Cleaning Business Invoice Template for Easy Billing

Proper documentation is essential for any service provider to ensure smooth transactions and build trust with clients. The process of requesting payment should be clear, professional, and easy to follow. Whether you are managing regular contracts or one-time jobs, a well-organized payment request helps establish credibility and maintain a healthy financial flow.

In order to simplify this process, having a structured document that includes all necessary details can save time and prevent errors. This tool not only helps you track payments but also provides a clear overview of the services rendered. With the right format, managing your earnings becomes straightforward and hassle-free.

For those offering recurring or specialized services, the ability to adapt the document to various situations is critical. Tailoring it to meet specific needs can streamline both communication and payment processes, ensuring that you stay on top of your financial responsibilities. A customized approach benefits both the provider and the client, fostering long-term professional relationships.

Essential Features of Service Payment Requests

For any service provider, ensuring that payment details are clear and easy to understand is crucial for maintaining a professional image and facilitating prompt transactions. A well-structured document plays a key role in ensuring both parties have the same understanding of the services provided and the amount due. Certain elements must be included to guarantee that the request is comprehensive and legally sound.

Key Components to Include

The most important features are the service details, contact information, and payment terms. Each component plays a vital role in ensuring the payment process goes smoothly, with no misunderstandings or delays.

| Component | Description |

|---|---|

| Service Description | Clear and detailed description of the work completed, including the time spent and any additional costs incurred. |

| Contact Information | Accurate contact details for both the provider and the client to ensure prompt communication regarding any questions or clarifications. |

| Payment Terms | Clear information regarding due dates, acceptable payment methods, and any penalties for late payments. |

| Total Amount Due | The full amount owed, including taxes and any additional charges, should be clearly visible and easy to calculate. |

Why These Features Matter

These components are vital to maintaining transparency and avoiding confusion between the service provider and the client. A detailed breakdown helps ensure that both parties understand the agreement fully, reducing the likelihood of disputes. Furthermore, it enables easy tracking of payments, allowing the provider to stay organized and on top of their financial records.

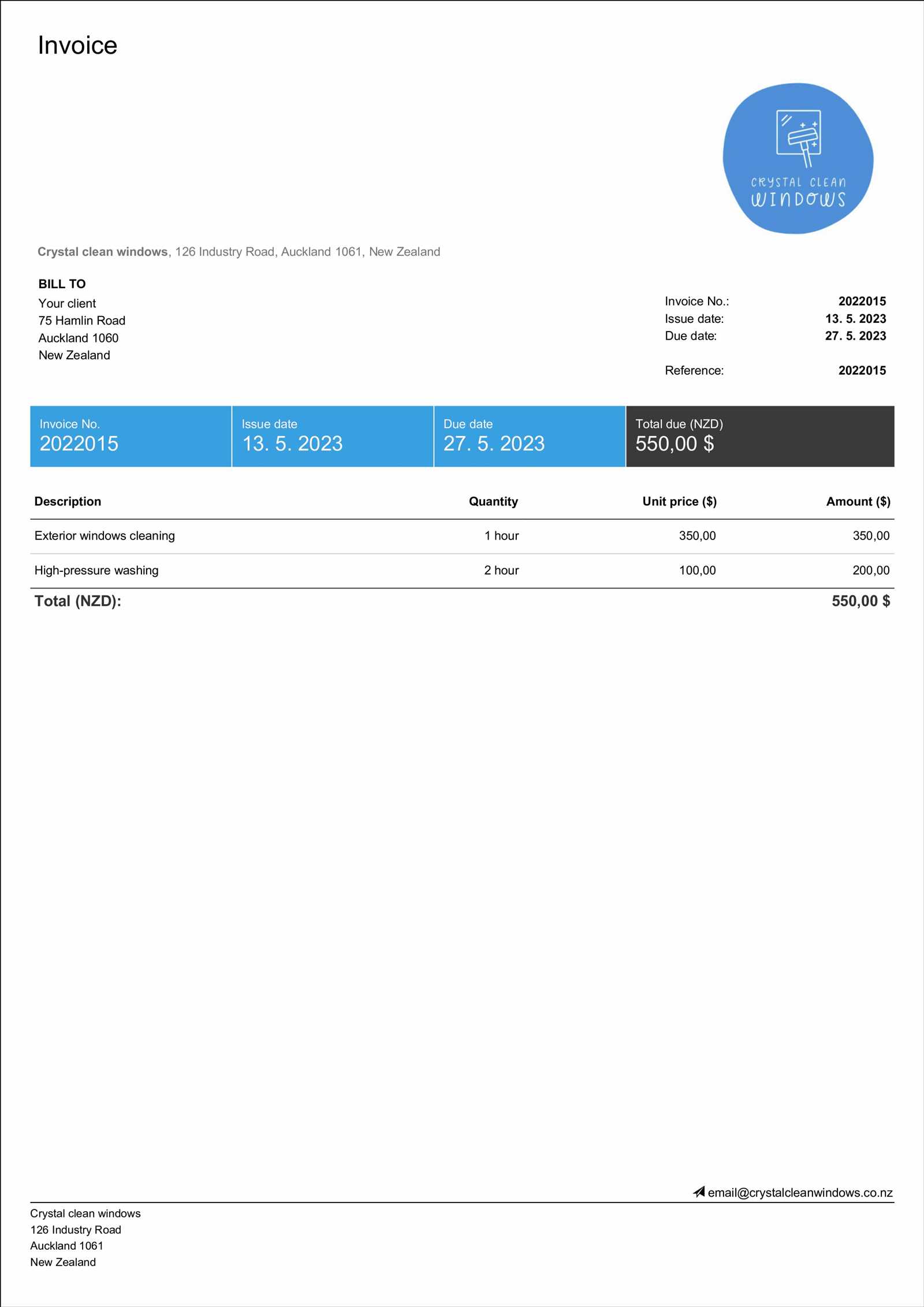

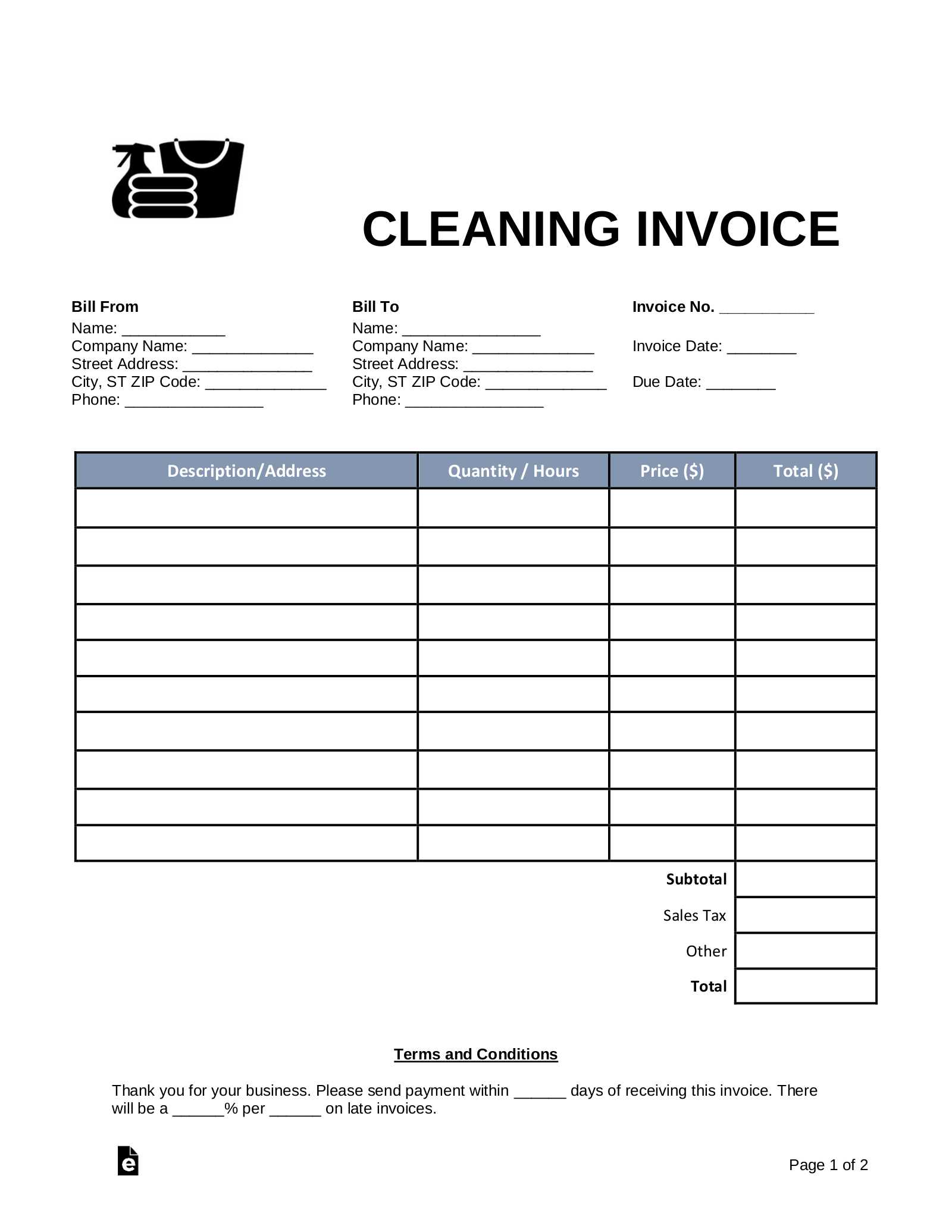

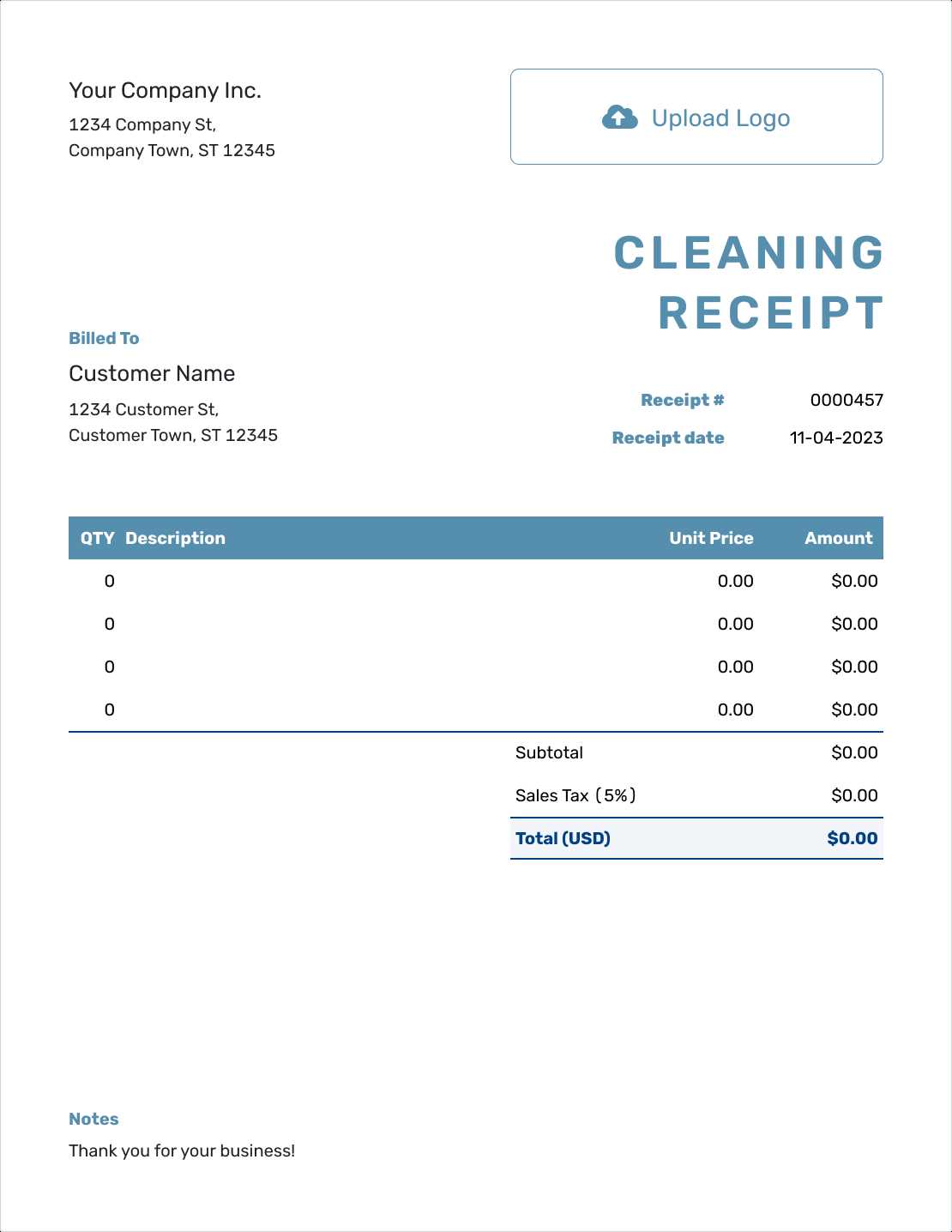

How to Customize an Invoice Template

Adapting a payment request form to fit the specific needs of your services is a key part of ensuring professionalism and efficiency. Customizing the document allows you to incorporate all the necessary details while maintaining a format that suits your unique requirements. By personalizing the layout and sections, you can streamline the process and present a polished appearance to clients.

Here are a few steps to consider when adjusting the document for your needs:

- Choose the Right Layout: Ensure that the overall structure suits the type of service provided. A clean and organized design will make it easier for clients to review and understand.

- Include Relevant Details: Adapt the form to include all the essential information, such as the services rendered, timeframes, and payment expectations.

- Personalize Branding: Add your logo, color scheme, and contact details to make the form uniquely yours and reinforce your brand identity.

- Modify Payment Terms: Tailor the payment terms section based on your preferences, whether you require deposits, early payment discounts, or late payment penalties.

In addition to the core features, make sure the document is easy to update. As your offerings or pricing change, the ability to quickly edit the details will save time and ensure accuracy.

For ongoing projects, consider including sections for recurring payments or specific milestones to keep everything clear for the client. A customized approach not only helps maintain transparency but also contributes to building trust and professionalism in every transaction.

Why Invoices Are Crucial for Cleaning Services

For any service provider, clear and accurate documentation of work completed is essential for ensuring smooth financial transactions. Having a formal request for payment not only protects both parties but also establishes a clear record of services provided and funds owed. This is especially important in industries where regular or recurring work is the norm.

In the context of cleaning services, a detailed payment request helps prevent misunderstandings and ensures that both the provider and client are on the same page regarding expectations. Whether it’s a one-time job or an ongoing arrangement, this document acts as a proof of the work performed and a reminder of the agreed-upon payment.

Additionally, having a structured payment request aids in maintaining financial organization. It provides a transparent record of earnings and assists in tracking payments, which is essential for managing cash flow and taxes. For cleaning professionals, this tool is indispensable in managing multiple clients and ensuring timely payment for services rendered.

Step-by-Step Guide to Invoice Creation

Creating a professional payment request is an essential skill for any service provider. The process ensures that both parties understand the terms of payment and helps to establish clear documentation of services rendered. By following a simple, structured approach, you can produce a document that is both functional and easy for clients to understand.

Here’s how to create a comprehensive request for payment:

- Include Your Contact Information: Start by adding your name, company name (if applicable), phone number, and email address. This makes it easy for clients to reach you in case of any issues or questions.

- Specify Client Details: Add the client’s name, address, and contact information. This ensures the payment is linked to the correct recipient.

- Provide a Unique Identification Number: Assign a reference number to each document. This helps in organizing and tracking multiple requests over time.

- Detail Services Rendered: Clearly describe the work done, including dates, hours worked, or specific tasks completed. This provides transparency and helps avoid disputes.

- List Pricing Information: Break down the cost for each service provided, including any applicable taxes. This allows the client to see a clear breakdown of the charges.

- Set Payment Terms: Indicate the due date and acceptable payment methods. You can also include information on late fees or early payment discounts if applicable.

- Include Total Amount Due: Ensure the total amount is clearly displayed and includes all charges, taxes, and any other relevant fees.

Once these details are added, double-check everything for accuracy. A well-crafted request will not only ensure smooth financial transactions but also help reinforce your professionalism in the eyes of the client.

Choosing the Right Invoice Format

Selecting the appropriate layout for your payment requests is a crucial step in ensuring clarity and professionalism. The format you choose will affect how easily your client can understand the details of the services provided and the amount due. Whether you prefer a simple design or a more comprehensive layout, it is important that the structure aligns with the needs of your service and enhances communication.

When selecting a format, consider the following factors:

- Complexity of Services: For simple tasks, a minimal design may suffice, listing only the basic details. For more involved work, a detailed breakdown of services with separate charges and taxes might be necessary.

- Client Expectations: If your clients are accustomed to a specific format or you work with corporate clients, adopting a more formal, standardized approach may be beneficial.

- Ease of Use: Choose a format that is easy for you to update and track. The simpler the layout, the less time you will spend managing it.

- Digital vs. Paper: Decide if you will be sending payment requests electronically or via physical mail. Digital formats may offer more flexibility for customization, while printed ones can benefit from a more traditional, professional appearance.

Ultimately, the right format should reflect your level of professionalism and make it easy for your clients to understand and process payments. The choice of layout can also help convey your brand identity and ensure that your communication is consistent and effective.

Common Mistakes in Service Payment Requests

Even small errors in a payment request can lead to misunderstandings, delays, or even missed payments. It is essential to be thorough and careful when preparing these documents to ensure both accuracy and professionalism. Certain mistakes are frequently made, but they are easy to avoid once you know what to look for.

Here are some common mistakes to avoid when creating payment requests:

| Error | Consequences | How to Avoid |

|---|---|---|

| Missing or Incorrect Client Information | Confusion over the recipient of the payment, possible misdelivery of the document. | Double-check client name, address, and contact details before sending. |

| Unclear Service Descriptions | Client may question the charges or not understand what is being paid for. | Provide a detailed, clear description of the work completed, including time, materials, or tasks. |

| Incorrect Pricing or Calculations | Disputes over pricing, delayed payments, or loss of trust. | Double-check all rates, totals, and any additional charges before submission. |

| Failure to Include Payment Terms | Confusion about when and how to pay, which may lead to late payments. | Clearly state the due date, accepted payment methods, and any late fees if applicable. |

| Not Using a Unique Reference Number | Difficulty tracking payments and organizing financial records. | Assign a unique reference number to each document for easy tracking. |

By avoiding these common mistakes, you ensure that the process of requesting payment is clear and professional, which can help avoid confusion and strengthen your relationship with clients.

Automating Payment Requests for Service Providers

Automating the process of generating payment requests can significantly reduce the time and effort involved in managing transactions. By leveraging technology, service providers can streamline their financial processes, ensuring accuracy and consistency while freeing up time to focus on the core aspects of their work. Automation tools can handle repetitive tasks, reducing the chances of human error and improving efficiency.

Here are some benefits of automating payment requests:

- Time Efficiency: Automation saves valuable time by eliminating the need to manually create each document, which is especially helpful when dealing with multiple clients or recurring services.

- Accuracy: Automated systems reduce the risk of errors in calculations, client details, and service descriptions, ensuring that each document is correct.

- Consistency: Automation ensures that every payment request follows the same structure and includes all the necessary information, creating a more professional and reliable impression.

- Faster Payment Collection: With automated reminders and due date tracking, clients are more likely to pay on time, improving cash flow and reducing overdue payments.

- Easy Record-Keeping: Automated systems often come with built-in reporting tools that make it easier to track outstanding payments, manage accounts, and generate financial summaries.

To automate your payment requests, consider using online platforms or software that offer features such as recurring billing, customizable templates, and automatic reminders. These tools are designed to simplify the process and integrate with other aspects of financial management, making it easier to handle large volumes of work and payments efficiently.

Overall, automation enhances operational efficiency, reduces the administrative burden, and improves the overall client experience, all of which contribute to the long-term success of any service-oriented operation.

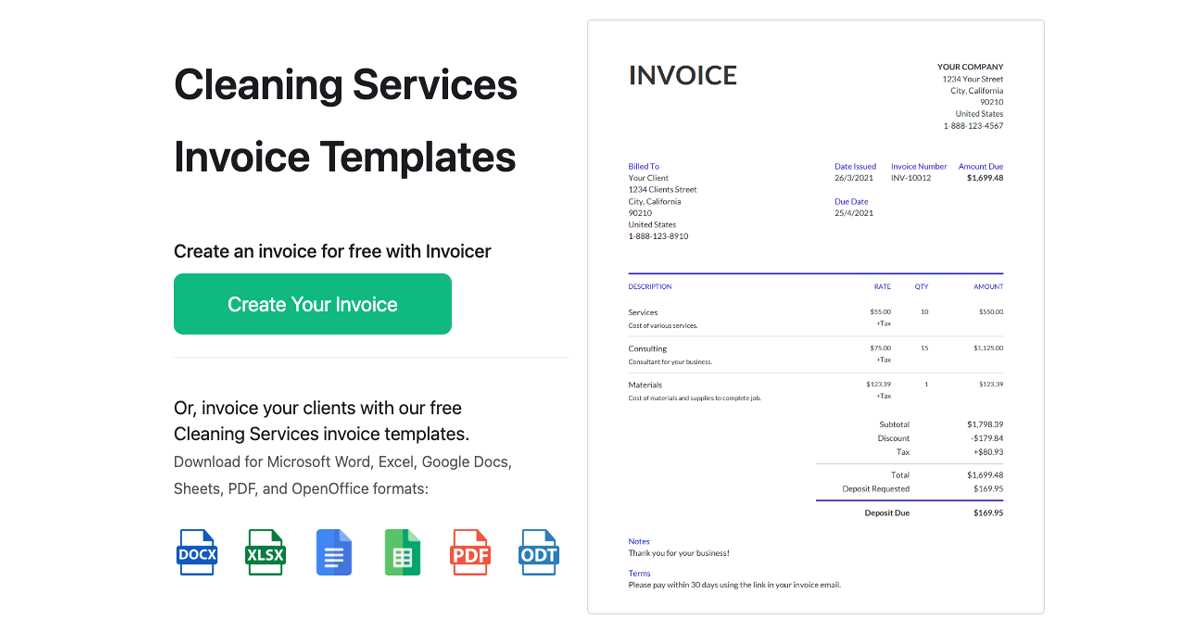

Best Software for Service Payment Requests

Choosing the right software to generate payment requests can simplify the financial aspects of your service offerings. With a variety of tools available, selecting the one that best suits your needs can improve your workflow and ensure timely payments. These platforms not only automate the creation of requests but also offer additional features to help you track finances, manage clients, and streamline your operations.

Here are some of the best software options for creating and managing payment requests:

1. QuickBooks

QuickBooks is one of the most popular accounting software solutions for service providers. It allows you to create customizable documents, track payments, and integrate with other financial tools. It’s ideal for both small and large operations looking for a comprehensive solution to manage finances.

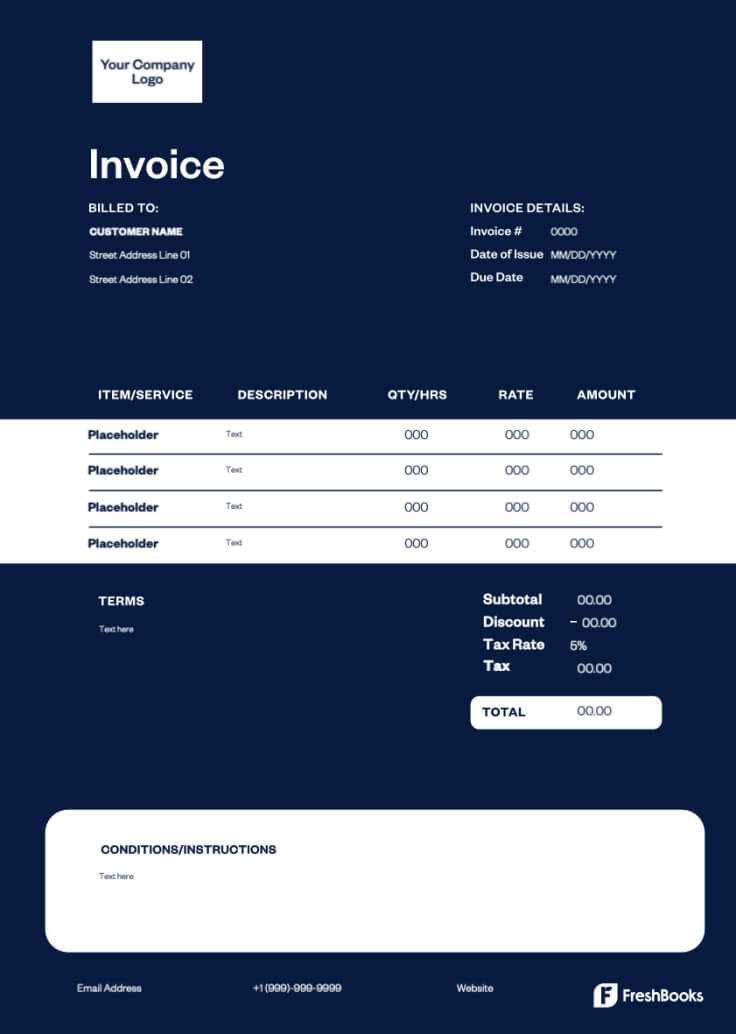

2. FreshBooks

FreshBooks is user-friendly software designed for freelancers and small business owners. It offers a variety of templates, easy expense tracking, and automated billing, making it an excellent choice for those needing a simple yet powerful tool to manage payment requests.

- Features: Time tracking, recurring invoices, online payment integration.

- Pros: Easy-to-use interface, excellent customer support, mobile app access.

- Cons: Limited reporting options in the lower-tier plans.

3. Zoho Invoice

Zoho Invoice offers a range of professional and customizable layouts, along with features for automatic reminders, payment tracking, and multi-currency support. It’s a great option for service providers who need a tool that can grow with their business.

- Features: Recurring billing, multi-currency support, detailed financial reports.

- Pros: Highly customizable, integrates with other Zoho tools, no hidden fees.

- Cons: Slightly steep learning curve for beginners.

4. Wave

Wave is an affordable solution, especially for smaller operations. It offers free invoicing features along with additional tools for accounting and receipt scanning. It’s a good option for those who ne

Understanding Payment Terms on Invoices

Payment terms are a critical aspect of financial agreements between service providers and clients. These terms outline the conditions under which payments are expected and can significantly affect cash flow and client relationships. Clear and well-structured payment terms help avoid confusion, ensure timely payments, and set expectations for both parties.

Here are some key points to understand when setting payment terms:

- Due Date: The most important element, this specifies when the payment is expected. Common due dates include “net 30” (30 days from the date of the document) or “due on receipt,” which requires immediate payment.

- Late Fees: Many service providers include late fees in their terms to encourage timely payments. It’s important to specify the amount or percentage that will be added if the payment is overdue, along with any grace periods.

- Accepted Payment Methods: Clearly listing the methods of payment you accept, such as bank transfers, checks, or online payments, helps avoid delays or misunderstandings.

- Discounts for Early Payment: Offering a discount for early payment can incentivize clients to pay ahead of the due date, improving cash flow. For example, “2% discount if paid within 10 days” is a common practice.

- Partial Payments: If you allow clients to make partial payments, specify the amounts and due dates for each installment. This helps in managing expectations and ensuring consistency in payment collection.

By being clear about your payment expectations and terms, you protect both your interests and those of your clients. Make sure that these terms are easy to understand, and always communicate them upfront to prevent any potential conflicts down the line.

How to Handle Late Payments Effectively

Dealing with overdue payments can be a challenging aspect of managing client relationships and cash flow. It is crucial to have a clear strategy in place to address late payments professionally and efficiently. Taking the right steps can help maintain good relationships with clients while ensuring that your financial needs are met.

1. Send Polite Reminders

The first step in addressing overdue payments is to send a friendly reminder to your clients. Often, clients may simply forget or overlook the due date. A polite reminder can be sent via email or even a phone call to notify them of the outstanding balance.

- Timing: Wait a few days past the due date before reaching out, giving clients time to process payments.

- Content: Keep the tone professional and courteous, expressing understanding while clearly stating the amount due and the due date.

2. Offer Payment Plan Options

If a client is facing financial difficulties, offering flexible payment options may help recover the outstanding balance while accommodating their situation. A payment plan breaks the total amount into smaller, more manageable installments.

- Flexibility: Make sure the terms are reasonable and fit within the client’s budget to avoid further delays.

- Clarity: Outline the payment schedule and agree on specific dates for each installment, so both parties are clear on expectations.

Handling overdue payments effectively requires a balance between firmness and understanding. By maintaining open communication, offering flexible options, and following up consistently, you can increase the likelihood of receiving payments while preserving positive client relationships.

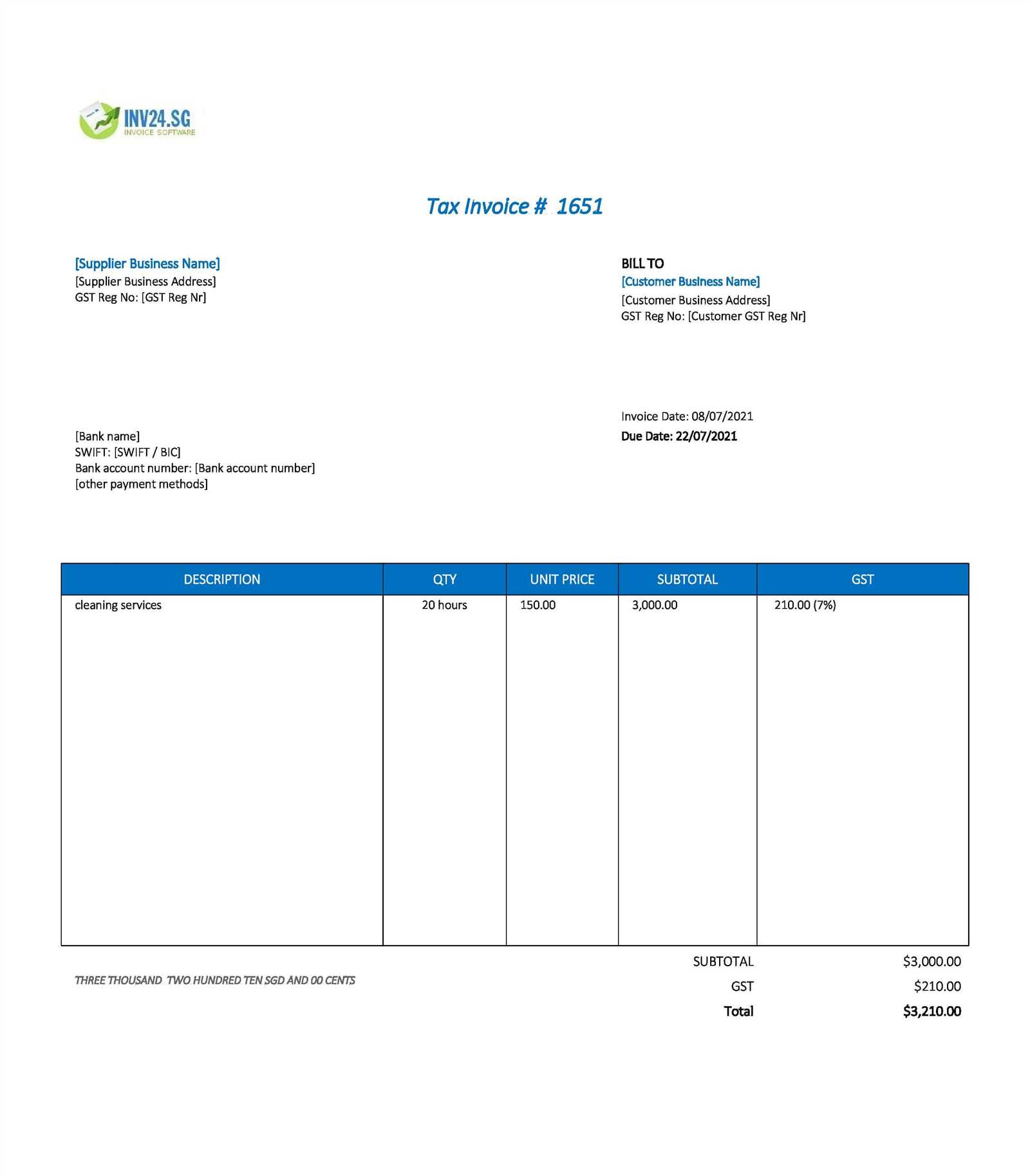

Incorporating Tax Rates on Payment Requests

When providing services, it’s essential to understand how to include tax rates in your payment requests. These rates vary depending on location, service type, and the specific tax regulations in your jurisdiction. Properly applying and displaying taxes on your payment documents ensures transparency and compliance, making it clear for your clients what they are being charged for.

1. Understand Local Tax Requirements

Before incorporating tax rates into your payment documents, familiarize yourself with the local tax laws. Different regions may have varying tax rates depending on the nature of the service provided or the location of the transaction. Research and ensure you are applying the correct rates for your area.

- Sales Tax: Most services require a sales tax, which can be a fixed percentage of the total cost.

- Value-Added Tax (VAT): Some regions require VAT, which is added to the cost of the service at different rates.

- Exemptions: Be aware of any exemptions for specific types of services that may not require tax charges.

2. Clearly Display Tax Information

Once you’ve determined the appropriate tax rates, it’s important to clearly display them on the payment documents. Transparency helps build trust with your clients and ensures they understand the breakdown of the total amount due.

- Tax Line: Include a separate line item for taxes to avoid confusion with the service charges.

- Percentage and Amount: Show both the percentage applied and the actual amount charged for taxes.

- Total Amount: Always display the total amount due, including both the service charge and tax, for clarity.

Incorporating tax rates into your payment documents might seem complicated at first, but understanding the requirements and formatting the information clearly will ensure smooth transactions and help you stay compliant with local regulations.

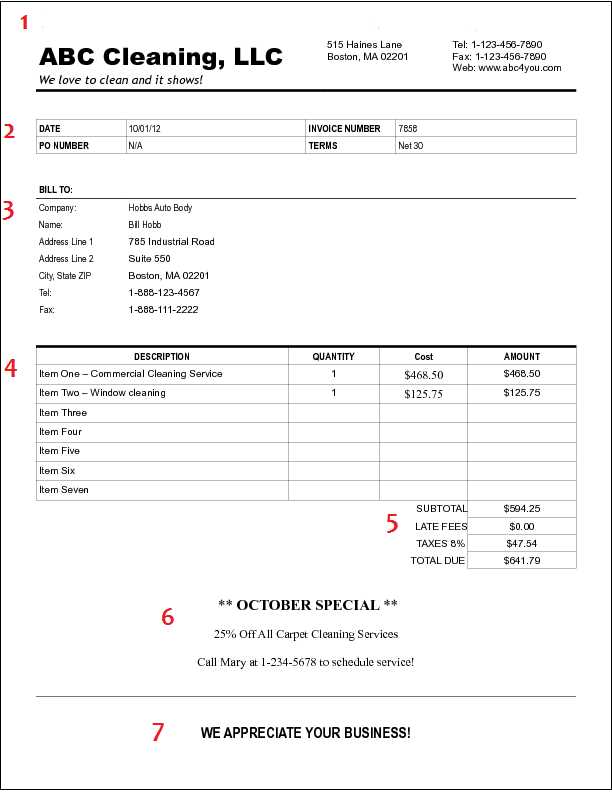

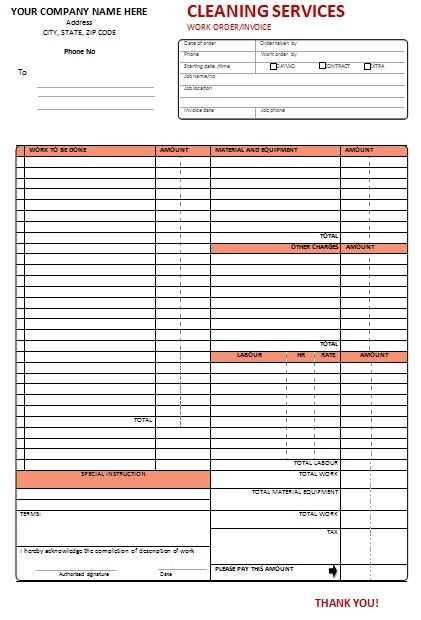

Design Tips for Professional Invoices

Creating well-structured and visually appealing payment documents is essential for maintaining a professional image. A well-designed request not only helps convey your brand identity but also improves clarity for clients, ensuring that they understand the charges and terms. By focusing on design, you can make the document easy to navigate and more likely to be paid promptly.

1. Keep It Clean and Simple

A cluttered or overly complicated layout can make your payment documents hard to read and can lead to confusion. Stick to a clean, minimalistic design that focuses on key details.

- Use White Space: Allow for plenty of space between sections to make the content easy to follow.

- Avoid Overcrowding: Limit the amount of text and use bullet points or tables for easy-to-digest information.

- Use Simple Fonts: Choose professional, easy-to-read fonts like Arial, Calibri, or Helvetica.

2. Organize Information Logically

Make sure that all essential details are easy to find. A well-organized document ensures that your clients can quickly access the information they need, from the services rendered to payment terms.

- Header Section: Include your name or company logo, contact information, and the document title at the top.

- Service Breakdown: Use tables to list the services provided along with the corresponding costs.

- Total Section: Clearly highlight the total amount due, taxes, and any discounts.

3. Use Consistent Branding

Incorporating your brand’s colors and logo into the design helps strengthen your identity and adds a touch of professionalism. However, make sure not to overdo it–your design should still prioritize readability.

- Logo Placement: Place your logo in the header or footer for consistent branding.

- Brand Colors: Use your brand’s color scheme sparingly to highlight key sections, like totals or headings.

- Brand Voice: Incorporate your business tone in any text or notes, ensuring consistency with other client-facing materials.

By applying these design tips, you can create a payment request that no

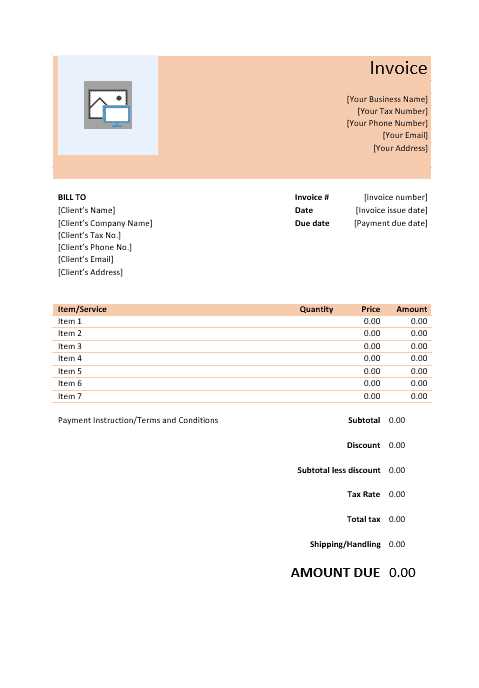

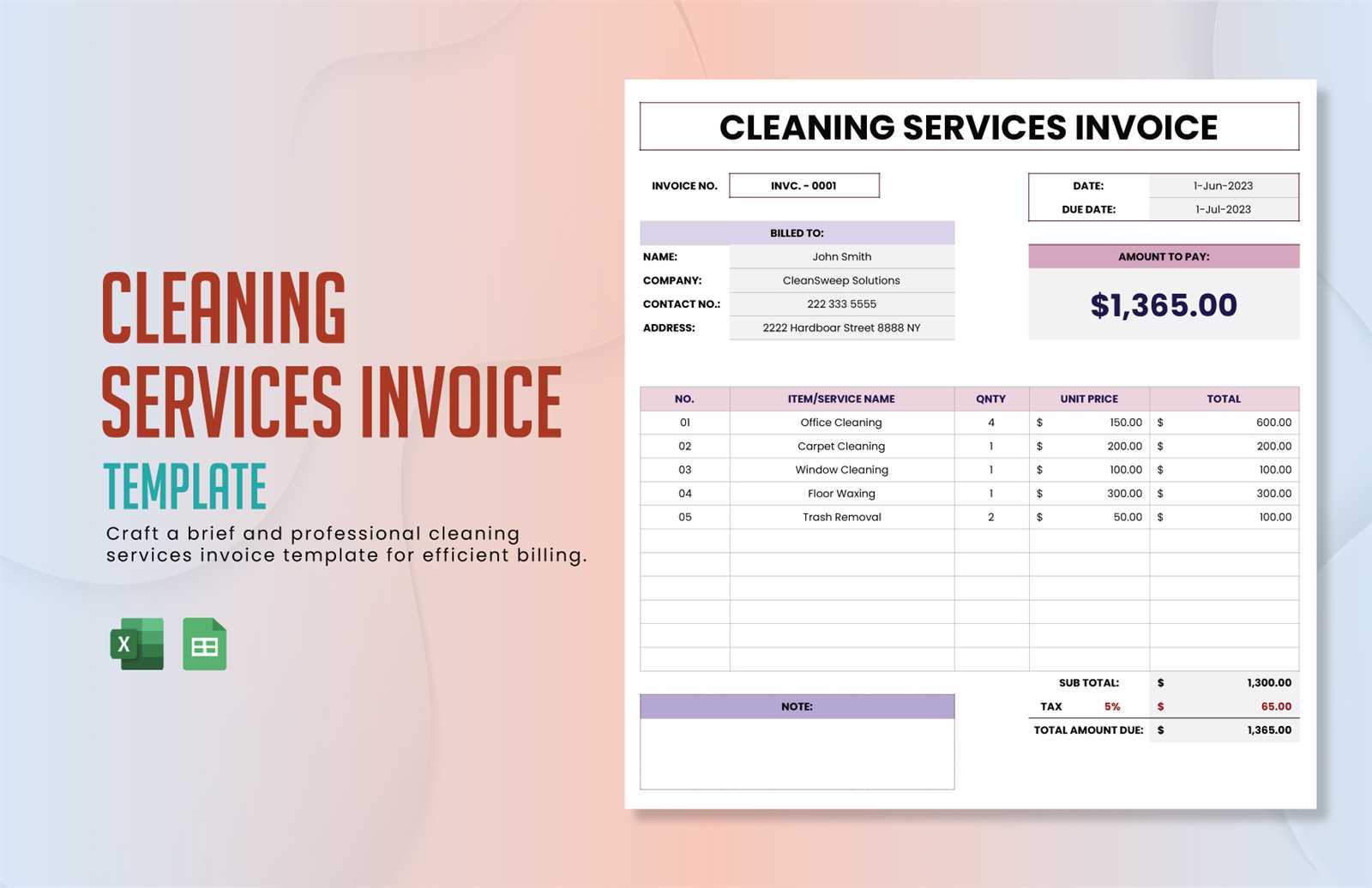

Invoice Templates for Different Cleaning Jobs

Different services require varying details and structures when creating payment requests. Each type of task may involve unique considerations, such as time spent, materials used, or specialized labor. Customizing your documents according to the specific job ensures that clients are provided with clear and relevant information that accurately reflects the services performed.

1. Standard Residential Jobs

For regular household tasks, payment documents tend to be straightforward, focusing primarily on time and general services provided. However, it’s important to still include all relevant details for clarity and transparency.

- Time-Based Charges: Include the number of hours worked and the hourly rate, if applicable.

- Task List: Outline specific services performed, such as dusting, mopping, or vacuuming.

- Total Cost: Clearly show the final amount due, including any applicable taxes or discounts.

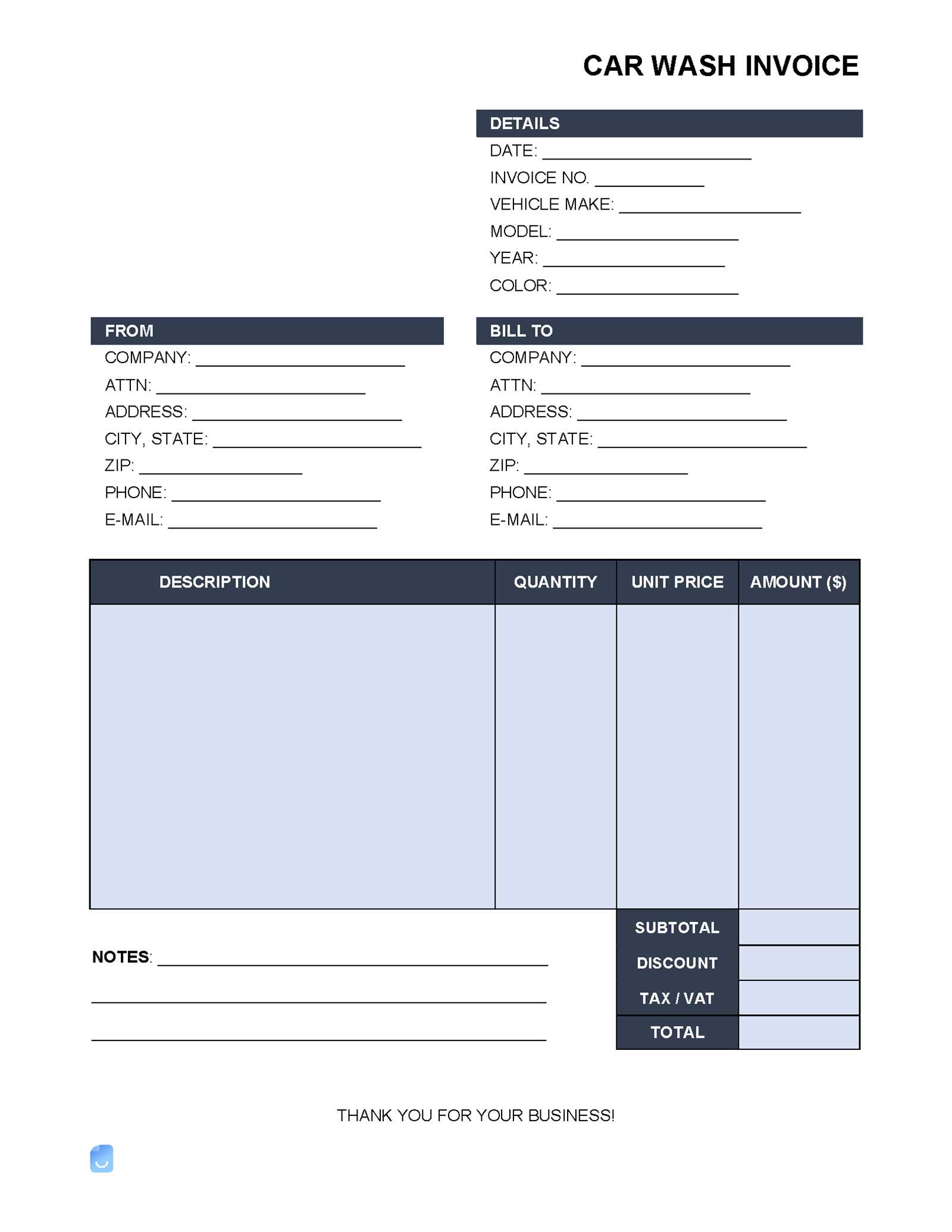

2. Commercial or Specialized Jobs

For more complex or specialized tasks, such as office maintenance or post-construction cleaning, your payment request might need additional details to reflect the scale or difficulty of the job. These documents should break down the work in more detail.

- Labor and Materials: Separate charges for labor and any specialized equipment or materials used.

- Job Scope: Provide a clear description of the specific tasks performed, such as window washing or floor waxing.

- Recurring Charges: If the job is part of a larger ongoing agreement, include the frequency of services and total contract value.

By tailoring your payment documents to the specific needs of each type of job, you help ensure accuracy and avoid misunderstandings, ultimately making transactions sm

How to Send Invoices to Clients

Effectively delivering payment requests to clients is crucial for ensuring timely payments. The method you choose for sending these documents can impact the client’s experience and the speed with which you receive payment. There are several options available, each offering its own benefits depending on the preferences of your clients and the scale of your operations.

Email Delivery

Sending payment documents via email is one of the most common and convenient methods. It’s fast, easy to track, and allows for the inclusion of necessary attachments.

- Format: Attach the document as a PDF to ensure that it is easily accessible and cannot be altered.

- Subject Line: Make sure to include a clear subject, such as “Payment Request for Recent Services.”

- Cover Message: Include a brief message in the body of the email to explain the document and politely remind the client of the payment terms.

Postal Delivery

Though less common in today’s digital age, mailing hard copies of payment documents may still be preferred by some clients. This can help maintain a formal, professional appearance, especially for high-value projects.

- Include a Return Envelope: Make it easy for clients to send back any needed forms or payments.

- Clear Addressing: Ensure that the client’s name and address are clearly visible, and use proper postage to avoid delays.

- Record Keeping: Consider using a service that provides delivery confirmation to track the receipt of your payment documents.

Online Payment Platforms

Many businesses now use online platforms to streamline the process of sending payment requests and collecting payments. These platforms typically allow for secure transactions and offer a professional, automated way to send requests.

- Integration: Many platforms can be integrated with your accounting software, automatically generating and sending requests to clients.

- Payment Options: Allow clients to pay directly through the platform using various methods such as credit cards, PayPal, or bank transfers.

- Notifications: Clients receive instant notifications when the request is sent and when payments are due or completed.

Regardless of which method you use, it is important to ensure that the payment request is clear, professional, and easy for the client to process. Tracking deliveries, setting up automatic reminders, and offering multiple payment methods can help speed up the payment process and keep your

Tracking Payments and Invoice History

Keeping track of payments and the history of payment requests is essential for maintaining organized financial records and ensuring timely cash flow. Efficient tracking systems allow you to monitor which payments are pending, completed, or overdue. Additionally, maintaining a record of past requests helps in managing client relationships and resolving any disputes that may arise.

Benefits of Tracking Payments

- Cash Flow Management: By knowing which payments are due or have been paid, you can plan your finances more effectively and avoid any disruptions.

- Dispute Resolution: Having a clear history of transactions helps in resolving misunderstandings with clients, especially if there are discrepancies in amounts or due dates.

- Tax Filing: A well-documented payment history makes tax preparation easier by providing a clear record of earned income and expenses.

Methods for Tracking Payments

- Accounting Software: Many modern accounting programs offer features for tracking payments, marking them as received, and generating reports for analysis.

- Manual Ledgers: For smaller operations, a manual ledger or spreadsheet can be used to record payments, dates, and outstanding balances.

- Online Payment Platforms: Some payment platforms automatically track transactions, making it easy to see whether a payment has been received or is still pending.

Tracking Payment History

- Client Payment History: Keeping a detailed record of every transaction for each client can help build a trustworthy relationship and provide transparency.

- Automated Reminders: Set up reminders for due payments to avoid delays, keeping clients informed and encouraging timely settlements.

- Reports and Insights: Periodically review payment histories to assess patterns, such as clients who regularly delay payments, and adjust your approach if necessary.

Having an organized system to track payments and payment history not only improves operational efficiency but also provides peace of mind by ensuring that all financial matters are handled correctly and on time. Whether you choose software or manual methods, maintaining accurate records is crucial for the long-term success of any operation.