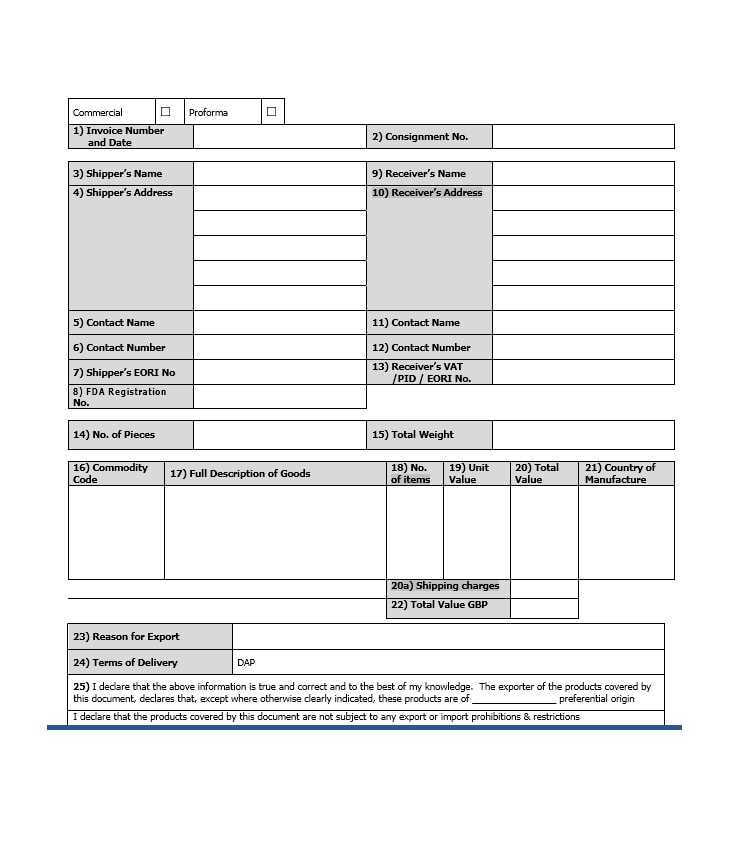

Commercial Invoice Template for Shipping Easy Download and Customization

When goods are exchanged across borders, proper documentation is crucial to ensure smooth transactions and compliance with customs regulations. This important document serves as a record of the sale, listing the goods being transferred, their value, and the terms of the agreement. It not only acts as proof of transaction but also helps in calculating duties and taxes for imports and exports.

Having a well-structured form to record these details is essential for businesses engaged in global trade. A standardized format streamlines the process, reducing the risk of errors and delays. With the right format, companies can save time and avoid complications in the customs clearance process, ensuring their shipments reach the destination without unnecessary setbacks.

Whether you’re a small business or a large enterprise, using the right format can simplify the documentation process, minimize mistakes, and ensure that all necessary information is provided clearly and accurately. By understanding the key elements of this form, you can enhance your operational efficiency and stay compliant with international trade rules.

Why You Need a Commercial Invoice

When conducting business across international borders, proper documentation is essential to ensure smooth transactions and legal compliance. Without the correct paperwork, shipments can be delayed, rejected, or incur additional fees. A well-prepared document detailing the goods, their value, and the terms of the agreement is critical for both the seller and the buyer, as it provides clarity and transparency in every transaction.

Legal and Customs Requirements

Customs authorities in both the exporting and importing countries rely on this document to determine duties, taxes, and to verify the legitimacy of the goods being traded. Failure to provide accurate and complete information can result in delays, fines, or the return of the goods. Here’s why it’s important:

- Customs Clearance: The document helps customs officials assess the proper fees and taxes.

- Legal Protection: It serves as evidence of the sale and can protect both parties in case of disputes.

- International Regulations: Many countries require this paperwork to comply with international trade laws.

Operational Efficiency

Using a standardized document reduces the chances of errors and simplifies the shipping process. Whether you’re a small business or a large enterprise, efficiency is key. With a clear record of each transaction, the logistics process becomes more manageable. Some key benefits include:

- Time-Saving: A clear, pre-filled document reduces the need for revisions or follow-ups.

- Consistency: Standardized formats prevent confusion and improve the speed of processing.

- Better Tracking: Having all necessary details in one document makes it easier to track and manage goods in transit.

Key Elements of a Shipping Invoice

When preparing the necessary documentation for cross-border transactions, it is crucial to include specific details that ensure the proper processing of goods. Each section of the document serves a unique purpose, from identifying the parties involved to providing a breakdown of the goods being transferred. A comprehensive form not only facilitates smooth customs clearance but also ensures transparency and accuracy in international trade.

