Consignment Invoice Template for Efficient Transaction Tracking

In the world of retail and wholesale, there are methods for tracking product transfers that enable smoother interactions between suppliers and sellers. Structured documents for managing stock flow help ensure clear and organized record-keeping for all parties involved. Using these forms effectively allows businesses to manage product exchanges, payments, and inventory adjustments with accuracy and transparency.

For any organization handling large volumes of items on behalf of another, adopting a standardized approach to documenting these transactions is invaluable. These documents simplify the process by clearly outlining quantities, values, and responsibilities, making it easier to maintain accountability. With the right format, managing item lists, tracking payment statuses, and ensuring accurate record-keeping become far more efficient.

Choosing a well-designed layout for these transactional forms can greatly reduce errors and streamline processes. When tailored to specific needs, these forms help create a comprehensive record, providing a reliable reference for inventory updates and revenue calculations. Businesses can thus keep their records precise, avoid miscommunications, and foster strong partnerships with collaborators.

Understanding Consignment Invoices and Their Purpose

In business transactions where one party supplies goods for another to sell, clear documentation plays a vital role in maintaining accountability. These structured forms act as essential records, detailing the movement of products, financial responsibilities, and payment terms agreed upon by both sides. Their purpose is not only to track item flow but also to establish a formal agreement that benefits both parties in the exchange.

These documents are particularly useful for tracking items that remain owned by one party until sold. By outlining specific details related to the transaction, they help both sides avoid misunderstandings and stay on top of financial obligations. The structure typically includes:

- Product Details – Lists items with descriptions, quantities, and other identifying information.

- Pricing Information – States the agreed pricing terms, fees, or commission percentages.

- Transaction Terms – Defines how and when the supplier will be compensated after the sale of goods.

- Duration and Return Policy – Specifies the time frame for unsold items and any applicable return conditions.

Using these forms brings multiple advantages. First, they improve

Key Elements of a Consignment Invoice

For effective management of goods provided to another party for sale, certain structured details are crucial. These documents are designed to ensure transparency and establish trust by capturing all relevant information about the goods, transaction terms, and financial responsibilities. Including specific elements helps maintain clarity, making each transaction traceable and mutually beneficial.

Some of the essential parts that should be included in these records are:

- Item Descriptions – Clearly lists each product with details such as name, model, or unique identification numbers to prevent confusion.

- Quantity and Pricing – Specifies the number of items involved and the pricing arrangement, whether it’s per unit or based on other terms.

- Payment Terms – Defines when and how the provider will receive payment, including any applicable fees or commissions.

- Ownership Details – Indicates that the ownership of the goods remains with the original supplier until items are sold, rein

How Consignment Invoices Differ from Sales Invoices

Although both documents play a key role in business transactions, they serve distinct purposes and reflect different types of agreements. While one focuses on tracking products provided for potential sale, the other confirms completed sales and immediate ownership transfer. Understanding these differences helps businesses manage their finances and inventory more accurately.

The primary distinctions between these forms include:

- Ownership Transfer – In a traditional sales record, ownership shifts immediately to the buyer. However, in arrangements where goods are supplied for resale, the original owner retains rights until items are sold.

- Payment Timing – Sales receipts typically require immediate or pre-arranged payment. By contrast, with items held for resale, the supplier is compensated only after items are sold, often on a periodic basis.

- Inventory Control – Sales records finalize inventory changes, reducing the seller’s stock permanently. In contrast, goods on hold for resale may be returned if unsold, requiring ongoing stock tracking.

- Risk and Liability – Completed sales tra

Benefits of Using a Consignment Invoice Template

Employing a structured form for managing goods provided for sale offers multiple advantages for businesses and suppliers. These documents simplify tracking, reduce errors, and facilitate a smooth working relationship between parties involved in the transaction. A ready-made format helps keep records organized and ensures that all necessary details are included.

Some of the key benefits include:

- Time Efficiency – Using a pre-designed form eliminates the need to create new documents from scratch, allowing businesses to quickly document transactions and focus on core tasks.

- Improved Accuracy – A standardized format ensures that essential information is always recorded, minimizing the risk of missing critical details and reducing discrepancies.

- Enhanced Transparency – Clear documentation builds trust by outlining terms and expectations, making it easy for both parties to understand their roles and responsibilities.

- Simplified Inventory Management – Having a consistent layout helps track product quantities, locations, and sales statuses, improving overall stock control.

- Legal Protection – A comprehensive document serves as a formal agreement, offering legal backing and protecting the interests of both the supplier and the seller.

