Free Carpenter Invoice Template in Word Format for Easy Billing

Managing payments and maintaining a clear record of transactions is essential for any skilled tradesperson. An organized system not only helps in tracking earnings but also ensures a professional approach when dealing with clients. With the right tools, this process becomes simpler and more streamlined, allowing craftsmen to focus on their work rather than administrative tasks.

One of the most effective ways to handle this is through customized documents that can be easily updated and personalized for each client. These documents provide a structured way to detail services rendered, hours worked, and agreed costs. Moreover, they offer a convenient format for both professionals and customers to reference when settling accounts.

By using a flexible and editable format, you can create a personalized document that meets your specific needs, keeping things clear and transparent. This not only fosters trust but also ensures that every transaction is documented properly for future reference.

Carpenter Invoice Template Word Overview

When it comes to professional billing, having a standardized document to outline services provided and payments due is crucial for clarity and organization. A well-structured document allows tradespeople to present charges in a clear, easy-to-understand format, ensuring transparency for both parties involved. Whether you’re dealing with a one-time project or long-term clients, a reliable document can help you manage financial transactions smoothly and efficiently.

Why Choose an Editable Format

Opting for a flexible, editable format offers numerous advantages. It allows you to customize each document according to the specific job and client, ensuring that the information presented is always relevant and accurate. With this approach, there is no need to start from scratch for every new project, saving both time and effort.

Key Benefits of a Structured Document

A standardized document not only helps maintain professionalism, but it also reduces the risk of errors and misunderstandings. With clear sections for materials, labor costs, and additional fees, clients can easily review the details of the agreement. This method helps prevent confusion and strengthens trust, ensuring prompt payments and continued business relationships.

Why Use a Carpenter Invoice Template

Having a standardized document for recording services and payments is essential for any professional. It ensures consistency, simplifies the billing process, and reduces the chances of mistakes. When you can quickly generate a document that covers all the necessary details, you save valuable time and focus more on your work. A reliable tool helps you present your charges clearly, which is important for maintaining good client relationships and ensuring prompt payments.

Advantages of a Standardized Document

Using a ready-made format provides numerous benefits, such as ease of use and quick customization for each job. With a professional-looking document, you project a polished image to your clients, which is essential for building credibility and trust. Furthermore, having a clear record of the work done helps in case of disputes or clarifications down the road.

Essential Information in Every Document

A properly structured document covers all necessary details, ensuring both parties are on the same page. Below is an example of typical sections you might include:

| Section | Description |

|---|---|

| Client Information | Includes name, contact details, and address of the client. |

| Job Description | A detailed breakdown of the work performed, including materials and hours worked. |

| Cost Breakdown | Clear itemization of charges for labor, materials, and any additional fees. |

| Payment Terms | Information on payment methods, due dates, and any late fee policies. |

| Additional Notes | Any relevant terms or notes about the job or the agreement. |

With all these components in one document, it becomes much easier to maintain financial organization and avoid misunderstandings. Whether you’re dealing with a large project or a small repair, this format ensures that every aspect is documented correctly.

Benefits of Word Invoice Format

Choosing the right format for your billing documents can significantly improve the efficiency of your business transactions. A flexible, text-based document format provides several key advantages over other file types, making it an excellent choice for professionals looking to create clear, professional-looking records of services rendered and payments due.

One of the major benefits of this format is its ease of customization. Whether you need to update client information, adjust payment terms, or add specific job details, making changes is straightforward and quick. This adaptability is especially useful when dealing with unique projects or clients with varying requirements.

Additionally, compatibility is another significant advantage. The format can be opened and edited on most devices and operating systems without requiring specialized software, ensuring that both you and your clients can access the document easily. This convenience makes it a go-to choice for professionals who need to send documents promptly.

Another key benefit is the ability to create professional-looking documents with minimal effort. Pre-formatted styles, fonts, and layout options allow for a polished appearance, ensuring that your billing statements look consistent and clear every time. This professionalism can help build trust and foster strong client relationships.

How to Customize Your Carpenter Invoice

Personalizing your billing document is a simple yet essential step to ensure that it reflects the specifics of each job you complete. Customization allows you to tailor each document to the client, service provided, and payment terms, making the process more efficient and professional. By adjusting key sections, you can create a document that suits your business needs while maintaining a clear and organized structure.

Adjusting Basic Information

The first step in personalizing your document is to modify the basic information. This includes updating the client’s contact details, job description, and the unique aspects of the project. Make sure to include any specific materials used, hours worked, and any special terms related to the job. Accurate client information ensures that the document is relevant and easily understood by all parties involved.

Adding Payment Terms and Special Notes

Customizing the payment section is also crucial for clarity. Specify payment deadlines, preferred methods, and any late fees or discounts for early payment. Additionally, include any special terms or conditions that apply to the job, such as warranty details or follow-up work. This helps avoid confusion and provides both you and the client with a clear understanding of expectations.

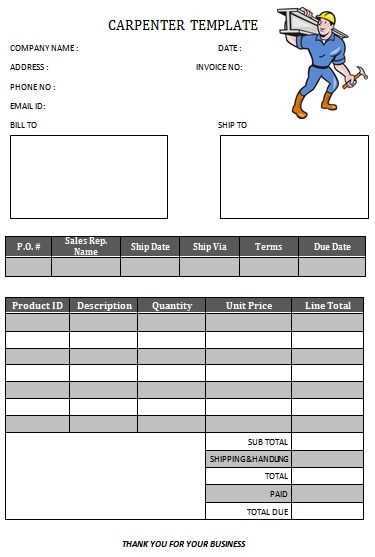

Steps to Create an Invoice in Word

Creating a professional billing document from scratch can seem daunting, but it is a straightforward process when broken down into simple steps. Using an editable format, you can easily customize the layout, include all necessary details, and ensure accuracy before sending it to your client. This guide will take you through the key stages of designing a clear and effective payment request.

Step 1: Set Up Document Header

The first step is to set up the header of the document, where you’ll place essential information such as your business name, logo (if applicable), and contact details. Make sure to include your full name, address, phone number, and email address. It is also helpful to add the date of the document’s creation, so both you and the client have a clear reference for the timing of the transaction. This ensures the client can easily reach you for any questions.

Step 2: Include Client Information and Service Details

Next, add the client’s information, including their name, address, and contact details. Below that, provide a description of the work performed, including materials used and the time spent on the job. Break down the charges into categories such as labor costs, materials, and any additional expenses. Clear and detailed descriptions help avoid misunderstandings and ensure both parties are in agreement on the charges.

Finally, be sure to specify payment terms, including the due date and the preferred method of payment. You can also add any late payment penalties or discounts for early settlement, depending on your business policies. With all these steps, you’ll have a professional and well-organized document ready for distribution.

