Commercial Invoice and Packing List Template Excel for Efficient Shipping

In the world of international commerce, managing proper documentation is key to ensuring smooth transactions. Whether you’re shipping goods to a distant market or receiving products from a supplier, accurate records are essential. This involves providing detailed information about the items being shipped, their value, and the terms of the transaction, all of which help streamline the process and ensure compliance with customs regulations.

One of the most effective ways to handle these documents is through the use of digital formats that allow for quick edits, easy customization, and straightforward organization. Using a simple spreadsheet tool, businesses can create structured, clear forms that fulfill legal requirements while reducing the risk of costly errors. These forms help both the sender and the recipient understand the key details of a shipment, ensuring timely delivery and minimizing the chances of miscommunication or delays.

In this guide, we’ll explore how to set up these critical shipping documents using a widely accessible tool. By using the right layout and following a few key principles, anyone can create accurate, professional documentation that meets both internal and external needs. This approach helps save time, avoid mistakes, and maintain a higher level of control over logistics operations.

Understanding the Importance of Commercial Invoices

Accurate documentation is a fundamental part of any transaction, especially when goods are being shipped internationally. These records serve multiple purposes, from verifying the contents of a shipment to ensuring compliance with regulations in both the sending and receiving countries. Without detailed, well-prepared paperwork, businesses risk facing delays, fines, or even rejection of shipments. Properly structured forms help both parties understand the terms of the deal, reducing the potential for disputes and misunderstandings.

Role in Customs Clearance

One of the most important functions of this document is its role in customs procedures. Customs authorities rely on detailed shipping records to assess duties, taxes, and ensure that goods comply with international trade laws. A complete, correct record provides the information necessary to clear the goods without delays or complications. Inaccuracies can lead to shipments being held up, which may affect delivery times and overall business operations.

Legal and Financial Significance

Beyond customs, these records are crucial for both legal and financial reasons. They serve as proof of transaction terms, protecting both buyers and sellers in case of disputes. For businesses, they also play a role in bookkeeping, tax reporting, and inventory management. Ensuring that each document is accurate and complete helps avoid issues that might arise during audits or financial reviews.

What is a Packing List and Why It Matters

A detailed shipping document that outlines the contents of a package is essential for both the sender and the receiver. It serves as a checklist, ensuring that the right items are sent, and provides valuable information to facilitate the smooth movement of goods through the supply chain. The document typically includes item descriptions, quantities, weights, and any other relevant details needed to track and verify the shipment’s contents.

This form plays a vital role in several areas of logistics and trade:

- Accuracy of Shipment: Helps verify that the correct products are included in the shipment, preventing errors and misunderstandings.

- Customs Clearance: Assists customs officers in inspecting the goods, confirming their nature, quantity, and value to calculate duties and taxes.

- Dispute Resolution: Acts as proof of what was sent, which can be crucial in case of damaged or missing items.

- Inventory Management: Aids businesses in tracking their stock and ensuring accurate records of what has been shipped or received.

For companies engaged in global trade, having a detailed document is more than just a formality–it is an essential tool for streamlining operations and ensuring compliance with international laws.

How Excel Templates Simplify Documentation

Managing shipping paperwork manually can be time-consuming and prone to errors. However, using structured digital formats can significantly streamline the process, making it faster, more accurate, and less stressful. A well-organized spreadsheet not only allows for easy data entry but also enables quick edits and automatic calculations, reducing the likelihood of mistakes. With customizable fields, businesses can tailor documents to their specific needs, ensuring that all required information is captured correctly each time.

Here are several ways in which using spreadsheets can simplify documentation tasks:

- Consistency: Pre-designed fields ensure that important details are consistently included every time, avoiding the omission of crucial information.

- Automation: Built-in formulas can automatically calculate totals, taxes, and other variables, saving time and reducing errors.

- Ease of Updates: Updates and changes to the document can be made quickly and efficiently without starting from scratch each time.

- Customization: Spreadsheets allow for easy customization to fit specific business needs, such as adding extra fields or adjusting layouts.

- Improved Organization: Data is stored in an easily accessible format, making it simpler to track, review, and share documentation across departments or with external partners.

By shifting to a digital format, businesses can enhance both productivity and accuracy, ensuring that shipping documentation is always ready when needed and easily shared with relevant parties.

