Free Commercial Invoice Template Excel for Easy Customization and Use

For any business, clear and accurate billing is essential for smooth financial transactions. Whether you’re a freelancer, small business owner, or large company, having a streamlined system for creating and managing payment requests can save time and reduce errors. A well-designed billing document not only outlines the cost of goods or services provided but also ensures a professional appearance when dealing with clients and partners.

Many businesses turn to digital tools to automate and simplify this process. With the right format, creating detailed financial records becomes quick and easy. Templates offer a pre-designed structure that can be personalized to meet specific needs, making it easier to track sales, calculate totals, and manage payment schedules. By utilizing such formats, businesses can ensure consistency and accuracy across all transactions.

In this guide, we will explore the key aspects of using a widely adopted format for billing documents, helping you understand how to customize, track, and optimize your billing practices. From calculating taxes to managing multiple requests, the right structure can make a significant difference in the overall efficiency of your business operations.

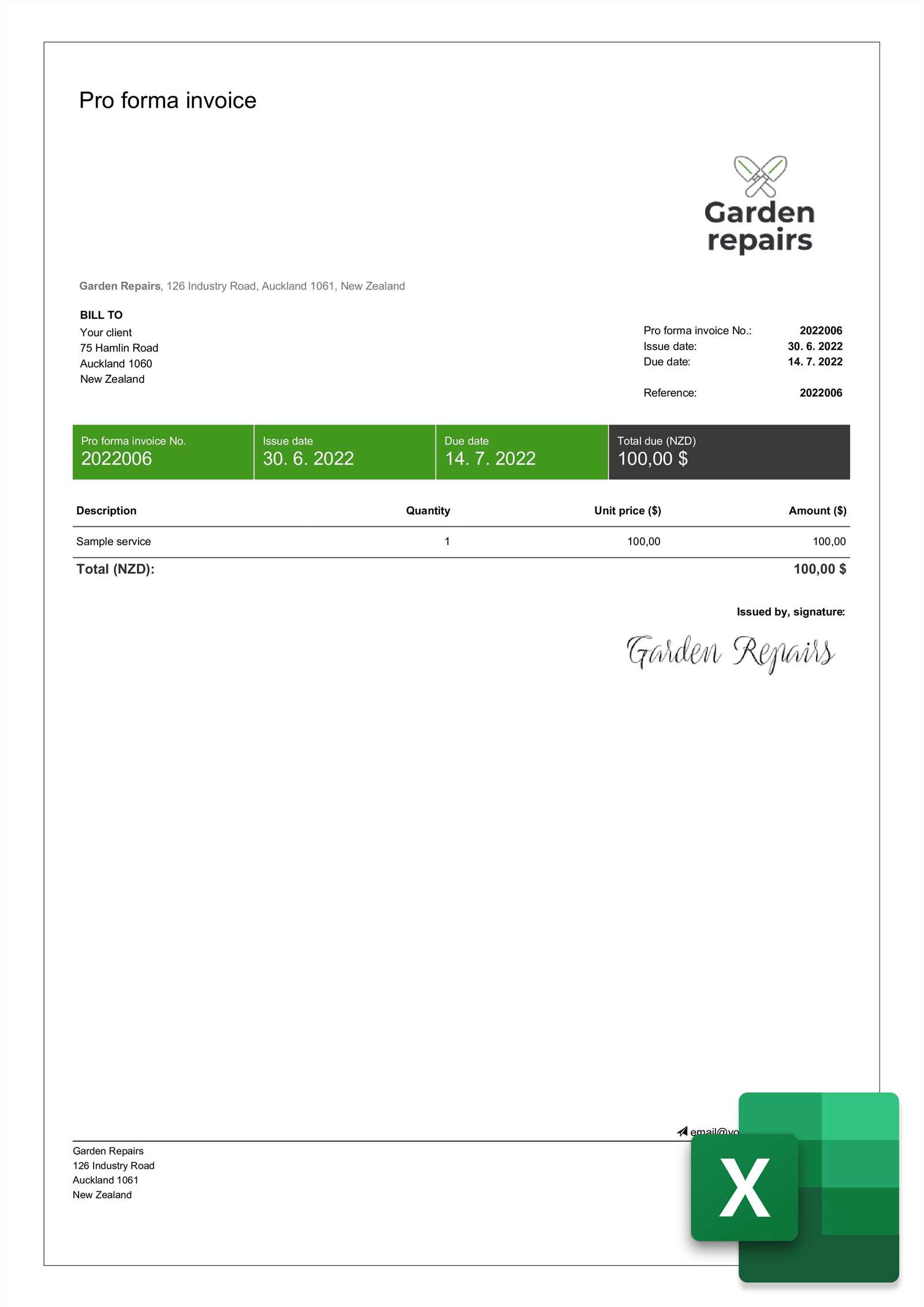

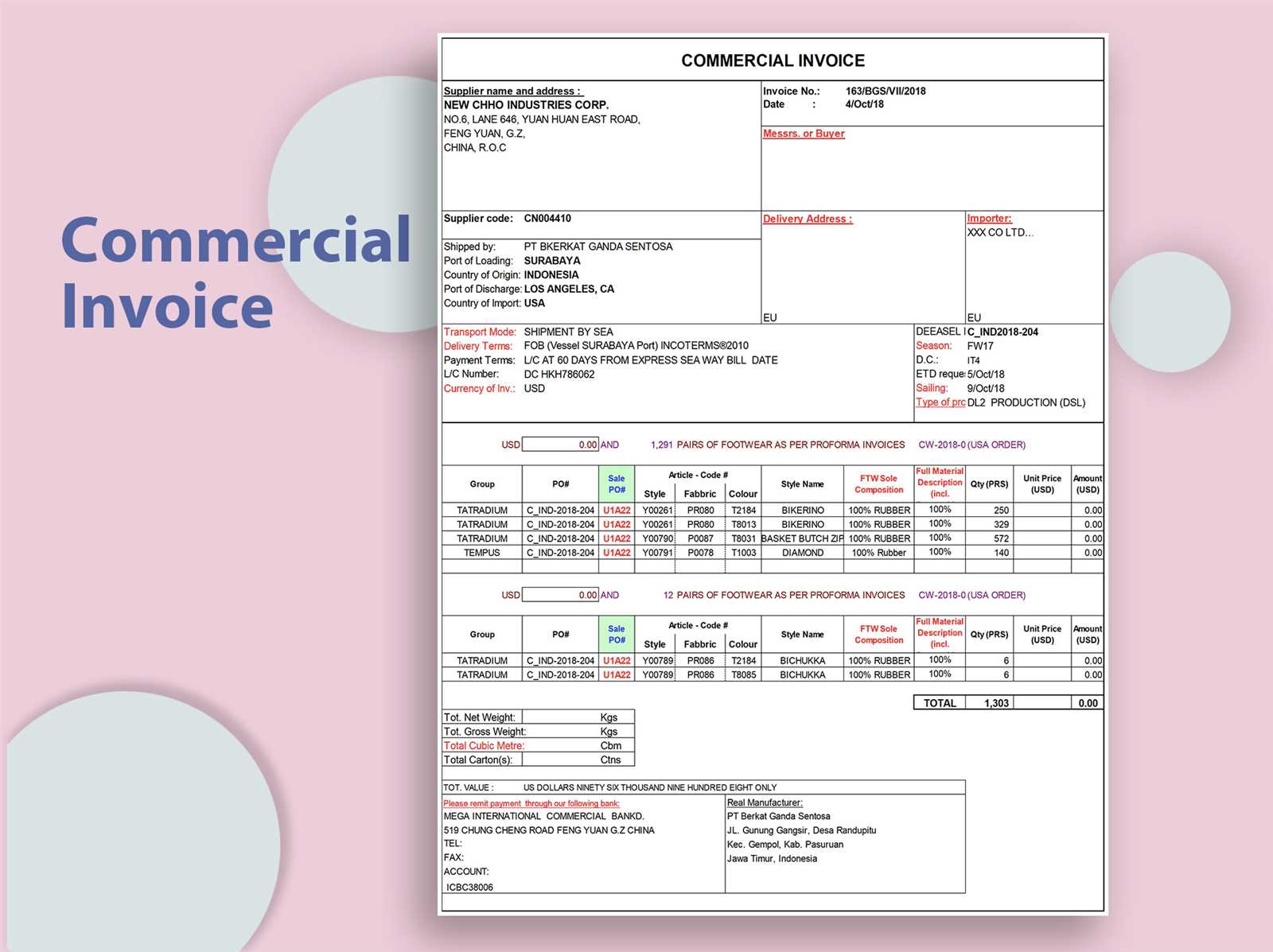

Commercial Invoice Template Excel Overview

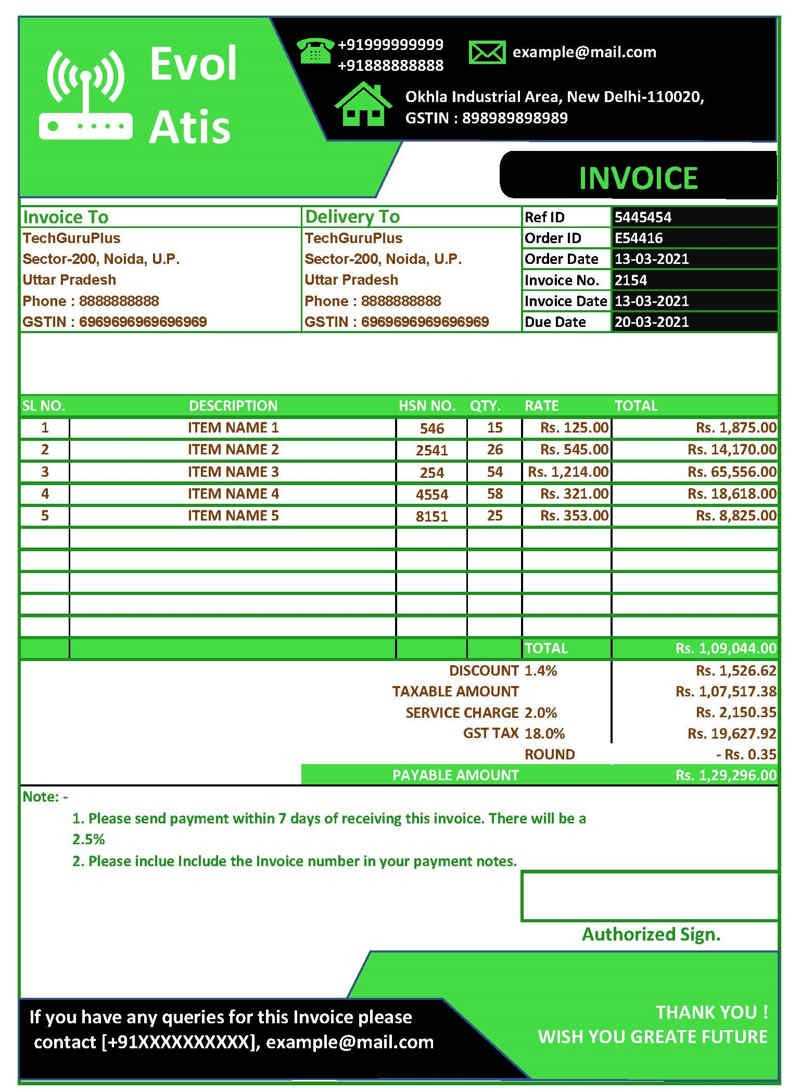

A well-structured billing document is vital for businesses to ensure clear communication with clients and smooth financial operations. It serves as a formal record that outlines the products or services provided, the payment due, and essential details that help both parties keep track of the transaction. Using a standardized structure simplifies this process, reduces errors, and saves valuable time for business owners and their teams.

This document is typically designed to automatically calculate totals, apply taxes, and ensure that all necessary details are included in one easy-to-read format. It is ideal for businesses of all sizes and helps maintain a professional appearance when sending payment requests to clients. The ability to customize it based on specific business needs further enhances its usefulness.

