Commercial Invoice Template for Shipping from Canada to US

When shipping goods internationally, having the proper paperwork is essential to ensure smooth customs processing and avoid delays. Proper documentation provides authorities with crucial information about the contents, value, and origin of the items being shipped, ensuring compliance with import/export regulations. Without this, shipments can be held up or even rejected at the border.

For shipments between the US and other countries, including those from the northern neighbor, specific forms are required. These documents help customs officials assess any applicable taxes, duties, or other fees associated with the goods being imported. Additionally, they serve as a receipt and can be used to settle any disputes that may arise during transport.

Using a well-structured form is the easiest way to ensure all the necessary details are included and that the shipment meets legal and regulatory requirements. These forms are simple to fill out and can be customized based on the type of goods being shipped, making them an essential tool for smooth and efficient international trade.

Document Format for Cross-Border Shipments to the US

When sending goods from one country to another, especially to the United States, having the correct paperwork is crucial. This document serves as a detailed declaration of the items being shipped, ensuring that customs authorities have all the necessary information to process the goods efficiently. It includes vital details such as the sender’s and recipient’s information, a description of the items, their value, and the country of origin.

Using a pre-designed format for this paperwork simplifies the process. A ready-to-use form makes it easier to organize and present all the required data clearly, reducing the chances of errors or omissions. It ensures that all necessary fields are included, allowing for faster customs clearance and minimizing the risk of delays or complications during transit.

Such a document is not just a requirement for customs but also acts as a receipt for both the sender and recipient. It provides proof of the transaction and can be used in case of disputes or claims. By filling out the document accurately and completely, businesses and individuals can ensure smoother, hassle-free shipping between countries.

What is a Commercial Invoice?

A commercial document used in international trade outlines the details of goods being shipped across borders. It serves as a declaration to customs authorities, providing them with key information about the items being transported. This document is required for customs clearance and helps determine the applicable taxes, duties, and any restrictions that may apply to the shipment.

Key Elements of the Document

- Sender Information: Name, address, and contact details of the seller or exporter.

- Recipient Information: Name, address, and contact details of the buyer or importer.

- Description of Goods: A detailed list of the items being shipped, including quantity, weight, and type.

- Value of Goods: The monetary value of the goods being shipped, often used to calculate taxes and duties.

- Shipping Terms: Information about the shipping method, delivery terms, and payment for shipping costs.

- Country of Origin: The country where the goods were produced or manufactured.

Purpose and Importance

This document is vital for both the sender and recipient, as it provides proof of the transaction and ensures that all regulatory requirements are met. It also protects both parties in case of disputes, damages, or discrepancies during transit. Without the proper documentation, shipments could face delays, additional fees, or even be held at customs.

Why You Need a Commercial Invoice

When shipping goods internationally, accurate and complete documentation is crucial for smooth processing at the border. A detailed form that outlines the goods being shipped helps customs authorities determine taxes, duties, and eligibility for import. Without the necessary paperwork, shipments can be delayed, rejected, or even subjected to fines.

Benefits of Using the Right Documentation

- Customs Clearance: This document allows customs to evaluate and approve the shipment based on the goods’ details, ensuring that it is processed quickly.

- Tax and Duty Calculation: It helps authorities determine the applicable taxes and import duties that need to be paid, preventing unexpected costs.

- Proof of Transaction: The form serves as a legal record of the sale, helping resolve disputes or verifying the transaction if necessary.

- Preventing Shipment Delays: A correctly filled form reduces the risk of customs holding the shipment due to incomplete or incorrect information.

Risks of Not Using Proper Documentation

- Shipment Hold-ups: If the required paperwork is missing or inaccurate, customs may hold the shipment for extended periods.

- Additional Fees: Incomplete or improper documentation may result in penalties or extra fees to correct the issues.

- Rejection of Goods: In some cases, goods may be rejected and sent back if the correct documents are not provided.

Ensuring that the right documentation is prepared and submitted correctly helps avoid these issues, making the shipping process more efficient and reliable for both the sender and the recipient.

Key Information on a Commercial Invoice

To ensure smooth processing at customs, the documentation used for international shipments must include several essential details. These details provide the necessary information to customs authorities, helping them determine the legality, value, and classification of the goods being shipped. The more accurately these key elements are filled out, the faster and more efficient the clearance process will be.

Essential Details to Include

- Seller and Buyer Information: The full name, address, and contact information of both the sender and recipient are crucial for identification and communication purposes.

- Description of Goods: A clear and detailed description of each item being shipped, including quantities, model numbers, and other relevant identifiers.

- Value of Goods: The monetary value of the items being shipped, which is needed for calculating customs duties and taxes.

- Country of Origin: The country where the goods were manufactured or produced, important for determining eligibility for trade agreements or tariffs.

- Shipping Method and Terms: Information regarding the chosen shipping carrier, shipping terms (such as FOB or CIF), and the cost of freight if applicable.

- Date of Shipment: The date when the goods are sent, helping to establish timelines for delivery and tracking purposes.

- Harmonized Code: The international code that categorizes the goods, important for tariff classification and customs processing.

Including all these key pieces of information ensures the proper handling of your shipment, helping both the sender and the receiver avoid potential delays and costs during the shipping process.

How to Create a Commercial Invoice

Creating the correct documentation for international shipments involves including all the necessary information to ensure smooth processing at customs. The process is straightforward, but accuracy is key to avoid delays or complications. By following a step-by-step guide, you can easily prepare the required paperwork for your shipment.

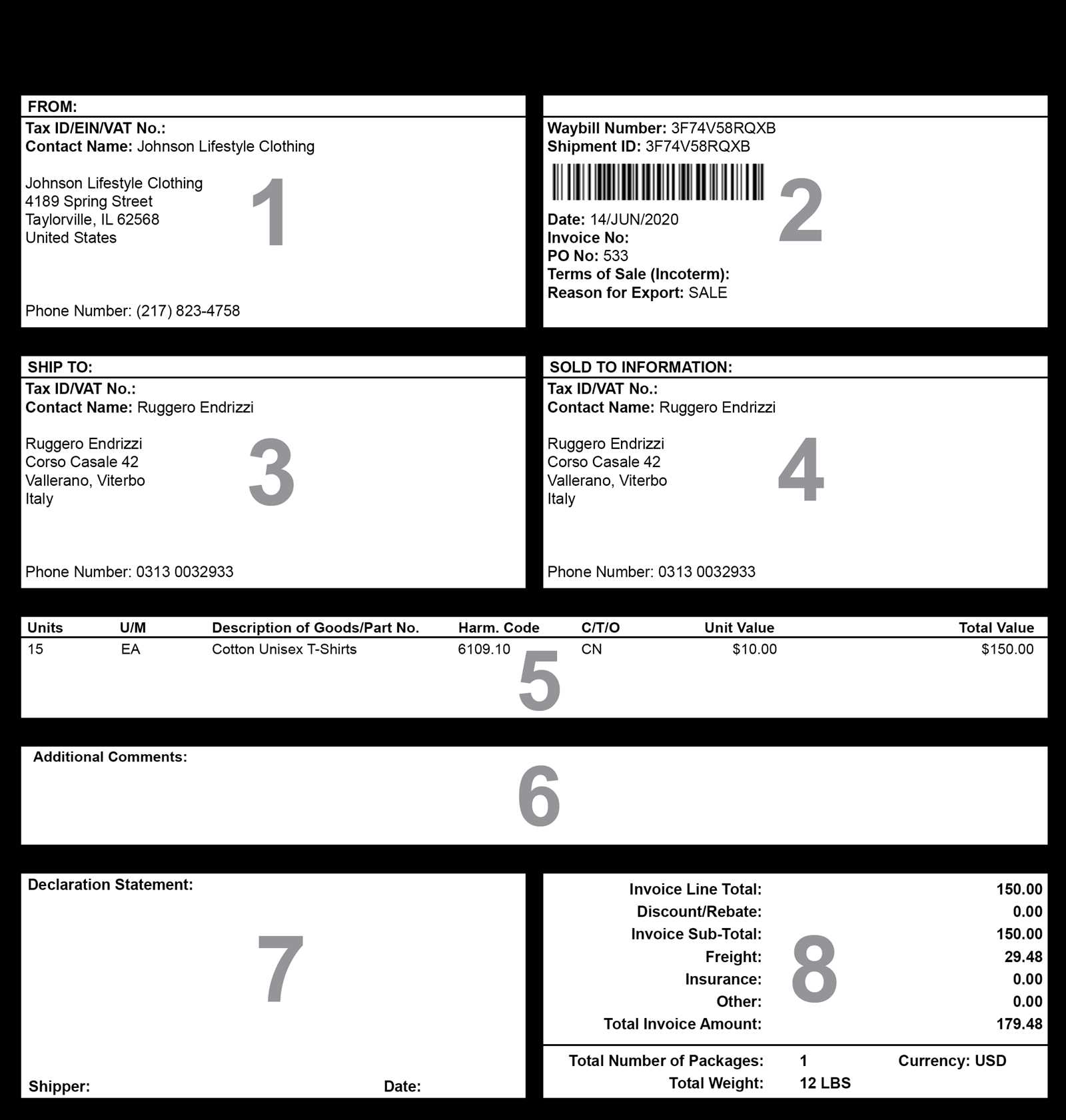

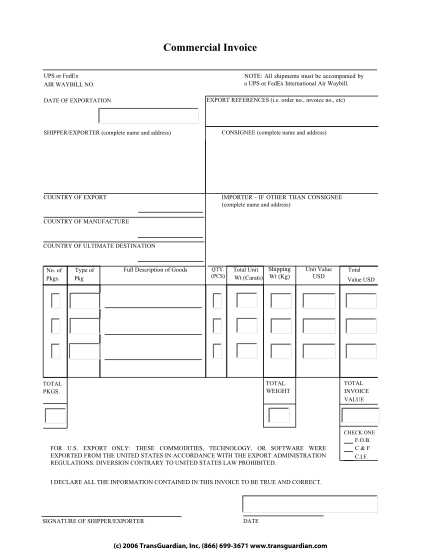

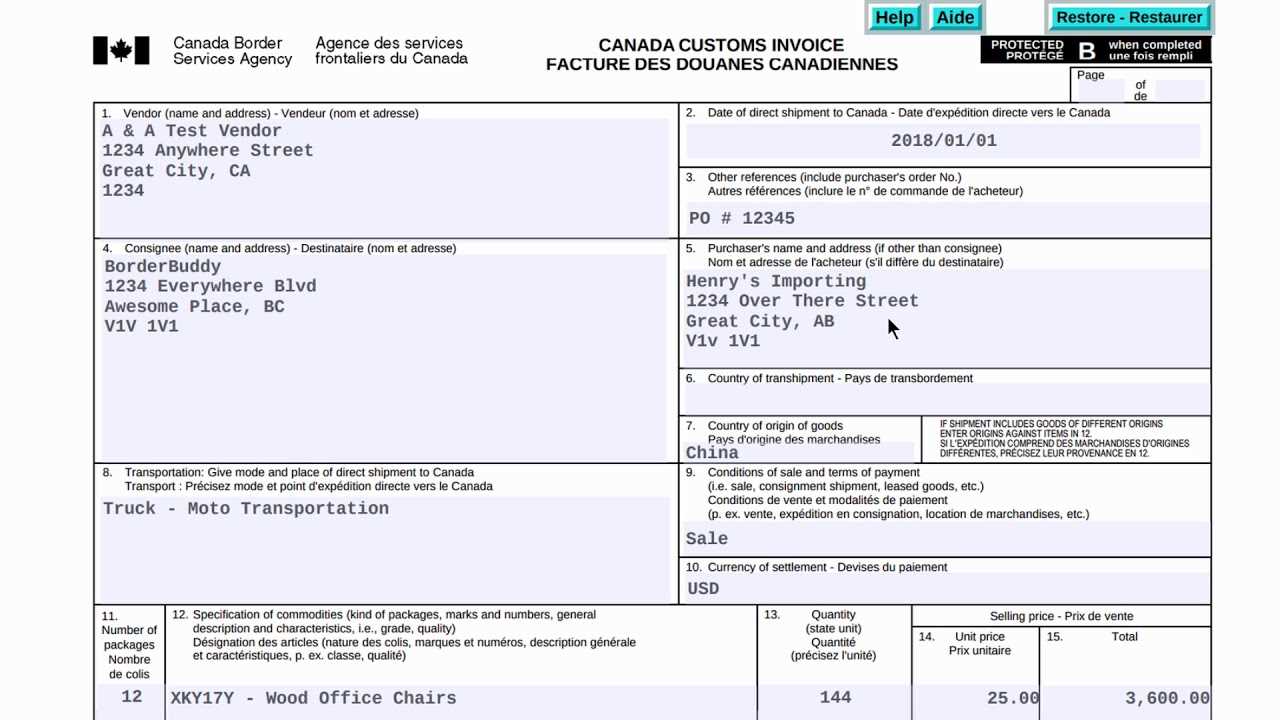

Step-by-Step Guide to Creating the Document

- Include Sender and Recipient Details: Provide the full names, addresses, and contact information for both the exporter and the importer. Make sure the details are accurate to avoid confusion during delivery.

- Provide a Detailed Description of the Goods: List each item being shipped along with a brief description, quantity, unit price, and any identifying marks, model numbers, or serial numbers if applicable.

- Declare the Total Value of the Shipment: Indicate the total value of the items being sent. This value is essential for calculating any duties or taxes that may apply.

- Specify the Shipping Terms: Clearly state the terms of shipment, such as who will pay for shipping costs, and whether delivery is based on FOB (Free On Board) or CIF (Cost, Insurance, and Freight).

- Include the Country of Origin: Indicate where the goods were produced or manufactured, as this is necessary for determining any preferential tariffs or trade agreements that may apply.

- Add Harmonized Codes (if applicable): Include the correct product codes based on the Harmonized System (HS) to classify the goods for customs purposes.

- Provide Payment and Shipping Instructions: Specify any payment details or special shipping instructions to ensure the proper processing of the goods during transit.

Finalizing the Document

- Double-check for Accuracy: Review all the information carefully to ensure there are no mistakes or missing details.

- Sign and Date the Document: The document should be signed by the sender and dated to confirm its authenticity.

- Submit the Document: Once completed, include the document with the shipment or submit it to the relevant authorities for customs processing.

By following these steps and

Essential Components of a Commercial Invoice

For international shipments, providing a detailed document that includes all relevant information is critical for smooth customs processing. This document serves as the official record for the shipment and helps authorities verify the nature, value, and origin of the goods. To ensure accuracy and avoid delays, it’s important to include all necessary components.

Key Elements to Include

- Sender and Recipient Information: This includes the name, address, and contact details of both the shipper and the receiver. Accurate details ensure that the shipment can be delivered without confusion.

- Detailed Description of Goods: A clear and concise description of each item in the shipment, including quantity, weight, and value. This helps customs authorities determine the classification of the goods.

- Total Value of Goods: The value of the items being shipped is crucial for calculating any applicable duties, taxes, or fees. This value should be declared in the currency of the seller.

- Country of Origin: Indicating the country where the goods were produced or manufactured is necessary for determining eligibility for trade agreements and calculating tariffs.

- Shipping Terms: These terms specify who is responsible for the shipping costs and how the goods will be delivered, typically using Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight).

- Payment Terms: The document should outline the payment method and any agreed-upon terms, such as net payment days or payment in advance.

- Harmonized Code: A specific classification code for the goods being shipped, which helps customs assess the correct duties and taxes based on the product type.

- Date of Shipment: This indicates when the goods were shipped, which is useful for tracking and determining the delivery schedule.

Additional Details

- Freight Charges: Any costs associated with shipping and handling should be listed, especially if they are to be paid by the buyer or are included in the total value of the shipment.

- Signatures: The document should be signed by the shipper to validate the accuracy of the information and confirm that the goods are being sent as described.

- Customs Declaration: This section may include any necessary certifications, declarations, or other information required by customs authorities to comply with import/export regulations.

Including all these essential components ensures the document is complete, accurate, and complies with international trade regulations, facilitating a smooth shipment process from start to finish.

Understanding the Role of Customs Declarations

Customs declarations play a vital role in international trade by providing authorities with the information they need to assess the legality, value, and classification of goods being transported across borders. These documents ensure that shipments comply with the regulations of both the exporting and importing countries, helping to prevent delays, fines, or confiscations of goods. By including accurate and complete details, businesses can facilitate smoother customs clearance and avoid complications during transit.

When goods are shipped internationally, customs authorities must review the details of the shipment to determine if any duties, taxes, or restrictions apply. A customs declaration provides all the necessary information about the nature, value, and origin of the goods, as well as the terms of shipment and payment. This document helps authorities assess whether the goods qualify for exemptions, reduced tariffs, or special trade agreements between countries.

Key Functions of Customs Declarations

- Compliance with Trade Regulations: The declaration ensures that all items meet the requirements of both countries’ laws, avoiding penalties or shipment delays.

- Calculation of Duties and Taxes: By providing the total value and classification of the goods, the declaration helps customs calculate the appropriate tariffs and taxes that must be paid by the importer.

- Security and Safety: Customs declarations help protect against the import of illegal or dangerous goods, such as counterfeit items or restricted substances.

- Enforcement of Import/Export Restrictions: Declarations help authorities enforce quotas, bans, or licenses on specific goods to ensure compliance with international agreements and national policies.

Accurate customs declarations are essential for facilitating trade and maintaining security. By carefully preparing and submitting these forms, businesses can reduce the risk of delays and ensure that their goods move efficiently through the customs process.

Common Mistakes in Commercial Invoices

When preparing documentation for international shipments, errors can lead to significant delays, fines, or even the rejection of goods at customs. The process of filling out the required forms may seem straightforward, but there are several common mistakes that can complicate the clearance process. Understanding and avoiding these mistakes is crucial for ensuring smooth and efficient cross-border shipping.

Frequent Errors to Watch Out For

- Incorrect or Missing Information: Failing to include essential details such as the full name, address, or contact information of the sender or recipient can cause delays or miscommunication during transit.

- Unclear Description of Goods: A vague or inaccurate description of the goods being shipped may lead to confusion or even customs inspection. Always provide a detailed and accurate description, including quantities, values, and specific product identifiers.

