Carrier Invoice Template for Efficient Billing and Easy Customization

Effective billing is essential for smooth operations in any business, especially in industries dealing with transportation, logistics, or freight services. A well-structured billing document ensures clear communication, prevents errors, and helps maintain professional relationships with clients. By using a standardized form, you can easily capture all necessary details and avoid delays in payment processing.

Whether you’re a small business owner or managing a large logistics company, having a consistent approach to billing can save you time and reduce administrative workload. Customizing your documents to suit your specific needs and client requirements can make a significant difference in how efficiently you handle financial transactions. A clear, precise layout also helps to ensure that clients understand the charges and are less likely to dispute the amount due.

In this guide, we’ll explore various options for creating a functional and professional billing document that can be adapted to your business. From understanding the core elements of a billing statement to exploring tools and resources for customization, you’ll learn how to optimize your financial processes for better results.

Carrier Invoice Template for Logistics Companies

For logistics businesses, having a standardized document to track and process payments is crucial for maintaining efficiency and accuracy. A well-designed billing document helps ensure that all necessary information is clearly presented and understood by clients, reducing the likelihood of errors or misunderstandings. This is especially important when dealing with complex services, varying rates, and multiple clients across different regions.

Key Elements of a Professional Billing Document

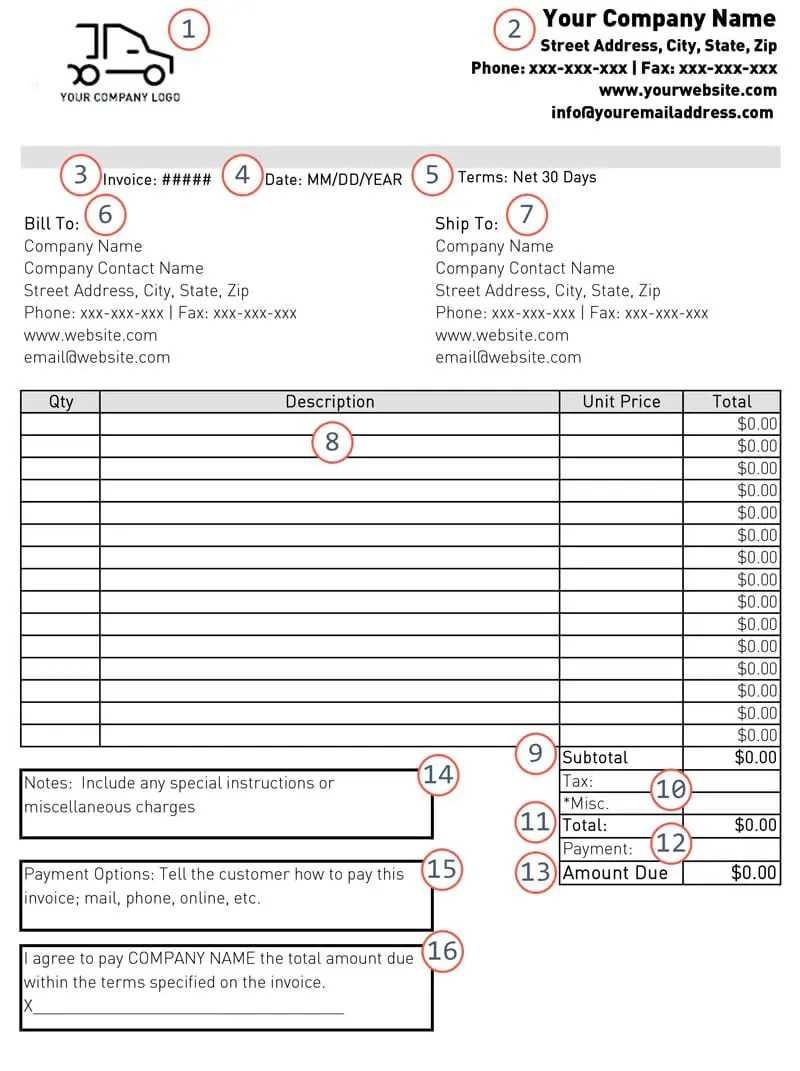

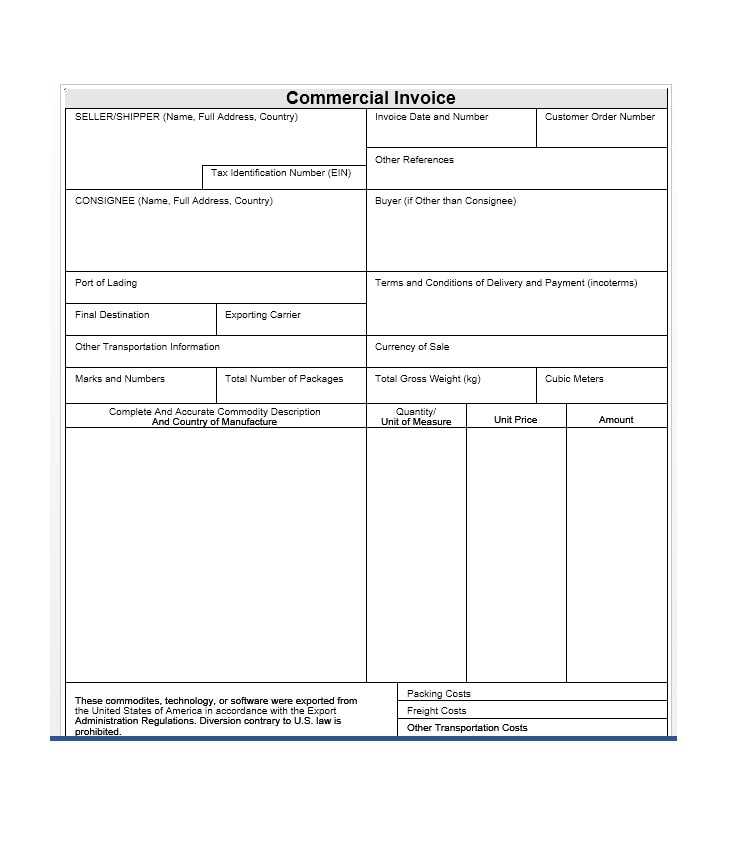

When creating a billing document for your logistics company, it’s essential to include all relevant details that both you and your clients need for smooth financial transactions. Some of the key components to consider are:

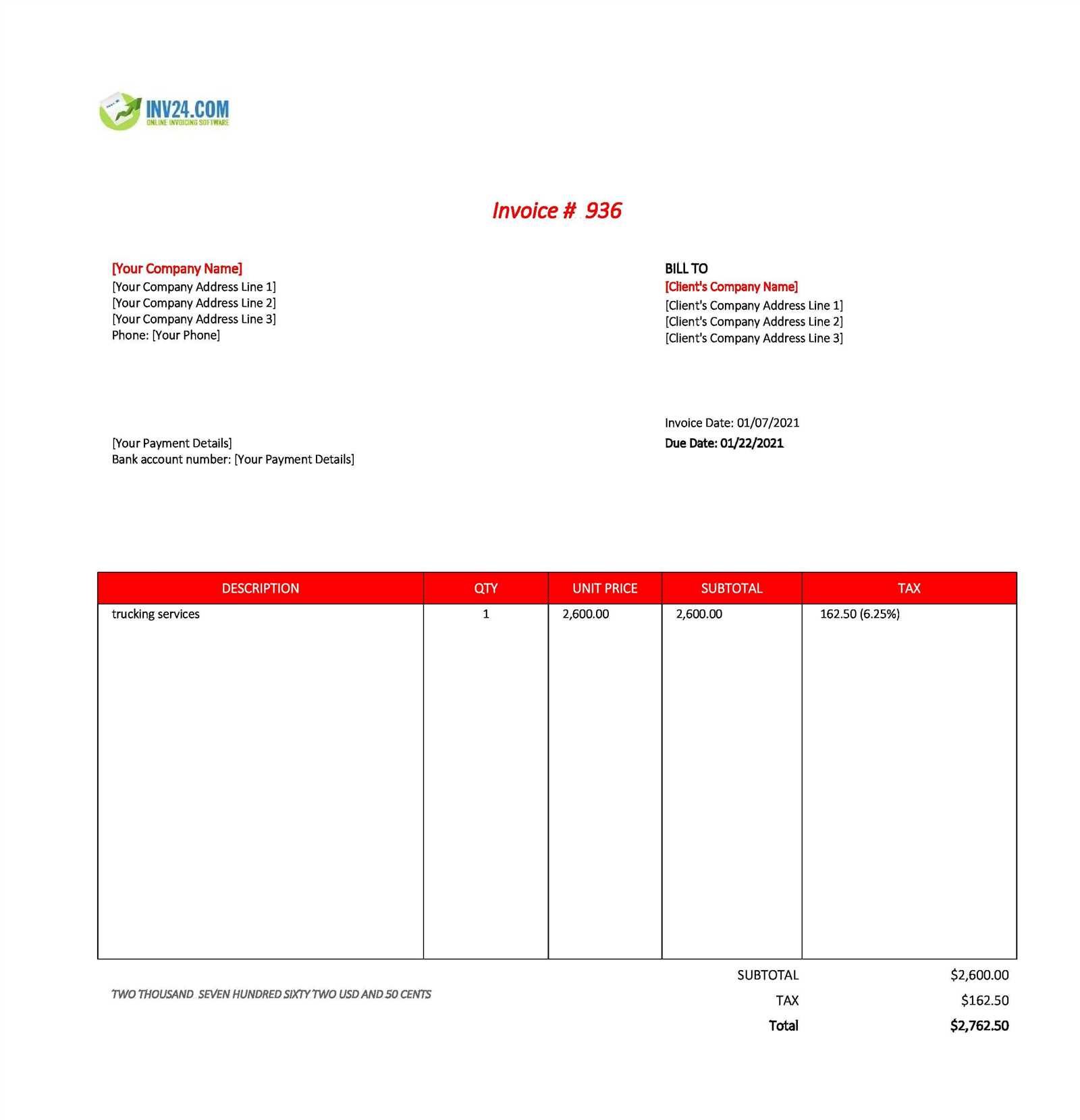

- Service Description: A clear outline of the services provided, including specific shipments, routes, or special handling requirements.

- Client Details: Include the full name, address, and contact information of the customer or business being billed.

- Rates and Charges: Break down the rates charged for transportation, fuel surcharges, and any additional fees related to the service.

- Payment Terms: Clearly state the due date and any penalties for late payments, if applicable.

- References or Tracking Numbers: Include shipment identifiers or tracking numbers to link the document to the actual transaction.

- Total Amount Due: Ensure the final sum is clearly highlighted to avoid confusion and ensure prompt payment.

Customizing Billing Documents for Your Business

Every logistics company has its own unique needs, and therefore customizing your billing statements is essential for maximum efficiency. Consider the following options for tailoring documents to your specific requirements:

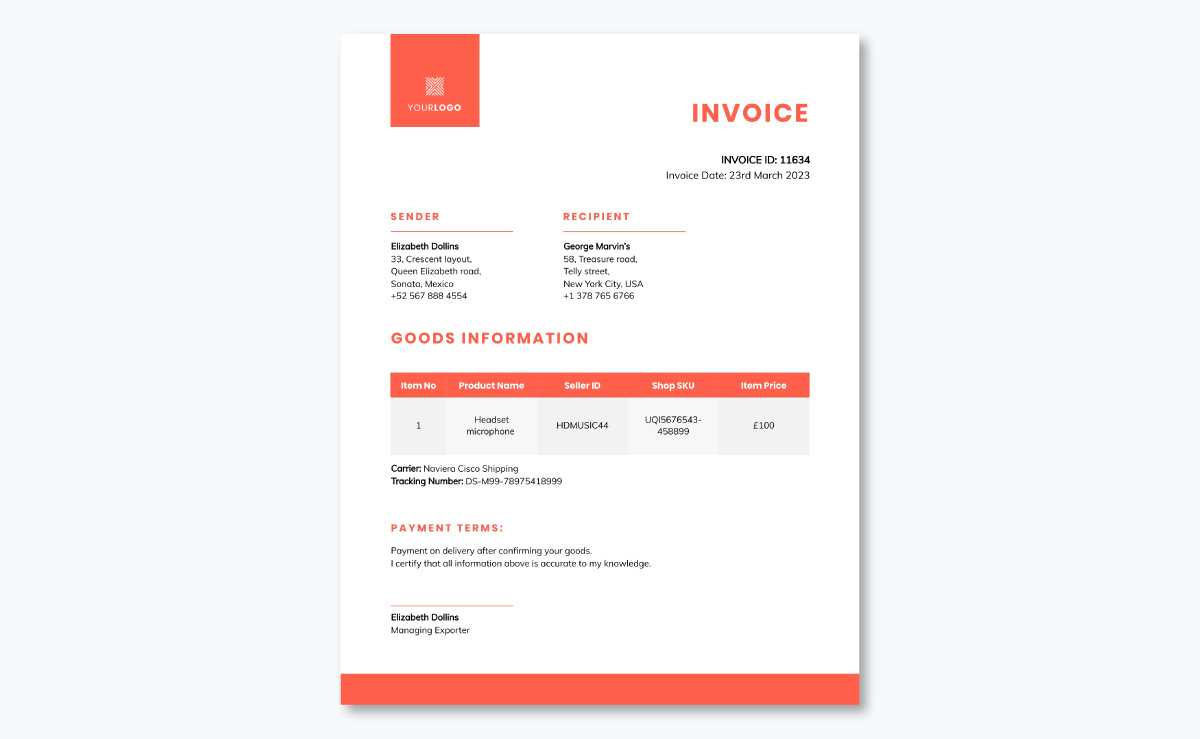

- Branding: Add your company’s logo and color scheme to the document to create a professional, branded look.

- Multiple Service Options: If you offer different types of services (e.g., expedited delivery or standard shipping), make sure these are reflected in separate line items.

- Tax and Compliance: Ensure the document adheres to local tax laws and industry standards for accounting and reporting.

- Online Payment Links: Including links to online payment platforms can speed up the payment process and improve customer satisfaction.

By carefully considering these aspects, logistics companies can create a more organized and user-friendly billing system that helps foster strong client relationships and promotes timely payments.

Why Use a Carrier Invoice Template

Having a consistent format for billing documents is essential for any business, especially in industries where transactions are frequent and involve multiple details. A structured document ensures that all necessary information is captured accurately, reducing errors and streamlining the entire process. This not only improves operational efficiency but also helps businesses maintain clear communication with clients regarding financial obligations.

Using a pre-designed document layout offers several advantages, including time savings, improved accuracy, and enhanced professionalism. Below, we’ve outlined some of the key benefits of adopting a standardized billing form:

| Benefit | Description |

|---|---|

| Consistency | A consistent format ensures that each document looks the same, making it easier for clients to review and process payments. |

| Efficiency | By using a ready-made layout, you can quickly fill in the necessary information, reducing time spent on document creation. |

| Professional Appearance | A well-organized document gives a professional impression, helping to build trust and credibility with clients. |

| Accuracy | Standardized forms reduce the chances of omitting important details or making mistakes, leading to fewer disputes or delays in payments. |

| Customization | Many pre-designed documents allow for easy customization to fit your specific business needs, such as adding company logos or adjusting payment terms. |

By using a standardized billing document, businesses can not only save time but also ensure that their financial transactions are accurate, professional, and clearly understood by clients.

Key Components of a Carrier Invoice

When preparing a billing statement, it’s essential to include all necessary details to ensure clarity and avoid confusion between businesses and clients. Each element of the document plays a specific role in conveying important information, from service descriptions to payment terms. A well-structured document not only helps in prompt payment collection but also ensures accuracy in financial transactions.

Essential Elements of a Billing Statement

Every document should contain key pieces of information to ensure both parties are on the same page. Some of the most important components include:

- Business Information: Include your company’s name, address, phone number, and email. This helps clients easily identify the sender and reach out for any questions.

- Client Details: Clearly list the name and contact details of the customer being billed. It’s essential for tracking payments and addressing any concerns.

- Description of Services: Break down the services provided, including specific routes, handling, or special instructions. This section should be detailed to avoid disputes.

- Dates: Include the date when the services were provided and the date the document was issued. This is crucial for managing payment deadlines.

- Total Amount Due: Display the total amount clearly, including any taxes or additional charges. This makes it easy for clients to understand what they owe.

Additional Considerations for a Complete Document

Beyond the basic elements, there are other factors to consider when creating an accurate and professional billing document:

- Payment Terms: Specify when the payment is due and any late fees that may apply. This ensures clients understand the time frame for payments.

- Reference Numbers: Include tracking numbers or order references to link the document to the service provided. This helps with record-keeping and future inquiries.

- Legal or Compliance Information: In some regions, certain disclosures or regulatory requirements need to be included on official documents. Make sure your statements comply with local laws.

By ensuring that each of these elements is present and clearly outlined, businesses can create a billing statement that is both functional and professional, facilitating smoother transactions and improving payment timelines.

How to Create a Custom Carrier Invoice

Designing a personalized billing document that meets the specific needs of your business can significantly improve the efficiency and accuracy of your payment processes. Customization allows you to tailor each document to reflect the unique services you provide, the preferences of your clients, and the legal or financial requirements of your region. By carefully structuring your document, you ensure clarity and reduce the likelihood of errors or disputes.

Follow these steps to create a tailored billing form that suits your business:

Step 1: Choose the Right Format

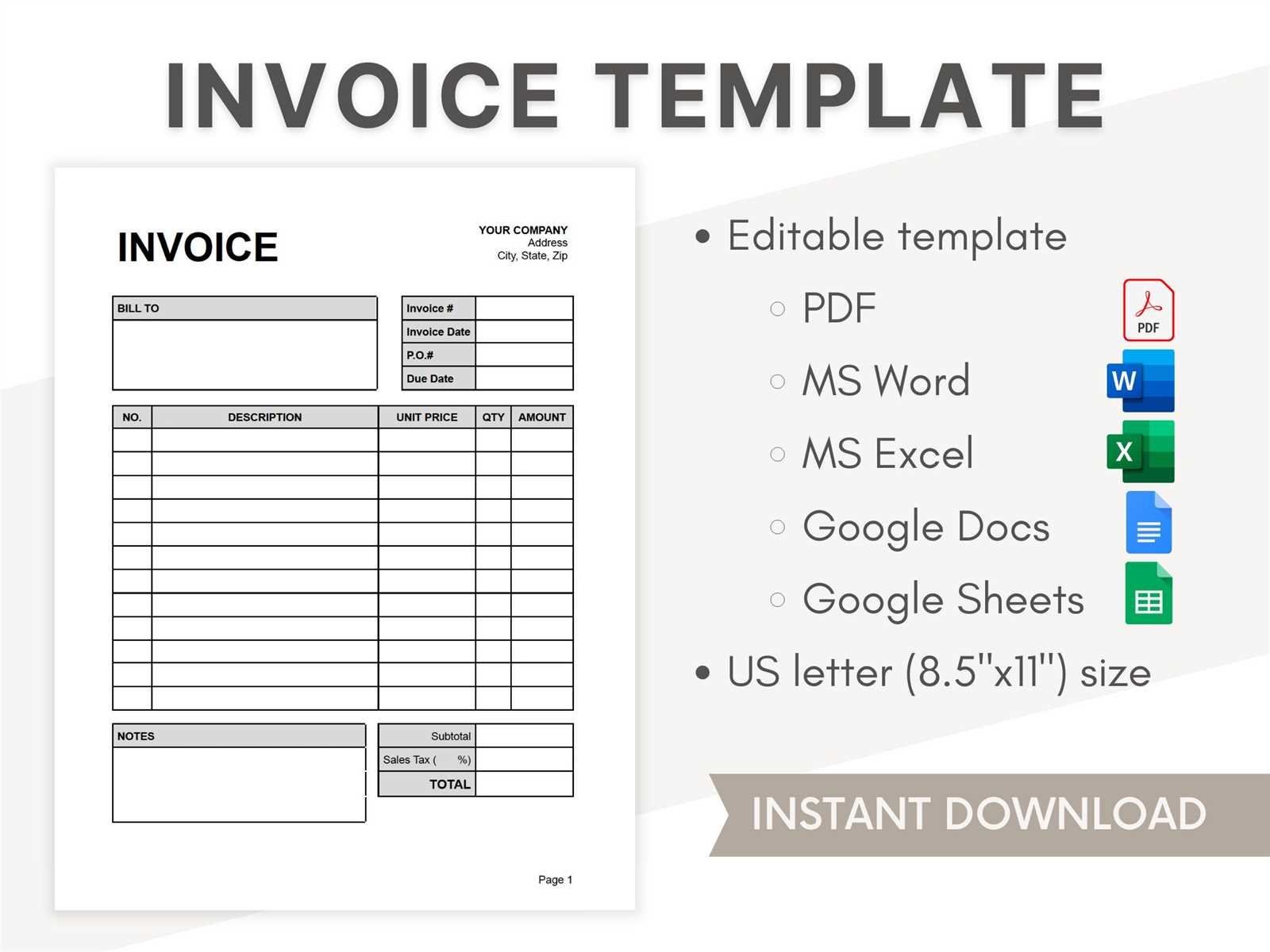

The first step is selecting the best format for your document. Consider whether you want to create it from scratch using a word processor, use an online form builder, or download a pre-made layout for further customization. Some formats to consider include:

- Word Processing Software: Allows for full customization but requires manual setup of the layout and design.

- Online Tools: Many websites offer easy-to-use design platforms with pre-built options that you can quickly edit to suit your needs.

- Spreadsheet Software: If your billing process involves complex calculations, a spreadsheet might be the best option for managing totals and taxes.

