Commercial Rent Invoice Template for Easy Billing and Payment Tracking

Managing rental agreements and ensuring timely payments is a key responsibility for property owners. One of the most essential aspects of this process is creating clear, professional documents to request payments. A well-structured payment request not only streamlines financial operations but also builds trust between landlords and tenants.

Having the right tools in place can simplify this task. By using standardized forms, property owners can quickly generate consistent and accurate records. These documents ensure that all necessary details are captured, from payment amounts to due dates, reducing the risk of confusion or errors.

In this article, we will explore the advantages of utilizing pre-designed forms for billing, discuss how to customize them to suit your needs, and highlight best practices to maintain smooth financial operations across multiple properties.

Understanding Billing Requests for Property Leasing

For property owners and managers, ensuring tenants receive clear and professional payment requests is crucial. These documents serve as formal reminders for the amount owed and the due date, helping maintain a structured approach to financial transactions. Understanding how to create and manage these documents effectively can simplify the leasing process and foster positive landlord-tenant relationships.

Such billing requests typically include several key components that help outline the details of the payment. They can vary depending on the property type and the lease terms, but the following are commonly included:

- Tenant Information: Name, address, and contact details of the tenant.

- Property Details: Description of the leased property or unit.

- Payment Amount: The total amount due, often broken down into charges such as utilities, maintenance, or other fees.

- Due Date: The date by which the payment must be made.

- Payment Instructions: How and where the tenant can make the payment.

While these requests may seem straightforward, creating them manually can lead to inconsistencies and errors. This is why many property managers turn to pre-designed forms that allow for quick and accurate document creation. These forms help ensure all necessary details are included and formatted correctly every time.

Moreover, using standardized forms helps with record-keeping, as each payment request can be easily stored and referenced for future use. This is especially beneficial when managing multiple properties or handling numerous tenants, as it ensures consistency and reduces the chances of missing critical information.

What is a Payment Request for Leasing?

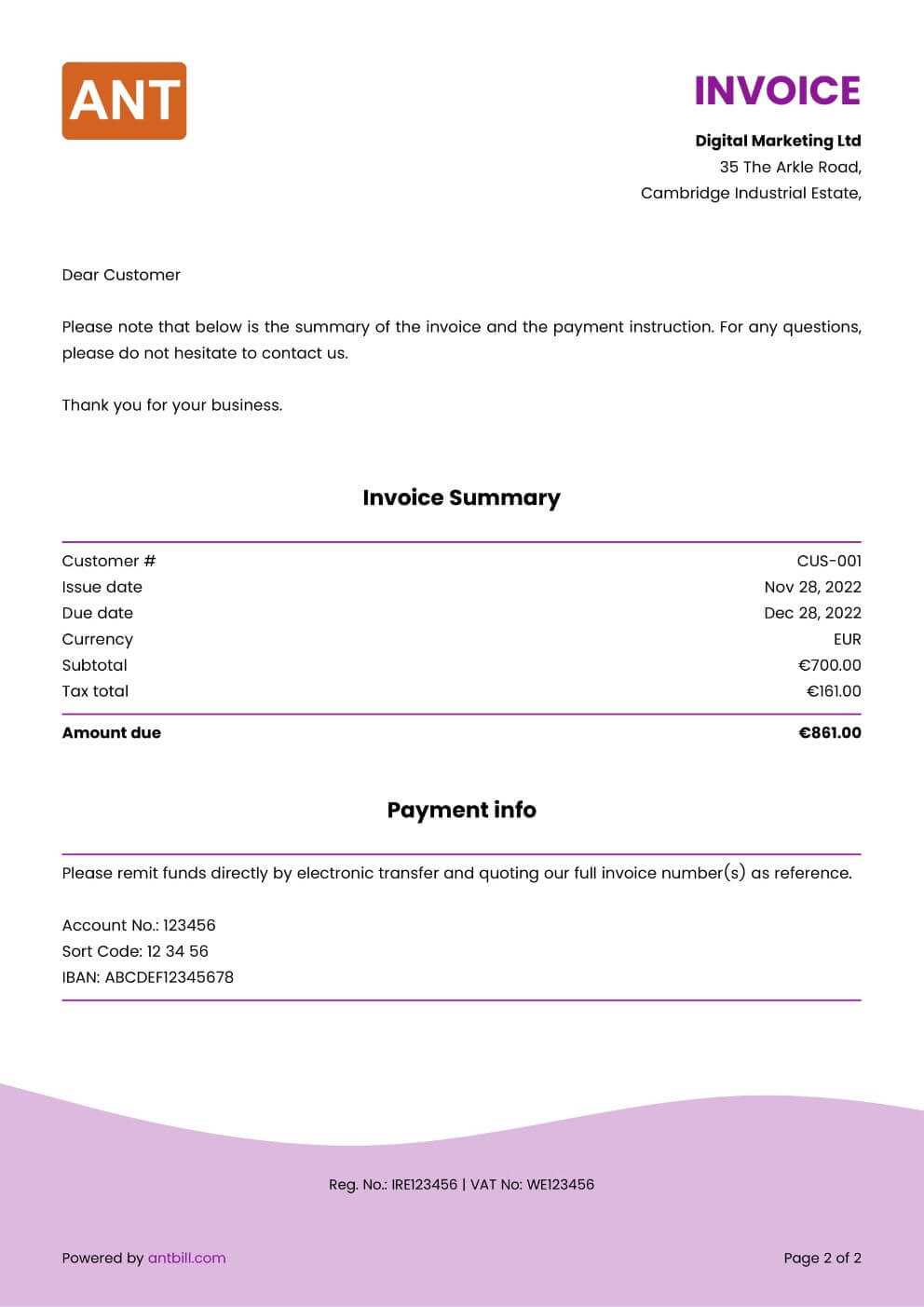

A payment request for leasing is a formal document used by property owners or managers to request funds from tenants. This document serves as an official reminder of the amount owed and outlines the necessary details regarding the payment. Its main purpose is to ensure that tenants are aware of their financial obligations, the due date, and the preferred method of payment.

Such a document typically includes the following key elements:

- Tenant Information: The full name, contact details, and address of the tenant being billed.

- Property Description: Specific details of the leased property or unit that the payment applies to.

- Amount Due: A breakdown of the total amount that is expected to be paid, which could include base charges, additional fees, or taxes.

- Due Date: The specific date by which the payment must be made to avoid late fees or penalties.

- Payment Instructions: Clear instructions on how to pay, including methods of payment and account details if necessary.

This type of document is an essential part of managing property leasing agreements, as it ensures both clarity and accountability between the landlord and tenant. It also helps keep track of financial records, providing both parties with a reference point for future transactions.

Why Use a Payment Request Form?

Using a pre-designed payment request form simplifies the process of managing financial transactions between property owners and tenants. These forms are an efficient way to create accurate, professional documents that clearly outline the amount owed and other important details. By standardizing the billing process, property managers can save time, reduce errors, and ensure consistency in their financial communications.

Here are some reasons why using a pre-made form is beneficial:

- Time Efficiency: With a ready-to-use form, you can quickly generate payment requests without having to start from scratch each time.

- Consistency: Standardized forms ensure that all necessary information is included every time, avoiding omissions or mistakes.

- Professional Appearance: A well-organized, clear document gives tenants confidence and demonstrates professionalism.

- Accuracy: Using a form helps eliminate the risk of missing important details such as payment amounts, due dates, or payment methods.

- Easy Customization: These forms can often be customized to suit specific needs, allowing property owners to add their own terms or conditions.

By adopting a standardized approach to financial documentation, property managers can ensure smoother operations, minimize disputes, and maintain clear records for future reference. This is especially helpful when managing multiple tenants or properties, where consistency becomes even more crucial.

Key Elements of a Payment Request

A well-structured payment request is essential for ensuring clear communication between property owners and tenants. To avoid misunderstandings and ensure timely payments, it’s important that each document includes all the necessary details. The following are the key elements that should be included in every billing document for leasing purposes:

Essential Details

- Property Owner’s Information: Name, address, and contact details of the person or company issuing the payment request.

- Tenant’s Information: Full name, address, and contact information of the tenant being billed.

- Property Description: Clear identification of the leased property or unit being billed, including address or unit number.

- Amount Due: A detailed breakdown of the total amount due, including rent, utilities, maintenance, or any other applicable charges.

- Due Date: The specific date by which the payment must be made to avoid late fees or penalties.

Additional Information

- Payment Instructions: Clear guidance on how the tenant can make the payment, including payment methods and relevant account details.

- Late Fees and Penalties: Information about any penalties that will be incurred if the payment is not made by the due date.

- Terms and Conditions: Any specific terms related to the lease agreement that might affect the payment process, such as early payment discounts or service charges.

By including these key elements, property owners ensure that all critical details are addressed upfront, reducing the chance of confusion and helping maintain a smooth and efficient leasing process.

How to Create a Payment Request for Leasing

Creating a payment request for leasing is a straightforward process, but it requires attention to detail to ensure all necessary information is included. A well-crafted document helps clarify the amount owed, the due date, and payment instructions, reducing the chances of confusion and delays. Here’s a simple guide on how to generate an accurate and professional payment request.

Follow these steps to create an effective payment request:

- Start with Your Contact Information: Include your name, address, and any relevant contact details at the top of the document. This ensures the tenant knows where to reach you if they have questions.

- Add the Tenant’s Information: Include the tenant’s full name, address, and any other contact details to specify who is being billed.

- Specify the Property Details: Clearly mention the property or unit that the payment applies to. This helps avoid confusion if you manage multiple properties.

- List the Amount Due: Break down the payment into individual charges, such as the base cost, utilities, maintenance fees, or any other applicable charges. Total these amounts and make sure the final sum is clear.

- Set a Payment Due Date: Indicate the exact date when the payment is due. This ensures the tenant understands the time frame for making the payment and avoids any misunderstandings.

- Provide Payment Instructions: Specify how and where the tenant should make the payment. Include bank account details or online payment links if necessary.

- Include Any Additional Terms: If there are penalties for late payment or discounts f

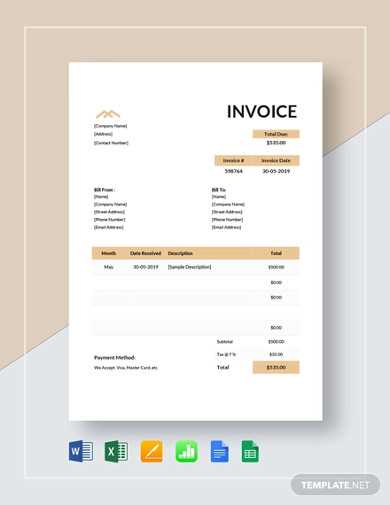

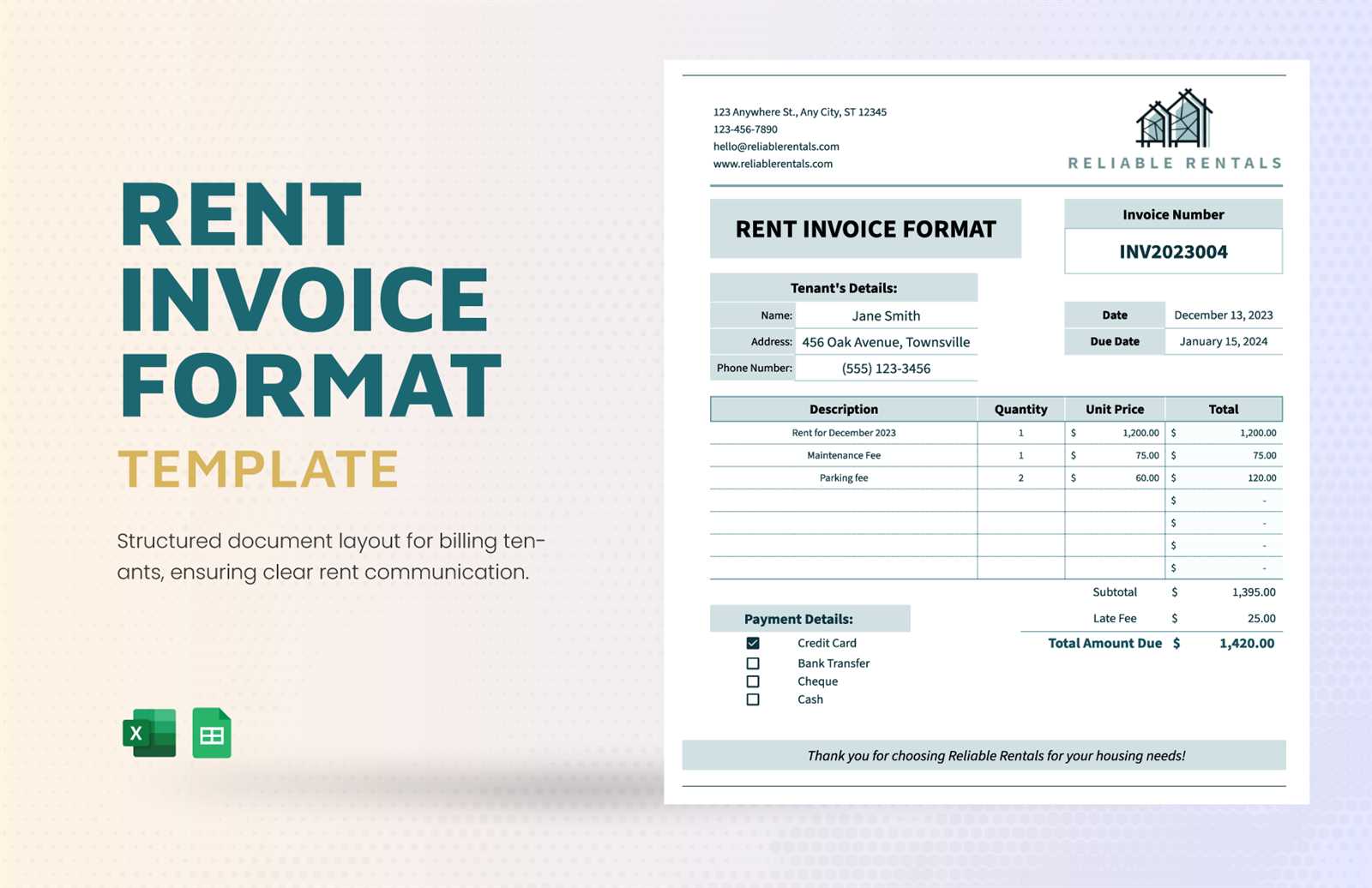

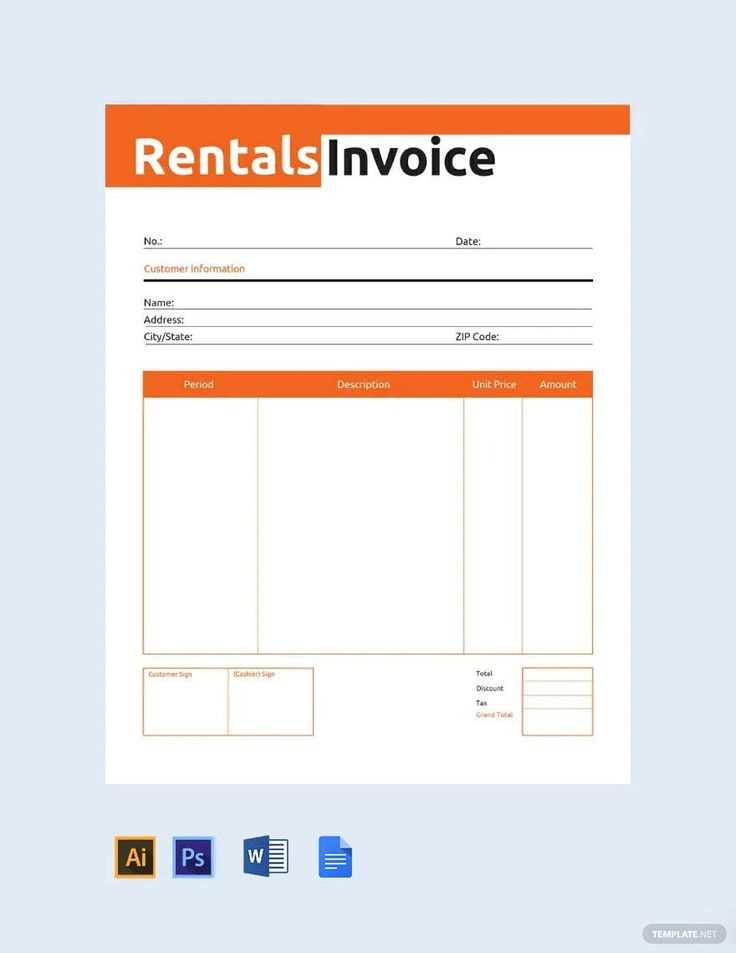

Free Payment Request Forms for Property Leasing

When managing leasing agreements, having access to pre-designed forms can greatly simplify the process of requesting payments. Free, downloadable forms provide an easy way to create accurate and professional billing documents without the need for complex software or manual formatting. These forms typically come with essential sections already built in, allowing for quick customization and efficient handling of financial transactions.

Here are some benefits of using free forms for payment requests:

- Time-Saving: Pre-made forms allow you to generate documents quickly, saving time on formatting and design.

- Easy to Customize: Most forms are customizable, allowing you to adjust the details to suit your specific needs, such as adding extra charges or payment instructions.

- Professional Look: Using a standardized, polished document helps project professionalism and ensures that your payment requests are clear and well-organized.

- Cost-Effective: Free forms eliminate the need for purchasing expensive software or hiring a designer, making them a great option for budget-conscious property managers.

- Compatibility: These forms are often available in multiple file formats (e.g., Word, PDF, Excel), making them easy to edit and share digitally or print out.

By taking advantage of free forms, property owners and managers can ensure that they are maintaining a streamlined, efficient payment collection process while keeping things cost-effective and professional. These tools provide the foundation for consistent financial communication and a smoother leasing experience overall.

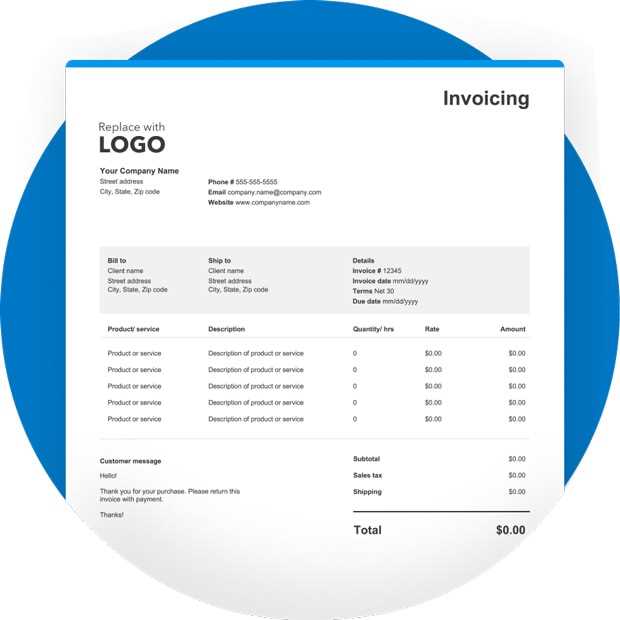

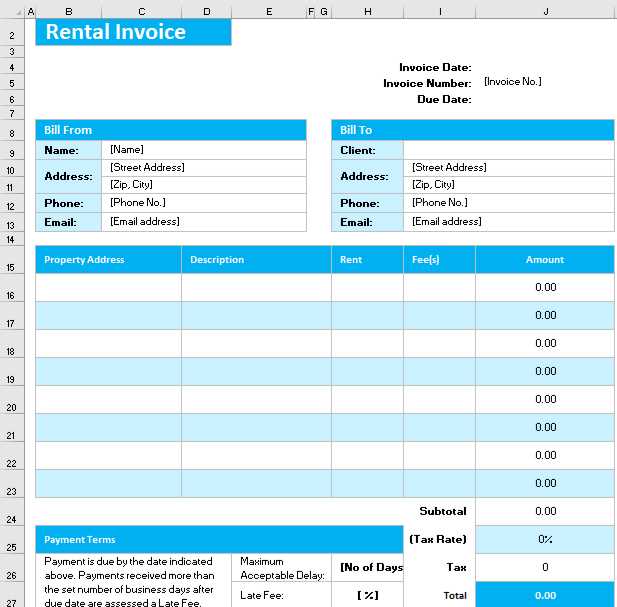

Customizing Your Payment Request Form

Personalizing a payment request form allows property owners to tailor the document to their specific needs, ensuring that it includes all relevant details and aligns with their business practices. By adjusting sections like payment terms, property details, and contact information, you can create a document that is both efficient and professional, reflecting your brand and ensuring clarity for tenants.

Here are a few key areas to consider when customizing your payment request form:

- Header Information: Ensure that your business name, logo, and contact details are prominently displayed. This helps establish professionalism and makes it easy for tenants to reach out if needed.

- Payment Breakdown: Customize how charges are listed. You may want to separate basic leasing fees from additional costs like utilities, maintenance, or late fees, depending on your agreement.

- Due Date and Terms: Adjust the due date format and payment terms to match your lease agreements. If you offer discounts for early payments or charge penalties for late payments, make sure to include this information clearly.

- Payment Methods: Add specific payment instructions based on the methods you accept, such as bank transfers, online payments, or checks. Including clear details can help avoid confusion.

- Additional Notes: You can include a section for notes or reminders, such as information about property maintenance or important dates, making the document more informative for your tenants.

By making these adjustments, you can ensure that each payment request is customized to reflect your property’s specific needs, making it easier for tenants to understand their obligations and streamline the payment process. Customizing your forms also helps maintain consistency and professionalism across all your transactions.

Common Mistakes in Payment Requests

Creating a payment request can seem simple, but even small errors can lead to confusion or delays in payments. These mistakes can affect the professionalism of the document and cause frustration for both property owners and tenants. It’s important to be aware of the most common issues that arise when drafting billing documents to ensure smooth transactions and maintain positive relationships with tenants.

Here are some of the most frequent mistakes to avoid when preparing a payment request:

- Missing or Incorrect Contact Information: Failing to include the correct contact details or listing outdated information can prevent tenants from reaching out with questions or making timely payments.

- Ambiguous Payment Terms: If the payment terms are unclear, such as the exact due date or whether penalties for late payments apply, tenants may be uncertain about their obligations, leading to delays or disputes.

- Inconsistent Charges: A lack of clarity or consistency in how charges are listed can confuse tenants. For example, combining multiple charges under one generic category without clear breakdowns can make it hard for tenants to understand what they are paying for.

- Failure to Include a Payment Method: Not specifying how the tenant should pay or leaving out details about accepted payment methods can delay the process. Always include clear instructions on how and where payments can be made.

- Omitting Late Fees or Discounts: If your agreement includes late fees or early payment discounts, it’s crucial to mention these in the document. Failing to do so can lead to confusion if tenants make late payments without understanding the consequences.

- Not Keeping Records: Failing to keep a copy of the payment request or not tracking payments can make it difficult to follow up on overdue payments or verify previous transactions.

By avoiding these common mistakes, property owners can ensure that their billing documents are clear, accurate, and professional. This will help streamline the payment process, reduce misunderstandings, and foster better relationships with tenants.

Benefits of Using Digital Forms for Payment Requests

Digital forms have become an invaluable tool for property owners and managers looking to streamline their financial processes. By using electronic versions of payment request documents, landlords can save time, reduce human error, and improve the overall efficiency of billing. These forms offer flexibility, convenience, and accuracy that traditional paper forms simply cannot match.

Efficiency and Speed

One of the main advantages of digital forms is the speed at which they can be created and processed. Unlike physical documents that need to be printed, signed, and mailed, electronic forms can be customized, completed, and sent with just a few clicks. This speed allows property managers to send out requests promptly and follow up quickly if necessary.

Organization and Accessibility

Digital forms are easy to store, track, and access. Rather than sorting through piles of paper, you can organize all your billing documents on your computer or cloud storage, making it easy to find any past transaction or payment request at a moment’s notice. Additionally, these forms can be easily shared or emailed to tenants, providing instant access without the delays associated with physical mail.

Overall, using digital forms for payment requests offers a modern, efficient, and secure way to manage financial transactions. Whether you manage one property or multiple, these tools can save you time, reduce administrative tasks, and ensure your billing is clear, consistent, and professional.

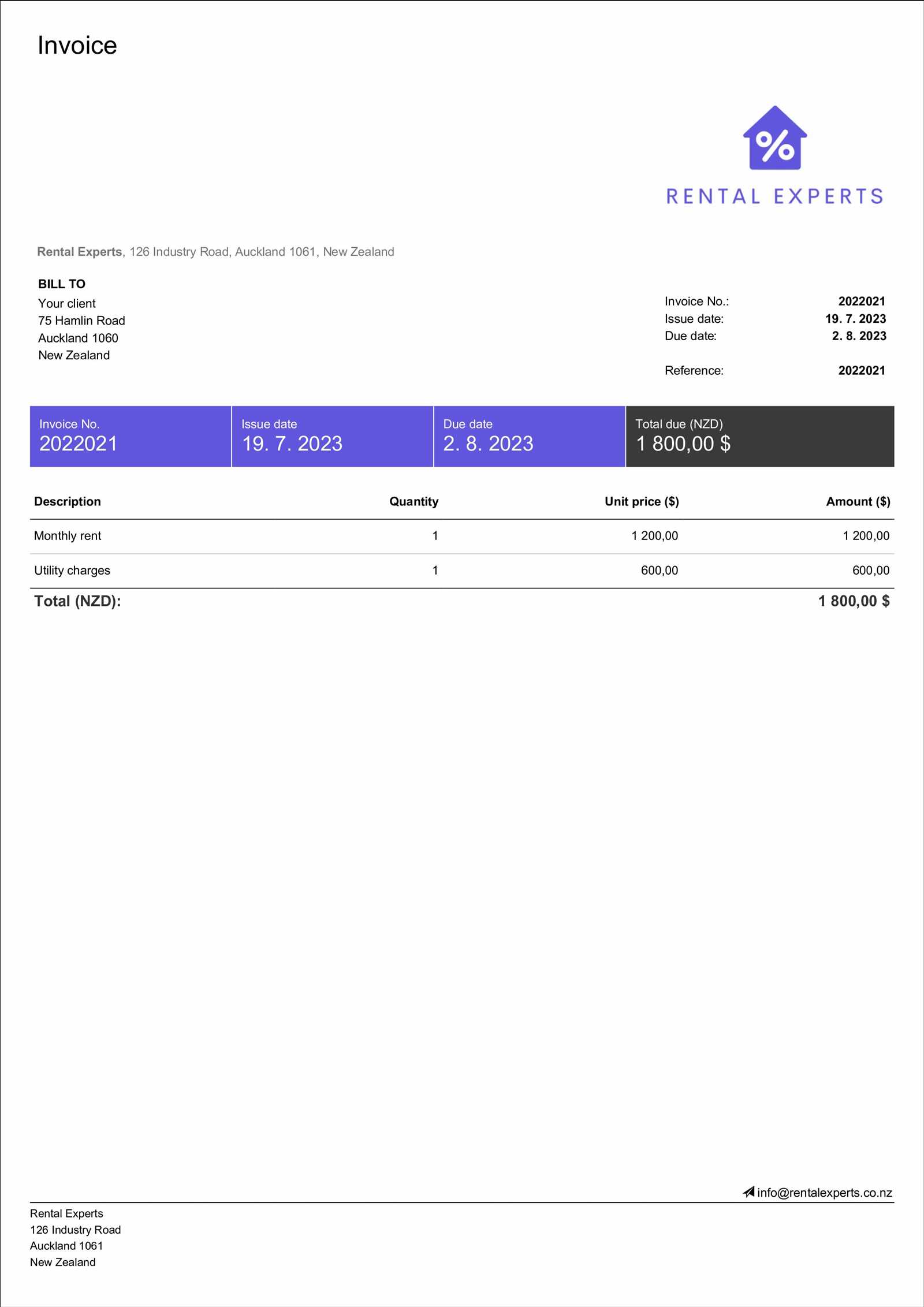

How to Format a Payment Request Document

Properly formatting a payment request is crucial for ensuring clarity and professionalism. A well-organized document not only helps the tenant understand the amount due but also improves the likelihood of timely payments. The layout should be clean, easy to follow, and structured in a way that highlights the most important information.

Essential Sections for a Well-Formatted Document

When creating a payment request, make sure to include the following sections in a logical and consistent order:

- Header: At the top of the document, include your business name, logo (if applicable), and contact information. This makes it easy for tenants to identify the document as official and provides them with a point of contact.

- Tenant Information: Clearly list the tenant’s name, address, and any relevant contact information. This ensures there is no confusion about who is being billed.

- Payment Details: Include a detailed breakdown of the charges. List each cost separately–such as base charges, utilities, or maintenance fees–followed by the total amount due. This ensures transparency and reduces disputes.

- Due Date: Make sure the due date is highlighted and easy to spot. This ensures that the tenant knows exactly when the payment is expected.

- Payment Instructions: Provide clear instructions on how and where the tenant can make the payment, whether through bank transfer, credit card, or other methods.

Tips for a Professional Look

To enhance the appearance and readability of your payment request, follow these formatting tips:

- Use Headings and Subheadings: Break the document into sections using headings and subheadings to make it easy to navigate.

- Maintain Consistent Font Style and Size: Use a professional, easy-to-read font, and make sure the font size is consistent throughout the document, except for headings and key information.

- Leave Adequate White Space: Avoid cluttering the page with too much text. Use sufficient spacing between sections and lines to make the document visually appealing.

- Highlight Important Information: Use bold text or a different color to draw attention to the due date, total amount, or payment instructions.

By following these guidelines, you can ensure your payment requests are not only functional but also professional and easy to understand. Proper formatting helps avoid confusion, encourages timely payments, and maintains a strong, professional image for your business.

Tracking Payments with Payment Requests

Keeping track of payments is an essential part of property management. By systematically monitoring each payment, property owners can ensure that all tenants meet their financial obligations and avoid any overdue balances. Payment requests are not only useful for billing, but they also serve as a record to track whether payments are made on time or if follow-up actions are required.

Methods for Tracking Payments

There are various ways to track payments, and choosing the right method depends on the number of tenants and the complexity of your leasing agreements. Below are some common approaches:

- Manual Record-Keeping: This method involves keeping a log or spreadsheet with details of each payment, including the tenant’s name, amount due, amount paid, payment date, and any outstanding balances. While this can be time-consuming, it is an option for smaller property owners with fewer tenants.

- Digital Tools and Software: Many property management software solutions offer built-in payment tracking features. These tools allow you to monitor payments, generate reports, and send reminders for overdue payments automatically, saving you time and reducing errors.

- Receipts and Acknowledgements: After receiving payment, always provide tenants with a receipt or confirmation. This gives both parties proof of the transaction and can serve as a reference in case of disputes.

Benefits of Proper Payment Tracking

Effectively tracking payments brings several benefits:

- Timely Follow-Ups: By having a clear record of payments, you can quickly identify tenants who may be behind and follow up with reminders or late fees.

- Reduced Errors: Keeping accurate records helps avoid mistakes in billing, ensuring that tenants aren’t overcharged or undercharged.

- Financial Insights: Tracking payments helps property owners gain insights into cash flow, allowing for better financial planning and decision-making.

- Improved Tenant Relationships: Transparent records of payments foster trust and clarity, minimizing confusion and potential conflicts.

Incorporating a reliable system for tracking payments can help ensure smooth operations and timely revenue collection, while also maintaining a positive relationship with tenants.

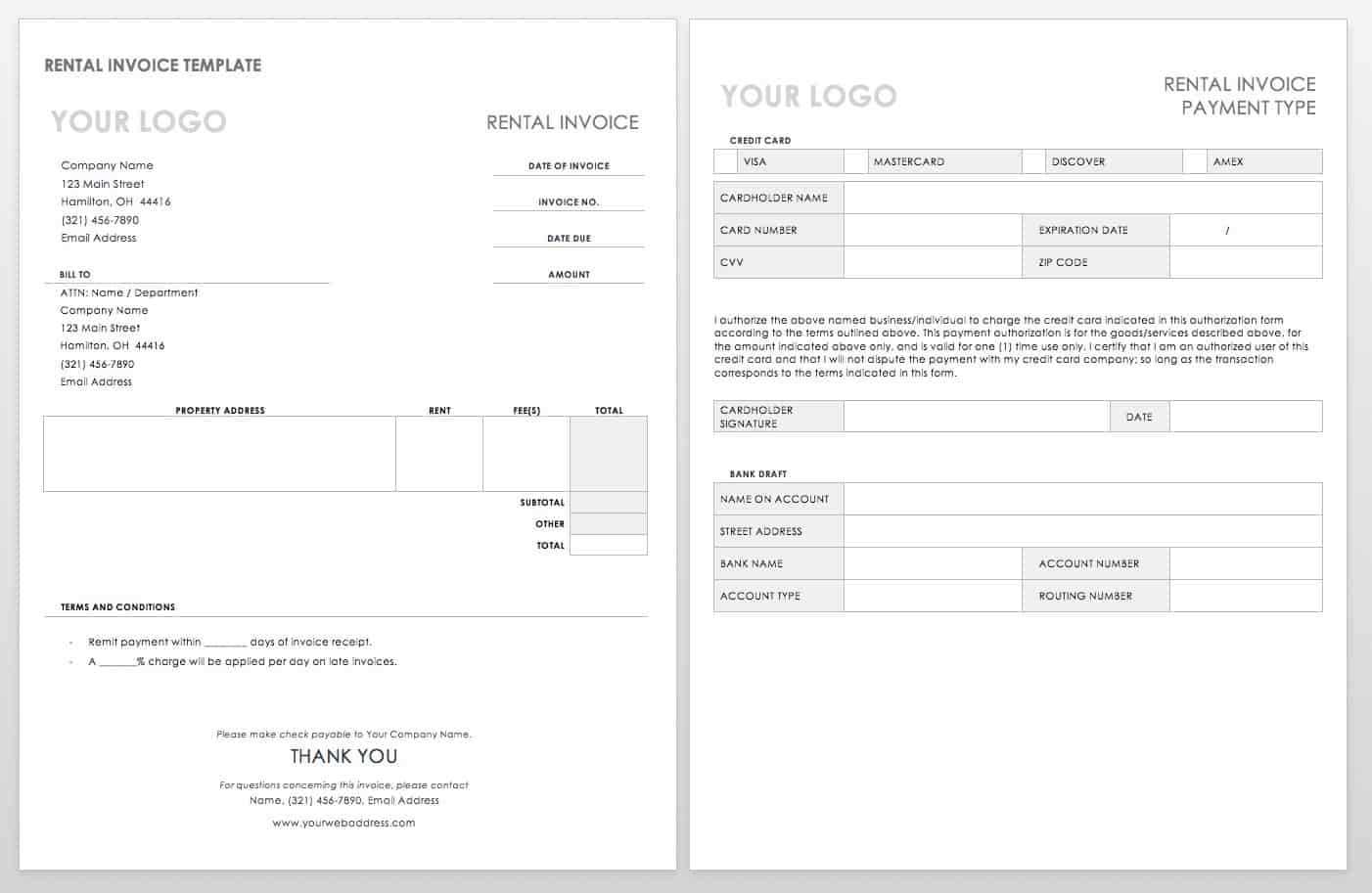

Legal Requirements for Payment Requests

When issuing payment requests, it’s crucial to ensure that the document complies with applicable legal regulations. Depending on your location, there may be specific rules regarding what information must be included, how the document should be formatted, and when it should be provided to tenants. Adhering to these legal requirements helps protect both the property owner and the tenant, reducing the risk of disputes and ensuring that financial transactions are legally sound.

The legal requirements for payment requests can vary by region, but some general guidelines should always be followed:

Essential Information to Include

To comply with legal standards, payment requests typically need to contain certain key details:

- Landlord or Property Owner Details: This includes the name, business name (if applicable), address, and contact information of the person or organization issuing the request.

- Tenant Details: The full name and address of the tenant being billed must be clearly stated to avoid confusion.

- Property Address: It’s essential to specify the address of the leased property to avoid any ambiguity regarding which property the charges apply to.

- Amount Due: A clear breakdown of the total amount owed, including base fees, utilities, and any additional charges, should be outlined.

- Due Date: The date by which payment must be received should be clearly marked to ensure there is no misunderstanding about the timeline for payment.

- Payment Method: Clear instructions on how and where payments should be made, including bank account details or online payment options, must be included.

- Late Fees or Penalties: If applicable, any fees for late payment should be explicitly stated to avoid confusion or disputes later on.

Timely Delivery and Record Keeping

In addition to including the right information, payment requests should be delivered in a timely manner. In many jurisdictions, the property owner is required to send the document a certain number of days before the payment due date to give tenants adequate time to make the payment. Proper record-keeping is also important, as you may need to provide proof of payment or the original request if a dispute arises.

By following these legal requirements, property owners ensure that their payment requests are compliant, transparent, and enforceable, minimizing the risk of legal issues and fostering better relationships with tenants.

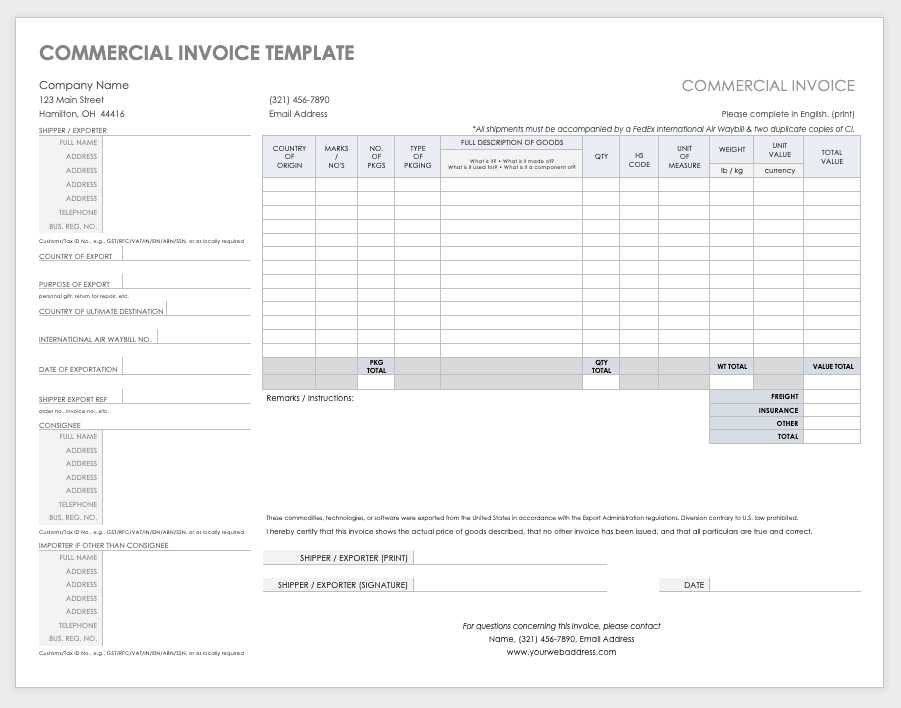

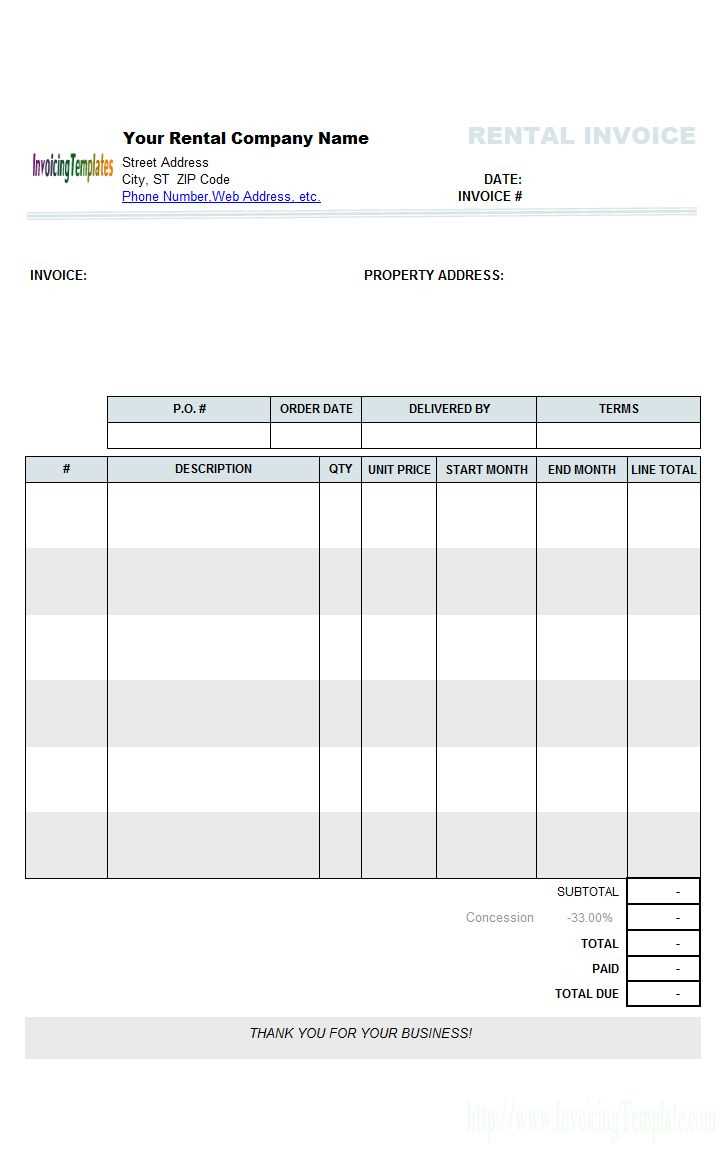

Choosing the Right Payment Request Document

Selecting the right form for your payment requests is essential for ensuring clarity and efficiency in billing. With so many options available, it’s important to choose one that aligns with your business needs, is easy to customize, and reflects the professionalism of your brand. The right document will streamline the payment process, reduce confusion, and help maintain positive tenant relationships.