Required Information for Proper Documentation

While the specific layout may vary, there are a few key pieces of information that should be included in every form to prevent issues during transit or customs processing. These details ensure both buyer and seller have a clear understanding of the transaction.

| Section | Description |

|---|---|

| Sender and Recipient Details | Name, address, and contact information of both parties involved in the transaction. |

| Item Description | A clear description of each item being sold, including quantity, weight, and value. |

| Payment Terms | Information on agreed-upon payment conditions, including due dates and methods. |

| Customs Declaration | Details on customs codes and tariffs applicable to the goods. |

| Shipping Method | Details on how the goods will be delivered, including carrier and tracking numbers. |

Additional Elements for Clarity

Beyond the essential details, adding extra notes or clarifications can help avoid misunderstandings and ensure smooth processing on both ends of the transaction. This can include any specific instructions or remarks related to packaging, special handling requirements, or delivery conditions.

How to Create a Shipping Invoice Template

Creating an accurate and effective document for cross-border transactions is a key part of ensuring smooth operations. A well-structured form not only simplifies the process for both the seller and the buyer, but also helps avoid delays or complications at customs. By following a few essential steps, you can create a document that contains all the necessary information and meets legal requirements.

Step-by-Step Process

To begin, start by organizing the document into logical sections. Each part serves a specific purpose and must be easily understood. Here are the key steps to follow:

- Gather Necessary Information: Collect the details about the sender, recipient, and the goods being sold. This includes addresses, contact information, item descriptions, quantities, and values.

- Choose a Layout: Select a clear and organized layout. Most forms follow a similar structure, which includes sections for contact details, item descriptions, and payment terms.

- Include Legal Requirements: Ensure that all necessary customs and legal information is included. This may involve specific codes, tariffs, or country-specific requirements for international transactions.

- Double-Check Accuracy: Verify all the details, especially the numbers, weights, and customs declarations. Even a small mistake can cause major delays.

Tools for Creating a Document

You don’t need to be a designer or have specialized software to create an effective form. There are a number of tools that can help you build a clear and professional document:

- Word Processors: Use Microsoft Word or Google Docs to create simple documents with tables and clear headings.

- Spreadsheet Software: Excel or Google Sheets can help you create a more structured and easily editable document, especially if you’re dealing with large amounts of data.

- Online Services: There are many online platforms that offer customizable templates and forms designed for international trade.

Benefits of Using Invoice Templates

Using pre-designed forms for business transactions offers numerous advantages, especially when dealing with cross-border exchanges. These forms help standardize processes, reduce errors, and ensure that all required information is included. By utilizing ready-made structures, businesses can streamline operations and focus on other important tasks while maintaining accuracy and consistency in their documentation.

One of the primary benefits is saving time. Instead of starting from scratch with each transaction, you can quickly fill in the necessary details, which speeds up the process. Additionally, using standardized formats reduces the risk of missing crucial information, which could delay shipments or cause confusion at customs.

Another significant advantage is the ability to maintain professional consistency. A well-structured form reflects positively on a business, showing clients and partners that transactions are handled efficiently and in compliance with international standards. Whether it’s the clarity of item descriptions or the accuracy of pricing and payment terms, consistency is key to building trust and reducing the potential for disputes.

Customizing Your Commercial Invoice Template

Personalizing your transaction documentation allows you to meet both your business needs and the specific requirements of international trade. Tailoring the layout and sections ensures that every detail relevant to your particular transaction is clearly communicated. Customization not only improves efficiency but also allows you to include any special instructions, branding elements, or industry-specific information that may be necessary.

Key Customization Areas

When modifying your form, consider the following areas where you can add or adjust information to best suit your business practices:

| Section | Customization Options |

|---|---|

| Business Branding | Include your logo, company name, and contact details for consistency across all documents. |

| Item Details | Adjust the columns to match the way you categorize products, whether by SKU, type, or weight. |

| Terms and Conditions | Customize payment terms, delivery instructions, or warranties according to your agreements. |

| Legal and Compliance | Ensure that the form reflects specific customs regulations or trade restrictions that apply to your industry or destination country. |

Tools and Tips for Personalization

Most document creation tools offer customizable features, allowing you to edit pre-existing forms or build one from the ground up. Here are a few helpful tips:

- Use Spreadsheets: Programs like Excel or Google Sheets allow you to easily adjust columns, add formulas for totals, and create a consistent layout for all your transactions.

