Catering Invoice Templates for Streamlined Billing

Running a successful food service business involves more than just preparing great meals; it requires an organized approach to managing financial transactions. One of the most essential aspects of this process is ensuring clear and accurate records for all services rendered. Using structured documents to detail charges, terms, and services can help streamline the payment process and reduce errors.

By utilizing pre-designed formats tailored for food-related businesses, you can easily generate professional documents that meet both your needs and those of your clients. These documents not only improve efficiency but also help establish trust and professionalism in your transactions. Whether you’re managing events, deliveries, or other services, having a reliable way to track payments is crucial.

Adopting such solutions not only saves time but also ensures that all relevant information is included, from service descriptions to pricing breakdowns. This approach simplifies the billing cycle and helps maintain a smooth cash flow for your business.

How to Create a Billing Document for Food Services

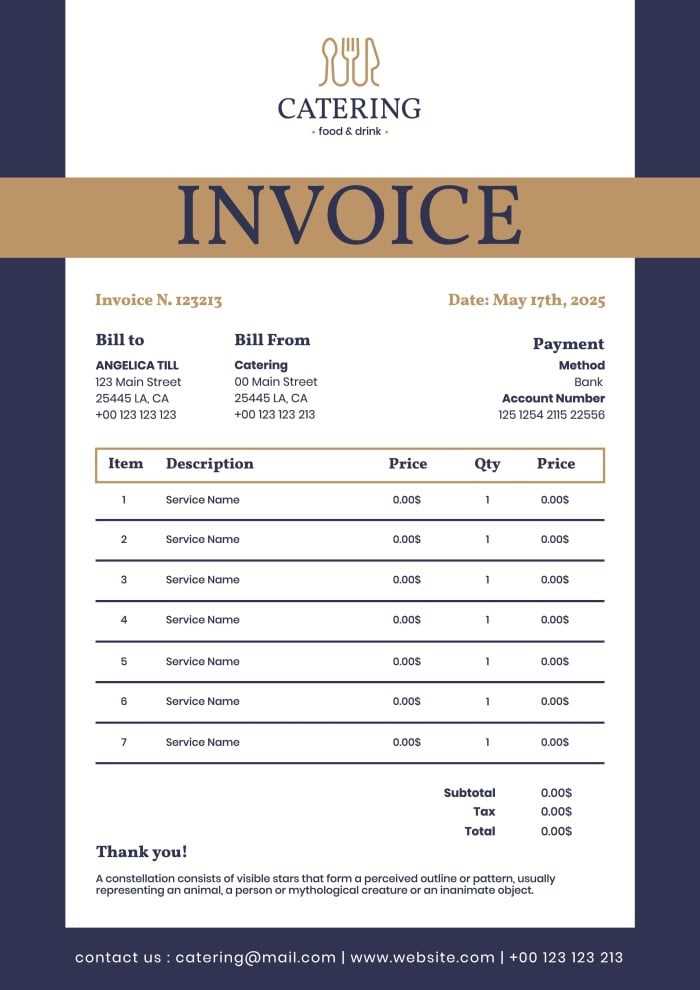

Creating a well-structured payment record is an essential step in any food-related business transaction. A clear and organized document ensures that both parties understand the terms of the service, including the total cost, payment methods, and any additional fees. The process of creating this type of record is straightforward when following a few key steps.

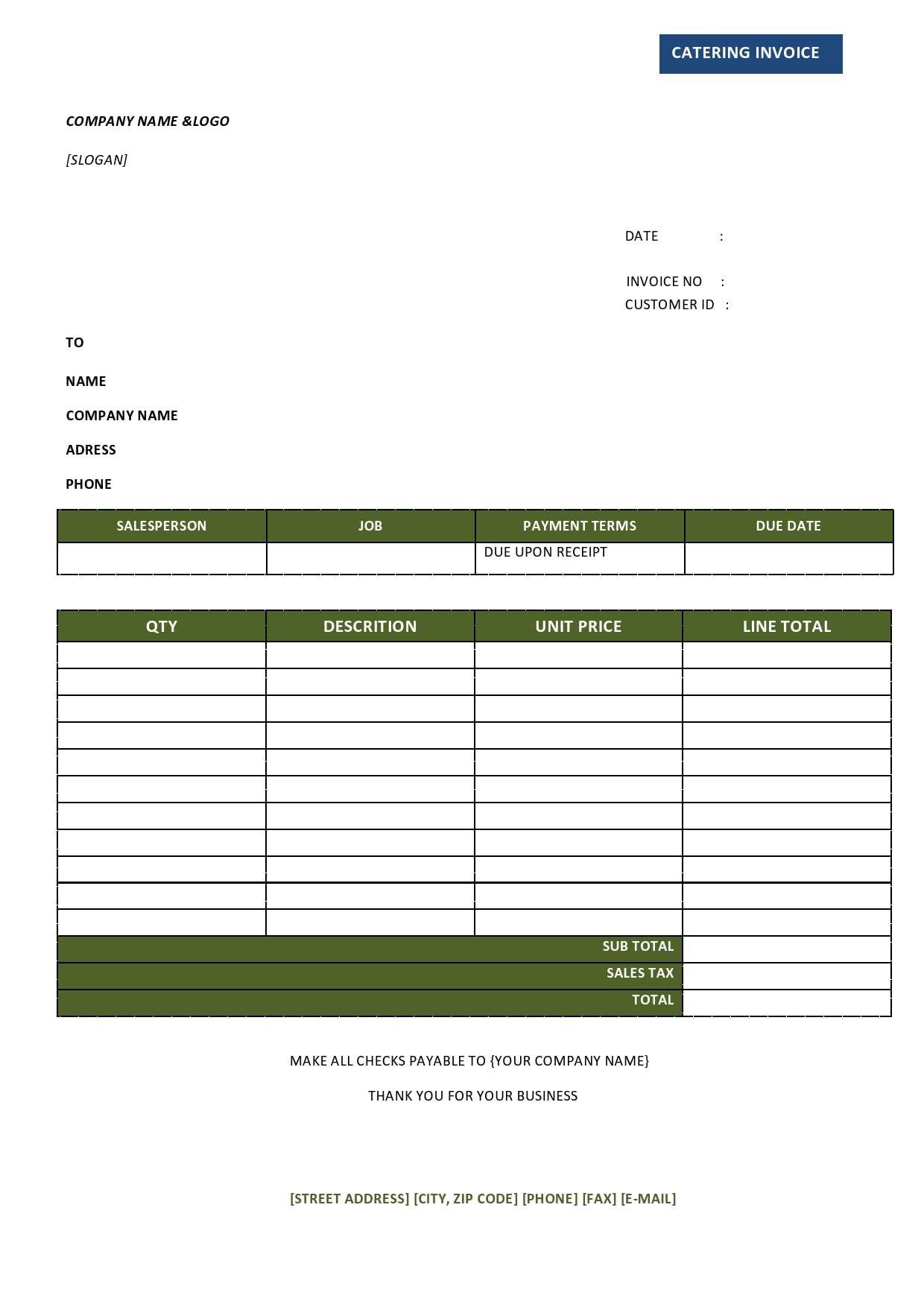

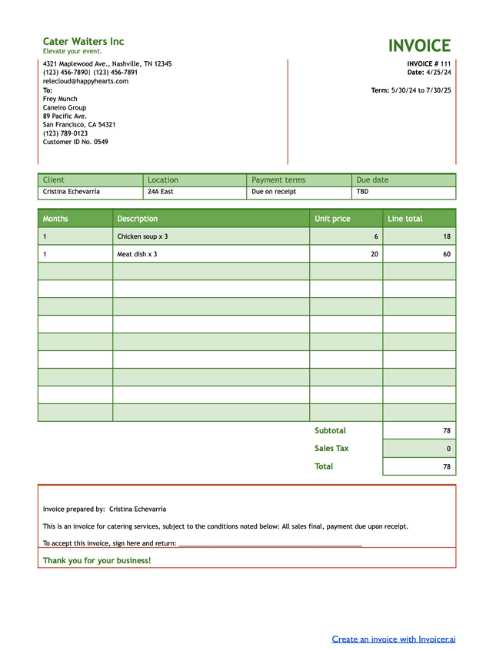

Begin by including the basic details of your business and the client’s information. This sets the foundation for the document, making it easy to identify both parties. Next, you’ll list all the services provided with a clear breakdown of each item’s cost. This level of transparency helps avoid any confusion later. Finally, include the payment terms, due date, and any special instructions to ensure a smooth transaction.

Here’s a simple structure to follow:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Food Service A | 1 | $100 | $100 |

| Food Service B | 2 | $50 | $100 |

| Total | $200 |

By following this format, you can easily create clear and professional billing records for your clients. This helps maintain organization and transparency throughout the business relationship, leading to smoother transactions and better client trust.

Essential Features of Billing Documents for Food Services

For any food service business, a payment record must contain key information that ensures clarity and avoids confusion. It should be detailed enough to reflect the full scope of the service provided while being easy to read and understand. The main goal is to create a document that both parties can use to confirm the terms of the transaction.

Key Information to Include

- Business and Client Details: Clearly list the names, addresses, and contact details of both the service provider and the client.

- Service Description: A detailed list of the food services provided, including quantities, unit prices, and total amounts.

- Payment Terms: Specify when the payment is due, any late fees, and accepted payment methods.

- Unique Reference Number: Including a reference number or code makes it easier to track the record in case of disputes or future queries.

Additional Important Elements

- Tax Information: Indicate any applicable taxes and break down how they affect the total amount due.

- Itemized Breakdown: For clarity, list each service separately, with prices and quantities for full transparency.

- Special Instructions: Include any custom instructions or agreements related to the transaction, such as delivery terms or dietary restrictions.

By incorporating these elements into your documents, you ensure that all necessary information is provided, making the payment process smoother and reducing the likelihood of misunderstandings.

Benefits of Using Structured Billing Documents

Utilizing pre-designed formats for creating payment records offers several advantages for food service businesses. These structured documents save time, reduce errors, and help maintain professionalism in every transaction. By relying on well-organized systems, businesses can focus more on their services while ensuring accurate financial records.

One of the main benefits is the time saved by using ready-made formats, which eliminates the need to design a new document for each transaction. This efficiency allows you to focus on growing your business without compromising on the quality or accuracy of your financial documentation.

Additionally, these structured formats help minimize errors. With consistent fields for all required details, there’s less room for forgetting important information, which can lead to confusion or payment delays. This consistency builds trust with clients, ensuring clear expectations for both parties.

| Benefit | Description |

|---|---|

| Time Efficiency | Ready-made formats save time by eliminating the need for manual document creation. |

| Consistency | Standardized formats ensure all necessary information is included every time. |

| Accuracy | Pre-designed documents reduce the risk of missing important details or making errors. |

| Professionalism | Well-organized records reflect positively on your business and foster client trust. |

By incorporating these organized systems, food service businesses can streamline their operations while ensuring clear, professional, and error-free payment records for every client.

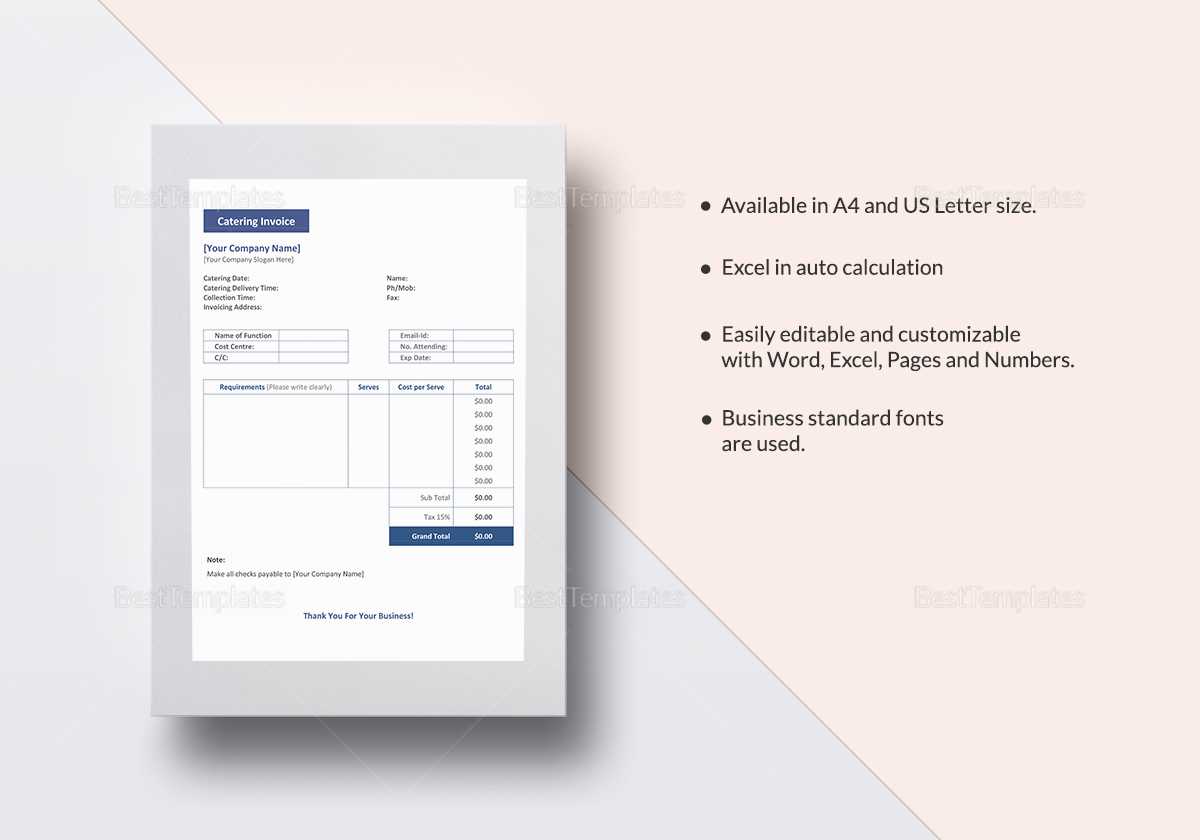

Customizing Documents for Your Business

Adapting pre-designed formats to suit the specific needs of your food service business can help improve efficiency and create a more personalized experience for your clients. Customizing these records allows you to reflect your brand, adjust content for different services, and ensure that all relevant details are included.

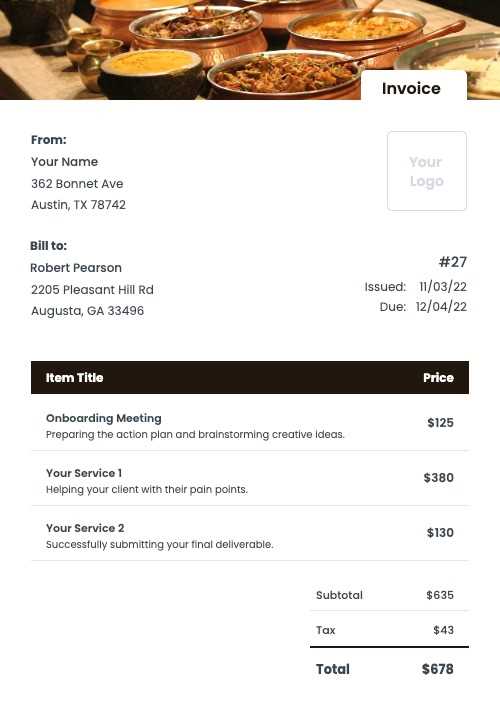

Personalizing the Layout and Design

- Brand Identity: Incorporate your business logo, colors, and fonts to maintain brand consistency across all documents.

- Document Structure: Adjust the order of sections to prioritize what’s most important for your business, such as payment terms or itemized lists.

- Visual Appeal: Use clear headings, bullet points, and spacing to make the document easy to read and professional in appearance.

Modifying Content for Specific Services

- Service Descriptions: Customize the descriptions of your offerings to match the unique features of each event or order.

- Pricing Variations: Adjust pricing fields based on seasonality or the scale of the service provided, allowing flexibility in your billing system.

- Client-Specific Information: Include personalized notes or special agreements relevant to the client’s specific requirements.

By making these adjustments, you ensure that every document reflects the unique nature of your services while maintaining a professional and organized approach to billing.

Common Mistakes in Billing Documents for Food Services

Creating accurate payment records is crucial for maintaining trust and professionalism in your food service business. However, mistakes can occur, leading to confusion, delayed payments, or even strained client relationships. Recognizing and avoiding common errors is essential to ensure smooth financial transactions.

Omitting Essential Information

- Missing Client Details: Failing to include correct client contact information can lead to confusion or delays in communication.

- Incomplete Service Breakdown: Leaving out detailed descriptions or quantities for each item can result in misunderstandings about what was provided and at what cost.

- Neglecting Payment Terms: Omitting clear terms regarding due dates, late fees, and accepted payment methods can create confusion regarding payment expectations.

Calculation Errors

- Incorrect Pricing: Errors in calculating item prices or totals can lead to inaccurate billing, which may harm your business reputation.

- Overlooking Taxes: Forgetting to include taxes or miscalculating the tax amount can lead to legal issues and customer dissatisfaction.

- Double-Counting or Under-Counting: Failing to properly tally quantities or amounts can result in clients being overcharged or undercharged.

By paying close attention to these common mistakes, you can ensure that your payment documents are accurate, clear, and professional, leading to smoother transactions and better client relations.

How to Avoid Billing Errors

Accurate billing is essential for maintaining a smooth workflow and strong client relationships in the food service industry. Mistakes in payment documents can lead to confusion, delays, or lost revenue. By following a few simple practices, you can ensure that your financial records are accurate, clear, and professional.

Double-Check Your Calculations

- Review Totals: Always verify the math in your records to ensure the totals match the prices and quantities listed.

- Confirm Tax Rates: Ensure that the appropriate tax rate is applied correctly to avoid discrepancies.

- Cross-Check Quantities: Double-check the number of items or services listed to prevent overcharging or undercharging.

Maintain Consistency and Clarity

- Standardized Formatting: Use a consistent format for your documents, so all the necessary information is easy to find and review.

- Clear Service Descriptions: Ensure each service is described in detail to avoid confusion about what was provided and at what price.

- Detailed Payment Terms: Include clear payment expectations, including due dates, payment methods, and late fees if applicable.

By adopting these practices, you can reduce the risk of billing errors and maintain clear, accurate records that support the success and professionalism of your business.

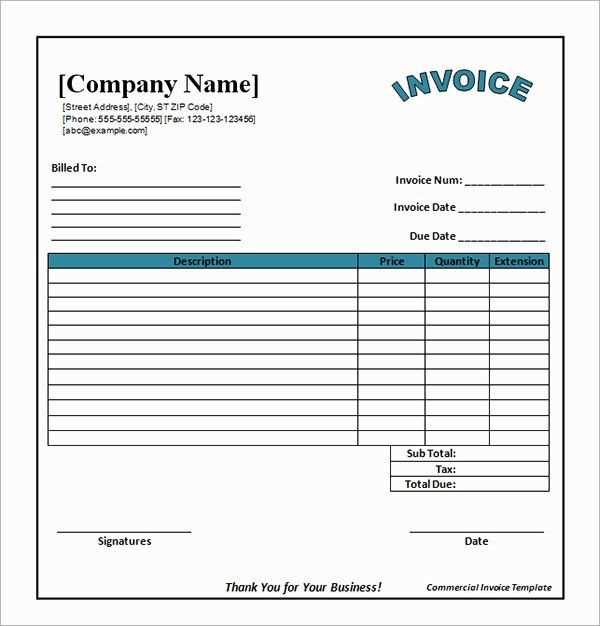

Best Practices for Billing Document Design

Creating a well-structured and visually appealing payment document is essential for ensuring clarity and professionalism. A well-designed document not only communicates essential details but also enhances your business’s reputation. By following a few best practices, you can create documents that are both effective and easy for clients to understand.

Keep It Simple and Clear

- Minimalistic Layout: Use a clean and simple design to ensure the information is easily readable. Avoid clutter and focus on key details.

- Logical Flow: Arrange the information in a logical order, such as client details, service breakdown, totals, and payment terms.

- Legible Fonts: Use clear and readable fonts that are easy on the eyes. Avoid using more than two or three different fonts in one document.

Highlight Important Information

- Use of Headers: Organize sections with clear headers to help clients quickly locate the information they need.

- Bold Key Figures: Make the total amount and due date stand out by using bold text or larger font sizes.

- Color Accents: Use color sparingly to draw attention to important details without overwhelming the reader.

Incorporate Your Branding

- Logo and Brand Colors: Include your company logo and brand colors to make the document recognizable and aligned with your overall branding.

- Custom Design: Personalize the layout to match your business’s style, ensuring consistency across all client-facing materials.

By following these best practices, you can create payment records that are not only functional but also professional and visually appealing, enhancing both the client experience and the efficiency of your business transactions.

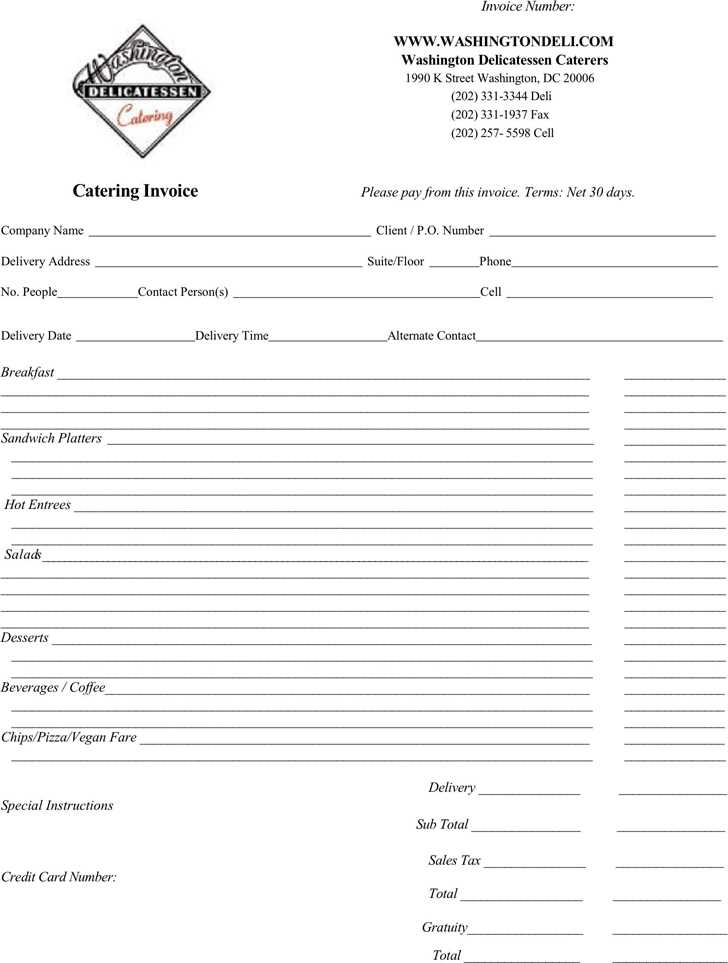

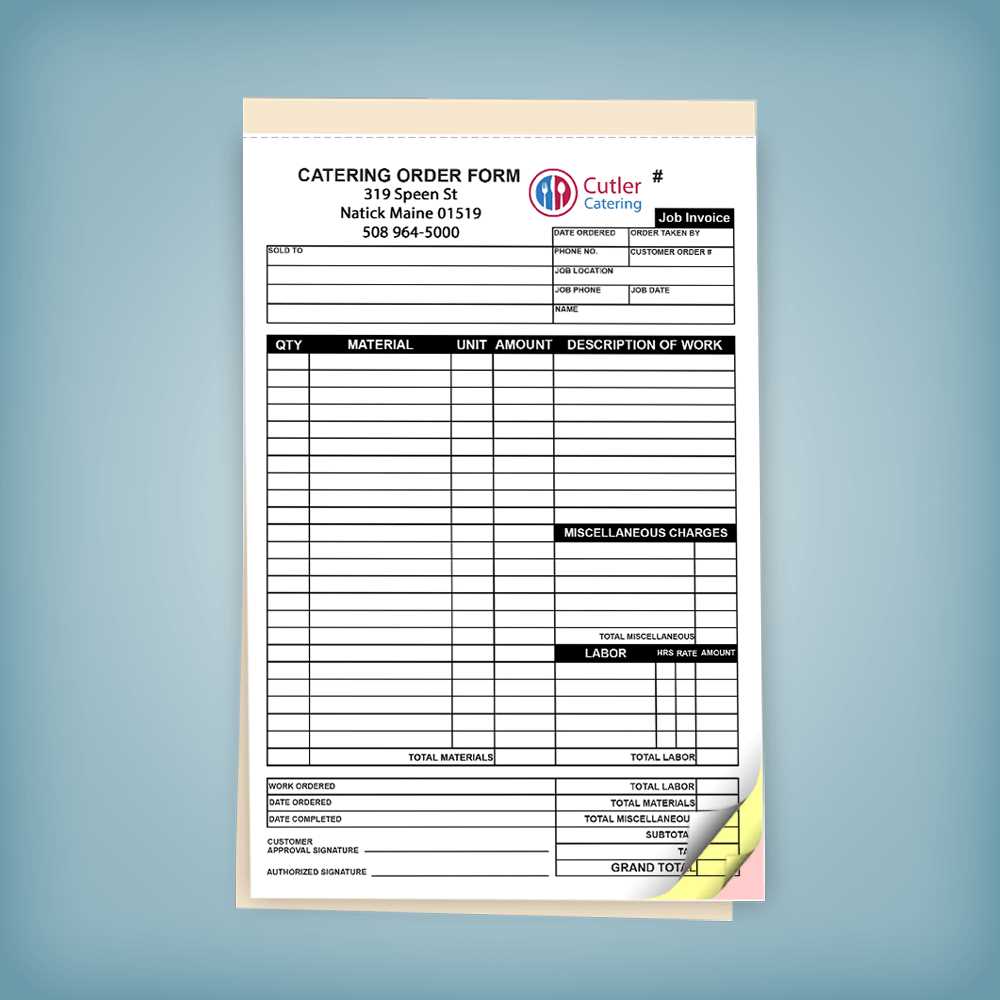

Choosing the Right Billing Document Format

Selecting the correct format for your payment records is essential to ensure that all necessary information is presented clearly and professionally. The right structure can help streamline your administrative process, making it easier for both you and your clients to understand the details. A well-chosen format reflects your business’s efficiency and can help avoid errors or misunderstandings.

Consider factors such as the complexity of the services provided, the number of clients you handle, and how much customization is needed when deciding on the best layout. Simple formats may be ideal for straightforward transactions, while more detailed documents might be necessary for larger, more intricate events. It is also important to choose a format that suits both digital and paper communication methods, ensuring flexibility for your clients.

Ultimately, the right format ensures that your payment records are easy to process, meet your client’s expectations, and support a professional image for your business.

Legal Requirements for Billing Documents

Ensuring that your payment records comply with legal standards is critical for maintaining transparency and avoiding potential disputes. Various legal requirements dictate the structure and content of financial documents in many industries. Understanding and adhering to these guidelines will help protect your business and ensure you meet both tax and contractual obligations.

Essential Information to Include

Each billing document should include specific details to meet legal standards. The inclusion of these elements ensures clarity, accountability, and compliance with tax laws.

| Required Element | Description |

|---|---|

| Business Information | Include your company’s name, address, and tax identification number. |

| Client Information | Include the client’s name, address, and contact details for proper identification. |

| Unique Reference Number | Assign a unique identifier to each document to facilitate tracking and record-keeping. |

| Itemized List | Clearly list services or products provided, along with their respective prices and quantities. |

| Tax Details | Include applicable tax rates and total tax amounts for transparency and legal compliance. |

| Payment Terms | Clearly state payment deadlines, accepted methods, and any late payment fees. |

Regional Variations and Considerations

Be aware that legal requirements may vary depending on your location. Different jurisdictions may have specific regulations about what needs to be included in a billing document, such as VAT details or additional customer information. It’s essential to stay informed about local laws to avoid penalties or disputes.

By ensuring that your documents meet legal requirements, you foster trust with clients and stay compliant with regulations, ultimately contributing to smoother business operations.

Including Tax Information on Billing Documents

Tax compliance is a critical aspect of managing financial records. Including the correct tax details on your payment records ensures that both you and your clients are clear on the applicable charges. Properly displaying tax information helps to maintain transparency and avoid any confusion about the amounts due, as well as ensuring your business remains in line with tax regulations.

Key Tax Information to Include

There are several tax-related details that should always be included on your payment documents to ensure compliance and clarity:

- Tax Rate: Clearly state the tax rate applied to the services or products provided. This can vary based on location or service type.

- Tax Amount: Show the exact amount of tax charged for each line item, as well as the total tax due for the entire document.

- Tax Identification Number: Include your business’s tax ID number to confirm your eligibility to charge tax and to provide proof of tax registration.

- Tax Exemptions (if applicable): If the client is exempt from certain taxes, ensure that the applicable exemptions are clearly stated on the document.

Why Tax Information Matters

By including tax information accurately, you ensure that both you and your client are clear about the financial obligations. This helps to avoid misunderstandings, maintains your business’s compliance with local tax laws, and can even protect you in case of audits or legal inquiries.

Properly displaying tax details not only makes your financial documentation more transparent but also helps to build trust with your clients, demonstrating that your business adheres to legal requirements and operates with integrity.

How to Track Payments for Services

Tracking payments is a vital part of managing finances in any business. By keeping a clear record of all transactions, you ensure that you can quickly identify which amounts have been paid, which are still due, and any outstanding balances. Effective payment tracking not only improves cash flow management but also helps maintain positive relationships with clients by keeping everything organized and transparent.

To effectively monitor payments, it’s important to use a system that allows you to log each payment received, the date it was paid, the payment method, and any remaining balances. This will enable you to stay on top of your accounts and provide clients with accurate information about their payments, ensuring that no payment goes unnoticed.

Payment Record Management Tips for Services

Efficient management of payment records is crucial for any business, especially in service-based industries. Having a streamlined process ensures that all transactions are tracked accurately, payments are collected on time, and financial records remain organized. With proper management, you can avoid common billing errors, reduce delays in payments, and ensure smoother operations overall.

To maintain control over your payment documentation, consider these helpful tips:

- Automate Your Process: Use software to automate the creation, sending, and tracking of payment records. This minimizes human error and saves time, allowing you to focus on other aspects of your business.

- Set Clear Payment Terms: Always define the payment terms up front, including due dates, late fees, and accepted payment methods. Clear communication helps avoid misunderstandings with clients.

- Follow Up on Late Payments: Proactively send reminders to clients with overdue balances. Establish a routine for follow-ups to prevent payments from slipping through the cracks.

- Organize Your Records: Keep your payment records organized by date, client, or service. This allows for easy access when reviewing past transactions or preparing for tax season.

- Keep Clients Informed: Provide clients with detailed and transparent records. Include itemized lists, payment status updates, and any necessary details about previous payments.

By following these simple yet effective tips, you can manage your financial records more efficiently, reduce the likelihood of errors, and ensure that your business runs smoothly with minimal stress.

Automation Tools for Managing Payment Records

Automating the management of payment records can significantly improve efficiency and reduce errors. By utilizing digital tools, businesses can streamline the process of creating, sending, and tracking financial documents. Automation not only saves time but also ensures that every transaction is documented accurately, minimizing the risk of human mistakes and helping you stay organized.

Key Features of Automation Tools

Automation tools typically offer a variety of features designed to simplify the process of managing financial transactions. Some of the key features include:

- Customizable Templates: Tools that allow you to create and save reusable documents for quick generation of new records.

- Automatic Reminders: Sending payment reminders automatically to clients before and after due dates.

- Payment Tracking: Real-time tracking of payments, helping you stay updated on outstanding amounts and paid transactions.

- Integration with Payment Systems: Connecting directly with online payment platforms for easy processing and reconciliation of payments.

Benefits of Using Automation for Billing

By integrating automation into your payment management process, you can reduce administrative workload, increase accuracy, and improve cash flow. Automated systems ensure that you don’t miss deadlines, maintain consistent records, and streamline the follow-up process for late payments. In addition, many tools also provide reporting features, which can be invaluable when preparing for audits or taxes.

Leveraging the power of automation tools will help your business stay organized, efficient, and compliant while freeing up time for more important tasks.

Benefits of Digital Billing Solutions

Digital solutions for managing billing processes offer numerous advantages over traditional paper-based methods. These tools provide businesses with a more efficient, organized, and streamlined way to handle financial transactions. By utilizing digital tools, you can save time, reduce errors, and improve overall business operations.

One of the primary benefits of digital solutions is the automation of routine tasks. With features such as automatic generation and sending of payment documents, you can eliminate manual data entry and reduce the likelihood of mistakes. Additionally, digital records are easier to organize and access, allowing you to quickly retrieve information when needed.

Moreover, digital billing solutions often include features like integrated payment processing, real-time tracking, and easy reporting, helping businesses maintain better control over their finances. These solutions also enhance customer experience, as clients can receive clear, professional-looking documents instantly, with the ability to make payments online without delays.

Overall, adopting digital billing systems can help businesses improve efficiency, increase accuracy, and provide better service to clients, all while reducing the environmental impact associated with paper-based processes.

Integrating Payment Systems with Billing Records

Integrating payment systems with financial documents is a crucial step for modern businesses aiming to streamline transactions and improve cash flow management. This process enables the seamless transfer of data between billing records and payment platforms, reducing manual entry and enhancing accuracy. By combining these tools, businesses can automate the payment collection process, making it quicker and more efficient for both clients and providers.

Here are some key benefits of integrating payment systems with your financial documents:

- Faster Transactions: Payments can be processed instantly through integrated platforms, reducing the time it takes for funds to be received and deposited into your account.

- Reduced Human Error: Automation ensures that payment details are accurately recorded, eliminating mistakes that can occur when manually entering data.

- Improved Tracking: Integration allows businesses to automatically track payments, making it easier to monitor outstanding balances and identify when transactions have been completed.

- Better Customer Experience: Clients can pay directly from the financial record, offering them a convenient and secure way to complete transactions online, without needing to manually transfer payment details.

- Streamlined Reporting: Integrated systems can generate real-time reports, helping businesses track revenue, monitor payment patterns, and ensure that all payments are accounted for correctly.

Incorporating payment systems into your billing process simplifies administrative tasks, speeds up transactions, and ultimately contributes to a more efficient and customer-friendly experience.

How to Streamline Your Billing Process

Streamlining the billing process is essential for increasing operational efficiency and ensuring timely payments. By simplifying and automating key steps in the financial management workflow, businesses can reduce administrative burdens, minimize errors, and enhance customer satisfaction. A streamlined process not only saves time but also helps maintain consistent cash flow, which is vital for long-term success.

Automate Key Tasks

Automation is one of the most effective ways to speed up and simplify your financial processes. By using software to generate and send out financial records, you can eliminate the need for manual data entry. Automated systems can also handle payment reminders, updates, and confirmations, which reduces the risk of human error and ensures that all steps are completed on time.

Consolidate Systems for Easy Access

Centralizing all financial management activities into one platform can drastically improve efficiency. By using an integrated system that handles everything from billing generation to payment tracking, businesses can avoid the need to switch between multiple tools. This reduces confusion, prevents duplication of work, and allows for quicker decision-making.

Key Tips for Streamlining Billing:

- Use recurring billing: For clients with ongoing services, set up automatic billing cycles to save time and ensure timely payments.

- Customize records: Tailor your financial documents to reflect your brand, while still providing all necessary details for clarity and compliance.

- Track payments in real-time: Use tools that allow you to monitor the status of payments instantly, making it easier to follow up when necessary.

By implementing these strategies, you can create a more efficient, transparent, and error-free billing process that benefits both your business and your clients.

Saving Time with Billing Document Templates

Efficiently managing financial records can save a significant amount of time for businesses. By using pre-designed documents for your transactions, you can eliminate repetitive tasks and streamline your workflow. Instead of starting from scratch with each new entry, ready-made layouts allow for quicker data entry, ensuring that all relevant information is captured without unnecessary delays.

Benefits of Pre-designed Documents

Using standardized forms can help reduce the time spent on creating and managing records. These documents often include pre-set sections that cover all the necessary details, such as client information, services provided, and payment terms. As a result, you can simply fill in the specific details for each transaction, rather than worrying about formatting or layout each time.

How to Maximize Efficiency

To get the most out of these documents, it’s essential to choose the right ones for your business needs. Here are some key strategies for maximizing efficiency:

- Personalize and Save: Customize the template to reflect your brand’s logo, contact information, and payment terms. Save this version so you don’t have to make adjustments each time.

- Use Digital Tools: Leverage software that automatically populates your templates with client details from your CRM system. This eliminates the need for manual entry, speeding up the process.

- Set Up Recurring Formats: If you have clients with regular transactions, create templates that automatically adjust for billing frequency, ensuring consistency and reducing effort.

Example of a Basic Layout

| Field | Example |

|---|---|

| Client Name | John Doe |

| Service Provided | Event Planning |

| Total Amount | $500 |

| Payment Terms | Due within 30 days |

By incorporating these methods into your routine, you can ensure that your time is spent more efficiently, allowing you to focus on what really matters–growing your business and serving your clients.

How Templates Improve Efficiency

Using pre-designed documents can greatly enhance productivity in any business. By providing a structured format that includes all essential elements, these ready-made solutions eliminate the need for repetitive tasks and ensure consistency across all transactions. This leads to faster processing times, fewer errors, and a more streamlined workflow, which ultimately frees up valuable time for other important business operations.

Consistency and Accuracy

One of the major benefits of utilizing these ready-made layouts is that they help maintain consistency and accuracy across all business transactions. With fixed fields for key information, such as service descriptions, amounts, and payment terms, there is less chance of missing important details. This reduces the likelihood of mistakes that could otherwise lead to confusion or delays in payments.

Time Savings

By eliminating the need to manually create new documents from scratch for each transaction, businesses save valuable time. Pre-designed formats allow you to quickly input necessary data without worrying about layout or design. The time saved on document creation can then be redirected toward improving client relationships, business growth, and other strategic initiatives.

Additional Benefits:

- Faster Document Creation: Less time spent on formatting allows for quicker turnaround times, especially during high-demand periods.

- Reduced Human Error: Pre-filled fields ensure that common mistakes, like miscalculations or missing information, are less likely to occur.

- Professional Appearance: Ready-made designs ensure that all documents maintain a polished and professional look, reinforcing your business’s credibility.

By integrating these efficient solutions into your workflow, your business will not only save time but also improve its overall operational efficiency and customer satisfaction.