Free Commercial Invoice Template XLS for Easy Billing and Customization

Managing financial transactions and ensuring timely payments is a critical aspect of running any business. One of the most effective ways to organize and streamline this process is by using structured documents that capture essential details clearly and professionally. Excel provides a versatile platform for creating such records, offering both simplicity and customization to meet the unique needs of your operations.

By utilizing pre-designed forms in spreadsheet format, businesses can easily record client information, products or services provided, payment terms, and other necessary data. This approach not only saves time but also minimizes errors, allowing for a smoother workflow. With the flexibility of Excel, users can modify the layout, incorporate formulas for calculations, and save the documents in various formats for convenient sharing.

Whether you’re a small business owner or managing a larger enterprise, having an organized system in place can make a significant difference in efficiency. With the right tools, you can maintain a professional standard of communication and reduce the complexity of financial documentation, helping you focus on growing your business.

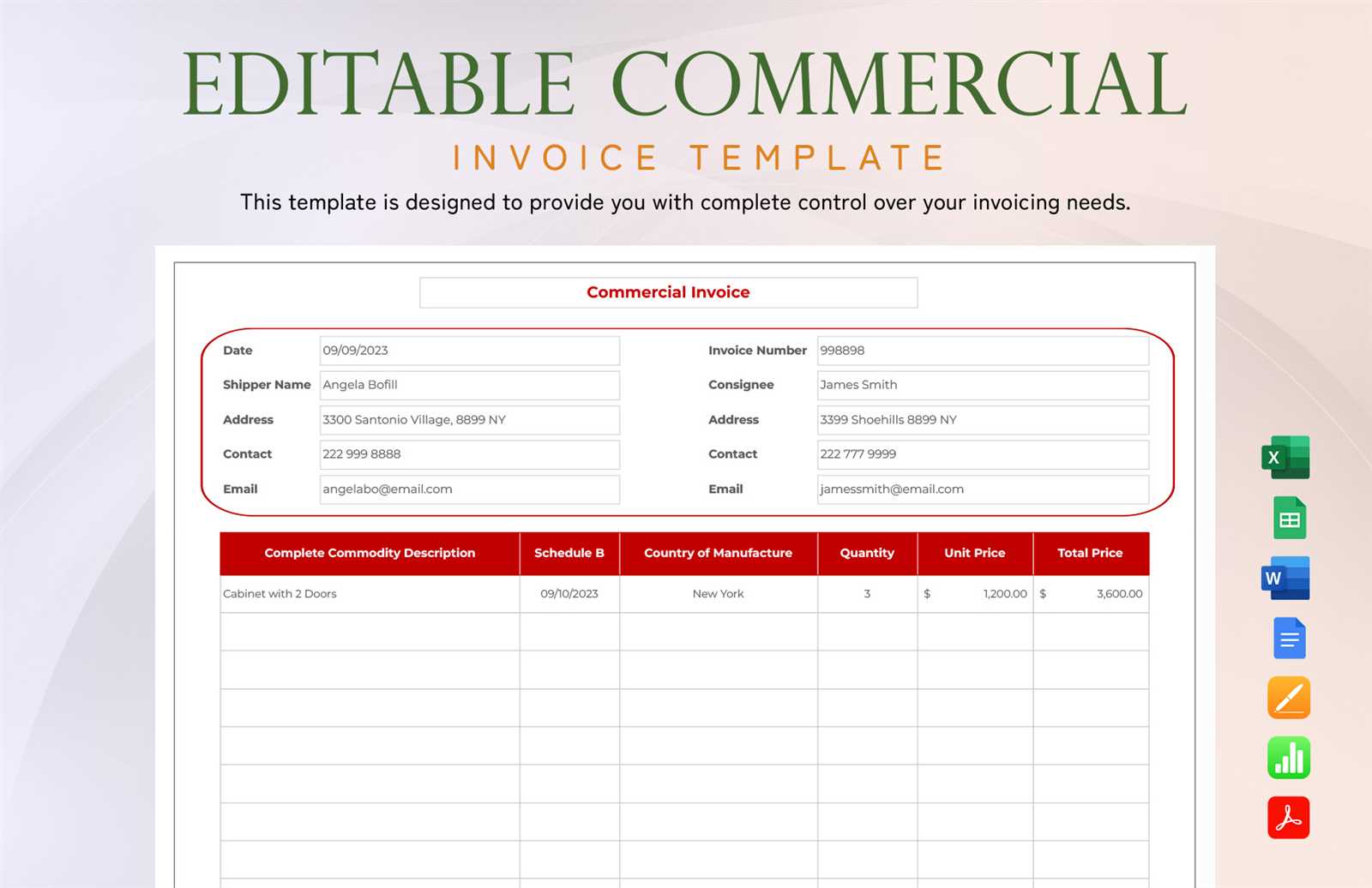

Commercial Invoice Template XLS Overview

When it comes to handling billing for goods or services, an organized and structured approach is crucial. Using a pre-designed document in a spreadsheet format allows businesses to efficiently capture all necessary transaction details, from customer information to payment terms. These forms are flexible, easy to modify, and can be tailored to specific business needs, ensuring accuracy and consistency with every transaction.

These ready-made files typically include all the essential fields required for invoicing, such as item descriptions, quantities, unit prices, and total amounts due. The use of a spreadsheet enables users to quickly calculate totals, apply taxes or discounts, and ensure that all data is presented in a professional format. Additionally, this solution offers the convenience of saving, editing, and sharing documents electronically, making it ideal for both small and large businesses.

