Client Invoice Template for Easy and Professional Billing

Managing financial transactions with clients requires a clear and professional approach. Whether you’re a freelancer, a small business owner, or a large enterprise, having a streamlined system for documenting payments is essential. A well-structured billing document not only helps you maintain transparency but also ensures that your customers understand the charges clearly.

Creating accurate and professional documents for each transaction can save time, reduce errors, and improve overall workflow. With the right structure, you can make sure that every payment request is easy to understand and process, leading to faster settlements and fewer disputes.

Using a pre-designed format can significantly improve efficiency. It eliminates the need to start from scratch every time, while still allowing flexibility for customization. By choosing the right layout and including essential details, businesses can maintain consistency and professionalism across all outgoing requests for payment.

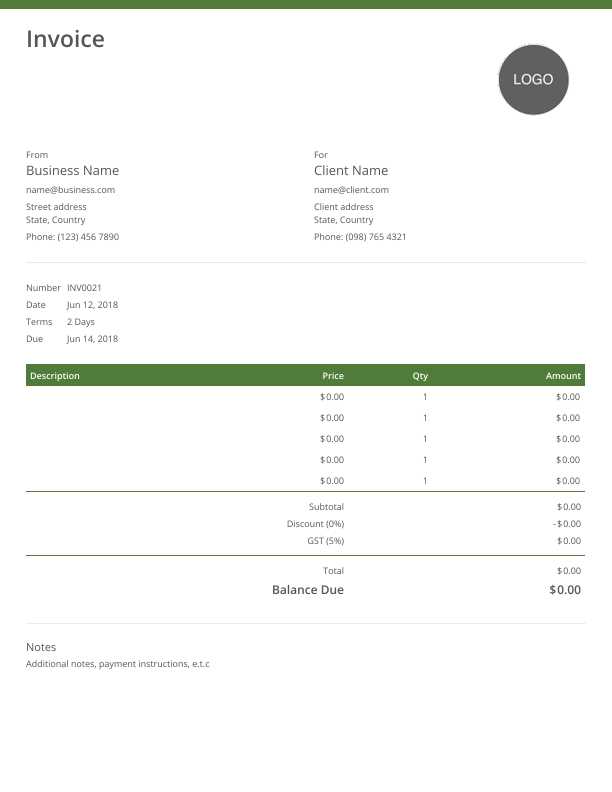

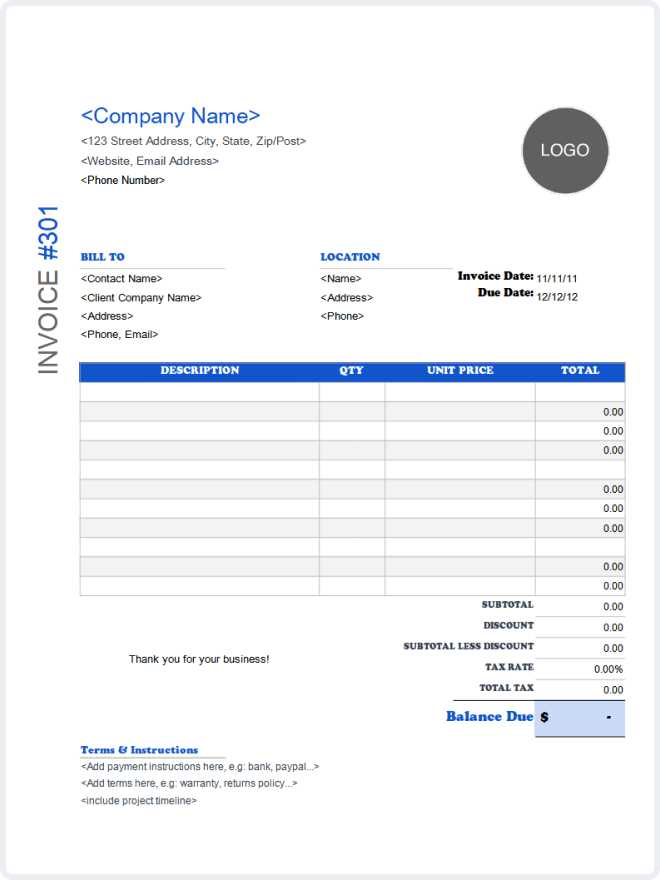

Client Invoice Template Overview

Having a consistent and professional method for documenting payment requests is crucial for any business. The right document layout ensures that all important details are included, helping both the service provider and the recipient understand the charges clearly. By using a pre-made format, companies can avoid mistakes, save time, and improve their overall payment collection process.