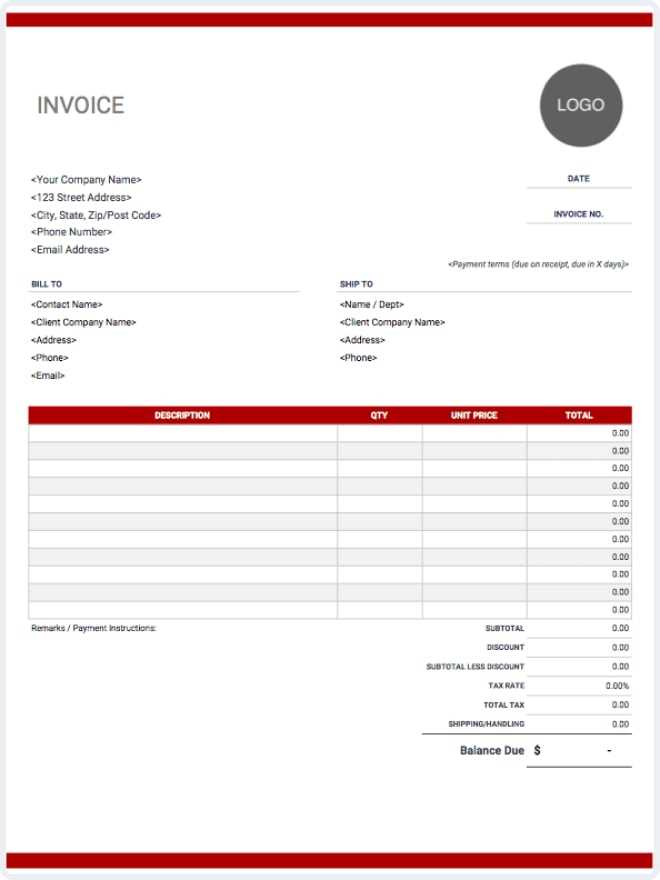

Essential Elements of a Carpenter Invoice

Creating a clear and accurate billing document is essential for maintaining transparency and professionalism in your business transactions. A well-structured record ensures that both you and your client have a shared understanding of the services rendered and the corresponding charges. To avoid confusion and ensure timely payment, it is important to include key details in every billing statement.

The following are the critical components that should be included in every billing document:

- Business Information: Include your full name, business name (if applicable), address, phone number, and email address. This provides a clear point of contact for the client.

- Client Information: Clearly list the client’s name, address, and contact details. This ensures that the document is properly addressed and traceable.

- Document Date: Specify the date the document was created. This helps both you and your client track when the charges were agreed upon.

- Description of Services: Include a detailed breakdown of the services performed, materials used, and any special terms or agreements. Be as specific as possible to avoid any ambiguity.

- Cost Breakdown: Itemize each charge, including labor, materials, and any additional fees. This allows the client to understand how the total amount was calculated.

- Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any late fees or discounts for early payment.

- Additional Notes: Add any relevant information, such as warranty details, follow-up instructions, or reminders of specific client agreements.

By including these elements, you ensure that both you and your client are fully informed and on the same page. This clarity not only promotes professionalism but also reduces the chance of disputes or confusion over payments.

