Free Commission Invoice Template for Easy Invoice Creation

Managing payments and ensuring accuracy in billing is crucial for businesses of all sizes. Whether you’re a freelancer, contractor, or run a sales-driven organization, having a structured method to document earnings can save time and prevent mistakes. Simplified processes can significantly improve your workflow, allowing you to focus on growing your business rather than getting lost in administrative tasks.

For those who rely on performance-based earnings, organizing financial records becomes even more essential. Creating professional documents that detail the terms of compensation ensures transparency and fosters trust between parties. In this guide, we will explore a range of accessible resources that help streamline this task, making it easier for you to create the necessary paperwork with minimal effort.

Free Commission Invoice Templates for Professionals

For any professional who works based on performance or sales, having an efficient way to document earned amounts is essential. Access to ready-made resources allows you to quickly generate the necessary paperwork without having to design each document from scratch. These tools help ensure that all necessary details are included, creating a professional and consistent look for your records.

With the right resources, professionals can easily create documents that outline the agreed-upon terms and payment amounts. This is especially important when managing multiple clients or dealing with complex earning structures. Many online platforms offer downloadable forms that can be customized according to individual needs, reducing the time spent on administrative tasks and helping you stay focused on core business activities.

How Ready-Made Documents Help Professionals

Using pre-designed formats allows you to bypass the need for manually creating each document. These structures typically include all the essential fields, such as payment rates, dates, and client details, minimizing the risk of missing important information. Moreover, many resources are simple to adjust, ensuring they fit your unique business requirements.

Where to Find Customizable Resources

There are several reliable platforms where professionals can access and download customized documents. Some websites offer a wide selection of options that are completely adaptable to your specifications. These sites provide various designs that are suitable for different industries, ensuring your paperwork looks polished and well-organized.

Why Use a Commission Invoice Template

When it comes to tracking earnings based on performance, having a standardized method for documenting and requesting payments is essential. This ensures that both parties are clear on the terms, reducing misunderstandings and disputes. Using a well-structured document helps to streamline the billing process, allowing professionals to focus on their work rather than administrative tasks.

By using a pre-designed form, you can save time, maintain consistency, and ensure that all necessary information is included. The right structure helps to avoid errors and guarantees that your financial records are accurate and professional.

Key Benefits of Using Structured Payment Documents

- Time-Saving: You don’t need to create a new document every time; simply fill in the required details and send it out.

- Professional Appearance: A polished and consistent document enhances your credibility with clients and partners.

- Accuracy: A predefined layout ensures that all relevant information is included, reducing the chances of missing critical details.

- Customization: Easily adaptable to suit different types of agreements, whether you’re working with a single client or managing multiple contracts.

How Templates Enhance Workflow Efficiency

- Consistency: Reusing the same format ensures that each document looks the same, creating a uniform presentation across all records.

- Reduced Errors: With key fields already defined, there’s less room for human error or omissions.

- Faster Processing: The structured format speeds up the entire process, from creating the document to submitting it for payment.

Top Benefits of Commission-Based Invoices

When payments are tied to sales or performance, documenting these transactions in a clear and organized manner offers several advantages. Using structured payment records helps to ensure both parties understand the agreed-upon terms, and it simplifies the entire billing process. For professionals relying on variable pay based on results, this method provides transparency, accountability, and a streamlined approach to getting compensated.

The use of performance-based payment records can enhance workflow efficiency, making it easier to track earnings over time and maintain accurate financial records. Here are some key benefits of using this approach:

| Benefit | Description |

|---|---|

| Clear Payment Terms | Clearly outlines how much is owed, what actions or milestones trigger payment, and when it is due, reducing confusion between parties. |

| Improved Cash Flow | With structured payment documents, payments are processed faster, which helps maintain a steady cash flow for businesses and individuals. |

| Accuracy and Accountability | Predefined fields help avoid errors, ensuring that both the payee and payer agree on the figures, minimizing disputes. |

| Professional Image | Using consistent and organized records reflects professionalism and strengthens trust between clients and contractors. |

| Time Savings | Quickly generating records from predefined formats speeds up the billing process, allowing you to spend more time on your core tasks. |

How to Customize a Commission Invoice

Personalizing your payment request documents allows you to tailor them to specific agreements, ensuring all relevant details are included for both clarity and accuracy. Customization not only helps reflect the unique terms of each deal but also makes the final document look professional and organized. Whether you’re adjusting the layout, changing the payment terms, or adding personalized branding, customizing these records can streamline the billing process and reduce errors.