- Inaccurate Value Declaration: Underestimating the value of goods or leaving out costs like shipping charges can result in underpaid taxes and duties, potentially leading to penalties. Ensure the total value of the shipment is correctly calculated.

- Missing Harmonized Codes: Failing to include the correct harmonized system (HS) code can slow down the customs process. These codes help classify goods and determine the applicable tariffs and duties.

- Incorrect Shipping Terms: Misunderstanding or incorrectly stating shipping terms such as FOB or CIF can cause confusion over who is responsible for freight costs and insurance, leading to potential disputes.

- Failure to Sign the Document: Some exporters forget to sign the document, which can make it invalid. Always ensure that the form is signed by the sender to verify its authenticity.

How to Avoid These Mistakes

- Double-check the Information: Before submitting, carefully review all the details to ensure accuracy. This includes verifying contact information, the description of goods, and the declared value.

- Use Reliable Tools: Utilize accurate forms or trusted software that can guide you through the required fields to reduce the risk of errors.

- Stay Updated on Regulations: Customs regulations and tariff codes may change. Keep up to date with the latest requirements to avoid submitting outdat

How to Avoid Invoice Errors

Errors in shipping documents can result in significant delays, additional costs, and potential issues with customs clearance. Ensuring the accuracy of the paperwork is crucial to avoid complications and ensure that your goods reach their destination smoothly. By following a few best practices, you can reduce the risk of errors and streamline the process for both the sender and the recipient.

Best Practices for Accurate Documentation

- Double-Check All Information: Always review the document for accuracy, including names, addresses, and contact details of both parties. Small mistakes can cause delays or misdelivery.

- Provide Clear Descriptions of Goods: Ensure that each item is listed with a detailed description, including quantity, weight, and any identifying codes or serial numbers. Vague descriptions can lead to confusion and unnecessary inspections by customs.

- Declare the Correct Value: Accurately declare the value of each item and the total shipment value. Underestimating the value can lead to fines, while overestimating can cause unnecessary duties and taxes.

- Verify Shipping Terms: Make sure that the shipping terms (such as FOB or CIF) are clearly stated. Misunderstanding these terms can result in confusion about who is responsible for certain costs and liabilities.

- Include Harmonized Codes: Always include the correct product classification codes. These codes help customs determine the correct tariff rates and avoid delays in processing the shipment.

- Ensure Proper Signatures: Always sign the document before submitting it to ensure its authenticity. Some customs authorities may reject forms that lack a signature or proper verification.

Tools to Minimize Errors

- Use Reliable Software: Consider using shipping and invoicing software that can generate accurate forms and help guide you through the required fields.

- Follow Checklists: Create a checklist to ensure you don’t miss any important details, such as required descriptions, values, or shipping terms.

- Stay Updated on Regulations: International trade regulations can change. Regularly review the latest customs requirements to ensure your paperwork meets current standards.

By adhering to these best practices, you can significantly reduce the likelihood of errors in your documents, ensuring a s

Benefits of Using a Template

Using a standardized form for documenting shipments helps ensure consistency, accuracy, and efficiency in international trade. It allows businesses to follow a set structure that meets all legal and customs requirements, while reducing the risk of errors. By utilizing a pre-designed structure, both exporters and importers can save time and ensure that critical details are not overlooked.

Time-Saving and Efficiency

- Consistency: A predefined format ensures that all required fields are consistently filled in every time, reducing the chances of missing important information.

- Faster Processing: By using a ready-made structure, you can complete the necessary documentation quickly, without having to figure out which details need to be included.

- Eliminates Redundancy: Templates often come with built-in sections for common shipping details, which can save you from repeatedly writing the same information over and over.

Accuracy and Compliance

- Reduced Risk of Errors: Templates guide users to include all required information in the right format, decreasing the chances of making mistakes that could delay shipments.

- Customs Compliance: Many templates are designed to meet the specific requirements of customs authorities, ensuring that the documentation is compliant with international trade regulations.

- Clear and Professional Presentation: A consistent format looks more professional and can help ensure that your documents are easily understood by customs officials, reducing the likelihood of misunderstandings or issues.

Using a pre-designed form for your shipping documentation not only streamlines the process but also ensures that your shipments comply with legal and

Free Templates for Canada to US Shipments

When shipping goods across borders, using a well-structured document can simplify the process and ensure compliance with customs regulations. Thankfully, there are free resources available that provide easy-to-use forms specifically designed for shipments between countries. These documents can save time and reduce errors by guiding the user through the necessary fields and required information for successful processing.

Where to Find Free Templates

- Online Platforms: Several websites offer downloadable documents that can be customized for any shipment, with built-in fields for all essential information.

