Chinese Invoice Template Free Download and Customization Guide

Creating accurate and professional billing documents is essential for smooth business transactions, especially in international trade. In many countries, including the one we focus on here, having a well-structured document can ensure that payments are processed efficiently and according to legal standards. Whether you’re a small business owner or part of a larger organization, understanding how to prepare these records can save time and help avoid costly errors.

In this guide, we will explore how to design, customize, and use a well-organized billing document for operations involving clients or suppliers. You will learn about the most important elements to include, how to tailor them to suit different needs, and where to find reliable resources to streamline the process. With a strong focus on practicality and legal compliance, this article will ensure you have all the tools needed to create documents that reflect professionalism and meet all necessary regulations.

Chinese Invoice Template Overview

Having a standardized document for billing is crucial for any business, ensuring consistency and compliance with regulations. This structured document serves as the official record of a transaction, detailing the exchange of goods or services between a buyer and a seller. It is essential not only for accounting purposes but also for maintaining transparency and clarity in financial dealings.

Understanding the key elements of such a document helps businesses avoid common mistakes and ensures that all necessary information is captured accurately. Below is an overview of the common components typically found in a well-organized billing record:

| Section | Description |

|---|---|

| Header | Includes the name and contact details of both parties involved in the transaction. |

| Unique Number | A reference number for easy tracking and identification of the record. |

| Date | The date of the transaction or when the document is issued. |

| Items and Services | A detailed list of goods or services provided, along with quantities and unit prices. |

| Total Amount | The total cost of the transaction, including any applicable taxes or discounts. |

| Payment Terms | Details regarding the payment method and due date for settling the balance. |

By including all these critical elements, businesses can ensure that their documents are both functional and legally compliant, making the transaction process smoother for both parties involved.

What Is a Chinese Invoice Template?

A well-structured document used to record business transactions plays a crucial role in maintaining clear and accurate financial records. This document serves as an official statement that outlines the details of goods or services exchanged between a seller and a buyer. It not only ensures that both parties agree on the terms of the transaction but also complies with regulatory requirements for business operations.

The document typically follows a specific format designed to capture all necessary information in a clear and organized manner. This format allows for easy reference and tracking of payments, making it an essential tool for businesses engaged in international commerce. Below is a breakdown of the essential elements that are generally included in this type of record:

| Element | Description |

|---|---|

| Document Title | Clearly indicates the purpose of the document, such as ‘Receipt’ or ‘Billing Statement’. |

| Parties Involved | Details of the buyer and seller, including names, addresses, and contact information. |

| Transaction Date | The date when the goods or services were exchanged or when the document was created. |

| Items/Services List | A detailed listing of the products or services, including quantities, unit prices, and any discounts applied. |

| Amount Due | The total amount owed, including taxes, fees, and other applicable charges. |

| Payment Terms | The conditions under which payment should be made, such as due dates or payment methods. |

By following this standardized format, businesses can ensure their records are both clear and compliant, minimizing errors and misunderstandings in financial transactions.

Key Features of Chinese Invoice Templates

Effective billing documents are designed to capture essential transaction details in a straightforward, easy-to-read format. These key features ensure that the document serves both legal and practical purposes, providing a clear record for both parties. A well-constructed record includes specific sections to cover all aspects of the transaction, from contact information to payment terms, making it easier for businesses to manage finances and comply with local regulations.

Below are the critical characteristics that make a billing document both functional and compliant with legal standards:

| Feature | Description |

|---|---|

| Clear Header | Contains the name and contact details of both the buyer and seller, ensuring identification. |

| Unique Identification Number | A reference code assigned to each document for easy tracking and organization. |

| Transaction Date | The date when the goods or services were provided or when the document was issued. |

| Detailed Itemized List | A breakdown of products or services, including quantities, descriptions, and unit costs. |

| Amount and Taxes | The total due, with clear calculations of any taxes or discounts applied. |

| Payment Instructions | Details on how and when the payment should be made, including due dates and payment methods. |

| Legal Compliance | Includes all necessary details required by law, such as tax numbers and other legal disclaimers. |

These features are essential in creating a document that not only meets business needs but also ensures transparency and legal adherence, making the billing process more efficient and reliable for all parties involved.

Why Use a Chinese Invoice Template?

Using a standardized document for recording business transactions offers numerous benefits, especially when engaging in international trade. It simplifies the billing process, ensuring that all necessary information is captured consistently and accurately. This reduces the risk of errors, helps businesses maintain clear financial records, and ensures that both parties understand the terms of the exchange.

One of the main reasons to utilize a pre-designed format is efficiency. Rather than starting from scratch with every transaction, businesses can save time by filling out a ready-made document that adheres to legal and professional standards. It also makes it easier to manage and track payments, improving cash flow and overall financial organization.

Additionally, using a standard format ensures compliance with local regulations. Specific fields and structures are often required by law in many countries, particularly in international trade. By using a reliable format, businesses can avoid potential legal issues and ensure that their records meet all necessary requirements for tax and auditing purposes.

Understanding Chinese Invoice Format

The structure of a billing document plays a critical role in ensuring that all necessary details are presented clearly and accurately. The format typically includes specific sections that must be filled out to comply with legal and business requirements. Understanding the format helps businesses streamline their financial record-keeping and ensures that both parties in a transaction are on the same page regarding the terms of the agreement.

Key Components of the Document

The core sections that appear in a properly formatted record are designed to capture both transaction details and legal information. Some of the most important components include:

- Seller and Buyer Information: Clearly identifies the two parties involved, including names, addresses, and contact details.

- Transaction Details: A breakdown of the products or services provided, including quantities, descriptions, and unit prices.

- Total Amount Due: The sum of the transaction, including applicable taxes or discounts.

- Payment Terms: Details regarding when and how payment should be made, such as due dates and acceptable methods of payment.

Legal and Regulatory Compliance

In many jurisdictions, certain elements must be included for the document to be legally recognized. This can include tax identification numbers, registration details, or specific wording required by the local authorities. Understanding these requirements helps businesses avoid fines and ensures that the document can be used for auditing or tax purposes.

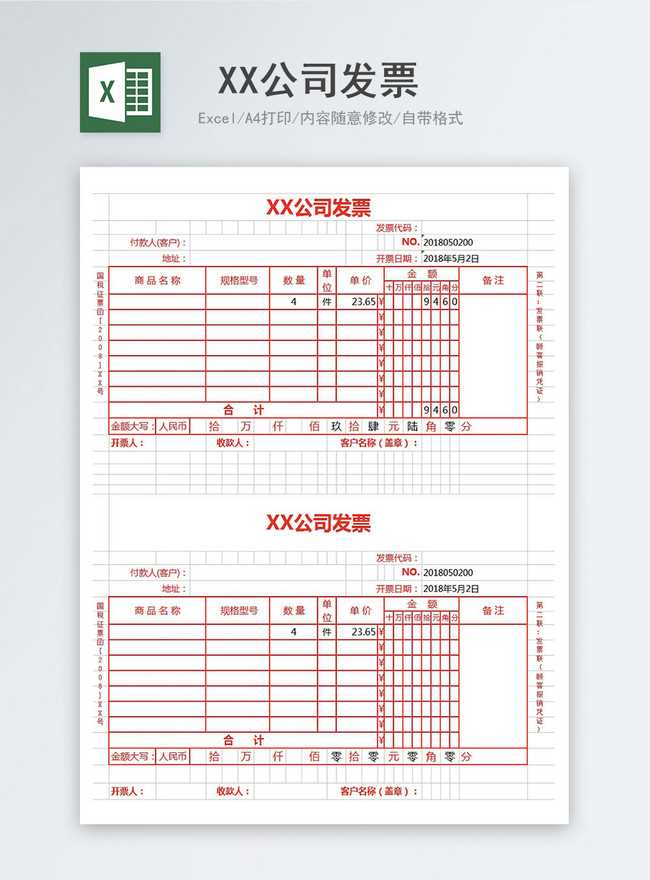

How to Customize Your Chinese Invoice

Customizing a billing document is essential for ensuring that it meets your specific business needs while maintaining professional standards. By adjusting the layout, design, and content, you can tailor the document to reflect your brand, incorporate unique transaction details, and comply with local requirements. Customization allows businesses to create a personalized, efficient system for managing transactions.

Here are some key steps to help you modify your billing document:

- Adjust the Header: Customize the header to include your company’s logo, name, contact information, and any legal disclaimers required for your industry.

- Include Relevant Details: Make sure the document captures all essential transaction details such as the buyer’s information, product/service descriptions, quantities, and prices. You can also add custom fields to reflect specific payment terms or discounts.

- Design Flexibility: Modify the design and layout to match your branding. You can change fonts, colors, and the positioning of various elements to create a document that aligns with your company’s visual identity.

- Legal and Tax Information: Ensure that the document includes any necessary legal or tax information, such as tax registration numbers or compliance statements, required by local authorities or your industry.

By customizing your billing records in this way, you create a more professional and efficient document that not only looks good but also serves its purpose effectively and in accordance with regulations.

Legal Requirements for Chinese Invoices

In many countries, including the one we focus on here, there are specific legal requirements that must be met when issuing billing documents. These requirements are designed to ensure transparency, protect consumers, and maintain proper records for taxation and auditing purposes. Failing to meet these legal standards can result in penalties or complications with authorities, so it’s crucial for businesses to understand and adhere to these regulations.

Essential Legal Elements

To comply with local regulations, certain details must be included in a properly formatted billing document. These elements ensure that the document is recognized by authorities and can be used for tax reporting and other legal purposes. Below is a list of the most important legal elements to include:

| Element | Legal Requirement |

|---|---|

| Tax Identification Number | Required for both the seller and the buyer in most transactions, especially for VAT purposes. |

| Official Stamp or Seal | Some regions require a physical or digital stamp/seal from the issuing business to authenticate the document. |

| Transaction Type | It is essential to clearly state the nature of the transaction, such as whether it is a sale, service, or other type of exchange. |

| Legal Compliance Statement | A brief statement ensuring that the document complies with local tax laws or financial regulations. |

| Currency Information | The currency in which the transaction is conducted must be clearly indicated, especially for cross-border deals. |

Additional Compliance Considerations

In addition to the above elements, businesses must also ensure that their documents adhere to any industry-specific regulations or local customs that may apply. For instance, specific industries such as healthcare, construction, or electronics may have additional reporting requirements. It’s important to stay updated on any legal changes that may affect the structure or content of these documents.

Common Mistakes to Avoid in Invoices

Even the most experienced businesses can make errors when preparing billing documents, which can lead to confusion, delayed payments, and potential legal issues. Avoiding common mistakes is essential to ensure that your records are accurate, professional, and compliant with all necessary regulations. By understanding and addressing these pitfalls, you can streamline your billing process and prevent unnecessary complications.

1. Missing Essential Information

One of the most frequent mistakes is failing to include all the necessary details in the billing document. This can lead to confusion and delays in processing payments. Common missing elements include:

- Buyer and Seller Information: Omitting contact details or inaccurate information can lead to difficulties in tracking or following up on transactions.

- Unique Transaction Number: Without a reference number, it becomes challenging to identify specific transactions, especially in large volumes.

- Payment Terms: Clearly stating payment methods, deadlines, and any late fees is critical to avoid misunderstandings.

2. Incorrect Calculations or Amounts

Errors in calculations are not only frustrating but can also cause legal issues or a loss of trust. Common mistakes in this area include:

- Tax Calculations: Incorrect tax rates or missing tax information can make the document non-compliant with local regulations.

- Discounts and Charges: Failing to apply agreed discounts or adding unauthorized fees can result in disputes with customers.

- Total Amount Due: Always double-check the total sum to ensure that it includes all taxes, fees, and other adjustments.

By paying attention to these common mistakes and ensuring that all required information is accurate and complete, businesses can create more efficient and reliable billing documents.

Best Practices for Creating Chinese Invoices

Creating an effective billing document is crucial for ensuring that transactions are clear, accurate, and compliant with relevant regulations. By following best practices, businesses can streamline their financial processes, reduce errors, and maintain professional standards. A well-crafted document not only helps in smooth transactions but also builds trust between parties and supports efficient financial management.

1. Ensure Accuracy and Completeness

One of the most important aspects of preparing any billing document is ensuring that all the details are correct and complete. This includes not only basic transaction data but also the inclusion of all legal and financial information required by both parties. Here are some key tips to follow:

- Double-check the Numbers: Always verify the quantities, unit prices, and total amounts before finalizing the document.

- Correct Contact Information: Ensure that the names, addresses, and contact details for both the buyer and seller are accurate.

- Unique Reference Number: Assign a unique transaction number for easy tracking and future reference.

2. Make the Document Professional and Clear

A well-designed document reflects professionalism and helps prevent misunderstandings. A clean, easy-to-read layout ensures that all key information is quickly accessible. Follow these practices to improve the clarity and presentation of your billing records:

- Use Clear Section Headings: Break the document into logical sections, such as “Transaction Details” or “Payment Instructions,” to make it easier to read.

- Readable Font and Layout: Choose legible fonts and organize the content in a clean, uncluttered way.

- Highlight Important Details: Use bold or underlined text to highlight critical information, such as the total amount due or payment deadline.

3. Stay Compliant with Local Regulations

Legal compliance is essential when preparing any business document, especially when dealing with cross-border transactions. Ensure that your billing document includes all the necessary details required by local authorities:

- Tax Identification Numbers: Include both parties’ tax IDs to comply with local tax regulations.

- Official Seals or Signatu

Free vs Paid Chinese Invoice Templates

When selecting a format for creating billing documents, businesses often face the decision between using free or paid options. Each choice comes with its own set of advantages and limitations, depending on the specific needs of the business. Free options are often more accessible and cost-effective, while paid versions tend to offer more advanced features, support, and customization options. Understanding the differences between these two can help businesses make an informed decision based on their requirements.

Free Templates

Free billing formats are widely available and can be a good choice for small businesses or startups looking to minimize expenses. However, these templates may have certain limitations when it comes to customization, features, and support. Here are some benefits and drawbacks of using free formats:

- Benefits:

- Cost-effective, often available at no charge.

- Simple and easy to use, with minimal setup required.

- Great for businesses with basic billing needs.

- Drawbacks:

- Limited customization options (e.g., design, branding).

- Lack of advanced features such as automatic calculations or integration with accounting software.

- May not include necessary legal or regulatory information required in some regions.

Paid Templates

Paid formats often provide enhanced features, including advanced customization options and additional tools that can improve the efficiency of billing processes. These templates are generally designed for businesses with more complex needs, such as larger enterprises or those dealing with international clients. Here are some reasons why businesses might choose paid templates:

- Benefits:

- Highly customizable to match the branding and specific requirements of the business.

- Advanced features such as automated calculations, tax compliance, and easy integration with accounting software.

- Professional support for troubleshooting and updat

How to Download a Chinese Invoice Template

Downloading a ready-made billing document is a quick and convenient way to streamline your business’s invoicing process. These documents are often available in various formats, such as Word, Excel, or PDF, and can be easily customized to fit your specific needs. The process of downloading a billing format is typically straightforward, but it’s important to know where to find reliable sources and what to look for when selecting the right version for your business.

Steps to Download a Billing Document

Follow these simple steps to download and set up your billing document:

- Step 1: Choose a Reliable Source

Make sure to download your document from a trusted website or service. Some reputable sources offer free or paid formats that comply with local regulations and professional standards. Look for official business resource websites or reputable software providers that offer templates designed for your industry.

- Step 2: Select the Right Format

Depending on your needs, choose a format that is compatible with your system. Common formats include Microsoft Word, Excel, or PDF. Excel files may allow for automatic calculations, while PDFs are typically read-only for easier printing and distribution.

- Step 3: Download the File

After selecting the desired format, click the download link or button. Ensure your internet connection is stable to avoid incomplete downloads. Save the file to an easily accessible location on your computer.

- Step 4: Customize the Document

Open the downloaded file and customize it by adding your company’s details, transaction information, and any legal or tax information required. Adjust the layout and design to match your branding if necessary.

Where to Find Templates

There are several platforms where you can find downloadable formats for billing records:

- Free Resource Websites: Many websites offer free downloads, which are great for small businesses or startups with basic needs. These may include simple, no-frills templates that can be customized easily.

- Paid Platforms: Premium services often provide more advanced templates with additional features such as automatic tax calculations, invoicing history tracking, and more complex formatting options. These are ideal for larger businesses or those requiring advanced functionality.

- Software Providers: Some accounting or business management software platforms offer billing document templates as part of their tools, with seamless integration into your accounting system for easier use and tracking.

By following these steps, you can quickly download and customize a suitable document to meet your business needs, s

Essential Information on a Chinese Invoice

For any billing document to be effective, it must contain specific details that clearly outline the transaction between the buyer and the seller. These key elements not only ensure clarity but also help maintain compliance with legal and financial regulations. Whether for internal records or external auditing, a well-structured document that includes all necessary information reduces the risk of errors, disputes, and delays in payment.

Below are the most important details that should be included in a properly formatted billing document:

- Seller and Buyer Information: The full names, addresses, and contact details of both parties involved in the transaction. This is essential for proper identification and communication.

- Unique Transaction Number: A reference number assigned to each document for tracking and record-keeping. This number helps differentiate one transaction from another and makes future reference easy.

- Description of Goods or Services: A detailed breakdown of the items or services provided, including quantities, unit prices, and any applicable product/service codes. Clear descriptions help prevent misunderstandings about the delivered goods or services.

- Total Amount Due: The total cost of the transaction, including all relevant taxes, shipping fees, and any discounts or promotions applied. This is often broken down into smaller components for transparency.

- Payment Terms: Information on when and how payment is expected, including due dates, accepted payment methods, and any penalties for late payment. This section helps clarify the buyer’s obligations.

- Tax Information: The tax rate applied to the transaction and the total tax amount. This is critical for businesses to comply with tax laws and for customers to verify the amount of tax being paid.

- Legal Compliance Information: Any legal or regulatory details required by local authorities, such as tax identification numbers, company registration numbers, or certification seals. These details help verify the legitimacy of the document.

Including all of these elements ensures that the document serves its purpose in a clear and legally compliant manner. This also helps create a transparent process for both the buyer and the seller, reducing the chances of disputes and facilitating smooth financial transactions.

How to Add Tax Details on Invoices

Including accurate tax information on billing documents is crucial for both legal compliance and financial transparency. Properly documenting taxes helps prevent confusion for both the business and the customer, and ensures that the transaction complies with local tax laws. Knowing how and where to include tax details ensures that the document is complete and aligns with both business and legal requirements.

Step 1: Identify the Applicable Tax Rate

Before including tax information on your billing document, it’s important to determine the correct tax rate for the transaction. This rate will depend on various factors, including the type of product or service being provided, the location of the buyer and seller, and any regional tax laws. Make sure to research and apply the correct tax rate according to local regulations.

- Sales Tax: Typically applied to goods or services sold within a specific jurisdiction. Different regions may have different rates.

- Value Added Tax (VAT): Applied in many countries, this tax is added at each stage of production or distribution.

- Service Tax: Often applicable to professional services, depending on the nature of the service and location.

Step 2: Include Tax Information on the Document

Once you’ve identified the applicable tax rate, it’s time to incorporate it into the billing document. Tax details should be clearly displayed and easy to understand to avoid confusion. Here’s how to add the necessary information:

- List the Tax Rate: Clearly state the tax rate applied to the transaction (e.g., 5%, 10%, or VAT exempt). You can add this information next to each item or in a separate section.

- Specify the Tax Amount: Include the total tax amount for the entire transaction, making it clear how much of the total cost is attributed to taxes. This amount should be calculated based on the applicable tax rate and the total price of the goods or services.

- Show the Tax Breakdown: For larger transactions, consider breaking down the tax information by item or service. This gives more clarity, especially for clients who may need detailed reports for their own accounting purposes.

- Include Tax Identification Number: Some jurisdictions require that the tax identification number of both the seller and buyer be included. This ensures that the transaction is recorded correctly with tax authorities.

By following these steps and clearly documenting tax details, you ensure that your billing document is not only legally compliant but also transparent for your custo

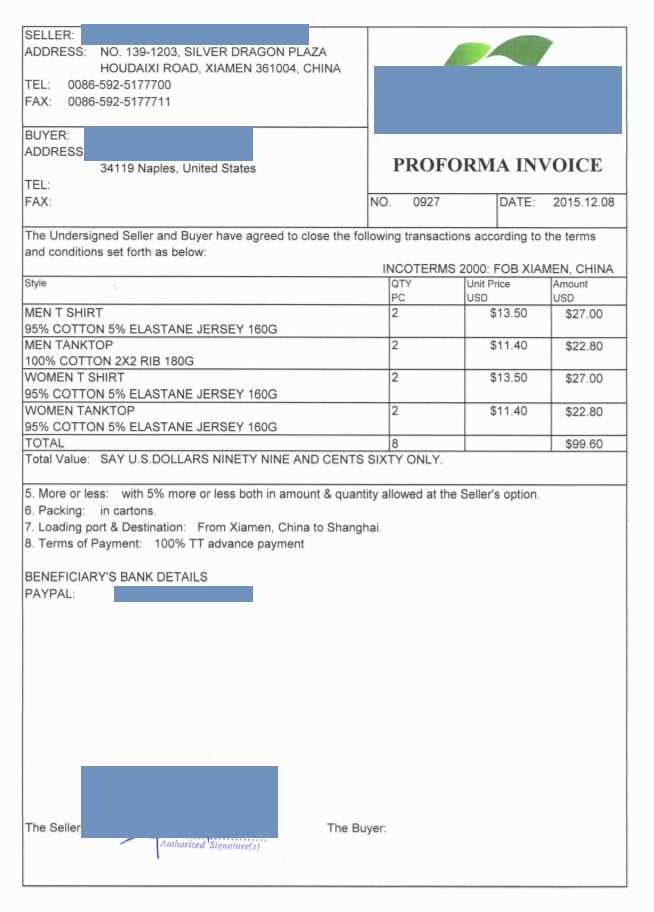

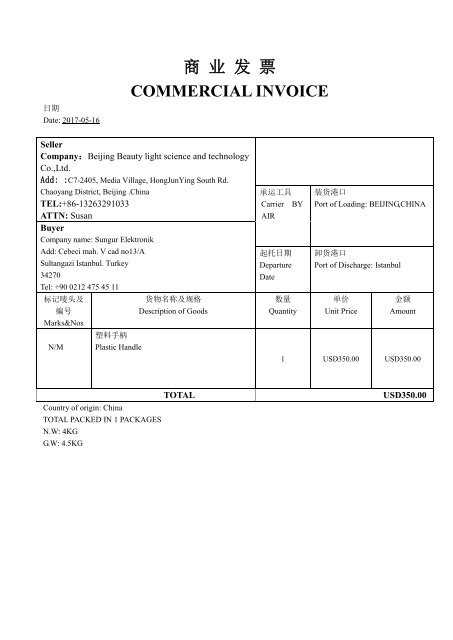

Using a Template for International Business

In international trade, having a consistent and professional format for documenting transactions is essential. Whether you’re exporting goods or providing services across borders, using a standardized document helps ensure that all necessary details are captured and that the transaction is understood by all parties involved. This document serves not only as a formal record but also as a tool for managing cross-border financial interactions efficiently.

When dealing with international clients, it is vital to use a format that meets both local legal requirements and international business standards. A well-designed document can prevent miscommunication, reduce errors, and help avoid costly delays in payments. Below are some key reasons why using a pre-designed document can be especially beneficial in international business:

1. Ensuring Clarity Across Borders

For international transactions, clarity is paramount. A clear and standardized document helps avoid any confusion regarding the terms of the agreement, product descriptions, pricing, or delivery expectations. Here are some points to keep in mind:

- Language Considerations: Choose a template that accommodates multiple languages or has the option to translate key sections to make it easier for all parties to understand.

- Currency Specifications: Specify the currency of the transaction clearly. This can prevent confusion over exchange rates and the final payment amount.

- Detailed Descriptions: Include detailed descriptions of products or services, including quantities, unit prices, and delivery timelines, to ensure that both parties are on the same page.

2. Compliance with International Regulations

Each country has different rules regarding taxation, export regulations, and business documentation. Using a pre-designed document ensures that all necessary legal and regulatory information is included, preventing delays in processing the transaction. Key elements to consider include:

- Tax Information: Make sure to include any applicable tax rates, customs duties, or VAT required by the local government

Benefits of Digital Chinese Invoice Templates

In the digital age, transitioning from paper-based billing systems to electronic formats brings numerous advantages. By using digital documents for transactions, businesses can streamline their operations, reduce errors, and improve efficiency. These benefits not only simplify the administrative process but also help maintain accuracy and compliance with regulatory requirements. The shift to digital formats has become a game-changer for businesses of all sizes.

Here are some key advantages of utilizing electronic formats for billing documents:

1. Increased Efficiency and Time Savings

One of the most significant benefits of using a digital document format is the time it saves in creating, processing, and managing records. Unlike traditional paper documents, digital versions can be easily created, edited, and stored. Some key time-saving aspects include:

- Quick Customization: Digital formats allow for easy modifications to match specific transaction details, client preferences, or business needs.

- Automated Calculations: Many digital formats come with built-in formulas to calculate totals, taxes, and discounts automatically, reducing the chances of manual errors.

- Instant Sharing: Electronic records can be sent instantly via email or uploaded to a cloud platform, speeding up the process of invoice delivery and payment collection.

2. Cost-Effectiveness

Using digital documents reduces the need for printing, paper, postage, and physical storage. This results in lower operational costs for businesses, especially when dealing with large volumes of transactions. Moreover, many electronic billing formats are available for free or at a low cost, making them a more affordable option compared to traditional methods.

- No Printing Costs: There’s no need to print paper forms, saving on ink, paper, and maintenance for printers.

- Reduced Postage and Delivery Costs: Sending documents electronically eliminates postage and courier fees, which can be significant, particularly for international transactions.

- Lower Storage Costs: Digital records take up no physical space, reducing the need for filing cabinets and storage rooms.

3. Better Accuracy and Fewer Errors

Manual data entry and paper-based records are prone to human error. Digital formats, on the other hand, can be set up to automatically calculate totals, taxes, and discounts, minimizing the chances of mistakes. Additionally, once data is entered, it can be easily edited or updated, ensuring that your records are always accurate and up-to-date.

- Automatic Calculatio

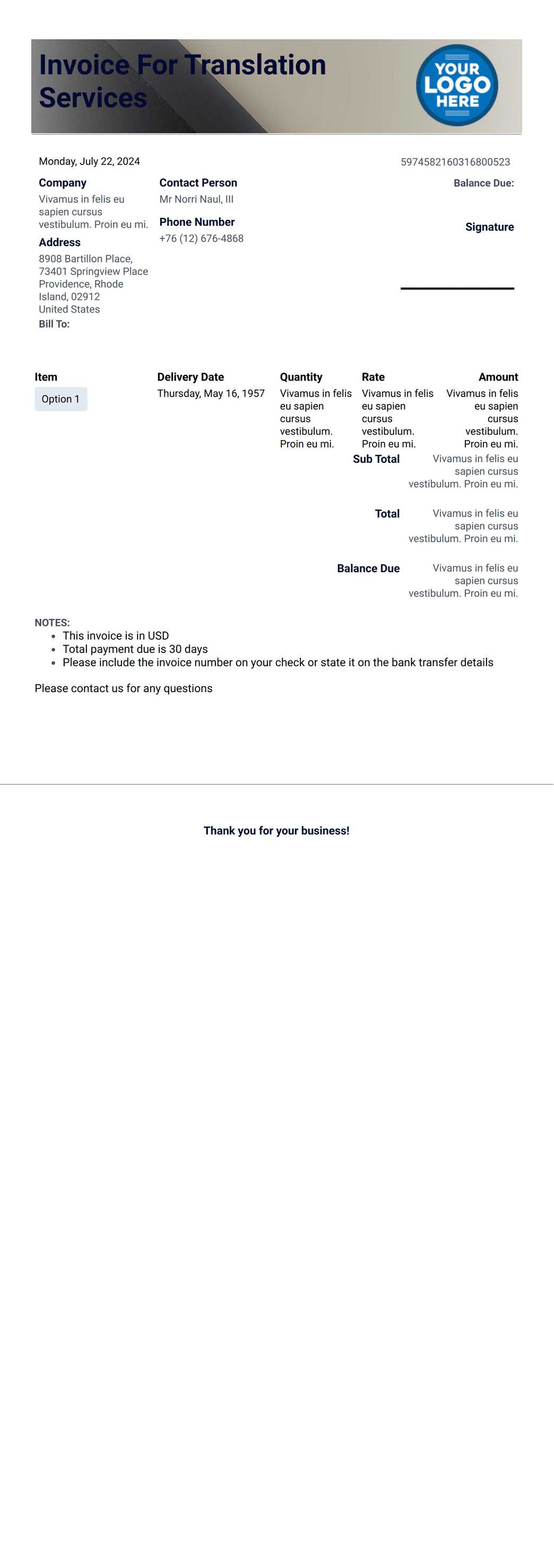

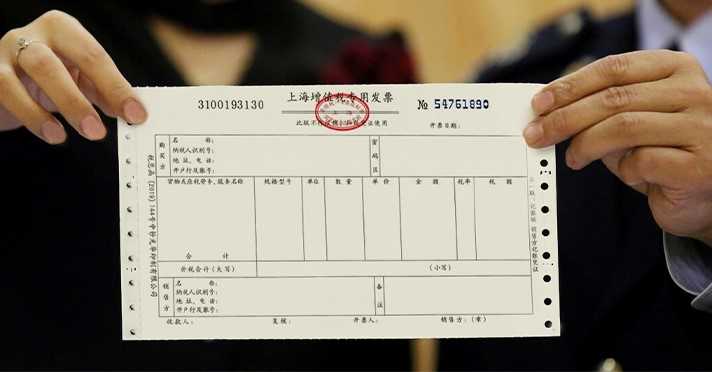

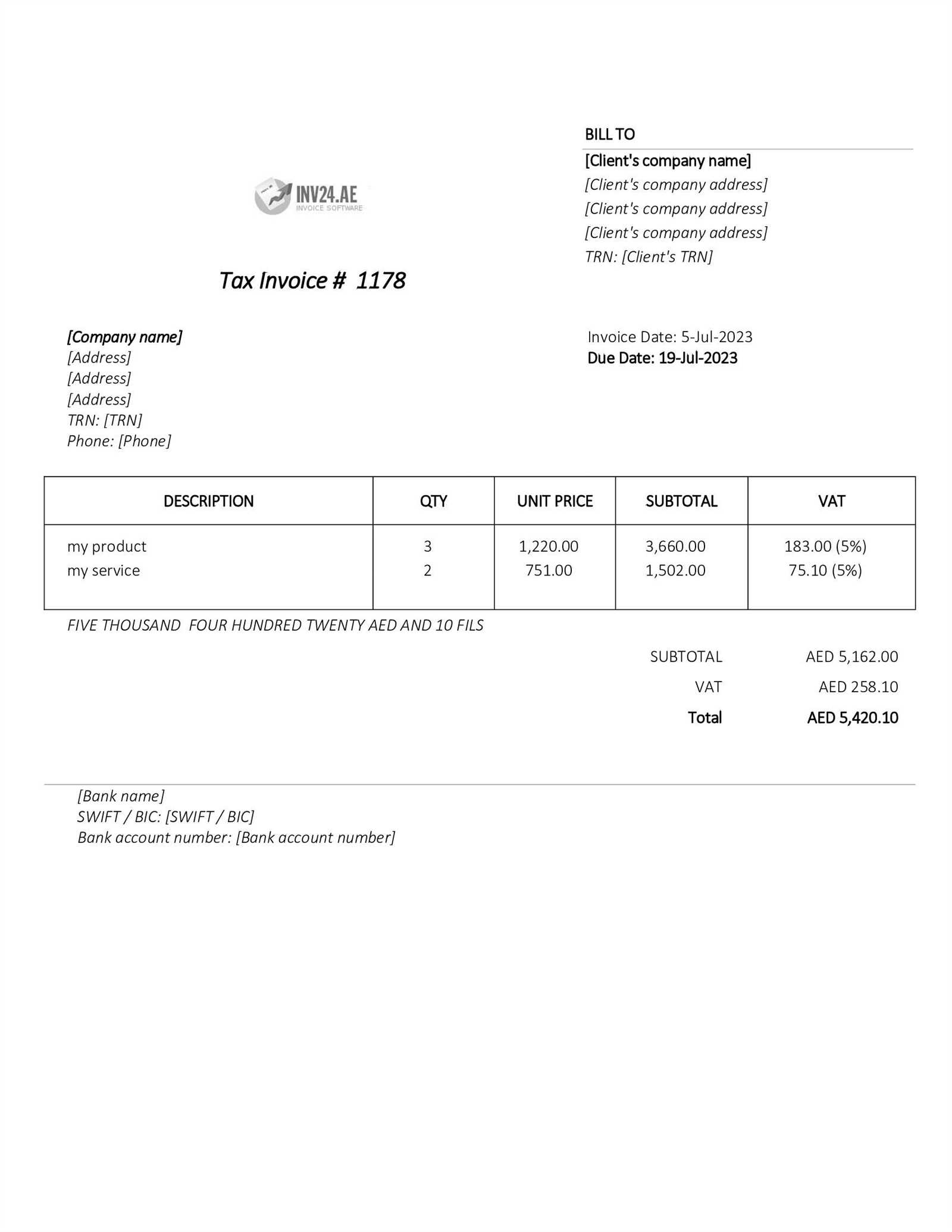

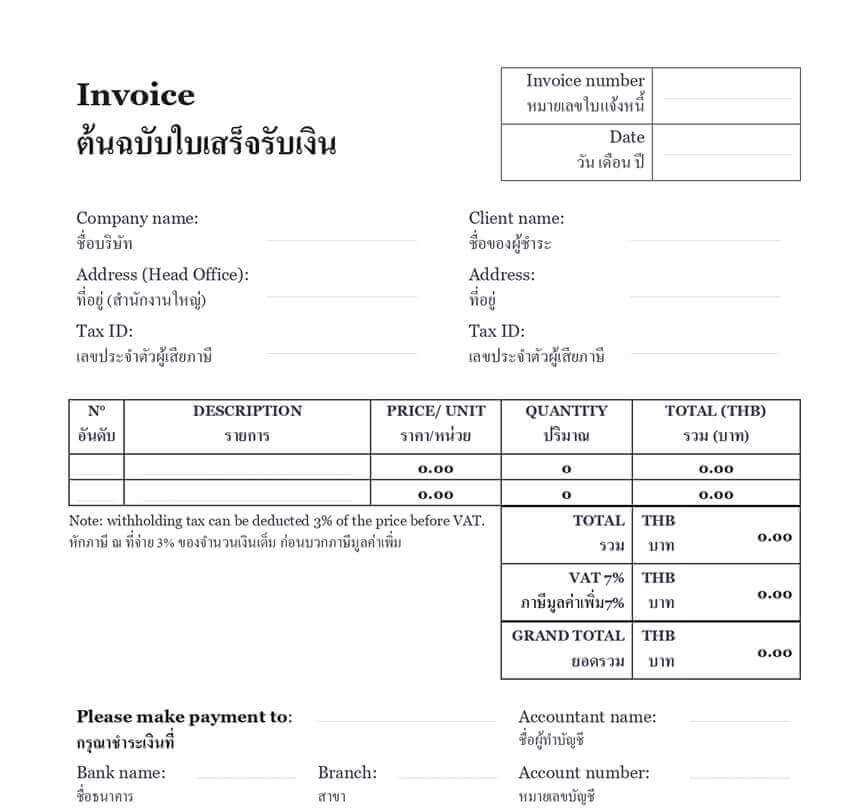

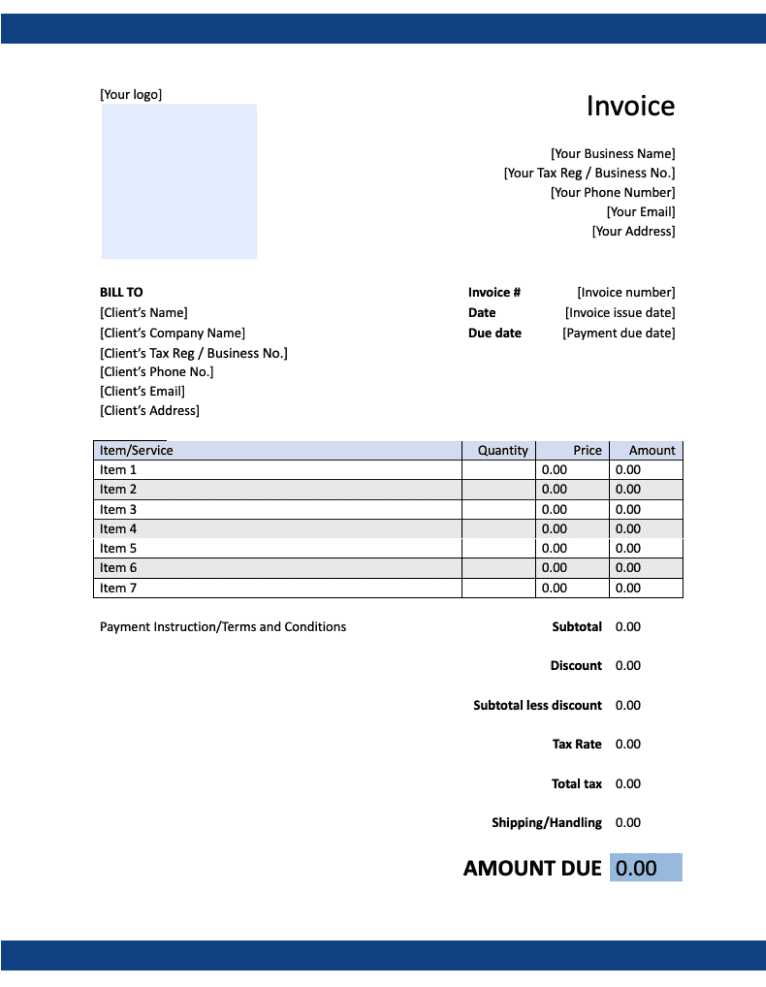

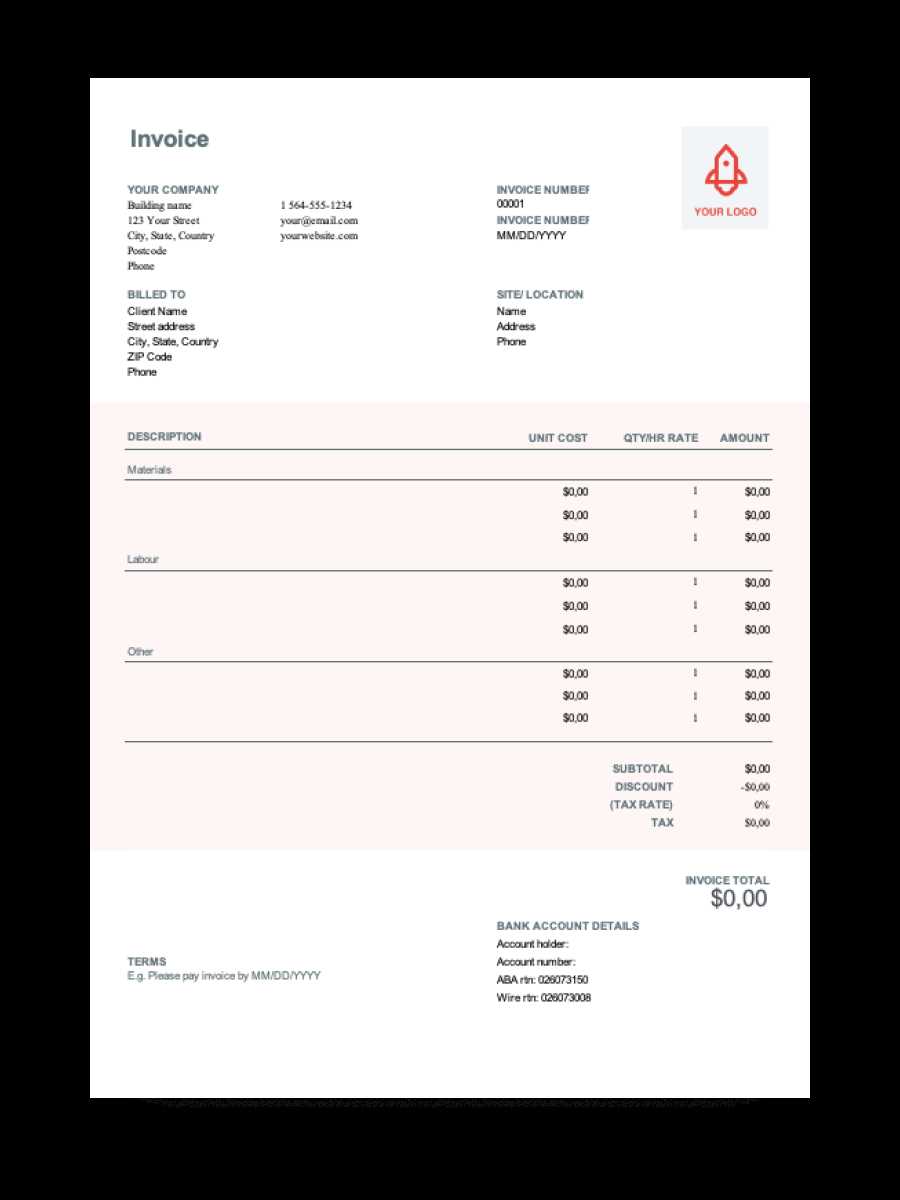

Examples of Professional Chinese Invoices

In business transactions, a well-organized and professional document is essential for creating a strong impression with clients and partners. Professional records ensure clarity and help maintain transparency in all financial exchanges. The key to an effective document lies in its design, structure, and the inclusion of all necessary information to facilitate smooth transactions.

Below are some examples of how a professional document might be structured. These examples highlight the essential elements that should be included, as well as the formatting choices that make these documents look polished and business-like:

Example 1: Simple Billing Document

A basic yet professional format is ideal for small transactions or routine services. This type of document focuses on clear communication and includes essential details such as the buyer’s and seller’s information, description of products or services, pricing, and payment terms. An example of such a record may look like this:

- Company Name: ABC Supplies Ltd.

- Client Name: XYZ Corp.

- Transaction Date: 1st September 2024

- Item Description: Office Supplies (Pens, Paper, etc.)

- Total Amount Due: $500

- Payment Due Date: 15th September 2024

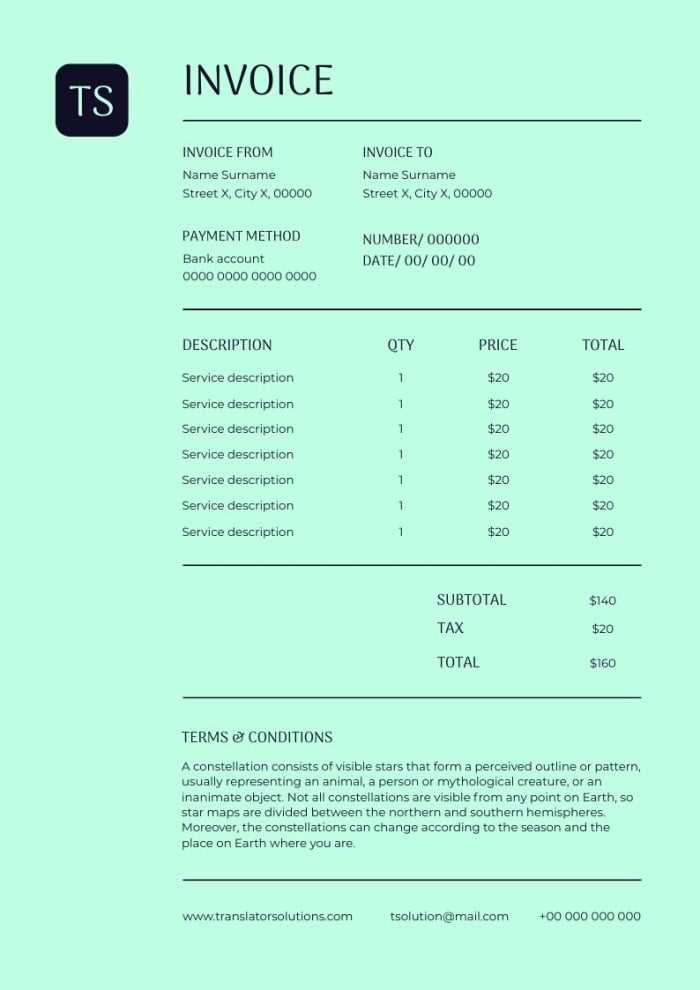

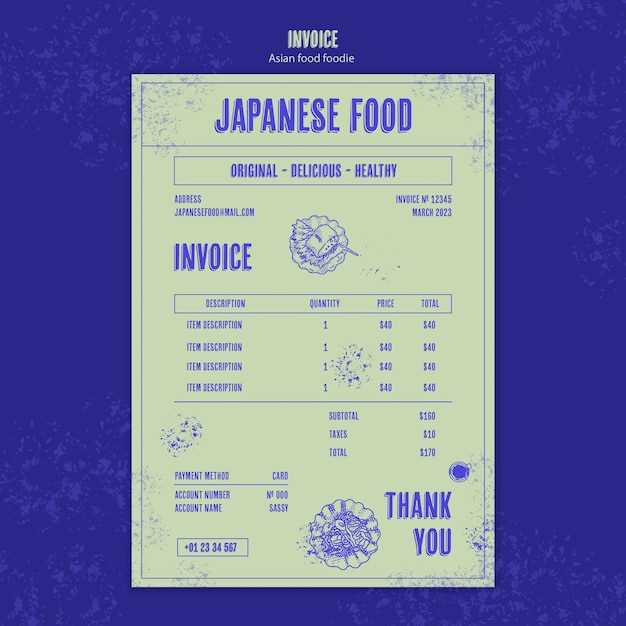

Example 2: Detailed Business Transaction Record

For more complex transactions, especially those involving multiple items or services, a more detailed document is required. This example includes a breakdown of individual items or services provided, their quantities, unit prices, and applicable taxes. This format is ideal for larger-scale businesses or international trade:

- Company Name: Global Tech Solutions

- Client Name: XYZ Enterprises

- Transaction Date: 5th October 2024

- Itemized List:

- Product A – 10 units @ $50 each

- Product B – 5 units @ $100 each

- Service C – Consulting fee @ $200

- Total Amount Before Tax: $1,000

- Tax Rate: 5%

- Total Amount Due (Including Tax): $1,050

- Payment Due Date: 20th October 2024

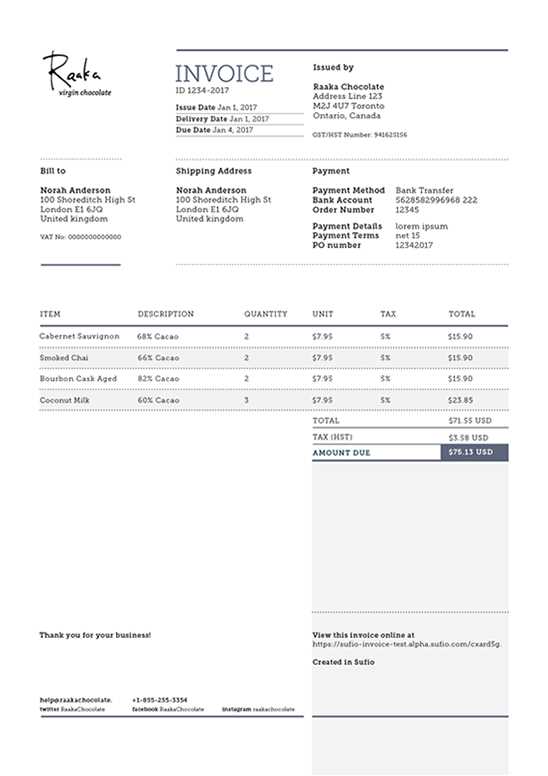

Example 3: Comprehensive International Business Record

For international transactions, it’s crucial to include additional information such as the currency, country of origin, and shipping terms. A comprehensive document will also specify the mode of payment, as well as include any customs duties or international taxes that apply. This example demonstrates the format for a cross-border transaction:

- Company Name: International Goods Co.

- Client Name: Global Buyers Inc.

- Transaction Date: 10th November 2024

- Country of Origin: United States

- Currency: USD

- Shipping Terms: DAP (Delivered at

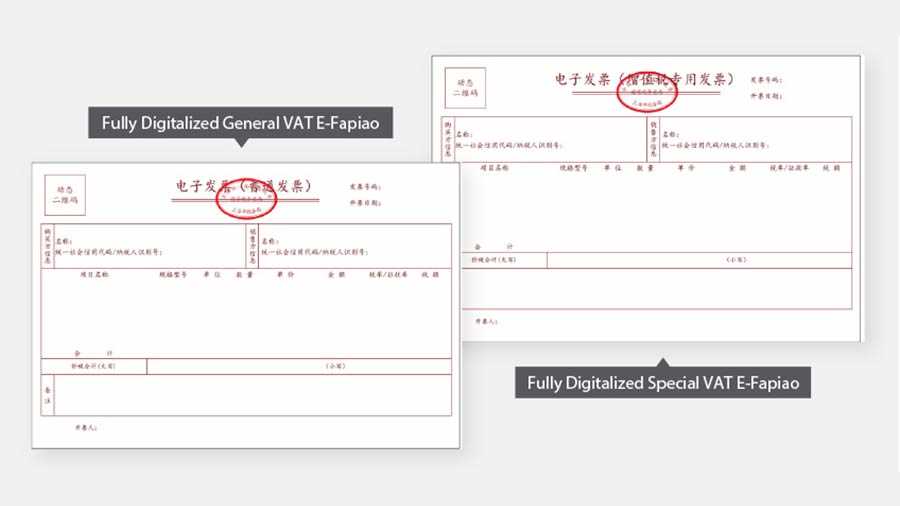

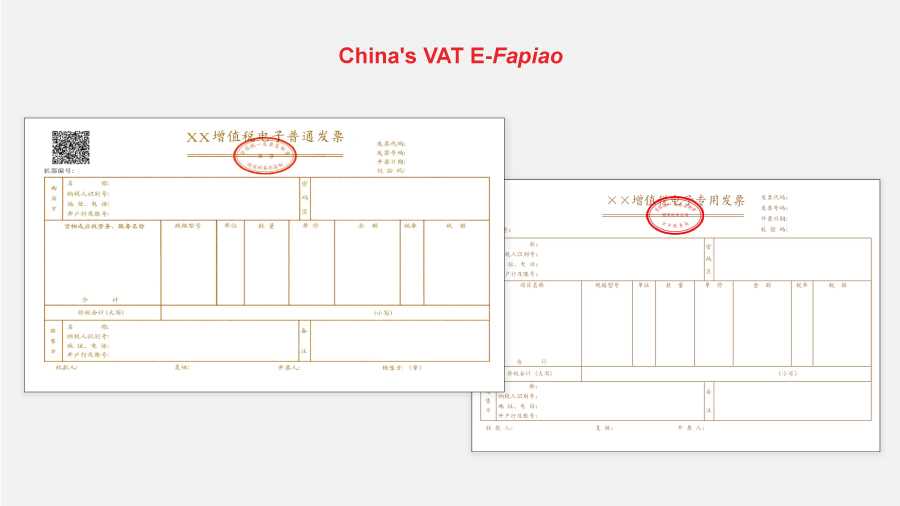

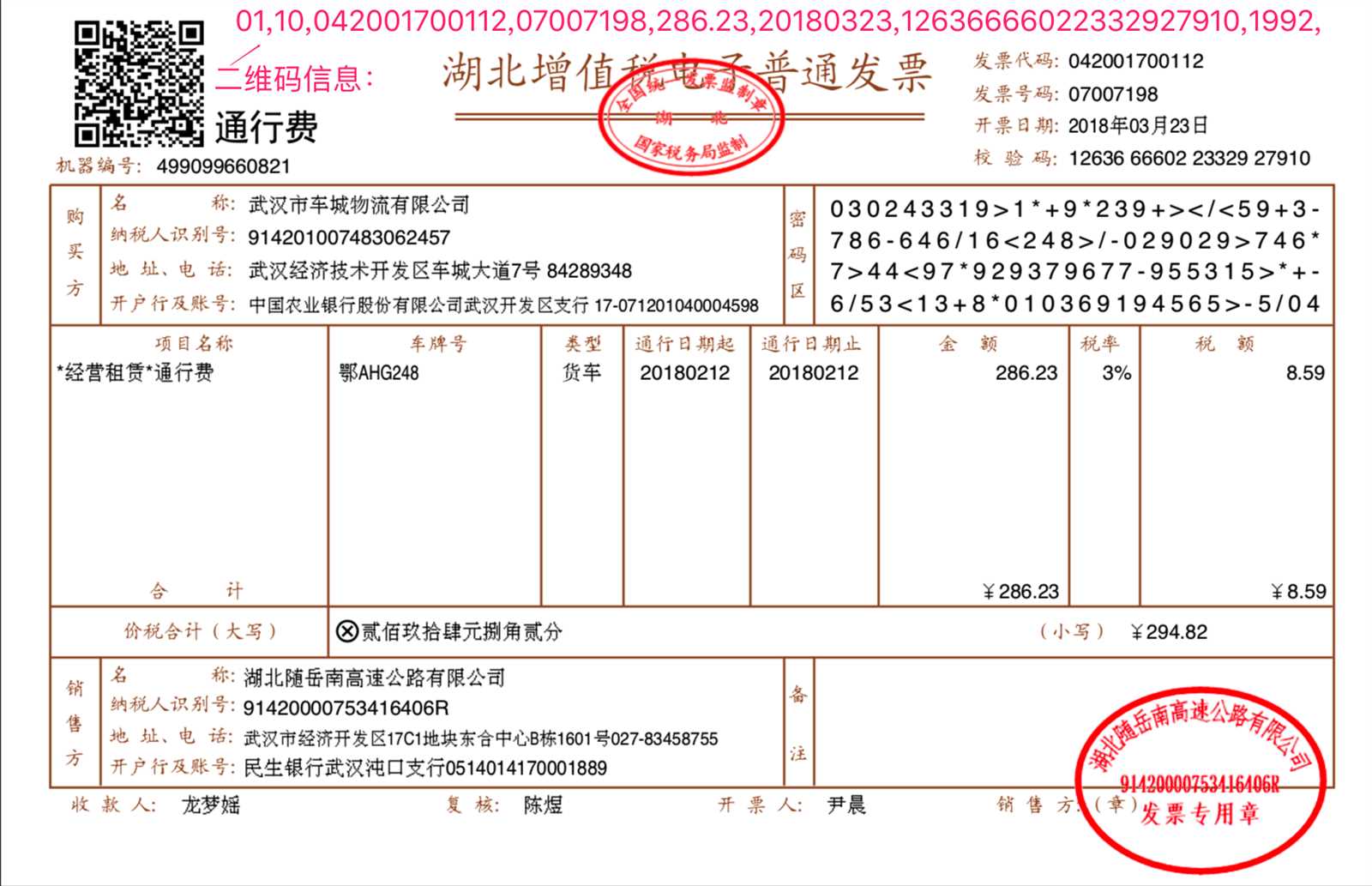

How to Ensure Invoice Compliance in China

Ensuring that financial documents meet legal and regulatory standards is crucial for any business operating in a foreign market. In China, businesses must adhere to specific rules when issuing official records of transactions, especially when it comes to tax reporting and financial auditing. Compliance with local requirements not only helps avoid penalties but also fosters trust with clients and government authorities.

In this section, we will discuss the essential steps businesses need to follow to ensure their billing documents comply with the laws in China. These steps cover the main aspects of formatting, required information, and how to handle tax matters appropriately.

1. Understanding Local Tax Regulations

The first step to ensure compliance is to familiarize yourself with China’s tax regulations. Businesses must understand the rules regarding Value-Added Tax (VAT), which applies to most goods and services. In addition, companies must be aware of the different VAT rates depending on the type of goods or services being provided. Properly applying tax rates and documenting them is essential for maintaining compliance.

- VAT Rates: China has multiple VAT rates that vary based on the type of goods or services. These rates must be accurately calculated and clearly stated in the financial records.

- Tax Identification Number: It is mandatory to include the company’s tax identification number (TIN) on all official records to ensure proper reporting to the government.

- Tax Invoices (Fapiaos): These are special tax receipts used in China. Businesses must issue these official documents to customers for all taxable transactions.

2. Required Information on Financial Documents

For any business document to be legally valid in China, it must contain specific information. This includes basic company details, transaction specifics, and tax-related information. The inclusion of all necessary elements helps ensure that the record can be used for legal purposes, such as audits or tax filings.

- Company Information: This should include the business name, address, contact information, and the TIN.

- Transaction Details: A clear description of goods or services, quantities, unit prices, total amounts, and pay

Choosing the Right Template for Your Business

Selecting the right format for your business transactions is crucial for maintaining professionalism and ensuring accuracy. The right document structure can help streamline your financial operations, simplify communication with clients, and keep your records organized. Choosing an appropriate design depends on the specific needs of your business, the complexity of your transactions, and the industry standards in which you operate.

When deciding on the best structure for your business, there are several factors to consider. A well-chosen format should not only meet legal requirements but also reflect your brand’s image, making it easier for clients and partners to engage with your business. Below, we’ll explore key aspects to consider when selecting the ideal structure for your financial documentation.

- Business Size: Small businesses may prefer simpler formats, while larger organizations may need more detailed structures to capture a broader range of transaction information.

- Industry-Specific Needs: Certain industries have specific requirements for documenting transactions. For example, a service-based business may need a detailed breakdown of hours worked, while a retail business might focus more on product details.

- Customization Options: Flexibility in design is essential, as it allows you to adjust the document to suit the unique aspects of each transaction, whether it’s including additional fees, discounts, or special payment terms.

- Compliance Requirements: Ensure that the format you choose meets legal and tax compliance standards in your operating region. This may involve incorporating features like tax rates, itemized descriptions, and specific reference numbers.

By taking these factors into account, you can select a format that not only simplifies your operations but also enhances your brand’s professional image and ensures smooth communication with clients and authorities.

- Step 1: Choose a Reliable Source

- Benefits: