Free Commercial Invoice Template for Effortless Billing

In any business transaction, it is essential to have a clear and structured record of the products or services provided. This helps both the seller and the buyer stay on the same page regarding payment terms, quantities, and prices. A well-organized billing document is a key part of maintaining smooth business operations and avoiding potential misunderstandings.

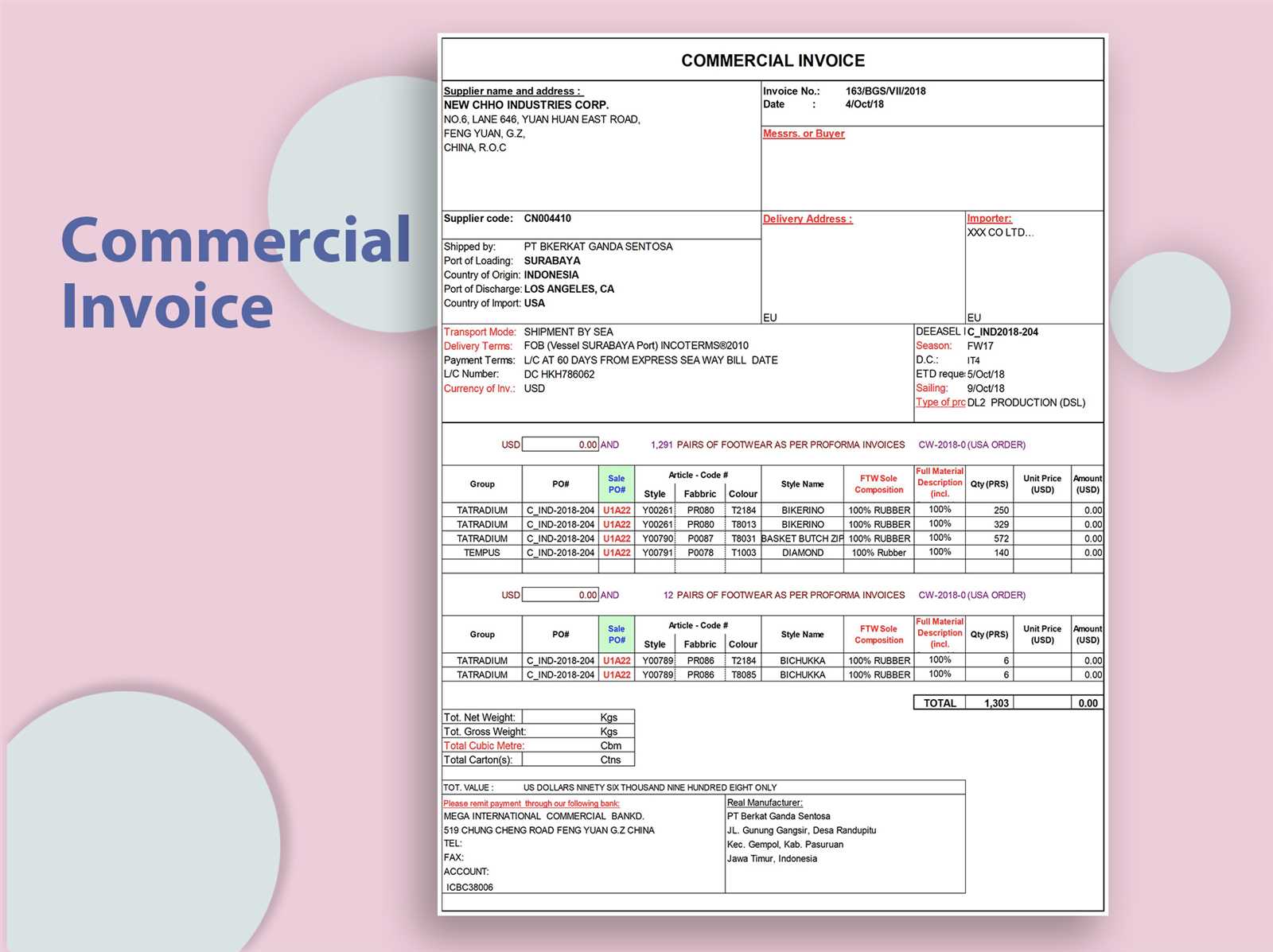

For businesses that deal with international transactions, having a standardized form to list essential details can be a game-changer. This document not only ensures accuracy but also simplifies the process of customs clearance and accounting. With the right format, creating these documents becomes a quick and efficient task that can be tailored to meet specific needs.