- Online Platforms: There are online services that let you drag and drop elements into your document, making customization quick and easy.

- Save as Template: Once customized, save your form as a reusable file for future transactions, ensuring consistency across all orders.

Common Mistakes in Shipping Invoices

Even with the best intentions, errors can occur when preparing documents for cross-border transactions. These mistakes not only cause delays but can also result in added fees, penalties, or complications with customs clearance. Recognizing and addressing common issues can help streamline the process and avoid unnecessary setbacks.

Frequent Errors to Avoid

Here are some of the most common mistakes businesses make when creating transactional documents:

- Missing or Incorrect Contact Information: Failing to include accurate details for both the sender and recipient, such as addresses or phone numbers, can cause delays in delivery or confusion with customs.

- Incorrect Item Descriptions: Vague or incomplete descriptions of the goods, including missing weights, dimensions, or quantities, can lead to complications during customs clearance or result in the wrong duties being applied.

- Omitting Customs Details: Not providing the correct harmonized codes, tax numbers, or declarations for imports can trigger customs rejections or delays at the border.

- Inconsistent Pricing: Discrepancies between the agreed-upon price and the one listed on the document can lead to payment disputes or customs issues. Always double-check unit prices and totals.

- Missing Signatures or Authorization: Some jurisdictions may require the sender’s or recipient’s signature or other forms of authorization, which are often overlooked.

- Not Including Terms of Sale: Failing to specify payment terms, delivery conditions, or return policies can lead to misunderstandings between both parties involved in the transaction.

How to Avoid These Mistakes

To reduce the risk of errors, take the following steps:

- Double-Check All Information: Before submitting any document, review the data to ensure that it matches the actual transaction and that all required fields are filled out correctly.

- Use Automated Systems: Consider using automated solutions that help reduce human error by pre-filling information based on previous records or templates.

- Seek Professional Guidance: When dealing with international regulations, consult with experts to ensure all legal and compliance requirements are met.

- Keep Updated on Regulations: Stay informed of any changes in international trade laws or customs rules that may affect how you prepare and submit your documents.

What Information Should Be Included

When preparing a document for international transactions, it’s essential to provide all the necessary details to ensure clarity and compliance. Each piece of information serves a specific purpose, helping customs authorities, shipping carriers, and both parties involved in the transaction understand the terms of the deal. By including all required elements, you can avoid confusion, delays, and potential legal issues.

Essential Details to Include

The following key sections should always be included in any form related to cross-border sales:

- Sender and Recipient Information: Include full names, addresses, and contact details for both the seller and the buyer. This ensures that there are no mistakes in the delivery process.

- Description of Goods: Clearly list each item, including quantity, weight, dimensions, and a detailed description. This is critical for customs classification and valuation.

- Value of Goods: The value of the items being traded, including unit prices and total value, must be clearly stated to calculate duties and taxes correctly.

- Payment Terms: Specify whether payment is made upfront, on delivery, or through other agreed-upon methods. Be sure to include payment due dates and any applicable discounts or fees.

- Customs Codes and Declarations: Provide accurate HS codes (Harmonized System codes) for each item, which will help determine import duties and ensure proper classification at customs.

- Delivery Instructions: Clearly state the terms of delivery, such as the agreed-upon shipping method, delivery location, and any special handling instructions.

- Signatures: Many countries require signatures from both parties to confirm the authenticity of the transaction and the details provided in the document.

Additional Information to Consider

Depending on the nature of the transaction or the destination country, you may need to include additional details, such as:

- Insurance Information: If the goods are insured, include policy numbers and coverage details.

- Shipment Tracking Numbers: Provide tracking numbers or other reference IDs that can help both parties monitor the movement of the goods.

- Terms of Sale or Return Policies: Clearly outline return instructions or policies regarding defective or unsatisfactory goods.

Understanding Incoterms in Invoices

Incoterms, or International Commercial Terms, play a vital role in global trade, as they define the responsibilities of buyers and sellers in relation to the delivery of goods. These terms clarify important aspects such as who is responsible for shipping costs, customs duties, insurance, and the risk of loss during transport. Properly including Incoterms in your documents ensures that both parties understand their obligations and helps avoid misunderstandings or disputes.

How Incoterms Affect Transaction Documentation

When preparing forms for international trade, it’s essential to specify the agreed-upon Incoterm. Including the correct term in your document will ensure that both you and your trading partner are aligned on who is responsible for what during the shipping process. These terms are often abbreviated, so it is important to understand their full meaning and implications.

- EXW (Ex Works): The seller makes the goods available at their premises, and the buyer assumes all costs and risks associated with transportation.

- FOB (Free On Board): The seller is responsible for delivery up to the point the goods are loaded onto the transport vessel, while the buyer assumes responsibility from that point onward.

- CIF (Cost, Insurance, and Freight): The seller covers shipping costs and insurance up to the destination port, while the buyer assumes responsibility once the goods arrive at the destination port.

- DDP (Delivered Duty Paid): The seller assumes full responsibility for shipping, including costs, customs duties, and delivery to the final destination.

Why Incoterms Are Crucial for Both Parties

Including Incoterms in your form helps prevent confusion regarding payment obligations, insurance, and delivery risks. It provides a clear and standardized understanding between parties, reducing the likelihood of disputes and ensuring that each party knows when the transfer of responsibility occurs. By specifying the correct Incoterm, you protect both your business interests and those of your trading partner.

How to Avoid Invoice Errors

Creating accurate documentation for international transactions is essential to ensure timely delivery and smooth customs clearance. Errors in your forms can lead to delays, fines, and confusion between parties involved in the transaction. Avoiding these mistakes requires attention to detail, a clear understanding of the information required, and proper verification before submission.

Steps to Minimize Errors

Follow these best practices to ensure that your documents are accurate and complete:

- Double-Check All Data: Ensure that all information, such as names, addresses, item descriptions, and quantities, is correct. Even a small mistake can cause significant delays in processing.

- Verify Payment Terms: Clearly outline payment methods, due dates, and any applicable fees. Misunderstandings about payment terms can lead to disputes and delays.

- Accurate Item Descriptions: Provide detailed descriptions for each product, including correct weights, quantities, and harmonized codes. This will help with both customs clearance and calculating the correct duties and taxes.

- Stay Consistent with Units of Measure: Make sure that all measurements (weight, dimensions, volume) are expressed using the appropriate units recognized by the destination country.

- Include Correct Customs Information: Always include the right classification codes (HS codes) and tariff details. Missing or incorrect codes can result in customs delays or the wrong duties being applied.

Additional Tips for Accuracy

To further reduce the risk of errors, consider the following:

- Use Software Tools: Many accounting and documentation software solutions offer features to help automatically calculate totals, check data consistency, and ensure all necessary fields are filled out.

- Set Internal Review Processes: Have another team member review the document before finalizing it. A second set of eyes can often catch errors that might have been overlooked.

- Stay Informed on Regulations: International trade rules and customs regulations can change frequently. Stay updated on these changes to ensure that your documentation is always compliant.

Commercial Invoice for International Shipments

When engaging in cross-border transactions, it’s crucial to provide the right documentation to ensure the smooth movement of goods across borders. A detailed and accurate document not only serves as a record of the transaction but also helps to navigate customs clearance processes efficiently. Whether you’re sending products to another country for sale or personal use, this document must include critical details that meet international trade regulations.

Why This Document is Essential

This document serves multiple purposes in international transactions. First, it acts as a receipt of purchase, confirming that a transaction has occurred between two parties. Second, it provides the necessary details for customs authorities to assess the goods for import duties and taxes. Including the correct information ensures that the goods are processed swiftly and helps avoid delays at the customs checkpoint.

Key Details to Include

The following table outlines the essential information that should be included in this document for international shipments:

| Section | Description |

|---|---|

| Sender and Recipient Information | Complete names, addresses, and contact details of both the seller and the buyer. |

| Goods Description | Detailed descriptions of the items being sent, including the quantity, weight, dimensions, and material composition if applicable. |

| Value of Goods | The price of each item along with the total value of the shipment. This helps customs calculate the appropriate duties. |

| Payment Terms | Details of how and when payment will be made, such as payment on delivery, before shipment, or via other methods. |

| Customs Information | Harmonized codes, customs tariffs, and any relevant regulatory information required by the destination country. |

| Shipping Method | The chosen carrier and the expected shipping method, whether by air, sea, or land transport. |

| Insurance and Risk | Details on whether the goods are insured during transit, and which party is responsible for insurance and risk. |

How to Print and Send Shipping Invoices

Once the necessary documentation is complete, it is important to ensure it is printed and sent properly. Accurate handling of this step guarantees that all parties involved have the required records for reference and that the goods move smoothly through the customs and delivery process. Whether you’re sending documents electronically or by traditional mail, the method of transmission should be both secure and efficient to avoid delays.