There are several key elements you can modify to meet your needs:

- Header Information: Add your business logo, name, contact details, and client information at the top of the document to ensure easy identification.

- Payment Terms: Clearly state when the payment is due and any conditions, such as late fees or discounts, to avoid misunderstandings.

- Earnings Breakdown: Specify the details of the work completed and the agreed-upon rate, whether it’s a percentage of a sale or a fixed amount based on performance.

- Additional Notes: Include space for any relevant terms, project details, or reminders that may be helpful to the client.

Once you’ve made adjustments to fit your specific needs, save your document as a reusable format for future transactions. This will ensure consistency in how you present your financial records and allow you to quickly generate similar documents in the future without starting from scratch.

What to Include in a Commission Invoice

When creating a document to request payment based on performance or sales, it’s essential to include all relevant details to ensure clarity and avoid potential confusion. A well-structured record helps both the payer and the payee stay aligned on the terms, amounts, and expectations. The following elements are crucial to making sure the document is complete and professional.

| Element | Description |

|---|---|

| Contact Information | Include both your details and those of the client, such as names, addresses, and contact numbers for easy reference. |

| Document Date | The date the document is created is important for tracking and payment terms. It helps both parties know when the request was made. |

| Work Description | Provide a clear explanation of the work completed or the sales made, so the client knows exactly what the payment relates to. |

| Payment Amount | State the total amount due, including the rate or percentage of earnings and how it was calculated. |

| Payment Terms | Specify the due date, any discounts for early payment, or late fees for overdue payments to ensure mutual understanding. |

| Additional Notes | Include any other relevant details, such as project milestones, next steps, or special terms agreed upon with the client. |

Including all of these key components in your document helps ensure that there are no misunderstandings regarding the payment and makes it easier for clients to process your request without delays.

Free Templates vs Paid Commission Invoices

When deciding how to create payment request documents, businesses often choose between using no-cost resources or opting for paid options. Both approaches have their advantages and drawbacks, depending on your needs. Free resources can be an appealing choice for smaller businesses or individuals with straightforward billing requirements, while paid options may offer additional features and flexibility for more complex or professional needs. Understanding the key differences can help you make a more informed decision based on your unique circumstances.

Comparison of Features and Benefits

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization options, with limited room for design changes. | Full flexibility in design, layout, and content to suit specific business needs. |

| Ease of Use | Simple to use, often with pre-set fields and minimal complexity. | May require more time to set up initially but offers advanced functionality. |

| Design Quality | Basic and straightforward design, often with limited aesthetic appeal. | High-quality, professional designs that can reflect your brand image. |

| Support | Minimal or no customer support; relies on community forums or self-help guides. | Access to dedicated customer support and additional resources for troubleshooting. |

| Cost | Completely free to use. | Requires a one-time fee or subscription, but offers more comprehensive services. |

When to Choose Each Option

Free resources are often ideal for individuals or small businesses with simple, low-volume billing needs. If you only need basic payment documentation and don’t require specialized features, a no-cost option may be sufficient. However, for larger businesses, or those with more complex arrangements, investing in a paid resource can save time in the long run and offer a more polished, professional result.

Best Platforms for Downloading Templates

For professionals looking to streamline their billing process, finding the right platform to download structured documents is essential. There are numerous websites offering a variety of pre-designed resources that cater to different business needs. These platforms provide easy access to well-organized documents that can be customized to suit specific requirements. Below are some of the best options for downloading reliable resources quickly and efficiently.