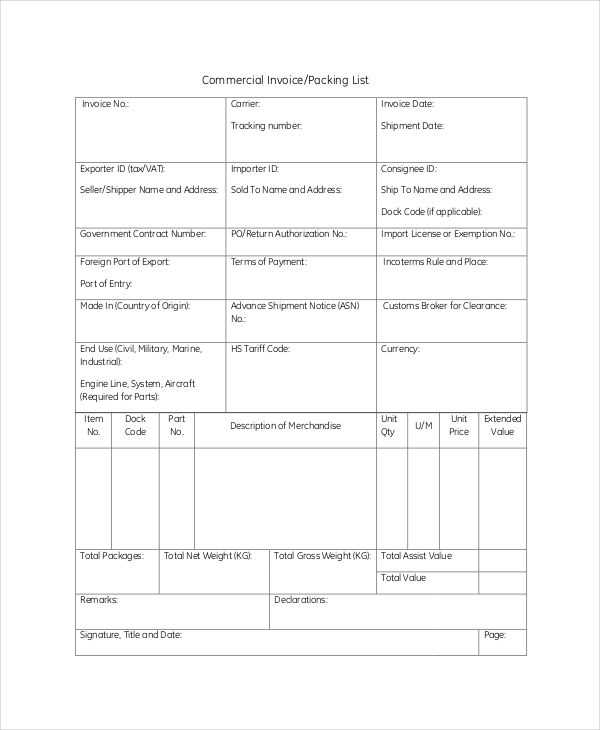

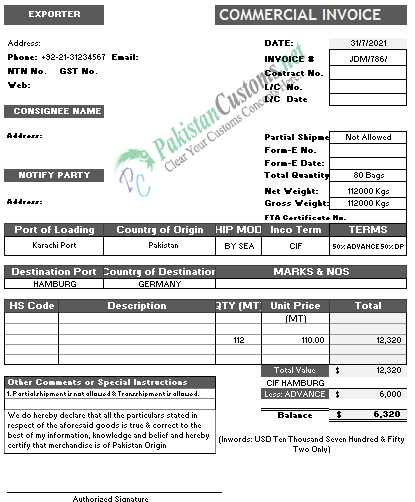

Key Components of a Commercial Invoice

A well-structured document for shipment transactions should include several key details to ensure smooth processing and compliance with regulations. Each part of the document provides critical information that allows both the sender and recipient to clearly understand the terms of the shipment, its contents, and the agreed-upon financials. Without these essential components, the transaction may be delayed, or misunderstandings may arise between the involved parties.

The following table outlines the most important elements that should be included in every document related to a shipment:

| Component | Description |

|---|---|

| Seller and Buyer Information | Details about both parties, including names, addresses, and contact information. |

| Shipment Date | The date the goods were dispatched from the seller’s location. |

| Description of Goods | A detailed list of the items being shipped, including quantities, weight, and any special identifiers. |

| Pricing Details | The agreed-upon price for each item or the total cost of the shipment, including any additional charges like taxes or shipping fees. |

| Terms of Sale | The payment and delivery conditions that apply to the transaction, including delivery method, timeframes, and payment terms. |

| Currency | The currency used in the transaction. |

| Signature | The sign-off from the seller, certifying the document’s accuracy and validity. |

These components work together to provide all the necessary information for proper documentation, clearance, and processing of goods through various stages of the supply chain, ensuring that shipments reach their destination without issues.

How to Create a Commercial Invoice in Excel

Creating a detailed shipping document using a digital spreadsheet tool can help streamline the process of managing transactions. This method allows businesses to easily input, modify, and organize the necessary details to ensure smooth processing, accuracy, and compliance. By using a digital format, you also gain the flexibility to customize each record to fit your specific needs while reducing the likelihood of errors.

Follow these steps to create a well-organized shipping document:

- Open a New Spreadsheet: Start by opening a new file in your preferred spreadsheet tool. Choose a blank sheet to begin entering the necessary data.

- Enter Header Information: In the first few rows, include the business details of both the seller and the buyer. This includes company names, addresses, phone numbers, and email addresses.

- Include Transaction Details: In the next section, input the date of shipment, transaction number, and any relevant reference numbers that help identify the order.

- Describe the Goods: Create a table where you can list the products being shipped. For each item, include the description, quantity, unit price, total price, and any other relevant identifiers (such as SKU or serial number).

- Specify Payment Terms: Outline the payment terms, including the method of payment, currency, and payment due date. Make sure the terms are clearly defined to avoid any confusion.

- Include Delivery Details: Add a section that covers shipping details such as delivery method, shipping costs, and expected delivery dates. Specify who will bear the cost of transportation and other related charges.

- Apply Formulas for Totals: Utilize spreadsheet formulas to calculate the total cost for each item, as well as the grand total of the entire shipment. This will ensure accuracy and help you avoid manual calculations.

