Professional Computer Technician Invoice Template

Managing payments for tech-related services requires clear, organized documentation. Whether you’re offering repairs, installations, or consultations, ensuring that both you and your clients understand the charges is essential for smooth transactions. A well-structured document can make the billing process seamless and professional.

Properly designed documents help maintain transparency, making it easier to outline the services provided, the total cost, and any payment terms. This not only boosts your credibility but also minimizes the potential for misunderstandings with clients.

Using an organized layout for recording service details ensures that both you and your customers stay on the same page. From specifying hourly rates to adding any applicable taxes, each section of the document plays a vital role in the billing process. A good system keeps your business operations running smoothly, while providing clients with the clarity they need to make prompt payments.

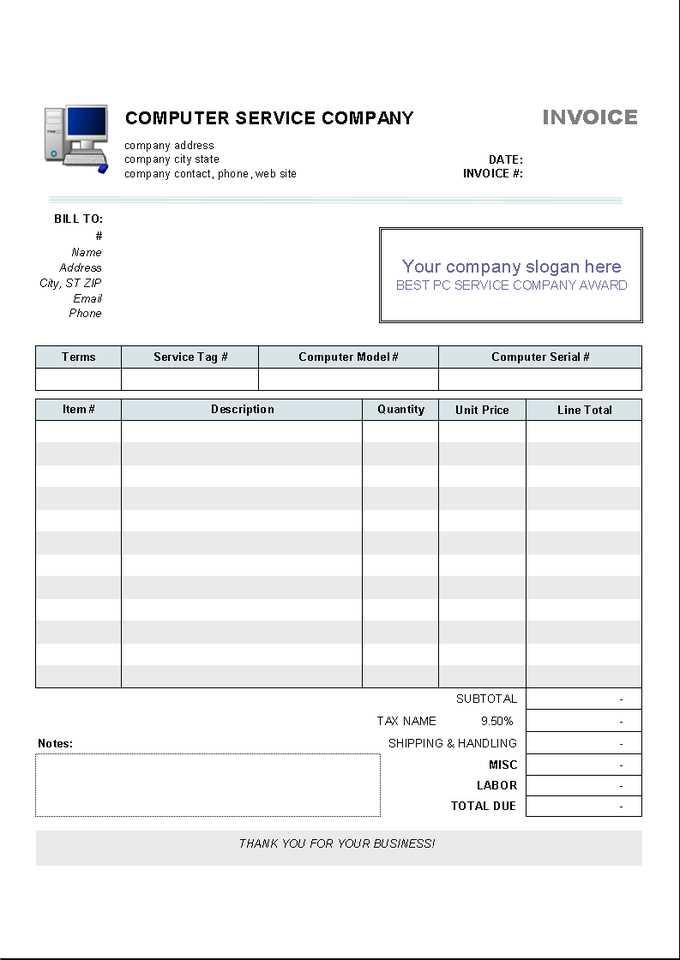

Essential Features of Technician Invoices

When creating a billing document for technical services, it’s crucial to include certain key elements that provide clarity and ensure both parties are on the same page. A well-organized document not only outlines the services provided but also sets clear expectations regarding payment, helping to avoid confusion or disputes.