Key Features of a Spreadsheet Invoice

A well-designed spreadsheet for billing will have several built-in features that enhance its functionality. Below is an overview of some of the key aspects:

| Feature | Description |

|---|---|

| Customizable Fields | Easy to adjust for different businesses, including client info, product details, and pricing. |

| Automated Calculations | Pre-set formulas for calculating totals, taxes, discounts, and overall amounts due. |

| Multiple Format Options | Can be saved in various formats like PDF, ensuring compatibility with different platforms. |

| Professional Layout | Structured presentation of all relevant information to maintain a high standard of communication. |

Benefits for Small and Large Businesses

For small businesses, these spreadsheets simplify financial tracking, ensuring that all necessary data is captured without the need for complex software. Larger businesses can also benefit from scalability, as the templates can handle multiple transactions and integrate seamlessly with other accounting systems. Ultimately, these forms provide a practical, efficient, and professional way to manage financial documentation in any business setting.

Why Use an XLS Invoice Template?

Efficiently managing financial transactions is essential for the smooth operation of any business. Using a well-structured document in a spreadsheet format provides a simple yet powerful tool for organizing billing details, ensuring that every transaction is recorded accurately. This approach helps businesses streamline their accounting processes, reduce errors, and save time.

Spreadsheets offer a range of benefits, from automation of calculations to easy customization. By utilizing pre-designed forms, businesses can avoid the complexities of manual calculations and reduce the likelihood of mistakes. Additionally, the flexibility of spreadsheet software allows for easy adjustments to the format, enabling users to adapt the document to their specific needs without requiring technical expertise.

Automation of Calculations

One of the key advantages of using spreadsheet-based documents is the ability to automate calculations. With built-in formulas, users can easily compute totals, apply taxes, and calculate discounts with minimal effort. This feature not only saves time but also ensures that the numbers are accurate every time, reducing the risk of errors that could affect payment processing or client relationships.

Ease of Customization and Flexibility

Another major reason for using spreadsheet-based documents is the level of customization they offer. Whether you need to add specific fields for unique business information or modify the layout to suit your branding, spreadsheets provide the flexibility to make adjustments with ease. The simplicity of editing ensures that businesses can maintain professional, tailored documentation that reflects their unique needs and preferences.

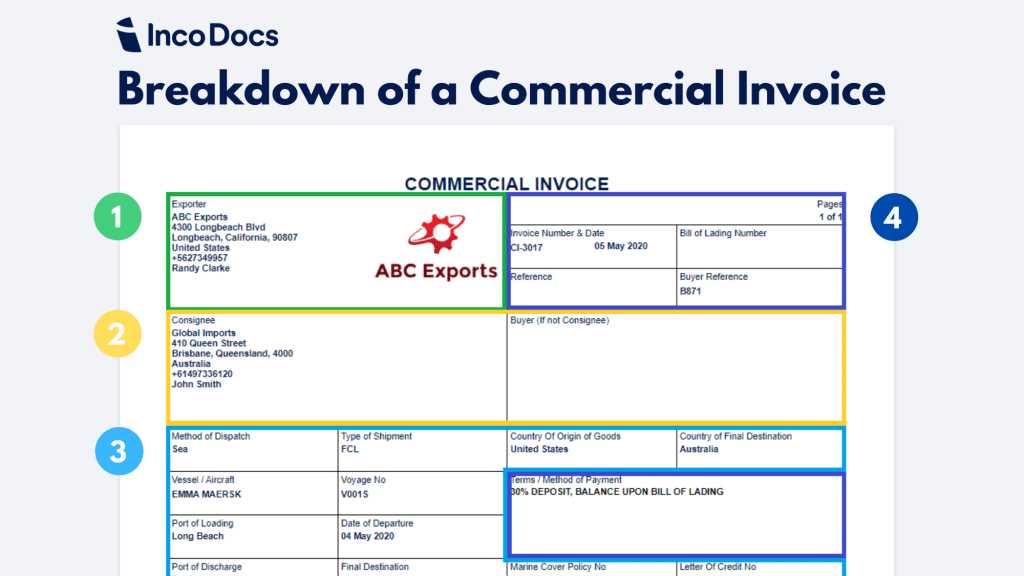

Key Features of a Billing Document

When creating a document to capture the details of a financial transaction, it’s important to ensure that all necessary information is included for clarity and accuracy. A well-structured record should not only reflect the items or services provided but also include essential elements that enable easy tracking, calculation, and communication with clients. These elements make the document both functional and professional.

The core features of such a document typically include fields for contact information, a breakdown of products or services, pricing details, payment terms, and additional notes. These features help establish transparency, reduce misunderstandings, and facilitate the payment process. Below are some key components that every business should include when preparing such documents.

Essential Information

To ensure that both parties are aligned on the transaction, it’s important to include clear and complete details. The essential fields typically include:

- Sender and Recipient Information: Full names, addresses, and contact details of both parties involved in the transaction.

- Description of Goods or Services: A clear and concise list of what was provided, along with quantities and unit prices.

- Transaction Date: The date when the goods were shipped or services rendered, as well as the payment due date.

Financial Details

Accurate financial details are crucial for the transaction to be completed correctly. These include:

- Total Amount: The sum of all charges, including any applicable taxes, fees, or discounts.

- Payment Terms: The conditions under which the payment is to be made, including due dates and accepted methods.

- Currency: The type of currency in which the transaction is being conducted.

By ensuring these features are included, businesses can create professional, clear, and comprehensive records that support effective communication and smooth financial operations.