Steps for Printing the Document

Before printing, make sure all information is reviewed for accuracy. Once confirmed, follow these steps:

| Step | Description |

|---|---|

| 1. Check Document Format | Ensure the document is formatted correctly, with clear headers, tables, and easy-to-read sections. |

| 2. Use High-Quality Paper | Print on durable paper to ensure that the document remains intact throughout its journey, especially if it’s being mailed. |

| 3. Ensure Printer Settings Are Correct | Choose the appropriate printer settings to ensure the printout is of high quality, particularly when printing details like item descriptions and pricing. |

| 4. Print Multiple Copies | Print at least two copies – one for the recipient and one for your records. Consider additional copies for customs or other stakeholders if required. |

How to Send the Document

Once printed, the next step is to send the document to the appropriate party. You can choose between electronic submission or physical delivery, depending on the requirements and the parties involved.

- Electronic Submission: If the recipient prefers digital documents, scan the printed document and send it via email or through an online portal. Make sure the document is clear and legible after scanning, and keep a backup copy of the file.

- Postal Service: For physical shipments, mail the printed document using a reliable courier or postal service. Consider using tracking services to ensure the document reaches the destination securely and on time.

- Include Documents with the Shipment: When the goods are being sent, include a printed copy of the document in the package or attach it to the outer packaging, especially if it’s required by customs authorities.

Digital vs Paper Commercial Invoices

When managing international transactions, one key decision businesses face is whether to use digital or physical documentation for their transactions. Both methods have their advantages and disadvantages depending on the nature of the transaction, the parties involved, and the requirements of the destination country. Understanding the differences between these two formats can help you choose the best option for your business needs.

Advantages of Digital Documentation

Digital documents have become increasingly popular in recent years due to their efficiency and ease of use. Here are some reasons why many businesses prefer electronic formats:

- Faster Processing: Digital documents can be sent instantly via email or online portals, speeding up the overall process compared to traditional mail.

- Cost-Effective: Sending digital files eliminates postage costs, as well as the expense of printing materials.

- Easy Storage and Access: Storing digital copies is much more convenient than physical records. They take up no physical space and can be easily retrieved when needed.

- Environmental Benefits: Using digital files reduces paper waste and the overall environmental footprint of your business operations.

Advantages of Paper Documentation

While digital documents are becoming more common, there are still situations where physical copies are preferred or required. Here are some reasons why paper records remain important:

- Legal Requirements: In some countries, authorities may require physical documentation to process certain transactions, particularly for customs clearance.

- Traditional Business Practices: Some clients or business partners may prefer physical documents, especially if they are not familiar with digital systems.

- Security and Authentication: Physical copies can be more secure in certain situations, as they cannot be easily altered or hacked like digital documents.

- Reliability in Case of Technology Failures: If there are issues with email systems or internet connectivity, paper copies can serve as a backup to ensure business continuity.

Making the Right Choice

The decision to use digital or paper documentation depends largely on the specific needs of your business and the preferences of your clients or partners. Here are some factors to consider:

- Regulatory Requirements: Always check the legal and regulatory requirements of the destination country, as some customs authorities may mandate paper documentation for imports or exports.

- Business Partner Preferences: Understand the preferences of your clients or suppliers. If they require paper copies for their records, it may be necessary to provide them.

- Cost and Efficiency: Consider the cost of printing, postage, and handling when choosing the physical option. If speed and cost-efficiency are priorities, digital might be the best choice.

How to Track Payment with Invoices

Monitoring payments is crucial for maintaining healthy cash flow in any business. The right documentation not only serves as proof of transaction but also helps track the status of payments and identify outstanding amounts. Ensuring that payment tracking is done effectively will help avoid overdue balances and prevent potential misunderstandings with clients.

Key Elements to Include for Payment Tracking

When creating the necessary documents for transactions, it’s important to include specific details that will allow you to easily track payments. Here’s a list of the key elements to include:

- Payment Due Date: Clearly state when the payment is expected to be made. This helps both parties understand the timeframe and avoid any confusion.

- Payment Method: Specify the method of payment (e.g., bank transfer, credit card, PayPal) to avoid any ambiguity and ensure a smooth transaction process.

- Unique Identifier: Include a unique number or reference code for each transaction. This will make it easy to track the payment associated with that specific document.

- Amount Due: Clearly display the total amount that is expected to be paid, including any applicable taxes, shipping costs, or fees. This ensures that both parties agree on the amount.

- Outstanding Balance: If partial payments have been made, always include an outstanding balance section, so both parties can quickly see what remains to be paid.

