Chasing Invoices Template Letters for Quick Payment Recovery

Maintaining a healthy cash flow is crucial for any business. One of the most common challenges faced by companies is ensuring timely payments from clients. When a payment deadline passes, businesses must take action to prompt their customers to fulfill their financial obligations. However, requesting payments can be a delicate task that requires both professionalism and clarity.

Clear communication is key when addressing overdue amounts. A well-crafted reminder can help businesses recover outstanding balances while preserving positive relationships with clients. The right tone, structure, and content in these communications play a vital role in ensuring that the process is efficient and respectful.

In this article, we explore how to create effective reminders that encourage prompt payment without causing friction. You’ll discover various approaches to crafting messages that are both firm and courteous, ultimately helping your business streamline its receivables and minimize late payments.

Why You Need Invoice Reminder Templates

Every business encounters the need to follow up on overdue payments at some point. Without an organized approach, requesting payments can become a time-consuming and often uncomfortable process. Having a ready-made set of professional communication formats simplifies the task, ensuring that reminders are sent promptly and consistently. A well-structured message not only encourages quicker responses but also helps maintain positive client relationships.

Consistency and Professionalism

Using pre-written formats guarantees consistency in the way payment requests are presented to clients. When your communications follow a clear structure, clients are more likely to take them seriously. Each message is crafted to convey a professional tone, ensuring that your business is perceived as organized and reliable.

Time Efficiency and Customization

Time is a valuable resource for any business owner. With ready-made communication formats, you eliminate the need to draft a new message each time a payment is overdue. These formats can be easily customized for individual clients, allowing you to quickly adapt the content to fit specific situations while saving time on repetitive tasks.

Having a set of well-crafted reminders means you can stay on top of your financial operations without delays. You ensure your clients are reminded of their obligations without wasting time on crafting new messages, all while maintaining a professional image.

How Chasing Invoices Helps Improve Cash Flow

Maintaining healthy cash flow is essential for the smooth operation of any business. When payments are delayed, it can disrupt your financial stability and hinder your ability to pay bills, invest in growth, or cover operational costs. By proactively requesting overdue amounts, businesses can recover funds more quickly, preventing cash flow gaps and reducing the risk of financial strain.

Faster Payments Lead to Better Liquidity

Timely reminders push clients to settle their outstanding balances, ensuring your business has the liquidity it needs to function effectively. The quicker payments are received, the less time your business spends in a state of financial uncertainty. By staying on top of overdue payments, you are able to allocate funds to areas that drive growth or improve operations, rather than relying on credit or external financing.

Strengthening Relationships and Trust

When you follow up on overdue payments professionally, clients are reminded of their commitments. Regular, courteous communication helps reinforce trust, showing that your business values timely transactions. Over time, this approach can encourage better payment habits, reducing the likelihood of future delays and contributing to a healthier financial relationship with your customers.

By maintaining a proactive approach to requesting overdue payments, businesses can improve their cash flow, reduce stress over finances, and ensure continued growth and success.

Best Practices for Sending Payment Reminders

Effectively requesting overdue payments requires a strategic approach to ensure timely responses while maintaining good client relations. A well-crafted reminder can help prompt action without damaging the business relationship. Following best practices when reaching out for payments not only increases the chances of quick resolution but also reflects positively on your business’s professionalism.

Be Clear and Specific

When sending a payment reminder, it’s important to provide all necessary details clearly. Include the original amount, due date, and any relevant account or reference numbers. Specificity ensures that the client has all the information needed to make the payment quickly, reducing the likelihood of confusion or delays.

Maintain a Polite and Professional Tone

Regardless of how overdue the payment is, it’s crucial to keep the tone respectful and professional. Avoid sounding confrontational or aggressive. A courteous approach helps maintain a positive business relationship and encourages the client to fulfill their obligations promptly. Being firm yet polite increases the likelihood of a successful outcome.

By adhering to these best practices, you create a smoother and more efficient payment process, ultimately helping to keep your business operations running smoothly and reducing stress over outstanding amounts.

Crafting Professional Invoice Follow-Up Letters

Following up on overdue payments requires a delicate balance between professionalism and firmness. The way you communicate with clients can greatly influence their response time and willingness to settle outstanding balances. A well-written follow-up message not only encourages payment but also reinforces your business’s credibility and reliability.

Key Elements of a Follow-Up Message

To ensure your payment requests are clear and effective, include the following components in your follow-up communication:

- Polite Introduction: Start with a courteous greeting, thanking the client for their business.

- Clear Payment Details: Mention the amount due, original due date, and any other pertinent details (e.g., invoice number, client reference).

- Action Request: Politely but firmly request the payment, specifying how and when you expect the client to make the payment.

- Contact Information: Offer assistance or clarification in case there are any issues with the payment process.

- Friendly Closing: Close the message professionally with appreciation for their prompt attention to the matter.

Maintaining a Professional Tone

While it’s important to be clear about the urgency of the situation, it’s equally important to maintain a professional and courteous tone throughout your follow-up. Use respectful language and avoid sounding accusatory, even if the payment is significantly overdue. This approach helps keep the client relationship intact, while still pressing for timely payment.

By incorporating these essential elements and maintaining a professional tone, you’ll increase the likelihood of receiving the payment promptly while preserving strong relationships with your clients.

Common Mistakes in Chasing Unpaid Invoices

When requesting overdue payments, businesses often make several mistakes that can hinder the collection process or damage client relationships. It’s essential to approach the situation carefully, maintaining professionalism while ensuring clear communication. Avoiding common errors can help expedite the payment process and preserve long-term business partnerships.

Typical Pitfalls in Payment Requests

Here are some frequent mistakes to watch out for when seeking outstanding payments:

- Delaying Follow-Up: Waiting too long before contacting clients can make the payment request seem less urgent, allowing the issue to escalate.

- Being Vague: Not providing sufficient details, such as the original amount due or the payment deadline, can confuse the recipient and delay action.

- Lacking a Clear Call to Action: Failing to specify what steps the client should take or how to resolve the issue can lead to inaction.

- Using Aggressive Language: An overly harsh tone can strain the relationship with the client and may even discourage them from settling the amount.

- Ignoring Client Communication: Not responding to client inquiries or concerns during the follow-up process can leave them feeling disregarded and reduce the chances of prompt payment.

How to Avoid These Mistakes

By addressing these common mistakes, you can improve the effectiveness of your payment reminders and maintain positive business relationships. Prompt, clear, and professional communication is the key to ensuring timely payments and avoiding future delays.

How to Personalize Your Payment Reminder Templates

Personalization is a key element in effective payment reminders. A generic, impersonal message may come across as robotic and fail to engage the recipient. By customizing your follow-up messages, you can create a more meaningful connection with the client and increase the likelihood of receiving payment quickly. Personalizing your communication shows clients that you value them, which can lead to better responses and long-term business relationships.

Steps to Personalize Payment Reminders

To make your payment requests more personalized, consider the following tips:

- Use the Client’s Name: Addressing the recipient by name makes the message feel more personal and less like a mass communication.

- Reference Specific Details: Mention specific aspects of the transaction, such as the product or service provided, invoice number, or due date. This shows that the reminder is tailored to their particular situation.

- Maintain a Friendly Tone: Use polite and warm language while still conveying the importance of the payment. A friendly tone can help soften the request without losing urgency.

- Offer Assistance: Inquire if there are any issues with the payment or the service provided, showing that you’re open to resolving potential concerns and making the process smoother for the client.

- Be Flexible with Payment Terms: If possible, offer options for payment extensions or alternative payment methods. This shows understanding and can increase the chances of the client responding positively.

Why Personalization Matters

Personalizing your payment reminders helps to build trust and maintain a positive rapport with clients. It also reduces the chances of the message being ignored, as recipients are more likely to respond to something that feels tailored to their needs. By taking the extra step to personalize your communication, you show professionalism and attentiveness, which can foster stronger business relationships and ensure timely payments.

When to Send a Second Invoice Reminder

Following up on unpaid amounts requires careful timing to ensure that your reminders are effective without being overly aggressive. While an initial reminder is important, there often comes a time when a second communication is necessary. Sending a second request at the right moment can help move the process along and encourage clients to settle their outstanding balances.

Timing Your Second Reminder

The timing of your second follow-up message is crucial. Sending it too soon may seem rushed, while waiting too long could cause the client to forget about the overdue payment. Ideally, the second reminder should be sent:

- 7 to 14 days after the first reminder: This allows the client enough time to process the first request, while still keeping the issue fresh in their mind.

- When the payment is 30-45 days overdue: If no payment has been received after the first communication, a follow-up reminder becomes more urgent, yet should still remain polite.

Content of the Second Reminder

Your second reminder should include all necessary details from the first, including the amount due, the original due date, and payment instructions. However, it’s important to adopt a slightly firmer tone than the first message while remaining professional. Be sure to reiterate the importance of settling the balance promptly to avoid further delays or complications.

By waiting an appropriate amount of time and crafting a well-worded second request, you increase your chances of receiving payment without damaging your relationship with the client.

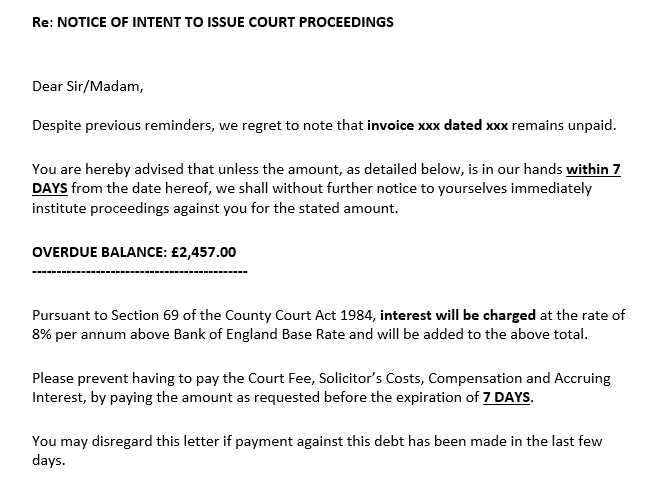

Legal Considerations for Invoice Chasing Letters

When requesting overdue payments, it’s important to understand the legal framework surrounding payment reminders. Although you have the right to pursue outstanding amounts, there are certain laws and regulations that govern how you can communicate with clients. Ensuring that your payment requests are legally compliant not only helps avoid disputes but also protects your business from potential legal repercussions.

First, it’s crucial to avoid any language that could be perceived as threatening, harassing, or coercive. The tone of your reminders should remain polite and professional at all times. Harassment laws in many countries prevent businesses from making excessive or inappropriate demands for payment. Additionally, you must respect privacy laws and refrain from disclosing payment details to third parties without consent, unless required by law.

Another important consideration is the timing and frequency of your payment reminders. Some jurisdictions have specific rules about how often you can contact a client about a debt and the methods you can use (e.g., email, phone calls). Overly aggressive collection efforts may lead to legal action from the client, which could harm your business’s reputation and result in financial penalties.

Before sending any payment demands, it’s advisable to familiarize yourself with the local laws governing collections, including consumer protection regulations, and, when in doubt, consult with a legal professional. By understanding the legal boundaries of debt collection, you can ensure that your actions are both effective and compliant, minimizing risks while maximizing the chances of recovering the outstanding amount.

How to Avoid Damaging Client Relationships

When requesting overdue payments, it’s essential to strike a balance between firmness and respect. While you need to ensure timely payments for your business, it’s also crucial to maintain positive relationships with clients. Aggressive or poorly timed payment reminders can strain connections and lead to dissatisfaction. By following thoughtful communication practices, you can recover outstanding amounts while preserving trust and fostering long-term partnerships.

Tips for Maintaining a Positive Relationship

To avoid damaging your relationship with clients while addressing overdue balances, consider the following strategies:

| Strategy | Why It Helps |

|---|---|

| Be polite and professional | Maintains respect and reduces the chance of offending the client, keeping the relationship intact. |

| Be clear but gentle | Ensures the client knows what is expected without feeling pressured or attacked. |

| Offer payment options | Shows flexibility and understanding, increasing the likelihood of a timely response. |

| Keep communication lines open | Allows clients to express concerns or issues, promoting a collaborative approach to resolving any issues. |

Why Empathy Matters

While it’s important to be firm about payments, showing empathy toward your clients’ situations is just as critical. Many clients may face temporary cash flow issues or have internal processes that delay payment. By acknowledging these challenges, you demonstrate understanding, which strengthens your relationship and encourages clients to prioritize your business. A little empathy can go a long way in building trust and ensuring future collaborations.

By implementing these strategies and maintaining an empathetic, clear, and professional approach, you can recover overdue amounts without jeopardizing the relationship with your clients.

Key Elements of an Effective Payment Reminder

When requesting overdue payments, the effectiveness of your communication plays a crucial role in encouraging timely action. A well-structured and clear reminder increases the chances of receiving payment promptly while maintaining a professional relationship with the client. To ensure success, there are several key elements that should be included in any payment request.

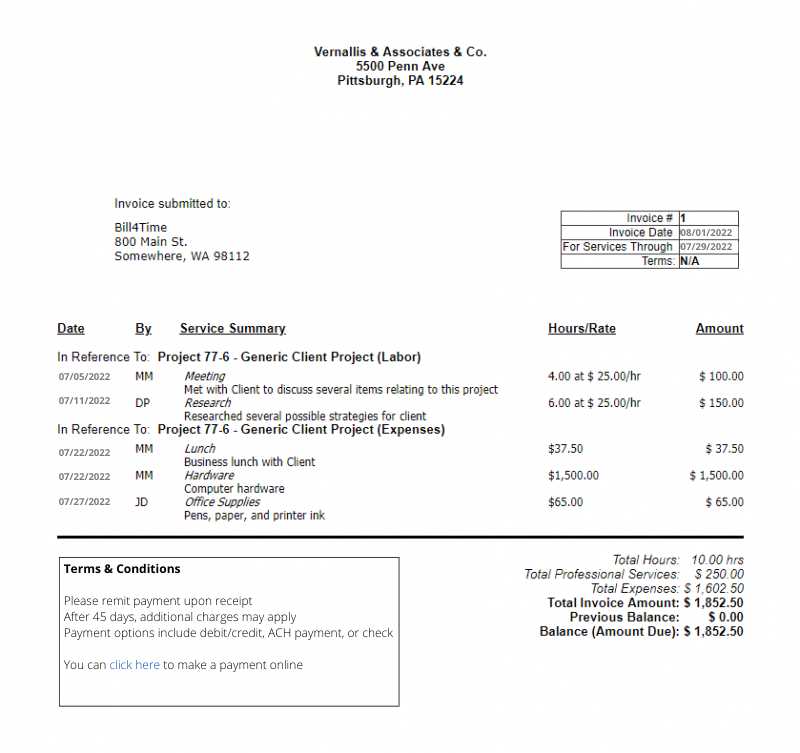

1. Clear Payment Details

It’s important to provide all relevant details about the outstanding amount to avoid confusion. A precise breakdown helps the recipient understand exactly what they owe and why. Make sure to include:

- The amount due: Specify the total balance that remains unpaid.

- Due date: Clearly state the original payment deadline to remind the client of the overdue status.

- Invoice or reference number: Including these details ensures the recipient can easily identify the transaction in question.

2. Polite and Professional Tone

The tone of your message should remain polite and respectful at all times. While it’s important to be clear about the urgency of the situation, using aggressive or harsh language can damage relationships. Maintain a professional yet courteous tone throughout the reminder to ensure the recipient feels respected and valued.

Firm but courteous language is essential in encouraging payment while keeping the conversation amicable and open. A positive, collaborative approach often yields better results than an aggressive one.

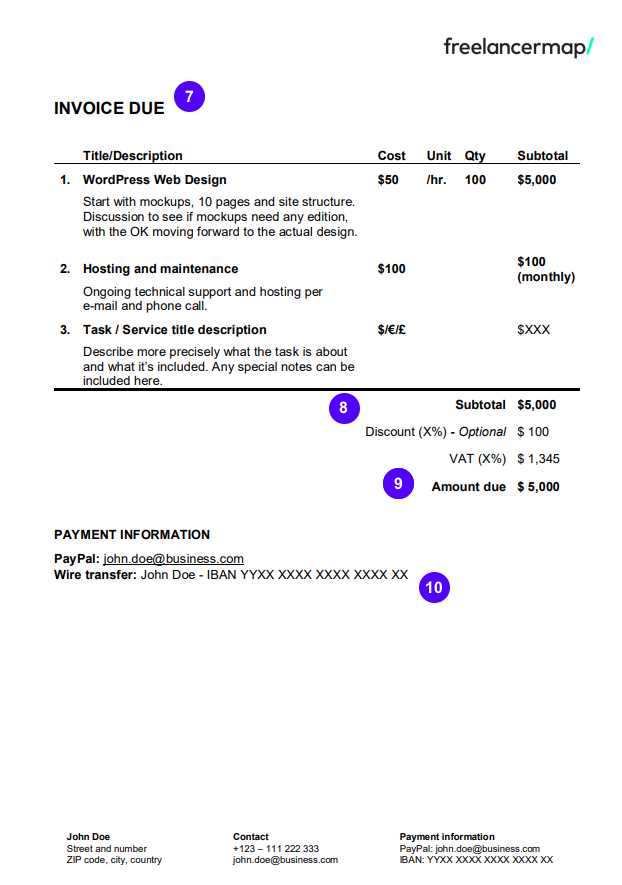

3. Clear Instructions for Payment

Make it easy for the recipient to pay by providing clear instructions on how to settle the balance. This might include details such as:

- Payment methods accepted: Whether through bank transfer, credit card, or other options.

- Account details: Ensure that the necessary banking or payment information is provided for easy reference.

- Contact information: In case the client has questions or concerns, provide a way to contact you easily.

4. A Strong but Polite Request

End the message with a polite but firm request for payment. Let the client know that their prompt action is appreciated and necessary. It’s also a good idea to set a new payment deadline, if appropriate, to create a sense of urgency.

By including these key elements–clarity, professionalism, clear payment instructions, and a firm but polite request–you create a payment reminder that encourages prompt action without damaging yo

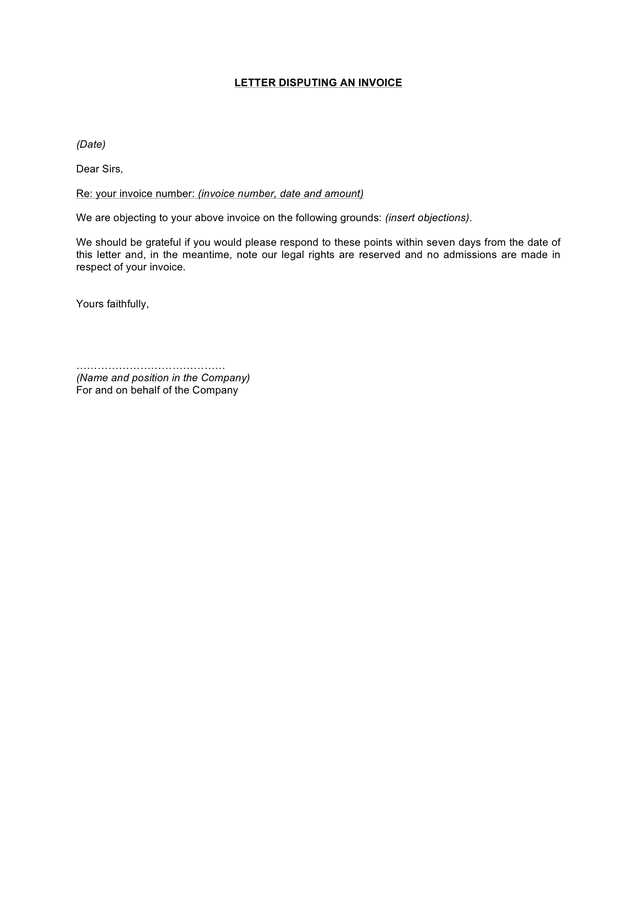

How to Handle Disputed Invoices in Letters

Disputes over outstanding payments can arise for various reasons, from misunderstandings to disagreements over the amount owed. When faced with such situations, it’s important to approach the matter calmly and professionally. Addressing disputes effectively through written communication is key to resolving the issue amicably while maintaining a positive relationship with the client. Understanding how to handle these situations can help avoid escalation and ensure that both parties come to a fair agreement.

1. Acknowledge the Dispute Respectfully

Start by acknowledging the client’s concern in a respectful and understanding manner. It’s important to show that you’re open to resolving the issue. Acknowledge the dispute without placing blame, and assure the client that you are willing to review the details together. For example:

“We understand that there seems to be some confusion regarding the amount owed, and we appreciate you bringing this to our attention. We are more than happy to review the details and work together to reach a resolution.”

2. Provide Clear and Detailed Information

After acknowledging the dispute, provide a clear breakdown of the charges in question, along with any supporting documentation that justifies the amount owed. This helps clarify any misunderstandings and demonstrates that you have a valid reason for the payment request. Include relevant details such as:

- Specific services or products provided: Clarify exactly what was delivered and when.

- Contractual terms or agreements: Reference any signed agreements or terms that support the charges.

- Previous communications: Mention any prior discussions or approvals that may have been given.

Being transparent about the transaction can help the client understand the reason for the payment and work toward resolving the dispute swiftly.

3. Offer a Solution or Compromise

If the dispute is valid, be prepared to offer a fair solution or compromise. Whether it’s adjusting the amount owed or extending the payment deadline, demonstrating flexibility can help maintain goodwill and strengthen the business relationship. Let the client know that you are open to negotiating a solution that works for both parties.

By approaching disputed payments in a calm, respectful, and transparent manner, you can resolve conflicts efficiently while preserving a positive relationship with the client. Effective communication

What to Include in an Overdue Invoice Letter

When addressing overdue payments, it’s important to craft a clear, professional, and respectful communication that encourages prompt action while maintaining a good relationship with your client. The content of your reminder should be straightforward, with all the necessary details to help the recipient understand the situation and act accordingly. Ensuring that your message includes the right elements will increase the likelihood of a positive outcome and minimize misunderstandings.

1. Clear Identification of the Debt

Start by clearly identifying the outstanding balance in question. Mention the specific amount owed, and be sure to include any relevant reference numbers, such as the original bill number or the contract number, to avoid confusion. This will help the recipient quickly recognize the purpose of your communication. Key details to include:

- Outstanding amount: Clearly specify the total balance due.

- Invoice or reference number: Include identifiers like the invoice number or purchase order number.

- Original due date: Remind the client of the payment due date to highlight the overdue status.

2. A Polite and Professional Tone

While it’s essential to convey the urgency of the situation, it’s equally important to maintain a polite and professional tone throughout the letter. Avoid using harsh or confrontational language, which could damage the client relationship. A respectful tone encourages a cooperative response and shows that you value the client, despite the payment delay. Some useful phrases might include:

“We kindly request that you settle the outstanding amount at your earliest convenience.”

3. Clear Payment Instructions

Make it as easy as possible for the client to make the payment by including clear instructions. Provide details on the available payment methods, such as bank transfer or online payment platforms. If there are specific steps to follow, such as including a reference number with the payment, make sure to mention this as well.

- Payment methods accepted: Specify how the payment can be made (e.g., bank transfer, credit card, etc.).

- Bank account or payment details: Provide any necessary information such as account numbers or payment links.

- Contact information: Offer a way for the client to reach you in case there are any issues or questions regarding the payment.

4. A Clear Request for Payment

End the letter with a clear request for the payment to be made by a specific date. Set a new deadline if necessary, and encourage the client to act promptly. While it’s important to maintain a friendly tone, making it clear that timely payment is necessary helps emphasize the importance of resolving the issue without further delay.

By including these key elements–clear identification of the debt, a polite tone, detailed payment instructions, and a firm request for payment–y

How to Write Polite but Firm Payment Requests

When it comes to requesting overdue payments, it’s essential to strike the right balance between professionalism and assertiveness. While you want to ensure that the client understands the importance of timely payment, it’s equally important to maintain a respectful and courteous tone. Writing a polite but firm request helps maintain positive client relationships while still conveying the necessity of settling the outstanding amount.

1. Start with a Friendly Greeting

Begin your request on a positive note by addressing the client warmly. A polite greeting sets the tone for a respectful exchange and shows that you are coming from a place of professionalism. Even if the payment is overdue, your language should be courteous and non-confrontational. For example:

- Example: “Dear [Client Name], I hope this message finds you well.”

- Example: “I trust everything is going well with your business.”

2. Clearly State the Purpose

Be straightforward about the reason for your communication. Clearly mention the outstanding payment, the amount due, and the original due date. This ensures there is no confusion about the purpose of the message. Make the request clear but gentle, so the client understands the situation without feeling rushed or pressured. For example:

- Example: “We noticed that the payment of [amount] for [service/product] was due on [due date] and has not yet been received.”

- Example: “I wanted to follow up regarding the outstanding balance of [amount] for invoice [invoice number].”

3. Set a New Deadline for Payment

It’s important to be firm by suggesting a reasonable deadline for payment. Providing a specific date for payment encourages the client to take action promptly while still being respectful. You can also give them an option for discussion if needed. For instance:

- Example: “We kindly ask that the payment be processed by [new deadline] to avoid any further delays.”

- Example: “Please make arrangements to settle the amount by [date], and let us know if there are any issues with this timing.”

4. Offer Payment Options

Offering different payment methods can make it easier for the client to settle the balance. Be clear about the available options and provide any necessary instructions. This shows flexibility and may encourage quicker payment. For example:

- Example: “You can make the payment via bank transfer, credit card, or our online payment portal. Please find the details below.”

- Time efficiency: Automated tools send reminders without requiring constant manual intervention.

- Consistency: Ensures that reminders are sent on schedule, reducing the chances of delays or missed follow-ups.

- Personalization: Many tools allow you to customize messages, so clients receive personalized reminders even in an automated process.

- Reduced administrative workload: Automating follow-ups frees up time for other important tasks, such as client service or new business development.

- Customizable messages: The tool should allow you to personalize the content to reflect your brand voice and the nature of the payment issue.

- Scheduling options: Look for a system that allows you to set up reminders based on specific intervals (e.g., 7, 14, 30 days after the due date).

- Multiple communication channels: Ideally, the tool should support various communication channels, such as email, SMS, or even automated phone calls, to reach clients through their preferred method.

- Payment integration: The tool should be able to integrate with payment gateways or systems, enabling clients to pay directly from the reminder message.

Leveraging Automated Tools for Invoice Follow-Ups

In today’s fast-paced business environment, staying on top of outstanding payments can be time-consuming and tedious. Thankfully, automated tools can help streamline the process of reminding clients about overdue balances, reducing the manual effort involved and ensuring timely follow-ups. By using automation, businesses can efficiently manage payment reminders while maintaining a professional tone and saving valuable time.

1. Benefits of Automation for Payment Reminders

Using automated systems for payment follow-ups offers several key benefits. These tools can save time, reduce the risk of human error, and help maintain consistent communication. Some of the advantages include:

2. Key Features to Look for in Automated Tools

When selecting an automated follow-up tool, it’s important to choose one with the right features to meet your business needs. Here are some essential features to consider:

3. How to Implement Automated Follow-Ups in Your Workflow

Integrating an automated tool into your payment reminder workflow is simple, but requires some planning. Here are a few steps to help you get started:

- Select the right tool: Choose an automation platform that suits your business size and requirements. Some popular tools include FreshBooks, QuickBooks, and Zoho.

- Set up your payment schedule: Configure the system to send follow-ups at the right intervals. You can start with a gentle reminder, then increase the urgency if needed.

- Customize your message: Tailor the content to be polite, clear, and professional. Most tools allow you to save templates that can be reused.

- Track and analyze results: Use reporting features to monitor the success of your reminders, including payment collection rates and any client responses.

4. Overcoming Challenges with Automated Tools

While automation can significantly improve efficiency, there are a few challenges to keep in mind. Some clients may prefe

Importance of Clear Payment Terms in Letters

Clear payment terms are crucial for avoiding misunderstandings and ensuring timely payment. When terms are explicitly stated, both parties know exactly what to expect, reducing the likelihood of disputes. By defining payment expectations from the beginning, businesses can foster positive relationships with clients while safeguarding their own cash flow. This clarity helps manage expectations and creates a professional framework for transactions, ensuring that both sides are aligned on their obligations.

Key Elements of Payment Terms

Effective payment terms are not just about specifying an amount due but also about defining when and how that payment should be made. Here are some critical components that should be included in any communication regarding payment expectations:

| Element | Description |

|---|---|

| Payment Amount | Clearly state the total amount owed, including any applicable taxes or fees, to avoid confusion. |

| Due Date | Specify the exact date by which payment should be received. This helps establish a clear timeline for both parties. |

| Payment Methods | Detail the acceptable methods of payment (e.g., bank transfer, credit card, online payment platforms) to make the process easy for the client. |

| Late Payment Penalties | If applicable, outline any fees or interest that will be charged if the payment is not made by the specified due date. |

| Dispute Resolution Process | Include steps for resolving any payment disputes to avoid unnecessary delays or complications. |

Benefits of Clear Payment Terms

Setting clear payment terms from the outset brings several advantages:

- Prevents Misunderstandings: When clients know exactly when and how to pay, there is less chance of confusion about deadlines or amounts.

- Encourages Timely Payments: Clear deadlines and payment methods make it easier for clients to comply with your expectations, ensuring you get paid on time.

- Protects Your Business: Well-defined terms provide a solid basis for taking action if payment is delayed, whether that’s charging late fees or taking legal steps if necessary.

- Promotes P

Tracking Your Invoice Reminder Success Rate

Monitoring the effectiveness of your payment follow-up process is essential for improving cash flow and ensuring timely settlements. By keeping track of how well your reminders are performing, you can identify trends, adjust your approach, and fine-tune your strategy. Knowing your success rate helps you understand what works and what doesn’t, ultimately leading to more efficient collection practices.

Key Metrics to Measure Success

To accurately track the success of your follow-up efforts, it’s important to focus on several key performance indicators (KPIs). These metrics give you valuable insights into how well your payment reminders are resonating with clients and whether they are driving the desired results:

Metric Description Response Rate The percentage of clients who respond to your reminder, either by making a payment or providing an explanation for the delay. Payment Completion Rate Measures how many clients actually settle their balance after receiving a reminder, reflecting the effectiveness of your request. Average Time to Payment The average time it takes for clients to make a payment after receiving a follow-up message. A shorter time indicates greater effectiveness. Late Payment Fee Revenue If applicable, track the revenue generated from late payment penalties as an indicator of both the urgency of your reminders and client compliance. Improving Your Success Rate

Once you’ve collected data on these key metrics, you can take action to improve the effectiveness of your payment reminders. Here are a few strategies to increase your success rate:

- Timing Adjustments: Analyze the response time for reminders and experiment with different sending intervals to find the most effective timing for each client.

- Message Customization: Tailor your follow-up messages based on client history or previous interactions, maki