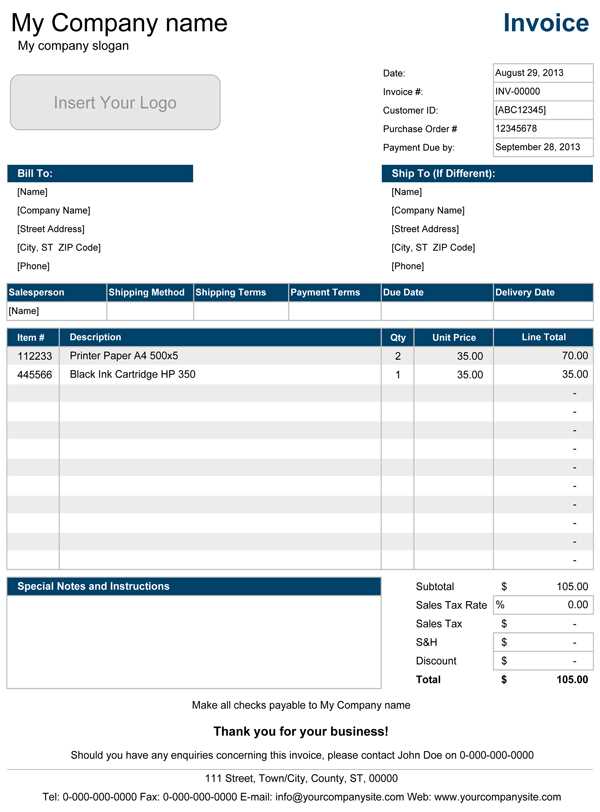

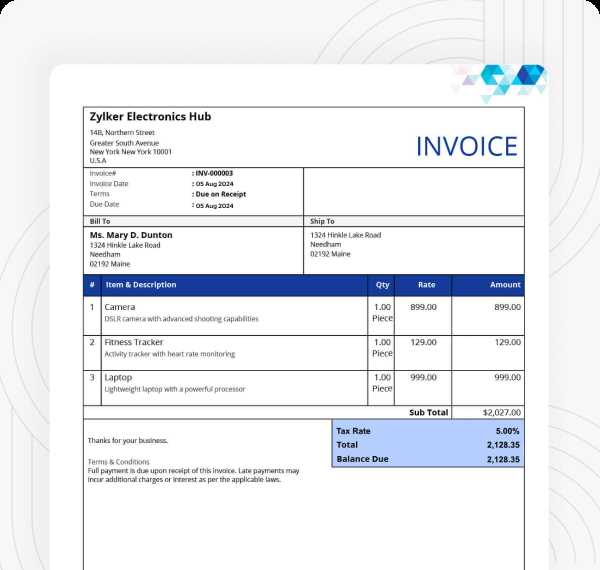

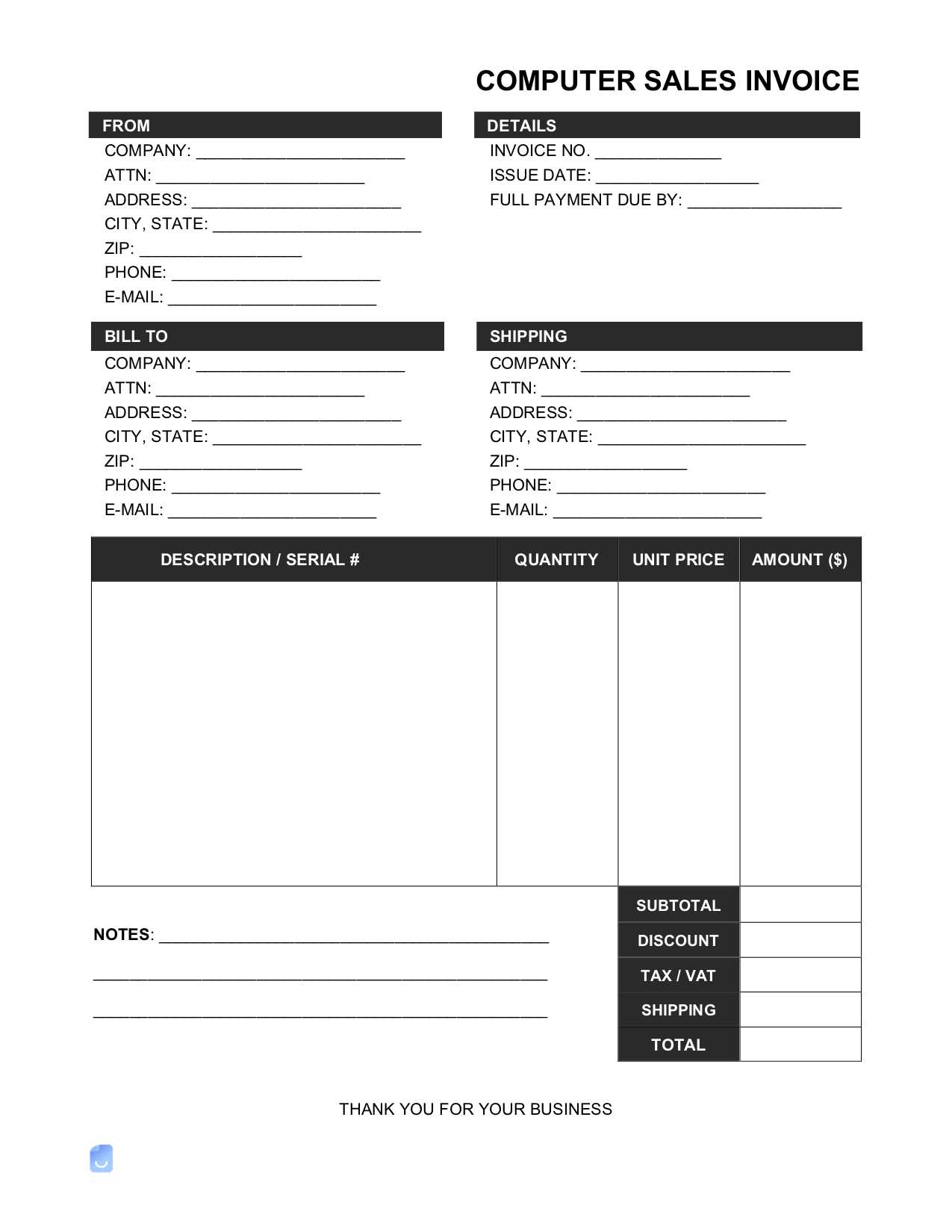

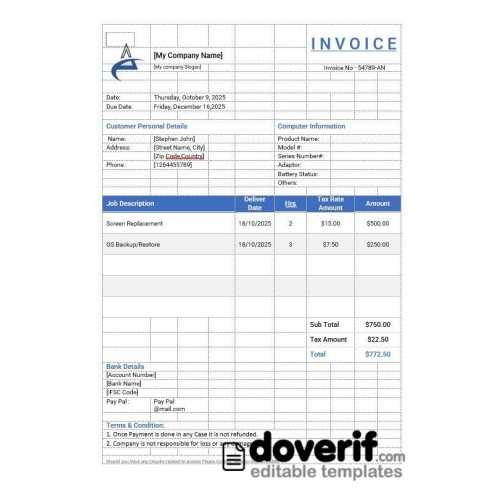

First and foremost, the document should have a section for client and service provider details. This includes the names, addresses, and contact information of both parties, ensuring that the service can be traced back to the correct individual or business. Additionally, a unique reference number is important for record-keeping and tracking multiple transactions.

Another critical feature is a detailed breakdown of the services rendered. This section should include descriptions of the work completed, the time spent on each task, and the corresponding charges. Including hourly rates, flat fees, or part costs allows for full transparency and helps clients understand the cost structure. Payment terms, such as deadlines and accepted payment methods, should also be clearly stated to avoid delays.