In this guide, we’ll explore the importance of these essential business forms, how to create them, and the key information they must include. Whether you’re a small business owner or a large corporation, understanding how to generate an effective billing record is crucial to maintaining professionalism and ensuring timely payments.

What is a Billing Document Format

A billing document format is a standardized record used by businesses to detail the products or services provided to a customer. It serves as an official request for payment, outlining the terms of the transaction, including the quantities, prices, and total amount due. Such a document helps ensure both parties are in agreement regarding the terms of sale and payment obligations.

This format typically includes key elements such as the seller’s and buyer’s contact details, a list of items or services sold, applicable taxes, payment instructions, and delivery terms. By using a pre-designed structure, businesses can save time and avoid errors while maintaining consistency across all transactions. It is especially useful for companies that deal with frequent or complex billing scenarios, allowing them to streamline their accounting process.

In summary, this type of business document is essential for record-keeping, financial planning, and legal purposes. It can also help to avoid disputes by providing clear and accurate information on both the transaction details and payment expectations.

Importance of a Billing Document in Business

A well-structured billing document plays a crucial role in the smooth operation of any business. It not only facilitates payment collection but also serves as a formal record of the transaction between the buyer and the seller. Whether a business is dealing with local or international clients, having a clear and accurate record is vital for maintaining transparency, trust, and legal compliance.

Why Accurate Billing is Essential

Having an accurate record ensures both parties are on the same page regarding the products or services provided, their prices, and the agreed-upon payment terms. Inaccuracies in the billing process can lead to delays in payments, disputes, and even legal challenges. Furthermore, these documents are necessary for tax purposes and can serve as evidence in case of any financial audit or dispute.

Key Benefits for Businesses

In addition to ensuring timely payments, using a standardized billing format offers numerous advantages for businesses:

| Benefit | Description |

|---|---|

| Clarity | Clearly outlines all transaction details, reducing misunderstandings. |

| Efficiency | Saves time and effort by using a pre-designed structure for all transactions. |

| Compliance | Helps meet legal requirements and tax regulations in different regions. |

| Record-Keeping | Maintains a comprehensive and organized system for financial records. |

Ultimately, an effective billing document is an indispensable tool for ensuring smooth financial operations, strengthening business relationships, and complying with regulatory requirements.

How to Create a Billing Record

Creating a clear and professional billing document is an essential skill for any business. This record ensures that both the seller and buyer have a mutual understanding of the transaction terms, including the price, quantity, and payment schedule. The process of creating such a document requires attention to detail, as it serves as a formal request for payment and is a critical piece of financial documentation.

Step 1: Gather Necessary Information

Before creating a billing record, ensure you have all the required details at hand. This includes the following key elements:

- Seller’s Information: Company name, address, and contact details.

- Buyer’s Information: Name, address, and any relevant contact information.

- Transaction Details: A list of goods or services provided, including quantities, descriptions, and unit prices.

- Payment Terms: Specify the due date, payment method, and any discounts or late fees if applicable.

Step 2: Format the Document Properly

The layout and structure of the document are important for clarity and professionalism. Begin by placing the business details at the top, followed by a unique document number and the date of issue. Below this, list the items or services provided, along with their individual prices and totals. Always ensure that the final amount is clearly highlighted, and include any applicable taxes or additional charges. Finally, specify payment instructions, including how and when the amount is due.

By following these steps, businesses can easily create a billing record that is both accurate and easy to understand, ensuring smooth transactions and fostering trust with clients.

Key Elements of a Billing Record

Every billing document needs to include specific details to ensure the transaction is clearly understood by both the seller and the buyer. These essential components not only help in processing payments smoothly but also serve as a formal record for legal and accounting purposes. A well-organized document reduces the chance of errors and disputes and ensures both parties are in agreement about the terms of the transaction.