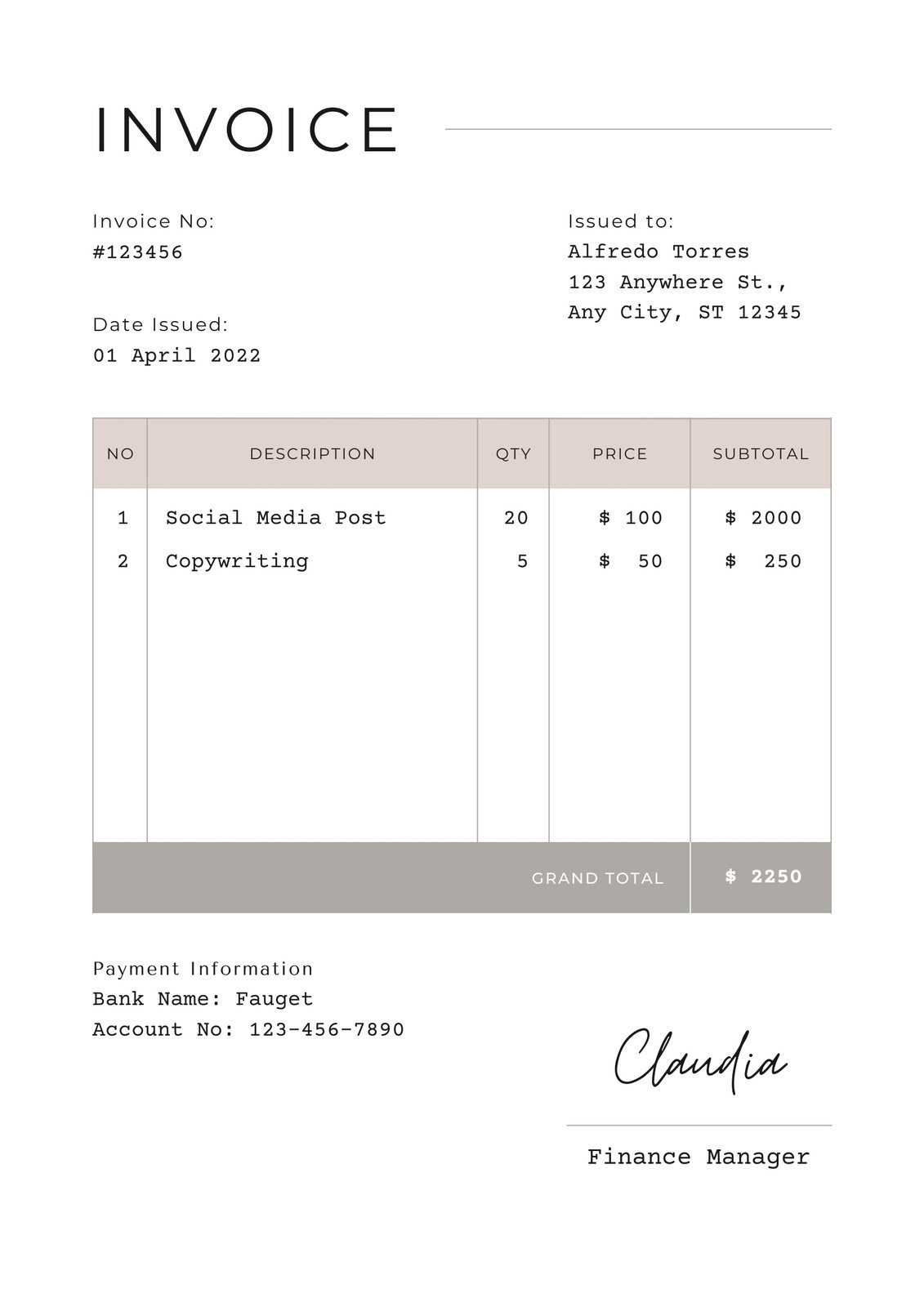

Below is a basic overview of the key elements included in a typical structure used for financial transactions:

| Section | Description |

|---|---|

| Business Information | Includes company name, address, contact details, and tax information. |

| Client Details | Contains the client’s name, address, and contact info for invoicing purposes. |

| Itemized List | A breakdown of products or services, including quantities, unit prices, and totals. |

| Subtotal | The total amount before taxes, discounts, or other adjustments. |

| Tax and Fees | Calculations for applicable taxes or additional charges based on the region or transaction type. |

| Total Amount Due | The final amount that the client is required to pay. |

| Payment Terms | Details about payment deadlines, methods, and any penalties for late payments. |

By leveraging a pre-designed structure, businesses can quickly generate accurate billing documents, ensuring that all necessary components are included and calculations are correct. This format is not only time-efficient but also helps maintain consistency and professionalism in every transaction.

Why Use Excel for Invoices

When managing payment requests, having a flexible and efficient system is essential. A versatile software solution that allows businesses to create, track, and organize these documents can significantly streamline the billing process. By using a widely available and powerful tool, companies can ensure accuracy while saving time and effort on each transaction.

One of the main reasons to choose this tool is its ability to handle complex calculations automatically. It allows businesses to create formulas for calculating totals, taxes, and discounts, reducing human error and ensuring consistency across all transactions. Additionally, it provides a customizable structure that can be adjusted to suit the specific needs of any company.

- Flexibility: It can be easily tailored to fit various business models, whether for small-scale transactions or large-scale operations.

- Automation: Built-in formulas help with automatic calculations for totals, taxes, and discounts, saving valuable time.

- Familiarity: Many businesses already use the software for other tasks, making it a convenient choice without the need for new software or learning curves.

- Cost-Effective: The software is often included with office productivity suites or available at a low cost, making it an affordable option for small and large businesses alike.

- Data Management: Businesses can easily manage and store payment records, ensuring that past transactions are always accessible when needed.

- Customization: Users can modify fields, add branding elements, or adjust formats to reflect their business style and requirements.

Incorporating this solution into your billing practices can not only enhance productivity but also improve organization and accuracy across the board. By offering a simple yet effective way to manage financial documentation, businesses can focus more on growth and less on administrative tasks.

Benefits of Using Templates for Invoicing

Creating payment requests from scratch can be time-consuming and prone to errors, especially when managing multiple transactions. Using a pre-designed structure for billing documents offers numerous advantages that help businesses save time, maintain consistency, and reduce mistakes. By adopting ready-made formats, companies can streamline the entire billing process and focus more on core activities.

Time Savings and Efficiency

One of the primary benefits of using a pre-built structure is the significant amount of time saved. Instead of starting each document from scratch, businesses can quickly fill in the necessary details, such as client information, product descriptions, and pricing. This streamlined process reduces administrative effort and allows teams to focus on other important tasks.

Consistency and Accuracy

Templates ensure that every document follows the same structure and includes all necessary components. This consistency not only helps maintain a professional appearance but also minimizes the chance of missing important information, such as taxes, payment terms, or delivery details. Moreover, automated calculations built into many formats help ensure that totals and other financial details are accurate every time.

By using ready-to-go formats, businesses can quickly adapt to new projects or clients without compromising quality. This consistency also builds trust with clients, who can easily navigate the billing process and rely on accurate, well-organized documents for each transaction.

How to Download an Invoice Template

Getting started with a standardized billing document is simple, and downloading a pre-made structure is an easy way to save time and effort. Many platforms offer free or paid options that can be customized to suit your specific needs. The process of finding and downloading a suitable document is straightforward and can be done in just a few steps.

Follow these steps to download a suitable format for your business:

- Choose a trusted source: Look for reputable websites or platforms that offer high-quality, customizable formats. Many business resource websites provide free options that are easy to use.

- Filter by features: Identify the features you need, such as the ability to calculate totals, include tax rates, or track payments. Make sure the format supports your requirements.

- Preview the format: Before downloading, preview the design to ensure it includes all necessary sections and fits your business needs.

- Download the file: Once you’ve selected the right one, click the download button and save the document to your computer. Most formats are available in common file types such as .xlsx or .csv.

- Customize it: After downloading, open the document and add your business information, logo, payment terms, and other specifics to personalize it for your clients.

By following these steps, you can quickly access a professional and functional structure to enhance your business transactions. It’s an easy way to get started with accurate, organized billing without the need for creating documents from scratch.