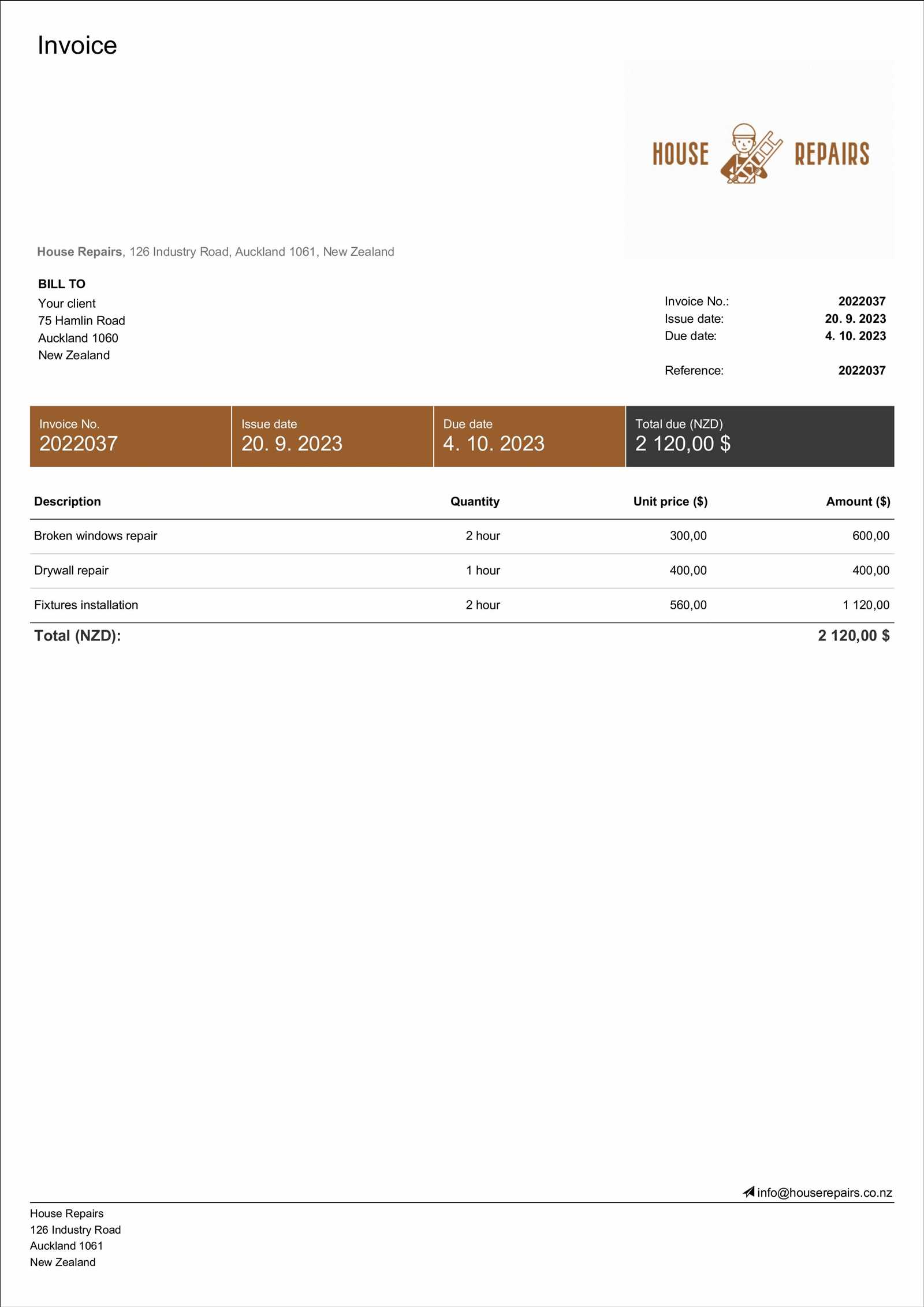

Free Invoice Templates for Carpenters

Accessing a ready-made billing document can save valuable time and effort when it comes to managing client payments. Free resources are available online, offering easy-to-use and customizable documents designed for professionals in need of an efficient way to document their services and charges. These free formats allow you to quickly create professional records without having to design a document from scratch.

Why Use Free Billing Documents?

Using a free pre-designed format offers multiple benefits, such as reducing administrative workload and maintaining consistency across your transactions. Many of these documents come with all necessary sections pre-built, which means you only need to fill in the specific details of each job. This makes the billing process faster and more efficient, allowing you to focus on your core work.

Where to Find Free Resources

There are numerous websites that offer free downloadable formats, ranging from simple templates to more detailed designs. These resources are often fully editable, so you can tailor them to suit your business needs. Many offer simple layouts that include everything from payment breakdowns to detailed job descriptions, ensuring you always present a clear and professional document to your clients.

How to Track Payments with Invoices

Efficiently tracking payments is crucial for maintaining a healthy cash flow in any business. By utilizing a clear billing document, you can easily monitor amounts owed, received, and outstanding. A well-organized record helps you stay on top of your finances and ensures timely payments, reducing the risk of misunderstandings with clients.

Key Steps to Track Payments

Here are several steps to help you track payments effectively using a detailed payment request:

- Assign Unique Numbers: Each document should have a unique reference number. This makes it easier to locate and track individual transactions, especially when managing multiple clients.

- Set Clear Payment Terms: Clearly state when the payment is due, and if applicable, include late fees or discounts for early payments. This helps both you and the client understand the payment schedule.

- Record Payments: As payments are made, update your records immediately with the amount received, the date of payment, and the method used. This will give you an up-to-date overview of outstanding balances.

- Track Outstanding Amounts: Always highlight any remaining balances or overdue payments. This makes it easy to follow up with clients who have not paid in full.

Using Payment Tracking Systems

If you handle a large number of transactions, consider using digital tools to automate the process. Many software programs and online tools allow you to input payment details and automatically generate reports on outstanding balances and payment history. This can save you time and reduce the risk of human error.

By following these steps, you can maintain clear financial records and ensure that payments are processed promptly, helping you manage your cash flow effectively.

Common Mistakes to Avoid in Invoices

Creating a billing document that is clear, accurate, and professional is crucial for maintaining positive client relationships and ensuring timely payments. However, there are several common errors that can cause confusion, delays, or even disputes. Being aware of these mistakes and taking steps to avoid them will help you maintain better financial records and smoother business operations.

Common Errors to Watch Out For

- Incorrect Client Information: Ensure that all client details, including names, addresses, and contact information, are accurate. A small mistake can cause delays in communication or payment processing.

- Missing or Incomplete Descriptions: Always provide a clear, detailed description of the services or products provided. Ambiguous or vague entries can lead to misunderstandings and disputes.

- Failure to Include Payment Terms: Clearly outline payment terms, including the due date and accepted payment methods. Not specifying these details can cause confusion and may lead to late payments.

- Omitting or Miscalculating Taxes: Double-check that all applicable taxes are properly added. Missing or incorrectly calculated tax amounts can lead to financial discrepancies or legal issues.

- Not Numbering Documents Sequentially: Each document should have a unique reference number. Failing to use a sequential numbering system makes it harder to track and organize transactions.

- Not Updating Outstanding Balances: If a payment has been partially made or the total amount has changed, make sure the document reflects the current outstanding balance. Leaving outdated information can cause confusion.

How to Avoid These Mistakes

To prevent these issues, make a habit of reviewing your billing documents thoroughly before sending them to clients. If you’re using a digital tool or editable format, ensure that all the fields are filled out correctly and consistently. Using pre-built forms that are already structured and tested can also help reduce human error.

By staying vigilant and double-checking your documents, you can avoid these common mistakes and maintain a smooth, professional billing process.

Invoice Design Tips for Carpenters

When it comes to creating a billing document, design plays a crucial role in how professional and clear your communication will be. A well-designed record not only makes the details of the work easily accessible but also conveys professionalism and attention to detail. By following some simple design tips, you can create documents that are both functional and visually appealing.

Keep It Clean and Simple

A cluttered or overly complicated document can confuse your clients. Stick to a clean, simple layout that highlights the most important information, such as the services provided, the cost breakdown, and payment terms. Use clear headings and adequate spacing to ensure that each section stands out. Avoid unnecessary graphics or distractions that could detract from the essential content.

Focus on Readability and Professionalism

Always choose a readable font style and size for the text. Too many different fonts or overly decorative styles can make the document difficult to read. Opt for standard fonts like Arial or Times New Roman, and make sure the font size is large enough to be legible. In addition, consider using bold text for important sections, such as totals and due dates, to make them stand out.

Finally, incorporate your branding elements, like your logo and business name, to add a personal touch. This helps reinforce your brand identity while maintaining a polished, professional appearance.

Managing Multiple Client Invoices Efficiently

Handling multiple billing records can become overwhelming, especially when you’re managing various clients and projects at the same time. To avoid confusion and delays, it’s crucial to implement efficient strategies for organizing, tracking, and following up on each document. By establishing a solid system, you can ensure timely payments and maintain clear financial records across all your transactions.

Organize by Client and Due Dates

One of the simplest and most effective methods is to categorize your documents by client and due date. Create a clear folder system (either digital or physical) where each client has a designated folder, and each document is named based on the client and the date. This allows for easy tracking and quick access. Additionally, use calendar reminders or project management tools to set deadlines and payment reminders, so nothing slips through the cracks.

Use Digital Tools for Automation

Another efficient approach is to take advantage of digital tools and software that automate many aspects of the billing process. These tools allow you to generate and store multiple documents, track payments, and even send automatic reminders for overdue amounts. Automation reduces the time spent manually managing each transaction and minimizes the chance of errors or missed deadlines.

By staying organized and leveraging digital solutions, you can keep track of multiple client transactions with ease, ensuring smooth operations and timely payments across the board.

How to Send an Invoice in Word

Sending a billing document in a digital format is an efficient way to ensure that your clients receive it promptly and securely. With the right steps, you can easily send your document via email or other communication channels, allowing for quick payment processing. Below are some simple instructions on how to send your document, ensuring professionalism and clarity throughout the process.

Step 1: Save the Document Correctly

Before sending, make sure your document is saved in the appropriate format. If you’re working in an editable format, save it as a PDF or another universally accessible file type to preserve its layout and prevent accidental changes. This ensures that the client sees the document as you intended.

- Save as PDF: Click “File” > “Save As” > Choose PDF as the file format. This locks the content in place.

- Use Descriptive Naming: Name the document using a clear and professional naming convention, such as “ClientName_Services_Invoice_Date.” This makes it easier for both you and the client to locate the document later.

Step 2: Send via Email

After saving your document, attach it to an email with a clear subject line and a brief message in the body. Be sure to include all relevant information, such as the payment due date and any other instructions regarding payment. Here’s how to structure your email:

- Subject Line: “Payment Request for [Client’s Name] – [Project or Service Name] – Due [Due Date].”

- Message Body: Politely remind the client of the work completed, the amount due, and the payment terms.

By following these steps, you ensure that the document reaches your client efficiently and looks professional, increasing the likelihood of timely payment.

Legal Considerations for Carpenter Invoices

When issuing a billing document, it’s crucial to ensure that it meets all necessary legal requirements to avoid disputes and protect both parties involved. A legally sound record not only helps ensure timely payment but also safeguards your business in case of any future legal issues. Below are key legal factors you should consider when preparing and sending payment requests.

1. Include Complete and Accurate Information

Every billing document should contain detailed and accurate information. This includes both your business details (name, address, contact information) and the client’s information (name, address, contact details). Additionally, you should include a description of the work completed, the agreed-upon price, and the payment terms. Inaccurate or missing details can lead to confusion and legal disputes, especially if a payment issue arises.

2. Clearly Define Payment Terms and Deadlines

Clearly outlining the payment terms is essential for avoiding misunderstandings. Include information on the payment due date, accepted methods of payment, and any penalties for late payments. Specify any interest or fees for overdue amounts, and make sure that the client has agreed to these terms before beginning work. Clarity and transparency in the payment terms will protect both you and your client legally in the event of a delay or non-payment.

By adhering to these legal guidelines, you can create billing records that are not only professional but also legally binding and enforceable, helping to ensure timely and fair payments for your services.

How to Add Taxes to Your Invoice

Adding taxes to your billing documents is an essential part of ensuring that you comply with local tax regulations and that both you and your client understand the total cost of services. Taxes can vary depending on the region and type of service provided, so it’s important to calculate and apply them correctly to avoid any legal or financial issues. Below are the steps to help you add taxes accurately to your billing statements.

Step 1: Identify the Correct Tax Rate

First, determine the applicable tax rate for the services you’ve provided. Tax rates can differ based on your location and the nature of your business, so make sure to research local sales tax or value-added tax (VAT) regulations. The tax rate might be a flat percentage or vary depending on the type of service or product being offered. It’s important to apply the correct tax rate to avoid any discrepancies.

Step 2: Calculate the Tax Amount

Once you know the applicable rate, calculate the amount of tax to be added to your total charges. To do this, multiply the subtotal of your services by the tax rate. For example, if your subtotal is $1,000 and the tax rate is 10%, you would calculate the tax as follows:

Tax Amount = Subtotal x Tax Rate

Tax Amount = $1,000 x 0.10 = $100

After calculating the tax, add this amount to the subtotal to determine the final total amount due.

Step 3: Display the Tax Clearly

Make sure to clearly show the tax amount on the document. In addition to showing the subtotal, list the tax as a separate line item with the percentage and the amount added. This ensures transparency and allows your client to easily understand the breakdown of costs. For example:

- Subtotal: $1,000

- Tax (10%): $100

- Total Amount Due: $1,100

By following these steps, you ensure that taxes are properly calculated and added, and your billing document remains clear, professional, and compliant with tax laws.

Automating Invoice Creation for Carpenters

Automating the creation of billing documents can significantly streamline your workflow, saving you valuable time and reducing the risk of errors. With the right tools and processes in place, you can generate accurate and professional records quickly and consistently, allowing you to focus more on your projects and less on administrative tasks. Below are some effective strategies for automating the process of generating payment requests.

Step 1: Use Accounting Software

One of the most efficient ways to automate billing is by using accounting software. Many programs are designed to help you create, manage, and send billing documents with minimal manual input. Here’s how to make the most of accounting software:

- Set up Client Profiles: Input client information once, and the software will automatically populate it on future records.

- Customize Templates: Most accounting tools offer customizable templates for different types of services. This allows you to maintain a consistent look while saving time.

- Track Payments: The software can track payments automatically, showing outstanding balances and sending reminders for overdue amounts.

Step 2: Integrate with Payment Systems

To further automate the process, consider integrating your accounting software with online payment systems. This allows your clients to pay directly from the billing document, making the process seamless for both you and the client. Many platforms also allow automatic payment reminders to be sent, ensuring timely payments without the need for follow-up calls or emails.

Step 3: Use Automation Tools for Recurring Work

If you provide ongoing services or have regular clients, set up automated recurring payment schedules. This feature will generate and send new billing documents at regular intervals (e.g., monthly or weekly) based on pre-set conditions. It ensures that you never miss a billing cycle and helps establish consistency in your cash flow.

By automating your billing process, you can save time, reduce administrative work, and maintain accurate financial records, all of which contribute to better overall business efficiency.

Best Practices for Invoice Follow-ups

Following up on billing records is an essential part of maintaining cash flow and ensuring timely payments. However, it’s important to approach this task with professionalism and tact, as delayed payments can sometimes result from simple oversights or misunderstandings. Implementing best practices for follow-ups can help you maintain positive relationships with clients while ensuring you’re compensated for your work. Below are some effective strategies to keep in mind when following up on overdue payments.

1. Send a Reminder Before the Due Date

One of the best practices is to send a friendly reminder before the due date. A simple email or message confirming the upcoming payment deadline can help remind clients about their obligations and reduce the chances of late payments. Here’s how you can structure it:

- Be polite: Keep the tone courteous and professional.

- State the due date: Clearly mention the due date to avoid confusion.

- Offer assistance: Ask if there are any questions or concerns regarding the payment.

2. Follow Up Immediately After the Due Date

If the payment has not been made by the due date, follow up as soon as possible. This follow-up should be more direct but still polite. Remind the client of the overdue payment, and provide any necessary details, such as the amount owed and the original payment terms. You might also want to include a late fee clause, if applicable. The goal is to remain firm but respectful.

- Be clear and concise: State the outstanding amount and due date, and explain any late fees or penalties.

- Use a professional tone: Avoid sounding accusatory; instead, focus on resolving the matter.

3. Offer Flexible Payment Options

Sometimes, clients miss payments due to financial difficulties or other reasons. If you feel comfortable, consider offering flexible payment options such as installment plans or extended deadlines. Offering solutions can help maintain a positive relationship and encourage the client to pay in a way that’s manageable for them.

4. Send a Formal Collection Notice

If several attempts to collect payment have been unsuccessful, sending a formal collection notice might be necessary. This document should outline the amount due, the history of your attempts to contact the client, and any further actions you may take, such as involving a collections agency or pursuing legal action. Be sure to keep the tone professional, as this step may be critical in the event of further legal action.

By following these best practices for follow-ups, you can increase your chances of timely payments while maintaining strong client relationships and protecting your business’s financial health.