- Canva – A user-friendly platform that offers a wide range of customizable templates for different business purposes. With easy drag-and-drop editing, you can adjust the layout and design to match your branding.

- Template.net – Offers a large selection of professional-grade documents for various industries, including ready-made options for performance-based earnings documentation. Most templates are available in multiple formats such as Word, PDF, and Excel.

- Zoho Invoice – While primarily a billing software, Zoho also provides free, customizable designs that you can use to create and track payment requests. Its templates are designed for efficiency and clarity.

- Microsoft Office Templates – A trusted source for business documents, offering a variety of pre-designed formats available for quick download and editing through Word or Excel.

- TemplateLab – This platform provides a wide selection of simple yet professional documents, many of which are geared toward small businesses and freelancers looking for cost-effective solutions.

Each of these platforms offers different features, from basic designs to more advanced customization options, ensuring you can find the right resource for your needs. Whether you need a minimalist layout or something more complex, these sites provide plenty of variety to accommodate any preference.

How Commission Invoices Simplify Payments

Structured payment requests are essential tools for making the billing process smoother and more efficient. By clearly outlining the terms of payment and the amount owed, these documents ensure both parties are aligned and reduce confusion. For businesses that rely on performance-based payments, having a predefined document to track earnings and set clear expectations can make the entire process more transparent and easier to manage.

One of the primary ways these documents simplify payments is by providing clarity. With a structured format, all essential details are clearly presented, such as the amount due, the work completed, and the payment terms. This transparency reduces the likelihood of disputes and makes it easier for clients to process the payment quickly.

Furthermore, standardized documents save time for both the payer and the payee. Since the format is already set, the process of creating, sending, and processing the payment request becomes much more streamlined. This efficiency helps ensure payments are made on time, contributing to smoother cash flow management.

In addition, these resources often include all the necessary legal language and guidelines for payment, reducing the need for additional back-and-forth between parties. Whether you’re a freelancer or a business owner, using such documents makes managing performance-based payments more straightforward and professional.

Common Mistakes to Avoid in Commission Invoices

When creating documents to request payments based on performance or sales, it’s crucial to ensure every detail is accurate and clear. Small mistakes can lead to delays in payment, confusion, or even disputes. Avoiding common errors can streamline the process and improve the professionalism of your documents, ultimately leading to a smoother transaction experience for both parties involved.

Missing or Incorrect Payment Details

One of the most frequent mistakes is failing to provide clear payment information. This includes not specifying the total amount due, the rate applied, or the payment due date. If these elements are unclear or omitted, the client may be confused about how much they owe or when payment is expected, potentially delaying the process.

Failure to Include Necessary Terms and Conditions

Another common oversight is not including important terms, such as payment deadlines, late fees, or any other conditions that apply. Without these terms, it becomes difficult to enforce agreements and can lead to misunderstandings between you and the client. Always ensure that payment terms are well-defined, especially if there are any specific agreements in place, like discounts or penalties for delayed payments.

Legal Considerations for Commission Invoices

When creating documents to request payment based on sales or performance, it’s essential to ensure that the terms and conditions outlined are legally sound. Clear and accurate payment requests help protect both parties and prevent future disputes. Understanding the legal implications of such documents is key to ensuring they are enforceable and comply with local regulations.

Firstly, it’s important to include clear payment terms, such as when the payment is due and what actions will be taken in the case of late payments. This is not only a best practice but also helps you maintain legal standing should a payment dispute arise. Clearly outlining payment conditions can avoid complications and set expectations upfront.

Additionally, always include specific details about the work performed or the sales made. This helps establish the legitimacy of the payment request and prevents challenges from the payer regarding the validity of the charge. Both parties should have a mutual understanding of what was agreed upon, whether it’s a specific amount or percentage, to avoid any confusion or misunderstandings later on.

Another consideration is whether to include any penalties or interest rates in the case of late payments. If your business practices allow for such terms, it’s important to clearly communicate them in the document. Legal guidelines may vary by jurisdiction, so make sure these terms align with local laws.

