Free Commercial Invoice and Packing List Template for Efficient Shipping

When shipping goods internationally, providing accurate paperwork is crucial to ensure smooth customs clearance and timely delivery. Proper documentation not only helps avoid delays but also ensures compliance with import-export regulations. With the right documents, both exporters and importers can streamline the process, reduce risks, and maintain a smooth flow of goods across borders.

Among the essential documents required for international shipments are those that detail the contents, value, and destination of the items being sent. These documents serve as a proof of transaction, as well as a guide for customs officers to verify the shipment. Utilizing pre-designed forms can save time, minimize errors, and ensure consistency in documentation across multiple shipments.

In this article, we will explore how to effectively use these essential forms, what to include, and the benefits of utilizing ready-made options. By understanding the structure and importance of these shipping documents, businesses can optimize their international logistics and avoid common pitfalls associated with inaccurate or incomplete paperwork.

What is a Commercial Invoice

A key document in global trade, this form outlines the details of a transaction between the seller and the buyer. It serves as both a proof of the agreement and a record for financial purposes, often required by customs authorities. This document provides essential information about the items being shipped, their value, and the terms of sale. Understanding what needs to be included in this document ensures smooth processing at various stages of international shipping.

The primary purpose of this document is to facilitate customs clearance. Customs officials use it to determine duties, taxes, and whether the goods comply with local regulations. Additionally, it acts as a confirmation of the sale, which may be needed for both tax reporting and future reference in case of disputes or claims.

The following table outlines the typical components found in this document:

| Section | Description |

|---|---|

| Seller’s Information | Name, address, and contact details of the person or company sending the goods. |

| Buyer’s Information | Name, address, and contact details of the recipient or purchaser. |

| Product Description | A detailed list of the items, including quantity, weight, and value. |

| Terms of Sale | Conditions agreed upon for the transaction, such as delivery terms and payment arrangements. |

| Total Amount | The total value of the goods, including any discounts, taxes, or fees. |

| Currency | The currency in which the transaction is conducted (e.g., USD, EUR). |

| Shipping Information | Details on how and when the goods will be shipped, including tracking information if applicable. |

By including these essential elements, this document ensures clarity between the buyer and seller while meeting the requirements of customs and other regulatory bodies.

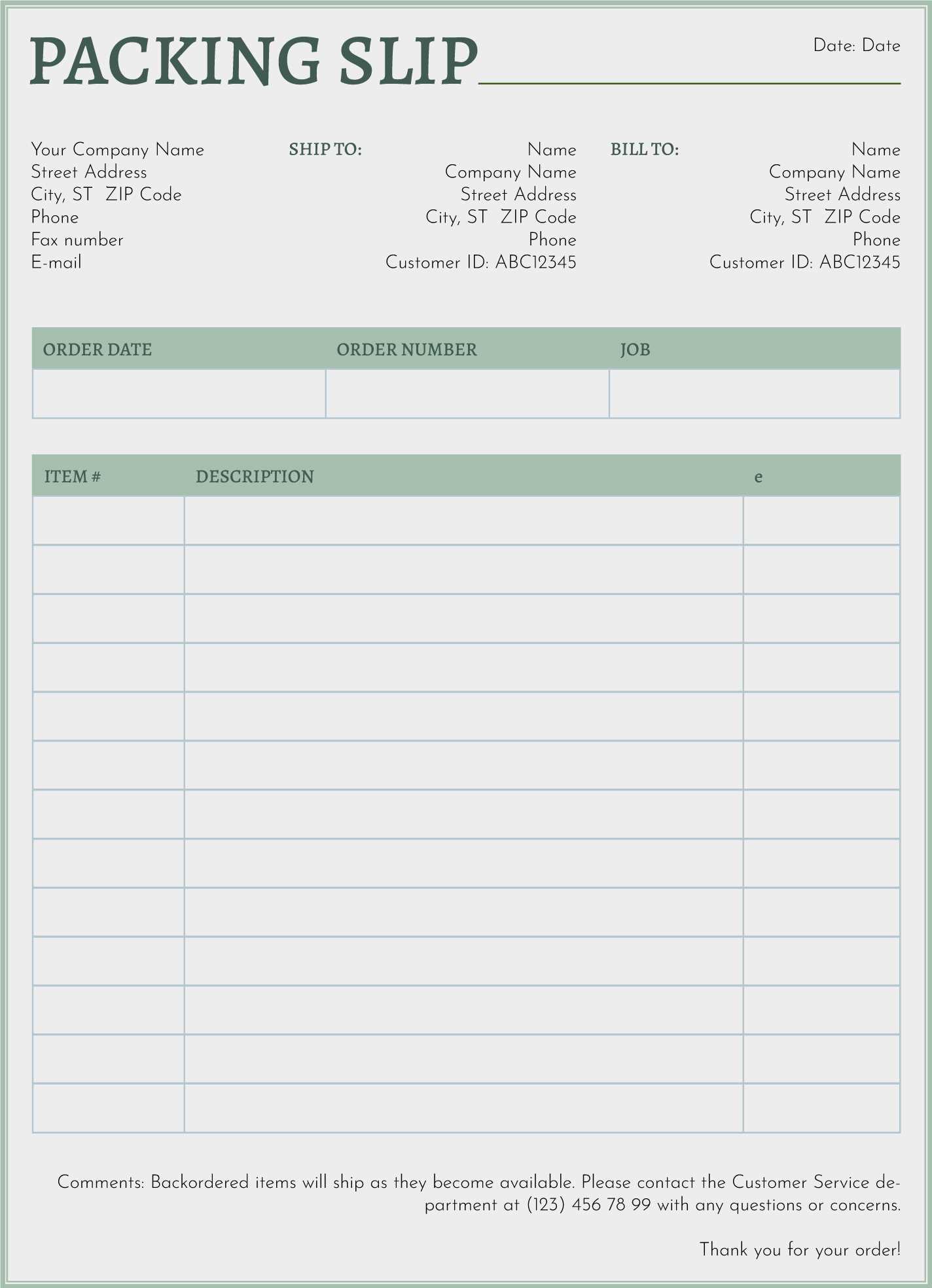

Importance of Packing List in Shipping

When sending goods internationally, having a well-organized document detailing the contents of a shipment is essential for smooth handling at various stages of transport. This specific document acts as a guide for both the shipper and the receiver, ensuring that the correct items are delivered in the right quantities. Its role extends beyond just tracking items–it plays a crucial part in simplifying customs clearance, minimizing errors, and avoiding delays.

Here are some key reasons why this document is indispensable in the shipping process:

- Facilitates Customs Clearance: Customs officers rely on this document to verify the contents of the shipment, ensuring that goods meet regulatory requirements and that taxes or duties are correctly assessed.

- Prevents Shipping Errors: A detailed breakdown of the shipment helps avoid confusion regarding missing or incorrect items, reducing the risk of costly mistakes during transport.

- Ensures Accurate Delivery: This document assists in confirming that the correct items are delivered to the right destination, providing an added layer of security and reducing potential disputes between the seller and buyer.

- Simplifies Inventory Management: With a clear record of all goods being shipped, both parties can easily track the status of the shipment, making it easier to manage inventory and prepare for the arrival of the goods.

- Supports Claim Processes: In the event of loss or damage during transport, this document acts as a reference for any insurance claims or legal actions, ensuring that all parties are on the same page about the shipment’s contents.

Overall, this document serves as a vital tool that enhances efficiency, accuracy, and accountability in the logistics process, making it a must-have for any international shipment.

Key Elements of a Commercial Invoice

In global trade, providing clear and accurate documentation is essential for smooth transactions and customs clearance. A well-prepared document detailing the sale of goods includes various components that serve different purposes, from confirming the agreement between the buyer and seller to helping customs authorities assess duties and taxes. Knowing the key elements to include ensures that your documentation is complete and meets all legal and regulatory requirements.

The following are the crucial elements typically found in this type of document:

- Seller’s Information: The name, address, and contact details of the business or individual sending the goods.

- Buyer’s Information: The name, address, and contact details of the recipient or purchaser, ensuring accurate delivery.

- Item Description: A detailed description of each item being shipped, including quantity, weight, size, and model number (if applicable).

- Unit Price: The price per unit of each item in the shipment, helping to calculate the total value of the goods being sent.

- Total Value: The total monetary value of the goods, including any discounts or adjustments, as well as the sum of individual items’ values.

- Currency of Transaction: The currency in which the goods are priced (e.g., USD, EUR, GBP), which is essential for payment processing and customs valuation.

- Payment Terms: The terms agreed upon between the buyer and seller, such as payment method, due date, and conditions of sale.

- Shipping Details: Information about the delivery method, including the carrier, shipping date, tracking number, and any special shipping instructions.

- Incoterms: The agreed shipping terms that define the responsibilities of the buyer and seller, such as “FOB” or “CIF”.

- Signature: The signature of the seller or their representative, confirming the accuracy and authenticity of the document.

Each of these components plays a key role in ensuring transparency, accuracy, and compliance with international trade regulations. A complete and detailed document not only helps with customs processing but also provides a solid foundation for resolving any disputes or issues that may arise during transit.

How to Create a Packing List

Creating an organized document that details the contents of a shipment is a vital step in the logistics process. This record helps to ensure that all items are accounted for before shipment, assists in proper inventory management, and facilitates customs procedures. By following a clear structure, you can ensure that both the sender and recipient have an accurate understanding of what is being sent and in what quantities.

Steps to Prepare a Complete Shipment Breakdown

Here are the essential steps to follow when compiling this document:

- Identify the Contents: Begin by listing every item being shipped. Include a detailed description for each product, specifying type, model, size, and any relevant features.

- Determine Quantity: Include the number of units for each item being shipped. This helps avoid confusion or potential shortages when the goods arrive at their destination.

- Weight and Dimensions: Record the weight and dimensions of each individual item or package. This information is essential for shipping calculations and ensuring that items fit within required container sizes.

- Provide SKU or Serial Numbers: If applicable, include specific identification codes or serial numbers for products, especially for high-value or sensitive goods.

- Indicate Packaging Method: Note how each item is packed, whether it is in a box, crate, or other type of container. This will help handlers identify fragile or special care items during transport.

Additional Tips for Accuracy

- Double-check for Completeness: Before finalizing, review all information for accuracy. Missing details can cause delays during customs processing or lead to confusion during delivery.

- Use Clear Formatting: Ensure that the document is easy to read, with each section clearly labeled and all quantities and descriptions easy to understand. A well-organized document minimizes the risk of mistakes.

- Keep a Copy: Always maintain a copy of the record for your records. This is helpful for tracking purposes or in case of discrepancies during transit.

By following these steps, you can create a clear and effective document that supports the smooth movement of goods, ensures regulatory compliance, and improves overall shipping efficiency.

Why Templates Simplify International Shipping

Using pre-designed documents for international shipments can greatly streamline the entire process. These ready-made forms ensure that all necessary details are included, reducing the chances of errors or omissions that could lead to delays or complications. With clearly defined sections, templates help both the sender and receiver stay organized, making it easier to comply with various regulations and keep track of important shipping information.

Here’s how these forms simplify global shipping operations:

| Benefit | Explanation |

|---|---|

| Consistency | Templates offer a standardized format, ensuring that all required information is presented clearly and consistently across shipments. |

| Time-Saving | By eliminating the need to create documents from scratch each time, templates save valuable time, allowing businesses to focus on other critical tasks. |

| Accuracy | Pre-designed forms guide users through the necessary fields, reducing the risk of mistakes and ensuring that all relevant information is provided correctly. |

| Compliance | Templates are often designed to meet international shipping regulations, helping businesses comply with customs and avoid penalties. |

| Ease of Use | Templates are user-friendly and can be quickly filled out, even by those without extensive shipping experience, ensuring that documents are prepared efficiently. |

By using these pre-built forms, businesses can significantly reduce the administrative burden of shipping, enhance operational efficiency, and ensure a smooth transaction process for both the sender and the recipient. This ultimately leads to faster processing, fewer delays, and a more reliable shipping experience overall.