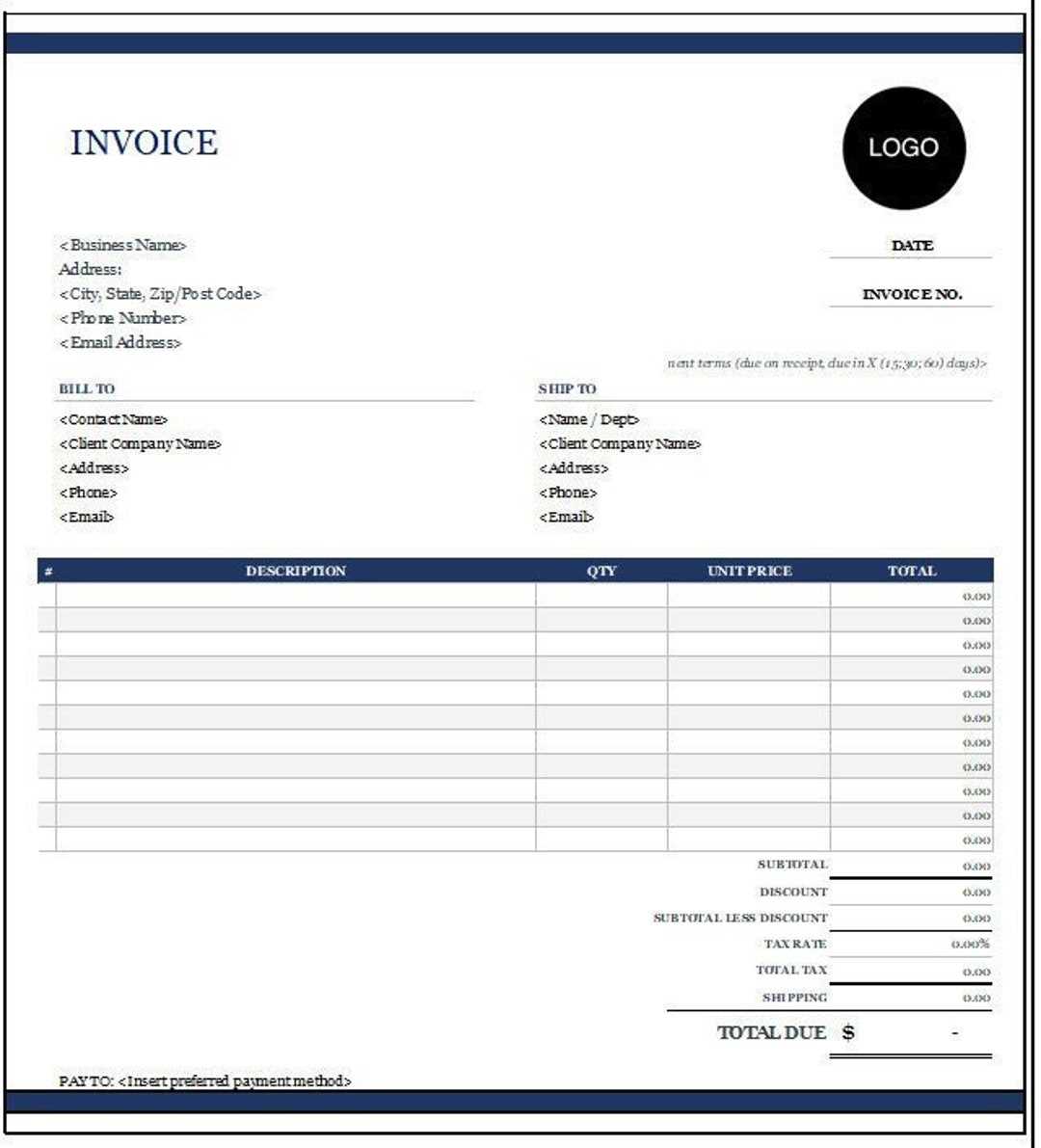

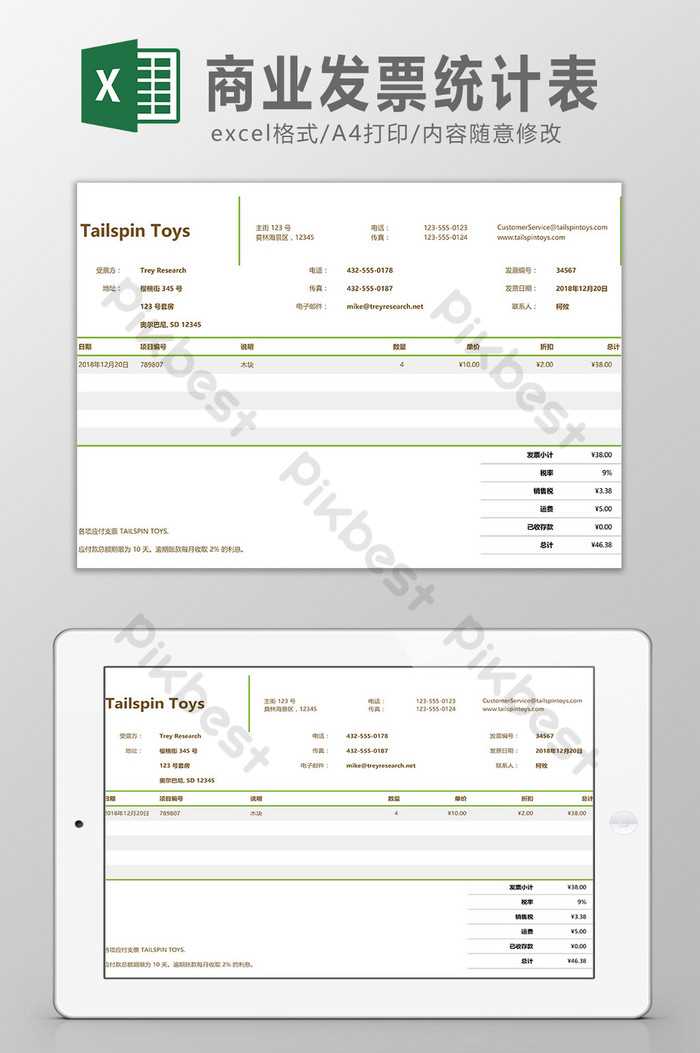

Customizing Your Excel Invoice Template

Once you’ve downloaded a pre-designed structure for billing documents, it’s important to tailor it to your business needs. Personalizing the document ensures it reflects your brand, includes all necessary information, and aligns with your specific billing requirements. Customizing the format can be done quickly using simple tools available in most spreadsheet software.

Here are the key steps to customize your billing document:

- Update Business Details: Add your company name, address, phone number, email, and tax identification number. These details are essential for clients to recognize your business and contact you if needed.

- Insert Your Logo: Including your company logo at the top of the document gives it a professional look and reinforces your brand identity. This can usually be done by inserting an image into the header section.

- Adjust Formatting: Modify the layout to match your preferences, such as font size, color scheme, or cell borders. This helps make the document visually appealing and easier for clients to read.

- Add Payment Terms: Clearly state your payment terms, including due dates, acceptable payment methods, and any penalties for late payments. This ensures clients understand the expectations and timeline for settlement.

- Modify Itemized Sections: Depending on your business, you may need to adjust the fields for the products or services you offer. Add columns for descriptions, quantities, unit prices, and discounts if applicable.

- Include Tax Information: If taxes are applicable, set up formulas to automatically calculate the tax based on your local rates. You can easily input tax percentages into the structure to streamline this process.

Customizing your billing format is not only about making it look professional but also about ensuring it meets your specific business needs. By adjusting these elements, you create a seamless process that saves time and helps maintain accuracy in every transaction.

Key Elements of a Billing Document

When creating a payment request document, it’s important to ensure that all necessary details are included to avoid confusion and ensure smooth transactions. A well-structured record should contain specific information that both the sender and recipient can easily understand. This ensures that the client knows exactly what they are being charged for, the total amount due, and the payment terms.

Essential Information

The core elements of any billing document include essential details about the transaction. These details ensure both parties are clear about the terms and that the document is legally binding. The following are the key sections that should always be present:

- Business Information: The document should start with the seller’s company details, including the company name, address, contact information, and tax ID. This information helps identify the seller and establish the legitimacy of the transaction.

- Client Information: The buyer’s contact information should also be listed, including the name, address, and email. This ensures the document reaches the correct party and that they can be contacted in case of any issues.

- Unique Reference Number: Each document should have a unique number or identifier. This helps keep track of individual transactions and allows for easier record-keeping.

Financial Details

To avoid any ambiguity, the document should clearly list the goods or services provided, the quantities, unit prices, and applicable discounts. Additionally, financial information such as taxes, fees, and the total amount due must be displayed in a clear and logical manner.

- Itemized List: A detailed breakdown of each item or service being billed, including quantities, unit prices, and descriptions. This ensures the client knows exactly what they are being charged for.

- Subtotals and Totals: The subtotal should list the total cost before taxes or fees, followed by any additional charges. The final amount due should be clearly displayed, taking into account any adjustments or discounts.

- Payment Terms: Clearly state the payment deadline, methods of payment, and any late fees that might apply. This helps establish clear expectations between both parties.

By including these essential elements, you ensure that the payment document

How to Add Tax Information in Excel

Including tax information in your billing documents is crucial for ensuring that the final amount is accurate and legally compliant. Calculating taxes manually can be time-consuming and prone to error, but with the right formulas and structure, this task can be automated. Most spreadsheet software allows you to easily add tax rates, calculate totals, and display this information clearly in your documents.

Here’s how you can efficiently add tax details to your billing record:

- Step 1: Add a Tax Column – In the section where you list items or services, add a new column specifically for tax. Label it clearly so it’s obvious what the value represents.

- Step 2: Input Tax Rate – Enter the applicable tax rate in a separate cell. This could be a fixed percentage (e.g., 10%) or vary depending on the region or product type. Ensure the rate is easily adjustable in case of future changes.

- Step 3: Apply Formula for Tax Calculation – Use a formula to multiply the item price by the tax rate. For example, if your item price is in cell B2 and the tax rate is in cell C1, the formula in the tax column might look like this: =B2*$C$1. This will automatically calculate the tax for each item based on the price.

- Step 4: Total Tax Calculation – At the bottom of the tax column, use a SUM function to add up all individual tax amounts. This will give you the total tax for the transaction.

- Step 5: Display Final Amount Due – Add another section that sums up the item prices and taxes to show the total amount due. For example, you can use a formula like =SUM(B2:B10) for the subtotal and =SUM(D2:D10) for the tax, and then combine them in the total section.

By following these steps, you can ensure that tax calculations are accurate and automatically updated as you make changes to the prices or tax rates. This not only saves time but also minimizes the risk of errors, providing you and your clients with a seamless and professional billing experience.

Managing Multiple Invoices in Excel

When handling several transactions at once, organizing billing documents effectively is key to staying on top of payments and maintaining an accurate record. Managing multiple requests in a single file or across several sheets allows businesses to keep everything in one place while minimizing the risk of confusion. Using a structured approach ensures that all relevant details are easy to find and update, saving time and preventing errors.

Using Multiple Sheets for Organization

One effective way to manage several requests is by using separate sheets within a single file for each client or transaction. This method makes it easy to keep related information grouped together and allows you to access each record individually without the need for multiple files. Each sheet can have the same structure, making it easy to compare records and track outstanding payments.

- Create a New Sheet for Each Client: Label each sheet with the client’s name or the month of the transaction to make it easy to locate.

- Uniform Structure Across Sheets: Ensure all sheets follow the same layout for consistency. This makes it easier to spot discrepancies and track payments across all transactions.

- Linking Sheets: You can link specific cells between sheets, such as a summary page that pulls total amounts or payment status from all individual client sheets.

Tracking Payments and Due Dates

It’s crucial to track which transactions are still pending and which have been paid. Excel offers a variety of tools to automate this process, allowing you to easily monitor payment status and manage deadlines.

- Use Conditional Formatting: Highlight overdue payments or transactions marked as “paid” with different colors to quickly identify the status of each one.

- Set Up Payment Reminders: Utilize date-based functions to automatically alert you when a payment is due or overdue. This ensures that no payment slips through the cracks.

- Summary Dashboard: Create a dashboard that pulls key data from each sheet, such as totals, due amounts, and payment statuses, allowing you to quickly assess the overall financial status.

By organizing and tracking several transactions in this way, businesses can efficiently manage their billing process, ensuring that everything is up to date and under control. This approach minimizes the risk of losing track of payments and helps maintain a professional, organized record of all financial interactions.

How to Save and Share Excel Invoices

Once your billing documents are created and customized, saving and sharing them efficiently is essential for maintaining smooth transactions with clients. Whether you’re sending a single request or managing multiple files, knowing how to store and distribute these documents properly ensures professionalism and keeps your financial records organized.

Saving Your Billing Documents

It’s important to save your completed documents in a format that makes them easy to access and share. Most spreadsheet programs allow you to save files in a variety of formats, each offering different advantages depending on how you plan to use them.

- Saving in Excel Format: If you plan to make future edits or need to track changes, saving your document in the native spreadsheet format (.xlsx) is ideal. This format allows you to retain all formulas, calculations, and formatting intact.

- Saving as PDF: For a more polished and professional look, saving your document as a PDF (.pdf) is often preferred when sharing with clients. PDF files are non-editable, ensuring that the document remains unchanged during transit.

- Organizing Files: Keep your saved documents organized by creating specific folders on your computer or cloud storage. You can categorize them by client name, date, or transaction type to make future retrieval easier.

Sharing Billing Documents

Once saved, it’s time to share your billing documents with clients or colleagues. There are several efficient methods for distributing these files, depending on your preferences and the needs of your clients.

- Email: One of the most common methods is attaching the saved file to an email. Ensure the file is clearly named (e.g., “Invoice_123_ClientName.pdf”) to avoid confusion and make it easy for clients to identify.

- Cloud Storage: For clients who prefer not to receive attachments, using cloud storage services like Google Drive, Dropbox, or OneDrive can be a great option. You can upload the file to your cloud account and share a link, ensuring easy access without cluttering inboxes.

- File Sharing Tools: If you manage multiple clients or transactions, consider using dedicated file-sharing platforms. These tools offer secure storage and allow clients to access

Common Mistakes When Using Invoice Templates

While using pre-designed structures for billing documents can save time, there are several common mistakes that can compromise the accuracy and professionalism of the final product. These errors, often overlooked in the rush to complete tasks, can lead to confusion, missed payments, or strained business relationships. Being aware of these pitfalls and taking steps to avoid them can improve the quality of your billing process and ensure smooth transactions with clients.

- Missing or Incorrect Client Information: One of the most frequent mistakes is failing to include or incorrectly entering the client’s contact details. Always double-check that the name, address, and contact information are accurate to avoid sending the document to the wrong party or causing delays in communication.

- Inconsistent Formatting: Consistency is key in any business document. Using different fonts, sizes, or layout styles within a single document can make it appear unprofessional. Stick to a clean and uniform design that is easy to read and visually appealing.

- Incorrect or Missing Payment Terms: Always include clear payment terms, including the due date, acceptable payment methods, and any late fees. Omitting this information can lead to misunderstandings about when and how payment should be made.

- Failure to Update Tax Rates: Another common error is forgetting to update tax rates. Depending on your location or industry, tax rates can change, and failing to adjust them in the document can lead to incorrect charges and potential legal issues.

- Overlooking Discounts or Promotions: If you offer discounts or special offers, ensure these are correctly reflected in the final total. Leaving out or miscalculating discounts can create confusion for the client and impact your credibility.

- Not Using Formulas for Calculations: Some users may manually enter totals, taxes, and discounts, which increases the likelihood of human error. Utilizing built-in formulas can automate these calculations, ensuring accuracy and reducing the risk of mistakes.

- Leaving Out a Unique Document Number: A unique reference number for each document helps track and organize transactions efficiently. Failing to include this nu

How to Automate Invoice Creation in Excel

Creating billing documents manually can be time-consuming, especially when dealing with multiple transactions. Automating the process not only saves time but also reduces the risk of human error. By setting up certain functions and formulas in your spreadsheet software, you can streamline the creation of these records, making the process faster and more efficient.

Setting Up Automated Calculations

The first step in automating the creation of billing documents is to set up formulas that automatically calculate totals, taxes, and discounts. This eliminates the need to manually perform calculations every time you create a new record.

- Automatic Item Totals: For each product or service listed, use a formula to multiply the quantity by the unit price. For example, if the quantity is in column B and the unit price is in column C, use the formula =B2*C2 to calculate the total for each line item.

- Subtotal Calculation: Sum up all item totals using the SUM function. For example, =SUM(D2:D10) will add up the total from rows 2 to 10, where the individual item totals are located.

- Tax Calculation: Use a simple formula to calculate taxes based on the subtotal. If the tax rate is in cell F1, for example, you can apply the formula =D11*$F$1, where D11 is the subtotal and F1 contains the tax rate.

- Total Amount: To calculate the final total, sum the subtotal and tax. Use the formula =D11+E11, where D11 is the subtotal and E11 is the calculated tax.

Using Data Validation and Dropdowns

To further simplify the process, you can use data validation tools such as dropdown lists to select products or services, which will automatically populate relevant fields. This is especially helpful for businesses that offer a fixed set of products or services.

- Creating Dropdown Menus: In Excel, you can create dropdown lists for product or service selection. Under the “Data” tab, choose “Data Validation,” then select “List” and input the options. This will allow you to easily select items, which can then auto-fill prices and descriptions in the corresponding columns.

- Using Lookup Functions: If you maintain a list of prices and descriptions elsewhere in your file, you can use the VLOOKUP function to automatically pull the relevant data. For instance, if a product code is i

Excel Formulas for Invoice Calculations

Automating calculations for billing documents is essential for improving accuracy and saving time. By using the right formulas in your spreadsheet software, you can ensure that all calculations–from item totals to taxes and discounts–are done automatically. This reduces the risk of errors and speeds up the process of preparing financial records.

Here are some of the most common formulas that can be used to calculate various components of a billing document:

Description Formula Example Item Total (Unit Price * Quantity) =B2*C2 If unit price is in B2 and quantity is in C2, the total will be calculated automatically. Subtotal (Sum of all item totals) =SUM(D2:D10) Summing up the item totals listed in column D. Tax Calculation (Subtotal * Tax Rate) =D11*$F$1 If the subtotal is in D11 and the tax rate is in F1, this formula calculates the tax amount. Total Amount (Subtotal + Tax) =D11+E11 This formula adds the subtotal (D11) and the tax (E11) to give the total amount due. Discount (Price * Discount Percentage) =B2*(1-$F$2) If the price is in B2 and the discount rate is in F2, this calculates the price after discount. By using these formulas, you can streamline your billing process. Each time you input or adjust data, the spreadsheet automatically updates all relevant totals, taxes, and final amounts without needing to perform manual calculations. This not only saves time but also reduces the chance of mistakes, making your financial documentation both efficient and reliable.

How to Include Payment Terms in Excel

Clearly defined payment terms are crucial for both the client and the business to understand when payment is due, what methods are acceptable, and any potential late fees. Including these terms in your financial documents not only provides clarity but also ensures that both parties are aligned on expectations. By incorporating payment terms directly into your document, you can easily communicate important information and avoid misunderstandings.

Adding Payment Terms to Your Document

To ensure that payment terms are visible and easily accessible, include them in a dedicated section of your document. This section should be placed at the bottom or near the totals, making it one of the final details a client reviews before processing payment.

- Payment Due Date: Specify the exact date when the payment is expected. This could be based on the date of the transaction or a set number of days from the issue date. For example, “Payment due 30 days from the issue date.”

- Accepted Payment Methods: List the types of payments you accept, such as bank transfer, credit card, or checks. Be clear about any details related to the payment method (e.g., bank account information or credit card details).

- Late Fees or Penalties: If applicable, mention any additional charges for late payments. For example, “A 5% fee will be added to the total if payment is received more than 15 days after the due date.”

Using Formulas to Track Payment Due Dates

To automate the calculation of due dates, use date functions to make it easier for both you and the client to track when payment is due.

- Formula for Due Date: If you want the payment due date to automatically calculate based on the issue date, use a formula like

=A2+30, where A2 is the cell containing the issue date. This will automatically adjust the due date to 30 days later. - Conditional Formatting for Overdue Payments: To visually track overdue payments, apply conditional formatting. For example, you can highlight the due date in red if it is more than 30 days past the current date, helping you quickly spot late payments.

By incorporating these elements, you can clearly outline payment expectations in your financial documents, reducing the risk of late payments and improving your overall cash flow management.

Tracking Payments with Excel Invoice Template

Keeping track of payments is a critical part of managing your business finances. By organizing and tracking payments effectively, you ensure that your accounts are accurate and up to date. Using spreadsheet software for this task makes it easier to monitor the status of each transaction, quickly identify unpaid amounts, and follow up on outstanding balances. With the right setup, tracking payments can become a seamless part of your workflow.

Setting Up a Payment Tracking System

To track payments efficiently, it’s essential to create a simple yet effective tracking system within your spreadsheet. This system should include details such as the date of issue, payment due date, the amount due, payment received, and any remaining balance. By including these fields, you can easily calculate the amount remaining for each client and track which invoices have been fully paid or are still pending.

- Payment Status Column: Add a column to indicate the payment status for each transaction. Use terms like “Paid,” “Pending,” or “Overdue” to categorize payments quickly.

- Payment Date: Include a column where you can enter the date when a payment was received. This helps you stay organized and allows you to track whether payments are being made on time.

- Amount Due: Keep track of the original amount due for each transaction, even after partial payments have been made. This ensures transparency and makes it easy to identify outstanding balances.

- Amount Paid: Include a column to record payments as they come in. This allows you to see how much has been paid toward each transaction.

- Remaining Balance: Use a formula to calculate the remaining balance after each payment. The formula could look something like

=C2-D2, where C2 is the original amount due and D2 is the amount paid.

Automating Payment Tracking with Formulas

To make payment tracking even more efficient, you can use formulas to automatically calculate the status of each payment and highlight overdue payments.