- Government Websites: Both the export and import countries often provide free forms and guidelines that align with their regulations.

- Shipping Software Providers: Many software tools used for logistics offer free or trial versions of their forms, which can be a great starting point for businesses.

Key Features of Free Forms for Cross-Border Shipments

Feature Description Easy Customization These forms can be tailored to fit specific shipments, ensuring that every necessary detail is included. Compliance with Regulations Free resources are designed to meet both exporting and importing country regulations, ensuring compliance with all legal requirements. Simple Interface Most free forms come with a user-friendly interface that walks you through the process step by step, making it accessible for businesses of all sizes. Downloadable and Printable The forms are available for download, allowing you to complete the document offline and print it when needed. By using free resources available online, businesses can easily access structured forms that streamline the documentation process for shipments between countries. These free tools ensure that essential details are correctly filled out, reducing the risk of delays and helping shipments pass smoothly through customs.

How to Fill Out the Template Correctly

Completing the required shipping document accurately is essential for ensuring that your goods are processed quickly and efficiently through customs. Providing detailed and correct information not only helps avoid delays but also ensures compliance with international trade regulations. Below are some key steps to help you fill out the required forms correctly and avoid common mistakes.

Step-by-Step Guide

- Start with Complete Sender and Recipient Information: Make sure the names, addresses, and contact numbers of both the sender and the recipient are clearly listed. Double-check for any spelling errors to avoid confusion or delays in delivery.

- Provide Accurate Descriptions of the Goods: Clearly describe each item in the shipment. Include the quantity, weight, and any specific identifiers, such as model numbers or serial numbers. This ensures that customs can accurately assess the goods.

- Declare the Correct Value of Goods: Accurately calculate the total value of the shipment. This includes the cost of the goods themselves, as well as any associated shipping costs, if applicable. Under-declaring the value can lead to penalties or fines.

- Include Harmonized Codes: The correct classification code (HS code) for each item should be included. These codes are used by customs authorities to determine applicable tariffs, taxes, and regulations. Make sure to research or consult with a professional to ensure these codes are accurate.

- State the Shipping Terms: Clearly indicate who is responsible for the shipping costs and under what conditions. Terms such as FOB (Free on Board) or CIF (Cost, Insurance, and Freight) must be included to avoid any misunderstandings regarding responsibility for the goods during transit.

- Check for Required Signatures: Some forms require the sender’s signature to verify that the details provided are correct. Make sure to sign the document before submission to prevent any complications.

Double-Check Your Work

- Review All Details: Before submitting the document, carefully go through each section again to ensure that no field is left incomplete. Missing information can cause unnecessary delays in processing.

- Ensure Compliance with Regulations: Make sure that the form complies with both the exporting and importing country’s customs requirements. Consult relevant government or shipping websites to ensure all required fields are covered.

By carefully following these st

How Shipping Documentation Affects Shipping Costs

The accuracy and completeness of your shipping paperwork can have a significant impact on the overall cost of transporting goods. Properly filled-out documents ensure that customs procedures are followed smoothly, preventing unnecessary delays and avoiding fines. However, errors in the paperwork, such as incorrect values or missing details, can lead to increased shipping costs. Understanding how the information in the required documents influences these costs can help you save money and streamline your international shipping process.

Factors That Influence Shipping Costs

- Customs Duties and Taxes: The value of the goods declared in the shipping documents directly affects the amount of customs duties and taxes that must be paid. If the value is under-declared or incorrectly stated, customs authorities may impose penalties or higher fees, increasing the total shipping cost.

- Tariff Classification: The correct classification of goods using Harmonized System (HS) codes is crucial for determining applicable tariffs. Incorrect classifications can result in higher import duties or fines, leading to unexpected costs.

- Shipping Terms: Terms such as FOB (Free on Board) or CIF (Cost, Insurance, Freight) specify who is responsible for various aspects of the shipment, including transport and insurance costs. If these terms are not clearly defined or are incorrect, disputes may arise, leading to additional costs.

- Weight and Volume: Shipping fees are often determined based on the weight or volume of the shipment. If the weights or dimensions are inaccurately reported on the shipping forms, the cost of transportation may increase due to adjustments in the shipping class or rates.

- Delays and Inspections: Inaccurate or incomplete paperwork can cause delays at customs, leading to extra storage or handling fees. If your shipment is flagged for inspection due to incorrect documentation, it may incur additional charges that would otherwise be avoidable.