Essential Information for a Commercial Invoice

When preparing documents for international trade, it’s crucial to include specific details that ensure accuracy and compliance with customs requirements. A well-organized document helps to avoid delays, prevent confusion, and guarantee that all parties involved are on the same page regarding the transaction. The correct information not only facilitates the smooth movement of goods across borders but also ensures that all legal obligations are met.

Key Details to Include

Below are the critical elements that should be included in the document to ensure it meets international shipping standards:

| Section | Description |

|---|---|

| Seller’s Information | The full name, address, and contact details of the business or individual sending the goods. This information is necessary for proper identification. |

| Buyer’s Information | The recipient’s full name, address, and contact details. Accurate details ensure that the shipment reaches the correct destination. |

| Product Description | A detailed description of the goods, including the type, model, quantity, and value. This helps customs assess the shipment and ensures correct classification for tariffs. |

| Value of Goods | The total price for each item being shipped, including the unit price and any applicable discounts or taxes. |

| Payment Terms | The agreed conditions for payment, such as when payment is due, method of payment, or other financial arrangements between the parties. |

| Shipping Information | Details regarding the shipping method, carrier, shipping date, and any tracking numbers that will help trace the shipment during transit. |

| Signature | The seller’s signature or that of their authorized representative, which certifies the accuracy of the document and confirms the transaction. |

Why This Information is Crucial

Each of these details plays a critical role in ensuring that the transaction is legally binding, that customs procedures are followed correctly, and that the goods are shipped without unnecessary delays. Accurate records also provide essential backup in case of disputes or claims, offering clarity and transparency to all parties involved in the trade.

Common Mistakes to Avoid in Invoices

When preparing essential documents for international shipments, it’s important to ensure that all details are accurate and complete. Even small errors can lead to delays, confusion, or compliance issues with customs. By understanding common mistakes, you can avoid costly setbacks and streamline the shipping process. Below are some frequent errors that should be carefully avoided.

- Missing or Incorrect Seller/Buyer Information: Incomplete or incorrect contact details for either the sender or recipient can cause major delays. Ensure that all addresses, phone numbers, and email addresses are accurate and up to date.

- Inaccurate Item Descriptions: Vague or incomplete descriptions of products can lead to misunderstandings or customs issues. Be specific about the items’ characteristics, such as model numbers, sizes, and quantities.

- Omitting or Misstating the Value of Goods: Providing inaccurate pricing or omitting the value of the goods is a serious mistake that can cause issues with both customs and payments. Ensure that all items are correctly valued and reflect the true transaction cost.

- Not Including the Correct Currency: Always specify the currency used for the transaction. If you fail to do this, it can lead to confusion regarding the amount due or complications in converting currencies during payment.

- Incorrect Payment Terms: Be sure to clearly state the agreed payment terms, such as whether it is prepaid, payable upon receipt, or under other conditions. Vague or missing payment terms can cause disputes and delays.

- Missing Shipping Details: Omitting shipping information, such as the delivery method, tracking number, or carrier details, can create confusion and prevent timely delivery. Always include full shipping instructions.

- Failure to Include Required Signatures: Not providing the signature of the seller or authorized representative can invalidate the document. Make sure to sign the document to verify its authenticity.

- Leaving Out or Misunderstanding Legal or Regulatory Requirements: Depending on the destination country, certain regulations or forms may be required for the goods to clear customs. Not adhering to these legal requirements can result in delays or even fines.

By carefully reviewing these common mistakes, you can ensure that all documents are properly filled out and meet all legal and shipping requirements. Avoiding these errors not only makes the process smoother but also helps you maintain good relations with buyers, customs, and other stakeholders involved in the shipping process.

How to Choose the Right Template

Selecting the appropriate form for documenting shipments is crucial for ensuring smooth transactions and compliance with customs regulations. The right document should not only contain the required information but also be easy to use and adaptable to your specific shipping needs. Choosing a template that aligns with your business requirements can save time, minimize errors, and prevent delays.

Here are some key factors to consider when selecting the best option for your shipments:

- Purpose of the Shipment: Consider the type of goods you’re shipping. For example, high-value items may require additional details, such as serial numbers or insurance information, which should be reflected in the chosen form.

- Customization Options: Ensure the document can be customized to fit your unique needs. You may need to add specific fields or remove unnecessary sections depending on the type of goods or your company’s processes.

- Compliance with Regulations: Verify that the form meets the customs requirements of both the sending and receiving countries. Some regions may have stricter documentation guidelines, so it’s important that the chosen format adheres to local laws.

- Ease of Use: Select a form that is easy to fill out and understand, even for those who are not familiar with the process. A user-friendly layout helps reduce mistakes and speeds up the completion process.

- Digital or Physical Format: Decide if you need a digital form that can be easily filled out and shared electronically, or a physical version that will be printed and included with shipments. Some businesses may require both depending on the shipping method.

- Integration with Other Systems: If you use an enterprise resource planning (ERP) or logistics management system, look for a form that can integrate with these tools to streamline your workflow and reduce manual data entry.

By taking these factors into account, you can select a document that will not only fulfill the basic requirements but also streamline the shipping process, making it more efficient and accurate for all parties involved.

How Packing Lists Aid Customs Clearance

During international shipments, customs clearance is one of the most critical stages. It ensures that goods comply with all legal and regulatory requirements before they are allowed to enter a country. A well-prepared document that details the contents of a shipment can significantly expedite this process. By providing a clear and organized breakdown of the items being sent, this document helps customs officials assess the shipment, verify its value, and apply the correct duties and taxes.

Here’s how such a document plays an essential role in speeding up customs clearance:

- Detailed Breakdown: A clear and comprehensive record of the goods enables customs officers to easily identify each item, reducing the time spent inspecting shipments. The more accurate the details, the smoother the clearance process.

- Verification of Item Value: Customs authorities rely on this document to verify the declared value of goods. With precise information, they can quickly assess whether the correct taxes and duties are being applied, preventing delays.

- Compliance with Regulations: Different countries have different import rules and restrictions. This document ensures that the shipment meets the specific requirements of the destination country, helping to avoid potential confiscations or fines.

- Customs Classification: The detailed descriptions in this document assist in the correct classification of goods, ensuring they are categorized under the right tariff codes. This prevents misclassification issues that could delay processing or result in incorrect duty assessments.

- Tracking and Transparency: Customs officials often use these records to trace the contents of a shipment, ensuring transparency throughout the shipping process. This level of detail helps prevent misunderstandings or disputes between the sender, recipient, and customs authorities.

By providing all the necessary information upfront, this document significantly reduces the chances of delays or complications at the border. With a proper breakdown of goods, customs clearance becomes a more efficient process, ensuring that shipments are delivered on time and in compliance with all applicable laws.

Customizing Your Invoice Template

Adapting your document to fit your specific business needs is essential for maintaining professionalism and ensuring smooth transactions. Customization allows you to tailor the format and information to suit the type of goods being shipped, your company’s branding, and the unique requirements of your clients or regulatory authorities. By adjusting key sections, you can create a document that accurately reflects your business operations and helps you avoid potential issues during customs or payments.

Here are some key elements you can customize to better suit your business:

- Branding and Logo: Incorporate your company’s logo and branding elements to make the document reflect your business identity. A professional appearance builds trust with your clients and partners.

- Additional Fields: You may need to add specific fields that are relevant to your products or services. For example, if you are shipping hazardous materials, adding safety data or handling instructions can be important.

- Payment Terms: Customize the payment section to reflect your specific terms. This can include details like due dates, discounts for early payment, or different payment methods accepted by your business.

- Shipping Details: Ensure that the form allows you to specify shipping methods, tracking numbers, and carrier information clearly, especially if you work with multiple shipping providers.

- Tax and Currency Information: Modify sections to reflect applicable taxes, VAT, or other duties, ensuring the document aligns with the financial regulations of your region or the recipient’s country.

- Custom Notes or Instructions: Add a section for any special instructions, whether it’s about the handling of the goods, delivery schedules, or important conditions that need to be addressed between you and the buyer.

- Legal Disclaimers: If your business deals with specific warranties, return policies, or other legal agreements, you can include a section for these terms to protect both parties legally.

Customizing your document ensures it is more than just a legal requirement–it becomes a functional and professional tool that reflects your business’s standards and improves communication with your customers. Tailor it to your needs, and you’ll streamline your processes while maintaining a strong, reliable brand image.

Difference Between Invoice and Packing List

While both documents play crucial roles in the shipping process, they serve different purposes and contain different types of information. Understanding the distinctions between them is important for businesses to ensure that their shipments are processed correctly and efficiently. One document primarily focuses on financial transactions, while the other is centered around the physical shipment details. Both are essential for smooth operations, but each fulfills a unique role in the supply chain.

Purpose and Focus

The first document is typically a record of the financial transaction between the buyer and seller. It outlines the agreed payment terms, prices of the goods, and any taxes or duties owed. It acts as a request for payment and may be used for accounting or tax purposes.

The second document, on the other hand, is a detailed summary of the items being shipped. It lists the contents of the shipment, including the quantity, weight, and packaging details. It is primarily used to ensure that the recipient knows exactly what has been shipped and to assist in handling, sorting, or inspecting the goods.

Key Differences

- Content: The financial document includes pricing, payment terms, and total amounts due, whereas the physical document includes detailed descriptions of the products, packaging, and quantities.

- Function: One serves as a financial tool for payment and accounting, while the other is a logistical tool used to confirm the shipment’s contents and facilitate handling and delivery.

- Usage: The first document is mainly used for transaction verification, customs declarations, and financial records. The second is used by shipping departments, customs officials, and recipients to verify the goods and ensure the correct delivery.

In summary, while both documents are critical for international shipping, they serve distinct functions–one focused on financial transaction details and the other on the physical aspects of the goods being shipped. Understanding their differences helps businesses keep accurate records and ensures the proper handling of both the financial and logistical elements of the shipment.

Best Practices for Packing List Accuracy

Ensuring the accuracy of shipping documents is essential for a smooth transaction process. A well-organized, error-free list not only helps to prevent delays in transit but also minimizes the risk of disputes or misunderstandings between parties. To avoid costly mistakes, it’s important to follow certain best practices when documenting the items being shipped.

Key Practices for Ensuring Accuracy

- Double-check Product Details: Always verify that the descriptions of the goods are accurate, including their size, model, and quantity. Ensure that every item matches what was agreed upon in the sales contract or purchase order.

- Update Quantities Regularly: Confirm the number of units being shipped before finalizing the document. Missing or incorrect quantities can lead to delays at customs or confusion on the receiving end.

- Cross-reference with Other Documents: Compare the details on the shipment record with the original sales order, packing slips, or purchase agreements. Cross-checking can help identify any discrepancies before they cause issues.

- Include Detailed Packaging Information: Indicate how items are packed, including the number of boxes, cartons, or pallets. This will assist in logistics and ensure that everything is handled properly during transit.

- Use Clear and Consistent Terminology: Avoid ambiguous terms when describing products. Use universally recognized terminology to ensure that everyone involved understands the specifics of the shipment.

- Review Shipment Destination: Confirm the delivery address and shipping instructions to avoid any errors in routing or delivery. This ensures the correct goods reach the right location without complications.

- Incorporate Serial Numbers or Batch Codes: For high-value or regulated items, always include serial numbers or batch codes where applicable. This information aids in tracking, quality control, and customs clearance.

Tools for Enhancing Accuracy

- Automated Systems: Use software solutions that integrate with your inventory or shipping systems to reduce human errors and ensure data consistency across all documents.

- Barcode Scanning: Incorporate barcode scanning to quickly verify product details and ensure that the right items are included in the shipment.

- Clear Documentation Guidelines: Establish clear guidelines for how packing information should be recorded, and train staff to follow them to maintain consistency and avoid errors.

By following these best practices, businesses can ensure that their shipping records are accurate and reliable. Accuracy reduces the chances of delays, fines, or disputes and ultimately leads to a more efficient and professional shipping process.

How to Print and Organize Documents

Efficient document management is crucial for maintaining smooth operations, especially when dealing with international shipments. Ensuring that all necessary records are properly printed, organized, and easily accessible can help prevent delays, errors, and miscommunication. A well-organized system not only saves time but also ensures compliance with legal and logistical requirements.

Steps for Printing Shipping Documents

Follow these steps to ensure your records are printed correctly and professionally:

- Verify All Information: Before printing, double-check that all the details on the document are correct, including product descriptions, quantities, values, shipping details, and payment terms.

- Choose the Right Paper Size: Select a paper size that is standard for your industry or region (usually A4 or letter size) and make sure the document fits on the page without cutting off any important information.

- Ensure Clear Legibility: Use a high-quality printer to ensure that all text and barcodes are legible. Faded or unclear printing can cause delays during inspection or at customs.

- Print in Color (When Necessary): If your document includes logos, barcodes, or important visual indicators, consider printing in color to ensure clarity and prevent mistakes.

Organizing Documents for Easy Access

Proper organization of your printed shipping documents will help maintain order and streamline the shipping process:

- Label and Categorize: Create a labeling system to differentiate between different types of documents (e.g., contracts, receipts, shipment records). This will help you locate any document quickly when needed.

- Use Folders or Binders: Store documents in clearly marked folders or binders for easy retrieval. For frequent shipments, consider organizing by shipment date or order number.

- Use Digital Copies: In addition to physical records, maintain digital versions of all important documents. This provides backup copies in case the physical ones are lost or damaged.

- Separate by Shipment Type: For businesses that handle multiple types of shipments (e.g., small packages, freight), keep separate folders or sections for each type. This ensures the right documents are paired with the right shipments.

Recommended Tools for Organizing Documents

- Free Templates vs Paid Options

When preparing shipping documentation, businesses often face the decision of whether to use free resources or invest in premium solutions. While free options are appealing due to their no-cost nature, paid options typically offer additional features, customization, and support. Understanding the pros and cons of both choices can help you decide which is best suited for your specific needs.

Advantages of Free Resources

- No Cost: The most obvious benefit of free options is that they come with no financial investment, making them an attractive choice for small businesses or startups with tight budgets.

- Quick Access: Free resources are usually easy to access and download, allowing businesses to get started immediately without long setup times or subscriptions.

- Simple Designs: These resources typically offer basic, no-frills designs that are easy to use for straightforward shipments without requiring advanced features.

Drawbacks of Free Resources

- Limited Customization: Free templates often come with predefined structures and limited options for customization. This can make it difficult to adapt the documents to specific business needs or branding requirements.

- Basic Features: Many free options lack advanced features such as automated calculations, integration with other systems, or detailed reporting, which may limit their usefulness for growing businesses.

- Potential for Errors: Free solutions may not always be updated regularly, leading to potential errors in tax calculations or format incompatibilities with other systems.

Advantages of Paid Solutions

- Advanced Features:

When to Use a Commercial Invoice Template

Utilizing standardized documents is essential for smooth and efficient transactions in international trade. The right documents can facilitate the customs clearance process, ensure accurate financial records, and help businesses avoid delays or disputes. A well-structured document serves as a clear record of the sale, outlining critical transaction details such as the cost, shipping terms, and goods involved. But knowing when to use this particular document template is just as important as understanding its contents.

Scenarios Requiring a Structured Document

Here are some situations where using a standardized document format can streamline processes and reduce the risk of errors:

- International Shipments: When goods are being shipped across borders, customs authorities require detailed documentation to assess the value, origin, and purpose of the items. This helps ensure the correct payment of duties and taxes.

- Payment Requests: If your business is requesting payment for goods or services, a properly formatted document helps clearly communicate the amount due, payment terms, and any applicable charges or discounts.

- Regulatory Compliance: In some countries, specific forms are required for the clearance of goods through customs or to comply with trade regulations. Using a standardized version of this document ensures compliance with international trade laws.

- Insurance Claims: When dealing with shipping insurance, providing a clear, accurate record of the shipped goods can help facilitate claims in case of damage, theft, or loss during transit.

- Returns and Refunds: When returning items to suppliers or requesting a refund, a structured document can outline the reason for return, the condition of the items, and the associated costs.

Advantages of Using a Structured Format

By using a predefined document format, you ensure that all essential information is included and presented clearly, reducing the chance of oversight or mistakes. Key benefits include:

- Consistency: A uniform approach ensures that all transaction records are similar in structure, making it easier to compare or audit details across multiple shipments or orders.