- Review and Finalize: Double-check the document for any errors or missing information. Make sure all fields are completed and correct before finalizing the document.

By following these steps, you can easily generate a professional, organized document that accurately reflects the transaction details and helps ensure efficient processing and delivery of goods.

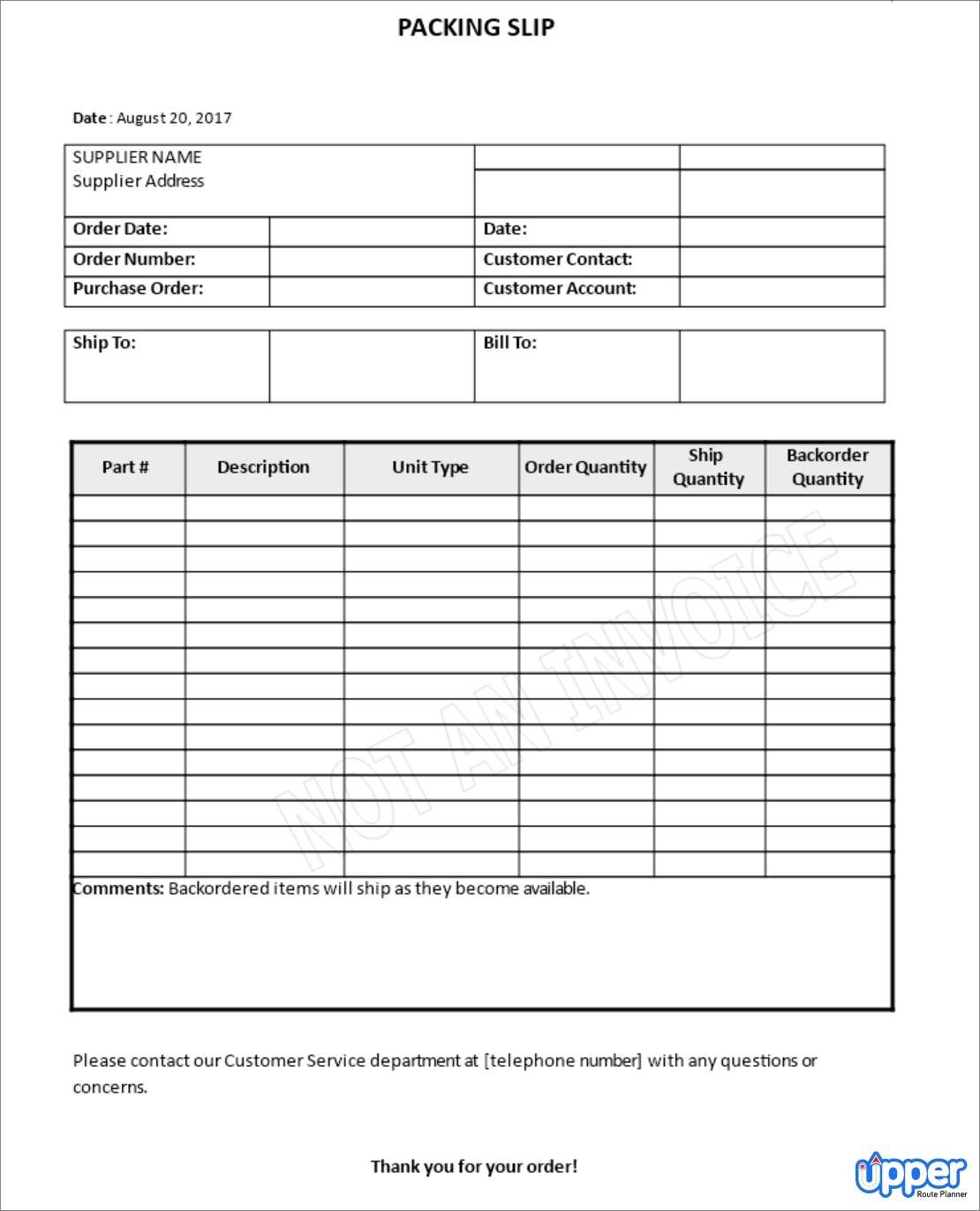

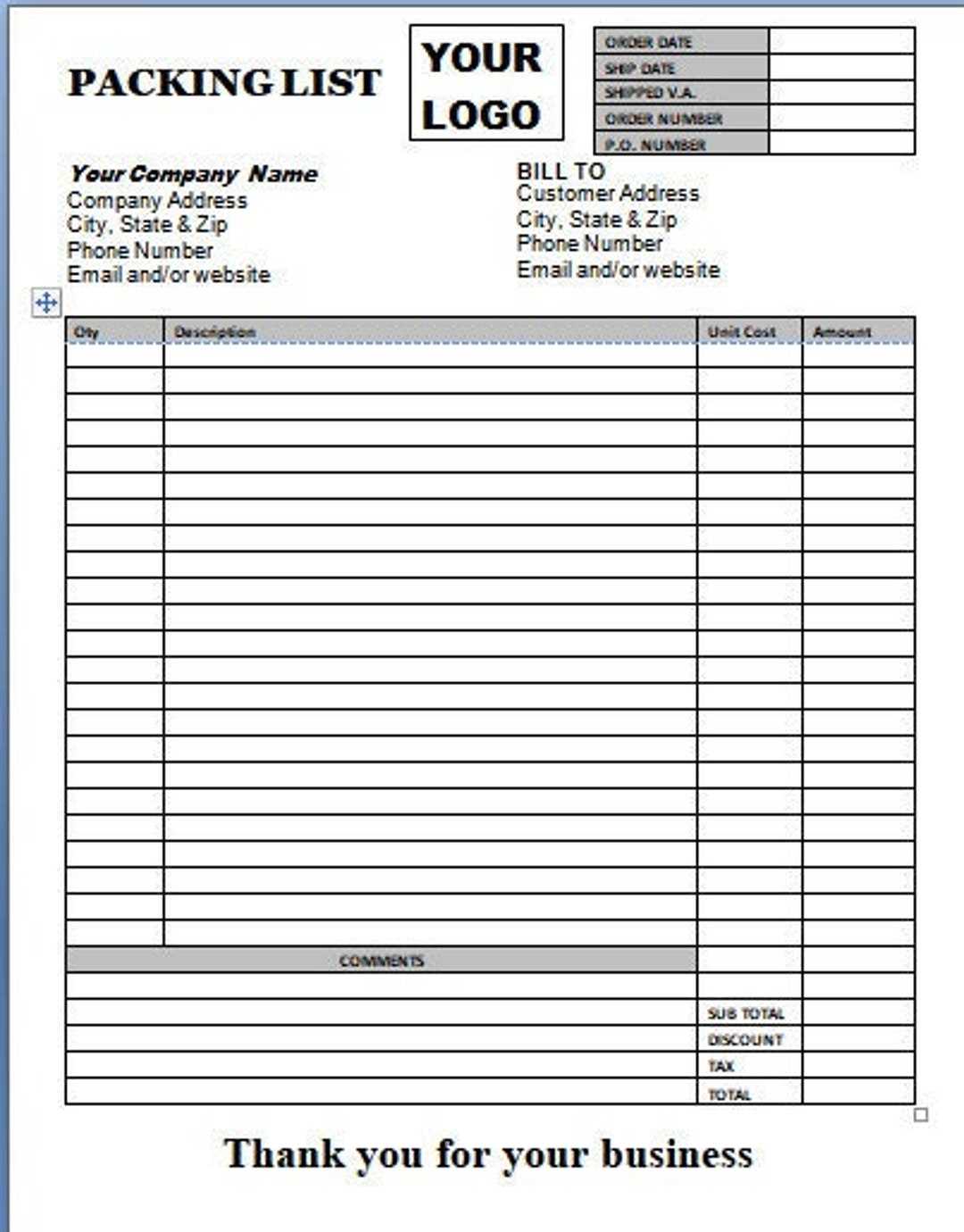

Using Excel for Packing List Creation

Creating a detailed document for tracking goods in transit is a key part of the shipping process. A well-organized record helps ensure that all items are accounted for and that there are no discrepancies between what is being shipped and what the recipient expects. By using a digital spreadsheet, you can easily list, manage, and update these details, reducing the risk of errors and improving overall efficiency in logistics management.

Benefits of Using Spreadsheets for Tracking Shipments

Using digital tools to manage shipment records offers several advantages. It simplifies data entry, allows for easy edits, and ensures all relevant information is easily accessible. Additionally, spreadsheets make it possible to automate certain tasks, such as totaling item quantities or calculating weight, which saves time and improves accuracy.

Key Information to Include in the Shipping Record

When creating a document to track your goods, it’s important to include all relevant details. Below is an example of the essential components:

| Component | Description |

|---|---|

| Item Description | A detailed name or description of the product being shipped, including any model numbers or identifiers. |

| Quantity | The number of units being shipped for each item. |

| Weight | The weight of each item or total weight of the shipment. |

| Dimensions | The measurements of the packaging or the individual items to help calculate space and shipping costs. |

| Package Type | Type of packaging used (e.g., box, pallet, crate) and any special handling requirements. |

| Destination Details | The recipient’s address and any delivery instructions or contact information. |

By including these details in a structured format, you ensure clarity and prevent mistakes that could lead to shipment delays or confusion. The flexibility of digital tools allows for easy customization to suit specific shipping needs, helping businesses improve their overall logistics process.

Best Practices for Customizing Templates

Creating documents for shipping and transaction management often requires customization to meet specific business needs or comply with local regulations. While pre-built formats can save time, tailoring these documents ensures that all relevant details are captured accurately and in a way that aligns with your processes. Customizing forms also provides flexibility, allowing businesses to track essential data points that may be unique to their operations.

Understanding Your Business Needs

Before you begin customizing a digital form, it’s important to understand the unique requirements of your business and the specific transaction. Identify the key data fields that are most relevant to your operations, whether that’s adding additional product identifiers, delivery terms, or payment conditions. By knowing exactly what information needs to be captured, you can design a document that fits your workflow and ensures consistency.

Customization Tips for Enhanced Efficiency

Here are several best practices to follow when adjusting a digital form:

- Use Clear Labels: Ensure that each section of the document is clearly labeled, so the information is easy to identify and input.

- Incorporate Drop-Down Menus: To reduce errors and speed up data entry, use drop-down menus for recurring fields such as payment methods, product categories, or shipping options.

- Automate Calculations: Utilize formulas to automatically calculate totals, taxes, shipping fees, and other necessary financial figures. This reduces manual work and prevents errors.

- Maintain Flexibility: Customize fields that can be easily adjusted for different shipment types, client needs, or unique circumstances.

- Include Space for Notes: Allow room for additional comments or special instructions, particularly for complex or non-standard transactions.

By following these tips, you ensure that the document is not only customized for your specific needs but also remains organized, efficient, and user-friendly, which will ultimately enhance your business operations.

Automating Your Shipping Process with Excel

Streamlining the shipping workflow is crucial for improving efficiency and reducing errors. By automating key tasks, businesses can significantly cut down on manual work, enhance accuracy, and speed up the overall process. Using a digital spreadsheet tool allows for the automation of various functions, from calculating costs to generating reports, all while keeping important data organized and easily accessible.

Key Areas for Automation

When it comes to automating shipping records, several areas can benefit from digital tools, reducing the time spent on routine tasks:

- Calculating Total Costs: Using formulas to automatically calculate the total price of goods, shipping fees, taxes, and other charges helps avoid manual errors and ensures accuracy in every transaction.

- Generating Shipping Labels: With pre-filled data fields, creating consistent shipping labels becomes much faster. Fields like weight, destination address, and tracking numbers can be populated automatically based on earlier data entries.

- Tracking Shipments: Automating tracking updates by linking shipment numbers with tracking services can help maintain real-time visibility on shipments, making it easier to monitor delivery progress.

- Managing Inventory: By automatically updating stock levels as goods are shipped, businesses can stay on top of inventory without the need for manual counting and adjustments.

Using Formulas for Efficiency

Another powerful way to automate the shipping process is by using built-in formulas within the spreadsheet. For example:

- IF Statements: These can be used to create conditional fields that automatically adjust based on certain inputs, such as applying discounts when specific criteria are met.

- VLOOKUP: This function helps populate fields like item descriptions, unit prices, or shipping methods based on a single reference input, reducing the need for manual entry.

- SUM & AVERAGE: These formulas can be used to quickly calculate totals for a list of products, track payments, or calculate average shipment times.

By automating repetitive tasks through these formulas, businesses can improve their efficiency, reduce errors, and focus on more strategic aspects of their operations. Automation transforms what was once a time-consuming and error-prone process into a smooth and reliable system that supports growt

Common Mistakes to Avoid in Commercial Invoices

Creating accurate documentation for shipments is critical for ensuring smooth transactions and avoiding delays or misunderstandings. However, even small errors can lead to significant issues, such as customs complications, payment disputes, or inventory discrepancies. By being aware of common mistakes, businesses can take proactive steps to avoid them and ensure their records are complete and accurate.

Here are some of the most common mistakes to avoid:

- Incorrect or Incomplete Contact Information: Failing to include accurate details for both the sender and the recipient, such as addresses, phone numbers, and email addresses, can lead to delivery issues and cause delays in resolving any shipping problems.

