Chiropractic Invoice Template for Simplified Billing

Running a healthcare practice requires precise and timely financial management. One of the most important aspects of maintaining a smooth workflow is ensuring that billing processes are both organized and clear. Having a structured system in place can help you avoid errors and improve cash flow, making it easier to focus on providing quality care.

Customizable billing forms can play a key role in this, offering a simple way to keep track of patient charges, payment records, and any insurance claims. With a clear and professional layout, these documents can also enhance your practice’s reputation by portraying a well-organized and trustworthy image to your clients.

Whether you are a new practitioner or have been in business for years, streamlining your financial documentation with an efficient solution can save you valuable time and reduce the stress of administrative tasks. The right approach ensures that every aspect of the billing process runs smoothly, from generating statements to tracking payments.

Chiropractic Invoice Template Overview

Effective billing documentation is essential for healthcare professionals to ensure accurate payments and maintain a well-organized practice. These documents serve as a record of services provided and charges incurred, simplifying financial management. A well-structured document not only saves time but also promotes professionalism and trust between practitioners and clients.

Having a customizable form allows healthcare providers to tailor the layout to their specific needs while keeping the core information clear and accessible. From patient details to service descriptions and payment terms, these forms can be adjusted to match the unique requirements of each practice. Proper use of such a system can minimize errors, reduce administrative workload, and accelerate payment cycles.

In this section, we will explore the core aspects of these essential documents, focusing on their design, functionality, and how they can streamline the billing process in a healthcare setting.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document offers numerous advantages for healthcare professionals. One of the most significant benefits is the ability to save time by eliminating the need to create a new form from scratch for every transaction. With a ready-made structure, you can quickly input relevant details and focus more on patient care rather than administrative tasks.

Consistency is another key benefit. A standardized format ensures that every document follows the same structure, reducing the chances of errors and confusion. This consistency not only improves internal organization but also presents a professional image to clients, fostering trust and transparency in your business practices.

Additionally, having a customizable form can streamline the entire billing process. Whether you’re tracking services, payment terms, or insurance claims, a well-organized form ensures all necessary information is captured accurately and efficiently. This can lead to faster payment processing, fewer disputes, and a smoother financial operation for your practice.

Key Elements of a Chiropractic Invoice

An effective billing document should include several important components to ensure clarity and efficiency in the payment process. Each element plays a crucial role in conveying essential information to the client, while also keeping the financial records organized and easy to track. Below are the core elements that should be included:

- Practice Information: Include the practice’s name, address, contact details, and any relevant licensing information to establish credibility.

- Patient Details: Record the patient’s name, contact information, and any identification numbers (e.g., insurance or account number) to personalize the billing.

- Date of Service: Clearly indicate when the services were provided, helping both the provider and the patient keep track of treatment history.

- Detailed List of Services: Break down the treatments or consultations provided, with clear descriptions and individual pricing for each service rendered.

- Payment Terms: Specify payment due dates, any discounts, and penalties for late payments to avoid confusion later.

- Total Amount Due: Summarize the overall cost, including taxes or additional fees, if applicable, for a complete understanding of what the client owes.

- Insurance Information: If applicable, include insurance details and claim information for a smooth reimbursement process.

Including these key elements in your documents ensures all parties involved are on the same page, reducing potential for misunderstandings or disputes. Properly structured records also contribute to more effective financial tracking and reporting.

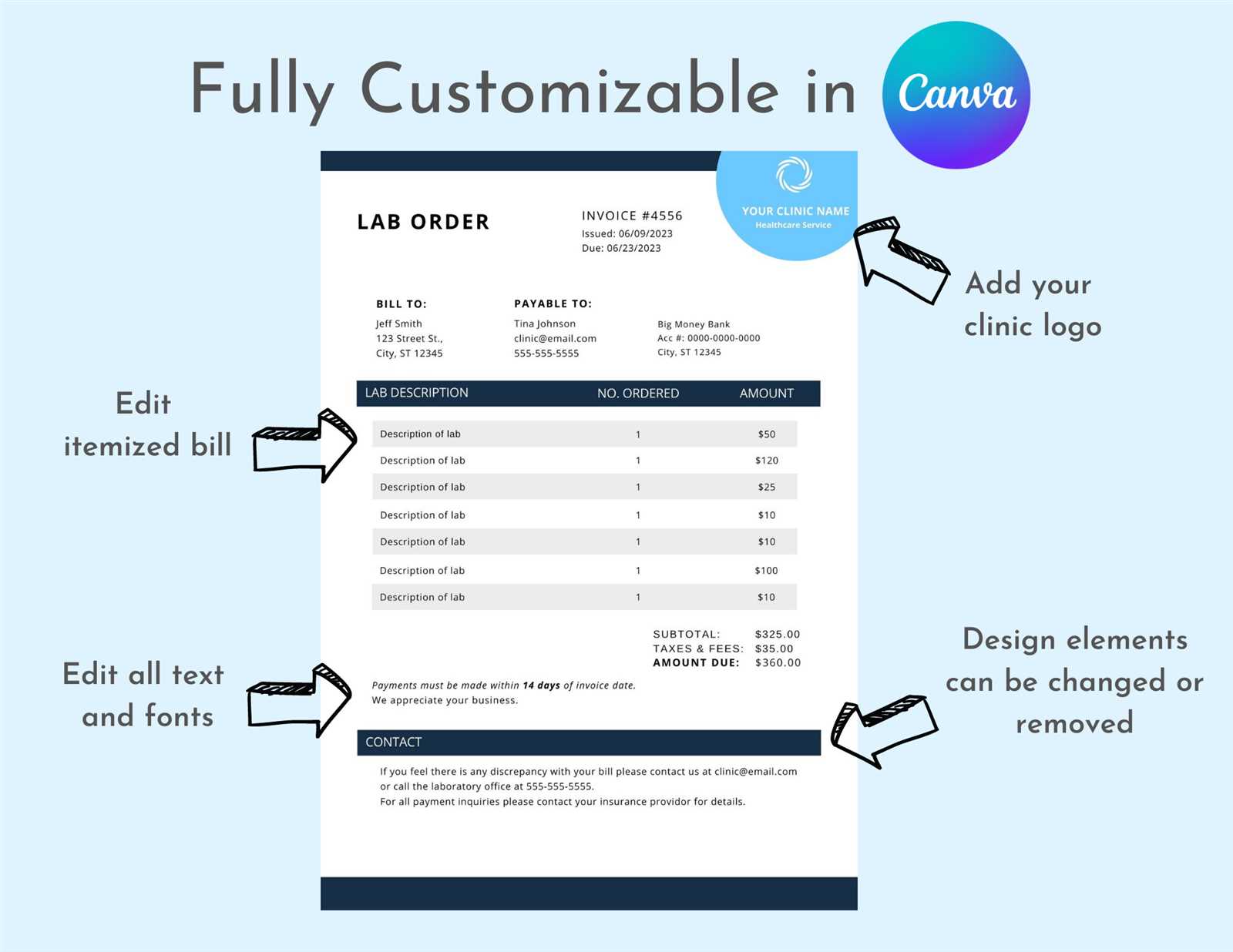

How to Customize Your Invoice

Customizing a billing document allows you to tailor it to the unique needs of your practice, ensuring it aligns with your branding and provides all the necessary information clearly. A personalized layout not only helps streamline your administrative work but also enhances the overall professionalism of your practice. Here’s how you can easily customize your billing forms:

- Choose the Right Format: Decide whether you want a digital or paper form. Digital formats, like PDFs or Word documents, can be easily customized and shared electronically, while printed forms can be tailored with logos and personal touches.

- Add Your Branding: Include your practice’s logo, colors, and contact details at the top of the document. This makes the form instantly recognizable and adds a professional touch.

- Modify Service Descriptions: Customize the list of services provided by adding descriptions that match the treatments you offer. You can also create categories or group similar services to make the document more organized.

- Set Payment Terms: Adjust the terms of payment based on your practice’s policies. Include information about discounts for early payment, due dates, or any late fees.

- Adjust Layout and Fonts: Tailor the layout to suit your needs. You can modify fonts, spacing, and column structure to create a clean, easy-to-read document. Ensure that key information, such as the total amount due, stands out.

- Include Custom Fields: Depending on your requirements, you may want to add additional fields for notes, payment methods, or specific billing instructions to accommodate different patient needs.

Customizing your billing documents ensures that they not only fit the requirements of your practice but also improve the clarity and efficiency of your financial processes.

Choosing the Right Format for Your Invoice

Selecting the correct format for your billing documentation is essential to ensure it meets your practice’s needs and is easy to use for both you and your clients. The right format not only impacts the ease of creating and sending documents but also influences how clients perceive your professionalism and the clarity of the financial information. There are various formats to choose from, each with its own advantages.

Digital vs. Paper Format

One of the first decisions you’ll need to make is whether to use a digital or paper-based form. Digital formats, such as PDF or Word documents, are often preferred due to their convenience and ease of distribution via email. These formats can also be stored and accessed easily, making record-keeping more efficient. On the other hand, printed forms may be necessary for clients who prefer physical documents or for those without reliable internet access.

Customizable Online Platforms

For even more flexibility, many healthcare providers choose to use online platforms that allow for easy customization and automatic calculations. These tools often come with built-in features, such as payment tracking, reminders for overdue bills, and integration with accounting software. By selecting an online format, you can streamline the billing process, saving time and reducing errors.

Choosing the best format depends on your practice’s workflow, the preferences of your clients, and the level of customization you require. Consider the pros and cons of each option to ensure that the billing system you choose supports both efficiency and professionalism.

Common Mistakes to Avoid in Invoicing

Accurate and professional billing is crucial for smooth financial operations in any healthcare practice. However, small mistakes can lead to confusion, delays in payments, or even disputes with clients. It’s essential to be mindful of these common errors to ensure that your documents are clear, complete, and effective.

- Missing or Incorrect Contact Information: Always double-check that both your practice’s and the patient’s contact details are correct. Any errors in this section can delay communication and payments.

- Unclear Service Descriptions: Vague or ambiguous descriptions of services can lead to confusion. Be as detailed as possible about the treatments or consultations provided to ensure the client understands what they are being charged for.

- Failure to Include Payment Terms: Not specifying due dates, payment methods, or penalties for late payments can result in delayed payments. Clearly state when payment is expected and any consequences for late submission.

- Inconsistent Formatting: Using inconsistent fonts, layouts, or structures can make the document difficult to read. Stick to a professional and uniform format to maintain clarity and consistency.

- Omitting Tax or Discount Information: If applicable, make sure taxes or discounts are clearly mentioned and calculated. Failure to include this can lead to confusion or missed opportunities for discounts and adjustments.

- Not Tracking Payments: Failing to mark paid invoices or keep accurate records can cause confusion when clients ask about their payment status. It’s important to regularly update your records to avoid any discrepancies.

Avoiding these mistakes will not only make your billing process smoother but also help maintain positive relationships with your clients by ensuring transparency and professionalism.

How to Save Time with Templates

Streamlining administrative tasks is essential for any busy healthcare provider. By using pre-designed forms, you can significantly reduce the time spent on generating billing documents. These forms provide a ready-to-use structure, allowing you to quickly fill in client details and service information without starting from scratch each time. This saves both time and effort, enabling you to focus on your core activities, such as patient care.

Automating Repetitive Tasks

One of the main advantages of using structured forms is the ability to automate repetitive elements, such as dates, patient information, and service descriptions. This helps ensure consistency across all documents and reduces the risk of errors. Additionally, once the initial setup is done, you can quickly modify any field to suit the specific needs of each patient.

Maximizing Efficiency in Documentation

By using a standardized system, you eliminate the need to re-enter similar information multiple times. Whether you are handling billing, insurance claims, or service tracking, a consistent layout allows you to copy and paste data, speeding up the process. This is especially helpful when working with returning clients, as their details can be stored and reused in future documents.

| Task | Time Without Pre-Designed Forms | Time With Pre-Designed Forms |

|---|---|---|

| Filling in Client Details | 5-10 minutes | 1-2 minutes |

| Creating a Service List | 10-15 minutes | 2-3 minutes |

| Finalizing and Sending | 5-10 minutes | 1-2 minutes |

By reducing the time spent on each task, these forms allow you to efficiently handle more clients and keep your practice running smoothly. The convenience of having a ready-made structure eliminates common bottlenecks and enhances your overall workflow.

Tracking Payments with Your Template

Efficient financial management is crucial for maintaining a healthy cash flow in any practice. One of the key advantages of using pre-designed forms is the ability to easily track payments and ensure that all dues are paid on time. By incorporating payment tracking features into your documents, you can stay on top of outstanding balances, manage receipts, and follow up with clients when necessary.

With an organized structure, it becomes much simpler to mark payments as received, record partial payments, or note overdue amounts. This can be done directly within the document, allowing you to keep everything in one place. Additionally, by clearly indicating the total amount due and the payment status, both you and the client can easily track the progress of each transaction.

Key Features for Payment Tracking:

- Payment Status: Clearly label whether the payment is pending, completed, or overdue.

- Due Dates: Include the payment due date and any late fees for overdue payments.

- Partial Payments: Record any payments made in installments and the remaining balance.

- Payment Method: Note the payment method (e.g., credit card, check, cash) for easy reference.

Benefits of Payment Tracking:

- Improved Cash Flow Management: Keep track of all incoming payments and identify overdue accounts faster.

- Reduced Administrative Errors: Minimize mistakes by having a clear record of all transactions.

- Enhanced Client Communication: Easily send reminders for overdue payments or receipts for completed transactions.

Incorporating these payment tracking features into your billing documents ensures a more streamlined and organized financial process, helping you manage your finances with greater ease and transparency.

Design Tips for Professional Invoices

The design of your billing documents plays a crucial role in how your practice is perceived by clients. A well-structured and visually appealing document not only ensures clarity but also reinforces professionalism. By focusing on layout, typography, and key visual elements, you can create documents that make a positive impression while conveying all necessary information effectively.

Keep it Simple and Clean: A cluttered design can overwhelm clients and make it harder for them to find the important details. Use a clean layout with adequate white space to ensure readability. Stick to a simple color scheme and avoid using too many fonts or decorative elements that may distract from the key content.

Highlight Important Information: Clearly distinguish critical details such as the total amount due, due date, and payment instructions. Use bold fonts or boxes to draw attention to these areas. This helps clients easily locate the most important aspects of the document without having to search for them.

Use a Consistent Layout: Consistency in your design helps create a professional look and feel. Arrange information in a logical flow, with sections like contact details, service descriptions, and payment information all placed in easily identifiable areas. A consistent structure also makes it easier to update or modify your documents when needed.

Incorporate Branding Elements: Include your practice’s logo, color scheme, and other branding elements to make the document feel more personalized. This adds a professional touch and reinforces your brand identity. Make sure these elements don’t overpower the content but rather complement the overall design.

Ensure Mobile Compatibility: Many clients may view their documents on mobile devices, so it’s essential to ensure your design is responsive. Avoid overly complex layouts and large file sizes that could hinder readability on smaller screens.

By following these design tips, you can create billing documents that not only look professional but also improve the clarity and efficiency of your financial processes. A well-designed document helps to communicate your professionalism and enhances your client’s experience when interacting with your practice.

Integrating Invoice Templates with Software

Integrating pre-designed documents with software solutions can greatly enhance efficiency and streamline your billing processes. By connecting these forms to your practice management or accounting systems, you can automate data entry, reduce errors, and speed up the overall workflow. This integration not only saves time but also improves the accuracy of the information you send to clients and helps maintain organized financial records.

Automation and Efficiency

With the right software integration, you can automatically populate client details, services provided, and pricing information into your pre-designed forms. This eliminates the need for manual data entry, which is both time-consuming and prone to mistakes. Furthermore, automated calculations for taxes, discounts, or payment totals can be added, ensuring that all figures are correct before sending the document.

Seamless Data Transfer and Record-Keeping

Integration allows for seamless transfer of data between your billing documents and other systems like accounting platforms or CRM tools. This connection ensures that all transactions are automatically recorded, making it easier to track payments, generate reports, and stay on top of financial health. It also reduces the need for double-entry and keeps your records consistent across different platforms.

By integrating these documents with your practice’s software, you can not only save time and reduce errors but also ensure a more professional and organized approach to handling financial transactions.

Automating Billing for Chiropractic Services

Automating your billing process can significantly improve the efficiency of your practice. By reducing the need for manual entries and repetitive tasks, you can focus more on providing quality care while ensuring timely and accurate billing. With the help of specialized software and automated systems, managing payments and generating receipts becomes a streamlined process, making it easier for both practitioners and clients.

Benefits of Automation

Automation in billing not only saves time but also reduces human errors that can occur with manual processes. It allows for quick generation of accurate documents, tracks payments, and sends reminders for overdue amounts. This way, your clients receive clear and consistent records, and you can easily monitor financial transactions without the administrative burden.

How Automation Works

When set up properly, an automated system pulls client data and service details from your records and fills out the required information for you. This can include things like services provided, charges, payment terms, and due dates. Payment tracking becomes a breeze as well, with the system notifying you when payments are due or overdue.

| Process | Benefit |

|---|---|

| Data Entry Automation | Faster document creation and fewer errors |

| Payment Reminders | Ensures clients pay on time and reduces follow-up work |

| Recurring Billing | Automates regular billing cycles for ongoing services |

By integrating automated billing solutions into your practice, you can achieve greater financial organization, enhance client experience, and reduce the time spent on administrative tasks, ultimately leading to a more efficient and profitable business.

How to Handle Late Payments

Dealing with overdue payments is a challenge that every business faces. Late payments can disrupt cash flow and cause unnecessary stress, but with a proactive approach, you can reduce their frequency and maintain positive relationships with clients. It’s important to handle these situations with professionalism while ensuring that your financial health remains intact.

Set Clear Terms Upfront: One of the best ways to prevent late payments is by setting clear expectations from the start. Ensure that clients understand your payment terms, including due dates, penalties for late payments, and available payment methods. Having this information in writing helps avoid misunderstandings and encourages timely payments.

Send Reminders: Often, late payments are simply the result of forgetfulness. Send a polite reminder shortly after the due date, thanking the client for their business and gently reminding them of the outstanding balance. If necessary, follow up with a second reminder and offer assistance in case they encounter any issues with making the payment.

Implement Late Fees: Consider adding a small late fee for overdue payments to encourage clients to pay on time. The fee should be reasonable and clearly communicated in your terms. Over time, this can help deter clients from delaying payments and ensure that they prioritize settling their balance.

Offer Payment Plans: In some cases, clients may be struggling financially and unable to pay in full right away. Offering a payment plan can help them manage their balance over time while ensuring that you still receive payment. Be sure to outline the terms of the plan, including the payment amount, due dates, and any interest charges.

Know When to Escalate: If a payment is significantly overdue and all reminders and offers have been exhausted, it may be time to consider more formal actions. This could include sending a formal demand letter, involving a collections agency, or even taking legal action in extreme cases. Always weigh the potential cost and impact on your business before taking such steps.

By establishing clear payment terms, communicating regularly with clients, and taking appropriate action when needed, you can minimize the impact of late payments and ensure the financial stability of your business.

Best Practices for Invoice Record Keeping

Maintaining organized records for all financial transactions is crucial for smooth business operations. Proper documentation helps ensure that you stay on top of payments, track expenses, and comply with tax regulations. By following best practices for record keeping, you can improve your financial management, reduce errors, and make the process more efficient.

Organize Your Documents

Start by keeping all financial records, including payment receipts, service records, and contracts, in an orderly system. Whether you choose physical or digital records, it’s essential to have a consistent method for organizing them. Here are some tips:

- Label documents clearly by client name, service date, and payment status.

- Store records in a secure and easily accessible location.

- Use folders or software to separate documents by category, such as payments, expenses, and taxes.

Keep Detailed Records

Ensure that all the necessary details are included in your records. Missing information can lead to confusion or disputes down the line. Keep track of the following:

- Client details (name, contact information, and payment history).

- Service description (what was provided, along with dates and quantities).

- Payment terms and due dates.

- Amounts paid and any outstanding balances.

Implement a Consistent Filing System

Having a consistent and systematic filing approach is key to efficient record keeping. Whether you use digital tools or physical files, create a structured system that is easy to follow. Consider:

- Using cloud storage or accounting software to automate data entry and reduce errors.

- Setting up monthly or quarterly review schedules to ensure your records are up to date.

- Archiving older records and retaining only the necessary documents for active transactions.

Backup Your Records

In case of technical issues or unexpected incidents, it’s vital to have a backup of your records. Make sure to:

- Store digital records in secure, cloud-based systems with automatic backups.

- Keep physical copies of essential documents in a safe and secure location.

By implementing these best practices, you’ll ensure that your financial records are accurate, accessible, and secure, which will ultimately help your business stay organized and financially stable.

Legal Requirements for Chiropractic Billing

Ensuring compliance with legal standards is essential for any business that manages financial transactions. Proper documentation and adherence to regulations protect both the service provider and the client. Understanding and implementing legal requirements for financial records helps avoid legal disputes and ensures that business practices are aligned with industry standards and laws.

When it comes to managing payments for services rendered, several key aspects must be considered to stay compliant with the law:

Key Legal Considerations

- Clear Payment Terms: All agreements should outline clear payment terms, including due dates, accepted payment methods, and any potential penalties for late payments. These terms should be communicated effectively to clients before services are provided.

- Tax Compliance: Ensure that your billing records are accurate and comply with relevant tax laws. This includes applying the correct sales tax (if applicable), reporting income properly, and maintaining necessary documentation for tax filing.

- Data Protection and Privacy: If you store client information, such as names, addresses, and payment details, you must comply with data protection laws, such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act). Proper security measures should be in place to protect sensitive data.

- Accurate Record Keeping: Properly documenting each transaction, including the services rendered, amounts billed, and payment history, is crucial for legal compliance. Failure to maintain accurate records may lead to audits or legal issues.

Common Legal Requirements for Billing

- Itemized Statements: An itemized bill should provide a detailed breakdown of services or goods provided, along with the corresponding costs. This transparency helps clients understand exactly what they are being charged for.

- Payment Receipts: Provide clients with receipts for every payment made, which should include the date, the total amount paid, and the method of payment. These receipts serve as proof of payment and help both parties track transactions.

- Late Payment Penalties: Clearly state any applicable late fees or interest charges in your agreement to avoid misunderstandings. Ensure that these charges comply with state laws regarding maximum allowable fees.

By adhering to these legal requirements, you not only protect your business from potential legal challenges but also foster trust with clients, ensuring that all transactions are handled professionally and fairly.

How to Send Invoices Effectively

Sending billing statements efficiently is crucial for maintaining a smooth financial workflow. A well-managed process ensures timely payments and builds a positive relationship with clients. By choosing the right method and following best practices, businesses can minimize delays and reduce the risk of errors in payment processing.

To ensure your financial documents are received and processed promptly, consider the following tips:

Choosing the Right Delivery Method

- Electronic Delivery: Sending invoices via email is fast and ensures quick delivery. Using digital formats such as PDFs allows clients to access and print the documents easily.

- Postal Mail: In some cases, especially with clients who prefer physical copies, sending printed bills via postal mail may be necessary. Ensure the correct address is on file to avoid delivery issues.

- Payment Platforms: Many businesses use online payment platforms that automatically generate and send billing statements to clients. These platforms can offer convenience and help streamline the payment process.

Best Practices for Sending Bills

- Timeliness: Always send statements promptly after providing services or products. This shows professionalism and encourages quicker payments.

- Clear and Professional Language: Use clear and concise language in your financial documents. Include all necessary details, such as itemized lists, amounts due, and payment instructions, to avoid confusion.

- Follow-Up Reminders: If payments are not received by the due date, sending a polite reminder can help. Many businesses use automated systems to send reminder emails or messages when payments are overdue.

- Include Payment Instructions: Make sure to specify the available payment methods, deadlines, and any late fees if applicable. This makes it easier for clients to know how to complete their payment.

By implementing these strategies, businesses can ensure that their billing process is smooth, professional, and effective in getting paid on time.

Setting Payment Terms in Your Template

Defining clear payment terms is essential for any business to ensure smooth financial transactions. These terms outline when and how payments are due and help manage cash flow effectively. Properly setting expectations up front can minimize misunderstandings and prevent payment delays, making the entire billing process more efficient.

When designing your financial documents, consider the following factors for establishing payment terms:

Key Components of Payment Terms

- Due Date: Specify the exact date by which the payment must be received. For example, you might state “Payment due within 30 days from the issue date.”

- Late Fees: Indicate any penalties or interest that will be applied if the payment is late. Clearly state the amount or percentage and when it will be charged.

- Payment Methods: List all accepted methods of payment, such as bank transfers, credit card payments, checks, or online payment systems.

- Discounts for Early Payment: Consider offering a discount for clients who pay early. For example, “2% discount if paid within 10 days.”

Examples of Payment Terms

| Payment Term | Details |

|---|---|

| Net 30 | Payment is due 30 days after the document date. |

| Due on Receipt | Payment is due immediately upon receiving the document. |

| 2/10 Net 30 | A 2% discount is offered if payment is made within 10 days; otherwise, the full amount is due in 30 days. |

| 50% Upfront | Half of the payment is due before work begins, with the remaining balance due upon completion. |

Setting clear and reasonable payment terms in your documents helps ensure you get paid promptly and builds trust with clients. Be sure to communicate these terms clearly and consistently for every transaction.

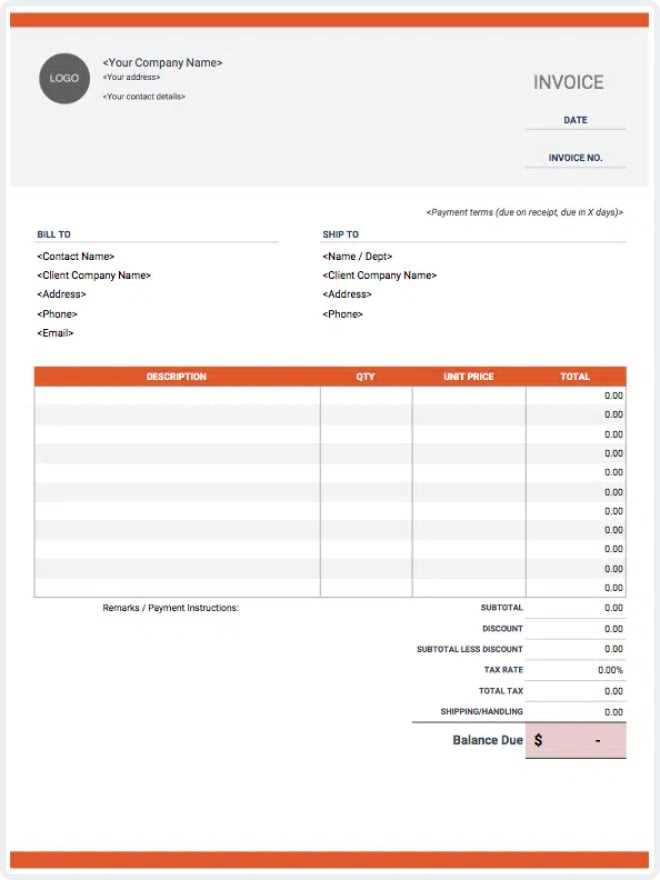

Free vs Paid Chiropractic Invoice Templates

When choosing between free and paid options for your financial documents, it’s important to consider your business needs, the features you require, and the overall value each option offers. Free options can be a good starting point, especially for small businesses with basic requirements. However, paid options often come with added features that can save time and improve the professionalism of your documents.

Below are the key differences between free and paid options:

Advantages of Free Options

- Cost-effective: Free options are perfect for those just starting out or with minimal financial management needs.

- Basic Features: Often includes the necessary components for a simple billing system, such as client information, services provided, and a total amount due.

- Easy to Use: Free templates tend to be simple and intuitive, making them easy to customize without advanced technical skills.

Benefits of Paid Options

- Customization: Paid options offer more flexibility for customization, allowing you to align the design with your brand and specific service offerings.

- Professional Features: Many paid templates include advanced features such as automatic tax calculations, integrated payment gateways, and multiple currency options.

- Support: With a paid option, you typically get customer support, which can be helpful if you encounter issues or need assistance with customization.

- Increased Security: Paid options often offer additional data security features, ensuring that client and payment information is protected.

Ultimately, the choice between free and paid options comes down to your business size, budget, and specific needs. Free templates are a great option for those starting out, while paid templates provide more professional features and customization for growing businesses.