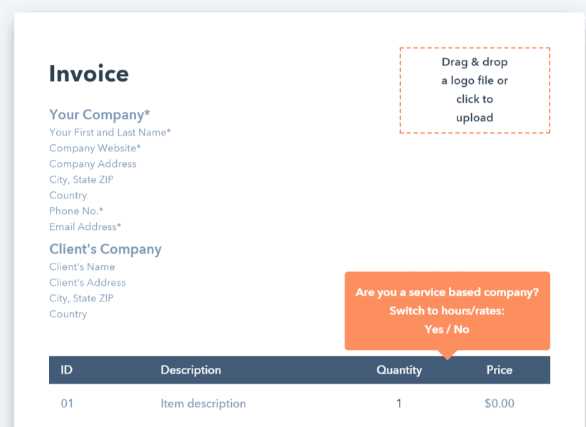

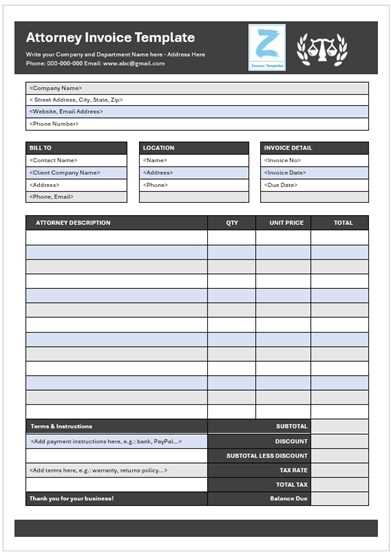

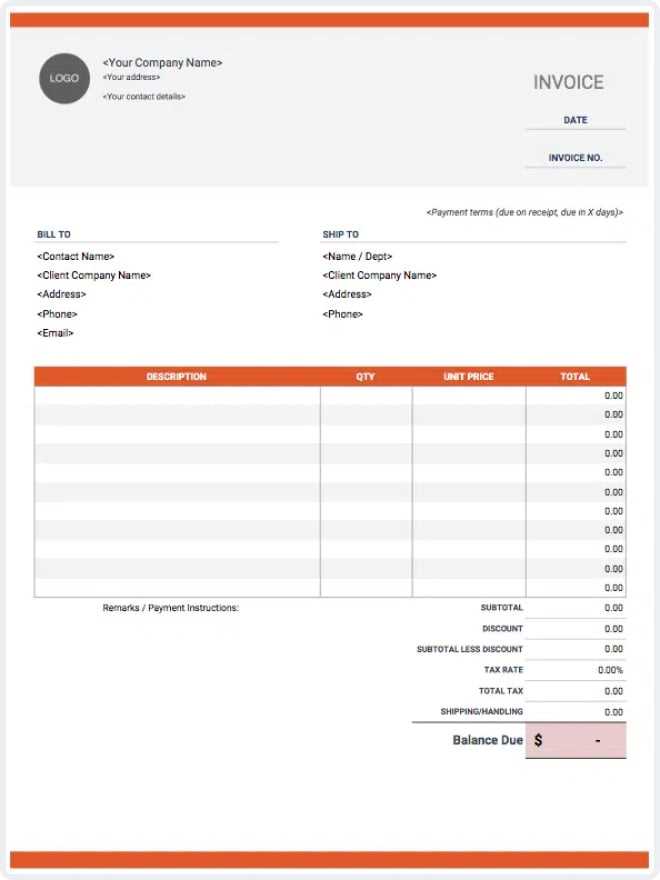

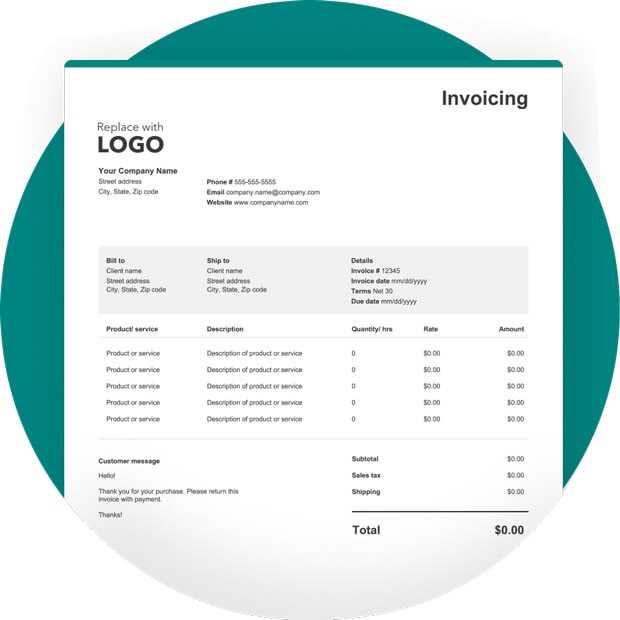

This format typically includes sections for basic information such as the names of the involved parties, a breakdown of products or services rendered, the amount due, and the payment due date. It may also feature customizable fields to accommodate specific needs or industry standards. The goal is to provide clarity and create a formal record that both sides can reference if needed.

Adopting a ready-made document saves significant effort, reducing the chances of errors while maintaining consistency across all transactions. Whether sent digitally or in print, this type of document establishes professionalism and improves your business’s credibility with customers.

Why Use a Client Invoice Template

Using a standardized document for payment requests simplifies financial transactions and enhances the professionalism of your business. A pre-designed layout ensures that all essential details are included, reducing the chances of missing important information and avoiding confusion for both parties involved.

Time efficiency is one of the main benefits. Instead of creating a new document from scratch every time a payment is due, you can quickly customize a reusable structure. This saves effort and helps maintain consistency, whether you’re dealing with one or multiple customers.

Another advantage is accuracy. With a ready-made format, you are less likely to overlook critical elements like due dates, tax rates, or payment terms. This leads to fewer mistakes and ultimately a smoother transaction process, improving cash flow and strengthening customer relationships.

Key Elements of an Invoice

For a payment request document to be clear and effective, it needs to include several key components. These sections provide all necessary details that ensure both parties understand the terms and prevent any confusion during the transaction process.

