Free Cleaning Invoice Template for Efficient Billing and Payments

Managing payments efficiently is crucial for any service-based business. Clear documentation of the work completed and the amount due ensures smooth financial transactions and promotes transparency between service providers and clients. By using a well-structured document to detail the work, providers can avoid misunderstandings and maintain professional relationships with customers.

A professionally designed document that outlines the services rendered can save time and effort, offering a simple solution for both invoicing and payment tracking. Whether you are offering one-time jobs or ongoing services, having a reliable tool to create these records will help you stay organized and consistent with your billing practices.

In this guide, we will explore the key components of a well-crafted billing document, the advantages of using customizable formats, and practical tips for tailoring the document to fit your specific needs. With the right approach, you can improve both efficiency and customer satisfaction while keeping your financial management smooth and straightforward.

Billing Document Guide

Creating a clear and professional document for service charges is an essential part of running a business. Whether you’re working on a short-term project or providing recurring services, having a structured format to record the details of the job and payment expectations ensures that you and your client are on the same page. This guide will help you understand the key components of an effective billing document and how to create one that meets your needs.

Key Components of a Billing Document

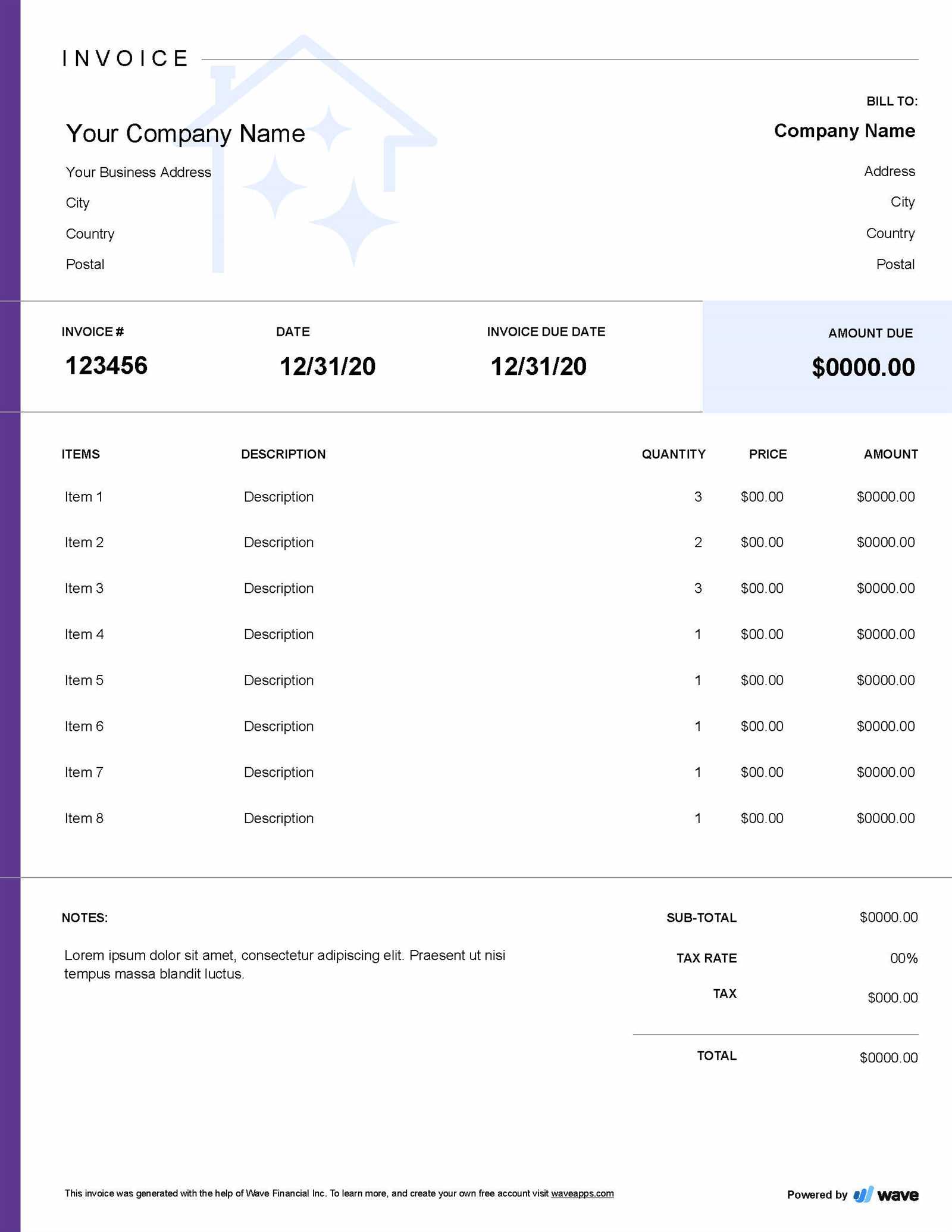

A well-designed document should contain several important elements to ensure clarity and professionalism. These include:

- Service Provider Information: Name, address, phone number, and email.

- Client Information: The client’s name, contact details, and address.

- Job Description: A brief overview of the work performed, including any specific tasks completed.

- Cost Breakdown: Detailed pricing for each service, along with the total amount due.

- Payment Terms: The payment due date, method of payment, and any late fees or discounts offered.

- Tax Information: Any applicable taxes or fees should be clearly outlined.

- Invoice Number: A unique identifier for the document for tracking purposes.

How to Use This Guide

By following the structure provided, you can create a document that not only meets legal and business standards but also enhances the customer experience. Start by entering the necessary details and ensure that all charges are clearly outlined. You can then customize the document by adding any additional terms or conditions that apply to your specific services. The goal is to create a simple, clear, and professional document that makes the billing process easier for both parties involved.

What is a Billing Document?

A billing document is a formal record that outlines the services provided, the associated costs, and the payment terms between a service provider and a client. It serves as a request for payment and ensures both parties are clear on the expectations regarding financial transactions. This document acts as proof of the work completed and details the amount due for the services rendered.

Such a record is essential for maintaining transparency, promoting trust, and avoiding disputes. It is particularly important for service-based businesses, where the client may require a detailed breakdown of the costs involved. A well-organized document helps keep the payment process smooth and efficient.

Key Features of a Billing Document

- Service Details: A clear description of the tasks completed, whether it’s a one-time job or ongoing work.

- Payment Amount: A detailed breakdown of charges, including any hourly rates or flat fees.

- Terms and Conditions: Information on payment deadlines, late fees, and acceptable payment methods.

- Tax Information: Any taxes or additional fees that apply to the total amount due.

- Client and Provider Information: Contact details for both parties to ensure clarity in communication.

By creating this type of document, service providers ensure their clients have a clear understanding of what they are being charged for, how much they owe, and when payments are due. This helps avoid confusion and ensures timely compensation for the services provided.

Why Use a Billing Document Format?

Using a structured format for recording service charges offers a variety of benefits for both service providers and clients. It simplifies the process of tracking payments, ensures accuracy, and helps maintain a professional appearance. Instead of manually creating records from scratch for each transaction, a pre-designed document makes it easier to capture all necessary details quickly and consistently.

With a ready-to-use structure, service providers can save time and reduce the risk of errors, such as missed charges or incorrect totals. Additionally, this approach helps build trust with clients, as they can clearly see the breakdown of services, costs, and payment expectations. A consistent, organized document also reflects professionalism and enhances the overall customer experience.

Benefits of Customizable Billing Formats

Customizable formats for billing provide significant advantages, allowing service providers to tailor the document to their specific needs and preferences. These adaptable structures ensure that each record is perfectly aligned with the unique requirements of the business, enhancing both efficiency and accuracy in the payment process. Whether you offer one-time services or recurring tasks, having the ability to modify the format lets you reflect the nature of each job clearly and professionally.

One of the key benefits is the ability to adjust the layout and content, ensuring that all relevant details are included and presented in a way that suits your business style. You can add specific fields, such as payment terms, tax information, or discounts, depending on the type of work completed. This flexibility not only saves time but also strengthens your brand image by presenting a document that looks professional and meets the expectations of your clients.

Essential Elements of a Billing Document

A well-crafted record for services rendered should include several key components to ensure clarity, accuracy, and professionalism. These essential elements not only provide important information for the client but also help maintain transparency in the financial transaction. Whether you are issuing a one-time request for payment or handling ongoing services, these elements are critical for proper documentation and smooth business operations.

Key Components to Include

- Service Provider Information: Include your name, business name, address, and contact details to identify the party requesting payment.

- Client Information: Include the client’s name, address, and contact details to ensure proper identification.

- Service Description: Provide a clear, concise description of the work completed, including specific tasks and any relevant details to avoid confusion.

- Cost Breakdown: Clearly list the charges for each service, whether hourly or flat-rate, and the total amount due for payment.

- Payment Terms: Include the due date, accepted payment methods, and any applicable fees for late payment.

- Tax Information: Specify any taxes or additional charges that apply to the total amount, as required by law.

- Unique Document Identifier: Assign a unique number to the document for easy tracking and reference.

Why These Elements Matter

These details not only protect both parties in case of disputes but also ensure a smooth transaction process. Providing a thorough and clear document shows professionalism and enhances customer trust, making it easier for clients to understand what they are being charged for and how they should proceed with payment. A well-organized billing record can also make accounting and financial tracking more efficient for your business.

How to Create a Billing Document

Creating a professional record of services rendered is essential for ensuring clarity and smooth transactions with your clients. Whether you are providing one-time or recurring services, having a structured approach to creating this document will help ensure accuracy and minimize misunderstandings. Below is a step-by-step guide to help you build an effective document that includes all the necessary details for both you and your client.

Steps to Follow

To begin, gather all the relevant information about the service, your client, and the payment terms. Then, use the following process to create a clean, easy-to-understand record:

- Start with Your Details: Include your business name, address, and contact information at the top of the document.

- Client Information: Add the name, address, and contact details of the person or business receiving the service.

- Describe the Service: Write a brief but clear description of the work that was completed, including dates and any specifics about the job.

- Break Down the Costs: List each service provided with its corresponding price, whether it’s an hourly rate, flat fee, or itemized charges.

- Include Payment Terms: Specify the due date, payment methods accepted, and any penalties or discounts for early or late payment.

- Add Tax Information: If applicable, include taxes or other fees related to the service charges.

Example of a Service Record Layout

| Service Description | Rate | Quantity | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Office Cleaning | $50/hour | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization (e.g., text and colors) | Advanced customization (e.g., logo, layout, fonts) |

| Functionality | Limited features (manual entry, no automation) | Full functionality (automated reminders, reports, recurring billing) |

| Support | Minimal or no customer support | Dedicated customer support and resources |

| Cost | Free | Subscription or one-time fee |

| Integration with Other Tools | Often no integrations | Integration with accounting, payment systems, and more |

When deciding between free and paid options, it’s important to consider your business’s specific needs and the volume of records you need to manage. For small

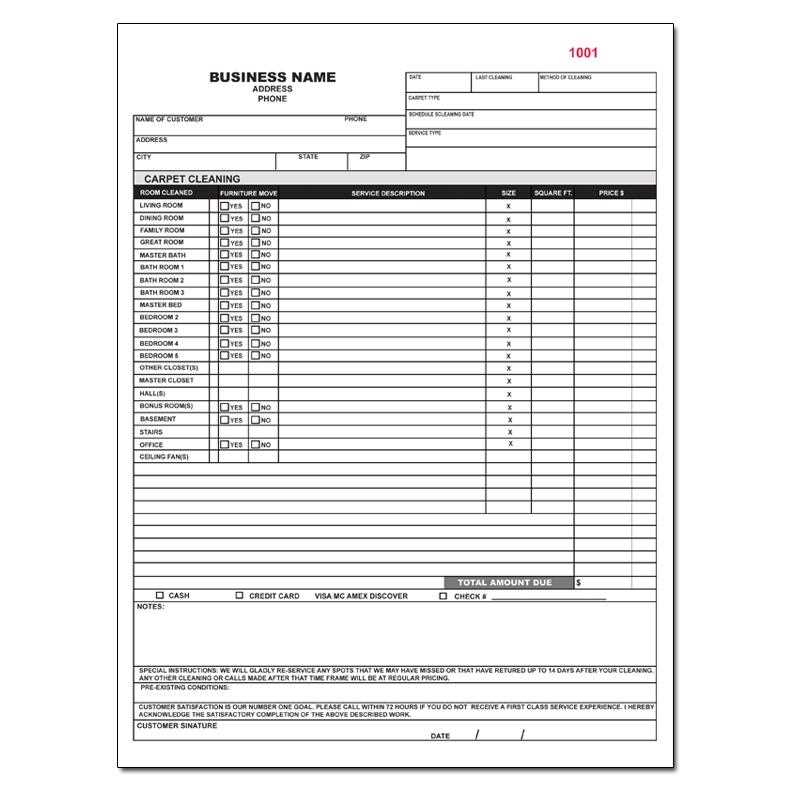

How to Add Service Details to a Billing Document

Adding clear and detailed information about the services provided is essential for creating a transparent and professional billing document. This ensures that your client understands exactly what they are being charged for, and it helps avoid any confusion or disputes later on. Including service details not only improves communication but also strengthens trust between you and your client.

When adding service information to a billing document, it’s important to break down the work in a way that is easy to understand. Be specific about the tasks completed, the time spent, and any additional charges that might apply. Providing this level of detail will help both you and your client stay organized and on the same page.

Essential Service Details to Include

- Task Description: Clearly describe each task or service provided, including any special requests or additional details.

- Quantity or Time: Indicate the number of units, hours, or amount of work done for each service.

- Rate: Specify the rate per hour, unit, or service, depending on how you charge.

- Total Cost: Calculate and list the total cost for each service based on the quantity and rate.

- Additional Charges: Include any extra fees, such as for materials, travel time, or rush requests, if applicable.

