Easy to Use Computer Shop Invoice Template for Your Business

Running a business involves many crucial tasks, and managing financial transactions is one of the most essential. A well-organized approach to documenting sales can save time, reduce errors, and enhance overall efficiency. Whether you’re selling hardware, offering repair services, or providing accessories, having a structured method for tracking payments is key to smooth operations.

Incorporating a consistent method of recording transactions allows for greater accuracy and easier management of finances. With the right tools, you can automate the process, ensuring that all necessary details are included and that records are easily accessible. This helps you stay organized and ensures you are always prepared for tax season or audits.

Streamlining your business operations can be achieved through effective documentation methods that cater to your specific needs. Emphasizing clarity and professionalism in every transaction promotes trust with clients and helps establish a transparent business environment. By implementing a smart system for payment tracking, you not only keep things running smoothly but also demonstrate your attention to detail and commitment to excellent service.

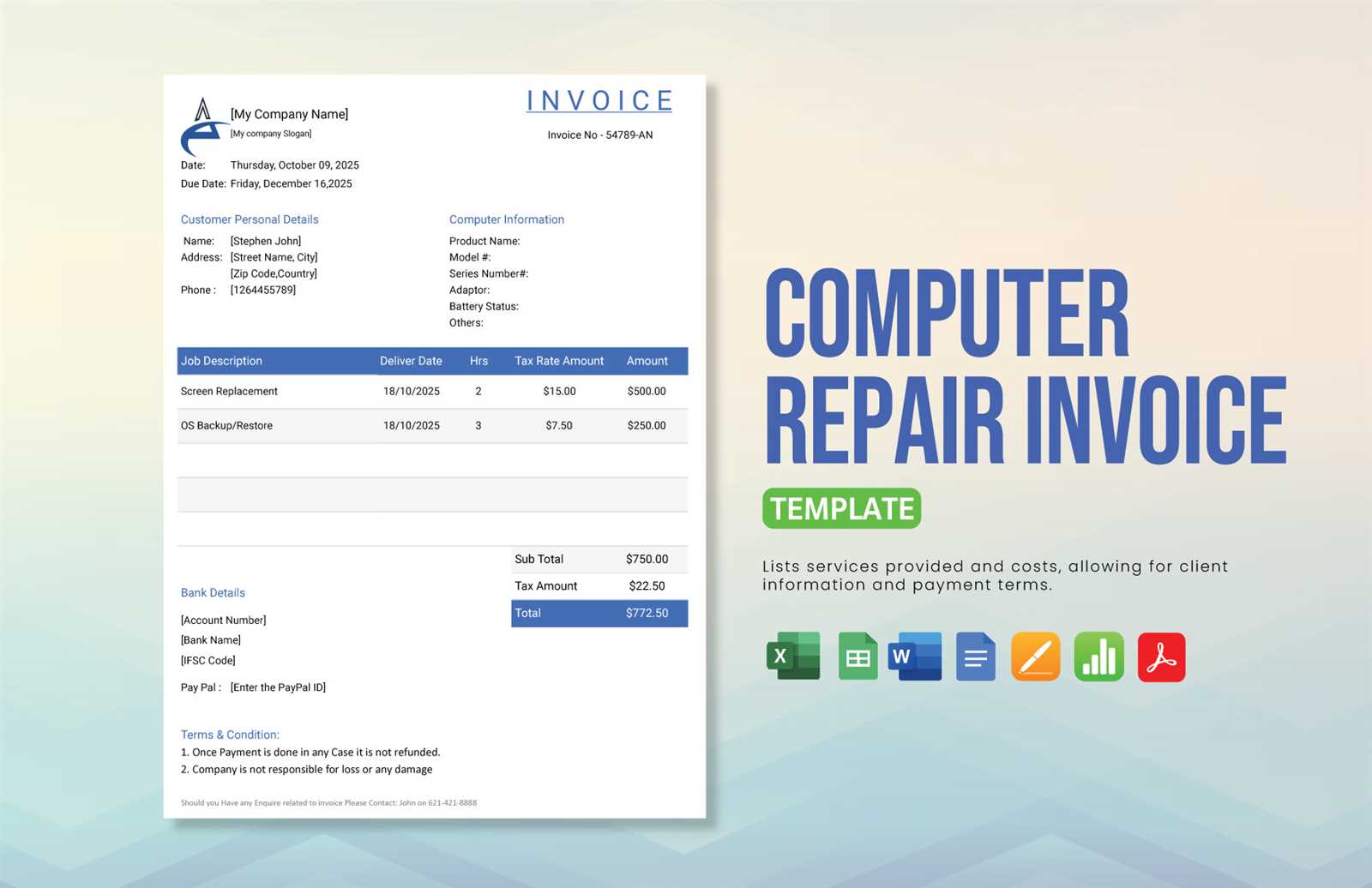

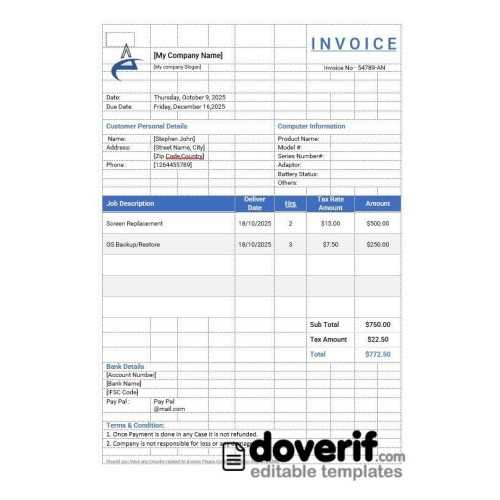

Computer Shop Invoice Template Overview

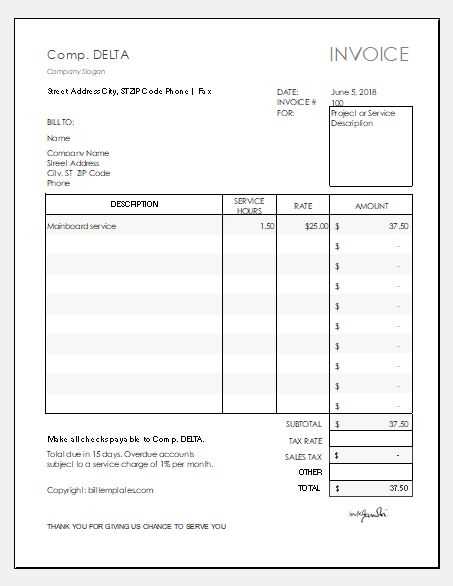

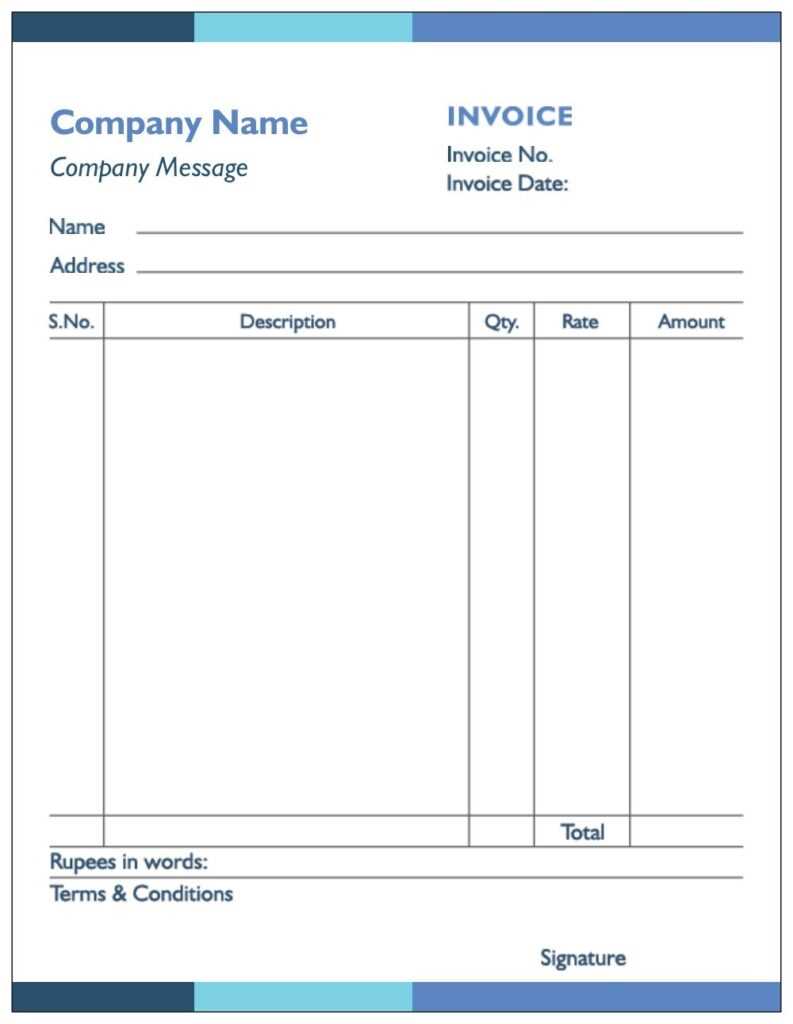

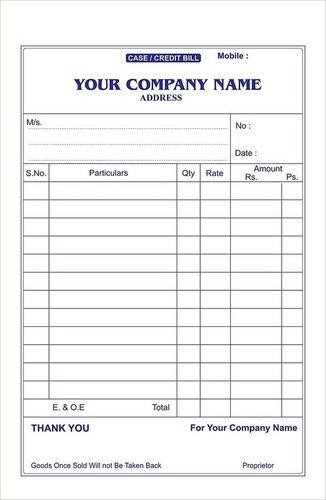

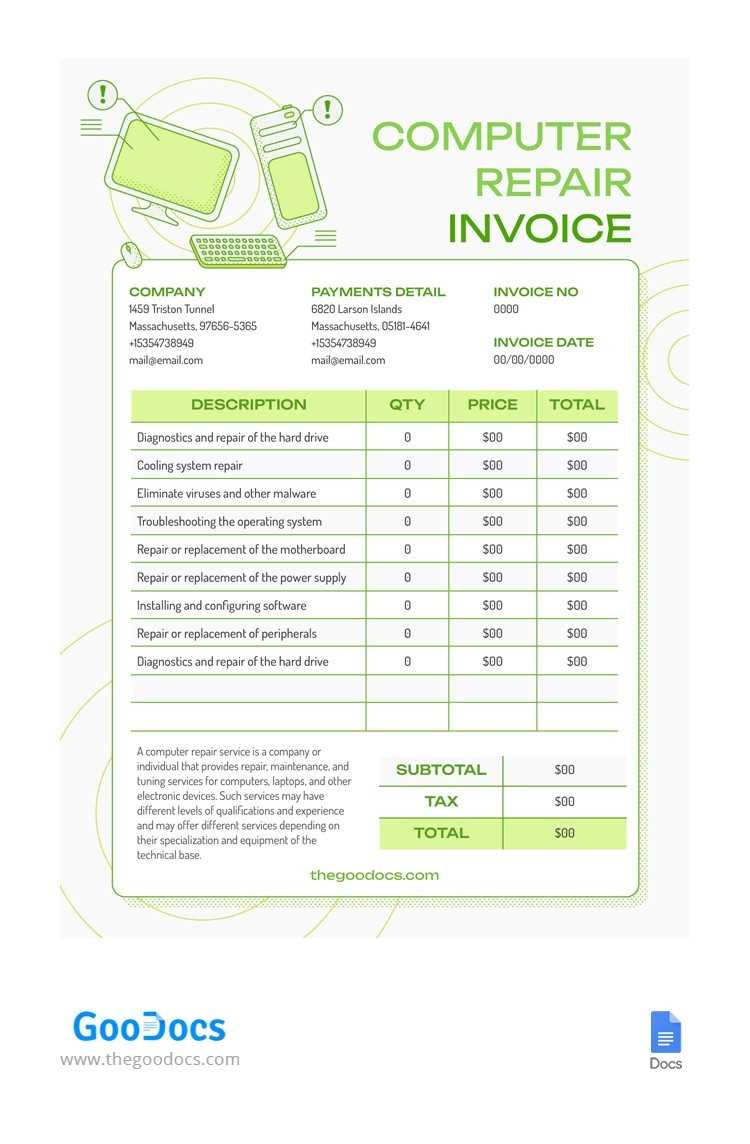

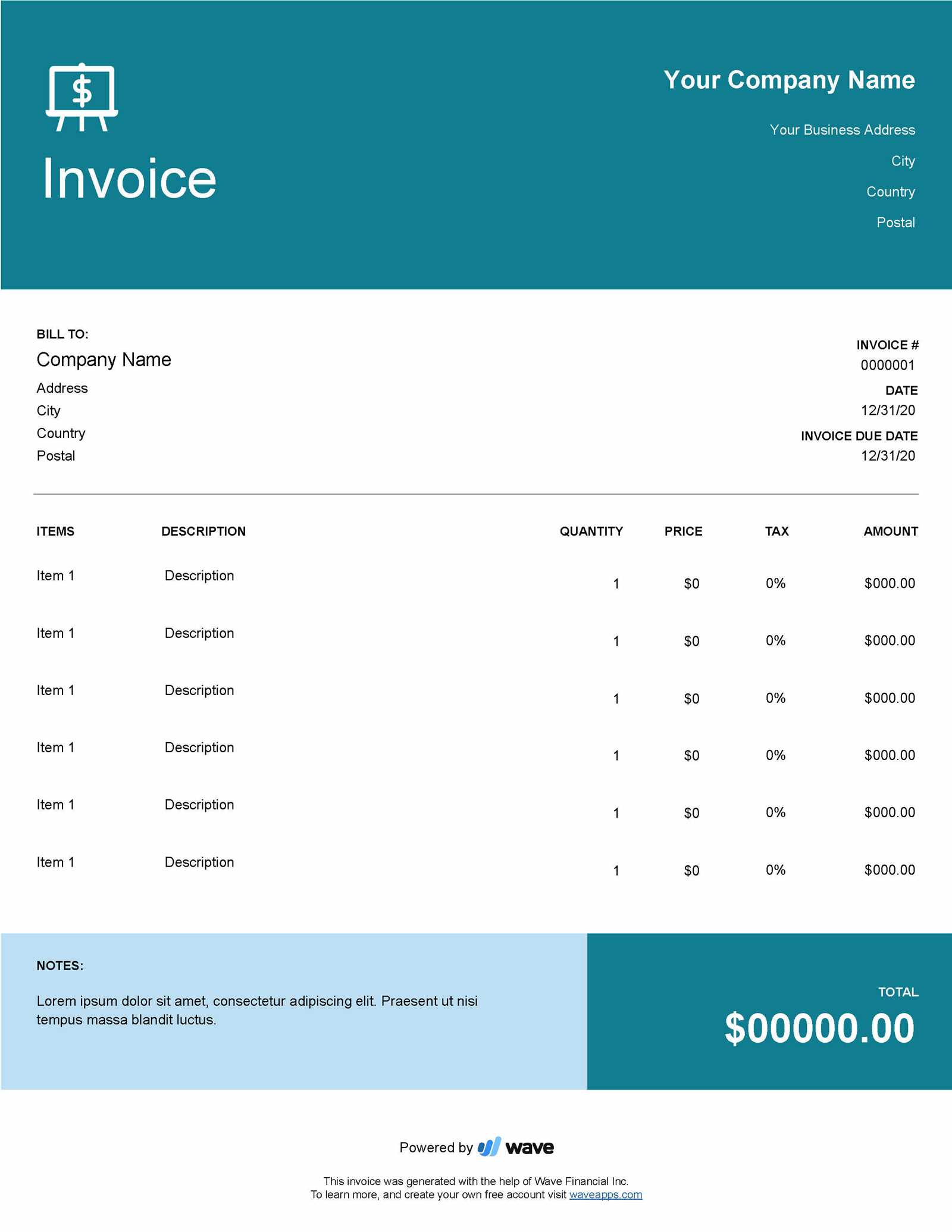

When managing a business that deals with technology products or services, having an organized system for tracking transactions is crucial. A well-structured document for recording sales and services ensures accuracy and professionalism. It provides a clear record of what was provided, the cost, and essential customer details, helping both the business owner and the client stay on the same page.