How to Minimize Shipping Costs Through Proper Documentation

- Be Accurate with Value Declarations: Ensure that the declared value of your goods reflects their true market value. Over or under-reporting the value can l

Understanding Tariffs and Duties in Shipping Documents

When goods are shipped internationally, they are subject to various tariffs and duties, which can significantly impact the overall cost of the shipment. These charges are determined by the destination country and are based on factors like the type of goods, their value, and their country of origin. Accurately documenting this information in shipping paperwork is essential to avoid unexpected costs and delays. Understanding how tariffs and duties are calculated and how to report them correctly can help you ensure compliance with customs regulations and manage shipping costs more effectively.

How Tariffs and Duties Are Determined

- Product Classification: Goods are classified under the Harmonized System (HS) code, which is used worldwide to determine tariffs. Each product type has a specific code, and the correct classification ensures the correct duty rate is applied.

- Customs Valuation: The value of the goods is another key factor in determining duties. The declared value should reflect the transaction price of the goods, including the cost of production, packaging, and shipping.

- Country of Origin: Some countries have agreements that reduce or eliminate duties on certain goods. The origin of the product can affect the tariff rate applied, with products from certain countries benefiting from lower or no duties under free trade agreements.

- Shipping Terms: The terms agreed upon in the shipping contract (e.g., FOB or CIF) also impact who is responsible for customs duties and taxes. These terms define who will cover costs such as insurance, freight, and any applicable tariffs.

How to Accurately Report Tariffs and Duties

- Accurate Product Description: Ensure that each item in the shipment is described clearly and accurately, as this will influence the tariff rate applied. Vague or incorrect descriptions can lead to misclassification and incorrect duty charges.

- Provide Correct HS Codes: Using the correct HS code for each item is crucial. Incorrect codes can lead to the wrong tariff rates, fines, or delays in customs clearance.

- Declare the Correct Value: Accurately report the value of the goods being shipped. Under-declaring the value to reduce duties can lead to penalties, while over-declaring can result in paying unnecessary higher duties.

- Include All Additional Costs: Include any additional fees such as shipping, insurance, and handling in the total value of the goods, as these may affect the customs duties and taxes calculated by the destination country.

Properly documenting tariffs and duties in your shipping paperwork ensures that your goods are processed smoothly throug

How to Submit Shipping Documentation

Submitting the correct paperwork for international shipments is crucial for ensuring that goods pass smoothly through customs without unnecessary delays or fines. The submission process may vary depending on the destination country and the specific carrier used, but understanding the basic steps will help ensure compliance and accuracy. Proper submission of your shipment’s documentation not only helps expedite the customs process but also avoids complications during transit.

Steps to Submit the Required Documents

- Prepare All Necessary Information: Ensure that all required details are included in the shipping forms, such as the sender and recipient information, a complete description of the goods, their value, and applicable HS codes. Double-check that the total value of the goods matches the declared value and that the descriptions are clear and accurate.

- Review the Requirements of the Destination Country: Different countries may have different rules for submitting shipping documentation. It is important to confirm any additional requirements, such as special permits, certifications, or extra paperwork, that may be necessary based on the type of goods being shipped or the countries involved.

- Choose the Right Submission Method: Depending on the carrier and the destination, there are several ways to submit your shipping documents:

- Online Submission: Many carriers and shipping platforms allow for electronic submission of shipping documents. Ensure that all forms are completed digitally and uploaded to the correct portal, often as PDF or other accepted file formats.

- Paper Submission: If electronic submission is not an option, print out the completed forms and include them with the physical shipment. Make sure to include multiple copies if required by customs authorities.

- File the Documents with the Carrier: Submit the completed documentation to the carrier or freight forwarder, whether electronically or in person. This is an essential step to ensure that your goods are properly tracked and that customs clearance can proceed smoothly.

- Track the Submission: After submitting your documentation, track the status of your shipment. Keep an eye on any updates from customs or the carrier. If additional information is required or there are issues with the documents, address them promptly to prevent delays.

Important Tips for a Smooth Submission

- Ensure Accuracy: Double-check that all fields are filled out correctly before submission. Missing or incorrect details can cause unnecessary delays or result in the rejection of your shipment.

- Be Aware of Deadlines: Some shipping methods or international regulations require documentation to be submitted a certain number of days before the shipment departs. Make sure to plan ahead to avoid rushing the process.

- Keep Copies of Everything: Retain copies of all documents submitted, both for your records and in case any issues arise with the shipment later on.

Submitting your shipping documentation accurately and on time ensures that your goods are processed smoothly through customs, reducing the risk of delays, fines, or additional costs. By understanding the requirements and following the submission process carefully, you can ensure the timely and efficient delivery of your shipment.

How to Track Your Shipments

Tracking your shipment is an essential part of the international shipping process. By keeping an eye on the status of your goods, you can ensure they are moving according to plan and address any issues that may arise along the way. Whether you are sending or receiving items, being able to track their journey provides peace of mind and helps you stay informed about delivery timelines. This section will guide you through the various methods of tracking and provide tips on how to manage the process effectively.