- Formula for Remaining Balance: As mentioned earlier, the formula

=C2-D2will subtract the amount paid from the amount due, giving you the remaining balance for each transaction. - Conditional Formatting for Overdue Payments: Apply conditional formatting to highlight overdue payments. For example, use a formula like

=TODAY()>C2to format cells in red when the payment due date has passed, ensuring overdue transactions are easily spotted. - Tracking

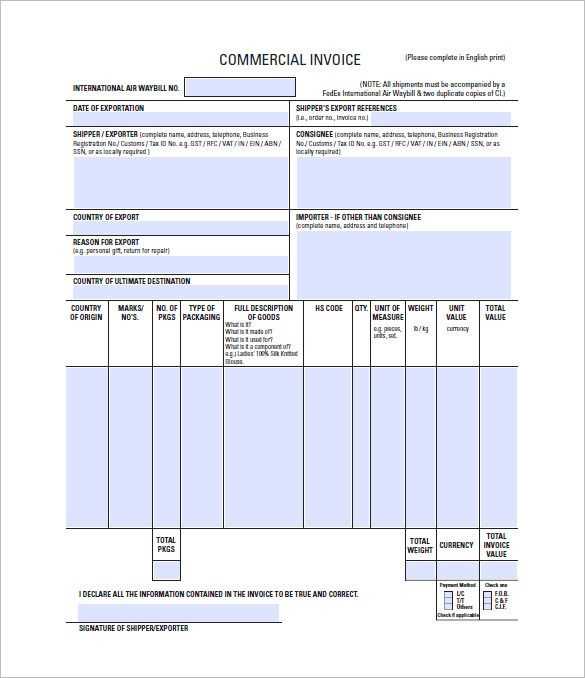

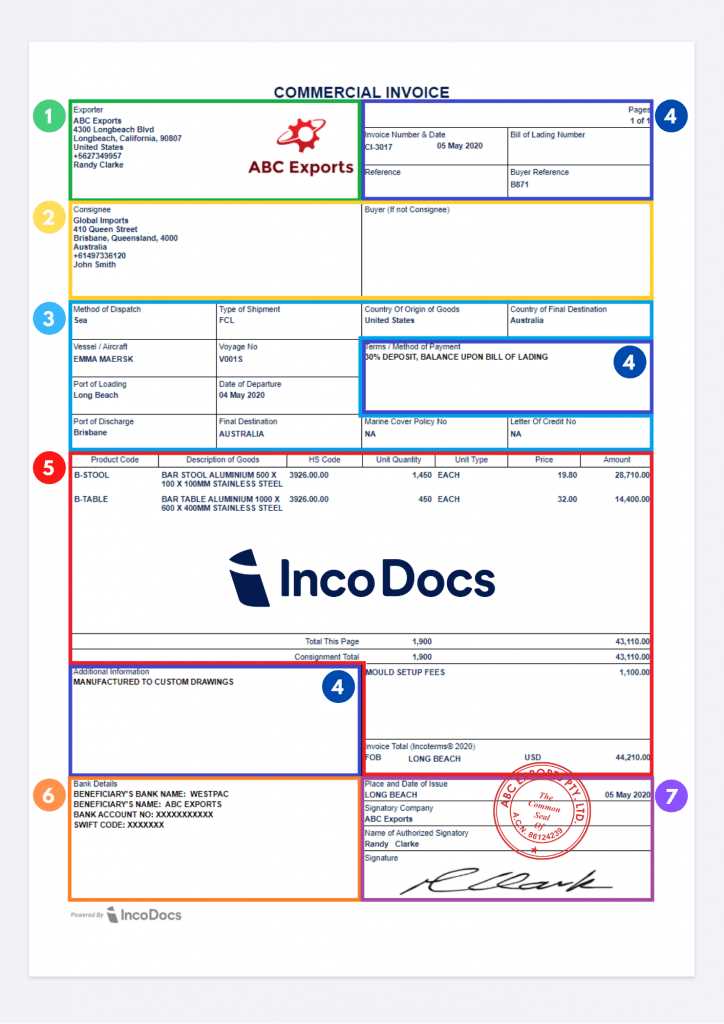

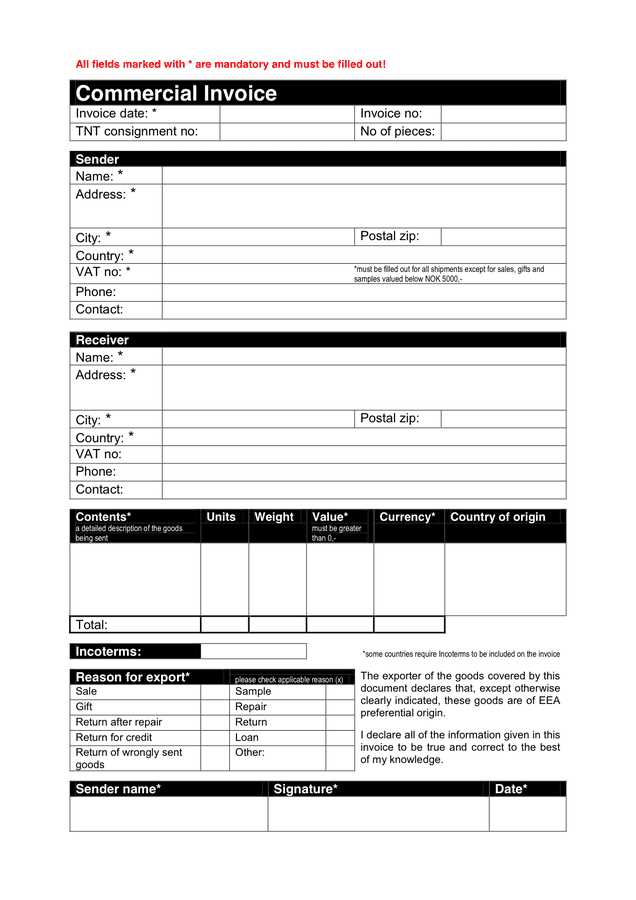

Excel Invoice Template for International Sales

When dealing with cross-border transactions, it’s essential to account for additional details that are not typically necessary for domestic sales. International sales require specific information such as currency conversion, customs duties, shipping costs, and country-specific regulations. By adapting your spreadsheet system to accommodate these elements, you can ensure that your records are clear, accurate, and compliant with international trade standards.

Key Components for International Transactions

When creating a billing document for international sales, you need to include fields and formulas that can handle global nuances. These may include the country of origin, currency details, shipping methods, and taxes specific to the destination country.

- Currency Conversion: For international transactions, you must indicate the currency in which the sale is being conducted. Add a column to specify the currency (e.g., USD, EUR, GBP) and another to track the exchange rate applied to convert the amount into your local currency. This allows for transparent currency conversions and simplifies the accounting process.

- Customs Duties and Taxes: Include a column for customs duties, taxes, and other import/export fees that are applicable in the buyer’s country. You may need to research the applicable rates for the specific country to ensure accuracy.

- Shipping Costs: Shipping charges often vary based on the destination. Include a field for shipping costs, or even better, automate it by including the cost based on the destination country, weight, and other factors using lookup functions.

- HS Code: In some cases, especially for goods that are regulated, it is necessary to include a Harmonized System (HS) code for the products being sold. This code helps customs authorities classify goods for tax purposes and ensures smooth customs clearance.

Handling International Sales with Formulas

To streamline international transactions, you can use formulas that help automate calculations related to currency exchange, taxes, and shipping fees. This helps you avoid manual errors and ensures that all costs are correctly applied in each billing document.

- Currency Conversion Formula: If your sale is in a foreign currency, use a formula like

=B2*C2, where B2 is the sale amount in foreign currency and C2 is the exchange rate. This will convert the amount into your local currency automatically. - Customs Duties Calculation: Use the formula

=B3*D2, where B3 is the product price and D2 is the duty rate, to automatica

Ensuring Compliance with Invoice Standards

Adhering to legal and industry standards when creating billing documents is essential for maintaining trust with clients and avoiding potential legal issues. Compliance ensures that your documents meet regulatory requirements, prevent disputes, and provide the necessary information for taxation, audits, and other business needs. Understanding the key components and following best practices will help you create accurate, standardized records that are both professional and legally sound.

Key Elements for Compliance

To ensure your billing documents are compliant, it is important to include all the necessary information that is required by local laws, international trade agreements, or industry standards. Here are some essential elements to include:

- Legal Business Information: Include your full company name, business registration number, address, and contact details. This not only adds credibility but also ensures that your business is properly identified for taxation or legal purposes.

- Client Details: Always include the client’s name, address, and contact information. If applicable, include their business registration number or VAT number to ensure compliance with tax regulations.

- Item Descriptions and Quantities: Clearly describe the goods or services provided, along with their quantities and unit prices. This transparency ensures that both parties are clear on what is being exchanged and helps with any audits or claims.

- Tax Information: If applicable, include the correct tax rates and amounts for the jurisdiction in which the transaction is taking place. Failure to include this information can lead to tax-related penalties or disputes.

- Payment Terms and Due Dates: Clearly specify the payment terms, such as due date, method of payment, and any late fees or penalties for overdue payments. This helps avoid payment delays and sets clear expectations for both parties.

Best Practices for Compliance

In addition to including the necessary elements, following best practices can further ensure that your billing documents meet all compliance standards:

- Consistent Formatting: Use a standardized format for all documents to ensure that all information is presented clearly and uniformly. This can help ensure that all relevant details are included, reducing the risk of missing critical information.

- Accurate Currency and Tax Calculations: Always ensure that any currency conversions, tax calculations, or shipping costs are accurate. Double-checking the figures or using formulas to automate calculations can reduce errors and improve compliance.

- Retention of Records: Keep detailed records of all billing documents for the required duration specified by local regulations. This is crucial for tax reporting, audits, and resolving any potential disputes.

- Regular Updates: Stay updated on changes in tax laws, international trade regulations, and industry standards to ensure that your documents remain compliant over time.

By following these steps and ensuring that your billing documents meet the required legal and industry standards, you help protect your business and foster trust with clients. Compliance is not just about following the law–it’s also about creating clear, transparent, and professional records that serve both your business and your clients effectively.

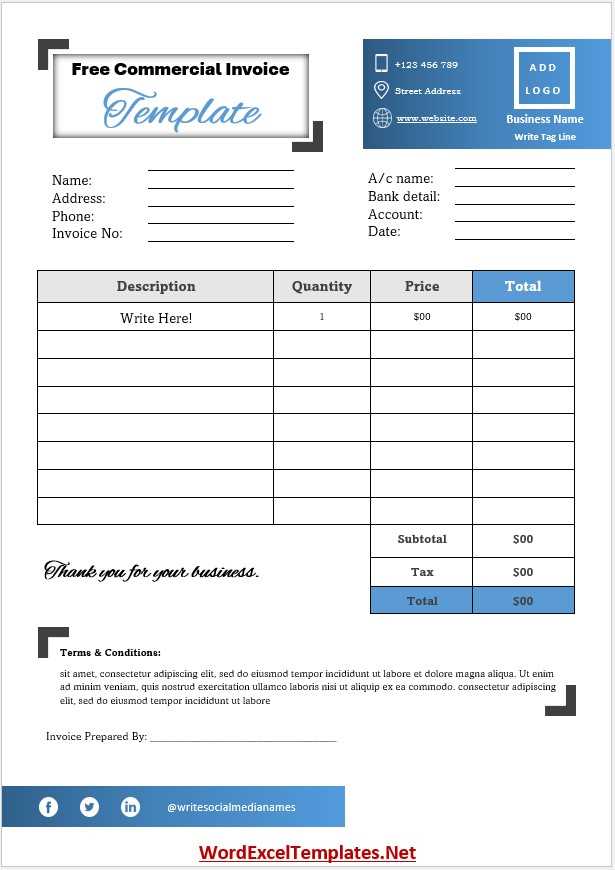

Free vs Paid Commercial Invoice Templates

When choosing a billing document layout for your business, one of the first decisions you’ll face is whether to use a free or paid version. Both options have their advantages, depending on your business needs, the complexity of your transactions, and the level of customization you require. While free options may be suitable for small businesses with straightforward needs, paid layouts often offer more advanced features, customization, and support. Understanding the differences between the two can help you decide which option best fits your requirements.

Advantages of Free Templates

Free templates are a great choice for small businesses, startups, or individuals just starting out. They offer a no-cost solution and are often easy to find and use. However, there are some limitations to keep in mind.

- Cost-Effective: The most obvious benefit of free layouts is that they come at no cost, making them an ideal option for those with limited budgets.

- Quick Setup: Most free layouts are simple to use and don’t require a lot of technical knowledge. They can be easily downloaded and customized with basic details like your business name, client information, and product details.

- Basic Features: Free options often come with the essential fields necessary for invoicing, such as item descriptions, quantities, and payment terms. This can be enough for smaller businesses with straightforward billing processes.

Advantages of Paid Templates

Paid options often come with additional features that can streamline your business processes and improve your workflow. While they require an initial investment, the extra features may justify the cost for growing or more complex businesses.

- Customization Options: Paid layouts typically offer more flexibility in terms of design and layout. You can tailor the appearance of your billing documents to align with your brand, adding logos, custom fonts, and color schemes.

- Advanced Features: Paid versions may include built-in features such as automatic tax calculation, currency conversion, and more sophisticated fields for tracking payments or including shipping costs. These features can save time and reduce manual errors.

- Professional Support: Many paid options offer customer support, ensuring that you can get help if you run into any issues or need assistance with customization or functionality.

- Compliance and Updates: Paid layouts are often more regularly updated to comply with changes in tax laws, industry standards, or new software updates. This ensures that your documents are always legally compliant and up-to-date.

Choosing between a free and paid option depends largely on your business’s specific needs. If you’re jus

Tips for Organizing Your Invoices in Excel

Efficiently managing your financial documents is crucial for maintaining smooth business operations, especially when handling multiple transactions. By organizing your records in a structured manner, you can quickly access important details, track payments, and generate reports without unnecessary stress. Using spreadsheet software offers flexibility, but without proper organization, even the best tools can become overwhelming. Here are some tips to help you keep your financial records well-organized and easy to navigate.

1. Use Separate Sheets for Different Categories

One of the most effective ways to stay organized is to separate your records by categories. For example, create different sheets for sales, payments, and outstanding balances. This not only helps keep information distinct but also allows for easy filtering and reporting.

- Sales Sheet: This sheet should include all the details related to sales, such as customer information, products or services sold, quantities, unit prices, and payment terms.

- Payment Tracking: This sheet can be dedicated to tracking which invoices have been paid, the payment method, and the payment date.

- Outstanding Balances: A separate sheet can be used to monitor unpaid invoices. You can set up conditional formatting to highlight overdue amounts, ensuring you never miss a payment follow-up.

2. Implement a Clear Naming Convention

Establishing a consistent naming system for your financial records makes it easier to locate documents. Using clear, descriptive names for your files and columns will save time and reduce confusion. For example, use a naming format like “CustomerName_InvoiceNumber_Date” to ensure clarity.

File Name Example Explanation JohnDoe_12345_2023-10-05 Customer name, unique identifier, and date of issue XYZCompany_67890_2023-10-10 Company name, unique identifier, and date of issue 3. Use Data Validation for Consistency

Data validation tools in spreadsheet software can help ensure consistency and accuracy across your records. For instance, you can set up drop-down lists for selecting payment methods, tax rates, or product categories. This minimizes errors and streamlines the entry