Free Computer Service Invoice Template for Easy Billing

Managing financial transactions in any technical business requires precision and professionalism. A well-structured document that outlines the services provided, the time spent, and the costs incurred helps maintain clear communication between the provider and the client. These records not only ensure accurate payments but also serve as a reference for both parties in case of any future disputes.

Creating efficient billing documents is essential for maintaining a smooth workflow. A customizable structure can simplify this task, allowing business owners to focus on their core operations rather than administrative burdens. Having a consistent format can enhance your brand’s credibility and foster trust with customers.

In this article, we will explore how a carefully designed billing record can streamline financial interactions, reduce errors, and improve payment tracking. Whether you’re a freelancer or managing a larger team, these tools can be tailored to meet your specific needs, ensuring professionalism in every transaction.

Why Use a Professional Billing Document Structure

Maintaining consistency and accuracy in financial records is essential for any business. By using a predefined layout for tracking payments, businesses can ensure that all necessary details are included, reducing the risk of mistakes. A standardized approach streamlines the entire process, making it quicker and easier to issue detailed statements to clients.

Time Efficiency and Accuracy

One of the main advantages of adopting a structured document design is the time saved. Rather than creating records from scratch for each transaction, a ready-made framework allows you to input information quickly and efficiently. This ensures that no important details are missed, from labor costs to additional charges, and helps avoid the potential for errors.

Enhanced Professionalism and Trust

Presenting a uniform, polished document to clients enhances your business’s professionalism. It shows that you are organized and take your financial dealings seriously. Clients are more likely to pay promptly and feel confident in your services when they receive a clear and concise breakdown of the work completed and the associated fees.

Key Benefits of Customizing Billing Documents

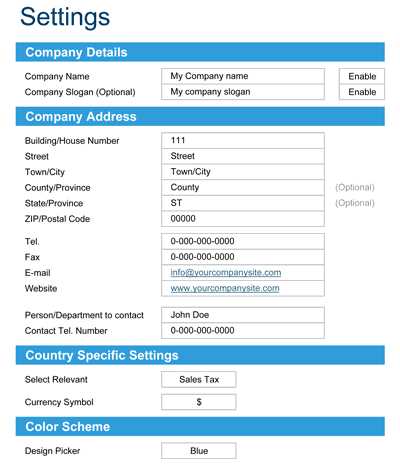

Customizing financial documents provides several advantages, particularly for businesses looking to create a tailored experience for their clients. A personalized layout allows you to adjust the document according to specific needs, whether it’s adding additional fields for unique services, incorporating your brand’s logo, or offering more detailed descriptions of the work done. This flexibility can improve clarity and streamline the communication process between you and your clients.

Another significant benefit is the ability to align the document with your business operations. You can include important information such as payment terms, deadlines, and special discounts that are specific to your offerings. This level of customization not only enhances professionalism but also ensures that all necessary details are consistently presented, reducing the risk of confusion or errors.

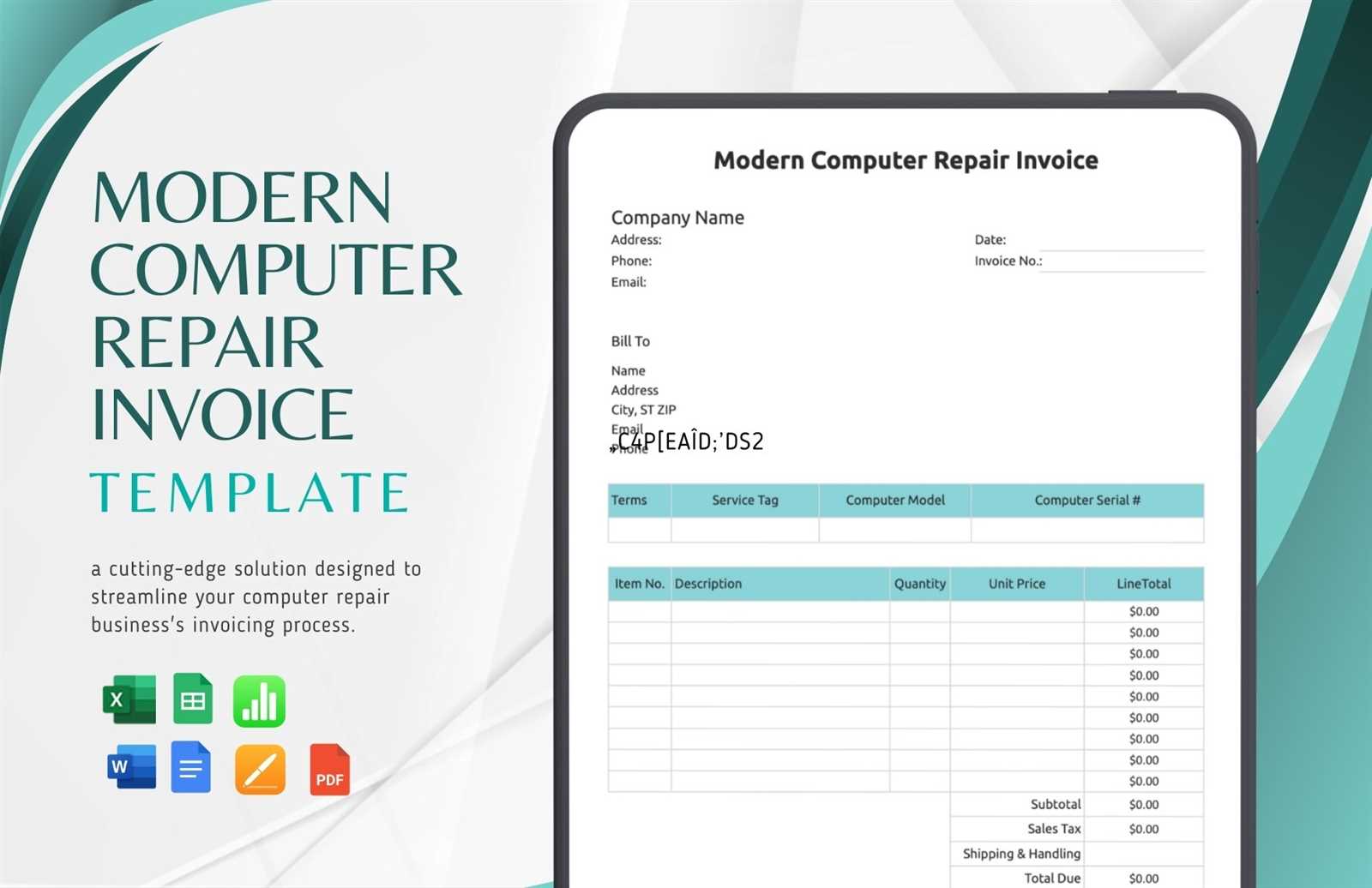

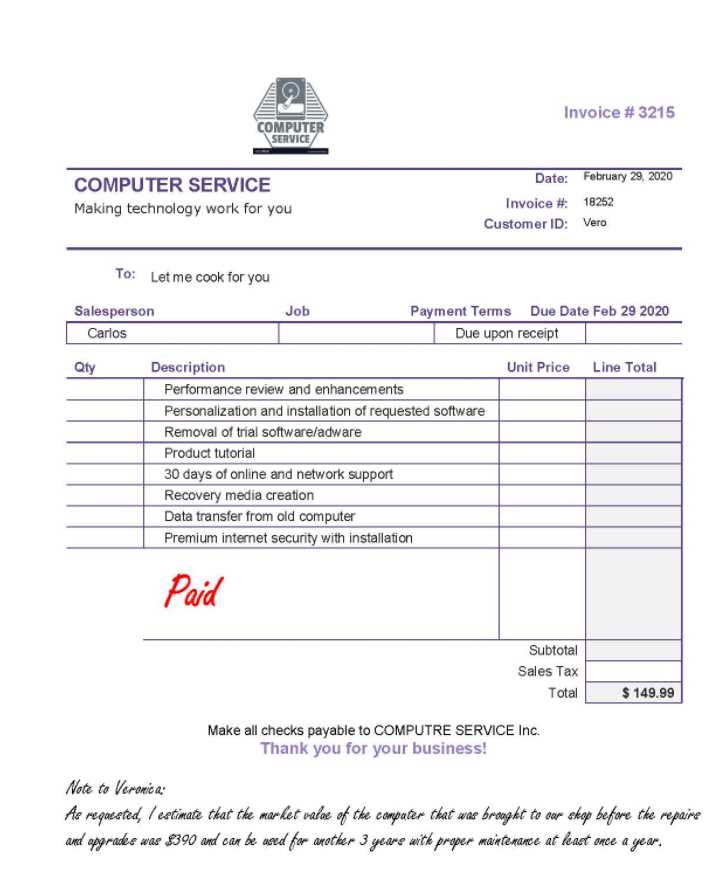

Essential Elements of a Billing Document

To ensure clarity and accuracy in financial transactions, it’s crucial to include specific details in every document issued. Key components not only help clients understand the charges but also serve as a record for both parties in case of future inquiries or disputes. Having the right information ensures transparency and a smooth payment process.

Contact Information: Always include your business name, address, phone number, and email, along with the client’s details. This creates a clear point of reference for both sides.

Work Description: A brief yet detailed explanation of the tasks performed is essential. This helps the client understand exactly what they are being charged for and eliminates any ambiguity.

Cost Breakdown: Clearly itemized charges are vital. List the individual costs for labor, materials, and any other relevant fees, along with the total amount due. This level of detail helps avoid misunderstandings and ensures that the client knows exactly what they are paying for.

Payment Terms: Specify the due date, payment methods accepted, and any penalties for late payments. This establishes clear expectations and encourages timely settlement.

Including these essential elements not only improves the professionalism of your financial records but also contributes to a smoother, more transparent business operation.

How to Create a Professional Billing Document

Creating an effective billing record involves more than just listing charges. A well-crafted document should be clear, detailed, and easy to understand, ensuring that clients are fully aware of the services provided and the corresponding costs. The process can be broken down into a few simple steps to ensure you include all the necessary information while maintaining a professional appearance.

Here’s a step-by-step guide on how to build a comprehensive and well-organized document:

| Step | Description |

|---|---|

| 1. Contact Information | Begin by including both your business details and the client’s. Make sure to add names, addresses, and contact numbers for both parties. |

| 2. Unique Reference Number | Assign a unique reference or document number to track the transaction and make future references easier. |

| 3. Detailed Description | Provide a concise description of the work performed, breaking down each task or item separately for clarity. |

| 4. Itemized Costs | List individual costs for each task, material, or resource used, followed by the total charge for each. |

| 5. Payment Terms | Include details about payment methods, due dates, and any applicable late fees or discounts for early payment. |

| 6. Final Total | Sum up all the charges and present a final amount that the client needs to pay, ensuring it matches the itemized list. |

By following these steps, you can create a clear and detailed document that facilitates smoother transactions and ensures both parties are on the same page.

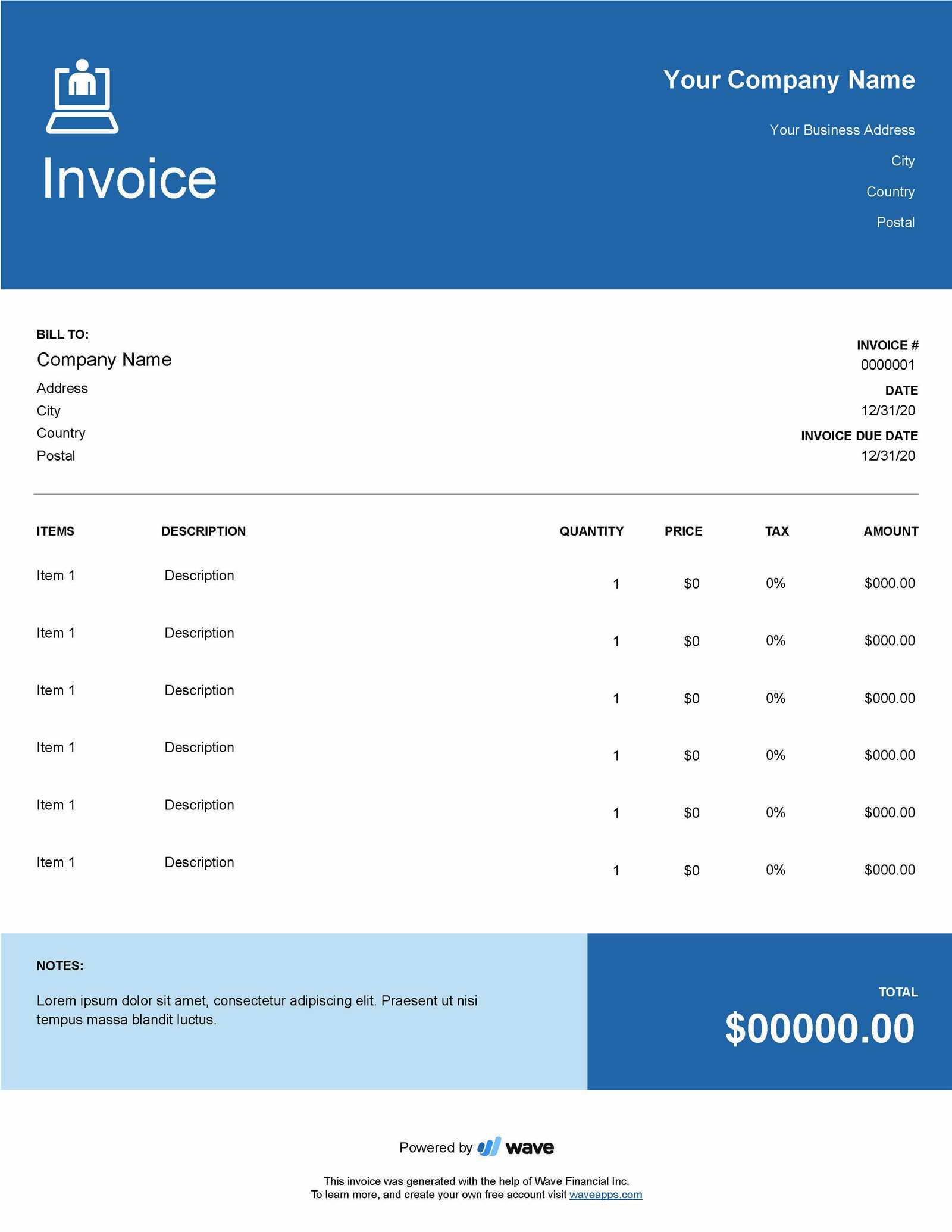

Choosing the Right Billing Document Format

Selecting the right format for your financial records is crucial for maintaining clarity and professionalism. A well-structured document ensures that all the necessary details are included, making it easy for both you and your clients to understand the charges. The format you choose can influence the way clients perceive your business, so it’s important to pick one that aligns with your needs and enhances your workflow.

Types of Formats to Consider

When selecting the most appropriate layout, consider the following options:

- Basic Layout: A simple, easy-to-read structure with minimal distractions. Ideal for small businesses or one-off transactions.

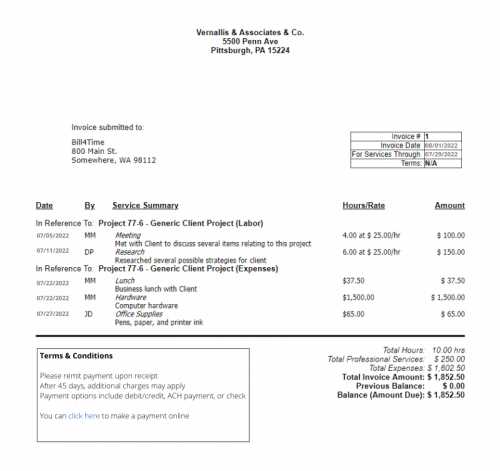

- Itemized Layout: Includes detailed descriptions and individual pricing for each task or resource used. This format is useful for projects with multiple components or ongoing work.

- Professional Design: Includes your business logo and branding elements, creating a polished, corporate appearance. Recommended for larger companies or those aiming to establish a strong brand identity.

Factors to Keep in Mind

When deciding on the format, ensure it includes the following critical elements:

- Clarity: The layout should be clean and easy to read, with sufficient spacing between sections.

- Consistency: Stick to a consistent format for all your records to ensure a professional presentation each time.

- Flexibility: Choose a format that can be easily adjusted as your business grows or your needs change.

By carefully selecting the right format, you can improve both the functionality and the appearance of your billing records, making them easier to process and more likely to be paid on time.

Design Tips for Professional Billing Documents

The design of your financial documents plays a crucial role in creating a lasting impression and ensuring clarity. A well-designed document not only reflects your professionalism but also makes it easier for clients to understand the charges and process payments. By paying attention to details like layout, typography, and branding, you can create a document that is both functional and visually appealing.

Key Design Elements to Consider

When crafting your financial records, consider the following design aspects to enhance both functionality and aesthetics:

- Consistency in Layout: Ensure that the layout is clean and organized. Use consistent headers, sections, and spacing to help the reader navigate the document easily.

- Readable Fonts: Choose fonts that are easy to read and professional. Avoid overly decorative fonts, and stick to standard choices like Arial, Helvetica, or Times New Roman for clarity.

- Minimalism: Keep the design simple. Avoid clutter by focusing only on essential information and limiting the use of excessive colors or graphics.

Branding and Customization

Incorporating your brand identity into your financial records can help you stand out and create a professional image. Here’s how you can personalize your documents:

- Logo and Colors: Include your company logo and use your brand’s colors to create a cohesive, branded experience.

- Custom Fields: Add custom fields that are relevant to your business, such as special payment terms, project references, or client-specific discounts.

- Header and Footer: Include your contact details or legal disclaimers in the header or footer, ensuring they’re easily accessible to the client.

By focusing on these design tips, you can create billing documents that are not only professional but also reflect your brand’s identity and commitment to quality.

Common Mistakes in Billing Documents

Creating accurate and clear financial records is essential for maintaining good relationships with clients and ensuring timely payments. However, many businesses make simple mistakes when preparing their billing documents, which can lead to confusion, delays, or even disputes. Recognizing these errors is the first step in preventing them and streamlining your billing process.

Frequent Errors to Avoid

Here are some of the most common mistakes that can occur when preparing financial documents:

- Missing Contact Information: Failing to include either your or the client’s full contact details can cause delays in communication and payment. Ensure all relevant information is clearly stated.

- Unclear Payment Terms: Not specifying payment due dates, late fees, or accepted payment methods can lead to misunderstandings. Always set clear expectations for your clients.

- Inaccurate or Incomplete Descriptions: Vague or missing details about the work performed can result in confusion. Make sure to provide a precise breakdown of the services or products delivered.

- Omitting Tax Information: If applicable, neglecting to include taxes or not providing a breakdown of tax rates can create problems during tax season. Always specify any taxes and rates where necessary.

Formatting and Layout Mistakes

In addition to content-related errors, poor formatting can also undermine the professionalism of your billing documents. Consider these tips to avoid common layout mistakes:

- Cluttered Layout: A crowded, difficult-to-read format can make it harder for clients to understand the charges. Use clear sections, bold headings, and adequate spacing for better readability.

- Inconsistent Style: Changing fonts or colors throughout the document can create a disorganized appearance. Stick to a consistent, professional style to maintain a cohesive look.

- Incorrect Totals: Double-check your calculations to ensure that the final total matches the itemized list of charges. Errors here can damage your credibility and lead to payment delays.

By avoiding these common pitfalls, you can create more effective, professional billing records that ensure smooth transactions and strong client relationships.

How to Organize Billing Information Effectively

Effective organization of billing information is key to ensuring clarity, reducing errors, and making payment processing easier for both you and your clients. A well-organized document allows for a smooth transaction process and helps build trust with your customers. Proper structuring of details ensures that all necessary data is easily accessible and that both you and your clients can quickly find relevant information when needed.

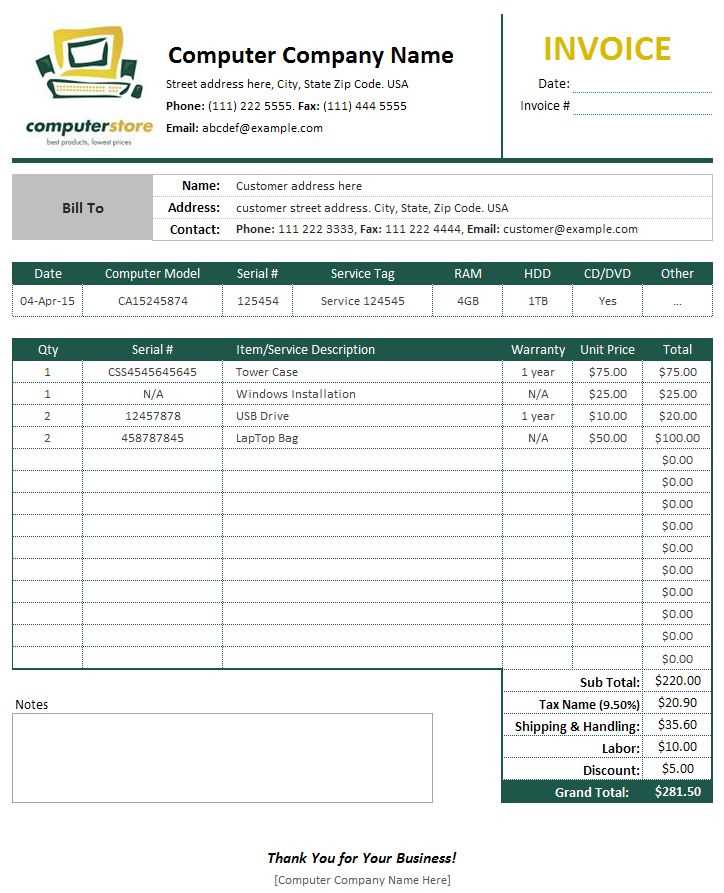

Breakdown by Sections: Structuring your document with clear sections is essential. Start with the basics like your business and client information, followed by the description of work done, and end with payment details. This logical progression helps clients quickly navigate through the document.

Use of Tables for Itemization: When listing the work completed or products delivered, using a table format can help you present information in an organized and easy-to-read manner. A clear table with columns for descriptions, quantities, prices, and totals allows clients to quickly see the breakdown of charges.

Prioritize Key Information: Place the most critical information at the top or in prominent positions, such as the total due, payment terms, and due date. This ensures that your clients immediately know what’s expected of them and prevents confusion about amounts and deadlines.

Include Clear Totals and Subtotals: Always include subtotals for individual categories (such as labor, materials, and taxes), followed by the final total. This transparency helps clients understand how the final figure was calculated and reinforces trust in your billing practices.

By following these strategies, you can create a well-organized and easy-to-understand financial record that minimizes confusion and facilitates a quicker, smoother payment process.

Importance of Clear Payment Terms

Clear and well-defined payment terms are crucial for any business transaction. They set expectations, reduce misunderstandings, and ensure that both parties are on the same page regarding when and how payments should be made. Without clear payment guidelines, there can be confusion, delays, and potential conflicts over amounts due or deadlines, which can ultimately harm your cash flow and client relationships.

Benefits of Transparent Payment Guidelines

Minimized Disputes: By explicitly stating payment conditions, you prevent any confusion or disagreements over payment dates, amounts, or methods. Clear terms help ensure both parties know exactly what to expect, reducing the likelihood of disputes.

Improved Cash Flow: When payment terms are clearly outlined, clients are more likely to pay on time, ensuring a smoother cash flow for your business. Clear deadlines and penalties for late payments encourage prompt settlement and can help avoid delays that affect your operations.

Key Elements to Include

To make sure your payment terms are both clear and comprehensive, include the following details in every document:

- Due Date: Specify the exact date when payment is expected. This removes any ambiguity and helps clients understand the urgency.

- Accepted Payment Methods: Outline the methods through which clients can pay, such as bank transfer, credit card, or online payment systems.

- Late Fees: Mention any penalties or interest that will apply if payment is not made by the due date. This encourages timely payment and protects your revenue.

- Early Payment Discounts: If applicable, offer discounts for early payments to incentivize prompt settlement.

By including these details, you create a transparent, professional agreement that ensures smoother transactions a

Tracking Payments with Billing Records

Keeping track of payments is essential for maintaining healthy cash flow and ensuring that all transactions are properly recorded. A well-organized billing document not only outlines the services provided but also serves as a tool for tracking incoming payments. This process helps businesses stay on top of outstanding balances, monitor overdue payments, and maintain financial accuracy.

By effectively tracking payments, you can quickly identify which clients have paid and which still owe, allowing you to take appropriate action when necessary. Here’s how to structure your records for efficient payment tracking:

| Payment Status | Client Name | Amount Due | Amount Paid | Balance | Payment Date |

|---|---|---|---|---|---|

| Paid | John Doe | $500 | $500 | $0 | 2024-10-01 |

| Unpaid | Jane Smith | $350 | $0 | $350 | 2024-10-05 |

| Partial Payment | Mike Johnson | $700 | $400 | $300 | 2024-10-03 |

As shown in the table, keeping track of payment status, amounts due, and amounts paid ensures a clear overview of your financial situation. It also helps you identify partial payments or overdue accounts so you can follow up accordingly.

Regularly updating your payment records and reviewing the status of each transaction will keep you organized and help prevent payment-related issues down the line.

How to Handle Late Payments in Billing Documents

Late payments can create significant challenges for businesses, affecting cash flow and potentially leading to financial instability. It’s important to address overdue payments promptly and professionally to maintain a good relationship with your clients while ensuring you are compensated for the work you’ve done. Having a clear strategy for managing late payments can help resolve issues quickly and keep your finances on track.

To effectively handle overdue payments, consider the following steps:

Step-by-Step Process for Managing Late Payments

- Send a Reminder: If a payment is overdue, start by sending a friendly reminder. Sometimes clients simply forget, and a gentle nudge can often resolve the issue.

- Provide Clear Payment Terms: Always refer to the payment terms listed in your billing document, including the due date and any late fees. Ensure these terms were clearly communicated to the client beforehand.

- Offer Flexible Solutions: If a client is facing financial difficulties, consider offering flexible payment arrangements, such as a payment plan or an extension of the due date.

- Apply Late Fees: Enforce your late payment penalties as outlined in your terms. Late fees provide an incentive for clients to pay on time and discourage delayed payments.

- Send a Final Notice: If the payment remains unpaid despite reminders and negotiations, send a final notice indicating the potential consequences, such as suspension of services or legal action.

Example of Late Payment Tracking

The following table outlines an example of how to track late payments and manage overdue balances:

| Client Name | Amount Due | Due Date | Days Overdue | Status | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| John Doe | $450 | 2024-09-15 | 15 | Late – Reminder Sent | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jane Smith | $200 | 2024-09-25 | 5 |

Free vs. Paid Billing DocumentsWhen it comes to creating billing records, businesses often face a decision between using free or paid solutions. Both options have their benefits and drawbacks, and the choice largely depends on your specific needs, budget, and the level of customization you require. Free options may be appealing for their zero cost, but they often come with limitations in design and functionality. On the other hand, paid solutions offer advanced features and more professional designs but require a financial investment. Understanding the pros and cons of both can help you make an informed decision. Advantages of Free Billing DocumentsFree options are widely accessible and perfect for small businesses or startups that have limited resources. Here are some benefits:

Advantages of Paid Billing DocumentsPaid options generally provide more advanced features and customization. Here are the main advantages:

Comparison TableThe table below compares the key features of free and paid billing records to help you make an informed choice:

Ultimately, whether you choose a free or paid option depends on the complexity of your needs and the resources you have available. For businesses just starting out or those with simple requirements, free solutions may be sufficient. However, if you need advanced features and more customization, investing in a paid option might be worth the cost. Best Software for Billing Record CreationCreating professional and accurate billing records is essential for any business. The right software can simplify the process, save time, and help ensure that every detail is correct. With the wide range of tools available, choosing the best software depends on your business needs, level of customization, and budget. Some tools focus on simplicity and ease of use, while others offer advanced features for businesses that require more complex invoicing systems. Here are some of the top options for creating billing documents, each catering to different business needs: Comparison of Top Billing Tools

Each of these tools offers unique features designed to streamline the billing process. Whether you’re just starting out or have complex invoicing needs, choosing the right software will depend on factors such as the number of clients, required features, and budget. For those looking for simplicity, free solutions like Wave or PayPal Invoicing may be sufficient, while businesses with more complex requirements may benefit from using QuickBooks or FreshBooks. How to Add Taxes to Your Billing RecordAdding taxes to your billing documents is an essential step to ensure compliance with local tax laws and to accurately reflect the total amount due from your clients. Whether you need to apply a sales tax, VAT, or other types of levies, correctly including them in your documents helps avoid confusion and ensures transparency. Understanding how to calculate and display taxes can also improve professionalism and credibility with your customers. Steps to Calculate and Add Taxes

Before adding taxes, you need to determine the correct tax rate based on your location and the nature of the transaction. Here’s how you can apply taxes effectively:

Displaying Taxes on Billing DocumentsIt’s important to clearly display the tax on your billing record, so clients can easily see the breakdown of the charges. Here’s how you can format it:

For example, a billing record could look like this:

|