Methods to Track Your Shipments

- Use the Carrier’s Tracking System: Most shipping companies offer an online tracking system that allows you to monitor the status of your shipment in real-time. All you need is the tracking number provided when the goods are dispatched. Enter this number on the carrier’s website to get detailed updates on your shipment’s location and estimated delivery date.

- Third-Party Tracking Tools: If your goods are being handled by multiple carriers or you are unsure of the specific carrier, third-party tracking websites can aggregate information from different sources. These tools let you enter a tracking number to see updates from various carriers in one place, streamlining the process.

- Mobile Tracking Apps: Many carriers also provide mobile applications for tracking shipments. These apps allow you to receive push notifications, so you stay updated on your shipment’s progress, and they often offer the convenience of tracking from anywhere, at any time.

- Best Practices for Cross-Border Shipments

Shipping goods across international borders involves more than just getting them from point A to point B. To ensure a smooth and efficient process, it is crucial to follow best practices that help minimize delays, reduce additional costs, and ensure compliance with customs regulations. By paying attention to details such as documentation, packaging, and choosing the right shipping method, businesses and individuals can streamline their cross-border shipping experience and avoid common pitfalls.

Essential Tips for Successful Cross-Border Shipping

- Understand Import and Export Regulations: Each country has its own set of rules governing the import and export of goods. Familiarize yourself with both the sending and receiving country’s requirements to ensure your shipment complies with all laws, including those related to customs, tariffs, and restricted goods.

- Complete Accurate Documentation: Proper documentation is key to ensuring your goods are processed quickly and accurately through customs. Ensure all required forms are filled out completely and correctly, including details about the contents, value, origin, and any necessary permits or certifications.

- Correctly Classify Goods with Harmonized Codes: Use the correct Harmonized System (HS) code for each product. Misclassifying goods can lead to incorrect tariffs or delayed processing. Proper classification helps customs authorities quickly assess duties and taxes, speeding up the clearance process.

- Choose the Right Shipping Method: Selecting the right carrier and service type (e.g., express, standard, or economy shipping) depends on factors like urgency, cost, and the nature of the goods being shipped. Consider the delivery timeframes, costs, and tracking features offered by each service to find the best option for your needs.

Packaging and Labeling Best Practices

- Secure Packaging: Ensure your products are packed securely to withstand transit. Use high-quality packaging materials that protect goods from damage during handling and transport. Consider climate conditions and the potential for rough handling when selecting your packaging materials.

- Labeling Requirements: Clear, accurate labeling is crucial for cross-border shipments. Include the recipient’s full name, address, and contact information. Be sure to follow specific labeling regulations for both the sender’s and recipient’s countries, including any required customs declarations or identification codes.

- Mark Hazardous Materials: If

Tips for Smooth Customs Clearance

Ensuring that your shipment passes through customs without delays is essential for timely delivery and avoiding extra costs. Smooth customs clearance depends on proper documentation, accurate declarations, and compliance with the destination country’s regulations. By following best practices and staying organized, you can minimize the risk of issues at the border and ensure that your goods arrive on schedule. Below are key tips to help facilitate a hassle-free customs process.

Prepare Proper Documentation

- Provide Detailed Descriptions: Ensure that the contents of your shipment are clearly described on all necessary forms. Customs authorities rely on these descriptions to assess the correct duties and taxes. Ambiguous or vague descriptions may cause delays or misclassification of goods.

- Include Accurate Values: Declare the correct value of the goods being shipped, including any shipping costs, in your documentation. Under-declaring the value can lead to fines or confiscation, while over-declaring may result in higher duties or taxes.

- Complete All Required Forms: Ensure you fill out all required customs forms accurately, including the harmonized system codes (HS codes) and any certificates or permits needed. Incomplete or incorrect forms can significantly delay the clearance process.

- Ensure Proper Signatures: Many customs forms require signatures from both the sender and receiver. Ensure that all necessary signatures are included to avoid unnecessary delays.

Be Aware of Local Regulations

- Understand Restrictions and Prohibited Goods: Some items may be restricted or prohibited from entering certain countries. Familiarize yourself with the list of prohibited goods for the destination country and ensure that your shipment does not include any restricted items.

- Comply with Duties and Taxes: Be aware of the customs duties and taxes that apply to your shipment. These fees vary depending on the destination, product type, and value of the goods. Consider prepaying these costs, if possible, to prevent delays upon arrival.

- Consider Local Customs Holidays: Some countries observe customs holidays or have specific working hours for processing shipments. Check the customs working schedul