A well-designed record-keeping tool is not only functional but can also be customized to fit the unique needs of your business. From detailing product names to specifying service charges, a comprehensive document helps ensure that all the necessary information is captured efficiently. This also aids in quicker payments, smoother operations, and better overall customer relations.

Using a reliable document solution also facilitates easy integration with other business tools, such as accounting software, enabling streamlined financial management. It provides clear insight into the status of transactions and makes it easier to manage inventory and track payments. The ultimate goal is to have a clear, accurate, and professional document that reflects the quality of your business.

Why You Need an Invoice Template

In any business, having a consistent way to document transactions is vital for maintaining order and ensuring smooth operations. A standardized method for recording sales not only saves time but also enhances the accuracy of your financial records. Without a proper system, it becomes easy to overlook details or make mistakes that can affect customer relations or tax reporting.

Key Reasons for Using a Structured Document

- Accuracy – A consistent format ensures that all essential details are captured every time.

- Professionalism – A well-organized document reflects the professionalism of your business and helps build trust with clients.

- Efficiency – Streamlining the process of creating and managing records saves you time and reduces administrative work.

- Compliance – It ensures that all necessary information is included for tax purposes, helping you stay compliant with local laws.

Benefits for Customer and Business Owner

- Clear communication – Both parties understand the terms of the transaction, including payment amounts and due dates.

