How to Use a Chef Invoice Template for Professional Culinary Services

When providing cooking services, it’s crucial to have a structured method for requesting payment. A clear, well-organized document not only ensures prompt compensation but also establishes professionalism in your business dealings. Whether you’re a personal cook, caterer, or running a small culinary business, having the right tools to manage financial transactions is essential for smooth operations.

Customizing financial documents for your specific needs can save time and eliminate confusion. With the right approach, you can create a detailed and polished record of your services, which helps both you and your clients stay on track. A professional layout can also improve your reputation, making it easier for clients to trust you with future projects.

In this guide, we’ll explore the necessary components and best practices for crafting effective financial requests. By the end, you’ll know how to tailor these documents to fit your style and ensure you get paid on time for your culinary expertise.

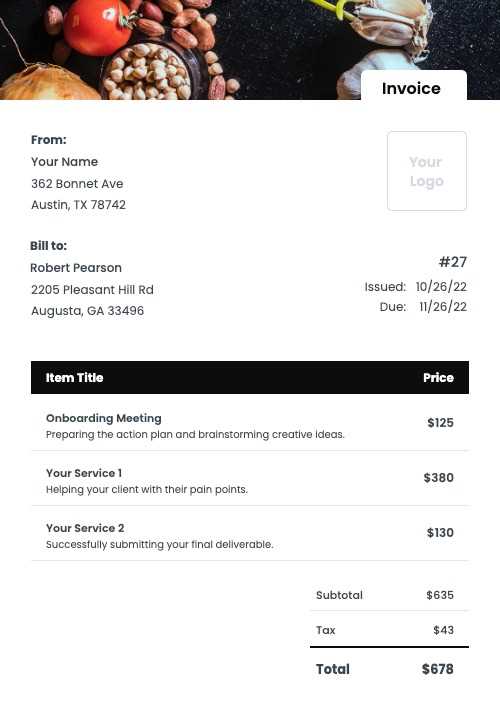

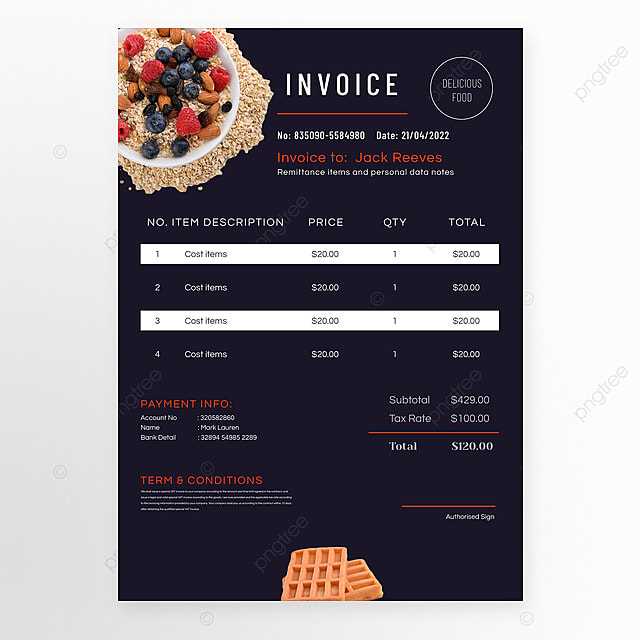

Chef Invoice Template Overview

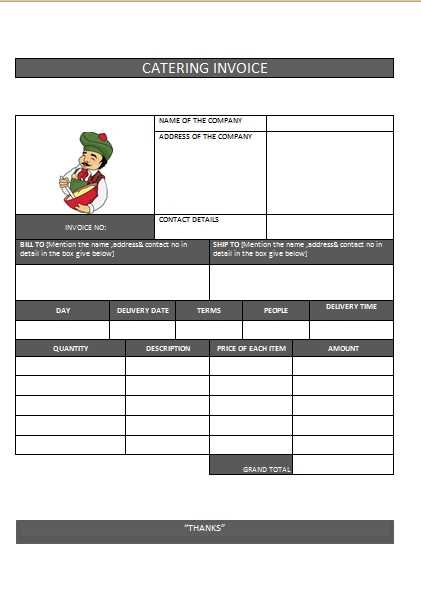

For those in the culinary profession, having an organized method for requesting payment is key to running a successful business. A well-structured document that details services rendered and payment terms ensures clarity for both the provider and the client. Whether for private events, catering, or other culinary services, using a consistent, professional approach helps maintain smooth business operations.

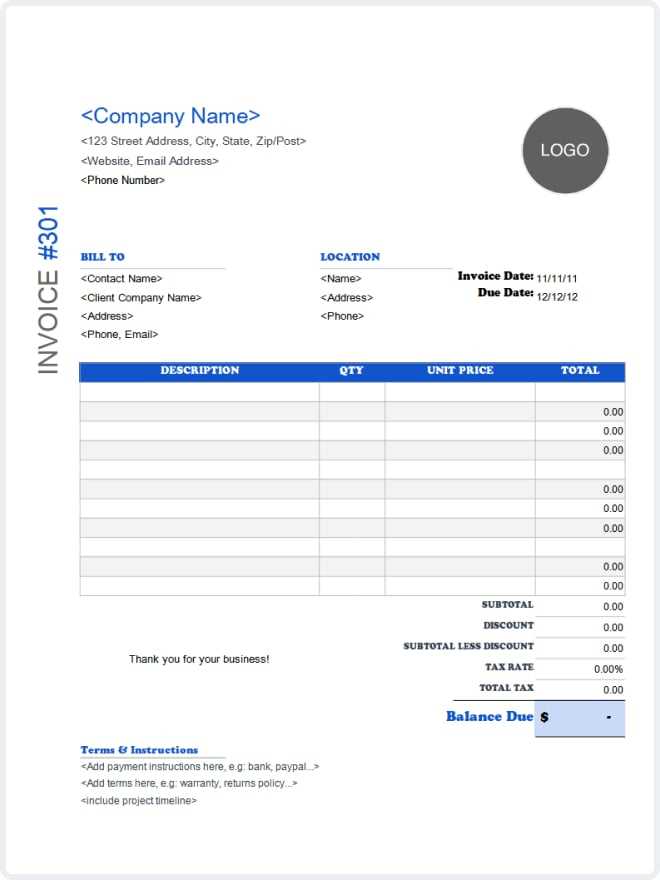

These billing records typically include essential information such as the service description, payment due dates, and applicable charges. The format can vary, but the goal remains the same: to create a transparent and accurate request that reflects the value of the service provided. Below is an overview of the typical sections included in a well-crafted payment request document:

| Section | Description |

|---|---|

| Contact Information | Details of both the service provider and client, including names, addresses, and phone numbers. |

| Service Description | A breakdown of the work performed, including dates, hours, and specific tasks completed. |

| Pricing | The total charges for the services, with itemized costs where applicable. |

| Payment Terms | Details on how and when the payment should be made, along with any penalties for late payments. |

| Additional Notes | Any extra details such as discounts, tips, or specific instructions for payment. |

By including these key elements, you create a document that not only helps you manage finances efficiently but also builds trust and professionalism in your client relationships. Whether you’re creating a document from scratch or using a pre-designed format, ensuring accuracy and clarity is always the top priority.

Why You Need a Culinary Billing Document

For those offering cooking services, having a formal document to request payment is essential to ensure clarity and professionalism in business transactions. Whether you’re preparing meals for a private event, providing catering, or working on a freelance basis, a well-constructed billing document serves as a vital tool for tracking services and securing timely payments.

First and foremost, such a document ensures transparency. It allows both the service provider and the client to clearly understand the work done and the agreed-upon costs. This reduces the risk of misunderstandings and disputes over payment terms. Additionally, it serves as a useful reference for both parties in case of any future questions or discrepancies.

Another significant reason to have a detailed request for payment is to maintain financial organization. Proper documentation of each job helps keep accurate records of earnings, which is crucial for tax purposes, budgeting, and future planning. It also provides an easy way to track payments, outstanding balances, and any overdue amounts.

Lastly, presenting a polished, formal billing record can enhance your reputation as a professional. Clients are more likely to value your services and trust you with future events when they receive a clear and professional statement of charges. This small detail helps establish credibility and fosters positive business relationships.

Key Features of a Culinary Billing Document

When creating a formal request for payment, certain elements are essential to ensure that both the service provider and the client have a clear understanding of the services rendered and the terms of payment. These key components not only help maintain transparency but also contribute to the professionalism and accuracy of the document.

Essential Information to Include

The most critical feature of any payment request is clear contact information. This should include the names, addresses, and phone numbers of both the provider and the client. Additionally, including the date the service was provided and the due date for payment ensures that both parties are on the same page regarding the timeline of the transaction. This clarity prevents any confusion about when payment is expected or when the services were rendered.

Detailed Breakdown of Services and Charges

A well-structured payment request should also include a detailed list of services offered, along with the corresponding charges for each. This breakdown helps clients understand exactly what they are paying for, making the payment process smoother and more transparent. The total amount should reflect all applicable fees, taxes, or additional charges, ensuring that nothing is overlooked or misunderstood.

How to Customize Your Billing Document

Personalizing your payment request is crucial for maintaining a professional appearance and aligning the document with your business style. Customizing the layout and content can make your billing process more efficient, improve client relationships, and ensure that all necessary information is included. By adapting the design to reflect your unique brand or the nature of the service, you create a document that is both functional and tailored to your needs.

Start by adjusting the design elements, such as font style, colors, and logos. These small adjustments can create a cohesive and branded look. You can also modify the sections based on the type of services you provide–whether you offer hourly rates, flat fees, or project-based pricing. This ensures that the document reflects the specifics of each job.

Additionally, it’s important to make sure that all required fields are easy to update. Having pre-set areas for client details, service descriptions, charges, and payment terms will save time while ensuring consistency. Don’t forget to include a space for any specific notes, such as payment methods or additional terms, which may be relevant for certain clients or projects.

Essential Details to Include in Billing Documents

To ensure that your payment request is clear, accurate, and professional, it’s important to include all the necessary information that both you and your client need. A well-organized document helps avoid confusion and ensures timely payment. There are several key elements that must be present in every billing statement to maintain transparency and efficiency in the transaction process.

Start by including complete contact information for both parties involved. This should consist of names, addresses, phone numbers, and email addresses, making it easy for either side to reach out if needed. It’s also crucial to include the date when the service was performed and the due date for payment to ensure both parties are clear about the timeline.

Additionally, a detailed breakdown of the services provided is essential. List each task or service with its corresponding cost, whether it’s based on hourly rates or a flat fee. Be sure to include any taxes, additional charges, or discounts that apply. This transparency helps prevent misunderstandings and ensures that your client knows exactly what they are being billed for.

Lastly, include clear payment terms, such as accepted payment methods, penalties for late payments, and any discounts for early payment. These details ensure that both you and your client understand the financial expectations and can help facilitate a smooth and timely transaction.

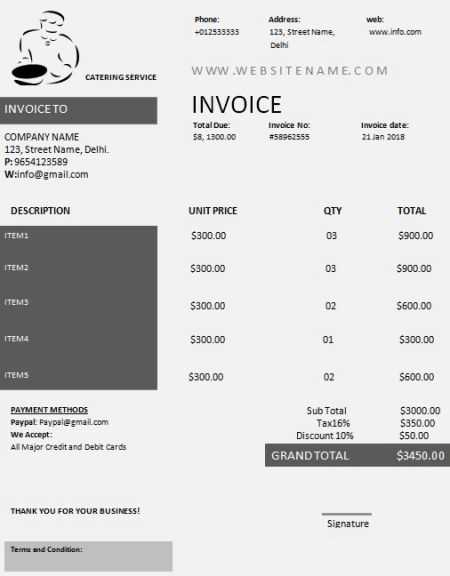

How to Calculate Service Fees

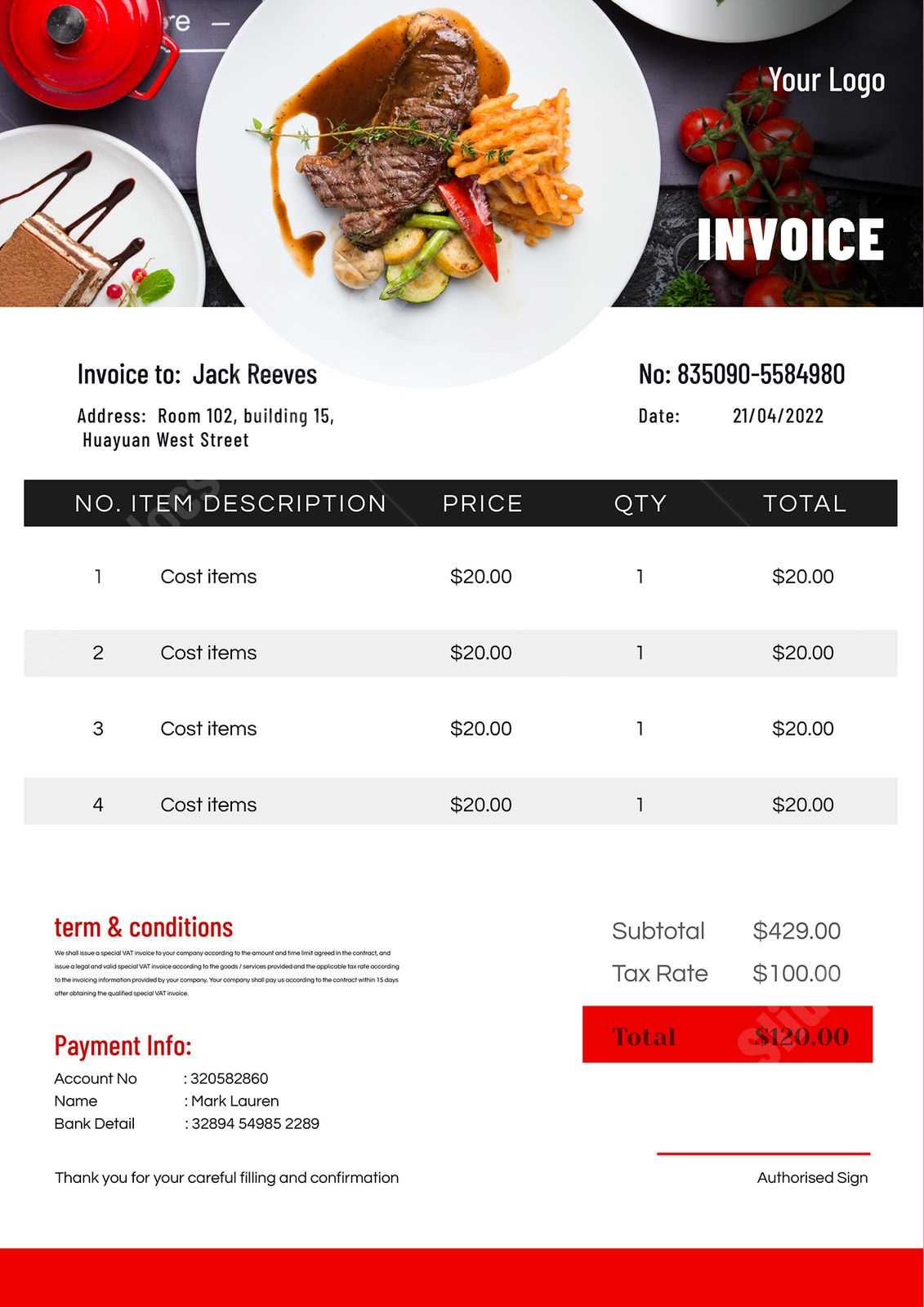

When setting a price for culinary services, it’s essential to consider several factors that contribute to the final fee. The process of calculating a fair and accurate charge ensures both the provider and the client understand the cost of the service. Properly calculating fees also helps maintain financial transparency and ensures the provider is compensated fairly for their time and expertise.

Start by determining the basic rate for your time, whether it’s an hourly rate, a flat fee for an event, or a per-person charge for catering. Additional costs, such as ingredients, travel expenses, or any special equipment needed, should also be factored into the total amount. Below is an example breakdown of how to calculate service fees:

| Item | Description | Cost |

|---|---|---|

| Base Rate | Hourly or flat rate for service | $50 per hour |

| Ingredients | Cost of food and supplies used | $200 |

| Travel Fees | Cost of transportation, if applicable | $30 |

| Additional Services | Extra charges for any additional tasks | $40 |

| Total | Sum of all costs | $320 |

After calculating the total cost based on the service provided, make sure to include any taxes or tips that may apply. This transparent breakdown ensures that your clients can see exactly where their money is going and avoids confusion regarding the charges.

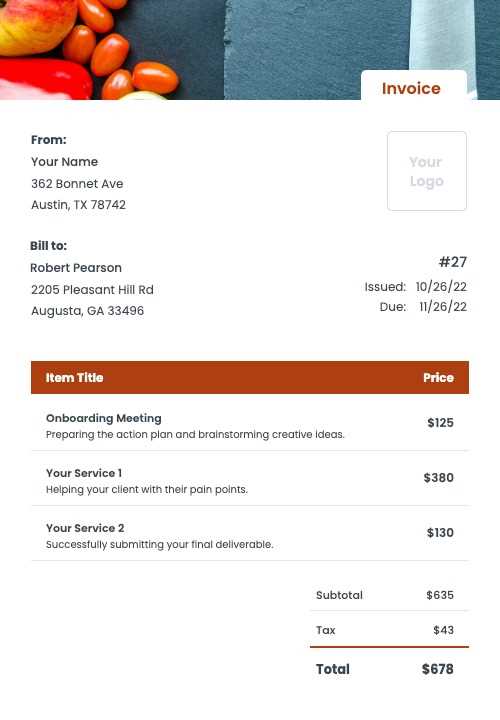

Design Tips for a Professional Billing Document

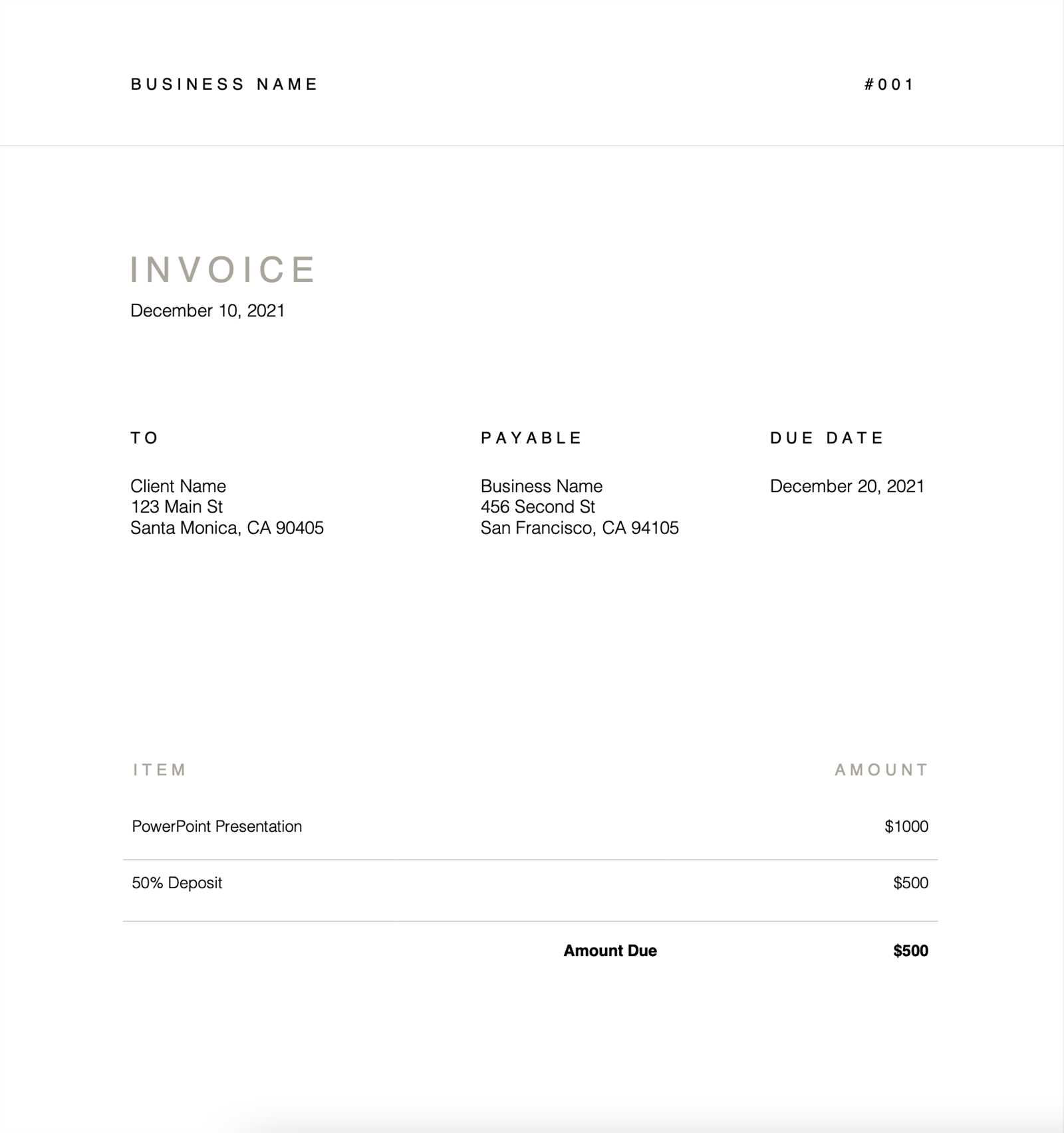

Creating a visually appealing and easy-to-read billing document is just as important as ensuring its accuracy. The design of your financial request should reflect your professionalism while making the information clear and accessible to your clients. A well-designed document not only looks polished but also enhances the overall client experience, encouraging timely payments and fostering trust.

First and foremost, keep the layout clean and organized. Use a simple, structured format with clearly defined sections for contact details, services rendered, payment terms, and the total amount due. Avoid clutter by leaving enough white space between sections, which makes it easier for clients to read and locate important information quickly.

Typography also plays a crucial role in the overall design. Choose professional, easy-to-read fonts for both headings and body text. Stick to one or two fonts at most, as this maintains consistency and keeps the document visually appealing. Ensure that text size is legible, with larger font sizes for headings and smaller, but still readable, text for descriptions and totals.

Another important design tip is to incorporate your branding elements, such as your logo, color scheme, or business name. This creates a cohesive look across all your business documents and reinforces your identity. However, make sure the design doesn’t overshadow the content–clarity and readability should always be the top priority.

Common Mistakes to Avoid in Billing Documents

Even a small mistake in a payment request can lead to confusion, delayed payments, or even disputes with clients. To maintain professionalism and ensure timely compensation, it’s crucial to avoid common errors when creating your billing statements. Here are some of the most frequent mistakes to watch out for when preparing a financial document.

One of the most common mistakes is failing to include complete or accurate contact information. Missing or incorrect details, such as the client’s name, address, or your own contact information, can cause delays or miscommunication. Always double-check these details before sending out any document to ensure it’s correct.

Another issue to be mindful of is not providing a clear breakdown of services and charges. Ambiguous descriptions or unclear pricing can confuse clients and lead to misunderstandings. Be specific about the tasks completed, the time spent, and the exact charges for each service. This will make it easier for clients to review the document and avoid disputes over what they are paying for.

A third mistake is overlooking payment terms. If you don’t clearly state when the payment is due, what methods are accepted, or any penalties for late payment, it could lead to delayed or missed payments. Always include clear, concise payment terms to ensure both parties understand the financial expectations from the start.

Lastly, don’t forget to review the document for spelling or grammatical errors. These small details can undermine your professionalism and cause clients to question the accuracy of the rest of the document. A thorough proofread will ensure that your request is polished and credible.

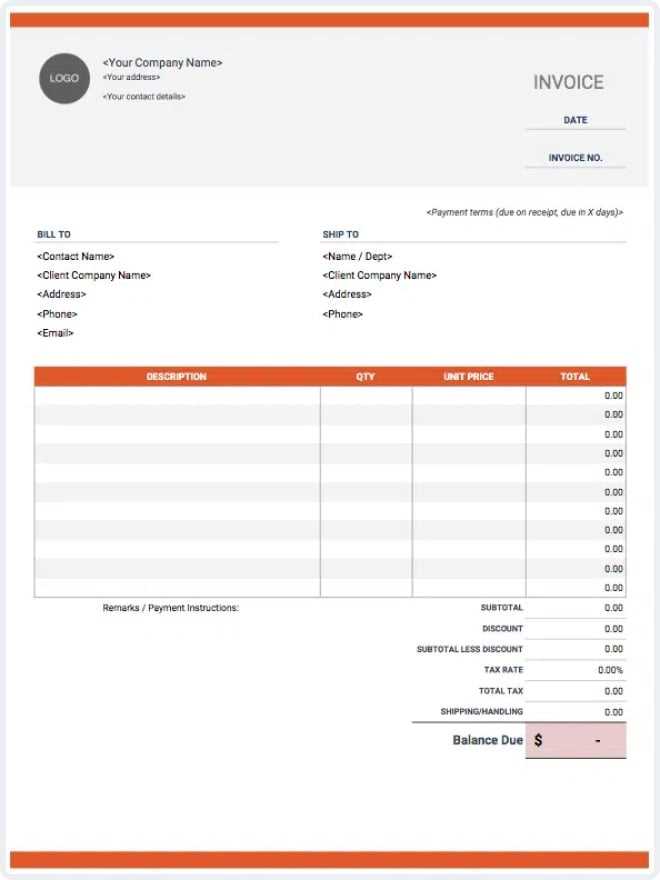

Choosing the Right Billing Format

Selecting the correct format for your financial requests is an important step in maintaining professionalism and efficiency in your business operations. The format you choose should align with the nature of your services, the expectations of your clients, and your personal preferences. A well-chosen format can help streamline the payment process, minimize errors, and enhance communication.

There are several factors to consider when choosing the right format:

- Service Type: If you offer various types of services, you may need different formats. For example, an hourly rate format will differ from a flat-fee format or a per-person charge.

- Client Preferences: Some clients may prefer digital documents, while others might request paper copies. Offering both options ensures convenience and flexibility.

- Customization: A customizable format allows you to tailor each request to the specific needs of the job, such as adding custom terms, descriptions, or discounts.

- Ease of Use: Whether you’re using software or a physical template, choose a format that’s simple to update and use regularly. This minimizes time spent on paperwork and ensures consistency across all documents.

Here are a few common format options to consider:

- Digital Templates: Easily customizable, these formats allow for quick adjustments and can be sent directly to clients via email or through online payment systems.

- Spreadsheet Formats: Using spreadsheets allows for automatic calculations, making them ideal for detailed billing with multiple variables, such as hourly rates or itemized charges.

- Word or PDF Documents: For those who prefer to create documents from scratch, word processors or PDF files offer flexibility in design and formatting.

Ultimately, the best format is one that ensures accuracy, simplifies your workflow, and is easily understandable for your clients. The right choice will depend on the size of your business, the nature of the service provided, and how you prefer to manage your financial documentation.

Managing Multiple Billing Documents

Handling multiple payment requests can become overwhelming if not organized properly. For culinary professionals who work with various clients, events, and services, it’s essential to have an efficient system in place to track and manage each financial document. Proper management ensures that all payments are received on time, details are easily accessible, and no important information is missed.

The key to managing multiple requests is staying organized. You can start by keeping a detailed record of each transaction. Whether using digital tools or physical files, ensure that each document is categorized by client name, event date, and payment status. This will make it easier to track which payments have been received and which are still pending.

Consider using digital tools like spreadsheets or invoicing software that allows you to quickly generate and track multiple records. These tools can automate calculations, create templates for faster use, and send reminders for overdue payments. Additionally, organizing documents by folders or tags can help you quickly retrieve specific records when needed.

Lastly, establish clear communication with clients regarding payment terms. Make sure that every client knows when to expect the request and when payment is due. By setting these expectations upfront and following up on overdue payments, you’ll maintain a steady cash flow and build a professional relationship with your clients.

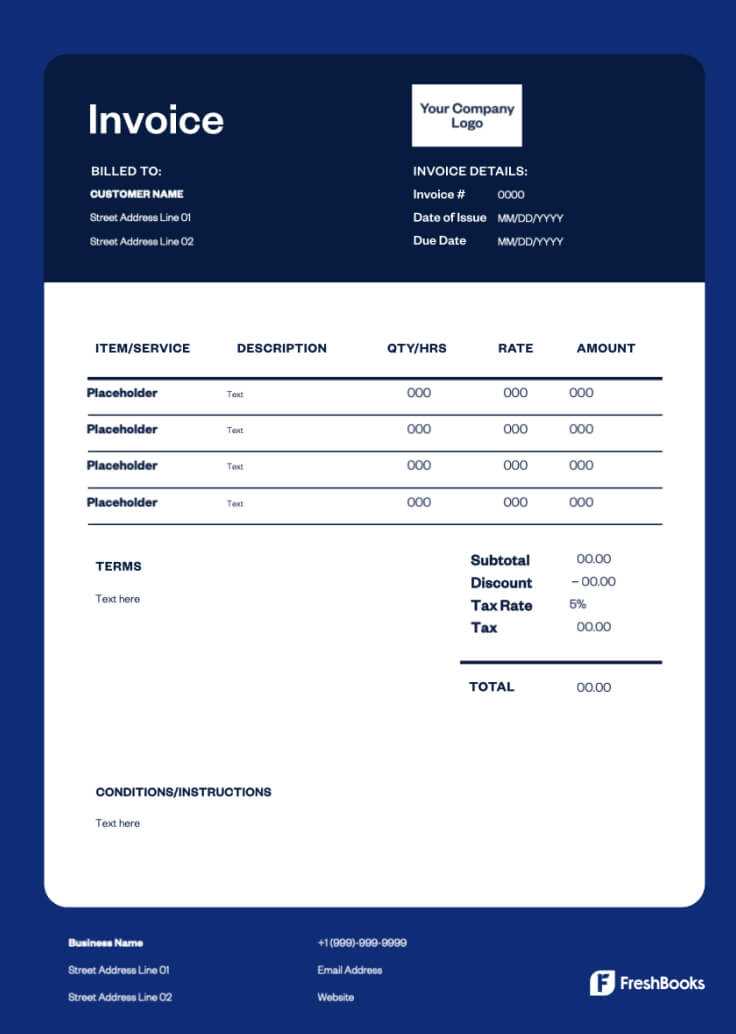

Best Tools for Creating Billing Documents

For those who need to create formal payment requests regularly, using the right tools can save a significant amount of time and effort. The right software can streamline the process, ensuring that the documents are both professional and easy to generate. There are many options available, ranging from simple templates to more advanced invoicing systems that offer features like automatic calculations, tracking, and reminders.

Top Tools for Easy Document Creation

Here are some of the best tools to help you create professional billing documents efficiently:

- Microsoft Word – Ideal for creating customized documents, with the flexibility to add your branding and adjust the layout easily.

- Google Docs – A free, cloud-based solution that allows for real-time collaboration and easy document sharing with clients.

- Excel/Google Sheets – Useful for creating itemized billing records, with automatic calculations for different charges, taxes, and discounts.

- Canva – A design-focused tool that allows you to create visually appealing and unique billing documents using a variety of templates.

Comprehensive Invoicing Software

If you need more advanced features, consider using invoicing software that automates many aspects of the billing process. These platforms often provide customizable templates, tracking, payment reminders, and even integration with accounting software. Some popular options include:

- FreshBooks – A user-friendly tool that offers time tracking, expense management, and customizable billing templates.

- QuickBooks – Ideal for small business owners, offering invoicing, accounting, and reporting features in one platform.

- Zoho Invoice – A cloud-based solution with a wide range of customization options and automation features for recurring invoices.

- Wave – A free, cloud-based invoicing tool that includes features for tracking payments, managing clients, and creating customized documents.

Choosing the right tool depends on your specific needs, whether you’re looking for simplicity, design flexibility, or advanced features for managing multiple clients. By selecting the right solution, you can ensure that your billing process is efficient, professional, and easy to manage.

How to Send Billing Documents Efficiently

Sending payment requests efficiently is crucial for maintaining a smooth cash flow and ensuring that clients receive the necessary documentation in a timely manner. Whether you’re working with individuals or corporate clients, choosing the right method and timing for sending your requests can help you streamline the process, avoid delays, and improve overall client satisfaction.

First, consider using digital delivery methods. Sending your payment requests via email or through an online platform ensures that your client receives the document instantly, no matter where they are. This also allows you to track delivery and confirm receipt without relying on traditional mail. Additionally, using a secure PDF or cloud-based document ensures that the content cannot be easily altered, giving both you and your client peace of mind.

For a more organized approach, consider automating the sending process. Many invoicing software tools allow you to schedule and automate the delivery of your billing documents. You can set reminders for overdue payments, automatically send recurring requests, and even create personalized emails that accompany your financial documents, saving you time on follow-ups.

If you prefer a more personal touch, make sure to include a brief note in the email or message that accompanies the request. This adds a level of professionalism and helps build a positive client relationship. Be polite, professional, and ensure that your contact details are easy to find in case the client has questions.

Lastly, always keep records of sent documents. If you are using email, save copies of the messages and attachments, and if using a physical method, keep a log of when and where the documents were sent. This documentation is helpful in case of disputes or questions regarding the payment process.

Payment Terms for Culinary Services

Establishing clear payment terms is essential for ensuring smooth transactions between service providers and clients. Setting specific expectations regarding when and how payment should be made helps prevent confusion and fosters a professional relationship. It is important to outline these terms upfront, so clients are aware of the deadlines, accepted payment methods, and any penalties for late payments.

Key Payment Terms to Include

When setting up payment terms, consider including the following elements:

- Payment Due Date: Clearly specify when payment is expected, whether it’s upon completion of the service, within a specific number of days (e.g., 30 days), or after receiving the request.

- Accepted Payment Methods: List the methods you accept, such as bank transfer, credit card, checks, or online payment platforms like PayPal or Venmo.

- Late Payment Fees: State any penalties for overdue payments. For example, you might charge a percentage of the total amount or a flat fee for each day the payment is delayed.

- Discounts for Early Payment: Consider offering a small discount if clients pay early. This can incentivize prompt payment and help ensure faster cash flow.

- Deposits or Advance Payments: For larger jobs or events, require a deposit upfront, with the balance due after the service is rendered. This protects you from cancellations and ensures commitment from the client.

Best Practices for Clear Payment Terms

To make the payment terms easy to understand and avoid disputes:

- Make sure the payment terms are prominently displayed on your billing document.

- Communicate your terms before starting any project or event, so the client is aware of your expectations.

- Send reminders ahead of the due date, particularly for clients who have agreed to longer payment windows.

By clearly defining your payment terms, you not only ensure that you get paid on time, but also maintain a professional reputation and improve client relationships.

Tracking Payment and Expense Records

Effective financial tracking is essential for maintaining a smooth cash flow and understanding the financial health of your business. By keeping track of payments and expenses, you ensure that you’re receiving the compensation you’re owed while also being aware of your out-of-pocket costs. Whether you’re managing multiple clients or working on various projects, an organized system for monitoring payments and expenses can help you stay on top of your finances and avoid misunderstandings.

The first step in tracking payments is recording when and how each payment is made. This includes noting the payment method (e.g., bank transfer, check, credit card) and confirming receipt. It’s important to mark whether a payment was partial or full, and keep a record of any outstanding balances. This information will allow you to follow up with clients who haven’t paid on time and keep an eye on overdue amounts.

Tracking your expenses is just as crucial. From ingredients and supplies to transportation costs and equipment rentals, these expenses should be recorded alongside your income. By documenting both your income and expenditures, you can better assess your profit margins and ensure that you’re pricing your services appropriately. Additionally, keeping a detailed record of expenses helps with tax reporting and business deductions.

There are several tools and methods to help with tracking:

- Spreadsheets: A simple and effective way to track payments and expenses. Using columns for date, amount, client name, and payment status makes it easy to monitor cash flow.

- Accounting Software: Programs like QuickBooks, FreshBooks, or Xero offer more advanced features for managing both payments and expenses, with automated reports and the ability to sync with bank accounts.

- Mobile Apps: Apps such as Wave or Expensify can track your transactions and expenses on-the-go, making it easier to log details immediately after a payment is received or an expense is incurred.

By staying organized and consistent in tracking your payments and expenses, you not only improve your financial management but also position yourself for long-term success and growth in your business.

How to Handle Late Payments

Late payments can disrupt your business operations and create unnecessary stress. Whether it’s a one-time occurrence or a recurring issue, knowing how to handle delayed payments professionally is key to maintaining a positive relationship with clients while ensuring that you’re compensated on time. Clear communication, consistent follow-ups, and enforcing payment terms are all important steps in managing late payments effectively.

When a payment is overdue, the first step is to reach out to the client with a polite reminder. Sometimes, clients simply forget or overlook the payment, and a friendly follow-up can resolve the issue without further complication. Always remain professional and courteous in your communication.

If reminders don’t result in payment, consider implementing more formal follow-ups. Here are some strategies to handle late payments:

- Set Clear Payment Terms: Clearly outline payment expectations before beginning any work, including due dates and penalties for late payments. This sets the tone for a more straightforward process.

- Send Friendly Reminders: Send an email or message as soon as the payment due date passes, politely reminding the client of the outstanding balance and when the payment is expected.

- Establish Late Fees: Include a penalty for overdue payments, such as a percentage fee or flat rate after a certain number of days. This incentivizes clients to pay on time and helps you cover any administrative costs incurred by the delay.

- Offer Payment Plans: If a client is having difficulty paying the full amount at once, offer an installment plan. This can make it easier for clients to pay off their balance while allowing you to receive compensation over time.

Below is a sample of how late fees might accumulate over time:

| Days Late | Late Fee | Total Amount Due |

|---|---|---|

| 1-7 days | 5% of the total amount | $100 + $5 = $105 |

| 8-14 days | 10% of the total amount | $100 + $10 = $110 |

| 15+ days | 15% of the total amount | $100 + $15 = $115 |

In cases where the client continues to ignore payment reminders, consider taking more serious steps, such as sending a formal letter or seeking legal advice. However, always try to resolve the issue amicably before escalating matters, as maintaining a positive working relationsh

Legal Considerations for Billing Documents

When managing payments for services, it is essential to ensure that all financial documents comply with local laws and industry regulations. This includes understanding the legal obligations surrounding payment terms, tax calculations, and documentation requirements. By being aware of these legal considerations, you can protect your business, avoid disputes, and ensure that your financial practices are transparent and lawful.

Here are several legal aspects to consider when creating and sending payment documents:

- Clear Payment Terms: It’s crucial to outline your payment terms clearly before beginning any work. This includes due dates, accepted payment methods, and penalties for late payments. Having these terms in writing ensures both parties are aware of their obligations and helps prevent legal disputes in the future.

- Tax Compliance: Ensure that your payment documents are compliant with tax regulations. This might include adding sales tax, VAT, or other applicable taxes to your charges. Depending on your location, you may need to include your tax ID number or register as a business entity to ensure tax compliance.

- Client Identification: For legal purposes, it’s important to include clear details about the client, such as their full name, business name (if applicable), and contact information. This helps to avoid confusion and ensures proper documentation in case of legal disputes.

- Contractual Agreements: Whenever possible, establish a formal contract with your clients before providing services. This contract should outline the scope of work, payment terms, and any other important details that will form the basis of the financial document.

- Record Keeping: Maintain thorough records of all transactions, including payment documents, contracts, and any communications regarding payments. These records can serve as important evidence in case of legal disputes or audits.

- Late Fees and Penalties: While it’s legal to charge late fees, they should be reasonable and disclosed upfront in your payment terms. Ensure that any fees charged are in accordance with the law and not excessive, as some jurisdictions may regulate the maximum amount that can be charged for late payments.

By taking these legal factors into account, you can ensure that your billing practices are not only professional but also legally sound. This protects both your business and your clients, fostering trust and clarity in your professional relationships.

How a Professional Billing Document Boosts Credibility

A well-crafted financial document not only serves as a tool for payment collection, but also plays a significant role in enhancing your business’s reputation. When clients receive a professional, clear, and accurate payment request, it reinforces your reliability and attention to detail. A high-quality financial document can distinguish you from competitors and build trust with clients, making them more likely to return for future services and recommend your business to others.

Here are some ways a professional financial document can boost your credibility:

- Demonstrates Professionalism: A clean, organized, and properly formatted document reflects your attention to detail and commitment to delivering a high standard of service. Clients are more likely to trust a business that appears professional in all aspects, including financial transactions.

- Builds Trust with Clients: Clients expect transparency and clarity when it comes to financial matters. Providing a well-detailed payment request with clear terms, amounts, and breakdowns shows that you’re honest and straightforward. This builds trust and reduces the chances of misunderstandings or disputes.

- Shows Organization: A consistent and well-structured financial document helps convey that you’re organized and on top of your business affairs. Clients will feel more confident knowing that you track payments and expenses meticulously, which reassures them about their own financial dealings with you.

- Enhances Brand Image: Including your business logo, contact details, and a personalized touch in your financial documents can reinforce your brand identity. It makes your business appear established and adds an extra layer of professionalism that can differentiate you from others in the market.

- Improves Client Relationships: When your financial documentation is clear, your clients can easily understand the terms of payment. This transparency helps establish a positive relationship, making clients feel more comfortable and confident in your services.

By investing in a professional and well-designed financial document, you communicate to clients that your business is reliable, trustworthy, and committed to providing high-quality service. This can go a long way in fostering long-term relationships and boosting your overall reputation in the industry.

Free and Paid Billing Documents for Professionals

When managing payments for services, having access to reliable and efficient tools is crucial for maintaining a professional approach. Whether you’re just starting out or looking to streamline your existing processes, there are both free and paid options available to help create polished financial documents. Each option has its advantages, and understanding the differences can help you choose the best one based on your business needs.

Free Options

Free billing documents are a great way to start if you’re just getting your business off the ground or are working with a limited budget. Many online platforms offer simple, downloadable options that you can easily fill out with your own details. Some of the key benefits of using free options include:

- Cost-effective: No initial investment is required, making it a perfect choice for new businesses or freelance professionals.

- Ease of Use: Most free options are simple to use and require no advanced knowledge of design or finance tools.

- Variety: There are many free resources available, allowing you to choose a design that aligns with your brand or style.

However, free options may lack advanced features, such as automated calculations, recurring billing, or customization. They may also not offer as much professional polish compared to paid alternatives.

Paid Options

Paid solutions generally offer more advanced features and a higher level of customization. If you need a tool that can handle large volumes of transactions, automate tasks, or integrate with other software, a paid option may be the right choice. Some of the benefits of using paid billing systems include:

- Advanced Features: Many paid tools offer automated calculations, tax settings, and reminders for overdue payments.

- Customization: Paid options allow for greater customization, from layout designs to adding your logo or adjusting payment terms to suit your specific needs.

- Support and Updates: With a paid service, you’ll have access to customer support and regular updates to keep your documents up to date with legal requirements or industry standards.

Paid options may come with a monthly or yearly subscription fee, but the features they offer can make them worth the investment, especially for businesses with a larger client base or complex billing needs.

Ultimately, whether you choose a free or paid option depends on your business size, your need for customization, and the complexity of your financial management. Both can provide a solid foundation for managing transactions professionally and efficiently.