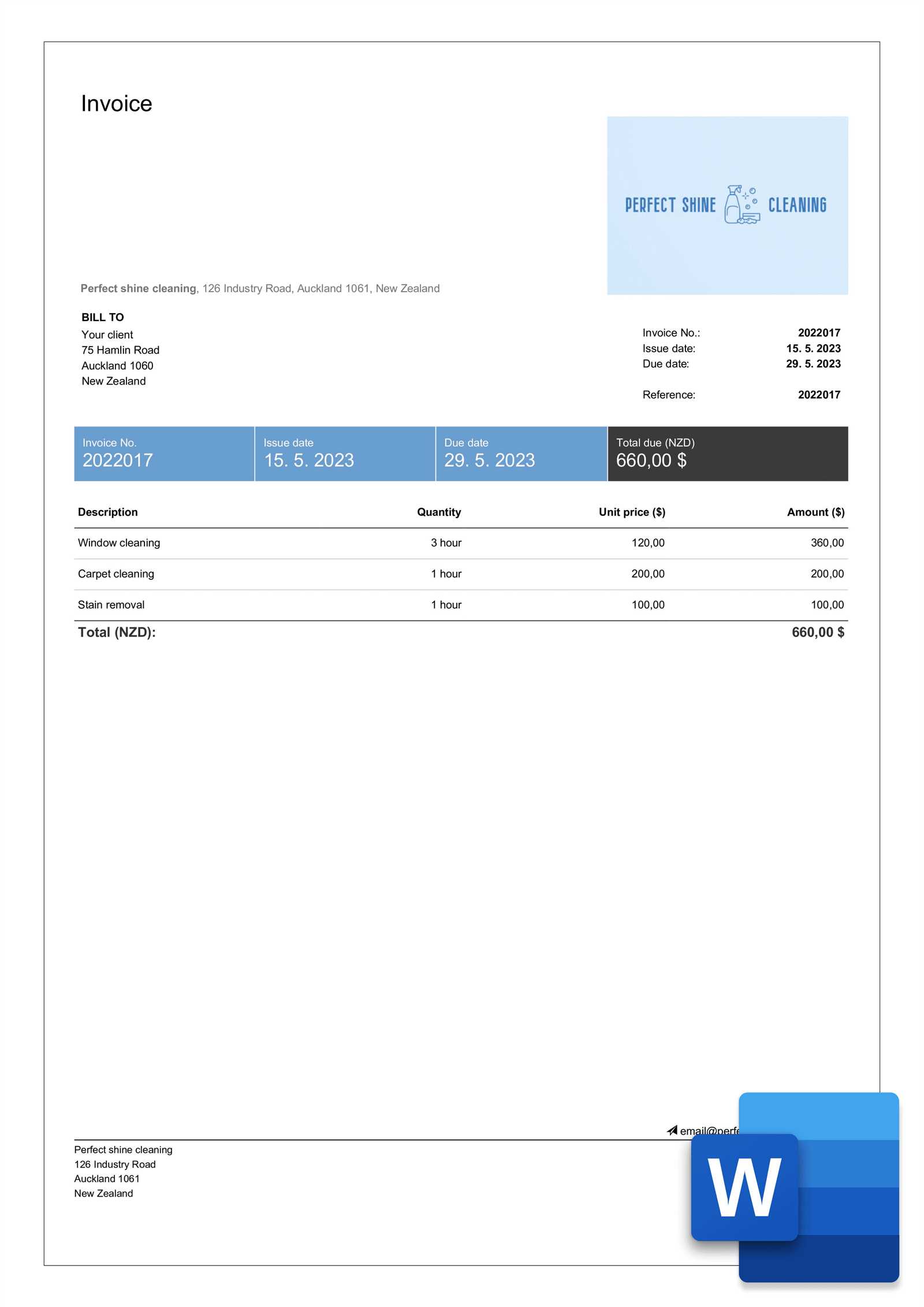

Example of Service Details in a Billing Document

| Service Description | Rate | Quantity | Total Cost |

|---|---|---|---|

| General Office Cleaning | $50/hour | 4 hours | $200 |

| Window Washing | $30/hour | 2 hours | $60 |

| Total | $260 | ||

By including these essential details in your billing document, you provide a clear, accurate representation of the work completed and the costs associated with it. This not only helps your client understand the charges but also

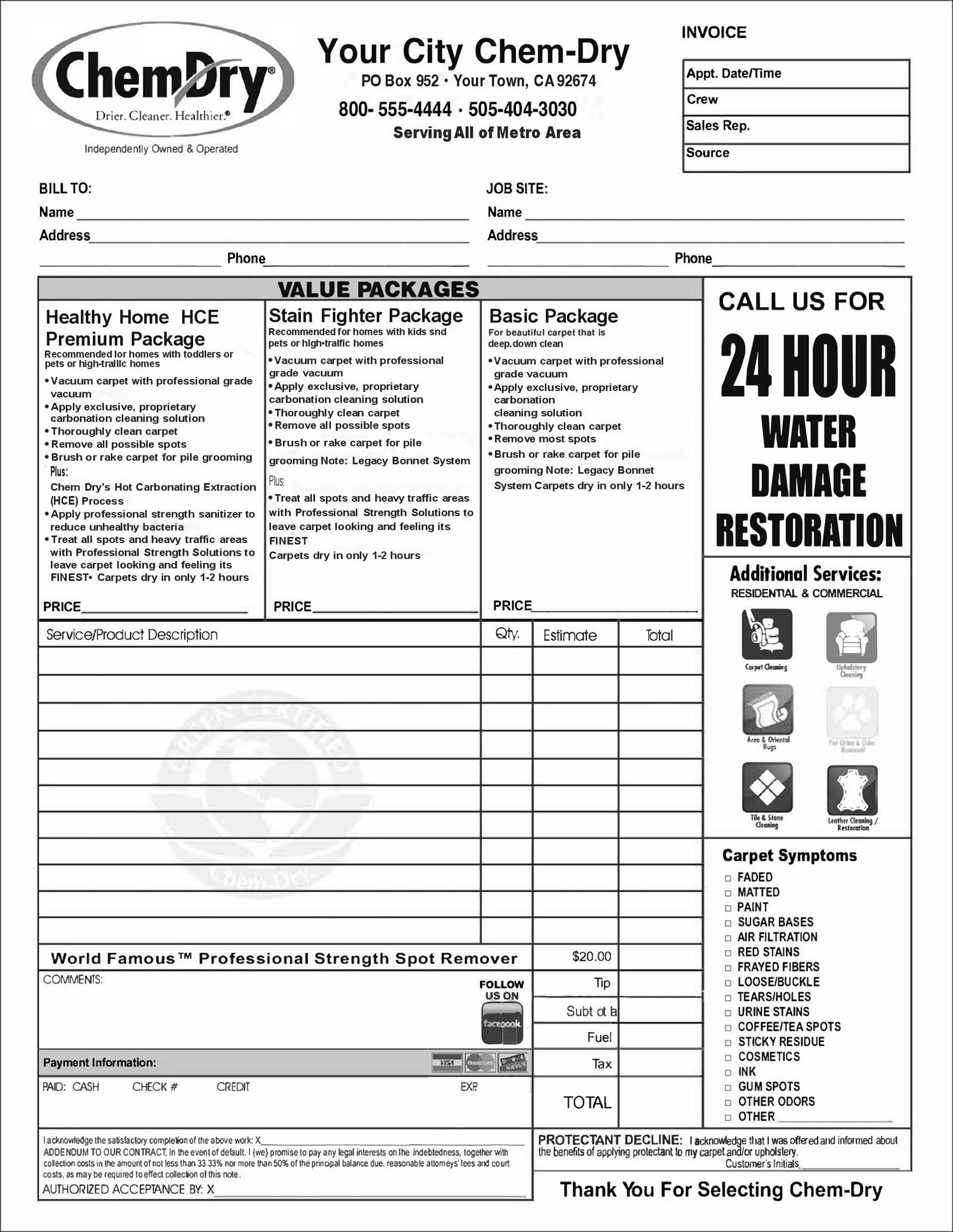

Tips for Setting Payment Terms

Setting clear and fair payment terms is crucial for managing your cash flow and ensuring timely compensation for the services you provide. By outlining your payment expectations upfront, you minimize the risk of misunderstandings and late payments. Well-defined terms also help establish a professional reputation and build trust with your clients.

When setting payment terms, it’s important to balance flexibility with clarity. This means defining exactly when payments are due, the accepted methods of payment, and any penalties for late payments. Consider your business needs, client preferences, and industry standards when deciding on the most appropriate terms for your services.

Important Payment Terms to Consider

- Due Date: Clearly specify when payment is expected. Common options include “Due upon receipt,” “Net 30” (payment due 30 days after service), or “Net 15.”

- Accepted Payment Methods: Indicate which forms of payment are acceptable, such as credit cards, bank transfers, or checks.

- Late Payment Fees: Set a clear policy for late payments, such as a flat fee or a percentage of the total amount due for every week or month the payment is overdue.

- Discounts for Early Payment: Offering a small discount for early payment can incentivize clients to pay faster and improve cash flow.

- Partial Payments: If applicable, you may choose to allow clients to make partial payments, especially for larger projects or ongoing services.

Example of Clear Payment Terms

Below is an example of what you might include in your payment terms:

- Payment is due within 30 days from the date of service.

- A 2% discount is applied to any payment made within 10 days of the service date.

- A late fee of 5% of the total amount will be added for payments received after 30 days.

- Accepted payment methods include credit card, bank transfer, and checks.

By establishing and clearly communicating your payment terms, you create a transparent, professional process for collecting payments, helping to ensure timely compensation and maintain healthy business relationships with your clients.

How to Include Taxes on Billing Documents

Adding taxes to a billing document is a necessary part of ensuring compliance with local tax laws and maintaining transparency with your clients. Including taxes accurately in your billing records not only helps avoid legal issues but also ensures that your client understands the full breakdown of the charges. The process of applying taxes can vary depending on the service provided and the tax regulations in your area.

When including taxes on your service record, it’s essential to clearly show the tax rate, the total amount of tax charged, and how it is applied to the overall cost. This helps clients see exactly what portion of the total amount is tax-related and how it affects their payment. Let’s look at how to do this in a clear and professional manner.

Steps to Include Taxes

- Determine the Tax Rate: Research the applicable tax rate for your location and service type. This could be a flat percentage or vary depending on your area or type of work.

- Calculate the Tax Amount: Multiply the total cost of the services by the tax rate to get the total tax due.

- Show the Tax on the Document: Clearly list the tax amount as a separate line item in the billing record so clients can easily identify it.

- Include Tax Information: In some cases, you may also need to include your tax identification number or specify that the price is before or after tax.