When choosing the right payment request format, consider the following factors:

Factor Considerations Complexity Choose a format that matches the complexity of your leasing arrangements. For straightforward billing, a simple layout may suffice. For more complex transactions, select a form that allows for detailed breakdowns of costs. Customization Look for a form that can be easily edited to include your business name, logo, payment methods, and specific terms. A customizable document helps ensure that all relevant details are included. Professional Appearance The form should reflect your business’s level of professionalism. Choose a clean, polished design that ensures clarity and reinforces your credibility with tenants. Compatibility The form should be compatible with the software or tools you use, whether it’s a word processor, spreadsheet, or PDF editor. Make sure the format works for both digital and printed communication. Legal Compliance Ensure that the form includes all required details to comply with local regulations. This might include payment terms, due dates, late fees, and other legal elements specific to your area. By taking these factors into account, you can select a payment request document that meets your needs and ensures a smooth, efficient billing process. Whether you manage one property or multiple, choosing the right format will help you stay organized and maintain good financial practices.

Automating Payment Request Documents

Automating the process of creating and sending payment requests can save property managers a significant amount of time and effort. With the right tools, you can set up a system where billing is done automatically, ensuring that tenants receive timely, accurate requests without any manual input. This not only improves efficiency but also helps reduce the risk of errors and delays.

There are several key benefits to automating your payment requests:

- Consistency: Automation ensures that all payment requests are formatted correctly and include the necessary details. This consistency helps avoid mistakes and confusion.

- Time Savings: By automating repetitive tasks, property managers can focus on more important aspects of the business, such as tenant relations and property maintenance.

- Timeliness: Automated systems can send payment requests on a set schedule, ensuring tenants receive them at the appropriate time without delays.

- Reduced Human Error: Automation minimizes the chances of overlooking details like due dates, amounts due, or payment instructions, which are common issues when done manually.

- Convenience: Tenants benefit from receiving their requests directly via email or other digital methods, making it easier for them to keep track of payment due dates and avoid late fees.

To automate payment requests, property owners can use specialized software or services. These tools often allow for the creation of templates that can be filled in automatically with the correct tenant and property details. You can also set up reminders for overdue payments and generate reports to track the payment status for each tenant.

Ultimately, automating payment requests enhances operational efficiency and ensures that financial transactions are handled smoothly. By reducing the administrative burden and improving accuracy, property owners can maintain a better cash flow and reduce potential conflicts with tenants.

Best Practices for Billing Documents

Effective and efficient billing is essential for maintaining healthy cash flow and positive tenant relationships. By following a few best practices when preparing and sending payment requests, property owners can ensure accuracy, minimize confusion, and foster trust. Consistent and professional billing practices help prevent errors, reduce disputes, and improve overall operational efficiency.

Clarity and Transparency

One of the key principles in creating payment requests is ensuring clarity and transparency. Each document should be easy to read, with all charges clearly outlined. Avoid using jargon or complicated terms that could confuse tenants. Instead, break down the charges into understandable categories, such as base fees, utilities, maintenance costs, and any other applicable charges. Provide a clear total at the end of the document, and highlight the due date to ensure there are no misunderstandings.

Timeliness and Consistency

Sending payment requests promptly is critical to maintaining a steady cash flow. Ensure that all requests are sent well in advance of the due date, allowing tenants sufficient time to make payments. Setting a consistent schedule for issuing documents–whether monthly or quarterly–helps tenants anticipate when they will receive their request and reduces the likelihood of late payments. Automating the process can help maintain this consistency while saving time and effort.

Additionally, keeping a consistent format for all documents–such as using the same layout, font style, and structure–makes it easier for tenants to recognize the document and understand the information. This consistency not only enhances professionalism but also helps streamline the billing process, making it more efficient for both parties.

Record Keeping and Follow-Up

Proper documentation is essential for keeping track of payments and maintaining accurate financial records. Ensure that you keep a copy of each request for your records, as well as any receipts or proof of payment. This helps you track which payments have been made and which are still pending. If a tenant is late with a payment, having a detailed record allows you to follow up promptly and professionally.

By following these best practices–focusing on clarity, timeliness, consistency, and thorough record-keeping–you can ensure that your billing process runs smoothly, which ultimately benefits both you and your tenants.

Managing Multiple Properties with Payment Requests

When overseeing multiple properties, managing payments and keeping track of billing for each tenant can quickly become complex. Property owners or managers must have an organized system to handle multiple payment requests, ensuring accuracy and timely collection across all properties. This is especially important when dealing with various tenants, payment schedules, and unique terms for each property.

To effectively manage payments for multiple properties, it’s crucial to establish a systematic approach. The following tips can help simplify the process:

Centralized Record Keeping

One of the most important aspects of managing payments across multiple properties is keeping all records centralized. This allows for easy access and quick updates to payment details for each tenant. A well-organized database or property management software can help you track payments, manage overdue accounts, and even generate reports for each property.

Property Tenant Amount Due Due Date Status Building A Tenant 1 $2,000 15th of every month Paid Building B Tenant 2 $1,500 10th of every month Pending Building C Tenant 3 $2,300 20th of every month Paid Automation and Payment Tracking

Automating the billing process can make managing multiple properties much more efficient. Using property management software, you can automate the creation and sending of payment requests, set reminders for overdue accounts, and monitor payment statuses in real-time. Automation also reduces the risk of human error and ensures that tenants receive their payment requests on time every month.

Having a reliable system for tracking payments–whether manual or automated–helps you stay on top of your financial obligations and ensures that your business remains organized and efficient. By centralizing your records and automating key tasks, managing multiple properties becomes muc