- Efficiency: A template helps eliminate the need to re-enter repetitive details for each transaction, saving time and reducing the chances of human error.

- Professionalism: Using a standardized document demonstrates professionalism and helps build trust with clients, partners, and customs officials.

In summary, using a structured document when shipping goods, requesting payment, or dealing with customs not only ensures compliance but also helps streamline processes, reduce errors, and improve operational efficiency. Recognizing when to use it and understanding its importance can save tim

How Templates Save Time and Reduce Errors

In any business, especially those involved in shipping and logistics, efficiency and accuracy are paramount. Using predefined document structures can significantly streamline operations by eliminating manual data entry and ensuring consistency across various records. By having a clear and standardized format, businesses can reduce the time spent on document preparation while minimizing the risk of mistakes.

Time-Saving Benefits

Pre-designed forms save businesses significant time in a variety of ways:

- Pre-Filled Fields: Many predefined formats come with fields that are already set up for specific data, such as product descriptions, quantities, and pricing. This reduces the need to manually fill in these details each time, speeding up the overall process.

- Faster Processing: With a ready-to-use structure, employees can quickly input data into the necessary sections, ensuring that records are completed faster and sent to recipients in a timely manner.

- Consistency Across Documents: By following a consistent layout, teams can work more efficiently since everyone is familiar with the format. It also makes it easier to compare or cross-check multiple records.

Reducing Errors and Inaccuracies

Templates play a critical role in minimizing mistakes that can occur during manual document creation:

- Standardized Structure: Having a fixed structure ensures that key information is never omitted, reducing the chance of overlooking essential details like dates, values, or delivery instructions.

- Built-In Validation: Some predefined forms come with built-in checks, such as automatic calculations or fields that prompt for missing information, helping to prevent errors before they occur.

- Uniformity: A standardized document minimizes inconsistencies that can arise when different team members use different formats. It ensures that all records adhere to the same structure, leading to fewer misunderstandings and discrepancies.

By integrating predefined forms into everyday workflows, businesses can not only speed up document generation but also improve the accuracy and reliability of their records. This leads to fewer mistakes, less backtracking, and more streamlined operations, all of which contribute to a more efficient and cost-effective business model.

Ensuring Compliance with Shipping Regulations

Shipping goods internationally involves adhering to a wide range of legal and regulatory requirements. Whether it’s meeting customs demands, ensuring proper documentation, or following international trade rules, compliance is critical to prevent delays, fines, or even the confiscation of goods. Properly structured shipping documents are an essential part of this process, as they ensure that all necessary information is clearly communicated to authorities and partners, allowing shipments to move smoothly across borders.

Key Regulatory Requirements for Shipping

Different countries and regions have specific rules that govern the movement of goods. Ensuring compliance often means being aware of the following:

- Customs Declarations: Most countries require a declaration of the goods being imported or exported, including their value, origin, and intended use. This helps customs authorities assess taxes, duties, and whether the items are restricted or prohibited.

- Accurate Classification: Shipping documents should classify items accurately according to international harmonized codes, which determine the applicable tariffs and regulations for each product type.

- Proof of Origin: Many countries require proof of origin documents to confirm where the goods were manufactured or produced. This is essential for calculating tariffs and verifying that goods comply with trade agreements.

How Structured Documents Help Maintain Compliance

Using standardized formats for shipping records helps businesses comply with these regulatory requirements more easily:

- Consistent Information: Predefined forms ensure that all essential details, such as product descriptions, values, and origin, are included in a consistent format, reducing the chances of missing key information required for customs clearance.

- Pre-Configured Fields: Templates with built-in fields for things like tax identification numbers, shipping terms, and delivery methods make it easier to ensure that all relevant data is captured accurately.

- Regulation-Focused Layout: Many predefined formats are designed to meet the specific requirements of international shipping, incorporating fields that align with the demands of different customs authorities and trade agreements.

By using structured documents designed for international shipping, businesses not only reduce the risk of regulatory violations but also increase efficiency in the overall process. Proper documentation ensures that goods move through customs with minimal delays, and that businesses can meet their legal obligations with ease.