Overall, structured forms bring consistency to inventory processes, streamline communication, and provide a reliable record of transactions. This approac

Creating an Effective Consignment Invoice Template

Crafting a well-organized form for tracking goods provided for sale requires attention to detail and thoughtful planning. A well-structured document not only simplifies record-keeping but also sets clear terms and expectations between parties. Designing a useful format involves incorporating specific elements that cover essential aspects of the transaction, making the process smoother and more transparent.

To create an effective layout, consider including these key components:

- Comprehensive Product Details – Include fields for item names, descriptions, model numbers, and quantities to ensure clarity about the goods being tracked.

- Pricing and Payment Terms – Define the agreed-upon prices and specify payment arrangements, such as timing and method, for clear financial understanding.

- Ownership Clauses – Outline ownership conditions, including when and how ownership may transfer, to prevent misunderstandings and maintain accountability.

- Return Policy for Unsold Goods – Add sections that detail return terms for items that remain unsold, specifying timelines and conditions for returns or exchanges.

- Signatures and Dates – Ensure space for authorized signatures and date stamps to validate

Must-Have Information in Consignment Invoices

For a transaction involving goods supplied for resale to be properly documented, certain crucial details must always be included. These pieces of information help ensure that both the supplier and seller are on the same page, providing a transparent record that can be referred to later for accuracy or dispute resolution. Properly capturing all relevant data minimizes confusion and creates a formal agreement between the two parties involved.

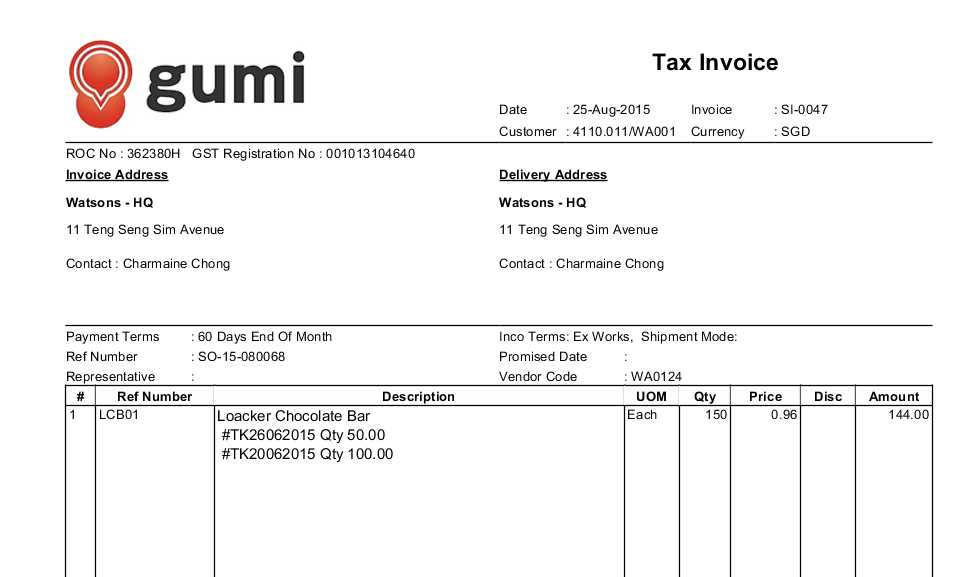

Essential Transaction Details

The document should clearly list the goods involved, including specific descriptions, quantities, and any identifying codes. Additionally, pricing information is vital for both parties to understand the cost of each item. Clear documentation of payment terms and schedules is equally important, ensuring there are no misunderstandings regarding how and when payments are expected.

Terms and Conditions

Any document used for this type of agreement should also include terms such as the duration of the resale period, return policies for unsold goods, and any penalties or fees associated with non-compliance. The inclusion of these details provides clear expectations and helps avoid potential disputes later on.

Step-by-Step Guide to Filling Out a Consignment Invoice

Completing a document for goods provided for resale is a straightforward process, but accuracy is essential to ensure all necessary details are included. By following a clear sequence of steps, you can make sure every required field is filled out correctly, avoiding errors and ensuring that both parties have a clear record of the transaction.

Below is a step-by-step guide to help you fill out the necessary fields:

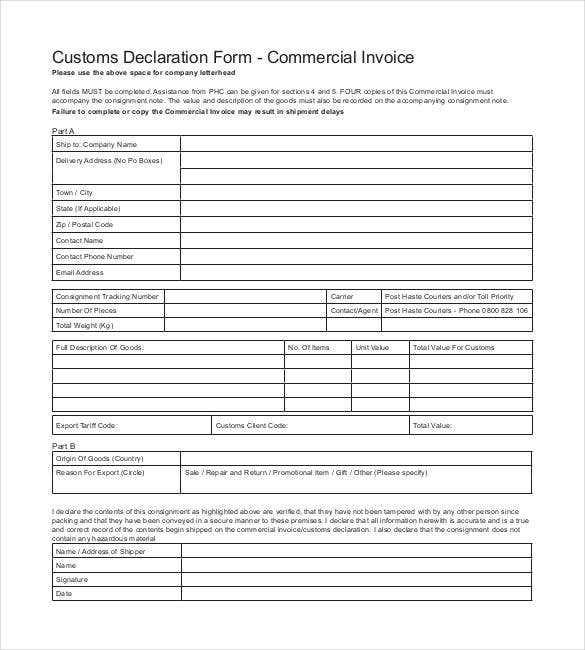

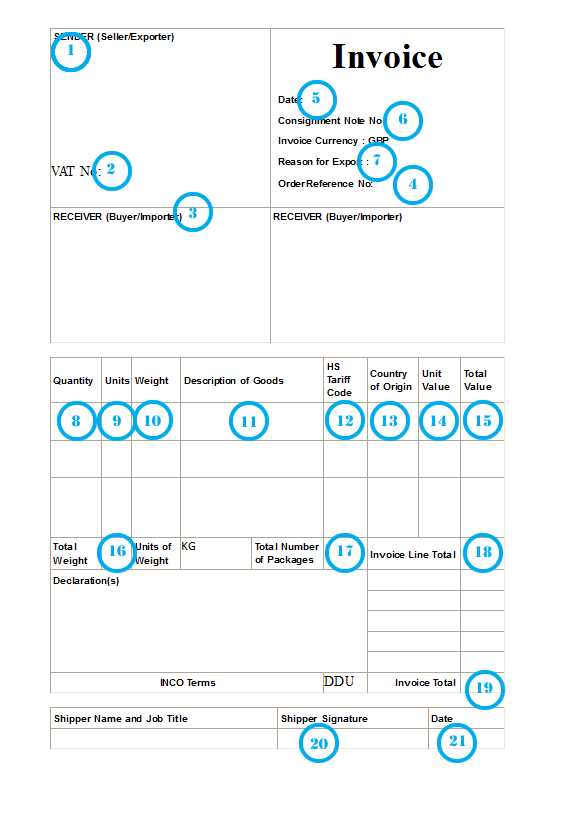

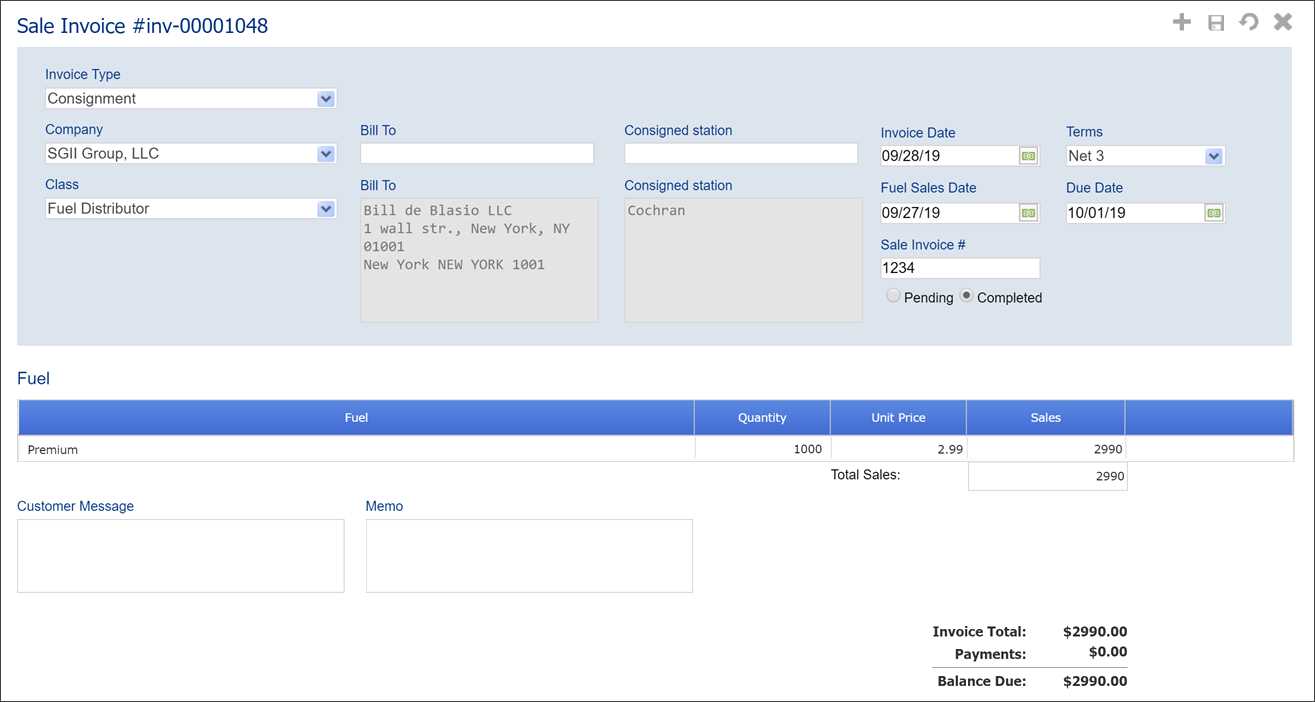

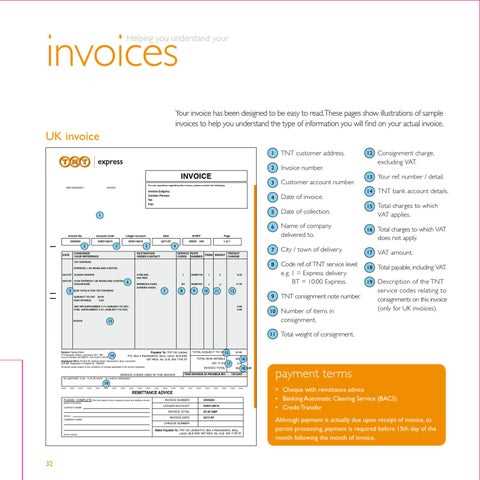

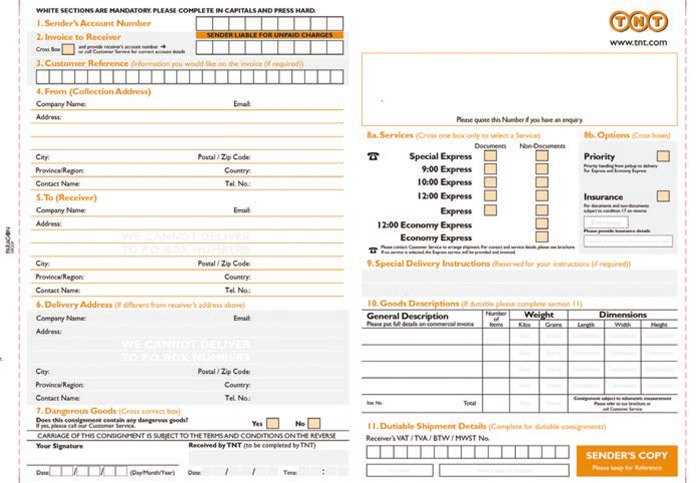

Step Description 1. Enter Business Information Start by including your company details, such as name, address, and contact information, as well as those of the recipient. 2. List Product Details Document the items being provided for resale, including product names, descriptions, quantities, and any relevant codes or serial numbers. 3. Specify Pricing Information Clearly state the agreed prices for each product, including any discounts or special offers that apply. 4. Define Payment Terms Include payment details, such as the due date, accepted payment methods, and any deposit or payment schedule agreed upon. 5. Note Return Policy State the conditions under which unsold goods can be returned and any associated deadlines or fees. 6. Include Signatures Leave space for both parties to sign and date the document, confirming the agreement and terms. By carefully following these steps and ensuring every section is properly filled out, you will create a comprehensive document that ensures transparency and a clear understanding between all parties involved.

Tracking Consignment Transactions with Invoices

Properly documenting and monitoring the flow of goods provided for resale is essential for both businesses and individuals involved. Using detailed records helps track the movement, sale, and payment of products, ensuring that both the supplier and seller maintain accurate records. This tracking process ensures financial clarity and prevents disputes over goods or payments.

Key Components for Tracking Transactions

When monitoring transactions, it is important to capture specific details that will allow easy tracking of all relevant information. These components include dates of delivery, quantities of goods, and the prices at which products were provided. Additionally, having clear documentation of any payments made or due helps track the financial side of each transaction effectively.

Creating a Transaction Tracking Table

Using a table to organize all relevant transaction details makes it easier to review past records and ensure everything is accounted for. Below is an example of how to structure the tracking of goods and payments:

Transaction Date Product Description Quantity Price per Unit Total Amount Status 2024-11-01 Product A 100 $10 $1,000 Paid 2024-11-02 Product B 50 $20 $1,000 Pending 2024-11-03 Product C 30 $15 $450 Paid By regularly updating and reviewing this table, businesses can effectively track the flow of products and payments, keeping the process transparent and well-organized.

Tips for Accurate Consignment Invoicing

Ensuring that all transaction records are precise and complete is critical for maintaining clear financial communication between suppliers and sellers. Accuracy in documenting goods provided for sale helps avoid potential errors in payment, tracking, and overall business operations. Below are some key tips to ensure that all details are correctly captured and easily verifiable.

Key Best Practices

- Double-check product details: Always confirm the product descriptions, quantities, and unit prices to avoid any discrepancies.

- Clear payment terms: Specify payment deadlines and any applicable fees to ensure both parties understand the conditions of the transaction.

- Correct delivery dates: Make sure to accurately note the date when goods are delivered to prevent confusion about the timing of sales or payments.

- Include unique identifiers: Use reference numbers or codes for each item to streamline tracking and reduce the risk of mix-ups.

Organizing Financial Information

- Break down costs: List each cost separately, including any discounts, taxes, and fees to give a detailed breakdown of the total amount owed.

- Track partial payments: If payments are made in installments, record each payment received and any outstanding balances.

- Maintain consistency: Ensure that all documents follow the same format and structure to make it easier to review and audit records.

By adhering to these practices, you can ensure that your records are both accurate and efficient, helping maintain transparency and trust in business relationships.

Top Mistakes to Avoid in Consignment Invoices

When managing financial transactions, precision and attention to detail are crucial. Failing to account for key elements can lead to errors in payments, miscommunication, and even disputes. Below are some common mistakes to avoid to ensure the accuracy and reliability of your transaction records.

Common Errors in Documentation

- Incorrect Product Descriptions: Always ensure that the descriptions and quantities are accurate to avoid confusion and discrepancies during the settlement process.

- Missing Payment Terms: Clearly outline payment deadlines, penalties for late payments, and any other relevant terms to prevent misunderstandings.

- Overlooking Delivery Dates: Double-check delivery dates and shipping details to ensure the timeline aligns with the sales agreement and expectations.

- Inconsistent Reference Numbers: Avoid using vague or repeated reference numbers. Each transaction should have a unique identifier to ensure tracking and accountability.

Financial Details and Transparency

- Omitting Fees or Discounts: Neglecting to mention any discounts, taxes, or additional fees can lead to confusion over the final amount due.

- Failure to Record Payments: Not updating the document with partial or full payments can cause discrepancies when reconciling accounts.

- Errors in Totals: Always double-check the total amount listed at the bottom of the record to avoid calculation errors that may affect financial reporting.

Avoiding these mistakes ensures smoother operations and fosters trust between parties, allowing for clear financial transactions without unnecessary complications.

Best Practices for Managing Consignment Payments

Effectively managing payments in transactions involving goods on a sales arrangement requires a clear strategy and adherence to essential practices. Proper documentation, transparency, and timely actions are crucial to maintaining financial order and fostering strong business relationships. Below are some best practices to ensure smooth handling of payments for such transactions.

Setting Clear Terms and Deadlines

Establishing well-defined payment terms from the start will help avoid misunderstandings and disputes. Ensure that both parties are fully aware of the expectations regarding payment dates, methods, and any penalties for late payments.

Action Best Practice Payment deadlines Clearly outline specific dates by which payments should be made. Payment methods Agree on preferred payment channels such as bank transfers, checks, or online payments. Late payment fees Specify additional charges if payments are not made on time. Tracking Payments and Reconciling Accounts

Keeping accurate records of all transactions is key to managing finances effectively. Use a reliable system to track received payments, pending amounts, and any adjustments. Regularly reconcile your accounts to ensure all payments are accounted for and any discrepancies are addressed promptly.

Action Best Practice Payment tracking Implement a digital ledger or accounting software to monitor transactions. Account reconciliation Regularly compare payment records with bank statements to verify accuracy. Adjustments Ensure any adjustments are made promptly, and records are updated. By following these best practices, you can maintain an organized payment process, reduce the likelihood of financial issues, and keep your business operations running smoothly.

Why Consignment Businesses Need Invoicing Templates

For businesses operating under sales arrangements, having an organized and standardized method for managing billing and payments is essential. Using a predefined document to track transactions ensures accuracy and consistency, making it easier to manage financial records and maintain transparency with partners. Below are some reasons why these businesses benefit from having structured formats for documenting sales.

Streamlining the Billing Process

Having a ready-made format for documenting transactions can simplify the entire process. A structured approach allows business owners to quickly fill in relevant details and issue documents promptly without having to start from scratch each time. This not only saves time but also reduces the likelihood of errors that could delay payments.

- Consistency: Every document follows the same structure, ensuring no crucial information is missed.

- Time efficiency: Quickly generate the necessary paperwork with minimal effort.

- Reduced errors: With a predefined structure, there’s less chance of overlooking important details.

Improving Financial Management and Record-Keeping

Accurate and reliable financial records are critical for effective management. A standardized method helps businesses easily track their sales, payments, and outstanding amounts. By using consistent formats, businesses can ensure all transactions are recorded in a way that is easy to review and reconcile during audits or tax filing periods.

- Easy tracking: Keep all records in a centralized system, making it easier to find and review past transactions.

- Audit readiness: Well-organized documentation makes it easier to prepare for financial reviews.

- Transparency: A clear structure promotes transparency in business dealings, which is vital for maintaining trust with partners and clients.

By adopting structured documents, businesses operating under sales agreements can maintain smooth financial operations, improve accountability, and reduce the chance of financial discrepancies.

How Consignment Invoices Support Inventory Management

Effective inventory management is crucial for businesses that work with goods on temporary sale or storage arrangements. The right documentation helps ensure accurate tracking of stock levels, provides a clear picture of goods moving in and out, and supports smooth operational processes. By utilizing standardized records for transactions, businesses can gain better control over their inventory and ensure timely updates to their stock information.

Tracking Stock Movement

One of the main benefits of using structured records is that they provide clear documentation of goods that are shipped or received. This helps businesses track the movement of items in and out of their stock. Each transaction can be recorded with precise details, such as the quantity of items, the value, and the date of movement, allowing businesses to maintain accurate records of their stock levels.

- Accurate updates: Ensure stock levels are always up to date with detailed transaction records.

- Clear history: Easily track the movement of items, which helps in managing reorder points and sales trends.

- Efficient auditing: Organized records make it easier to review past transactions and manage inventory counts.

Minimizing Stock Loss and Overstocking

By providing clear insights into the number of goods on hand and the quantity being sold or returned, these documents help businesses avoid both stockouts and overstocking. Businesses can quickly identify when certain products need to be reordered or when they have excess stock, ensuring they make data-driven decisions about purchasing and storage.

- Prevent stockouts: Always have the right amount of stock available to meet demand.

- Avoid overstocking: Minimize the risk of excess inventory taking up valuable storage space.

- Better forecasting: Gain insights into sales trends and plan inventory more accurately.

By integrating detailed transaction records into the inventory management system, businesses can maintain better control over their stock, reduce waste, and make more informed purchasing decisions.

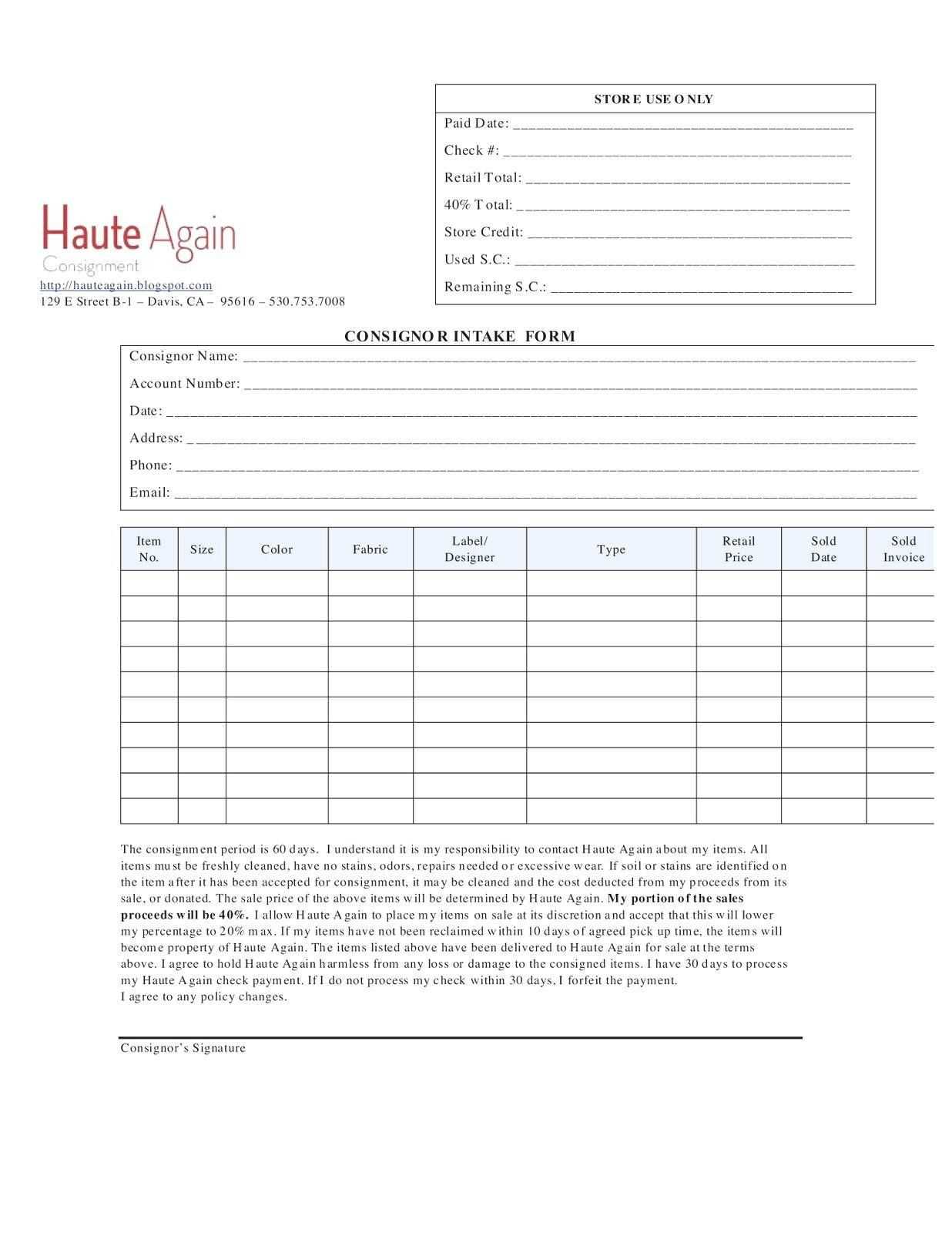

Choosing the Right Template for Your Needs

Selecting the most suitable document structure is essential to streamline processes and ensure accuracy in business transactions. Whether you are managing goods on temporary sale or tracking inventory, having a well-designed form can improve efficiency and help avoid errors. By customizing your approach, you can tailor the structure to meet the specific requirements of your operations and ensure smooth communication between parties.

Assess Your Business Needs

The first step in selecting the right format is to evaluate your business’s requirements. Consider factors like the number of transactions, the complexity of the items, and how often the document will be used. A simple format may suffice for smaller operations, while larger businesses might require more advanced features such as automated calculations or integration with inventory systems.

- Simple forms: Best for small businesses with fewer transactions.

- Advanced forms: Ideal for larger operations with more complex requirements.

- Customizable options: Ensure flexibility for your specific needs, such as adding product descriptions or varying payment terms.

Ease of Use and Compatibility

Another key factor is the ease of use. The document should be simple for all involved parties to understand and complete, minimizing errors. It is also important to ensure that the structure is compatible with your existing systems, whether you use digital tools or paper-based records. The form should be adaptable and integrate smoothly with other aspects of your business workflow.

- User-friendly: Look for formats that are easy to navigate and fill out.

- Digital compatibility: Ensure it works with your accounting or inventory software.

- Adaptability: Select a structure that can be easily updated as business needs evolve.

By carefully considering your business’s size, transaction volume, and system compatibility, you can select the most appropriate form to support your operations and ensure that everything runs smoothly.

Digital vs. Printable Consignment Invoice Options

When it comes to managing business transactions, there are two primary formats for creating records: digital and paper-based. Each has its own set of advantages and limitations, and the choice between the two often depends on the nature of the business, available resources, and personal preferences. Understanding the benefits of both options can help you decide which method works best for your needs.

Digital Formats

Digital formats are increasingly popular due to their convenience and efficiency. These options allow for quick generation, storage, and sharing of documents without the need for paper. Here are some benefits of using digital formats:

- Ease of Access: Digital files can be easily stored and accessed from any device, making them ideal for businesses that operate remotely or across multiple locations.

- Time-saving: Digital formats can be created and sent instantly, speeding up the process of tracking and confirming transactions.

- Automation: Many digital tools allow for automated calculations, reducing errors and saving time when processing payments and inventory.

- Environmental Benefits: By using fewer resources, digital records help reduce paper waste and are more sustainable.

Printable Formats

While digital formats are often more efficient, printable options still have their place, especially in industries where physical documentation is required. Here are the key benefits of using printable formats:

- Tangible Records: Printable documents provide a physical record that can be easily stored, organized, and filed for later reference.

- Legal Requirements: Some industries or regions require physical documentation for certain types of transactions or audits.

- Personal Preference: Some clients or businesses may prefer paper for keeping records, or may not be comfortable with digital tools.

Ultimately, the decision between digital and printable formats comes down to your specific needs and preferences. Both have their merits, so choosing the right option for your operations will ensure smooth and efficient transactions.

Legal Considerations for Consignment Invoicing

When managing business transactions, it is essential to understand the legal framework that governs the exchange of goods and services. Proper documentation is not only crucial for ensuring clear agreements but also for complying with local laws and regulations. For businesses that work with agreements involving goods on sale or return, understanding the legalities of creating and maintaining records is important to avoid disputes and financial issues.

Key Legal Requirements

There are several legal requirements that businesses should consider when preparing documentation for transactions. These include accurate record-keeping, proper terms, and adherence to tax laws. Below are the important aspects to keep in mind:

- Accurate Record-Keeping: Ensure that all transactions are documented clearly, with essential details like product description, quantities, and agreed-upon payment terms.

- Tax Compliance: Accurate reporting is required for tax purposes. In many jurisdictions, businesses must track and report both sales and purchases for tax assessment.

- Clear Terms and Conditions: Any agreements between parties, including payment terms, responsibility for damages, and the method of return, should be clearly outlined in the documents.

- Legal Jurisdictions: Understand the legal requirements of your region or the region in which you are doing business to ensure compliance with local laws.

Dispute Prevention and Resolution

Another important legal consideration is how to manage disputes. Properly structured records can help avoid misunderstandings, but in the event of disagreements, having clear guidelines for resolution is essential. This can include:

- Dispute Resolution Clauses: Include terms that outline the process for resolving disputes, such as mediation or arbitration, to avoid costly legal battles.

- Liability Clauses: Clarify which party is responsible for any damages, losses, or liabilities related to the goods.

Legal Aspect Importance Tax Compliance Ensures adherence to tax laws and proper reporting of business activities. Clear Terms Prevents disputes by outlining responsibilities and expectations of both parties. Dispute Resolution Provides a clear process for resolving issues, minimizing legal risks. By understanding and adhering to these legal considerations, businesses can protect themselves, build stronger relationships with partners, and ensure smooth operations within the framework of the law.

Optimizing Record-Keeping with Invoice Templates

Efficient and organized record-keeping is vital for any business. It helps ensure accurate financial tracking, simplifies tax filing, and supports effective decision-making. By using well-structured documentation for transactions, businesses can streamline their operations and maintain a clear audit trail. Standardized formats for tracking payments, goods, and services can significantly reduce errors and time spent on manual processes.

Benefits of Structured Documentation

Using a standardized approach to recording business transactions offers several advantages:

- Consistency: Standard formats ensure uniformity, making it easier to review and track transactions over time.

- Accuracy: With predefined fields and categories, the likelihood of errors in recording details is minimized.

- Efficiency: Automated calculations and consistent layouts help save time and reduce manual work.

- Ease of Access: Well-organized records can be retrieved quickly, helping businesses stay on top of their financials.

How to Improve Record-Keeping

To optimize record-keeping and improve business operations, consider the following practices:

- Use Predefined Fields: Include necessary details such as product descriptions, prices, and quantities to ensure all information is captured.

- Automate Calculations: Set up automatic calculations for totals, taxes, and discounts to reduce manual work and improve accuracy.

- Implement Cloud Storage: Store all records digitally in a cloud-based system for easy access and secure backups.

- Review Regularly: Schedule regular audits of records to ensure all transactions are properly documented and there are no discrepancies.

By optimizing record-keeping with a structured approach, businesses can reduce errors, save time, and gain a clearer understanding of their financial health.