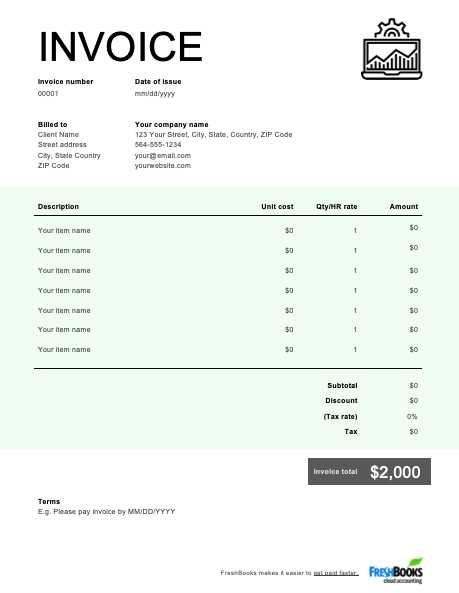

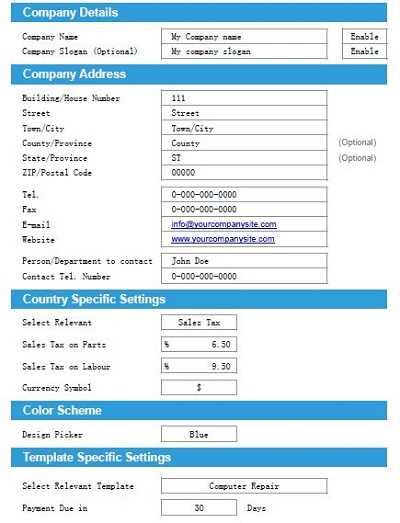

How to Customize Your Invoice Template

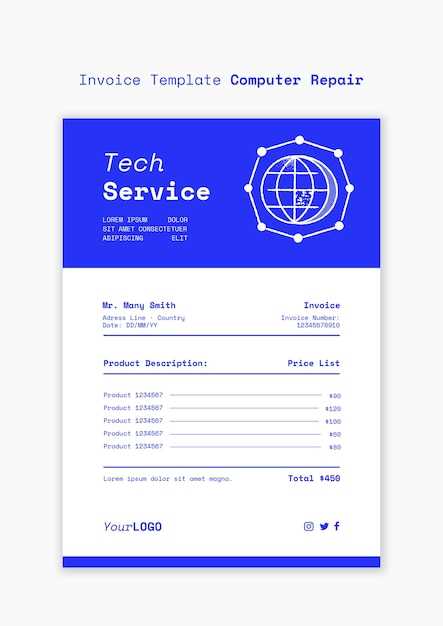

Customizing a billing document is essential to make it fit your business style and needs. By adjusting the layout, design, and content, you can ensure that it reflects your branding while maintaining all necessary details for clarity and professionalism. Customization helps create a unique document that is both practical and visually appealing to clients.

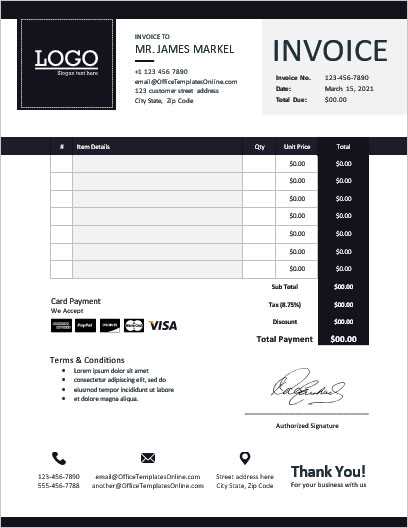

Personalizing the Design

Start by adjusting the layout to match your business identity. Include your company logo, choose colors that align with your brand, and use a clean, easy-to-read font. The design should make the document look professional yet approachable, ensuring clients feel confident in your services. A well-organized layout also makes it easier for clients to find important information quickly.

Modifying the Content Structure

Next, customize the sections to best suit the type of work you perform. You can add or remove fields depending on your services, such as adding a section for parts or products used, or specifying the duration of the service. Clearly list payment terms, deadlines, and accepted methods to avoid confusion. Additionally, adjust the wording of each section to reflect your business’s voice and tone.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages that streamline business operations. These ready-made structures not only save time but also help maintain consistency, making the entire billing process more efficient and professional. Whether you’re handling a single project or managing multiple clients, having a standard format simplifies the task of tracking payments and services.

Time and Efficiency

One of the primary benefits of using ready-made billing structures is the significant time savings. Instead of creating a new document for each transaction, you can quickly fill in the relevant details and send it to your client. This reduces administrative workload and allows you to focus more on providing quality service.

- Pre-fill client information

- Streamline service descriptions

- Save time with automated calculations

Professional Appearance and Consistency

By using a structured format, you ensure that every document you send to clients looks consistent and professional. This helps build trust and credibility with your clients, reinforcing the image of a well-organized business. A polished, uniform appearance for all transactions can leave a lasting positive impression.

- Consistency in layout and design

- Improved client perception

- Clear and readable information

Choosing the Right Format for Your Invoice

Selecting the appropriate structure for your billing document is crucial for ensuring clarity and ease of use. The right format helps organize key information such as service details, costs, and payment terms, making it easier for both you and your clients to manage financial transactions. A well-chosen format can also enhance the professionalism of your business.

Factors to Consider When Choosing a Format

When deciding on a format, consider how you want to present your services and payment details. The document should be easy to read, with clearly defined sections for all necessary information. Whether you choose a simple text layout or a more sophisticated design, the goal is to keep the content organized and accessible for your clients.

- Client preferences and industry standards

- Ease of use for both parties

- Level of detail required

Different Formats to Consider

There are several formats to choose from, depending on your business needs. Some prefer a basic layout with just the essentials, while others may opt for a more detailed structure with itemized services and additional charges. Consider the following options:

- Simple format: For quick and straightforward billing.

- Detailed format: For more complex services requiring itemization.

- Digital format: For electronic delivery and ease of tracking.

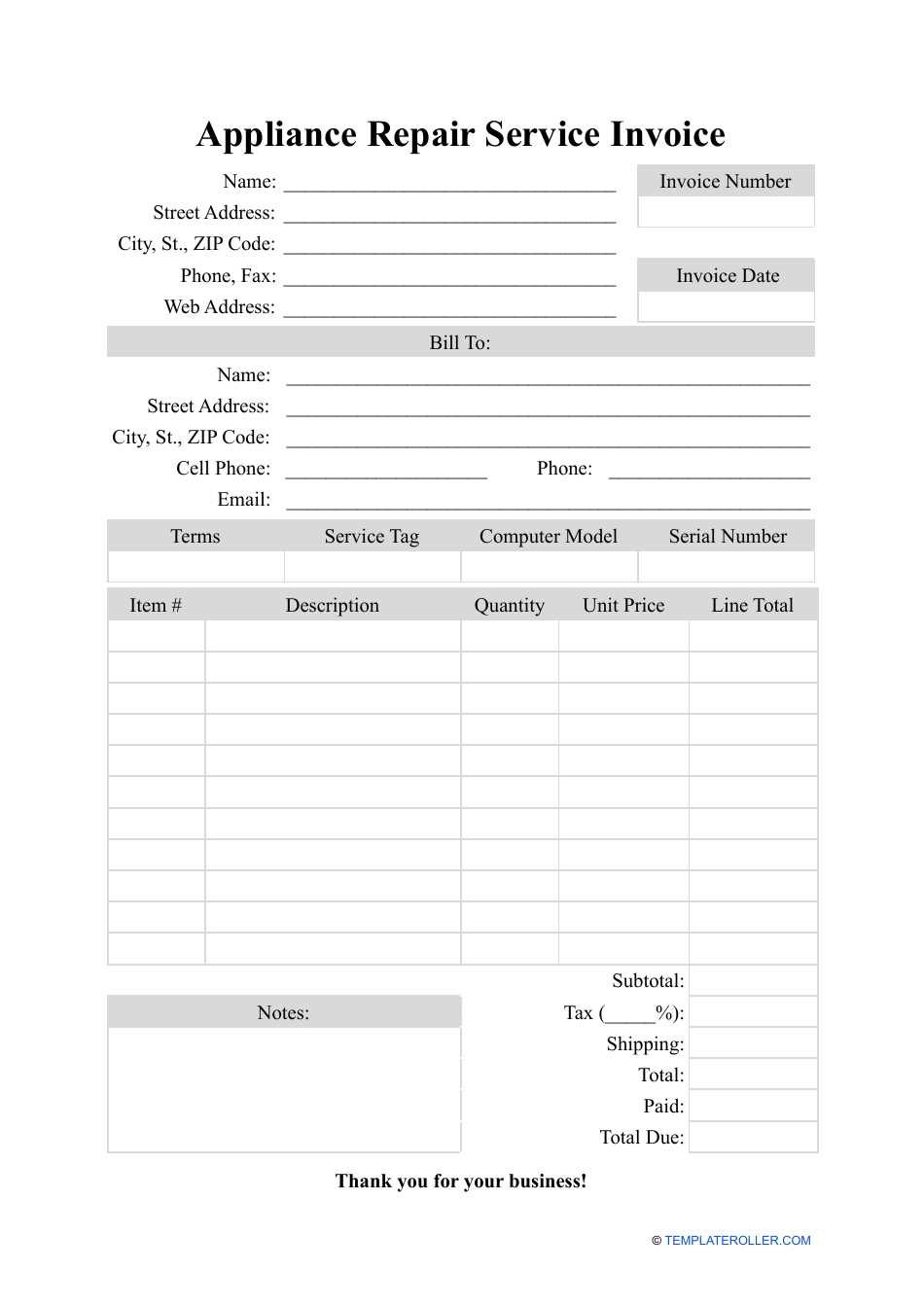

Key Elements in an Invoice Template

A well-structured billing document must include several essential components to ensure clarity and avoid confusion. These elements not only provide necessary details about the services rendered but also set clear expectations for both the service provider and the client. Having the right sections in place ensures that all aspects of the transaction are covered.

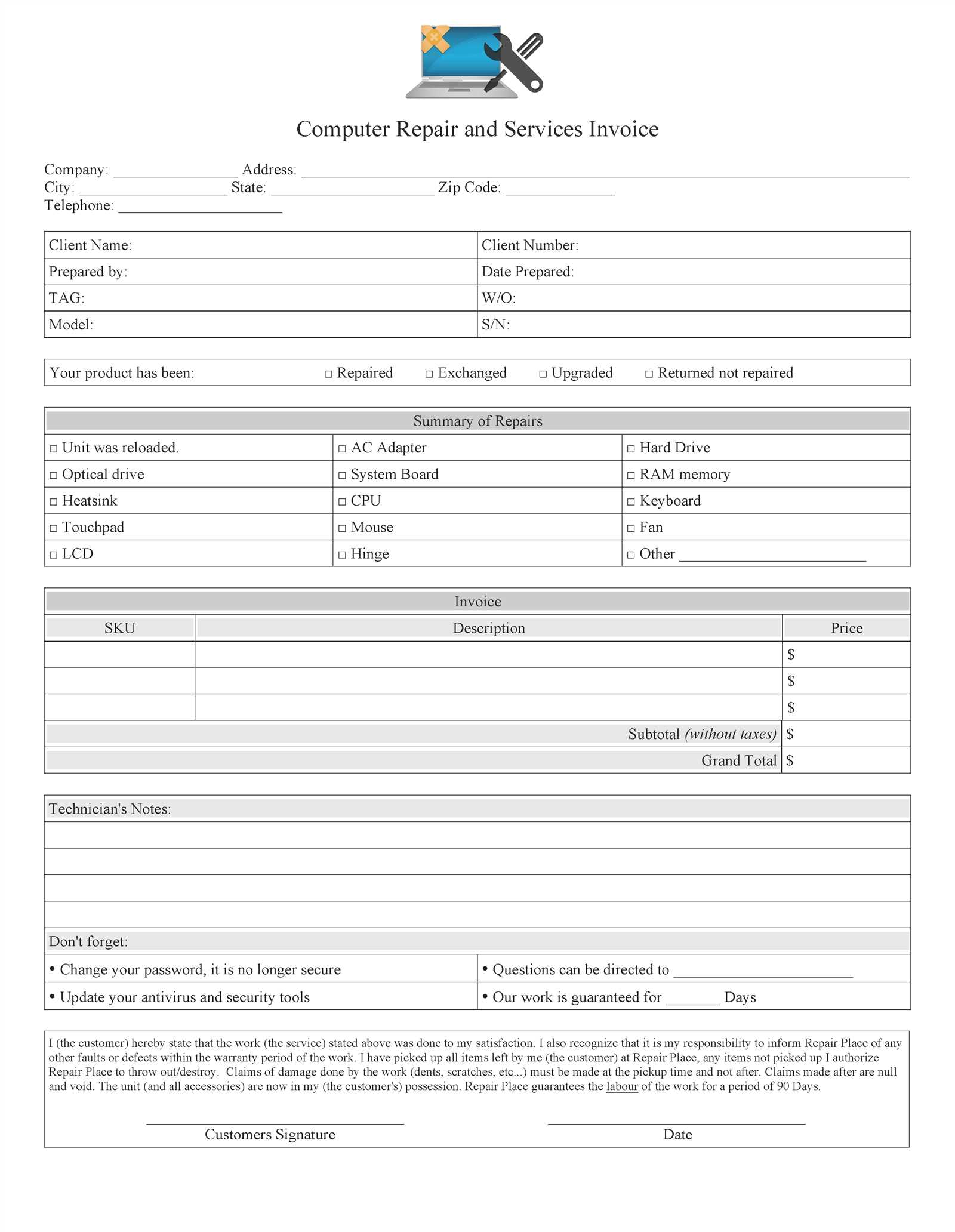

Essential Information for Both Parties

The document should clearly display the names and contact details of both the service provider and the client. This includes the business name, address, phone number, and email for easy communication. Identifying both parties ensures that there is no ambiguity regarding who is involved in the transaction.