- Easy tracking – Keeping a record of past transactions allows you to monitor outstanding payments and follow up as needed.

- Financial organization – Using a standardized format helps maintain well-organized financial records, which are essential for budgeting and reporting.

Incorporating a professional and consistent document for every transaction ensures that your business runs smoothly and efficiently while maintaining a high level

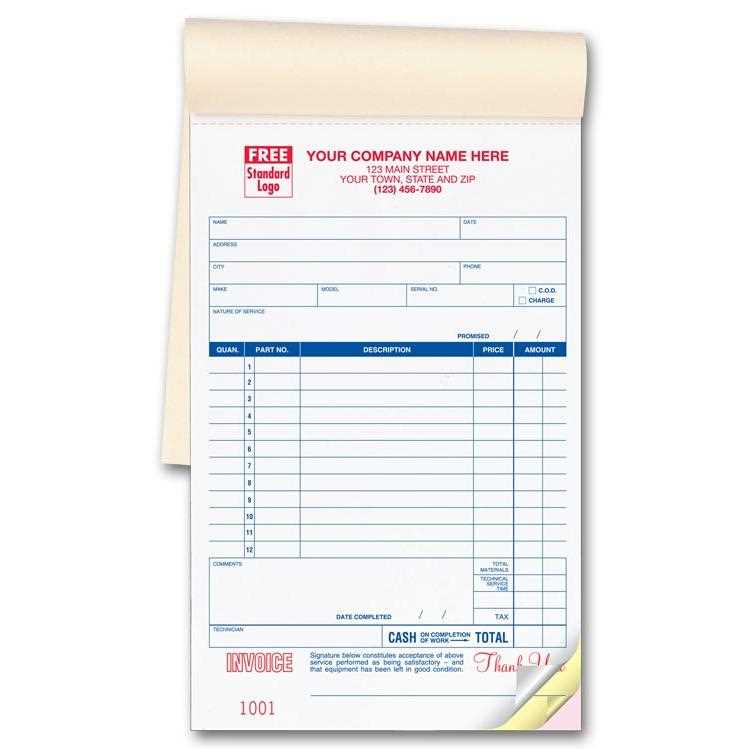

How to Create a Computer Shop Invoice

Creating an organized document for recording sales and services involves ensuring that all relevant details are included in a clear and consistent format. By following a few simple steps, you can generate a professional document that captures all the necessary information, streamlining your business operations and enhancing communication with customers. The process is straightforward and can be customized to meet your specific needs.