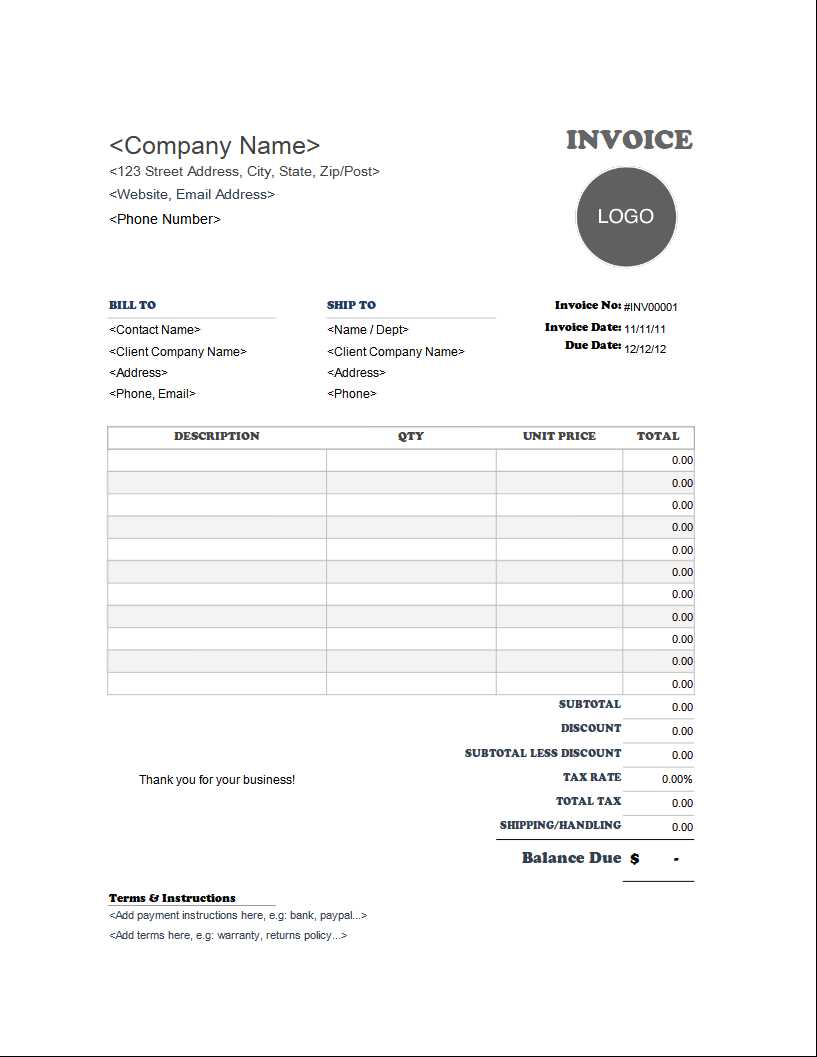

How to Create an Invoice in Excel

Creating a professional billing document in Excel is a simple process that allows you to efficiently capture all necessary details for a transaction. With Excel’s built-in tools and customization options, you can design a document that suits your business needs, ensuring accuracy and clarity in every sale. The following steps guide you through the process of building your own billing record from scratch, with everything you need to track products, services, and payment terms.

To start, open a new worksheet and begin entering the basic information that will make up the document. Excel allows you to create sections for all key elements, including contact information, itemized lists, and totals. You can use simple formatting to organize the data and ensure that it’s easy to read and understand. The following table provides an overview of the essential components you should include in your document:

| Section | Description |

|---|---|

| Header | Include your business name, address, and contact information, along with the recipient’s details. |

| Itemized List | List each product or service provided, with columns for quantities, unit prices, and extended totals. |

| Subtotal | Calculate the total cost before taxes and discounts. |

| Taxes & Discounts | Include applicable tax rates or discounts and calculate the final amount due. |

| Payment Details | Specify payment terms, due date, and accepted payment methods. |

Once you’ve entered all the necessary information, use Excel’s built-in formulas to automatically calculate totals, taxes, and discounts. You can also add styling elements such as borders, bold headings, and currency symbols to give your document a professional look. After finalizing the design, simply save the file, and it’s ready to be sent to your client in the preferred format, such as PDF or Excel itself.

Customizing Your XLS Invoice Template

Personalizing a billing document in a spreadsheet format is essential for making it reflect your business’s branding and specific needs. Customization allows you to adapt the structure, layout, and functionality to suit different transaction types, industries, or preferences. Whether you want to adjust the look, modify calculation methods, or add additional fields, Excel provides a versatile platform to tailor every aspect of the document.

By customizing the design, you can enhance readability, align with your company’s style, and ensure that the document meets all legal or industry-specific requirements. The flexibility of a spreadsheet lets you incorporate logos, color schemes, and fonts, giving your document a professional appearance. Below are a few common ways to customize your billing record in Excel:

Adjusting Layout and Design

Customizing the layout and overall appearance of your document helps make it visually appealing and easier for recipients to understand. Some tips for adjusting the design include:

- Adding Branding: Insert your company logo, use your business colors, and choose professional fonts that match your brand’s identity.

- Formatting for Clarity: Use bold headings, shaded areas, and clear column separations to highlight important information like amounts due, item descriptions, and payment terms.

- Adjusting Cell Size: Ensure that all data fits neatly by resizing rows and columns to accommodate longer product names or extra details.

Enhancing Functionality with Formulas

Beyond appearance, you can also improve the functionality of your document by incorporating various Excel formulas. These allow for automatic calculations of totals, taxes, and discounts, reducing the risk of errors. Some useful formulas include:

- Sum Function: Automatically calculate the total of all items in the list.

- Tax and Discount Calculations: Use percentage-based formulas to apply taxes or discounts based on specific rates.

- Dynamic Date Fields: Automatically insert the current date or calculate the due date based on the transaction date and payment terms.

By leveraging these customizations, you can create a document that not only suits your needs but also projects professionalism and consistency to your clients.

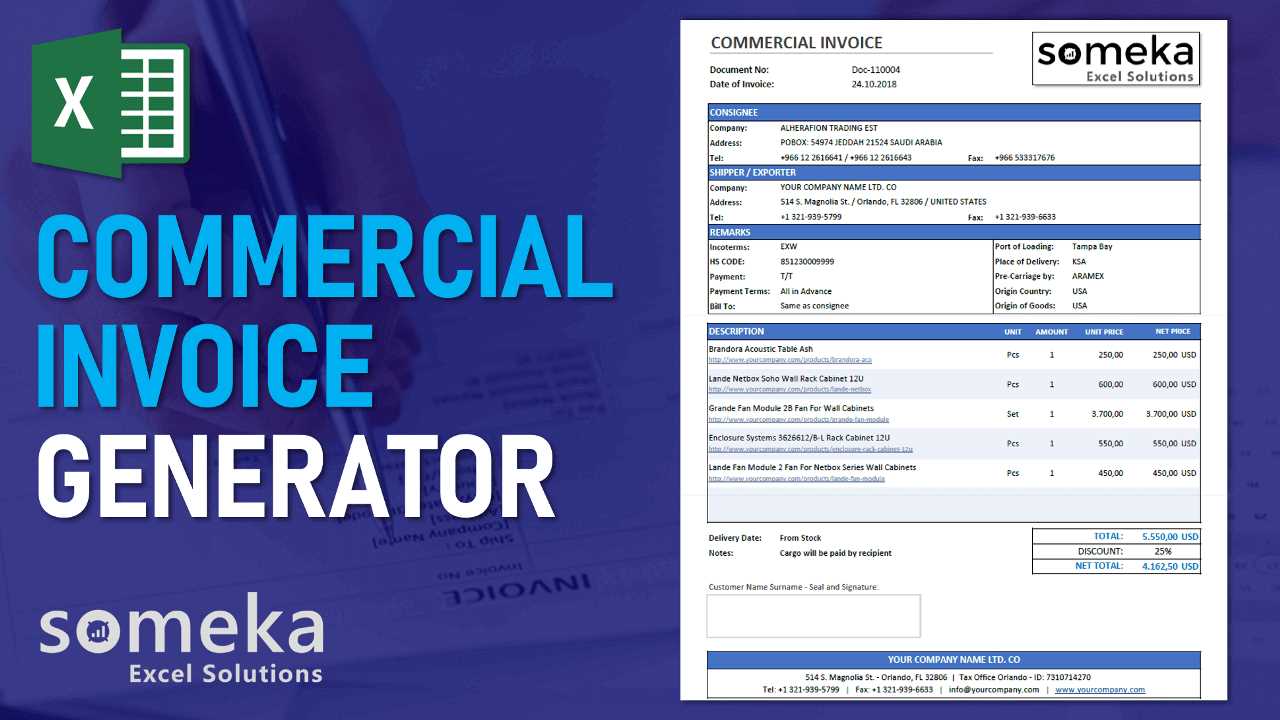

Free Commercial Invoice Templates for Excel

If you’re looking for an efficient way to manage your billing without starting from scratch, free spreadsheet forms are an excellent solution. These pre-designed documents come with the basic structure already in place, allowing you to easily input your transaction details and generate professional records. Using free resources can save time and effort, especially if you’re unfamiliar with creating such documents manually or need to quickly adapt to specific client needs.

There are a variety of free templates available online, each offering unique features, such as automated calculations, customizable layouts, and different formats for various industries. These templates are typically compatible with Excel, providing flexibility for modification and ensuring that they suit your business’s requirements. Below are some benefits of using these free resources:

Advantages of Using Free Templates

- Time-Saving: Pre-designed forms allow you to start working immediately, avoiding the need to create a document from the ground up.

- Customization: While the layout is pre-built, these forms can be easily modified to include your company branding, adjust fields, or add specific terms.

- Cost-Effective: Many platforms offer free options, meaning you can have access to professional-looking documents without spending money on specialized software.

- Accuracy: Templates often include built-in formulas for calculating totals, taxes, and discounts, reducing the risk of human error.

Where to Find Free Billing Forms

There are numerous websites and platforms that provide free downloadable billing sheets in Excel format. Some of the best places to find them include:

- Microsoft Office Templates: Microsoft’s official template gallery offers a wide selection of customizable forms for various business needs.

- Template Websites: Websites such as Template.net or Vertex42 offer a range of professional forms that can be easily downloaded and used in Excel.

- Online Marketplaces: Free templates can also be found on platforms like Etsy or even through Google searches, often designed by independent creators.

By utilizing these free options, businesses can quickly implement efficient billing systems without investing in expensive tools, all while maintaining a professional standard in their financial communications.

Benefits of Using Excel for Invoices

Using a spreadsheet program like Excel for creating and managing financial records offers several significant advantages. Excel’s powerful features make it an ideal tool for streamlining the billing process, from calculations to formatting, all while offering flexibility and ease of use. Whether you’re handling a few transactions or dealing with large volumes, Excel ensures accuracy and saves time, making it a go-to solution for many businesses.

Excel’s ability to automate key tasks, such as calculating totals or applying taxes, reduces manual effort and the risk of errors. Additionally, it provides an organized structure, allowing users to quickly modify and customize their documents. Below are some of the key benefits of using Excel for managing your billing documentation:

Time Efficiency

- Automated Calculations: Excel’s built-in formulas can automatically calculate totals, taxes, and discounts, saving time and minimizing errors.

- Fast Setup: Excel provides an easy-to-use framework, so creating professional-looking billing documents takes minutes rather than hours.

- Bulk Processing: Excel’s capabilities allow you to manage multiple transactions in one file, streamlining the process when dealing with large volumes of data.

Customization and Flexibility

- Tailor to Your Needs: Excel allows you to customize layouts, add logos, or change the color scheme to match your brand’s style.

- Adaptable for Different Purposes: You can easily adjust the document to fit various business types, from small local enterprises to large-scale operations.

- Simple Data Modification: Changing or adding new information is straightforward, making it easy to update documents whenever necessary.