Example of Taxes on a Billing Document

| Service Description | Amount | Tax Rate | Tax Amount | Total Amount Due |

|---|---|---|---|---|

| Office Cleaning | $200 | 8% | $16 | $216 |

| Window Washing | $60 | 8% | $4.80 | $64.80 |

| Total | $260 | $20.80 | $280.80 |

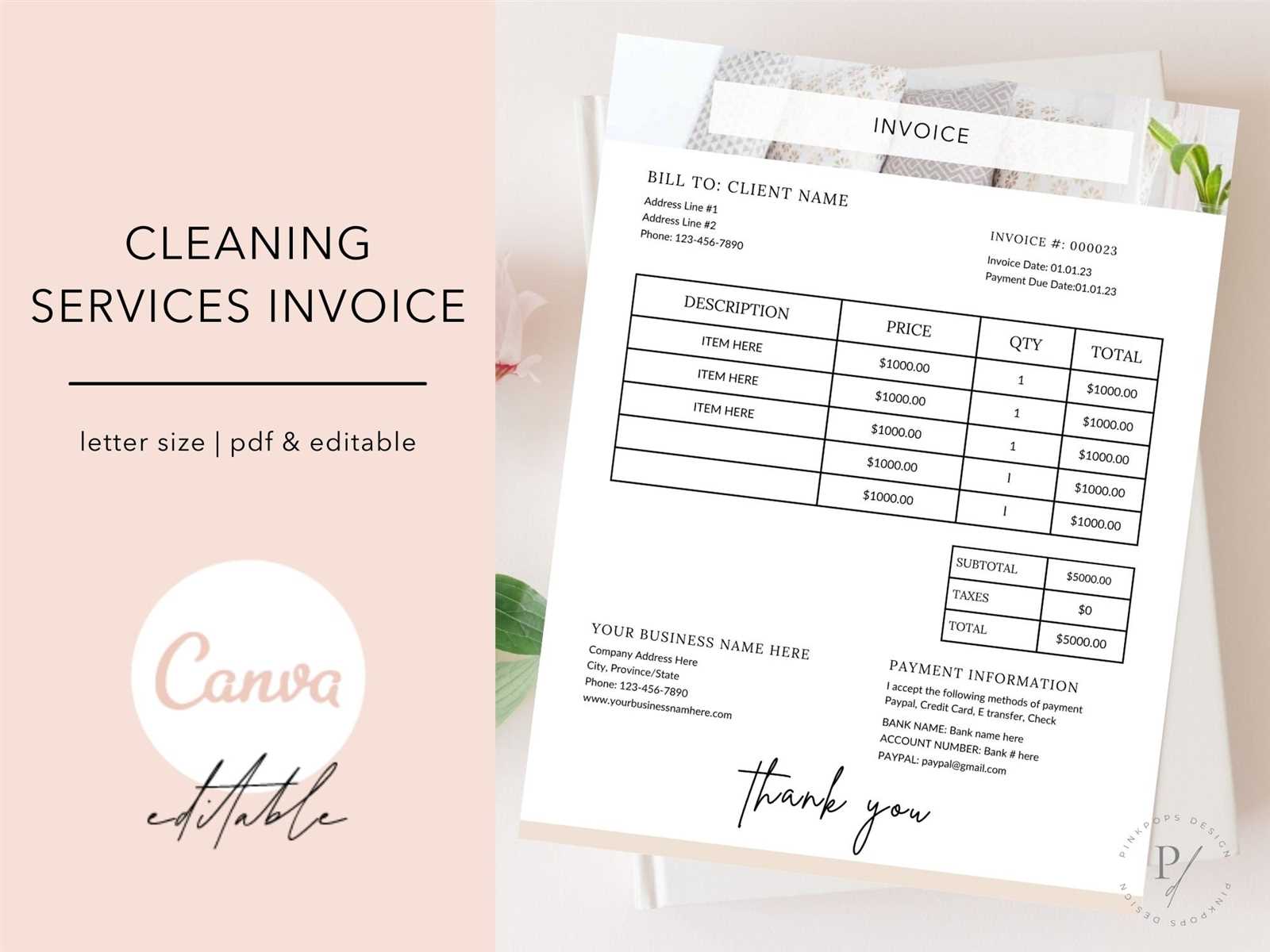

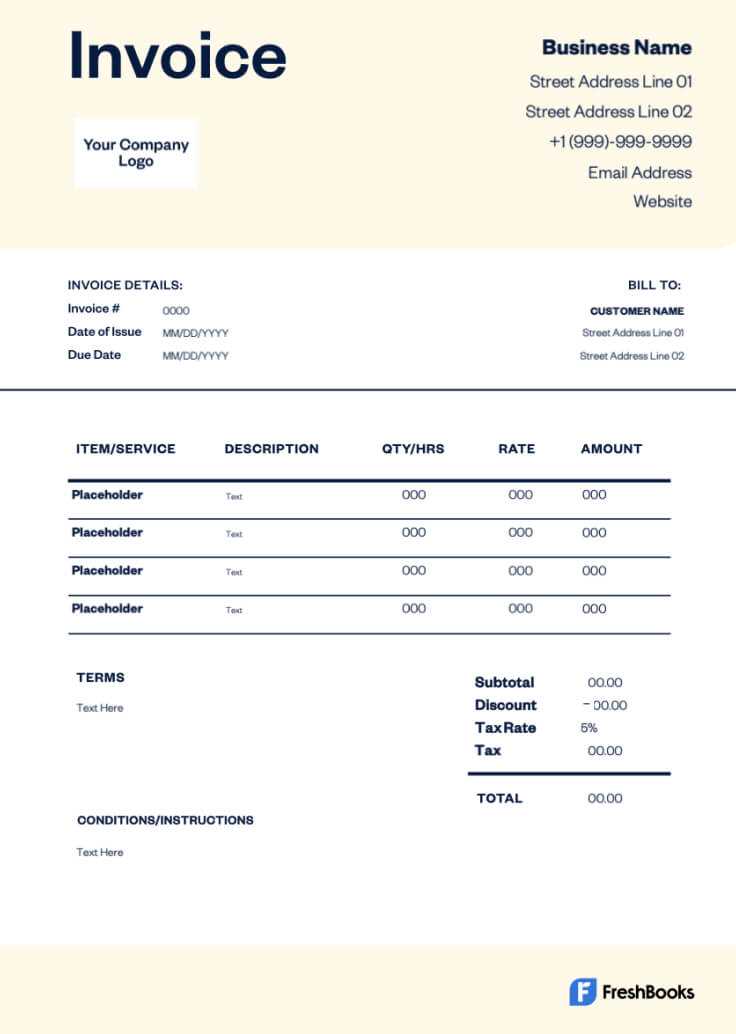

How to Format Your Billing Document

Formatting your service record correctly is essential for presenting a professional appearance and ensuring clarity for your client. A well-organized document makes it easier for both you and your client to understand the charges, terms, and any other relevant details. Proper formatting also ensures that all necessary information is included and easily accessible, reducing the risk of errors or confusion.

When formatting your billing document, it’s important to maintain a clear structure, with distinct sections that highlight essential details like service descriptions, costs, and payment terms. A clean and simple layout will not only make the document easier to read but also help reinforce the professionalism of your business.

Key Formatting Elements

- Header: Start with your business name, logo (if applicable), and contact information at the top. Include the client’s name and contact details below yours to clearly identify both parties.

- Unique Reference Number: Assign a unique number to each record for easy reference and tracking.

- Service Details: Clearly list the services rendered with brief descriptions, quantities (e.g., hours or units), and rates.

- Cost Breakdown: Provide a detailed breakdown of the charges, including taxes, additional fees, and discounts, if applicable.

- Payment Information: Clearly outline the total amount due, payment terms, and accepted methods of payment. Include the due date and any late payment penalties.

Example Format for a Service Record

The following layout can help you structure your billing document in a professional and organized way:

- Your Business Name and Contact Info

Address, Email, Phone Number

- Client’s Information: Client’s Name, Address, Email, Phone Number

- Document Number and Date: Unique Reference Number, Date of Service

- Service Description:

Example: Office cleaning, 3 hours at $50/hour

- Total Charges: Total service cost, Tax, Additional Fees

- Payment Terms: Payment due within 30 days, Accept

Common Mistakes in Billing Documents

When creating billing records, mistakes can lead to confusion, delayed payments, or disputes. Many of these errors are avoidable with attention to detail and a clear understanding of the essential elements to include. Common mistakes often arise from overlooking key information, inconsistent formatting, or failing to communicate terms properly. Identifying these errors and learning how to avoid them can help maintain professionalism and ensure timely payment.

Here are some of the most frequent mistakes made when preparing service records and tips on how to avoid them.

Common Mistakes

- Missing or Incorrect Contact Information: Not including the correct details for both your business and the client can lead to confusion and delays in payment. Always double-check addresses, phone numbers, and email addresses to ensure accuracy.

- Unclear Service Descriptions: Vague or incomplete descriptions of the services provided can lead to misunderstandings. Be as specific as possible about what was done, including the time spent and any special requests.

- Incorrect Calculation of Costs: Errors in math, such as miscalculating rates, hours, or taxes, can cause discrepancies in the final amount due. Always double-check all figures and ensure you’ve applied the correct tax rate or discount.

- Failure to Include Payment Terms: Not specifying payment terms–such as due dates or late fees–can cause confusion and delays. Always include clear instructions on when the payment is due, how it should be made, and any penalties for late payments.

- Lack of a Unique Reference Number: Not assigning a unique reference number to each billing document can make tracking difficult, especially for recurring clients. Always include a unique ID for each document to make future reference easier for both you and your client.

- Not Accounting for Additional Fees: Failure to mention extra charges, such as travel fees or materials, can result in unexpected disputes. Ensure all additional charges are clearly outlined in the record before sending it to the client.

By being mindful of these common mistakes and taking steps to address them, you can ensure that your service records are accurate, clear, and professional. This will not only improve the efficiency of your billing process but also help to build stronger, more trusting relationships with your clients.

How to Track Payments with Billing Documents

Tracking payments effectively is crucial for maintaining a steady cash flow and ensuring that you get compensated for the services you provide. A well-organized system for monitoring payments allows you to quickly identify which accounts are paid and which ones are overdue. By keeping detailed records, you can avoid confusion and stay on top of financial management without the risk of missing payments or losing track of outstanding balances.

Using a structured approach to document payments will also improve your ability to follow up on overdue balances, ensuring that you remain professional while encouraging prompt payment from your clients.

Best Practices for Payment Tracking

- Assign Unique Reference Numbers: Each billing document should have a unique identifier. This makes it easy to track and cross-reference payments against specific services or clients.

- Clearly Mark Payment Status: Indicate whether the payment has been made or is still pending. You can add simple labels like “Paid,” “Pending,” or “Overdue” to keep things clear and organized.

- Use Payment Due Dates: Always specify the due date on your billing record. This helps both you and your client stay on the same page regarding payment expectations.

- Record Payment Amounts: Keep a record of the exact amount paid and the date the payment was received. This is especially important for partial payments or adjustments to the original amount due.

- Track Payment Methods: Make note of how the payment was made (e.g., bank transfer, credit card, cash). This helps you maintain accurate financial records and follow up with clients if there are issues with the payment method.