Basic Information

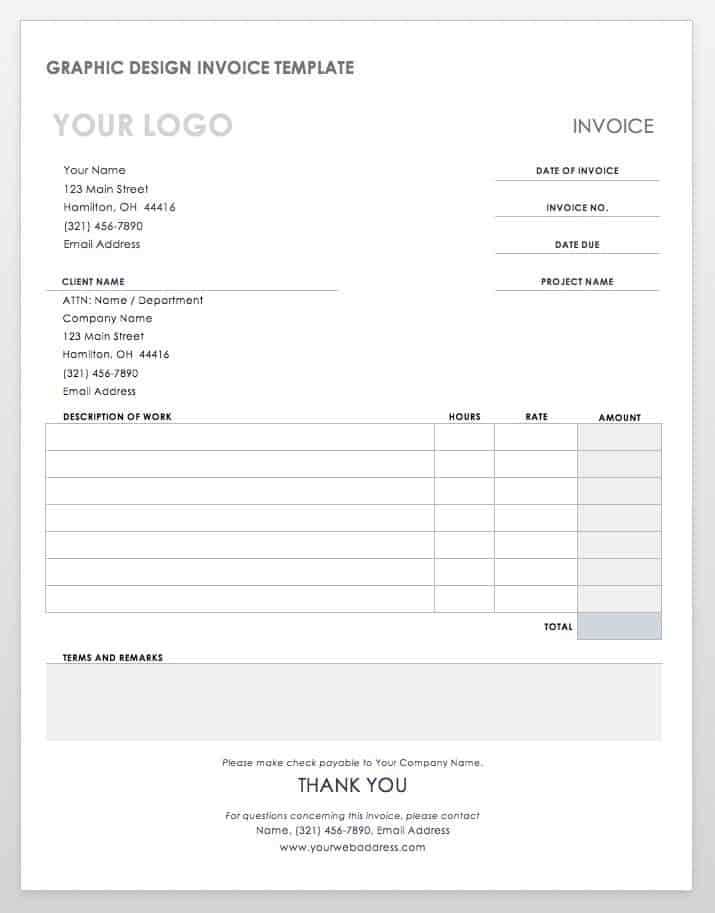

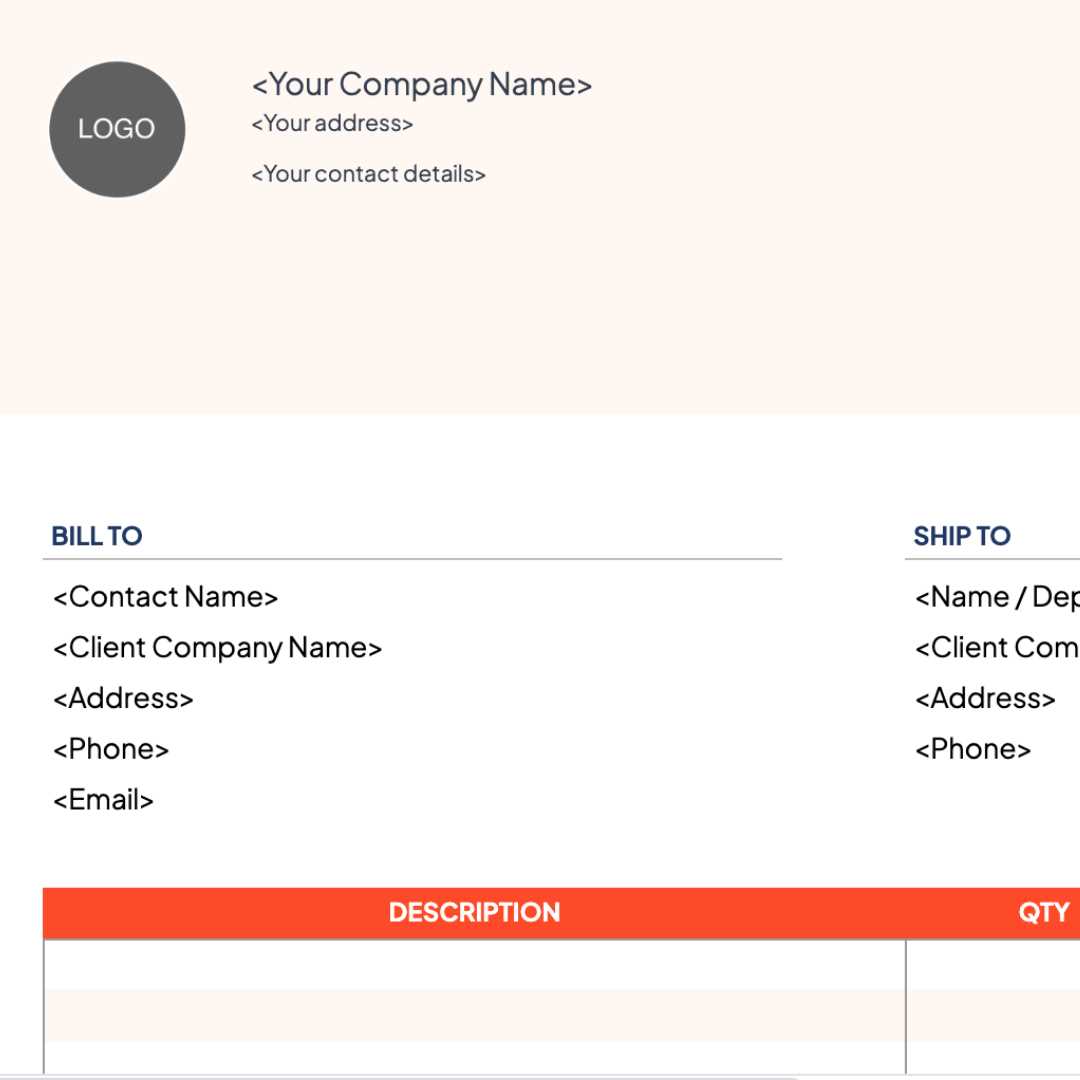

At the top of the document, you should include the names and contact information of both the sender and the recipient. This typically includes the business or individual name, address, phone number, and email. Clear identification of both parties is essential for accuracy and record-keeping purposes.