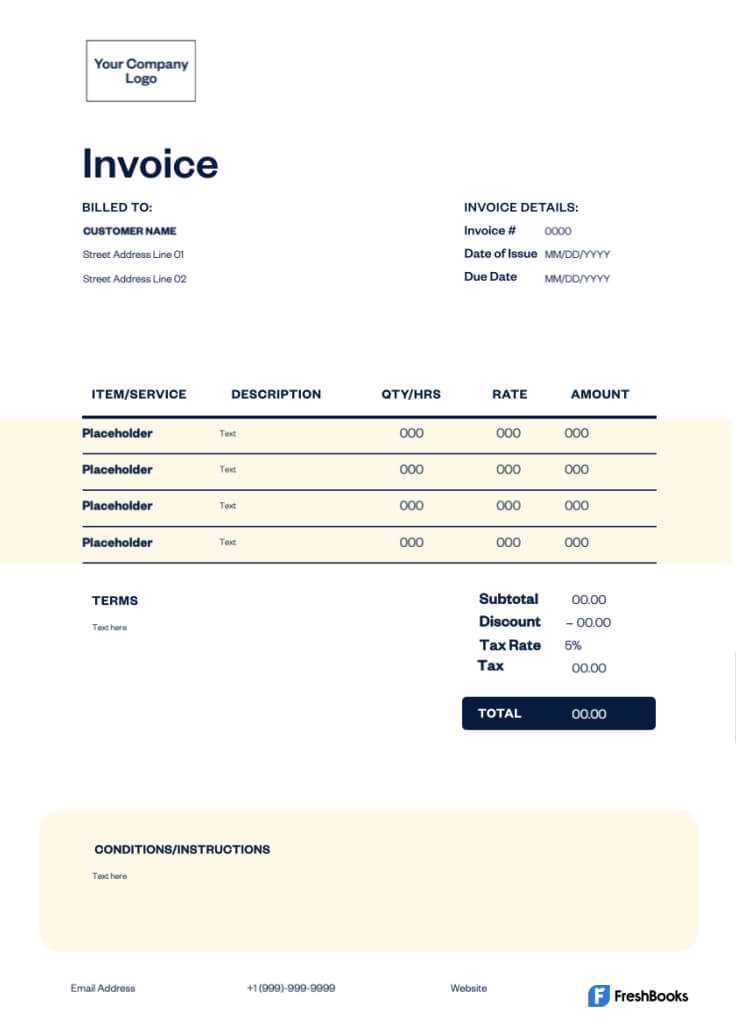

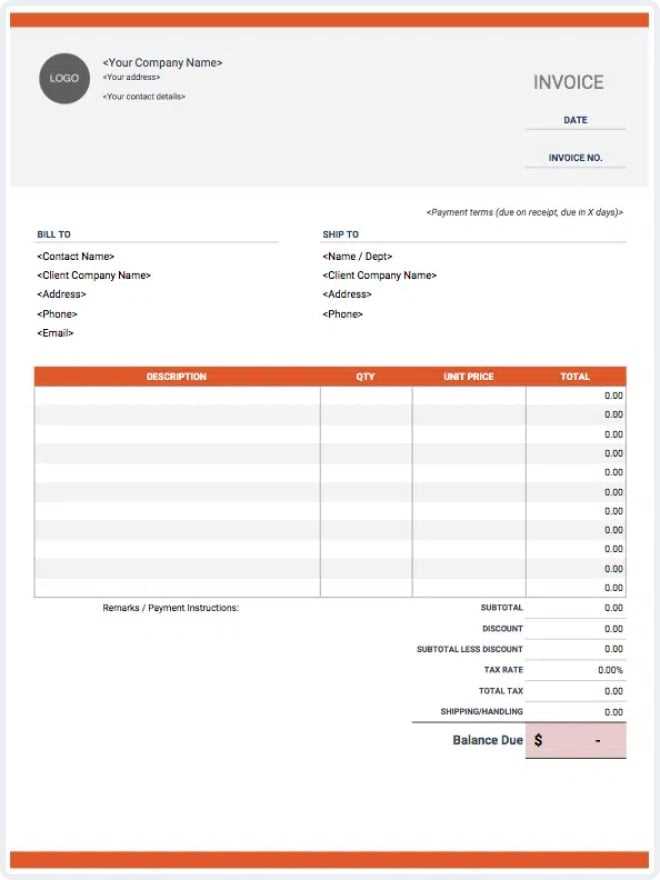

Step 2: Customize the Layout

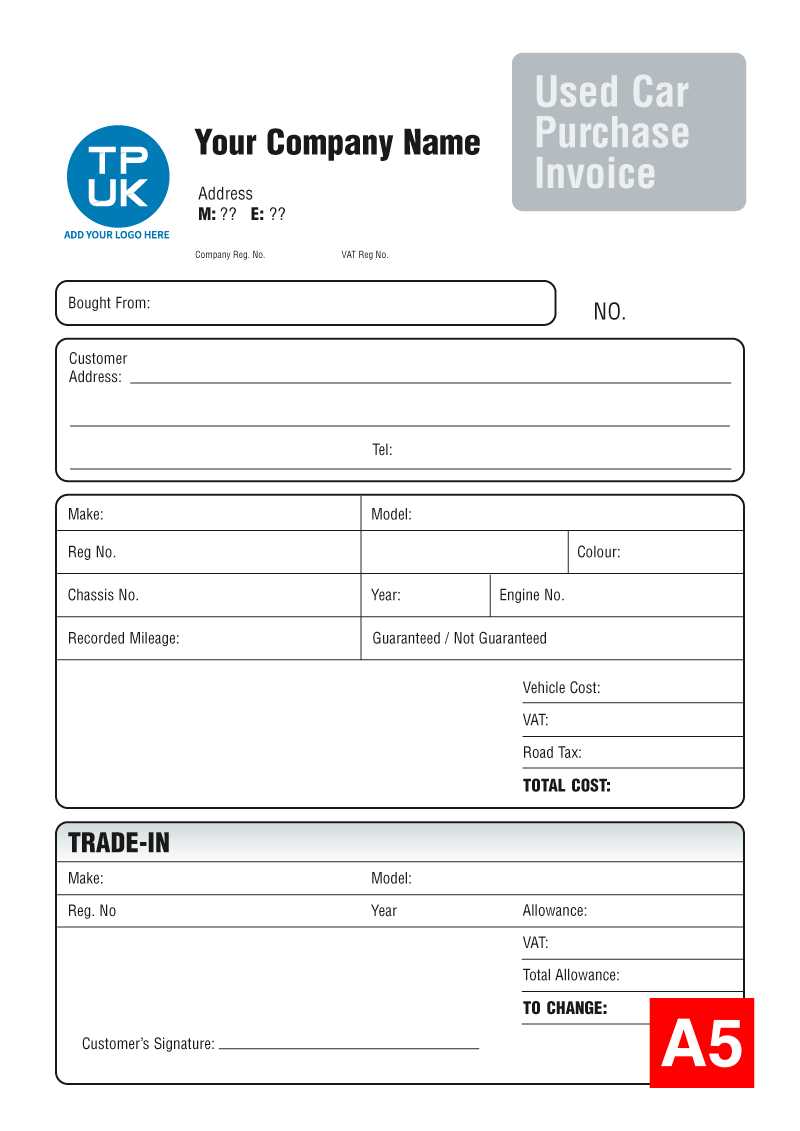

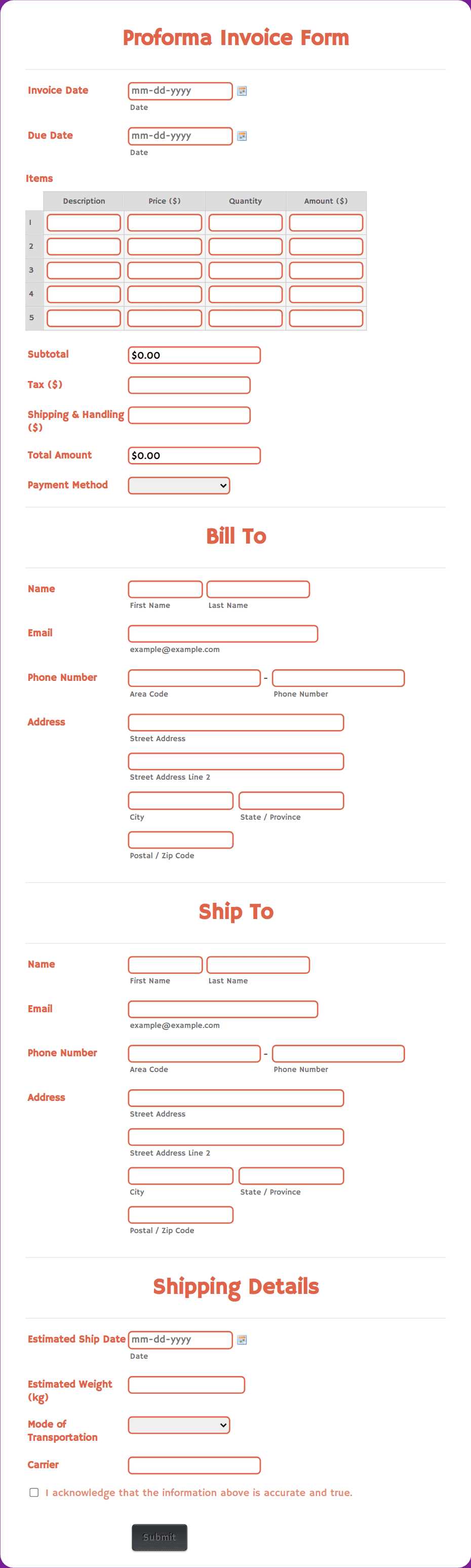

Next, you’ll want to adapt the layout of the document to reflect the most important elements of your business. Consider the following design tips:

- Branding: Add your company logo and use your business’s color scheme to make the document look professional and on-brand.

- Clear Structure: Organize the document with headers, sections, and line items to make it easy for clients to read and understand the charges.

- Use of Tables: Including tables can help neatly present pricing, quantities, or detailed breakdowns of services offered.

Step 3: Add Relevant Information

Include all critical details necessary for your client to understand the services rendered and their associated costs. This may include:

- Client and Company Details: Include your business’s name, contact info, and client’s name and address.

- Service Breakdown: Clearly list each service, shipment, or task provided, along with the respective charges.

- Terms and Conditions: Specify payment terms, due dates, and any additional fees or discounts.

By following these steps, you can easily create a customized billing document that not only meets your business’s needs but also enhances the professionalism of your operations. Customization ensures that each document is tailored to your unique business model and reduces the chances of confusion or delays in payment.

Billing Document for Small Businesses

For small businesses, managing finances and maintaining a professional image are crucial for success. One of the most important tools for ensuring smooth financial transactions is a well-structured billing document. A simple, easy-to-use form that includes all necessary details can save time and reduce errors, allowing business owners to focus on growth and customer service rather than chasing payments or resolving disputes.

Creating a customized billing statement for your small business allows you to capture essential information and communicate clearly with clients. The right layout not only ensures that payments are processed on time but also helps your business appear more organized and trustworthy. Here are a few things to consider when designing a billing document for your small business:

- Simplicity: Keep the design clean and straightforward. Small businesses often benefit from no-frills formats that prioritize clarity over elaborate design elements.

- Custom Fields: Include specific fields relevant to your services or products, such as delivery addresses, service descriptions, and custom charges.

- Clear Payment Terms: Always specify the payment due date, late fees, and any discounts for early payment to set clear expectations with clients.

- Branding: Even for small businesses, including your logo and company contact details on each document adds a professional touch and reinforces your brand identity.

Using a simple yet effective billing document can streamline your operations, improve cash flow, and reduce administrative work. By focusing on essential elements and tailoring the layout to your specific needs, you can create a document that supports both the financial and professional growth of your small business.

Benefits of Using Invoice Templates

Utilizing a pre-designed billing document offers several advantages for businesses, helping to streamline processes and enhance accuracy. Standardized formats save time, reduce human error, and ensure that all essential information is included in every transaction. Whether you’re a large corporation or a small business, using a structured form helps improve financial management and communication with clients.

Improved Efficiency and Time Savings

One of the primary benefits of using a standardized billing document is the time saved in creating new statements from scratch. Instead of starting from a blank page, you can quickly fill in the details of each transaction, which accelerates the billing process and reduces administrative workload. This efficiency is particularly valuable for businesses that handle high volumes of transactions on a regular basis.

Enhanced Accuracy and Consistency

Consistency in your financial documents helps avoid mistakes that can lead to misunderstandings or delayed payments. By using a standard format, you ensure that all relevant information, such as service descriptions, payment terms, and totals, is included every time. This reduces the risk of missing important details, which could otherwise cause confusion or disputes with clients.

Additional Advantages:

- Professional Appearance: A well-designed form helps create a polished and professional image, fostering trust and credibility with clients.

- Customization: Even with a standardized format, many systems allow for easy adjustments to reflect your branding, services, or pricing changes.

- Legal Compliance: Pre-designed forms often include fields for tax information and regulatory requirements, ensuring compliance with local laws.

By incorporating a well-structured billing document into your operations, you can streamline processes, reduce errors, and ensure a more professional experience for both your business and your clients.

Best Practices for Carrier Billing

Establishing efficient billing practices is essential for any business that provides transportation, logistics, or similar services. Ensuring that your financial documents are accurate, clear, and timely helps facilitate smoother transactions and fosters stronger relationships with clients. Adopting best practices for billing not only improves cash flow but also reduces the potential for misunderstandings or disputes.

1. Clearly Define Services and Charges

One of the key components of effective billing is transparency. Always break down the services provided in detail, specifying the type of service, routes, or special handling involved. This prevents confusion and ensures clients understand exactly what they are paying for. Be clear about any additional charges such as fuel surcharges, administrative fees, or special requests.

2. Establish Consistent Payment Terms

Setting clear payment terms is essential for maintaining healthy cash flow. Ensure that the terms are communicated upfront and consistently applied across all transactions. Specify due dates, late fees, and available payment methods. Offering early payment discounts can also incentivize quicker settlements. Having standard terms in place reduces the likelihood of disputes or delays in payment.

3. Use Automated Billing Systems

Automating the billing process can save significant time and reduce errors. Automated systems can generate financial documents based on pre-set criteria, reducing the risk of manual mistakes. They also allow you to quickly send out bills, track payment status, and follow up on overdue payments. Many modern accounting platforms integrate with transportation management software, streamlining the entire process.

4. Regularly Review and Update Rates

It’s important to regularly evaluate your pricing structure to ensure it remains competitive and aligned with market conditions. Updating rates based on inflation, rising fuel costs, or changes in service offerings helps you stay profitable. Make sure to communicate any changes to clients in advance, ensuring transparency and minimizing any confusion.

5. Keep Detailed Records

Proper record-keeping is crucial for both financial management and compliance. Keep thorough records of all services provided, payments received, and outstanding balances. This not only helps with day-to-day management but also simplifies tax filing and auditing processes. Using an electronic system to store and organize records makes retrieval and tracking much easier.

By adhering to these best practices, businesses can ensure their billing processes are efficient, accurate, and professional, which ultimately leads to better cash flow and stronger client relationships. A well-organized system helps avoid errors, reduce disputes, and maintain a high level of customer satisfaction.

Common Mistakes in Carrier Invoices

Even with the best intentions, errors in financial documents can occur, leading to confusion, payment delays, or disputes. These mistakes can range from minor oversights to significant inaccuracies that affect cash flow and client relationships. Recognizing and avoiding common errors in billing documents is crucial for maintaining efficiency and professionalism in business transactions.

1. Missing or Incorrect Information

One of the most frequent issues is incomplete or inaccurate details. This can include missing client information, incorrect service descriptions, or errors in the total amount due. Missing or incorrect data can lead to misunderstandings and delay payments. Here are some common mistakes to avoid:

- Incorrect contact details for clients

- Wrong service descriptions or unclear terms

- Omitting important identifiers, such as order numbers or tracking codes

2. Lack of Clear Payment Terms

Failure to clearly state payment terms is another common mistake. If the due date, penalties for late payments, or available payment methods are not clearly outlined, clients may be unsure of their obligations, leading to payment delays. Ensure that payment terms are always included and easy to understand:

- Clearly state the due date

- Specify any late fees or interest charges for overdue payments

- Indicate the preferred payment methods

3. Errors in Calculations

Mathematical errors, such as incorrect totals or tax calculations, are not only frustrating for clients but can also lead to disputes. Double-checking all calculations, including taxes, discounts, and additional charges, is essential to avoid these issues. Common errors include:

- Incorrect addition of service costs and taxes

- Failure to apply discounts correctly

- Rounding mistakes

4. Not Adhering to Local Regulations

Another mistake is neglecting to include required legal information or not adhering to local tax laws. Each region may have specific requirements regarding tax calculations, invoicing details, or compliance statements. To avoid legal issues, make sure your document complies with local regulations:

- Include tax identification numbers, if applicable

- Adhere to local tax laws and reporting requirements

- Ensure your document meets industry standards for compliance

5. Failing

How to Automate Billing Documents

Automating your financial documentation process can save a considerable amount of time, reduce errors, and improve the efficiency of your operations. By using automated systems, businesses can ensure that billing records are generated consistently, sent to clients promptly, and tracked effectively. Automation is particularly beneficial for businesses that process high volumes of transactions or work with multiple clients at once.

1. Choose the Right Software

The first step in automating billing processes is selecting the appropriate software. Various tools and platforms offer specialized solutions for automating financial documentation, and it’s important to choose one that aligns with your business needs. Here are some options to consider:

- Accounting Software: Popular platforms like QuickBooks, Xero, and FreshBooks offer automated billing solutions that integrate with other financial tools.

- Enterprise Resource Planning (ERP) Systems: For larger businesses, ERP systems can automate multiple functions, including billing, inventory, and customer relationship management.

- Custom Solutions: If your needs are unique, consider working with a developer to create a bespoke system tailored to your business model.

2. Set Up Automated Data Entry

To fully automate your billing documents, it’s essential to eliminate manual data entry. This can be done by integrating your accounting system with your customer database or other operational tools. Automated data entry ensures that customer details, pricing, services rendered, and other essential information are pulled directly from existing records, minimizing the risk of errors.

- Integrate with CRM Systems: Integrating with your customer relationship management system will allow billing details to be automatically populated from client profiles.

- Link with Sales or Delivery Data: Syncing with sales or delivery management systems ensures that the services or goods billed are automatically recorded.

3. Configure Billing Rules and Templates

Set up rules for automatically generating billing documents based on specific criteria. For example, configure your system to generate a document each time a shipment is completed or when an order is fulfilled. Pre-designed layouts and templates can be configured to ensure all necessary fields are filled in automatically, including:

- Client information

- Service details

- Pricing and tax calculations

- Payment terms and due dates

4. Automate Sending and Tracking

Once the billing documents are generated, the next step is automation of delivery and tracking. Many automated systems allow you to email bills directly to clients upon creation, ensuring prompt receipt. You can also set up reminders and follow-ups for unpaid bills. Here’s how to automate this process:

- Email Notifications: Set up automatic emails that send out billing documents to clients as soon as they are generated.

- Automatic Payment Reminders: Configure the system to automatically send reminders as the payment due date approaches or if payment is overdue.

- Track Payment Status: Use software that tracks when clients have viewed or paid their bills, allowing you to monitor your cash flow effectively.

5. Monitor and Optimize the System

Even with automated systems, it’s important to periodically review and optimize your process to ensure everything is functioning correctly. Regular audits and updates to your system can help identify areas for improvement, such as:

- Adjusting pricing rules or discounts

- Reviewing client-specific needs or customizations

- Improving the user interface for easier operation

By automating your billing processes, you can reduce administrative overhead, improve accuracy, and ensure timely payments. With

Top Features of an Effective Billing Document

Creating a well-organized and professional billing document is essential for any business that handles financial transactions. An effective document not only ensures clarity and accuracy but also helps build trust with clients by providing a clear breakdown of charges and services. The design and structure of your financial documents can have a significant impact on payment speed and client satisfaction.

1. Clear and Concise Layout

One of the most important aspects of an effective billing document is a clear and concise layout. Clients should be able to quickly identify the key details of the transaction without confusion. A structured format that separates important sections–such as client information, services rendered, payment terms, and totals–helps achieve this goal. Here are some tips:

- Organized Sections: Use distinct headers for each section, such as “Service Details,” “Charges,” and “Payment Terms.”

- Easy-to-Read Fonts: Use legible fonts and appropriate font sizes to ensure that the document is easy to read.

- Logical Flow: Arrange the information in a logical order, such as listing services first, followed by payment information, and then the total amount due.

2. Essential Information Included

For a billing document to be effective, it must contain all the necessary details to avoid confusion and ensure smooth transactions. A comprehensive document should include the following elements:

- Client and Company Details: Make sure both the sender’s and recipient’s names, addresses, and contact details are clearly displayed.

- Service Descriptions: Include a detailed list of services provided or products delivered, along with their corresponding costs.

- Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any penalties for late payments.

- Unique Identifiers: Include invoice or order numbers, shipment tracking numbers, and any other reference numbers that help keep track of the transaction.

3. Professional Design and Branding

A polished, professional design enhances the credibility of your business and leaves a positive impression on clients. Even if your business is small, a well-branded financial document can demonstrate professionalism. Here are some design elements to include:

- Logo and Branding: Include your company logo, color scheme, and fonts that match your brand identity.

- Consistent Style: Ensure that the document has a consistent style, with uniform spacing, aligned text, and balanced margins.

- Customizable Fields: Use customizable fields so that the document can easily be adjusted to suit each individual client or project.

Integrating Billing Documents with Accounting Software

Integrating your financial documentation with accounting software streamlines the entire billing and payment process. By automatically transferring data between the two systems, businesses can reduce the risk of errors, improve accuracy, and enhance financial tracking. This integration saves time, increases efficiency, and ensures that records are consistent across all platforms.

1. Benefits of Integration

Connecting your billing documents directly with accounting software brings a wide range of benefits. Here are some of the most significant advantages:

- Time Savings: Automatic data transfer eliminates the need for manual entry, reducing the time spent on repetitive tasks.

- Accuracy and Error Reduction: Integration minimizes human errors, such as incorrect data entry or missed payments, by ensuring that financial records are automatically updated in real time.

- Real-Time Financial Tracking: Automatically synced data allows you to monitor cash flow, outstanding balances, and profit margins more effectively, providing real-time insights into your financial status.

- Improved Reporting: Integrated systems can automatically generate detailed reports, helping businesses better track revenue, expenses, taxes, and other key financial metrics.

2. How to Integrate Billing with Accounting Software

Integrating billing data with your accounting software is typically straightforward but requires careful planning to ensure a smooth process. Below are the steps you can take to successfully integrate your systems:

- Choose Compatible Software: Ensure that your billing platform and accounting software are compatible. Many modern accounting systems (like QuickBooks, Xero, or FreshBooks) offer integration options with various billing platforms.

- Set Up Automated Data Sync: Once compatibility is confirmed, set up automatic synchronization between the two systems. This will ensure that every new transaction or update in your billing software is automatically reflected in your accounting records.

- Map Data Fields: Make sure that all necessary data fields, such as client names, service descriptions, amounts, and payment terms, are mapped correctly between the two systems. This will ensure that the data flows seamlessly and no information is lost or misinterpreted.

- Test and Monitor the Integration: Before fully relying on the integration, test the system with a few transactions to ensure that data is transferring accurately. Continuously monitor the process and make adjustments as necessary to maintain accuracy.

3. Tools and Software for Integration

Many tools and platforms

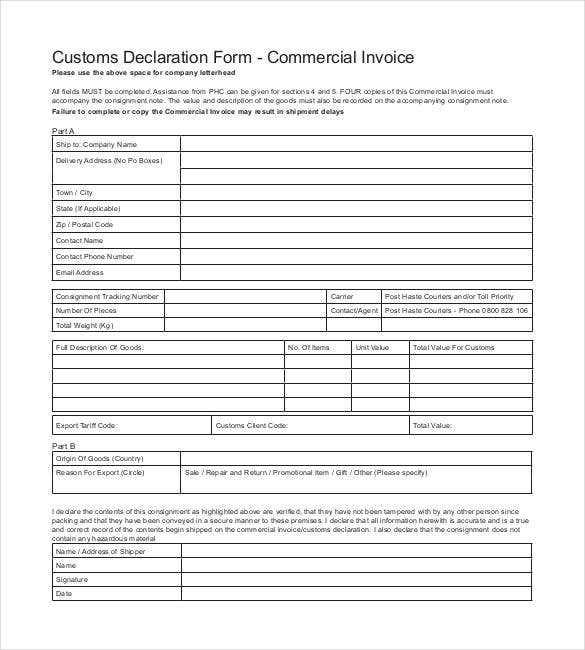

Legal Requirements for Billing Documents

When creating financial documents for transactions, it’s essential to comply with the legal regulations in your country or region. These requirements ensure that your documents are valid, transparent, and acceptable for accounting and tax purposes. Failing to include mandatory details or adhering to legal guidelines can result in penalties, disputes, or even legal issues. Understanding the legal framework around these documents can help protect your business and ensure smooth financial operations.

1. Mandatory Information on Billing Documents

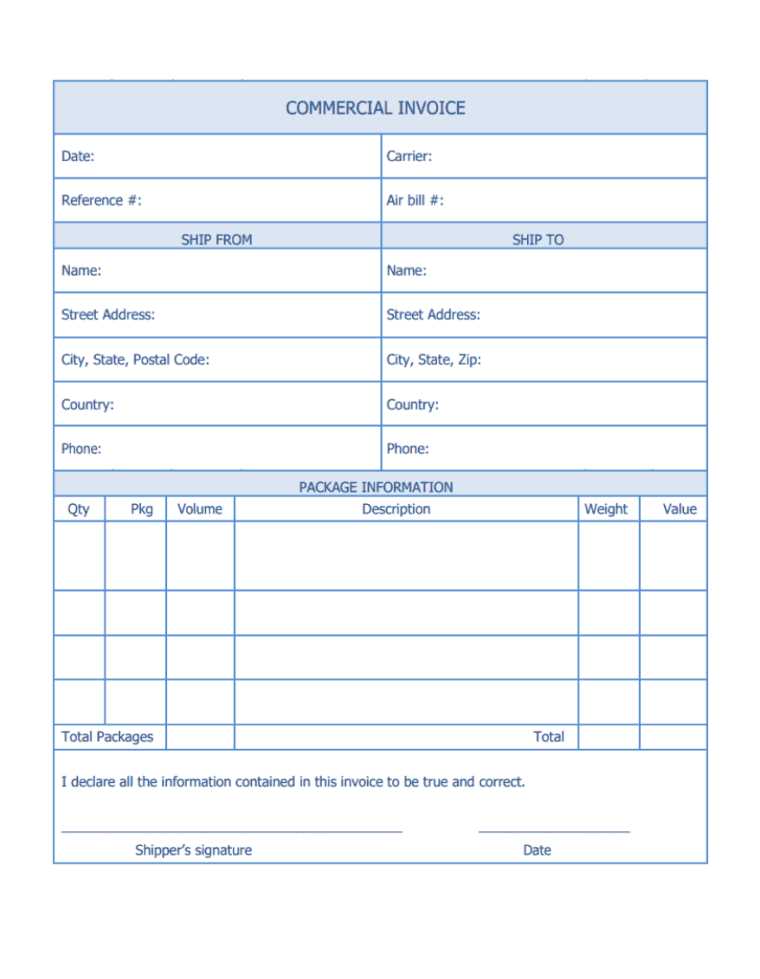

To meet legal requirements, it’s crucial that certain details are included in every document. These pieces of information help verify the transaction and provide transparency for both the service provider and the client:

- Identification Numbers: Include your business’s tax identification number (TIN), VAT registration number, or other relevant tax codes.

- Client Information: Ensure that the client’s full name or company name, address, and contact information are clearly stated.

- Clear Description of Services: A detailed description of the services provided or goods delivered, including quantities, dates, and individual costs, must be included.

- Payment Terms: Specify payment due dates, accepted payment methods, and any late fees or interest charges for overdue payments.

- Tax Information: Accurately calculate and display any applicable taxes, such as sales tax or VAT, and ensure they comply with local tax laws.

2. Tax Compliance and Regulations

One of the most critical aspects of creating compliant documents is adhering to tax laws. Different regions have varying requirements for how taxes should be calculated, applied, and reported. Here’s what you should consider:

- Correct Tax Rate: Apply the correct tax rate based on the type of service or product and the jurisdiction where the transaction occurs.

- Inclusion of Tax Breakdown: If applicable, provide a clear breakdown of the taxes applied to each item or service, as well as the total tax amount.

- Taxable and Non-Taxable Items: Some items or services may be exempt from taxes. Ensure that such items are marked as non-taxable and comply with local tax codes.

- VAT or Sales Tax Information: If you are subject to VAT or sales tax, include the proper VAT registration number and a statement that the tax has been applied according to the relevant laws

How to Avoid Invoice Disputes

Disputes over financial documents can create unnecessary friction between businesses and clients, leading to delays in payments and strained relationships. To prevent these issues, it’s important to take proactive steps in ensuring clarity, accuracy, and transparency in all your billing procedures. By addressing potential problems before they arise, businesses can streamline their payment processes and maintain good customer relations.

1. Ensure Accurate Information

The most common cause of disputes is the presence of incorrect or unclear information on financial documents. Accuracy is crucial to avoid misunderstandings and ensure that both parties are on the same page. Here are some steps to take:

- Verify Client Details: Always double-check the client’s name, address, and contact information before sending any documents. A minor mistake can create confusion.

- Itemize Services and Charges: Provide a detailed breakdown of all services provided or goods delivered, along with their corresponding costs. Ambiguities in pricing can lead to disagreements.

- Correct Payment Terms: Clearly outline payment due dates, methods, and any applicable discounts or late fees. Inconsistent payment terms often lead to confusion.

2. Communicate Clearly and Proactively

Clear communication throughout the transaction process helps set expectations and minimizes the chances of a dispute. Keep your clients informed and maintain open lines of communication:

- Confirm Details Before Sending: Before sending a final billing document, confirm all details with the client, especially if they are complex or unique.

- Clarify Terms Early: Make sure the client understands payment terms, deadlines, and expectations from the beginning of the agreement.

- Keep Clients Updated: Notify clients about the status of their order or service, including any delays, changes in terms, or adjustments to the bill.

3. Use Consistent Formats and Standards

Using a consistent format for your financial documents helps your clients easily understand the billing details and reduces the chance of errors or omissions. A familiar, standardized structure also makes it easier to spot discrepancies. Here are some tips:

- Standardized Templates: Use a consistent template for all your billing documents. This includes uniform fonts, header styles, and clearly defined sections like “Services Provided,” “Charges,” and “Payment Terms.”

- Include Reference Numbers: Assign a unique reference number to each document to make tracking and resolving disputes easier. Clients are more likely to remember and reference specific trans

Customizing Billing Documents for Different Clients

Each client has unique needs and preferences, and customizing your financial documents accordingly can improve client satisfaction and streamline the payment process. Whether it’s adjusting the level of detail, formatting, or payment terms, personalization ensures that your clients receive the most relevant and clear information. By tailoring documents to meet the specific requirements of each client, you foster stronger business relationships and ensure smoother transactions.

1. Adjusting Layout and Content

To ensure your financial documents align with each client’s expectations, it’s important to tailor both the layout and content. Here are some ways to customize:

- Include Client-Specific Information: Some clients may require more detailed descriptions of the services rendered or goods delivered. For example, for a long-term project, you may need to break down milestones and their corresponding costs.

- Adjust Payment Terms: Each client may have different payment preferences. While some may require extended payment terms, others may need discounts for early payments. Be sure to adjust payment conditions accordingly.

- Personalize Branding: For a more professional touch, include your client’s branding (such as their logo) alongside your own, if applicable. This can help reinforce the relationship and maintain a cohesive look across documents.

2. Tailoring Documents for Industry-Specific Requirements

Some industries may have particular regulations or practices that should be reflected in the billing documents. Customizing them for industry-specific needs can help ensure compliance and avoid confusion:

- Legal or Regulatory Information: Certain industries, such as healthcare or finance, may require specific legal language or disclosures on their documents. Ensure that these are included to maintain compliance with industry laws.

- Itemized Charges: In industries like consulting or construction, clients often expect detailed breakdowns of services and associated costs. Customizing the level of detail can make these documents more transparent.

- Incorporate Custom Fields: Some clients may require custom fields such as order numbers, project codes, or tracking numbers. Including these fields ensures that the client can easily reference and process the document on their end.

3. Payment Preferences and Methods

Different clients may have distinct preferences regarding payment methods. Customizing billing documents to accommodate these preferences can streamline the payment process:

- Payment Method Options: Offer clients the ability to pay through their preferred method, whether it’s bank transfer, credit card, PayPal, or another platform. Specify these options clearly on the document.

- Currency Customization: If you’re working with international clients, provide the option to issue documents in the client’s local currency. This helps avoid confusion and ensures accurate payments.

- Flexible Payment Plans:

Choosing the Right Format for Billing Documents

Selecting the correct format for your financial documents is essential for ensuring smooth communication with clients and efficient payment processing. The right format helps to present all necessary information clearly, making it easier for clients to understand the charges and the payment terms. Whether you opt for a traditional, printed version or a digital file, understanding the needs of your business and your clients can guide you in choosing the most suitable format for your billing documents.

When deciding on the best format, consider factors such as ease of use, accessibility, and client preferences. Some businesses may find that digital formats streamline their processes, while others may prefer the more personal touch of physical documents. It’s also important to take into account the types of clients you work with, as industries such as retail, service, or logistics may have specific formatting needs that differ from one another.

The following are key considerations for choosing the appropriate format for your billing documents:

- Client Preferences: Some clients may prefer receiving electronic documents via email, while others might request hard copies. Always ask clients about their preferred format to avoid any issues or delays.

- Digital vs. Physical: Digital formats, such as PDFs, are easier to store, share, and track. However, physical documents may still be preferred in certain industries, particularly where signatures or official stamps are required.

- Software Compatibility: Choose a format that is compatible with your accounting or billing software. Most modern tools allow you to generate PDFs or other standardized formats that can be easily shared and processed.

- Compliance and Regulations: Depending on your region or industry, there may be specific compliance requirements related to document format. Ensure that the format you select adheres to any legal regulations that apply to your business.

By carefully considering these factors, you can select the most effective format for your financial documents, ensuring smooth communication and efficient operations for both your business and your clients.

Free Billing Document Templates Online

Many businesses today are turning to online resources for customizable financial documents. These free resources offer convenient and accessible solutions for those looking to save time and effort in creating professional billing statements. By utilizing online tools, businesses can quickly generate well-structured documents that align with their specific needs, without the need for expensive software or in-depth design work.

Online platforms often provide a wide variety of templates tailored to different industries and business requirements, making it easier to create customized documents for each client. Whether you’re sending a simple service charge or a detailed breakdown of a complex project, these tools allow you to generate professional-looking records with minimal hassle.

Advantages of Using Free Online Resources

There are several reasons why businesses prefer using free online billing document generators:

- Cost-Effective: As the name suggests, these resources are free to use, making them an ideal solution for small businesses or startups looking to reduce operational costs.

- Ease of Use: Most online platforms are user-friendly and do not require advanced technical skills. Users can fill in the necessary fields and instantly generate a document.

- Customizable Formats: Many platforms offer the ability to customize the layout, content, and branding of the document to suit your business style and client needs.

- Time-Saving: With pre-designed layouts and automatic calculations, businesses can quickly generate and send documents without the need for manual formatting.

Popular Free Online Resources

Here are some widely-used online platforms where you can find free document templates:

Platform Features Zoho Invoice Offers customizable, professional templates and the ability to send documents directly to clients. Wave Free tool for creating, sending, and tracking invoices with options for branding and automatic calculations. Invoice Generator Simple interface for quickly creating billing documents with a variety of design options. PayPal Invoicing Allows users to create and send invoices directly via PayPal with options for customizing and automating payment reminders. These platforms no