Example of Payment Tracking System

Here is a simple example of how you can track payments for each service provided:

- Reference Number: #12345

- Service Description: Office Cleaning

- Amount Due: $300

- Amount Paid: $300

- Payment Method: Bank Transfer

- Payment Date: October 15, 2024Improving Client Trust with Professional Billing Documents

Providing well-structured and clear billing records is key to building trust with your clients. When you present a professional document that includes all necessary details–such as accurate service descriptions, payment terms, and transparent costs–you demonstrate that your business is organized and reliable. A professional approach to billing not only enhances your credibility but also reduces the likelihood of payment disputes, helping to maintain strong, long-term relationships with your clients.

Clients are more likely to feel confident in your services when they see that you are serious about how you handle financial matters. By creating documents that are clean, comprehensive, and easy to understand, you set the tone for an effective and trustworthy business relationship.

Key Elements that Build Trust

- Clear and Transparent Pricing: Provide a detailed breakdown of costs, including any additional charges or fees. Clients appreciate knowing exactly what they are paying for.

- Accurate and Consistent Information: Always double-check client details, service descriptions, and the total amount due to avoid mistakes that could create confusion or distrust.

- Professional Design: A clean, easy-to-read layout shows that you pay attention to detail and are serious about your business practices. It reflects well on your overall professionalism.

- Clear Payment Terms: Specify payment deadlines, accepted methods, and any applicable late fees to set clear expectations from the start.

- Timely Delivery: Sending a billing document promptly after completing the service demonstrates efficiency and respect for the client’s time.

Example of a Professional Billing Document

Here is a sample of how a professional billing document could be structured:

Service Description Hours Rate Subtotal Office Cleaning 5 hours $40/hour $200 Window Washing 2 hours $30/hour $60 Total Amount Due How to Send and Manage Billing Documents

Efficiently sending and managing service records is essential for maintaining a smooth business operation. The process involves not only delivering accurate documents to clients but also keeping track of the status of each one. Managing these documents ensures that payments are received on time and that you stay organized throughout your business dealings. A streamlined approach to sending and monitoring these records can save you time and reduce the risk of overdue payments.

By using an organized system, whether digital or manual, you can quickly follow up on unpaid amounts and keep your financial records up to date. Here are some steps to follow when sending and managing your service documents.

Steps for Sending Service Records

- Double-Check the Details: Before sending, ensure that all information, such as client details, services rendered, costs, and payment terms, is correct.

- Choose the Right Delivery Method: Decide whether to send the document via email, postal mail, or through a professional online platform. Digital delivery is faster, but some clients may prefer hard copies.

- Include Clear Payment Instructions: Make sure the client knows exactly how to make a payment, including accepted methods (bank transfer, credit card, etc.) and your payment terms.

- Send in a Professional Format: Always use a clear and professional format when sending documents. Whether by email or post, ensure that your document is legible and well-organized.

- Request Confirmation: When possible, ask clients to confirm receipt of the document to avoid any misunderstandings.

How to Manage Service Records

- Keep Track of Payments: Maintain a system for recording payments once they are received. This helps you stay on top of which clients have paid and which are still outstanding.

- Use a Payment Management System: Consider using accounting software or online tools that allow you to manage service records and payment statuses automatically. This reduces manual work and helps prevent errors.

- Follow Up on Overdue Amounts: If a payment is not received by the due date, send a polite reminder. Include the original document and request that the client settle the balance as soon as possible.

- Organize for Future Reference: Keep a well-organized record of all sent documents, whether in digital or paper form, so you can easily

