Commercial Invoice for Customs Purposes Only Template Guide

When shipping goods across borders, certain documentation is required to ensure smooth clearance and compliance with international trade regulations. One of the most critical documents involved in this process serves to outline the details of the transaction, the value of the goods, and other essential information needed by authorities. This document plays a pivotal role in the processing of shipments and helps facilitate timely delivery.

Understanding the structure and requirements of such a document is vital for both importers and exporters. While the specific format may vary depending on the country or destination, the key elements remain consistent. Providing accurate and detailed information not only ensures compliance but also helps avoid delays or additional charges during shipment processing.

In this guide, we will explore how to properly create and complete this essential paperwork, highlighting the necessary sections and common pitfalls to avoid. Whether you are a seasoned exporter or new to the process, having a clear understanding of how to manage this document will streamline your international trade efforts.

Document Required for International Shipping Compliance

When shipping goods across borders, having the correct paperwork is essential to ensure compliance with international trade regulations. This document serves as a key requirement for processing shipments and avoiding delays. It helps authorities verify the details of the transaction and the nature of the goods being shipped. Understanding how to prepare this document is crucial for smooth customs clearance and efficient delivery.

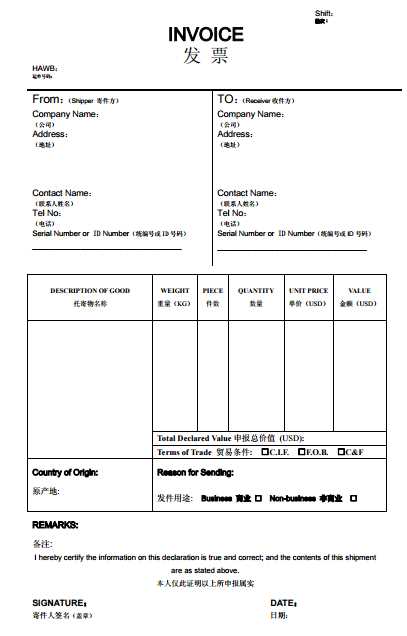

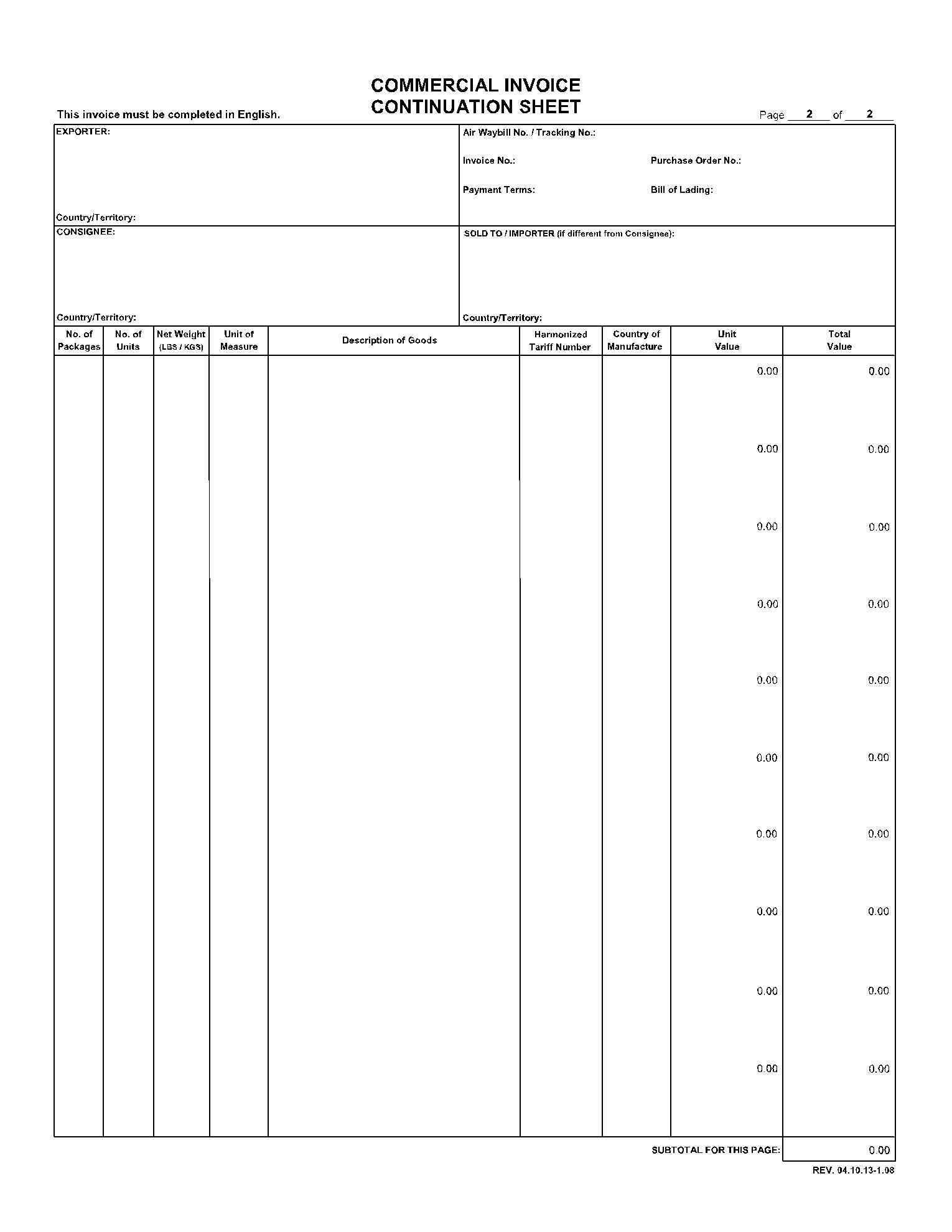

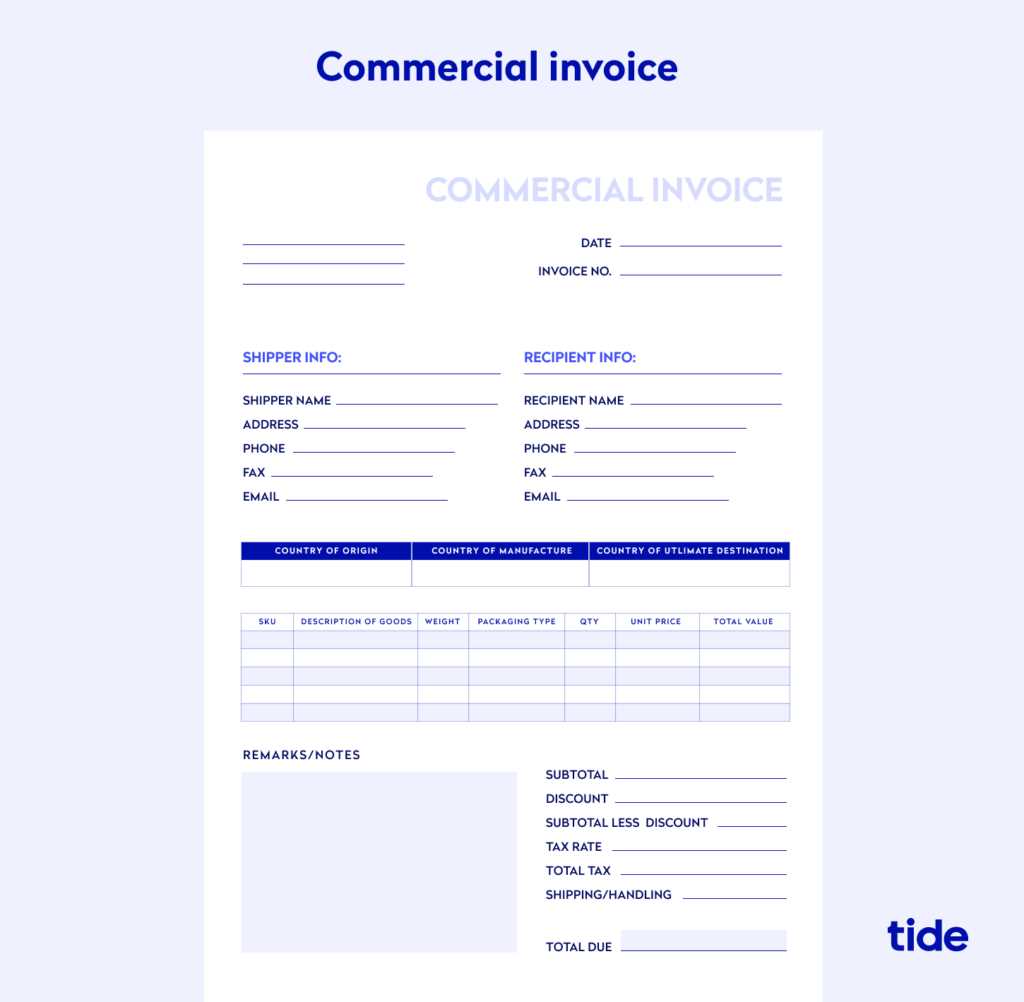

The structure of this essential form can vary depending on the country or region, but there are certain core elements that are typically required in most cases. These include details about the sender, recipient, product description, value, and shipping terms. Filling out the document accurately will help prevent any issues during the shipment process and ensure that everything moves forward without unnecessary hold-ups.