Cost-Effectiveness

- No Additional Software Needed: Most businesses already use Excel, eliminating the need for purchasing separate invoicing software or tools.

- Free Templates: There are many free templates available online, reducing upfront costs and providing a professional solution without spending extra money.

In conclusion, Excel offers a combination of speed, customization, and cost-efficiency, making it a valuable tool for businesses of all sizes looking to simplify and automate their billing processes.

Step-by-Step Guide to Excel Invoicing

Creating a billing document in Excel is a straightforward process that helps ensure accuracy, efficiency, and a professional appearance for your business transactions. With Excel’s user-friendly interface and powerful features, you can quickly generate detailed records that track the products or services provided, amounts due, and payment terms. Below is a step-by-step guide to help you create a billing record from start to finish using Excel.

Follow these steps to ensure that your document includes all the necessary details and is ready for distribution to your clients:

Step 1: Set Up Your Document

Start by opening a new worksheet in Excel. You can either create your own layout or use a free template from the Microsoft Office library. The first section of the document should include your business’s contact information at the top, including:

- Your business name

- Address

- Phone number and email

- Client’s information: Name, address, and contact details.

Step 2: Add a Detailed Itemized List

Below the contact section, create columns for listing the products or services provided. Each row should contain the following details:

- Description of the item/service

- Quantity

- Unit price

- Extended total (calculated by multiplying quantity by unit price)

For convenience, you can use Excel’s formula functions to automatically calculate totals for each line.

Step 3: Calculate Subtotal, Taxes, and Total

Once all items have been listed, calculate the subtotal by summing the extended totals. Next, add any applicable taxes or discounts based on your region or business rules. Use Excel’s formula functions for tax calculations, or apply a discount percentage if needed. Finally, sum up the final amount due to ensure the calculations are correct.

Step 4: Specify Payment Terms

At the bottom of the document, include details on payment terms, such as:

- Due date

- Accepted payment methods (e.g., bank transfer, PayPal)

Common Mistakes in Commercial Invoices When creating billing documents for clients, small errors can lead to confusion, delayed payments, and even legal issues. Despite the simplicity of the task, many businesses overlook crucial details or make mistakes that affect the accuracy of the document. Understanding the most common pitfalls in preparing these records can help ensure that your business communications are clear, professional, and free of costly errors.

Here are some of the most frequent mistakes made when creating billing records, along with tips on how to avoid them:

Missing or Incorrect Contact Information

- Incorrect Client Details: Failing to include the correct name, address, or contact information for the client can cause delays or confusion.

- Omitted Business Information: Not listing your own business name, contact details, and tax identification number may make the document look unprofessional.

Inaccurate or Incomplete Product/Service Descriptions

- Vague Descriptions: Avoid generic terms like “items” or “services.” Be specific about what was provided to the client, including quantities, models, or service types.

- Missing Details: Not listing all the items or services provided, or omitting critical details like unit prices, can create confusion about the final amount due.

Calculation Errors

- Wrong Totals: Simple math mistakes, such as incorrect addition or multiplication, can lead to billing discrepancies.

- Omitted Taxes or Fees: Failing to include applicable taxes or shipping charges can result in undercharging, while forgetting discounts or promotions could lead to overcharging.

Unclear Payment Terms

- Missing Due Dates: Not specifying when the payment is due can create confusion and lead to delayed payments.

- Unclear Payment Methods: Failing to provide clear instructions on how the client should pay (e.g., bank account details, PayPal) can cause unnecessary delays.

Failure to Include Unique Invoice Number

- No Unique Identifier: Without a unique reference number, keeping track of multiple billing records becomes challenging, especially for future reference or audits.

- Sequential Numbering Issues: Skipping invoice numbers or reusing the same one for different transactions can lead to confusion when searching for past documents.

By being mindful of these common mistakes and taking the time to double-check your details, you can avoid confusion and ensure that your billing process runs smoothly and professionally.

Essential Fields in an Invoice Template

To ensure that your billing documents are clear, accurate, and professional, it’s important to include several key elements. These fields not only help your clients understand the transaction but also protect your business by ensuring that all necessary details are recorded for future reference. A well-structured document should contain basic information about the transaction, as well as specific details about the goods or services provided, payment terms, and any additional charges or discounts.

Below are the essential fields that should be included in any billing document, ensuring that you cover all the necessary aspects of a transaction:

Basic Contact and Transaction Information

- Sender and Recipient Details: Include the name, address, and contact information of both your business and the client. This ensures clear communication and helps avoid any delivery issues.

- Document Date: The date when the billing document is created, which helps track the timing of the transaction.

- Unique Reference Number: A unique identifier for the document, which makes it easier to track and reference in the future.

Product or Service Details

- Description of Items: A detailed list of the products or services provided, including quantities, specifications, and any relevant product codes or serial numbers.

- Unit Price: The price for each individual product or service unit, which helps the client understand the cost breakdown.

- Total Price per Item: Calculated by multiplying the unit price by the quantity, providing a clear cost for each line item.

Payment Information

- Subtotal: The sum of all items before applying taxes, fees, or discounts.

- Tax and Discounts: Any applicable taxes and discounts should be clearly shown to avoid confusion and ensure transparency.

- Total Amount Due: The final amount owed after adding taxes and applying discounts, providing the client with a clear picture of the total payment required.

- Payment Terms: Indicate the due date for payment, as well as any late fees or penalties for delayed payments.

By including these essential fields, you ensure that your billing documents are thorough, easy to understand, and legally sound, helping to establish professionalism and transparency in your business transactions.

How to Add Taxes and Discounts

Adding taxes and discounts to your billing documents is a crucial step to ensure accuracy and compliance with local laws. Calculating these amounts properly can prevent confusion and ensure that your client understands the final cost of the transaction. Whether you are applying a sales tax or offering a special discount, it’s important to present these adjustments clearly on the document, so the client knows exactly what they are paying for.

Here’s how to add taxes and discounts to your financial records in a clear and accurate manner:

Step 1: Calculate Taxes

To apply tax, you need to know the tax rate applicable to the items or services being sold. Tax rates vary depending on location and the type of goods or services involved. Follow these steps:

- Determine the applicable tax rate based on your region or the client’s location.

- Multiply the subtotal (the sum of all items before tax) by the tax rate to find the amount of tax due. For example, if your subtotal is $100 and the tax rate is 10%, the tax amount will be $10.

- Add the tax amount to the subtotal to get the total amount due.

For clarity, list the tax separately on the document to ensure transparency with your client.

Step 2: Apply Discounts

Discounts are often offered as a percentage of the total amount or as a fixed amount. To apply a discount correctly:

- Determine the discount percentage or amount. For example, a 15% discount on a $200 order would be $30.

- If using a percentage discount, multiply the subtotal by the discount rate (e.g., $200 x 15% = $30). If it’s a fixed amount, simply subtract that amount from the subtotal.

- Subtract the discount from the subtotal to get the discounted total.

Like taxes, it’s important to clearly show the discount amount on the document, so the client knows the original price, the discount applied, and the new total.

By following these steps, you can accurately apply taxes and discounts to your billing documents, ensuring both compliance and transparency for your clients.

Saving and Sharing Your Invoice Template

Once you’ve created your billing document, it’s important to know how to save and share it efficiently. Properly saving your file ensures that your data remains intact and easy to access when you need it. Additionally, sharing it with clients or colleagues in the right format guarantees smooth communication and prompt payments. Knowing how to handle the file in a way that preserves formatting and content is key to maintaining professionalism.

Here’s how you can save and share your billing document to make sure everything goes smoothly:

Step 1: Save Your Document

- Choose the Right Format: When saving your file, choose a format that will preserve its structure and make it easy to open on different devices. Common options include:

- Excel format (.xlsx): Ideal if you plan to make future edits or track multiple records in one file.

- PDF format (.pdf): Best for sharing the final version of your document, as it preserves the layout and prevents accidental changes.

- Name the File Clearly: Use a descriptive and consistent naming convention, such as “Invoice_ClientName_Date” to easily locate and track each document.

- Organize Your Files: Keep all your billing documents organized in clearly labeled folders, making it easier to access past transactions when necessary.

Step 2: Share Your Document

- Email: The most common way to share billing records. When emailing, attach the file in PDF format for easy viewing. Always include a clear subject line and a brief message with the attachment.

- Cloud Storage: If you work with a team, store your files in cloud services like Google Drive, OneDrive, or Dropbox for easy access and sharing.

- Client Portals: For businesses with a larger client base, using a client portal or billing software allows secure sharing of documents directly with clients.

Step 3: Keep a Backup

- Regular Backups: Ensure that you have regular backups of your billing documents, especially if they contain

Automating Invoice Calculations in Excel

Manually calculating totals, taxes, and discounts for each transaction can be time-consuming and prone to errors. However, Excel’s built-in functions offer powerful tools to automate these calculations, saving you time and reducing the risk of mistakes. By setting up formulas and using features like cell references, you can easily calculate subtotals, apply taxes, and determine final amounts due without needing to do the math by hand.

Here’s how you can automate calculations in your billing documents using Excel:

Step 1: Setting Up Basic Formulas

Start by organizing your document with the necessary columns for quantities, unit prices, and totals. Once the basic structure is in place, you can apply simple formulas to automate calculations:

- Calculating Item Total: Use the multiplication formula to calculate the total for each item by multiplying the quantity by the unit price. For example, if the quantity is in cell B2 and the unit price is in C2, the formula in the “Total” column (D2) would be:

=B2*C2. - Summing Subtotals: Use the

SUMfunction to add up the totals from each item. For example, if the totals are in cells D2 to D10, the formula would be:=SUM(D2:D10).

Step 2: Applying Taxes Automatically

To automate tax calculations, you can set up a formula that multiplies the subtotal by the applicable tax rate:

- Tax Calculation: If your subtotal is in cell D11 and the tax rate is in cell D12 (e.g., 10%), you can use the formula:

=D11*D12to calculate the tax amount. - Adding Taxes to Subtotal: To calculate the total due after taxes, simply add the tax amount to the subtotal using the formula:

=D11+D13, where D13 is the cell containing the calculated tax.

Step 3: Automating Discounts

If you offer discounts, you can use a similar approach to automate the discount process. If you apply a percentage discount, here’s how to calculate it:

- Calculating Discount: If the subtotal is in D11 and the discount percentage is in D14 (e.g., 15%), use the formula:

=D11*D14to calculate the discount amount. - Applying Discount to Subtotal: Subtract the discount from the subtotal to find the new total due. Use the formula:

=D11-D15, where D15 is the discount amount.

Step 4: Finalizing with Automatic Totals

Once you have set up your formulas for item totals,

Top Tips for Efficient Invoice Management

Managing financial documents efficiently is key to maintaining a smooth business operation. With proper organization, you can ensure timely payments, reduce errors, and keep your records in order. Streamlining your process not only saves time but also improves cash flow and minimizes the risk of overlooking important transactions. Here are some essential tips to help you stay organized and manage your billing documents more effectively.

1. Stay Organized with a Consistent Naming System

- Use Descriptive Names: Name your files systematically by including the client’s name, the date, and the document type. For example, “ClientName_Invoice_2024-11-06” makes it easier to find and track documents.

- Organize by Folders: Create a folder structure for each client or project to store related billing records together, which will make retrieval quicker when needed.