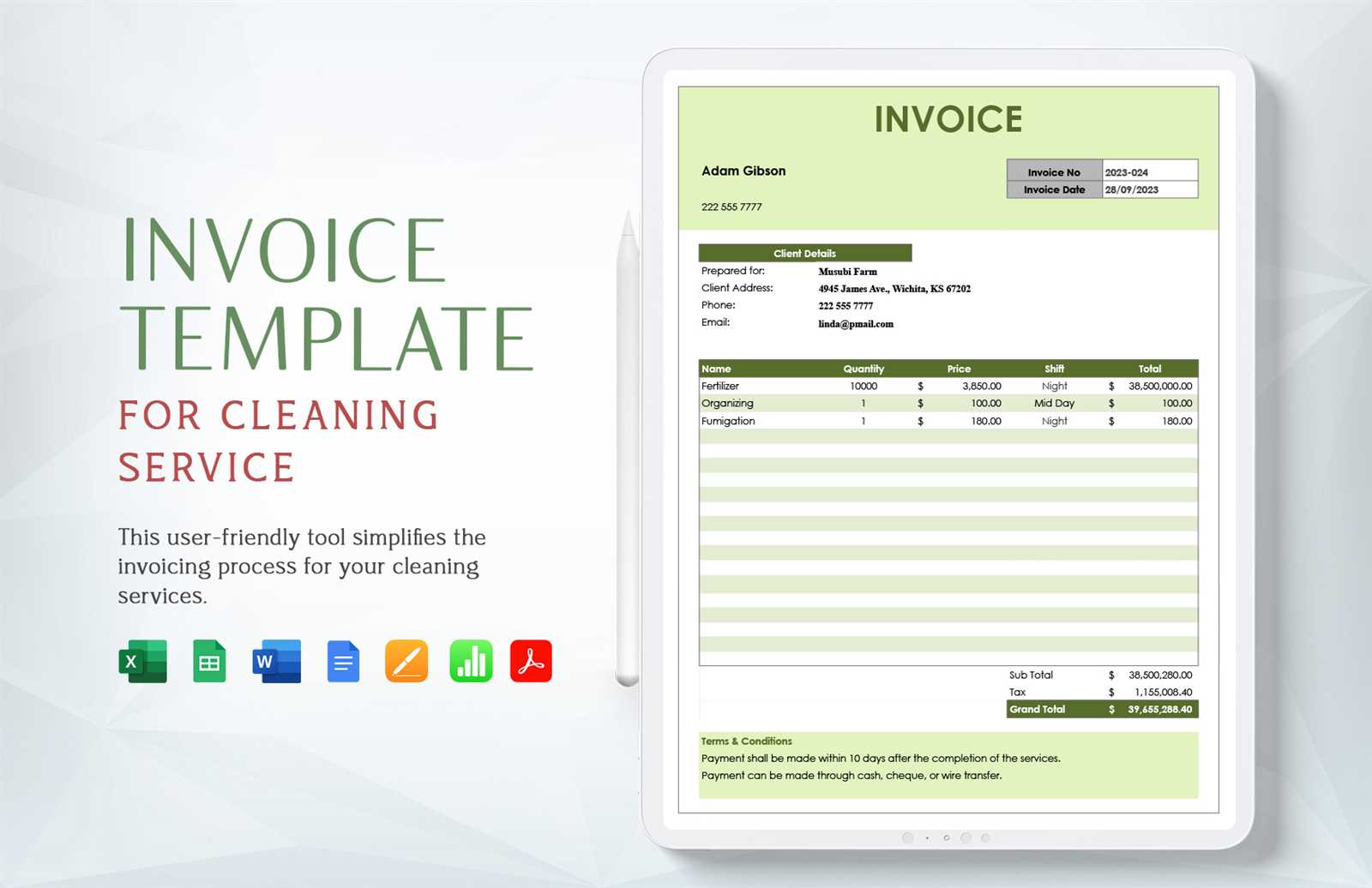

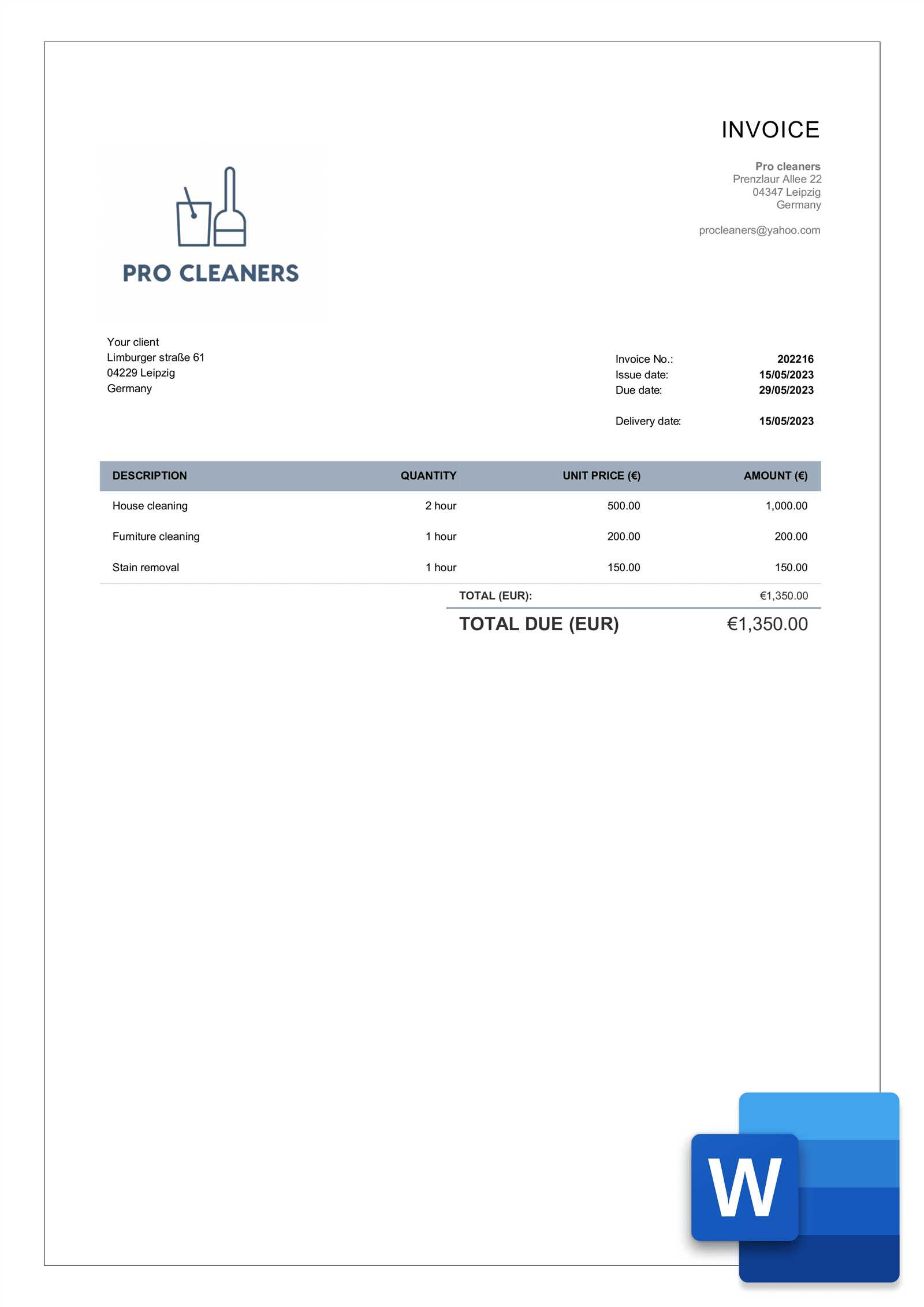

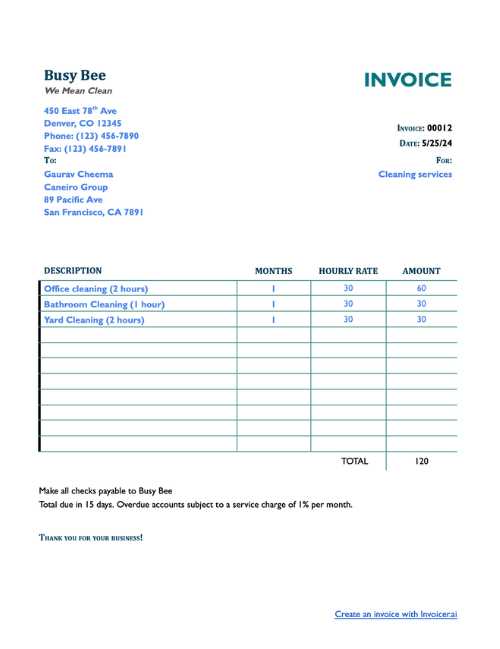

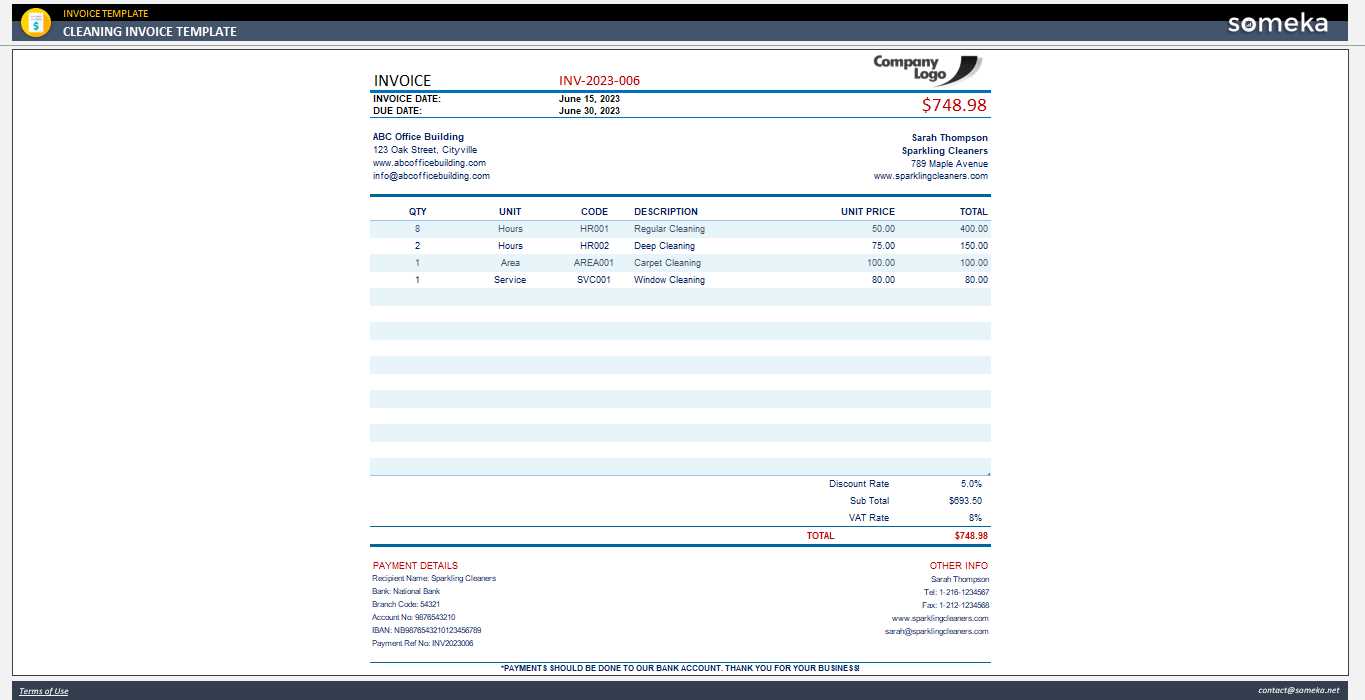

Examples of Service Billing Documents

When creating billing records for your services, it’s important to have a clear, professional format that ensures all necessary information is included. A well-designed record not only helps clients understand the breakdown of charges but also establishes your business as organized and trustworthy. Below are a few examples of how you might structure these documents, each designed for different types of services and business needs.

These examples highlight the essential elements that should be included to make the process as clear and efficient as possible. Each example can be customized according to the specific needs of your business and your clients.

Basic Service Billing Example

- Client Information: Name, address, and contact details of both the service provider and the client.

- Service Description: A brief description of the work performed, including time spent and specific tasks completed.

- Pricing: Breakdown of the rate or fee charged for each task or service, along with the total amount due.

- Payment Terms: Clearly stated payment methods, due dates, and any late fees that may apply.

- Additional Fees: If applicable, any extra charges for materials, transportation, or other services.

This type of document is ideal for straightforward jobs where the pricing structure is simple and there are no additional complexities to address.

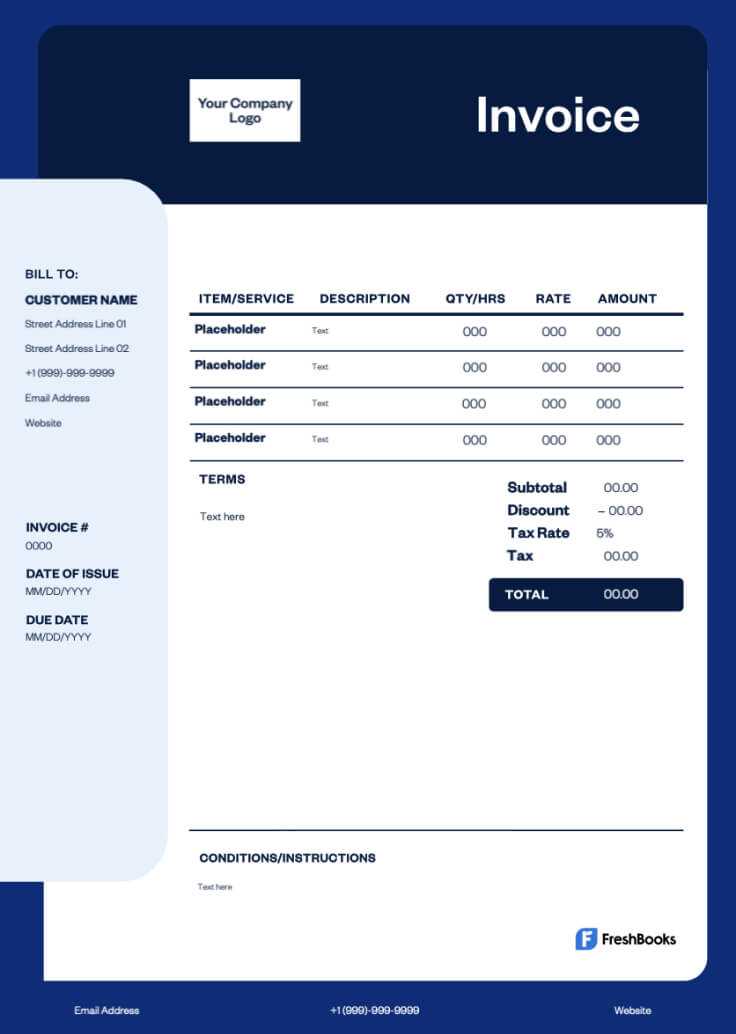

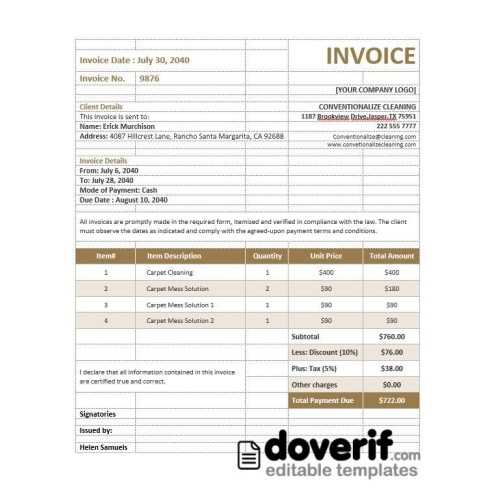

Detailed Service Record Example

- Client and Business Information: Full names, addresses, phone numbers, and email addresses.

- Service Breakdown: A detailed list of all services performed, with timestamps, quantities, and specific pricing for each element.

- Subtotal and Taxes: An itemized list of the costs for each service and applicable taxes. The subtotal should be followed by a line item showing tax amounts.

- Payment Instructions: Clear guidelines for how payment should be made, including methods (credit card, bank transfer, etc.) and deadlines.

- Terms and Conditions: Additional clauses related to payment terms, cancellation policies, or warranties.

This format is great for businesses that provide more complex or variable services, where different pricing structures or special terms need to be clearly explained.

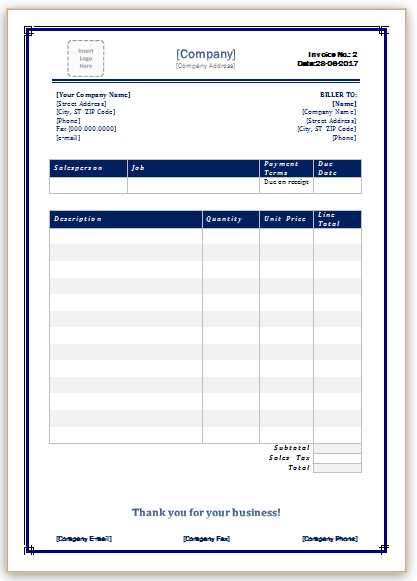

Recurring Service Record Example

- Client and Provider Details: As with other examples, include names and contact information for both parties.

- Service Frequency: A clear statement of how often the service is to be performed (e.g., weekly, monthly) and any related dates.

- Service List: List of services included in the recurring agreement, with pricing for each and total cost.

- Payment Schedule: Include payment dates and frequency (e.g., monthly, quarterly), along with total expected charges over a specific period.

- Cancellation Terms: Any terms regarding the cancellation or modification of the service agreement.

This type of record is useful for clients with long-term contracts or recurring services, ensuring both parties are clear on payment expectations and service schedules.

Each of these examples provides a solid foundation for a service billing document. Depending on the complexity of your work and the specific needs of your clients, you can adjust the structure and content to best suit your business.