upon completion, or on a specific date.

- State Accepted Payment Methods: List the methods of payment you accept, such as bank transfer, credit card, or check.

- Include Late Payment Penalties: If applicable, mention any fees or interest charges for overdue payments to encourage timely settlement.

- Clarify Deposit Requirements: If you require a deposit before starting the work, be sure to include this information along with the deposit amount.

Be Clear and Consistent

It’s important to be clear and consistent with your payment terms across all transactions. Avoid vague language, and ensure that clients understand the expectations from the beginning of your agreement. This will help maintain a professional relationship and ensure a smooth payment process.

Incorporating Client Details on Invoices

Including accurate client information in your billing documents is essential for proper record-keeping and smooth communication. It helps ensure that the correct person or organization receives the statement and that the details are aligned with the agreement made. Properly listed client data also fosters professionalism and ensures that you can easily follow up on outstanding payments if necessary.

Client details typically include the full name or company name, billing address, contact number, and email address. In some cases, including additional information like project references or contract numbers can help to further personalize the document, making it easier for the client to track and verify the charges. This level of clarity not only aids in reducing errors but also strengthens your relationship with the client by showing attention to detail.

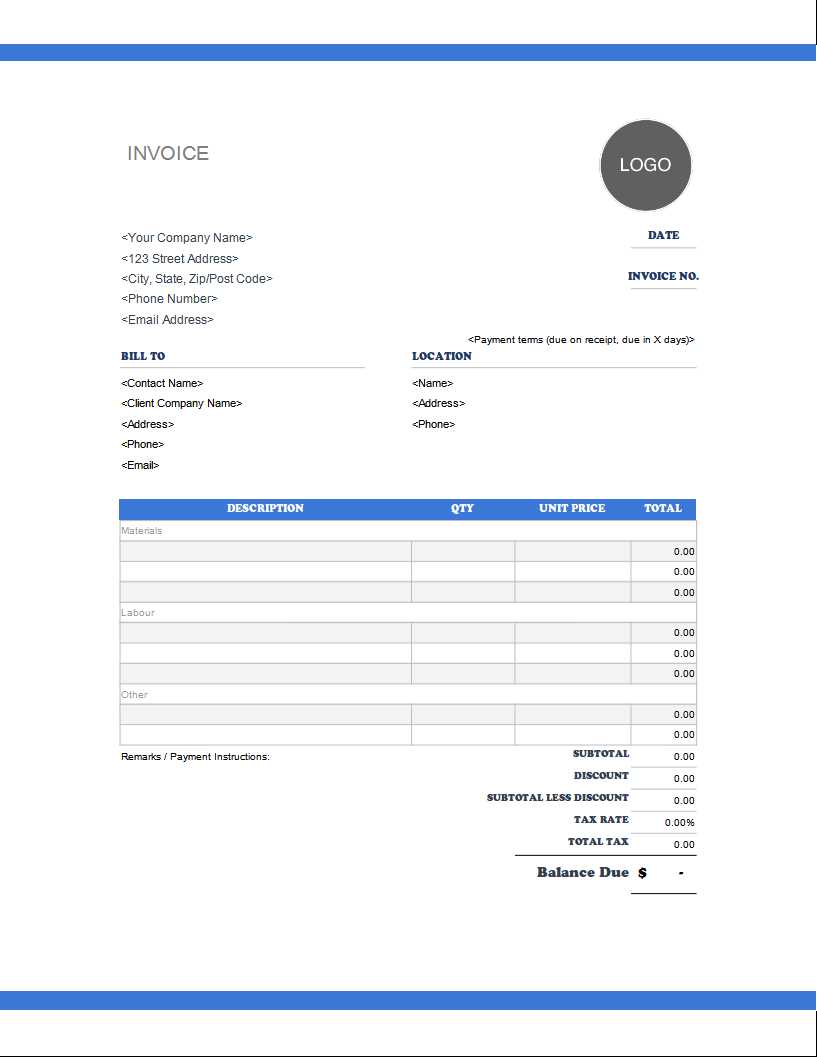

How to Include Project Details

Including project-specific information in your billing document ensures clarity and helps both parties understand the context of the work performed. By outlining the details of the project, such as scope, location, and timeline, you make it easier for clients to match the charges with the work completed. This level of transparency fosters trust and helps to avoid disputes over what was agreed upon.

Key Information to Include

Here are some key project details that should be mentioned:

- Project Name or Reference: A clear title or reference number allows clients to identify the project easily.

- Project Description: A brief summary of the work completed or services provided can clarify what was done.

- Start and Completion Dates: Specify when the work began and ended to align with the billing period.

- Location: Including the project address ensures that both parties can easily link the charges to the right site.

Why It’s Important

Including these details not only helps your client verify the accuracy of the charges but also enhances the professional appearance of your billing document. It provides a clear reference for both parties, ensuring that everyone is on the same page regarding the scope of work and payment expectations.

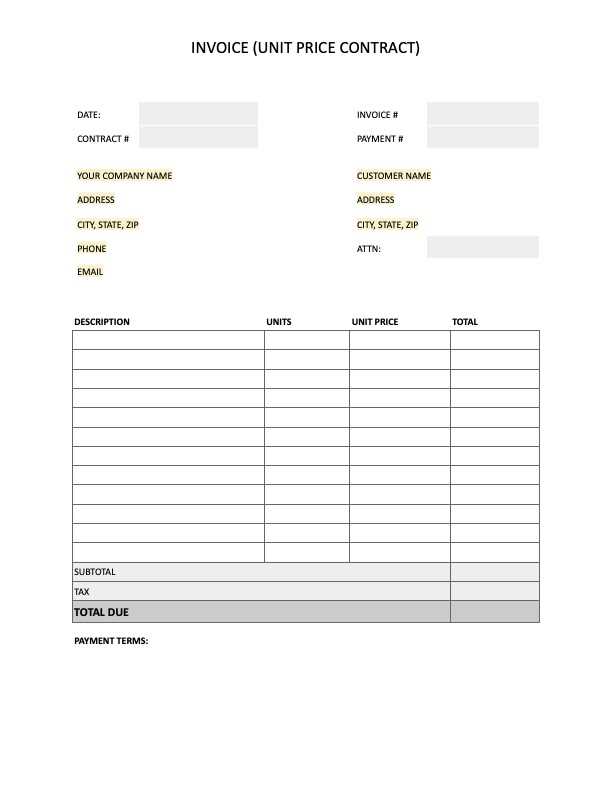

Using Your Template for Multiple Projects

Having a reusable form for all your tasks can streamline your billing process, especially when managing multiple assignments. By customizing a standard document, you can save time and ensure consistency across various jobs. This approach also helps maintain a professional appearance, as clients will receive documents with a familiar format for each project.

Advantages of Using a Standardized Form

Here are some benefits of utilizing a consistent structure for different projects:

- Time-Saving: You avoid creating a new document from scratch for each project.

- Consistency: Your clients will recognize the same format, which builds familiarity and trust.

- Customization Options: A reusable format can easily be updated for specific details like project names and costs, ensuring relevance for each task.

How to Adapt for Each New Project

When using a standard document for multiple projects, make sure to adjust the following details to reflect each unique job:

- Project-Specific Information: Update the project description, location, and other relevant details.

- Timeframes and Deadlines: Adjust the dates and payment schedules according to the terms of the new assignment.

- Custom Charges: Ensure that costs specific to each project are accurately reflected in the document.

By applying a single, adaptable document across all your tasks, you can keep your billing process efficient and professional, no matter the number of assignments you’re handling.

Digital vs Printed Construction Invoices

When it comes to sending billing documents, there are two primary options: digital and printed. Both have their own advantages and considerations, depending on the needs of the client and the scale of the project. Understanding the benefits of each can help you choose the best method for delivering professional paperwork while ensuring smooth payment processes.

Benefits of Digital Billing Documents

Digital documents offer a number of advantages for both senders and recipients:

- Speed: Digital files can be sent instantly via email, allowing for quicker delivery and reducing delays.

- Convenience: Clients can view and store digital copies easily on their devices, reducing the chance of losing important paperwork.

- Cost-Effective: Sending digital documents eliminates printing and postage costs, making it an economical option for regular transactions.

- Environmentally Friendly: Digital formats reduce paper usage, contributing to a more sustainable business practice.

Advantages of Printed Billing Documents

Although digital documents are increasingly popular, printed versions still have their place in certain situations:

- Physical Proof: Some clients prefer to receive a hard copy for their records, providing a tangible document that they can store physically.

- Professional Appearance: Printed documents can create a more formal, traditional impression, which may be important in some industries or with certain clients.

- Personal Touch: Mailing a physical document adds a level of personalization, which might be appreciated by clients looking for a more traditional experience.

Choosing between digital and printed formats depends on factors like client preferences, project scale, and budget. Both methods can be effective, but understanding their unique benefits helps ensure that you make the right choice for each situation.

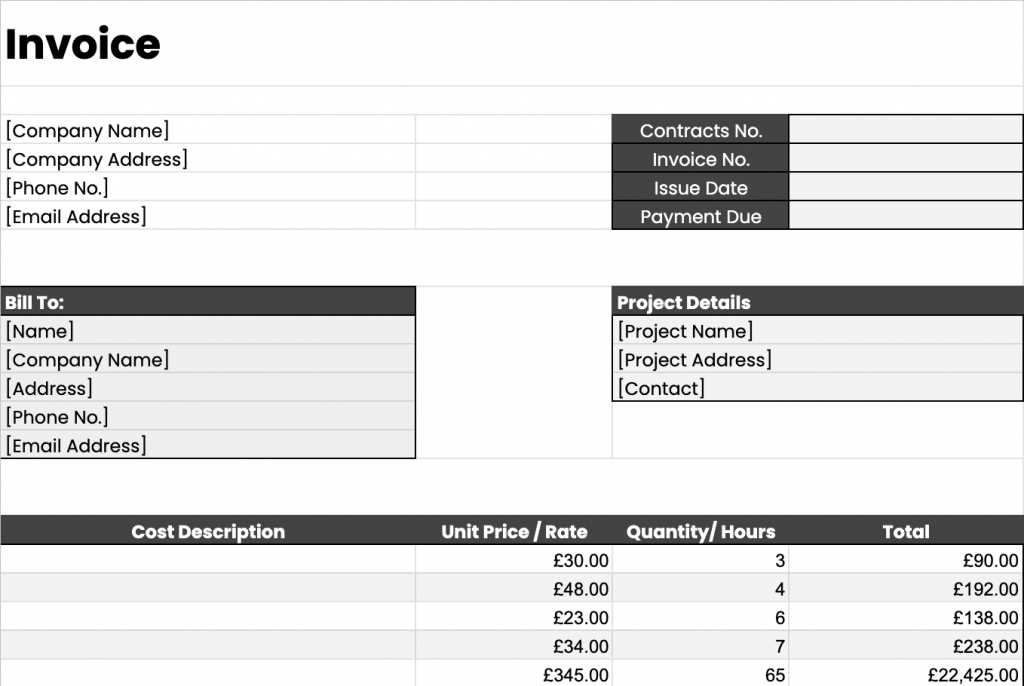

Ensuring Accurate Tax Calculation

Properly calculating taxes on each billing document is essential to maintain accuracy, compliance, and transparency. Whether working on multiple projects or a single task, including accurate tax details ensures that the document reflects the correct amount owed, preventing potential discrepancies. Below is a guide on how to organize and apply tax information effectively.

Here is an example table to illustrate the key components of a tax calculation section:

| Description | Amount | Tax Rate (%) | Tax Amount | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Service 1 | $1,000.00 | 10 | $100.00 | $1,100.00 | ||||||

| Component | Description | |||||

|---|---|---|---|---|---|---|

| Client Information | Basic details about the client, including name, address, and contact information. | |||||

| Service Description | Brief but detailed list of servi

Choosing the Right Invoice SoftwareSelecting a reliable platform for managing financial documents is crucial for ensuring smooth operations and accurate record-keeping. With the right tool, you can streamline billing, track payments, and reduce errors. Here are some factors to consider when deciding on the most suitable software for your needs. Compatibility with Your Requirements is essential. Look for software that aligns with the specific services you provide. Many tools offer customizable fields, enabling you to adapt them to reflect itemized services, rates, and any unique project details. Compatibility also extends to devices and operating systems, so verify that the software works across all platforms you commonly use. Automation and Ease of Use are features that can save time and reduce manual input. Software with automation capabilities can calculate taxes, apply discounts, and send reminders for upcoming payments. These features not only streamline processes but also help minimize errors, improving overall accuracy and efficiency. Security is another key aspect to consider. Billing documents contain sensitive information, so choosing a platform with robust data protection, including encryption and secure backups, is critical to safeguarding client and How to Handle Late Payments

Managing overdue balances is an essential part of maintaining a steady cash flow and ensuring smooth operations. Late payments can disrupt project timelines and create financial strain, making it important to implement clear procedures for addressing delays effectively. Here’s a guide on setting expectations and encouraging timely payments. Establish Clear Payment Terms from the start. By specifying due dates, accepted payment methods, and any late fees, you set a clear framework that encourages punctuality. This transparency helps clients understand the expectations and the potential consequences of missing deadlines. Send Friendly Reminders as the due date approaches. Often, a gentle reminder a few days before the deadline is enough to prompt timely action. If the payment is already overdue, send a courteous follow-up that includes all necessary details, such as the amount due and ways to complete the payment. Consider Late Fees as a deterrent. If delays become a recurring issue, implementing a late fee policy may encourage quicker responses. Late fees should be reasonable and clearly outlined in the original agreement to avoid surprises for clients. If payments are significantly overdue, consider escalating communication by offering alternative payment options or negotiating a payment schedule. Some clients may face unexpecte Common Mistakes in Construction InvoicesErrors in billing documents can lead to delays in receiving payments, confusion, and even disputes with clients. Recognizing common oversights and avoiding them is essential for creating accurate records and ensuring smooth transactions. Below are frequent mistakes to watch out for, along with tips to prevent them. 1. Missing or Incorrect Project Details

2. Inaccurate Calculations

3. Unclear Payment Terms

|