- Service provider’s details: Name, business address, and contact information.

- Client’s details: Full name, company name (if applicable), and contact information.

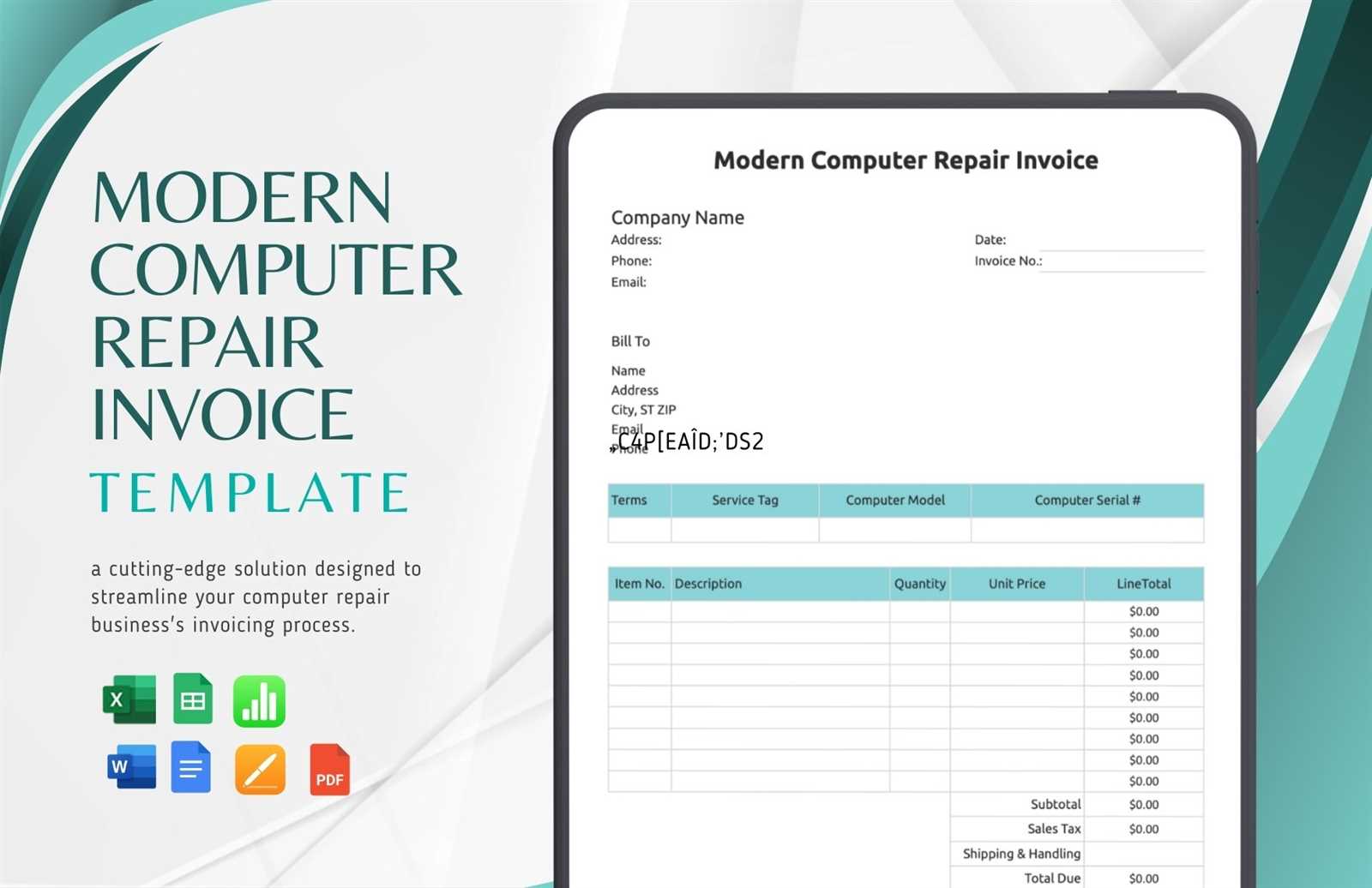

Breakdown of Services and Charges

It’s essential to include a detailed description of the services provided. This section should outline the type of work done, the amount of time spent, and the cost associated with each task. This breakdown should be easy to understand, showing individual charges and the total amount due, ensuring transparency between both parties.

- Description of services: What work was performed and how long it took.

- Cost per service: Hourly rate, flat fee, or cost of materials used.

- Total amount due: Final cost with any applicable taxes or discounts.

Understanding Tax and Service Charges

When preparing a billing document, it’s important to account for both taxes and service fees accurately. These charges help reflect the true cost of the service provided and ensure compliance with local regulations. Including taxes and additional fees correctly prevents confusion and ensures that both parties understand the final amount due.

Taxes are typically based on the location of the service, and the rate can vary. Service charges, on the other hand, may cover things like administrative fees, travel costs, or special handling. Both types of charges need to be clearly explained to avoid misunderstandings and ensure clients are aware of the breakdown.

| Charge Type | Description | Example |

|---|---|---|

| Sales Tax | Tax applied based on the local jurisdiction | 8% of the total service cost |

| Service Fee | A fee for specific services like travel or expedited work | $25 for on-site service |

| Materials Fee | Cost of any materials or parts used during service | $15 for replacement parts |

Setting Payment Terms in an Invoice

Establishing clear payment terms is essential for ensuring timely compensation for services rendered. Defining these terms upfront helps manage expectations and minimizes delays in payment. Whether offering a discount for early payment or specifying a due date, setting transparent payment conditions creates a smoother transaction for both the service provider and the client.

Key Elements to Include in Payment Terms

When determining your payment terms, it’s important to specify the following key details:

- Due Date: Clearly state when payment is expected (e.g., within 30 days).

- Accepted Payment Methods: List the methods clients can use to make payments (e.g., credit card, bank transfer, online payment platforms).

- Late Payment Fees: Indicate any fees or interest that will apply if payment is delayed beyond the due date.

- Early Payment Discounts: Offer a discount for clients who pay before the due date, if applicable.

Common Payment Terms Options

There are several common payment terms options to consider when setting up your conditions:

- Net 30: Payment due within 30 days of the service date.

- Due on Receipt: Payment expected immediately after the service is completed.

- Installments: Allow clients to pay in multiple installments over a set period.