Finally, ensure that both parties agree to the terms. This can be done by including a signature line or an acknowledgment statement. It’s a good idea to keep a copy of all signed documents in case they are needed for future reference or legal purposes.

How to Track Commissions with Invoices

Tracking performance-based earnings is essential for maintaining accurate financial records and ensuring timely payments. Using structured documents to request payment makes it easier to monitor how much is owed and when payments are due. By incorporating detailed breakdowns of earnings into your payment requests, you can keep an organized record of each transaction, making it easier to track commissions over time.

To effectively track commissions, it’s important to include specific details in the document that clearly outline how the amounts were calculated. A well-organized document will not only request payment but also provide a clear record of the earnings, making future reference or audits easier.

| Element | How It Helps Track Earnings |

|---|---|

| Work Description | By providing a clear description of the work completed or sales achieved, you establish a direct link between the payment and the task performed, making it easier to track progress over time. |

| Payment Rate | Specify the agreed-upon rate or percentage of sales to be paid. This helps clarify how much is owed for each transaction and can be referenced when tracking accumulated earnings. |

| Dates and Period | Indicating the date or the billing period covered by the document helps you easily track when commissions were earned and ensures that the payments are processed on time. |

| Total Amount Due | Summing up the total amount due based on the completed work or sales allows for an accurate and transparent accounting of commissions earned over a specific time frame. |

By incorporating these elements into your documents, you can create a clear and efficient system for tracking earned payments and ensuring that all commissions are accounted for properly.

Tips for Sending Commission Invoices on Time

Timely payment requests are essential for maintaining a smooth cash flow and ensuring that clients receive clear expectations regarding when payment is due. However, sending these documents on time requires proper planning and organization. Following a few best practices can help ensure that you never miss a deadline and that your requests are processed efficiently.

- Set a Consistent Schedule: Determine a regular schedule for sending payment requests. Whether it’s weekly, bi-weekly, or monthly, having a consistent routine helps you stay on top of deadlines.

- Automate Reminders: Set up automated reminders for both yourself and your clients. Use digital tools that can alert you when it’s time to generate and send payment requests.

- Prepare in Advance: Keep track of the work completed or sales made in real time, so you’re not scrambling to gather details when it’s time to send the request. This reduces the risk of errors or delays.

- Use Pre-Made Formats: Utilize structured formats that are easy to fill out and don’t require starting from scratch each time. This can speed up the process significantly.

- Confirm Receipt: Always confirm that your client has received the payment request, especially if it’s an important or high-value transaction. This can prevent misunderstandings about the timing of payment.

- Plan for Delays: Even with the best planning, occasional delays may occur. Always communicate with clients if there’s any unexpected holdup, and keep them informed about any changes to the expected timeline.

By following these strategies, you can ensure that your payment requests are submitted on time, reducing the chances of delays and maintaining positive relationships with your clients.

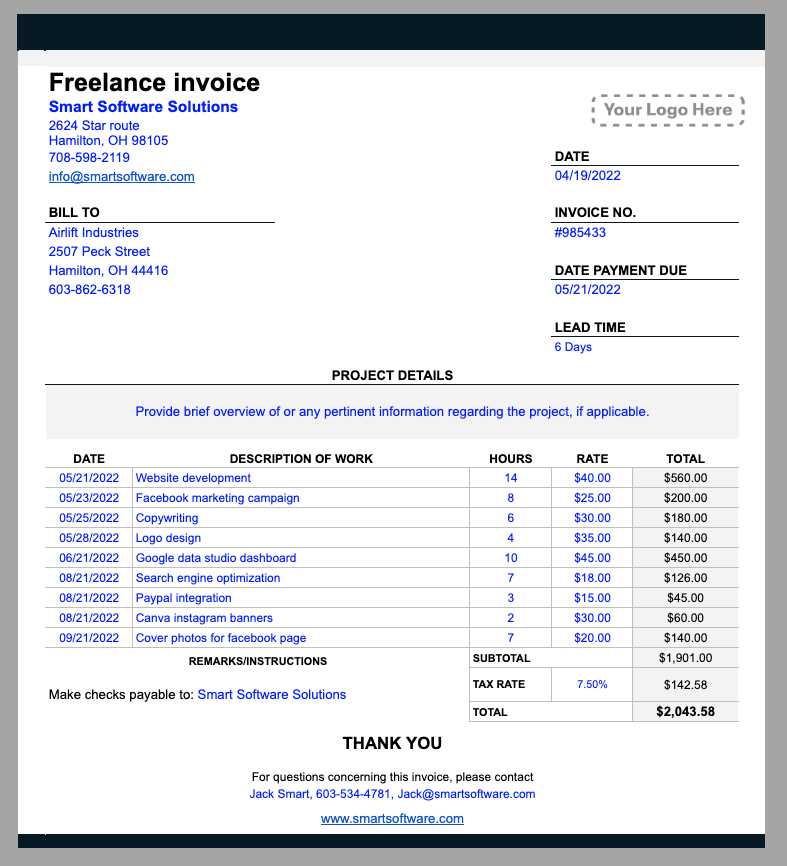

Creating a Professional Look for Your Invoice

Making sure your payment request documents appear polished and professional is essential for establishing trust with clients. A well-designed document not only reflects your attention to detail but also ensures that important information is easy to understand. Whether you are a freelancer, a small business owner, or a large enterprise, having a consistent, professional look for your payment requests can help create a positive impression and improve the likelihood of timely payments.

Start by using clear, legible fonts and avoiding cluttered designs. The layout should be simple but informative, with sections clearly separated for ease of navigation. Important details, such as the total amount due, due date, and payment terms, should stand out, so they are easy to find at a glance. Additionally, incorporating your brand’s colors, logo, and contact information can give the document a personalized touch and reinforce your brand identity.

Using high-quality design elements can elevate the overall look of your document. Incorporate subtle lines, boxes, or other separators to organize the content without making it visually overwhelming. Also, ensure that the document is well-spaced and that there’s sufficient margin around the edges to prevent it from looking cramped.

Ultimately, a professional-looking payment request shows your clients that you are serious about your business and expect the same level of professionalism in return. With the right design approach, your documents will not only be more visually appealing but also more functional and easier for clients to process.

How Commission Invoices Improve Cash Flow

Properly structured payment requests are key to maintaining a healthy cash flow for any business. By ensuring that payments are clearly defined, timely, and easy to process, businesses can reduce delays and improve the overall speed at which funds are collected. When using well-organized documents, you can track what is owed and ensure that payments are made on time, ultimately leading to smoother financial operations.

By incorporating key elements such as due dates, amounts owed, and clear breakdowns of earnings, these documents provide both the business and the client with a mutual understanding of what is expected. This leads to fewer misunderstandings and accelerates the payment process. A smooth payment flow can help businesses avoid cash shortages and ensure that operational costs are met without delays.

| Element | How It Improves Cash Flow |

|---|---|

| Clear Payment Terms | Setting clear payment terms ensures that clients understand the expectations, making it easier to receive timely payments and avoid confusion. |

| Timely Submission | Submitting requests promptly keeps the cash flow consistent, preventing unnecessary delays in receiving funds that can disrupt business operations. |

| Accurate Calculations | Providing accurate breakdowns of payments prevents disputes and ensures that the correct amounts are paid, avoiding the need for corrections that may slow down the process. |

| Consistent Tracking | Tracking payments regularly through these documents helps businesses stay on top of outstanding amounts, reducing the risk of overdue payments that can negatively affect cash flow. |

By implementing effective practices in creating and sending payment requests, businesses can ensure their financial health remains strong, reducing the risk of cash flow problems while fostering trust with clients.

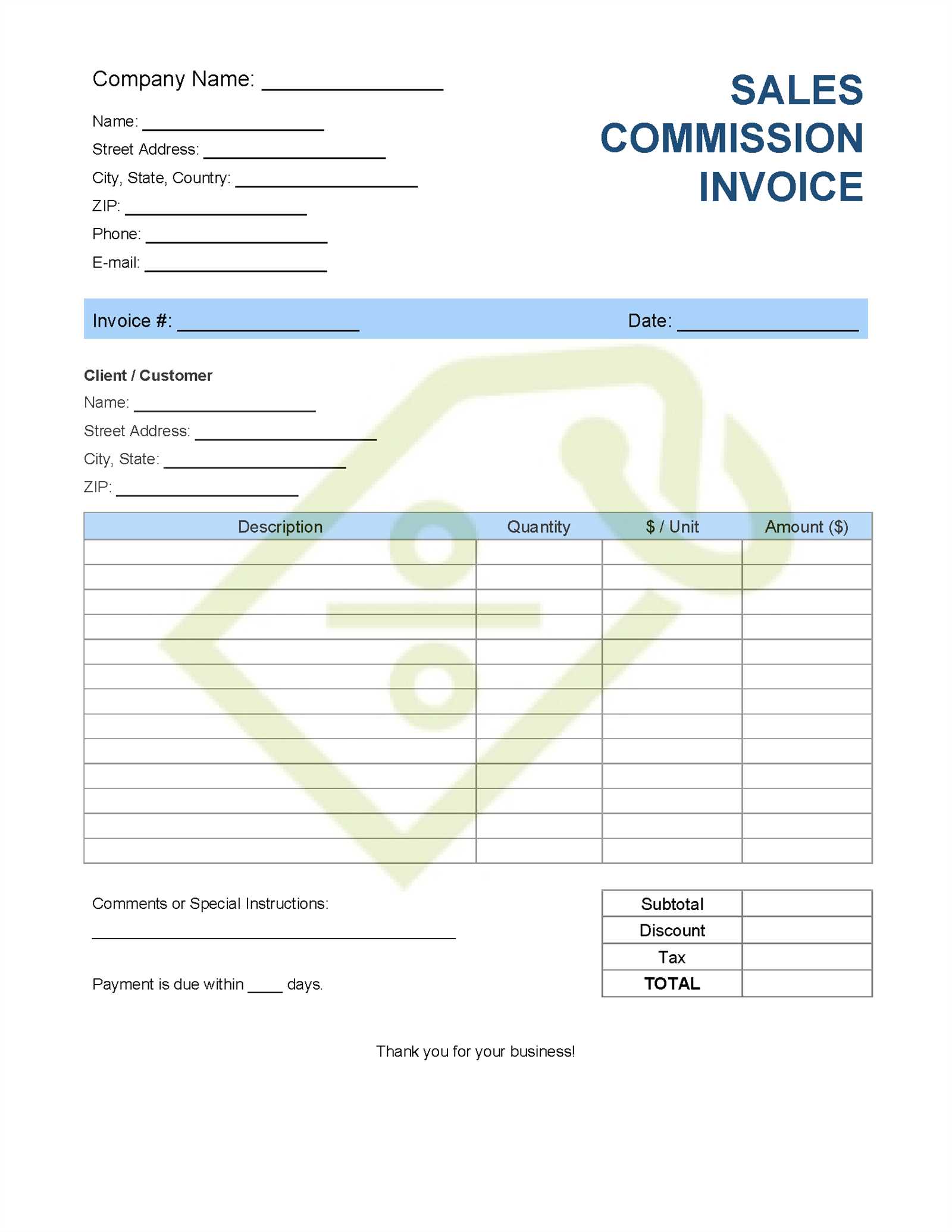

Examples of Effective Commission Invoice Templates

When requesting payments based on performance or sales, it’s important to use well-designed documents that clearly outline the necessary details. A great document helps both you and your client stay on the same page, reduces confusion, and ensures timely payments. Below are some examples of effective document formats that can be tailored to different business needs and industries.

1. Basic Payment Request

This format is straightforward and easy to use, making it ideal for freelancers and small businesses. It includes all essential information in a simple layout:

- Client Name and Address: Clearly state the client’s contact details.

- Work Description: A brief overview of the work completed or services rendered.

- Total Amount Due: The amount to be paid based on the agreed terms.