2. Automate Repetitive Tasks

- Set Up Recurring Entries: For clients with regular payments, use automated functions in your spreadsheet software to create recurring entries that only need minor adjustments each time.

- Use Pre-built Forms: Save time by using pre-designed forms that only require you to input specific information like amounts, dates, and item descriptions.

3. Track Payment Status

- Monitor Due Dates: Keep track of payment due dates and send reminders before the due date to encourage timely payments.

- Mark Paid Transactions: When payments are received, immediately mark the documents as “Paid” or “Settled” to avoid confusion later.

4. Keep Clear and Detailed Records

- Itemized Details: Always break down the charges clearly, including quantities, prices, and any taxes or discounts applied. This makes it easier for both you and your clients to understand the charges.

- Include Terms: Ensure that your terms and conditions, such as payment methods, discounts, and late fees, are always included in your document to avoid disputes.

5. Backup Your Documents Regularly

- Cloud Storage: Store your financial records in the cloud to ensure that they are safe and accessible from anywhere.

- Backup Locally: In addition to cloud storage, maintain a local back

How to Convert XLS to PDF for Clients

When preparing financial documents to send to clients, it’s often necessary to convert your working file into a more universally accessible format, such as PDF. This ensures that your document maintains its formatting and can be easily opened by clients regardless of the software they use. Converting to PDF not only preserves the layout but also prevents unwanted modifications, ensuring that the information stays intact.

Here’s a step-by-step guide on how to convert your working file to PDF format for easy sharing with clients:

Step 1: Preparing the Document

Before converting your document, make sure it’s complete and formatted correctly. This includes reviewing the layout, adjusting column widths, and ensuring all necessary data is included.

- Check Alignment: Ensure that all columns, rows, and text are properly aligned to enhance readability.

- Adjust Page Breaks: If the document is too large, use manual page breaks to ensure it prints neatly across multiple pages.

- Review Content: Double-check for any errors or incomplete entries that might need correction before converting.

Step 2: Converting the Document

Once your document is ready, follow these steps to convert it into a PDF format:

- Using Excel: Open your file in Excel, and then navigate to the “File” menu.

- Select “Save As”: In the drop-down menu, choose the location where you want to save the PDF file.

- Choose PDF Format: From the “Save as type” dropdown, select PDF.

- Set Options: Before saving, click on “Options” to choose whether you want to convert the entire workbook or just the active sheet.

- Click “Save”: After confirming your settings, click “Save” to generate the PDF file.

Step 3: Reviewing the PDF

Once your document has been converted, it’s important to open the PDF and review it to ensure the layout and formatting were preserved correctly. Make sure:

- Page Breaks: Check that content isn’t cut off or misplaced due to page breaks.

- Text Visibility: Ensure all text and numbers are legible and properly formatted.

- Accuracy: Double-check that all financial data and client details are accurate.

Once satisfied, the PDF is ready to be shared with your client via email or through a secure file-sharing platform.

By following these steps, you can easily convert your working files into a professional PDF format that’s ready for distribution. This ensures that your clients receive a clear, easily accessible version of your document, helping to streamline communication and maintain a professional image.

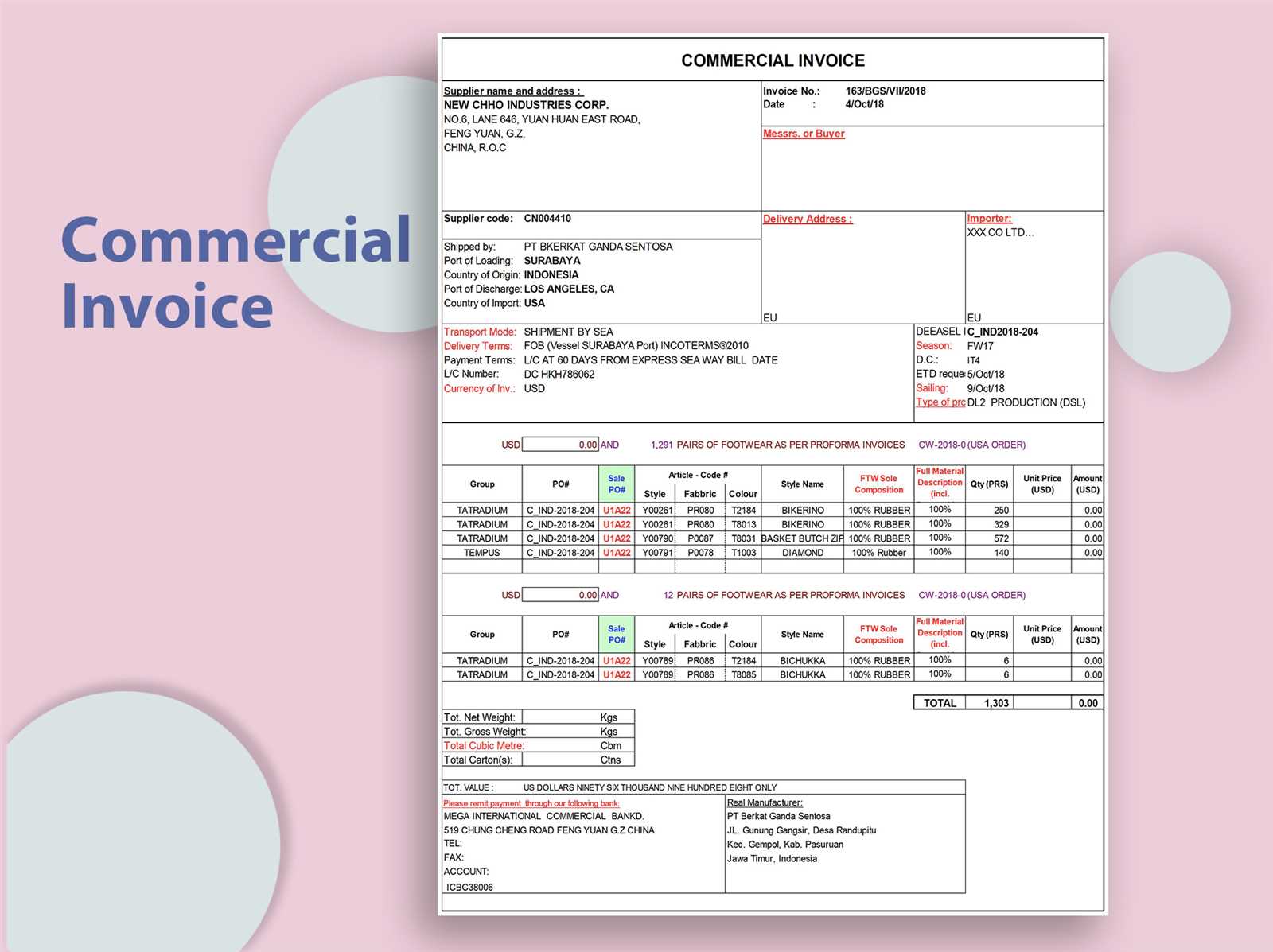

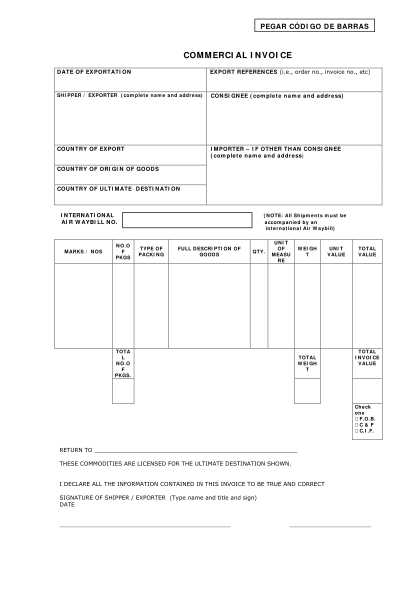

Legal Requirements for Commercial Invoices

When preparing official billing documents for international transactions, it’s essential to comply with local and international regulations. A well-structured document not only ensures smooth business operations but also helps avoid legal issues, such as customs disputes or delayed payments. The legal requirements can vary depending on the country, type of transaction, and goods or services involved, but there are several common elements that should always be included to meet legal standards.

Key Information to Include

To ensure your financial documents are legally compliant, make sure to include the following essential details:

- Full Names and Addresses: The full names, addresses, and contact details of both the seller and the buyer should be clearly stated. This includes the legal business name of both parties.

- Description of Goods or Services: A detailed description of the items or services being provided is crucial. This helps prevent confusion and ensures transparency in case of a dispute.

- Unique Document Number: Each billing document should have a unique reference number for identification purposes. This number helps track transactions and is necessary for record-keeping and auditing.

- Date of Issue: The date on which the document is issued should be listed to establish the payment timeline and avoid confusion.

- Payment Terms: Clearly outline the payment terms, including due dates, penalties for late payments, and accepted methods of payment. This is important for both parties to understand their obligations.

- Tax Identification Numbers: In some countries, it’s necessary to include both the seller’s and buyer’s tax ID numbers, particularly in international transactions, for tax compliance purposes.

- Currency and Amount: Specify the currency in which payment is expected, along with the total amount due, including any taxes, discounts, or additional fees.

Additional Considerations for International Transactions

When conducting cross-border transactions, there are additional legal requirements to consider:

- Customs Declaration: For international shipments, a declaration of the goods’ value and origin is often required. This is especially important for customs clearance.

- Harmonized System Code: In some regions, the goods or services being sold may require a harmonized system (HS) code, which is used by customs authorities to classify products.

- Compile Client Information: Make sure all the necessary details are readily available for each client, such as contact details, product or service purchased, and agreed-upon pricing.

- Standardize Payment Terms: Ensure that payment terms (e.g., due dates, discounts, late fees) are consistent or can be applied universally across all bills.

- Insert Client-Specific Data: For bulk billing, automation tools allow you to merge client details directly into the document, eliminating the need for manual entry for each customer.

- Apply Custom Fields: Use fields for dynamic data, such as discounts, taxes, or multiple line items that might vary depending on the client’s order.

How to Use Invoice Templates for Bulk Billing

When managing multiple transactions or clients, sending individual billing statements can quickly become a time-consuming task. Using pre-designed billing formats can significantly streamline the process, especially when dealing with large volumes. Bulk billing allows businesses to create and send multiple documents at once, saving time and reducing the likelihood of errors. By customizing the format and automating certain tasks, you can efficiently generate invoices for many clients without losing accuracy or professionalism.

Step 1: Preparing Data for Bulk Billing

Before you can generate multiple statements, ensure that all client information is correctly compiled. This includes the names, addresses, itemized lists of services or products, payment terms, and amounts due. If you already have this data stored in a database or a spreadsheet, you can easily import it into your billing software or format for mass processing.

Step 2: Customizing the Billing Format

Using an appropriate format is essential for making sure all documents are clear, professional, and legally compliant. Most software allows you to easily create or adjust formats, including adding logos, payment instructions, and terms that apply to all customers. Customizing a base template ensures uniformity and reduces the time spent adjusting each bill individually.

Step 3: Generating Multiple Documents

Once your format is ready and the necessary information has been inserted, the next step is to generate all the documents at once. With the right tools, you can produce all your billing documents in a matter of minutes. If you’re using

- Calculating Item Total: Use the multiplication formula to calculate the total for each item by multiplying the quantity by the unit price. For example, if the quantity is in cell B2 and the unit price is in C2, the formula in the “Total” column (D2) would be: