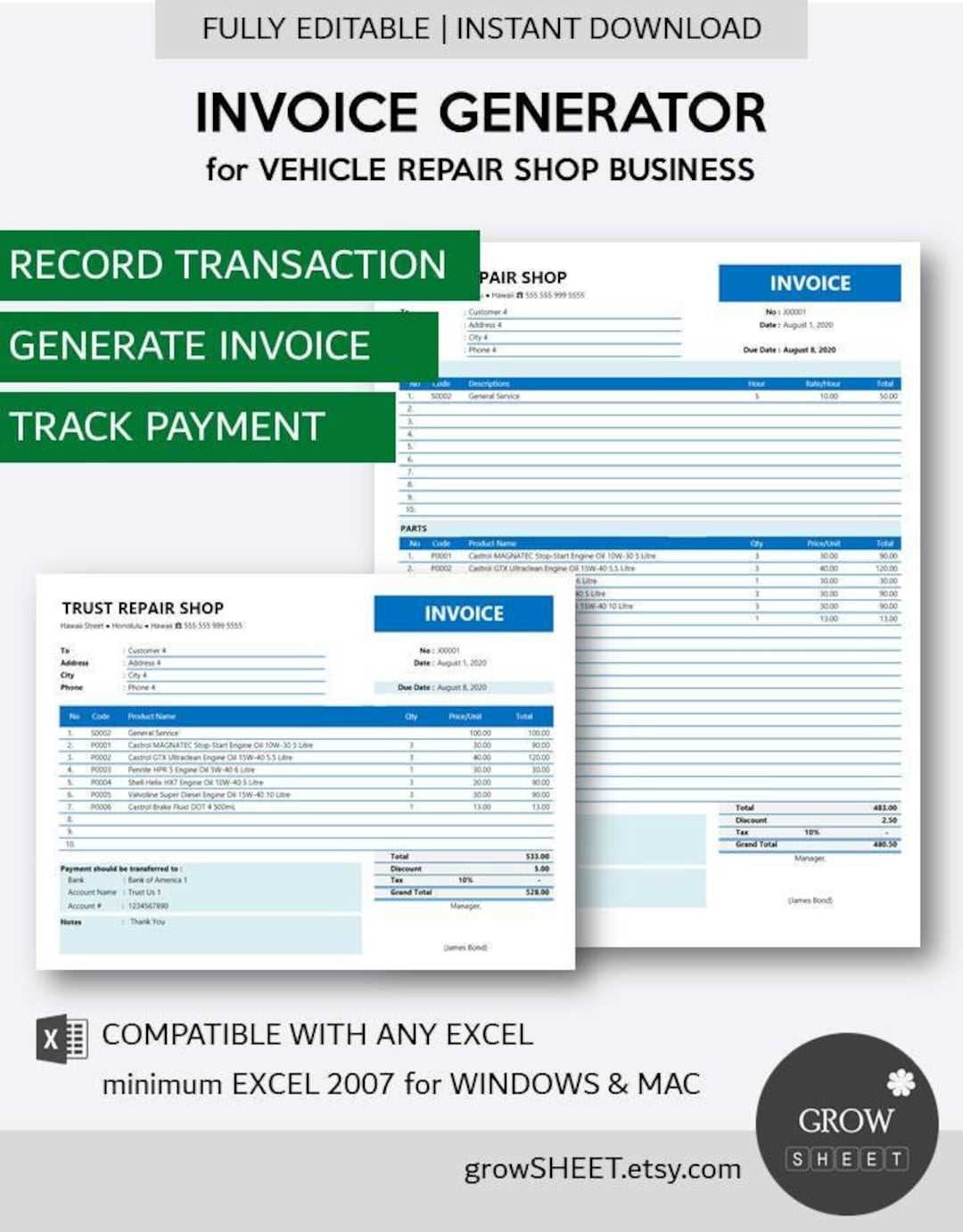

Computer Repair Invoice Template Excel for Streamlined Billing

Managing billing for technical services can be a challenging task, especially when dealing with multiple clients and varying service requirements. Having the right tool can simplify this process and save valuable time. Whether you are running a small business or working independently, using a digital solution to handle financial records and charges is essential for maintaining smooth operations.

Customizable solutions that allow you to adjust fields and automate calculations provide a professional way to handle client accounts. These tools help ensure that all details, from services rendered to payment terms, are clearly outlined. The convenience of an editable file format means you can quickly adapt the document to suit different needs or recurring tasks.

By adopting an efficient system for creating and tracking financial documents, you not only improve accuracy but also foster a more transparent relationship with your clients. The use of digital formats also makes sharing and archiving easy, ensuring that records are accessible when needed.

Computer Repair Invoice Template Excel Guide

Efficient billing is crucial for any service-based business, particularly when managing a diverse range of tasks and clients. A well-structured financial document can save time and reduce errors, ensuring clarity between you and your clients. By using customizable formats, you can easily create and track charges for various services while maintaining a professional appearance in your communications.

Customizing Your Document for Specific Needs

One of the main advantages of using a flexible format is the ability to tailor each section to your specific business requirements. Fields like service description, labor hours, and part costs can be adjusted to reflect the details of each job. You can also set payment terms, due dates, and any additional charges, allowing you to present a comprehensive summary for clients.

Automating Calculations for Accuracy

Incorporating automated formulas within your document ensures that all costs are calculated accurately, eliminating the need for manual math. These formulas can automatically update totals based on unit prices, quantities, and applicable taxes, helping you avoid costly mistakes. With these features in place, you can focus on delivering quality service while leaving the administrative tasks to your customized financial record.

Why Use an Invoice Template

Utilizing a structured document for billing not only improves efficiency but also ensures professionalism in your business transactions. With a standardized layout, you can create consistent records for all your clients, helping to minimize confusion and errors. Such a system is ideal for service providers who need to keep track of payments, due dates, and any changes in pricing over time.

Key Benefits of Using a Pre-Formatted Solution

- Time Efficiency: Quickly generate billing documents without having to recreate the format each time.

- Consistency: Maintain a uniform look and feel for all your financial records, regardless of the task or client.

- Professionalism: Present your business in a polished manner, reinforcing trust with clients.

- Ease of Use: Streamlined process with clear fields for important details like costs, hours, and payment terms.

How Pre-Built Solutions Help Your Business

With a ready-to-use format, you can focus on the work itself rather than spending time managing paperwork. Automation features, like auto-calculating totals and taxes, remove the risk of human error, allowing you to provide accurate billing to your clients. Additionally, it simplifies the process of organizing your records for future reference or tax purposes.

Benefits of Excel for Invoices

Using a digital spreadsheet for managing financial records offers numerous advantages. The ability to customize, automate, and organize data in an easily accessible format makes it an ideal tool for professionals who need to streamline billing processes. With powerful features at your disposal, you can significantly reduce manual errors and save time on routine tasks.

Why Choose a Spreadsheet for Billing

- Customization: You can design the document to meet your specific needs, adjusting fields and layouts as required.

- Automation: Built-in formulas allow you to calculate totals, taxes, and discounts automatically, ensuring accuracy.

- Data Management: Easily organize and update records, making it simple to track payments and outstanding amounts.

- Cost-Effective: No need for expensive software when a spreadsheet program can meet all your billing needs.

How a Spreadsheet Enhances Efficiency

Incorporating automated calculations into your billing system removes the need for manual math, saving time and reducing the risk of mistakes. You can also easily modify rates, quantities, or client information without the hassle of reformatting. With the ability to instantly adjust your records and generate new documents, managing your finances becomes a much more efficient process.

How to Customize Your Template

Adapting your financial documents to suit your specific business needs is crucial for maintaining clarity and professionalism. By adjusting the layout and content, you can ensure that all necessary details are clearly presented, making the process of tracking payments and services more efficient. Customization allows you to personalize each document, reflecting your brand and workflow.

Modifying Essential Sections

Start by reviewing the key sections of your document, such as service descriptions, client details, and pricing information. Ensure that each field is appropriately labeled and easy to fill out. You can also adjust the font style or size to make the information stand out clearly, depending on the importance of each section.

Adding Automated Features

Integrating formulas is an essential step to make your documents work more efficiently. Use calculation functions for totals, taxes, and discounts so that they update automatically. This will save time and reduce human error. Additionally, you can create dropdown menus or checkboxes for quick selection of common services or payment terms, making the document even easier to use.

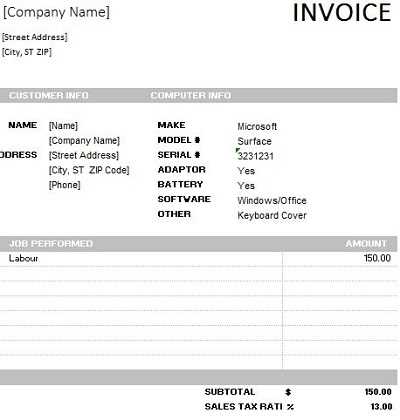

Key Fields in Repair Invoices

Every financial document for services provided should include certain essential information to ensure transparency and clarity. These key fields help both the service provider and client understand the charges, terms, and any additional details related to the transaction. Properly structuring your document ensures that all the necessary information is included, making payment tracking straightforward.

Essential Information to Include

Client Details: Start by including the client’s name, contact information, and billing address. This ensures the document is properly personalized and easily traceable to the right person or business.

Service Description: Clearly list the work performed, including any specific tasks or services provided. Be as detailed as possible to avoid misunderstandings later.

Time and Materials: Include labor hours and any materials used during the process. This section should have clear breakdowns of the hourly rate, the number of hours worked, and costs of parts or materials used.

Payment Terms: Set clear payment deadlines and methods. Specify whether payment is due immediately, within a certain number of days, or upon completion of specific milestones.

Additional Fields for Clarity

Discounts or Adjustments: If any discounts or adjustments are applied, they should be clearly noted to avoid confusion.

Taxes and Fees: Ensure that any applicable taxes or extra fees are calculated and shown separately for clarity.

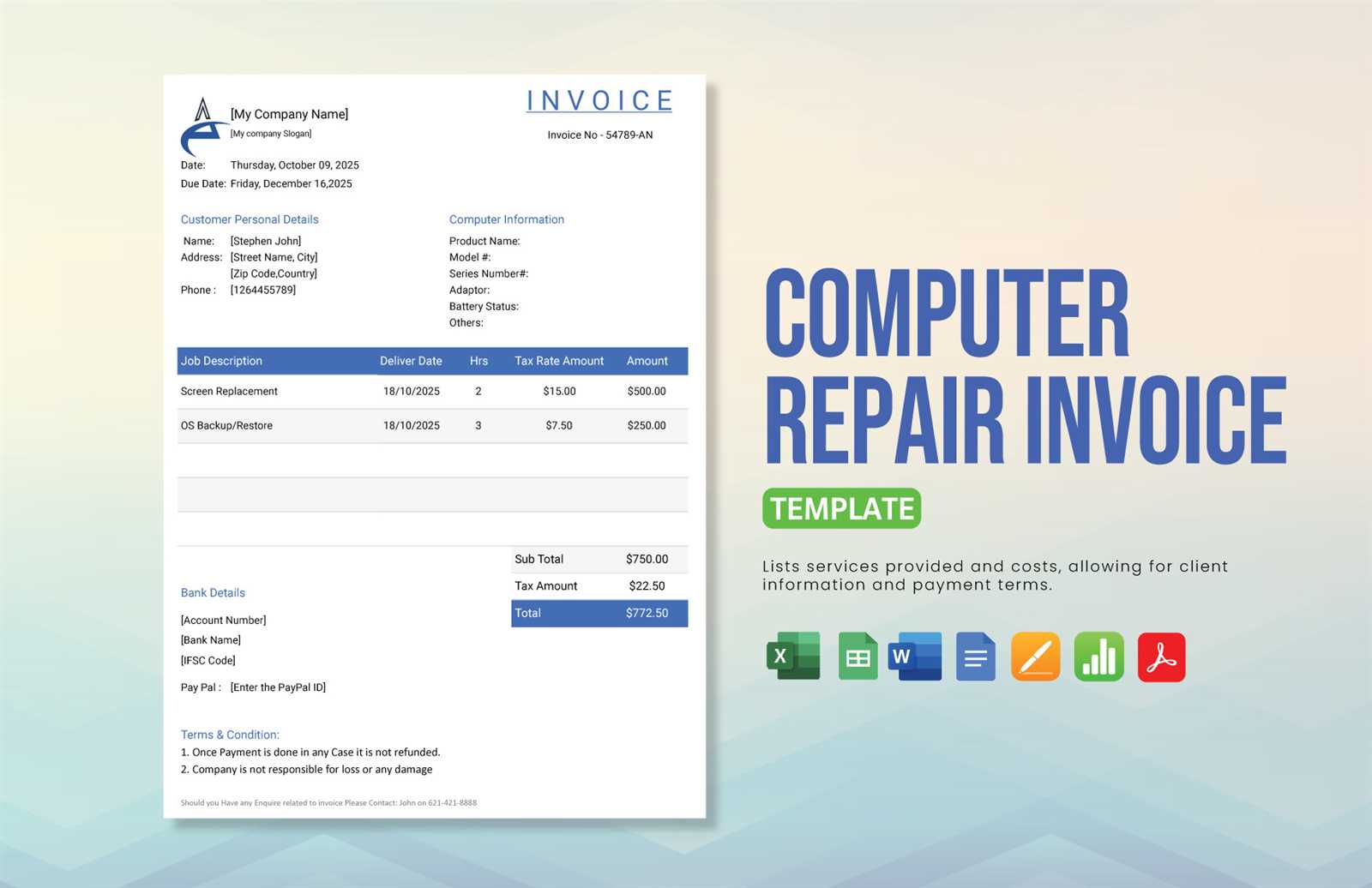

Creating a Professional Invoice Layout

A well-designed financial document is key to presenting your business in a professional manner. An organized and clear layout not only makes the document more readable but also enhances client trust. A clean structure helps ensure all necessary information is included and easy to find, which is essential for smooth transactions and positive client relationships.

Structure Your Document for Clarity

Begin by organizing the content in a logical flow. Start with your business information at the top, followed by the client’s details, and then move into the specifics of the service provided. Each section should be clearly separated, using spacing and bold fonts to highlight important information. Keep the layout simple and easy to follow, with a clear hierarchy of data.

Design Tips for a Professional Look

Consistency is key when it comes to design. Use the same font throughout, choosing one that is easy to read. Stick to a minimalist color scheme, avoiding bright or distracting colors. Including your business logo and contact details can add a personalized touch without overwhelming the layout. Ensure that your totals and payment terms are prominently displayed so they are easily visible to the client.

How to Track Repairs and Payments

Monitoring service activities and corresponding financial transactions is crucial for maintaining a healthy business. Effective tracking helps you understand which services have been completed, the status of payments, and overall financial health. Implementing a systematic approach ensures that all details are recorded accurately, minimizing the risk of errors and enhancing client satisfaction.

Setting Up a Tracking System

Establish a clear method for recording each service performed. This can be done using spreadsheets or dedicated software that allows you to log important details such as service dates, client information, and costs incurred. Create a separate section for tracking payments, indicating the amount received, payment date, and any outstanding balances. This organized system will allow you to easily review past activities and follow up on pending payments.

Utilizing Software Tools

Consider leveraging technology to simplify the tracking process. Many software options are available that can automate the recording of services and payments. Look for tools that offer features such as automatic reminders for overdue payments and reports on service history. This not only saves time but also provides a comprehensive overview of your financial activities, helping you make informed decisions for your business.

Adding Taxes to Your Invoice

Incorporating applicable taxes into your financial documents is essential for compliance and transparency. Understanding how to calculate and display taxes correctly ensures that clients are fully informed of their total charges. This process not only fosters trust but also simplifies the payment process, making it clear what portion of the total is attributed to tax obligations.

Understanding Tax Rates

Before adding taxes, familiarize yourself with the relevant tax rates in your jurisdiction. Rates can vary based on location, type of service, or product. It is important to apply the correct percentage to avoid overcharging or undercharging your clients. Keep a record of any changes in tax laws that may affect your calculations.

Calculating and Displaying Taxes

To calculate taxes, simply multiply the subtotal of services by the tax rate. Clearly outline this calculation in your document, showing both the subtotal and the total amount due after tax is applied. It is beneficial to include a separate line item for taxes, labeled clearly, so clients can see how much they are paying in tax. This practice not only enhances clarity but also demonstrates your professionalism.

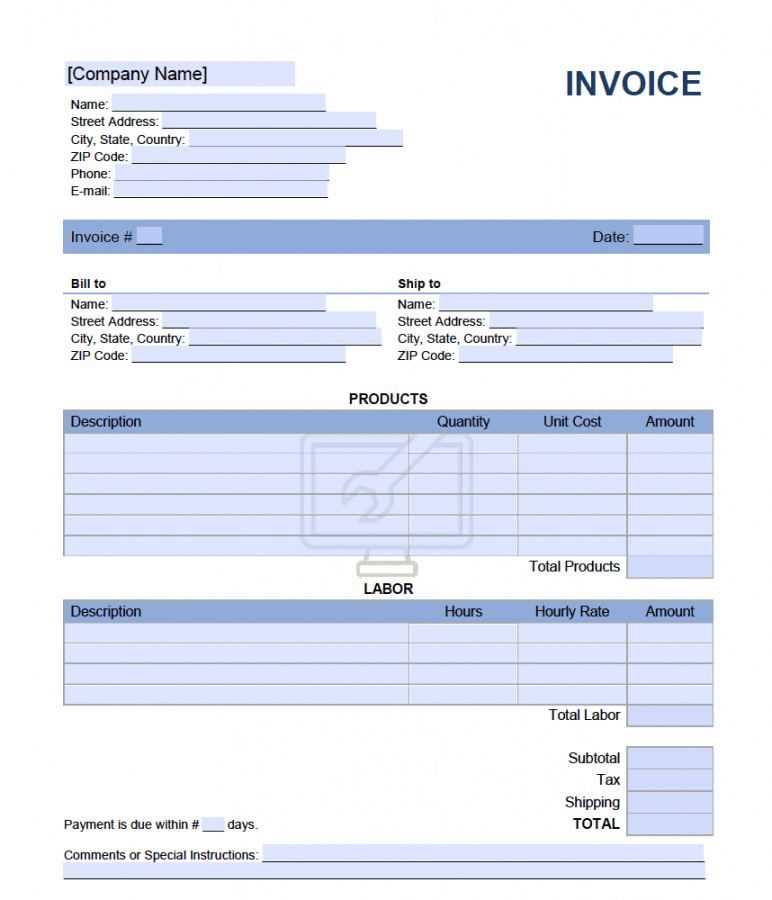

How to Include Parts and Labor Costs

In any service-based business, clearly outlining the expenses related to materials and services is vital for transparency and accurate billing. Including detailed information about the costs incurred allows clients to understand what they are paying for, fostering trust and minimizing disputes. Properly itemizing these charges is essential to convey the full scope of the work done.

- List Parts Separately: Provide a detailed account of all materials used. Include descriptions, quantities, and individual costs for each item. This breakdown helps clients see exactly what was required for the task.

- Detail Labor Charges: Clearly define the time spent on each service. Specify the hourly rate and include the total hours worked. This transparency ensures clients understand how labor costs are calculated.

- Combine Costs: After listing parts and labor, present a subtotal that combines both expenses. Clearly label this subtotal to avoid confusion. This allows clients to see the cumulative cost before taxes and any additional charges are applied.

- Provide Total Amount: Finally, ensure that the total amount due is prominently displayed. This should encompass parts, labor, taxes, and any other applicable fees, giving a complete picture of the charges incurred.

lessCopy code

By meticulously detailing both materials and labor, you not only improve clarity for your clients but also enhance the professionalism of your service. This practice contributes to better customer relations and encourages prompt payment.

Setting Payment Terms in Your Template

Establishing clear payment conditions is crucial for any business transaction. Well-defined payment terms not only facilitate smoother financial processes but also enhance communication between service providers and clients. By outlining expectations, you can prevent misunderstandings and ensure timely payments.

- Define Payment Methods: Clearly specify the accepted methods for payments, such as credit cards, bank transfers, or cash. Providing multiple options can make it easier for clients to settle their accounts.

- Set Due Dates: Indicate when payment is expected, whether it’s upon completion of the service or within a specified number of days. Clear due dates help clients plan their payments and avoid late fees.

- Include Late Payment Policies: Outline any penalties or interest that may apply if payments are not made on time. This encourages prompt payments and helps manage cash flow effectively.

- Offer Discounts for Early Payments: Consider providing a small discount for clients who pay their bills promptly. This can incentivize early payments and strengthen customer relationships.

- Communicate Clearly: Use straightforward language to convey your payment terms. Avoid jargon that might confuse clients, ensuring they fully understand their obligations.

phpCopy code

By establishing comprehensive payment terms, you set clear expectations for your clients, ultimately leading to better financial management and a more professional business image.

Using Formulas for Calculations

Automating calculations can significantly streamline the process of managing payments and costs. By using built-in formulas, you can save time and reduce errors when tallying up costs, taxes, or totals. Formulas can perform complex calculations instantly, ensuring accuracy and efficiency in every transaction.

Basic Calculations

Start by implementing simple formulas like addition and multiplication to quickly calculate totals and prices. For example, multiplying the unit price of a service or item by the quantity needed will provide the correct amount due for each entry.

Advanced Calculations

For more detailed tracking, consider using formulas that handle percentages, such as calculating discounts, taxes, or fees. These formulas can be adjusted to suit the specific needs of each calculation, helping you manage complex financial figures with ease.

Using formulas for calculations not only simplifies the process but also enhances accuracy and consistency in your financial records, providing a reliable system for tracking transactions.

How to Manage Multiple Clients

Handling several customers at once can become overwhelming without the right approach. It is essential to keep clear and organized records to track individual needs, billing, and services. The key is creating a system that ensures each client is managed effectively while maintaining smooth operations.

Use Organized Records to avoid confusion between clients. Creating separate files or sections for each client allows you to track their specific requests, payments, and deadlines. Keep all communications and agreements in one place for easy reference.

Prioritize Deadlines to stay on top of tasks. Set reminders for upcoming appointments or due dates to ensure timely completion of each job. A well-organized schedule can prevent overlapping tasks and missed deadlines, helping you deliver excellent service to each client.

Track Payments and Services to keep accurate financial records. It’s vital to monitor payment status and services rendered, ensuring that nothing is overlooked. This can help with budgeting and maintaining healthy business relationships by providing transparency in billing.

By implementing a structured approach, you can effectively manage multiple clients without compromising service quality or efficiency.

Saving and Sharing Invoices in Excel

Properly saving and sharing documents is crucial for maintaining organization and ensuring seamless communication with clients. With the right tools, you can easily manage and distribute important files, ensuring quick access and accurate records. This section explores the best practices for securely saving and sharing your documents.

Save Documents in an Accessible Format to make it easier to locate and access files. Popular formats, such as PDF or spreadsheet files, are ideal because they preserve the layout and ensure compatibility across different devices and platforms. Regularly back up your files to avoid data loss.

Share Files Securely by using cloud-based storage or encrypted email services. This allows you to send documents directly to clients, ensuring privacy and security. Many platforms also offer version control, which is useful for tracking updates and modifications over time.

Organize Files Properly by categorizing them based on client names, dates, or types of services. Creating a consistent naming system helps you quickly locate the needed documents, saving you time when searching for past records or preparing future reports.

By following these methods, you can efficiently save, share, and organize your important documents, improving both your workflow and communication with clients.

Integrating with Accounting Software

Efficient financial management requires the seamless connection between different tools used for tracking and recording business transactions. Integrating your documents with accounting software simplifies the process of keeping accurate financial records, reducing manual work and ensuring consistency across your reports.

Automated Data Transfer allows for automatic synchronization of financial data between your document and accounting platform. This eliminates the need to manually input details, reducing the risk of errors and saving valuable time. By setting up integration, all relevant transaction information can flow smoothly into your accounting system.

Real-time Updates ensure that any changes made to a document, such as adding new charges or modifying payment details, are immediately reflected in your accounting software. This keeps your financial reports up-to-date and accurate without the need for extra effort from your side.

Improved Reporting and Analytics allows for more accurate analysis of your business’s financial status. By integrating with accounting software, you can easily generate comprehensive financial reports and forecasts, offering insights into profitability, cash flow, and more. This integration also helps in generating tax reports and other compliance-related documents effortlessly.

By connecting your documents with accounting tools, you streamline your business processes, reduce errors, and improve overall financial accuracy, all while saving time on manual data entry.

How to Create Recurring Invoices

Setting up recurring charges is a practical way to streamline the billing process for ongoing services or subscriptions. With automated billing cycles, you can ensure that clients are billed consistently and on time without needing to manually create new documents each period. This approach saves time and ensures that payments are never missed.

Choose a Billing Cycle for your recurring charges, such as weekly, monthly, or annually. By selecting the right frequency, you can align your billing with the services provided, ensuring both your business and the customer have clear expectations for payment timing.

Set Up Automated Reminders within your system to notify clients about upcoming payments. This reduces the chances of missed payments and keeps customers informed about their obligations. Automated reminders can be sent via email or text, depending on your preferred communication method.

Track Payment Status to easily monitor whether payments have been made on time or if any issues need addressing. Many tools offer features to automatically track payments and provide updates on overdue accounts, simplifying your financial management.

Customize for Each Client by adjusting the details for each recurring charge. Some clients may have unique payment terms or discounts, which can be accommodated by tailoring the billing document. This flexibility ensures that you meet the specific needs of each customer while maintaining consistency in your process.

By following these steps, you can easily set up recurring billing, ensuring smooth operations and reducing administrative workload over time.

Ensuring Accuracy in Billing

Maintaining precision in billing is essential for both the service provider and the customer. Accurate charges help prevent disputes, maintain trust, and ensure timely payments. To achieve this, it’s important to implement systematic practices that double-check all the details and calculations involved.

Double-Check Service Details

Start by confirming the services provided before entering any information into the document. Ensure that each service listed aligns with the agreement made with the client. This includes:

- Correct descriptions of the services or goods offered.

- Accurate quantities and units where applicable.

- Clear identification of any discounts or special offers, if agreed upon.

Verify Pricing and Discounts

Be sure that the pricing for each service or product is correct. This can be done by referencing previous documents, standard price lists, or contracts. Also, apply any discounts, if applicable, and ensure they are clearly stated so there are no misunderstandings.

Use Automated Calculations

To avoid human error, utilize tools that automatically calculate totals and taxes. This reduces the risk of miscalculations and ensures that the final amount is correct. Make sure all formulas are set up properly and tested to confirm their accuracy.

Review Client Information

Always double-check client information, including their contact details, billing address, and payment terms. This ensures the document is correctly addressed and sent to the right recipient. Mistakes in this area could lead to delayed payments or miscommunications.

By following these steps, you can ensure that your billing process remains precise, professional, and trustworthy.

Security Tips for Your Invoice Files

Protecting sensitive financial documents is essential to avoid data breaches, identity theft, and other security risks. It is crucial to implement several measures to safeguard your files and ensure they are only accessible to authorized individuals. Here are some practical steps you can take to secure your billing documents.

Use Password Protection

Always password-protect your files, especially when they contain sensitive customer information. Most spreadsheet programs allow you to set a password to restrict unauthorized access. Choose a strong, unique password that combines letters, numbers, and special characters to increase security.

Keep Backup Copies

Store backup copies of your financial documents in multiple secure locations. Cloud storage services with encryption are a great option, but also consider saving files on external hard drives or encrypted USB drives. Ensure these backups are regularly updated to prevent data loss.

Limit File Sharing

Share billing files only with the necessary parties and use secure communication channels. Avoid sending sensitive documents via unencrypted emails. If sharing files online, use secure file-sharing services with encryption to ensure they are protected during transit.

Use Anti-Virus Software

Keep your system safe by using updated anti-virus software that can detect and block malware or ransomware attacks. These programs help prevent unauthorized access to your files and protect your devices from potential threats.

Regularly Update Software

Ensure that your software, including spreadsheets and storage solutions, is always up to date. Regular updates often include security patches that protect your files from vulnerabilities exploited by hackers.

By following these security best practices, you can protect your billing documents from unauthorized access and potential threats, ensuring the confidentiality and safety of your financial information.

Updating Your Invoice Template Regularly

It is essential to keep your financial document layout current to ensure it meets changing legal, business, and operational requirements. Regular updates help maintain accuracy, prevent errors, and adapt to any new rules or technological advancements. Keeping your system up-to-date also improves efficiency and enhances professionalism in your transactions.

Reasons for Regular Updates

- Compliance with Legal Changes: Laws and tax rates change, and it is crucial to reflect those changes in your billing structure to avoid penalties.

- Incorporating New Features: Technology evolves, and new features such as payment gateways or digital signatures can streamline your process.

- Enhancing Aesthetic Appeal: Updating the design helps keep the documents looking professional, organized, and in line with modern business standards.

Best Practices for Updating Your Billing Documents

| Action | Benefit |

|---|---|

| Review legal requirements | Ensure all tax rates and legal disclaimers are up-to-date |

| Modernize layout | Improve clarity and user-friendliness |

| Integrate new features | Streamline payment processing and enhance customer experience |

| Test functionality | Ensure all formulas, fields, and formatting are working as intended |

By making regular updates to your financial document system, you maintain accuracy and adapt to both external and internal changes. This practice not only keeps you compliant but also improves the overall efficiency of your workflow.