Key Elements to Include

While the format may differ from one jurisdiction to another, the following details are generally included in the document:

- Sender and Receiver Information: Full names, addresses, and contact details of both parties involved.

- Product Description: A clear and accurate description of each item being shipped, including quantity and model numbers, if applicable.

- Value and Currency: The total value of the goods being shipped, usually expressed in the currency of the sender’s country.

- Country of Origin: The country where the goods were manufactured or produced.

- HS Code: The Harmonized System code used to classify the goods for duty and tax purposes.

- Terms of Sale: The agreed terms, such as shipping method and payment conditions (e.g., FOB, CIF, etc.).

How to Complete the Document Correctly

To ensure that everything is filled out properly, follow these guidelines:

- Accuracy: Double-check all information for accuracy, including addresses, product descriptions, and values.

- Clarity: Use clear and concise language to describe the goods, avoiding ambiguity.

- Consistency: Ensure that the details on the document match other shipment paperwork, such as packing lists or bills of lading.

- Compliance: Be aware of the specific requirements of the destination country and make sure all necessary information is included.

Properly preparing this form not only ensures compliance with international shipping standards but also helps facilitate smoother processing at the destination port, reducing the risk of delays or additional charges.

What is a Document for International Shipments?

This important document is required when sending goods across borders to provide authorities with clear details about the transaction. It serves as a formal declaration of the contents, value, and purpose of the shipment, ensuring that the right duties and taxes are applied. Without it, shipments may face delays, additional charges, or even confiscation, making it a crucial part of the international shipping process.

Purpose of the Document