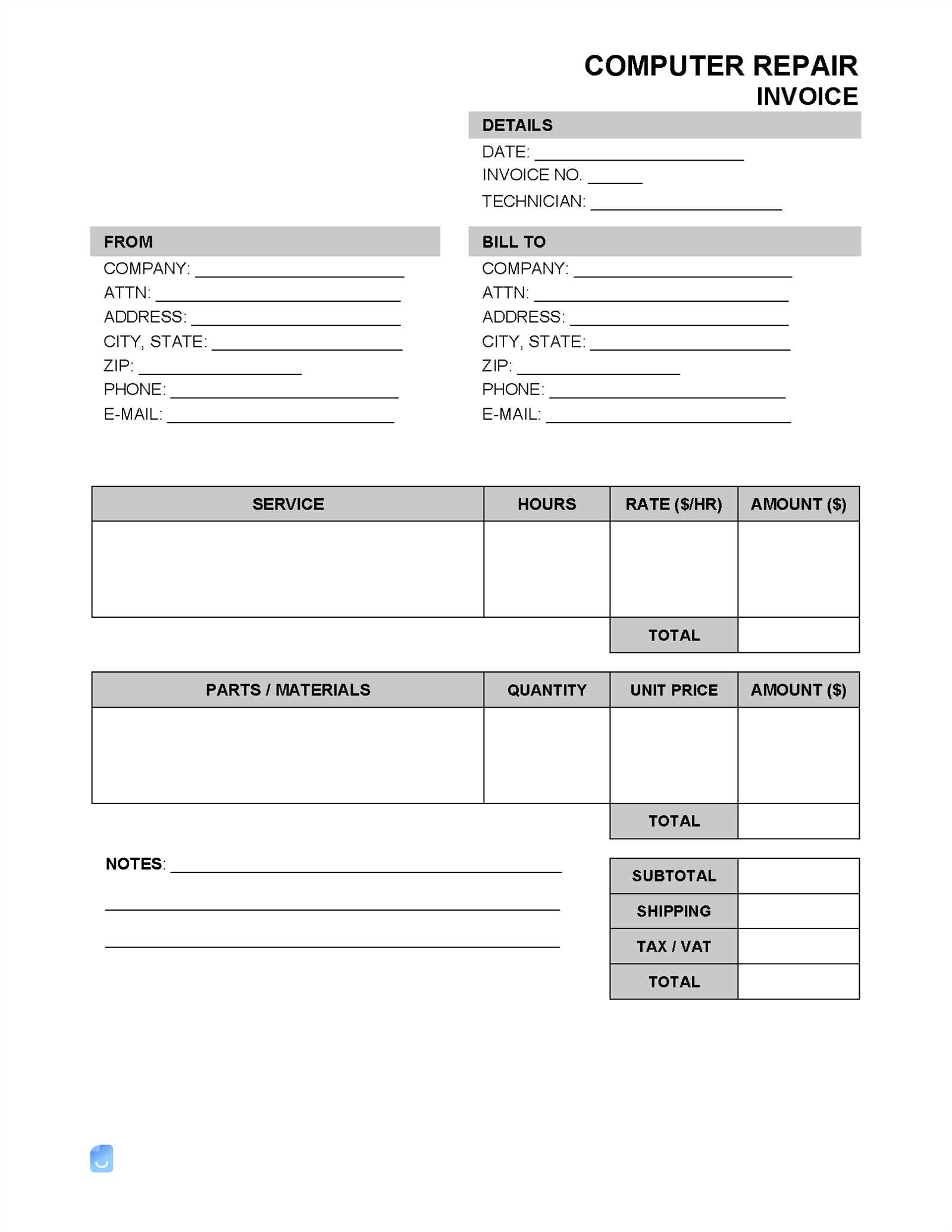

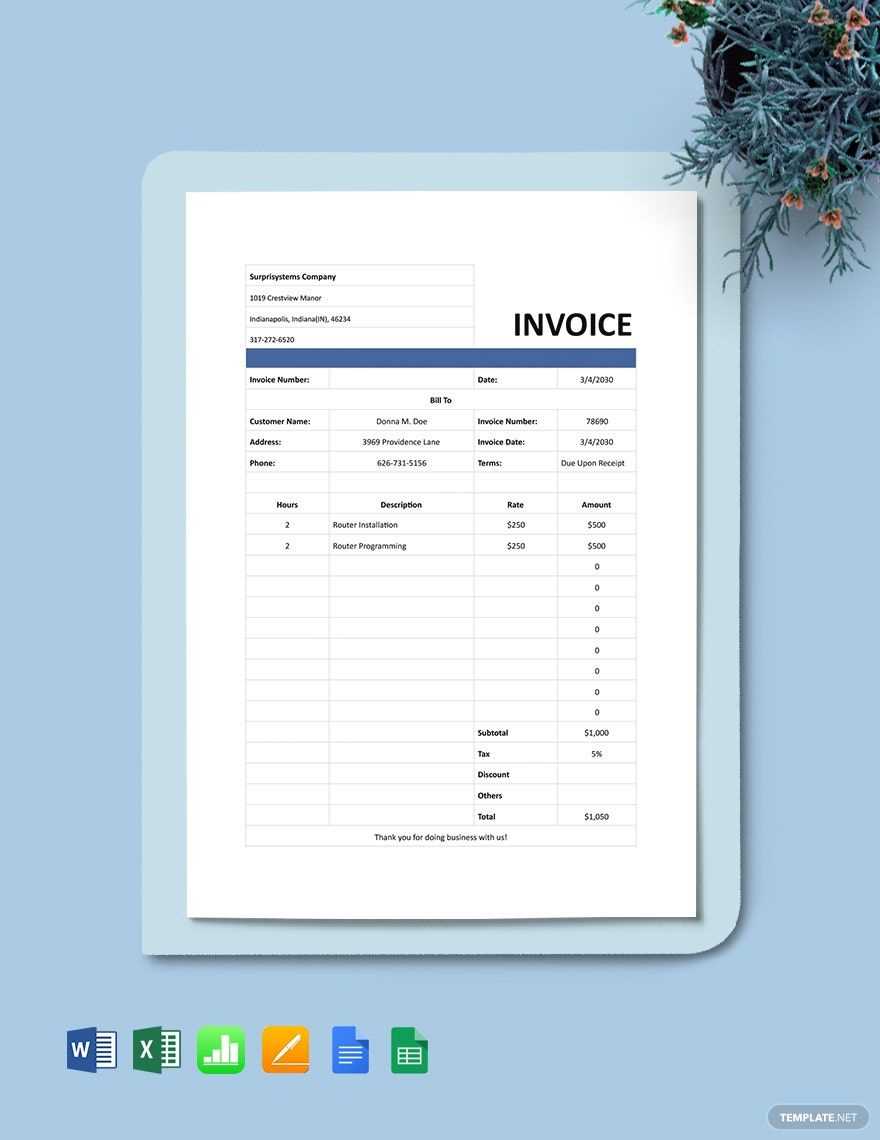

How to Include Hourly Rates on Invoices

When providing services that are billed by the hour, it is important to clearly indicate the hourly rate on the billing document. Doing so ensures transparency between the service provider and the client, and helps avoid any confusion regarding the total amount owed. Clearly itemizing the time spent and the associated rate allows both parties to understand how the final cost is calculated.

To include hourly rates effectively, make sure the following information is outlined in the document:

- Hourly Rate: State the exact amount charged per hour of service.

- Time Spent: Specify the total number of hours worked or the duration of each task performed.

- Task Breakdown: If applicable, provide a brief description of the tasks performed during the hours worked.

For example, if the hourly rate is $50 and the total time worked is 4 hours, the calculation should be clear and simple. If there were multiple tasks performed during the service, consider breaking down the time for each task to provide more clarity for the client.

Common Mistakes to Avoid on Invoices

Creating a billing document may seem straightforward, but there are several common errors that can lead to confusion, delayed payments, or even disputes. Avoiding these mistakes ensures that your financial documents are clear, professional, and easy to understand. By paying attention to the details, you can prevent issues that may cause frustration for both you and your clients.

Incorrect or Missing Client Information

One of the most common mistakes is failing to include accurate details about the client. Ensure that their full name, address, and contact information are correct. Missing or incorrect information can lead to delays in payment or misunderstandings.

- Double-check contact details: Ensure names, addresses, and phone numbers are accurate.

- Include business information: If the client is a company, make sure the business name is included.

Not Specifying Payment Terms Clearly

Another common issue is not clearly stating the payment terms. Without specifying when payment is due, what methods are accepted, or any late fees, clients may be uncertain about how to proceed. Being specific about payment terms avoids confusion and helps maintain timely payments.

- Set clear deadlines: Include exact due dates and payment expectations.

- List accepted payment methods: Mention whether you accept credit cards, checks, or online payments.

Overlooking Service Details

Failing to provide a breakdown of services can cause misunderstandings. Always include a clear description of the work performed, along with the corresponding charges. This transparency ensures that your clients know exactly what they are paying for and helps prevent disputes over the charges.

- Be specific: List each service provided and the time spent on each task.

- Include any additional fees: Make sure to include any extra charges, such as materials or travel fees.

How to Manage Client Payments Effectively

Efficiently handling client payments is crucial for maintaining a smooth cash flow and strong professional relationships. By implementing a clear and organized payment process, you can reduce the risk of late payments, manage financial expectations, and ensure timely compensation for the services provided. Whether it’s setting clear payment terms or following up on overdue balances, good payment management practices are essential for business success.

Set Clear Payment Terms Upfront

The foundation of effective payment management starts with clear communication about payment expectations. Always define your payment terms from the outset, including due dates, accepted payment methods, and any late fees or discounts for early payments. This will prevent any confusion or delays later on.

- Establish due dates: Specify when payments are expected, such as within 30 days of service completion.

- Offer multiple payment options: Allow clients to choose from different methods like bank transfer, online payment systems, or checks.

- Include any discounts or penalties: Encourage timely payments by offering discounts for early settlement or applying late fees for overdue payments.

Follow Up on Outstanding Payments

If payments are not made on time, a polite follow-up can help resolve the issue quickly. Keep a record of all invoices issued and their respective due dates. Send reminders before and after the due date to ensure that clients are aware of their pending payments. Consistent communication is key to maintaining a healthy cash flow.

- Send reminder emails: A friendly reminder a few days before the due date can prompt timely payment.

- Follow up on overdue balances: Contact clients promptly if payments are not received after the due date, and offer flexible solutions if necessary.

Tracking Services Rendered in Invoices

Accurately tracking and documenting the services provided is crucial for both the client and the service provider. It ensures that the client understands what they are being charged for, while also helping the provider maintain clear records of work performed. Detailing the services on billing documents not only promotes transparency but also reduces the risk of misunderstandings and disputes.

Breakdown of Each Service Provided

It’s essential to list each task or service performed in detail. This way, clients can easily see what they are paying for, and the service provider can maintain a clear record of the time and effort spent. Each service should be listed separately, with the duration and cost clearly stated next to it.

- Service Description: Provide a short but clear explanation of the service performed.

- Time Spent: Specify the number of hours or units of time dedicated to each task.

- Cost for Service: List the cost associated with each specific service provided, whether it’s hourly or flat-rate pricing.

Organizing Services in a Structured Format

To make it easier to track and review, organize the listed services in a logical order. Group similar tasks together and use bullet points or tables to separate them. A well-organized format makes it easier for both the provider and the client to navigate the document and quickly understand the breakdown of services and charges.

- Use tables: Tables are an excellent way to display service information clearly, with columns for description, time, and cost.

- Group related tasks: If several services are related, group them under a common heading to make the breakdown more readable.

How to Include Discounts on Invoices

Incorporating discounts into financial documents can help incentivize early payments, attract repeat clients, and demonstrate flexibility. It’s important to clearly specify any discounts applied to ensure both parties understand the terms. Whether offering a percentage reduction or a fixed amount off, documenting these adjustments properly is key to maintaining transparency and trust.

Types of Discounts to Consider

There are various ways to apply discounts, depending on the nature of the service and the agreement with the client. Common options include percentage-based reductions, fixed amount discounts, or promotional offers for returning customers. Whatever method is used, it should be clearly stated on the financial record.

- Percentage-based discounts: Offer a specific percentage off the total amount, such as 10% for early payment.

- Fixed amount discounts: Deduct a set dollar or currency amount from the total, such as a $50 discount for large orders.

- Promotional discounts: Provide a discount for first-time customers or repeat business.

How to Document Discounts Clearly

To avoid any confusion, it’s essential to display discounts in a way that clearly shows how they affect the total amount due. Discounts should be listed separately from the subtotal, and the final price should reflect the reduction. Make sure to specify any conditions, such as the discount being available only if the payment is made by a certain date.

- Clearly label discounts: Use phrases like “Early Payment Discount” or “First-Time Customer Discount” for clarity.

- Show both original and adjusted amounts: List the original price, the discount amount, and the final price to avoid confusion.

Legal Requirements for Technician Invoices

When creating financial documents for services rendered, it’s important to be aware of the legal standards and requirements that must be met. These legalities ensure that both the provider and the client have clear, enforceable records of the transaction. Meeting the legal obligations helps avoid disputes and ensures compliance with tax laws and business regulations.

Mandatory Information to Include

There are specific details that must be included on financial documents to make them legally valid. These elements not only protect both parties but also help the document function as an official record in case of audits or legal issues. Below are key items that should be featured:

- Business Identification: Include the name, address, and contact information of both the service provider and the client.

- Unique Identifier: Assign a unique number to each document for tracking and referencing purposes.

- Detailed Description of Services: Clearly describe the work performed, including quantities, rates, and hours worked.

- Terms of Payment: Specify payment deadlines and any late fees or interest rates that may apply.

- Tax Information: Include any applicable taxes or VAT that must be added to the total amount.

Compliance with Tax and Financial Laws

Each jurisdiction may have specific tax rules and business regulations that apply to financial documents. It’s important to understand the local tax rates and include them properly. Additionally, maintaining accurate records is crucial for tax reporting and avoiding penalties.

- Include applicable taxes: Ensure all relevant sales tax, VAT, or other tax charges are added correctly.

- Recordkeeping obligations: Maintain copies of all financial documents for the required period as dictated by local laws.

- Legal disclaimers: If applicable, include any disclaimers about payment terms or legal rights related to the services provided.

Automating Your Invoice Creation Process

Streamlining the process of generating financial records can save valuable time and reduce the risk of errors. By automating the creation of such documents, you can ensure consistency, improve efficiency, and focus more on the core aspects of your business. Automation tools help generate professional documents quickly, ensuring that all necessary details are included and formatted correctly.

Benefits of Automation

Implementing automation in the creation of these documents offers numerous advantages. From reducing manual workload to ensuring compliance with tax regulations, automated systems make the entire process more reliable and efficient.

- Time-saving: Automation reduces the time spent creating each document, allowing you to handle more clients in less time.

- Consistency: Automated systems ensure that all necessary fields are filled out consistently across all documents.

- Error reduction: By minimizing manual input, you decrease the chances of mistakes in pricing, terms, or other important details.

- Faster payments: Timely creation and delivery of financial documents can encourage quicker payment from clients.

How to Implement Automation

To take full advantage of automation, there are various tools and software options available. Many of these solutions integrate seamlessly with your business operations, offering customizable features to meet your specific needs.

- Use dedicated software: There are various platforms designed specifically for automating the creation of professional documents, which often include templates and tax calculations.

- Integration with accounting systems: Some automation tools can be linked with accounting software, enabling seamless synchronization of payments, expenses, and other financial data.

- Cloud-based solutions: Cloud services allow you to generate, store, and send documents from anywhere, providing flexibility and convenience.

Best Tools for Invoice Customization

Customizing financial documents to reflect your brand and meet client needs can significantly enhance professionalism and improve client relations. With the right tools, you can easily adjust layouts, add your logo, personalize information, and ensure that all necessary details are included. Here are some of the best tools for tailoring these documents to your specific requirements.

- QuickBooks: QuickBooks offers robust features for customizing billing statements. With various templates and options for adding your logo, colors, and other personal touches, it ensures that your documents maintain a professional appearance while being tailored to your business style.

- Zoho Invoice: Zoho provides excellent customization features with its easy-to-use interface. You can choose from pre-designed templates, adjust fonts, colors, and logos, and even add custom fields to capture unique business data.

- FreshBooks: FreshBooks is known for its user-friendly design and the ability to personalize documents fully. You can modify layouts, select from different color schemes, and add your business details effortlessly. It also offers integration with other business tools for smoother operations.

- Invoicely: Invoicely offers a free, flexible platform for customizing financial documents. With its wide range of templates, users can quickly adjust various elements like logos, fonts, and content placement. This tool is ideal for businesses of all sizes.

- Canva: While Canva is typically known for graphic design, it also excels in creating and personalizing invoices. With drag-and-drop ease, you can design documents from scratch or modify templates, making it perfect for users looking for creative and visually appealing financial records.

- Wave: Wave is a free and easy-to-use platform for customizing billing documents. It allows you to personalize templates with your business name, logo, and contact information, all while automating key tasks like tax calculations and recurring billing.

These tools enable businesses to produce well-designed, professional documents that leave a positive impression on clients. Whether you’re looking for simplicity or advanced features, these platforms provide everything needed to customize your business paperwork effectively.

Staying Organized with Invoice Templates

Maintaining clear and efficient records is essential for smooth business operations. By using structured documents for billing, businesses can stay organized and ensure that all transactions are properly tracked. Whether you are managing multiple clients or handling a large volume of work, consistency in the format and content of these documents can help prevent errors, reduce confusion, and streamline your financial processes.

Consistency in Record Keeping

Using a standardized format for all financial records simplifies the process of reviewing past transactions. With pre-designed layouts, you can ensure that each record includes the same crucial details, such as client information, services provided, and payment terms. This consistency not only helps you avoid mistakes but also makes it easier to track outstanding payments and identify any discrepancies.

Efficient Document Storage and Retrieval

Staying organized also means keeping records easily accessible. When all your business documents follow the same structure, you can efficiently categorize and store them, whether digitally or in physical form. By saving these documents in a system that is both logical and easy to navigate, you can quickly retrieve any file when needed, saving valuable time during audits or when responding to client inquiries.

Benefits of Staying Organized:

- Reduces the risk of errors in billing and payments

- Helps track overdue payments more efficiently

- Facilitates faster document retrieval for business audits or client queries

- Improves professionalism and consistency in client communications

By implementing a structured approach to document creation and management, you can enhance your workflow, improve client relations, and maintain better financial oversight for your business.