Transaction Details

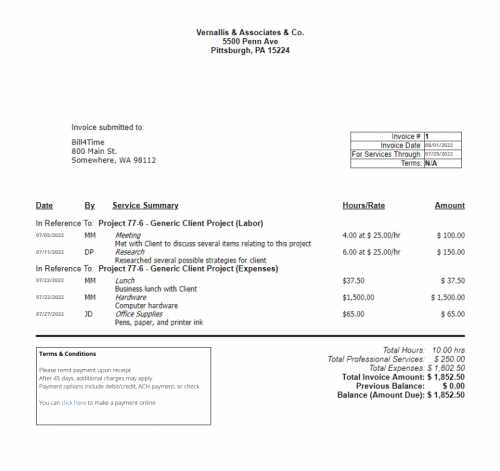

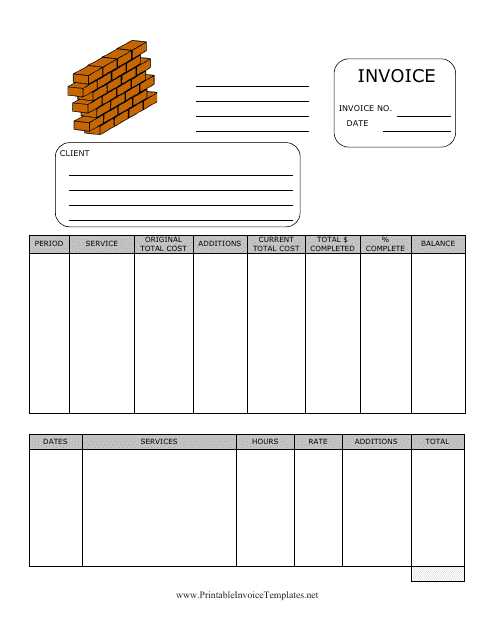

Next, the document should outline the specifics of the transaction, such as the list of services or products provided. This includes a description of each item, the quantity, unit price, and total amount for each line. Including a detailed breakdown helps avoid misunderstandings and provides transparency about the charges being applied.

Additionally, it is important to include the total amount due, any taxes applied, and the payment due date. This section helps ensure that there are no disputes over the amount owed and sets clear expectations for when payment is required.

How to Create an Invoice Template

Designing a professional payment request document involves setting up a structure that can be easily customized for each transaction. The goal is to create a reusable format that includes all necessary details and maintains consistency across all outgoing requests. By following a few simple steps, you can build a document that streamlines your billing process and ensures clarity for both you and your customers.

Step 1: Organize the Layout

The first step in creating an efficient structure is organizing the layout. You want to ensure that all key elements are easy to find and clearly presented. Divide the document into sections for your contact information, transaction details, payment terms, and totals. A clean, well-organized layout will make the document easy to read and professional-looking.

Step 2: Use Tables for Clarity

One of the most effective ways to display transaction details is by using a table. This allows you to clearly list the items or services provided, their individual cost, and the total amount due. A table makes it easy for both parties to see how the final amount is calculated.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $500 | $500 |

| SEO Optimization | 1 | $300 | $300 |

In this example, the table clearly lists the services provided, their respective costs, and the final amount due. Using a table like this helps avoid confusion and makes the entire billing process more transparent.

Common Mistakes to Avoid in Invoices

Creating a clear and accurate payment request document is crucial for maintaining professionalism and avoiding misunderstandings with customers. Even small errors can lead to delayed payments, disputes, or confusion. By being aware of the common pitfalls, you can ensure that your documents are error-free and help facilitate smooth transactions.

One frequent mistake is neglecting to include all the essential details. Missing key information, such as the recipient’s contact details, payment terms, or a breakdown of the charges, can leave the recipient unsure about the legitimacy or specifics of the request. This lack of clarity can lead to payment delays or even disputes.

Another common issue is failing to specify payment terms clearly. Whether it’s the due date, late fees, or accepted payment methods, these details must be outlined upfront. Without them, there’s room for confusion about when payments are expected, potentially leading to late or incomplete payments.

Lastly, double-checking for incorrect calculations is essential. Mistakes in totals, tax rates, or quantity pricing are easy to overlook but can have a significant impact on the payment process. Ensuring everything adds up correctly helps maintain credibility and avoids the need for follow-up corrections.

Customizing Your Client Invoice Template

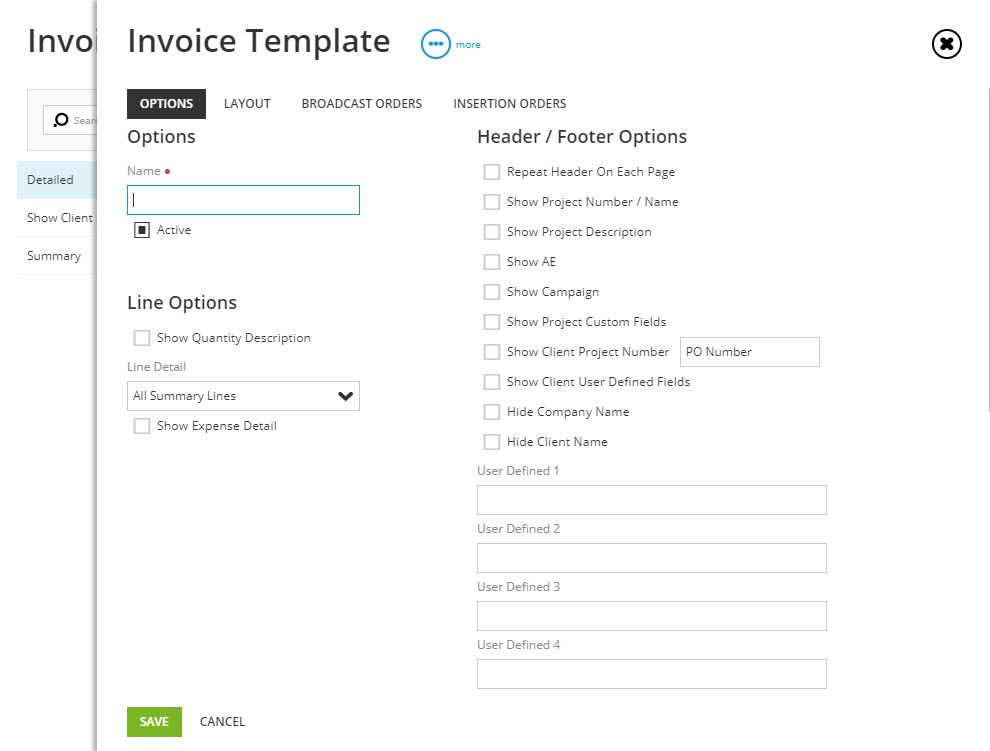

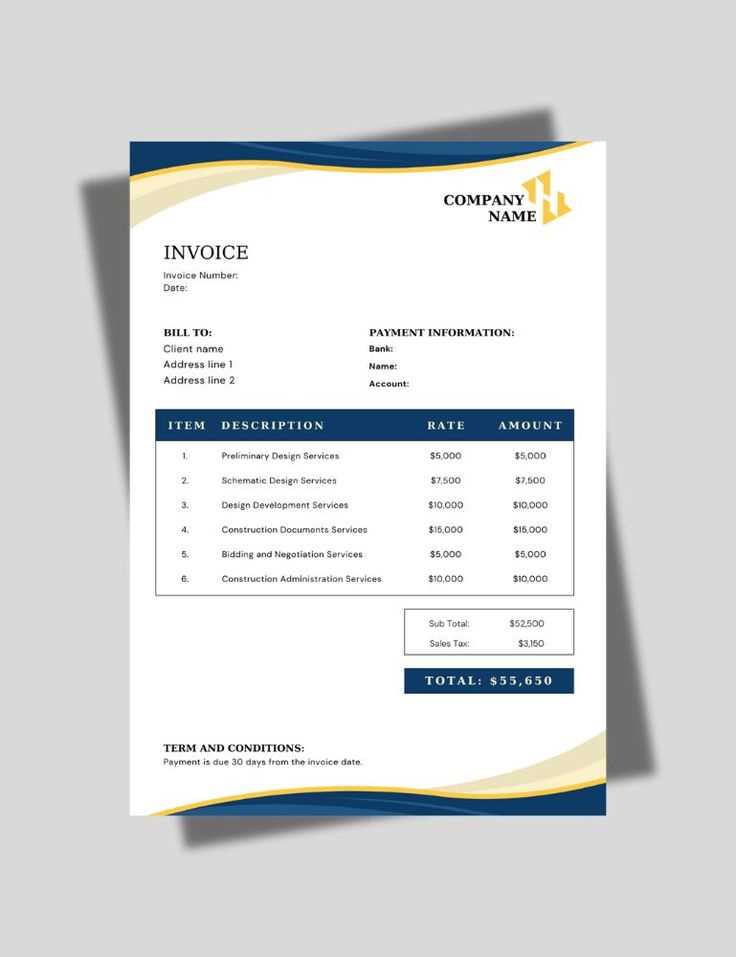

Personalizing your payment request document is a key step in aligning it with your brand and making it more functional for your specific needs. Customization allows you to add elements that reflect your business identity while ensuring that all necessary information is presented clearly. By adjusting the layout and details, you can make the document more efficient and professional.

One of the first areas to customize is the design. Adding your business logo, adjusting fonts, or using your brand colors helps create a cohesive look that aligns with your overall marketing materials. Additionally, customizing headers and footers can help you include any legal disclaimers or business policies you want your clients to see.

Another important aspect of customization is modifying the layout to suit the nature of your services or products. For instance, if you sell products, your structure may need extra fields for SKU numbers or product descriptions. Below is an example of a customized payment request document that highlights these details.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Custom Web Development | 1 | $1,200 | $1,200 |

| SEO Services | 1 | $500 | $500 |

In this example, the customized layout includes a clear description of the services rendered, as well as the breakdown of charges. Personalizing these fields ensures that each document is tailored to the specific transaction and meets the expectations of your clients.

Free vs Paid Invoice Templates

When creating payment request documents, businesses often face the choice between using free or paid pre-designed formats. Both options come with their advantages, but the decision depends on the specific needs of your business and the level of customization you require. Understanding the differences can help you make the right choice for your company’s workflow and professionalism.

Free options are easily accessible and suitable for small businesses or individuals who are just starting out. They usually come with basic features and limited customization, making them an ideal choice for those who need a simple solution without any added expense. However, free layouts may lack advanced features, like automated calculations, branding options, or integrated payment gateways.

Paid formats, on the other hand, often offer more flexibility and a greater range of features. These solutions usually come with professional designs, extensive customization options, and added tools like automatic tax calculations, payment tracking, and even client management systems. If your business is growing or you require a more polished, branded appearance, a paid option can save time and ensure a more refined presentation.

Ultimately, the choice between free and paid comes down to the complexity of your needs and your budget. While free formats work well for simple transactions, a paid layout can offer more sophisticated tools to help you streamline your processes and present a more professional image to your customers.

Best Software for Invoice Templates

Choosing the right software for creating and managing payment request documents can significantly impact your business efficiency. With the right tools, you can save time, improve accuracy, and ensure consistency across all outgoing billing statements. There are many options available, each offering different features tailored to various business needs. The following software solutions stand out for their ease of use, customization, and functionality.

Top Software Solutions

- QuickBooks – A widely used accounting software that offers a variety of pre-designed billing formats. It integrates with other financial tools and allows for automatic calculations, making it ideal for small businesses and freelancers.

- FreshBooks – Known for its user-friendly interface, FreshBooks provides customizable billing layouts, recurring billing options, and expense tracking. It’s perfect for service-based businesses and freelancers.

- Zoho Invoice – This software offers extensive customization options, including the ability to create personalized branding for payment requests. Zoho also allows automation of billing processes, saving you time on follow-ups and payment reminders.

- Wave – A free software solution that includes customizable billing layouts, as well as tools for managing expenses and accounting. It’s ideal for small businesses looking for a no-cost, effective solution.

- Microsoft Word/Excel – While not specifically built for billing, these widely available tools allow you to create simple and customized formats from scratch. They offer flexibility but may require more manual effort compared to specialized software.

Choosing the Right Software

The best software for your business depends on several factors, including your business size, frequency of transactions, and the level of automation you need. For small businesses or freelancers, simple tools like QuickBooks or Wave may be enough. However, larger businesses or those with more complex needs might benefit from the advanced features offered by FreshBooks or Zoho Invoice.

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is essential for setting expectations and ensuring timely payments. Payment terms outline the conditions under which the recipient is expected to make the payment, such as the due date, accepted payment methods, and any penalties for late payments. Properly specifying these details helps avoid confusion and disputes, ensuring smooth transactions for both parties.

To effectively add payment terms, it’s crucial to be specific and transparent. Below is an example of how to present payment terms in a clear and structured manner:

| Payment Term | Details |

|---|---|

| Due Date | Payment is due within 30 days from the issue date. |

| Late Fee | A 5% late fee will be applied for payments made after the due date. |

| Accepted Methods | Payments can be made via bank transfer, PayPal, or credit card. |

| Discount for Early Payment | A 2% discount is available if payment is received within 10 days. |

As shown in the table, payment terms should clearly outline when payment is due, any applicable late fees, and the methods of payment you accept. Offering discounts for early payments can also encourage faster settlements and foster better relationships with your customers.

Design Tips for Professional Invoices

A well-designed billing document not only ensures clarity but also enhances your business’s professionalism. The design of the document can influence how the recipient perceives your brand and how quickly they process the payment. Simple yet effective design principles can make your request for payment both visually appealing and easy to understand. Here are a few tips to help you create a polished and professional look for your billing documents.

First, keep the layout clean and organized. Avoid clutter by using clear sections for each piece of information and leaving enough space between them. This makes the document easy to read and navigate, ensuring that key details don’t get overlooked.

Incorporating a table to present transaction details is one of the most effective ways to keep everything organized and easy to follow. Below is an example of how to present product or service details in a structured format:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $1,000 | $1,000 |

| SEO Optimization | 1 | $300 | $300 |

Secondly, incorporate your brand’s logo and colors. A consistent color scheme and logo placement help reinforce your business identity and make the document feel cohesive with your other materials. Make sure the fonts are easy to read and keep the text size large enough to be legible without overwhelming the page.

Finally, include essential information in a clear, logical order. Start with contact details, followed by the payment breakdown, and conclude with the due date and payment terms. This sequence ensures that the recipient can quickly access all the information they need.

Importance of Invoice Numbering System

Having a clear and consistent numbering system for your billing documents is essential for both organization and legal compliance. A proper numbering system helps keep track of payments, ensures that documents are easy to reference, and makes it simpler to manage your accounting records. Without an organized structure, tracking transactions becomes more difficult and can lead to errors or confusion down the line.

Benefits of a Numbering System

- Better Organization – A well-structured numbering system allows you to easily find and reference any document in your records. Whether you are looking for a specific transaction or reconciling accounts, having sequential numbers helps streamline the process.

- Improved Financial Tracking – Each number can represent a specific transaction, making it easier to track payments and monitor outstanding balances. This also makes it easier to detect any discrepancies or missed payments.

- Legal Compliance – In many regions, keeping a record of transaction numbers is required by tax authorities. An organized numbering system can ensure that you meet legal and regulatory requirements for financial documentation.

- Professionalism – A consistent numbering system projects professionalism and reliability to your customers. It shows that you are organized and serious about your business practices.

How to Create an Effective Numbering System

To establish a solid numbering system, consider the following tips:

- Start with a simple sequential structure: Begin with a unique number for each document (e.g., 001, 002, 003) and continue sequentially.

- Incorporate dates or project details: For additional clarity, include the year or month in the number (e.g., 2024-001 or 08-2024-001). This can help you track when transactions occurred or group them by time period.

- Avoid reusing numbers: Each document should have a unique number. Reusing numbers can lead to confusion and complicate your accounting records.

- Make it scalable: Ensure that your numbering system can accommodate future growth. If you plan to issue hundreds or thousands of documents, choose a system that can handle large numbers.

Implementing an effective numbering system helps maintain order in your financial records, aids in efficient tracking, and ensures professionalism in your business transactions.

How to Include Taxes on Invoices

Incorporating taxes into payment request documents is an essential part of ensuring compliance with local tax regulations. Taxes can significantly impact the total amount due, so it is important to clearly outline the applicable rates and amounts on each document. Doing so not only helps avoid confusion but also ensures that your business meets legal obligations and maintains transparency with customers.

To include taxes accurately, you should specify the tax rate applied, the total amount of tax, and the final amount due. This breakdown should be clear and easy to follow, so the recipient understands how the total is calculated. Below is an example of how you can structure these details:

Example of Tax Breakdown

| Description | Amount |

|---|---|

| Subtotal (before tax) | $1,000 |

| Tax Rate (5%) | $50 |

| Total Amount Due | $1,050 |

Steps to Include Taxes Correctly

- Identify the tax rate: Determine the applicable tax rate based on your region or the nature of the goods or services provided. Different products or services may be subject to different rates.

- Calculate the tax: Multiply the subtotal (the amount before tax) by the tax rate to get the tax amount. For example, if the subtotal is $1,000 and the tax rate is 5%, the tax would be $50.

- List the tax separately: Display the tax amount as a separate line item on the document, clearly indicating the tax rate applied. This ensures that the recipient knows how the total is calculated.

- A

Sending Invoices via Email or Mail

Sending payment request documents efficiently is a key part of managing business transactions. Whether you choose to send them digitally via email or in physical form through traditional mail, it’s important to ensure that the method you use aligns with your client’s preferences and your own business needs. Both methods have their benefits, and choosing the right one can help streamline your process and ensure timely payments.

Sending via email is quick and cost-effective. It allows for immediate delivery and can easily include any supporting documentation, such as contracts or receipts. Additionally, digital delivery provides a record of when the document was sent, offering a clear timestamp for reference. On the other hand, physical mail may be preferred for clients who don’t engage with digital platforms or when a more formal approach is necessary.

Regardless of the method chosen, it’s essential to include all necessary details and ensure that the document is easy to access. If sending via email, attach the document in a universally accessible format, such as PDF, and consider adding a brief message to introduce the document. For physical mail, ensure that the document is printed clearly, with all key details visible, and that it’s sent to the correct address to avoid delays.

Here are some best practices for each method:

- Email:

- Use a professional subject line, such as “Payment Request for Services Rendered.”

- Attach the document in a PDF format to preserve the layout and prevent any alterations.

- Include a brief message in the body of the email, politely reminding the recipient of the due date.

- Verify the recipient’s email address before sending to avoid delivery errors.

- Mail:

- Print the document clearly, ensuring that all details are legible.

- Use a professional envelope and include any necessary supporting documents, like terms and conditions or payment instructions.

- Choose a reliable mailing service with tracking to confirm delivery.

By following these best practices, you can ensure that your payment request documents are delivered efficiently and professionally, minimizing the risk of delays and miscommunications.

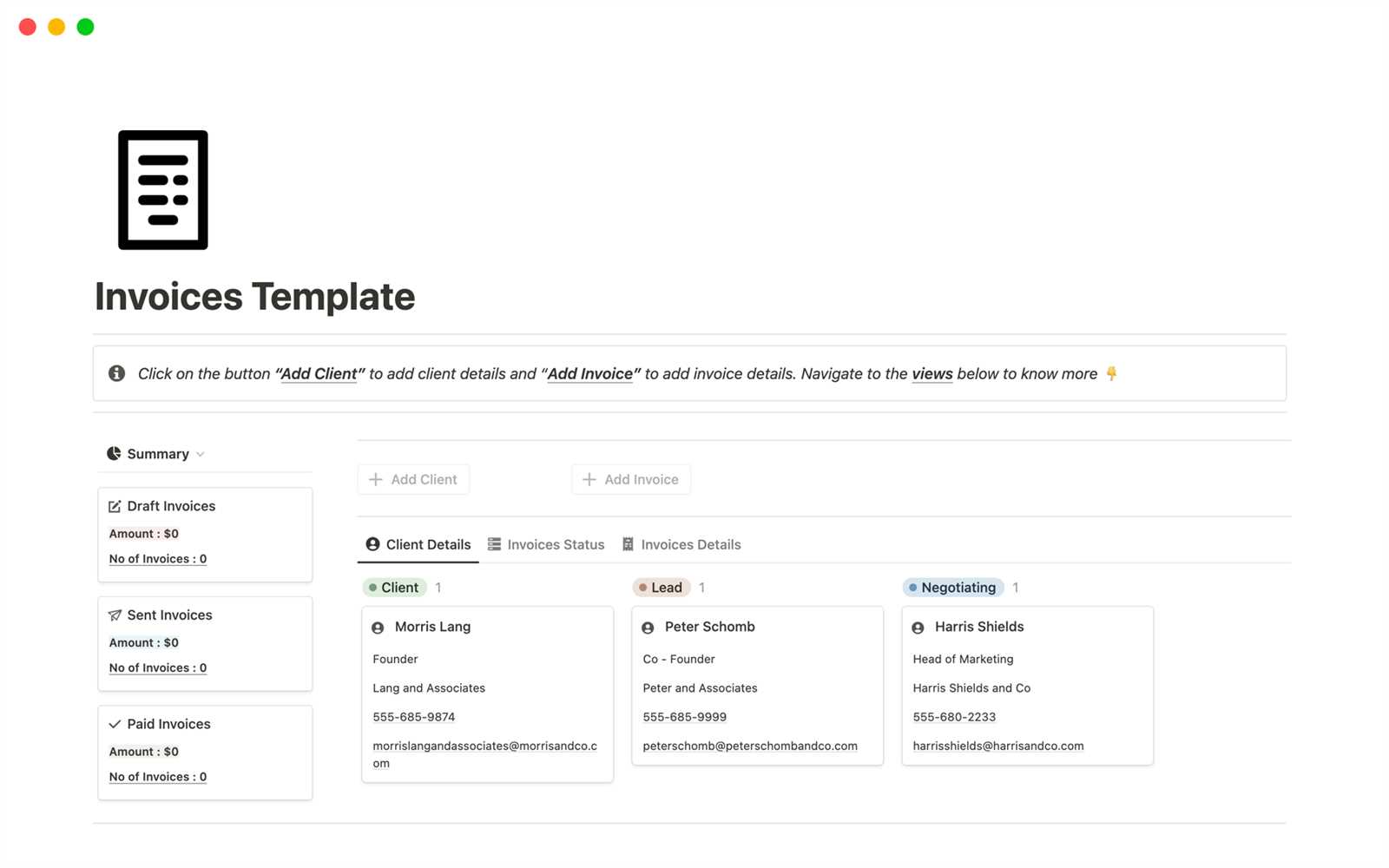

How to Track Invoice Payments

Tracking payments for services rendered or goods provided is crucial for maintaining accurate financial records and ensuring that your business operations run smoothly. Without an organized system for tracking payments, it can become difficult to manage outstanding balances, reconcile accounts, and follow up on overdue payments. Here are some key strategies to help you effectively monitor payment statuses and ensure prompt settlements.

Methods for Tracking Payments

- Manual Recordkeeping: For small businesses or those with fewer transactions, manually tracking payments in a spreadsheet can be a simple and effective method. Create columns for key details such as the date the payment was due, the date received, the payment amount, and any balance remaining. This method is labor-intensive but offers full control over your records.

- Accounting Software: Using dedicated accounting tools such as QuickBooks, FreshBooks, or Zoho Books automates payment tracking. These platforms allow you to record transactions, set payment reminders, and automatically update your accounts when payments are made. They also generate reports that provide a comprehensive overview of your financial status.