The primary goal of this paperwork is to outline the terms of the trade and provide the necessary details to customs authorities. It helps to verify the transaction and the goods involved, ensuring that both the sender and recipient are in compliance with import/export regulations. The document typically includes a description of the goods, their value, the country of origin, and other critical information to determine any applicable duties or taxes.

Key Features of the Document

While the format may differ between countries, this document usually contains the following key elements:

- Sender and Receiver Information: Complete names and addresses for both parties involved in the shipment.

- Item Descriptions: Clear details about the goods being shipped, including quantity, type, and any relevant codes.

- Monetary Value: The value of the goods being shipped, expressed in the appropriate currency.

- HS Code: The Harmonized System code used to classify the products for international trade.

- Shipping Terms: The conditions of the transaction, such as delivery method and responsibilities of each party.

By including these details, this document ensures smooth processing through various regulatory checkpoints, allowing the goods to reach their destination efficiently and without complication.

Why Shipping Documents are Required

When sending goods across international borders, having the proper documentation is essential to meet legal and regulatory requirements. This paperwork serves as proof of the transaction and outlines the key details of the shipment, helping to ensure that the goods comply with import and export regulations. Without this document, goods may face unnecessary delays, additional charges, or even rejection at the border.

Ensuring Compliance with Regulations

International trade involves complex regulations that vary between countries. Having this document helps ensure that both the sender and receiver follow the necessary legal processes. It provides customs authorities with the information needed to assess the shipment, apply appropriate taxes or duties, and verify that the shipment adheres to trade laws. Failure to provide it can lead to significant issues during the shipping process.

Benefits of Providing the Document

- Smooth Processing: Proper documentation speeds up the approval process at customs and reduces the likelihood of delays.

- Clear Transaction Details: It provides a clear record of the goods being exchanged, making it easier for authorities to classify them correctly and assess any duties.

- Prevents Confusion: With accurate details about the goods and their value, there’s less chance for misunderstandings or disputes between parties involved in the shipment.

- Protects Against Penalties: Incomplete or inaccurate paperwork can result in penalties, fines, or confiscation of goods. Providing the right documentation helps prevent this risk.

Ultimately, the document serves as an essential tool to facilitate international shipping by ensuring compliance with legal and financial regulations, minimizing the risk of delays, and promoting efficient cross-border trade.

Essential Elements of the Document

When preparing the necessary paperwork for international shipments, certain key details must always be included to ensure proper processing and compliance with trade regulations. These elements serve to clearly define the transaction, the value of the goods, and the parties involved, allowing authorities to verify the legitimacy of the shipment. Below is an overview of the essential components that should be present in any such document.

| Element | Description |

|---|---|

| Sender Information | Full name, address, and contact details of the sender to ensure accurate identification. |

| Receiver Information | Complete name, address, and contact details of the recipient, ensuring delivery accuracy. |

| Product Description | Detailed description of the items being shipped, including their quantity, model, and any unique identifiers. |

| Value of Goods | The monetary value of the goods, typically listed in the sender’s local currency, which is crucial for determining any applicable duties. |

| Country of Origin | The country where the goods were manufactured or produced, which can affect tariffs and taxes. |

| Harmonized System (HS) Code | A classification code used to identify products internationally, helping to determine applicable duties and taxes. |

| Shipping Terms | Specific details about how the goods are being shipped (e.g., FOB, CIF), which outline the responsibilities of each party involved in the transaction. |

Including all of these key elements helps prevent delays and ensures that the shipment is processed smoothly through customs and other regulatory checkpoints. Properly filled-out documentation not only facilitates legal compliance but also promotes efficient international trade practices.

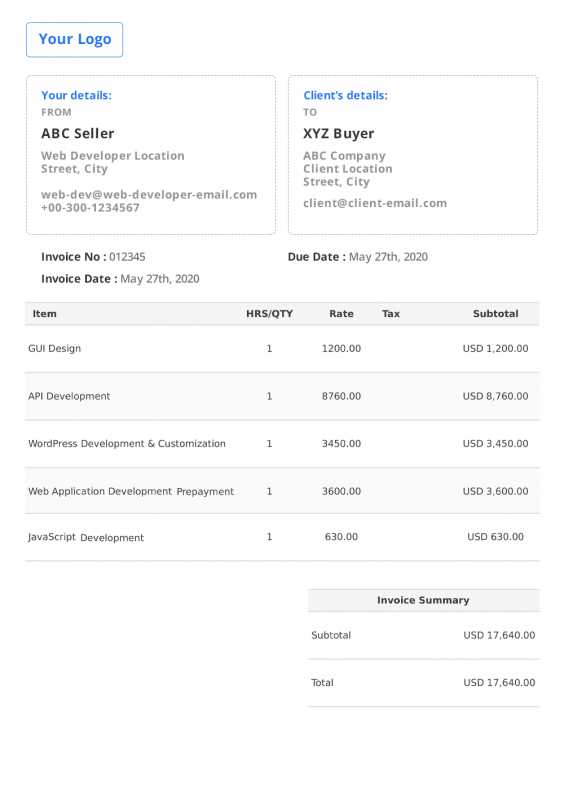

How to Customize Your Document

When preparing the necessary paperwork for shipping goods internationally, it’s important to tailor the document to fit the specific details of the transaction and the regulations of the destination country. Customizing this document ensures that all required fields are filled out accurately, helping to prevent delays or issues with customs clearance. Each shipment may have unique characteristics, so understanding how to modify the document accordingly is key to ensuring smooth processing.

The first step in customizing the document is reviewing the required fields. These typically include sender and recipient information, product details, value, and shipping terms. Some countries may have specific formatting requirements or additional information that must be included, so it’s crucial to be familiar with these before filling out the document.