- Due Date: A clear due date to ensure timely payment.

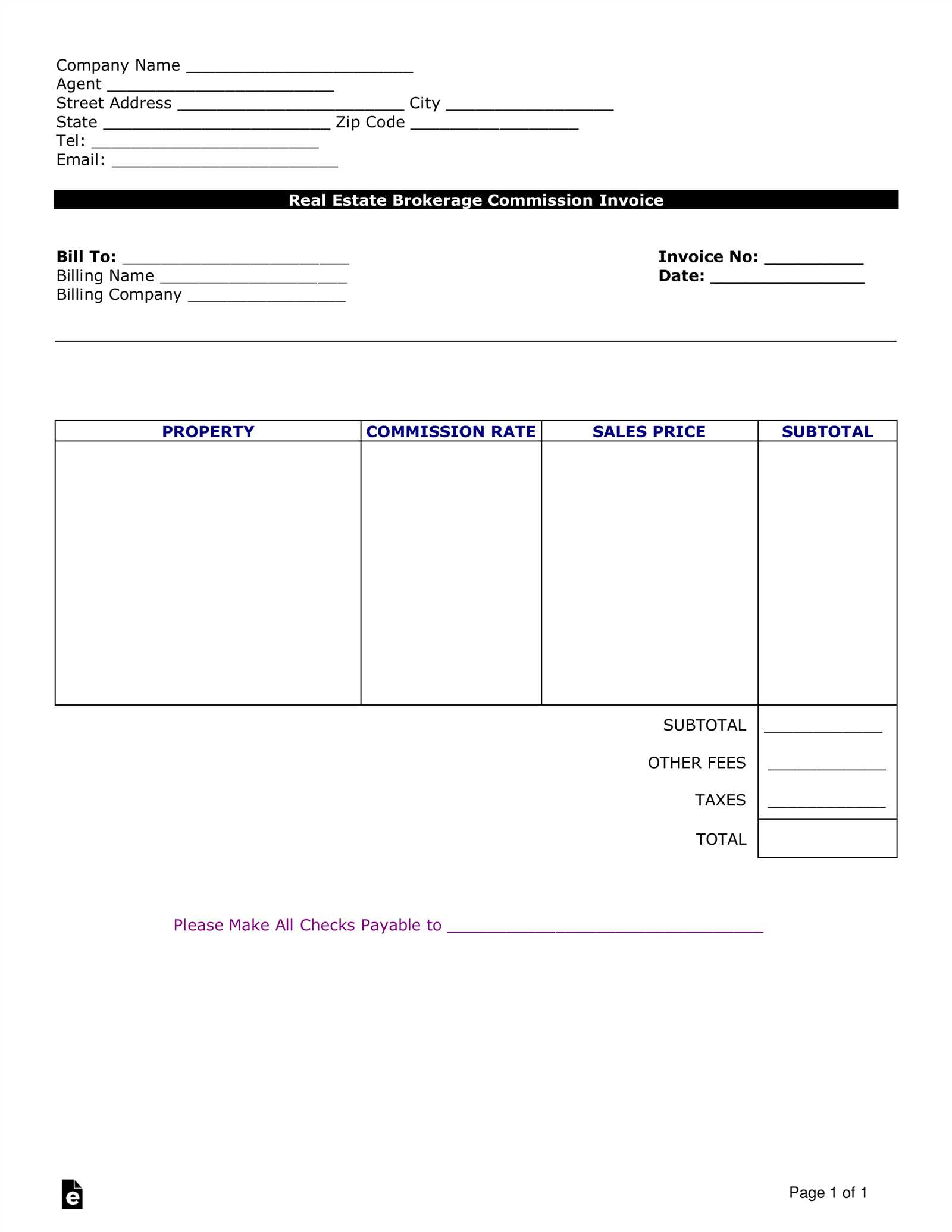

2. Detailed Sales-Based Request

For businesses that rely on a percentage of sales, a more detailed document may be required. This format includes:

- Itemized Breakdown: A list of sales made or projects completed with corresponding earnings.

- Payment Rate: The agreed-upon percentage or amount for each sale or service.

- Total Earnings: The final amount owed based on the rates and sales details.

- Payment Terms: Clarify when and how payment should be made.

3. Retainer-Based Document

For clients who pay on a retainer or ongoing basis, a more structured document can help track payments over time. This version typically includes:

- Retainer Fee: The upfront fee or amount paid periodically.

- Service Hours or Milestones: A breakdown of hours worked or specific milestones achieved.

- Remaining Balance: Tracking the remaining balance to be paid once certain conditions are met.

These examples highlight how different formats can cater to various business models, helping you create a payment request that’s clear, professional, and effective.

How to Automate Commission Invoice Generation

Automating the creation of payment requests can save you valuable time and reduce the risk of errors in the billing process. By setting up automated systems, businesses can generate documents based on pre-defined criteria, such as sales or performance milestones, and send them to clients without manual intervention. This streamlines the entire payment cycle and ensures consistency in the documents you send.

To automate the creation of payment requests, follow these steps:

- Use Accounting Software: Many accounting platforms offer automation features for generating payment requests. These tools can be customized to automatically calculate amounts based on pre-set percentages or sales data, removing the need for manual calculations.

- Integrate Sales Platforms: If your business uses a sales platform (e.g., CRM or e-commerce software), integrate it with your accounting software. This will allow real-time data synchronization and enable automatic generation of documents based on recent transactions or sales.

- Set Up Triggers: Configure triggers for when payment requests should be generated. For example, set a trigger to create a payment document when a milestone is completed or after a certain time period, such as the end of the month.

- Customize Document Formats: Once your automation system is in place, customize the layout of your documents to match your brand identity and ensure that all necessary details are included, such as work descriptions, payment terms, and due dates.

- Schedule Sending: Many automation tools allow you to schedule when documents are sent out. Set reminders or specify exact dates so that payment requests are sent automatically at regular intervals.

By automating the generation of payment documents, businesses can ensure they never miss a deadline, minimize administrative work, and reduce the chances of human error. This not only improves operational efficiency but also enhances client satisfaction by maintaining consistency and professionalism in all payment requests.

Frequently Asked Questions About Commission Invoices

When managing performance-based payments, there are often common questions that arise regarding how to structure and manage payment requests effectively. Whether you’re a freelancer, a sales agent, or a business owner, it’s important to understand the key aspects of these documents to ensure clarity and professionalism in your financial transactions. Below are answers to some frequently asked questions that can help you navigate the process.

1. What Information Should Be Included in a Payment Request?

To ensure your payment request is clear and complete, the following details should be included:

- Client Details: Name, address, and contact information of the recipient.

- Work Description: A clear description of the services or sales that have been completed or achieved.

- Payment Amount: The total amount due based on the agreed-upon terms.

- Due Date: A specified date when the payment should be made.

- Payment Instructions: Clear guidelines on how the payment should be made, including bank details or online payment options.

2. When Should I Send Payment Requests?

Timing is critical when it comes to ensuring timely payments. Here are some key moments to send your payment requests:

- After Completing Work: As soon as a project or task is finished, submit your request so the client can process the payment promptly.

- End of Billing Cycle: If you work on a recurring basis, it’s important to send payment requests at regular intervals, such as weekly, bi-weekly, or monthly.

- Upon Reaching Milestones: For larger projects, send a request when specific milestones are achieved, clearly linking each stage to the agreed payment structure.

3. How Do I Ensure My Payment Requests Are Paid on Time?

To improve the chances of timely payment, consider the following tips:

- Clear Payment Terms: Set clear payment terms in your agreement, including due dates, and specify any late payment penalties if applicable.

- Send Reminders: Send reminders a few days before the payment due date to prompt the client to take action.

- Professional Appearance: A professional, well-organized payment request can help convey urgency and importance, encouraging clients to pay promptly.

By addressing these questions, you can streamline the process of requesting payments and maintain a smooth financial workflow for your business or freelance work.