- Missing or Wrong Product Descriptions: Not providing enough detail or using incorrect descriptions for the items being shipped can lead to confusion and delays during customs clearance. Each product should be clearly identified with correct descriptions, including model numbers or part identifiers.

- Omitting Payment Terms: It’s essential to clearly outline the terms of payment, such as due dates, currency, and method of payment. Failure to include this information can result in payment delays or disputes.

- Failure to Include All Fees and Charges:

How to Include Tariff Codes on Invoices

When shipping goods internationally, correctly classifying items according to their tariff or customs codes is essential for ensuring smooth customs clearance and accurate tax calculations. Tariff codes help customs authorities identify the type of goods being imported or exported, which directly impacts duties, taxes, and compliance with regulations. Including the appropriate tariff codes on your shipment documents is crucial for avoiding delays or additional charges at borders.

Why Tariff Codes Matter

Each product has a unique classification code that corresponds to its category under international trade regulations. These codes are used to determine duties and taxes applicable to the shipment. By ensuring the correct code is used, businesses can:

- Ensure compliance with local customs regulations.

- Avoid delays in shipment processing at customs.

- Prevent overpayment or underpayment of import duties and taxes.

- Maintain transparency and avoid legal complications in trade transactions.

Steps to Include Tariff Codes on Shipment Documents

Including the right tariff code is relatively simple when following these steps:

- Research the Correct Code: Use the Harmonized System (HS) or the local customs database to find the correct tariff code for each product. Each country may have a slightly different system, so make sure to use the code that corresponds to the destination country.

- List the Code on the Document: Once you have the correct code, add it to the document, typically in a separate column next to the product description or SKU. The format will depend on the document style, but it should be clearly labeled as the tariff or HS code.

- Double-check for Accuracy: Verify that the codes match the products being shipped. Even minor mistakes in the code can result in incorrect tariff calculations or delayed shipments.

- Provide Additional Details: If applicable, include extra information, such as the country of origin or any certifications that support the classification of the goods, as some products may require additional documentation for clearance.

By following these steps, you can ensure your documents are properly prepared, speeding up the customs process and avoiding unnecessary delays or penalties.

Benefits of Using Excel for Shipping Documents

Using digital tools to manage shipping records offers numerous advantages for businesses of all sizes. These tools provide flexibility, accuracy, and efficiency, helping companies streamline the process of tracking orders, calculating costs, and generating reports. By leveraging a digital platform, businesses can significantly reduce the manual effort required to manage shipping documents, while also improving data accuracy and accessibility.

Here are some of the key benefits of using digital spreadsheets for managing shipping documentation:

- Efficiency in Data Entry: Digital spreadsheets allow for easy input and updates. Predefined fields and data validation can help speed up the process, especially for recurring information such as customer details, product descriptions, or shipping methods.

- Accuracy and Automation: Using built-in formulas and functions ensures calculations, such as totals, taxes, or shipping costs, are automatically performed, reducing the risk of human error.

- Customization: You can tailor the layout and structure of the document to suit your specific needs. Whether it’s adding new fields, adjusting the format, or including extra sections for special instructions, digital records can be customized to reflect your business processes.

- Easy Updates: Any changes in pricing, quantities, or other details can be quickly updated, and the document will reflect these changes in real-time across all relevant sections, making the process more dynamic and responsive.

- Centralized Storage: Storing documents digitally makes it easy to organize, retrieve, and share shipping records. You can store a large volume of data in an organized way, without the clutter and inefficiency of paper-based systems.

- Data Analysis and Reporting: Digital tools allow you to analyze past transactions, track shipping trends, and generate reports, providing valuable insights into your operations. You can use pivot tables, charts, and other analytical tools to assess performance and make data-driven decisions.

- Integration with Other Systems: Many digital tools can integrate with other business systems, such as inventory management or accounting software, enabling seamless data flow across different departments and improving overall efficiency.

Overall, using a digital platform for managing shipping documentation not only helps streamline the process but also enhances operational efficiency, reduces errors, and provides valuable insights to optimize business performance.

Managing International Shipments with Excel Templates

When handling cross-border shipments, maintaining accuracy and efficiency is paramount. Managing the flow of goods between countries involves complex processes, including compliance with international trade regulations, customs declarations, and coordinating logistics. A digital spreadsheet provides a versatile tool to track, organize, and manage these processes, ensuring smoother operations and reducing the risk of errors.

By using digital records for international shipments, businesses can streamline the documentation process, track key shipping milestones, and ensure that all necessary information is readily available for customs and shipping purposes.

Key Elements for Managing International Shipments

Here are some important components to track when managing international deliveries:

- Customs Declarations: Accurately recording and including necessary customs codes, tariff classifications, and other relevant data ensures that shipments pass through customs smoothly.

- Shipping Costs and Fees: Detailed breakdowns of freight charges, taxes, insurance, and handling fees help maintain transparency and provide clear financial information for both businesses and customers.

- Product Descriptions: Clear and concise product descriptions, including quantity, weight, and dimensions, are essential for accurate customs declarations and billing.

- Tracking Information: Keeping track of tracking numbers and statuses allows for real-time updates and enables better communication with customers about their shipments.

How Digital Records Improve Cross-Border Management

Utilizing a digital format for organizing international shipments provides several advantages that manual methods simply can’t match:

- Centralized Data: All shipping details, from product descriptions to tracking numbers, can be stored in a single file, reducing the need for multiple systems or paper records.

- Automated Calculations: Built-in formulas can help calculate total costs, taxes, and duties, ensuring consistency and reducing errors in financial reporting.

- Real-Time Updates: Digital records can be easily updated as shipments progress, providing up-to-date information on delivery status, changes in costs, or modifications in customs clearance.

- Compliance with Regulations: By customizing the spreadsheet to include fields for required documentation (such as HS codes, certificates of origin, or other regulatory details), businesses can ensure they meet all international shipping requirements.

- Ease of Sharing: Digital documents can be easily shared with stakeholders, from suppliers to customs brokers, facilitating better collaboration and transparency in the shipping process.

By leveraging digital tools for managing international shipments, businesses can optimize their processes, improve accuracy, and maintain better control over their global supply chain, ultimately enhancing customer satisfactio

How to Track Shipments with Invoice Templates

Tracking the progress of shipments is a critical aspect of logistics management, especially when goods are moving across borders or long distances. A well-organized document can help businesses efficiently monitor the status of their deliveries, ensuring that key details like shipment dates, tracking numbers, and delivery progress are easily accessible. Using a digital format to manage and track these shipments can significantly improve visibility, reduce errors, and provide transparency for both businesses and customers.

Key Fields for Tracking Shipments

When creating documents to track shipments, certain fields are essential to maintain accurate and up-to-date records. Here are some of the most important components to include:

Field Description Shipment Date Record the date the shipment was dispatched to track the timeline. Tracking Number Include the tracking number provided by the carrier for real-time updates. Carrier List the shipping company or logistics provider handling the shipment. Destination Clearly mention the delivery address to ensure accurate routing and delivery. Status Indicate the current status of the shipment (e.g., “In Transit,” “Delivered,” etc.). Expected Delivery Date Provide an estimated delivery date based on the shipping method and carrier. How to Organize Shipment Tracking

To track shipments effectively, it’s important to keep all relevant information in a centralized, easy-to-update format. Here’s how you can manage shipment tracking:

- Centralized Record-Keeping: Use a dedicated section of your document to track each shipment separately, ensuring that you can easily retrieve tracking numbers, carrier details, and status updates.

- Automated Updates: If possible, link your document to live tracking services or use automated formulas to update delivery status and estimated arrival times.

- Historical Tracking: Keep records of past shipments in the same document for reference. This can help with any future queries or disputes regarding deliveries.

- Notify Stakeholders: Use the document to easily share updates with customers, suppliers, or internal teams to keep all parties informed about shipment status.

By incorporating these elements into your shipping documentation, you can effectively track the movement of goods, identify potential delays, and maintain better control over your logistics operations, ultimately improving customer satisfaction and streamlining your supply chain processes.

Why Accuracy is Critical in Commercial Invoices

In any business transaction, especially those involving goods shipped across borders, ensuring precision in documentation is essential. Accurate records help to prevent misunderstandings, delays, and financial discrepancies. Whether it’s for customs clearance, payment processing, or inventory tracking, precise details on shipping documents are crucial for smooth operations and maintaining trust with both clients and regulatory bodies.

Here are some key reasons why precision is so important when preparing shipping documentation:

- Compliance with Regulations: Accurate documentation is required to meet the legal requirements of both exporting and importing countries. Small errors in the details can result in penalties, delays, or even goods being held at customs.

- Avoiding Financial Discrepancies: Incorrect pricing, quantities, or product classifications can lead to errors in payments, overcharging or undercharging clients, and difficulties in reconciling financial records.

- Preventing Shipment Delays: Any inaccuracies in the shipping documents can lead to customs delays or hold-ups at various checkpoints, prolonging the delivery process and potentially damaging business relationships.