Step-by-Step Guide to Customization

To make sure your document meets all requirements, follow these steps:

- Update Sender and Receiver Information: Ensure that both parties’ names, addresses, and contact details are correctly listed. Verify that the details match other related shipping documents.

- Provide Accurate Product Descriptions: Use clear and concise language to describe each item being shipped, including any model numbers or serial identifiers. Include the quantity, type, and purpose of the items.

- State the Correct Value: List the true value of the goods, as this will impact the calculation of any potential duties or taxes. Be sure to convert to the correct currency if necessary.

- Include Harmonized System Codes: If required, make sure to list the appropriate HS codes for the products being shipped. This classification system helps ensure that the goods are categorized correctly for tax purposes.

- Define Shipping Terms: Clarify the shipping method, whether it’s freight on board (FOB), cost insurance and freight (CIF), or another term. This determines the responsibilities of both the sender and receiver during the transaction.

By taking the time to carefully customize the document, you help ensure that all the necessary information is in place for smooth processing through shipping channels. Additionally, customizing the document minimizes the chances of errors that could lead to delays or fines, making it an essential step in the international shipping process.

Common Mistakes to Avoid

When preparing the necessary paperwork for international shipments, even small errors can lead to delays, fines, or complications at the border. Ensuring the document is filled out accurately and completely is crucial to avoid these issues. Below are some of the most common mistakes that can occur when preparing this type of paperwork, along with tips on how to avoid them.

| Mistake | Description | How to Avoid It |

|---|---|---|

| Incorrect Sender or Receiver Details | Missing or inaccurate contact information can cause delays and prevent the shipment from being processed. | Double-check all names, addresses, and contact numbers for accuracy. |

| Ambiguous Product Descriptions | Vague or incomplete descriptions can lead to misunderstandings about the shipment’s contents, potentially triggering delays or fines. | Provide detailed and specific descriptions, including item type, quantity, and any distinguishing features. |

| Failure to Include Required Codes | Not including the proper classification codes (like the HS code) can lead to incorrect duty assessments or customs rejection. | Ensure the correct Harmonized System codes are included for each product. |

| Incorrect Valuation of Goods | Under- or over-valuing goods can raise suspicion or result in inaccurate duty assessments. | List the accurate value of the goods, and ensure that the currency used is consistent with the destination country’s regulations. |

| Omitting Shipping Terms | Failure to clarify shipping terms can create confusion about who is responsible for various aspects of the transaction. | Clearly define the shipping method (e.g., FOB, CIF) to avoid confusion or disputes. |

By taking care to avoid these common errors, you can help ensure that your shipment is processed smoothly and efficiently, reducing the likelihood of delays or complications at the border.

Benefits of Using a Predefined Document Format

Using a standardized format for preparing the necessary documentation for international shipments offers numerous advantages. It ensures consistency, reduces the risk of errors, and saves time, allowing for a more streamlined process when shipping goods across borders. With a structured format, you can be confident that all required details are included, minimizing the chances of delays or complications during the shipping process.

Key Advantages of Predefined Formats

| Advantage | Description |

|---|---|

| Consistency | A predefined structure ensures that each document follows the same format, making it easier to compare and process multiple shipments. |

| Time Efficiency | By using a ready-made layout, you save time on formatting, allowing you to focus on filling in the important details instead of worrying about document design. |

| Minimized Risk of Errors | With a clear, organized format, there is less chance of missing crucial information or making formatting mistakes that could cause delays. |

| Compliance Assurance | Standardized documents often include all the required fields, ensuring that you meet legal and regulatory requirements for international trade. |

| Professional Appearance | A structured format lends a professional appearance to your paperwork, which can help foster trust with recipients, customs authorities, and partners. |

How it Simplifies the Shipping Process

Utilizing a predefined document layout reduces the time spent on documentation and minimizes the risk of missing important details. This leads to quicker processing times at shipping and customs facilities, making the entire shipping process more efficient. Additionally, the standardized nature of such a format can help reduce confusion and improve communication with all parties involved.

How to Fill Out a Shipping Document

Filling out the necessary paperwork for shipping goods internationally can seem like a daunting task, but with the right steps, it becomes a straightforward process. Ensuring that every section is completed accurately is key to preventing delays and ensuring that your shipment reaches its destination without complications. By following a clear, organized approach, you can make the process simpler and more efficient.

