Computer Generated Invoice Template for Efficient Billing

Managing finances efficiently is crucial for any business. With the right tools, creating and sending accurate payment requests can be quick and error-free. A well-designed system allows you to handle financial transactions smoothly, ensuring that both you and your clients are on the same page. By automating the billing process, businesses can save valuable time and resources.

Automating billing eliminates the need for manual entry, reducing human errors and speeding up the entire procedure. Customizable forms can be tailored to suit your specific needs, making it easier to generate consistent and professional documents. Whether you’re a freelancer or a large corporation, having an efficient billing structure is key to maintaining healthy cash flow.

In this article, we will explore how to implement a digital solution to simplify your payment requests. From choosing the right tool to creating well-structured documents, we will cover essential aspects to help you optimize your financial processes.

Computer Generated Invoice Template Guide

Efficient financial documentation is essential for maintaining smooth business operations. Automating the creation of payment records not only saves time but also ensures consistency and accuracy in every transaction. By using digital systems, businesses can streamline their billing processes, avoiding the repetitive task of manually filling out forms and reducing the risk of errors.

One of the most effective ways to manage your financial documents is through customizable forms. These allow businesses to quickly generate professional-looking records that include all necessary details, from itemized lists to payment terms. Whether you are a small business owner or a large enterprise, such tools can help maintain clear communication with clients and ensure timely payments.

Automating document creation also provides the flexibility to make adjustments based on specific needs, such as adjusting payment due dates or including additional fees. Moreover, these tools often integrate with other financial systems, allowing for seamless synchronization of data. The result is a more efficient workflow and less time spent on administrative tasks.

Benefits of Using Digital Invoices

Switching to digital billing systems offers a wide range of advantages, enhancing the overall efficiency and accuracy of business transactions. By automating the creation and management of financial documents, businesses can save time, reduce errors, and ensure that payment requests are processed quickly and professionally.

Digital solutions provide several key benefits, including:

| Benefit | Description |

|---|---|

| Time Savings | Automating document creation and delivery speeds up the entire billing process, freeing up time for other tasks. |

| Accuracy | Digital tools minimize the risk of human error by automatically filling in fields and calculating totals. |

| Professional Appearance | Pre-designed formats allow for uniform, polished documents that build trust with clients. |

| Cost-Effective | Eliminates the need for paper, printing, and mailing, reducing operational costs. |

| Environmental Impact | Digital billing reduces paper usage, helping businesses lower their carbon footprint. |

Adopting a digital approach not only streamlines the workflow but also enhances the customer experience by providing fast, secure, and easily accessible records. As technology continues to evolve, digital tools will play an increasingly critical role in managing financial processes.

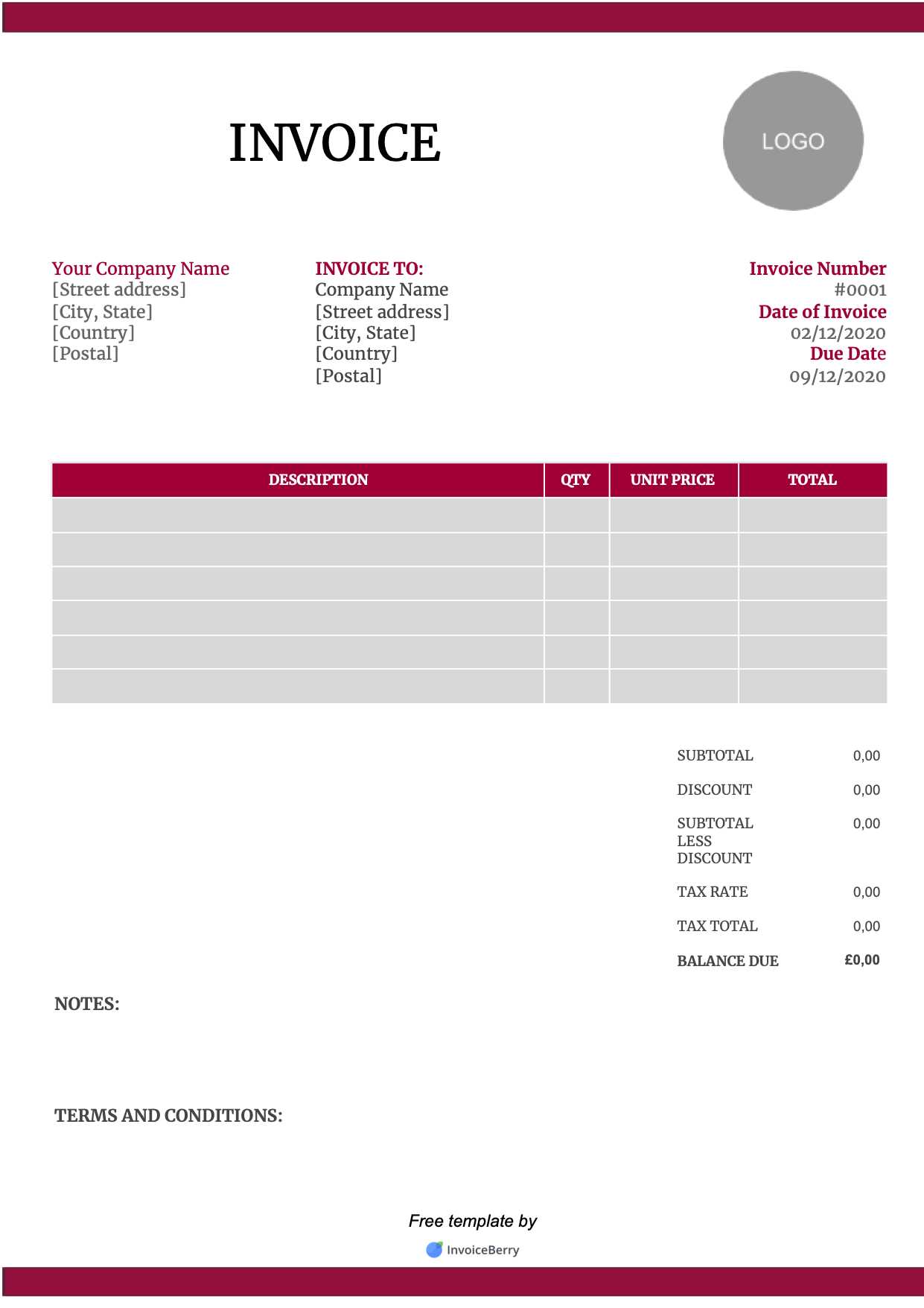

How to Create a Template for Billing

Designing an efficient form for financial transactions requires careful consideration of both functionality and clarity. A well-organized document ensures that all necessary details are included, making it easy for both parties to understand and process payments. By setting up a reusable structure, businesses can create a streamlined process that eliminates errors and saves time.

The essential components of a billing structure include the following:

| Section | Description |

|---|---|

| Header | Include your business name, contact information, and document title to clearly identify the record. |

| Client Information | Provide space for the client’s name, address, and other relevant contact details. |

| Transaction Details | List the services or products provided, along with their respective prices and quantities. |

| Payment Terms | Clearly state payment due dates, late fees, and accepted payment methods to avoid confusion. |

| Total Amount | Ensure the total cost is prominently displayed, including any taxes or additional charges. |

| Footer | Leave space for any additional information, such as a thank you note or payment instructions. |

Once the basic structure is established, customizing the document to suit specific business needs is straightforward. Using digital tools, these sections can be easily adjusted or updated to reflect new rates or services. This flexibility ensures that the billing process remains accurate and efficient, regardless of the type or scale of the business.

Customizing Your Invoice for Business Needs

Adapting financial records to match the specific requirements of your business is essential for maintaining clarity and efficiency. A customized form allows you to tailor the document’s layout, information, and functionality to suit your industry, ensuring that both you and your clients have all the necessary details for seamless transactions. By personalizing each aspect, you create a professional and consistent experience.