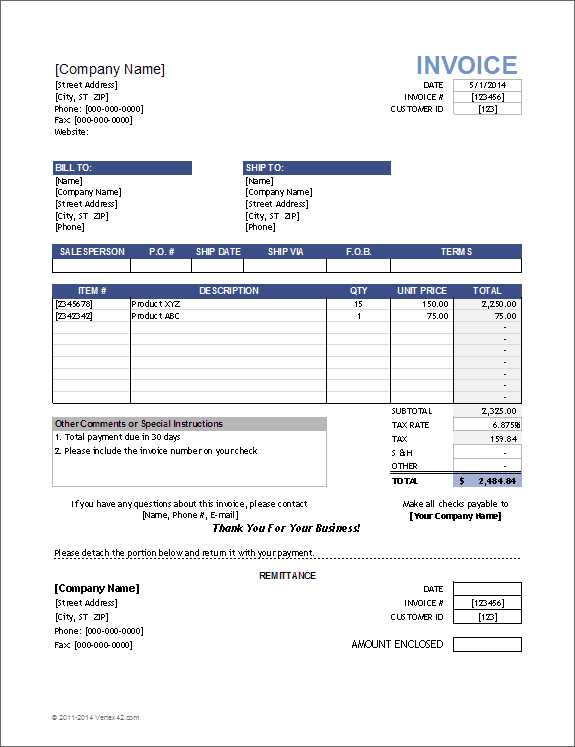

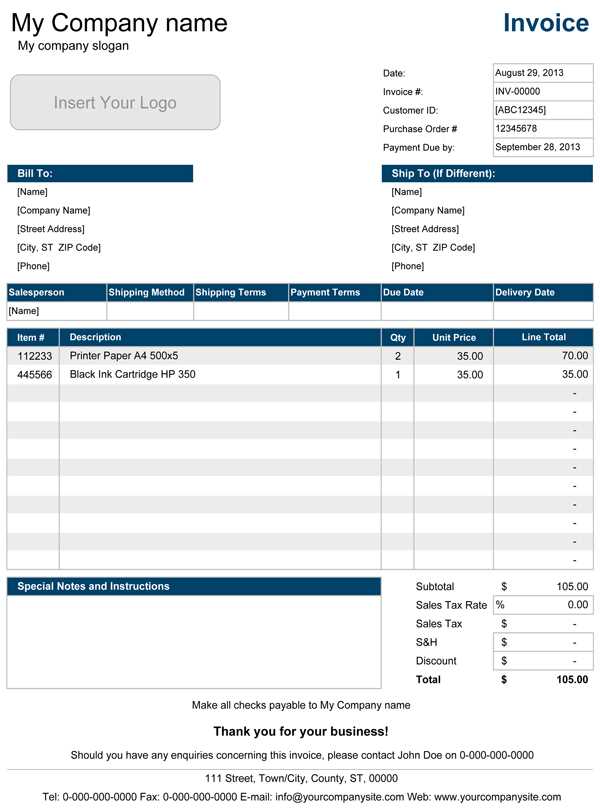

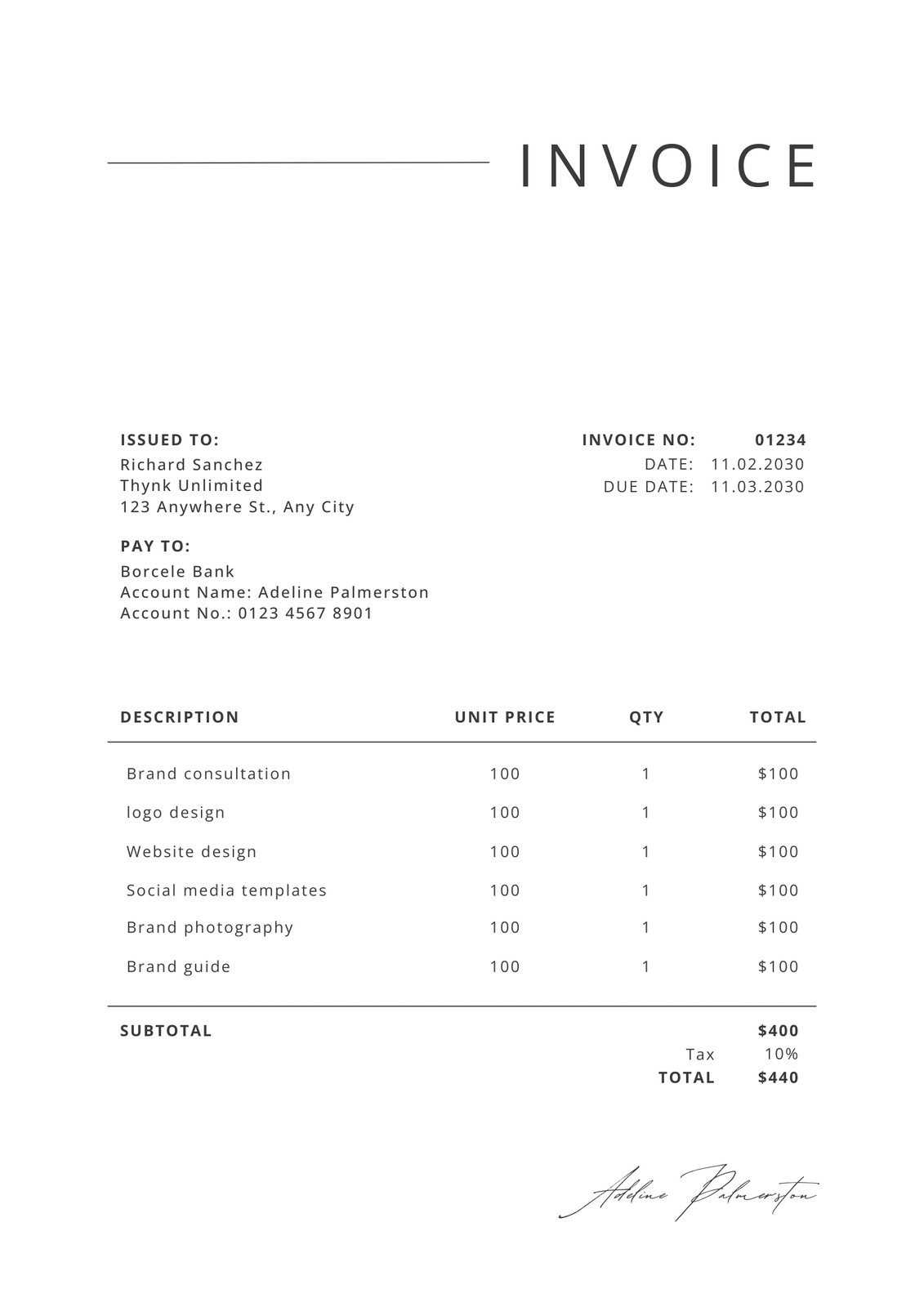

To start, the essential elements of a transaction must be included, such as customer details, product or service descriptions, prices, and payment terms. Below is an example of how you can structure this information in a well-organized document:

| Item/Service | Description | Quantity | Unit Price | Total | ||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Item Name | Brief description of the product or service | 1 | $100 | $100 | ||||||||||||||||||||||||||||||||||||||||||||||

| Item Name | Brief description of the product or service | 2 | $50 | $100 | ||||||||||||||||||||||||||||||||||||||||||||||

| Subtotal | $200 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Tax (10%) | $20 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Format | Pros | Cons | Best For | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Final versions of documents for clients or official records | |||||||||||||||||||||||||||||||||||

| Word |

|