Step-by-Step Guide

Follow these key steps when completing your shipment documentation:

- Enter Sender and Receiver Information: Start by filling in the contact details for both the sender and recipient, including names, addresses, and phone numbers. This ensures that both parties are clearly identified.

- Describe the Goods: Provide detailed descriptions of the items being shipped. Include product names, quantities, model numbers, and any distinguishing features. The more specific, the better.

- Specify the Value: Accurately list the value of the goods being shipped, including the currency. This will help calculate potential duties or taxes that might apply to the shipment.

- Include Origin and Destination Information: Be sure to specify the country of origin and the destination country for each product. This helps with the classification and tariff assessments.

- Shipping Method and Terms: Clearly define how the goods will be shipped and the terms of shipment (e.g., FOB, CIF). These terms outline the responsibilities and obligations of both the sender and the recipient.

Tips for Accurate Completion

Pay close attention to the following details to ensure the accuracy of your paperwork:

- Check for Consistency: Double-check that all information is consistent with other shipping documents, such as the packing list and bill of lading.

- Use Clear and Precise Language: Avoid vague or overly complex descriptions. Being clear and direct will help prevent misunderstandings.

- Verify Legal Requirements: Ensure that your document meets any legal or regulatory requirements specific to the destination country. Some countries may require additional details.

By following these steps and tips, you will ensure that your shipment is properly documented, minimizing the risk of delays or rejections at customs checkpoints. Properly completed documents facilitate smoother processing and faster delivery of goods to their destination.

Role of Invoices in International Shipping

In international shipping, accurate documentation plays a critical role in ensuring that goods are transferred smoothly across borders. One of the key documents involved in this process is used to outline the transaction details, such as the nature of the goods, their value, and the terms of delivery. This documentation not only helps facilitate the movement of goods but also serves as a tool for customs clearance, tax calculation, and legal compliance. Without a properly completed form, shipments may be delayed or rejected, and additional costs could arise.

The role of this essential paperwork extends beyond the shipment itself. It provides a clear record of the transaction between the sender and recipient, which can be used for accounting, dispute resolution, and future references. Furthermore, it ensures that both parties meet the legal and regulatory requirements of the involved countries, preventing unnecessary issues that could hinder the logistics process.

In essence, accurate and well-prepared documents are crucial for a smooth and efficient international shipping process, ensuring that all parties involved are in compliance with international trade laws and minimizing any risks associated with cross-border transactions.

Legal Requirements for Shipping Documentation

When shipping goods internationally, there are specific legal requirements that must be met to ensure compliance with regulations in both the sending and receiving countries. These requirements dictate the information that must be included in the necessary paperwork, ensuring that shipments pass through border controls without issues. The documentation serves as an official record of the transaction and is used by government authorities to assess duties, taxes, and other fees associated with the shipment.

Each country has its own set of rules regarding what information must be included in the documentation, such as the sender’s and recipient’s details, a description of the goods, and their value. Additionally, some countries may require additional documents or certifications, such as export permits or certificates of origin, depending on the type of goods being shipped. Failing to comply with these legal standards can result in delays, fines, or even confiscation of the goods.

To ensure that shipments comply with international trade laws, it’s essential to understand the legal documentation requirements for each destination and follow them precisely. This minimizes the risk of complications and ensures that goods are delivered efficiently and legally across borders.

Best Practices for Document Accuracy

Ensuring the accuracy of shipping documentation is vital for smooth international transactions. Mistakes in these documents can lead to delays, additional costs, or even legal complications. By following best practices, you can help avoid common errors and ensure that all necessary details are correctly represented. A well-prepared document not only facilitates the shipment process but also supports regulatory compliance and smooth customs clearance.

Here are some best practices to ensure your documentation is accurate:

| Practice | Description |

|---|---|

| Double-Check Information | Review all details, such as sender and receiver names, addresses, and contact information, to ensure there are no mistakes. |

| Be Specific in Descriptions | Provide clear and detailed descriptions of the goods being shipped, including quantities, model numbers, and any distinguishing features. |

| Ensure Accurate Value | Clearly state the value of each item being shipped and provide the correct currency to prevent issues with tax and duty calculations. |

| Review Regulatory Requirements | Familiarize yourself with the legal documentation requirements for the destination country to avoid missing any essential information. |

| Use Updated Formats | Always use the most current forms or digital systems to ensure your documents comply with current regulations and standards. |

By following these best practices, you ensure that all required information is accurate, which reduces the likelihood of issues during shipment processing. Accuracy in documentation helps facilitate quicker delivery times and avoids potential delays or fines at border control points.

How to Submit Your Documentation to Authorities

Submitting the required documentation for international shipments to the appropriate authorities is a key step in ensuring that goods are processed correctly. Proper submission helps prevent delays, fines, or complications with the shipment. Whether you’re submitting physical paperwork or using an online platform, following the correct procedures ensures compliance and smooth processing through regulatory channels.

Step-by-Step Process for Submission

When submitting your paperwork to authorities, it’s essential to follow the proper steps to avoid mistakes. Here’s a simple guide to ensure that you submit everything accurately:

| Step | Action |

|---|---|

| 1. Gather Required Documents | Ensure you have all necessary documents ready, including the transaction details and any supporting certificates, if required. |

| 2. Verify Information | Double-check all fields for accuracy, including the shipment’s value, description, and the sender and recipient details. |

| 3. Choose the Submission Method | Depending on the destination, you may submit your documents through a digital platform or in paper form. Be sure to use the method accepted by the destination country. |

| 4. Submit to the Right Department | Ensure the correct department receives the documents, whether it’s through a digital submission portal or physical delivery to customs offices. |

| 5. Confirm Receipt | After submitting, confirm receipt of your documentation and inquire about any next steps, such as waiting for clearance or additional documentation requests. |

Online Submission Platforms

Many countries now offer online platforms for submitting shipping documentation directly to the appropriate regulatory bodies. These platforms often simplify the process by allowing you to fill out forms electronically, upload supporting documents, and track your submission status. Be sure to familiarize yourself with the platform’s specific requirements before beginning the process.

Submitting your paperwork to the right authorities in a timely and accurate manner is critical to ensuring that shipments are processed without delays. By following these steps and ensuring all required documents are included, you can help facilitate the smooth transfer of goods across borders.

Types of Goods Requiring Documentation

Certain goods require specific documentation when shipped across borders due to their nature, value, or intended use. This documentation helps authorities assess the shipment’s legitimacy, value, and compliance with regulations. It ensures that goods are processed efficiently and that all legal requirements are met during international transportation.

Here are some categories of goods that generally require detailed documentation:

- High-Value Goods: Expensive items such as electronics, luxury goods, and artwork often require detailed descriptions and valuation for regulatory purposes.

- Restricted Items: Products such as pharmaceuticals, chemicals, or firearms may require specific permits and documentation to ensure compliance with international trade laws.

- Perishable Goods: Food products and other perishable items require proper documentation to guarantee safe handling, inspection, and timely delivery.

- Items with Tariff Codes: Certain products may have specific tariff codes assigned based on their category. These need to be included in the paperwork for accurate duty assessment.

- Items Involving Trade Agreements: Goods shipped under specific trade agreements or preferential trade terms may require additional documentation to verify eligibility for reduced tariffs or other benefits.

- Gift Shipments: When sending gifts, there may be restrictions on the value or quantity, and corresponding documentation is required to prove that the shipment meets these criteria.

Ensuring that these goods are accompanied by the correct documentation allows for smoother and quicker processing, reduces the risk of delays, and helps avoid fines or legal complications. Different countries may have varying rules for the required paperwork, so it’s important to research the specific needs for each shipment type.

Digital vs. Paper Documents

When handling shipments across borders, businesses often face the choice between submitting physical or electronic paperwork. Both formats serve the same purpose, ensuring that goods comply with necessary regulations. However, each method comes with its own advantages and challenges depending on the situation, technology available, and regulatory requirements of the destination country.

Let’s compare the two methods and their benefits:

Advantages of Digital Documents

- Efficiency: Digital documentation can be transmitted instantly, speeding up the processing time at checkpoints and customs.

- Cost Savings: Reduces the need for printing, shipping, and storing physical paperwork.

- Ease of Access: Electronic documents can be accessed and stored digitally, allowing for better organization and easy retrieval when needed.

- Environmentally Friendly: Minimizes paper waste and promotes sustainable practices in business operations.

Advantages of Paper Documents

- Universal Acceptance: Paper forms are often accepted in regions with less access to technology or in situations where digital submissions are not yet possible.

- Backup Assurance: Physical documents serve as a reliable backup in case of technical failures or errors in electronic systems.

- Regulatory Compliance: Some countries may still require paper copies of certain documents, particularly for specific types of shipments or trade agreements.

Choosing the right format often depends on the destination, the technology infrastructure in place, and the nature of the goods being shipped. Many businesses are now transitioning to digital systems due to their convenience and speed, but paper documents continue to play a critical role in certain circumstances.

How to Handle Multiple Documents

Managing multiple documents associated with different shipments can be complex, but with the right approach, it becomes a streamlined process. Whether you are dealing with several transactions in one go or managing a bulk order, organizing and tracking each piece of paperwork accurately is essential for smooth operations, especially when it

Understanding Duties and Taxes

When engaging in international trade, it’s essential to understand the various fees and charges that are applied to goods entering or leaving a country. These fees, often referred to as duties and taxes, can vary depending on the nature of the goods, their value, and the destination. Properly managing these financial obligations ensures that shipments are processed smoothly and without unnecessary delays.

Here’s a breakdown of the key concepts to help you navigate these charges:

Types of Duties

Duties are fees imposed by governments on imported or exported goods. The amount of duty charged depends on several factors, including the type of product, its value, and the country of origin. Common types of duties include:

- Ad Valorem Duty: This is a percentage-based duty calculated based on the value of the goods.

- Specific Duty: A fixed fee applied to specific goods, regardless of their value.

- Compound Duty: A combination of both ad valorem and specific duties, applied to certain goods.

- Anti-dumping Duty: Imposed to protect domestic industries from unfair competition, typically when goods are sold below market value.

Understanding Taxes

In addition to duties, taxes are also levied on goods entering or exiting a country. These are usually charged to generate revenue for the government and can include:

- Value Added Tax (VAT): A consumption tax placed on goods and services at each stage of production or distribution.

- Sales Tax: A tax applied to the sale of goods or services, often calculated as a percentage of the price.

- Excise Tax: A tax on specific goods, such as alcohol, tobacco, or fuel, often applied at the time of importation or manufacturing.

Understanding these charges and their impact on the cost of goods is crucial for accurate pricing and ensuring that all legal requirements are met. By familiarizing yourself with duties and taxes, you can better manage the costs associated with international shipments and avoid unexpected fees.

Where to Find Invoice Templates Online

For businesses and individuals engaged in international trade, finding the right documents can be critical to smooth operations. Fortunately, there are numerous online resources where you can access ready-made formats that can be customized to suit your specific needs. These resources offer a variety of layouts and designs to ensure your documents meet required standards and streamline the process of documentation.

Here are some key places where you can find customizable forms online:

- Online Document Generators: Many websites provide free or paid document generators that allow you to input necessary information and automatically generate the desired form. These tools often have built-in features to ensure compliance with legal and regulatory requirements.

- Cloud-Based Platforms: Cloud services such as Google Docs, Microsoft Office 365, or Zoho Docs provide templates that you can customize. They often include collaboration features that allow multiple team members to work on a document simultaneously.

- Specialized Websites: Numerous online platforms are specifically dedicated to offering document and form templates. Websites like Template.net, InvoiceSimple.com, or FormSwift.com have a wide selection of customizable documents for various business needs.

- Business Software Suites: Many accounting and business management software tools, such as QuickBooks, Xero, or FreshBooks, offer customizable formats as part of their service. These programs often include additional features like automatic tax calculations and integration with payment systems.

- Freelancer Marketplaces: If you’re looking for a unique design or specific features, freelance platforms like Upwork or Fiverr allow you to hire professionals who can create custom layouts that fit your specific requirements.

Using these online resources, you can easily find and adapt a document layout that suits your business needs, saving time and effort in the process of documentation preparation.