Below are the primary elements that should be included in any billing document:

| Element | Description |

|---|---|

| Document Number | A unique identifier for the transaction that makes it easy to reference and track. |

| Seller Information | Details of the company or individual providing the goods/services, including name, address, and contact info. |

| Buyer Information | Information about the customer, including their name, address, and contact details. |

| Transaction Date | The date when the goods or services were provided or when the document was issued. |

| Itemized List | A breakdown of the goods or services provided, including quantity, description, unit price, and total cost for each item. |

| Subtotal | The total cost of the items or services before tax, discounts, and additional charges. |

| Taxes and Fees | Any applicable taxes or extra charges, such as shipping fees or handling charges. |

| Total Amount Due | The final amount to be paid, including taxes and any other charges. |

| Payment Terms | Details about when and how payment should be made, including accepted payment methods and any deadlines or penalties for late payments. |

These elements are essential for making sure the billing document is complete, accurate, and legally compliant. Including them ensures that both parties understand the financial transaction and helps to prevent misunderstandings or issues later on.

Benefits of Using a Billing Document Format

Using a pre-designed billing document format offers numerous advantages for businesses, from saving time to improving accuracy. A standardized structure allows businesses to generate clear and professional records quickly, ensuring consistency in every transaction. The use of such formats reduces the risk of errors and ensures that all necessary details are included, which is crucial for maintaining a smooth cash flow and professional reputation.

Here are some key benefits of using a standardized structure for your billing records:

| Benefit | Description |

|---|---|

| Time-Saving | Pre-designed formats eliminate the need to create new documents from scratch for each transaction, speeding up the process. |

| Consistency | Using a consistent layout ensures that all important details are included, creating a professional and uniform presentation for each transaction. |

| Reduced Errors | Standardizing the structure reduces the likelihood of omitting crucial information or making formatting mistakes. |

| Better Organization | By using a template, businesses can easily track and organize financial records, making it simpler to manage multiple transactions. |

| Legal Compliance | A well-structured document helps ensure that all required information is included, which can be important for tax reporting and legal purposes. |

Ultimately, utilizing a pre-designed format can enhance operational efficiency, foster positive relationships with clients, and minimize administrative challenges. It is a simple yet effective tool for businesses looking to streamline their billing process.

Customizing Your Billing Document Format

Customizing a billing document format is essential for businesses that want to align the document with their branding, specific needs, and industry standards. A personalized design can enhance the professionalism of your business and ensure that the document includes all relevant details required for the transaction. Customizing the structure allows businesses to include their logo, specific payment terms, and any other unique elements that help distinguish their documents from others.

Personalizing the Layout

The layout of your billing record should reflect your company’s brand and be easy for the recipient to understand. Consider adding your company logo at the top, using your business’s color scheme, and organizing the document sections logically. You can adjust the font style and size to ensure readability while maintaining a clean, professional appearance. Customization also allows you to prioritize certain details, such as payment deadlines or itemized charges, making them stand out more clearly.

Adding Custom Fields

In addition to the basic components, businesses can include additional fields that reflect specific needs or preferences. For example, you may want to add sections for purchase order numbers, delivery dates, or customer reference numbers. Including these custom fields helps ensure that your billing documents are comprehensive and tailored to the unique needs of your clients or industry. By having the right fields in place, you reduce the risk of confusion or disputes down the road.

Customizing your billing format ensures that you present a professional image and meet the specific needs of your business, making it easier to manage transactions and keep your financial records organized.

Free Billing Document Formats Available Online

There are numerous free resources available online for businesses looking to simplify the process of creating professional billing records. These free formats are pre-designed, allowing companies to quickly customize and use them for their transactions without having to start from scratch. They come in various styles and designs, catering to different industries and business needs, making it easier for entrepreneurs and small business owners to manage their invoicing process efficiently.

Many online platforms offer downloadable options that can be easily edited in word processors or spreadsheet software. These formats are often flexible, allowing you to add your branding, adjust fields, and modify payment terms to match your specific business practices. Whether you need a basic layout or a more detailed, itemized record, there is a free resource available to suit your needs.

Benefits of Using Free Formats:

- Cost-effective: No need to invest in expensive invoicing software or design services.

- Time-saving: Ready-to-use designs mean you can focus on other areas of your business.

- Customizable: Tailor the format to fit your unique requirements with ease.

- Accessible: Available for immediate download from various websites, making it easy to start using right away.

By using these free resources, businesses can ensure they are providing clear, professional records for their clients without the burden of creating complex documents from scratch.