- Ensuring Proper Delivery: Errors in addresses, contact information, or product specifications can result in misdelivery, lost packages, or difficulty reaching the recipient, causing frustration for both businesses and customers.

- Maintaining Customer Satisfaction: Clients rely on accurate shipping information to track their orders and understand costs. Providing correct details ensures clear communication and fosters trust between businesses and their customers.

- Improving Operational Efficiency: When all details are correct from the start, it reduces the need for follow-up communication or corrections later, streamlining internal processes and improving overall workflow.

Ultimately, ensuring that all details are accurate from the outset will not only keep things running smoothly but also strengthen business relationships, reduce operational risk, and improve overall efficiency. Precision in shipping documentation is not just a legal or operational necessity; it’s also key to building trust and credibility in the marketplace.

Ensuring Compliance with Export Regulations

When conducting international trade, adhering to the rules and regulations set by both exporting and importing countries is essential for smooth operations. Non-compliance can lead to fines, shipment delays, or even seizure of goods. Every transaction involves specific paperwork that must be accurate and aligned with international trade laws. Ensuring that all required data is correctly documented not only avoids legal issues but also builds trust with clients and customs authorities.

Here are some key steps to ensure compliance with export regulations:

- Understanding Local and International Laws: Familiarize yourself with the import and export rules of both the home country and the destination market. Different regions may have varying requirements for goods, such as special certifications, tariffs, or restrictions.

- Correct Product Classification: Properly categorize each item with the correct tariff codes or harmonized system (HS) codes. Misclassification can lead to customs delays, fines, or higher tariffs, impacting the cost and efficiency of trade.

- Providing Accurate Documentation: Ensure that all documents, such as shipping records, certificates of origin, and licenses, are complete and accurate. Missing or incorrect information can cause unnecessary complications during the customs process.

- Export Licensing Requirements: Verify whether the goods being exported require an export license. Certain products may be subject to export controls, and failure to obtain the necessary license can result in penalties or denial of shipment.

- Conforming to Safety Standards: Different countries have varying standards for product safety and quality. Make sure your products meet the necessary regulations, such as labeling or certification, before shipping.

- Clear Terms of Sale: Include precise terms of sale on the shipping documents, such as the Incoterms (International Commercial Terms), to clarify the responsibilities of both the seller and the buyer during the shipping process.

By taking the time to understand and follow the necessary steps, businesses can reduce the risks associated with international shipments. Complying with regulations ensures that goods move smoothly across borders, minimizing delays and avoiding costly penalties. Keeping up with the latest changes in laws and trade policies is also critical to maintaining a successful global operation.

How to Export and Share Excel Files Efficiently

Sharing important business documents with clients, partners, or internal teams requires an organized and efficient method. When it comes to spreadsheets, exporting and distributing files properly ensures that your data remains intact, secure, and accessible. Whether you need to send reports, shipment details, or financial records, knowing how to export and share files effectively is crucial for smooth communication and collaboration.

Best Practices for Exporting Files

Here are a few essential steps to ensure that your data is exported correctly:

- Choose the Right Format: Select the appropriate file format for sharing. For most situations, .xlsx is ideal, but if compatibility is an issue, consider exporting to formats like .csv or .pdf, which offer broader compatibility with various devices and software.

- Check File Size: Large files can be difficult to send via email or upload to file-sharing platforms. If your document is too large, consider compressing it or splitting it into smaller sections to make sharing easier.

- Ensure Data Integrity: Before exporting, double-check that all the necessary data is included and formatted correctly. This will help avoid mistakes during the transfer and prevent miscommunication.

- Export for Specific Platforms: Some platforms (like cloud services or accounting software) may require specific file types. Make sure to export your data in a compatible format to ensure easy upload or integration.

Efficient Ways to Share Files

Once you have exported the file, sharing it in a timely and secure manner is essential for smooth communication. Here are a few tips for distributing documents effectively:

- Cloud Storage Services: Use cloud platforms like Google Drive, Dropbox, or OneDrive to store and share files securely. These services allow for easy access from multiple devices, while also providing version control and file sharing permissions.

- Email Attachments: For smaller files, email remains one of the simplest methods for sharing documents. Make sure to include a clear subject line and a brief message to ensure the recipient knows what the file contains.

- File Sharing Links: For larger files or multiple documents, you can generate a shareable link through a cloud service. This way, recipients can access the files directly without the need to send large email attachments.

- Password Protection: If your document contains sensitive data, consider adding password protection or encryption before sharing it. This ensures that only authorized individuals can access the file.

- Collaborati