Key Customization Areas

- Branding: Incorporate your business logo, colors, and font styles to reflect your company’s identity.

- Payment Terms: Adjust payment deadlines, early payment discounts, or late fees based on your specific business model.

- Tax Information: Include tax rates that apply to your region or industry to ensure compliance with local regulations.

- Service/Item Descriptions: Customize the way services or products are listed to match the language or terminology used within your field.

- Client Information: Add sections for additional client-specific details such as project codes or customer references if necessary.

Enhancing Usability

Along with structural adjustments, improving the document’s functionality will make it easier for both parties to navigate and use. Here are some additional ways to enhance usability:

- Ensure clear section headings for easy reference to key information like amounts due or payment deadlines.

- Include easy-to-understand instructions for payment, preferred methods, and any relevant account information.

- Use a consistent format to maintain professionalism and reduce confusion for your clients.

- Consider adding automated features like calculation fields for totals or taxes to minimize errors and save time.

By tailoring your financial documents, you can create a more personalized and efficient process, ultimately leading to smoother transactions and improved client satisfaction.

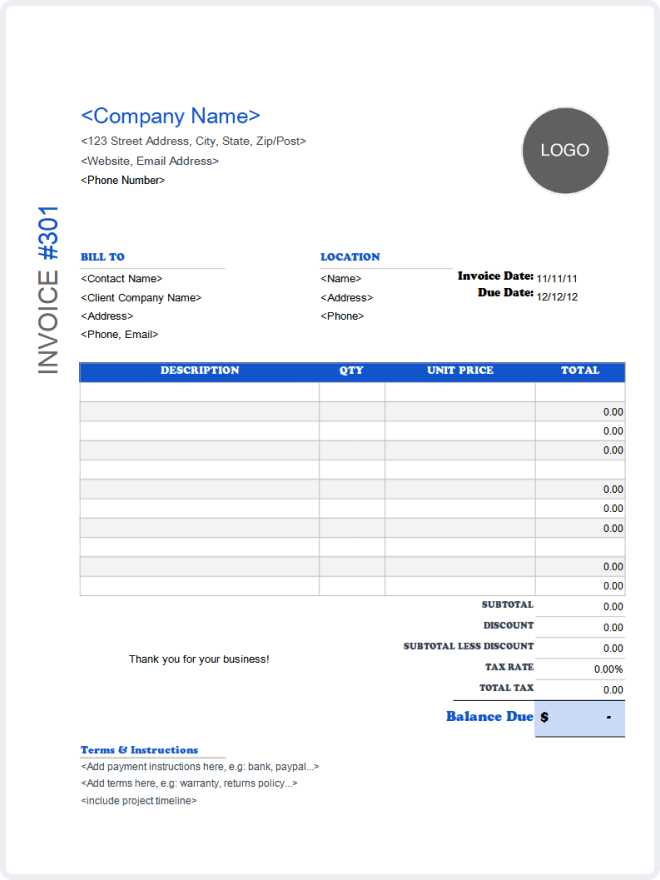

Essential Elements in an Invoice Template

Creating a comprehensive and clear financial document requires including all necessary details that facilitate smooth transactions and avoid confusion. A well-structured document ensures that both the business and the client have all the relevant information to process payments efficiently. Here are the key components that should be present in every financial document.

| Element | Description |

|---|---|

| Header Information | Includes the company’s name, logo, and contact information, ensuring easy identification and professional appearance. |

| Client Details | Client’s name, address, and contact details are essential for correct identification and communication. |

| Document Title | A clear title, such as “Payment Request” or “Billing Statement”, should be prominently displayed to indicate the nature of the document. |

| Transaction List | A detailed breakdown of goods or services provided, including descriptions, quantities, and unit prices. |

| Payment Terms | Include payment due date, late fees, and accepted payment methods to avoid ambiguity. |

| Total Amount | Clearly display the total amount due, including taxes, shipping fees, or any other additional charges. |

| Footer Section | Optional information such as a thank-you message, payment instructions, or a business registration number. |

By ensuring these essential elements are included in your financial documents, you create a clear, professional record that helps avoid disputes and promotes timely payments. Customizing these sections to suit your business can further enhance the document’s effectiveness and clarity.

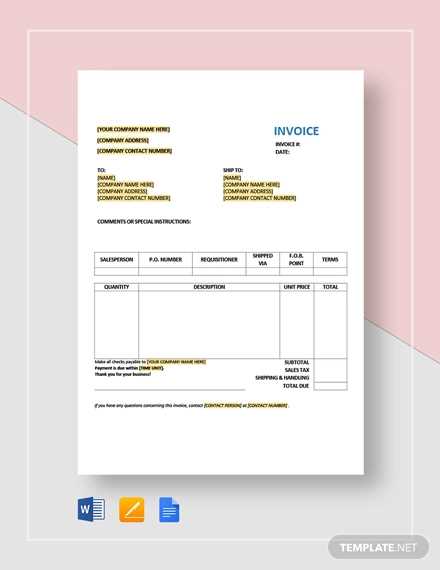

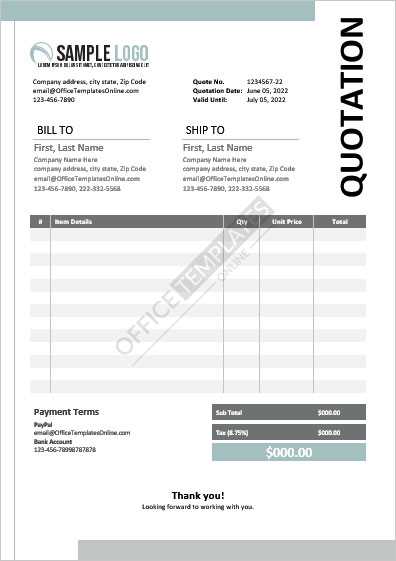

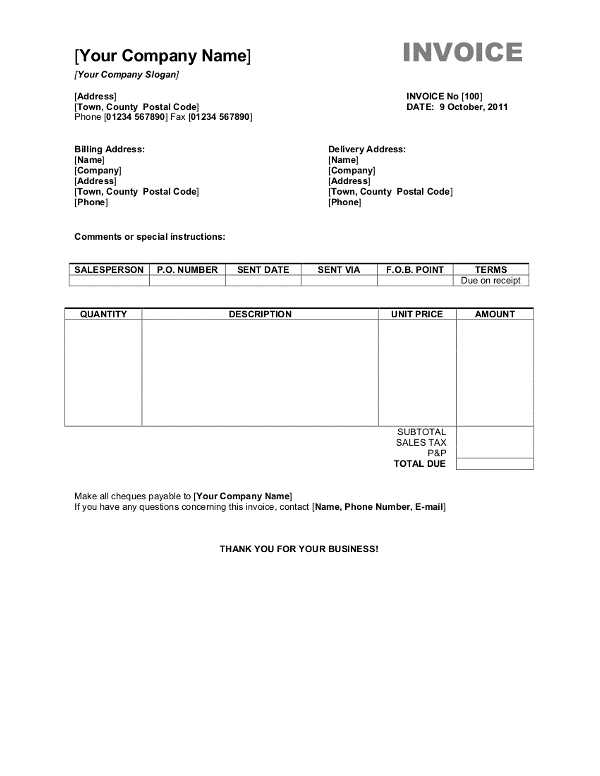

Different Invoice Formats and Styles

When it comes to creating financial documents, choosing the right format and style can significantly impact clarity, professionalism, and ease of use. Depending on the nature of your business and the preferences of your clients, various formats and styles can be employed to ensure that the document meets specific needs while maintaining consistency. Here, we explore some of the most common options available.

Popular Formats

- Traditional Paper Layout: This format typically includes all essential elements on a single page, making it suitable for businesses that still operate in more conventional settings.

- PDF Format: A widely-used, secure format that ensures the document remains unaltered and can be easily shared and printed.

- Excel or Spreadsheet Formats: These allow businesses to input and manipulate data directly in the document, making it useful for large or complex transactions with multiple line items.

- Online Billing Platforms: These digital solutions automatically generate and send documents, providing an integrated approach to invoicing and payment tracking.

Design Styles

- Minimalist Style: A simple, clean design with ample white space that focuses solely on the essential details without distraction.

- Modern and Bold: A more contemporary look that may incorporate colorful accents, creative fonts, and company branding to make the document stand out.

- Classic Professional: A straightforward and formal design that features traditional fonts and a balanced layout, emphasizing professionalism.

- Custom-Branded: Tailored to reflect the unique identity of the business, incorporating logos, color schemes, and even a personalized message for the client.

The choice of format and style can significantly influence how your financial documents are recei

Steps to Generate Invoices Automatically

Automating the creation of financial documents can save businesses a significant amount of time and effort. By leveraging digital tools and software, you can streamline the process, reducing manual input and ensuring consistency in your records. Below are the essential steps for setting up an automatic billing system.

Key Steps to Automate Billing

- Choose an Automation Tool: Select a software or platform that supports automated document creation, such as an accounting system or online billing service.

- Set Up Client Information: Enter your clients’ contact details, payment preferences, and any recurring billing details into the system.

- Define Product/Service Information: Input your product or service catalog, including descriptions, prices, and any applicable taxes or discounts.

- Customize Document Layout: Configure the layout to match your business branding, including logo, colors, and format preferences.

- Set Payment Terms: Define the payment due date, late fees, and acceptable payment methods, ensuring these details are automatically included in every document.

Finalizing the Setup

- Enable Recurring Billing (if needed): Set up automatic generation for recurring payments, such as subscriptions or ongoing services.

- Schedule and Automate Delivery: Configure the system to automatically send the documents to clients via email or other channels once they are created.

- Track Payments: Use the software to track incoming payments and match them with the corresponding documents, ensuring everything is up to date.

By following these steps, you can create a seamless and efficient process for generating and managing financial records, reducing errors and administrative workload.

How Templates Improve Time Efficiency

Using pre-designed formats for creating business documents can drastically reduce the time spent on administrative tasks. Instead of starting from scratch with each new transaction, these structured formats allow businesses to quickly generate accurate records, minimizing the need for repetitive data entry. By streamlining the process, employees can focus more on strategic tasks rather than routine paperwork.

With standardized layouts and automated fields, all the essential details are already in place, requiring only minimal updates. This eliminates errors caused by inconsistent formatting and ensures uniformity across all documents, making them faster to process and easier to understand for both parties involved.

Furthermore, templates can be customized to automatically include specific information such as client details, services rendered, or payment terms. This feature accelerates the workflow and reduces the chances of omitting important elements. Ultimately, time is saved not only in document creation but also in tracking, organizing, and maintaining records.

Ensuring Accuracy with Automated Billing

Automating the process of creating financial documents plays a crucial role in ensuring that all details are accurate and consistent. By reducing the reliance on manual data entry, businesses can eliminate human errors that commonly occur when handling calculations, amounts, or client details. Automated systems are designed to pull data from pre-established fields, ensuring that every document is generated with the correct information, every time.

These automated systems not only streamline the creation process but also reduce the risk of inconsistencies across multiple records. By maintaining a set structure, the tool ensures that all necessary components are included, from pricing to payment terms, and prevents any key information from being overlooked.

Additionally, built-in checks and validations help catch potential discrepancies before they are finalized. For example, the software can flag missing information, duplicate entries, or incorrect formats, prompting the user to make necessary corrections. This leads to more reliable records and helps maintain a high level of trust with clients.

How to Save Costs with Digital Invoices

Switching to digital financial documents can provide businesses with significant savings by eliminating many of the traditional costs associated with manual processing. Printing, paper, postage, and physical storage all contribute to overhead, and digital solutions offer a more efficient, cost-effective alternative. By automating document creation and delivery, businesses can reduce both time and resource consumption.

Digital formats also reduce the likelihood of errors, which can be costly to correct. With automated calculations and pre-filled fields, the chance of mistakes is minimized, saving both time and money spent on reprocessing or addressing disputes. Additionally, electronic records are easier to store, access, and organize, reducing the need for physical storage space and helping to cut costs related to filing and archiving.

Furthermore, by using digital tools that integrate directly with accounting or payment systems, businesses can streamline their cash flow management. These systems often allow for quicker payments by offering options for instant online transactions, minimizing delays, and improving overall financial efficiency.

Integrating Payment Options in Templates

Including payment methods directly within your billing documents streamlines the payment process for both you and your clients. By offering multiple payment options, businesses make it easier for customers to complete transactions quickly and conveniently. This integration not only accelerates cash flow but also enhances the overall customer experience by providing flexibility and ease of access.

Modern solutions allow businesses to embed various payment gateways, such as credit card processing, bank transfers, or online payment platforms like PayPal, directly into the document. This feature eliminates the need for customers to manually input their payment details into a separate system, thus reducing friction and speeding up the payment cycle.

Benefits of integrating payment options:

- Faster Transactions: Clients can pay instantly, reducing delays in processing payments.

- Increased Customer Satisfaction: Offering preferred payment methods boosts convenience and encourages timely payments.

- Reduced Errors: By automating the process, you minimize the risk of errors in payment details.

- Better Cash Flow: Prompt payments result in a more predictable financial outlook for your business.

By incorporating payment options directly into your billing documents, you simplify the process for everyone involved, making it easier to track and manage transactions efficiently.

Common Mistakes to Avoid in Invoices

Creating accurate financial documents is crucial for maintaining a professional reputation and ensuring smooth business transactions. However, even small errors can lead to confusion, delayed payments, and potential disputes. Understanding and avoiding common mistakes is essential to ensure that your documents are clear, correct, and reliable.

Frequent Errors in Financial Documents

- Missing or Incorrect Client Information: Ensure all details, such as the client’s name, address, and contact information, are accurate and up-to-date to avoid confusion and delivery issues.

- Incorrect Pricing or Calculation Errors: Double-check all prices and totals to avoid discrepancies, which can lead to disputes or non-payment.

- Unclear Payment Terms: Clearly state payment deadlines, accepted payment methods, and any applicable late fees to prevent misunderstandings.

- Lack of Item Descriptions: Always include a detailed description of the products or services provided. This will help clarify what the payment is for and can prevent unnecessary queries.

Additional Issues to Watch For

- Omitting Dates: Missing dates, such as the issue date or due date, can lead to confusion and delays in payments.

- Not Including Unique Reference Numbers: A unique reference or invoice number is essential for tracking payments and managing records efficiently.

- Not Updating the Format: Ensure your document layout remains professional and easy to read, as a cluttered or unorganized layout can affect its credibility.

By being mindful of these common mistakes, you can ensure your documents are clear, accurate, and professionally presented, helping to maintain good relationships with your clients and ensuring smooth transactions.

Legal Considerations for Digital Invoices

When transitioning to electronic billing, it’s essential to understand the legal requirements that govern the use of digital documents. Digital records are subject to specific regulations that ensure they are legally recognized and enforceable in business transactions. These rules vary by country or region, and businesses must comply with them to avoid potential legal issues.

Key Legal Requirements for Electronic Documents

- Data Integrity: The information in electronic documents must remain accurate and unaltered. Secure systems should be used to prevent unauthorized changes and ensure the document’s authenticity.

- Electronic Signatures: In many jurisdictions, electronic signatures are legally binding if they meet certain criteria. These can help verify the identity of the sender and indicate acceptance of the terms outlined in the document.

- Retention Periods: Legal frameworks often require that electronic records, including financial documents, be stored for a specified period. It’s essential to have a secure system for archiving and retrieving digital files in accordance with local laws.

Ensuring Compliance with Local Laws

- Tax Regulations: Some regions may have specific rules regarding the format, content, or submission of digital records for tax purposes. Ensure compliance with the relevant tax authorities to avoid penalties.

- Cross-Border Transactions: If doing business internationally, be aware of any cross-border legal requirements regarding electronic documentation. Different countries may have varying standards for recognition and enforcement.

By understanding and adhering to these legal considerations, businesses can ensure that their digital documents are fully compliant and legally enforceable, minimizing the risk of disputes or penalties in the future.

How to Handle Taxes with Templates

Managing taxes effectively is a key part of any business transaction. When creating financial documents, it’s important to ensure that the tax details are accurate and compliant with local regulations. A well-structured document can help streamline the process of calculating, recording, and reporting taxes, reducing the risk of errors and simplifying the tax filing process.

Steps to Properly Include Tax Information

- Clearly Specify Tax Rates: Ensure the applicable tax rates are clearly indicated on the document, including any sales tax, VAT, or other relevant taxes based on the location and type of goods or services provided.

- Separate Tax from Subtotal: Display the tax amount separately from the subtotal. This makes it easier for both the business and the client to review the breakdown of the total cost, ensuring transparency.

- Include Tax Identification Numbers: If required by local regulations, include your business’s tax ID or VAT number on the document. This helps identify the business as a legitimate entity for tax purposes.

- Account for Tax Exemptions: For certain goods or services, there may be exemptions from tax. Ensure that such exemptions are clearly indicated and supported by any necessary documentation to avoid confusion.

Considerations for International Transactions

- Understand International Tax Laws: When dealing with cross-border transactions, ensure you are aware of the tax regulations in both your country and the customer’s jurisdiction. Different regions may have different tax rates, exemptions, or requirements.

- Currency and Tax Rate Adjustments: For international sales, make sure to account for currency conversions and varying tax rates. Clearly state the tax amount in the correct currency and indicate any necessary adjustments.

By carefully managing the tax details in your financial documents, businesses can ensure they remain compliant with tax laws and avoid unnecessary complications during audits or tax filings.

Improving Professionalism with Invoice Design

The design of financial documents plays a crucial role in how businesses present themselves to clients. A well-organized and visually appealing layout not only makes the document easier to understand but also conveys professionalism and attention to detail. When creating such documents, it’s essential to balance functionality with aesthetics to leave a lasting impression on your clients.

Key Elements of a Professional Layout

- Consistent Branding: Incorporating your company’s logo, color scheme, and font choices helps reinforce brand identity and gives your documents a cohesive look that clients can recognize.

- Clear and Organized Information: Ensure that the details are well-structured and easy to read. Grouping related information, such as payment terms and product descriptions, can improve the clarity of the document.

- Whitespace: Proper use of whitespace can make the document less cluttered and more visually appealing. It allows the most important information to stand out and ensures readability.

Enhancing Trust and Client Relationships

- Transparency and Accuracy: A professional design allows for clear communication of payment terms, taxes, and any other important details. This level of transparency builds trust and reduces the chances of disputes.

- Customizable Layouts: Tailoring the design to the needs of the client or the type of service provided can make the document feel more personal and thoughtful. This attention to detail can strengthen your professional relationships.

Incorporating an effective design into your financial documents not only improves the clarity and appeal of the information but also elevates the professional image of your business, helping you stand out in a competitive marketplace.

Using Invoice Templates for Small Businesses

For small businesses, managing finances and keeping track of payments can be a daunting task. Having an organized and efficient system for billing clients is crucial to ensure timely payments and maintain smooth operations. By using pre-designed billing documents, business owners can save time and reduce errors while maintaining a professional appearance.

Benefits for Small Business Owners

- Time Efficiency: Pre-made documents allow for quick customization, reducing the time spent on each transaction. Instead of creating a new layout from scratch, you can simply input the necessary details, speeding up the billing process.

- Consistency: Using a standardized format helps maintain uniformity in your business communications, ensuring that each client receives a professional-looking document with all the required details every time.

- Cost-Effective: Small businesses often have limited resources. Using ready-made billing structures eliminates the need for costly accounting software or professional design services, making it a cost-effective solution for invoicing.

Key Features to Include in Your Billing Documents

| Feature | Description |

|---|---|

| Business Information | Include your business name, contact details, and logo to ensure clients know who the bill is coming from. |

| Client Details | Always list the client’s name, address, and contact details to ensure clarity about the recipient of the document. |

| Payment Terms | Specify the due date, payment methods, and any penalties for late payments to avoid confusion and ensure prompt settlement. |

| Breakdown of Charges | Clearly list the products or services provided, along with prices, taxes, and any applicable discounts, for transparency. |

Utilizing pre-built billing documents can significantly streamline your operations, allowing small business owners to focus on other aspects of their business. This method ensures accuracy, professionalism, and efficiency, contributing to overall growth and success.

Choosing the Right Software for Templates

When it comes to streamlining your business processes, selecting the right software for creating and managing your billing documents is crucial. With a range of options available, each offering different features and functionalities, it’s important to choose a platform that aligns with your specific needs. A well-chosen tool can enhance productivity, ensure accuracy, and save time in the long run.

To make an informed decision, consider factors such as ease of use, customization options, integrations with other tools, and scalability. Below, we’ll highlight some key considerations when selecting software for your business document needs.

Key Features to Consider

| Feature | Description |

|---|---|

| Ease of Use | Choose software with a user-friendly interface that requires minimal training. It should allow you to quickly create, customize, and send documents without any technical expertise. |

| Customization Options | Look for a tool that offers flexibility in design. You should be able to add your logo, adjust fonts, and choose the layout that best suits your business style. |

| Integration with Other Systems | Consider whether the software integrates with other platforms you already use, such as accounting or customer management systems. This can simplify your workflow and reduce manual data entry. |

| Cloud Access | Cloud-based software allows you to access your documents from anywhere, ensuring you can manage billing tasks on the go. It also provides enhanced security and automatic updates. |

| Customer Support | Choose a provider that offers reliable customer support, including tutorials, troubleshooting guides, and live assistance when needed. |

By selecting the right software, you can ensure your business documents are handled efficiently and professionally, helping you maintain good client relationships and manage your finances effectively.

How to Protect Your Invoices from Fraud

Ensuring the security of your business documents is essential to protect against fraudulent activities. Whether you’re handling payment requests, sales records, or other financial paperwork, it’s crucial to implement strategies that safeguard your information. Fraud can lead to financial losses, reputational damage, and legal complications. By taking proactive steps, you can minimize the risk of fraudulent activities and maintain the integrity of your financial processes.

Below are several practical measures you can take to protect your documents from fraud:

- Use Secure Software: Invest in reliable and secure software that offers encryption, authentication, and data protection features. This ensures that your business documents are stored and transmitted safely.

- Implement Watermarking: Add visible watermarks to your documents. This makes them harder to alter and creates a clear indication of authenticity for recipients.

- Set Up Two-Factor Authentication: When accessing or sending financial documents, enable two-factor authentication to verify your identity. This adds an extra layer of security against unauthorized access.

- Regularly Monitor Your Transactions: Stay vigilant by monitoring your financial transactions for any unusual activity. Regular audits help detect discrepancies early, minimizing the impact of fraud.

- Limit Access to Documents: Restrict access to sensitive business documents. Only authorized personnel should have permission to view, create, or send them, reducing the risk of internal fraud.

- Verify Recipient Information: Before sending any financial documents, verify the recipient’s details, such as email addresses and payment accounts, to ensure you’re not falling victim to phishing schemes.

By taking these precautions, you can protect your financial documents from fraud and ensure your business remains secure. Consistently updating your security practices and staying informed about the latest threats will help you maintain a secure environment for your transactions.