- Late Fees (if applicable): Outline any late payment penalties or fees to encourage timely payment and prevent delays.

Methods of Tracking Payments

Tracking payments can be done manually or using automated systems. Here are some approaches to consider:

- Manual Tracking: You can keep a record of payments in a spreadsheet or ledger. This method requires you to enter each payment detail manually and track balances, but it’s often effective for smaller businesses with fewer transactions.

- Accounting Software: Many accounting tools offer automatic tracking features. These tools can generate payment reminders, update outstanding balances in real time, and even sync with bank accounts to show when payments have been received.

- Online Payment Platforms: If you’re using an online payment system like PayPal or Stripe, these platforms offer built-in payment tracking features. They can help you monitor transactions and automatically update payment statuses.

Legal Requirements for Commercial Invoices

When conducting international trade, proper documentation is essential not only for ensuring smooth transactions but also for complying with various legal regulations. Accurate and complete records help businesses meet the legal requirements of both the exporting and importing countries. Failing to include the correct details can lead to delays, fines, or even the seizure of goods by customs authorities.

Essential Legal Information to Include

The following details are typically required by law to ensure compliance with international trade regulations:

- Accurate Descriptions of Goods: Customs authorities need a clear description of the items being sold, including their nature, quantity, and value. This helps in determining the appropriate duties and taxes.

- Proper Classification Codes: Include the Harmonized System (HS) code for each product. This standardized code helps customs classify goods and apply the correct tariffs and taxes.

- Origin of Goods: Indicating the country of origin for each item is necessary for customs clearance and to avoid anti-dumping or countervailing duties.

- Clear Payment Terms: Stating when and how payment will be made ensures that both parties are aligned and helps with the customs clearance process.

- Exporter and Importer Information: Provide the full name, address, and contact details of both the exporter and the importer. This is essential for tracking the goods and resolving any issues that arise during customs processing.

- Value of the Shipment: Include the total value of the goods being sold. This is critical for assessing any taxes, customs fees, and duties the buyer may need to pay upon arrival.

Country-Specific Legal Considerations

Different countries have varying requirements for documentation. Below are some country-specific factors to consider:

- European Union: In the EU, exporters must follow specific value-added tax (VAT) regulations and include VAT registration numbers for both the seller and buyer in certain cases.

- United States: U.S. Customs requires accurate descriptions, correct HS codes, and a declared value for all goods entering the country. In some cases, an export declaration may also be required.

- China: The Chinese government requires both the commercial documentation and a packing list for customs clearance. Detailed descriptions, along with product codes and values, are essential.

- India: India requires a declaration from the exporter about the origin of goods, along with an official certificate when applicable, to confirm compliance with Indian regulations.

How to Simplify Shipping Documentation

Managing documentation for international transactions can be complex and time-consuming, but streamlining this process can significantly reduce errors, delays, and operational costs. By organizing your records and implementing efficient practices, you can ensure smoother processing of goods across borders while meeting all necessary requirements. Here are some ways to make the documentation process more efficient and less burdensome.

Key Steps to Streamline Documentation

Following a few basic steps can help simplify and speed up the preparation of necessary paperwork:

- Use Digital Tools: Leverage software or online platforms that automatically generate and manage documents. This can significantly reduce the time spent on manual data entry and reduce errors.

- Standardize Your Documents: Create standard forms or checklists for every transaction. By having a consistent format, you’ll save time while reducing the risk of forgetting key details.

- Integrate Your Systems: Use integrated accounting and logistics software that can automatically pull data from your inventory system. This reduces redundancy and ensures accurate information across all documents.

- Pre-fill Regular Information: For recurring transactions, pre-fill information that doesn’t change, such as business addresses, payment terms, and product descriptions. This will save time and reduce the likelihood of errors.

- Prepare Documents in Advance: Have all documentation ready ahead of time, especially if you’re anticipating shipments. This can prevent last-minute stress and help avoid missed deadlines.

Tips for Efficient Document Submission

Once the documents are prepared, submitting them can also be made more efficient with these tips:

- Use Electronic Submission: Whenever possible, submit documents through digital means, such as email or online portals. This allows for quicker delivery and easier tracking.

- Utilize Tracking Systems: Implement a document tracking system that allows you to monitor the status of all shipments and their associated paperwork, ensuring you’re always aware of what has been submitted or needs attention.

- Automate Reminders: Set up automated reminders for key deadlines (e.g., payment due dates, document submissions). This will help avoid delays and ensure you meet all necessary requirements in a timely manner.