How to Fill Out a Billing Document

Completing a billing document correctly is crucial for ensuring that both the seller and buyer have a clear understanding of the transaction details. By carefully filling out each section of the document, you avoid confusion, disputes, and potential delays in payment. The following steps will guide you through the process of filling out a professional and accurate billing record.

Step 1: Provide Seller and Buyer Information

The first section of the document should include the names, addresses, and contact information for both the seller and the buyer. This ensures that both parties are clearly identified and helps prevent errors in delivery or payment. Make sure the details are accurate and up to date to avoid issues later on.

Step 2: List the Goods or Services Provided

Next, include a detailed description of the products or services you are providing. This section should include the quantity, unit price, and a short description of each item. If applicable, include product codes, sizes, or specifications to make the description as clear as possible. Calculate the total for each item by multiplying the quantity by the unit price, then list the subtotals for each item or service.

Once all items have been listed, calculate the total amount due, including any taxes, shipping fees, or discounts. Ensure that the final amount is clearly highlighted, and specify the payment terms, such as the due date and accepted methods of payment.

By following these steps, you can ensure that the billing document is complete, accurate, and ready for processing, helping to facilitate a smooth transaction and prompt payment.

Common Mistakes in Billing Records

Even with a standardized format, errors in creating a billing document can still occur. These mistakes can lead to payment delays, misunderstandings, or even legal complications. It’s important to be aware of the most common mistakes and take steps to avoid them, ensuring that your documents are both professional and accurate.

Incorrect or Missing Contact Information

One of the most frequent mistakes is providing inaccurate or incomplete contact details for either the seller or the buyer. Failing to include the correct names, addresses, or phone numbers can cause confusion, delays in communication, and issues with deliveries. Always double-check the contact information before finalizing the document to ensure everything is correct and up-to-date.

Errors in Item Descriptions or Pricing

Another common mistake is inaccurately listing the products or services being provided. This can include errors in the quantity, unit price, or even a failure to describe the items clearly. Additionally, omitting important details like product codes or specifications can make it difficult for the buyer to understand what they are being charged for. Always ensure that each item is described clearly and that the correct price is listed to prevent confusion and disputes.

Other common mistakes include:

- Forgetting to add taxes or shipping fees: Failing to include these can lead to an inaccurate total amount due.

- Not specifying payment terms: Without clear instructions on how and when payment is due, payments can be delayed.

- Missing or incorrect dates: Ensure the document is issued with the correct date and that any deadlines are clearly stated.

By carefully reviewing your billing documents for these common mistakes, you can avoid unnecessary complications and ensure that the transaction proceeds smoothly.

Legal Requirements for Billing Documents

When preparing a billing record, it is essential to ensure that it meets all necessary legal requirements. Depending on the country or region in which your business operates, there may be specific rules governing what information must be included in the document. These regulations help to protect both the buyer and seller by ensuring transparency and compliance with tax laws, as well as providing proof of the transaction in case of a dispute.

Essential Legal Information

To comply with legal standards, a billing document must include certain mandatory details. These elements vary by jurisdiction, but the following are generally required:

- Seller and Buyer Information: Both parties’ names, addresses, and contact information are often required for identification purposes.

- Unique Document Number: A reference number for each transaction to track and identify the billing record.

- Date of Issue: The date when the document was created, which may be important for tax purposes and payment deadlines.

- Clear Description of Goods or Services: A list of the items provided, including quantities, unit prices, and a detailed description.

- Total Amount Due: A clearly stated total that includes all items, taxes, and applicable fees.

- Tax Information: Depending on the jurisdiction, the tax rates and the seller’s tax identification number may be required.

Additional Legal Considerations

Some regions may require additional details on the billing document, including:

- Currency: The currency in which the transaction is conducted, especially for international business.

- Payment Terms: A clear statement of the payment schedule, including due dates and any late fees.

- Shipping Information: For goods that are shipped, shipping methods and delivery terms may be legally required.

- Customs Declaration: In international transactions, a customs declaration may be needed, listing the nature of the goods being exported or imported.

Failure to comply with these legal requirements can lead to penalties, disputes, or difficulties in processing payments. By ensuring that each billing document includes the correct information, businesses can avoid legal complications and maintain transparent and efficient operations.

Billing Record vs Proforma Billing Record

While both a billing record and a proforma billing record contain similar information, they serve distinct purposes in the world of business transactions. Understanding the difference between these two documents is essential for ensuring proper financial and legal processes are followed. Though they may appear similar at first glance, the key distinction lies in their use and the stage at which they are issued in a transaction.

What is a Proforma Billing Record?

A proforma record is essentially a preliminary document issued before a transaction is completed. It provides the buyer with an estimate of what the total cost will be, including an itemized list of products or services, along with their expected prices. However, it is not considered a final or legally binding document. Rather, it acts as an advance notice, giving the buyer an idea of the cost and terms before the official transaction takes place.

- Purpose: To provide an estimate or quotation before the sale.

- Legal Status: Not a legally binding document; it does not serve as a request for payment.

- Usage: Often used in international transactions to secure financing or for customs purposes.

What is a Billing Record?

On the other hand, a billing record is issued after the goods or services have been provided and represents a formal request for payment. Unlike a proforma record, it is a legally binding document that details the final amounts owed by the buyer. This document includes all terms of the sale and serves as proof of the transaction, often required for tax reporting and financial records.

- Purpose: To request payment for completed goods or services.

- Legal Status: A legally binding document that must be paid according to the agreed terms.

- Usage: Used to collect payment and document the transaction for accounting purposes.

In summary, the primary difference between these two types of documents lies in their timing and purpose. A proforma document is used before a transaction to outline an estimated cost, while a billing record is issued once the transaction is complete and serves as a formal request for payment.

How to Save Time with Billing Document Formats

Using pre-designed billing record structures can significantly reduce the time spent on administrative tasks, allowing businesses to focus on core activities. Instead of creating each document from scratch, you can simply fill in the necessary details, speeding up the process and improving overall efficiency. Whether you’re a freelancer, small business owner, or part of a large enterprise, these time-saving formats can streamline your operations and help you manage transactions more effectively.

Time-Saving Benefits of Pre-Designed Formats

Here are several ways in which using pre-made billing formats can help save valuable time:

- Quick Customization: Pre-built structures allow you to quickly fill in details such as names, amounts, and item descriptions, without having to worry about layout or formatting.

- Consistency: Using a standardized layout ensures all necessary fields are included every time, reducing the chance of forgetting important information.

- Professional Appearance: Ready-made formats often come with polished designs that make your documents look professional and reliable without the need for design skills.

- Minimized Errors: With predefined fields and sections, there is less chance of omitting important details, reducing the need for corrections later on.

How to Maximize Efficiency with Billing Document Formats

To further streamline your process, consider the following tips when using pre-designed formats:

- Personalize Your Format: Customize the template to fit your business needs, such as adding your logo, payment terms, or specific fields for industry-related details.

- Save as a Reusable File: Keep a master version that you can easily update with client-specific information, saving you time with every new transaction.

- Use Automation Tools: Many software platforms allow you to integrate billing document creation into your workflow, automatically filling out fields based on client data and previous transactions.

By using pre-designed formats, businesses can ensure they are working more efficiently, reducing the time spent on administrative tasks and enhancing overall productivity.

Exporting and Printing Your Billing Document

Once you’ve completed a billing record, the next step is to prepare it for distribution or filing. Exporting and printing the document efficiently ensures that it is ready for delivery to the client or for your internal records. The process can vary slightly depending on the software you’re using, but the essential steps remain the same. Whether you need to send the document electronically or provide a physical copy, the goal is to ensure the document is accurate, professional, and accessible.

Exporting Your Billing Record

Most software programs allow you to export the document in a variety of formats, with PDF being the most common choice for its professional appearance and ease of sharing. Exporting in PDF format preserves the document’s layout, fonts, and design, ensuring that it looks exactly as intended no matter where it is opened. Here’s how you can export your billing record:

| Step | Action |

|---|---|

| 1 | Complete all fields and review the document for accuracy. |

| 2 | Select the “Export” or “Save As” option from the file menu. |

| 3 | Choose the format (e.g., PDF) and specify the location where the file will be saved. |

| 4 | Click “Save” or “Export” to generate the document. |

Printing Your Billing Record

If you prefer to provide a physical copy, printing the document is straightforward. Ensure your printer settings are correct and that the document will fit neatly on the page. Here are some tips for printing:

- Use High-Quality Paper: Printing on high-quality paper enhances the professional look of your document.

- Check Margins: Ensure there is enough space around the edges so that no information is cut off during printing.

- Print Preview: Always preview the document before printing to ensure everything appears as it should.

- Number of Copies: Depending on your needs, print multiple copies for your records or for distribution.

Once printed, the document can be

Why Accurate Billing Documents Are Crucial for Business

Accurate billing records are essential for any business transaction. They serve as the foundation for financial communication between a seller and a buyer, ensuring both parties understand the terms of the transaction. When these records are correct, it helps establish trust, reduces the risk of disputes, and ensures timely payments. On the other hand, errors or omissions in billing documents can lead to confusion, delays, and financial discrepancies, which can negatively affect a business’s operations.

Key Reasons Accuracy Matters

Here are some key reasons why ensuring the accuracy of your billing documents is critical for your business:

- Ensures Timely Payments: Correctly filled-out records make it clear to customers how much they owe and when payment is due, minimizing the chances of delays.

- Reduces Disputes: By including all relevant details like quantities, prices, and payment terms, you can prevent misunderstandings and disputes that may arise over unclear or incorrect charges.

- Tax Compliance: Accurate records are necessary for tax reporting and ensure that you comply with local tax laws. Mistakes can lead to fines or penalties during audits.

- Improves Professionalism: Well-structured and accurate billing documents project professionalism, which can enhance your reputation and foster strong relationships with clients.

- Facilitates Record Keeping: When your records are accurate, it’s easier to keep track of business transactions and financial status, making it simpler to reconcile accounts at the end of each period.

Consequences of Inaccurate Billing Records

Inaccurate billing documents can lead to several negative consequences for a business, including:

- Delayed Payments: Mistakes in amounts, payment terms, or client details can confuse customers and delay payments.

- Legal Issues: Incorrect documentation can lead to legal disputes, especially if a client claims they were charged incorrectly or if the record fails to meet legal requirements.

- Damaged Business Reputation: Repeated errors in billing can harm your business’s reputation and may lead customers to take their business elsewhere.

- Financial Losses: Errors in calculating costs, taxes, or shipping fees can result in undercharging, potentially causing your business to lose revenue.

Ensuring that every billing document is accurate is a crucial step in maintaining smooth business operations, fostering good customer relations, and protecting your business’s financial health.

Billing Document for International Shipping

When shipping goods internationally, having the correct documentation is crucial for smooth customs clearance and timely delivery. One of the most important documents in this process is the billing record, which serves as a detailed statement of the transaction between the buyer and seller. This document provides customs officials with the necessary information about the goods being shipped, their value, and the terms of the sale. Without it, shipments may be delayed, or additional fees may be incurred.

Key Information for International Shipping

To ensure your shipment passes through customs without issues, the billing record should include the following key details:

- Sender and Recipient Information: The full name, address, and contact details of both the seller and the buyer are essential for identifying the parties involved in the transaction.

- Description of Goods: A detailed list of the items being shipped, including quantities, unit values, and precise descriptions of the products. Customs officials need to know exactly what is being shipped to calculate duties and taxes.

- Value of Goods: The total value of the shipment, including the price of each item, should be clearly stated. This value helps determine the applicable customs duties and taxes.

- Origin of Goods: Indicate the country where the goods were manufactured or produced. This is important for determining any import restrictions or tariffs that may apply.

- Shipping Terms: The document should clearly state the terms of delivery, such as who is responsible for shipping costs, insurance, and handling (commonly referred to as Incoterms).

- Payment Information: Specify any payment terms, such as whether the buyer will pay before shipment or upon delivery. Payment methods and due dates should be included where applicable.

Importance for Customs Clearance

Accurate and complete documentation is essential for ensuring that goods pass through customs without delay. Customs authorities rely on the information provided in the billing document to assess import duties and taxes, verify the legitimacy of the shipment, and check for compliance with local regulations. Incomplete or inaccurate records can result in customs delays, additional fees, or even the rejection of the shipment.

In international shipping, having a properly completed billing document is more than just good practice; it’s a necessary step to ensure that the goods reach their destination efficiently and without unnecessary complications.