- Payment Reminders: Automated reminders can be set up to notify both you and your customer when a payment is due or overdue. Whether through email or text, reminders are an efficient way to encourage timely payments and prevent delayed transactions.

Best Practices for Payment Tracking

- Maintain Detailed Records: Always keep track of essential payment information, including the payment method, transaction date, and the amount paid. This ensures that you have a clear record of all financial activity for future reference or audits.

- Match Payments to Documents: When payments are received, link them to the respective transaction or billing document. This helps avoid confusion and ensures that every payment is accounted for correctly.

- Use a Payment Schedule: Create and maintain a payment schedule that outlines due dates for each customer. This can help you stay organized and follow up on any payments that are late.

- Reconcile Regularly: Set aside time to regularly reconcile your payment records with your bank statements or payment processors. This helps ensure accuracy and can help identify discrepancies early on.

By implementing these tracking methods and practices, you can stay on top of your payment process and improve cash flow management. Whether you choose manual tracking or use automated systems, consistency is key to ensuring that payments are received on time and recorded properly.

How to Handle Late Payments on Invoices

Dealing with overdue payments is an inevitable part of managing a business. Late payments can disrupt cash flow and affect your ability to cover operational costs. It’s essential to have a clear strategy for handling delayed transactions to minimize their impact and encourage timely future payments. By setting expectations and following a structured approach, you can ensure that your business continues to function smoothly even when payments are delayed.

First, always establish clear payment terms upfront. Include due dates and specify any penalties for late payments in your agreements. This sets the tone for what is expected and helps manage client expectations from the start.

When a payment is late, the first step is to reach out to the customer with a polite reminder. Often, clients simply forget or experience delays themselves. A gentle follow-up can resolve the issue without escalating the situation. If the payment remains unpaid, it may be necessary to send a formal notice or apply a late fee according to the terms outlined in the original agreement.

If the late payment persists, it might be time to consider more formal actions, such as halting further work or implementing stricter payment terms for future transactions. In extreme cases, you may need to pursue legal action or use collections services to recover the outstanding amount.

In summary, handling late payments effectively requires clear communication, firm but professional follow-ups, and a willingness to enforce the agreed-upon terms. By managing late payments proactively, you can reduce the chances of disruptions and maintain positive relationships with your customers.

Legal Considerations for Invoices

When creating billing documents, it’s crucial to understand the legal implications to ensure compliance with local laws and protect your business interests. These documents not only serve as a request for payment but also act as legal records that may be used in case of disputes, audits, or financial verification. Knowing what information to include and how to structure the document can help avoid potential legal issues and ensure clarity between both parties.

Key Legal Considerations

- Clear Terms and Conditions: It’s essential to outline the payment terms clearly in every document. This includes the amount due, payment due date, and any penalties for late payments. Ensure that these terms are agreed upon in advance and easily accessible to both parties.

- Tax Information: Depending on your region, you may be legally required to include tax rates and amounts. Make sure to follow the tax laws applicable to your business and display these figures correctly on the document.

- Accurate Descriptions: Each item or service provided should be described accurately, including the quantity, unit price, and any relevant details that clarify what the payment covers. Misleading or vague descriptions can cause disputes or legal complications.

- Contact Information: Include accurate contact details such as your business name, address, phone number, and email. This allows the recipient to easily reach you for any queries or issues related to the document.

- Recordkeeping Requirements: Depending on your location, businesses may be required to keep billing documents for a certain period (e.g., 5 years) for tax and auditing purposes. Ensure you keep copies of all issued documents and any related correspondence.

Consequences of Non-Compliance

- Late Fees and Penalties: Failure to comply with legal requirements, such as missing tax information or inaccurate records, could result in penalties, fines, or interest charges on late payments.

- Legal Disputes: Inaccurate or ambiguous billing information can lead to disagreements or lawsuits. If a client contests the charges, having a legally sound document can help resolve the issue more efficiently.

- Tax Issues: Incorrectly reporting taxes or failing to comply with tax laws can lead to audits, fines, or even legal action. Ensure all tax details are accurate and up-to-date to avoid complications with authorities.

By considering these legal factors and ensuring that your documents comply with relevant laws, you can protect your business, maintain positive relationships with clients, and avoid costly mistakes. Always stay informed about your local regulations and consult with legal professionals if necessary to ensure full compliance.

How to Save Time with Invoice Templates

Streamlining the process of creating payment requests can significantly reduce the time spent on administrative tasks. Using pre-designed documents allows you to quickly fill in necessary details, ensuring that you don’t have to start from scratch every time. This approach not only saves time but also minimizes errors and ensures consistency across all billing documents.

Benefits of Using Pre-Designed Billing Documents

- Speed: Pre-made formats save time by eliminating the need to design a new document each time you need to request payment. Simply enter the relevant details like the amount, due date, and description of services, and the document is ready to send.

- Consistency: A standardized structure ensures that every document you send has a professional and uniform appearance. This consistency helps avoid confusion and builds trust with your recipients.

- Reduced Errors: Templates are often designed with all necessary fields and information already included, so there’s less chance of missing key details. This reduces the likelihood of mistakes that could delay payments or lead to misunderstandings.

How to Maximize Time Savings

- Use Automation: Many accounting tools and software offer automated billing features where you can create recurring payment requests based on predefined templates. This eliminates the need to manually enter the same information for repeat customers or services.

- Customize for Specific Clients: Even though templates are pre-designed, most allow for customization. Adjusting a few fields, such as discounts or payment terms, for each client can make the document more personalized while still saving time.

- Integrate with Payment Systems: Link your documents to online payment platforms or integrate them with accounting software to make it easier for recipients to pay instantly. This speeds up the process and ensures that payments are tracked automatically.

By using pre-designed formats, you can significantly cut down on the time spent preparing payment requests, reduce the risk of errors, and enhance the professionalism of your business communications. With these tools in place, you’ll have more time to focus on growing your business and serving your customers.

- Email: